Parcel Sortation System Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Activated Roller Belt Sorters, Pop Up Sorters, Shoe Sorters, Cross Belt Sorters, Tilt Tray Sorters), Offering (Hardware, Software, Services), Application (Logistics, E-commerce) - Global Forecast to 2028

Updated on : October 22, 2024

Parcel Sortation System Market Size

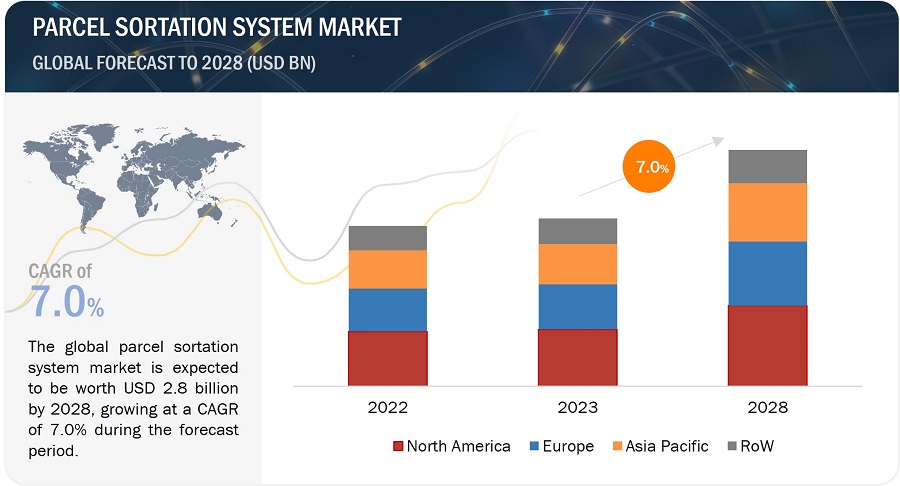

[236 Pages Report] The global Parcel Sortation System Market Size is estimated to be worth USD 2.0 Billion in 2023 and is projected to reach USD 2.8 Billion by 2028, growing at a CAGR of 7.0% during the forecast period 2023 to 2028

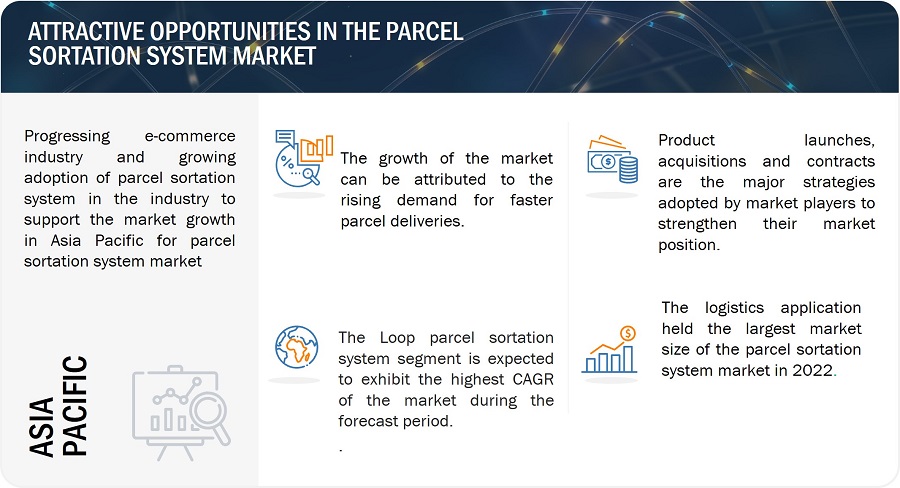

The market is expanding due to several factors. Significantly growing e-commerce industry and growing adoption of parcel sortation system in industry, labor cost inflation and increase in industrial automation. Additionally, rising demand for faster delivery is driving the growth of the market.

Parcel Sortation System Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Parcel Sortation System Market Trends

Driver: Thriving e-commerce industry and growing adoption of parcel sortation system in the industry

E-commerce refers to the buying and selling of products and services over the internet, and it has experienced explosive growth in recent years. The demand for e-commerce is increasing worldwide. This is driving the parcel sortation systems market growth as there is an increasing need to sort and deliver a greater number of parcels. This growth can be attributed to various factors, including the increasing convenience and accessibility of online shopping, improved logistics and shipping networks, and a shift in consumer preferences towards digital platforms. According to the US Department of Commerce, e-commerce sales as a percentage of the total retail sales in the US have increased from USD 503.3 billion in 2019 to USD 856.8 billion in 2022, contributing 9% and 11.2%, respectively.

Restraint: Higher costs related to deployment and maintenance of parcel sortation systems

The expenses related to parcel sortation systems broadly include the initial capital expenditure for purchasing the sorting equipment, installation costs, ongoing maintenance, repairs, and upgrades. The set up and installation of parcel sortation systems requires high capital expenditure as it involves the installation of conveyors, actuators, and belts, among others. These costs can burden budgets and make it difficult for firms to justify the investment, especially for smaller organisations or those with limited resources. Depending on the sorting capacity of the overall system, the installation project cost can reach up to USD 2–5 million. The high costs discourage several midsized and small end users that opt for traditional/manual parcels sorting systems; this affects the overall demand for parcel sortation systems. Several companies abstain from investing in parcel sorting systems due to high initial investments and a long payback period.

Opportunity: Integration of emerging technologies like AI, Industry 4.0, IoT, with sorting systems

The evolution of traditional warehouses into smart, connected, and more efficient automated warehouses through integrating Industry 4.0 has provided huge growth opportunities for the companies in the parcel sortation systems market. The deployment of Industry 4.0-based systems creates an operational environment with optimal output through integrating, automating, and managing the logistic movement of goods inside a warehouse, a distribution center, or a fulfillment center. The increasing adoption of Industry 4.0-based systems necessitates transitioning traditional or manual ways of all operations in a supply chain, such as sorting, picking, and transporting, toward automation. This is expected to boost the adoption of parcel sortation systems.

The increasing adoption of Internet of Things (IoT) systems in the field of warehouse management and logistics is another trend expected to revolutionize manufacturing operations. IoT devices, along with radio-frequency identification (RFID) and sensors, offer several benefits in terms of reduced labor costs, increased shipment accuracy and operation speed, improved tracking, and enhanced visibility for retailers, among others. Moreover, Incorporating AI algorithms into parcel sortation systems can enable intelligent decision-making skills. The modular architecture of Industry 4.0 and IoT systems enables simple scaling, allowing greater package volumes and seamlessly expanding operations.

Challenge: Real-time technical issues during sortation

Real-time technical challenges related to any sensing element in a parcel sorting system could disrupt the entire sorting process. For instance, if the camera or sensor installed in a parcel sortation system is not able to read a barcode properly, it would not be able to react effectively to a given command. Camera or sensor failure can also lead to the halting of the process, resulting in a delay in the entire production process. Mechanical failure may also be the consequence of improper maintenance; it may cause decreased production and poor performance. Parcel sortation systems are designed to handle standard package sizes and shapes. However, irregularly shaped, or damaged parcels can pose challenges during sorting. Moreover, any fault in the control software may lead to the improper functioning of the parcel sortation system. Sorting errors can arise when parcels are routed incorrectly or directed to the wrong destination. This might occur as a result of technical flaws in the sorting mechanism, misalignment of diverters or conveyors, or faulty sensors that detect package qualities.

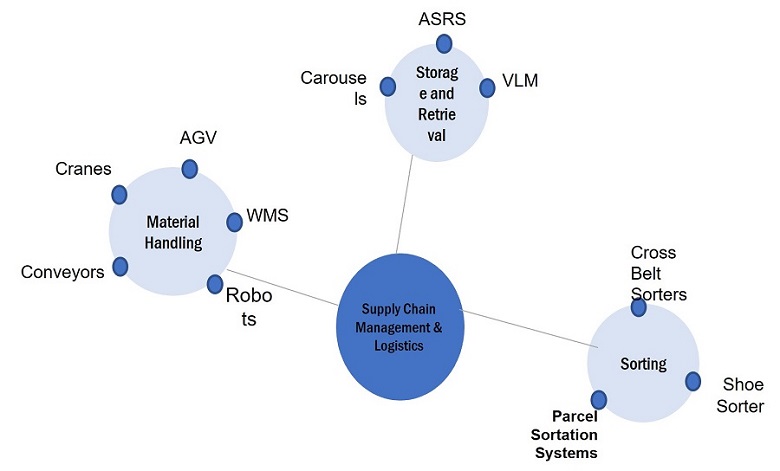

Parcel Sortation System Market Ecosystem

Parcel Sortation System Market Share

Vanderlande,Beumer Group, Honeywell International, Bastian Solutions, and Fives are the top players in the parcel sortation system market share. These parcel sortation system companies boast sortation technology trends with a comprehensive product portfolio and solid geographic footprint.

Loop parcel sortation system to grow with highest CAGR during the forecast period 2023-2028.

Loop or circular parcel sorters are used to sort parcels or cartons in facilities with space constraints or challenging layouts. These sorters can handle tight-radius curves as well as inclines and declines, thereby maximizing space utilization. Parcel induction points and sortation destinations can be arranged in several ways enabling users to utilize space better and achieve optimal sortation system performance. Moreover,the Loop Parcel Sortation System can seamlessly integrate with existing warehouse management systems, allowing for streamlined operations and real-time tracking of parcels. This integration enables efficient inventory management, order fulfillment, and enhanced visibility throughout the supply chain.

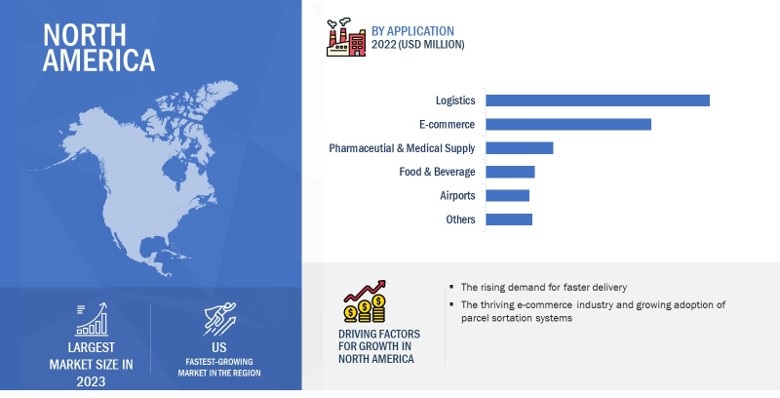

Logistics application of parcel sortation system to account for the largest share in the market during forecast period.

The rising demand for faster delivery is a key driver for the expansion of the Logistics application market. Logistics companies are facing challenges in terms of delivery of parcels, such as increasing volume of parcels or cartons, growing pressure to meet service level demands, shorter order delivery time, smaller orders, and rising need to provide accuracy in terms of order delivery. These all challenges can be resolved by adoptiong the parcel sortation systems. These systems ensure precise and effective parcel routing by automating the sorting procedure. They identify and sort parcels according to their destination, size, weight, or other specifications by scanning barcodes or using cutting-edge technology like optical character recognition. These companies use parcel sortation systems to expedite the delivery of parcels to their respective destinations while maintaining a high level of customer service.

Software segment to grow with a highest CAGR in the market during forecast period

Software in a parcel sortation system is used for analyzing the data about a parcel’s parameters generated via sensors and cameras. It is also used to make logical reasoning to sort packages and forward them to their respective destinations, through diverters and conveyor systems, It enables automation, tracking, and coordination of various components within the system, ensuring smooth package flow, accurate sorting, and real-time monitoring. Earlier, companies used historical data for decision making and sorting; however, with the adoption of Industry 4.0 and IoT applications, a large volume of data is generated to make decisions through the software installed in the parcel sortation systems.

Parcel Sortation System Market Regional Analysis

North America held the largest share of the parcel sortation system market in 2022.

The parcel sortation industry in North America is a rapidly growing market for the logistics and e-commerce industries. North America, comprising countries like the US and Canada, has a robust and highly developed logistics infrastructure, propelling the demand for efficient parcel sortation systems. North America also has a thriving logistics industry driven by critical factors such as extensive supply chains and warehousing and distribution networks. Parcel sortation systems play a crucial role in optimizing the flow of packages through these complex logistics networks and ensuring accurate and timely deliveries.

Parcel Sortation System Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Parcel Sortation System Companies: Key players

The major companies in the parcel sortation system market include

- Vanderlande (Netherlands),

- Beumer Group (Germany),

- Honeywell International (US), and

- Bastian Solutions (US),

- Fives (France). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the parcel sortation system companies.

Parcel Sortation System Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 2.0 Billion |

|

Projected Market Size in 2028 |

USD 2.8 Billion |

|

Growth Rate |

CAGR of 7.0% |

|

Years Considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Offering, Type, and Application |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Vanderlande (Netherlands), Beumer Group (Germany), Honeywell International (US), and Bastian Solutions (US), Fives (France). |

Parcel Sortation System Market Size Highlights

In this report, the overall parcel sortation system market size has been segmented based on offering, type, application, and region.

|

Segment |

Subsegment |

|

Parcel Sortation System Market Size , By Offering |

|

|

Parcel Sortation System Market Size, By Type |

|

|

Parcel Sortation System Market Size, By Application |

|

|

By Region |

|

Recent Developments in Parcel Sortation System Industry

- In March 2022, Vanderlande has announce a new automated piece picking robot as an addition to its smart item robotics (SIR) portfolio of technologies, which fits with Vanderlande’s strategy of accelerating the use of robotics for warehousing.

- In December 2021, Beumer Group has introduced a new type of small- and medium sized parcels sortation system into operation.

- In May 2021, Fives launched website for Smart Automation Solution. The new site, which replaces the previous Automation and Intralogistics pages, emphasises the Division's capacity to deliver a comprehensive offering for all markets.

Frequently Asked Questions (FAQ):

What is the market size for parcel sortation system market expected in next 5 years?

The parcel sortation system market is estimated to be worth USD 2.0 billion in 2023 and is projected to reach USD 2.8 billion by 2028, at a CAGR of 7.0% during the forecast period. The growth of the battery energy storage system market is primarily driven by the Thriving e-commerce industry and growing adoption of parcel sortation system in industry, and labor cost inflation and increase in industrial automation.

Who are the global parcel sortation storage system market winners?

Companies such as Vanderlande, Beumer Group, Honeywell International, and Bastian Solutions, Fives fall under the winners’ category.

Which region is expected to hold the highest share of the parcel sortation storage system market?

North America is expected to dominate the parcel sortation storage system market in 2023. The market growth in North America can be attributed to the presence of major logistics and e-commerce companies in the region. The growth of the parcel sortation system market in the US can be attributed to the large industrial base particularly for logistics, e-commerce, airports, pharmaceutical & medical supply, and food & beverage. Also, it can be attributed to the expectations of the customers for fast and efficient delivery. Factors such as integration of Industry 4.0 and IoT with warehouse distribution systems are expected to boost the demand for parcel sortation systems in the country.

What are the major drivers and opportunities related to the parcel sortation system market?

Thriving e-commerce industry and growing adoption of parcel sortation system in industry and unfolding the new application areas of parcel sortation system are some of the major drivers and opportunities for the parcel sortation system market.

What are the major strategies adopted by parsel sortation system companies?

The companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the parcel sortation system market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Labor cost inflation and increase in industrial automation- Thriving e-commerce industry and subsequent rise in adoption of parcel sortation systems- Rising demand for faster parcel deliveryRESTRAINTS- High costs related to deployment and maintenance of parcel sortation systemsOPPORTUNITIES- Emerging application areas of parcel sorting systems- Integration of emerging technologies, such as AI, Industry 4.0, and IoT, with sorting systemsCHALLENGES- Real-time technical issues during sortation- Requirement for high initial investments

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PORTER’S FIVE FORCES ANALYSIS

- 5.7 CASE STUDY ANALYSIS

-

5.8 TECHNOLOGY ANALYSISPREDICTIVE ANALYTICSINTERNET OF THINGSINDUSTRY 4.0MACHINE LEARNING

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) TRENDPRICING ANALYSIS OF PRODUCTS OFFERED BY KEY PLAYERS

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.12 KEY CONFERENCES AND EVENTS, 2022–2025

-

5.13 PATENT ANALYSIS

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS AND REGULATIONS RELATED TO PARCEL SORTATION SYSTEM MARKETSAFETY STANDARDS FOR PARCEL SORTATION SYSTEMS

- 6.1 INTRODUCTION

- 6.2 AUTOMATION AND ROBOTICS

- 6.3 MODULAR AND SCALABLE SYSTEMS

- 6.4 REAL-TIME TRACKING AND TRACEABILITY

- 6.5 INTEGRATION WITH LAST-MILE DELIVERY

- 6.6 SUSTAINABLE SOLUTIONS

- 6.7 ARTIFICIAL INTELLIGENCE (AI) OPTIMIZATION

- 7.1 INTRODUCTION

-

7.2 HARDWAREPROCESSORS- Help in data processing and coordination of componentsCAMERAS- Used to capture images of parcels from different anglesSENSORS- Used to extract information about parcels and make decisions based on that dataDIVERTERS- Separate single parcel from streams of parcelsOTHERS

-

7.3 SOFTWAREMAKES DECISIONS BY ANALYZING COLLECTED DATA

-

7.4 SERVICESINCLUDE MAINTENANCE AND UPGRADES

- 8.1 INTRODUCTION

-

8.2 LINEAR PARCEL SORTATION SYSTEMSACTIVATED ROLLER BELT SORTERS- Ideal for installation at warehouses with space constraintsPOP UP SORTERS- Ensure safe handling of delicate itemsSHOE SORTERS- Used to sort fragile products that require smooth, gentle movementPADDLE SORTERS- Ideal for difficult-to-sort parcelsPUSHER SORTERS- Ideal for applications in warehouses with space constraintsOTHERS

-

8.3 LOOP PARCEL SORTATION SYSTEMSCROSS BELT SORTERS- Versatile and efficient solutions for parcel sortingFLAT SORTERS- Used for parcel sorting applications by mid-sized and small end usersTILT TRAY SORTERS- Easy-to-use sortation systems used in small warehouses and distribution centers

- 8.4 OTHERS

- 9.1 INTRODUCTION

-

9.2 LOGISTICSCOURIER- Courier companies prime end users of parcel sortation systemsFREIGHT FORWARDING- Parcel sortation systems used by freight forwarding companies to distribute goods and products effectivelyPOSTAL SERVICES- Substantial adoption of parcel sortation systems in postal services to handle increasing volume of parcelsSTORAGE AND WAREHOUSING- Use parcel sortation systems to streamline operations and expedite delivery process

-

9.3 E-COMMERCERAPID GROWTH OF E-COMMERCE INDUSTRY TO SUPPORT MARKET GROWTH

-

9.4 AIRPORTSRISING AIR CARGO TRANSPORTATION TO DRIVE MARKET

-

9.5 PHARMACEUTICAL AND MEDICAL SUPPLYACTIVE PHARMACEUTICAL INGREDIENT SUPPLIERS- Use parcel sortation systems to improve efficiency in API manufacturingDRUG MANUFACTURERS- Use parcel sortation systems to speed up drug distributionDISTRIBUTORS- Accelerate pharmaceutical and medical supplies with parcel sortation systems

-

9.6 FOOD & BEVERAGEUNPROCESSED OR MINIMALLY PROCESSED FOOD- Parcel sortation systems used to optimize supply chain of unprocessed or minimally processed food itemsPROCESSED FOOD- Parcel sortation systems used to examine and sort eatables before dispatch

- 9.7 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Thriving e-commerce and logistics industries to drive marketCANADA- Presence of logistics and e-commerce companies to favor market growthMEXICO- Entry of prominent logistics and food and beverage companies to create opportunities for market players

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Rising demand from e-commerce industry to support market growthUK- Growing adoption of automation solutions in warehouses to create conducive environment for market growthFRANCE- Increasing adoption of AI and Industry 4.0 in industrial sector to support market growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Growing e-commerce industry and presence of key market players to drive marketSOUTH KOREA- Growing number of pharmaceutical and medical supply, food & beverage, and logistics companies to drive marketJAPAN- Presence of prominent parcel sortation system providers to boost marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)SOUTH AMERICA- Automation of food processing facilities to induce demand for parcel sortation systemsMIDDLE EAST- Saudi Arabia- UAE- Rest of Middle EastAFRICA- High focus on warehouse automation to accelerate market growth

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS OF TOP COMPANIES

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 PARCEL SORTATION SYSTEM MARKET: COMPANY FOOTPRINT

- 11.8 COMPETITIVE BENCHMARKING

- 11.9 COMPETITIVE SCENARIOS AND TRENDS

-

12.1 KEY PLAYERSVANDERLANDE- Business overview- Products offered- Recent developments- MnM viewBEUMER GROUP- Business overview- Products offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL- Business overview- Products offered- MnM viewBASTIAN SOLUTIONS- Business overview- Products offered- Recent developments- MnM viewFIVES- Business overview- Products offered- Recent developments- Others- MnM viewSIEMENS- Business overview- Products offered- Recent developmentsDEMATIC- Business overview- Products offeredINTERROLL- Business overview- Products offeredINVATA INTRALOGISTICS- Business overview- Products offeredMURATA MACHINERY- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSAMH MATERIAL HANDLINGATMOSBOWE SYSTECCONVEYCODORNEREQUINOX MHEEUROSORTFALCON AUTOTECHICONVEYINTRALOXKNAPPOKURA YUSOKIPITNEY BOWESSOLYSTICVIASTORE SYSTEMS

- 13.1 ASRS MARKET

- 13.2 INTRODUCTION

-

13.3 UNIT LOADOFFERS UNIQUE OPERATIONAL, SECURITY, AND PRODUCTIVITY BENEFITS

-

13.4 MINI LOADPROVIDES HIGH-DENSITY OPERATIONS, RAPID ACCELERATION, AND HIGH-SPEED MOVEMENT ON THREE-DIMENSIONAL AXIS

-

13.5 VERTICAL LIFT MODULE (VLM)OFFERS ADVANTAGES OF GREATER ACCURACY AND EFFICIENT SPACE UTILIZATION

-

13.6 CAROUSELVERTICAL CAROUSEL- Helps to save floor spaceHORIZONTAL CAROUSEL- Ensures effective storage and retrieval processes

-

13.7 MID LOADHIGHLY FLEXIBLE SOLUTION THAT CAN AUTOMATE NEW OR EXISTING PROCESSES

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 TOP 10 COUNTRIES IN TERMS OF E-COMMERCE CONTRIBUTION TO GDP IN 2022

- TABLE 2 PARCEL SORTATION SYSTEM MARKET: ECOSYSTEM

- TABLE 3 PARCEL SORTATION SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 UPS DEVELOPED ORION SYSTEM TO IMPROVE ROUTE PLANNING AND PACKAGE SORTING PROCESSES

- TABLE 5 ZALANDO USES FERAG’S PARCEL SORTATION SYSTEM IN ITS DISTRIBUTION CENTERS

- TABLE 6 MARKET ASSESSMENT FOR OPTIMIZING REVERSE LOGISTICS THROUGH PARCEL SORTATION

- TABLE 7 AVERAGE SELLING PRICE OF VARIOUS TYPES OF PARCEL SORTATION SYSTEMS

- TABLE 8 AVERAGE SELLING PRICE OF PARCEL SORTATION SYSTEMS, BY REGION

- TABLE 9 APPROXIMATE AVERAGE SELLING PRICE OF PARCEL SORTATION SYSTEMS, BY RUNNING SPEED

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 12 PARCEL SORTATION SYSTEM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 13 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- TABLE 14 LIST OF KEY PATENTS IN PARCEL SORTATION SYSTEM MARKET, 2021–2023

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MAJOR SAFETY STANDARDS

- TABLE 19 PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 20 PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 21 HARDWARE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 HARDWARE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SOFTWARE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 SOFTWARE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 SERVICES: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 SERVICES: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 30 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 31 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 32 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 LINEAR PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 36 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 38 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 39 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 LOOP PARCEL SORTATION SYSTEMS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 42 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 43 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 46 PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 LOGISTICS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 48 LOGISTICS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 49 LOGISTICS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 LOGISTICS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 E-COMMERCE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 52 E-COMMERCE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 53 E-COMMERCE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 E-COMMERCE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 AIRPORTS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 56 AIRPORTS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 AIRPORTS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 AIRPORTS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 PHARMACEUTICAL & MEDICAL SUPPLY: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 60 PHARMACEUTICAL & MEDICAL SUPPLY: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 PHARMACEUTICAL & MEDICAL SUPPLY: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 PHARMACEUTICAL & MEDICAL SUPPLY: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 FOOD & BEVERAGE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 64 FOOD & BEVERAGE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 65 FOOD & BEVERAGE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 FOOD & BEVERAGE: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 68 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 69 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 OTHERS: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 82 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 84 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 88 EUROPE: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 98 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 99 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 100 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 102 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 REST OF THE WORLD: PARCEL SORTATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 MIDDLE EAST: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 106 MIDDLE EAST: PARCEL SORTATION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 107 OVERVIEW OF STRATEGIES ADOPTED BY PARCEL SORTATION SYSTEM VENDORS

- TABLE 108 PARCEL SORTATION SYSTEM MARKET SHARE ANALYSIS, 2022

- TABLE 109 COMPANY FOOTPRINT

- TABLE 110 TYPE: COMPANY FOOTPRINT

- TABLE 111 APPLICATION: COMPANY FOOTPRINT

- TABLE 112 REGION: COMPANY FOOTPRINT

- TABLE 113 PARCEL SORTATION SYSTEM MARKET: LIST OF KEYS STARTUPS/SMES

- TABLE 114 PARCEL SORTATION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 115 PARCEL SORTATION SYSTEM MARKET: PRODUCT LAUNCHES, 2021−2022

- TABLE 116 PARCEL SORTATION SYSTEM MARKET: DEALS, 2021−2022

- TABLE 117 PARCEL SORTATION SYSTEM MARKET: OTHERS, 2022

- TABLE 118 VANDERLANDE: BUSINESS OVERVIEW

- TABLE 119 VANDERLANDE: PRODUCT OFFERINGS

- TABLE 120 VANDERLANDE: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 121 BEUMER GROUP: BUSINESS OVERVIEW

- TABLE 122 BEUMER GROUP: PRODUCT OFFERINGS

- TABLE 123 BEUMER GROUP: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 124 BEUMER GROUP: DEALS

- TABLE 125 HONEYWELL INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 126 HONEYWELL INTERNATIONAL: PRODUCT OFFERINGS

- TABLE 127 BASTIAN SOLUTIONS: BUSINESS OVERVIEW

- TABLE 128 BASTIAN SOLUTIONS: PRODUCT OFFERINGS

- TABLE 129 BASTIAN SOLUTIONS: DEALS

- TABLE 130 FIVES: BUSINESS OVERVIEW

- TABLE 131 FIVES: PRODUCT OFFERINGS

- TABLE 132 FIVES: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 133 FIVES: DEALS

- TABLE 134 FIVES: OTHERS

- TABLE 135 SIEMENS: BUSINESS OVERVIEW

- TABLE 136 SIEMENS: PRODUCT OFFERINGS

- TABLE 137 SIEMENS: PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 138 DEMATIC: BUSINESS OVERVIEW

- TABLE 139 DEMATIC: PRODUCT OFFERINGS

- TABLE 140 INTERROLL: BUSINESS OVERVIEW

- TABLE 141 INTERROLL: PRODUCT OFFERINGS

- TABLE 142 INVATA: BUSINESS OVERVIEW

- TABLE 143 INVATA: PRODUCT OFFERINGS

- TABLE 144 MURATA MACHINERY: BUSINESS OVERVIEW

- TABLE 145 MURATA MACHINERY: PRODUCT OFFERINGS

- TABLE 146 MURATA MACHINERY: OTHERS

- TABLE 147 AMH MATERIAL HANDLING: COMPANY OVERVIEW

- TABLE 148 ATMOS: COMPANY OVERVIEW

- TABLE 149 BOWE SYSTEC: COMPANY OVERVIEW

- TABLE 150 CONVEYCO: COMPANY OVERVIEW

- TABLE 151 DORNER: COMPANY OVERVIEW

- TABLE 152 EQUINOX MHE: COMPANY OVERVIEW

- TABLE 153 EUROSORT: COMPANY OVERVIEW

- TABLE 154 FALCON AUTOTECH: COMPANY OVERVIEW

- TABLE 155 ICONVEY: COMPANY OVERVIEW

- TABLE 156 INTRALOX: COMPANY OVERVIEW

- TABLE 157 KNAPP: COMPANY OVERVIEW

- TABLE 158 OKURA YUSOKI: COMPANY OVERVIEW

- TABLE 159 PITNEY BOWES: COMPANY OVERVIEW

- TABLE 160 SOLYSTIC: COMPANY OVERVIEW

- TABLE 161 VIASTORE: COMPANY OVERVIEW

- TABLE 162 ASRS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 163 ASRS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 164 UNIT LOAD: ASRS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 165 UNIT LOAD: ASRS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 166 UNIT LOAD: ASRS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 167 UNIT LOAD: ASRS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 168 MINI LOAD: ASRS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 169 MINI LOAD: ASRS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 170 MINI LOAD: ASRS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 171 MINI LOAD: ASRS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 172 VLM: ASRS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 173 VLM: ASRS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 174 VLM: ASRS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 175 VLM: ASRS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 176 CAROUSEL: ASRS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 177 CAROUSEL: ASRS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 178 CAROUSEL: ASRS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 179 CAROUSEL: ASRS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 180 MID LOAD: ASRS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 181 MID LOAD: ASRS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 182 MID LOAD: ASRS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 183 MID LOAD: ASRS MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 PARCEL SORTATION SYSTEM MARKET SEGMENTATION

- FIGURE 2 PARCEL SORTATION SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS FROM PARCEL SORTATION SYSTEMS

- FIGURE 6 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 PARCEL SORTATION SYSTEM MARKET, 2019−2028 (USD MILLION)

- FIGURE 8 LINEAR PARCEL SORTATION SYSTEMS SEGMENT HELD LARGER MARKET SHARE IN 2022

- FIGURE 9 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 10 LOGISTICS SEGMENT CAPTURED LARGEST MARKET SIZE IN 2022

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 12 RISING AUTOMATION IN LOGISTICS AND E-COMMERCE INDUSTRIES TO SUPPORT MARKET GROWTH

- FIGURE 13 HARDWARE SEGMENT ACCOUNTED FOR LARGEST MARKET SIZE IN 2022

- FIGURE 14 SHOE SORTERS TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 15 LOGISTICS SEGMENT TO CAPTURE LARGEST SHARE OF PARCEL SORTATION SYSTEM MARKET IN 2023

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN PARCEL SORTATION SYSTEM MARKET DURING 2023−2028

- FIGURE 17 PARCEL SORTATION SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 CHANGES IN LABOR COSTS BETWEEN 2015 AND 2022, BY REGION

- FIGURE 19 E-COMMERCE SALES AS PERCENTAGE OF TOTAL RETAIL SALES IN US, 2019–2022

- FIGURE 20 IMPACT ANALYSIS OF DRIVERS AND OPPORTUNITIES ON PARCEL SORTATION SYSTEM MARKET

- FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS AND CHALLENGES ON PARCEL SORTATION SYSTEM MARKET

- FIGURE 22 PARCEL SORTATION SYSTEM MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN PARCEL SORTATION SYSTEM MARKET

- FIGURE 24 PARCEL SORTATION SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE OF PARCEL SORTATION SYSTEMS, 2019−2028

- FIGURE 26 AVERAGE SELLING PRICE OF PARCEL SORTATION SYSTEMS, BY RUNNING SPEED

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 29 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8437, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8437, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 TOP 10 COMPANIES/INSTITUTIONS WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 32 NUMBER OF PATENTS GRANTED EVERY YEAR, 2013–2022

- FIGURE 33 PARCEL SORTATION SYSTEM MARKET, BY OFFERING

- FIGURE 34 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR IN PARCEL SORTATION SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 35 PARCEL SORTATION SYSTEM MARKET, BY TYPE

- FIGURE 36 LOOP PARCEL SORTATION SYSTEMS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 PARCEL SORTATION SYSTEM MARKET, BY APPLICATION

- FIGURE 38 E-COMMERCE SEGMENT TO REGISTER HIGHEST CAGR IN PARCEL SORTATION SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA TO ACCOUNT FOR LARGEST SIZE OF PARCEL SORTATION SYSTEM MARKET FOR E-COMMERCE DURING FORECAST PERIOD

- FIGURE 40 LOOP PARCEL SORTATION SYSTEMS TO ACCOUNT FOR LARGEST SIZE OF PARCEL SORTATION SYSTEM MARKET FOR PHARMACEUTICAL & MEDICAL SUPPLY FROM 2023−2028

- FIGURE 41 PARCEL SORTATION SYSTEM MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 42 NORTH AMERICA: PARCEL SORTATION SYSTEM MARKET SNAPSHOT

- FIGURE 43 EUROPE: PARCEL SORTATION SYSTEM MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: PARCEL SORTATION SYSTEM MARKET SNAPSHOT

- FIGURE 45 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN PARCEL SORTATION SYSTEM MARKET

- FIGURE 46 PARCEL SORTATION SYSTEM MARKET: SHARE OF KEY PLAYERS

- FIGURE 47 PARCEL SORTATION SYSTEM MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 48 PARCEL SORTATION SYSTEM MARKET (GLOBAL): SMES EVALUATION MATRIX, 2022

- FIGURE 49 VANDERLANDE: COMPANY SNAPSHOT

- FIGURE 50 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 51 FIVES: COMPANY SNAPSHOT

- FIGURE 52 SIEMENS: COMPANY SNAPSHOT

- FIGURE 53 INTERROLL: COMPANY SNAPSHOT

- FIGURE 54 MURATA MACHINERY: COMPANY SNAPSHOT

- FIGURE 55 ASRS MARKET, BY TYPE

- FIGURE 56 UNIT LOAD SEGMENT HELD LARGEST SHARE OF ASRS MARKET IN 2022

- FIGURE 57 ASIA PACIFIC TO HOLD LARGEST SHARE OF ASRS MARKET FOR VLM DURING FORECAST PERIOD

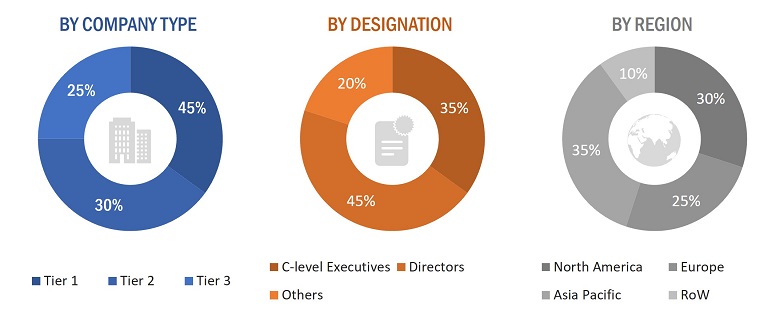

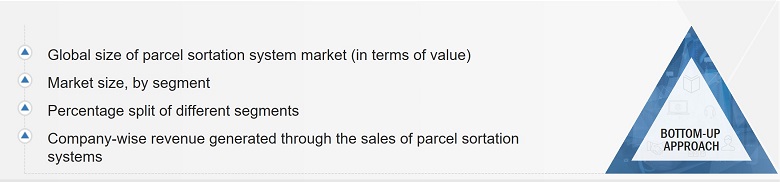

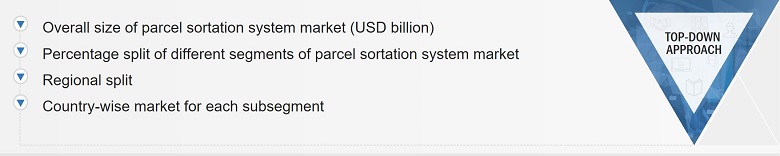

The study involves four major activities that estimate the size of the parcel sortation system market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the parcel sortation system market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research.

Primary Research

In the primary research process, numerous sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply-side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from parcel sortation system providers, such as Vanderlande (Netherlands), Beumer Group (Germany), Honeywell International (US), and Bastian Solutions (US), Fives (France).; research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the parcel sortation system market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

A parcel sortation system is an automated system used by logistics companies and shipping carriers to automate the sorting and routing of parcels or packages. This system helps to efficiently process large parcels and ensure timely delivery to the intended destinations. A parcel sortation system comprises several sub-components working together under the direction of a warehouse management system or warehouse control system and machine controllers. It enables automated parcel sorting, which can be done based on several parameters, including size, volume, bar code reading, or fragility of the items in the parcel.

Key Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Original equipment manufacturers (OEMs) of parcel sortation systems

- Traders and suppliers

- Parcel sortation system manufacturers

- Engineering and manufacturing companies

- E-commerce and retail companies

- Logistic companies

- Airports

- Pharmaceuticals and medical suppliers

- Retail service providers

- Research organizations and consulting companies

- Technology investors

- Technology standard organizations, forums, alliances, and associations

- Associations and industrial bodies

The main objectives of this study are as follows:

- To define, describe, and forecast the global parcel sortation system market, based on type, offering, application, and region, in terms of value

- To forecast the market size, in terms of value, for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the probable impact of the recession on the market in the future

- To provide a comprehensive overview of the value chain of the parcel sortation system ecosystem

- To profile the key players and comprehensively analyze their market rankings and core competencies2

- To analyze the competitive developments such as contracts, expansions, partnerships, and product launches in the parcel sortation system market

-

To analyze the opportunities in the market for various stakeholders by identifying

the high-growth segments of the parcel sortation system market and provide a detailed competitive landscape for the market players

Available Customizations:

With the given market data, MarketsandMarkets offer customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Growth opportunities and latent adjacency in Parcel Sortation System Market

Interested in seeing the break down of sortation systems by type and the growth in each region. Can you provide me with the estimates?

We have parcel business under the name of SCG Logistics in Thailand, and we are interested in parcel sortation system, hope these information could help us a lot to improve business growth. Can you provide us with the same? Also I would like to understand the scope of parcel sortation in Thailand.