Personalized Nutrition Market by Product Type (Active Measurement and Standard Measurement), Application, End Use (Direct-to-Consumer, Wellness & Fitness Centers, Hospitals & Clinics, and Institutions), Form and Region - Global Forecast to 2027

The global personalized nutrition market is estimated to reach $23.3 billion by 2027, growing at a 15.5% compound annual growth rate (CAGR). The global market size was valued $11.3 billion in 2022. With the increasing demand for tailor-made dietary plans, personalized nutrition is emerging as a promising sector, presenting businesses with an attractive opportunity to tap into this burgeoning market. The convergence of technology, genomics, and nutrition is fueling the growth of the personalized nutrition industry, enabling consumers to customize their diets based on their genetic makeup, lifestyle, and health goals.

As the market expands, it offers an exciting avenue for companies to innovate and create cutting-edge solutions that cater to the evolving needs of consumers.This presents a huge canvas of growth for the industry, making it an exciting and promising arena for investment and development. These estimates highlight the enormous potential and exciting future of the industry. The global market is being propelled forward by a perfect storm of technological advancements and heightened awareness of the crucial role that personalized nutrition plays in maintaining good health and preventing chronic diseases. Personalized nutrition plans offer a customized roadmap to optimal health and wellness, providing tailored recommendations for food, supplements, and other health products. With growing demand for these personalized products and services, the market is set to take off in the years to come.

To know about the assumptions considered for the study, Request for Free Sample Report

Personalized Nutrition Market Dynamics

Drivers: Shift in consumer preferences due to the rising health awareness

As people become more conscious of holistic well-being, the demand for personalized diets and supplements has increased significantly. The growing consumer health awareness and rising disposable income across regions have encouraged people to shift to personalized nutrition. The changing consumer preferences for health and wellness products have led to high demand for individually customized diets. There is an increasing trend of adopting a genetically based personalized diet due to consumers being more nutrition-specific. People are increasingly moving from regular supplements to personalized dietary supplements and nutrition plans customized according to their genetic make-up that addresses their health concerns. With changing preferences due to increased health awareness, consumers are increasingly seeking personalization in their daily experiences and shifting away from the ‘one-size-fits-all’ approach.

Opportunities: Increasing innovations and advancements in technologies

The personalized nutrition business is projected to witness growth in the coming years, and technology will remain one key factor supporting this growth. With the increasing advancements in technology, consumers now have a better understanding of their health and well-being, which leads to high demand for customized products, considering their health and lifestyle. Various new players in the personalized nutrition market are developing new and innovative solutions, such as genetic tests designed specifically for vegetarians and vegans who prefer plant-based personalized nutrition.

Technologies such as wellness-focused wearables offered by brands such as Fitbit and Apple help consumers track their activity levels and nutrient intake, further enabling them to personalize their meal plans. Some technologies help patients to detect their blood pressure levels, which helps them to provide accurate nutritional data to medical practitioners.

Emerging research and science in the personalized nutrition sector has led market players to develop genomic testing and gut health testing kits to provide individualized diets and pills to consumers based on their genomic and metabolic profiles. Start-ups, such as Nourished (UK), are developing innovative products, which include 3D-printed edibles. 3D-printed gummies are personalized daily nutrition snacks created through 3D printer technology. These gummy snacks are provided as nourishment recommendations by studying their proprietary algorithm’s response. 3D-printed personalized supplements are aimed at improving consumer-specific lifestyles and dietary habits. A range of technologies, from DNA-driven dietary recommendations to 3D-printed pills, are projected to offer numerous opportunities for the growth and expansion of the personalized nutrition market.

Restraints: High cost of personalized supplements

The price of a supplement might vary significantly based on the ingredients’ origin (synthetic or natural) and seasonality. Synthetic ingredients have lower production costs and eliminate the need to manage natural sources from which the functional principles are to be extracted. Synthetic raw materials, however, cannot match the quality of natural raw materials.

The bioavailability or seasonality of the raw materials in products is another factor that can influence the final cost of dietary supplements. Most natural ingredients are unavailable all year, or their prices may increase during certain months; these problems affect the cost of manufacturing a supplement. Moreover, third-party ingredient testing and certifications, like getting a product USP certified, almost certainly drive up the product price.

The packaging of various supplements of different forms in different packaging materials also increases the cost of personalized supplements offered by different companies. Moreover, the benefits of economies of scale are significantly reduced in personalized nutrition as buying one particular type of supplement is avoided by consumers and companies as well. Instead, a mix of different supplements in smaller quantities is used.

These high costs associated with personalized dietary supplements may affect their adoption, especially in price-sensitive countries such as South Africa and India.

Challenges: Presence of regulations in the personalized nutrition market

There are changing regulations and mandates regarding personalized nutrition. Changing standards of nutritional care have led to the formulation of these regulations. The US Food and Drug Administration (FDA) regulates the processing, manufacturing, and packaging of dietary supplements under the Federal Food, Drug, and Cosmetic Act (FFDCA) of 1938. Since the adoption of the FFDCA, dietary supplements have been regulated as food by the federal government.

The US Dietary Supplement Health and Education Act (DSHEA) established the regulatory framework for dietary supplements as foods through the FDA. The DSHEA defined the legal definition, labeling requirements, and process for dietary supplement adverse event reporting. The FDA also issued official recommendations on current Good Manufacturing Practices to ensure that supplement and ingredient manufacturing, packaging, labeling, and storage methods are documented and meet specifications to assure purity, composition, and strength. As per law, it is illegal to manufacture or market dietary supplement products that are adulterated or misbranded, and the FDA has the regulatory authority to remove such products from the marketplace.

In Canada, dietary supplements are regulated by the Natural and Non-Prescription Health Products Directorate (NNHPD) of Health Canada. All products and manufacturers must be licensed unless the products are created by healthcare practitioners who compound products on an individual basis for their patients or by retailers of natural health products (NHPs). Details must be provided on medicinal ingredients, source, dose, potency, nonmedicinal ingredients, and recommended use. The safety and efficacy of NHPs and their health claims must be supported by proper evidence so that consumers and Health Canada know that the products are safe and effective.

In Australia, although a food standard covers a limited number of these products, the majority are regulated as therapeutic goods under the Australian Therapeutic Goods Act. Regulations regarding vitamins and dietary supplements offered in South Africa ensure that all the products are registered and evaluated under SAHPRA.

The active measurement segment accounted for a larger share in the personalized nutrition market, by product type.

The active measurement segment is projected to be a leading segment due to the growing consumer awareness about personalized solutions through plans, kits, and apps. The segment’s growth is propelled by the increasing influence of digital health-related solutions in the personalized nutrition market. Many players in the personalized nutrition market offer nutritional supplements incorporated into individualized plans for customers. As consumers have become increasingly inclined toward personalized approaches, genomic testing kits for personalized nutrition are used to assist consumers with DNA-based diets. Changing lifestyle patterns have led adults to use apps for personalized nutrition.

The standard supplements segment is projected to account for a larger share during the forecast period, by application type.

By application, the standard supplements segment will account for a larger market share, followed by the disease-based segment. Standard supplements are dietary or nutritional supplements that are available in the form of capsules, liquids, powders, or tablets to maintain the balance of nutrients in the diet. Shifting consumer demands encourage health-enriching choices, which provide an opportunity to develop personalized solutions for addressing health issues. Consumers seek to obtain tailor-made solutions as a part of their daily routine. Standard supplements support in maintaining overall health and are not used to treat or prevent any targeted disease or disorder.

By end use, the direct-to-consumer segment is projected to hold the largest market share during the forecast period.

The direct-to-consumer segment is expected to hold the largest market share due to the changing preferences of consumers for nutrition-rich products available in the market to enhance their health. The growing trend of adopting keto, paleo, vegan, and plant-based diets has led to the increased use of personalized nutrition services such as apps and programs by households. Consumers are becoming aware of their body type and are curious about the available solutions. The adaptability among consumers for personalized nutrition and changing requirements are some of the major factors projected to drive the growth of the direct-to-customer segment in the personalized nutrition market.

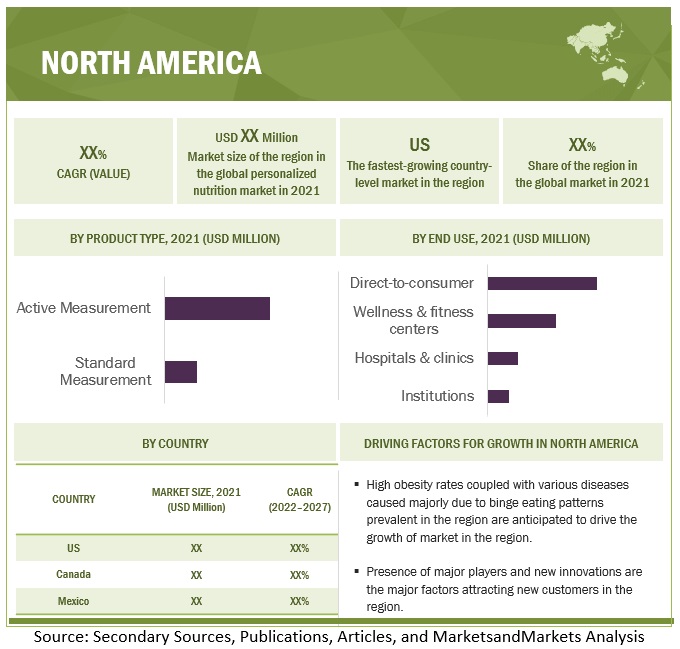

North America will account for the largest share in the personalized nutrition market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

North America is forecasted to be the largest in the personalized nutrition market during the forecast period, at more than half of the global market share. The market’s growth is attributed to the rise in health awareness among consumers, a shift in their preferences, high disposable income levels, a better understanding of health and fitness, and the presence of various emerging players in the personalized nutrition market in North America. The trend of genetic testing to obtain personalized recommendations on diet and nutrition using proprietary algorithms is also projected to drive the growth of the North American market. The US and Canada are the key markets for personalized nutrition in this region, while the personalized nutrition market in Mexico is witnessing steady growth.

Key Market Players:

Key players in the global personalized nutrition market include Amway (US), BASF (Germany), DSM (Netherlands), Herbalife Nutrition Ltd (US), DNAfit (UK), Care/of (US), Nutrigenomix (US), Zipongo (US), Viome (US), Habit (US), and Atlas Biomed Group Limited (UK). These players have broad industry coverage and high operational and financial strength.

Want to explore hidden markets that can drive new revenue in Personalized Nutrition Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Personalized Nutrition Market?

|

Report Metric |

Details |

|

Market valuation in 2022 |

USD 11.3 billion |

|

Financial outlook in 2027 |

USD 23.3 billion |

|

Progress rate |

CAGR of 15.5% |

|

Historical data |

2019-2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report coverage |

Revenue forecast, company ranking, driving factors, competitive landscape, and analysis |

|

Segments covered |

Product Type, Application, Form |

|

Regional scope |

Europe, North America, South America, Asia Pacific |

|

Prominent firms featured |

Amway (US), BASF (Germany), DSM (Netherlands), Herbalife Nutrition Ltd (US), DNAfit (UK), Care/of (US), Nutrigenomix (US), Zipongo (US), Viome (US), Habit (US), and Atlas Biomed Group Limited (UK) |

|

Leading determinants |

|

Target Audience:

- Supplement manufacturers

- Government and research organizations

- Personalized nutrition test kits distributors

- Marketing directors

- Key executives from various key companies and organizations in the personalized nutrition market

Report Segmentation

The market is primarily segmented based on source, type, application, nature, and region.

|

By Product Type |

By Application |

By End Use |

By Form |

By Region |

|

|

|

|

|

Recent Developments

- In August 2022, Herbalife Nutrition announced Herbalife One, a new digital transformation initiative centered around launching a single platform to create a simplified and integrated experience for distributors and their customers worldwide. It would help the company to increase its efficiency and productivity.

- In August 2022, Amway announced an investment in microbiome start-up Holzapfel Effective Microbes (HEM) as it pursues personalized probiotic supplement products. HEM uses Personalized Pharmaceutical Meta-Analytical Screening (PMAS) to determine how gut microbiota can be leveraged to impact human health and wellness. It would help the company to strengthen its position in the personalized nutrition market.

- In September 2021, BASF SE presented a comprehensive line-up of its health ingredients with a focus on vitamins, and carotenoids, including lutein and omega-3 oil, that relate to post-pandemic consumer trends.

- In July 2021, Wellness Coaches USA, LLC. expanded its capabilities in the digital healthcare sector following the strategic acquisition of Benovate, a next-generation digital health and wellness platform for the workplace. It would help the company to strengthen its position in the personalized nutrition market.

- In April 2021, DSM acquired Hologram Sciences (company), a consumer-facing company that will create brands that target various health conditions. The company will provide a holistic approach to health by combining health diagnostics, digital coaching, and personalized nutrition. It would help the company to increase its presence in the B2C personalized nutrition market.

Frequently Asked Questions (FAQ):

How big is the personalized nutrition market?

By 2027, the personalized nutrition market is projected to soar to $23.3 billion, showcasing a robust compound annual growth rate (CAGR) of 15.5%. This surge represents a substantial increase from its 2022 value of $11.3 billion.

Which players are involved in the manufacturing of the personalized nutrition market?

Key players in the global personalized nutrition market include Amway (US), BASF (Germany), DSM (Netherlands), Herbalife Nutrition Ltd (US), DNAfit (UK), Care/of (US), Nutrigenomix (US), Zipongo (US), Viome (US), Habit (US), and Atlas Biomed Group Limited (UK). These players have broad industry coverage and high operational and financial strength.

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for personalized nutrition market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 PERSONALIZED NUTRITION MARKET SEGMENTATION

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNITS CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 2 PERSONALIZED NUTRITION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 3 EXPERT INSIGHTS

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 PERSONALIZED NUTRITION MARKET SIZE ESTIMATION - METHOD 1

2.2.2 PERSONALIZED NUTRITION MARKET SIZE ESTIMATION - METHOD 2

2.2.3 PERSONALIZED NUTRITION MARKET SIZE ESTIMATION NOTES

2.3 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

TABLE 2 PERSONALIZED NUTRITION MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 5 PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 6 PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 7 PERSONALIZED NUTRITION MARKET, BY END USE, 2022 VS. 2027 (USD MILLION)

FIGURE 8 PERSONALIZED NUTRITION MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

FIGURE 9 PERSONALIZED NUTRITION MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PERSONALIZED NUTRITION MARKET

FIGURE 10 RISING DEMAND FOR PERSONALIZED NUTRITION DUE TO INCREASING DEMAND FOR PLANT-BASED FOOD

4.2 EUROPE: PERSONALIZED NUTRITION MARKET, BY END USE AND COUNTRY, 2021

FIGURE 11 DIRECT-TO-CONSUMER SEGMENT AND GERMANY ACCOUNTED FOR LARGEST SHARES IN EUROPE IN 2021

4.3 PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE

FIGURE 12 ACTIVE MEASUREMENT TO DOMINATE DURING FORECAST PERIOD

4.4 PERSONALIZED NUTRITION MARKET, BY END USE AND REGION

FIGURE 13 DIRECT-TO-CONSUMER AND NORTH AMERICA TO DOMINATE DURING FORECAST PERIOD

4.5 PERSONALIZED NUTRITION MARKET, BY APPLICATION

FIGURE 14 STANDARD SUPPLEMENTS TO DOMINATE DURING FORECAST PERIOD

4.6 PERSONALIZED NUTRITION MARKET, BY END USE

FIGURE 15 DIRECT-TO-CONSUMER TO DOMINATE DURING FORECAST PERIOD

4.7 PERSONALIZED NUTRITION MARKET, BY FORM

FIGURE 16 TABLETS TO DOMINATE DURING FORECAST PERIOD

4.8 PERSONALIZED NUTRITION MARKET SHARE, BY COUNTRY, 2021

FIGURE 17 US TO DOMINATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 PERSONALIZED NUTRITION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Shift in consumer preferences due to rise in health awareness

5.2.1.2 Rising geriatric population

FIGURE 19 AGING POPULATION IN JAPAN

FIGURE 20 BUSINESS MODEL OF NESTLE IN PERSONALIZED NUTRITION MARKET

5.2.1.3 Growing trend of digital healthcare

FIGURE 21 DIGITAL HEALTH TOOLS USED IN PERSONALIZED NUTRITION MARKET

5.2.1.4 Increasing obesity rates worldwide

5.2.2 RESTRAINTS

5.2.2.1 High cost of personalized testing and nutrition plans

5.2.2.2 High cost of personalized supplements

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing innovations and advancements in technologies

5.2.3.2 Collaborations and strategic partnerships present growth opportunities for manufacturers

5.2.3.3 Consumer awareness about micronutrient deficiencies

TABLE 3 FOODS THAT BOOST IMMUNE SYSTEM

TABLE 4 MICRONUTRIENT DEFICIENCY CONDITIONS AND THEIR WORLDWIDE PREVALENCE

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory policies

6 INDUSTRY TRENDS (Page No. - 70)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 22 PERSONALIZED NUTRITION: VALUE CHAIN ANALYSIS

6.2.1 SAMPLING

6.2.2 TESTING AND ASSESSMENT

6.2.3 INTERPRETATION & RECOMMENDATION

6.2.4 END USERS

6.3 PRICING ANALYSIS

TABLE 5 GLOBAL ASP: PRICING ANALYSIS OF PERSONALIZED NUTRITION, BY PRODUCT TYPE

TABLE 6 GLOBAL ASP: PRICING ANALYSIS OF PERSONALIZED NUTRITION, BY KEY PLAYER, FOR PRODUCT TYPE

FIGURE 23 PRICING AND COMPLEXITY OF OFFERINGS IN NEXT-GENERATION PERSONALIZED NUTRITION MARKET

6.4 ECOSYSTEM MAP

6.4.1 PERSONALIZED NUTRITION MARKET MAP

TABLE 7 PERSONALIZED NUTRITION MARKET ECOSYSTEM

6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS IN PERSONALIZED NUTRITION MARKET

FIGURE 24 REVENUE SHIFT FOR PERSONALIZED NUTRITION MARKET

6.6 TECHNOLOGY ANALYSIS

6.7 PATENT ANALYSIS

FIGURE 25 PATENTS GRANTED FOR PERSONALIZED NUTRITION MARKET, 2011–2021

FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED, 2011–2021

TABLE 8 KEY PATENTS PERTAINING TO PERSONALIZED NUTRITION MARKET, 2020–2021

6.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 PORTER’S FIVE FORCES ANALYSIS

6.8.1 DEGREE OF COMPETITION

6.8.2 BARGAINING POWER OF SUPPLIERS

6.8.3 BARGAINING POWER OF BUYERS

6.8.4 THREAT OF SUBSTITUTES

6.8.5 THREAT OF NEW ENTRANTS

6.9 CASE STUDIES

6.9.1 COMBINING AVA’S DIGITAL HEALTH PLATFORM WITH DSM’S EXPERTISE

6.9.2 WELLNESS COACHES USA, LLC. OFFERED NUTRITION SERVICES TO CORPORATE CLIENTS

6.10 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 10 DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING DIFFERENT PRODUCT TYPES

6.11.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR PERSONALIZED NUTRITION INDUSTRIAL FOOD APPLICATIONS

TABLE 12 KEY BUYING CRITERIA FOR PERSONALIZED NUTRITION INDUSTRIAL FOOD APPLICATIONS

7 KEY REGULATIONS FOR PERSONALIZED NUTRITION (Page No. - 85)

7.1 NORTH AMERICA

7.1.1 CANADA

7.1.2 US

7.1.3 MEXICO

7.1.4 EUROPEAN UNION REGULATIONS

7.1.4.1 Asia Pacific

7.1.4.1.1 China

7.1.4.1.2 India

7.1.4.1.3 Australia & New Zealand

7.2 TARIFF AND REGULATORY LANDSCAPE

7.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

8 PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE (Page No. - 91)

8.1 INTRODUCTION

FIGURE 28 PERSONALIZED NUTRITION MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 17 PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 18 PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

8.2 ACTIVE MEASUREMENT

8.2.1 GROWING AWARENESS ABOUT CUSTOMIZABLE NUTRITIONAL SOLUTIONS

TABLE 19 ACTIVE MEASUREMENT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 20 ACTIVE MEASUREMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 21 ACTIVE MEASUREMENT MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 22 ACTIVE MEASUREMENT MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

8.2.2 APPS

8.2.2.1 Busier lifestyles to drive demand for apps

8.2.3 TESTING KITS

8.2.3.1 Advancements in genetic profiling technologies to drive demand for testing kits

8.2.4 PROGRAMS

8.2.4.1 Increased preference for diet plans to drive demand for personalized programs

8.3 STANDARD MEASUREMENT

8.3.1 RISING HEALTH AWARENESS TO DRIVE DEMAND FOR STANDARD MEASUREMENT PLANS

TABLE 23 STANDARD MEASUREMENT MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 24 STANDARD MEASUREMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

9 PERSONALIZED NUTRITION MARKET, BY APPLICATION (Page No. - 99)

9.1 INTRODUCTION

FIGURE 29 PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 25 PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 26 PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 STANDARD SUPPLEMENTS

9.2.1 GROWING AWARENESS ABOUT NUTRITIONAL DEFICIENCY AND CUSTOMIZABLE SOLUTIONS

TABLE 27 STANDARD SUPPLEMENTS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 28 STANDARD SUPPLEMENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 STANDARD SUPPLEMENTS MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 30 STANDARD SUPPLEMENTS MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

9.2.2 HEALTH NUTRITION

9.2.2.1 Increasing awareness about healthier lifestyles to drive demand

9.2.3 SPORTS NUTRITION

9.2.3.1 Growing need for sports enthusiasts to improve athletic performance to drive demand

9.3 DISEASE-BASED

9.3.1 CHANGING LIFESTYLES AND CUSTOMIZED SOLUTIONS TO PREVENT DISEASES TO DRIVE GROWTH

TABLE 31 DISEASE-BASED MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 32 DISEASE-BASED MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 DISEASE-BASED MARKET, BY SUBTYPE, 2019–2021 (USD MILLION)

TABLE 34 DISEASE-BASED MARKET, BY SUBTYPE, 2022–2027 (USD MILLION)

9.3.2 LIFESTYLE

9.3.2.1 Dietary habits affecting consumer lifestyles to drive demand for personalized nutrition

9.3.3 INHERITED

9.3.3.1 Growing trend of genetic testing for personalized nutrition to drive market

10 PERSONALIZED NUTRITION MARKET, BY END USE (Page No. - 107)

10.1 INTRODUCTION

FIGURE 30 PERSONALIZED NUTRITION MARKET, BY END USE, 2022 VS. 2027 (USD MILLION)

TABLE 35 PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 36 PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

10.2 DIRECT-TO-CONSUMER

10.2.1 INCREASING DEMAND FOR NUTRITIONAL SUPPLEMENTS TO DRIVE GROWTH

TABLE 37 DIRECT-TO-CONSUMER MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 38 DIRECT-TO-CONSUMER MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 WELLNESS & FITNESS CENTERS

10.3.1 RISING HEALTH-CONSCIOUS POPULATION TO DRIVE DEMAND FOR PERSONALIZED NUTRITION

TABLE 39 WELLNESS & FITNESS CENTERS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 40 WELLNESS & FITNESS CENTERS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 HOSPITALS & CLINICS

10.4.1 PREVENTIVE HEALTHCARE IN HOSPITALS AND CLINICS TO DRIVE MARKET

TABLE 41 HOSPITALS & CLINICS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 42 HOSPITALS & CLINICS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 INSTITUTIONS

10.5.1 GROWING DEMAND FOR PERSONALIZED PROGRAMS TO IMPROVE EFFICIENCY AND PRODUCTIVITY OF INDIVIDUALS

TABLE 43 INSTITUTIONS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 44 INSTITUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

11 PERSONALIZED NUTRITION MARKET, BY FORM (Page No. - 114)

11.1 INTRODUCTION

FIGURE 31 PERSONALIZED NUTRITION MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

TABLE 45 PERSONALIZED NUTRITION MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 46 PERSONALIZED NUTRITION MARKET, BY FORM, 2022–2027 (USD MILLION)

11.2 TABLETS

11.2.1 LONGEVITY OF TABLETS TO DRIVE MARKET

TABLE 47 PERSONALIZED NUTRITION MARKET FOR TABLETS, BY REGION, 2019–2021 (USD MILLION)

TABLE 48 PERSONALIZED NUTRITION MARKET FOR TABLETS, BY REGION, 2022–2027 (USD MILLION)

11.3 CAPSULES

11.3.1 RAPID ABSORPTION OF NUTRIENTS THROUGH CAPSULES

TABLE 49 PERSONALIZED NUTRITION MARKET FOR CAPSULES, BY REGION, 2019–2021 (USD MILLION)

TABLE 50 PERSONALIZED NUTRITION MARKET FOR CAPSULES, BY REGION, 2022–2027 (USD MILLION)

11.4 LIQUIDS

11.4.1 HIGH ABSORPTION OF LIQUIDS TO PROPEL MARKET GROWTH

TABLE 51 PERSONALIZED NUTRITION MARKET FOR LIQUIDS, BY REGION, 2019–2021 (USD MILLION)

TABLE 52 PERSONALIZED NUTRITION MARKET FOR LIQUIDS, BY REGION, 2022–2027 (USD MILLION)

11.5 POWDERS

11.5.1 EASY RELEASE OF ACTIVE INGREDIENTS TO DRIVE USAGE OF POWDER FORM

TABLE 53 PERSONALIZED NUTRITION MARKET FOR POWDERS, BY REGION, 2019–2021 (USD MILLION)

TABLE 54 PERSONALIZED NUTRITION MARKET FOR POWDERS, BY REGION, 2022–2027 (USD MILLION)

11.6 OTHER FORMS

11.6.1 RELATIVELY LOW COST OF SOFT GELS TO DRIVE MARKET

TABLE 55 PERSONALIZED NUTRITION MARKET FOR OTHER FORMS, BY REGION, 2019–2021 (USD MILLION)

TABLE 56 PERSONALIZED NUTRITION MARKET FOR OTHER FORMS, BY REGION, 2022–2027 (USD MILLION)

12 PERSONALIZED NUTRITION MARKET, BY REGION (Page No. - 123)

12.1 INTRODUCTION

FIGURE 32 PERSONALIZED NUTRITION MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

FIGURE 33 CHINA TO WITNESS SIGNIFICANT GROWTH (2022–2027)

TABLE 57 PERSONALIZED NUTRITION MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 58 PERSONALIZED NUTRITION MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: PERSONALIZED NUTRITION MARKET SNAPSHOT

TABLE 59 NORTH AMERICA: PERSONALIZED NUTRITION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 60 NORTH AMERICA: PERSONALIZED NUTRITION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 62 NORTH AMERICA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 66 NORTH AMERICA: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: PERSONALIZED NUTRITION MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: PERSONALIZED NUTRITION MARKET, BY FORM, 2022–2027 (USD MILLION)

12.2.1 US

12.2.1.1 Presence of emerging players to create growth opportunities

TABLE 69 US: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 70 US: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 71 US: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 72 US: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 73 US: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 74 US: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Regulations regarding nutritional products to be potential challenge

TABLE 75 CANADA: CRUDE INCIDENCE RATES PER 100,000 PEOPLE AGED 65 YEARS AND OLDER

TABLE 76 CANADA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 77 CANADA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 78 CANADA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 79 CANADA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 80 CANADA: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 81 CANADA: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Low dietary intake among consumers to create growth opportunities for key players

TABLE 82 MEXICO: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 83 MEXICO: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 84 MEXICO: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 85 MEXICO: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 86 MEXICO: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 87 MEXICO: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.3 EUROPE

TABLE 88 EUROPE: PERSONALIZED NUTRITION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 89 EUROPE: PERSONALIZED NUTRITION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 91 EUROPE: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 93 EUROPE: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 95 EUROPE: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: PERSONALIZED NUTRITION MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 97 EUROPE: PERSONALIZED NUTRITION MARKET, BY FORM, 2022–2027 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Aging population to drive demand for personalized solutions

TABLE 98 GERMANY: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 99 GERMANY: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 100 GERMANY: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 101 GERMANY: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 102 GERMANY: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 103 GERMANY: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.3.2 FRANCE

12.3.2.1 Increasing trend of adopting high-nutrition diets to drive market growth

FIGURE 35 HEALTHCARE EXPENDITURE, 2019

TABLE 104 FRANCE: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 105 FRANCE: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 106 FRANCE: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 107 FRANCE: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 108 FRANCE: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 109 FRANCE: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.3.3 UK

12.3.3.1 Increasing health consciousness among consumers to drive growth

TABLE 110 UK: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 111 UK: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 112 UK: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 113 UK: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 114 UK: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 115 UK: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.3.4 ITALY

12.3.4.1 Growing inclination of consumers toward sports nutrition to positively impact Italian market

TABLE 116 ITALY: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 117 ITALY: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 118 ITALY: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 119 ITALY: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 120 ITALY: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 121 ITALY: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.3.5 SPAIN

12.3.5.1 Growing interest in maintaining healthy lifestyle to drive market

TABLE 122 SPAIN: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 123 SPAIN: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 124 SPAIN: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 125 SPAIN: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 126 SPAIN: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 127 SPAIN: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.3.6 REST OF EUROPE

12.3.6.1 Increasing premiumization trend to drive demand for customized solutions

TABLE 128 REST OF EUROPE: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 129 REST OF EUROPE: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 130 REST OF EUROPE: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 131 REST OF EUROPE: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 132 REST OF EUROPE: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 133 REST OF EUROPE: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET SNAPSHOT

TABLE 134 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 135 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 136 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 137 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 139 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 140 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 141 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 143 ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY FORM, 2022–2027 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Health-related concerns in China to drive personalized nutrition market

TABLE 144 CHINA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 145 CHINA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 146 CHINA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 147 CHINA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 148 CHINA: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 149 CHINA: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Aging population to drive demand for personalized nutrition

TABLE 150 JAPAN: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 151 JAPAN: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 152 JAPAN: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 153 JAPAN: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 154 JAPAN: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 155 JAPAN: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.4.3 SOUTH KOREA

12.4.3.1 Favorable government initiatives and regulations to support market growth

TABLE 156 SOUTH KOREA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 157 SOUTH KOREA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 158 SOUTH KOREA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 159 SOUTH KOREA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 160 SOUTH KOREA: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 161 SOUTH KOREA: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.4.4 AUSTRALIA

12.4.4.1 Growing health concerns among individuals to drive demand for personalized solutions

TABLE 162 AUSTRALIA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 163 AUSTRALIA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 164 AUSTRALIA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 165 AUSTRALIA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 166 AUSTRALIA: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 167 AUSTRALIA: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.4.5 INDIA

12.4.5.1 Millennials to play important role in driving demand for personalized nutrition

TABLE 168 INDIA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 169 INDIA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 170 INDIA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 171 INDIA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 172 INDIA: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 173 INDIA: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

12.4.6.1 Increasing consumer preferences for health-enriching alternatives to drive market

TABLE 174 REST OF ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 175 REST OF ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 177 REST OF ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 178 REST OF ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 179 REST OF ASIA PACIFIC: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.5 REST OF THE WORLD

TABLE 180 ROW: PERSONALIZED NUTRITION MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 181 ROW: PERSONALIZED NUTRITION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 182 ROW: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 183 ROW: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 184 ROW: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 185 ROW: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 186 ROW: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 187 ROW: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 188 ROW: PERSONALIZED NUTRITION MARKET, BY FORM, 2019–2021 (USD MILLION)

TABLE 189 ROW: PERSONALIZED NUTRITION MARKET, BY FORM, 2022–2027 (USD MILLION)

12.5.1 SOUTH AMERICA

12.5.1.1 Prevalence of chronic diseases leading to shift in consumer preferences for personalized products

TABLE 190 SOUTH AMERICA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 191 SOUTH AMERICA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 192 SOUTH AMERICA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 193 SOUTH AMERICA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 194 SOUTH AMERICA: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 195 SOUTH AMERICA: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.5.2 MIDDLE EAST

12.5.2.1 Growing lifestyle-related concerns to drive demand for personalized nutrition programs

FIGURE 37 OBESITY RATES IN MIDDLE EAST

TABLE 196 MIDDLE EAST: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 197 MIDDLE EAST: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 198 MIDDLE EAST: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 199 MIDDLE EAST: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 200 MIDDLE EAST: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 201 MIDDLE EAST: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

12.5.3 AFRICA

12.5.3.1 Low nutrition levels among consumers to present growth opportunities for personalized nutrition

TABLE 202 AFRICA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2019–2021 (USD MILLION)

TABLE 203 AFRICA: PERSONALIZED NUTRITION MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 204 AFRICA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 205 AFRICA: PERSONALIZED NUTRITION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 206 AFRICA: PERSONALIZED NUTRITION MARKET, BY END USE, 2019–2021 (USD MILLION)

TABLE 207 AFRICA: PERSONALIZED NUTRITION MARKET, BY END USE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 179)

13.1 OVERVIEW

13.2 MARKET SHARE ANALYSIS, 2O21

FIGURE 38 MARKET SHARE, 2021

13.3 STRATEGIES ADOPTED BY KEY PLAYERS

13.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

FIGURE 39 TOTAL REVENUE ANALYSIS OF KEY PLAYERS, 2019–2021 (USD BILLION)

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 40 PERSONALIZED NUTRITION MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

13.6 PRODUCT FOOTPRINT

TABLE 208 KEY PLAYERS’ FOOTPRINT, BY PRODUCT TYPE

TABLE 209 KEY PLAYERS’ PRODUCT FOOTPRINT, BY APPLICATION

TABLE 210 KEY PLAYERS’ PRODUCT FOOTPRINT, BY REGION

TABLE 211 KEY PLAYERS’ OVERALL FOOTPRINT

13.7 STARTUP/SME EVALUATION QUADRANT (OTHER PLAYERS)

13.7.1 PROGRESSIVE COMPANIES

13.7.2 STARTING BLOCKS

13.7.3 RESPONSIVE COMPANIES

13.7.4 DYNAMIC COMPANIES

TABLE 212 PERSONALIZED NUTRITION: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

FIGURE 41 PERSONALIZED NUTRITION MARKET: COMPANY EVALUATION QUADRANT, 2020 (OTHER PLAYERS)

13.8 PRODUCT FOOTPRINT

TABLE 213 OTHER PLAYERS’ FOOTPRINT, BY PRODUCT TYPE

TABLE 214 OTHER PLAYERS’ PRODUCT FOOTPRINT, BY APPLICATION

TABLE 215 OTHER PLAYERS’ PRODUCT FOOTPRINT, BY REGION

TABLE 216 OTHER PLAYERS’ OVERALL FOOTPRINT

13.9 COMPETITIVE SCENARIO

13.9.1 PRODUCT LAUNCHES

TABLE 217 PERSONALIZED NUTRITION MARKET: PRODUCT LAUNCHES, 2019–2022

13.9.2 DEALS

TABLE 218 PERSONALIZED NUTRITION MARKET: DEALS, 2019–2022

13.9.3 OTHERS

TABLE 219 PERSONALIZED NUTRITION MARKET: EXPANSIONS, 2019 - 2022

14 COMPANY PROFILES (Page No. - 199)

(Business overview, Products offered, Recent Developments, Right to win)*

14.1 COMPANIES WITH TECH PARTNERSHIPS

14.1.1 BASF SE

TABLE 220 BASF SE: BUSINESS OVERVIEW

FIGURE 42 BASF SE: COMPANY SNAPSHOT

TABLE 221 BASF SE: PRODUCT LAUNCHES

TABLE 222 BASF SE: DEALS

TABLE 223 BASF SE: OTHERS

14.1.2 DSM

TABLE 224 DSM: BUSINESS OVERVIEW

FIGURE 43 DSM: COMPANY SNAPSHOT

TABLE 225 DSM: DEALS

TABLE 226 DSM: OTHERS

14.2 COMPANIES WITH TECH CAPABILITIES

14.2.1 HERBALIFE NUTRITION LTD.

TABLE 227 HERBALIFE NUTRITION LTD.: BUSINESS OVERVIEW

FIGURE 44 HERBALIFE NUTRITION: COMPANY SNAPSHOT

TABLE 228 HERBALIFE NUTRITION LTD.: PRODUCT LAUNCHES

TABLE 229 HERBALIFE NUTRITION LTD.: OTHERS

14.2.2 AMWAY

TABLE 230 AMWAY: BUSINESS OVERVIEW

FIGURE 45 AMWAY: COMPANY SNAPSHOT

TABLE 231 AMWAY: DEALS

TABLE 232 AMWAY: OTHERS

14.2.3 DNAFIT

TABLE 233 DNAFIT: BUSINESS OVERVIEW

TABLE 234 DNAFIT: PRODUCT LAUNCHES

TABLE 235 DNAFIT: DEALS

TABLE 236 DNAFIT: OTHERS

14.2.4 WELLNESS COACHES USA, LLC.

TABLE 237 WELLNESS COACHES USA, LLC.: BUSINESS OVERVIEW

TABLE 238 WELLNESS COACHES USA, LLC.: PRODUCT LAUNCHES

TABLE 239 WELLNESS COACHES USA, LLC.: DEALS

14.2.5 ATLAS BIOMED GROUP LIMITED

TABLE 240 ATLAS BIOMED GROUP LIMITED: BUSINESS OVERVIEW

TABLE 241 ATLAS BIOMED GROUP LIMITED: PRODUCT LAUNCHES

TABLE 242 ATLAS BIOMED GROUP LIMITED: DEALS

TABLE 243 ATLAS BIOMED GROUP LIMITED: OTHERS

14.2.6 CARE/OF

TABLE 244 CARE/OF: BUSINESS OVERVIEW

TABLE 245 CARE/OF: PRODUCT LAUNCHES

14.2.7 VIOME LIFE SCIENCES, INC.

TABLE 246 VIOME LIFE SCIENCES, INC.: BUSINESS OVERVIEW

TABLE 247 VIOME LIFE SCIENCES, INC.: PRODUCT LAUNCHES

TABLE 248 VIOME LIFE SCIENCES, INC.: DEALS

14.2.8 PERSONA NUTRITION

TABLE 249 PERSONA NUTRITION: BUSINESS OVERVIEW

TABLE 250 PERSONA NUTRITION: PRODUCT LAUNCHES

TABLE 251 PERSONA NUTRITION: DEALS

14.2.9 BALCHEM CORPORATION

TABLE 252 BALCHEM CORPORATION: BUSINESS OVERVIEW

FIGURE 46 BALCHEM CORPORATION: COMPANY SNAPSHOT

TABLE 253 BALCHEM CORPORATION: DEALS

14.2.10 ZIPONGO, INC.

TABLE 254 ZIPONGO, INC.: BUSINESS OVERVIEW

14.2.11 DNALYSIS

TABLE 255 DNALYSIS: BUSINESS OVERVIEW

14.2.12 WELOCITY GENETICS PVT LTD.

TABLE 256 WELOCITY GENETICS PVT LTD.: BUSINESS OVERVIEW

14.2.13 DAYTWO INC.

TABLE 257 DAYTWO INC.: BUSINESS OVERVIEW

TABLE 258 DAYTWO INC.: OTHERS

14.2.14 MINDBODYGREEN LLC.

TABLE 259 MINDBODYGREEN LLC.: BUSINESS OVERVIEW

14.2.15 BIOGENIQ INC.

TABLE 260 BIOGENIQ INC.: BUSINESS OVERVIEW

14.2.16 HELIX

14.2.17 SEGTERRA, INC.

14.2.18 METAGENICS, INC.

14.2.19 BAZE

14.2.20 GX SCIENCES, INC.

14.2.21 NUTRIGENOMIX

*Details on Business overview, Products offered, Recent Developments, Right to win might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 250)

15.1 INTRODUCTION

TABLE 261 ADJACENT MARKETS TO PERSONALIZED NUTRITION

15.2 LIMITATIONS

15.3 DIETARY SUPPLEMENTS MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 262 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 263 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4 NUTRACEUTICAL PRODUCTS MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

TABLE 264 NUTRACEUTICAL PRODUCTS MARKET, BY TYPE, 2017–2025 (USD BILLION)

15.5 NUTRACEUTICAL EXCIPIENTS MARKET

15.5.1 MARKET DEFINITION

15.5.2 MARKET OVERVIEW

TABLE 265 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2018–2025 (USD MILLION)

TABLE 266 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2018–2025 (KT)

16 APPENDIX (Page No. - 255)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL:

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities in estimating the personalized nutrition market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders in the supply chain, including food & beverage manufacturers, suppliers, importers and exporters, and intermediary suppliers such as traders and distributors of personalized nutrition products. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include personalized nutrition supplement manufacturers, test service and kit providers, exporters, and importers. The primary sources from the demand side include hospitals, clinics, institutions, and end consumers.

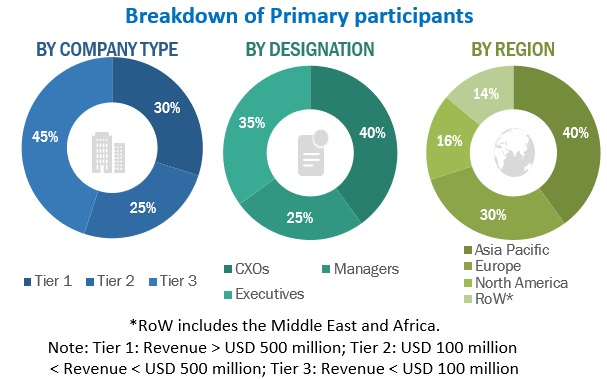

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the personalized nutrition market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the personalized nutrition market, in terms of value, were determined through primary and secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To describe and forecast the personalized nutrition market, in terms of product type, application, end use, form, and region

- To describe and forecast the personalized nutrition market, in terms of value, by region–North America, Europe, Asia Pacific, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the personalized nutrition market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the personalized nutrition market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze the strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in the personalized nutrition market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations for reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific personalized nutrition market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Personalized Nutrition Market