Soy Protein Ingredients Market by Type (Soy Protein Concentrates, Soy Protein Isolates, Textured Soy Protein, and Soy Flours), Application (Food and Feed), Form (Dry and Liquid), Nature, Function, and Region - Global Forecast to 2027

Soy Protein Ingredients Market Insights & Overview

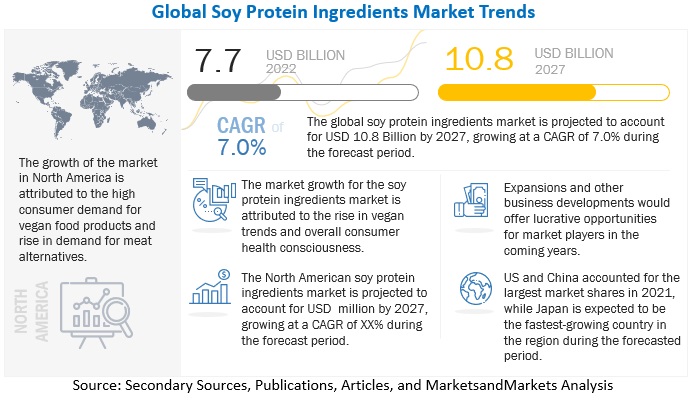

Global soy protein ingredients market size was valued at USD 7.7 billion in 2022 and is poised to grow USD 10.8 billion by 2027, growing at a CAGR of 7.0% in the forecast period (2022-2027).

Soy protein ingredients are produced by processing soymeal to obtain ingredients with higher protein concentrations, which can be used as a protein source in a range of food and animal feed applications. The demand for soy protein is growing in the food and animal feed industries, owing to their health benefits and functional properties. It is also a cheaper substitute for animal protein. The market is likely to grow at a significantly higher rate compared to other vegetable proteins.

To know about the assumptions considered for the study, Request for Free Sample Report

Soy Protein Ingredients Market Growth Insights

Drivers: Demand for cheaper protein source

Increased crop cultivation in developing regions such as South America and Asia Pacific, in addition to the already widespread cultivation across the globe, has increased the availability of soy proteins. Raw materials are, therefore, easy to obtain from contract farmers or oilseed crushers offering soy meal. The low processing costs associated with soy protein are suitable for the operational demands of manufacturers and thereby allow the processors to spend effectively on product development. As a result of these trends, soy proteins are cheaper when compared to that of other protein sources such as meat, dairy, and whey proteins. Additionally, the prices of conventional dairy products have increased in the recent past, and soy protein, one of the major plant sources of protein, is one of the best alternatives in terms of price.

Restraints: Ban on soy products of GM origin

The cultivation of genetically modified crops is forbidden in developed regions like Europe, where some member states of the European Union have passed laws prohibiting it. Germany, France, Northern Ireland, and Scotland are among the important nations. The conventional soybean market in the area has been impacted, and future expansion is predicted to be hampered by this. It is also anticipated to have an impact on the export of soybeans from developing nations like Argentina, where GM-based soybean crops are the norm.

Risks to human health and the environment have been linked to genetically modified (GM) soybeans by scientists. As a result, certain food producers in the US, Canada, Europe, and Japan are asking for soybeans that aren't genetically modified. Organizations in regions such as the Asia-Pacific and Europe have made it mandatory to declare genetic modification of food ingredients through labels on the packaging of all processed foods. Developing countries such as India, in 2013, have brought into effect the rule that requires GM-based food products to mention the same on packaged labels. European countries such as Germany and the U.K. have made the inclusion of GMO/non-GMO mentioned on the labels of dairy and processed meat products a mandate industry is restraining the market growth.

Opportunities: Demand for organic soy protein

The organic soy protein market has the potential to change the business landscape in the overall soy protein ingredients market. According to the Research Institute of Organic Agriculture (FiBL), around 1.8 million farmers across 162 countries carried out organic cultivation on more than 37.0 million hectares of agricultural land in 2013. Growth in the organic food products market is also expected to boost the growth of the organic market. Government and non-government organizations offer financial aid, R&D programs, and subsidies to support traditional farmers in switching to organic farming. These organizations include the Research Institute of Organic Agriculture, Switzerland (FiBL), the Agricultural & Processed Food Products Export Development Authority (APEDA) in India, and the US Department of Agriculture (USDA) in the US. Demand for organic food ingredients is high in developed regions such as North America and Europe. The consumer preference for healthy products is rising due to the increasing consumer awareness about the health benefits of consuming organic food products. As a result, marketing campaigns are planned to highlight their use and health benefit claims.

Challenges: Exhibition of unappealing flavor by soy products

Lately consumer shift towards “cholesterol-free” food items have elevated the demand for soy protein ingredients, slightly negatively impacting the demand for animal sourced proteins. However, soy protein is not recommended for eating due to its unpleasant flavour. Aldehydes, ketones, furans, and alcohols are among the substances that contribute to this off-flavor. One of the main causes of the beany and grassy taste of soy products is medium-chain aldehydes. The sole thing driving researchers to create novel and appealing soy product flavours is soy's inexpensive cost and great nutritional content. The addition of sugar molecules or during the extraction process are two potential neutralising methods being explored.

Soy Protein Isolates soy protein type in the soy protein ingredients market is projected to grow at the highest CAGR of 7.4% during the forecast period

Soy protein isolates are used not only to improve the texture of meat products but also to increase protein content, enhance moisture retention, and emulsify. The additional benefit of using soy protein isolates is their bland taste and high protein content; also, they are low in fat, oligosaccharides, and fiber, causing less flatulence due to bacterial fermentation. They are considered significant ingredients by food industries for their functional benefits. The food industry is the largest user of pure SPI, which is also used in the health/pharmaceutical industry. Soy protein isolates are also important ingredients in bakery products. They have the highest protein content (around 90%) out of all the types of soy protein available which is projected to drive their demand in the market.

Dry segment by form is estimated to dominate over the forecasted period

In the industry, powdered or dry ingredients are excellent texture enhancers. Moreover, with the rise in demand for meat alternatives, with growing trends for plant-based foods, industries are focused on maintaining the texture of soy-based food. They are trying to make it as close as to the texture of meat. Players in the market thus include texturized soy protein ingredients in their portfolios. They are mostly in dry form; thus, the rise in demand for texturized soy protein is driving the demand for dry form soy protein. Moreover, their longer shelf life, convenient packaging, ease of use in recipes, and ability to blend with other components is driving their demand in the market.

The food segment by application dominated the market with an estimated value of USD 6,282.1 million in 2022

Soybean and processed products are the most important ingredients in the food & beverage industry, and their functionality is still being studied. They have a major share in the meat alternatives and functional food segments. Technological advancements have helped enhance the functionality of soy protein, which has led to the successful replacement of meat protein with soy protein. Infant formulations for lactose intolerants comprise a large amount of soy protein isolates containing no lactose. Soy protein are formulated to suit specific applications, such as bakery, confectionery, beverage, dairy replacers, or meat alternatives. Consumer shift towards plant-based food is expected to drive the food segment in soy protein ingredients market.

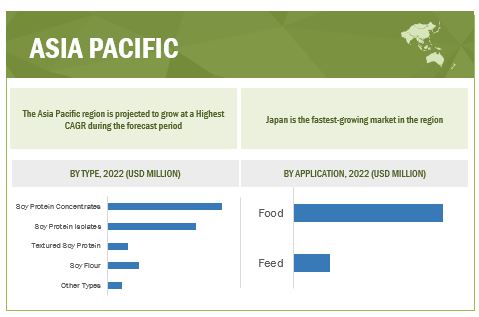

Asia Pacific is projected to be the fastest growing region in market, in 2022; it is anticipated to grow at a significant CAGR

To know about the assumptions considered for the study, download the pdf brochure

The soy protein ingredients market in Asia Pacific is projected to witness strong growth driven by large economies, such as China, India, Japan, and Australia. The level of overall investment in the region has increased substantially over the past decade, especially in China. The region has also witnessed a rise in vegan food consumption in recent years. The perceived benefits regarding people’s health, environment, and religious considerations significantly contribute to the adoption of vegan and vegetarian diets in the region. Also, the rising health concerns have led people to reduce their meat intake and add plant-based foods, including soy proteins, to their diets.

Key Players in Soy Protein Ingredients Industry

The key players in this market include ADM (US), Wilmar International Co., Ltd. (Singapore), Cargill, Incorporated (US), CHS, Inc. (US), and Fuji Oil Holdings Inc (Japan)

Soy Protein Ingredients Market Report Scope

|

Report Metric |

Details |

|

Market Valuation in 2022 |

USD 7.7 billion |

|

Revenue Forecast in 2027 |

USD 10.8 billion |

|

Surge rate |

CAGR of 7.0% |

|

Regions covered |

North America, Asia Pacific, Europe, South America and RoW |

|

Companies studied |

|

Target Audience:

- Soy protein raw material (ingredients) suppliers

- Soy Protein based product manufacturers

- Intermediate suppliers, such as traders and distributors of soy protein ingredients based food and feed

- Soy protein ingredients based food and feed exporting companies

- Government and soy protein research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- European Food Safety Authority (EFSA)

- The Association of American Feed Control Officials

- Food Standards Australia New Zealand

- US Food and Drug Administration (FDA) (US)

- World Health Organization (WHO)

Soy Protein Ingredients Market Report Segmentation:

|

Segment |

Subsegment |

| Market by Type |

|

| Market by Application |

|

| Market by Form |

|

| Market by Nature |

|

| Market by Function |

|

| Market by Region |

|

Recent Developments in Soy Protein Ingredients Market

- In August 2022, ADM signed an agreement with US-based food and feed ingredients manufacturer, Benson Hill. The agreement provides ADM with exclusive license in North America to process grain derived from Benson Hill’s ultra-high protein soybeans to produce and sell protein concentrates, texturized protein concentrates, protein isolates and high protein texturized flour for the human food ingredients market. This will enhance the quality of soy proteins offered by ADM, with greater protein content.

- In November 2019, Wilmar International Ltd announced to collaborate with US-based Bunge Limited in Vietnam’s meal market. Wilmar assumed the responsibility for sales of soymeal, corn, feed, wheat, and other agri products. This collaboration will help both the companies cater to the Vietnamese market, which will contribute to their sales revenue.

- In November 2022, Cargill, Incorporated entered into an agreement to add Owensboro Grain Company (US) to its North American agricultural supply chain business. The acquisition will help Cargill offer more soy products such as protein meal and hull pellets for animal feeds.

- In November 2022, International Flavors & Fragrances Inc. launched Supro Tex, a soy-based plant protein ingredient. The ingredient has 80% protein content which gives it’s a protein profile comparable to animal meat. It is the newest addition to IFF’s Reimagine-Protein Program commenced in 2017. The launch will help IFF expand its product portfolio in the soy protein ingredients category.

Frequently Asked Questions (FAQ):

How big is the soy protein ingredients market?

By 2027, the soy protein ingredients market will be worth $10.8 billion, increasing at a CAGR of 7.0% between 2022 and 2027.

What is the estimated growth rate of soy protein ingredients market?

The soy protein ingredients market is expected to grow at a CAGR of 7.0% from 2022 to 2027.

What are the major revenue pockets in the soy protein ingredients market currently?

The Asia Pacific soy protein ingredients market is set to witness strong growth, propelled by large economies like China, India, Japan, and Australia, supported by significant investment surge, particularly in China, over the past decade.

What are the segments of soy protein ingredients market?

The global soy protein ingredients market is segmented into type, application, form, nature, function and region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

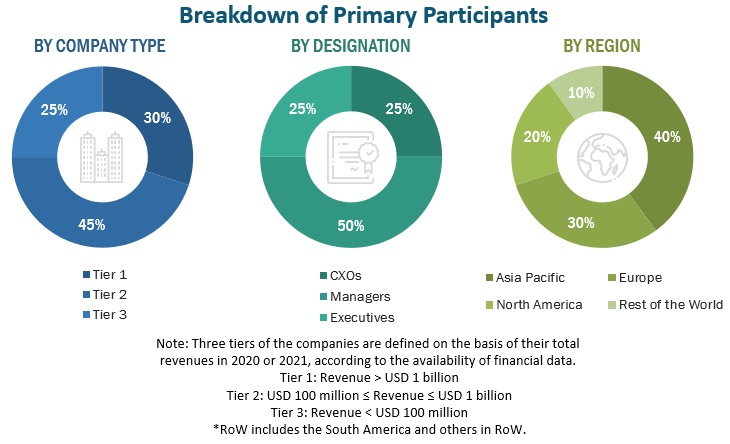

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the soy protein ingredients market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the research design applied in drafting this report on the market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the soy protein ingredients market.

To know about the assumptions considered for the study, download the pdf brochure

Soy Protein Ingredients Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major soy protein ingredients-based food and feed manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the soy protein ingredients market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global soy protein ingredients market on the basis of type, application, form, nature, function and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe region for soy protein ingredients market into Denmark, Russia, and other EU and non-EU countries.

- Further breakdown of the Asia Pacific region for market into Thailand, Vietnam, Indonesia, South Korea, Malaysia, Singapore, and the Philippines.

- Further breakdown of the Rest of South America region for market into Colombia, Chile, and Peru.

- Further breakdown of other countries in the RoW market for market into Middle East and Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Soy Protein Ingredients Market