Precious Metals E-Waste Recovery Market by Source(Household Appliances, It & Telecommunication, Consumer Electronics), Metal (Copper, Gold, Silver), & Geography - Global Forecast to 2025

Precious Metals E-Waste Recovery Market

The global precious metals e-waste recovery market was valued at USD 9.4 billion in 2020 and is projected to reach USD 11.8 billion by 2025, growing at 4.6% cagr during the forecast period. Growing investments in precious metals in emerging countries of Asia Pacific, demand from end-use industries and the necessity to treat e-waste before disposal are the key factors driving the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Precious Metals E-waste Recovery Market

The precious metals e-waste recovery market includes major Tier I and II companies like Johnson Matthey Plc (UK), Sims Limited (US), EnviroLeach Technologies Inc. (Canada), Umicore NV (Belgium), Materion Corporation (US), Boliden AB (Sweden), DOWA Holdings Co., Ltd. (Japan), Heraeus Holding GmbH (Germany), TES-AMM Pte. Ltd. (Singapore), Metallix Refining Inc. (US), and Tanaka Precious Metals (Japan). These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and Middle East & Africa. COVID-19 has impacted their businesses as well.

- In October 2020, EnviroLeach Technologies Inc. announced a 100 MT per month waste printed circuit board feedstock agreement with an undisclosed European supplier. The undisclosed supplier is a major player in the electronic waste sector and has an extensive network of relationships across European and Asian markets. This development will help EnviroLeach Technologies to expand its geographic reach in European and Asian markets along with a steady supply of raw materials for precious metals recovery.

- In August 2020, Sims Lifecycle Services, an operating segment of Sims Limited, announced the opening of its Tampa Innovation Center in Florida, US, the construction of which began in March 2019. This site is dedicated to the increasing redeployment, reuse, and recyclability of waste electronic and IT equipment, including data center materials. This additional facility will help the company to work with its North American clients closely along with providing sustainable solutions for waste electronics.

- In July 2020, TES-AMM Pte. Ltd. announced the expansion of its operations in the US with an additional facility constructed in Seattle, Washington. The new 42,000 sq. ft. facility will allow the company to serve clients in North America and the Pacific Northwest region. This facility is expected to be operational towards the end of 2020 due to the delay caused by the COVID-19 pandemic. The facility in Seattle will be a replica of the company’s other US-based facilities and will provide precious metal recovery from electronic waste. The company constructed this facility in view of the strong response received from the US market in recent years. This will help the company to grow its business in the North American region.

- In June 2020, TES-AMM Pte. Ltd. (TES) announced the expansion of its operations in Thailand and Hong Kong, thereby increasing the overall processing capacity of the company. In Thailand, the company acquired a 3,500-sq. m. facility in Ayutthaya province to support its full suite of IT lifecycle solutions, including electronic waste recycling, which is used for precious metal recovery. With the opening of these facilities, TES affirmed its dedication to providing IT lifecycle solutions for clients all over the world, apart from establishing the company as one of the leaders in the precious metals e-waste recovery business.

Precious Metals E-waste Recovery Market Dynamics

Driver: Demand for precious metals in industrial applications and as an investment tool

Real demand for precious metals, such as copper, gold, silver, platinum, and palladium, rises from their use in industrial applications. Copper is the most abundant and least expensive of the precious metals and provides excellent electrical and thermal conductivity. As a result, copper is used extensively in electrical power transmission, plumbing, and cookware. Gold is used in electronics, medical, and dental applications, primarily due to its high conductivity and resistance to corrosion. It is also used as a chemical catalyst in pharmaceutical drug manufacturing. However, the demand for gold is mostly influenced by the jewelry industry. Silver has predominantly been used in photography; however, its demand is now growing from new areas, such as the manufacturing of solar cells and phone and laptop batteries. Platinum and palladium are ductile, malleable, and offer high chemical resistance. Hence, they are widely used in electronics, vehicle emission control devices, and as catalysts in chemical reactions. These metals are, however, less abundant compared to copper, gold, and silver. The combination of all these factors creates an active global market for precious metals.

Restraint:Issues related to use of cyanide leaching in precious metal recovery from e-waste

For precious metal recovery from e-waste, vat leaching is generally preferred where the pulverized e-waste is mixed with a sodium cyanide solution in large tanks. As cyanide leaching is very efficient, it allows profitable recovery of precious metals. However, cyanide is a highly toxic chemical and can result in substantial environmental impacts and public health risks. Cyanide spills have resulted in contamination of drinking water supplies, destruction of agricultural lands, and loss of lives. Although aqueous solutions of cyanide degrade rapidly in sunlight, less toxic products, such as cyanates and thiocyanates, may persist in the soil for several years. Cyanide spills into groundwater can persist for longer periods and contaminate drinking water aquifers

Opportunities: Low recycling activities of e-waste for precious metal recovery

According to the Global E-waste Monitor 2020, in 2019, the world produced approximately 53.6 million MT of e-waste. However, the formal documented collection and recycling of e-waste amounted to only 9.3 million MT. This shows that the recycling activities are not keeping pace with the global growth of e-waste. Most of the undocumented domestic and commercial e-waste is probably mixed with other waste streams or metal waste, resulting in the loss of precious metals, which can be recovered for commercial purposes. Market entrants can view this scenario as an opportunity to build given the vast amount of e-waste available worldwide.

Challenges:Risk to human health and environment

Electrical and electronic equipment (EEE) are not hazardous per se. However, the hazardous constituents present in their waste render it dangerous for health and environment when they are recycled or processed for the recovery of precious metals. If e-waste is dismantled and processed in a crude manner, its toxic constituents can create major health issues on human body. These include birth defects, altered neurodevelopment, adverse learning outcomes, adverse respiratory effects, skin diseases, and even cancer in some cases. E-waste workers have also reported stress, headaches, shortness of breath, chest pain, and dizziness at work places due to prolonged exposure to harmful working conditions.

Based on source, household appliances is expected to grow at the highest CAGR during the forecast period.

Based on source, the household appliances segment is expected to grow at the highest CAGR from 2020 to 2025. Household appliances are electric and electromechanical devices which assist in homemaking and home functions such as cooking, cleaning and food preservation. Increasing population, urbanization and rising disposable income are projected to increase demand for electronic household appliances during the forecast period. Consumer electronics segment is expected to be the second-largest source segment during the forecast period

Copper is expected to be the fastest-growing metal segment of the precious metals e-waste recovery market.

Based on metal, the copper segment is projected to grow at the highest CAGR from 2020 to 2025. Use of copper in building construction, power generation and transmission, electronic product manufacturing, and the production of industrial machinery and transportation vehicles is expected to increase consumption of copper during the forecast period. Copper wiring and plumbing are also integral to the appliances, heating and cooling systems, and telecommunications links used every day in homes and businesses resulting in an increased consumption during the forecast period.

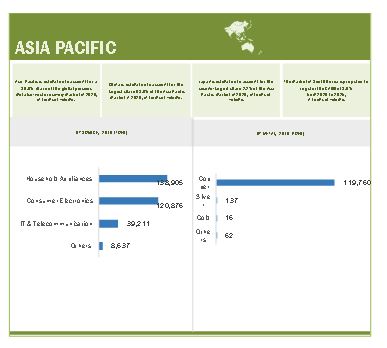

Asia Pacific is expected to be the fastest-growing regional segment in the precious metals e-waste recovery market.

The precious metals e-waste recovery market in the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. China, Japan, South Korea, Taiwan and Malaysia are the key countries contributing to the high demand for precious metals in the Asia Pacific region. Availability of cheap labor and raw materials has resulted in making Asia Pacific a preferred region for manufacturing facilities of electronic and automobile companies which consume pecious metals for better conductivity and to limit pollution respectively. This makes Asia Pacific the fastest-growing region of the precious metals e-waste recovery market.

APAC Snapshot

Precious Metals E-Waste Recovery Market Players

Some of the leading players operating in the precious metals e-waste recovery market include Johnson Matthey Plc (UK), Sims Limited (US), EnviroLeach Technologies Inc. (Canada), Umicore NV (Belgium), Materion Corporation (US), Boliden AB (Sweden), DOWA Holdings Co., Ltd. (Japan), Heraeus Holding GmbH (Germany), TES-AMM Pte. Ltd. (Singapore), Metallix Refining Inc. (US), and Tanaka Precious Metals (Japan) among others. These players have expansions, acquisitions, and agreements as the major strategies to consolidate their position in the market. Expansion has been the most dominant strategies adopted by the major players between 2017 and 2020.

Precious Metals E-Waste Recovery Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 9.4 Billion |

|

Revenue Forecast in 2025 |

USD 11.8 Billion |

|

CAGR |

4.6% |

|

Market Size Available for Years |

2018-2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020-2025 |

|

Forecast Units |

Value (USD) and Volume (KT) |

|

Segments Covered |

Source, Metal, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Some of the leading players operating in the precious metals e-waste recovery market include Johnson Matthey Plc (UK), Sims Limited (US), EnviroLeach Technologies Inc. (Canada), Umicore NV (Belgium), Materion Corporation (US), Boliden AB (Sweden), DOWA Holdings Co., Ltd. (Japan), Heraeus Holding GmbH (Germany), TES-AMM Pte. Ltd. (Singapore), Metallix Refining Inc. (US), and Tanaka Precious Metals (Japan) among others. |

This research report categorizes the precious metals e-waste recovery market based on source, metal and region.

Precious Metals E-Waste Recovery Market by Source:

- Household Appliances

- IT & Telecommunication

- Consumer Electronics

-

Others

- Professional Medical Tools

- Small Industrial Tools

Precious Metals E-Waste Recovery Market by End Metal:

- Copper

- Gold

- Silver

-

Others

- Nickel

- Platinum

- Palladium

Precious Metals E-Waste Recovery Market by Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In October 2020, EnviroLeach Technologies Inc. announced a 100 MT per month waste printed circuit board feedstock agreement with an undisclosed European supplier. The undisclosed supplier is a major player in the electronic waste sector and has an extensive network of relationships across European and Asian markets. This development will help EnviroLeach Technologies to expand its geographic reach in European and Asian markets along with a steady supply of raw materials for precious metals recovery.

- In August 2020, Sims Lifecycle Services, an operating segment of Sims Limited, announced the opening of its Tampa Innovation Center in Florida, US, the construction of which began in March 2019. This site is dedicated to the increasing redeployment, reuse, and recyclability of waste electronic and IT equipment, including data center materials. This additional facility will help the company to work with its North American clients closely along with providing sustainable solutions for waste electronics.

- In July 2020, TES-AMM Pte. Ltd. announced the expansion of its operations in the US with an additional facility constructed in Seattle, Washington. The new 42,000 sq. ft. facility will allow the company to serve clients in North America and the Pacific Northwest region. This facility is expected to be operational towards the end of 2020 due to the delay caused by the COVID-19 pandemic. The facility in Seattle will be a replica of the company’s other US-based facilities and will provide precious metal recovery from electronic waste. The company constructed this facility in view of the strong response received from the US market in recent years. This will help the company to grow its business in the North American region.

- In June 2020, TES-AMM Pte. Ltd. (TES) announced the expansion of its operations in Thailand and Hong Kong, thereby increasing the overall processing capacity of the company. In Thailand, the company acquired a 3,500-sq. m. facility in Ayutthaya province to support its full suite of IT lifecycle solutions, including electronic waste recycling, which is used for precious metal recovery. With the opening of these facilities, TES affirmed its dedication to providing IT lifecycle solutions for clients all over the world, apart from establishing the company as one of the leaders in the precious metals e-waste recovery business.

Frequently Asked Questions (FAQ):

What are precious metals ?

Precious metals (PMs) can be defined as rare metallic chemical element of high economic value. Precious metals, as a group, have a set of physical and chemical properties that are unrivalled by many other materials. Due to the cost and availability, these materials are limited to applications where only small amounts are used, such as spark plug tips and electrical contact plating.

What are the different end uses of precious metals?

Precious metals are used in different end-use industries such as electrical, electronics, automotive, medical, jewelry and investment.

What are the key driving factors for the growth of the global precious metals e-waste recovery market?

Precious metals are needed for fabricating electrical and electronic components of devices as these metals have superior thermal and electrical properties. Moreover, precious metals such as gold, silver and platinum are also traded as commodities at a global scale. These end-uses create a high demand for precious metals.

What is the biggest challenge for the growth of the global precious metals e-waste recovery market?

High capital expenditure for technology procurement, ban on cyanide leaching technology, human health and environmental risks along with illegal recycling activities in developing countries pose as entry barriers and hence pose as biggest challenges for growth of this market.

What are the key regions in the global precious metals e-waste recovery market?

In terms of region, the highest consumption was observed to be in Europe. This is primarily due to stringent regulations pertaining to disposal of e-waste and abundance of companies participating in the circular economy. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 PRECIOUS METALS E-WASTE RECOVERY MARKET, BY SOURCE: INCLUSIONS & EXCLUSIONS

TABLE 2 MARKET, BY METAL: INCLUSIONS & EXCLUSIONS

TABLE 3 MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 PRECIOUS METALS E-WASTE RECOVERY MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION (DEMAND SIDE): PRECIOUS METALS E-WASTE RECOVERY MARKET

FIGURE 4 MARKET SIZE ESTIMATION (SUPPLY SIDE): MARKET

2.3 MARKET ENGINEERING PROCESS

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3.1 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 4 PRECIOUS METALS E-WASTE RECOVERY MARKET SNAPSHOT, 2020 & 2025

FIGURE 7 BY SOURCE, HOUSEHOLD APPLIANCES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

FIGURE 8 BY METAL, COPPER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

FIGURE 9 ASIA PACIFIC ESTIMATED TO LEAD MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN PRECIOUS METALS E-WASTE RECOVERY MARKET

FIGURE 10 HIGH DEMAND FROM PRECIOUS METALS FROM END-USE INDUSTRIES AND INCREASING E-WASTE GENERATION DRIVE MARKET

4.2 PRECIOUS METALS E-WASTE RECOVERY MARKET, BY REGION

FIGURE 11 ASIA PACIFIC MARKET PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.3 ASIA PACIFIC MARKET, BY METAL & COUNTRY

FIGURE 12 COPPER SEGMENT AND CHINA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2020

4.4 PRECIOUS METALS E-WASTE RECOVERY MARKET, BY MAJOR COUNTRIES

FIGURE 13 MARKET IN CHINA PROJECTED TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

TABLE 5 QUANTITY OF PRECIOUS METALS IN ELECTRONIC DEVICES

5.2 MARKET DYNAMICS

FIGURE 14 PRECIOUS METALS E-WASTE RECOVERY MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Demand for precious metals in industrial applications and as an investment tool

5.2.1.2 Increasing consumption of electrical & electronic equipment and rising e-waste generation

FIGURE 15 GLOBAL USERS OF CONSUMER ELECTRONICS, 2016–2021

FIGURE 16 GLOBAL CONSUMER ELECTRONICS REVENUE, 2016–2021

FIGURE 17 GLOBAL E-WASTE GENERATION, 2016–2030

5.2.2 RESTRAINTS

5.2.2.1 Issues related to cyanide leaching in precious metal recovery from e-waste

5.2.2.2 Volatile pricing of precious metals

FIGURE 18 PRECIOUS METAL PRICES: 2018–2020

5.2.3 OPPORTUNITIES

5.2.3.1 Low recycling activities of e-waste for precious metal recovery

FIGURE 19 GLOBAL E-WASTE RECYCLING RATE, 2019

5.2.3.2 Alternate methods for precious metal recovery from e-waste

5.2.4 CHALLENGES

5.2.4.1 Risks to human health and environment

TABLE 6 TOXINS FROM E-WASTE AFFECTING HUMAN HEALTH

5.2.4.2 Illegal e-waste exports and the informal sector for precious metal recovery

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: PRECIOUS METALS E-WASTE RECOVERY MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF RIVALRY

6 INDUSTRY TREND ANALYSIS (Page No. - 63)

6.1 MARKET ECOSYSTEM AND SUPPLY CHAIN

FIGURE 21 SUPPLY CHAIN ANALYSIS OF E-WASTE REFINING AND PRECIOUS METAL RECOVERY

6.1.1 E-WASTE SUPPLIERS

6.1.2 E-WASTE REFINERS/RECYCLERS

6.1.3 TECHNOLOGY PROVIDERS

6.2 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING REFINING PHASE

6.2.1 LIFE CYCLE ANALYSIS

FIGURE 23 LIFE CYCLE OF PRECIOUS METALS

TABLE 7 PRECIOUS METALS CONCENTRATION IN E-WASTE (VOLUME SHARE)

TABLE 8 PRECIOUS METALS CONCENTRATION IN E-WASTE (VALUE SHARE)

6.2.2 PROMINENT COMPANIES

6.2.3 SMALL & MEDIUM ENTERPRISES

6.3 TECHNOLOGY ANALYSIS

6.3.1 INTRODUCTION

6.3.2 PYROMETALLURGICAL TECHNOLOGY

6.3.3 HYDROMETALLURGICAL TECHNOLOGY

6.3.4 ELECTROMETALLURGICAL TECHNOLOGY

6.3.5 BIO-METALLURGICAL TECHNOLOGY

6.4 PATENT ANALYSIS

6.5 PRECIOUS METALS E-WASTE RECOVERY MARKET REGULATIONS

6.5.1 INTRODUCTION

TABLE 9 E-WASTE MANAGEMENT LEGISLATION IN SELECT COUNTRIES

6.6 E-WASTE CLASSIFICATION AND LIST OF WASTES

6.6.1 E-WASTE CLASSIFICATION

TABLE 10 E-WASTE CLASSIFICATION

6.6.2 EUROPEAN LIST OF WASTES

TABLE 11 LIST OF WASTES

6.7 MACROECONOMIC INDICATORS

6.7.1 MEDICAL

FIGURE 24 HEALTHCARE SPENDING, 2019

6.7.2 AUTOMOTIVE

TABLE 12 GLOBAL AUTOMOTIVE SALES FOR SELECT COUNTRIES: 2016 TO 2019

6.7.3 ELECTRONICS

FIGURE 25 PRODUCTION BY GLOBAL ELECTRONICS AND IT INDUSTRIES

6.7.4 URBANIZATION

TABLE 13 URBAN POPULATION, SELECT COUNTRIES, 2019

6.7.5 PER CAPITA INCOME

TABLE 14 PER CAPITA INCOME, SELECT COUNTRIES, 2019

6.8 AVERAGE SELLING PRICE TREND ANALYSIS

TABLE 15 AVERAGE SELLING PRICE OF SELECT PRECIOUS METALS, BY REGION (USD/TON)

6.9 E-WASTE IMPORT EXPORT ANALYSIS

FIGURE 26 TRADE ROUTE S FOR ILLEGAL E-WASTE EXPORTS

7 COVID-19 IMPACT ANALYSIS (Page No. - 95)

7.1 INTRODUCTION

7.2 COVID-19 HEALTH ASSESSMENT

FIGURE 27 COUNTRY-WISE SPREAD OF COVID-19

7.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 28 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

7.3.1 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

FIGURE 29 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 30 SCENARIOS OF COVID-19 IMPACT

7.4 IMPACT OF COVID-19 ON PRECIOUS METALS E-WASTE RECOVERY MARKET

TABLE 16 RESPONSE TO COVID-19 BY COMPANIES

8 PRECIOUS METALS E-WASTE RECOVERY MARKET, BY METAL (Page No. - 103)

8.1 INTRODUCTION

FIGURE 31 PRECIOUS METALS E-WASTE RECOVERY MARKET, BY METAL, 2020 & 2025 (USD MILLION)

TABLE 17 MARKET, BY METAL, 2018–2025 (USD MILLION)

TABLE 18 MARKET, BY METAL, 2018–2025 (TONS)

8.1.1 COVID-19 IMPACT ON METAL SEGMENT

8.2 COPPER

8.2.1 COPPER ACCOUNTED FOR LARGEST SHARE IN GLOBAL PRECIOUS METALS E-WASTE RECOVERY MARKET

TABLE 19 MARKET SIZE FOR COPPER, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 MARKET SIZE FOR COPPER, BY REGION, 2018–2025 (TONS)

8.3 GOLD

8.3.1 GOLD ACCOUNTED FOR SECOND-LARGEST SHARE IN GLOBAL PRECIOUS METALS E-WASTE RECOVERY MARKET

TABLE 21 MARKET SIZE FOR GOLD, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 MARKET SIZE FOR GOLD, BY REGION, 2018–2025 (TONS)

8.4 SILVER

8.4.1 HIGH TEMPERATURE RESISTANCE AND ELECTRICAL CONDUCTIVITY HAVE RESULTED IN HIGH DEMAND FOR SILVER

TABLE 23 PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE FOR SILVER, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 MARKET SIZE FOR SILVER, BY REGION, 2018–2025 (TONS)

8.5 OTHERS

8.5.1 GROWING CONSUMPTION FROM ELECTRONICS AND AUTOMOBILE INDUSTRIES TO INCREASE DEMAND FOR OTHER METALS

TABLE 25 MARKET SIZE FOR OTHER METALS, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 MARKET SIZE FOR OTHER METALS, BY REGION, 2018–2025 (TONS)

9 PRECIOUS METALS E-WASTE RECOVERY MARKET, BY SOURCE (Page No. - 111)

9.1 INTRODUCTION

TABLE 27 PRECIOUS METALS E-WASTE RECOVERY MARKET, BY SOURCE & EEE CATEGORIES

FIGURE 32 MARKET, BY SOURCE, 2020 & 2025 (TONS)

TABLE 28 MARKET, BY SOURCE, 2018–2025 (TONS)

9.1.1 COVID-19 IMPACT ON SOURCE SEGMENT

9.2 HOUSEHOLD APPLIANCES

9.2.1 HOUSEHOLD APPLIANCES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE 114

TABLE 29 PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE FOR HOUSEHOLD APPLIANCES, BY REGION, 2018–2025 (TONS)

9.3 IT & TELECOMMUNICATION

9.3.1 IT & TELECOMMUNICATION SEGMENT ACCOUNTED FOR THIRD-LARGEST MARKET SHARE

TABLE 30 MARKET SIZE FOR IT & TELECOMMUNICATION, BY REGION, 2018–2025 (TONS)

9.4 CONSUMER ELECTRONICS

9.4.1 CONSUMER ELECTRONICS ARE RICHEST SOURCE FOR RECOVERING PRECIOUS METALS

TABLE 31 PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE FOR CONSUMER ELECTRONICS, BY REGION, 2018–2025 (TONS)

9.5 OTHERS

TABLE 32 MARKET SIZE FOR OTHER SOURCES, BY REGION, 2018–2025 (TONS)

10 PRECIOUS METALS E-WASTE RECOVERY MARKET, BY REGION (Page No. - 117)

10.1 INTRODUCTION

FIGURE 33 CHINA TO GROW AT FASTEST RATE DURING FORECAST PERIOD

TABLE 33 MARKET SIZE, BY REGION, 2018-2025 (TONS)

TABLE 34 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 35 MARKET SIZE, BY METAL, 2018-2025 (TONS)

TABLE 36 MARKET SIZE, BY METAL, 2018-2025 (USD MILLION)

TABLE 37 MARKET SIZE, BY SOURCE, 2018-2025 (TONS)

10.2 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC MARKET SNAPSHOT

TABLE 38 ASIA PACIFIC: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY COUNTRY, 2018–2025 (TONS)

TABLE 39 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 ASIA PACIFIC: MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 41 ASIA PACIFIC: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 42 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.2.2 JAPAN

10.2.1.1 Largest market for precious metals e-waste recovery in Asia Pacific

10.2.1.2 COVID-19 impact on China

TABLE 43 CHINA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 44 CHINA: MARKET SIZE, BY METAL, 2018-2025 (USD MILLION)

TABLE 45 CHINA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.2.3 TAIWAN

10.2.2.1 Second-largest market for precious metals e-waste recovery in Asia Pacific

10.2.2.2 COVID-19 impact on Japan

TABLE 46 JAPAN: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 47 JAPAN: MARKET SIZE, BY METAL, 2018-2025 (USD MILLION)

TABLE 48 JAPAN: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.2.4 SOUTH KOREA

10.2.3.1 Demand from electronics industry to drive market growth

10.2.3.2 Impact of COVID-19 on Taiwan

TABLE 49 TAIWAN: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 50 TAIWAN: MARKET SIZE, BY METAL, 2018-2025 (USD MILLION)

TABLE 51 TAIWAN: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.2.5 MALAYSIA

10.2.4.1 Strong e-waste recycling infrastructure driving market growth

10.2.4.2 COVID-19 impact on South Korea

TABLE 52 SOUTH KOREA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 53 SOUTH KOREA: MARKET SIZE, BY METAL, 2018-2025 (USD MILLION)

TABLE 54 SOUTH KOREA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.2.6 INDIA

10.2.5.1 Growing demand from electronics industry to drive market growth

10.2.5.2 COVID-19 impact on Malaysia

TABLE 55 MALAYSIA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 56 MALAYSIA: MARKET SIZE, BY METAL, 2018-2025 (USD MILLION)

TABLE 57 MALAYSIA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.2.7 REST OF ASIA PACIFIC

10.2.6.1 Poor e-waste management infrastructure restricts market growth

10.2.6.2 COVID-19 impact on India

TABLE 58 INDIA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 59 INDIA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018-2025 (USD MILLION)

TABLE 60 INDIA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

10.2.7.1 COVID-19 impact on Rest of Asia Pacific

TABLE 61 REST OF ASIA PACIFIC: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 62 REST OF ASIA PACIFIC: MARKET SIZE, BY METAL, 2018-2025 (USD MILLION)

TABLE 63 REST OF ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.3 NORTH AMERICA

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 64 NORTH AMERICA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY COUNTRY, 2018–2025 (TONS)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.3.2 CANADA

10.3.1.1 US accounted for largest share of North American market

10.3.1.2 COVID-19 impact on the US

TABLE 69 US: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 70 US: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 71 US: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

TABLE 75 CANADA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.3.2.1 Strong government support and organized recycling infrastructure to spur market growth

TABLE 72 E-WASTE COLLECTION ORGANIZATIONS IN CANADA

10.3.2.2 COVID-19 impact on Canada

TABLE 73 CANADA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 74 CANADA: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 75 CANADA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.4 EUROPE

10.3.3.1 Rising demand for consumer electronic products to boost market growth

10.3.3.2 COVID-19 impact on Mexico

TABLE 76 MEXICO: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 77 MEXICO: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 78 MEXICO: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.4 EUROPE

FIGURE 36 EUROPE: MARKET SNAPSHOT

TABLE 79 EUROPE: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY COUNTRY, 2018–2025 (TONS)

TABLE 80 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 82 EUROPE: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.4.2 UK

10.4.1.1 Germany accounted for largest market share in Europe

10.4.1.2 COVID-19 impact on Germany

TABLE 84 GERMANY: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 85 GERMANY: MARKET SIZE, BY METAL, 2018-2025 (USD MILLION)

TABLE 86 GERMANY: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.4.3 FRANCE

10.4.2.1 UK accounted for second-largest market share in Europe

10.4.2.2 COVID-19 impact on the UK

TABLE 87 UK: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 88 UK: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 89 UK: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.4.4 ITALY

10.4.3.1 France projected to witness fastest growth in European market during forecast period

10.4.3.2 COVID-19 impact on France

TABLE 90 FRANCE: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 91 FRANCE: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 92 FRANCE: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.4.5 BELGIUM

10.4.4.1 Growing demand from electronics and automotive industries expected to drive market

10.4.4.2 COVID-19 impact on Italy

TABLE 93 ITALY: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 94 ITALY: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 95 ITALY: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.4.6 SWEDEN

10.4.5.1 Robust e-waste recycling infrastructure provides boost to market

10.4.5.2 COVID-19 impact on Belgium

TABLE 96 BELGIUM: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 97 BELGIUM: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 98 BELGIUM: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.4.7 REST OF EUROPE

10.4.6.1 Organized e-waste management systems contribute to market growth

10.4.6.2 COVID-19 impact on Sweden

TABLE 99 SWEDEN: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 100 SWEDEN: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 101 SWEDEN: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.5 MIDDLE EAST & AFRICA

10.4.7.1 Stringent regulations drive precious metals recovery from e-waste in Rest of Europe

10.4.7.2 COVID-19 impact on Rest of Europe

TABLE 102 REST OF EUROPE: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 103 REST OF EUROPE: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 104 REST OF EUROPE: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.5 MIDDLE EAST & AFRICA

FIGURE 37 MIDDLE EAST & AFRICA: MARKET SNAPSHOT

TABLE 105 MIDDLE EAST & AFRICA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY COUNTRY, 2018–2025 (TONS)

TABLE 106 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 108 MIDDLE EAST & AFRICA: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.5.2 UAE

10.5.1.1 Saudi Arabia accounted for largest market share in Middle East & Africa

10.5.1.2 COVID-19 impact on Saudi Arabia

TABLE 110 SAUDI ARABIA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (KT)

TABLE 111 SAUDI ARABIA: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 112 SAUDI ARABIA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.5.3 EGYPT

10.5.2.1 High demand for new electronic products to drive market growth

10.5.2.2 COVID-19 impact on the UAE

TABLE 113 UAE: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 114 UAE: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 115 UAE: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.5.4 SOUTH AFRICA

10.5.3.1 Egypt produces most e-waste among Middle Eastern & African countries

10.5.3.2 COVID-19 impact on Egypt

TABLE 116 EGYPT: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 117 EGYPT: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 118 EGYPT: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.5.5 NIGERIA

10.5.4.1 Growing electronics industry expected to fuel demand for copper and silver

10.5.4.2 COVID-19 impact on South Africa

TABLE 119 SOUTH AFRICA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 120 SOUTH AFRICA: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 121 SOUTH AFRICA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.5.6 REST OF MIDDLE EAST & AFRICA

10.5.5.1 Stringent regulations expected to curb illegal e-waste recycling activities, thereby contributing to market growth

10.5.5.2 COVID-19 impact on Nigeria

TABLE 122 NIGERIA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 123 NIGERIA: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 124 NIGERIA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.6 SOUTH AMERICA

10.5.6.1 Stringent regulations expected to curb illegal e-waste recycling activities, thereby contributing to market growth

10.5.6.2 COVID-19 impact on Rest of Middle East & Africa

TABLE 125 REST OF MIDDLE EAST & AFRICA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 126 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 127 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

10.6 SOUTH AMERICA

11.1 OVERVIEW

FIGURE 38 COMPANIES ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2017 AND OCTOBER 2020

TABLE 128 SOUTH AMERICA: PRECIOUS METALS E-WASTE RECOVERY MARKET SIZE, BY METAL, 2018–2025 (TONS)

TABLE 129 SOUTH AMERICA: MARKET SIZE, BY METAL, 2018–2025 (USD MILLION)

TABLE 130 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2018–2025 (TONS)

11 COMPETITIVE LANDSCAPE (Page No. - 181)

11.1 OVERVIEW

FIGURE 38 COMPANIES ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2017 AND OCTOBER 2020

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 39 MARKET EVALUATION FRAMEWORK

11.3 MARKET SHARE ANALYSIS

11.4.4 PARTICIPANTS

FIGURE 40 TOP 5 PLAYERS IN PRECIOUS METALS E-WASTE RECOVERY MARKET (2019)

11.4 COMPANY EVALUATION MATRIX, 2019

11.5.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 42 PRODUCT PORTFOLIO OF TOP PLAYERS IN MARKET

11.5.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 43 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN PRECIOUS METALS E-WASTE RECOVERY MARKET

FIGURE 41 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

11.5 COMPETITIVE BENCHMARKING

11.6.2 STARTING BLOCKS

FIGURE 42 PRODUCT PORTFOLIO OF TOP PLAYERS IN PRECIOUS METALS E-WASTE RECOVERY MARKET

11.6.4 DYNAMIC COMPANIES

FIGURE 43 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

11.6 SME MATRIX, 2019

11.7.1 EXPANSIONS

TABLE 131 EXPANSIONS, 2017–2020

11.7.2 ACQUISITIONS

TABLE 132 ACQUISITIONS, 2017–2020

FIGURE 44 MARKET: SME COMPETITIVE LEADERSHIP MAPPING, 2019

11.7 KEY MARKET DEVELOPMENTS

12 COMPANY PROFILES

TABLE 131 EXPANSIONS, 2017–2020

(Business overview, Financial Assessment, Operational Assessment, Products offered, Recent Developments, COVID-19 Related Developments, SWOT Analysis, Winning Imperative, MNM view)*

TABLE 132 ACQUISITIONS, 2017–2020

FIGURE 45 JOHNSON MATTHEY PLC: COMPANY SNAPSHOT

TABLE 133 AGREEMENT, 2017–2020

12 COMPANY PROFILES (Page No. - 194)

12.1 KEY PLAYERS

(Business overview, Financial Assessment, Operational Assessment, Products offered, Recent Developments, COVID-19 Related Developments, SWOT Analysis, Winning Imperative, MNM view)*

12.1.4 UMICORE N.V.

FIGURE 45 JOHNSON MATTHEY PLC: COMPANY SNAPSHOT

12.1.5 MATERION CORPORATION

FIGURE 46 SIMS LIMITED: COMPANY SNAPSHOT

12.1.6 BOLIDEN AB

FIGURE 47 ENVIROLEACH TECHNOLOGIES INC.: COMPANY SNAPSHOT

12.1.7 DOWA HOLDINGS CO., LTD.

FIGURE 48 UMICORE N.V.: COMPANY SNAPSHOT

12.1.8 HERAEUS HOLDING GMBH

FIGURE 49 MATERION CORPORATION: COMPANY SNAPSHOT

12.1.10 METALLIX REFINING INC.

FIGURE 50 BOLIDEN AB: COMPANY SNAPSHOT

12.2 SME PROFILES

FIGURE 51 DOWA HOLDINGS CO., LTD.: COMPANY SNAPSHOT

12.2.2 ABINGTON RELDAN METALS, LLC

12.2.3 ALL GREEN RECYCLING INC.

12.2.4 ECR WORLD INC.

12.2.5 APEX ENVIRONMENTAL SERVICES INC.

12.2 SME PROFILES

12.2.7 HOBI INTERNATIONAL, INC.

12.2.8 AET ENVIRONMENTAL

12.2.9 CLOSED LOOP ENVIRONMENTAL ALLIANCE NETWORK INC. (CLEAN)

12.2.10 ARCH ENTERPRISES, INC.

12.2.11 M&K; RECOVERY GROUP INC.

12.2.12 GANNON & SCOTT

12.3 OTHER PLAYERS

12.3.1 HUNAN VARY TECHNOLOGY CO., LTD.

12.3.2 DELMER GROUP

12.3.4 MINT INNOVATION

*Details on Business overview, Financial Assessment, Operational Assessment, Products offered, Recent Developments, COVID-19 Related Developments, SWOT Analysis, Winning Imperative, MNM view might not be captured in case of unlisted companies.

12.3 OTHER PLAYERS

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

*Details on Business overview, Financial Assessment, Operational Assessment, Products offered, Recent Developments, COVID-19 Related Developments, SWOT Analysis, Winning Imperative, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 244)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

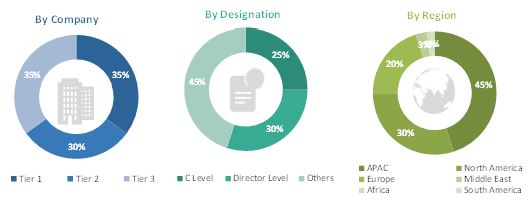

This research study involved four major activities in estimating the current market size for precious metals recovered from e-waste. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to for identifying and collecting information for this study. These secondary sources included the Global E-waste Monitor 2020, International Solid Waste Association journals, precious metal commodity management publications, annual reports of key players, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The precious metals e-waste recovery market comprises several stakeholders, such as raw material suppliers, refiners, technology providers , end-users, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the growth of the electronics, automobile, medical and jewelry industries. The supply side is characterized by advancements in technology. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents interviewed:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the precious metals e-waste recovery market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into two segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives

- To define, describe, and forecast the size of the precious metals e-waste recovery market based on source, metal, and region

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To forecast the size of the various segments of the precious metals e-waste recovery market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa, along with key countries in each of these regions

- To analyze the opportunities in the market for stakeholders and present a competitive landscape for the market leaders

- To analyze recent developments, such as expansions, acquisitions, and agreements in the precious metals e-waste recovery market

- To strategically profile the key players in the market and comprehensively analyze their core competencies*

Core competencies of companies are captured in terms of their key developments and key strategies adopted by them to sustain their position in the spunbond nonwovens market.

The following customization options are available for the report

With the given market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

- Further breakdown of the Rest of Asia Pacific, the Rest of Europe, and the Rest of Middle East & Africa in terms of Value

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Precious Metals E-Waste Recovery Market