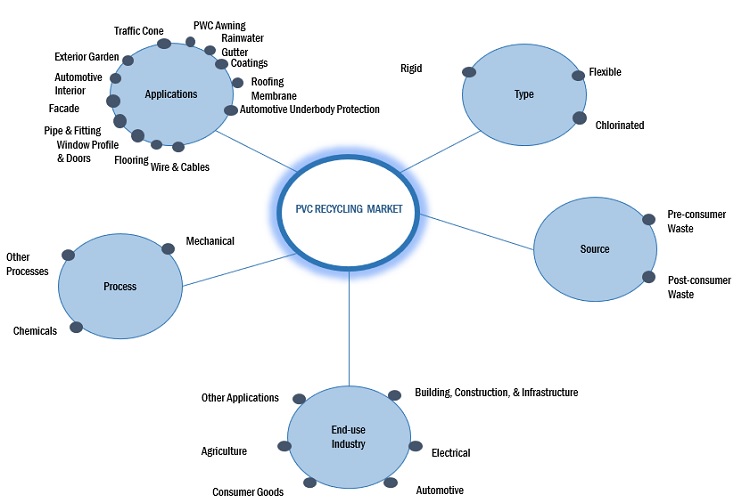

PVC Recycling Market by Source (Pre-consumer Waste, Post-consumer Waste), Type (Rigid, Flexible, Chlorinated), Process (Mechanical, Chemicals), Application, End-use Industry (Building, construction), and Region - Global Forecast to 2028

PVC Recycling Market

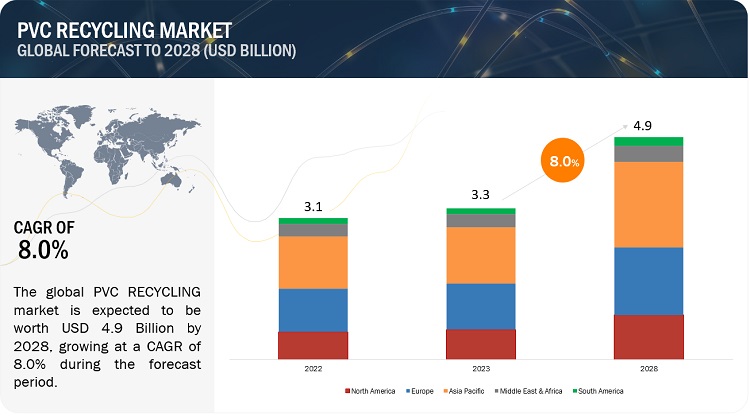

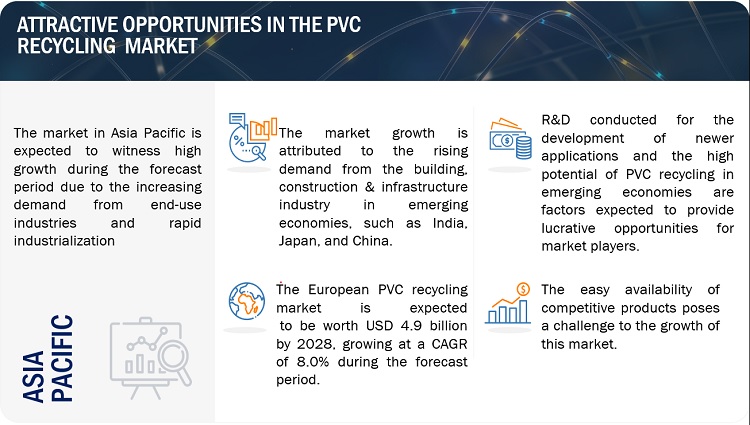

PVC Recycling Market is valued at USD 3.3 billion in 2023 and is projected to reach USD 4.9 billion by 2028, growing at a cagr 8.0% from 2023 to 2028. PVC recycling is the process of recovering PVC-based products into new, useful products. This process helps save energy and eliminates the need to extract more carbon from the ground. The market is growing, and the trend is expected to continue in the long term due to high demand from the building, construction, infrastructure, electrical, automotive, consumer goods, and agriculture industries.

ATTRACTIVE OPPORTUNITIES IN THE PVC RECYCLING MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

PVC Recycling Market Dynamics

Driver: Growing awareness of energy savings and government responses

The use of PVC recycling eliminates the need to create materials from scratch, which saves a lot of energy. Producing virgin plastics is a highly labor-intensive and energy-expensive process that involves extracting, transporting, and refining natural resources. Thus, using PVC recycling instead of new resources allows manufacturers to make the same products with much less energy. For instance, recycling PVC plastics from waste requires 71 trillion units of energy, which is less than the energy needed to produce the same amount of virgin PVC plastics. Therefore, the energy saved from recycling PVC products and containers is equivalent to the annual energy use of 750,000 US homes. The corresponding savings in GHG emissions would be 2.1 million tons of CO2 equivalents, which is comparable to taking 360,000 cars off the road. Thus, awareness about saving energy is likely to play a positive role in increasing demand for PVC recycling during the forecast period.

Government regulations have played a significant role in driving the PVC recycling industry. Many countries and regions, including the European Union and the US, have implemented laws and regulations that require companies to recycle a certain percentage of their PVC waste. Countries such as France, Germany, and the UK are implementing even more aggressive targets, fees for introducing non-recyclable packaging, and additional legislation such as using only recyclable packaging and setting higher recycling targets. These regulations provide an incentive for companies to invest in PVC recycling facilities and technologies. Thailand recently announced a nationwide ban on PVC plastic disposal, effective from January 2020, aiming for a complete ban to reduce non-biodegradable plastic leakage into the environment. China has banned imports of plastic waste and approved legislation to restrict and reduce plastics, increase recycling, recovery, and recirculation of used PVC plastics. In the past few years, there has been a considerable rise in awareness regarding PVC plastic recycling.

Restraint: Technical limitations of the PVC recycling process

PVC recycling processes face technical limitations that make it difficult to recycle PVC effectively. One of the main challenges is the difficulty of separating PVC from other plastics in mixed waste streams. PVC is often used with other plastics, such as PET or PE, making it difficult to isolate and recycle. Traditional mechanical recycling methods are ineffective in separating PVC from other plastics because they are based on physical properties such as density or melting point. Chemical recycling processes can help to overcome this challenge by breaking down PVC into its constituent monomers, which can then be purified and reused to make new PVC products. However, these processes require specialized equipment to process PVC waste. They are still in the early stages of development, making it expensive and less accessible to small and medium-sized recyclers. PVC is a highly durable material that can be difficult to break down and recycle using traditional mechanical methods. This requires specialized equipment, such as shredders or grinders, that can handle the rigid properties of PVC waste.

One major limitation is the presence of PVC additives in the PVC plastics, such as plasticizers, stabilizers, and pigments, which affects the quality and purity of the recycled material. The European Union has set strict regulations on the use of these additives in PVC products, which can make it difficult to recycle certain types of PVC. Also, there is a lack of consistent standards for PVC recycling across different countries in the world. This makes it difficult to ensure that recycled PVC products meet the necessary quality and safety requirements. Furthermore, the availability and accessibility of PVC recycling facilities can vary greatly across the region, limiting the amount of PVC waste that can be recycled. Thus, the technical limitations of PVC recycling processes act as a restraining factor to effectively recycling this widely used material PVC in the plastic recycling industry. However, efforts are being made to improve the recycling process and increase the sustainability of recycled PVC products.

Opportunity: Favorable initiatives to promote the use of recycled PVC in developed countries.

In the developed economies of North America and Europe, several regulations have been introduced to promote plastic recycling. For instance, the UK provides public sector funding of over USD 143 million per year (GBP 100 million/year) for recycling programs and has also imposed an increase in landfill tax. The European Union has implemented a tax on plastic bags and packaging to curb ocean pollution and has set a goal for all packaging products to be recyclable by 2030, with a requirement to recycle 55% of plastic packaging. In the US, the Internal Revenue Service (IRS) offers a depreciation credit for recycling to manufacturers of recycled products. Additionally, some US states provide tax incentives or credits to encourage plastic recycling. For example, Delaware offers set amounts or percentages to reduce the costs of purchasing recycling equipment, Texas offers a rebate program for manufacturers that use recycling equipment, and Maryland provides a personal property tax exemption for recycling. Furthermore, some states provide a tax exemption on the construction or renovation of recycling plants. Such initiatives are expected to create growth opportunities for recycled PVC.

Challenge: Quality issues of recycled PVC plastics

The quality of recycled PVC presents a significant challenge to the PVC recycling market. PVC waste comes from different sources, including construction, packaging, automotive, and electrical and electronic equipment, each with varying levels of contamination that can affect the quality of the recycled PVC. The recycling process itself can also affect the quality of PVC plastic. For example, mechanical recycling, which involves shredding and grinding PVC waste, can lead to a loss of material properties and a reduction in the molecular weight of PVC plastic, making it less suitable for certain applications. Chemical recycling, however, preserves the molecular weight of PVC and results in higher-quality recycled PVC. Nevertheless, chemical recycling is more expensive than mechanical recycling and not yet widely available.

PVC plastic contains several additives, such as plasticizers and stabilizers, that affect the material's performance, making it challenging to recycle PVC. Improved PVC waste collection and sorting systems and more advanced recycling technologies are necessary to address these challenges. There is also a need for greater collaboration between stakeholders in the PVC value chain, including waste generators, recyclers, and manufacturers, to ensure consistent quality in recycled PVC products. Regulations, such as the European Union's Waste Framework Directive & Packaging and Packaging Waste Directive, have set targets for the recycling of PVC and other materials and require member states to implement measures to enhance the quality of recycled materials. These regulations are driving innovation and investment in the PVC recycling industry and expected to improve the quality of recycled PVC over time. Hence, the quality of recycled PVC plastic is a significant challenge for the growth of the PVC recycling indsutry.

PVC RECYCLING MARKET ECOSYSTEM

"Rigid PVC was the largest type for PVC recycling market in 2022, in terms of value."

Rigid PVC is generally used for different products, including pipes, window frames, and siding. It has high demand in the PVC recycling market because it is well-suited for recycling as it can be easily melted down and reformed into new products without losing its structural integrity.

"Building, construction, & infrastructure processing was the largest end-use industry for PVC recycling market in 2022, in terms of value."

Recycled PVC products offer several benefits for the construction industry. It is cost-effective, durable, and easily integrated into existing systems. It has a lower carbon footprint than traditional construction materials, making it a more sustainable option. Recycled PVC products help improve buildings' energy efficiency, thereby reducing energy costs for consumers.

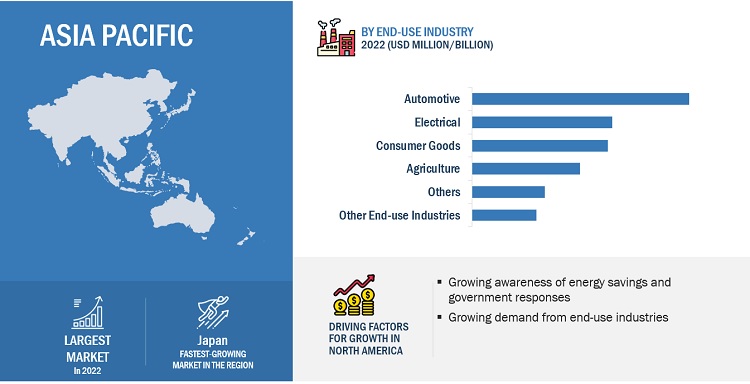

"Asia Pacific was the largest market for PVC recycling in 2022, in terms of value."

Asia Pacific was the largest market for global PVC recycling market, in terms of value, in 2022. China is the largest market in Asia Pacific. It is projected to grow at a CAGR of 8.3% during the forecast period considering of high usage of PVC in the region for building, construction, infrastructure, and consumer goods application.

To know about the assumptions considered for the study, download the pdf brochure

PVC Recycling Market Players

The key global players in the PVC recycling market include DS Smith (UK), Adams Plastics (US), Reclaim Plastics (Canada), Suez (France), Veolia (France), Veka Recycling (UK), Simplas PVC Recycling (UK), WRC Recycling (Scotland), Morris Recycling (UK), and Dekura (Germany) are the key players in the PVC recycling market. Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of PVC recycling have opted for new product launches to sustain their market position.

PVC Recycling Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 3.3 billion |

|

Revenue Forecast in 2028 |

USD 4.9 billion |

|

CAGR |

8.0% |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (KT); Value (USD Million/Billion) |

|

Segments |

Type, Source, Process, Application, End-use Industries, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

DS Smith (UK), Adams Plastics (US), Reclaim Plastics (Canada), Suez (France), Veolia (France), Veka Recycling (UK), Simplas PVC Recycling (UK), WRC Recycling (Scotland), Morris Recycling (UK), and Dekura (Germany) |

This report categorizes the global PVC recycling market based on type, source, process, application, end-use industry, and region.

Based on process, the PVC recycling market has been segmented as follows:

- Mechanical

- Chemicals

- Other Processes

Based on type, the PVC recycling market industry has been segmented as follows:

- Rigid

- Flexible

- Chlorinated

Based on application, the PVC recycling market has been segmented as follows:

- Pipe & Fittings

- Window Profile & Doors

- Flooring

- Wires & cables

- Façade

- Automotive Interior

- Traffic Cone

- Exterior Garden

- PVC Awning

- Rainwater Gutter

- Electric Gutter

- Roofing Membranes

- Automotive Underbody Protection

- Other Applications

Based on end-use industry, the PVC recycling market has been segmented as follows:

- Building, construction, & Infrastructure

- Electrical

- Automotive

- Consumer Goods

- Agriculture

- Other End-use Industries

Based on region, the PVC recycling market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In Feburary2020, LyondellBasell and SUEZ, a world leader in environmental services, announced the acquisition of TIVACO, a plastics recycling company located in Blandain, Belgium. The company will become part of Quality Circular Polymers (QCP). This will increase the production capacity for recycled materials to approximately 55,000 tons per year.

- In November 2020, SUEZ announced the sale of its recycling & recovery operations in Sweden to PreZero, the environmental division of Schwarz Group. The transaction enabled a solid future for the business and its employees within PreZero, a fast-growing division of the largest European retailer and a pioneer in the area of recyclables.

- In December 2020, SUEZ announced the opening of the SUEZ Circular Polymer Plant in Bang Phli, Thailand – the Group’s first plastic recycling plant in Asia. The project highlights SUEZ's commitment to preserving the natural capital and building a more sustainable future while contributing to Thailand’s ambitious 2030 target to achieve 100% plastic recycling.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the PVC recycling market?

The forecast period for the PVC recycling market in this study is 2023-2028. The PVC recycling market is expected to grow at a CAGR of 8.0%, in terms of value, during the forecast period.

Who are the major key players in the PVC recycling market?

The key global players in the PVC recycling market include DS Smith (UK), Adams Plastics (US), Reclaim Plastics (Canada), Suez (France), Veolia (France), Veka Recycling (UK), Simplas PVC Recycling (UK), WRC Recycling (Scotland), Morris Recycling (UK), and Dekura (Germany) are the key players in the PVC recycling market. are the leading manufacturers of PVC recycling.

What are the major regulations of the PVC recycling market in various countries?

The Basel Convention is an international treaty that regulates the transboundary movement of hazardous waste, including PVC waste. The Convention requires that PVC waste be managed in an environmentally sound manner, and it places obligations on the countries that generate and export PVC waste, as well as the countries that import and dispose of PVC waste.

What are the drivers and opportunities for the PVC recycling market?

Growing awareness of energy savings and government responses is driving the market during the forecast period. Demand for sustainable solutions from the construction and packaging industry acts as an opportunity during the forecast period.

Which are the key technology trends prevailing in the PVC recycling market?

The key technologies prevailing in the PVC recycling market include mechanical recycling, chemical recycling, and biodegradable additives.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Reduce environmental & economic impact of PVC plastics- Growing awareness of energy savings and government responses- Increasing use of PVC in various end-use industries- Chemical recycling process to drive marketRESTRAINTS- Technical limitations of PVC recycling process- Effects of downcyclingOPPORTUNITIES- Favorable initiatives to promote use of recycled PVC in developed countries- Demand for sustainable solutions from construction and packaging industries- New recycling technologies- Opportunities for chemical industriesCHALLENGES- Quality issues of recycled PVC plastics- Difficulty in collection of raw materials- High cost of recycling- Recycling facilities not accepting pigmented plastics

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISCOLLECTIONSORTINGSHREDDINGRECYCLINGEND USERS

-

5.5 TRADE ANALYSISIMPORT-EXPORT SCENARIO OF PVC RECYCLING MARKET

-

5.6 TECHNOLOGY TRENDSMECHANICAL RECYCLINGCHEMICAL RECYCLINGBIODEGRADABLE ADDITIVESDIGITALIZATION AND AUTOMATION

-

5.7 AVERAGE SELLING PRICE TRENDSAVERAGE SELLING PRICE OF RECYCLED PVC, BY REGIONAVERAGE SELLING PRICE OF RECYCLED PVC, BY TYPE

-

5.8 ECOSYSTEM

-

5.9 REGULATORY LANDSCAPEGOVERNMENT REGULATIONS AND POLICIES TO PROMOTE RECYCLING AND REDUCE PVC WASTEREGULATIONS TO RESTRICT HAZARDOUS SUBSTANCES IN PVC PRODUCTS AND WASTEINDUSTRY STANDARDS AND CERTIFICATIONS FOR SAFE AND ENVIRONMENTALLY RESPONSIBLE PVC RECYCLINGTRADE REGULATIONS AND AGREEMENTS IMPACTING PVC RECYCLING MARKET: IMPLICATIONS FOR GLOBAL SUPPLY CHAIN

- 5.10 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.12 CASE STUDIESTESCO WORKED WITH DS SMITH ON ITS ZERO WASTE AMBITIONS BY BACKHAULING CARDS, PLASTICS, ANIMAL BY-PRODUCTS, AND METALSCLOSED-LOOP PLASTIC RECYCLING

-

5.13 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEPATENT PUBLICATION TRENDSINSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS- List of major patentsTOP 10 PATENT OWNERS IN LAST 10 YEARS

-

5.14 KEY FACTORS AFFECTING BUYING DECISIONQUALITYPRICINGAVAILABILITY AND SUPPLY CHAINSUSTAINABILITYREGULATIONS AND COMPLIANCECUSTOMER RELATIONSHIPS

- 6.1 INTRODUCTION

- 6.2 RIGID PVC

- 6.3 FLEXIBLE PVC

- 6.4 CHLORINATED PVC

-

7.1 INTRODUCTIONPOST-CONSUMER WASTEPRE-CONSUMER WASTE

- 8.1 INTRODUCTION

-

8.2 MECHANICAL RECYCLINGSHREDDINGWASHINGDRYINGPELLETIZING

-

8.3 CHEMICAL RECYCLINGDEPOLYMERIZATIONPYROLYSISHYDRO-CRACKINGGASIFICATION

- 8.4 OTHERS RECYCLING PROCESSES

- 9.1 INTRODUCTION

- 9.2 WINDOW PROFILE & DOORS

- 9.3 PIPE & FITTINGS

- 9.4 FACADE CLADDING/SIDING

- 9.5 RAINWATER GUTTER

- 9.6 PVC AWNINGS

- 9.7 ELECTRICAL WIRE GUTTER

- 9.8 ROOFING MEMBRANES

- 9.9 WIRE & CABLES

- 9.10 AUTOMOTIVE INTERIOR

- 9.11 AUTOMOTIVE UNDERBODY PROTECTION

- 9.12 TRAFFIC CONES

- 9.13 EXTERIOR GARDENS

- 9.14 OTHERS

- 10.1 INTRODUCTION

- 10.2 BUILDING, CONSTRUCTION, AND INFRASTRUCTURE

- 10.3 ELECTRICAL

- 10.4 AUTOMOTIVE

- 10.5 CONSUMER GOODS

- 10.6 AGRICULTURE

- 10.7 OTHERS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICCHINA- Potential increase in domestic plastic recycling to drive marketJAPAN- Government initiatives to recycling PVC to reduce waste and conserve resources to drive marketINDIA- Favorable government rules to create demandSOUTH KOREA- Government initiatives promoting PVC recycling to drive marketREST OF ASIA PACIFIC

-

11.3 EUROPEGERMANY- Well-established recycling infrastructure to drive marketUK- Increasing demand in construction applications to support market growthITALY- Regulations to reduce PVC waste to drive marketFRANCE- Government initiatives fostering PVC recycling to drive marketSPAIN- Comprehensive framework to regulate production and use of recycled PVC products to boost marketBELGIUM- Construction industry to increase demand for recycled PVC productsNETHERLANDS- Well-established circular economy framework to support marketPOLAND- Goal to achieve recycling rate of 55% by 2025 to drive marketREST OF EUROPE

-

11.4 NORTH AMERICAUS- Focus on sustainable practices to drive marketCANADA- Development of new recycling technologies to boost market growthMEXICO- Focus on creating effective recycling practices to support market growth

-

11.5 MIDDLE EAST & AFRICASAUDI ARABIA- Construction and packaging industries to support market growthSOUTH AFRICA- Government regulations to promote and regulate recycling of PVC to drive marketUAE- Conducive environment to increase demandREST OF MIDDLE EAST & AFRICA

-

11.6 SOUTH AMERICABRAZIL- Improved use of recycled PVC to drive marketARGENTINA- Initiatives to increase sustainability and promote circular economy to drive marketREST OF SOUTH AMERICA

-

12.1 INTRODUCTIONPVC RECYCLING MARKET, KEY DEVELOPMENTS

-

12.2 RANKING ANALYSIS OF KEY MARKET PLAYERSSUEZVEOLIADS SMITHSIKAADAMS PLASTICS

- 12.3 MARKET SHARE ANALYSIS

- 12.4 MARKET EVALUATION MATRIX

-

12.5 COMPETITIVE EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 COMPANY TYPE FOOTPRINT

-

12.7 COMPETITIVE EVALUATION QUADRANT, OTHER PLAYERSSTARTING BLOCKSRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIES

- 12.8 COMPETITIVE BENCHMARKING

-

12.9 COMPETITIVE SITUATIONS AND TRENDSDEALSOTHERS

-

13.1 KEY PLAYERSSUEZ- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVEOLIA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDS SMITH- Business overview- Products/Solutions/Services offered- MnM viewSIKA SARNAFIL- Business overview- Products/Solutions/Services Offered- Deals- MnM viewADAMS PLASTICS- Business overview- Products/Solutions/Services offered- MNM viewWRC RECYCLING- Business overview- Products/Solutions/Services offered- MnM viewRECLAIM PLASTICS- Business overview- Products/Solutions/Services offered- MNM viewSIMPLAS PVC RECYCLING- Business overview- Products/Solutions/Services offered- MnM viewVEKA RECYCLING- Business overview- Products/Solutions/Services offered- MnM viewGD ENVIRONMENTAL- Business overview- Products/Solutions/Services offered- MnM view

-

13.2 OTHERSPOWER PLASTIC RECYCLING LTD.B. SCHOENBERG & CO., INC.RECYPLAST CZ S.R.O.LIGHT BROTHERS LIMITEDD.C.L. PLASTIC CO., LTD.REKUPLAST S.R.O.WESPACKCPE ENTOSORGUNGECOPLASPWR TRADING AND EXTRUSION BVNORWICH PLASTICSPVC ENTERPRISE LTD.PT. REJEKI ADIGRAHARECOVINYLPLASTIC EXPERT

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 IMPORT TRADE DATA FOR PLATES, SHEETS, FILM, FOIL, AND STRIPS, OF NON-CELLULAR PLASTICS, NOT REINFORCED, AND LAMINATED

- TABLE 2 EXPORT TRADE DATA FOR PLATES, SHEETS, FILM, FOIL, AND STRIPS, OF NON-CELLULAR PLASTICS, NOT REINFORCED, AND LAMINATED

- TABLE 3 PVC RECYCLING: ECOSYSTEM

- TABLE 4 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 PVC RECYCLING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 6 PVC RECYCLING MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 7 PVC RECYCLING MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 8 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 9 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 10 PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (KILOTON)

- TABLE 11 PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 12 PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (USD MILLION)

- TABLE 13 PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 14 PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (KILOTON)

- TABLE 15 PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (KILOTON)

- TABLE 16 PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 17 PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 18 PVC RECYCLING MARKET, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 19 PVC RECYCLING MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 20 PVC RECYCLING MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 21 PVC RECYCLING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 22 PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 23 PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 24 PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 25 PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 26 PVC RECYCLING MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 27 PVC RECYCLING MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 28 PVC RECYCLING MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 29 PVC RECYCLING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 ASIA PACIFIC: PVC RECYCLING MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 31 ASIA PACIFIC: PVC RECYCLING MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 32 ASIA PACIFIC: PVC RECYCLING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 33 ASIA PACIFIC: PVC RECYCLING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (KILOTON)

- TABLE 35 ASIA PACIFIC: PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 36 ASIA PACIFIC: PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 39 ASIA PACIFIC: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 40 ASIA PACIFIC: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 41 ASIA PACIFIC: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (KILOTON)

- TABLE 43 ASIA PACIFIC: PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (KILOTON)

- TABLE 44 ASIA PACIFIC: PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 45 ASIA PACIFIC: PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 47 ASIA PACIFIC: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 48 ASIA PACIFIC: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: PVC RECYCLING MARKET, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 51 ASIA PACIFIC: PVC RECYCLING MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 52 ASIA PACIFIC: PVC RECYCLING MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 53 ASIA PACIFIC: PVC RECYCLING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 54 CHINA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 55 CHINA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 56 CHINA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 57 CHINA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 58 JAPAN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 59 JAPAN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 60 JAPAN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 61 JAPAN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 62 INDIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 63 INDIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 64 INDIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 65 INDIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 66 SOUTH KOREA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 67 SOUTH KOREA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 68 SOUTH KOREA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 69 SOUTH KOREA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 71 REST OF ASIA PACIFIC: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 72 REST OF ASIA PACIFIC: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 74 EUROPE: PVC RECYCLING MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 75 EUROPE: PVC RECYCLING MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 76 EUROPE: PVC RECYCLING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 77 EUROPE: PVC RECYCLING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (KILOTON)

- TABLE 79 EUROPE: PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 80 EUROPE: PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (USD MILLION)

- TABLE 81 EUROPE: PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 83 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 84 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 85 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (KILOTON)

- TABLE 87 EUROPE: PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (KILOTON)

- TABLE 88 EUROPE: PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 89 EUROPE: PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 91 EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 92 EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 93 EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 95 EUROPE: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 96 EUROPE: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 97 EUROPE: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 GERMANY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 99 GERMANY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 100 GERMANY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 101 GERMANY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 102 UK: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 103 UK: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 104 UK: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 105 UK: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 106 ITALY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 107 ITALY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 108 ITALY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 109 ITALY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 110 FRANCE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 111 FRANCE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 112 FRANCE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 113 FRANCE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 114 SPAIN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 115 SPAIN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 116 SPAIN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 117 SPAIN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 118 BELGIUM: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 119 BELGIUM: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 120 BELGIUM: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 121 BELGIUM: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 122 NETHERLANDS: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 123 NETHERLANDS: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 124 NETHERLANDS: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 125 NETHERLANDS: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 126 POLAND: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 127 POLAND: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 128 POLAND: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 129 POLAND: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 130 REST OF EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 131 REST OF EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 132 REST OF EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 133 REST OF EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 135 NORTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 136 NORTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (KILOTON)

- TABLE 139 NORTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 140 NORTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 143 NORTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 144 NORTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (KILOTON)

- TABLE 147 NORTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (KILOTON)

- TABLE 148 NORTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 149 NORTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 151 NORTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 152 NORTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 153 NORTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 155 NORTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 156 NORTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 157 NORTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 158 US: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 159 US: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 160 US: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 161 US: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 162 CANADA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 163 CANADA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 164 CANADA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 165 CANADA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 166 MEXICO: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 167 MEXICO: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 168 MEXICO: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 169 MEXICO: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 171 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 172 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (KILOTON)

- TABLE 175 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 176 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 179 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 180 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY PROCESS, 2023–2028(KILOTON)

- TABLE 184 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 188 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 192 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 193 SOUTH AMERICA: PVC RECYCLING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 194 SAUDI ARABIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 195 SAUDI ARABIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 196 SAUDI ARABIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 197 SAUDI ARABIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 198 SOUTH AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 199 SOUTH AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 200 SOUTH AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 201 SOUTH AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 202 UAE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 203 UAE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 204 UAE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 205 UAE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 210 SOUTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 211 SOUTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 212 SOUTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 213 SOUTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 214 SOUTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (KILOTON)

- TABLE 215 SOUTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (KILOTON)

- TABLE 216 SOUTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2020–2022 (USD MILLION)

- TABLE 217 SOUTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 218 SOUTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (KILOTON)

- TABLE 219 SOUTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 220 SOUTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 221 SOUTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 222 SOUTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (KILOTON)

- TABLE 223 SOUTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (KILOTON)

- TABLE 224 SOUTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 225 SOUTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 226 SOUTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 227 SOUTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 228 SOUTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 229 SOUTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 230 SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 231 SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 232 SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 233 SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 234 BRAZIL: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 235 BRAZIL: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 236 BRAZIL: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 237 BRAZIL: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 238 ARGENTINA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 239 ARGENTINA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 240 ARGENTINA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 241 ARGENTINA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 242 REST OF SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 243 REST OF SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 244 REST OF SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 245 REST OF SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 246 OVERVIEW OF STRATEGIES ADOPTED BY SOME KEY MARKET PLAYERS

- TABLE 247 PVC RECYCLING MARKET: DEGREE OF COMPETITION

- TABLE 248 MARKET EVALUATION MATRIX

- TABLE 249 PVC RECYCLING MARKET: DETAILED LIST OF SMES

- TABLE 250 PVC RECYCLING MARKET: COMPETITIVE BENCHMARKING OF SMES

- TABLE 251 PVC RECYCLING MARKET: DEALS, 2020–2023

- TABLE 252 PVC RECYCLING MARKET: OTHERS, 2020–2022

- TABLE 253 SUEZ: COMPANY OVERVIEW

- TABLE 254 SUEZ: PRODUCT OFFERINGS

- TABLE 255 SUEZ: DEALS

- TABLE 256 SUEZ: OTHER DEVELOPMENTS

- TABLE 257 VEOLIA: COMPANY OVERVIEW

- TABLE 258 VEOLIA: PRODUCT OFFERINGS

- TABLE 259 VEOLIA: DEALS

- TABLE 260 DS SMITH: COMPANY OVERVIEW

- TABLE 261 DS SMITH: PRODUCT OFFERINGS

- TABLE 262 SIKA SARNAFIL: COMPANY OVERVIEW

- TABLE 263 SIKA SARNAFIL: DEALS

- TABLE 264 ADAMS PLASTICS: COMPANY OVERVIEW

- TABLE 265 ADAMS PLASTICS: PRODUCT OFFERINGS

- TABLE 266 WRC RECYCLING: COMPANY OVERVIEW

- TABLE 267 WRC RECYCLING: PRODUCT OFFERINGS

- TABLE 268 RECLAIM PLASTICS: COMPANY OVERVIEW

- TABLE 269 RECLAIM PLASTICS: PRODUCT OFFERINGS

- TABLE 270 SIMPLAS PVC RECYCLING: COMPANY OVERVIEW

- TABLE 271 SIMPLAS PVC RECYCLING: PRODUCT OFFERINGS

- TABLE 273 VEKA RECYCLING: PRODUCT OFFERINGS

- TABLE 274 GD ENVIRONMENTAL: COMPANY OVERVIEW

- TABLE 275 GD ENVIRONMENTAL: PRODUCT OFFERINGS

- TABLE 276 POWER PLASTIC RECYCLING LTD.: COMPANY OVERVIEW

- TABLE 277 B. SCHOENBERG & CO., INC.: COMPANY OVERVIEW

- TABLE 278 RECYPLAST S.R.O.: COMPANY OVERVIEW

- TABLE 279 LIGHT BROTHERS LIMITED: COMPANY OVERVIEW

- TABLE 280 D.C.L. PLASTIC CO., LTD.: COMPANY OVERVIEW

- TABLE 281 REKUPLAST S.R.O.: COMPANY OVERVIEW

- TABLE 282 WESPACK: COMPANY OVERVIEW

- TABLE 283 CPE ENTOSORGUNG: COMPANY OVERVIEW

- TABLE 284 ECOPLAS: COMPANY OVERVIEW

- TABLE 285 PWR TRADING AND EXTRUSION BV: COMPANY OVERVIEW

- TABLE 286 NORWICH PLASTICS: COMPANY OVERVIEW

- TABLE 287 PVC ENTERPRISE LTD.: COMPANY OVERVIEW

- TABLE 288 PT. REJEKI ADIGRAHA: COMPANY OVERVIEW

- TABLE 289 RECOVINYL: COMPANY OVERVIEW

- TABLE 290 PLASTIC EXPERT: COMPANY OVERVIEW

- FIGURE 1 PVC RECYCLING: MARKET SEGMENTATION

- FIGURE 2 PVC RECYCLING MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 PVC RECYCLING MARKET: DATA TRIANGULATION

- FIGURE 7 POST-CONSUMER WASTE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 RIGID TYPE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 CHEMICAL PROCESS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 BUILDING & CONSTRUCTION TO BE LARGEST SEGMENT OF PVC RECYCLING MARKET

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF PVC RECYCLING MARKET

- FIGURE 12 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN PVC RECYCLING MARKET DURING FORECAST PERIOD

- FIGURE 13 FLEXIBLE PVC MATERIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 POST-CONSUMER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 MECHANICAL PROCESS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 BUILDING & CONSTRUCTION TO LEAD MARKET BY 2027

- FIGURE 17 FLEXIBLE PVC AND CHINA ACCOUNTED FOR LARGEST SHARES

- FIGURE 18 MARKET IN GERMANY TO GROW AT HIGHEST CAGR

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PVC RECYCLING MARKET

- FIGURE 20 PVC RECYCLING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE (2021–2028), BY REGION

- FIGURE 23 AVERAGE SELLING PRICE (2021–2028), BY TYPE

- FIGURE 24 GRANTED PATENTS

- FIGURE 25 NUMBER OF PATENTS YEAR-WISE DURING LAST 10 YEARS

- FIGURE 26 CHINA ACCOUNTED FOR HIGHEST NUMBER OF PATENTS

- FIGURE 27 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 28 SUPPLIER SELECTION CRITERION

- FIGURE 29 PVC RECYCLING MARKET SIZE, BY TYPE (USD MILLION)

- FIGURE 30 PVC RECYCLING MARKET, BY SOURCE (USD MILLION)

- FIGURE 31 ELECTRIC GUTTER TO BE FASTEST-GROWING APPLICATION SEGMENT OF PVC RECYCLING MARKET

- FIGURE 32 PVC RECYCLING MARKET, BY END-USE INDUSTRY (USD MILLION)

- FIGURE 33 ASIA PACIFIC AND NORTH AMERICA TO EMERGE AS NEW STRATEGIC DESTINATIONS FOR PVC RECYCLING MARKET

- FIGURE 34 ASIA PACIFIC: PVC RECYCLING MARKET SNAPSHOT

- FIGURE 35 PVC RECYCLING: MARKET SHARE ANALYSIS

- FIGURE 36 PVC RECYCLING MARKET: GLOBAL COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES

- FIGURE 37 PVC RECYCLING MARKET (GLOBAL): COMPANY EVALUATION MATRIX FOR SMES

- FIGURE 38 SUEZ: COMPANY SNAPSHOT

- FIGURE 39 VEOLIA: COMPANY SNAPSHOT

- FIGURE 40 DS SMITH: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the PVC recycling market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, associations websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The PVC recycling market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the PVC recycling industry have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the PVC recycling industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, raw material, application type, end-use industries, and regions. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of PVC recycling and the outlook of their business which will affect the overall market.

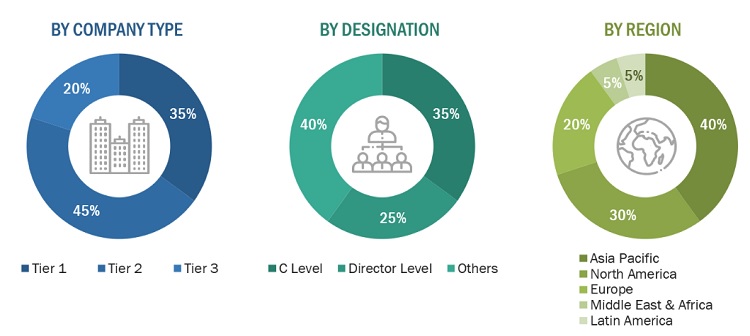

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

DS Smith |

Industry Expert |

|

Adams Plastics |

Sales Manager |

|

Reclaim Plastics |

Director |

|

Veolia |

Marketing Manager |

Market Size Estimation

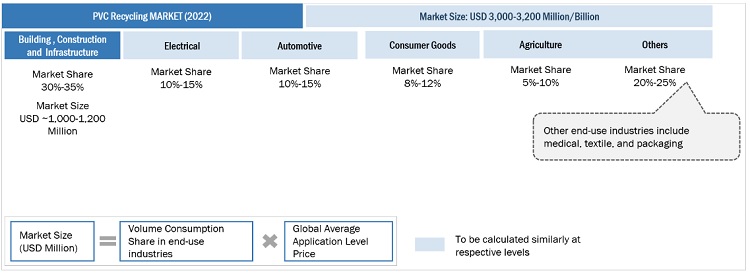

The top-down and bottom-up approaches have been used to estimate and validate the size of the PVC recycling market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

PVC Recycling Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

PVC Recycling Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

PVC recycling is the process of recovering PVC-based products or materials into new, useful products. PVC waste is split into pre-consumer and post-consumer waste and is sorted into five different categories derived from a pyramid model. PVC can be either reused or processed mechanically and chemically recycled. There has been a shift in recent years toward recycling PVC plastics because of new regulations in several countries. In response, companies are developing products from both post-consumer waste and recycled materials such as plastics.

PVC is sorted into categories according to the pyramid model, which organizes PVC by quality and usability. These category placements determine the processes used to recycle or reuse PVC plastic. Recycling PVC can drastically reduce the carbon footprint compared to production with fresh material. It helps in saving energy and eliminates the extraction of more carbon from the ground.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the PVC recycling market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, process, source, application, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in PVC Recycling Market