Plant Extracts Market by Product Type (Oleoresins, Essential Oils, Flavonoids, Alkaloids, Carotenoids), Application (Food & Beverages, Cosmetics, Pharmaceuticals, Dietary Supplements), Form, Source and Region - Global Forecast to 2027

Plant Extracts Market Size & Trends Overview

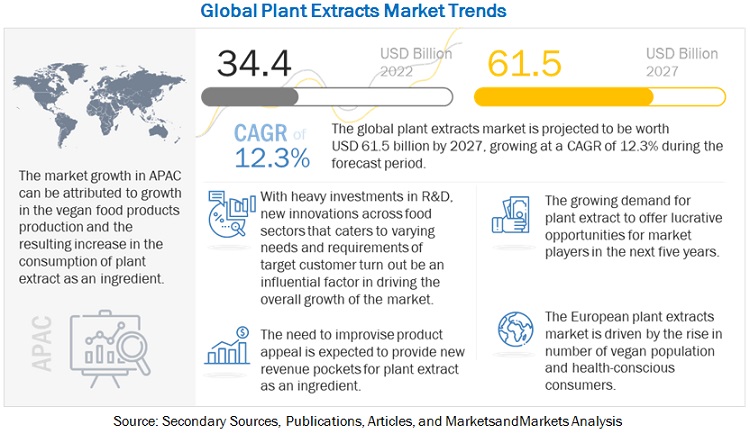

The plant extracts market is estimated at USD 34.4 billion in 2022; it is projected to grow at a CAGR of 12.3% to reach USD 61.5 billion by 2027.

Various factors have played a major role in driving the market growth across the globe. The use of plant extracts is growing as consumers seek out natural and healthy products, and as new extraction methods are developed and new plant species are discovered with beneficial properties. The urban population is becoming health-conscious resulting in a spike in the alternative market of pharmaceuticals and therapies as more and more people developing trust in natural products. Digitalization has taken up the world completely, example being the automation of spice and herb processing. Digital solutions are being incorporated to cater to the rising demand globally. Several European projects support developments in the area of robotics for agriculture, including a robotic herb harvester in Denmark. Also, changes in lifestyles and the increase in the demand for natural flavors from consumers are observed in developing economies, leading to the growth in the demand.

To know about the assumptions considered for the study, Request for Free Sample Report

Plant Extracts Market Growth Insights

Drivers: Demand for essential oil within cosmetic industry

Essential oils are widely used in cosmetics, perfumery, food and beverages, cleaning products, and home fragrances, for their relaxing, stimulating, antiseptic, bactericidal, decongestant, soothing, antispasmodic, and anti-inflammatory properties. Besides being used for fragrance, essential oils like lemon and orange possess antiseptic properties, garnering attention as promising cosmetic active ingredients. Essential oils are also being used in skincare with anti-acne, anti-aging, skin lightening, and sun protection characteristics. Skincare is the most important product category, in which a wide range of products use natural ingredients. Essential oils are mainly used as fragrances, while various other plant-based extracts are also used for their active properties. Essential oils are also used in soaps, color cosmetics, and deodorants. Companies within the ecosystem are focusing on further expanding the market for essential oils within cosmetics. Primavera Life, a producer of natural cosmetics and essential oils, uses a wide range of essential oils in its products, including lemongrass from Bhutan and Nepal, cajeput from Cambodia and lemon verbena and myrtle from Peru.

Higher-priced essential oils are usually used in the perfumery and personal care sector. According to the European Federation of Essential Oils (E.F.E.O), fragrances, cosmetics and aromatherapy generate about one third of the demand for essential oils. There is an expected increase in demand from the cosmetics sector, because many natural and conventional cosmetics companies are using essential oils as fragrances. Some of the highly valued essential oils used as fragrances include eucalyptus, citrus, floral oils, tea tree and lavender. Geraniol, citral, linalool, limonene and citronellol are some of the other notable fragrances popular among the masses. These are the driving factors of plant extracts market.

Restraints: Price fluctuation and inadequacy of raw materials

The Botanical Survey of India estimates that there are over 8,000 different species of medicinal plants in India. Some plant species are no longer available due to forest degradation and species extinction. Additionally, because these medicinal plants are only grown in a few countries, the supply is constrained. Additionally, because these plants only produce once a year and have a limited supply, there is an imbalance in supply and demand. It also has an impact on the cost of raw materials, and the added expense of storage makes it expensive. It becomes challenging to standardize the final product's price because of these wide price differences.Supply bottlenecks, and an increased demand in the countries of origin and weather unpredictability cause distress at times.

Lack of harvest workers, slowdown in production, and lockdown impacted port closures have caused crop failures and shortages. Extreme weather conditions such as heavy rain in Southern Europe or enormous drought and forest fires in Eastern Europe exacerbate these failures. Spice industry in Europe and adjacent regions have high dependency on imports. Distortions in freight and logistics have a direct impact on the spice trade. The consequences, such as the lack of availability of shipping containers, are omnipresent and lead to drastic cost increases. As the demand outstrips supply, the annual demand stands risky despite seasonal harvests and disrupting continuity of supply restraining the plant extracts market.

Opportunities: Technological intervention in the production process give rise to opportunities in plant extracts market

Technological intervention across the supply chain helps the business to propel. Bioactive extraction is witnessing high technology adoption. Besides, “Green technologies” are being adopted to result in significant sustainable measures. For instance, polar-nonpolar-sandwiching (PNS) technology was used for the extraction of a spectrum of bioactive, including curcuminoid, polyphenols, protein, fiber, and essential oils from within turmeric root extract. Ultrasound assisted extraction (UAE) is a green technology for bioactive extraction. Givaudan, a leading player in flavors and fragrances industry, performs sustainable extraction through one of its innovative biomimetic technologies: Natural Deep Eutectic Solvents (NaDES).

This green fractionation technology enables the extraction of an analyte from a sample according to its physical or chemical properties. Such specialized extraction technique is used to extract botanicals. Vapor Cartridge Technology LLC, in 2022, announced patenting of environmentally conscious method of extracting essential oils/resins from cannabis plants. An Israeli start-up, AvoMed, has developed technology that can extract a bioactive PFA (polyhydroxylated fatty alcohols) from avocado, further used as an active ingredient in topical cosmetic products to treat skin damage and inflammatory disorders.

Adulteration and authenticity are being tested using technology, promoting the consumption of herbal supplements, thereby increasing the demand for plant extracts. Herbal products sold worldwide as medicines or foods are perceived as low risk because they are considered natural and thus safe. However, the quality of these products is ineffectively regulated and controlled. DNA testing technology was used to analyze the authenticity of herbal products. Introduction of such technical expertise is bolstering the demand for plant extracts market.

Challenges : Adulteration and cost margin for natural additives compared to synthetic counterparts

One of the major challenges faced by the plant extracts market is the prevalence of adulterated extracts. Such adulterated products do not possess the actual properties of pure extracts and mislead the consumers. According to the National Academy of Science, USA, synthetic oils are primarily made of 95% of the chemicals that can be typically found in mineral oil and petroleum jelly are both by-products of petroleum production. Manufacturers of synthetic fragrances add many toxic chemicals for the fragrances to spread and dissipate into the air. Benzene derivatives, and aldehydes are the most common additive chemicals apart from other known toxins which can cause adverse health effects. The major reason for the adulteration of essential oils is their high price. For instance, high-quality, pure rose essential oil may cost approximately USD 78,000 for a liter, whereas the adulterated version of the same product costs approximately USD 200–300. Since the availability of some of the extracts is extremely low, the rate of adulteration is significantly high. Besides, as consumers favor natural essential oils over synthetic alternatives, the price of essential oil escalates, mainly due to expensive production costs.

Adverse side-effects of synthetic flavors led to a shift towards natural flavors

Food flavorings or micro ingredients are added to enhance food flavors, besides assisting in the preservation of products or help keep the product stay fresh for a prolonged period. Food flavorings are an integral part of the food & beverages industry as it confers specific sensory properties of taste and smell to processed foods. Food flavorings have a complex formulation and might as well be categorized as natural, synthetic, and nature identical. Food flavors are standardized by the FDA, and flavor manufacturing companies must comply the FDA and USDA norms for food production. Nowadays, increasing attention is being paid to food additives used, with the growing concerns related to their safety and potential health risks.

Government initiatives to promote natural ingredients drives the plant extracts market

Awareness is being created among consumers with respect to the benefits offered by natural ingredients and extracts, governments of various countries, and manufacturers have started taking initiatives and are investing in R&D. India has an indigenous supply of medicinal and herbal plants and is further promoting herbal cultivation. In 2021, Ministry of AYUSH, Government of India implemented a scheme supporting market driven cultivation of prioritized medicinal plants in identified cluster/zones. Ministry of AYUSH is supporting cultivation of medicinal plants on farmer’s land throughout the country by providing subsidy for 140 medicinal plants @30%, 50% and 75% of cost of its cultivation, depending upon the status of availability and market demand as per operational guidelines of the Scheme. The urban population is becoming health-conscious resulting in a spike in the alternative market of pharmaceuticals and therapies as more and more people developing trust in natural products. As under National Rural Livelihoods Mission (DAY-NRLM) sustainable livelihood generation and adoption of multiple livelihoods for a household is emphasized and a low input high output lemongrass farming is being promoted as an initiative for women empowerment by the Government of India.

Also, changes in lifestyles and the increase in the demand for natural flavors from consumers are observed in developing economies, leading to the growth in the demand. Kemin (US), offers vertically integrated sustainably grown plant extract blends such as rosemary, green tea, spearmint, and/or acerola, under the brand NaturFORT™. NaturFORT ARGT is a unique blend of acerola, rosemary and green tea extracts that provides optimal color and flavor shelf-life extension of meat and poultry products, while NaturFORT RS is a unique blend of rosemary and spearmint extracts that provides flavor stability in dressings and mayonnaise. The plant extract blends provide optimized oxidation protection without negative sensory impact, formulation support. Globalization has also led to greater exposure to flavors and fragrances of various cultures. Hence, identifying new & exotic spices and herbs and their properties in accordance with the changing consumer preferences is vital for plant extracts market manufacturers.

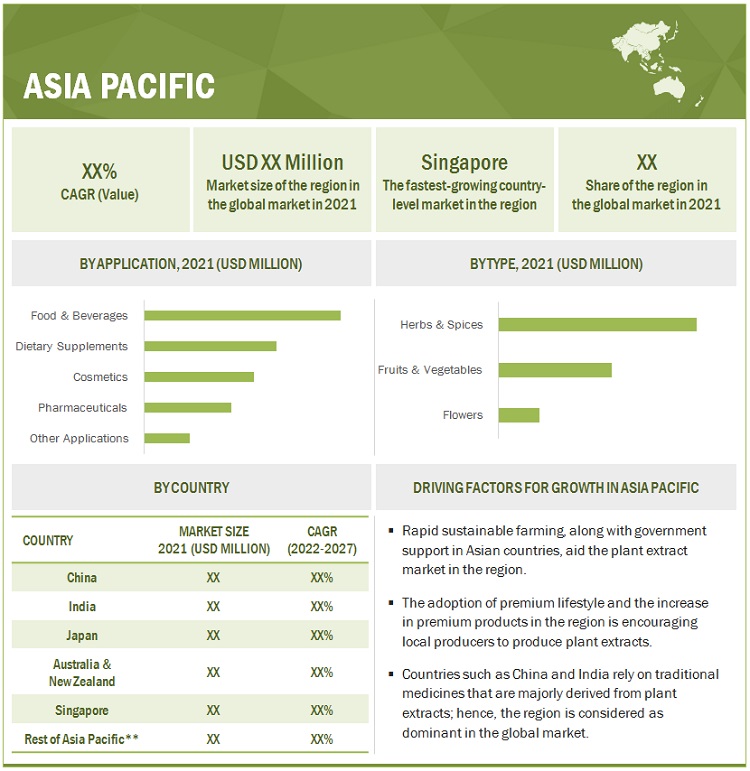

The increasing domestic and international demand contributing towards the growth of the market in the Asia Pacific region

Asia Pacific dominated the market in 2021 and is projected to continue its dominance during the forecast period. The market for plant extracts in the region is thriving due to strong local and international demand. The region has several small and medium-sized manufacturers of the market that are well-versed with the processing of extracts and aware of the benefits offered by them such as, Alchemy Chemicals, Vital Herbs, Sydler, Plantnat. Manufacturers in Indonesia, India, and Thailand are continuously investing in the market and focusing on innovation to expand their product range. This is due to the rise in the trade of plant extracts market between Asia and international manufacturers of spices and essential oils.

To know about the assumptions considered for the study, download the pdf brochure

Top Companies in Plant Extracts Market

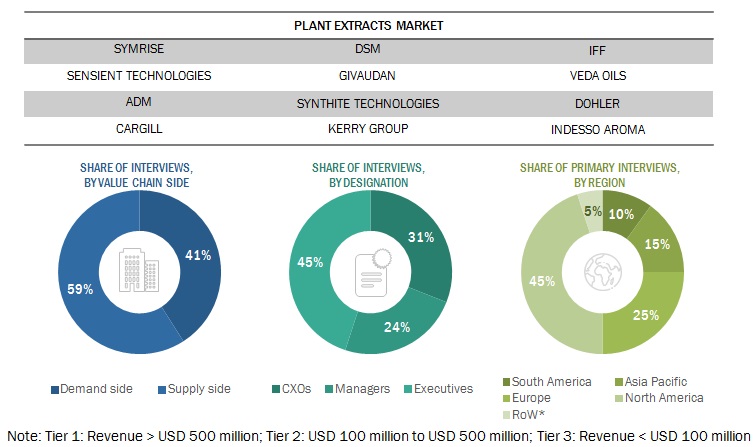

The key players in this market include International Flavors & Fragrances Inc. (US), Givaudan (Switzerland), Symrise (Germany), Kerry Group Plc (Ireland), ADM (US), and Synthite Industries Ltd (India), Kalsec Inc. (US), Kangcare bioindustry co. ltd. (China), Carbery Group (Ireland), DSM (Netherlands), Döhler (Germany), Synthite Industries Ltd (India), Indesso (Indonesia), and Vidya Herbs (India).

Plant Extracts Market Report Scope

|

Report Metric |

Details |

|

Market Estimated Size in 2022 |

USD 34.4 billion |

|

Projected Market Valuation in 2027 |

USD 61.5 billion |

|

Value-based CAGR (2022-2027) |

12.3% |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

Product type, form, source, region, and application. |

|

Regions covered |

North America, Europe, Asia pacific and RoW |

|

Companies studied |

|

|

Key Market Driver |

Growing Demand from Cosmetic Industry |

|

Largest Growing Region |

Asia Pacific |

|

Largest Market Share Segment |

Food Segment |

Plant Extracts Market Report Segmentation

This research report categorizes the market based on product type, application, form, source and region.

|

Segment |

Subsegment |

|

Market By Product Type |

|

|

Market By Application |

|

|

Market By Form |

|

|

Market By Source |

|

|

Market By Region |

|

Plant Extracts Market Recent Developments

- In July 2022, Symrise introduced Maison Lautier 1795 (fragrance), a naturals brand, and its first three product lines. The emphasis is on artisan, sustainably grown Mediterranean flowers and plants. This adds to the company's scent product portfolio.

- In November 2021, Sensient debuted Boundless, introduced a line of chili-based extracts, in its flavors & extracts segment. Boundless offers a variety of chili profiles, including Ancho Chili, Chipotle Chili, Green Jalapeno, Habanero Chili, and Red Jalapeno. This will help the company meet the growing demand for new flavors

- In February 2021, International Flavors & Fragrances Inc. DuPont’s N&B has merged with IFF, which supplies binders, plant-based proteins, and texturants which has increased the revenue exponentially and broadened the customer base for sustainable growth.

- In February 2021, Givaudan Taste & Wellbeing introduced Advanced Tools for Modelling (ATOM), which uses artificial intelligence to optimize food and flavor formulation to generate new options and insights based on consumer preferences. The tools investigate ingredient synergies and identify flavor drivers that are both positive and negative. This will support the Company's strategy and intent to lead the way in digitalization; these pioneering tools open new avenues for creative development and have the potential to shorten the time to market for new products.

- In December 2021, ADM Flavor Infusion International, S.A. (FISA), a provider of flavor and specialty ingredient solutions in Latin America and the Caribbean, was acquired by ADM. The addition of FISA will provide ADM with new growth opportunities in Latin America and the Caribbean.

- In September 2021, ADM purchased Yerbalatina Phyto actives, a Brazilian manufacturer of plant-based extracts and ingredients. To stay ahead of health and wellness trends, ADM is expanding its portfolio of ingredients derived from natural sources that promote health. This acquisition expands ADM's already substantial presence in Brazil.

- October 2021, Cargill, Incorporated Cargill introduced improved Nutrena Nature Wise formulas that improve the overall wellness, and productivity of chickens. This poultry feed contains essential oils (oregano and other herbs) that promote flock health and egg production. This launch aided the company expands its product portfolio and help meeting its customers' demand for wholesome feeds.

Frequently Asked Questions (FAQ):

How big is the market for Plant Extracts?

The global plant extract market size is projected to reach USD 61.5 billion by 2027.

What is the estimated growth rate (CAGR) of the global Plant Extracts Market for the next five years?

The global plant extract market is expected to grow at a compound annual growth rate (CAGR) of 12.3% from 2022 to 2027.

What are the major revenue pockets in the Plant Extracts Market currently?

Asia Pacific is estimated to account for the largest market share, in terms of both value and volume, in the global plant extracts market in 2021. The surge for natural and clean label ingredients is one of the key influential factors that drive the demand for plant extracts in Asia Pacific.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 PLANT EXTRACTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

FIGURE 5 BY MARKET SIZE ESTIMATION (DEMAND-SIDE)

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 BY MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 56)

TABLE 2 PLANT EXTRACTS MARKET SHARE SNAPSHOT, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET SIZE, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET SIZE, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET SIZE, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 13 GROWING DEMAND FOR NATURAL AND PLANT-BASED INGREDIENTS

4.2 MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 14 ASIA PACIFIC WAS LARGEST MARKET GLOBALLY IN 2021

4.3 ASIA PACIFIC: BY MARKET, BY SOURCE & COUNTRY

FIGURE 15 CHINA TO DOMINATE ASIA PACIFIC MARKET IN 2021

4.4 MARKET, BY FORM

FIGURE 16 DRY SEGMENT TO DOMINATE THE MARKET

4.5 BY MARKET, BY APPLICATION

4.6 MARKET, BY SOURCE

4.7 MARKET, BY TYPE & REGION

FIGURE 19 ASIA PACIFIC TO DOMINATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 67)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 EXPORT OF SPICES

FIGURE 20 INDIA: EXPORT DATA OF SPICE OILS & OLEORESINS, 2018-2021

5.2.2 CONSUMER PRICE INDEX

FIGURE 21 US: CONSUMER PRICE INDEX (URBAN CONSUMERS) OF FOOD & BEVERAGES, 2018-2022

FIGURE 22 PURCHASER PRICE INDEX FOR FOOD (HEALTH) SUPPLEMENT STORES, 2020-2022

5.2.3 ORGANIC FOOD DEMAND

5.3 MARKET DYNAMICS

FIGURE 23 PLANT EXTRACTS MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Demand for essential oils from cosmetics industry

5.3.1.2 Increasing demand for natural ingredients and clean label products

5.3.1.3 Growing market for nutraceuticals and herbal supplements

FIGURE 24 GROWING DEMAND FOR BOTANICAL DIETARY SUPPLEMENTS

5.3.1.4 Adverse side-effects of synthetic flavors

FIGURE 25 INCREASING DEMAND FOR NATURAL FLAVORS & FRAGRANCES

5.3.2 RESTRAINTS

5.3.2.1 Lack of standardization and varying regulations and quality standards

5.3.2.2 Price fluctuations and inadequate supply of raw materials

5.3.3 OPPORTUNITIES

5.3.3.1 Technological intervention in production processes

5.3.3.2 Growing trend of veganism among consumers

5.3.3.3 Government initiatives to promote natural ingredients

5.3.4 CHALLENGES

5.3.4.1 Lack of downstream processing facilities and resultant microbial contamination

5.3.4.2 Adulteration and cost margins for natural additives compared to synthetic counterparts

6 INDUSTRY TRENDS (Page No. - 81)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH & PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 MANUFACTURING

6.2.4 PACKAGING, STORAGE, AND DISTRIBUTION

6.2.5 END USERS

FIGURE 26 PLANT EXTRACTS MARKET: VALUE CHAIN

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 27 MARKET: SUPPLY CHAIN

6.4 MARKET MAP AND ECOSYSTEM OF PLANT EXTRACTS

6.4.1 DEMAND SIDE

6.4.2 SUPPLY SIDE

FIGURE 28 MARKET: ECOSYSTEM MAP

6.4.3 ECOSYSTEM MAP

TABLE 3 MARKET: ECOSYSTEM

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN THE MARKET

FIGURE 29 REVENUE SHIFT IMPACTING THE MARKET

6.6 TECHNOLOGY ANALYSIS

6.6.1 GREEN TECHNOLOGIES

6.6.2 DRYING TECHNOLOGY

6.6.3 CELLULAR EXTRACTION

6.7 PRICING ANALYSIS

6.7.1 SELLING PRICE CHARGED BY KEY PLAYERS IN TERMS OF PRODUCT SOURCE

FIGURE 30 SELLING PRICE OF KEY PLAYERS FOR PLANT EXTRACTS’ PRODUCT SOURCE

TABLE 4 SELLING PRICE OF KEY PLAYERS FOR PRODUCT FORM (USD/KG)

FIGURE 31 AVERAGE SELLING PRICE IN KEY REGIONS, BY PRODUCT TYPE, 2017–2021 (USD/KG)

TABLE 5 OLEORESINS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

TABLE 6 ESSENTIAL OILS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

TABLE 7 FLAVONOIDS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

TABLE 8 ALKALOIDS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

TABLE 9 CAROTENOIDS: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

TABLE 10 OTHER PRODUCT TYPES: AVERAGE SELLING PRICE, BY REGION, 2017–2021 (USD/KG)

6.8 PLANT EXTRACTS MARKET: PATENT ANALYSIS

FIGURE 32 NUMBER OF PATENTS GRANTED FOR PLANT EXTRACTS, 2011–2021

FIGURE 33 TOP PATENT APPLICANTS FOR PLANT EXTRACTS, 2019–2022

FIGURE 34 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PLANT EXTRACTS, 2019-2022

6.8.1 LIST OF MAJOR PATENTS

TABLE 11 LIST OF FEW PATENTS IN THE MARKET, 2019–2022

6.9 TRADE ANALYSIS: MARKET

6.9.1 EXPORT SCENARIO OF VEGETABLE SAPS AND EXTRACTS

FIGURE 35 VEGETABLE SAPS AND EXTRACTS EXPORTS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 12 EXPORT DATA OF VEGETABLE SAPS AND EXTRACTS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.2 IMPORT SCENARIO OF VEGETABLE SAPS AND EXTRACTS

FIGURE 36 VEGETABLE SAPS AND EXTRACTS IMPORTS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 13 IMPORT DATA OF VEGETABLE SAPS AND EXTRACTS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.3 EXPORT SCENARIO OF EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATÉ

FIGURE 37 EXPORTS: EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATÉ, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 14 EXPORT DATA OF EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATÉ FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.4 IMPORT SCENARIO OF EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATÉ

FIGURE 38 IMPORTS: EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATÉ, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 15 IMPORT DATA OF EXTRACTS, ESSENCES, AND CONCENTRATES OF COFFEE, TEA, OR MATÉ FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.5 EXPORT SCENARIO: ESSENTIAL OILS FROM CITRUS FRUITS

FIGURE 39 EXPORTS: ESSENTIAL OILS OF CITRUS FRUITS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 16 EXPORT DATA OF ESSENTIAL OILS OF CITRUS FRUIT FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.6 IMPORT SCENARIO: ESSENTIAL OILS FROM CITRUS FRUITS

FIGURE 40 IMPORTS: ESSENTIAL OILS OF CITRUS FRUITS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 17 IMPORT DATA FOR ESSENTIAL OILS OF CITRUS FRUITS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.7 EXPORT SCENARIO: EXTRACTED OLEORESINS

FIGURE 41 EXPORTS: EXTRACTED OLEORESINS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 18 EXPORT DATA OF EXTRACTED OLEORESINS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.9.8 IMPORT SCENARIO: EXTRACTED OLEORESINS

FIGURE 42 IMPORTS: EXTRACTED OLEORESINS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 19 IMPORT DATA FOR EXTRACTED OLEORESINS FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

6.10 CASE STUDIES: PLANT EXTRACTS MARKET

6.10.1 ARJUNA NATURAL: NATURAL SOLUTION FOR FRUIT JUICE PRESERVATION

6.10.2 SYMRISE: HALAL VANILLA

6.11 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 20 KEY CONFERENCES AND EVENTS IN THE MARKET

6.12 TARIFF AND REGULATORY LANDSCAPE

6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 23 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 24 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12.2 REGULATORY FRAMEWORK

6.12.2.1 North America

6.12.2.1.1 United States

6.12.2.1.2 Canada

6.12.2.2 Europe

6.12.2.3 Asia Pacific

6.12.2.3.1 China

6.12.2.3.2 India

6.12.2.3.3 Australia

6.12.2.4 South America

6.12.2.4.1 Brazil

6.12.2.4.2 Argentina

6.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 25 PLANT EXTRACTS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.13.1 DEGREE OF COMPETITION

6.13.2 BARGAINING POWER OF SUPPLIERS

6.13.3 BARGAINING POWER OF BUYERS

6.13.4 THREAT OF SUBSTITUTES

6.13.5 THREAT OF NEW ENTRANTS

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 43 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS

TABLE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS (%)

6.14.2 BUYING CRITERIA

FIGURE 44 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

TABLE 27 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 PLANT EXTRACTS MARKET, BY TYPE (Page No. - 119)

7.1 INTRODUCTION

FIGURE 45 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 28 BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 29 BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 30 BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 31 BY MARKET, BY TYPE, 2022–2027 (KT)

7.2 OLEORESINS

7.2.1 OLEORESINS PRESERVE ROBUST FLAVOR AND AROMA OF SPICES

TABLE 32 OLEORESINS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 OLEORESINS: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 OLEORESINS: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 35 OLEORESINS: BY MARKET, BY REGION, 2022–2027 (KT)

7.3 ESSENTIAL OILS

7.3.1 RISING TREND OF AROMATHERAPY IN DEVELOPING COUNTRIES

TABLE 36 ESSENTIAL OILS: BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 ESSENTIAL OILS: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 ESSENTIAL OILS: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 39 ESSENTIAL OILS: BY MARKET, BY REGION, 2022–2027 (KT)

7.4 FLAVONOIDS

7.4.1 ANTI-OXIDATIVE AND ANTI-INFLAMMATORY PROPERTIES

TABLE 40 FLAVONOIDS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 FLAVONOIDS: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 42 FLAVONOIDS:BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 43 FLAVONOIDS: BY MARKET, BY REGION, 2022–2027 (KT)

7.5 ALKALOIDS

7.5.1 ANTI-CANCEROUS PROPERTIES

TABLE 44 ALKALOIDS: BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 ALKALOIDS: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 ALKALOIDS: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 47 ALKALOIDS: BY MARKET, BY REGION, 2022–2027 (KT)

7.6 CAROTENOIDS

7.6.1 INCREASING INCLINATION OF CONSUMERS TOWARD NATURAL PRODUCTS

TABLE 48 CAROTENOIDS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 CAROTENOIDS: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 CAROTENOIDS: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 51 CAROTENOIDS: BY MARKET, BY REGION, 2022–2027 (KT)

7.7 OTHER TYPES

TABLE 52 OTHER TYPES: BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 53 OTHER TYPES: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 OTHER TYPES: MARKET, BY REGION, 2016–2021 (KT)

TABLE 55 OTHER TYPES: BY MARKET, BY REGION, 2022–2027 (KT)

8 PLANT EXTRACTS MARKET, BY APPLICATION (Page No. - 136)

8.1 INTRODUCTION

FIGURE 46 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 56 BY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 57 BY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 58 BY MARKET, BY APPLICATION, 2016–2021 (KT)

TABLE 59 BY MARKET, BY APPLICATION, 2022–2027 (KT)

8.2 PHARMACEUTICALS

8.2.1 INCREASED DEMAND FOR PLANT-BASED MEDICINES

TABLE 60 PHARMACEUTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 61 PHARMACEUTICALS: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 PHARMACEUTICALS: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 63 PHARMACEUTICALS: BY MARKET, BY REGION, 2022–2027 (KT)

8.3 DIETARY SUPPLEMENTS

8.3.1 BENEFITS SUCH AS BOOSTING IMMUNITY RELATED TO HERBAL SUPPLEMENTS

TABLE 64 DIETARY SUPPLEMENTS: BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 65 DIETARY SUPPLEMENTS: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 DIETARY SUPPLEMENTS: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 67 DIETARY SUPPLEMENTS: BY MARKET, BY REGION, 2022–2027 (KT)

8.4 FOOD & BEVERAGES

8.4.1 RISING VEGAN POPULATION DEMANDING PLANT-BASED FOODS

TABLE 68 FOOD & BEVERAGES: PLANT EXTRACTS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 69 FOOD & BEVERAGES: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 70 FOOD & BEVERAGES: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 71 FOOD & BEVERAGES: BY MARKET, BY REGION, 2022–2027 (KT)

8.5 COSMETICS

8.5.1 ANTIMICROBIAL AND ANTIOXIDANT PROPERTIES OF PLANT EXTRACTS LEADING TO ADOPTION OF HERBAL COSMETICS

TABLE 72 COSMETICS: BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 73 COSMETICS: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 COSMETICS: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 75 COSMETICS: BY MARKET, BY REGION, 2022–2027 (KT)

8.6 OTHER APPLICATIONS

TABLE 76 OTHER APPLICATIONS: BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 77 OTHER APPLICATIONS: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 (KT)

TABLE 79 OTHER APPLICATIONS: BY MARKET, BY REGION, 2022–2027 (KT)

9 PLANT EXTRACTS MARKET, BY SOURCE (Page No. - 150)

9.1 INTRODUCTION

FIGURE 47 MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

TABLE 80 BY MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 81 BY MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 82 BY MARKET, BY SOURCE, 2016–2021 (KT)

TABLE 83 BY MARKET, BY SOURCE, 2022–2027 (KT)

9.2 FRUITS & VEGETABLES

9.2.1 INTRODUCTION OF NEWER TECHNOLOGIES

TABLE 84 FRUITS & VEGETABLES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 85 FRUITS & VEGETABLES: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 86 FRUITS & VEGETABLES: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 87 FRUITS & VEGETABLES: BY MARKET, BY REGION, 2022–2027 (KT)

9.3 FLOWERS

9.3.1 RISING USAGE OF FLOWER EXTRACTS FOR FRAGRANCES IN THE COSMETICS INDUSTRY

TABLE 88 FLOWERS: BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 89 FLOWERS: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 90 FLOWERS: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 91 FLOWERS: BY MARKET, BY REGION, 2022–2027 (KT)

9.4 HERBS & SPICES

9.4.1 BIOACTIVE FUNCTION OF HERBS & SPICES

TABLE 92 SOURCES OF HERBS & SPICES

TABLE 93 BIOACTIVE FUNCTIONS OF SPICES & HERBS

TABLE 94 HERBS & SPICES: BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 95 HERBS & SPICES: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 96 HERBS & SPICES: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 97 HERBS & SPICES: PLANT EXTRACTS MARKET, BY REGION, 2022–2027 (KT)

10 PLANT EXTRACTS, BY FORM (Page No. - 159)

10.1 INTRODUCTION

FIGURE 48 MARKET (VALUE), BY FORM, 2022 VS. 2027

TABLE 98 BY MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 99 BY MARKET, BY FORM, 2022–2027 (USD MILLION)

10.2 DRY

10.2.1 INCREASING USE IN PHARMACEUTICALS AND DIETARY SUPPLEMENTS

TABLE 100 DRY: BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 101 DRY: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 LIQUID

10.3.1 SHIFTING CONSUMER PREFERENCES

TABLE 102 LIQUID: BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 103 LIQUID: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

11 PLANT EXTRACTS, BY REGION (Page No. - 165)

11.1 INTRODUCTION

FIGURE 49 GEOGRAPHIC SNAPSHOT (2022–2027): RAPIDLY GROWING MARKETS EMERGING AS NEW HOTSPOTS

FIGURE 50 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 104 BY MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 105 BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 106 BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 107 BY MARKET, BY REGION, 2022–2027 (KT)

11.2 NORTH AMERICA

FIGURE 51 NORTH AMERICA: MARKET SNAPSHOT

TABLE 108 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 109 NORTH AMERICA: BY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: BY MARKET, BY COUNTRY, 2016–2021 (KT)

TABLE 111 NORTH AMERICA: BY MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 112 NORTH AMERICA: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 115 NORTH AMERICA: BY MARKET, BY TYPE, 2022–2027 (KT)

TABLE 116 NORTH AMERICA: BY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: BY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: PLANT EXTRACTS MARKET, BY APPLICATION, 2016–2021 (KT)

TABLE 119 NORTH AMERICA: BY MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 120 NORTH AMERICA: BY MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 121 NORTH AMERICA: BY MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 122 NORTH AMERICA: BY MARKET, BY SOURCE, 2016–2021 (KT)

TABLE 123 NORTH AMERICA: BY MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 124 NORTH AMERICA: BY MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET, BY FORM, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Concept of healthy aging and rising trend of health-conscious diets

TABLE 126 US: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 127 US: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 128 US: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 129 US: BY MARKET, BY TYPE, 2022–2027 (KT)

11.2.2 CANADA

11.2.2.1 Rising consumption of plant-based products

TABLE 130 CANADA: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 131 CANADA: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 132 CANADA: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 133 CANADA:BY MARKET, BY TYPE, 2022–2027 (KT)

11.2.3 MEXICO

11.2.3.1 Growing health and wellness trend to drive market for phytomedicines and herbal extracts

TABLE 134 MEXICO: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 135 MEXICO: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 136 MEXICO: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 137 MEXICO: BY MARKET, BY TYPE, 2022–2027 (KT)

11.3 EUROPE

TABLE 138 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 139 EUROPE: BY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 140 EUROPE: BY MARKET, BY COUNTRY, 2016–2021 (KT)

TABLE 141 EUROPE: BY MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 142 EUROPE: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 143 EUROPE: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 144 EUROPE: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (KT)

TABLE 145 EUROPE: BY MARKET, BY TYPE, 2022–2027 (KT)

TABLE 146 EUROPE: BY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 147 EUROPE: BY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 148 EUROPE: BY MARKET, BY APPLICATION, 2016–2021 (KT)

TABLE 149 EUROPE: BY MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 150 EUROPE: BY MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 151 EUROPE: BY MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 152 EUROPE: BY MARKET, BY SOURCE, 2016–2021 (KT)

TABLE 153 EUROPE: BY MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 154 EUROPE: MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 155 EUROPE: BY MARKET, BY FORM, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Thriving food & beverage industry and growing demand for natural ingredients

TABLE 156 GERMANY: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 157 GERMANY: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 158 GERMANY: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 159 GERMANY: BY MARKET, BY TYPE, 2022–2027 (KT)

11.3.2 UNITED KINGDOM

11.3.2.1 Herbal tea gaining popularity

TABLE 160 UK: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 161 UK: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 162 UK: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 163 UK: BY MARKET, BY TYPE, 2022–2027 (KT)

11.3.3 FRANCE

11.3.3.1 Consumption of plant extracts for production of dietary supplements and functional foods

TABLE 164 FRANCE: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 165 FRANCE: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 166 FRANCE: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (KT)

TABLE 167 FRANCE: BY MARKET, BY TYPE, 2022–2027 (KT)

11.3.4 ITALY

11.3.4.1 Growth of food supplements

TABLE 168 ITALY: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 169 ITALY: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 170 ITALY: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 171 ITALY: BY MARKET, BY TYPE, 2022–2027 (KT)

11.3.5 SPAIN

11.3.5.1 Increasing focus of food manufacturers on producing functional food & beverages

TABLE 172 SPAIN: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 173 SPAIN: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 174 SPAIN: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 175 SPAIN: BY MARKET, BY TYPE, 2022–2027 (KT)

11.3.6 RUSSIA

11.3.6.1 Consumption of herbal dietary supplements to create dynamic opportunities

TABLE 176 RUSSIA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 177 RUSSIA: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 178 RUSSIA: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 179 RUSSIA: BY MARKET, BY TYPE, 2022–2027 (KT)

11.3.7 POLAND

11.3.7.1 Reduced consumption of meat leading to plant-based alternatives

TABLE 180 POLAND: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 181 POLAND: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 182 POLAND: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 183 POLAND: BY MARKET, BY TYPE, 2022–2027 (KT)

11.3.8 REST OF EUROPE

TABLE 184 REST OF EUROPE: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 185 REST OF EUROPE: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 186 REST OF EUROPE: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 187 REST OF EUROPE: BY MARKET, BY TYPE, 2022–2027 (KT)

11.4 ASIA PACIFIC

FIGURE 52 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 188 ASIA PACIFIC: PLANT EXTRACTS MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 189 ASIA PACIFIC: BY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 190 ASIA PACIFIC: BY MARKET, BY COUNTRY, 2016–2021 (KT)

TABLE 191 ASIA PACIFIC: BY MARKET, BY COUNTRY, 2022–2027 (KT)

TABLE 192 ASIA PACIFIC: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 193 ASIA PACIFIC: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 194 ASIA PACIFIC: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 195 ASIA PACIFIC: BY MARKET, BY TYPE, 2022–2027 (KT)

TABLE 196 ASIA PACIFIC: BY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 197 ASIA PACIFIC: BY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 198 ASIA PACIFIC: BY MARKET, BY APPLICATION, 2016–2021 (KT)

TABLE 199 ASIA PACIFIC: BY MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 200 ASIA PACIFIC: BY MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 201 ASIA PACIFIC: BY MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 202 ASIA PACIFIC: BY MARKET, BY SOURCE, 2016–2021 (KT)

TABLE 203 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 204 ASIA PACIFIC: BY MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 205 ASIA PACIFIC: BY MARKET, BY FORM, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Increasing rejection of chemical products

TABLE 206 CHINA: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 207 CHINA: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 208 CHINA: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 209 CHINA: BY MARKET, BY TYPE, 2022–2027 (KT)

11.4.2 INDIA

11.4.2.1 Shifting trend from synthetic to herbal medicines

TABLE 210 INDIA: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 211 INDIA: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 212 INDIA: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 213 INDIA: BY MARKET, BY TYPE, 2022–2027 (KT)

11.4.3 JAPAN

11.4.3.1 Increasing need for natural ingredients in health care, cosmetics, and toiletries

TABLE 214 JAPAN: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 215 JAPAN: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 216 JAPAN: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 217 JAPAN: BY MARKET, BY TYPE, 2022–2027 (KT)

11.4.4 AUSTRALIA & NEW ZEALAND

11.4.4.1 Rising investments by governments

TABLE 218 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 219 AUSTRALIA & NEW ZEALAND: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 220 AUSTRALIA & NEW ZEALAND: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 221 AUSTRALIA & NEW ZEALAND: BY MARKET, BY TYPE, 2022–2027 (KT)

11.4.5 SINGAPORE

11.4.5.1 Rising concerns over health risks

TABLE 222 SINGAPORE: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 223 SINGAPORE: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 224 SINGAPORE: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 225 SINGAPORE: BY MARKET, BY TYPE, 2022–2027 (KT)

11.4.6 REST OF ASIA PACIFIC

TABLE 226 REST OF ASIA PACIFIC: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 227 REST OF ASIA PACIFIC: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 228 REST OF ASIA PACIFIC: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 229 REST OF ASIA PACIFIC: BY MARKET, BY TYPE, 2022–2027 (KT)

11.5 REST OF THE WORLD

TABLE 230 ROW: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 231 ROW: BY MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 232 ROW: BY MARKET, BY REGION, 2016–2021 (KT)

TABLE 233 ROW: BY MARKET, BY REGION, 2022–2027 (KT)

TABLE 234 ROW: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 235 ROW: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 236 ROW: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 237 ROW: BY MARKET, BY TYPE, 2022–2027 (KT)

TABLE 238 ROW: PLANT EXTRACTS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 239 ROW: BY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 240 ROW: BY MARKET, BY APPLICATION, 2016–2021 (KT)

TABLE 241 ROW: BY MARKET, BY APPLICATION, 2022–2027 (KT)

TABLE 242 ROW: BY MARKET, BY SOURCE, 2016–2021 (USD MILLION)

TABLE 243 ROW: BY MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 244 ROW: BY MARKET, BY SOURCE, 2016–2021 (KT)

TABLE 245 ROW: BY MARKET, BY SOURCE, 2022–2027 (KT)

TABLE 246 ROW: BY MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 247 ROW: MARKET, BY FORM, 2022–2027 (USD MILLION)

11.5.1 SOUTH AMERICA

TABLE 248 SOUTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 249 SOUTH AMERICA: BY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 250 SOUTH AMERICA: BY MARKET, BY COUNTRY, 2016–2021 (KT)

TABLE 251 SOUTH AMERICA: BY MARKET, BY COUNTRY, 2022–2027 (KT)

11.5.1.1 Brazil

11.5.1.1.1 Biodiversity to enable development of variety of plant extract products

TABLE 252 BRAZIL: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 253 BRAZIL: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 254 BRAZIL: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 255 BRAZIL: BY MARKET, BY TYPE, 2022–2027 (KT)

11.5.1.2 Rest of South America

11.5.1.2.1 Rising demand for organic products in food, cosmetics, and pharma industries

TABLE 256 REST OF SOUTH AMERICA: PLANT EXTRACTS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 257 REST OF SOUTH AMERICA: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 258 REST OF SOUTH AMERICA: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 259 REST OF SOUTH AMERICA: BY MARKET, BY TYPE, 2022–2027 (KT)

11.5.2 AFRICA

TABLE 260 AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 261 AFRICA: BY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 262 AFRICA: BY MARKET, BY COUNTRY, 2016–2021 (KT)

TABLE 263 AFRICA: BY MARKET, BY COUNTRY, 2022–2027 (KT)

11.5.2.1 South Africa

11.5.2.1.1 Unique qualities of plant extracts leading to their increased use in cosmetics

TABLE 264 SOUTH AFRICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 265 SOUTH AFRICA: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 266 SOUTH AFRICA: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 267 SOUTH AFRICA: BY MARKET, BY TYPE, 2022–2027 (KT)

11.5.2.2 Rest of Africa

11.5.2.2.1 Inability of western medicine to provide cures for some diseases and infections

TABLE 268 REST OF AFRICA: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 269 REST OF AFRICA: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 270 REST OF AFRICA: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 271 REST OF AFRICA: PLANT EXTRACTS MARKET, BY TYPE, 2022–2027 (KT)

11.5.3 MIDDLE EAST

11.5.3.1 Growing import demand for plant extracts from North America

TABLE 272 MIDDLE EAST: BY MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 273 MIDDLE EAST: BY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 274 MIDDLE EAST: BY MARKET, BY TYPE, 2016–2021 (KT)

TABLE 275 MIDDLE EAST: BY MARKET, BY TYPE, 2022–2027 (KT)

12 COMPETITIVE LANDSCAPE (Page No. - 244)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2021

TABLE 276 MARKET: DEGREE OF COMPETITION (COMPETITIVE)

12.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 53 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD MILLION)

12.4 KEY PLAYER STRATEGIES

TABLE 277 STRATEGIES ADOPTED BY KEY PLANT EXTRACT MANUFACTURERS

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 54 MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

12.5.5 PRODUCT FOOTPRINT

TABLE 278 COMPANY FOOTPRINT, BY SOURCE

TABLE 279 COMPANY FOOTPRINT, BY APPLICATION

TABLE 280 COMPANY FOOTPRINT, BY REGION

TABLE 281 OVERALL COMPANY FOOTPRINT

12.6 MARKET: EVALUATION QUADRANT FOR START-UPS/SMES, 2021

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 55 BY MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UPS/SMES)

12.6.5 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 282 BY MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 283 PLANT EXTRACTS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

12.7 COMPETITIVE SCENARIO

12.7.1 NEW PRODUCT LAUNCHES

TABLE 284 PLANT EXTRACTS: NEW PRODUCT LAUNCHES, 2021–2022

12.7.2 DEALS

TABLE 285 PLANT EXTRACTS: DEALS, 2019–2022

12.7.3 OTHERS

TABLE 286 PLANT EXTRACTS: OTHERS, 2021–2022

13 COMPANY PROFILES (Page No. - 263)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 SYMRISE

13.2.1.1 Business overview

TABLE 287 SYMRISE: BUSINESS OVERVIEW

FIGURE 56 SYMRISE: COMPANY SNAPSHOT

13.2.1.2 Products/Solutions/Services offered

TABLE 288 SYMRISE: PRODUCTS OFFERED

13.2.1.3 Recent developments

13.2.1.3.1 New product launches

TABLE 289 SYMRISE: NEW PRODUCT LAUNCHES

13.2.1.3.2 Deals

TABLE 290 SYMRISE: DEALS

13.2.1.3.3 Others

TABLE 291 SYMRISE: OTHERS

13.2.1.4 MnM view

13.2.1.4.1 Right to win

13.2.1.4.2 Strategic choices

13.2.1.4.3 Weaknesses and competitive threats

13.2.2 SENSIENT TECHNOLOGIES CORPORATION

13.2.2.1 Business overview

TABLE 292 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 57 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

13.2.2.2 Products/Solutions/Services offered

TABLE 293 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

13.2.2.3 Recent developments

13.2.2.3.1 New product launches

TABLE 294 SENSIENT TECHNOLOGIES CORPORATION: NEW PRODUCT LAUNCHES

13.2.2.3.2 Deals

TABLE 295 SENSIENT TECHNOLOGIES CORPORATION: DEALS

13.2.2.4 MnM view

13.2.2.4.1 Right to win

13.2.2.4.2 Strategic choices

13.2.2.4.3 Weaknesses and competitive threats

13.2.3 INTERNATIONAL FLAVORS & FRAGRANCES INC.

13.2.3.1 Business overview

TABLE 296 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

FIGURE 58 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

13.2.3.2 Products/Solutions/Services offered

TABLE 297 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS OFFERED

13.2.3.3 Recent developments

13.2.3.3.1 Deals

TABLE 298 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

13.2.3.4 MnM view

13.2.3.4.1 Right to win

13.2.3.4.2 Strategic choices

13.2.3.4.3 Weaknesses and competitive threats

13.2.4 GIVAUDAN

13.2.4.1 Business overview

TABLE 299 GIVAUDAN: PLANT EXTRACTS MARKET BUSINESS OVERVIEW

FIGURE 59 GIVAUDAN: COMPANY SNAPSHOT

13.2.4.2 Products/Solutions/Services offered

TABLE 300 GIVAUDAN: PRODUCTS OFFERED

13.2.4.3 Recent developments

13.2.4.3.1 New product launches

TABLE 301 GIVAUDAN: NEW PRODUCT LAUNCHES

13.2.4.3.2 Deals

TABLE 302 GIVAUDAN: DEALS

13.2.4.4 Others

TABLE 303 GIVAUDAN: OTHERS

13.2.4.5 MnM view

13.2.4.5.1 Right to win

13.2.4.5.2 Strategic choices

13.2.4.5.3 Weaknesses and competitive threats

13.2.5 ADM

13.2.5.1 Business overview

TABLE 304 ADM: BUSINESS OVERVIEW

FIGURE 60 ADM: COMPANY SNAPSHOT

13.2.5.2 Products/Solutions/Services offered

TABLE 305 ADM: PRODUCTS OFFERED

13.2.5.3 Recent developments

13.2.5.3.1 Deals

TABLE 306 ADM: DEALS

13.2.5.4 MnM view

13.2.5.4.1 Right to win

13.2.5.4.2 Strategic choices

13.2.5.4.3 Weaknesses and competitive threats

13.2.6 CARGILL, INCORPORATED

13.2.6.1 Business overview

TABLE 307 CARGILL, INCORPORATED: BUSINESS OVERVIEW

FIGURE 61 CARGILL, INCORPORATED: COMPANY SNAPSHOT

13.2.6.2 Products/Solutions/Services offered

TABLE 308 CARGILL, INCORPORATED: PRODUCTS OFFERED

13.2.6.3 Recent developments

13.2.6.3.1 New product launches

TABLE 309 CARGILL, INCORPORATED: NEW PRODUCT LAUNCHES

13.2.6.4 MnM view

13.2.6.4.1 Right to win

13.2.6.4.2 Strategic choices

13.2.6.4.3 Weaknesses and competitive threats

13.2.7 DSM

13.2.7.1 Business overview

TABLE 310 DSM: BUSINESS OVERVIEW

FIGURE 62 DSM: COMPANY SNAPSHOT

13.2.7.2 Products/Solutions/Services offered

TABLE 311 DSM: PRODUCTS OFFERED

13.2.7.3 Recent developments

13.2.7.3.1 Deals

TABLE 312 DSM: DEALS

13.2.7.4 MnM view

13.2.8 KERRY GROUP PLC

13.2.8.1 Business overview

TABLE 313 KERRY GROUP PLC: BUSINESS OVERVIEW

FIGURE 63 KERRY GROUP PLC: COMPANY SNAPSHOT

13.2.8.2 Products/Solutions/Services offered

TABLE 314 KERRY GROUP PLC: PRODUCTS OFFERED

13.2.8.3 Recent developments

13.2.8.3.1 Deals

TABLE 315 KERRY GROUP PLC: DEALS

13.2.8.4 Others

TABLE 316 KERRY GROUP PLC: OTHERS

13.2.8.5 MnM view

13.2.9 DÖHLER

13.2.9.1 Business overview

TABLE 317 DÖHLER: BUSINESS OVERVIEW

13.2.9.2 Products/Solutions/Services offered

TABLE 318 DÖHLER: PRODUCTS OFFERED

13.2.9.3 Recent developments

13.2.9.3.1 Deals

TABLE 319 DÖHLER: DEALS

13.2.9.4 MnM view

13.2.10 CARBERY GROUP

13.2.10.1 Business overview

TABLE 320 CARBERY GROUP: BUSINESS OVERVIEW

13.2.10.2 Products/Solutions/Services offered

TABLE 321 CARBERY GROUP: PRODUCTS OFFERED

13.2.10.3 Recent developments

13.2.10.3.1 Deals

TABLE 322 CARBERY GROUP: DEALS

13.2.10.4 Others

TABLE 323 CARBERY GROUP: OTHERS

13.2.10.5 MnM view

13.2.11 SYNTHITE INDUSTRIES LTD

13.2.11.1 Business overview

TABLE 324 SYNTHITE INDUSTRIES LTD: BUSINESS OVERVIEW

13.2.11.2 Products/Solutions/Services offered

TABLE 325 SYNTHITE INDUSTRIES LTD: PRODUCTS OFFERED

13.2.11.3 Recent developments

13.2.11.4 MnM View

13.2.12 INDESSO

13.2.12.1 Business overview

TABLE 326 INDESSO: PLANT EXTRACTS MARKET BUSINESS OVERVIEW

13.2.12.2 Products/Solutions/Services offered

TABLE 327 INDESSO: PRODUCTS OFFERED

13.2.12.3 Recent developments

13.2.12.3.1 Deals

TABLE 328 INDESSO: DEALS

13.2.12.4 Others

TABLE 329 INDESSO: OTHERS

13.2.12.5 MnM View

13.2.13 VIDYA HERBS

13.2.13.1 Business overview

TABLE 330 VIDYA HERBS: BUSINESS OVERVIEW

13.2.13.2 Products/Solutions/Services offered

TABLE 331 VIDYA HERBS: PRODUCTS OFFERED

13.2.13.3 Recent developments

13.2.13.3.1 New product launches

TABLE 332 VIDYA HERBS: NEW PRODUCT LAUNCHES

13.2.13.4 MnM View

13.2.14 KALSEC INC.

13.2.14.1 Business overview

TABLE 333 KALSEC INC.: BUSINESS OVERVIEW

13.2.14.2 Products/Solutions/Services offered

TABLE 334 KALSEC INC.: PRODUCTS OFFERED

13.2.14.3 Recent developments

13.2.14.3.1 New product launches

TABLE 335 KALSEC INC.: NEW PRODUCT LAUNCHES

13.2.14.3.2 Deals

TABLE 336 KALSEC INC.: DEALS

13.2.14.4 Others

TABLE 337 KALSEC INC.: OTHERS

13.2.14.5 MnM View

13.2.15 MARTINBAUER

13.2.15.1 Business overview

TABLE 338 MARTINBAUER: BUSINESS OVERVIEW

13.2.15.2 Products/Solutions/Services offered

TABLE 339 MARTINBAUER: PRODUCTS OFFERED

13.2.15.3 Recent developments

13.2.15.3.1 Deals

TABLE 340 MARTINBAUER: DEALS

13.2.15.4 Others

TABLE 341 MARTINBAUER: OTHERS

13.2.15.5 MnM View

13.2.16 KANGCARE BIOINDUSTRY CO. LTD.

13.2.16.1 Business overview

TABLE 342 KANGCARE BIOINDUSTRY CO. LTD.: BUSINESS OVERVIEW

13.2.16.2 Products/Solutions/Services offered

TABLE 343 KANGCARE BIOINDUSTRY CO. LTD.: PRODUCTS OFFERED

13.2.16.3 Recent developments

13.2.16.4 MnM View

13.3 OTHER PLAYERS (SMES/START-UPS)

13.3.1 NATIVE EXTRACTS PTY LTD

13.3.1.1 Business overview

TABLE 344 NATIVE EXTRACTS PTY LTD: BUSINESS OVERVIEW

13.3.1.2 Products/Solutions/Services offered

TABLE 345 NATIVE EXTRACTS PTY LTD: PRODUCTS OFFERED

13.3.1.3 Recent developments

13.3.1.3.1 New product launches

TABLE 346 NATIVE EXTRACTS PTY LTD: NEW PRODUCT LAUNCHES

13.3.1.3.2 Deals

TABLE 347 NATIVE EXTRACTS PTY LTD: DEALS

13.3.1.4 MnM View

13.3.2 ARJUNA NATURAL

13.3.2.1 Business overview

TABLE 348 ARJUNA NATURAL: BUSINESS OVERVIEW

13.3.2.2 Products/Solutions/Services offered

TABLE 349 ARJUNA NATURAL: PRODUCTS OFFERED

13.3.2.3 Recent developments

13.3.2.3.1 New product launches

TABLE 350 ARJUNA NATURAL: NEW PRODUCT LAUNCHES

13.3.2.4 MnM View

13.3.3 BLUE SKY BOTANICS

13.3.3.1 Business Overview

TABLE 351 BLUE SKY BOTANICS: BUSINESS OVERVIEW

13.3.3.2 Products/Solutions/Services offered

TABLE 352 BLUE SKY BOTANICS: PRODUCTS OFFERED

13.3.3.3 Recent developments

13.3.3.4 MNM view

13.3.4 TOKIWA PHYTOCHEMICAL CO., LTD.

13.3.4.1 Business Overview

TABLE 353 TOKIWA PHYTOCHEMICAL CO., LTD.: BUSINESS OVERVIEW

13.3.4.2 Products/Solutions/Services offered

TABLE 354 TOKIWA PHYTOCHEMICAL CO., LTD.: PRODUCTS OFFERED

13.3.4.3 Recent developments

13.3.4.4 MnM view

13.3.5 SHAANXI JIAHE PHYTOCHEM CO., LTD (JIAHERB, INC.)

13.3.5.1 Business Overview

TABLE 355 SHAANXI JIAHE PHYTOCHEM CO., LTD (JIAHERB, INC.): BUSINESS OVERVIEW

13.3.5.2 Products/Solutions/Services offered

TABLE 356 SHAANXI JIAHE PHYTOCHEM CO., LTD. (JIAHERB, INC.): PRODUCTS OFFERED

13.3.5.3 Recent developments

13.3.5.4 MnM view

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view

(Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

13.3.6 ALCHEMY CHEMICALS

13.3.7 PRINOVA GROUP LLC

13.3.8 VITAL HERBS

13.3.9 SYDLER INDIA PVT. LTD.

13.3.10 PLANTNAT

14 ADJACENT & RELATED MARKETS (Page No. - 336)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 ESSENTIAL OIL MARKET

14.3.1 PLANT EXTRACTS MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 ESSENTIAL OIL MARKET, BY TYPE

TABLE 357 ESSENTIAL OILS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 358 ESSENTIAL OILS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 359 ESSENTIAL OILS MARKET, BY TYPE, 2017–2020 (KT)

TABLE 360 ESSENTIAL OILS MARKET, BY TYPE, 2021–2026 (KT)

14.3.4 ESSENTIAL OIL MARKET, BY REGION

TABLE 361 ESSENTIAL OILS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 362 ESSENTIAL OILS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 363 ESSENTIAL OILS MARKET, BY REGION, 2017–2020 (KT)

TABLE 364 ESSENTIAL OILS MARKET, BY REGION, 2021–2026 (KT)

14.4 BOTANICAL EXTRACTS MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

14.4.3 BOTANICAL EXTRACTS MARKET, BY SOURCE

TABLE 365 BOTANICAL EXTRACTS MARKET, BY SOURCE, 2015–2022 (USD MILLION)

TABLE 366 BOTANICAL EXTRACTS MARKET, BY SOURCE, 2015–2022 (TONS)

14.4.4 BOTANICAL EXTRACTS MARKET, BY REGION

TABLE 367 BOTANICAL EXTRACTS MARKET, BY REGION, 2015–2022 (USD MILLION)

TABLE 368 BOTANICAL EXTRACTS MARKET, BY REGION, 2015–2022 (TONS)

15 APPENDIX (Page No. - 346)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

This research involves the extensive use of secondary sources; directories; and databases, such as the Food and Drug Administration (FDA), Herb Society of America, American Herbal Products Association, American Spice Trade Association, Essential Oils Association of India, Bloomberg, and Factiva, to identify and collect information useful for a technical, market-oriented, and commercial study of the plant extracts market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Drug Administration (FDA), European Spices Association, Spices Board, European Flavors & Fragrances Association, The International Federation of Essential Oils and Aroma Trades, were referred to identify and collect information for this study. The secondary sources also include medical journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The plant extracts market comprises several stakeholders, including fruits & vegetables, and spices & herbs suppliers, ingredient suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply-side include research institutions involved in R&D to introduce technology, distributors, wholesalers, importers & exporters of spices and herbs, plant extract manufacturers and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of food & beverage product, cosmetics, dietary supplements, and pharmaceuticals manufacturing companies, through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the plant extracts market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The peer market—the essential oils and botanical extracts market—was considered to validate further the market details of plant extracts.

Bottom-up approach:

- The market size was analyzed based on the share of each type of plant extract at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

-

Other factors include the penetration rate of plant extracts in distinguished application sectors, such as food & beverages, dietary supplements, pharmaceuticals, cosmetics; consumer awareness; and function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the plant extracts market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall plant extracts market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying numerous factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for plant extracts market based on product type, application, form, source, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the South America plant extracts market, by key country

- Further breakdown of the Rest of Europe market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plant Extracts Market