Security Robots Market Size, Share, Statistics and Industry Growth Analysis Report by Type (UAV (Fixed Wing, Rotary Wing), UGV (Wheeled, Tracked, Legged, Hybrid), UUV (Autonomous Underwater Vehicles, Remotely Operated Underwater Vehicles)), Application, End User and Geography - Global Forecast to 2027

Updated on : April 24, 2023

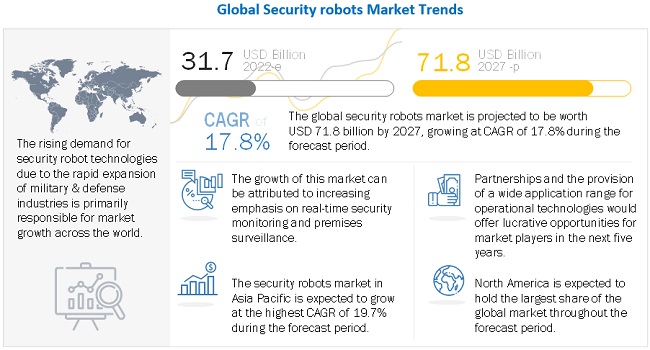

[257 Pages Report] The Security Robots Market Size is estimated to be USD 31.7 billion in 2022 and is projected to reach USD 71.8 billion by 2027; it is expected to grow at a CAGR of 17.8% from 2022 to 2027.

Security robots are autonomous robotic systems designed to perform their tasks without human intervention. Security robots enable security personnel to detect potential threats, take a close-in first look from a safe distance, and provide detailed information about the threat to take preventative measures.

The major drivers of the market include the growing adoption of security robots for commercial and residential applications, rising emphasis on security at national or regional levels, increasing investments and spending on defense by countries globally, and surging demand for autonomous systems that make real-time monitoring smarter. The Security Robots Industry has been segmented based on component, type, application, end user, and region.

To know about the assumptions considered for the study, Request for Free Sample Report

Security Robots Market Dynamics

DRIVERS: Rising defense spending of countries worldwide related to boost of Security Robots Market

Countries across the world are using forefront technologies to safeguard their borders against underwater threats. In the present global scenario, there has been an increase in threats from pirates, terrorists, and seafarers creating trouble across marine borders. According to the UN, in 2019, an average of 580 ships traversed the ~2,800-kilometer coastline of South Africa, resulting in growing transnational crimes at sea. This, in turn, negatively impacted the revenue of the country, as well as led to the smuggling of small arms, light weapons, and drugs, along with human trafficking. Bringing these crimes under control has led to a significant increase in defense spending worldwide. Defense forces use UUVs for mine countermeasures, rapid environmental assessment, intelligence, surveillance, reconnaissance activities, harbor protection tasks & port clearance operations, and anti-submarine warfare. Hence, security robots such as UUVs are expected to be increasingly used in the coming years to tackle underwater security threats, thereby leading to the growth of the market globally.

RESTRAINT: nreliability of security robots in terms of their functionality in military operations, a critical restraining factor that is holding back growth of market

The reliability of security robots is of critical importance in various defense applications. Failures in these robots can be classified into design failures, technology failures, manufacturing failures, environmental failures, and operational failures. Effective precautionary measures and contingency plans are required in the case of a failure. Prior arrangements need to be made to transport the broken-down security robots back to the base station. The unreliability of security robots, in terms of their functionality, restricts their use in various military and covert operations as this can result in the transfer and loss of confidential data and makes it susceptible to exploitation by enemy forces. Currently, the reliability of UGVs can be increased only with significantly high financial investments. For instance, the Mars Rover, which is a one-of-its-kind sophisticated UGV, has high reliability, but it is used for special applications such as space exploration missions. In the coming years, the maintenance and repair of security robots are expected to gain importance as improvements in their reliability are expected to take a long time.

OPPORTUNITIES: Development and incorporation of advanced technologies in UUVs

The limited battery life of UUVs necessitates human interference for charging purposes. Nickel-metal hydride (NiMH) batteries used in UUVs have a slower degradation rate and less leakage probability at the time of accidents than Li-ion batteries. This leads to the increased use of NiMH batteries in high-speed UUVs. The onboard sensors used in UUVs improve their capability to carry electronic equipment for imaging and monitoring applications. They also reduce the power consumption rate of onboard electronics. For instance, WiBotic (US) offers underwater wireless power and battery intelligence solutions. Kongsberg Maritime (Norway) offers EELUME AUV, which can be permanently deployed on the seabed owing to its underwater charging capability. The adoption of these solutions can help UUV operators reduce the effort required to swap old batteries with new ones during continuous underwater operations.

CHALLENGES: Requirement for high-level expertise associated with security robots and their hardware and software malfunctions

The initial setup of industrial robots requires a lot of training and expertise. Additionally, robots suffer from hardware and software malfunctions. Even though they are designed and built for tough situations, they continue to face unknown challenges. The challenges can be of different types, such as extreme temperatures, component breakdowns, software jams, etc. UGVs are controlled by human operators either through tethered modes or remotely. In certain cases, human operators lose control of these robots or sometimes robots miscalculate commands, thereby resulting in mission failures. Engineers face challenges in creating fully autonomous robots as this technology is still in the developmental phase. As a result, it is important to consider the investment a company must make to bring in that expertise or retrain its existing staff on the intended application, functionalities, and working of these robots.

UAV EXPECTED TO GROW AT HIGHEST CAGR IN SECURITY ROBOTS MARKET DURING THE FORECAST PERIOD

The market for unmanned aerial vehicles market is expected to grow at highest CAGR between 2022 and 2027. UAVs are used in various countries worldwide as an effective measure against terrorist activities. The US army and NATO alliances use these UAVs against terrorist outfits in Syria, Libya, Iraq, and Afghanistan, among others. Also, several Asian countries such as India, China, and Pakistan, among others are procuring armed drones to strengthen their border security. In addition, different security agencies are using UAVs for the patrolling and surveillance of major public events such as the Indian Premier League (IPL), FIFA World Cup, and Euro Cup, among others.

MILITARY & DEFENSE EXPECTED TO HOLD LARGEST SHARE OF SECURITY ROBOTS MARKET THROUGHOUT FORECAST PERIOD

The market for military & defense is expected to hold the largest share throughout the forecast period among security robot end users. This is primarily because countries across the world have started acknowledging the potential significance of UAVs, resulting in increasing military research and funding for the development of new and advanced UAVs. The market for UGVs for military applications is expected to witness tremendous potential in the future. Technological advancements to improve functionalities and autonomic decision-making capabilities of a robot for complex remote operations are a few of the key factors driving the unmanned ground vehicles market.

To know about the assumptions considered for the study, download the pdf brochure

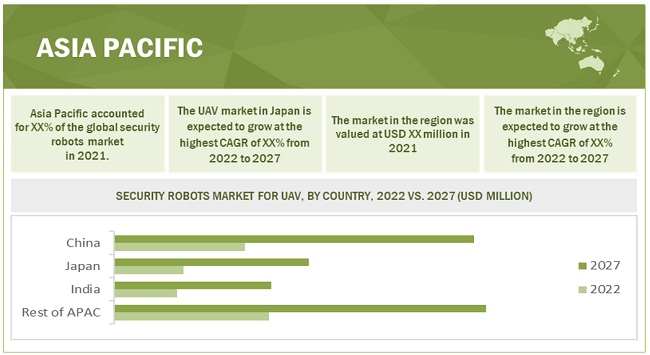

Asia Pacific held the largest share of the hydraulics market in 2021

The Security Robots Market size in Asia Pacific held the largest share of the Security Robots Market in 2021. The major factors driving the security robots market growth in the region are increasing defense spending by countries such as Australia, South Korea, and India, while Japan’s spending remained steady. Vietnam, which has had tensions with China over territorial disputes in the South China Sea, increased its military expenditure. Asia Pacific is one of the potential markets for unmanned vehicles as countries such as China, India, Japan, Australia, and South Korea, among others are actively focusing on strengthening their military systems. The geopolitical dynamics of the region play a major role in the measures taken by major economies such as India and China toward the enhancement of military capabilities and strength.

The Security Robots Companies is dominated by a few globally established players such as Emerson (US), ABB (Sweden), Schneider Electric (France), Yokogawa (Japan), and Endress+Hauser (Switzerland).

Security Robots Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 31.7 Billion |

| Projected Market Size | USD 71.8 Billion |

| Growth Rate | CAGR of 17.8% |

|

Market size available for years |

2022–2027 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Rising Defense spending of Countries Worldwide |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | MILITARY & DEFENSE Segment |

| Highest CAGR Segment | UAV Segment |

This research report segments the Security Robots Market Share based on type, component, application, end user, and region.

Based on Type, the Security Robots Market been Segmented as follows:

- UAV

- UUV

- UGV

Based on Application, the Security Robots Market been Segmented as follows:

- Spying

- Explosive Detection

- Firefighting

- Demining

- Rescue Operation

- Transportation

- Patrolling

Based on End User, the Security Robots Market been Segmented as follows:

- Defense & Military

- Residential

- Commercial

- Others

Based on Region, the Security Robots Market been Segmented as follows:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In December 2020, BAE Systems, in alliance with UAVTEK, created a nano bug drone and delivered the first 30 units to the British Army

- In September 2020, BAE Systems added an updated version of UUV 12 to its unmanned undersea vehicle (UUV) portfolio. With the launch of the 12” diameter vehicle, the company has entered the medium UUV market.

- In March 2020, UMS SKELDAR, a collaborative undertaking of Saab and UMS Aero Group, launched its new V-150 UAV that is proficient in VTOL.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the security robots market during 2022-2027?

The global security robots market is expected to record a CAGR of 17.8% from 2022–2027.

What are the driving factors for the security robots?

The growing adoption of security robots for commercial and residential applications, rising emphasis on security at national or regional levels, increasing investments and spending on defense by countries globally, and surging demand for autonomous systems that make real-time monitoring smarter.

Which end user will lead the security robots market in the future?

Military & defence is expected to lead the security robots market during the forecast period.

Which are the significant players operating in the security robots market?

Northrop Grumman, Lockheed Martin Corporation, Elbit Systems, BAE Systems, and The Boeing Company are some of the major companies operating in the security robots market.

Which region will lead the security robots market in the future?

North America is expected to lead the security robots market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SECURITY ROBOTS MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 SECURITY ROBOTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 3 MARKET RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM UUV IN SECURITY ROBOTS MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis (demand side)

FIGURE 5 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by using top-down analysis (supply side)

FIGURE 6 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 8 IMPACT ANALYSIS OF COVID-19 ON SECURITY ROBOTS MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 9 MARKET FOR UAV IS EXPECTED TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

FIGURE 10 MARKET FOR MILITARY & DEFENSE IS EXPECTED TO HOLD LARGEST SHARE OF MARKET FOR UAV THROUGHOUT FORECAST PERIOD

FIGURE 11 MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR SECURITY ROBOTS MARKET

FIGURE 12 MARKET IS EXPECTED TO WITNESS HUGE GROWTH OPPORTUNITIES IN ASIA PACIFIC

4.2 MARKET, BY TYPE

FIGURE 13 MARKET FOR UAV IS EXPECTED TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

4.3 MARKET, BY END USER

FIGURE 14 MARKET FOR MILITARY & DEFENSE IS EXPECTED TO HOLD LARGEST SHARE OF MARKET FOR UAV THROUGHOUT FORECAST PERIOD

4.4 MARKET, BY REGION

FIGURE 15 ASIA PACIFIC IS EXPECTED TO WITNESS HIGHEST CAGR IN MARKET FOR UAV DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 SECURITY ROBOTS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising defense spending of countries worldwide

5.2.1.2 Surging adoption of security robots in civil and commercial applications

5.2.1.3 Increasing capital expenditure of offshore oil & gas companies

5.2.1.4 Growing demand for autonomous systems in defense and commercial sectors

5.2.1.5 Improvements in regulatory frameworks related to drone operations

FIGURE 17 DRIVERS FOR MARKET AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Unreliability of security robots, in terms of their functionality, in military operations

5.2.2.2 High operational costs of security robots

5.2.2.3 Lack of trained staff for operating drones and infrastructures such as runways

5.2.2.4 Issues related to safety and security of security robots

FIGURE 18 RESTRAINTS FOR MARKET AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in adoption of IoT and cloud technologies

5.2.3.2 Development and incorporation of advanced technologies in UUVs

5.2.3.3 Development of fully autonomous UGVs

FIGURE 19 TIMELINE FOR 30-YEAR GROUND VEHICLE STRATEGY OF US GOVERNMENT

FIGURE 20 OPPORTUNITIES FOR MARKET AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Requirement for high-level expertise associated with security robots and their hardware and software malfunctions

5.2.4.2 Requirement for continuous and uninterrupted power supply in UGVs

FIGURE 21 CHALLENGES FOR MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 SECURITY ROBOTS MARKET: VALUE CHAIN ANALYSIS

5.3.1 PLANNING AND REVISING FUNDS

5.3.2 RESEARCH AND DEVELOPMENT

5.3.3 MANUFACTURING

5.3.4 ASSEMBLY AND DISTRIBUTION

5.3.5 POST-SALES SERVICES

5.4 ECOSYSTEM ANALYSIS

FIGURE 23 SECURITY ROBOTS MARKET: ECOSYSTEM

TABLE 2 COMPANIES AND THEIR ROLES IN SECURITY ROBOTS ECOSYSTEM

5.5 PRICING ANALYSIS OF SECURITY ROBOTS

TABLE 3 AVERAGE SELLING PRICES OF SECURITY ROBOTS AND THEIR COMPONENTS, 2021–2022

5.5.1 AVERAGE SELLING PRICES OF MARKET PLAYERS

FIGURE 24 AVERAGE SELLING PRICES OF KEY PLAYERS, BY TYPE

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 25 SECURITY ROBOTS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.7 TECHNOLOGICAL TRENDS

5.7.1 UUV FOR SWARM OPERATIONS

5.7.2 CROSS-PLATFORM OPERATIONS

5.7.3 AUTONOMOUS UNDERWATER VEHICLES

5.7.3.1 Rapid technological advancements

5.7.3.2 Pipeline inspection trend in AUV

5.7.3.3 Longer mission life

5.7.3.4 Increased functionality

5.7.3.5 Miniaturization

5.7.4 REMOTELY OPERATED VEHICLES

5.7.4.1 Hybrid ROVs

5.7.4.2 HD camera and video

5.7.4.3 Rescue vehicles

5.7.4.4 Reduced vehicle size

5.7.5 3D PRINTING IN UNMANNED UNDERWATER VEHICLES

5.7.6 MULTIBEAM ECHO SOUNDERS

5.7.7 REMOTE CONTROL STATIONS

5.7.8 SEMI-AUTONOMOUS ROBOTICS FOR FUTURE COMBAT SYSTEMS

5.7.9 APPLIQUE KITS

5.7.10 ARTIFICIAL INTELLIGENCE IN UAV

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 SECURITY ROBOTS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREATS OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWERS OF SUPPLIERS

5.8.4 BARGAINING POWERS OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS (%)

5.9.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 END USERS

TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END USERS

5.10 CASE STUDIES

5.10.1 SWARMDIVER BY AQUABOTIX (AUSTRALIA)

5.10.2 VECTOR HAWK FROM LOCKHEED MARTIN (US)

5.10.3 UAVS DEPLOYED BY VARIOUS COMPANIES FOR DELIVERY SERVICES

5.10.4 UAVS FOR DELIVERY SERVICES DURING PANDEMIC

5.10.4.1 Drones of Zipline were used to transfer test samples to research laboratories during pandemic in Rwanda, Ghana, and US

5.10.4.2 Delivery of medical prescriptions using drones by Manna Aero in Ireland during pandemic

5.10.4.3 Mexico-based Sincronia Logistica uses drones to deliver medical supplies to public hospitals during pandemic

5.11 TRADE ANALYSIS

FIGURE 28 IMPORTS DATA FOR CAMERAS, 2017–2021 (USD MILLION)

FIGURE 29 EXPORTS DATA FOR CAMERAS, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 30 TOP COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS RELATED TO SECURITY ROBOTS

FIGURE 31 PATENT ANALYSIS RELATED TO SECURITY ROBOTS

TABLE 7 LIST OF TOP 20 PATENT OWNERS IN SECURITY ROBOTS MARKET IN LAST 10 YEARS

TABLE 8 LIST OF MAJOR PATENTS

5.13 KEY CONFERENCES & EVENTS

TABLE 9 SECURITY ROBOT MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 SECURITY ROBOTS MARKET, BY TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 32 MARKET, BY TYPE

FIGURE 33 UNMANNED AERIAL VEHICLES TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 14 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 15 MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2 UNMANNED AERIAL VEHICLES

6.2.1 UNMANNED AERIAL VEHICLES, BY WING TYPE

TABLE 16 MARKET FOR UAV, BY WING TYPE, 2018–2021 (USD MILLION)

TABLE 17 MARKET FOR UAV, BY WING TYPE, 2022–2027 (USD MILLION)

TABLE 18 MARKET FOR UAV IN NORTH AMERICA, BY WING TYPE, 2018–2021 (USD MILLION)

TABLE 19 MARKET FOR UAV IN NORTH AMERICA, BY WING TYPE, 2022–2027 (USD MILLION)

TABLE 20 MARKET FOR UAV IN EUROPE, BY WING TYPE, 2018–2021 (USD MILLION)

TABLE 21 MARKET FOR UAV IN EUROPE, BY WING TYPE, 2022–2027 (USD MILLION)

TABLE 22 MARKET FOR UAV IN ASIA PACIFIC, BY WING TYPE, 2018–2021 (USD MILLION)

TABLE 23 MARKET FOR UAV IN ASIA PACIFIC, BY WING TYPE, 2022–2027 (USD MILLION)

TABLE 24 MARKET FOR UAV IN ROW, BY WING TYPE, 2018–2021 (USD MILLION)

TABLE 25 MARKET FOR UAV IN ROW, BY WING TYPE, 2022–2027 (USD MILLION)

6.2.1.1 Fixed wing

6.2.1.1.1 Increased use of fixed-wing UAVs in military applications

6.2.1.1.2 CTOL

6.2.1.1.3 VTOL

TABLE 26 MARKET FOR UAV WITH FIXED WING TYPE, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 MARKET FOR UAV WITH FIXED WING TYPE, BY REGION, 2022–2027 (USD MILLION)

6.2.1.2 Rotary wing

6.2.1.2.1 High demand for rotary-wing UAVs in search and rescue operations, precision farming, and law enforcement applications

6.2.1.2.2 Single rotor

6.2.1.2.3 Multirotor

6.2.1.2.3.1 Bicopters

6.2.1.2.3.2 Tricopters

6.2.1.2.3.3 Quadcopters

6.2.1.2.3.4 Hexacopters

6.2.1.2.3.5 Octocopters

TABLE 28 MARKET FOR UAV WITH ROTARY WING TYPE, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 MARKET FOR UAV WITH ROTARY WING TYPE, BY REGION, 2022–2027 (USD MILLION)

6.2.2 UNMANNED AERIAL VEHICLES, BY MODE OF OPERATION

6.2.2.1 Remotely piloted

6.2.2.1.1 Increasing demand for aerial exploration activities to fuel demand for remotely piloted UAVs

6.2.2.2 Optionally piloted

6.2.2.2.1 Rising use of optionally piloted UAVs in military and commercial applications to boost market growth

6.2.2.3 Fully autonomous

6.2.2.3.1 Surging deployment of fully autonomous UAVs for high-altitude applications to drive market growth

TABLE 30 MARKET FOR UAV, BY OPERATION MODE, 2018–2021 (USD MILLION)

TABLE 31 MARKET FOR UAV, BY OPERATION MODE, 2022–2027 (USD MILLION)

6.2.3 UNMANNED AERIAL VEHICLES, BY FUNCTION

TABLE 32 MARKET FOR UAV, BY FUNCTION, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR UAV, BY FUNCTION, 2022–2027 (USD MILLION)

6.2.3.1 Special-purpose drones

6.2.3.1.1 Use of special-purpose drones in military and combat operations

6.2.3.1.2 Unmanned combat aerial vehicles

6.2.3.1.3 Lethal drones

6.2.3.1.4 Decoy drones

6.2.3.1.5 Swarm drones

6.2.3.1.6 Stratospheric drones

6.2.3.1.7 Exo-stratospheric drones

6.2.3.2 Passenger drones

6.2.3.2.1 Development of new passenger drones to mitigate various challenges faced by them

6.2.3.2.2 Personal air vehicles

6.2.3.2.3 Drone taxis

6.2.3.2.4 Air shuttles

6.2.3.2.5 Air ambulances

6.2.3.3 Inspection & monitoring drones

6.2.3.3.1 Incorporation of artificial intelligence in inspection & monitoring drones leads to their increased global demand

6.2.3.4 Surveying & mapping drones

6.2.3.4.1 Quick and accurate measurement of topographic points offered by surveying & mapping drones

6.2.3.5 Spraying & seeding drones

6.2.3.5.1 Use of drones for spraying pesticides and seeding crops

6.2.3.6 Cargo air vehicles

6.2.3.6.1 Development of cargo air vehicles to carry out cargo deliveries

6.2.3.7 Others

6.2.3.7.1 Photography/filming drones

6.2.3.7.2 Cargo delivery drones

6.3 UNMANNED GROUND VEHICLES

TABLE 34 SECURITY ROBOTS MARKET FOR UGV, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 MARKET FOR UGV, BY REGION, 2022–2027 (USD MILLION)

TABLE 36 MARKET FOR UGV IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR UGV IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

TABLE 38 MARKET FOR UGV IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 39 MARKET FOR UGV IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 40 MARKET FOR UGV IN ASIA PACIFIC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 41 MARKET FOR UGV IN ASIA PACIFIC, BY TYPE, 2022–2027 (USD MILLION)

TABLE 42 MARKET FOR UGV IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 43 MARKET FOR UGV IN ROW, BY TYPE, 2022–2027 (USD MILLION)

6.3.1 UNMANNED GROUND VEHICLES, BY MOBILITY

TABLE 44 SECURITY ROBOTS MARKET FOR UGV, BY MOBILITY, 2018–2021 (USD MILLION)

TABLE 45 MARKET FOR UGV, BY MOBILITY, 2022–2027 (USD MILLION)

6.3.1.1 Wheeled

6.3.1.1.1 Increasing demand for wheeled robots for surveillance applications to drive market growth

6.3.1.2 Tracked

6.3.1.2.1 Use of tracked robots for rough, off-road, and unpredictable terrains to boost market growth

6.3.1.3 Hybrid

6.3.1.3.1 Hybrid robots are dynamic, fast, and energy-efficient, which are key factors driving market growth

6.3.1.4 Legged

6.3.1.4.1 High adaptability of legged robots for large number of applications to boost demand for these vehicles

6.3.2 UNMANNED GROUND VEHICLES, BY MODE OF OPERATION

TABLE 46 SECURITY ROBOTS MARKET FOR UGV, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR UGV, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 48 MARKET FOR UGV IN NORTH AMERICA, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 49 MARKET FOR UGV IN NORTH AMERICA, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 50 MARKET FOR UGV IN EUROPE, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 51 MARKET FOR UGV IN EUROPE, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 52 MARKET FOR UGV IN ASIA PACIFIC, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 53 MARKET FOR UGV IN ASIA PACIFIC, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

TABLE 54 MARKET FOR UGV IN ROW, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 55 MARKET FOR UGV IN ROW, BY MODE OF OPERATION, 2022–2027 (USD MILLION)

6.3.2.1 Tethered

6.3.2.1.1 Tethered operation assists humans in line-of-site missions, which is key factor driving market growth

TABLE 56 MARKET FOR TETHERED UGV, BY REGION, 2018–2021 (USD MILLION)

TABLE 57 MARKET FOR TETHERED UGV, BY REGION, 2022–2027 (USD MILLION)

6.3.2.2 Teleoperated

6.3.2.2.1 Teleoperated UGVs are deployed for mine detection and clearing operations

TABLE 58 MARKET FOR TELEOPERATED UGV, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 MARKET FOR TELEOPERATED UGV, BY REGION, 2022–2027 (USD MILLION)

6.3.2.3 Autonomous

6.3.2.3.1 Fully autonomous

6.3.2.3.1.1 Fully autonomous UGVs assist soldiers in target tracking, surveillance, and reconnaissance missions

6.3.2.3.2 Semi-autonomous

6.3.2.3.2.1 Semi-autonomous UGVs have greater adoption as weapon platform

TABLE 60 MARKET FOR AUTONOMOUS UGV, BY TYPE, 2018–2021 (USD MILLION)

TABLE 61 MARKET FOR AUTONOMOUS UGV, BY TYPE, 2022–2027 (USD MILLION)

TABLE 62 MARKET FOR AUTONOMOUS UGV, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 MARKET FOR AUTONOMOUS UGV, BY REGION, 2022–2027 (USD MILLION)

6.4 UNMANNED UNDERWATER VEHICLES

6.4.1 UNMANNED UNDERWATER VEHICLES, BY TYPE

TABLE 64 MARKET FOR UUV, BY TYPE, 2018–2021 (USD MILLION)

TABLE 65 MARKET FOR UUV, BY TYPE, 2022–2027 (USD MILLION)

6.4.1.1 Autonomous underwater vehicles

6.4.1.1.1 Autonomous underwater vehicles, by propulsion type

6.4.1.1.1.1 Electric systems

6.4.1.1.1.2 Fully electric systems

6.4.1.1.1.3 Hybrid systems

6.4.1.1.2 Non-electric systems

6.4.1.1.2.1 Need for longer endurance along with high power requirement for heavy work application to drive segmental growth

TABLE 66 MAPPING: DEVELOPMENT OF FUEL CELLS

TABLE 67 SECURITY ROBOTS MARKET FOR AUV, BY PROPULSION TYPE, 2018–2021 (USD MILLION)

TABLE 68 MARKET FOR AUV, BY PROPULSION TYPE, 2022–2027 (USD MILLION)

TABLE 69 MARKET FOR AUV IN NORTH AMERICA, BY PROPULSION TYPE, 2018–2021 (USD MILLION)

TABLE 70 MARKET FOR AUV IN NORTH AMERICA, BY PROPULSION TYPE, 2022–2027 (USD MILLION)

TABLE 71 MARKET FOR AUV IN EUROPE, BY PROPULSION TYPE, 2018–2021 (USD MILLION)

TABLE 72 MARKET FOR AUV IN EUROPE, BY PROPULSION TYPE, 2022–2027 (USD MILLION)

TABLE 73 MARKET FOR AUV IN ASIA PACIFIC, BY PROPULSION TYPE, 2018–2021 (USD MILLION)

TABLE 74 MARKET FOR AUV IN ASIA PACIFIC, BY PROPULSION TYPE, 2022–2027 (USD MILLION)

TABLE 75 MARKET FOR AUV IN ROW, BY PROPULSION TYPE, 2018–2021 (USD MILLION)

TABLE 76 MARKET FOR AUV IN ROW, BY PROPULSION TYPE, 2022–2027 (USD MILLION)

6.4.1.1.3 Autonomous underwater vehicles, by shape

6.4.1.1.3.1 Torpedo

6.4.1.1.3.2 Laminar flow body

6.4.1.1.3.3 Streamlined rectangular style

6.4.1.1.3.4 Multi-hull vehicle

TABLE 77 SECURITY ROBOTS MARKET FOR AUV, BY SHAPE, 2018–2021 (USD MILLION)

TABLE 78 MARKET FOR AUV, BY SHAPE, 2022–2027 (USD MILLION)

6.4.1.2 Remotely operated underwater vehicles

6.4.1.2.1 Remotely operated underwater vehicles, by product type

6.4.1.2.1.1 Small vehicles

6.4.1.2.1.2 High-capacity vehicles

6.4.1.2.1.3 Light work class vehicles

6.4.1.2.1.4 Heavy work class vehicles

TABLE 79 MARKET FOR ROV, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 80 MARKET FOR ROV, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

6.4.1.2.2 Remotely operated underwater vehicles, by propulsion system

6.4.1.2.2.1 Electric systems

6.4.1.2.2.2 Fully electric

6.4.1.2.2.3 Hybrid

6.4.1.2.3 Non-electric systems

6.4.1.2.3.1 Extensive R&D to develop highly efficient fuel cell propulsion systems to drive market

TABLE 81 SECURITY ROBOTS MARKET FOR ROV, BY PROPULSION TYPE, 2018–2021 (USD MILLION)

TABLE 82 MARKET FOR ROV, BY PROPULSION TYPE, 2022–2027 (USD MILLION)

TABLE 83 MARKET FOR ROV IN NORTH AMERICA, BY PROPULSION TYPE, 2018–2021 (USD MILLION)

TABLE 84 MARKET FOR ROV IN NORTH AMERICA, BY PROPULSION TYPE, 2022–2027 (USD MILLION)

TABLE 85 MARKET FOR ROV IN EUROPE, BY PROPULSION TYPE, 2018–2021 (USD MILLION)

TABLE 86 MARKET FOR ROV IN EUROPE, BY PROPULSION TYPE, 2022–2027 (USD MILLION)

TABLE 87 MARKET FOR ROV IN ASIA PACIFIC, BY PROPULSION TYPE, 2018–2021 (USD MILLION)

TABLE 88 MARKET FOR ROV IN ASIA PACIFIC, BY PROPULSION TYPE, 2022–2027 (USD MILLION)

TABLE 89 MARKET FOR ROV IN ROW, BY PROPULSION TYPE, 2018–2021 (USD MILLION)

TABLE 90 MARKET FOR ROV IN ROW, BY PROPULSION TYPE, 2022–2027 (USD MILLION)

7 SECURITY ROBOTS MARKET, BY APPLICATION (Page No. - 124)

7.1 INTRODUCTION

FIGURE 34 MARKET, BY APPLICATION

7.2 SPYING

7.3 EXPLOSIVE DETECTION

7.4 FIREFIGHTING

7.5 DEMINING

7.6 RESCUE OPERATIONS

7.7 TRANSPORTATION

7.8 PATROLLING

8 SECURITY ROBOTS MARKET, BY END USER (Page No. - 127)

8.1 INTRODUCTION

FIGURE 35 MARKET, BY END USER

FIGURE 36 MILITARY & DEFENSE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FOR UAV FROM 2022 TO 2027

TABLE 91 MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 92 MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 93 MARKET FOR UAV, BY END USER, 2018–2021 (USD MILLION)

TABLE 94 MARKET FOR UAV, BY END USER, 2022–2027 (USD MILLION)

TABLE 95 MARKET FOR UGV, BY END USER, 2018–2021 (USD MILLION)

TABLE 96 MARKET FOR UGV, BY END USER, 2022–2027 (USD MILLION)

TABLE 97 MARKET FOR ROV, BY END USER, 2018–2021 (USD MILLION)

TABLE 98 MARKET FOR ROV, BY END USER, 2022–2027 (USD MILLION)

TABLE 99 MARKET FOR AUV, BY END USER, 2018–2021 (USD MILLION)

TABLE 100 MARKET FOR AUV, BY END USER, 2022–2027 (USD MILLION)

8.2 COMMERCIAL

8.2.1 INCREASING APPLICATIONS OF SECURITY ROBOTS IN COMMERCIAL SECTOR OWING TO THEIR EFFICIENCY IN OPERATIONS

8.3 CIVIL/RESIDENTIAL

8.3.1 EASE OF USAGE OF SECURITY ROBOTS FOR RESIDENTIAL PURPOSES TO DRIVE DEMAND FOR SECURITY ROBOTS

8.4 MILITARY & DEFENSE

8.4.1 RISING DEMAND FOR SMALL DRONES IN DEFENSE SECTOR FOR SURVEILLANCE AND RECONNAISSANCE ACTIVITIES AND BORDER SECURITY APPLICATIONS

8.5 OTHERS

8.5.1 LAW ENFORCEMENT

8.5.1.1 Increase in terrorist activities has resulted in use of security robots for law enforcement applications

8.5.2 FEDERAL LAW ENFORCEMENT

8.5.2.1 UGVs are extensively used by federal law enforcement agencies for dangerous missions

9 GEOGRAPHIC ANALYSIS (Page No. - 135)

9.1 INTRODUCTION

FIGURE 37 GEOGRAPHIC SNAPSHOT: SECURITY ROBOTS MARKET

FIGURE 38 NORTH AMERICA EXPECTED TO HOLD LARGEST SHARE OF MARKET FOR UAV THROUGHOUT FORECAST PERIOD

TABLE 101 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 103 MARKET FOR UGV, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 MARKET FOR UGV, BY REGION, 2022–2027 (USD MILLION)

TABLE 105 MARKET FOR AUV, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 MARKET FOR AUV, BY REGION, 2022–2027 (USD MILLION)

TABLE 107 MARKET FOR ROV, BY REGION, 2018–2021 (USD MILLION)

TABLE 108 MARKET FOR ROV, BY REGION, 2022–2027 (USD MILLION)

TABLE 109 MARKET FOR UAV, BY REGION, 2018–2021 (USD MILLION)

TABLE 110 MARKET FOR UAV, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 IMPACT OF COVID-19 ON SECURITY ROBOTS MARKET IN NORTH AMERICA

FIGURE 39 NORTH AMERICA: SNAPSHOT OF MARKET

FIGURE 40 US ESTIMATED TO ACCOUNT FOR LARGER SHARE OF MARKET FOR UAV IN NORTH AMERICA IN 2027

TABLE 111 MARKET FOR UAV IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 112 MARKET FOR UAV IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 113 MARKET FOR UGV IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 114 MARKET FOR UGV IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 115 MARKET FOR AUV IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 MARKET FOR AUV IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 MARKET FOR ROV IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 118 MARKET FOR ROV IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.2 US

9.2.2.1 Innovations and changes in regulations related to security robots to fuel market growth

9.2.3 CANADA

9.2.3.1 Deployment of security robots to keep check on human trafficking, smuggling, and illegal migration across international borders to boost market growth

9.3 EUROPE

9.3.1 IMPACT OF COVID-19 ON SECURITY ROBOTS MARKET IN EUROPE

FIGURE 41 EUROPE: SNAPSHOT OF MARKET

FIGURE 42 UK ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR UAV IN EUROPE IN 2027

TABLE 119 MARKET FOR UAV IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 120 MARKET FOR UAV IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 121 MARKET FOR UGV IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 122 MARKET FOR UGV IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 123 MARKET FOR AUV IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 124 MARKET FOR AUV IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 125 MARKET FOR ROV IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 MARKET FOR ROV IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Increasing investments in defense and border control expected to drive growth of UAV market

9.3.3 GERMANY

9.3.3.1 Growing investments for high-performance drone development for civil and commercial sectors to boost market growth

9.3.4 FRANCE

9.3.4.1 Rising importance of drones for civil and commercial applications to propel growth of market

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 IMPACT OF COVID-19 ON SECURITY ROBOTS MARKET IN ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: SNAPSHOT OF MARKET

FIGURE 44 CHINA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET AMONG OTHER COUNTRIES IN ASIA PACIFIC IN 2027

TABLE 127 MARKET FOR UAV IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 128 MARKET FOR UAV IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 129 MARKET FOR UGV IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 130 MARKET FOR UGV IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 131 MARKET FOR AUV IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 132 MARKET FOR AUV IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 133 MARKET FOR ROV IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 134 MARKET FOR ROV IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Rising demand for unmanned systems given their immense roles in civil & defense applications to drive market growth

9.4.3 JAPAN

9.4.3.1 Surging demand for mini-UAVs for radiation detection techniques along with surveillance to boost market growth

9.4.4 INDIA

9.4.4.1 Frequent terrorist attacks and border disputes with neighboring countries to boost demand for security robots in India

9.4.5 REST OF APAC

9.5 ROW

9.5.1 IMPACT OF COVID-19 ON SECURITY ROBOTS MARKET IN ROW

FIGURE 45 MIDDLE EAST ESTIMATED TO ACCOUNT FOR LARGER SHARE OF MARKET IN ROW IN 2027

TABLE 135 MARKET FOR UAV IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 136 MARKET FOR UAV IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 137 MARKET FOR UGV IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 138 MARKET FOR UGV IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 139 MARKET FOR ROV IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 140 MARKET FOR ROV IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 141 MARKET FOR AUV IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 142 MARKET FOR AUV IN ROW, BY REGION, 2022–2027 (USD MILLION)

9.5.2 SOUTH AMERICA

9.5.2.1 Rising demand for security surveillance to drive market growth

9.5.3 MIDDLE EAST & AFRICA

9.5.3.1 Increasing defense spending to ensure security to boost market growth

10 COMPETITIVE LANDSCAPE (Page No. - 162)

10.1 INTRODUCTION

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN SECURITY ROBOTS MARKET

10.3 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 46 TOP 5 PLAYERS IN UUV MARKET, 2017–2021

10.4 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2020–2021

TABLE 143 GLOBAL UUV MARKET: MARKET SHARE ANALYSIS

10.5 COMPETITIVE EVALUATION QUADRANT, 2020

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 47 SECURITY ROBOTS MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2021

10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2020

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 48 MARKET (GLOBAL) SME EVALUATION QUADRANT, 2021

10.6.5 SECURITY ROBOTS MARKET: COMPANY FOOTPRINT

TABLE 144 COMPANY COMPONENTS FOOTPRINT

TABLE 145 COMPANY END USER FOOTPRINT

TABLE 146 COMPANY REGION FOOTPRINT

TABLE 147 COMPANY FOOTPRINT

10.6.6 SECURITY ROBOTS MARKET: STARTUP MATRIX

TABLE 148 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 149 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SME, BY TYPE

TABLE 150 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SME, END USER AND REGION

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT LAUNCHES

TABLE 151 MARKET: PRODUCT LAUNCHES

10.7.2 DEALS

TABLE 152 MARKET: DEALS

11 COMPANY PROFILES (Page No. - 180)

(Business overview, Products offered, Recent developments & MnM View)*

11.1 KEY PLAYERS

11.1.1 AEROVIRONMENT, INC.

TABLE 153 AEROVIRONMENT, INC.: BUSINESS OVERVIEW

FIGURE 49 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

TABLE 154 AEROVIRONMENT, INC.: PRODUCT OFFERINGS

11.1.2 BAE SYSTEMS

TABLE 155 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 50 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 156 BAE SYSTEMS: PRODUCT OFFERINGS

11.1.3 BOSTON DYNAMICS

TABLE 157 BOSTON DYNAMICS: BUSINESS OVERVIEW

TABLE 158 BOSTON DYNAMICS: PRODUCT OFFERINGS

11.1.4 SAAB

TABLE 159 SAAB: BUSINESS OVERVIEW

FIGURE 51 SAAB: COMPANY SNAPSHOT

TABLE 160 SAAB: PRODUCT OFFERINGS

TABLE 161 SAAB: PRODUCT LAUNCHES AND DEVELOPMENTS

11.1.5 COBHAM LIMITED

TABLE 162 COBHAM LIMITED: BUSINESS OVERVIEW

TABLE 163 COBHAM LIMITED: PRODUCT OFFERINGS

11.1.6 ECA GROUP

TABLE 164 ECA GROUP.: BUSINESS OVERVIEW

TABLE 165 ECA GROUP.: PRODUCT OFFERINGS

11.1.7 ELBIT SYSTEMS LTD.

TABLE 166 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

FIGURE 52 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 167 ELBIT SYSTEMS LTD.: PRODUCT OFFERINGS

11.1.8 KNIGHTSCOPE, INC.

TABLE 168 KNIGHTSCOPE, INC.: BUSINESS OVERVIEW

FIGURE 53 KNIGHTSCOPE, INC.: COMPANY SNAPSHOT

TABLE 169 KNIGHTSCOPE, INC.: PRODUCT OFFERINGS

11.1.9 KONGSBERG

TABLE 170 KONGSBERG: BUSINESS OVERVIEW

FIGURE 54 KONGSBERG.: COMPANY SNAPSHOT

TABLE 171 KONGSBERG: PRODUCT OFFERINGS

11.1.10 LEONARDO S.P.A.

TABLE 172 LEONARDO S.P.A.: BUSINESS OVERVIEW

FIGURE 55 LEONARDO S.P.A.: COMPANY SNAPSHOT

TABLE 173 LEONARDO S.P.A.: PRODUCT OFFERINGS

11.1.11 LOCKHEED MARTIN CORPORATION

TABLE 174 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

FIGURE 56 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 175 LOCKHEED MARTIN CORPORATION: PRODUCT OFFERINGS

11.1.12 NORTHROP GRUMMAN

TABLE 176 NORTHROP GRUMMAN: BUSINESS OVERVIEW

FIGURE 57 NORTHROP GRUMMAN: COMPANY SNAPSHOT

TABLE 177 NORTHROP GRUMMAN: PRODUCT OFFERINGS

11.1.13 QINETIQ

TABLE 178 QINETIQ: BUSINESS OVERVIEW

FIGURE 58 QINETIQ: COMPANY SNAPSHOT

TABLE 179 QINETIQ: PRODUCT OFFERINGS

11.1.14 SMP ROBOTICS

TABLE 180 SMP ROBOTICS: BUSINESS OVERVIEW

TABLE 181 SMP ROBOTICS: PRODUCT OFFERINGS

11.1.15 THALES

TABLE 182 THALES: BUSINESS OVERVIEW

FIGURE 59 THALES: COMPANY SNAPSHOT

TABLE 183 THALES: PRODUCT OFFERINGS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 AUTONOMOUS SOLUTIONS, INC.

11.2.2 BOEING

11.2.3 DJI

11.2.4 FLIR SYSTEMS

11.2.5 TEXTRON

11.2.6 RHEINMETALL AG

11.2.7 L3 HARRIS TECHNOLOGIES

11.2.8 RECONROBOTICS INC.

11.2.9 ROBOTEX INC.

11.2.10 COBALT ROBOTICS

12 ADJACENT & RELATED MARKETS (Page No. - 236)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 COLLABORATIVE ROBOTS MARKET

12.4 COLLABORATIVE ROBOTS MARKET, BY PAYLOAD

12.4.1 INTRODUCTION

TABLE 184 COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 185 COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021–2027 (USD MILLION)

TABLE 186 COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2017–2020 (UNITS)

TABLE 187 COLLABORATIVE ROBOT MARKET, BY PAYLOAD, 2021–2027 (UNITS)

12.5 UP TO 5 KG

12.5.1 COBOTS WITH PAYLOAD CAPACITY BELOW 5 KG ARE INHERENTLY SAFE

TABLE 188 COMPANIES OFFERING COBOTS WITH PAYLOAD CAPACITY UP TO 5 KG

TABLE 189 COLLABORATIVE ROBOT MARKET FOR PAYLOAD UP TO 5 KG, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 190 COLLABORATIVE ROBOT MARKET FOR PAYLOAD UP TO 5 KG, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 191 COLLABORATIVE ROBOT MARKET FOR PAYLOAD UP TO 5 KG, BY APPLICATION, 2017–2020 (UNITS)

TABLE 192 COLLABORATIVE ROBOT MARKET FOR PAYLOAD UP TO 5 KG, BY APPLICATION, 2021–2027 (UNITS)

TABLE 193 COLLABORATIVE ROBOT MARKET FOR PAYLOAD UP TO 5 KG, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 194 COLLABORATIVE ROBOT MARKET FOR PAYLOAD UP TO 5 KG, BY INDUSTRY, 2021–2027 (USD MILLION)

12.6 5–10 KG

12.6.1 MOST COBOTS WITH 5–10 KG PAYLOAD CAPACITY CAN BE EQUIPPED WITH IN-BUILT FORCE SENSORS

TABLE 195 COMPANIES OFFERING COBOTS WITH 5–10 KG PAYLOAD CAPACITY

TABLE 196 COLLABORATIVE ROBOT MARKET FOR 5–10 KG PAYLOAD, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 197 COLLABORATIVE ROBOT MARKET FOR 5–10 KG PAYLOAD, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 198 COLLABORATIVE ROBOT MARKET FOR 5–10 KG PAYLOAD, BY APPLICATION, 2017–2020 (UNITS)

TABLE 199 COLLABORATIVE ROBOT MARKET FOR 5–10 KG PAYLOAD, BY APPLICATION, 2021–2027 (UNITS)

TABLE 200 COLLABORATIVE ROBOT MARKET FOR 5–10 KG PAYLOAD, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 201 COLLABORATIVE ROBOT MARKET FOR 5–10 KG PAYLOAD, BY INDUSTRY, 2021–2027 (USD MILLION)

12.7 MORE THAN 10 KG

12.7.1 ADVANCES IN ROBOTIC HARDWARE ENABLE MANUFACTURERS TO DEVELOP COLLABORATIVE ROBOTS WITH PAYLOAD CAPACITY ABOVE 10 KG

TABLE 202 COMPANIES OFFERING COBOTS WITH PAYLOAD CAPACITY MORE THAN 10 KG

TABLE 203 COLLABORATIVE ROBOT MARKET FOR MORE THAN 10 KG PAYLOAD, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 204 COLLABORATIVE ROBOT MARKET FOR MORE THAN 10 KG PAYLOAD, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 205 COLLABORATIVE ROBOT MARKET FOR MORE THAN 10 KG PAYLOAD, BY APPLICATION, 2017–2020 (UNITS)

TABLE 206 COLLABORATIVE ROBOT MARKET FOR MORE THAN 10 KG PAYLOAD, BY APPLICATION, 2021–2027 (UNITS)

TABLE 207 COLLABORATIVE ROBOT MARKET FOR MORE THAN 10 KG PAYLOAD, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 208 COLLABORATIVE ROBOT MARKET FOR MORE THAN 10 KG PAYLOAD, BY INDUSTRY, 2021–2027 (USD MILLION)

13 APPENDIX (Page No. - 252)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

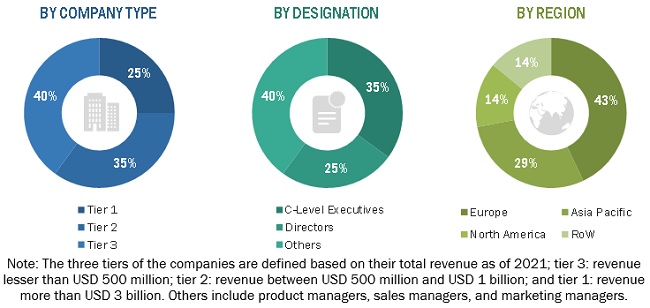

The study involved four major activities in estimating the current size of the security robots market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Finally, both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly conducted to obtain key information about the industry’s supply chain, value chain of the market, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the security robots ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall security robots market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Major players operating in the security robots market have been identified and considered for the report through extensive secondary research.

- The supply chain and market size of the security robots market, both in terms of value and units, have been estimated/determined through secondary and primary research processes.

- All estimations and calculations, including percentage share, revenue mix, splits, and breakdowns have been determined through use of secondary sources which are further verified through primary sources.

Global security robots market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe and forecast the security robots market, in terms of value, based on type, end user, application, and component

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the security robots ecosystem

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Security Robots Market