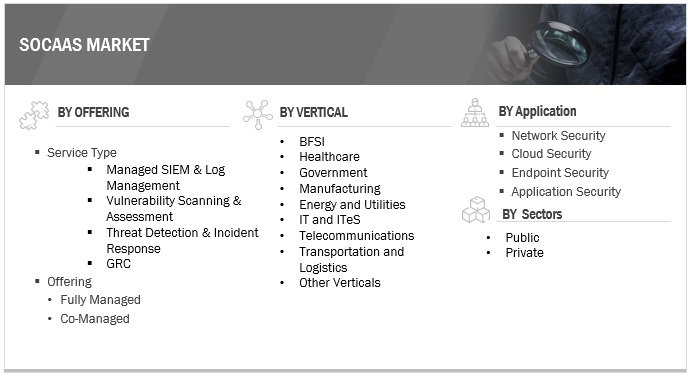

SOC as a Service Market by Service Type (Managed SIEM and log Management, Vulnerability Scanning and assessment, Threat Detection & Incident Response, and GRC), Offering, Application, Sectors, Vertical and Region - Global Forecast to 2028

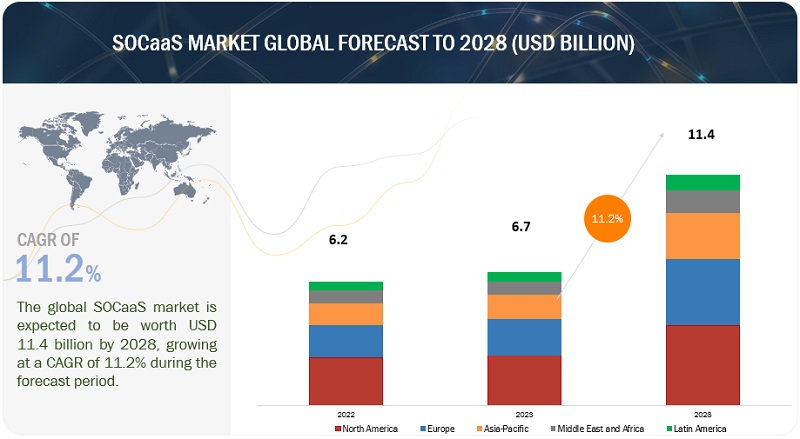

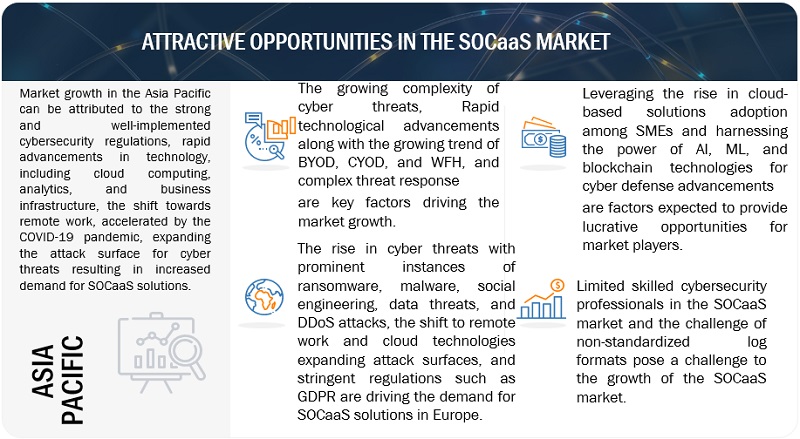

[392 Pages Report] The global SOC as a Service Market size is projected to grow from USD 6.7 billion in 2023 to USD 11.4 billion by 2028 at a CAGR of 11.2% during the forecast period. The SOCaaS market is witnessing significant growth driven by several factors. These factors encompass the escalating intricacy of cyber risks, swift progressions in technology, and the increasing adoption of practices like BYOD, CYOD, and WFH, along with intricate countermeasures against threats. Businesses are actively pursuing resilient SOCaaS resolutions to shield their data and activities while adopting contemporary methodologies and advancements in cybersecurity. In response to this demand, SOCaaS providers are leveraging the opportunity by furnishing inventive remedies to secure digital properties and guarantee the confidentiality and soundness of information. These trends collectively contribute to the expansion and importance of SOCaaS in the market. The SOCaaS market benefits from opportunities driven by leveraging the rise in cloud-based solutions adoption among SMEs and harnessing the power of AI, ML, and blockchain technologies for cyber defense advancements. These factors create favorable conditions for the market’s growth, with organizations seeking advanced solutions to safeguard their systems and valuable data, further contributing to the rising demand for SOCaaS solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

In the context of the SOCaaS market, the advent of a recession introduces a twofold challenge and opportunity landscape. Typically regarded as a bastion of stability due to the perpetual nature of cyber threats, the SOCaaS market is not immune to the economic flux brought about by recessions. Organizations, prompted by financial prudence, may reevaluate their cybersecurity expenditure, potentially impacting the rate of SOCaaS adoption. However, this period of financial constraint also elevates the significance of robust cybersecurity, as threat actors capitalize on economic vulnerabilities. This duality prompts SOCaaS providers to navigate a complex path. To address these dynamics, providers must underscore the cost-effective nature of their services, emphasizing risk mitigation while also showcasing their capacity to counteract intensifying cyber threats adeptly. This balance will determine the sector’s ability to endure recessionary pressures and emerge stronger by aligning cybersecurity needs with fiscal realities.

COVID-19 Impact

The COVID-19 pandemic profoundly impacted the SOCaaS market, driven by the sudden surge in remote work and online activities. With the shift to work-from-home arrangements, organizations had to adopt SOCaaS tools and services to ensure business continuity rapidly. However, this rapid transition also exposed vulnerabilities and challenges in SOCaaS. Schools faced cybersecurity struggles as they transitioned to distance learning, leaving them susceptible to security breaches. Social engineering attacks increased, preying on people’s fears and reliance on online information. Small and medium-sized businesses facing financial constraints found it challenging to prioritize SOCaaS.

The rush to develop contact tracing apps and remote healthcare solutions also led to security oversights, making these platforms potential targets for cyberattacks. Furthermore, cloud-based video conferencing and entertainment platforms witnessed a massive increase in demand, requiring robust encryption and protection measures.

Socaas Market Dynamics

Driver: Complex Threat Response Drives Demand for SOCaaS

The journey from threat identification to protection is intricate in the cybersecurity domain. The process, known as “Cumbersome Administration After Threat Detection,” involves complex administrative steps post-detection. SOCaaS streamlines this process by leveraging specialized teams and advanced technologies to handle administrative tasks. This allows internal teams to focus on strategic decisions, accelerating response times and enhancing threat mitigation effectiveness. Thus, SOCaaS is a key driver in efficiently transitioning from threat detection to resolution, bolstering overall cybersecurity.

Restraint: Data Privacy and Compliance Concerns

As organizations consider adopting SOCaaS to enhance cybersecurity, data privacy, and compliance concerns arise due to entrusting data to external providers. Stricter data protection regulations like GDPR necessitate thorough scrutiny of SOCaaS practices to ensure data security. Neglecting data privacy and compliance can lead to financial penalties and reputational damage. Organizations must evaluate SOCaaS protocols, including encryption, access controls, and contracts. Secure data management is vital not only for compliance but also for building trust with clients. Prioritizing data privacy and compliance in SOCaaS adoption builds trust and accountability for sustained data security efforts.

Opportunity: Harnessing the Power of AI, ML, and Blockchain Technologies for Cyber Defense Advancements

The SOCaaS market is undergoing a transformative shift through the strategic incorporation of cutting-edge technologies such as AI, ML, and blockchain. This convergence offers unprecedented opportunities to enhance cyber defense capabilities. AI and ML enable SOCaaS providers to analyze vast data volumes swiftly and accurately, surpassing human abilities. It empowers proactive threat detection and even prediction of future attacks. Additionally, integrating blockchain technology ensures data integrity and transparency, strengthening collaboration between SOCaaS providers and organizations. This amalgamation enables SOCaaS solutions to offer advanced, adaptive security measures that keep pace with evolving cyber threats, heralding a new era of cyber defense sophistication.

Challenge: Limited Skilled Cybersecurity Professionals in the SOCaaS Market

A significant challenge confronting the SOCaaS market is enterprises’ shortage of skilled cybersecurity professionals. As the demand for robust cyber defense escalates, the lack of adept experts becomes a substantial barrier to unlocking the full potential of SOCaaS solutions.

In the face of an evolving threat landscape, a workforce well-versed in tackling intricate cyber challenges is imperative. However, the scarcity of cybersecurity professionals with the knowledge to effectively navigate threat detection, analysis, and response impedes the seamless adoption and utilization of SOCaaS solutions. Organizations contend with fierce competition for a limited talent pool possessing specialized skills to manage advanced security tools, interpret threat cues, and orchestrate efficient incident response strategies. This challenge is exacerbated by the rapidly changing cyber threat landscape, necessitating a constant learning curve for cybersecurity professionals. The shortage of skilled experts risks creating a disparity between the advanced capabilities of SOCaaS solutions and the capacity to maximize their benefits. As organizations prioritize safeguarding digital assets and sensitive data, the scarcity of proficient cybersecurity professionals emerges as a critical challenge, urging the pursuit of innovative resolutions.

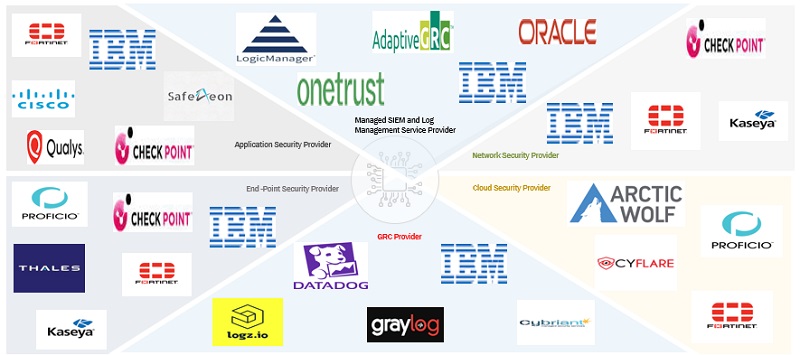

SOCaaS Market Ecosystem

By Service Type, the threat detection and incident response segment accounts for the highest CAGR during the forecast period.

The threat detection and incident response segment achieved the highest CAGR in the SOCaaS market’s service type segmentation due to its pivotal role in countering evolving cyber threats. The following segment encompasses rapid threat detection, expert incident response, and proactive measures to prevent breaches. As cyberattacks grow in sophistication, organizations seek specialized services to identify and mitigate threats swiftly. SOCaaS offerings in threat detection and incident response provide real-time monitoring, advanced threat analysis, and efficient coordination in tackling security incidents. This demand, driven by the urgency to safeguard digital assets and maintain business continuity, positions the threat detection and incident response segment as a central driver of SOCaaS market growth during the forecasted period.

By Security Type, the endpoint security segment accounts for the largest market size during the forecast period

The endpoint security segment held the largest market size in the SOCaaS market’s security type segmentation due to its critical role in countering diverse and evolving cyber threats. Endpoints are common targets for attacks, especially with the rise of remote work, necessitating robust protection. SOCaaS’s endpoint security offers real-time monitoring, rapid threat detection, and incident response for devices like laptops, smartphones, and IoT gadgets. With data breaches and various attack vectors becoming more sophisticated, organizations prioritize endpoint security solutions for comprehensive protection. The demand, driven by the ubiquity of endpoints and the increasing complexity of threats, establishes the endpoint security segment as the largest in the SOCaaS market during the forecasted period.

By Vertical, BFSI vertical accounts for the largest market size during the forecast period.

The BFSI vertical held the largest size in the SOCaaS market’s vertical segmentation due to its unique blend of factors. These include the sector’s handling of high-value data, stringent regulatory compliance demands like HIPAA, the escalating landscape of cyber threats, its complex digital transformation, vulnerabilities tied to healthcare IoT devices, the direct impact on patient safety, reputation preservation, and the imperative to protect critical research data. As healthcare advances in the digital age, SOCaaS is indispensable to ensure patient privacy, regulatory adherence, and uninterrupted, safe, and secure healthcare services. Thus, the convergence of challenges and demands positions the BFSI vertical as a pivotal driver of SOCaaS market growth in the forecasted period.

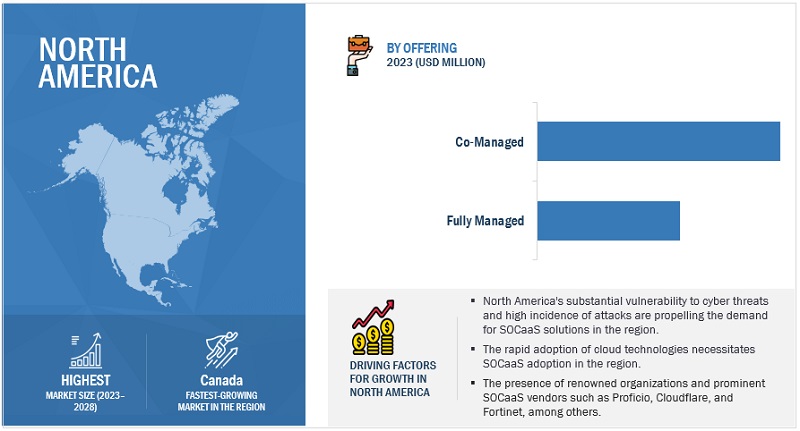

By region, North America accounts for the highest market size during the forecast period.

During the forecast period, North America commands the largest market share by region. This dominance is attributed to a confluence of factors, including the presence of key industry players, a heightened frequency of cyberattacks, the rapid adoption of cloud-based technologies, and the imperative to adhere to rigorous security regulations. North America’s substantial market size reflects its vulnerability to cyber threats, with notable cyberattack increases in recent years. This heightened risk and the region’s concentration of critical infrastructure and sensitive data have spurred the demand for robust security solutions like SOCaaS. Furthermore, the surge in cloud-based applications has amplified the need for enhanced cybersecurity, driving North American organizations to embrace SOCaaS for vigilant monitoring and protection. The region’s proactive response to compliance requirements further solidifies its position as a frontrunner in the SOCaaS market, as organizations turn to these solutions to meet stringent security standards.

Key Market Players

Some of the well-established and key market players in the SOCaaS market include NTT (Japan), Verizon (US), Lumen Technology (US), Atos (France), Fortinet (US), Thales (France), Kaseya (US), Cloudflare (US), AT&T (US), Arctic Wolf (US), Trustwave (US), Proficio (US), Airbus (France), ConnectWise (US), Clearnetwork, Inc (US)., Stratosphere Networks (US), eSec Forte (India), Cybersafe Solutions (US), eSentire (Canada), CyberSecOp (US), TECEZE (UK), Netsurion (US), Foresite Cybersecurity (US), Ascend Technologies (US), inSOC (US), SafeAeon (US), SOCWISE (Hungary), Wizard Cyber (UK), and Eventus Security (India).

Want to explore hidden markets that can drive new revenue in SOC as a Service Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in SOC as a Service Market?

|

Report Metrics |

Details |

|

Market size available for years |

|

|

Base year considered |

|

|

Forecast period |

|

|

Forecast units |

|

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

|

The study categorizes the SOCaaS market by service type, offering, application, sectors, verticals, and regions.

By Region:

Recent Developments

- In June 2023, AT&T (France) partnered with Vertek (US) to offer Unified Security Management (USM) Anywhere services to enterprises. The collaboration involved Vertek’s advanced SOC, providing proactive and predictive threat detection and mitigation services to safeguard clients from global cyber threats. Further, the SOC services offered by Vertek, powered by AT&T Cybersecurity’s platform, encompass real-time intrusion detection, monitoring, response, vulnerability scanning, behavioral monitoring, and SIEM and log management.

- In April 2022, NTT Communications (Japan) introduced “OsecT,” a cloud-based security service that visualizes and identifies security risks within control systems for factory production lines, primarily focusing on SMEs. The service’s visualization and detection capabilities aligned with the goals of SOCaaS by enhancing risk visibility and enabling prompt responses to anomalies. By addressing potential vulnerabilities in control systems, “OsecT” contributed to a more secure and resilient manufacturing environment, aligning with the broader objectives of the SOCaaS market.

- In October 2022, Arctic Wolf (US) extended its comprehensive security operations solutions to the Australian and New Zealand markets. This portfolio includes Managed Detection and Response, Managed Risk, and Managed Security Awareness, all seamlessly delivered through the Arctic Wolf Security Operations Cloud.

- In August 2022, Fortinet (US) and NEC Corporation (Japan) entered a global agreement to jointly build secure 5G networks for communication service providers (CSPs). This collaboration aimed to ensure secure and sustainable networking in the 5G era, addressing emerging threats and architectural shifts brought by increased data traffic and Multi-access Edge Computing (MEC). The partnership would focus on network security use cases and services crucial to 5G, such as Radio Access Network, Mobile Roaming, Gi-LAN/N6, and Telco/Edge Cloud Security. The combined strengths of Fortinet’s security solutions and NEC’s network integration capabilities would empower CSPs to protect against known and unknown threats while maintaining customer experience.

- In May 2021, Cloudflare (US) launched SOC as a Service, a security product, and a team of cybersecurity experts within Cloudflare. It combined its security products with a team of cybersecurity experts to provide 24×7×365 monitoring for security threats and operational disruptions. The service included triaging and responding to alerts, performing in-depth analysis, implementing countermeasures, and offering proactive engagement to keep organizations safe. Additionally, it collaborated with MSSPs to provide a comprehensive end-to-end security solution.

Frequently Asked Questions (FAQ):

What are the opportunities in the global SOCaaS market?

Leveraging the rise in cloud-based solutions adoption among SMEs and harnessing the power of AI, ML, and blockchain technologies for cyber defense advancements are creating market opportunities for the global SOCaaS market.

What is the definition of the SOCaaS market?

According to MarketsandMarkets, SOCaaS is defined as the outsourced or third-party services that provide 24x7x365 days of monitoring and managing a company's security infrastructure with the support of a security analyst. This security infrastructure includes SIEM/logs, devices, clouds, networks, and internal security and IT team assets.

Which region is expected to show the highest market share in the SOCaaS market?

North America is expected to account for the largest market share during the forecast period.

Who are the key players operating in the 5G security market?

Major vendors, namely, include NTT (Japan), Verizon (US), Lumen Technology (US), Atos (France), Fortinet (US), Thales (France), Kaseya (US), Cloudflare (US), AT&T (US), Arctic Wolf (US), Trustwave (US), Proficio (US), Airbus (France), ConnectWise (US), Clearnetwork, Inc (US)., Stratosphere Networks (US), eSec Forte (India), Cybersafe Solutions (US), eSentire (Canada), CyberSecOp (US), TECEZE (UK), Netsurion (US), Foresite Cybersecurity (US), Ascend Technologies (US), inSOC (US), SafeAeon (US), SOCWISE (Hungary), Wizard Cyber (UK), and Eventus Security (India).

What is the current size of the global SOCaaS market?

The global SOCaaS market size is projected to grow from USD 6.7 billion in 2023 to USD 11.4 billion by 2028 at a CAGR of 11.2% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 EVOLUTIONEARLY DAYS AND TRADITIONAL FOCUSINTEGRATION OF COMPLIANCE AND TECHNOLOGYGOLDEN PERIOD OF EVOLUTIONEMERGENCE OF MANAGED SECURITY SERVICES PROVIDERS (MSSPS)RISE OF NEXT-GEN SOCSTHREAT INTELLIGENCE AND CLOUD SECURITYPOST-PANDEMIC CHALLENGES AND BEYONDMODERN CYBER DEFENSE CENTERSSERVICES OFFERED BY MODERN CYBER DEFENSE CENTERS

-

5.3 FRAMEWORKBENEFITS OF SOC AS A SERVICEFEATURES OF SOC AS A SERVICE MARKET FRAMEWORK

-

5.4 MARKET DYNAMICSDRIVERS- Increase in complexity of cyber threats- Rapid technological advancements along with growing trends of BYOD, CYOD, and WFH- Complex threat response processRESTRAINTS- Data privacy and compliance concerns- Integration complexity with compatibility and interoperability issues- Cost constraintsOPPORTUNITIES- Rise in adoption of cloud-based solutions among SMEs- Harnessing power of AI, ML, and blockchain technologies for cyber defense advancementsCHALLENGES- Limited skilled cybersecurity professionals- Non-standardized log formats

-

5.5 CASE STUDY ANALYSISINSPIRA ENHANCED CYBERSECURITY WITH MODERNIZED SOC POWERED BY IBM QRADARCHILLISOFT AND ADVANTAGE EMPOWERED FIJI NATIONAL UNIVERSITY’S CYBERSECURITY WITH SOC AS A SERVICECYBERSECOP HELPED MULTIPLE INDUSTRIES IN ENHANCING CYBER SECURITY WITH SOC AS A SERVICE

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 ECOSYSTEM

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 PRICING ANALYSISSOC PRICES OF KEY PLAYERS, BY SOC TYPE

-

5.10 TECHNOLOGY ANALYSISEXTENDED DETECTION AND RESPONSE (XDR)DECEPTION TECHNOLOGYCLOUD-NATIVE SECURITYZERO TRUST ARCHITECTUREBLOCKCHAIN TECHNOLOGYAI/ML ADVANCEMENT- Real-time threat detection- Behavioral analytics- Threat hunting & analysis- Security orchestration & automation- Predictive analyticsQUANTUM-SAFE CRYPTOGRAPHY

-

5.11 PATENT ANALYSIS

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

- 5.13 TECHNOLOGY ROADMAP

-

5.14 BUSINESS MODELCUSTOMERSPRODUCTS AND SERVICESPRICINGDISTRIBUTION CHANNELSMARKETING & SALESPARTNERSHIPSOPERATIONSPROFITABILITY

-

5.15 TARIFF AND REGULATORY LANDSCAPEPAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI–DSS)GENERAL DATA PROTECTION REGULATION (GDPR)SARBANES-OXLEY ACT (SOX)CALIFORNIA CONSUMER PRIVACY ACT (CCPA)GRAMM-LEACH-BLILEY ACT OF 1999 (GLBA)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) STANDARD 27001REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.16 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.17 KEY CONFERENCES AND EVENTS

-

6.1 INTRODUCTIONTHREAT TYPE: MARKET DRIVERS

-

6.2 ADVANCED PERSISTENT THREATS (APTS)SURGE IN APT THREATS ALONG WITH TECHNOLOGICAL ADVANCEMENTS

-

6.3 INSIDER THREATSEMERGING PRACTICES, INCLUDING BYOD, REMOTE WORK, AND ONGOING MIGRATION

-

6.4 DISTRIBUTED DENIAL OF SERVICE (DDOS) ATTACKSINCREASED DIGITALIZATION, POLITICAL UNREST, AND SURGE IN WORK-FROM-HOME ACTIVITIES

-

6.5 MALWARE & RANSOMWARELACK OF CYBERSECURITY PREPAREDNESS, ALONG WITH COMBINATION OF TECHNOLOGICAL, FINANCIAL, AND SOCIETAL FACTORS

-

6.6 PHISHING & SOCIAL ENGINEERING ATTACKSGLOBAL REACH OF ONLINE PLATFORMS AND SURGE IN REMOTE WORK

-

7.1 INTRODUCTIONSERVICE TYPE: MARKET DRIVERS

-

7.2 MANAGED SIEM & LOG MANAGEMENTEXPERT SECURITY MONITORING, ADVANCED THREAT DETECTION, AND EFFICIENT INCIDENT RESPONSEMANAGED SIEM & LOG MANAGEMENT: MARKET DRIVERS

-

7.3 VULNERABILITY SCANNING & ASSESSMENTENHANCED PROACTIVE SECURITY, INCIDENT RESPONSE, AND THREAT MITIGATION CAPABILITIESVULNERABILITY SCANNING & ASSESSMENT: MARKET DRIVERS

-

7.4 THREAT DETECTION & INCIDENT RESPONSEEARLY THREAT IDENTIFICATION, SWIFT RESPONSE, AND EFFECTIVE MITIGATIONTHREAT DETECTION & INCIDENT RESPONSE: MARKET DRIVERS

-

7.5 GOVERNANCE RISK & COMPLIANCE (GRC)EMPHASIZING IMPORTANCE OF RISK MANAGEMENT, COMPLIANCE, AND UNIFIED SECURITY STRATEGYGOVERNANCE RISK & COMPLIANCE: MARKET DRIVERS

- 8.1 INTRODUCTION

-

8.2 FULLY MANAGEDRISE IN DEMAND FOR CONVENIENCE ALONG WITH COST AND TIME EFFICIENCYFULLY MANAGED: MARKET DRIVERS

-

8.3 CO-MANAGEDCO-MANAGED SERVICES HELP ADDRESS PRIVACY AND SCALABILITY CONCERNSCO-MANAGED: MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 LARGE ENTERPRISESRAPID INCREASE IN BYOD/CYOD FOLLOWED BY RISE IN SECURITY ATTACKSLARGE ENTERPRISES: MARKET DRIVERS

-

9.3 SMESCOST BENEFITS AND HIGH-SECURITY RISKS TO FACTOR IN FOR SMESSMES: MARKET DRIVERS

- 10.1 INTRODUCTION

-

10.2 NETWORK SECURITYINCREASE IN USAGE OF CLOUD AND DIGITAL PLATFORMS AND RISE IN NETWORK ATTACKSNETWORK SECURITY: MARKET DRIVERS

-

10.3 CLOUD SECURITYCONCERNS REGARDING SENSITIVE DATA STORED ON CLOUDCLOUD SECURITY: MARKET DRIVERS

-

10.4 ENDPOINT SECURITYHIGHER NUMBER OF MOBILE DEVICES AND GROWTH IN BYOD/CYOD TRENDENDPOINT SECURITY: MARKET DRIVERS

-

10.5 APPLICATION SECURITYGROWTH IN DIGITALIZATION AND BUSINESS-SENSITIVE APPLICATIONSAPPLICATION SECURITY: MARKET DRIVERS

-

11.1 INTRODUCTIONSECTOR: MARKET DRIVERS

-

11.2 PUBLIC SECTORMANAGEMENT OF CRITICAL INFRASTRUCTURE AND STRINGENT REGULATIONSPUBLIC SECTOR: MARKET DRIVERS

-

11.3 PRIVATE SECTORINCREASE IN CYBERATTACKS AND NEED TO PROTECT HUGE DATAPRIVATE SECTOR: MARKET DRIVERS

-

12.1 INTRODUCTIONVERTICAL: MARKET DRIVERS

-

12.2 BFSIGROWTH IN IMPORTANCE OF DATA CONFIDENTIALITY AND INTEGRITY

-

12.3 HEALTHCARERISE IN AWARENESS REGARDING PROTECTION OF PATIENT DATA

-

12.4 GOVERNMENTNEED TO MAINTAIN DATA INTEGRITY AND CONFIDENTIALITY

-

12.5 MANUFACTURINGAUTOMATION AND NEED TO PROTECT CRITICAL SYSTEMS AND DATA

-

12.6 ENERGY & UTILITIESINCREASE IN DIGITALIZATION AND HANDLING OF HUGE SENSITIVE CUSTOMER DATA

-

12.7 IT & ITESHIGHER DEPENDENCY ON DIGITAL INFRASTRUCTURE AND TECHNOLOGY-DRIVEN OPERATIONS

-

12.8 TELECOMMUNICATIONSNEED TO SAFEGUARD VARIOUS NETWORK COMPONENTS AND URGENCY TO STOP SEVERAL FRAUDS

-

12.9 TRANSPORTATION & LOGISTICSDEMAND FOR IOT AND CLOUD-BASED APPLICATIONS WITH LACK OF CYBER REGULATIONS

- 12.10 OTHER VERTICALS

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Government-backed initiatives and escalating cyber threatsCANADA- Elevated cyber breaches and ransomware attacks

-

13.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Resilient response to escalating cyber threats and cloud transitionGERMANY- Germany’s dynamic digitalization and critical infrastructure vulnerabilitiesFRANCE- Increase in French organizations’ interest in adopting AI/ML, automation, loT, and blockchain to fight cybersecurity concernsSPAIN- Evolution of cybersecurity landscapeITALY- Escalation of cyber threats, especially ransomware attacksNETHERLANDS- Urgent need for SoC with evolving threat landscapeREST OF EUROPE

-

13.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Technological surge and large-scale adoption of cloud solutionsJAPAN- Early adoption of advanced technologies and rise in cybersecurity breachesINDIA- Rapid adoption of cloud and advanced technologies, especially in banking and financial servicesSINGAPORE- Escalating cyber threats, especially phishing threats, amid rapid cloud adoptionAUSTRALIA & NEW ZEALAND- Australia's Secure Cloud Strategy and New Zealand's revised 2020 policy, Cloud First, focusing on secure cloud utilizationREST OF ASIA PACIFIC

-

13.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEUAE- Increase in government support with surge in cyber-attacksSOUTH AFRICA- Fifth largest number of cybercrime victimsKINGDOM OF SAUDI ARABIA (KSA)- National Cybersecurity Authority issued Essential Cybersecurity Controls, underlining significance of third-party cybersecurityQATAR- Q-CERT and Critical Information Infrastructure Protection collaborate with organizations and citizens to bolster overall cybersecurityISRAEL- Increase in cloud adoption and emerging SOC as a Service vendorsREST OF THE MIDDLE EAST & AFRICA

-

13.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Dominant economy and early adopter of advanced technologiesMEXICO- Growth in digitalization and presence of SOC as a Service vendorsREST OF LATIN AMERICA

- 14.1 OVERVIEW

- 14.2 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 14.3 HISTORICAL REVENUE ANALYSIS

- 14.4 VALUATION AND FINANCIAL METRICS OF KEY SOC AS A SERVICE VENDORS

- 14.5 RANKING OF KEY PLAYERS

- 14.6 MARKET SHARE ANALYSIS

-

14.7 KEY COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING OF KEY PLAYERS

-

14.8 STARTUP/SME COMPANY EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING FOR STARTUPS

-

14.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES & ENHANCEMENTSDEALS

-

15.1 KEY PLAYERSNTT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVERIZON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLUMEN TECHNOLOGY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewATOS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFORTINET- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHALES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKASEYA- Business overview- Products/Solutions/Services offered- Recent developmentsCLOUDFLARE- Business overview- Products/Solutions/Services offered- Recent developmentsAT&T- Business overview- Products/Solutions/Services offered- Recent developmentsARCTIC WOLF- Business overview- Products/Solutions/Services offered- Recent developmentsTRUSTWAVE- Business overview- Products/Solutions/Services offered- Recent developmentsPROFICIO- Business overview- Products/Solutions/Services offered- Recent developmentsAIRBUS- Business overview- Products/Solutions/Services offered- Recent developmentsCONNECTWISE- Business overview- Products/Solutions/Services offered- Recent developments

-

15.2 OTHER PLAYERSCLEARNETWORK, INC.STRATOSPHERE NETWORKSESEC FORTECYBERSAFE SOLUTIONSESENTIRECYBERSECOPTECEZENETSURIONFORESITE CYBERSECURITYASCEND TECHNOLOGIESINSOCSAFEAEONSOCWISEWIZARDCYBEREVENTUS SECURITY

- 16.1 LIMITATIONS

- 16.2 MANAGED DETECTION AND RESPONSE (MDR) MARKET

- 16.3 MANAGED SECURITY SERVICES (MSS) MARKET

- 16.4 SECURITY INFORMATION AND EVENT MANAGEMENT (SIEM) MARKET

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2017–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 STUDY ASSUMPTIONS

- TABLE 4 STUDY LIMITATIONS

- TABLE 5 SOC AS A SERVICE MARKET ECOSYSTEM

- TABLE 6 PORTER’S FIVE FORCES MODEL: IMPACT ANALYSIS

- TABLE 7 SOC PRICES OF KEY PLAYERS, BY SOC TYPE (USD MILLION)

- TABLE 8 COST BREAKDOWN FOR DIFFERENT LEVELS OF SECURITY OPERATIONS CENTERS (SOCS)

- TABLE 9 CP CYBER: PRICING ANALYSIS

- TABLE 10 TECHNOLOGY ROADMAP

- TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 13 CONFERENCES AND EVENTS, 2023–2024

- TABLE 14 SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 15 SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 16 MANAGED SIEM & LOG MANAGEMENT SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 17 MANAGED SIEM & LOG MANAGEMENT SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 VULNERABILITY SCANNING & ASSESSMENT SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 19 VULNERABILITY SCANNING & ASSESSMENT SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 THREAT DETECTION & INCIDENT RESPONSE SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 21 THREAT DETECTION & INCIDENT RESPONSE SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 GRC SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 23 GRC SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 25 SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 26 FULLY MANAGED SOC AS A SERVICE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 27 FULLY MANAGED SOC AS A SERVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 CO-MANAGED SOC AS A SERVICE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 CO-MANAGED SOC AS A SERVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 31 SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 32 LARGE ENTERPRISES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 LARGE ENTERPRISES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 SMES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 SMES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 37 SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 NETWORK SECURITY APPLICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 NETWORK SECURITY APPLICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 CLOUD SECURITY APPLICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 CLOUD SECURITY APPLICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 ENDPOINT SECURITY APPLICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 ENDPOINT SECURITY APPLICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 APPLICATION SECURITY APPLICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 APPLICATION SECURITY APPLICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 47 SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 48 PUBLIC SECTOR MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 PUBLIC SECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 PRIVATE SECTOR MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 PRIVATE SECTOR MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 53 SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 54 BFSI VERTICAL MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 BFSI VERTICAL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 HEALTHCARE VERTICAL MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 HEALTHCARE VERTICAL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 GOVERNMENT VERTICAL MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 GOVERNMENT VERTICAL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MANUFACTURING VERTICAL MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 61 MANUFACTURING VERTICAL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 ENERGY & UTILITIES VERTICAL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 IT & ITES VERTICAL MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 65 IT & ITES VERTICAL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 67 TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 69 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 SOC AS A SERVICE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 71 SOC AS A SERVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: SOC AS A SERVICE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: SOC AS A SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 US: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 87 US: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 88 US: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 89 US: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 90 US: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 91 US: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 92 US: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 93 US: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 94 US: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 95 US: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 US: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 97 US: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 98 CANADA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 99 CANADA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 100 CANADA: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 101 CANADA: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 102 CANADA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 103 CANADA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 104 CANADA: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 105 CANADA: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 106 CANADA: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 107 CANADA: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 CANADA: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 109 CANADA: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 111 EUROPE: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 113 EUROPE: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 114 EUROPE: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 115 EUROPE: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 116 EUROPE: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 117 EUROPE: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 118 EUROPE: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 119 EUROPE: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 EUROPE: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 121 EUROPE: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: SOC AS A SERVICE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 123 EUROPE: SOC AS A SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 UK: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 125 UK: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 126 UK: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 127 UK: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 128 UK: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 129 UK: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 130 UK: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 131 UK: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 132 UK: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 133 UK: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 UK: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 135 UK: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 136 GERMANY: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 137 GERMANY: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 138 GERMANY: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 139 GERMANY: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 140 GERMANY: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 141 GERMANY: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 142 GERMANY: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 143 GERMANY: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 144 GERMANY: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 145 GERMANY: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 GERMANY: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 147 GERMANY: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 148 FRANCE: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 149 FRANCE: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 150 FRANCE: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 151 FRANCE: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 152 FRANCE: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 153 FRANCE: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 154 FRANCE: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 155 FRANCE: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 156 FRANCE: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 157 FRANCE: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 158 FRANCE: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 159 FRANCE: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 160 SPAIN: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 161 SPAIN: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 162 SPAIN: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 163 SPAIN: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 164 SPAIN: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 165 SPAIN: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 166 SPAIN: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 167 SPAIN: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 168 SPAIN: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 169 SPAIN: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 170 SPAIN: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 171 SPAIN: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 172 ITALY: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 173 ITALY: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 174 ITALY: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 175 ITALY: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 176 ITALY: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 177 ITALY: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 178 ITALY: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 179 ITALY: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 180 ITALY: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 181 ITALY: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 182 ITALY: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 183 ITALY: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 184 NETHERLANDS: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 185 NETHERLANDS: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 186 NETHERLANDS: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 187 NETHERLANDS: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 188 NETHERLANDS: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 189 NETHERLANDS: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 190 NETHERLANDS: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 191 NETHERLANDS: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 192 NETHERLANDS: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 193 NETHERLANDS: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 194 NETHERLANDS: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 195 NETHERLANDS: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 196 REST OF EUROPE: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 197 REST OF EUROPE: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 198 REST OF EUROPE: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 199 REST OF EUROPE: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 200 REST OF EUROPE: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 201 REST OF EUROPE: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 202 REST OF EUROPE: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 203 REST OF EUROPE: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 204 REST OF EUROPE: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 205 REST OF EUROPE: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 206 REST OF EUROPE: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 207 REST OF EUROPE: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 208 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 209 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 210 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 211 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 213 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 215 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 217 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 219 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 220 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY COUNTRY/REGION, 2017–2022 (USD MILLION)

- TABLE 221 ASIA PACIFIC: SOC AS A SERVICE MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 222 CHINA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 223 CHINA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 224 CHINA: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 225 CHINA: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 226 CHINA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 227 CHINA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 228 CHINA: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 229 CHINA: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 230 CHINA: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 231 CHINA: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 232 CHINA: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 233 CHINA: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 234 JAPAN: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 235 JAPAN: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 236 JAPAN: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 237 JAPAN: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 238 JAPAN: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 239 JAPAN: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 240 JAPAN: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 241 JAPAN: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 242 JAPAN: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 243 JAPAN: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 244 JAPAN: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 245 JAPAN: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 246 INDIA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 247 INDIA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 248 INDIA: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 249 INDIA: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 250 INDIA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 251 INDIA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 252 INDIA: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 253 INDIA: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 254 INDIA: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 255 INDIA: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 256 INDIA: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 257 INDIA: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 258 SINGAPORE: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 259 SINGAPORE: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 260 SINGAPORE: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 261 SINGAPORE: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 262 SINGAPORE: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 263 SINGAPORE: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 264 SINGAPORE: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 265 SINGAPORE: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 266 SINGAPORE: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 267 SINGAPORE: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 268 SINGAPORE: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 269 SINGAPORE: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 270 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 271 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 272 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 273 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 274 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 275 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 276 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 277 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 278 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 279 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 280 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 281 AUSTRALIA & NEW ZEALAND: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 282 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 283 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 284 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 285 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 286 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 287 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 288 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 289 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 290 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 291 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 292 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 293 REST OF ASIA PACIFIC: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 294 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 296 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 298 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 300 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 302 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 303 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 304 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 305 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 306 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 308 UAE: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 309 UAE: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 310 UAE: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 311 UAE: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 312 UAE: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 313 UAE: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 314 UAE: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 315 UAE: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 316 UAE: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 317 UAE: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 318 UAE: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 319 UAE: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 320 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 321 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 322 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 323 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 324 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 325 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 326 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 327 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 328 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 329 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 330 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 331 SOUTH AFRICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 332 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 333 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 334 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 335 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 336 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 337 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 338 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 339 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 340 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 341 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 342 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 343 KINGDOM OF SAUDI ARABIA: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 344 QATAR: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 345 QATAR: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 346 QATAR: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 347 QATAR: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 348 QATAR: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 349 QATAR: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 350 QATAR: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 351 QATAR: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 352 QATAR: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 353 QATAR: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 354 QATAR: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 355 QATAR: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 356 ISRAEL: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 357 ISRAEL: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 358 ISRAEL: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 359 ISRAEL: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 360 ISRAEL: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 361 ISRAEL: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 362 ISRAEL: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 363 ISRAEL: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 364 ISRAEL: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 365 ISRAEL: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 366 ISRAEL: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 367 ISRAEL: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 368 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 369 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 370 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 371 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 372 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 373 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 374 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 375 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 376 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 377 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 378 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 379 REST OF MIDDLE EAST & AFRICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 380 LATIN AMERICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 381 LATIN AMERICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 382 LATIN AMERICA: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 383 LATIN AMERICA: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 384 LATIN AMERICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 385 LATIN AMERICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 386 LATIN AMERICA: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 387 LATIN AMERICA: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 388 LATIN AMERICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 389 LATIN AMERICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 390 LATIN AMERICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 391 LATIN AMERICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 392 LATIN AMERICA: SOC AS A SERVICE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 393 LATIN AMERICA: SOC AS A SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 394 BRAZIL: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 395 BRAZIL: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 396 BRAZIL: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 397 BRAZIL: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 398 BRAZIL: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 399 BRAZIL: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 400 BRAZIL: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 401 BRAZIL: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 402 BRAZIL: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 403 BRAZIL: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 404 BRAZIL: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 405 BRAZIL: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 406 MEXICO: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 407 MEXICO: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 408 MEXICO: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 409 MEXICO: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 410 MEXICO: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 411 MEXICO: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 412 MEXICO: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 413 MEXICO: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 414 MEXICO: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 415 MEXICO: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 416 MEXICO: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 417 MEXICO: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 418 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2017–2022 (USD MILLION)

- TABLE 419 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 420 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY SECTOR, 2017–2022 (USD MILLION)

- TABLE 421 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY SECTOR, 2023–2028 (USD MILLION)

- TABLE 422 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 423 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 424 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 425 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 426 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 427 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 428 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 429 REST OF LATIN AMERICA: SOC AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 430 SOC AS A SERVICE MARKET: DEGREE OF COMPETITION

- TABLE 431 KEY COMPANY FOOTPRINT, BY SERVICE TYPE

- TABLE 432 KEY COMPANY FOOTPRINT, BY REGION

- TABLE 433 LIST OF STARTUPS/SMES AND FUNDING

- TABLE 434 REGIONAL FOOTPRINT OF STARTUPS/SMES

- TABLE 435 SOC AS A SERVICE MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, MARCH 2022–AUGUST 2023

- TABLE 436 SOC AS A SERVICE MARKET: DEALS, FEBRUARY 2022–AUGUST 2023

- TABLE 437 NTT: BUSINESS OVERVIEW

- TABLE 438 NTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 439 NTT: PRODUCT LAUNCHES

- TABLE 440 NTT: DEALS

- TABLE 441 VERIZON: BUSINESS OVERVIEW

- TABLE 442 VERIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 443 VERIZON: DEALS

- TABLE 444 LUMEN TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 445 LUMEN TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 446 LUMEN TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 447 LUMEN TECHNOLOGY: DEALS

- TABLE 448 ATOS: BUSINESS OVERVIEW

- TABLE 449 ATOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 450 ATOS: PRODUCT LAUNCHES

- TABLE 451 FORTINET: BUSINESS OVERVIEW

- TABLE 452 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 453 FORTINET: PRODUCT LAUNCHES

- TABLE 454 FORTINET: DEALS

- TABLE 455 THALES: BUSINESS OVERVIEW

- TABLE 456 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 457 THALES: DEALS

- TABLE 458 KASEYA: BUSINESS OVERVIEW

- TABLE 459 KASEYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 460 KASEYA: PRODUCT LAUNCHES

- TABLE 461 KASEYA: DEALS

- TABLE 462 CLOUDFLARE: BUSINESS OVERVIEW

- TABLE 463 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 464 CLOUDFLARE: PRODUCT LAUNCHES

- TABLE 465 CLOUDFLARE: DEALS

- TABLE 466 AT&T: BUSINESS OVERVIEW

- TABLE 467 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 468 AT&T: DEALS

- TABLE 469 ARCTIC WOLF: BUSINESS OVERVIEW

- TABLE 470 ARCTIC WOLF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 471 ARCTIC WOLF: PRODUCT LAUNCHES

- TABLE 472 ARCTIC WOLF: DEALS

- TABLE 473 TRUSTWAVE: BUSINESS OVERVIEW

- TABLE 474 TRUSTWAVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 475 TRUSTWAVE: DEALS

- TABLE 476 PROFICIO: BUSINESS OVERVIEW

- TABLE 477 PROFICIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 478 PROFICIO: PRODUCT LAUNCHES

- TABLE 479 PROFICIO: DEALS

- TABLE 480 AIRBUS: BUSINESS OVERVIEW

- TABLE 481 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 482 AIRBUS: PRODUCT LAUNCHES

- TABLE 483 AIRBUS: DEALS

- TABLE 484 CONNECTWISE: BUSINESS OVERVIEW

- TABLE 485 CONNECTWISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 486 CONNECTWISE: PRODUCT LAUNCHES

- TABLE 487 CONNECTWISE: DEALS

- TABLE 488 ADJACENT MARKETS AND FORECASTS

- TABLE 489 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 490 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 491 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 492 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 493 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 494 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 495 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 496 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 497 MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 498 MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 499 MANAGED SECURITY SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

- TABLE 500 MANAGED SECURITY SERVICES MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

- TABLE 501 MANAGED SECURITY SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 502 MANAGED SECURITY SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 503 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 504 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 505 MANAGED SECURITY SERVICES MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

- TABLE 506 MANAGED SECURITY SERVICES MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

- TABLE 507 MANAGED SECURITY SERVICES MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 508 MANAGED SECURITY SERVICES MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 509 MANAGED SECURITY SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 510 MANAGED SECURITY SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 511 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 512 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

- TABLE 513 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

- TABLE 514 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

- TABLE 515 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

- TABLE 516 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

- FIGURE 1 SOC AS A SERVICE MARKET: RESEARCH DESIGN

- FIGURE 2 APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SERVICES OF SOC AS A SERVICE VENDORS

- FIGURE 3 APPROACH 1 (SUPPLY-SIDE) ANALYSIS: STEPS AND SOURCES

- FIGURE 4 SOC AS A SERVICE MARKET ESTIMATION: RESEARCH FLOW

- FIGURE 5 APPROACH 2 (BOTTOM-UP, DEMAND SIDE): SOC AS A SERVICE MARKET

- FIGURE 6 SOC AS A SERVICE MARKET: DATA TRIANGULATION

- FIGURE 7 COMPANY EVALUATION QUADRANT (KEY PLAYERS): CRITERIA WEIGHTAGE

- FIGURE 8 COMPANY EVALUATION QUADRANT (STARTUPS): CRITERIA WEIGHTAGE

- FIGURE 9 SOC AS A SERVICE MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 10 SOCAAS MARKET: SEGMENTS SNAPSHOT

- FIGURE 11 SOC AS A SERVICE MARKET: REGIONAL SNAPSHOT

- FIGURE 12 RISE IN CYBER-ATTACKS, NEED FOR ROUND-THE-CLOCK MONITORING, AND RAPID INCIDENT RESPONSE SERVICES TO BOOST MARKET GROWTH

- FIGURE 13 MANAGED SIEM & LOG MANAGEMENT SERVICES TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 14 FULLY MANAGED SOC AS A SERVICE TO BE LARGER MARKET THAN CO-MANAGED SERVICES DURING FORECAST PERIOD

- FIGURE 15 ENDPOINT SECURITY TO ACCOUNT FOR LARGEST APPLICATION MARKET DURING FORECAST PERIOD

- FIGURE 16 SOC AS A SERVICE IN PRIVATE SECTOR TO BE LARGER MARKET DURING FORECAST PERIOD

- FIGURE 17 ADOPTION OF SOC AS A SERVICE BY LARGE ENTERPRISES TO REMAIN LARGER DURING FORECAST PERIOD

- FIGURE 18 BFSI TO BE LARGEST VERTICAL MARKET DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 20 EVOLUTION OF SECURITY OPERATIONS CENTER

- FIGURE 21 SECURITY OPERATIONS CENTER AS A SERVICE FRAMEWORK

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SOC AS A SERVICE MARKET

- FIGURE 23 VALUE CHAIN OF SOC AS A SERVICE MARKET

- FIGURE 24 KEY PLAYERS IN SOC AS A SERVICE ECOSYSTEM

- FIGURE 25 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 PATENT ANALYSIS

- FIGURE 27 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 29 MANAGED SIEM & LOG MANAGEMENT SERVICES TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 30 FULLY MANAGED SOC AS A SERVICE OFFERINGS TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 31 LARGE ENTERPRISES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 32 CLOUD SECURITY APPLICATION TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 33 PRIVATE SECTOR USE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 HEALTHCARE VERTICAL TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC TO GROW AT HIGHEST CAGR BY 2028

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 38 SOC AS A SERVICE: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- FIGURE 39 HISTORICAL REVENUE ANALYSIS OF KEY SOC AS A SERVICE VENDORS, 2017–2022 (USD MILLION)

- FIGURE 40 VALUATION AND FINANCIAL METRICS OF KEY SOC AS A SERVICE VENDORS, 2022

- FIGURE 41 RANKING OF KEY SOC AS A SERVICE MARKET PLAYERS

- FIGURE 42 SOC AS A SERVICE MARKET SHARE, 2022

- FIGURE 43 SOC AS A SERVICE MARKET: KEY COMPANY EVALUATION QUADRANT, 2022

- FIGURE 44 SOC AS A SERVICE MARKET: STARTUP/SME COMPANY EVALUATION QUADRANT, 2022

- FIGURE 45 VERIZON: COMPANY SNAPSHOT

- FIGURE 46 LUMEN TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 47 ATOS: COMPANY SNAPSHOT

- FIGURE 48 FORTINET: COMPANY SNAPSHOT

- FIGURE 49 THALES: COMPANY SNAPSHOT

- FIGURE 50 CLOUDFLARE COMPANY SNAPSHOT

- FIGURE 51 AT&T: COMPANY SNAPSHOT

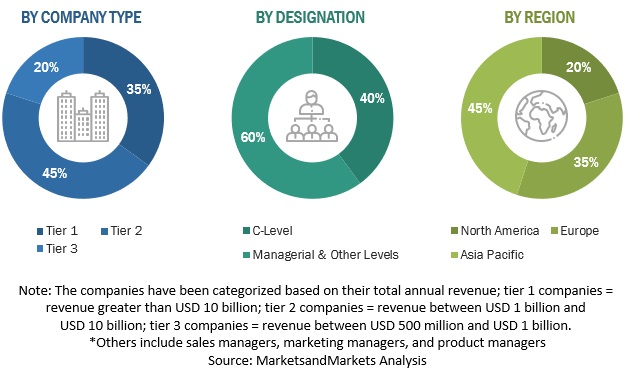

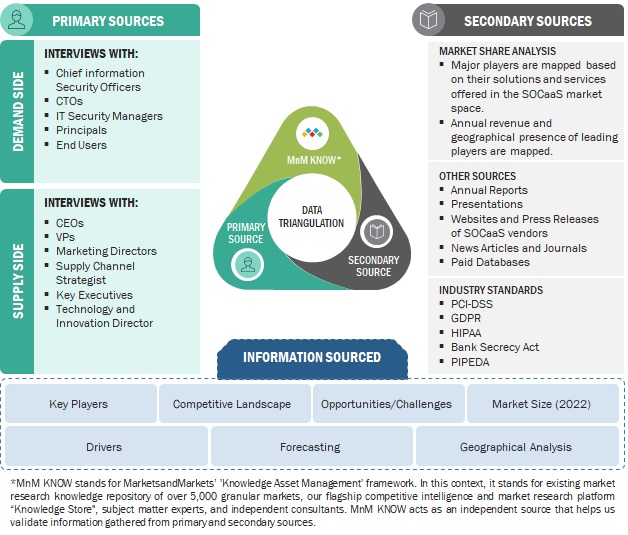

The study involved significant activities in estimating the current market size for SOCaaS. Intensive secondary research was conducted to collect information about SOCaaS and related ecosystems. The industry executives validated these findings, assumptions, and sizing across the value chain using a primary research process as a next step. Top-down and bottom-up market estimation approaches were used to estimate the market size globally, followed by the market breakup and data triangulation procedures to assess the market segment and sub-segments in SOCaaS.

Secondary Research Process:

In the secondary research process, various sources were referred to for identifying and collecting information regarding SOCaaS. These sources include annual reports, press releases, SOCaaS software and service vendor investor presentations, forums, vendor-certified publications, and industry/association white papers. These secondary sources were utilized to obtain key information about the SOCaaS’s solutions and services supply & value chain, a list of 100+ key players and SMEs, market classification, and segmentation per the industry trends and regional markets. The secondary research also gives us insights into the key developments from market and technology perspectives, which primary respondents further validated.

The factors considered for estimating the regional market size include technological initiatives undertaken by governments of different countries, gross domestic product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of primary SOCaaS solutions and service vendors.

Primary Research Process: