PTFE Market by Form, Application, End Use Industry (Chemical & Industrial Processing, Automotive & Aerospace, Electrical & Electronics, Building & Construction, Consumer Goods), and Region - Global Forecast to 2029

PTFE Market

The global PTFE market is valued at USD 2.8 billion in 2024 and is projected to reach USD 3.5 billion by 2029, growing at 4.3% cagr from 2024 to 2029. The PTFE market is gaining momentum, because of diverse application of this versatile material across different sectors. PTFE is available in various forms such as granular/molded powder, fine powder, dispersion and micronized powder. It serves various application such as coatings, pipes, films, sheets and other application, all of which use different properties of PTFE to enhance their performance, particularly in terms of high heat tolerance capacity. The advanced properties and innovative technologies in PTFE propel the PTFE market forward. The PTFE market is further segmented by end use industries which include chemical & industrial processing, electrical & electronics, automotive & aerospace, building & construction, consumer goods and other end use industries. Each of these sectors use PTFE for different applications for its exceptional properties, including chemical resistance, low friction and thermal stability.

Attractive Opportunities in the PTFE Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

PTFE Market Dynamics

Driver: High Growth in End Use Industries

The growing demand from industries such as chemical & industrial processing, electrical & electronics, automotive & aerospace, building & construction, consumer goods and other end use industries, that uses the PTFE extensively for the versatile properties of PTFE. Factors such as good chemical resistance, resistance to heat & low temperature, good electrical insulating power in hot and wet environments, good resistance to light, UV, and weathering, and low coefficient of friction increase the demand for PTFE in the end-use industry. PTFE is a excellent electrical insulator, it can also withstand extreme temperatures, chemicals and pressures making it suitable for use in various end use industries.

Restraint: Environmental Impact of PTFE Production

PTFE production often involves complex processes which utilizes highly toxic and environmentally harmful substances notably perfluorooctanoic acid (PFOA) and perfluorooctane sulfonic acid (PFOS). These chemical are released in environment when the manufacturing process is done, these gases have shown persistence for longer periods contributing to widespread of environmental contamination. When PTFE is overheated it releases toxic fumes which is harmful for human health and the environment. In response to this various regulations are being implemented globally for the mitigation of environmental impact of PTFE and related chemicals.

Opportunities: Increasing Use of PTFE in Medical applications

PTFE products had a significant presence in medical field for around 30 years, the unique properties such as chemical resistance, low friction, biocompatibility and non stick characteristics, make PTFE a preferred material for various medical applications. PTFE is extensively used in manufacturing of surgical implants, catheters and various medical devices. PTFE coated guide wires are used in cardiovascular procedures to minimize the risk of tissue damage and bleeding. PTFE is also utilized in pharmaceutical applications, where it is used in production of gaskets, seals, and other components that come into contact with drugs and chemicals.

Challenges: NonBiodegradable nature of PTFE

PTFE is a nonbiodegradable material owing to its highly stable molecular structure, which make it resistant to degradation by micro organism or enzymes in the environment. This means that PTFE does not break down through biological process. The long term presence of PTFE in environment can cause several environmental problems if not managed properly. When PTFE is not disposed, it accumulates in various ecosystems such as landfills, waterbodies, which can cause harm to wildlife and ultimately human health. To avoid these the disposal should be done responsibly and in proper manner which can avoid PTFE from accumulating at one place and causing various environmental problems.

PTFE Market: Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of PTFE. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include AGC Inc. (US), Gujarat Fluorochemical Limited (India), DAIKIN INDUSTRIES, Ltd., (Japan), The Chemours Company (US), 3M (US), SYENSQO (Belgium), HaloPolymer, OJSC (Russia), Shanghai Huayi 3F New Materials Co.Ltd (China), and Micropowders,Inc. (US).

Based on Form, Granular/Molded form is the largest segment in terms of volume in PTFE market .

PTFE granular resins (molding powders) are manufactured in a variety of grades to obtain a different balance between handling and properties. Granular fluoropolymers are ideal for compression and molding a variety of components and shapes such as rods, tubes, and sheets. Based on its particle size, granular PTFE powder can be further classified into fine-cut PTFE and pelletized PTFE. Fine-cut PTFE which has the smallest particle size of granular resins and transmit superior mechanical properties to the finished products. It is compression molded into stock shapes for machining into industrial parts. Pelletized PTFE particles are denser and exhibit better flow characteristics than fine-cut resins. They are compliant to a wider range of processing techniques such as ram extrusion.

Based on application, Sheets is the third-largest segment in terms of volume in PTFE market.

PTFE which is a multipurpose and adaptable material being used by manufacturers of PTFE Sheets. Depending on the various applications, PTFE sheets come in different sizes, thicknesses, and grades. PTFE sheets are commonly used in industries such as pharmaceutical, aerospace, and chemical processing. In food processing industry PTFE sheets are used as baking sheets, conveyor belts, non stick liners in cooking utensils. PTFE sheets are utilized in the architecture and construction industry because of their low friction characteristics, which can increase the lifespan of structures. PTFE sheets are also utilized in the electrical & electronics industry for the insulation of connector assemblies and cables.

Based on the end use industry, Electrical & Electronics is projected to be the second-largest end use industry in terms of volume during the forecasted period.

PTFE is known for its excellent electrical insulating properties, making it a most used material in the electrical and electronics industry, it is resistant to extreme conditions such as high temperature and exposure to harsh chemicals. Its unique molecular structure provides outstanding resistance to both chemical degradation and thermal stress. These properties of PTFE position it to be the superior alternative to conventional insulation materials. PTFE is widely used in applications, including coaxial cables, insulated wires and many others, due to its ability to maintain reliable dielectric properties across a broad temperature range. Its non flammable nature and low friction coefficient enhances its appeal.

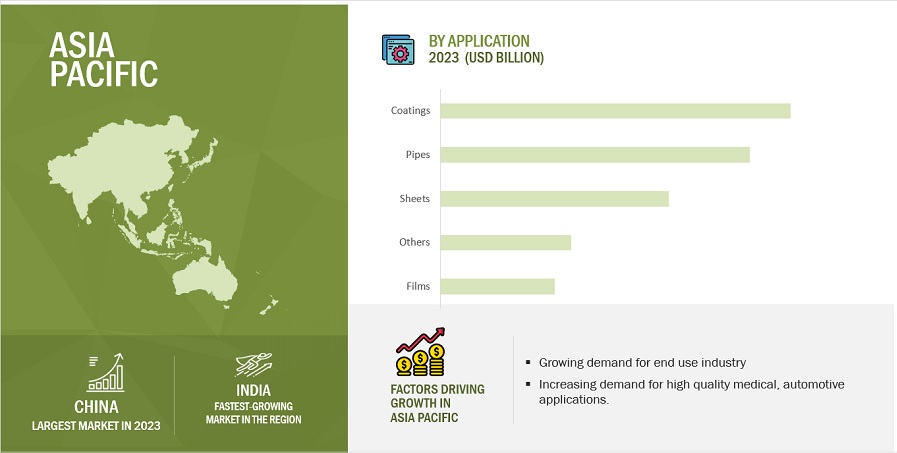

Asia Pacific is expected to be the largest market during the forecast period.

Asia Pacific emerges as the foremost hub for the global PTFE market, owing to the economic growth of countries such as India, China, Japan, South Korea and others. The presence of highly populated countries, such as China and India, has benefited the PTFE market, owing to the increasing demand for high-quality medical, automotive, consumer, and electronic products. China, India, Japan, and South Korea are among the world's biggest automakers, which consistently generates demand for PTFE products in the transportation sector. In addition to that, these countries are leading manufacturers and exporters of medical & pharmaceutical, electronics, consumer goods, and chemical products.

To know about the assumptions considered for the study, download the pdf brochure

PTFE Market Players

The PTFE market is dominated by a few major players that have a wide regional presence. The key players in the PTFE market are as AGC Inc. (US), Gujarat Fluorochemical Limited (India), DAIKIN INDUSTRIES, Ltd., (Japan), Dongyue Group (China), The Chemours Company (US), 3M (US), SYENSQO (Belgium), HaloPolymer, OJSC (Russia), Shanghai Huayi 3F New Materials Co.Ltd (China), and Micropowders,Inc. (US).

In the last few years, the companies have adopted growth strategies such as product launches, investments, acquisitions, and expansions to capture a larger share of the PTFE market.

PTFE Market Scope

|

Report Metric |

Details |

|

Years considered for the study |

2021-2029 |

|

Base Year |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Value (USD Million), Volume (Kilo tons) |

|

Segments |

Form, Application, End Use Industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

AGC Inc. (US), Gujarat Fluorochemical Limited (India), DAIKIN INDUSTRIES, Ltd., (Japan), Dongyue Group (China), The Chemours Company (US), 3M (US), SYENSQO (Belgium), HaloPolymer, OJSC (Russia), Shanghai Huayi 3F New Materials Co.Ltd (China), and Micropowders,Inc. (US) |

This report categorizes the global PTFE market based on form, application, end use industry, and region.

On the basis of form, the PTFE market has been segmented as follows:

- Granular/Molded Powder

- Fine Powder

- Dispersion

- Micronized Powder

On the basis of application, the PTFE market has been segmented as follows:

- Coatings

- Sheets

- Pipes

- Films

- Other applications

On the basis of end use industry, the PTFE market has been segmented as follows:

- Chemical & industrial processing

- Automotive & aerospace

- Electrical & electronics

- Building & construction

- Consumer goods

- Other end use industry

On the basis of region, the PTFE market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In June 2023, Using the commissioning of the new factory in Changshu as a launchpad, Daikin intends to further expedite the expansion of its fluorine chemicals business to China and the global market, thereby enhancing its influence in the global market.

- In November 2022, Gujarat Fluorochemicals Limited (GFL) announced a successful development in the use of non-fluorinated polymerization aid (NFPA) technology to manufacture PTFE fine powder and PFA. With this development, the company will be able to manufacture its entire fluoropolymer portfolio without the use of fluorinated polymerization aids.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the PTFE market?

The growth of the PTFE market is influenced by factors such as growing interest from developing markets in the Asia-Pacific region, heightened demand for PTFE driven by stringent environmental regulations, increase in the use of PTFE materials for their properties such as high temperature tolerance, non-stickiness, low friction and others.

Which are the key forms driving the PTFE market?

The key types driving the demand for PTFE are granular/molded powder and fine powder.

Who are the major manufacturers?

Major manufacturers include AGC Inc. (US), Gujarat Fluorochemical Limited (India), DAIKIN INDUSTRIES, Ltd., (Japan), Dongyue Group (China), The Chemours Company (US), 3M (US), SYENSQO (Belgium), HaloPolymer, OJSC (Russia), Shanghai Huayi 3F New Materials Co.Ltd (China), and Micropowders,Inc. (US).

What will be the growth prospects of the PTFE market?

The PTFE market is expected to witness robust growth due to rising demand from end use industries and high demand from Asia Pacific region.

What will be the growth prospects of the PTFE market in terms of CAGR in next five years?

The CAGR of the market will be in between 4.3% in next five years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the PTFE market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, corporate documents, white papers, certified publications, trade directories, certified publications, articles from recognized authors, associations, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

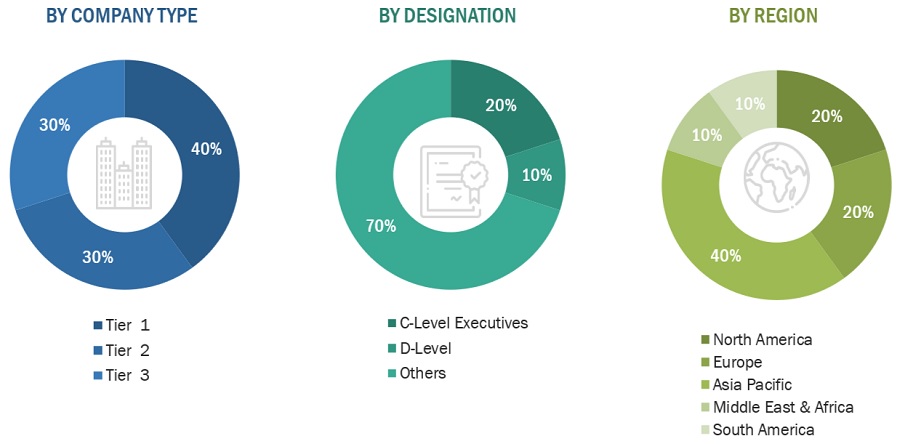

The PTFE market comprises several stakeholders in the value chain, which include raw material suppliers, component manufacturers, manufacturers and end consumers. Various primary sources from the supply and demand sides of the PTFE market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the PTFE industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to form, application, end use industry and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of PTFE and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for PTFE for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on form, application, end use industry and region were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

PTFE Market: Bottom-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

PTFE Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process of PTFE above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

PTFE is a type of synthetic fluoropolymer. It is a high molecular weight, solid substance that comes in granular powder, fine powder, dispersion, and micronized powder forms. Because of its special qualities, which include low friction coefficient, strong resistance to heat, chemicals, and water, it is utilized in a wide range of applications. Products like gaskets, coatings, tubes, hoses, membranes, sheets, and textiles are made with PTFE resin. Several end-use sectors, including consumer products, automotive & aerospace, building & construction, chemical & industrial processing, and electronics & electrical, are the main drivers of the PTFE market.

Key Stakeholders

- PTFE Manufacturers

- Raw Material Suppliers

- Manufacturing Technology Providers

- Industry Associations

- Manufacturers in End-Use Industries

Report Objectives

- To define, describe, and forecast the size of the PTFE market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on form, application, end use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on PTFE market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in PTFE Market

Report title not mentioned

PTFE Market report

Interested in Chemical tubes market from the aspect of market size, industry profile, end-use industry, etc.

PTFE market

General information on overall PTFE consumption and specific focus on PTFE tubes

General information on overall PTFE consumption and specific focus on automotive industry