Rare Earth Metals Recycling Market by Application (Permanent Magnets, Alloys, Polishing Materials, Glass, Catalyst, Phosphor, Ceramics, Hydrogen Storage Alloys), Technology (Hydrometallurgical, Pyrometallurgical) and Region - Global Forecasts to 2026

Updated on : April 15, 2024

Rare Earth Metals Recycling Market

The global rare earth metals recycling market size was valued at USD 248 million in 2021 and is projected to reach USD 422 million by 2026, growing at a cagr 11.2% from 2021 to 2026. The demand for these elements is likely to rise over the forecast period due to their sustained demand in are key components in emerging applications, including metal alloys, catalysts, permanent magnets, phosphors, polishing, and glass additives.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global rare earth metals recycling market

The COVID-19 pandemic has exhibited notable effect on various industries including automotive with the car manufacturers announcing a suspendion in production, which has now resumed on a global level. The market actors including, but not limited to Tier 1 and Tier 2 suppliers and other upstream entities were affected by this demand-side shock and as a result ramped down their production. Furthermore, the supply chain steps located in countries strongly impacted by the onset of the pandemic were hampered leading to a severe supply chain disruption. This resulted in a demand for the security of the supply of strategic raw materials needed for the long-term competitiveness across the globe. The European Green Deal targets 2050 climate neutrality and recognizes access to resources as a strategic security question to fulfill its ambition. The upgraded Industrial Strategy for Europe provides for the raw materials as key enablers for a globally competitive, green, and digital Europe. It also aims to accomplish a European competitiveness based on a new Alliance on Raw Materials and advertises for the importance of industrial ecosystems for accelerating innovation and growth in Europe. A more protective, sovereign, and inclusive economic model that is in line with the Green Deal has been put forward to be adoped by the recently launched Green Recovery Alliance. EIT RawMaterials, funded by the European Institute of Innovation and Technology (EIT), which also aims to have a vision to develop raw materials into a major strength for Europe. It is said to be the world’s largest network in the raw materials sector, which is expected to connect industry, research, and education. This makes EIT RawMaterials a key contributor to secure sustainable access and supply of raw materials for a green, digital, and competitive Europe.

The coronavirus outbreak in China has resulted in a damage laden prospect for the industry. Truck drivers refused to make deliveries into the locations that were either identified as or suspected of harboring the disease. This resulted in a disruption in the flow of minerals out of the affected areas and also led to the refining and manufacturing of metals, food, and fuel.

Rare earth-enabled components for moving machinery, such as automobiles, trucks, trains, aircraft, industrial motors and generators, home appliances, and consumer goods are procured from China or Japan. These items are unable to be re-sourced due to China’s monopoly of rare-earth metals production and its monopsony of rare earth-enabled component manufacturing.

Rare Earth Metals Recycling Market Dynamics

Driver: Increasing demand for clean energy

The green energy market is exhibiting a notable boost as new legislation are passed by different regulatory bodies across the world. These legislations are banning the use of conventional materials in industries in a bid to attain sustainability, and they require the use of green technologies, such as wind turbines, hybrid electric vehicles, and compact fluorescent lighting. Wind turbines have begun the use of direct drive permanent magnets, wherein the use of rare earth metals, such as europium, neodymium, dysprosium, praseodymium, and, terbium, is extensive. The increasing demand for environmental protection results in the development of clean energy sources, for instance, wind energy. The wind turbines and water turbine markets offer another growth opportunity for permanent magnets. Direct-drive (DD) generators for wind turbines use about 650 kg of permanent magnets per megawatt (MW) of power output. The chart mentioned below shows the installation of wind power systems in the past 16 years. This provides for the usage of permanent magnets relatively economical and helps indiustries to become responsible evironmentally, thereby making the technology sustainable. All these growing sectors that have significant usage of permanent magnets offer a huge impetus for the growth of this market.

Restraint: Fluctuating costs of rare earth metals

The global recession of 2008-09 had several negative implications on a number of markets, and the rare earth metals market was not an exception. Rare earth metal prices increased suddenly in 2011 after China introduced a 40% cut on its export quotas, citing environmental reasons. The cost of dysprosium oxide, used in magnets, lasers, and nuclear reactors, rose to about USD 1,470 a kilogram from USD 700 to USD 740, buoyed by demand and concerns over future availability. These fluctuations in prices coupled with rising energy costs are destabilizing the supply chains of rare earth elements. This factor makes it difficult for manufacturers to deliver quality products at a profit.

Spurred by the fluctuations in the prices of the raw materials, the manufacturers have the option of either absorbing the additional costs or increase the prices of the products. Price fluctuations leave no room for error whilst planning a project’s budget and have quite a few manufacturers walking a thin line between success and operating at a loss.

When the price of raw materials rises suddenly, some manufacturers search for new suppliers that allow them to maintain revenue targets. This results in sourcing materials from lower-cost economies. Switching to a different source of raw materials carries a high risk of disrupting the supply chain. Rare earth elements are not traded in any commodity exchanges in the way other precious or nonferrous metals are. However, they are sold in the private market, which makes their prices tricky to track and monitor. The elements are not usually sold in their pure form, but distributed in mixtures of varying purity, for example, 99% neodymium metal. In any case, pricing can vary based on the quantity and quality required by the end-use applications.

Opportunity: Recycling of rare earth metals leads to steady material sourcing

Production of many minerals that are vital for energy transitions is concentrated in a few geographical areas. For instance, the top three rare earth metals producers dominate more than half of the global production. China holds a significant position in the rare earth value chain where it is responsible for more than 70% of the processing operations associated with rare earth metal mining. This has resulted in concern for companies that manufacture solar panels, batteries, and wind turbines, amongst others, as this can affect their supply chains due to trade barriers, regulatory changes, and political instability. In addition, the current extraction practices of rare earth metals are inefficient, unsafe, and generate pollution. Rare earth metal processing requires a substantial amount of harmful chemicals and results in the production of high volumes of solid waste and wastewater, which are sometimes handled inappropriately. This leads to challenges in the stable sourcing of minerals impacting the social and environmental concerns

Recycling provides an opportunity to maintain the steady sourcing of rare earth metals. For this, it is important that the importing countries strengthen the management of products and components which have reached the end of life. This would promote recycling and retrieval of valuable minerals. Research and development efforts by research institutions would result in large-scale recycling of rare earth metals and would generate environmental and security benefits along with a reduction in dependency on foreign countries for material sourcing.

Challenge: Safety of workers in rare earth metals recycling process

Recycling of rare earth metals is considered to solve the balance problem of supply and demand for rare earth metals. However, caution is required for rare earth metals recycling process due to hazardous chemicals which should be treated properly. The United Nations Environment Programme (UNEP) classified hazardous substance emissions in the rare earth metals recycling into three categories. The first is primary, where the emissions include lead, mercury, arsenic, polychlorinated biphenyls, sulfides, and ozone-depleting substances which are obtained from electronic waste. The secondary emission includes dioxins and furans, amongst others, which are generated from reactions due to inappropriate treatment of plastics. The tertiary emissions include harmful substances and reagents such as cyanide and leaching agents that are exposed due to inappropriate management. This is becoming a challenge in developing countries where inappropriate recycling systems are prevalent. Thus, it is vital to have a verified monitoring system for the recycling of rare earth metals to eradicate the potential threat to humans and the environment. To ensure safety in the workplace, it is necessary to have appropriate protective gear, management of hazardous substances, and regular safety education.

“Permanent Magnets segment to be the fastest growing segment in terms of value during the forecast period”

The permanent magnets industry is the largest end user of rare earth elements. The magnets made from neodymium, praseodymium, and dysprosium are the strongest known permanent magnets. The automotive industry is one of the key consumers of the permanent magnets. Key industries requiring these permanent magnets are hybrid car engines and the growing wind power turbine industry. There may also be needed in regular power plants.

“Pyrometallurgical technology segment was the second-largest market in 2020.”

Pyrometallurgical process is able to separate and recover almost 99% of rare earth metals from waste NiMH batteries and NdFeB (neodymium magnet) scraps. Experimental results also show that rare earth metals obtained from the high-temperature treatment can reach purity of 96 weight percent. The current use of pyrometallurgical methods to recover rare earth metals from these materials is being analyzed, with the focus being on waste products such as high-coercivity magnets and nickel-metal-hydride batteries.

“Magnets to be the fastest growing source of rare earth metals during the forecast period.”

Rare earth metals are crucial for ‘green’ technology applications, and the demand is growing. Their main use is in permanent magnets made from an alloy of neodymium, iron, and boron (NdFeB) for highly efficient motors for hybrid-electric vehicles and wind turbine generators. Currently, rare earths can be extracted from their original electronic sources, but some, such as magnets, cannot be reused in the same way. One common method for recycling rare earths is acid dissolution to recover the materials as oxides.

The most common rare earth magnets are based on neodymium-iron-boron with small additives of Pr (Praseodymium), Tb (Terbium), and especially Dy (Dysprosium).

“APAC is the largest market for rare earth metals recycling”

Asia Pacific is the highest producer, and China is the most dominant country in the production of rare earth metals, with over 95% of the global output of rare earth minerals. The increasing alliances among industry players coupled with leading innovations and developments are further expected to foster rare earth metals recycling in the APAC region.

To know about the assumptions considered for the study, download the pdf brochure

Rare Earth Metal Recycling Market Players

The rare earth metals recycling market is dominated by a few globally established players, such as Solvay SA (Belgium), Hitachi Metals, Ltd. (Japan), Umicore (Belgium), Osram Licht AG (Germany), Energy Fuels, Inc. (US), Global Tungsten & Powders Corp. (US), and REEcycle Inc.(US) among others.

Rare Earth Metal Recycling Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 248 million |

|

Revenue Forecast in 2026 |

USD 422 million |

|

CAGR |

11.2% |

|

Market Size Available for Years |

2019-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD million) |

|

Segments Covered |

Application, Technology, Source and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe and Rest of World |

|

Companies Covered |

Some of the leading players operating in the rare earth metals recycling market include Solvay SA (Belgium), Hitachi Metals, Ltd. (Japan), Umicore (Belgium), Osram Licht AG (Germany), Energy Fuels, Inc. (US), Global Tungsten & Powders Corp. (US), and REEcycle Inc.(US) |

This research report categorizes the rare earth metals recycling market based on application, source, technology and region.

Rare Earth Metals Recycling Market, By Application

- Alloy

- Catalyst

- Permanent magnets

- Glass

- Ceramics

- Phosphor

- Polishing materials

- Hydrogen storage alloys

Rare Earth Metals Recycling Market, By Source

- FCC

- Fluorescent lamps

- Magnets

- Batteries

- Industrial process

Rare Earth Metals Recycling Market, By Technology

- Hydrometallurgical

- Pyrometallurgical

Rare Earth Metals Recycling Market, By Region

- Asia Pacific

- North America

- Europe

- Rest of World

Recent Developments

- In December 2021, Umicore and Volkswagen AG established a joint venture to build precursor and cathode material production capacities in Europe to supply Volkswagen AG’s European battery cell production, making a considerable contribution to the region’s transition towards cleaner mobility.

- In December 2019, Audi and Umicore completed strategic research, which resulted in recovering more than 90% of the cobalt and nickel in high-voltage batteries. The car manufacturer and the materials technology and recycling expert cooperated on a closed-loop for cobalt and nickel. The recovered materials have been used in new battery cells.

Frequently Asked Questions (FAQ):

Which region is forecast to be the most lucrative for rare earth metals recycling growth?

Asia-pacific to be the highest revenue grossing region for the rare earth metals recycling market during the forecast period.

What is the fastest-growing application of the rare earth metals recycling market?

Permanent magnets are the fastest-growing application of the rare earth metals recycling market.

What is the main driver of the rare earth metals recycling market?

Increasing demand for clean energy and a greener environment is the main driver of the rare earth metals recycling market.

What is the current size of global rare earth metals recycling market?

The global rare earth metals recycling market is estimated to be USD 248 million in 2021 and is projected to reach USD 422 million by 2026, at a CAGR of 11.2% from 2021 to 2026.

How is the rare earth metals recycling market aligned?

The rare earth metals recycling market is competitive in terms of market share, with small and medium-scale manufacturers competing with each other and the big players.

Who are the key players in the global rare earth metals recycling market?

The key players operating in the rare earth metals recycling market are Solvay SA (Belgium), Hitachi Metals, Ltd. (Japan), Umicore (Belgium), Osram Licht AG (Germany), Energy Fuels, Inc. (US), Global Tungsten & Powders Corp. (US), and REEcycle Inc.(US) among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSION AND EXCLUSION

TABLE 1 INCLUSION AND EXCLUSION

1.4 MARKET SCOPE

FIGURE 1 RARE EARTH METALS RECYCLING MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

FIGURE 2 RARE EARTH METALS RECYCLING MARKET, BY REGION

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 3 RARE EARTH METALS RECYCLING MARKET: RESEARCH DESIGN

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY-SIDE APPROACH

FIGURE 4 RARE EARTH METALS RECYCLING MARKET: SUPPLY-SIDE APPROACH

2.2.2 DEMAND-SIDE APPROACH

FIGURE 5 RARE EARTH METALS RECYCLING MARKET: DEMAND-SIDE APPROACH

2.3 MARKET ENGINEERING PROCESS

2.3.1 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4.1 SECONDARY DATA

2.4.1.1 Key data from secondary sources

2.4.2 PRIMARY DATA

2.4.2.1 Key data from primary sources

2.4.2.2 Key industry insights

TABLE 2 LIST OF STAKEHOLDERS INVOLVED

2.4.2.3 Breakdown of primary interviews

2.5 ASSUMPTIONS

2.5.1 RISK ASSESSMENT

TABLE 3 RARE EARTH METALS RECYCLING MARKET: RISK ASSESSMENT

TABLE 4 RISK ANALYSIS

2.6 LIMITATIONS

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 9 MARKET GROWTH PROJECTIONS: DRIVERS AND OPPORTUNITIES

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 10 GLASS APPLICATION TO DOMINATE RARE EARTH METALS RECYCLING MARKET BY 2026

FIGURE 11 HYDROMETALLURGICAL TECHNOLOGY TO DOMINATE RARE EARTH METALS RECYCLING MARKET, 2021-2026

FIGURE 12 FLUORESCENT LAMPS TO BE LARGEST SOURCE OF RARE EARTH METALS, 2021-2026

FIGURE 13 ASIA PACIFIC DOMINATED RARE EARTH METALS RECYCLING MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 EMERGING ECONOMIES TO WITNESS RELATIVELY HIGHER DEMAND FOR RARE EARTH METALS RECYCLING

FIGURE 14 DEVELOPING COUNTRIES OFFER ATTRACTIVE OPPORTUNITIES IN RARE EARTH METALS RECYCLING MARKET

4.2 ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET, BY APPLICATION AND COUNTRY

FIGURE 15 CHINA WAS LARGEST MARKET FOR RARE EARTH METALS RECYCLING IN 2020

4.3 RARE EARTH METALS RECYCLING MARKET, BY APPLICATION

FIGURE 16 PERMANENT MAGNETS SEGMENT TO LEAD RARE EARTH METALS RECYCLING MARKET DURING FORECAST PERIOD

4.4 RARE EARTH METALS RECYCLING MARKET, BY TECHNOLOGY

FIGURE 17 HYDROMETALLURGICAL TECHNOLOGY TO LEAD RARE EARTH METALS RECYCLING MARKET DURING FORECAST PERIOD

4.5 RARE EARTH METALS RECYCLING MARKET, BY SOURCE

FIGURE 18 FLUORESCENT LAMPS TO BE LARGEST SOURCE FOR RARE EARTH METALS RECYCLING DURING FORECAST PERIOD

4.6 RARE EARTH METALS RECYCLING MARKET, BY COUNTRY

FIGURE 19 CHINA PROJECTED TO WITNESS HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 RARE EARTH METALS RECYCLING MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand from end-use industries

FIGURE 21 GLOBAL AUTOMOBILE PRODUCTION DATA, 2016–2020

FIGURE 22 GLOBAL ELECTRIC VEHICLE PRODUCTION DATA, 2016-2020

5.2.1.2 Increasing demand for clean energy

FIGURE 23 GLOBAL ENERGY DEMAND

FIGURE 24 GLOBAL WIND POWER CUMULATIVE CAPACITY

FIGURE 25 GLOBAL WIND POWER CUMULATIVE CAPACITY PROJECTION, 2020-2024

5.2.1.3 Initiative of associations & regulatory bodies

5.2.2 RESTRAINTS

5.2.2.1 Fluctuating costs of rare earth metals

5.2.2.2 Illegal mining of rare earth metal ores

5.2.3 OPPORTUNITIES

5.2.3.1 Recycling of rare earth metals leads to steady material sourcing

5.2.3.2 Net-zero goals by 2050 to promote recycling of rare earth metals

5.2.4 CHALLENGES

5.2.4.1 Safety of workers in rare earth metals recycling process

6 INDUSTRY TRENDS (Page No. - 52)

6.1 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 RARE EARTH METALS RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 5 RARE EARTH METALS RECYCLING MARKET: PORTER’S FIVE FORCES ANALYSIS

6.1.1 BARGAINING POWER OF SUPPLIERS

6.1.2 THREAT OF NEW ENTRANTS

6.1.3 THREAT OF SUBSTITUTES

6.1.4 BARGAINING POWER OF BUYERS

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

6.2 YC-YCC DRIVERS

FIGURE 27 YC-YCC DRIVERS

6.3 MARKET MAPPING/ECOSYSTEM MAP

FIGURE 28 ECOSYSTEM MAP

6.4 VALUE CHAIN ANALYSIS

FIGURE 29 RARE EARTH METALS VALUE CHAIN

6.4.1 MINING & RARE EARTH ORE PRODUCTION

6.4.2 SEPARATION OF RARE EARTH ORE TO FORM RARE EARTH OXIDES

6.4.3 REFINING OF RARE EARTH OXIDES

6.4.4 APPLICATION

6.4.5 END-USE INDUSTRIES

6.4.6 RARE EARTH METALS RECYCLING

6.5 RARE EARTH METALS RECYCLING MARKET PATENT ANALYSIS

6.5.1 METHODOLOGY

6.5.2 DOCUMENT TYPE

TABLE 6 TOTAL NUMBER OF PATENTS FOR RARE EARTH METALS RECYCLING MARKET

FIGURE 30 RARE EARTH METALS RECYCLING MARKET: GRANTED PATENT, LIMITED PATENT, AND PATENT APPLICATION

FIGURE 31 PUBLICATION TRENDS - LAST 10 YEARS

6.5.3 INSIGHT

6.5.4 LEGAL STATUS OF PATENTS

FIGURE 32 LEGAL STATUS OF PATENTS

FIGURE 33 JURISDICTION ANALYSIS

6.5.5 TOP COMPANIES/ APPLICANTS

FIGURE 34 TOP APPLICANTS OF RARE EARTH METALS RECYCLING PATENTS

TABLE 7 LIST OF PATENTS BY EASTMAN CHEM CO.

TABLE 8 LIST OF PATENTS BY CHINA PETROLEUM & CHEM CORP.

TABLE 9 LIST OF PATENTS BY NOVELIS INC.

TABLE 10 LIST OF TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6.6 REGULATORY LANDSCAPE

6.6.1 STANDARDS BY ISO/TC 298 (RARE EARTH)

6.6.1.1 ISO 22450:2020 (Recycling of rare earth elements — Requirements for providing information on industrial waste and end-of-life products)

6.6.1.2 ISO/TS 22451:2021 (Recycling of rare earth elements — Methods for the measurement of rare earth elements in industrial waste and end-of-life products)

6.6.1.3 ISO 22453:2021 (Exchange of information on rare earth elements in industrial wastes and end-of-life cycled products)

6.7 TRADE ANALYSIS

6.7.1 CHINA’S GROWING CONFLICT WITH WORLD TRADE ORGANIZATION: THE CASE OF EXPORT RESTRICTIONS ON RARE EARTH RESOURCES

6.7.2 CHINA’S GROWING CONFLICT WITH WTO

TABLE 11 EXPORT TRADE DATA FOR RARE EARTH METALS (2019)

TABLE 12 IMPORT TRADE DATA FOR RARE EARTH METALS (2019)

6.8 TECHNOLOGY ANALYSIS

6.8.1 SEREN TECHNOLOGIES

6.8.2 WORCESTER POLYTECHNIC INSTITUTE

6.9 PRICING ANALYSIS

FIGURE 35 MONTHLY CERIUM OXIDE PRICES, 2020

FIGURE 36 MONTHLY LANTHANUM OXIDE PRICES, 2020

FIGURE 37 MONTHLY NEODYMIUM OXIDE PRICES, 2020

FIGURE 38 MONTHLY YTTRIUM OXIDE PRICES, 2020

FIGURE 39 MONTHLY PRASEODYMIUM OXIDE PRICES, 2020

FIGURE 40 MONTHLY SAMARIUM OXIDE PRICES, 2020

FIGURE 41 MONTHLY GADOLINIUM OXIDE PRICES, 2020

FIGURE 42 MONTHLY DYSPROSIUM OXIDE PRICES, 2020

FIGURE 43 MONTHLY TERBIUM OXIDE PRICES, 2020

FIGURE 44 MONTHLY EUROPIUM OXIDE PRICES, 2020

TABLE 13 MONTHLY AVERAGE RARE EARTH OXIDE PRICES: JANUARY 2020-JUNE 2020 (USD/METRIC TON)

TABLE 14 MONTHLY AVERAGE RARE EARTH OXIDE PRICES: JULY 2020-DECEMBER 2020 (USD/METRIC TON)

TABLE 15 AVERAGE PRICES FOR RARE EARTH OXIDES (USD/METRIC TON), 2020

6.10 CASE STUDY ANALYSIS

6.10.1 NISSAN TESTING NEW RARE EARTH RECYCLING PROCESS

6.10.2 RECYCLING PROCESS OF RARE EARTH METALS FROM NI-MH BATTERIES PROPOSED BY HONDA

6.10.3 BENTLEY AIMS TO REVOLUTIONISE SUSTAINABILITY OF ELECTRIC MOTORS

6.11 COVID-19 IMPACT ON RARE EARTH METALS RECYCLING MARKET

6.12 COVID-19 IMPACT ON RARE EARTH METAL RECYCLING END-USE INDUSTRIES

7 RARE EARTH METALS RECYCLING MARKET, BY APPLICATION (Page No. - 76)

7.1 INTRODUCTION

FIGURE 45 GLASS APPLICATION TO LEAD OVERALL MARKET

TABLE 16 RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 17 RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

7.2 ALLOY

7.3 CATALYSTS

7.4 PERMANENT MAGNETS

7.5 GLASS

7.6 CERAMICS

7.7 PHOSPHORS

7.8 POLISHING MATERIALS

7.9 HYDROGEN STORAGE ALLOYS

8 RARE EARTH METALS RECYCLING MARKET, BY SOURCE (Page No. - 81)

8.1 INTRODUCTION

FIGURE 46 FLUORESCENT LAMPS SEGMENT TO LEAD OVERALL MARKET

TABLE 18 RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 19 RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

8.2 FCC

8.3 FLUORESCENT LAMPS

8.4 MAGNETS

8.5 BATTERIES

8.6 INDUSTRIAL PROCESS

9 RARE EARTH METALS RECYCLING MARKET, BY TECHNOLOGY (Page No. - 85)

9.1 INTRODUCTION

FIGURE 47 HYDROMETALLURGICAL SEGMENT TO LEAD OVERALL MARKET

TABLE 20 RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 21 RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

9.2 HYDROMETALLURGICAL

9.3 PYROMETALLURGICAL

10 RARE EARTH METALS RECYCLING MARKET, BY REGION (Page No. - 88)

10.1 INTRODUCTION

FIGURE 48 REGIONAL SNAPSHOT: CHINA PROJECTED TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

TABLE 22 GLOBAL RARE EARTH METALS RECYCLING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 23 GLOBAL RARE EARTH METALS RECYCLING MARKET SIZE, BY REGION, 2019–2026 (METRIC TON)

TABLE 24 GLOBAL RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 25 GLOBAL RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 26 GLOBAL RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 27 GLOBAL RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 28 GLOBAL RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 29 GLOBAL RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.2 ASIA PACIFIC

FIGURE 49 ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SNAPSHOT

TABLE 30 ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 31 ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY COUNTRY, 2019–2026 (METRIC TON)

TABLE 32 ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 33 ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 34 ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 35 ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 36 ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 37 ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.2.1 CHINA

10.2.1.1 Largest recycler and consumer of rare earth metals

TABLE 38 CHINA: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 39 CHINA: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 40 CHINA: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 41 CHINA: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 42 CHINA: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 43 CHINA: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.2.2 JAPAN

10.2.2.1 New sources of rare earth metals to make country self-sufficient

TABLE 44 JAPAN: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 45 JAPAN: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 46 JAPAN: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 47 JAPAN: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 48 JAPAN: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 49 JAPAN: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.2.3 REST OF ASIA PACIFIC

TABLE 50 REST OF ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 51 REST OF ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 52 REST OF ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 53 REST OF ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 54 REST OF ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 55 REST OF ASIA PACIFIC: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.3 NORTH AMERICA

TABLE 56 NORTH AMERICA: RARE EARTH METALS RECYCLING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: RARE EARTH METALS RECYCLING MARKET SIZE, BY COUNTRY, 2019–2026 (METRIC TON)

TABLE 58 NORTH AMERICA: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 60 NORTH AMERICA: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 62 NORTH AMERICA RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.3.1 US

10.3.1.1 Rising demand for electric vehicles driving market

TABLE 64 US: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 65 US: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 66 US: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 67 US: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 68 US: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 69 US: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.3.2 CANADA

10.3.2.1 Need for clean energy applications driving market

TABLE 70 CANADA: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 71 CANADA: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 72 CANADA: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 73 CANADA: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 74 CANADA: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 75 CANADA: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.4 EUROPE

TABLE 76 EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY COUNTRY, 2019–2026 (METRIC TON)

TABLE 78 EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 80 EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 81 EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 82 EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 83 EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.4.1 GERMANY

10.4.1.1 Rising demand for electric vehicles driving market

TABLE 84 GERMANY: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 85 GERMANY: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 86 GERMANY: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 87 GERMANY: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 88 GERMANY: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 89 GERMANY: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.4.2 FRANCE

10.4.2.1 Increase in demand for rare earth metals in high-technology and low-carbon industries

TABLE 90 FRANCE: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 91 FRANCE: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 92 FRANCE: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 93 FRANCE: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 94 FRANCE: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 95 FRANCE: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.4.3 UK

10.4.3.1 Increased demand for rare-earth metals in wind turbines and electric vehicles

TABLE 96 UK: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 UK: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 98 UK: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 99 UK: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 100 UK: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 101 UK: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.4.4 REST OF EUROPE

TABLE 102 REST OF EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 103 REST OF EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 104 REST OF EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 105 REST OF EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 106 REST OF EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 107 REST OF EUROPE: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

10.5 REST OF WORLD

TABLE 108 REST OF WORLD: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 109 REST OF WORLD: RARE EARTH METALS RECYCLING MARKET SIZE, BY APPLICATION, 2019–2026 (METRIC TON)

TABLE 110 REST OF WORLD: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 111 REST OF WORLD: RARE EARTH METALS RECYCLING MARKET SIZE, BY TECHNOLOGY, 2019–2026 (METRIC TON)

TABLE 112 REST OF WORLD: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 113 REST OF WORLD: RARE EARTH METALS RECYCLING MARKET SIZE, BY SOURCE, 2019–2026 (METRIC TON)

11 COMPETITIVE LANDSCAPE (Page No. - 124)

11.1 OVERVIEW

FIGURE 50 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY BETWEEN 2016 AND 2021

11.2 MARKET RANKING ANALYSIS

FIGURE 51 RANKING OF TOP FIVE PLAYERS IN RARE EARTH METALS RECYCLING MARKET, 2020

11.2.1 SOLVAY SA

11.2.2 HITACHI METALS, LTD.

11.2.3 UMICORE

11.2.4 ENERGY FUELS, INC.

11.2.5 GLOBAL TUNGSTEN & POWDERS CORP.

11.3 MARKET SHARE ANALYSIS

TABLE 114 RARE EARTH METALS RECYCLING MARKET: MARKET SHARE OF KEY PLAYERS

FIGURE 52 RARE EARTH METALS RECYCLING MARKET: MARKET SHARE ANALYSIS

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE

FIGURE 53 COMPETITIVE LEADERSHIP MAPPING: RARE EARTH METALS RECYCLING MARKET, 2020

11.5 SME MATRIX, 2020

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 54 SME MATRIX: RARE EARTH METALS RECYCLING MARKET, 2020

11.6 COMPETITIVE SCENARIO

11.6.1 COLLABORATION & ACQUISITION

TABLE 115 COLLABORATION & ACQUISITION, 2016–2021

12 COMPANY PROFILES (Page No. - 133)

12.1 KEY COMPANIES

(Business Overview, Products and solutions, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

12.1.1 SOLVAY SA

TABLE 116 SOLVAY SA: BUSINESS OVERVIEW

FIGURE 55 SOLVAY SA: COMPANY SNAPSHOT

TABLE 117 SOLVAY SA: PRODUCT OFFERED

TABLE 118 SOLVAY SA: DEALS

12.1.2 HITACHI METALS, LTD.

TABLE 119 HITACHI METALS, LTD.: BUSINESS OVERVIEW

FIGURE 56 HITACHI METALS, LTD.: COMPANY SNAPSHOT

TABLE 120 HITACHI METALS, LTD.: PRODUCT OFFERED

TABLE 121 HITACHI METALS, LTD.: DEALS

12.1.3 UMICORE

TABLE 122 UMICORE: BUSINESS OVERVIEW

FIGURE 57 UMICORE: COMPANY SNAPSHOT

TABLE 123 UMICORE: PRODUCT OFFERED

TABLE 124 UMICORE: DEALS

12.1.4 OSRAM LICHT AG

TABLE 125 OSRAM LICHT AG: BUSINESS OVERVIEW

FIGURE 58 OSRAM LICHT AG: COMPANY SNAPSHOT

TABLE 126 OSRAM LICHT AG: PRODUCT OFFERED

12.1.5 ENERGY FUELS, INC.

TABLE 127 ENERGY FUELS, INC.: BUSINESS OVERVIEW

FIGURE 59 ENERGY FUELS, INC.: COMPANY SNAPSHOT

12.1.6 GLOBAL TUNGSTEN & POWDERS CORP.

TABLE 128 GLOBAL TUNGSTEN & POWDERS CORP.: BUSINESS OVERVIEW

TABLE 129 GLOBAL TUNGSTEN & POWDERS CORP.: PRODUCT OFFERED

12.1.7 REECYCLE INC.

TABLE 130 REECYCLE INC.: BUSINESS OVERVIEW

12.1.8 SEREN TECHNOLOGIES LIMITED

TABLE 131 SEREN TECHNOLOGIES LIMITED: BUSINESS OVERVIEW

12.1.9 ROCKLINK GMBH

TABLE 132 ROCKLINK GMBH: BUSINESS OVERVIEW

TABLE 133 ROCKLINK GMBH: PRODUCT OFFERED

12.1.10 CLEAN EARTH INC.

TABLE 134 CLEAN EARTH INC.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12.2 OTHER COMPANIES

12.2.1 GEOMEGA RESOURCES INC.

TABLE 135 GEOMEGA RESOURCES INC.: BUSINESS OVERVIEW

12.2.2 TAIYUAN CHEMICAL INDUSTRY GROUP CO. LTD.

TABLE 136 TAIYUAN CHEMICAL INDUSTRY GROUP CO. LTD.: BUSINESS OVERVIEW

12.2.3 GUANGSHENG NONFERROUS METALS CO., LTD.

TABLE 137 GUANGSHENG NONFERROUS METALS CO., LTD.: BUSINESS OVERVIEW

12.2.4 CHENZHOU CITY JINGUI SILVER INDUSTRY CO., LTD.

TABLE 138 CHENZHOU CITY JINGUI SILVER INDUSTRY CO., LTD.: BUSINESS OVERVIEW

12.2.5 LYNAS RARE EARTHS, LTD.

TABLE 139 LYNAS RARE EARTHS, LTD.: BUSINESS OVERVIEW

12.2.6 ARAFURA RESOURCES LTD.

TABLE 140 ARAFURA RESOURCES LTD.: BUSINESS OVERVIEW

12.2.7 QINGDAO HUICHENG ENVIRONMENTAL TECHNOLOGY CO., LTD.

TABLE 141 QINGDAO HUICHENG ENVIRONMENTAL TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

12.2.8 MITSUBISHI ELECTRIC CORPORATION

TABLE 142 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

12.2.9 JIANGSU HUAHONG TECHNOLOGY STOCK CO., LTD.

TABLE 143 JIANGSU HUAHONG TECHNOLOGY STOCK CO., LTD.: BUSINESS OVERVIEW

12.2.10 SHOWA DENKO K.K.

TABLE 144 SHOWA DENKO K.K.: BUSINESS OVERVIEW

12.2.11 HYPROMAG LTD.

TABLE 145 HYPROMAG LTD.: BUSINESS OVERVIEW

12.2.12 OKON METALS, INC.

TABLE 146 OKON METALS, INC.: BUSINESS OVERVIEW

12.2.13 URBAN MINING COMPANY

TABLE 147 URBAN MINING COMPANY: BUSINESS OVERVIEW

12.2.14 AMERICAN RARE EARTH LLC

TABLE 148 AMERICAN RARE EARTH LLC.: BUSINESS OVERVIEW

12.2.15 REMRETECH GMBH

TABLE 149 REMRETECH GMBH: BUSINESS OVERVIEW

13 APPENDIX (Page No. - 165)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The global rare earth metals recycling market is estimated to be USD 248 million in 2021 and is projected to reach USD 422 million by 2026, at a CAGR of 11.2% from 2021 to 2026. Rare earth metals are considered key elements in developing technologies in the communications, electronics, automotive, and military weapon sectors. The demand for these elements is expected to increase in the near future as these are key components in emerging applications, such as green technology and electric and hybrid vehicles.

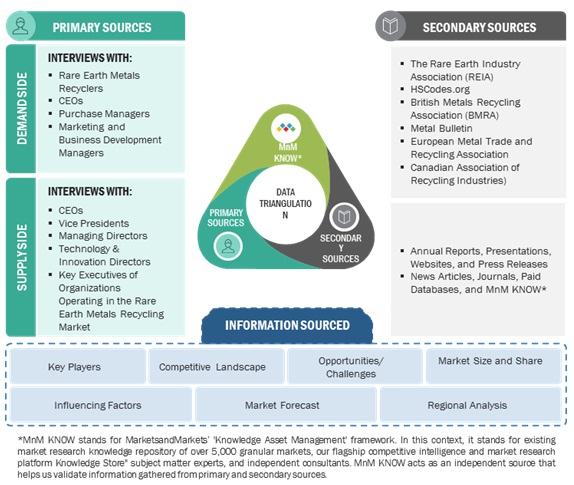

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, rare earth metals recyclers association, press releases & investor presentations of companies, white papers, rare earth metals recycling magazines and associations, certified publications, and articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total number of market players, market classification & segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

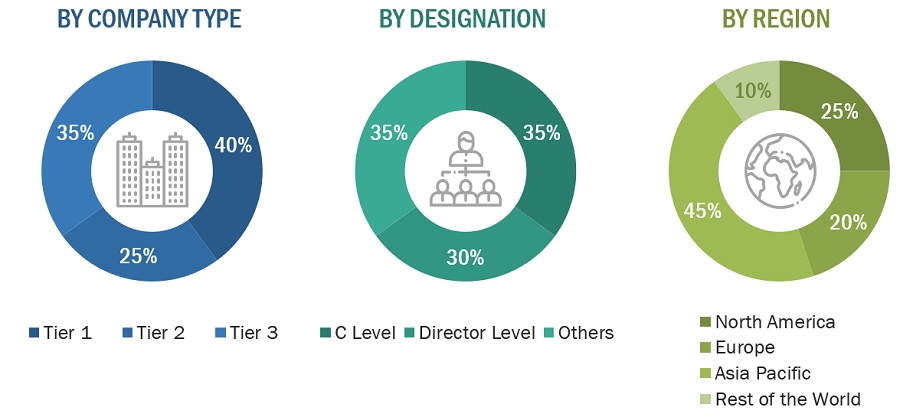

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology & innovation directors, consultants, and related key executives from major companies and organizations operating in the market. Primary sources from the demand side included researchers, technologists, and sales/purchase managers from the rare earth metals recycling industry. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

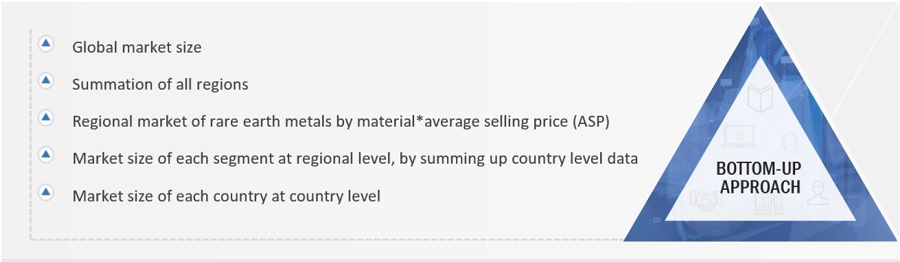

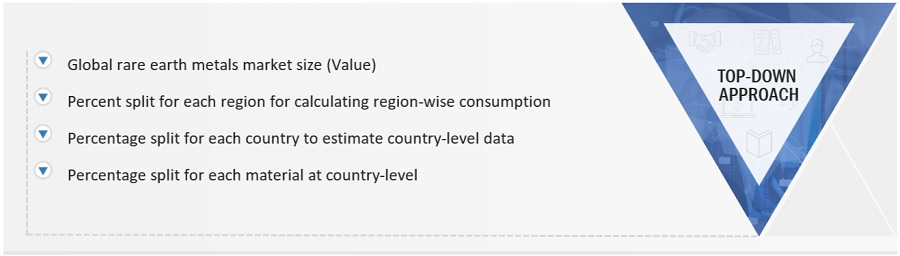

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the rare earth metals recycling market and various other dependent segments. The key players operating in the rare earth metals recycling market were identified through secondary research. Their annual capacity and production of rare earth metals recycling were identified at the global level through primary and secondary research. This procedure included the study of annual and financial reports of key market players and extensive interviews with industry leaders, such as Chief Executive Officers (CEOs), vice presidents, directors, and marketing executives of leading companies to obtain key insights.

The recycling of rare earth metals of each country considered in the scope of research was calculated and summed up to arrive at regional market numbers. The volume arrived at using the top-down and bottom-up approaches were multiplied by the ASP of rare earth metals recycling for the year 2020, at the global and country levels, to obtain the market size in terms of USD million.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the rare earth metals recycling market.

Rare Earth Metals Recycling Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Rare Earth Metals Recycling Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the overall market was split into several segments. In order to complete the market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, for every data segment, there are three sources — the top-down approach, the bottom-up approach, and expert interviews. The data was assumed to be correct only when the values arrived at from the three sources matched.

*MnM KNOW stands for MarketsandMarkets’ 'Knowledge Asset Management' framework. In this context, it stands for the existing market research knowledge repository of over 5,000 granular markets, our flagship competitive intelligence and market research platform “Knowledge Store", subject matter experts, and independent consultants. MnM KNOW acts as an independent source that helps us validate information gathered from primary and secondary sources.

Report Objectives

- To estimate and forecast the rare earth metals recycling market in terms of value and volume

- To elaborate on the drivers, restraints, opportunities, and challenges in the market

- To define, describe, and forecast the market size based on application, source, technology, and region

- To forecast the market size in key regions: North America, Europe, Asia Pacific, and the Rest of World, along with the key countries in these regions

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for the market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as merger & acquisition, expansion & investment, agreement, partnership & joint venture, and new product development in the rare earth metals recycling market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Rare Earth Metals Recycling Market