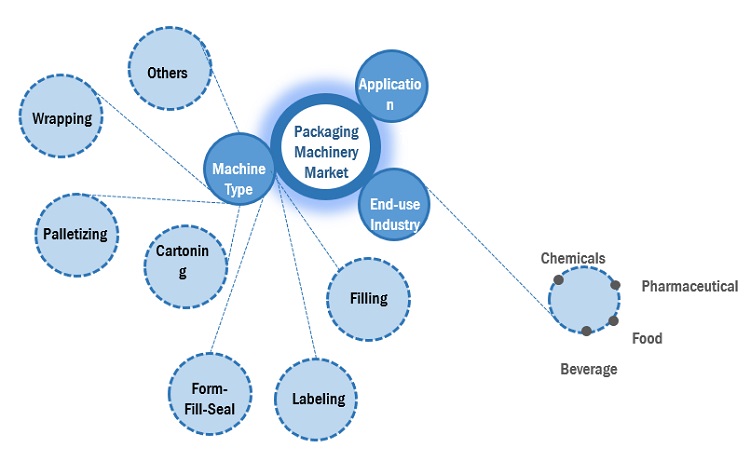

Packaging Machinery Market by Machine Type (Filling, Labeling, Form-Fill-Seal, Cartoning, Palletizing, Wrapping), End-use industry (Food, Pharmaceutical, Beverages, Chemical), Technology, and Region - Global Forecast to 2027

Packaging Machinery Market

The global packaging machinery market was valued at USD 46.4 billion in 2022 and is projected to reach USD 56.7 billion by 2027, growing at a cagr 4.1% from 2022 to 2027. The growing demand for pharmaceutical drugs is also expected to increase the need for efficient packaging systems, which, in turn, will drive the market for automated equipment to ensure high-speed packaging output.

Global Packaging Machinery Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Packaging Machinery Market Dynamics

Driver: Growing need for flexible and integrated packaging machinery

Packaging plays an important role in the commercialization of any pharmaceutical drug. Earlier, pharmaceutical packaging was used to protect and preserve items and communicate marketing and regulatory information to consumers. However, the focus has shifted towards developing a reliable packing line that delivers quick packaging of a combination of products without compromising protection, quality, patient comfort, and security needs. This can be attributed to the development of new therapies and novel drug delivery technologies, which have increased the need for new and innovative forms of packaging. Currently, pre-fillable syringes and parenteral formulations are novel drug delivery systems. These new formulations require flexible packaging equipment. The major therapy areas under focus include oncology, respiratory, anti-virals, autoimmune diseases, and immuno-suppressants, with several innovation projects underway in the biopharmaceutical space.

With these advancements, the demand for packaging that can maintain the stability of novel drugs and improve their shelf-life is increasing. Amid rising cost pressures, the initial cost of acquiring packaging machinery is one of the major concerns for pharmaceutical manufacturers. Currently, pharmaceutical manufacturers are opting for flexible packaging equipment that can fulfill the requirement of packaging a drug in two to three different formats, thus saving on capital investments. Recent advances show that biopharmaceutical companies, laboratories, and research facilities now produce smaller amounts of targeted drugs. This has generated a need to manufacture equipment platforms that can handle small batches at larger time intervals. While such packaging lines for smaller batches may reduce pressure on the pharmaceutical industry, their implementation will require frequent changeovers and maintenance. As a result, there is a high demand for packaging machinery that can create various small-batch drugs without sacrificing manufacturing speed.

Restraint: Growing preference for refurbished machinery

Refurbished machines are viable alternatives to new instruments for manufacturers in cases where time (taken to deliver and set up new machinery) and cost (new instruments being comparatively high-priced) are concerns. This is particularly evident in low-cost manufacturing locations across the Asia Pacific region, where regulatory guidelines are comparatively lenient. Purchasing refurbished equipment can save approximately 40–45% of the costs incurred on purchasing new machinery, thus lowering the capital expenditure required to set up a new production line. In addition, manufacturers can obtain a renewed or updated form of their existing products, thus eliminating the need to purchase a new product. However, evaluating the compatibility of refurbished equipment with existing manufacturing operations is a must to optimize the operational efficiency of a manufacturing facility. When changes are made to the function, design, or safety of a machine, there has to be an assessment to check the level of changes made to the equipment. If the changes are too significant, it may be considered a new product and be subject to conformity assessment and regulatory approvals. This will hold true even if a product was originally compliant and approved by regulatory bodies.

Opportunity: Growing demand for automation in the food & beverage industry

Growing urbanization and globalization have increased the demand for automation in the food industry. Food packaging is necessary to protect food products from contamination, tampering, and damage, owing to which food manufacturers need to pack more products with a higher level of accuracy and speed.

Over the years, consumption patterns have also changed considerably, mainly due to the rapidly growing global population. Consumers are becoming increasingly aware of food-related issues and their impact on health, the environment, and communities. Food labeling is an important means of communicating information to customers, due to which the use of automated labeling machines has grown in the food industry. Regulatory bodies such as the Food Safety and Standard Authority of India (FSSAI), the US Food and Drug Administration (FDA), the United States Department of Agriculture (USDA), the Department of Agriculture and Agri-Food (Canada), and the European Food Safety Authority (EFSA) provide guidelines on the labeling of food products to ensure that these products are not mislabeled.

Challenge: Maintaining sterility in fill-finish manufacturing operations

Aseptic fill-finish operations carry more risk than non-sterile processes. They require careful planning, trained personnel, and specialized facilities & equipment to execute the process properly. Ensuring sterility is of utmost importance, as any failure can lead to massive financial losses and life-threatening effects on patients. All the components used in aseptic fill-finishing processes must be sterilized before use. Sterilization with pressurized steam, irradiation, or hydrogen peroxide must be performed in a manner that does not affect the stability of the drug. This indicates the need for carefully designing cleanroom facilities to ensure sterility, thereby incurring high costs. Sterile lyophilizing requires investments in specialized equipment and facilities. For products that require lyophilizing, strict steps must be taken to ensure that the risk of contamination is minimized during the loading and unloading processes.

Packaging Machinery Market Ecosystem

Source: Secondary research, primary research, and MarketsandMarkets Analysis

Labelling segment to account for the third largest machine type in packaging machinery market

Labeling is one of the most essential operations in the primary as well as secondary packaging of products. The transition from manual labeling applications to semi-automatic operations to fully automated labeling lines offers many advantages to end users. A wide range of automatic labeling machines is available on the market—these range from high-production units that allow for complete automation of the print-and-apply process to simple label dispensing.

General packaging technology to dominate the packaging machinery market

General packaging packages and labels products in bulk and transforms them into finished products. General packaging machines apply higher than usual sealing pressures and are used for packaging potable water, juices, industrial grease, soaps, lotions, stews, soups, freezer gels, etc. General packaging machines form, fill, seal, wrap, clean, and package at different levels of automation. Packaging machines also include related machinery for sorting, counting, and accumulating.

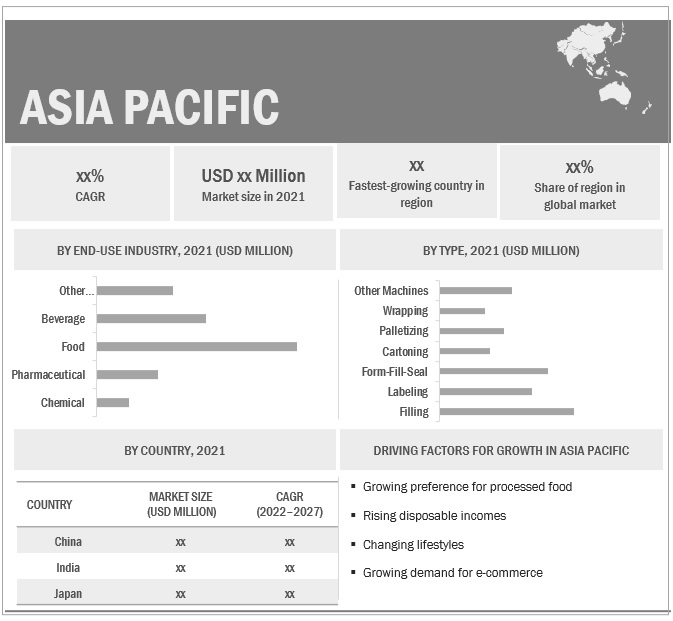

Asia Pacific to be the largest region in the packaging machinery market

To know about the assumptions considered for the study, download the pdf brochure

The countries covered in this region include China, Japan, India, and South Korea, along with the Rest of Asia Pacific countries. Factors such as the ready availability of raw materials and workforce, along with sophisticated technologies and innovations, have driven the economy's growth in the Asia Pacific region. According to the World Bank, the three economic giants of the Asia Pacific—China, Japan, and India—are the world’s second, third, and sixth-largest economies as of 2021.

The Asia Pacific was the largest packaging machinery market in 2021. Countries across the APAC are expected to experience significant demand for packaging machinery due to rapid economic development and government initiatives toward economic development. In addition, the growing population in these countries represents a strong customer base. According to the World Bank, the Asia Pacific is the world’s fastest-growing region in terms of both population and economic growth. In addition to this, the growing population in these countries presents a huge customer base for FMCG products and consumer durables, which, in turn, is expected to drive the growth of the packaging machinery market.

Packaging Machinery Market Players

KHS Group (Germany), SIG Combibloc Group Ltd. (Switzerland), Tetra Laval Group. (Sweden), Barry-Wehmiller (US), Marchesini Group (Italy), Syntegon Technology GmbH (Germany), GEA Group Aktiengesellschaft (Germany), Sacmi (Italy), Langley Holdings (UK), Douglas Machine Inc. (US), Coesia S.p.A (Italy), Maillis Group (Luxemberg) and Duravant (US) are the key players operating in the packaging machinery market among others.

Read More: Packaging Machinery Companies

Packaging Machinery Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 46.4 Billion |

|

Revenue Forecast in 2027 |

USD 56.7 Billion |

|

CAGR |

4.1% |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Million/USD Billion) |

|

Segments |

Machine Type, Application, End-use industry, Technology, and Region |

|

Regions |

North America, Europe, Asia-Pacific, Middle East & Africa, and South America |

|

Companies |

The major players include KHS Group (Germany), SIG Combibloc Group Ltd. (Switzerland), Tetra Laval Group. (Sweden), Barry-Wehmiller (US), Marchesini Group (Italy), Syntegon Technology GmbH (Germany), GEA Group Aktiengesellschaft (Germany), Sacmi (Italy), Langley Holdings (UK), Douglas Machine Inc. (US), Coesia S.p.A (Italy), Maillis Group (Luxemberg) and Duravant (US). |

This research report categorizes the packaging equipment based on machine type, end-use industry, technology, and region.

On the basis of machine type:

- Filling

- Labeling

- Form-Fill-Seal

- Cartoning

- Palletizing

- Wrapping

- Other Machines

On the basis of end-use industry

- Chemical

- Pharmaceutical

- Food

- Beverage

- Other Industries

On the basis of technology:

- General Packaging

- Modified Atmosphere Packaging

- Vacuum Packaging

On the basis of region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In January 2022, KHS Group launched the new Innopal PLR High-performance Palletizer that combines the advantages of low-feed machines with the capacity offered by high-transmission palletizers. The main issue, however, was increasing the efficiency of this system over current technologies.

- In January 2021, Syntegon Packaging Technology launched the Sigpack TTMD cartoner with built-in Delta robots.

- In August 2019, Tetra Pak invested in a new process in Revita Plant, which increases its capacity to process and clean polyols. With the use of the new structure, Revita is able to thoroughly dry and clean old polyols, eliminating any remaining fiber, water, or other impurities that would make it difficult to market as plastic. With the help of this new investment, Tetra Pak was able to expand into new areas, including extrusion, injection, and roto-molding, which enable them to create value along their supply chain.

Frequently Asked Questions (FAQ):

What are the segments of Packaging Machinery Market?

Packaging Machinery Market has been segmented on the basis of Machine Type, End-use industry, Technology and Region

What is the current size of global packaging machinery market?

The packaging machinery market is projected to reach USD 56.7 Billion by 2027 from USD 46.4 Billion in 2022, at a CAGR of 4.1%.

How is the packaging machinery market aligned?

The packaging machinery market is fragmented., and has many global, regional and domestic players who have a very strong presence in the market. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key players in the global packaging machinery market?

The key players operating in the packaging machinery market, are KHS Group, SIG Combibloc Group Ltd., Tetra Laval Group., Barry-Wehmiller, Marchesini Group Syntegon Technology GmbH, GEA Group Aktiengesellschaft, Sacmi, Langley Holdings, Douglas Machine Inc., Coesia S.p.A, Maillis Group and Duravant are the key players operating in the packaging machinery market in 2021.

What are the latest ongoing trends in the packaging machinery market?

The growing industrialization in emerging economies such as China, India, South Korea, Indonesia, Thailand, Taiwan, Mexico, Brazil, and Argentina is expected to drive the packaging machinery market during the next five years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 PACKAGING MACHINERY MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

FIGURE 2 PACKAGING MACHINERY MARKET, BY REGION

1.5 CURRENCY CONSIDERED

1.6 UNITS CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 3 PACKAGING MACHINERY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 4 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: SUPPLY SIDE

2.3 DATA TRIANGULATION

FIGURE 8 PACKAGING MACHINERY MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 STUDY LIMITATIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 9 FILLING MACHINES TO DOMINATE PACKAGING MACHINERY MARKET BY 2027

FIGURE 10 FOOD INDUSTRY TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC DOMINATED MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DUE TO RAPID URBANIZATION

FIGURE 12 EMERGING ECONOMIES OFFER LUCRATIVE GROWTH OPPORTUNITIES IN PACKAGING MACHINERY MARKET

4.2 ASIA PACIFIC: MARKET SHARE, BY TYPE AND COUNTRY

FIGURE 13 CHINA DOMINATED MARKET FOR PACKAGING MACHINERY IN 2021

4.3 MARKET SHARE, BY TYPE

FIGURE 14 FILLING MACHINES TO LEAD MARKET DURING FORECAST PERIOD

4.4 MARKET SHARE, BY END-USE INDUSTRY

FIGURE 15 FOOD INDUSTRY TO COMMAND LARGEST SHARE OF MARKET

4.5 MARKET, BY COUNTRY

FIGURE 16 CHINA PROJECTED TO WITNESS HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 PACKAGING MACHINERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rapidly growing generics and biopharmaceutical markets

5.2.1.2 Growing need for flexible and integrated packaging machinery

5.2.1.3 Technological advancements in fill-finish manufacturing processes

5.2.2 RESTRAINTS

5.2.2.1 Growing preference for refurbished machinery

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing pharmaceutical manufacturing in emerging economies

5.2.3.2 Growing demand for automation in food & beverage industry

5.2.4 CHALLENGES

5.2.4.1 Growing demand for personalized and precision medicine

5.2.4.2 Maintaining sterility in fill-finish manufacturing operations

5.2.4.3 Shorter shelf life of dairy products

6 INDUSTRY INSIGHTS (Page No. - 46)

6.1 PORTER’S FIVE FORCES

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

6.1.1 THREAT FROM SUBSTITUTES

6.1.2 THREAT FROM NEW ENTRANTS

6.1.3 BARGAINING POWER OF SUPPLIERS

6.1.4 BARGAINING POWER OF BUYERS

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 PACKAGING MACHINERY MARKET: PORTER’S FIVE FORCES ANALYSIS

6.2 VALUE CHAIN ANALYSIS

FIGURE 19 SUPPLY CHAIN ANALYSIS

6.3 TRADE ANALYSIS

TABLE 3 IMPORT DATA FOR PACKAGING MACHINERY OR WRAPPING MACHINERY MARKET, 2021 (USD THOUSAND)

TABLE 4 EXPORT DATA FOR PACKAGING MACHINERY OR WRAPPING MACHINERY MARKET, 2021 (USD THOUSAND)

6.4 TECHNOLOGY ANALYSIS

6.4.1 AUTOMATION AND INTEGRATION OF PACKAGING EQUIPMENT

6.4.2 GROWING DEMAND FOR ASEPTIC FILLING AND SEALING EQUIPMENT

6.5 REGULATORY ANALYSIS

6.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.6 CASE STUDY ANALYSIS

6.6.1 CASE STUDY: UPGRADE OF KETCHUP BOTTLE LABELING MACHINE INCREASED COMPANY’S THROUGHPUT BY 50%

6.6.2 CASE STUDY: HIGH-SPEED AUTOMATIC PACKAGING OF FRESH FRUIT OWES ITS PRECISION TO INTELLIGENT DRIVES FROM CONTROL TECHNIQUES

6.6.3 ECOSYSTEM MAP

FIGURE 20 PACKAGING MACHINERY MARKET ECOSYSTEM

6.7 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.7.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR PACKAGING MANUFACTURERS

FIGURE 21 REVENUE SHIFT FOR PACKAGING MACHINERY MANUFACTURERS

6.8 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 8 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.9 AVERAGE SELLING PRICE ANALYSIS

6.10 PATENT ANALYSIS

6.10.1 INTRODUCTION

6.10.2 METHODOLOGY

6.10.3 DOCUMENT TYPE

TABLE 9 LIST OF PATENTS

7 PACKAGING MACHINERY MARKET, BY TYPE (Page No. - 59)

7.1 INTRODUCTION

FIGURE 22 FILLING MACHINES TO DOMINATE PACKAGING MACHINERY MARKET DURING FORECAST PERIOD

TABLE 10 MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

7.2 FILLING MACHINES

7.2.1 LIQUID FILLING MACHINES

7.2.1.1 Growing demand for liquid filling machines in food & beverage industry to drive market

7.2.2 POWDER & GRANULATED FILLING MACHINES

7.2.2.1 Growing use of automation across packaging lines to drive adoption

7.3 FORM-FILL-SEAL MACHINES

7.3.1 VERTICAL FFS MACHINES

7.3.1.1 High-volume packing of products to drive demand for VFFS machines

7.3.2 HORIZONTAL FFS MACHINES

7.3.2.1 High demand for HFFS for manufacturing standup pouches to fuel growth

7.4 LABELING MACHINES

7.4.1 SELF-ADHESIVE LABELS

7.4.1.1 Extensive use of self-adhesive labels for wide variety of products to drive growth

7.4.2 ROTARY STICKERS

7.4.2.1 Presence of multiple labeling heads to drive demand for rotary labeling machines

7.4.3 WET GLUE LABELS

7.4.3.1 High demand for wet glue labels in beverage industry to support growth

7.5 PALLETIZING MACHINES

7.5.1 GROWING NEED TO HANDLE BIGGER PACKAGING SYSTEM LINES TO DRIVE DEMAND FOR PALLETIZING MACHINES

7.6 CARTONING MACHINES

7.6.1 GROWING DEMAND FOR CARTONING MACHINES IN FMCG SECTOR TO BOOST MARKET

7.7 WRAPPING MACHINES

7.7.1 RISING DEMAND FOR FLEXIBLE PACKAGING OPTIONS TO DRIVE DEMAND FOR WRAPPING MACHINES

7.8 OTHER MACHINES

8 PACKAGING MACHINERY MARKET, BY END-USE INDUSTRY (Page No. - 66)

8.1 INTRODUCTION

FIGURE 23 FOOD INDUSTRY TO LEAD PACKAGING MACHINERY MARKET DURING FORECAST PERIOD

TABLE 11 MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

8.2 CHEMICAL

8.2.1 GROWING CHEMICAL INDUSTRY TO FUEL DEMAND FOR PACKAGING MACHINERY

8.3 PHARMACEUTICAL

8.3.1 GROWING NEED FOR AUTOMATION OF PACKAGING LINES AND INCREASING USE OF ROBOTICS TO PROPEL GROWTH

8.4 FOOD

8.4.1 INNOVATION IN PACKAGING MACHINERY IN FOOD INDUSTRY TO SUPPORT MARKET GROWTH

8.5 BEVERAGE

8.5.1 GROWING USE OF AUTOMATION IN BEVERAGE PACKAGING INDUSTRY TO FUEL GROWTH

8.6 OTHER INDUSTRIES

9 PACKAGING MACHINERY MARKET, BY TECHNOLOGY (Page No. - 71)

9.1 INTRODUCTION

9.2 GENERAL PACKAGING

9.2.1 GROWING USE OF GENERAL PACKAGING MACHINERY FOR SORTING, COUNTING, AND ACCUMULATING TO DRIVE GROWTH

9.3 MODIFIED ATMOSPHERE PACKAGING

9.3.1 GROWING DEMAND FOR MODIFIED ATMOSPHERE PACKAGING IN FOOD INDUSTRY TO SUPPORT GROWTH

9.4 VACUUM PACKAGING

9.4.1 GROWING USE OF VACUUM PACKAGING FOR FOOD PRESERVATION APPLICATIONS TO BOOST MARKET

10 PACKAGING MACHINERY MARKET, BY REGION (Page No. - 72)

10.1 INTRODUCTION

FIGURE 24 REGIONAL SNAPSHOT: ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

TABLE 12 PACKAGING MACHINERY MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 25 ASIA PACIFIC: PACKAGING MACHINERY MARKET SNAPSHOT

TABLE 13 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 14 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 15 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Growing demand for consumer goods to drive adoption of packaging machinery in China

TABLE 16 CHINA: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 17 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.2.2 INDIA

10.2.2.1 Indian packaging machinery market to witness high demand from organized retail and e-commerce sectors

TABLE 18 INDIA: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 19 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.2.3 JAPAN

10.2.3.1 Rising disposable incomes and high proportion of urban population to drive market

TABLE 20 JAPAN: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 21 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.2.4 SOUTH KOREA

10.2.4.1 Rising demand for ready-to-eat and processed food to fuel growth

TABLE 22 SOUTH KOREA: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 23 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.2.5 REST OF ASIA PACIFIC

TABLE 24 REST OF ASIA PACIFIC: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 25 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.3 NORTH AMERICA

TABLE 26 NORTH AMERICA: PACKAGING MACHINERY MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.3.1 US

10.3.1.1 Changing consumer buying habits to positively impact packaging machinery market

TABLE 29 US: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 30 US: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Well-developed food and pharmaceutical industries to drive demand for packaging machinery

TABLE 31 CANADA: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 32 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Growing popularity of e-commerce to increase demand for packaging machinery

TABLE 33 MEXICO: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 34 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.4 EUROPE

TABLE 35 EUROPE: PACKAGING MACHINERY MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 36 EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 37 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 High demand for pharmaceutical packaging in Germany to drive growth

TABLE 38 GERMANY: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 39 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.4.2 UK

10.4.2.1 Growth in healthcare industry to offer lucrative market opportunities

TABLE 40 UK: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 41 UK: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.4.3 FRANCE

10.4.3.1 Increased spending on food and pharmaceuticals in France to drive demand for packaging machinery

TABLE 42 FRANCE: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 43 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.4.4 RUSSIA

10.4.4.1 Increasing demand for packaging machinery in various end-use industries to drive market

TABLE 44 RUSSIA: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.4.5 ITALY

10.4.5.1 Increasing demand from retail, food, and healthcare industries to drive market

TABLE 46 ITALY: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 47 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.4.6 SPAIN

10.4.6.1 Growing food & beverage industry in Spain to aid market growth

TABLE 48 SPAIN: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 49 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.4.7 REST OF EUROPE

TABLE 50 REST OF EUROPE: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

TABLE 52 MIDDLE EAST & AFRICA: PACKAGING MACHINERY MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.5.1 SAUDI ARABIA

10.5.1.1 Growing investments in pharmaceutical industry to fuel growth

TABLE 55 SAUDI ARABIA: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 56 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.5.2 UAE

10.5.2.1 Growing food & beverage industry in UAE to boost packaging machinery market

TABLE 57 UAE: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 59 REST OF MIDDLE EAST & AFRICA: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 60 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 61 SOUTH AMERICA: PACKAGING MACHINERY MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 62 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Growing pharmaceutical industry in Brazil to contribute to market growth

TABLE 64 BRAZIL: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Growing demand from food & beverage industry to boost adoption of packaging machinery

TABLE 66 ARGENTINA: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

10.6.3 REST OF SOUTH AMERICA

TABLE 68 REST OF SOUTH AMERICA: PACKAGING MACHINERY MARKET SIZE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 106)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 70 OVERVIEW OF STRATEGIES ADOPTED BY PACKAGING MACHINERY MANUFACTURERS

11.3 MARKET SHARE ANALYSIS

11.3.1 RANKING OF KEY MARKET PLAYERS

FIGURE 26 RANKING OF TOP FIVE PLAYERS IN PACKAGING MACHINERY MARKET, 2021

11.3.2 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 71 MARKET: MARKET SHARE OF KEY PLAYERS

FIGURE 27 MARKET: MARKET SHARE ANALYSIS

11.3.2.1 GEA Group Aktiengesellschaft

11.3.2.2 SIG Combibloc Group

11.3.2.3 Tetra Laval Group

11.3.2.4 Syntegon Packaging Technology

11.3.2.5 Barry-Wehmiller Group

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 PERVASIVE PLAYERS

11.4.3 EMERGING LEADERS

11.4.4 PARTICIPANTS

FIGURE 28 PACKAGING MACHINERY MARKET: COMPANY EVALUATION QUADRANT, 2021

11.5 COMPANY EVALUATION QUADRANTS FOR START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 29 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2021

11.6 COMPETITIVE BENCHMARKING

TABLE 72 PACKAGING MACHINERY MARKET: DETAILED LIST OF KEY PLAYERS

TABLE 73 MARKET, BY TYPE: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 74 MARKET, BY END-USE INDUSTRY: COMPETITIVE BENCHMARKING OF KEY PLAYERS

11.7 COMPETITIVE SITUATION AND TRENDS

11.7.1 NEW PRODUCT LAUNCHES

TABLE 75 PACKAGING MACHINERY MARKET: NEW PRODUCT LAUNCHES (2017–2022)

11.7.2 DEALS

TABLE 76 MARKET: DEALS (2017–2022)

12 COMPANY PROFILES (Page No. - 120)

12.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats)*

12.1.1 KHS GROUP

TABLE 77 KHS GROUP: BUSINESS OVERVIEW

FIGURE 30 KHS GROUP: COMPANY SNAPSHOT (2021)

TABLE 78 KHS GROUP: NEW PRODUCT LAUNCHES

TABLE 79 KHS GROUP: DEALS

12.1.2 SIG COMBIBLOC GROUP AG

TABLE 80 SIG COMBIBLOC GROUP AG: BUSINESS OVERVIEW

FIGURE 31 SIG COMBIBLOC GROUP AG: COMPANY SNAPSHOT (2021)

TABLE 81 SIG COMBIBLOC GROUP AG: DEALS

12.1.3 TETRA LAVAL GROUP

TABLE 82 TETRA LAVAL GROUP: BUSINESS OVERVIEW

FIGURE 32 TETRA LAVAL GROUP: COMPANY SNAPSHOT (2021)

TABLE 83 TETRA LAVAL GROUP: DEALS

12.1.4 SYNTEGON PACKAGING TECHNOLOGY GMBH

FIGURE 33 SYNTEGON PACKAGING TECHNOLOGY GMBH: COMPANY SNAPSHOT (2021)

TABLE 85 SYNTEGON PACKAGING TECHNOLOGY GMBH: NEW PRODUCT LAUNCHES

TABLE 86 SYNTEGON PACKAGING TECHNOLOGY GMBH: DEALS

12.1.5 MARCHESINI GROUP

TABLE 87 MARCHESINI GROUP: BUSINESS OVERVIEW

FIGURE 34 MARCHESINI GROUP: COMPANY SNAPSHOT (2021)

TABLE 88 MARCHESINI GROUP: DEALS

12.1.6 BARRY-WEHMILLER GROUP

TABLE 89 BARRY-WEHMILLER GROUP: BUSINESS OVERVIEW

FIGURE 35 BARRY-WEHMILLER GROUP: COMPANY SNAPSHOT (2021)

TABLE 90 BARRY-WEHMILLER GROUP: DEALS

12.1.7 LANGLEY HOLDINGS PLC

TABLE 91 LANGLEY HOLDINGS PLC: BUSINESS OVERVIEW

FIGURE 36 LANGLEY HOLDINGS PLC: COMPANY SNAPSHOT (2021)

12.1.8 SACMI

TABLE 92 SACMI: BUSINESS OVERVIEW

12.1.9 GEA GROUP AKTIENGESELLSCHAFT

TABLE 93 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

FIGURE 37 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT (2021)

12.1.10 DOUGLAS MACHINE INC.

TABLE 94 DOUGLAS MACHINE INC.: BUSINESS OVERVIEW

12.2 ADDITIONAL PLAYERS

12.2.1 COEASIA S.P.A

TABLE 95 COEASIA S.P.A: BUSINESS OVERVIEW

12.2.2 AETNA GROUP S.P.A

TABLE 96 AETNA GROUP S.P. A: BUSINESS OVERVIEW

12.2.3 MG AMERICA

TABLE 97 MG AMERICA: BUSINESS OVERVIEW

12.2.4 DURAVANT LLC

TABLE 98 DURAVANT LLC: BUSINESS OVERVIEW

12.2.5 THE MAILLIS GROUP

TABLE 99 THE MAILLIS GROUP: BUSINESS OVERVIEW

12.2.6 BUSCH MACHINERY

TABLE 100 BUSCH MACHINERY: BUSINESS OVERVIEW

12.2.7 MG2 S.R.L.

TABLE 101 MG2 S.R.L.: BUSINESS OVERVIEW

12.2.8 NJM PACKAGING

TABLE 102 NJM PACKAGING: BUSINESS OVERVIEW

12.2.9 UHLMANN GROUP

TABLE 103 UHLMANN GROUP: BUSINESS OVERVIEW

12.2.10 PAKMATIC

TABLE 104 PAKMATIC: BUSINESS OVERVIEW

12.2.11 GERHARD SCHUBERT

TABLE 105 GERHARD SCHUBERT: BUSINESS OVERVIEW

12.2.12 R.A JONES GROUP

TABLE 106 R.A JONES GROUP: BUSINESS OVERVIEW

12.2.13 VISY

TABLE 107 VISY: BUSINESS OVERVIEW

12.2.14 JACOB WHITE PACKAGING

TABLE 108 JACOB WHITE PACKAGING: BUSINESS OVERVIEW

12.2.15 PACKAGING CENTER INC.

TABLE 109 PACKAGING CENTER INC.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 158)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

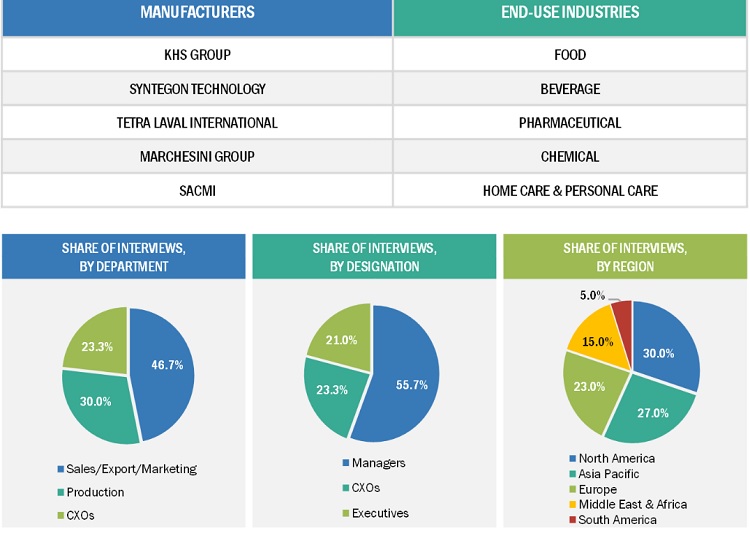

This research study involves the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Business, Reuters, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the packaging machinery market. The primary sources are mainly industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industry's supply chain. In-depth interviews have been conducted with various primary respondents that include key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Packaging Machinery Market Secondary Research

In the secondary research process, different sources have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles from recognized authors. Secondary research has been mainly used to obtain key information about the value chain of the industry, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Packaging Machinery Market Primary Research

After the complete market estimation process (which included calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, Porter’s Five Forces Analysis, key players, competitive landscape, industry trends, strategies of key players, and key market dynamics such as drivers, restraints, opportunities, and challenges.

Different sources from the supply and demand sides were interviewed in the primary research process to obtain qualitative and quantitative information. Primary sources included industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the packaging machinery market.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

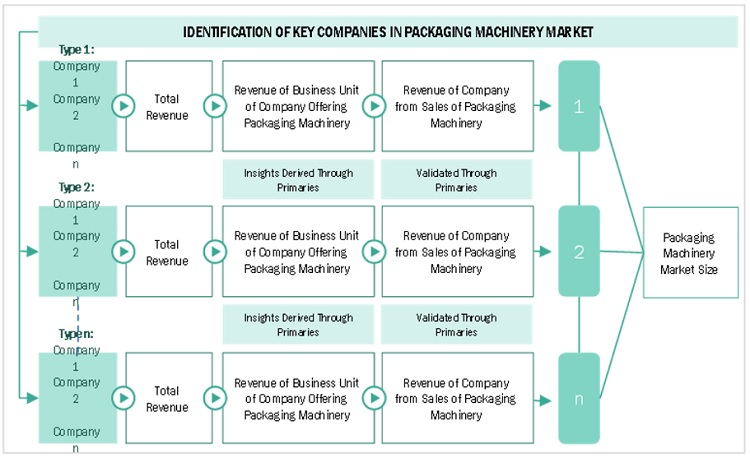

Packaging Machinery Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the packaging machinery market by machine type, end-use industry, technology, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the packaging machinery market have been identified through secondary research, and their revenues have been determined through primary and secondary research.

- The size of the packaging machinery market has been derived from the aggregation of the market shares of the leading players for each product, and the forecast is based on the analysis of market trends, such as pricing and consumption of packaging machinery in various end-use industries.

- The size of the packaging machinery market, by region, has been calculated by using the market sizes of each product in each end-use industry.

- The size of the packaging machinery market for each end-use industry, in terms of value, has been calculated by multiplying the market shares by the global value.

Packaging Machinery Market Size Estimation Supply Side Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Packaging Machinery Market Data Triangulation

After arriving at the overall market size from the process explained above, the total market was split into several segments and sub-segments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all the segments and sub-segments. The data was triangulated by studying various factors and trends from the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches.

Packaging Machinery Market Report Objectives

- To estimate and forecast the packaging machinery market in terms of value

- To elaborate on the drivers, restraints, opportunities, and challenges in the market

- To define, describe, and forecast the market size based on machine type, end-use industry, technology, and region

- To forecast the market size along with segments and submarkets in key regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as merger & acquisition, expansion & investment, agreement, partnership & joint venture, and new product development in the packaging machinery market

Packaging Machinery Market Report Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Packaging Machinery Market Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Packaging Machinery Market Regional Analysis

- Further breakdown of the Rest of APAC Packaging machinery market

- Further breakdown of Rest of Europe Packaging machinery market

Packaging Machinery Market Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Packaging Machinery Market