Rare Earth Metals Market by Type (Cerium Oxide, Lanthanum Oxide, Neodymium Oxide, Yttrium Oxide, Europium Oxide), Application (Permanent Magnets, Metal Alloys, Glass Polishing, Glass Additives, Phosphors, Catalysts), and Region - Global Forecast to 2029

Updated on : October 25, 2024

Rare Earth Metals Market

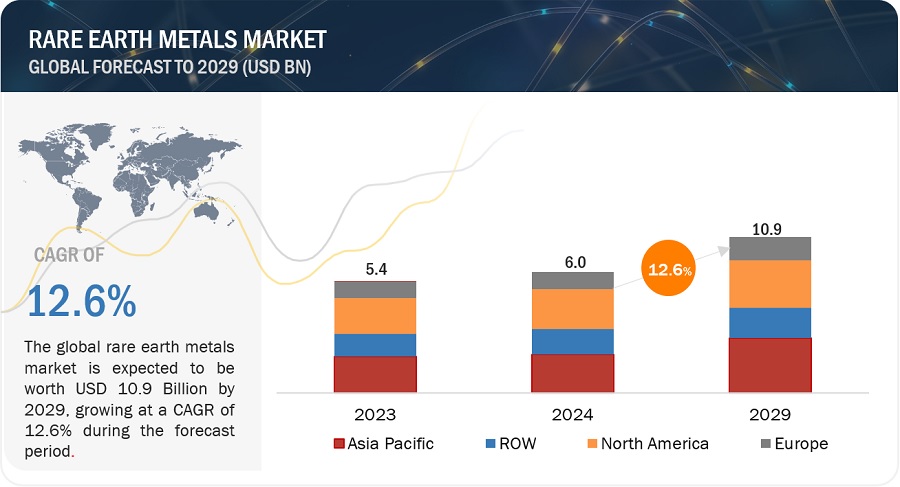

Rare Earth Metals Market is valued at USD 6.0 billion in 2024 and is projected to reach USD 10.9 billion by 2029, growing at 12.6% cagr from 2024 to 2029. The market is experiencing a significant surge, largely driven by the increasing utilization of these metals in permanent magnet applications. This trend is particularly evident in the Asia Pacific (APAC) region, which stands out as the fastest-growing market for rare earth metals. China, in particular, plays a pivotal role in this growth trajectory, witnessing a substantial rise in both production and consumption of rare earth metals. The burgeoning demand for permanent magnets, which heavily rely on rare earth metals, serves as a primary catalyst for the market's expansion in the region. These advanced materials find widespread application across various industries, including electronics, automotive, renewable energy, and more. As industries continue to seek efficient and high-performance solutions, the demand for rare earth metals is poised to escalate further, propelling the market forward in the Asia Pacific region. This growth not only underscores the region's industrial prowess but also highlights the indispensable role rare earth metals play in driving technological innovation and sustainable development initiatives.

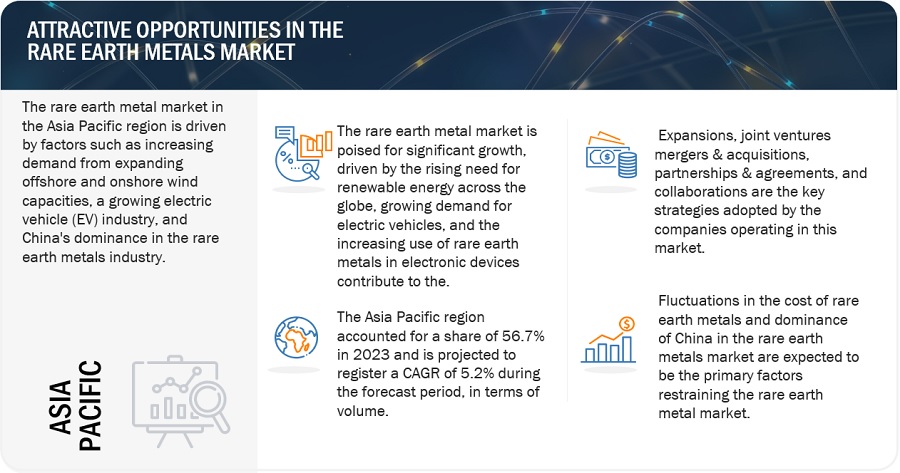

Attractive Opportunities in the Rare Earth Metals Market

To know about the assumptions considered for the study, Request for Free Sample Report

Rare Earth Metals Market Dynamics

Driver: growth in current and emerging applications

Owing to their various properties, rare earth metals are used in a wide range of industries. These include permanent magnets, catalysts, glass polishing powder & additives, batteries, metallurgy, ceramics, phosphors, and pigments.

Rare earth permanent magnets are projected to be the primary growth market over the next five to ten years. Key rare earth elements used in permanent magnet applications include neodymium, praseodymium, dysprosium, terbium, and yttrium. These metals offer unique properties such as remanence and high coercivity, allowing the permanent magnets to maintain their magnetism over extended periods. These magnets have significant applications in the automotive market, where demand for them is closely tied to the industry. Rare earth permanent magnets are utilized in both traditional and hybrid vehicles, with the hybrid electric vehicle (HEV) market poised to drive stronger growth due to its higher usage of rare earth magnets per vehicle compared to conventional vehicles. The rare earth content in a current state-of-the-art permanent magnet motors used in such HEVs is roughly 3-5g of rare earth material per kW of rated peak power. According to the European Institute of Innovation and Technology, in 2019, about 5,000 tons of rare earth permanent magnets were used in EVs worldwide. By 2030, the number may rise to between 40,000 and 70,000 tons on a global level. This will positively impact the demand for rare earth metals in the forecast period.

The use of rare earth magnets in wind turbines is projected to be a significant growth market over the long term. Modern direct drive wind turbines use rare earth magnets to eliminate the gearbox, resulting in reduced weight and fewer maintenance challenges. In addition to these applications, rare earth magnets are commonly used in consumer and industrial electronics such as smartphones, acoustic speakers, and hard disk drives due to their excellent performance-to-size ratio and high magnetic strength.

Rare earth metals play a crucial role in catalyst systems by absorbing, storing, and releasing oxygen, as well as stabilizing the operating environments. Lanthanum and cerium are the most commonly used rare earth metals in catalyst systems, primarily for automotive catalytic converters in cars and other vehicles, as well as fluid cracking catalysts (FCCs) in oil refineries. In addition to growth in global unit sales, demand for auto-catalysts is boosted by stricter worldwide regulations on vehicle emissions.

Restraint: Fluctuation in cost of rare earth metals

Fluctuations in raw material prices force manufacturers to either absorb extra costs or raise product prices. The demand for rare earth metals is tied to the demand for their applications, which in turn depends on end-user industries. This creates a complex supply chain, adding to the final cost to manufacturers. As a result, sudden price changes can impact project budgeting and push manufacturers close to operating at a loss.

When raw material prices rise suddenly, some manufacturers look for new suppliers to maintain revenue goals. This often involves sourcing from lower-cost economies but can pose supply chain risks. Rare earth elements are sold in the private market, not on exchanges, making prices difficult to track. They are often sold in mixtures of varying purity, like 99% neodymium metal, with prices varying depending on quantity and quality needed for specific applications.

Opportunities: Recycling and reuse of rare earth metals.

Rare earth metals were once more affordable until new applications were uncovered, causing a supply-demand disparity and a sharp price hike. Previously, these metals weren't as essential as they've become in the last five years, leading to significant wastage due to erratic market conditions. Presently, rare earth metals hold crucial roles in various industries like green technology and defense, sparking a global push for recycling to mitigate their criticality. Recycling offers a solution by providing a secondary supply source and reducing environmental impact compared to mining. The current recycling rate for rare earth metals stands below 5%, highlighting a significant opportunity for improvement. Increased recycling not only ensures a secondary supply but also benefits the environment by curbing waste and toxin contamination in water sources. The US Department of Energy, in collaboration with Oak Ridge National Laboratory (ORNL), has developed a recycling technology utilizing hollow fiber membranes, organic solvents, and neutral extractants to extract rare earth elements like neodymium, praseodymium, and dysprosium from magnets. Lab tests of the membrane extraction system have shown potential to recover over 90% of these elements in highly pure forms from scrap neodymium-based magnets. ORNL anticipates achieving a recovery rate closer to 97%. The resulting product is a combination of rare earth materials with a purity level of 99.6%.

Challenges Impact on environment

The extraction and processing of rare earth metals present significant environmental challenges for the market. These processes, including open-pit mining, acid leaching, and chemical treatment, often result in pollution, habitat destruction, and health risks for nearby communities. They generate harmful byproducts like radioactive waste and heavy metal contaminants, threatening soil, water, and air quality. Moreover, the energy-intensive production of rare earth metals contributes to greenhouse gas emissions, worsening climate change concerns. Increased awareness of these impacts has led to closer scrutiny from regulators and stakeholders, urging for stricter environmental standards and sustainable mining practices. Efforts to address these concerns include developing improved recycling technologies and reducing reliance on environmentally harmful practices.

Rare Earth Metals Market Ecosystem

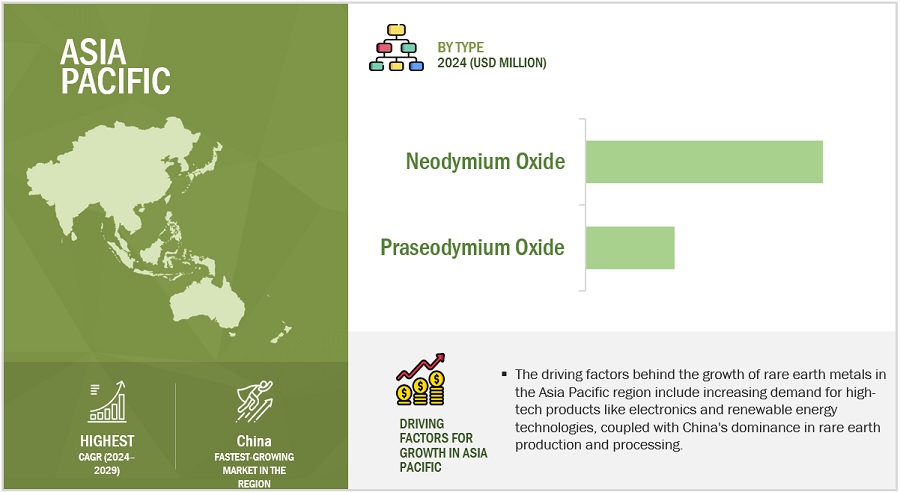

The Neodymium segment is projected to be the larger type segment of rare earth metal during the forecast period.

Neodymium oxide plays a crucial role in the production of high-strength permanent magnets known as neodymium-iron-boron (NdFeB) magnets. These magnets are exceptionally strong and are widely used in modern vehicles, aircraft, and popular consumer electronics like headphones, microphones, and computer discs. The increasing adoption of clean energy applications, such as wind turbines and electric vehicles, has been a key driver in the market demand for neodymium oxide. These magnets are essential components in many clean energy technologies, further boosting their importance in the modern world.

The permanent segment is projected to grow at the highest CAGR during the forecast period.

The permanent magnets segment in the rare earth metal market is poised for significant growth, with a projected high compound annual growth rate (CAGR) during the forecast period. This growth can be attributed to several key factors driving the demand for permanent magnets in various applications.

Firstly, permanent magnets are essential components in the production of electric vehicles (EVs), which are experiencing a surge in demand worldwide due to their environmental benefits and government incentives. Rare earth metals such as neodymium and dysprosium are crucial for the manufacturing of high-performance permanent magnets used in EV motors, contributing to the segment's growth.

Secondly, the increasing adoption of renewable energy sources, such as wind turbines and electric generators, is driving the demand for permanent magnets. These magnets are integral to the efficient operation of these technologies, further boosting the growth of the permanent magnets segment in the rare earth metal market.

Moreover, the growing electronics industry, particularly the demand for consumer electronics like smartphones, laptops, and other gadgets, is fueling the need for rare earth magnets. These magnets are used in various electronic components, including speakers, headphones, and hard disk drives, driving the growth of the permanent magnets segment.

Additionally, the aerospace and defense sectors are also significant consumers of permanent magnets for various applications, including radar systems, missile guidance systems, and aircraft instrumentation. The increasing investments in these sectors are expected to further drive the demand for rare earth magnets, supporting the growth of the segment.

In conclusion, the permanent magnets segment in the rare earth metal market is poised for substantial growth during the forecast period, driven by the increasing demand from key industries such as automotive, renewable energy, electronics, and aerospace. The unique properties of rare earth metals make them indispensable in the production of high-performance permanent magnets, ensuring their continued relevance and growth in various applications.

Asia Pacific is estimated to account for the largest market share during the forecast period.

The Asia Pacific region is poised to dominate the rare earth metals industry during the forecast period, with China at the forefront of this dominance. Rare earth metals are integral to various industries, including electronics, renewable energy, and defense, due to their unique properties. China holds a significant advantage in this market, primarily because it possesses the largest reserves of rare earth metals globally and has invested heavily in their extraction and processing infrastructure. The country accounts for a substantial portion of global rare earth metals production, giving it considerable influence over prices and supply dynamics. Additionally, China's vertically integrated supply chain, encompassing mining, refining, and manufacturing, provides it with a competitive edge in delivering these critical materials to global markets efficiently. Furthermore, China's control over rare earth metals has led to concerns about geopolitical implications, as demonstrated by past instances where it has utilized its dominance for strategic purposes. As a result, the Asia Pacific region, led by China, is expected to maintain its position as the primary driver of growth and innovation in the rare earth metals industry in the foreseeable future.

To know about the assumptions considered for the study, download the pdf brochure

Rare Earth Metals Market Players

The Rare earth metal market comprises key manufacturers such as are Lynas Rare Earths Ltd. (Australia), Australian Strategic Materials Ltd. (Australia), Arafura Rare Earths (Australia), MP Materials (US), and Shenghe Resources Hording Co., Ltd (China), China Rare Earth Holdings Limited (China), Avalon Advanced Materials Inc. (Canada), Bataou HEFA Rare Earth Co. Ltd (China), Canada Rare Earth Corporation (Canada), Northern Minerals Limited (Australia), are the top manufacturers covered in the rare earth metal market. Expansions, mergers & acquisitions, new product launches and deals were some of the major strategies adopted by these key players to enhance their positions in the rare earth metal market. A major focus was given to the expansions and deals.

Read More: Rare Earth Metals Companies

Rare Earth Metals Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million), Volume (Metric Ton) |

|

Segments Covered |

Type, Application and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World. |

|

Companies covered |

Lynas Rare Earths Ltd. (Australia), Australian Strategic Materials Ltd. (Australia), Arafura Rare Earths (Australia), China Rare Earth Holdings Limited (China), Avalon Advanced Materials Inc. (Canada), Bataou HEFA Rare Earth Co. Ltd (China), Canada Rare Earth Corporation (Canada), Northern Minerals Limited (Australia), MP Materials (US), and Shenghe Resources Hording Co., Ltd (China), among others. |

This research report categorizes the rare earth metals market based on Type, End-Use Industry and Region.

Rare Earth Metals Market based on Type:

- Lanthanum

- Cerium

- Praseodymium

- Neodymium

- Samarium

- Europium

- Gadolinium

- Terbium

- Dysprosium

- Yttrium

- Others

Rare Earth Metals Market based on Application:

- Permanent Magnets

- Catalysts

- Glass Polishing

- Phosphors

- Ceramics

- Metal Alloys

- Glass Additives

- Others

Rare Earth Metals Market based on Region:

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In March 2024, Australian Strategic Materials (ASM) formed a strategic partnership with global engineering company Bechtel Mining and Metals, Inc. (Bechtel) for its Dubbo Project in New South Wales (NSW). Bechtel will provide Front-End Engineering Design (FEED) services, a crucial step toward the final investment decision. This partnership strengthens ASM's position for new funding opportunities, including with a US government entity.

- In October 2023, Shenghe Resources Holding Co., Ltd also announced its plan to acquire shares in Vital Metals, a company headquartered in New South Wales, Australia, and listed on the Australian Securities Exchange (ASX). The acquisition aimed to support the development of Vital Metals' Nechalacho rare earth project in Canada and the Wigu Hill rare earth project in Tanzania, and further consolidate Shenghe's development foundation and optimize its global business layout by increasing rare earth resources in the global market.

- In August 2023, Australian Strategic Materials (ASM) signed a long-term metal sales and tolling framework agreement with USA Rare Earth, LLC (USARE). This agreement is a five-year contract for ASM to supply neodymium iron boron (NdFeB) alloy to USARE.

- In July 2023, ASM signed a non-binding Memorandum of Understanding (MOU) with Blackstone Minerals Limited (ASM) and Vietnam Rare Earths Company (VTRE). The goal of this MOU is to develop a complete rare earth industry in Vietnam, from mining to finished products.

- In May 2021, Lynas Corporation Limited and Blue Line Corporation signed an MOU for a joint venture to develop Rare Earth separation capacity in the US, addressing a significant gap in the US supply chain. This JV aims to provide US companies.

Frequently Asked Questions (FAQ):

What are rare earth metals, and why are they important in the market?

Rare earth metals are a group of 17 chemical elements crucial for various technological applications due to their unique magnetic, luminescent, and catalytic properties. They are vital in the production of electronics, renewable energy technologies, and defense systems.

Which countries dominate the production of rare earth metals?

China has historically been the largest producer of rare earth metals, accounting for over 80% of global production. Other significant producers include Australia, the United States, and Canada.

What are the major applications of rare earth metales?

The major applications of rare earth metales include permanent magnets, metal alloys, glass polishing, glass additives, catalysts, phosphors and ceramics.

What are the major drivers of the rare earth metal market?

The major driver of rare earth metal in the welding industry is the promising growth of the steel industry, which creates demand for welding equipment and services.

What are the upcoming opportunities in the rare earth metal market globally?

Rare earth metals are crucial for renewable energy technologies like wind turbines, electric vehicles, and solar panels, presenting a significant opportunity as countries transition to cleaner energy sources.

How are advancements in green technologies affecting the demand for rare earth metals?

The increasing demand for electric vehicles, wind turbines, and other green technologies has led to a surge in the demand for rare earth metals, particularly neodymium, praseodymium, and dysprosium, which are essential for manufacturing high-performance magnets used in these applications. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

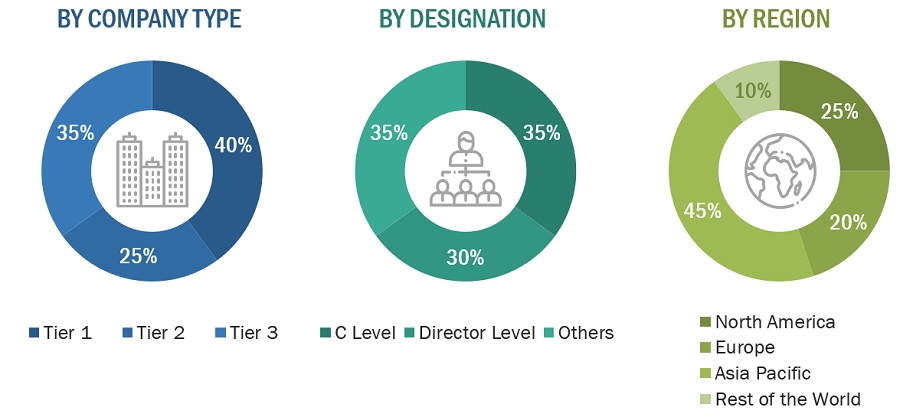

The study involved four major activities for estimating the current size of the global rare earth metals market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of rare earth metals through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the rare earth metals market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the rare earth metals market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The rare earth metals market comprises several stakeholders in the supply chain, which include raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the rare earth metals market. Primary sources from the supply side include associations and institutions involved in the rare earth metals industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2022: Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global Rare earth metals market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the rare earth metals market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Rare-earth elements are a set of 17 chemical elements that naturally occur together. This group includes yttrium and the 15 lanthanide elements, namely lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium. Scandium is found in most rare-earth element deposits and is sometimes classified as a rare-earth element. The International Union of Pure and Applied Chemistry includes scandium in their rare-earth element definition. These elements are all metals and are collectively known as "rare-earth metals." They share many similar properties, leading them to often be found together in geological deposits. They are also called "rare-earth oxides" because they are frequently sold in the form of oxide compounds.

Key Stakeholders

- Raw material suppliers

- Rare-earth metal companies

- Manufacturers in end-use industries

- Rare-earth research and development (R&D) institutions

- Rare-earth metal associations

- Investment banks

Report Objectives

- To define, analyze, and project the size of the rare earth metals market in terms of value based on type, application and region.

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders.

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the rare earth metals market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of Asia Pacific market

- Further breakdown of Rest of Europe market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Rare Earth Metals Market