Robotic Welding Market by Type (Spot Welding Robots, Arc Welding Robots), Payload (>150 kilograms, 50-150 kilograms), End user (Automotive and Transportation, Electrical and Electronics), Geography (2021-2026)

Updated on : October 22, 2024

Robotic Welding Market Size

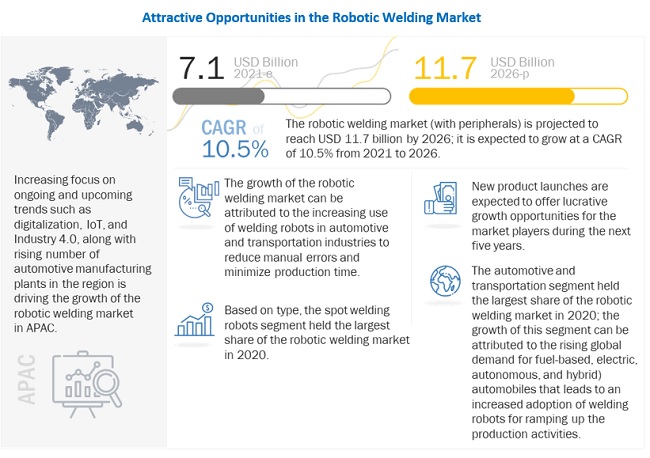

The robotic welding market size is projected to reach USD 11.7 billion by 2026 from an estimated USD 7.1 billion in 2021, growing at a CAGR of 10.5% from 2021 to 2026.

The robotic welding market is experiencing robust demand, fueled by the growing need for automation in manufacturing processes across various industries, including automotive, aerospace, construction, and shipbuilding. As manufacturers seek to enhance productivity, improve weld quality, and reduce labor costs, robotic welding solutions are increasingly being adopted for their precision and efficiency. Key trends driving market growth include advancements in robotic technology, such as artificial intelligence and machine learning, which are enabling smarter and more adaptive welding systems. Additionally, the rising emphasis on workplace safety, coupled with the need for consistent and high-quality welds in complex assemblies, is accelerating the shift towards automation. The expansion of manufacturing facilities in emerging economies and the increasing integration of Industry 4.0 practices further bolster the market, as companies aim to optimize their operations and remain competitive. As the demand for high-quality, cost-effective manufacturing solutions continues to rise, the robotic welding market is expected to expand significantly in the coming years.

The intensifying adoption of Industry 4.0 principles and the increasing adoption of welding robots in the automotive and transportation industries are among the factors driving the growth of the robotic welding market.

To know about the assumptions considered for the study, Request for Free Sample Report

Robotic Welding Market Trends and Dynamics:

Driver:Intensifying adoption of Industry 4.0 principles

Industry 4.0 fully automates manufacturing processes with very little to negligible human interference. It works on the industrial internet of things (IIoT), cyber-physical systems, cloud robotics, cloud computing, and big data. Thus, welding robot manufacturers are shifting towards networked and intelligent production of Industry 4.0-compatible robots.

Many end user industries such as automotive and transportation, metals and machinery, electrical and electronics, and aerospace and defense have started implementing Industry 4.0 concepts in their manufacturing processes to harness the advantages associated with it, including increased productivity, flexibility, and safety; better quality; reduced need for consumables; and reduced production costs.

Players in the robotic welding market are collaborating with end user industry giants to roll out advanced Industry 4.0-ready solutions. For instance, in October 2020, Fujitsu, FANUC Corporation, and NTT Communications established DUCNET Co., Ltd., a new company that will offer a cloud service to support digital transformation (DX) first in the machine tool industry and subsequently in the broader manufacturing industry. Also, earlier in 2014, General Motors (GM), one of the largest automotive companies in the US, along with FANUC Corporation, its welding robot supplier, and CISCO SYSTEMS, INC., developed the Zero Down Time (ZDT) solution.

This is a cloud-based software platform that analyzes data collected from robots across manufacturing factories to detect potential problems that could lead to production downtime. By implementing this solution, GM was able to avoid more than 100 instances of downtime, which brought about significant ROI for the company. In the automotive industry, downtime can cost companies nearly USD 20,000 per minute. These factors are driving the demand for highly advanced welding solutions, which, in turn, is driving the growth of the robotic welding industry.

Restraint:Perceived notion of losing jobs due to automation

The increased use of welding robots substitutes and displaces low-skilled workers. However, it would create more jobs in the long run through reskilling and upskilling. This is true for most developed countries but may not be the case for developing countries, which have a much higher proportion of low-skilled workers. For instance, in Japan and the US, investments in automation are in response to the shrinking working-age population, which is not the case in emerging economies such as India.

The penetration of automation in SMEs in developing countries can have an adverse effect, as they make up the larger part of any industry and are also the largest employers. Thus, the share of jobs that could be displaced by introducing automation is much higher in developing countries.

Economic and political trends can also hurt business prospects, and subsequently, the employees. Low-skilled workers are at the most risk in case of unfavorable events such as recession or political instability. Developing countries have to introduce a tax on the purchase of welding robots to support the workers made redundant by automation, which puts a barrier on the adoption of such robots for larger industries.

The Future of Jobs Report 2018, a report published by the World Economic Forum (WEF), suggests that there will be a 50% reduction in the workforce due to automation by 2022. The data also indicates that most regional companies are looking forward to automation to remain competitive in countries such as India, Indonesia, Mexico, the Philippines, Thailand, and Vietnam. If the companies in developing countries are not equipped with the resources for reskilling or upskilling the employees, they might not be able to retain them in case of deployment of robots. If companies are unwilling to automate, their business growth will be significantly hampered, reducing their ability to remain competitive. According to a report published by Oxford Economics, the number of robots in use worldwide multiplied three-fold over the past 2 decades to 2.25 million.

Trends suggest the global stock of robots will multiply even faster in the next 20 years, reaching as many as 20 million by 2030, with 14 million in China alone. As per the estimation, 20 million manufacturing jobs are set to be lost to robots by 2030. A report published by Brookings Institution states that approximately 25 percent of U.S. employment (36 million jobs in 2016) will face high exposure to automation in the coming decades (with greater than 70% of current task content at risk of substitution). At the same time, some 36% of US employment (52 million jobs in 2016) will experience medium exposure to automation by 2030, while another 39% (57 million jobs) will experience low exposure.

Opportunity:Emergence of laser and plasma welding technologies

A laser welding robot uses a laser beam, which is developed using carbon dioxide and targeted with the help of optics at workpieces to weld different parts together. Laser welding technology offers significant advantages in the production of medium- and large-batch sizes of output products at a low unit cost. It offers high welding speeds, reduces rework, provides high reliability, ensures increased weld quality, and offers high precision. This technology allows narrow welds that require minimal changes to the welded items.

Laser welding technology is used in remote welding locations that are hard to reach. It can also be used in high-volume applications that require increased accuracy in the automotive and transportation, electrical and electronics, and aerospace and defense industries. Similarly, plasma welding technology offers numerous advantages, including high power density, clean and smooth welds, high welding speed, low distortion, and improved gap bridging. The welds produced through plasma welding are very strong and less noticeable. Owing to its numerous advantages, plasma welding technology can be used in the automotive and transportation, and electrical and electronics industries, wherein flexibility is essential as velocity and temperatures can be easily adjusted.

The robotic welding market is majorly dominated by arc and spot welding processes. However, the emergence of laser and plasma welding processes is expected to create lucrative growth opportunities for welding robot manufacturers in the market during the forecast period.

Challenge:Lack of skilled workers for operating welding robots

Robotic welding was primarily adopted in the automotive manufacturing industry to overcome the scarcity of skilled labor for manual welding applications. Currently, welding robots are gaining traction across numerous manufacturing industries such as electrical and electronics, metals and machinery, aerospace and defense, construction, and pharmaceuticals. However, the shortage of skilled workforce to program and operate welding robots still persists.

Welding robots demand closer attention to ensure quality in the product manufacturing process. In addition, clamping and fixturing must be absolutely precise. The robots used for welding in industries need to be precisely programmed in order to avoid production shutdown or product wastage. Moreover, the person responsible for programming must have in-depth knowledge about the different programming tools as they vary from manufacturer to manufacturer. Any error in these definitions could result in a bad welding outcome or a collision during runtime.

A skilled welder can compensate for sloppy or ill-designed fixtures, varying trim lines, and dimensions of the product. However, welding robots need to be closely monitored. To overcome this challenge, a number of manufacturers offer in-depth training before the purchase of welding robots with additional informational tools such as videos and detailed manuals.

Robotic Welding Market Segmentation

The spot welding segment projected to hold the major share of the robotic welding market, in 2026.

The spot welding robots segment is projected to hold the largest share of the robotic welding market in 2026. Robotic spot welding, depending on the payload, offers significant advantages in the form of low-space requirements, heavy machine lifting (including welding guns and metal sheets), and strong, accurate, and high-quality welds. All these factors lead to the preference for robotic spot welding. This welding type is particularly useful for heavy-duty applications in automobile manufacturing. It is also used in the metals and machinery, as well as electronics and semiconductors industries that require highly precise welding.

51–150 kilogram payload segment of the robotic welding market is projected to grow at the highest CAGR during forecast period

The 51–150 kilogram payload segment of the robotic welding market is projected to grow at the highest CAGR from 2021 to 2026. Welding robots with 51–150 kilogram payloads are considered medium-payload welding robots. These robots can be floor-mounted, which helps save space in manufacturing facilities. They can be used in metals and machinery, electrical and electronics, pharmaceuticals, construction, and aerospace and defense industries. KUKA AG, ABB, and NACHI-FUJIKOSHI CORP. are among the key players offering medium-payload arc and spot welding robots.

The automotive and transportation segment of the robotic welding market is projected to account the largest share in 2026

The automotive and transportation segment is projected to capture the largest share of robotic welding market in 2026. The automotive and transportation industry is highly dynamic and hence, requires significant manufacturing flexibility from automotive manufacturers. The intensifying global competition between various automotive manufacturers and the increasing demand for automotive require smart production solutions combined with flexible logistic systems.

Robotic welding has been the leading application of robots in the automotive and transportation industry for a long time, as every vehicle requires a high number of welds before it is complete. Robotic welding enables the development of accurate and high-quality finished products, increases productivity, and enables high machine efficiency and manufacturing flexibility. Thus, the automotive and transportation industry is the largest end user of welding robots.

To know about the assumptions considered for the study, download the pdf brochure

Robotic Welding Industry Regional Analysis

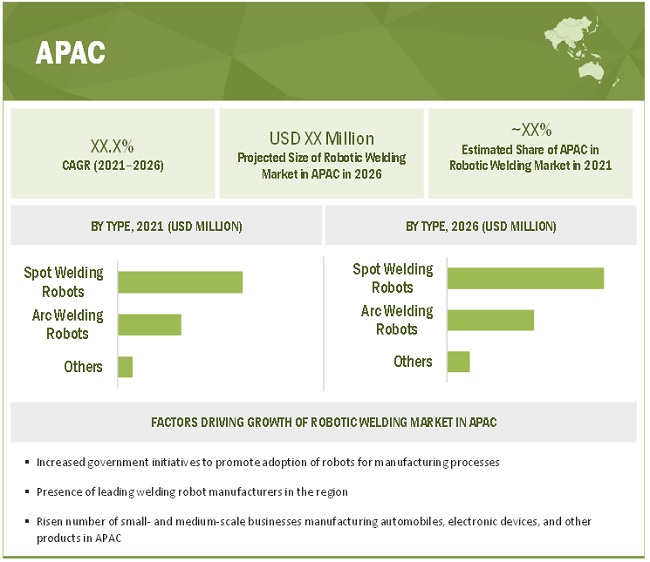

By region, APAC to hold the largest share of the robotic welding market throughout the forecast period

APAC is projected to account for the largest share of the overall robotic welding market in 2026. The market in this region is projected to grow at the highest CAGR from 2021 to 2026. According to the Ministry of Industry and Information Technology (MIIT), China accounted for ~30% of the global manufacturing output in 2020. The country has maintained its position of being the largest manufacturing hub in the world. Thus, the key players in the market are expanding their business in China. Inaddition, according to Hyundai Robotics, the country had the largest robot market in the world, with an annual unit of 130,000 robots in 2019. This led the company to plan the expansion of its business in China by enhancing its local sales network and discovering dealers, along with attracting new customers using its corporate relations in the country.

Top Robotic Welding Companies - Key Market Players

FANUC Corporation (Japan), YASKAWA Electric Corporation (Japan), KUKA AG (Germany), ABB (Switzerland), Kawasaki Heavy Industries, Ltd. (Japan), Panasonic Corporation (Japan), DAIHEN Corporation (Japan), NACHI-FUJIKOSHI CORP. (Japan), Comau S.p.A. (Italy), and Hyundai Robotics (South Korea) are some of the key players in the robotic welding companies.

Robotic Welding Market Report Scope:

|

Report Metric |

Details |

| Estimated Value | USD 7.1 Billion |

| Expected Value | USD 11.7 Billion |

| Growth Rate | CAGR of 10.5% |

|

Forecast Period |

2021–2026 |

|

On Demand Data Available |

2030 |

|

Market Size Availability for Years |

2017–2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

|

|

Geographies Covered |

|

| Market Leaders | FANUC Corporation (Japan), YASKAWA Electric Corporation (Japan), KUKA AG (Germany), ABB (Switzerland), Kawasaki Heavy Industries, Ltd. (Japan), Panasonic Corporation (Japan), DAIHEN Corporation (Japan), NACHI-FUJIKOSHI CORP. (Japan), Comau S.p.A. (Italy), and Hyundai Robotics (South Korea) |

| Key Market Driver | Intensifying adoption of Industry 4.0 principles |

| Key Market Opportunity | Emergence of laser and plasma welding technologies |

| Largest Growing Region | Asia Pacific |

|

Largest Market Share Segment |

Automotive and Transportation Segment |

| Highest CAGR Segment | 51–150 Kilogram Payload Segment |

This research report categorizes the robotic welding market based on type, payload, end user, and region

Robotic welding market:

Based on type:

- Arc Welding

- Spot Welding

- Others

Note: Other welding types include plasma and laser welding

Based on payload

- <50 kg Payload

- 50-150 kg Payload

- >150 kg Payload

Based on end user:

- Automotive & Transportation

- Metals and Machinery

- Electrical and Electronics

- Aerospace & Defense

- Others

Note: Other end users include construction, plastics, rubber and chemicals, pharmaceuticals and cosmetics, and packaging industries.

Based on region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- France

- Germany

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Rest of Asia Pacific

-

Rest of the world

- Middle East & Africa

- South America

Recent Developments in Robotic Welding Industry

- In 2020 November, FANUC Corporation expanded its extensive range of models with the addition of 2 robots—M-20iD/35 handling robot and the welding version ARC Mate 120iD/35. The two models have a maximum payload of 35 kg and a range of 1,831 mm.

- In 2020 September, KUKA AG introduced KR CYBERTECH nano, a highly flexible multi-functional robot. In the low payload category between 6 and 10 kilograms, the cost-efficient robot stands out for its speed, outstanding precision, and low investment and maintenance costs requirements.

- In 2020 July, ASTOR and Kawasaki Robotics signed a strategic agreement for strengthening Kawasaki Robotics’ presence in the robotics market in the Central and Eastern Europe (CEE) region. ASTOR will be responsible for the development of sales, marketing, and cooperation in the partner channel in 12 countries of Central and Eastern Europe, including Poland.

- In 2020 June, Hyundai Robotics established an office in Germany to offer industrial robots and other robot line-ups to European customers and manage the robots that were supplied to Korean auto companies located in Eastern Europe.

- In 2019 October, FANUC America Corporation, a subsidiary of FANUC CORPORATION in Japan, constructed a new 461,000-square-foot North Campus robotics and automation facility in Auburn Hills, Michigan that will be used for engineering, product development, manufacturing, and warehousing.

Frequently Asked Questions (FAQ):

Which are the major companies in the robotic welding market? What are their major strategies to strengthen their market presence?

The major companies in the Robotic welding market are – FANUC Corporation, YASKAWA Electric Corporation, KUKA AG, ABB, and Kawasaki Heavy Industries, Ltd.The major strategies adopted by these players are product launches, expansions, partnerships, contracts, joint ventures, agreements, and acquisitions.

Which is the potential market for the robotic welding in terms of region?

The APAC region is expected to dominate the robotic welding market due to the presence of leading players from the robotic welding ecosystem, such as FANUC Corporation, YASKAWA Electric Corporation, Kawasaki Heavy Industries, Ltd., Panasonic Corporation, DAIHEN Corporation, and NACHI-FUJIKOSHI CORP.

What are the opportunities for new market entrants?

There are significant opportunities in the robotic welding market for start-up companies. These companies are providing new products which are widely used in the automotive and transportation industry.

What are the drivers and opportunities for the robotic welding market?

Factors such as intensifying adoption of Industry 4.0 principles and the increasing demand for welding robots in the automotive and transportation industries are among the factors driving the growth of the robotic welding market. Moreover, government initiatives to support digital transformation in APAC to create lucrative opportunities in the robotic welding market.

Who are the major consumers of the robotic welding that are expected to drive the growth of the market in the next 5 years?

The major consumers for the robotic welding are automotive and transportation and metals and machinery industries are expected to have a significant share in this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 SCOPE

FIGURE 1 ROBOTIC WELDING MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY

1.5 MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 ROBOTIC WELDING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.2 FACTOR ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1–TOP-DOWN (SUPPLY SIDE)—REVENUES GENERATED BY COMPANIES FROM SALES OF WELDING ROBOTS (WITH PERIPHERALS)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1–TOP-DOWN (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATIONS FOR ONE COMPANY IN MARKET (WITH PERIPHERALS)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2—BOTTOM-UP (DEMAND SIDE)–DEMAND FOR WELDING ROBOTS (WITH PERIPHERALS)

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for obtaining market share using bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for obtaining market share using top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

3.1 IMPACT OF COVID-19 ON ROBOTIC WELDING MARKET

FIGURE 9 GLOBAL PROPAGATION OF COVID-19

TABLE 1 RECOVERY SCENARIOS FOR GLOBAL ECONOMY

3.2 REALISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

3.4 PESSIMISTIC SCENARIO

FIGURE 10 GROWTH PROJECTIONS OF MARKET (WITH PERIPHERALS) IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 11 PRE- AND POST-COVID-19 SCENARIOS OF MARKET (WITH PERIPHERALS)

FIGURE 12 SPOT WELDING ROBOTS SEGMENT TO HOLD LARGEST SHARE OF MARKET (WITH PERIPHERALS) IN 2021 AND 2026

FIGURE 13 >150 KILOGRAM PAYLOAD SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

FIGURE 14 AUTOMOTIVE AND TRANSPORTATION SEGMENT OF MARKET (WITH PERIPHERALS) TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 15 APAC TO LEAD MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET (WITH PERIPHERALS)

FIGURE 16 INCREASING ADOPTION OF DIGITALIZATION, IOT, AND INDUSTRY 4.0 TO FUEL MARKET GROWTH

4.2 MARKET (WITH PERIPHERALS), BY TYPE AND PAYLOAD

FIGURE 17 SPOT WELDING ROBOTS AND >150 KILOGRAM PAYLOAD SEGMENTS TO ACCOUNT FOR LARGEST SHARES OF MARKET (WITH PERIPHERALS) IN 2026

4.3 MARKET (WITH PERIPHERALS), BY END USER

FIGURE 18 AUTOMOTIVE AND TRANSPORTATION SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

4.4 MARKET (WITH PERIPHERALS), BY REGION

FIGURE 19 APAC TO ACCOUNT FOR LARGEST SHARE OF MARKET (WITH PERIPHERALS) IN 2021 AND 2026

4.5 MARKET (WITH PERIPHERALS), BY COUNTRY

FIGURE 20 MARKET (WITH PERIPHERALS) IN CHINA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Intensifying adoption of Industry 4.0 principles

5.2.1.2 Increasing adoption of welding robots in automotive and transportation industries

5.2.1.3 Ongoing penetration of 5G in industrial manufacturing

FIGURE 22 MARKET: DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Perceived notion of losing jobs due to automation

5.2.2.2 High initial costs associated with installation of welding robots for SME

FIGURE 23 MARKET: RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Government initiatives to support digital transformation in APAC

5.2.3.2 Emergence of laser and plasma welding technologies

FIGURE 24 ROBOTIC WELDING MARKET: OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled workers for operating welding robots

FIGURE 25 MARKET: CHALLENGES AND THEIR IMPACT

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 26 ROBOTIC WELDING SUPPLY CHAIN

5.4 TRENDS/DISRUPTIONS IMPACTING BUSINESS OF CUSTOMERS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET

FIGURE 27 REVENUE SHIFT IN MARKET

5.5 ROBOTIC WELDING ECOSYSTEM

FIGURE 28 ROBOTIC WELDING ECOSYSTEM

TABLE 2 LIST OF OEMS, SUPPLIERS, AND DISTRIBUTORS OF WELDING ROBOTS

5.6 PORTER’S FIVE FORCES MODEL

TABLE 3 ROBOTIC WELDING MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 THREAT OF NEW ENTRANTS

5.7 CASE STUDY

5.7.1 UNIVERSAL WELDING CELL OFFERED BY ENKO STAUDINGER GMBH HELPED KAUTH GMBH UND CO. KG IN ACHIEVING WELDING FLEXIBILITY

5.7.2 INDIANA-BASED CROWN EQUIPMENT REPLACED ITS EXISTING MIG AND STICK WELDING PROCESSES WITH WELDING ROBOTS AND CELLS TO REDUCE PRODUCTION DOWNTIME

5.7.3 KAWASAKI MOTORS MANUFACTURING CORP. REDUCED RELIANCE ON MANUAL WELDING USING ARC WELDING ROBOTS

5.7.4 MOTION CONTROLS ROBOTICS BUILT A TURNKEY SYSTEM FOR LUK USA LLC

5.8 TECHNOLOGY ANALYSIS

5.8.1 KEY TECHNOLOGIES

5.8.1.1 TIG welding

5.8.1.2 MIG welding

5.8.1.3 Submerged arc welding

5.8.1.4 Friction stir welding

5.8.1.5 Explosion welding

5.8.2 COMPLEMENTARY TECHNOLOGY

5.8.2.1 Penetration of Industrial Internet of Things (IIoT) and AI in industrial manufacturing

5.9 AVERAGE SELLING PRICE ANALYSIS

TABLE 4 AVERAGE SELLING PRICES OF WELDING ROBOTS (WITHOUT PERIPHERALS)

5.10 TRADE ANALYSIS

5.10.1 IMPORT SCENARIO

TABLE 5 IMPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.10.2 EXPORT SCENARIO

TABLE 6 EXPORT DATA, BY COUNTRY, 2016–2020 (USD MILLION)

5.11 PATENT ANALYSIS, 2015–2020

TABLE 7 TOP 20 PATENT OWNERS IN US FROM 2011 TO 2020

FIGURE 30 PATENTS GRANTED WORLDWIDE FROM 2011 TO 2020

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2011 TO 2020

5.12 TARIFFS AND REGULATIONS

5.12.1 TARIFFS

TABLE 8 MFN TARIFFS IMPOSED ON EXPORTS OF INDUSTRIAL ROBOTS BY US

TABLE 9 MFN TARIFFS IMPOSED ON EXPORT OF INDUSTRIAL ROBOTS BY CHINA

5.12.1.1 Positive impact of tariffs on industrial robot manufacturers

5.12.1.2 Negative impact of tariffs on industrial robot manufacturers

5.12.2 REGULATORY COMPLIANCE

5.12.2.1 Regulations and standards followed in countries of North America

5.12.2.2 Regulations and standards followed in countries of Europe

5.12.2.3 Regulations and standards followed in countries of APAC

6 ROBOTIC WELDING MARKET, BY TYPE (Page No. - 87)

6.1 INTRODUCTION

FIGURE 32 MARKET, BY TYPE

FIGURE 33 SPOT WELDING ROBOTS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) IN 2021

TABLE 10 MARKET (WITHOUT PERIPHERALS), BY TYPE, 2017–2020 (USD MILLION)

TABLE 11 MARKET (WITHOUT PERIPHERALS), BY TYPE, 2021–2026 (USD MILLION)

TABLE 12 MARKET (WITHOUT PERIPHERALS), BY TYPE, 2017–2020 (UNITS)

TABLE 13 MARKET (WITHOUT PERIPHERALS), BY TYPE, 2021–2026 (UNITS)

TABLE 14 MARKET (WITH PERIPHERALS), BY TYPE, 2017–2020 (USD MILLION)

TABLE 15 MARKET (WITH PERIPHERALS), BY TYPE, 2021–2026 (USD MILLION)

6.2 ARC WELDING ROBOTS

6.2.1 ADOPTION OF ARC WELDING ROBOTS FOR USE IN APPLICATIONS THAT REQUIRE ACCURACY AND HIGH REPEATABILITY

FIGURE 34 AUTOMOTIVE AND TRANSPORTATION SEGMENT TO HOLD LARGEST SIZE OF MARKET (WITH PERIPHERALS) IN 2021

TABLE 16 ROBOTIC ARC WELDING MARKET (WITH PERIPHERALS), BY END USER, 2017–2020 (USD MILLION)

TABLE 17 ROBOTIC ARC WELDING MARKET (WITH PERIPHERALS), BY END USER, 2021–2026 (USD MILLION)

TABLE 18 ROBOTIC ARC WELDING MARKET (WITH PERIPHERALS), BY REGION, 2017–2020 (USD MILLION)

TABLE 19 ROBOTIC ARC WELDING MARKET (WITH PERIPHERALS), BY REGION, 2021–2026 (USD MILLION)

6.3 SPOT WELDING ROBOTS

6.3.1 DEPLOYMENT OF SPOT WELDING ROBOTS FOR HEAVY-DUTY APPLICATIONS IN DIFFERENT INDUSTRIES

TABLE 20 ROBOTIC SPOT WELDING MARKET (WITH PERIPHERALS), BY END USER, 2017–2020 (USD MILLION)

TABLE 21 ROBOTIC SPOT WELDING MARKET (WITH PERIPHERALS), BY END USER, 2021–2026 (USD MILLION)

TABLE 22 ROBOTIC SPOT WELDING MARKET (WITH PERIPHERALS), BY REGION, 2017–2020 (USD MILLION)

TABLE 23 ROBOTIC SPOT WELDING MARKET (WITH PERIPHERALS), BY REGION, 2021–2026 (USD MILLION)

6.4 OTHERS

FIGURE 35 AEROSPACE AND DEFENSE SEGMENT OF OTHER ROBOTIC WELDING MARKET (WITH PERIPHERALS) TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 24 OTHER MARKET (WITH PERIPHERALS), BY END USER, 2017–2020 (USD MILLION)

TABLE 25 OTHER MARKET (WITH PERIPHERALS), BY END USER, 2021–2026 (USD MILLION)

TABLE 26 OTHER MARKET (WITH PERIPHERALS), BY REGION, 2017–2020 (USD MILLION)

TABLE 27 OTHER MARKET (WITH PERIPHERALS), BY REGION, 2021–2026 (USD MILLION)

7 ROBOTIC WELDING MARKET, BY PAYLOAD (Page No. - 98)

7.1 INTRODUCTION

FIGURE 36 MARKET, BY PAYLOAD

FIGURE 37 >150 KILOGRAM PAYLOAD SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) IN 2021

TABLE 28 ROBOTIC WELDING MARKET (WITHOUT PERIPHERALS), BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 29 MARKET (WITHOUT PERIPHERALS), BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 30 MARKET (WITH PERIPHERALS), BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 31 MARKET (WITH PERIPHERALS), BY PAYLOAD, 2021–2026 (USD MILLION)

7.2 <50 KILOGRAM PAYLOAD

7.2.1 USE OF <50 KILOGRAM PAYLOAD WELDING ROBOTS IN LIGHT AND HIGHLY PRECISE APPLICATIONS

TABLE 32 MARKET (WITH PERIPHERALS) FOR <50 KILOGRAM PAYLOAD, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 MARKET (WITH PERIPHERALS) FOR <50 KILOGRAM PAYLOAD, BY REGION, 2021–2026 (USD MILLION)

7.3 50–150 KILOGRAM PAYLOAD

7.3.1 50–150 KILOGRAM PAYLOAD SEGMENT OF MARKET (WITH PERIPHERALS) TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 34 MARKET (WITH PERIPHERALS) FOR 50–150 KILOGRAM PAYLOAD, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MARKET (WITH PERIPHERALS) FOR 50–150 KILOGRAM PAYLOAD, BY REGION, 2021–2026 (USD MILLION)

7.4 >150 KILOGRAM PAYLOAD

7.4.1 >150 KILOGRAM PAYLOAD SEGMENT TO HOLD LARGEST SHARE OF MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

FIGURE 38 APAC TO LEAD MARKET (WITH PERIPHERALS) FOR >150 KILOGRAM PAYLOAD FROM 2021 TO 2026

TABLE 36 MARKET (WITH PERIPHERALS) FOR >150 KILOGRAM PAYLOAD, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 MARKET (WITH PERIPHERALS) FOR >150 KILOGRAM PAYLOAD, BY REGION, 2021–2026 (USD MILLION)

8 ROBOTIC WELDING MARKET, BY END USER (Page No. - 105)

8.1 INTRODUCTION

FIGURE 39 MARKET, BY END USER

FIGURE 40 AUTOMOTIVE AND TRANSPORTATION SEGMENT TO LEAD MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

TABLE 38 MARKET (WITHOUT PERIPHERALS), BY END USER, 2017–2020 (USD MILLION)

TABLE 39 MARKET (WITHOUT PERIPHERALS), BY END USER, 2021–2026 (USD MILLION)

TABLE 40 MARKET (WITHOUT PERIPHERALS), BY END USER, 2017–2020 (UNITS)

TABLE 41 MARKET (WITHOUT PERIPHERALS), BY END USER, 2021–2026 (UNITS)

TABLE 42 MARKET (WITH PERIPHERALS), BY END USER, 2017–2020 (USD MILLION)

TABLE 43 MARKET (WITH PERIPHERALS), BY END USER, 2021–2026 (USD MILLION)

8.2 AUTOMOTIVE AND TRANSPORTATION

8.2.1 AUTOMOTIVE AND TRANSPORTATION INDUSTRY TO BE LARGEST END USER OF WELDING ROBOTS

TABLE 44 MARKET (WITH PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY TYPE, 2017–2020 (USD MILLION)

TABLE 45 MARKET (WITH PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY TYPE, 2021–2026 (USD MILLION)

TABLE 46 MARKET (WITH PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 MARKET (WITH PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY REGION, 2021–2026 (USD MILLION)

FIGURE 41 APAC TO LEAD ROBOTIC WELDING MARKET (WITHOUT PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION FROM 2021 TO 2026

TABLE 48 MARKET (WITHOUT PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY REGION, 2017–2020 (UNITS)

TABLE 49 MARKET (WITHOUT PERIPHERALS) FOR AUTOMOTIVE AND TRANSPORTATION, BY REGION, 2021–2026 (UNITS)

8.3 METALS AND MACHINERY

8.3.1 WELDING ROBOTS ENHANCE PRODUCTIVITY OF METALS AND MACHINERY INDUSTRY AND HELP ACHIEVE MARKED GAINS IN TERMS OF TIME-TO-MARKET AND COST METRICS

TABLE 50 MARKET (WITH PERIPHERALS) FOR METALS AND MACHINERY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 51 MARKET (WITH PERIPHERALS) FOR METALS AND MACHINERY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 52 MARKET (WITH PERIPHERALS) FOR METALS AND MACHINERY, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 MARKET (WITH PERIPHERALS) FOR METALS AND MACHINERY, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 MARKET (WITHOUT PERIPHERALS) FOR METALS AND MACHINERY, BY REGION, 2017–2020 (UNITS)

TABLE 55 MARKET (WITHOUT PERIPHERALS) FOR METALS AND MACHINERY, BY REGION, 2021–2026 (UNITS)

8.4 ELECTRICAL AND ELECTRONICS

8.4.1 MINIATURIZATION OF ELECTRONIC DEVICES DRIVES DEMAND FOR ROBOTIC WELDING SOLUTIONS IN ELECTRICAL AND ELECTRONICS INDUSTRY

TABLE 56 MARKET (WITH PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 57 MARKET (WITH PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY TYPE, 2021–2026 (USD MILLION)

FIGURE 42 MARKET (WITH PERIPHERALS) IN APAC PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 58 MARKET (WITH PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 ROBOTIC WELDING MARKET (WITH PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY REGION, 2021–2026 (USD MILLION)

TABLE 60 MARKET (WITHOUT PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY REGION, 2017–2020 (UNITS)

TABLE 61 MARKET (WITHOUT PERIPHERALS) FOR ELECTRICAL AND ELECTRONICS, BY REGION, 2021–2026 (UNITS)

8.5 AEROSPACE AND DEFENSE

8.5.1 ROBOTIC WELDING LOWERS MANUFACTURING COSTS AND IMPROVES PRODUCT QUALITY IN AEROSPACE AND DEFENSE INDUSTRY

FIGURE 43 SPOT WELDING ROBOTS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) FOR AEROSPACE AND DEFENSE FROM 2021 TO 2026

TABLE 62 MARKET (WITH PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 63 MARKET (WITH PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 64 MARKET (WITH PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 MARKET (WITH PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY REGION, 2021–2026 (USD MILLION)

TABLE 66 MARKET (WITHOUT PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY REGION, 2017–2020 (UNITS)

TABLE 67 MARKET (WITHOUT PERIPHERALS) FOR AEROSPACE AND DEFENSE, BY REGION, 2021–2026 (UNITS)

8.6 OTHERS

TABLE 68 ROBOTIC WELDING MARKET (WITH PERIPHERALS) FOR OTHER END USERS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 69 MARKET (WITH PERIPHERALS) FOR OTHER END USERS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 70 MARKET (WITH PERIPHERALS) FOR OTHER END USERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 MARKET (WITH PERIPHERALS) FOR OTHER END USERS, BY REGION, 2021–2026 (USD MILLION)

TABLE 72 MARKET (WITHOUT PERIPHERALS) FOR OTHER END USERS, BY REGION, 2017–2020 (UNITS)

TABLE 73 MARKET (WITHOUT PERIPHERALS) FOR OTHER END USERS, BY REGION, 2021–2026 (UNITS)

9 GEOGRAPHIC ANALYSIS (Page No. - 122)

9.1 INTRODUCTION

FIGURE 44 MARKET, BY REGION

FIGURE 45 MARKET (WITH PERIPHERALS) IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 74 MARKET (WITHOUT PERIPHERALS), BY REGION, 2017–2020 (USD MILLION)

TABLE 75 MARKET (WITHOUT PERIPHERALS), BY REGION, 2021–2026 (USD MILLION)

TABLE 76 MARKET (WITHOUT PERIPHERALS), BY REGION, 2017–2020 (UNITS)

TABLE 77 MARKET (WITHOUT PERIPHERALS), BY REGION, 2021–2026 (UNITS)

TABLE 78 MARKET (WITH PERIPHERALS), BY REGION, 2017–2020 (USD MILLION)

TABLE 79 MARKET (WITH PERIPHERALS), BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 46 SNAPSHOT: ROBOTIC WELDING MARKET IN NORTH AMERICA

TABLE 80 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 81 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

TABLE 82 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 83 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 84 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY END USER, 2017–2020 (USD MILLION)

TABLE 85 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY END USER, 2021–2026 (USD MILLION)

TABLE 86 MARKET (WITHOUT PERIPHERALS) IN NORTH AMERICA, BY END USER, 2017–2020 (UNITS)

TABLE 87 MARKET (WITHOUT PERIPHERALS) IN NORTH AMERICA, BY END USER, 2021–2026 (UNITS)

TABLE 88 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 89 MARKET (WITH PERIPHERALS) IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 90 MARKET (WITHOUT PERIPHERALS) IN NORTH AMERICA, BY COUNTRY, 2017–2020 (UNITS)

TABLE 91 MARKET (WITHOUT PERIPHERALS) IN NORTH AMERICA, BY COUNTRY, 2021–2026 (UNITS)

9.2.1 US

9.2.1.1 US to lead market (with peripherals) in North America from 2021 to 2026

TABLE 92 MARKET (WITH PERIPHERALS) IN US, BY TYPE, 2017–2020 (USD MILLION)

TABLE 93 MARKET (WITH PERIPHERALS) IN US, BY TYPE, 2021–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growth of manufacturing sector in Canada to drive adoption of welding robots in country

TABLE 94 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN CANADA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 95 MARKET (WITH PERIPHERALS) IN CANADA, BY TYPE, 2021–2026 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Large automobile exports from Mexico under NAFTA contribute to rising demand for welding robots in country

TABLE 96 MARKET (WITH PERIPHERALS) IN MEXICO, BY TYPE, 2017–2020 (USD MILLION)

TABLE 97 MARKET (WITH PERIPHERALS) IN MEXICO, BY TYPE, 2021–2026 (USD MILLION)

9.3 EUROPE

FIGURE 47 SNAPSHOT: MARKET IN EUROPE

TABLE 98 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 99 MARKET (WITH PERIPHERALS) IN EUROPE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 100 MARKET (WITH PERIPHERALS) IN EUROPE, BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 101 MARKET (WITH PERIPHERALS) IN EUROPE, BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 102 MARKET (WITH PERIPHERALS) IN EUROPE, BY END USER, 2017–2020 (USD MILLION)

TABLE 103 MARKET (WITH PERIPHERALS) IN EUROPE, BY END USER, 2021–2026 (USD MILLION)

TABLE 104 MARKET (WITHOUT PERIPHERALS) IN EUROPE, BY END USER, 2017–2020 (UNITS)

TABLE 105 MARKET (WITHOUT PERIPHERALS) IN EUROPE, BY END USER, 2021–2026 (UNITS)

FIGURE 48 GERMANY TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

TABLE 106 MARKET (WITH PERIPHERALS) IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 107 MARKET (WITH PERIPHERALS) IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 108 MARKET (WITHOUT PERIPHERALS) IN EUROPE, BY COUNTRY, 2017–2020 (UNITS)

TABLE 109 MARKET (WITHOUT PERIPHERALS) IN EUROPE, BY COUNTRY, 2021–2026 (UNITS)

9.3.1 UK

9.3.1.1 market (with peripherals) in UK to grow at highest CAGR from 2021 to 2026

TABLE 110 MARKET (WITH PERIPHERALS) IN UK, BY TYPE, 2017–2020 (USD MILLION)

TABLE 111 MARKET (WITH PERIPHERALS) IN UK, BY TYPE, 2021–2026 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Aerospace and defense industry and government initiatives to support growth of market (with peripherals) in France

TABLE 112 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN FRANCE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 113 MARKET (WITH PERIPHERALS) IN FRANCE, BY TYPE, 2021–2026 (USD MILLION)

9.3.3 GERMANY

9.3.3.1 Automotive and transportation industry to spur growth of market (with peripherals) in Germany

TABLE 114 MARKET (WITH PERIPHERALS) IN GERMANY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 115 MARKET (WITH PERIPHERALS) IN GERMANY, BY TYPE, 2021–2026 (USD MILLION)

9.3.4 SPAIN

9.3.4.1 Risen demand for arc and spot welding robots in automotive and transportation industry to propel market growth in Spain

TABLE 116 MARKET (WITH PERIPHERALS) IN SPAIN, BY TYPE, 2017–2020 (USD MILLION)

TABLE 117 MARKET (WITH PERIPHERALS) IN SPAIN, BY TYPE, 2021–2026 (USD MILLION)

9.3.5 ITALY

9.3.5.1 Italy witnesses highest production of automobiles in Europe, leading to growth of market (with peripherals) in country

TABLE 118 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN ITALY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 119 MARKET (WITH PERIPHERALS) IN ITALY, BY TYPE, 2021–2026 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 120 MARKET (WITH PERIPHERALS) IN REST OF EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 121 MARKET (WITH PERIPHERALS) IN REST OF EUROPE, BY TYPE, 2021–2026 (USD MILLION)

9.4 APAC

FIGURE 49 SNAPSHOT: MARKET IN APAC

TABLE 122 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 123 MARKET (WITH PERIPHERALS) IN APAC, BY TYPE, 2021–2026 (USD MILLION)

TABLE 124 MARKET (WITH PERIPHERALS) IN APAC, BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 125 MARKET (WITH PERIPHERALS) IN APAC, BY PAYLOAD, 2021–2026 (USD MILLION)

TABLE 126 MARKET (WITH PERIPHERALS) IN APAC, BY END USER, 2017–2020 (USD MILLION)

TABLE 127 MARKET (WITH PERIPHERALS) IN APAC, BY END USER, 2021–2026 (USD MILLION)

TABLE 128 MARKET (WITHOUT PERIPHERALS) IN APAC, BY END USER, 2017–2020 (UNITS)

TABLE 129 MARKET (WITHOUT PERIPHERALS) IN APAC, BY END USER, 2021–2026 (UNITS)

FIGURE 50 MARKET (WITH PERIPHERALS) IN CHINA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 130 MARKET (WITH PERIPHERALS) IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 131 MARKET (WITH PERIPHERALS) IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 132 MARKET (WITHOUT PERIPHERALS) IN APAC, BY COUNTRY, 2017–2020 (UNITS)

TABLE 133 MARKET (WITHOUT PERIPHERALS) IN APAC, BY COUNTRY, 2021–2026 (UNITS)

9.4.1 CHINA

9.4.1.1 China to lead market (with peripherals) from 2021 to 2026

TABLE 134 MARKET (WITH PERIPHERALS) IN CHINA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 135 MARKET (WITH PERIPHERALS) IN CHINA, BY TYPE, 2021–2026 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Emergence of Japan as predominant industrial robot manufacturer in world

TABLE 136 MARKET (WITH PERIPHERALS) IN JAPAN, BY TYPE, 2017–2020 (USD MILLION)

TABLE 137 MARKET (WITH PERIPHERALS) IN JAPAN, BY TYPE, 2021–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Strict adherence to quality standards, along with rising costs of skilled labor, urge companies in India to invest in robotics and automation

TABLE 138 MARKET (WITH PERIPHERALS) IN INDIA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 139 MARKET (WITH PERIPHERALS) IN INDIA, BY TYPE, 2021–2026 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Electrical and electronics industry in South Korea to fuel growth of market (with peripherals)

TABLE 140 MARKET (WITH PERIPHERALS) IN SOUTH KOREA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 141 MARKET (WITH PERIPHERALS) IN SOUTH KOREA, BY TYPE, 2021–2026 (USD MILLION)

9.4.5 TAIWAN

9.4.5.1 Large industrial base in Taiwan drives growth of market (with peripherals) in country

TABLE 142 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN TAIWAN, BY TYPE, 2017–2020 (USD MILLION)

TABLE 143 MARKET (WITH PERIPHERALS) IN TAIWAN, BY TYPE, 2021–2026 (USD MILLION)

9.4.6 REST OF APAC

TABLE 144 MARKET (WITH PERIPHERALS) IN REST OF APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 145 MARKET (WITH PERIPHERALS) IN REST OF APAC, BY TYPE, 2021–2026 (USD MILLION)

9.5 ROW

TABLE 146 MARKET (WITH PERIPHERALS) IN ROW, BY TYPE, 2017–2020 (USD MILLION)

TABLE 147 MARKET (WITH PERIPHERALS) IN ROW, BY TYPE, 2021–2026 (USD MILLION)

TABLE 148 MARKET (WITH PERIPHERALS) IN ROW, BY PAYLOAD, 2017–2020 (USD MILLION)

TABLE 149 MARKET (WITH PERIPHERALS) IN ROW, BY PAYLOAD, 2021–2026 (USD MILLION)

FIGURE 51 AUTOMOTIVE AND TRANSPORTATION SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET (WITH PERIPHERALS) FROM 2021 TO 2026

TABLE 150 MARKET (WITH PERIPHERALS) IN ROW, BY END USER, 2017–2020 (USD MILLION)

TABLE 151 MARKET (WITH PERIPHERALS) IN ROW, BY END USER, 2021–2026 (USD MILLION)

TABLE 152 MARKET (WITHOUT PERIPHERALS) IN ROW, BY END USER, 2017–2020 (UNITS)

TABLE 153 MARKET (WITHOUT PERIPHERALS) IN ROW, BY END USER, 2021–2026 (UNITS)

TABLE 154 MARKET (WITH PERIPHERALS) IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 155 MARKET (WITH PERIPHERALS) IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 156 MARKET (WITHOUT PERIPHERALS) IN ROW, BY REGION, 2017–2020 (UNITS)

TABLE 157 MARKET (WITHOUT PERIPHERALS) IN ROW, BY REGION, 2021–2026 (UNITS)

9.5.1 MIDDLE EAST AND AFRICA

9.5.1.1 Oil and gas industry to create lucrative growth opportunities for market in Middle East and Africa

TABLE 158 MARKET (WITH PERIPHERALS) IN MIDDLE EAST AND AFRICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 159 MARKET (WITH PERIPHERALS) IN MIDDLE EAST AND AFRICA, BY TYPE, 2021–2026 (USD MILLION)

9.5.2 SOUTH AMERICA

9.5.2.1 Mining and automotive industry to drive market growth in South America

TABLE 160 ROBOTIC WELDING MARKET (WITH PERIPHERALS) IN SOUTH AMERICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 161 MARKET (WITH PERIPHERALS) IN SOUTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 161)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

TABLE 162 OVERVIEW OF STRATEGIES DEPLOYED BY KEY ROBOTIC WELDING COMPANIES

10.2.1 PRODUCT PORTFOLIO

10.2.2 REGIONAL FOCUS

10.2.3 MANUFACTURING FOOTPRINT

10.2.4 ORGANIC/INORGANIC STRATEGIES

10.3 MARKET SHARE ANALYSIS, 2020

TABLE 163 DEGREE OF COMPETITION IN ROBOTIC WELDING MARKET, 2020

TABLE 164 RANKING ANALYSIS OF KEY COMPANIES OFFERING ARC WELDING ROBOTS

TABLE 165 RANKING ANALYSIS OF KEY COMPANIES OFFERING SPOT WELDING ROBOTS

10.4 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 52 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN MARKET

10.5 COMPANY EVALUATION MATRIX

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 53 ROBOTIC WELDING MARKET: COMPANY EVALUATION MATRIX, 2020

10.6 START-UP/SME EVALUATION MATRIX

TABLE 166 START-UPS/SME IN MARKET

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 54 ROBOTIC WELDING MARKET, START-UP/SME EVALUATION MATRIX, 2020

10.7 COMPANY FOOTPRINT

TABLE 167 COMPANY WELDING ROBOT TYPE FOOTPRINT

TABLE 168 COMPANY END USER FOOTPRINT

TABLE 169 COMPANY REGIONAL FOOTPRINT

TABLE 170 COMPANY FOOTPRINT

10.8 COMPETITIVE SITUATIONS AND TRENDS

FIGURE 55 ROBOTIC WELDING MARKET WITNESSED SIGNIFICANT DEVELOPMENTS FROM JANUARY 2018 TO DECEMBER 2020

10.8.1 PRODUCT LAUNCHES

TABLE 171 PRODUCT LAUNCHES, JANUARY 2021–DECEMBER 2020

10.8.2 DEALS

TABLE 172 DEALS, JANUARY 2018–DECEMBER 2020

10.8.3 OTHERS

TABLE 173 EXPANSION, JANUARY 2018–DECEMBER 2020

11 COMPANY PROFILES (Page No. - 177)

11.1 KEY PLAYERS

(Business overview, Products/solutions offered, Recent developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

11.1.1 FANUC CORPORATION

TABLE 174 FANUC CORPORATION: BUSINESS OVERVIEW

FIGURE 56 FANUC CORPORATION: COMPANY SNAPSHOT

11.1.2 YASKAWA ELECTRIC CORPORATION

TABLE 175 YASKAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 57 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

11.1.3 KUKA AG

TABLE 176 KUKA AG: BUSINESS OVERVIEW

FIGURE 58 KUKA AG: COMPANY SNAPSHOT

11.1.4 ABB

TABLE 177 ABB: BUSINESS OVERVIEW

FIGURE 59 ABB: COMPANY SNAPSHOT

11.1.5 KAWASAKI HEAVY INDUSTRIES, LTD.

TABLE 178 KAWASAKI HEAVY INDUSTRIES, LTD.: BUSINESS OVERVIEW

FIGURE 60 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

11.1.6 PANASONIC CORPORATION

TABLE 179 PANASONIC CORPORATION: BUSINESS OVERVIEW

FIGURE 61 PANASONIC CORPORATION: COMPANY SNAPSHOT

11.1.7 DAIHEN CORPORATION

TABLE 180 DAIHEN CORPORATION: BUSINESS OVERVIEW

11.1.8 NACHI-FUJIKOSHI CORP.

TABLE 181 NACHI-FUJIKOSHI CORP.: BUSINESS OVERVIEW

FIGURE 62 NACHI-FUJIKOSHI CORP.: COMPANY SNAPSHOT

11.1.9 COMAU S.P.A.

TABLE 182 COMAU S.P.A.: BUSINESS OVERVIEW

11.1.10 HYUNDAI ROBOTICS

TABLE 183 HYUNDAI ROBOTICS: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 IGM ROBOTERSYSTEME AG

11.2.2 ESTUN AUTOMATION CO., LTD.

11.2.3 THE LINCOLN ELECTRIC COMPANY

11.2.4 KEMPPI OY

11.2.5 FRONIUS INTERNATIONAL GMBH

11.2.6 STÄUBLI INTERNATIONAL AG

11.2.7 ESAB

11.2.8 SHANGHAI STEP ELECTRIC CORPORATION

11.2.9 SIASUN ROBOT AUTOMATION CO., LTD.

11.2.10 UNITED PROARC CORPORATION

*Details on Business overview, Products/solutions offered, Recent developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 223)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

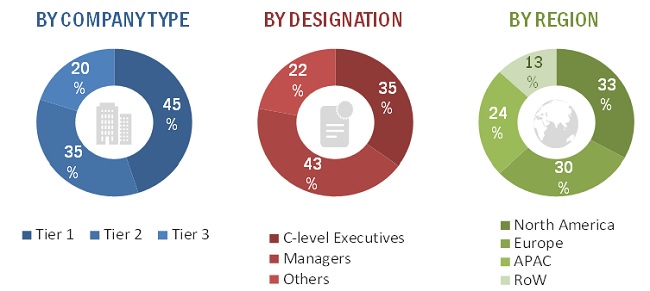

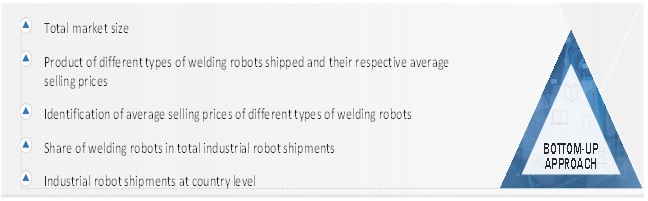

The study involved four major activities in estimating the size of the robotic welding market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases. Data has also been collected from secondary sources such as International Federation of Robotics (IFR), Robotic Industries Association (RIA), IEEE Robotics and Automation Society (RAS), Robotics Business Review (RBR), Japan Robot Association, Chinese Association of Automation, World Trade Organization (WTO), and The International Trade Centre (ITC).

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the Robotic welding market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the robotic welding market.

- Identifying the number of industrial robots shipped in each region

- Analyzing the global penetration of welding robots that fall under the category of industrial robots through secondary and primary research

- Identifying average selling prices of different types of welding robots

- Conducting multiple discussion sessions with the key opinion leaders to understand different types of welding robots and their deployment in multiple end-use industries; analyzing the break-up of the work carried out by each key company

- Verifying and crosschecking estimates at every level with the key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases for company- and region-specific developments undertaken in the robotic welding market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the total size of the robotic welding market.

- Focusing on top-line investments and expenditures being made in the ecosystem of the robotic welding industry; segmenting the market based on type, payload, end user, and region; and listing key developments in the leading markets

- Identifying all key players in the robotic welding market based on region and end user through secondary research that have been then duly verified through a brief discussion with the industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all the identified players to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with the industry experts to validate the information and identify the key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the Robotic welding market.

Report Objectives

- To define, describe, segment, and forecast the robotic welding market based on type and end user in terms of value (with peripherals) and volume (without peripherals)

- To define, describe, segment, and forecast the market based on payload in terms of value (with peripherals)

- To describe and forecast the market (with peripherals and without peripherals) for four key regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)—in terms of (with peripherals) value and volume (without peripherals)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the robotic welding market

- To provide a detailed overview of the supply chain pertaining to the robotic welding ecosystem, along with the average selling prices of welding robots

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market

- To describe the detailed impact of the COVID-19 on the market

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches, expansions, partnerships, contracts, joint ventures, agreement, and acquisitions in the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies2

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the robotic welding supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Robotic Welding Market

i want to watch the market size of welding robot graph.