Protein A Resin Market by Product (Agarose-based, Glass/Silica-based, Organic polymer-based), Type (Recombinant Protein A, Natural Protein A), Application (Antibody Purification, Immunoprecipitation), End User & Region - Global Forecast to 2028

Updated on : Aug 22, 2024

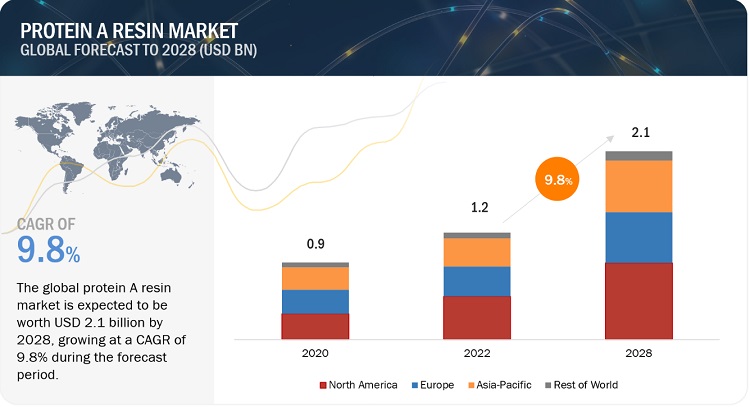

The global protein A resin market in terms of revenue was estimated to be worth $1.2 billion in 2022 and is poised to reach $2.1 billion by 2028, growing at a CAGR of 9.8% from 2022 to 2028 The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth of the market is attributed to the increased R&D investments in pharmaceutical industries, the growing demand for protein engineered products used in the development of vaccines and therapeutics.

Global protein A resin market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Protein A resin Market Dynamics

Driver: Increasing demand for therapeutic antibodies

Chromatography is an essential step in the purification of monoclonal antibodies (mAbs). Over the past decade, there has been a tremendous increase in the demand for monoclonal antibodies in oncology and several other therapeutic areas, including neurological, autoimmune, and inflammatory disorders. As a result, almost all major pharmaceutical companies are focusing on the R&D of therapeutic antibodies.

In the purification of monoclonal antibodies, anionic impurities, such as nucleic acids and endotoxins, are removed through chromatography. In drug discovery applications, this process consumes a large number of resins, as the usage is not limited to purification but also includes the study of the ionic interaction of molecules. Impurities such as albumin and transferrin are removed by size-exclusion chromatography (SEC). High levels of purification can be achieved through the use of protein A affinity resins. This is because antibodies selectively bind protein A ligands with the resins. This is expected to drive the demand for protein A resins during the forecast period. In June 2020, UK’s Medicines and Healthcare Products Regulatory Agency planned for new regulations to come into force in 2023. Products that already have conformity markings, either UKCA or CE, will be able to remain in the market after the regulations come into force.

Restraint: High cost of resins

Protein A resins cost around 5–10 times more than other types of resins. Though there are no alternative techniques that can achieve purification levels as high as protein A resins, their high cost makes end users look for alternatives. Some of the techniques that provide acceptable levels of purification include both chromatography and non-chromatography methods. mAb crystallization and precipitation by polyethylene glycol (PEG) precipitation are being explored as alternatives for protein A chromatography.

The impact of this restraining factor is more evident in emerging markets such as the Asia Pacific and Latin America. However, with the entry of new market players, the cost of protein A resins is expected to come down significantly. The increasing pressure on major market players is expected to result in price reduction, as small market entrants are offering resins at far lower prices while simultaneously offering comparable product quality.

Opportunity: Increasing number of CMOs and CROs

An increasing number of CMOs and CROs are offering their services to pharmaceutical companies across the globe. This is expected to offer potential growth opportunities to protein A resin manufacturers during the forecast period.

Pharmaceutical companies are increasingly relying on contract manufacturers in various areas of research to fulfill a number of basic needs, such as specialized competencies and cost reduction. The pharmaceutical contract manufacturing industry has experienced robust growth in recent years, and this trend is expected to continue in the coming years. The increasing pressure from several governments to reduce healthcare costs and declining R&D productivity have compelled core pharmaceutical producers to rely on contract manufacturing. Moreover, the rising demand for generic drugs in China and India is a key driver for CMO sales.

In the biologics sector, the biosimilars market is expected to witness the highest growth. The patent expiry of blockbuster biologics is expected to encourage a number of companies to invest in biosimilars during the forecast period. Chromatography is one of the key bioseparation techniques used in the manufacturing of biosimilar antibodies. The rising demand for biosimilars is thus estimated to increase the use of chromatography resins during the forecast period.

The currently available biosimilars are used to treat cancer, rheumatoid arthritis, infectious diseases, psoriasis, anemia, kidney failure, Type I and Type II diabetes, post-menopausal osteoporosis, and hormonal disorders. The key targeted therapeutic areas for which various biosimilars are in the pipeline include oncology, autoimmune disorders, diabetes, and hepatitis. Besides these, biosimilars can be developed for other chronic disorders, such as meningitis, breast cancer, adult T-cell leukemia, obesity, hypertension, and hepatitis E.

Most of the early biologic drugs lost their patent protection in the first half of the 20th century, while many of the current best-selling drugs will lose their patent protection in the coming years. This is creating new opportunities for biosimilar drugs. For instance, in 2020, the patent of Vyrologix (Leronlimab), prescribed in the treatment of cancer, COVID-19, HIV, and cancer, expired in the US. This is expected to create significant opportunities for lower-priced Vyrologix biosimilars in the US and Europe.

Challenge: Issues associated with scaling up production of protein A resins

The production of protein A resins is a complex process that involves many steps, including fermentation, extraction, purification, and packaging. Scaling up the production process to meet the growing demand requires careful planning and management to ensure consistency and quality throughout the production process.

Scaling up the production process can result in variability in the quality and consistency of the resin. Factors such as changes in the source material, equipment, and personnel can all contribute to this variability. Maintaining consistency in the manufacturing process is essential to ensure the quality of the final product.

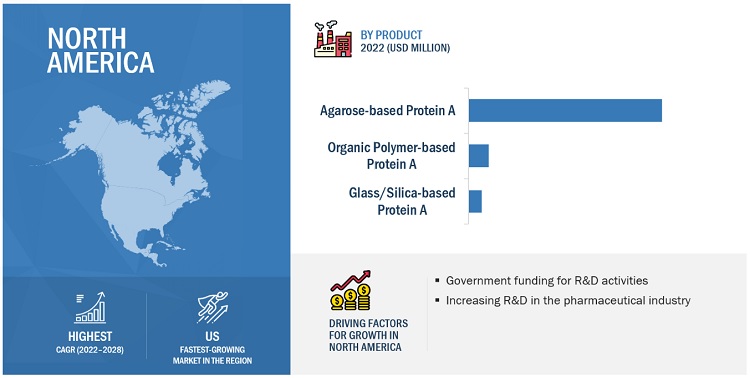

By product, the agarose-based protein A resin segment of global protein A resin market, accounted for the largest share during the forecast period.

Based on product, the market is segmented into agarose-based protein A resin, glass/silica based protein a resin and organic polymer based protein A resin. The agarose based protein A resin segment accounts for the largest share of the market. Agarose-based protein A resins exhibit enhanced durability, greater mechanical robustness, and a superior capacity to incorporate metal dopant absorption at pH levels that are appropriate.

By type, the recombinant protein A resin segment of protein A resin market, accounted for the largest share during the forecast period.

Based on type, the market is segmented into recombinant and natural protein A resin. The recombinant protein A resin segment accounts for the largest share of the market. Due to its advanced technological improvements in the drug discovery process, there is a rising need for recombinant protein resins in the pharmaceutical industry. This is because they offer a more targeted binding capacity, which is expected to propel the growth of this segment during the forecast period.

By application type, the antibody purification segment of protein A resin market is expected to witness a significant growth during the forecast period.

Based on application, the market is segmented into Based on application, the protein A resin is segmented into antibody purification, immunoprecipitation. The antibody purification segment is expected to witness a significant growth during the forecast period. The biopharmaceutical and biotechnology industries have facilitated the advancement of immunoprecipitation applications in the R&D sector, leading to its significant growth and dominance in the industry in the upcoming years.

By End User, pharmaceutical & biopharmaceutical companies’ segment of protein A resin market to grow at the fastest rate during the forecast period.

Based on end user, the global market is segmented into pharmaceutical & biopharmaceutical companies, academic and research institutes, other end users. The pharmaceutical and biopharmaceutical companies have facilitated the advancement of immunoprecipitation applications in the R&D sector, leading to its significant growth and dominance in the industry in the upcoming years. Also, the anticipated revenue growth of this segment during the forecast period is attributed to the rapid expansion of the biopharmaceutical industry worldwide and the technological advancements in the pharmaceutical and biotechnology sectors.

To know about the assumptions considered for the study, download the pdf brochure

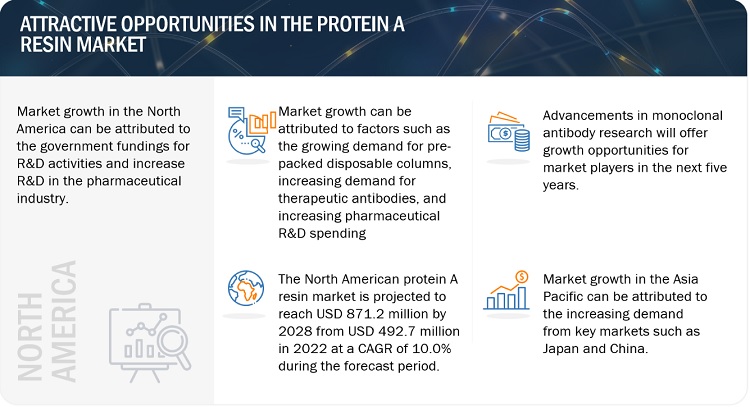

North America is expected to be the largest region of the global protein A resin market during the forecast period.

North America, comprising the US and Canada, held the largest share of the global market. This region is witnessing a surge in demand for protein-based therapeutics to combat infectious diseases, which is further amplified by the growing number of FDA-approved pharmaceutical and biotechnology companies in this region.

As of 2021, prominent players in the market are Danaher Corporation (US), Merck KGAa (Germany), Repligen Corporation (US), Thermo Fisher Scientific (US), Agilent Technologies (US), GenScript (China), PerkinElmer Inc. (US), Bio-Rad Laboratories, Inc. (US), Orochem Technologies Inc. (US), Kaneka Corporation (Japan), Abcam Plc. (UK), Agarose Bead Technologies (US), and Avantor, Inc. (US), among others.

Protein A Resin Market Report Scope:

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.2 billion |

|

Projected Revenue by 2028 |

$2.1 billion |

|

Revenue Rate |

poised to grow at a CAGR of 9.8% |

|

Growth Driver |

Increasing demand for therapeutic antibodies |

|

Growth Opportunity |

Increasing number of CMOs and CROs |

This report has segmented the global protein A resin market to forecast revenue and analyze trends in each of the following submarkets:

By product

- Agarose based protein A resin

- Glass/Silica based protein A resin

- Organic polymer based protein A resin

By Type

- Recombinant protein A resin

- Natural protein A resin

By Application

- Antibody Purification

- Immunoprecipitation

By end user

- Pharmaceutical and biopharmaceutical companies

- Academic Research institutes

- Other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Rest of the World

Recent Developments

- In September 2022, As part of its charitable efforts through the Agilent Foundation, Agilent Technologies partnered with Delaware State University (DSU) to boost the number of minority students who choose STEM careers.

- In October 2021, Tosoh Biosciences LLC completed the acquisition of Semba Biosciences, a privately held leading innovator in the field of multi-column chromatography (MCC) instrumentation and technology for the downstream purification of biologics.

- In September 2021, Repligen and Navigo completed their co-development of a novel affinity ligand that addresses aggregation issues associated with pH-sensitive antibodies and Fc-fusion proteins. This ligand, NGL-Impact HipH, is produced and supplied to Purolite for use in a platform usage resin product.

- In May 2021, The Life Sciences business of GE Healthcare was acquired by Danaher Corporation and rebranded as Cytiva.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the protein A resin market?

The protein A resin market boasts a total revenue value of $2.1 billion by 2028.

What is the estimated growth rate (CAGR) of the protein A resin market?

The global protein A resin market has an estimated compound annual growth rate (CAGR) of 9.8% and a revenue size in the region of $1.2 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for disposable pre-packed columns- Increasing demand for therapeutic antibodies- Increasing pharmaceutical R&D spending- Stringent regulatory control in healthcare industryRESTRAINTS- High cost of resins- Dearth of skilled professionalsOPPORTUNITIES- Increasing number of CMOs and CROsCHALLENGES- Regulatory restrictions- Issues associated with scaling up production of protein A resins

-

5.3 REGULATIONSNORTH AMERICA- US- CanadaEUROPEASIA PACIFICLATIN AMERICAMIDDLE EAST & AFRICA

- 5.4 PRICING ANALYSIS: PROTEIN A RESIN MARKET

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

- 6.1 INTRODUCTION

-

6.2 AGAROSE-BASED PROTEIN AAGAROSE-BASED PROTEIN A SEGMENT TO DOMINATE MARKET

-

6.3 GLASS/SILICA-BASED PROTEIN ALOW PH TOLERANCE OF SILICA-BASED RESINS TO LIMIT THEIR MARKET GROWTH

-

6.4 ORGANIC POLYMER-BASED PROTEIN AINCREASING POPULARITY OF ORGANIC POLYMERS TO DRIVE MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 RECOMBINANT PROTEIN ACOST-EFFICIENCY OF RECOMBINANT PROTEINS TO DRIVE MARKET GROWTH

-

7.3 NATURAL PROTEIN AADVANTAGES OF RECOMBINANT PROTEIN A HAVE RESTRICTED MARKET POTENTIAL OF NATURAL PROTEIN A

- 8.1 INTRODUCTION

-

8.2 ANTIBODY PURIFICATIONANTIBODY PURIFICATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

-

8.3 IMMUNOPRECIPITATIONIMMUNOPRECIPITATION SEGMENT TO GROW AT LOWER CAGR DURING FORECAST PERIOD

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIESPROTEIN A RESINS EXTENSIVELY USED TO PRODUCE BIOLOGICAL DRUGS

-

9.3 ACADEMIC RESEARCH INSTITUTESINCREASING R&D IN DRUG DISCOVERY TO DRIVE USE OF PROTEIN A RESINS

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Increasing R&D investments in pharmaceutical industry to propel market growthCANADA- Government initiatives focused on boosting pharmaceutical industry to drive market growth

-

10.3 EUROPEGERMANY- Flourishing biotechnology industry to drive market growthUK- Favorable R&D scenario to support market growthFRANCE- Favorable healthcare scenario to boost market growthITALY- Well-established pharmaceutical industry to spur demand for protein A resinsSPAIN- Presence of large number of biotech R&D service providers to support market growthREST OF EUROPE

-

10.4 ASIA PACIFICJAPAN- Increasing demand for generic drugs and monoclonal antibody biosimilars to drive resin consumptionCHINA- Increasing pharmaceutical R&D spending to drive market growthINDIA- Growth of pharma and biotech industries to drive demand for protein A resinsAUSTRALIA- Increasing demand for protein-based therapeutics for treatment of infectious diseases to drive growthSOUTH KOREA- Developments in biopharmaceutical sector to drive market growthREST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

-

11.3 COMPETITIVE LEADERSHIP MAPPINGSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.4 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSDANAHER CORPORATION- Business overview- Products offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC- Business overview- Products offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products offered- Recent developments- MnM viewREPLIGEN CORPORATION- Business overview- Products offered- Recent developments- MnM viewTOSOH BIOSCIENCE LLC- Business overview- Products offered- Recent developments- MnM viewAGILENT TECHNOLOGIES, INC.- Business overview- Products offered- Recent developments- MnM viewPUROLITE- Business overview- Products offered- Recent developmentsPERKINELMER INC.- Business overview- Products offeredNOVASEP HOLDING SAS- Business overview- Products offeredGENSCRIPT- Business overview- Products offeredBIO-RAD LABORATORIES, INC.- Business overview- Products offeredKANEKA CORPORATION- Business overview- Products offeredOROCHEM TECHNOLOGIES INC.- Business overview- Products offeredABCAM PLC- Business overview- Products offered- Recent developmentsAGAROSE BEAD TECHNOLOGIES- Business overview- Products offered

-

12.2 OTHER COMPANIESAVANTOR, INC.JSR LIFESCIENCES, LLCBIO-WORKSTAKARA BIO INC.GENERONGENO TECHNOLOGY INC.JNC CORPORATIONPROMEGA CORPORATIONSUZHOU NANOMICRO TECHNOLOGY CO., LTD.TRANSGEN BIOTECH CO., LTD.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 PROTEIN A RESIN MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 ADVANTAGES OF PRE-PACKED COLUMNS

- TABLE 3 PROTEIN A RESIN MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 5 AGAROSE-BASED PROTEIN A MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 6 NORTH AMERICA: AGAROSE-BASED PROTEIN A MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 7 EUROPE: AGAROSE-BASED PROTEIN A MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 8 ASIA PACIFIC: AGAROSE-BASED PROTEIN A MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 9 GLASS/SILICA-BASED PROTEIN A MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 10 NORTH AMERICA: GLASS/SILICA-BASED PROTEIN A MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 11 EUROPE: GLASS/SILICA-BASED PROTEIN A MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 12 ASIA PACIFIC: GLASS/SILICA-BASED PROTEIN A MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 13 ORGANIC POLYMER-BASED PROTEIN A MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 14 NORTH AMERICA: ORGANIC POLYMER-BASED PROTEIN A MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 15 EUROPE: ORGANIC POLYMER-BASED PROTEIN A MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 16 ASIA PACIFIC: ORGANIC POLYMER-BASED PROTEIN A MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 17 PROTEIN A RESIN MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 18 RECOMBINANT PROTEIN A MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 19 NATURAL PROTEIN A MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 20 PROTEIN A RESIN MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 21 PROTEIN A RESIN MARKET FOR ANTIBODY PURIFICATION, BY REGION, 2020–2028 (USD MILLION)

- TABLE 22 PROTEIN A RESIN MARKET FOR IMMUNOPRECIPITATION, BY REGION, 2020–2028 (USD MILLION)

- TABLE 23 PROTEIN A RESIN MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 24 PROTEIN A RESIN MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 25 PROTEIN A RESIN MARKET FOR ACADEMIC RESEARCH INSTITUTES, BY REGION, 2020–2028 (USD MILLION)

- TABLE 26 PROTEIN A RESIN MARKET FOR OTHER END USERS, BY REGION, 2020–2028 (USD MILLION)

- TABLE 27 PROTEIN A RESIN MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: PROTEIN A RESIN MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: PROTEIN A RESIN MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: PROTEIN A RESIN MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: PROTEIN A RESIN MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 33 US: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 34 CANADA: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 35 EUROPE: PROTEIN A RESIN MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 36 EUROPE: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 37 EUROPE: PROTEIN A RESIN MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 38 EUROPE: PROTEIN A RESIN MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 39 EUROPE: PROTEIN A RESIN MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 40 GERMANY: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 41 UK: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 42 FRANCE: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 43 ITALY: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 44 SPAIN: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 45 REST OF EUROPE: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 51 JAPAN: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 52 CHINA: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 53 INDIA: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 54 AUSTRALIA: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 55 SOUTH KOREA: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 56 REST OF ASIA PACIFIC: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 57 ROW: PROTEIN A RESIN MARKET, BY PRODUCT, 2020–2028 (USD MILLION)

- TABLE 58 ROW: PROTEIN A RESIN MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 59 ROW: PROTEIN A RESIN MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 60 ROW: PROTEIN A RESIN MARKET, BY END USER, 2020–2028 (USD MILLION)

- TABLE 61 PROTEIN A RESIN MARKET: PRODUCT LAUNCHES, JANUARY 2020 TO FEBRUARY 2023

- TABLE 62 PROTEIN A RESIN MARKET: DEALS, JANUARY 2020 TO FEBRUARY 2023

- TABLE 63 PROTEIN A RESIN MARKET: OTHER DEVELOPMENTS, JANUARY 2020 TO FEBRUARY 2023

- TABLE 64 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 65 THERMO FISHER SCIENTIFIC: COMPANY OVERVIEW

- TABLE 66 MERCK KGAA: COMPANY OVERVIEW

- TABLE 67 REPLIGEN CORPORATION: COMPANY OVERVIEW

- TABLE 68 TOSOH BIOSCIENCE LLC: COMPANY OVERVIEW

- TABLE 69 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 70 PUROLITE: COMPANY OVERVIEW

- TABLE 71 PERKINELMER INC.: COMPANY OVERVIEW

- TABLE 72 NOVASEP HOLDING SAS: COMPANY OVERVIEW

- TABLE 73 GENSCRIPT: COMPANY OVERVIEW

- TABLE 74 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 75 KANEKA CORPORATION: COMPANY OVERVIEW

- TABLE 76 OROCHEM TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 77 ABCAM PLC.: COMPANY OVERVIEW

- TABLE 78 AGAROSE BEAD TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET SIZE ESTIMATION: VENDOR REVENUE MAPPING APPROACH

- FIGURE 7 ANALYSIS OF VENDOR REVENUE MAPPING

- FIGURE 8 PROTEIN A RESIN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 9 CAGR PROJECTION: SUPPLY-SIDE ANALYSIS

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 PROTEIN A RESIN MARKET, BY PRODUCT, 2022 VS. 2028 (USD MILLION)

- FIGURE 12 PROTEIN A RESIN MARKET, BY TYPE, 2022 VS. 2028 (USD MILLION)

- FIGURE 13 PROTEIN A RESIN MARKET, BY APPLICATION, 2022 VS. 2028 (USD MILLION)

- FIGURE 14 PROTEIN A RESIN MARKET, BY END USER, 2022 VS. 2028 (USD MILLION)

- FIGURE 15 GEOGRAPHIC SNAPSHOT: PROTEIN A RESIN MARKET

- FIGURE 16 INCREASING DEMAND FOR PRE-PACKED DISPOSABLE COLUMNS TO DRIVE MARKET GROWTH

- FIGURE 17 AGAROSE-BASED PROTEIN A SEGMENT TO DOMINATE NORTH AMERICAN MARKET DURING FORECAST PERIOD

- FIGURE 18 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES SEGMENT TO CONTINUE TO DOMINATE ASIA PACIFIC MARKET DURING FORECAST PERIOD

- FIGURE 19 CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 PROTEIN A RESIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 SPENDING ON PHARMACEUTICAL RESEARCH AND DEVELOPMENT, 2020–2028 (USD BILLION)

- FIGURE 22 NORTH AMERICA: PROTEIN A RESIN MARKET SNAPSHOT

- FIGURE 23 ASIA PACIFIC: PROTEIN A RESIN MARKET SNAPSHOT

- FIGURE 24 PROTEIN A RESIN MARKET SHARE ANALYSIS (2021)

- FIGURE 25 PROTEIN A RESIN MARKET: COMPETITIVE LEADERSHIP MAPPING (2022)

- FIGURE 26 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 27 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2022)

- FIGURE 28 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 29 REPLIGEN CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 30 TOSOH BIOSCIENCE LLC: COMPANY SNAPSHOT (2021)

- FIGURE 31 AGILENT TECHNOLOGIES INC.: COMPANY SNAPSHOT (2022)

- FIGURE 32 PERKINELMER INC.: COMPANY SNAPSHOT (2022)

- FIGURE 33 GENSCRIPT: COMPANY SNAPSHOT (2021)

- FIGURE 34 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 35 KANEKA CORPORATION: COMPANY SNAPSHOT (2021)

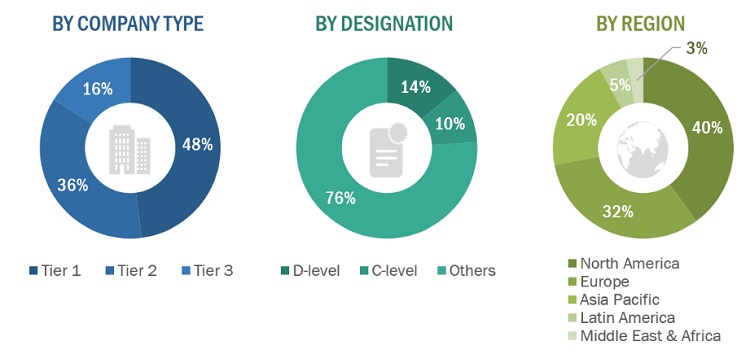

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the protein A resin market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the protein A resin market. The primary sources from the demand side include medical OEMs, Analytical instrument OEMs, CDMOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Tosoh Bioscience LLC |

Application Manager |

|

Cytiva |

Product Sales Specialist |

|

Cytiva |

Product Manager |

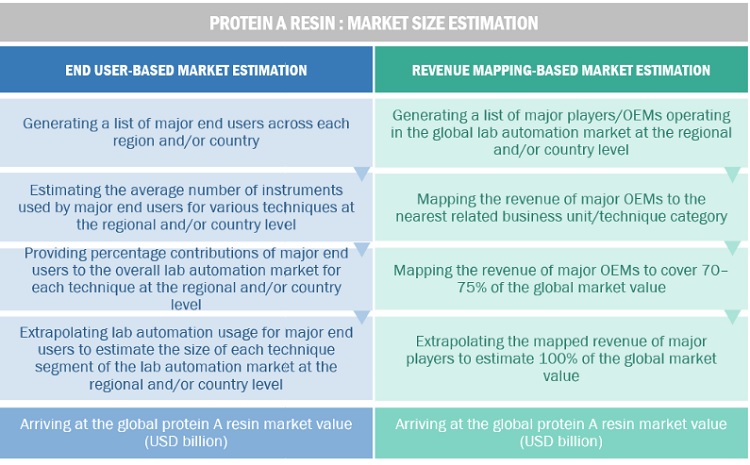

Market Estimation Methodology

In this report, the global protein A resin market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the protein A resin business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the protein A resin market

- Mapping annual revenues generated by major global players from the protein A resin segment (or nearest reported business unit/product category)

- Revenue mapping of key players to cover major share of the global market, as of 2021

- Extrapolating the global value of the protein A resin industry

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global protein A resin market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market was validated using both top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, and forecast the protein A resin market on the basis of product, type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global market

- To analyze key growth opportunities in the global market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, and the RoAPAC), and rest of the world.

- To profile the key players in the global market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global protein A resin market, such as product launches, agreements, expansions, and & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global protein A resin market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis

- Further breakdown of the Rest of Europe market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of Asia Pacific market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of the world market into Latin America, MEA, and Africa

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Protein A Resin Market

What are the top 2 use cases of protein A resin market in near future?