Sintered Steel Market by Type (Stainless Steel, Carbon Steel, Alloy Steel, Tool Steel), Process (Metal Injection Moulding, Additive Manufacturing, Conventional Manufacturing), End-Use, Application, & Region - Global Forecast 2028

Sintered Steel Market

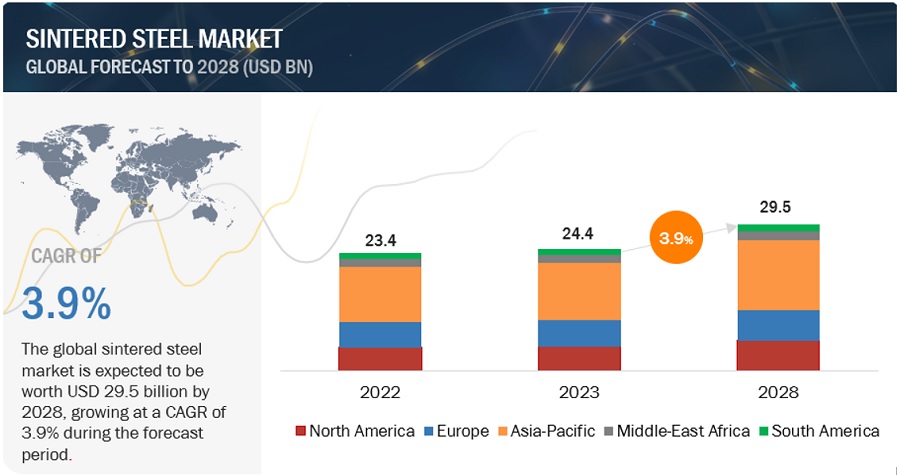

Sintered Steel Market is projected to grow from USD 24.4 billion in 2023 to USD 29.5 billion by 2028, at a cagr 3.9% during the forecast period. The market growth is driven by growing manufacturing and industrial sector. The industrialization and infrastructure development in emerging economies, such as China, India, and Southeast Asian countries, have increased the demand for sintered steel. The rapid urbanization, construction activities, and industrial growth in these regions drive the demand for sintered steel components in various sectors. Sintered steel finds applications in various industries, including machinery, construction, aerospace, and consumer goods. The increasing production activities and infrastructure development contribute to the demand for sintered steel components.

Attractive Opportunities in the Sintered Steel Market

To know about the assumptions considered for the study, Request for Free Sample Report

Sintered Steel Market Dynamics

Driver: Growing automotive industry

The growing automotive industry plays a significant role in driving the growth of the sintered steel market. The automotive industry is a major consumer of sintered steel components. As the global automotive production continues to rise, there is a higher demand for sintered steel parts in various vehicle systems. Sintered steel components are used in engines, transmissions, brakes, steering systems, fuel systems, and many other applications within vehicles. Sintered steel offers cost advantages over other manufacturing methods. The sintering process allows for efficient use of raw materials, reducing material waste and production costs. As the automotive industry seeks cost-effective solutions without compromising quality and performance, sintered steel becomes an attractive choice for various components. The growing automotive industry's focus on lightweighting, cost-efficiency, complex shapes, and high-performance applications aligns with the strengths of sintered steel. This synergy between the automotive industry's needs and the advantages of sintered steel drives its adoption and contributes to the growth of the sintered steel market.

Restraint: Volatile raw material (metal powders) prices

Raw material price fluctuations can be a considerable restraint for the sintered steel market, affecting the profitability and competitiveness of sintered steel companies The main raw materials required for sintered steel production include various metal powders such as iron, steel, tin, nickel, copper, molybdenum, and aluminum. When the cost of these raw materials increases, the cost of production increases. If sintered steel companies pass on these increased costs to their customers, they may lose business to competitors who can offer lower prices.

Opportunities: Growing electric vehicle (EV) market

The growing electric vehicle (EV) market presents significant opportunities for the sintered steel market. Electric vehicles require a range of specialized components, including electric motor cores, battery contacts, connectors, and power electronics. Sintered steel is well-suited for manufacturing these components due to its magnetic properties, high conductivity, and good dimensional accuracy. As the EV market expands, there will be a surge in demand for these sintered steel components, creating new opportunities for manufacturers.

Challenges: Material limitations

The mechanical properties of sintered steel, including strength, toughness, and fatigue resistance, can be influenced by factors such as powder composition, powder particle size distribution, and sintering conditions. Achieving specific mechanical properties can be challenging, and sintered steel may not always match the performance of other materials, such as forged steel or certain alloys, in demanding applications.

Despite these challenges, sintered steel remains widely used in various industries due to its advantages in terms of cost-effectiveness, complex shape capabilities, and the ability to produce large quantities of components with good mechanical properties. Manufacturers continuously work on improving sintering techniques and developing new materials to address these challenges and expand the application potential of sintered steel.

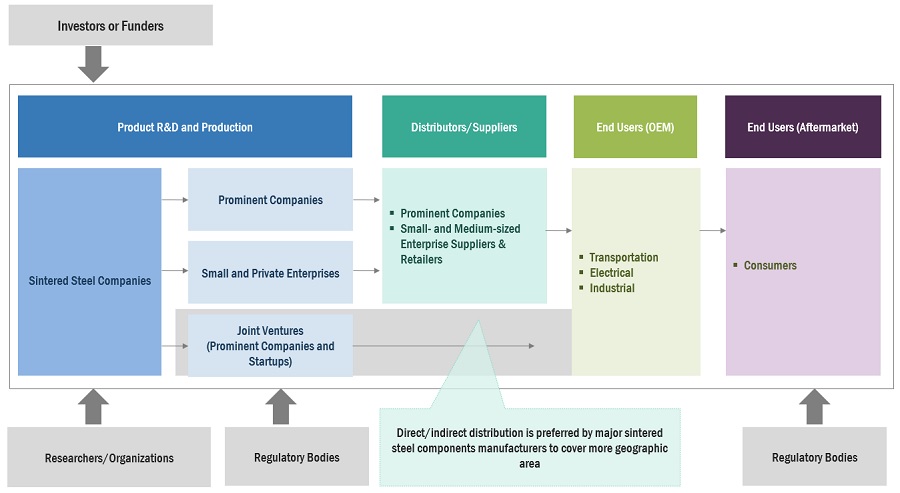

Ecosystem

By Steel Type, Tool steel accounted for the highest CAGR during the forecast period

Tool steel is a type of high-speed steel used in tool production. It is manufactured through a process that involves pressing powdered tool components to achieve the desired shape and density. This near-net-shape manufacturing technique reduces the need for extensive machining and allows for precise shaping. To enhance its properties, hot-temperature cemented carbides are added to the tool steel, ensuring optimal density and uniform carbide distribution. The resulting high-density tool steel exhibits excellent grindability and possesses desirable characteristics such as hardness, wear resistance, and toughness. These qualities make tool steel suitable for a wide range of tool applications in industries such as manufacturing, construction, automotive, aerospace, and woodworking. It is commonly used to create various tools, including drills, cutting blades, punches, dies, molds, and tooling components.

By Process, Additive manufacturing accounted for the highest CAGR during the forecast period

The additive manufacturing (Am) is the fastest growing in the sintered steel market during the forecast period. Additive manufacturing is experiencing rapid growth in the sintered steel market due to several factors. It offers design freedom, allowing the creation of complex geometries and customized parts. The reduced material waste and improved manufacturing efficiency make it cost-effective. Additive manufacturing enables faster prototyping and shorter time-to-market. It also provides increased design flexibility and customization options. Advancements in materials and technology have expanded its capabilities, leading to higher densities and improved mechanical properties in sintered steel products. Overall, additive manufacturing is driving innovation and transforming the manufacturing landscape in the sintered steel market.

By Application, Engines accounted for the highest CAGR during the forecast period

Engine applications dominate the sintered steel market. This is primarily due to the exceptional mechanical properties offered by sintered steel, including high strength and wear resistance, which make it well-suited for engine components operating under extreme conditions. The cost-effectiveness of sintered steel, achieved through near-net shape production and reduced material waste, appeals to engine manufacturers seeking efficient solutions. Furthermore, the design flexibility of sintered steel allows for the creation of customized and intricate shapes, enhancing engine performance. The strong demand from the transportation industry, along with the continuous growth in vehicle production and technological advancements, further contributes to the significant presence of engine applications in the sintered steel market.

By End Use Sector, Electrical accounted for the highest CAGR during the forecast period

The demand for sintered steel in the electrical industry is driven by the increasing adoption of renewable energy sources, such as wind and solar power. Sintered steel is utilized in the manufacturing of electrical contacts, connectors, and other components for renewable energy systems. As the renewable energy sector continues to expand, the demand for sintered steel in this industry is expected to grow significantly.

Sintered steel, with its high thermal conductivity, can aid in heat dissipation in electrical applications. It is often used in heat sinks and thermal management solutions, where it helps transfer heat away from sensitive electrical components, preventing overheating and ensuring efficient operation.

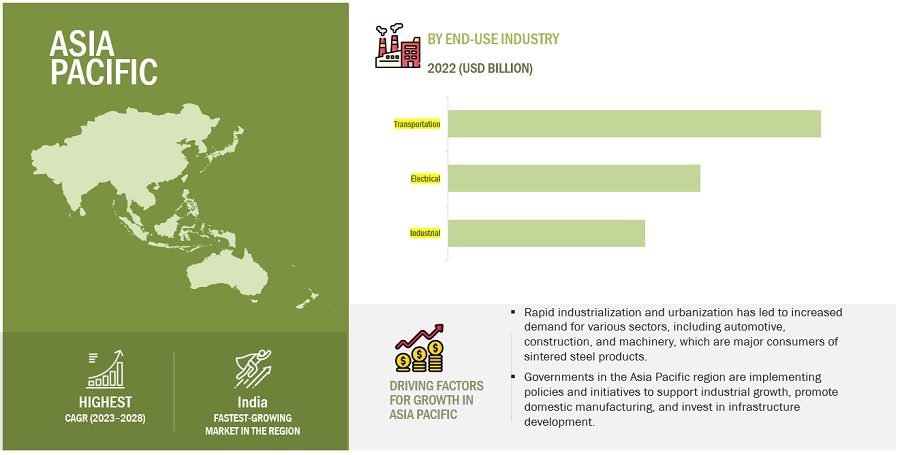

Asia Pacific is projected to account for the highest CAGR in the sintered steel market during the forecast period

The Asia Pacific region, particularly countries like China and India, is undergoing rapid industrialization and urbanization. This has led to increased demand for various sectors, including automotive, construction, and machinery, which are major consumers of sintered steel products. The expanding industrial base and infrastructure development projects are driving the growth of the sintered steel market in the region.

The Asia Pacific region is one of the largest automotive manufacturing hubs globally. Sintered steel components are extensively used in the automotive sector for applications such as engine parts, transmission components, bearings, and braking systems. The increasing production of vehicles in countries like China, Japan, India, and South Korea has propelled the demand for sintered steel in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Sintered steel market comprises key manufacturers such as Sumitomo Electric Industries Limited (Japan), GKN Powder Metallurgy (UK), Samvardhana Motherson Group (India), Resonac (Japan), The Miba Group (US), ASCO Sintering Co. (US), Schunk Sinter Metals (Germany), AMES Sintering Metallic Components (Spain), and Sintercom India Ltd. (India) and others. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the sintered steel market. Major focus was given to the new product development due to the changing requirements of transportation and electronics product consumers across the world.

Want to explore hidden markets that can drive new revenue in Sintered Steel Market?

Scope of the Report:

Want to explore hidden markets that can drive new revenue in Sintered Steel Market?

|

Report Metric |

Details |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion), Volume (Tons) |

|

Segments |

Type, Process, Application, and Region |

|

Regions |

North America, Asia Pacific, Europe, South America, and Rest of the World |

|

Companies |

The major players are Sumitomo Electric Industries Limited (Japan), GKN Powder Metallurgy (UK), Samvardhana Motherson Group (India), Resonac (Japan), The Miba Group (US), ASCO Sintering Co. (US), Schunk Sinter Metals (Germany), AMES Sintering Metallic Components (Spain), and Sintercom India Ltd. (India). |

This research report categorizes the global sintered steel market based on Steel Type, Process, Application, and Region

On the basis of Steel Type:

- Stainless Steel

- Carbon Steel

- Alloy Steel

- Tool Steel

On the basis of Process:

- Metal Injection Molding (Mim)

- Additive Manufacturing (Am)

- Conventional Manufacturing

- Powder Forged Manufacturing

On the basis of Application:

- Engines

- Transmissions

- Bodies

- Chassis

- Drivetrains

- Electrical Appliances

- Others

On the basis of End Use Industry:

- Transportation

- Electrical

- Industrial

- Others

On the basis of Region:

- North America

- Asia Pacific

- Europe

- South America

- Rest of the World

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In March 2023, A definitive license agreement was signed by Sumitomo Electric Industries Ltd. and US Conec Ltd., allowing Sumitomo Electric Lightwave Corp. to produce MMC connector and TMT ferrule components for the use in the deployment of next-generation, high-density, multi-fibre cable solutions.

- In May 2023, Sumitomo Electric Industries, Ltd. and the National Institute of Information and Communications Technology (NICT) have jointly achieved a major breakthrough in optical fibre technology. They have developed a multi-core optical fibre with an impressive 19 cores, which is the largest number of cores ever achieved in a standard outer diameter (0.125 mm) fibre. They successfully transmitted data at a staggering speed of 1.7 petabits per second over 63.5 km.

- Resonac, formed on January 1, 2023, through the merger of Showa Denko and Showa Denko Materials (formerly Hitachi Chemical), marks a new beginning for the company. Their goal is to achieve global leadership in the chemical industry by prioritizing advanced functional materials and continuous transformation initiatives.

- In October 2021, For the development of multicore optical fibre cable, Sumitomo Electric Industries, Ltd. partnered with OCC Corporation, a fully owned subsidiary of NEC Corporation.

- In May 2019, Sumitomo Electric Industries, Ltd. acquired 100% shares of the European manufacturers of powdered metal components, Sinterwerke Herne GmbH (SWH, Germany) and Sinterwerke Grenchen AG (SWG, Switzerland). Its Powder Metal Products Division operates globally along with Sumitomo Electric Sintered Alloy Ltd.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the sintered steel market?

The sintered steel is expected to witness significant growth in the future due to growing automotive industry, growing manufacturing & industrial sector.

What are the major challenges in the sintered steel market?

The major challenges in the sintered steel market are low awareness of powder metallurgy technology and material limitations.

What are the restraining factors in the sintered steel market?

The major restraining factor faced by the sintered steel market are volatile raw material (metal powders) prices and competition from alternative materials.

What is the key opportunity in the sintered steel market?

Growing electric vehicle (EV) market and emerging technological advancements in the powder metallurgy industry are key opportunity in the sintered steel market.

What are the end-use industries where sintered steel components are used?

The sintered steel components are majorly used in transportation, electrical, industrial equipment manufacturing industries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing automotive industry- Growing manufacturing & industrial sector- Environmental sustainabilityRESTRAINTS- Volatile raw material (metal powders) prices- Competition from alternative materialsOPPORTUNITIES- Growing electric vehicle (EV) market- Emerging technological advancements in powder metallurgy industryCHALLENGES- Low awareness about powder metallurgy technology- Limitations in achieving specific mechanical properties

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 TRENDS /DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSESREVENUE SHIFT & NEW REVENUE POCKETS FOR SINTERED STEEL MANUFACTURERSREVENUE SHIFT FOR SINTERED STEEL PLAYERS

-

5.6 TARIFF AND REGULATORY LANDSCAPE ANALYSISINTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)U.S. INTERNATIONAL TRADE COMMISSION (USITC)

-

5.7 REGULATORY BODIES AND GOVERNMENT AGENCIESREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- The Environmental Protection Agency (EPA)- Occupational Safety and Health Administration (OSHA)

-

5.8 SUPPLY CHAIN ANALYSISRAW MATERIAL SUPPLIERSSINTERED STEEL MANUFACTURERSDISTRIBUTORS AND SUPPLIERSEND USERSRECYCLING AND SCRAP MANAGEMENT

-

5.9 TECHNOLOGY ANALYSISDIRECT METAL LASER SINTERING (DMLS)METAL INJECTION MOLDING (MIM)

-

5.10 ECOSYSTEM

-

5.11 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES & EVENTS, 2023–2024

- 5.13 TRADE ANALYSIS

-

5.14 PATENT ANALYSISDOCUMENT ANALYSISJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.15 CASE STUDYPOWDER METALLURGY INSPECTION- Challenge- SolutionCONTACT FATIGUE AND CRACK PROPAGATION STUDIES OF SINTERED PM STEEL- Challenge- Solution

-

5.16 MACROECONOMIC OVERVIEWGLOBAL GDP OUTLOOK

- 5.17 PRICING ANALYSIS

- 5.18 IMPACT OF RECESSION: REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

- 6.1 INTRODUCTION

-

6.2 TOOL STEELEXCEPTIONAL STRENGTH AND ABILITY TO MAINTAIN SHARPNESS

-

6.3 STAINLESS STEELDESIGNED TO MANAGE HIGH PRESSURE AND CONTROLLED HEATING TO FUSE PARTICLES

-

6.4 CARBON STEELPROVIDES INCREASED STRENGTH AND HARDNESS TO SINTERED STEEL COMPONENTS

-

6.5 ALLOY STEELINCREASES STRENGTH, WEAR RESISTANCE, AND DIMENSIONAL ACCURACY

- 7.1 INTRODUCTION

-

7.2 CONVENTIONAL MANUFACTURINGENHANCES MACHINABILITY, WEAR RESISTANCE, AND LUBRICITY OF PARTS

-

7.3 METAL INJECTION MOLDING (MIM)PRECISE DIMENSIONAL ACCURACY, SUPERIOR SURFACE FINISH, AND FABRICATION OF INTRICATE GEOMETRIES

-

7.4 ADDITIVE MANUFACTURING (AM)IMPROVED MATERIAL UTILIZATION, INCREASED PRODUCTIVITY, AND ENHANCED DESIGN AND PRODUCTION FLEXIBILITY

-

7.5 POWDER FORGED MANUFACTURINGPROVIDES INCREASED DENSITY AND STRENGTH TO SINTERED STEEL COMPONENTS

- 8.1 INTRODUCTION

-

8.2 TRANSPORTATIONLIGHTWEIGHT, HIGH-PERFORMANCE, AND DURABLE COMPONENTS ENSURE PRODUCTION OF COST-EFFECTIVE AND SAFE VEHICLES

-

8.3 INDUSTRIALEXCELLENT STRENGTH, DIMENSIONAL STABILITY, AND WEAR RESISTANCE TO BOOST MARKET

-

8.4 ELECTRICALSUPERIOR MAGNETIC QUALITIES OF SINTERED STEEL FOR TRANSFORMERS AND INDUCTORS TO BOOST MARKET

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 ENGINESEMPLOYED FOR MAXIMUM ENGINE PERFORMANCE AND POWER TRANSMISSION IN ENGINES

-

9.3 TRANSMISSIONSIMPROVED HIGH-PERFORMANCE GEAR APPLICATIONS TO DRIVE DEMAND

-

9.4 BODIESWIDELY USED FOR WEIGHT REDUCTION AND DIMENSIONAL ACCURACY

-

9.5 CHASSISSTRUCTURAL INTEGRITY AND IMPROVED ABILITY TO WITHSTAND HEAVY LOADS AND FORCES TO DRIVE DEMAND

-

9.6 DRIVETRAINSWEAR RESISTANCE, IMPROVED DURABILITY, AND FUEL EFFICIENCY

-

9.7 ELECTRICAL APPLIANCESRELIABLE PERFORMANCE AND IMPROVED ENERGY EFFICIENCY TO DRIVE DEMAND

- 9.8 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Market growth to be supported by shipbuilding, construction, energy, and automotive sectorsINDIA- Automotive sector to be fastest-growing, boosting marketJAPAN- Technological advancements in construction and automotive sectors to benefit marketSOUTH KOREA- Emphasis on innovation and strong industrial foundation to drive marketTHAILAND- Government support and favorable business environment to drive marketINDONESIA- Industrial sector experiencing gradual growthREST OF ASIA PACIFIC

-

10.3 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Consumption of sintered steel to witness fastest growth in electrical segmentCANADA- Market projected to grow due to focus on lightweight materials to enhance fuel efficiencyMEXICO- Transportation and electrical sectors to witness fastest growth in terms of value and volume

-

10.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Growing manufacturing activities to boost marketUK- Increasing focus on renewable energy to offer lucrative opportunitiesFRANCE- Machinery and equipment manufacturing to drive marketITALY- Government incentives and energy efficiency initiatives to drive marketRUSSIA- Energy sector to offer attractive opportunities for market growthSPAIN- Increasing demand from automotive and machinery and equipment manufacturing industries to drive marketREST OF EUROPE

-

10.5 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Well-established automotive sector and substantial consumer base to drive marketCOLOMBIA- Increase in investments in transportation to drive marketREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICAIRAN- Market to be driven by expanding industrial sectorTURKEY- Electrical sector to be fastest-growing marketSOUTH AFRICA- Growing industrialization and urbanization to boost marketREST OF MIDDLE EAST & AFRICA

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- 11.3 KEY COMPANIES’ REVENUE ANALYSIS

-

11.4 COMPANY EVALUATION MATRIX (OVERALL MARKET)STARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

- 11.5 COMPETITIVE BENCHMARKING OF OVERALL MARKET

-

11.6 STRENGTH OF PRODUCT PORTFOLIOBUSINESS STRATEGY EXCELLENCE

-

11.7 COMPANY EVALUATION MATRIX (STARTUPS/SMES)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 DETAILED LIST OF KEY STARTUPS/SMESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

11.9 COMPETITIVE SCENARIORECENT DEVELOPMENTSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSSUMITOMO ELECTRIC INDUSTRIES LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGKN POWDER METALLURGY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAMVARDHANA MOTHERSON GROUP- Business overview- Products/Solutions/Services offered- MnM viewRESONAC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE MIBA GROUP- Business overview- Recent developments- MnM viewASCO SINTERING CO.- Business overview- Products/Solutions/Services offered- MnM viewSCHUNK SINTER METALS- Business overview- Products/Solutions/Services offered- MnM viewAMES SINTERED METALLIC COMPONENTS- Business overview- Products/Solutions/Services offered- MnM viewSINTERCOM INDIA LTD.- Business overview- Products/Solutions/Services offered- MnM view

-

12.2 ADDITIONAL PLAYERSSMC CORPORATIONCAPSTAN INC.FEDERAL-MOGUL GOETZE (INDIA) LIMITEDSSI SINTERED SPECIALTIESFINE SINTER CO. LTD.TECHNYMON GLOBAL BEARING TECHNOLOGIESSINTEX RETHINKING COMPONENTSPACIFIC SINTERED METALSMFS-SINTERINGATLAS PRESSED METALSALLIED SINTERINGS, INC.ALPHA PRECISION GROUPCOLDWATER SINTERED METAL PRODUCTSPHOENIX SINTERED METALSCALLO SINTERMETALL ABPRECISION SINTERED METALS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 IRON & STEEL MARKETMARKET DEFINITIONIRON & STEEL MARKET, BY TYPESTEEL MARKET, BY PRODUCTION TECHNOLOGYIRON & STEEL MARKET, BY END-USE INDUSTRYIRON & STEEL MARKET, BY REGION

-

13.4 STEEL REBAR MARKETMARKET DEFINITIONSTEEL REBAR MARKET, BY TYPESTEEL REBAR MARKET, BY PROCESSSTEEL REBAR MARKET, BY COATING TYPESTEEL REBAR MARKET, BY BAR SIZESTEEL REBAR MARKET, BY END-USE SECTORSTEEL REBAR MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 SINTERED STEEL MARKET: PORTER’S FIVE FORCE ANALYSIS

- TABLE 2 SINTERED STEEL MARKET: SUPPLY CHAIN

- TABLE 3 ECOSYSTEM OF SINTERED STEEL MARKET

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- TABLE 6 SINTERED STEEL MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 7 IRON OR STEEL, EXPORT DATA, HS CODE: 72, 2022 (USD MILLION)

- TABLE 8 IRON OR STEEL, IMPORT DATA, HS CODE: 72, 2022 (USD MILLION)

- TABLE 9 LIST OF PATENTS BY JFE STEEL CORPORATION

- TABLE 10 LIST OF PATENTS BY UNIVERSITY OF SCIENCE AND TECHNOLOGY BEIJING

- TABLE 11 LIST OF PATENTS BY CENTRAL SOUTH UNIVERSITY

- TABLE 12 US: PATENT OWNERS BETWEEN 2013 AND 2022

- TABLE 13 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 14 AVERAGE SELLING PRICES OF STEEL TYPES, BY REGION, 2022 (USD/TON)

- TABLE 15 SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (KILOTON)

- TABLE 16 SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (KILOTON)

- TABLE 17 SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (USD MILLION)

- TABLE 18 SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (USD MILLION)

- TABLE 19 SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (KILOTON)

- TABLE 20 SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (KILOTON)

- TABLE 21 SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (USD MILLION)

- TABLE 22 SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (USD MILLION)

- TABLE 23 SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 24 SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 25 SINTERED STEEL MARKET, BY END-USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 26 SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 27 SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 28 SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 29 SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 30 SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 31 SINTERED STEEL MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 32 SINTERED STEEL MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 33 SINTERED STEEL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 34 SINTERED STEEL MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: SINTERED STEEL MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 36 ASIA PACIFIC: SINTERED STEEL MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 37 ASIA PACIFIC: SINTERED STEEL MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 38 ASIA PACIFIC: SINTERED STEEL MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (KILOTON)

- TABLE 40 ASIA PACIFIC: SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (KILOTON)

- TABLE 41 ASIA PACIFIC: SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (USD MILLION)

- TABLE 42 ASIA PACIFIC: SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (KILOTON)

- TABLE 44 ASIA PACIFIC: SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (KILOTON)

- TABLE 45 ASIA PACIFIC: SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (USD MILLION)

- TABLE 46 ASIA PACIFIC: SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 48 ASIA PACIFIC: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 49 ASIA PACIFIC: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 50 ASIA PACIFIC: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 52 ASIA PACIFIC: SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 53 ASIA PACIFIC: SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 54 ASIA PACIFIC: SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 55 CHINA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 56 CHINA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 57 CHINA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 58 CHINA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 59 INDIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 60 INDIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 61 INDIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 62 INDIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 63 JAPAN: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 64 JAPAN: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 65 JAPAN: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 66 JAPAN: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 67 SOUTH KOREA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 68 SOUTH KOREA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 69 SOUTH KOREA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 70 SOUTH KOREA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 71 THAILAND: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 72 THAILAND: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 73 THAILAND: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 74 THAILAND: SINTERED STEEL MARKET, BY END USE E SECTOR, 2022–2028 (USD MILLION)

- TABLE 75 INDONESIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 76 INDONESIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 77 INDONESIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 78 INDONESIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 79 REST OF ASIA PACIFIC: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 80 REST OF ASIA PACIFIC: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 81 REST OF ASIA PACIFIC: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: SINTERED STEEL MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 84 NORTH AMERICA: SINTERED STEEL MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 85 NORTH AMERICA: SINTERED STEEL MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: SINTERED STEEL MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (KILOTON)

- TABLE 88 NORTH AMERICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (KILOTON)

- TABLE 89 NORTH AMERICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (KILOTON)

- TABLE 92 NORTH AMERICA: SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (KILOTON)

- TABLE 93 NORTH AMERICA: SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 96 NORTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 97 NORTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 98 NORTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 100 NORTH AMERICA: SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 101 NORTH AMERICA: SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 102 NORTH AMERICA: SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 103 US: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 104 US: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 105 US: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 106 US: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 107 CANADA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 108 CANADA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 109 CANADA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 110 CANADA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 111 MEXICO: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 112 MEXICO: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 113 MEXICO: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 114 MEXICO: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 115 EUROPE: SINTERED STEEL MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 116 EUROPE: SINTERED STEEL MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 117 EUROPE: SINTERED STEEL MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 118 EUROPE: SINTERED STEEL MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 119 EUROPE: SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (KILOTON)

- TABLE 120 EUROPE: SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (KILOTON)

- TABLE 121 EUROPE: SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (USD MILLION)

- TABLE 122 EUROPE: SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (USD MILLION)

- TABLE 123 EUROPE: SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (KILOTON)

- TABLE 124 EUROPE: SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (KILOTON)

- TABLE 125 EUROPE: SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (USD MILLION)

- TABLE 126 EUROPE: SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (USD MILLION)

- TABLE 127 EUROPE: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 128 EUROPE: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 129 EUROPE: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 130 EUROPE: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 131 EUROPE: SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 132 EUROPE: SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 133 EUROPE: SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 134 EUROPE: SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 135 GERMANY: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 136 GERMANY: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 137 GERMANY: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 138 GERMANY: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 139 UK: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 140 UK: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 141 UK: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 142 UK: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 143 FRANCE: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 144 FRANCE: SINTERED STEEL MARKET, BY END-USE SECTOR, 2022–2028 (KILOTON)

- TABLE 145 FRANCE: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 146 FRANCE: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 147 ITALY: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 148 ITALY: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 149 ITALY: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 150 ITALY: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 151 RUSSIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 152 RUSSIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 153 RUSSIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 154 RUSSIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 155 SPAIN: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 156 SPAIN: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 157 SPAIN: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 158 SPAIN: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 159 REST OF EUROPE: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 160 REST OF EUROPE: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 161 REST OF EUROPE: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 162 REST OF EUROPE: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 163 SOUTH AMERICA: SINTERED STEEL MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 164 SOUTH AMERICA: SINTERED STEEL MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 165 SOUTH AMERICA: SINTERED STEEL MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 166 SOUTH AMERICA: SINTERED STEEL MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 167 SOUTH AMERICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (KILOTON)

- TABLE 168 SOUTH AMERICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (KILOTON)

- TABLE 169 SOUTH AMERICA: SINTERED STEEL MARKET BY STEEL TYPE, 2018–2021 (USD MILLION)

- TABLE 170 SOUTH AMERICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (USD MILLION)

- TABLE 171 SOUTH AMERICA: SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (KILOTON)

- TABLE 172 SOUTH AMERICA: SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (KILOTON)

- TABLE 173 SOUTH AMERICA: SINTERED STEEL MARKET SIZE, BY PROCESS, 2018–2021 (USD MILLION)

- TABLE 174 SOUTH AMERICA: SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (USD MILLION)

- TABLE 175 SOUTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 176 SOUTH AMERICA: SINTERED STEEL MARKET SIZE, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 177 SOUTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 178 SOUTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 179 SOUTH AMERICA: SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 180 SOUTH AMERICA: SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 181 SOUTH AMERICA: SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 182 SOUTH AMERICA: SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 183 BRAZIL: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 184 BRAZIL: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 185 BRAZIL: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 186 BRAZIL: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 187 COLOMBIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 188 COLOMBIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 189 COLOMBIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 190 COLOMBIA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 191 REST OF SOUTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 192 REST OF SOUTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 193 REST OF SOUTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 194 REST OF SOUTH AMERICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 196 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 197 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (KILOTON)

- TABLE 200 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (KILOTON)

- TABLE 201 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2018–2021 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY STEEL TYPE, 2022–2028 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (KILOTON)

- TABLE 204 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (KILOTON)

- TABLE 205 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY PROCESS, 2018–2021 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY PROCESS, 2022–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 208 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 209 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 212 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 213 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 215 IRAN: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 216 IRAN: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 217 IRAN: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 218 IRAN: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 219 TURKEY: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 220 TURKEY: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 221 TURKEY: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 222 TURKEY: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 223 SOUTH AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 224 SOUTH AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 225 SOUTH AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 226 SOUTH AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (KILOTON)

- TABLE 228 REST OF MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (KILOTON)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2018–2021 (USD MILLION)

- TABLE 230 REST OF MIDDLE EAST & AFRICA: SINTERED STEEL MARKET, BY END USE SECTOR, 2022–2028 (USD MILLION)

- TABLE 231 COMPANIES ADOPTED MERGERS & ACQUISITIONS AS KEY GROWTH STRATEGY BETWEEN 2020 AND 2022

- TABLE 232 SINTERED STEEL MARKET: DEGREE OF COMPETITION

- TABLE 233 REVENUE OF TOP PLAYERS, 2022

- TABLE 234 SINTERED STEEL MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 235 DEALS, 2019 TO 2023

- TABLE 236 OTHER DEVELOPMENTS, 2019 TO 2023

- TABLE 237 SUMITOMO ELECTRIC INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 238 GKN POWDER METALLURGY: COMPANY OVERVIEW

- TABLE 239 SAMVARDHANA MOTHERSON GROUP: COMPANY OVERVIEW

- TABLE 240 RESONAC: COMPANY OVERVIEW

- TABLE 241 THE MIBA GROUP: COMPANY OVERVIEW

- TABLE 242 PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 ASCO SINTERING CO.: COMPANY OVERVIEW

- TABLE 244 SCHUNK SINTER METALS: COMPANY OVERVIEW

- TABLE 245 AMES SINTERED METALLIC COMPONENTS: COMPANY OVERVIEW

- TABLE 246 SINTERCOM INDIA LTD.: COMPANY OVERVIEW

- TABLE 247 SMC CORPORATION: COMPANY OVERVIEW

- TABLE 248 CAPSTAN INC.: COMPANY OVERVIEW

- TABLE 249 FEDERAL-MOGUL GOETZE (INDIA) LIMITED: COMPANY OVERVIEW

- TABLE 250 SSI SINTERED SPECIALTIES: COMPANY OVERVIEW

- TABLE 251 FINE SINTER CO. LTD.: COMPANY OVERVIEW

- TABLE 252 TECHNYMON GLOBAL BEARING TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 253 SINTEX RETHINKING COMPONENTS: COMPANY OVERVIEW

- TABLE 254 PACIFIC SINTERED METALS: COMPANY OVERVIEW

- TABLE 255 MFS-SINTERING: COMPANY OVERVIEW

- TABLE 256 ATLAS PRESSED METALS: COMPANY OVERVIEW

- TABLE 257 ALLIED SINTERINGS, INC.: COMPANY OVERVIEW

- TABLE 258 ALPHA PRECISION GROUP: COMPANY OVERVIEW

- TABLE 259 COLDWATER SINTERED METAL PRODUCTS: COMPANY OVERVIEW

- TABLE 260 PHOENIX SINTERED METALS: COMPANY OVERVIEW

- TABLE 261 CALLO SINTERMETALL AB: COMPANY OVERVIEW

- TABLE 262 IRON & STEEL MARKET, BY TYPE, 2020–2027 (USD BILLION)

- TABLE 263 IRON & STEEL MARKET SIZE, BY TYPE, 2020–2027 (MILLION TON)

- TABLE 264 STEEL MARKET, BY PRODUCTION TECHNOLOGY, 2020–2027 (MILLION TON)

- TABLE 265 IRON & STEEL MARKET, BY END-USE INDUSTRY, 2020–2027 (USD BILLION)

- TABLE 266 IRON & STEEL MARKET, BY END-USE INDUSTRY, 2020–2027 (MILLION TON)

- TABLE 267 IRON & STEEL MARKET, BY REGION, 2020–2027 (USD BILLION)

- TABLE 268 IRON & STEEL MARKET, BY REGION, 2020–2027 (MILLION TON)

- TABLE 269 STEEL REBAR MARKET, BY TYPE, 2018–2020 (MILLION TON)

- TABLE 270 STEEL REBAR MARKET, BY TYPE, 2021–2030 (MILLION TON)

- TABLE 271 STEEL REBAR MARKET, BY TYPE, 2018–2020 (USD BILLION)

- TABLE 272 STEEL REBAR MARKET, BY TYPE, 2021–2030 (USD BILLION)

- TABLE 273 ANALYSIS (WT%) OF BOS AND EAF STEEL REBAR

- TABLE 274 STEEL REBAR MARKET, BY PROCESS, 2018–2020 (MILLION TON)

- TABLE 275 STEEL REBAR MARKET, BY PROCESS, 2021–2030 (MILLION TON)

- TABLE 276 STEEL REBAR MARKET, BY PROCESS, 2018–2020 (USD BILLION)

- TABLE 277 STEEL REBAR MARKET, BY PROCESS, 2021–2030 (USD BILLION)

- TABLE 278 STEEL REBAR MARKET, BY COATING TYPE, 2018–2020 (MILLION TON)

- TABLE 279 STEEL REBAR MARKET, BY COATING TYPE, 2021–2030 (MILLION TON)

- TABLE 280 STEEL REBAR MARKET, BY COATING TYPE, 2018–2020 (USD BILLION)

- TABLE 281 STEEL REBAR MARKET, BY COATING TYPE, 2021–2030 (USD BILLION)

- TABLE 282 US REBAR SIZE CHART

- TABLE 283 STEEL REBAR MARKET, BY BAR SIZE, 2018–2020 (MILLION TON)

- TABLE 284 STEEL REBAR MARKET, BY BAR SIZE, 2021–2030 (MILLION TON)

- TABLE 285 STEEL REBAR MARKET, BY BAR SIZE, 2018–2020 (USD BILLION)

- TABLE 286 STEEL REBAR MARKET, BY BAR SIZE, 2021–2030 (USD BILLION)

- TABLE 287 STEEL REBAR MARKET, BY END-USE SECTOR, 2018–2020 (MILLION TON)

- TABLE 288 STEEL REBAR MARKET, BY END-USE SECTOR, 2021–2030 (MILLION TON)

- TABLE 289 STEEL REBAR MARKET, BY END-USE SECTOR, 2018–2020 (USD BILLION)

- TABLE 290 STEEL REBAR MARKET, BY END-USE SECTOR, 2021–2030 (USD BILLION)

- TABLE 291 STEEL REBAR MARKET, BY REGION, 2018–2020 (MILLION TON)

- TABLE 292 STEEL REBAR MARKET, BY REGION, 2021–2030 (MILLION TON)

- TABLE 293 STEEL REBAR MARKET, BY REGION, 2018–2020 (USD BILLION)

- TABLE 294 STEEL REBAR MARKET, BY REGION, 2021–2030 (USD BILLION)

- FIGURE 1 SINTERED STEEL MARKET SEGMENTATION

- FIGURE 2 SINTERED STEEL MARKET: RESEARCH DESIGN

- FIGURE 3 SINTERED STEEL MARKET: BOTTOM-UP APPROACH

- FIGURE 4 SINTERED STEEL MARKET: TOP-DOWN APPROACH

- FIGURE 5 SINTERED STEEL MARKET: DATA TRIANGULATION

- FIGURE 6 CARBON STEEL TYPE SEGMENT PROJECTED TO DOMINATE SINTERED STEEL MARKET DURING FORECAST PERIOD

- FIGURE 7 TRANSPORTATION END USE SECTOR PROJECTED TO DOMINATE SINTERED STEEL MARKET DURING FORECAST PERIOD

- FIGURE 8 ENGINES APPLICATION SEGMENT PROJECTED TO LEAD SINTERED STEEL MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO LEAD SINTERED STEEL MARKET DURING FORECAST PERIOD

- FIGURE 11 CHINA WAS LARGEST MARKET FOR SINTERED STEEL IN ASIA PACIFIC IN 2022

- FIGURE 12 CARBON STEEL TYPE SEGMENT PROJECTED TO LEAD SINTERED STEEL MARKET DURING FORECAST PERIOD

- FIGURE 13 ENGINES SEGMENT PROJECTED TO BE LARGEST APPLICATION IN SINTERED STEEL MARKET

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SINTERED STEEL MARKET

- FIGURE 15 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 16 PRODUCTION PROCESS CONTRIBUTES HIGHEST VALUE TO OVERALL PRICE OF SINTERED STEEL

- FIGURE 17 REVENUE SHIFT FOR SINTERED STEEL MANUFACTURERS

- FIGURE 18 SUPPLY CHAIN OF SINTERED STEEL INDUSTRY

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 20 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- FIGURE 21 GRANTED PATENTS 8% OF TOTAL COUNT BETWEEN 2013 AND 2022

- FIGURE 22 NUMBER OF PATENTS BETWEEN 2013 AND 2022

- FIGURE 23 NUMBER OF PATENTS, BY JURISDICTION

- FIGURE 24 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 25 CARBON STEEL SEGMENT TO BE FASTEST-GROWING STEEL TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 26 METAL INJECTION MOLDING (MIM) PROCESS SEGMENT PROJECTED TO GROW AT HIGH RATE DURING FORECAST PERIOD

- FIGURE 27 TRANSPORTATION END USE SECTOR TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 28 ENGINES SEGMENT PROJECTED TO GROW AT HIGH RATE DURING FORECAST PERIOD

- FIGURE 29 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR SINTERED STEEL DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC: SINTERED STEEL MARKET SNAPSHOT

- FIGURE 31 NORTH AMERICA: SINTERED STEEL MARKET SNAPSHOT

- FIGURE 32 MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 33 SINTERED STEEL MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 34 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- FIGURE 35 SUMITOMO ELECTRIC INDUSTRIES LIMITED: COMPANY SNAPSHOT

- FIGURE 36 GKN POWDER METALLURGY: COMPANY SNAPSHOT

- FIGURE 37 SAMVARDHANA MOTHERSON GROUP: COMPANY SNAPSHOT

- FIGURE 38 RESONAC: COMPANY SNAPSHOT

- FIGURE 39 THE MIBA GROUP: COMPANY SNAPSHOT

- FIGURE 40 SINTERCOM INDIA LTD.: COMPANY SNAPSHOT

Extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource have been used to identify and collect information for this technical, market-oriented, and commercial study of the sintered steel market. In-depth interviews were conducted with various primary respondents which included key industry participants, subject matter experts (SMEs), C-level executives of key industry players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases. Secondary research has mainly been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

The market size of sintered steel has been estimated based on secondary data available through paid and unpaid sources, and by analyzing the product portfolios of key companies. This data has been further validated through various primary sources.

Primary Research

The sintered steel market comprises various stakeholders in the supply chain and includes suppliers, manufacturers, and end-product manufacturers. Various primary sources from the supply and demand sides of the sintered steel market have been interviewed to obtain qualitative and quantitative information. Primary participants from the supply side include key opinion leaders, executives, vice presidents, and CEOs of companies in the market. Primary sources from the demand side include experts from end-use industries, associations, and institutions involved in the market, and key opinion leaders.

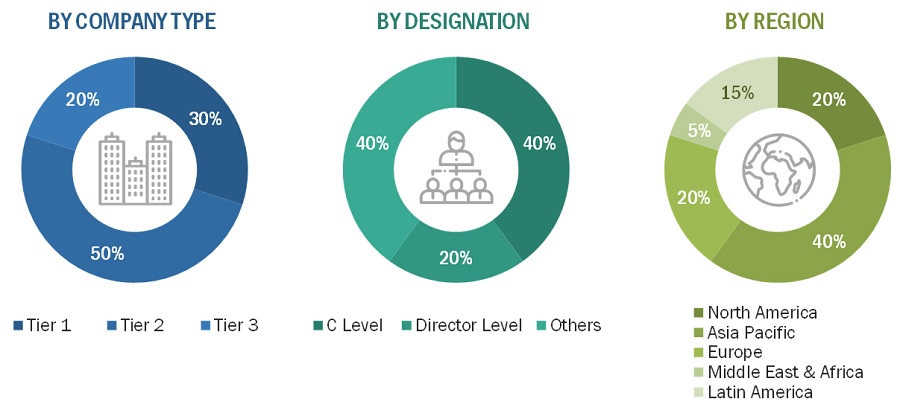

Following is the breakdown of primary respondents

Notes: *Others include sales, marketing, and product managers.

Tier 1: >USD 5 Billion; Tier 2: USD 1 Billion– USD 5 Billion; and Tier 3: <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The supply-side and demand-side approaches have been extensively used, along with several data triangulation methods, for market size estimation and forecast of the overall market segments listed in this report. Extensive qualitative and quantitative data were analyzed to list key information/insights throughout the report. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volumn, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of annual reports, reviews, sintered steel associations, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Sintered Steel Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Sintered Steel Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. To complete the overall market estimation process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Analysts use statistical tools, data modeling techniques, and market forecasting methodologies to estimate market size, growth potential, and future trends. They consider various factors such as historical data, market drivers, restraints, and industry dynamics to project the market's future performance.

Market Definition

Sintering is a powder metallurgy process that utilizes heat or pressure to compact and make solid products from metals and alloys such as steel, stainless steel, copper, aluminum, bronze, nickel, brass, and titanium. Sintered steel finds applications in automotive, electronics, electrical industries, and construction, where it improves metal strength, lifespan, and conductivity.

Sintered steel offers several advantages over traditional steel manufacturing methods. It allows for complex shapes to be formed with precise dimensional control, high material utilization, and the ability to incorporate various alloying elements. Sintered steel components are widely used in various industries, including automotive, aerospace, industrial machinery, and consumer goods, where they provide cost-effective solutions for applications requiring high strength, wear resistance, and dimensional stability.

Key stakeholders

- Raw material suppliers and producers

- Sintered steel manufacturers

- Sintered steel distributors/suppliers

- Regulatory bodies

- Local governments

Report Objectives

- To define, describe, and forecast the size of the sintered steel market in terms of value and volume

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To forecast and analyze the market based on packaging type and application

- To analyze and forecast the market size with respect to five main regions, namely, Asia Pacific, North America, Europe, South America, and Rest of the World, along with their respective key countries

- To analyze competitive developments such as mergers & acquisitions, joint ventures, and investments & expansions in the market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC Sintered steel Market

- Further breakdown of Rest of Europe Sintered steel Market

- Further breakdown of Rest of South America Sintered steel Market

- Further breakdown of Rest of Middle East & Africa Sintered steel Market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Sintered Steel Market