Modular Robotics Market by Robot Type (Articulated Modular Robots, SCARA Modular Robots and Collaborative Modular Robots), Industry (Automotive, Electrical and Electronic, Plastic, Rubber and Chemicals) and Geography - Global Forecast 2023

[139 Pages] The modular robotics market is expected to reach USD 10.76 billion by 2023 from USD 4.70 billion in 2018, at a CAGR of 18.00% The study involved four major activities in estimating the current size of the modular robotics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the modular robotics market begins with capturing data on revenue of key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the market. Vendor offerings have also been considered to determine the market segmentation. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

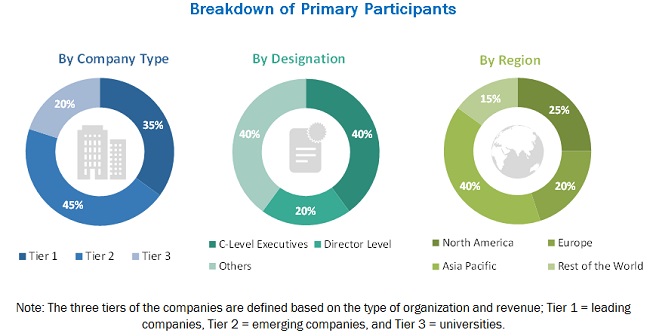

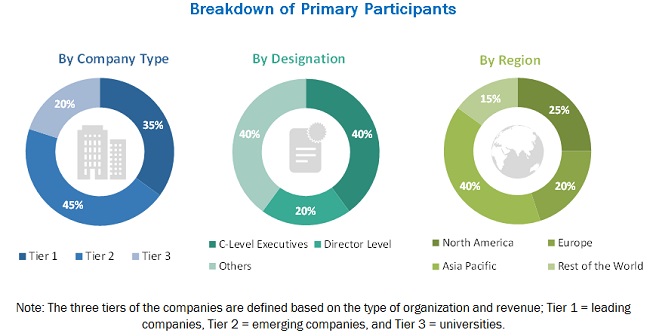

The modular robotics market comprises several stakeholders, such as suppliers of raw material and manufacturing equipment; standard components, original equipment manufacturers (OEMs); original device manufacturers (ODMs) of modular robotics; solutions providers; vendors of assembly, testing, and packaging solutions; and system integrators in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the modular robotics market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major application areas and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Research Objective

- To define, describe, and forecast the overall modular robotics market, in terms of value, segmented based on robot type, industry, and geography

- To forecast the market size for various segments with regard to 4 regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To forecast the market based on robot type in terms of volume

- To provide qualitative information regarding various architectures of modular robotic systems

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide a detailed overview of modular robotics value chain

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the overall modular robotics market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To strategically profile key players, comprehensively analyze their market rankings and core competencies, and detail the competitive landscape for market leaders

- To analyze competitive developments such as product launches and development; contracts and agreement; partnerships and collaboration; and acquisition in the overall market

Want to explore hidden markets that can drive new revenue in Modular Robotics Market?

Scope of the Report:

Want to explore hidden markets that can drive new revenue in Modular Robotics Market?

|

Report Metric |

Details |

|

Market size available for years |

2015–2023 |

|

Base year |

2017 |

|

Forecast period |

2018–2023 |

|

Units |

Value (USD Million/Billion) |

|

Segments covered |

Robot Type, Industry, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

ABB (Switzerland), Fanuc (Japan), Yaskawa (Japan), Kuka (Germany), Kawasaki Heavy Industries (Japan), Mitsubishi Electric (Japan), Denso (Japan), NACHI-FUJIKOSHI (Japan), Universal Robots (Denmark), Rethink Robotics (US), Stäubli International (Switzerland), DAIHEN (Japan), CMA Robotics SpA (Italy), Yamaha Motor (Japan), ENGEL (Austria), Comau SpA (Italy), Aurotek (Taiwan), Toshiba Machine (Japan), A.C.M.I spa (Italy), and Cassioli Srl (Italy). |

This report categorizes the modular robotics market based on robot type, industry, and region.

By Robot Type:

- Articulated modular robots

- Cartesian modular robots

- SCARA modular robots

- Parallel modular robots

- Collaborative modular robots

- Other modular robots

- Spherical robots

- Cylindrical robots

By Industry:

- Automotive

- Electrical and Electronics

- Plastic, Rubber, and Chemicals

- Metals and Machinery

- Food & Beverages

- Precision Engineering and Optics

- Pharmaceuticals and Cosmetics

- Others(oil & gas; paper and printing; foundry and forging; ceramics and stone; construction; textiles and clothing; supply chain management; and wood industries.)

By Region:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (Belgium, Sweden, Poland, and the Czech Republic among others)

- Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC (Taiwan, Thailand, Malaysia, Indonesia, Australia, and New Zealand among others)

- Rest of the World (RoW)

- The Middle East and Africa

- South America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Market size for 2019 and 2021 for segments such as robot type, and vertical, geography.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Critical questions would be;

- The modular robotics ecosystem faces the major challenge regarding the interoperability and integration with existing platforms. When will this scenario ease out?

- What are the approaches followed by the industry players to address this challenge?

Factors driving the growth of the market include growing investment in industrial automation and increasing adoption of collaborative modular robots owing to their benefits and features.

Based on robot type, the modular robotics market has been segmented into articulated modular robots, Cartesian modular robots, SCARA modular robots, parallel modular robots, collaborative modular robots, and other modular robots. The articulated modular robots are expected to hold the largest share of the market during the forecast period. The projected largest share of these robots in the market by 2018 is attributed to the high rate of adoption of these robots in the automotive industry for handling heavy automotive parts and in the metal and machinery industry for handling heavy metal sheets and components. The growing adoption of articulated modular robots in the food & beverages, plastics, rubber, and chemicals industries for automation of processing is the key factor expected to contribute to the growth of the modular robotics market during the forecast period.

Based on industry, the modular robotics market has been segmented into, automotive; electrical and electronics; plastics rubber and chemical; metals and machinery; food & beverage; precision engineering and optics; pharmaceutical and cosmetics; and others. The automotive industry is expected to hold the largest share of the market during the forecast period. In the automotive industry, new capabilities of modular robotics have responded to changing demands in a more efficient and cost-effective way. In addition, the new levels of speed, accuracy, precision, flexibility, and agility achieved through modular robotics provide improved competitiveness, quality, and productivity to the manufacturing processes. The growing demand for vehicles, especially from developing countries, has encouraged automotive manufacturers and OEMs to opt for automation to increase production volume and meet the market demand. This has contributed to the high demand for modular robots from the automotive industry.

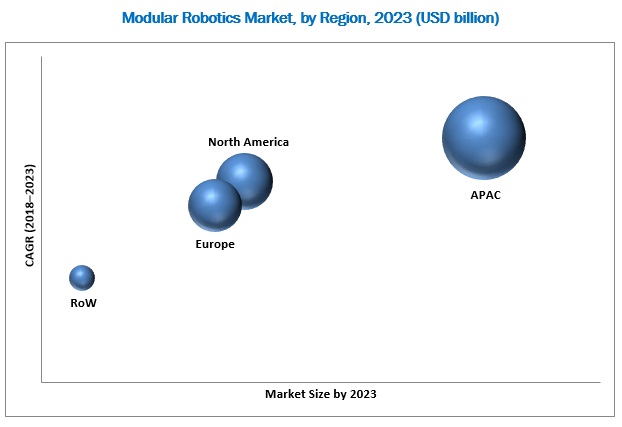

APAC is expected to dominate the modular robotics market during the forecast period. The increasing investment in automation by the automotive, and electrical and electronics players, especially in countries such as China, South Korea, and India, is expected to be the key driver for the market in APAC. Also, the increasing adoption of collaborative modular robots by manufacturers has elevated the demand for modular robotics in APAC.

The major challenge for the companies in the modular robotics market is the interoperability issues and difficulty in integration of different robotic frameworks into existing facilities and addressing the need for safe handling of industrial-grade operations. Companies have adopted the product launch, partnership, collaboration, contract, agreement, expansion, and acquisition strategies to expand their market presence and distribution networks in the market.

Some of the major players in the modular robotics market are ABB Ltd. (ABB, Switzerland), KUKA AG (KUKA, Germany), Mitsubishi Electric Corp. (Mitsubishi, Japan), FANUC Corporation (Fanuc, Japan), Kawasaki Heavy Industries Ltd. (Kawasaki Heavy Industries, Japan), and Yaskawa Electric Corporation (Yaskawa, Japan).

Growing investments in industrial automation

Automotive

Since the inception of modular robotics, the automotive industry has made intensive use of these robotics systems. In this industry, new capabilities of modular robotics have responded to changing demands in a more efficient and cost-effective way. In addition, the new levels of speed, accuracy, precision, flexibility, and agility achieved through modular robotics have improved competitiveness, quality, and productivity of the manufacturing processes.

Modular robotics systems have brought about significant improvements in the entire production chain from operations in stores, press shops, and paint shops to the final assembly and distribution activities in warehouses. In the automotive industry, robots carry out some major activities of material handling, palletizing, laser and camera operations, foundry operations, and painting. The modular robots are also used in rounding out the spectrum work; e.g., they are used to install the complete dashboard of a car, join the chassis (marriage/decking) for heavy automotive such as excavators, or install components.

Electrical and Electronics

There is a significant rise in the adoption of modular robotics systems in the electrical and electronics industries with the miniaturization of electrical and electronic equipment as well as complexity involved in the manufacturing processes. The incorporation of modular robotics leads to efficient automation and systematic manufacturing processes in these industries, which results in the frequent introduction of new electronic products on the market at affordable prices for customers. The rise in demand for these robots is attributed to the increased installation in APAC.

Critical questions would be;

- Where will all these developments take the industry in the mid to long term?

- Which industry will hold the major market potential in modular robotics ecosystem?

- Which will be the major market expansion strategy adopted by the players in the studied market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in Modular Robotics Market

4.2 Market, By Robot Type

4.3 Market, By Industry

4.4 Market in APAC, Country vs Industry

4.5 Market, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics: Overview

5.2.1 Drivers

5.2.1.1 Growing Investments in Industrial Automation

5.2.1.2 Increasing Adoption of Collaborative Modular Robots Owing to Their Benefits and Features

5.2.2 Restraints

5.2.2.1 Complexity of Modular Robots With Respect to Their Designs and Controlling Electronics

5.2.3 Opportunities

5.2.3.1 Rising Adoption of Robotics-As-A-Service Model

5.2.4 Challenges

5.2.4.1 Interoperability Issues and Difficulty in Integration of Different Robotic Frameworks Into Existing Facilities

5.2.4.2 Address the Need for Safe Handling of Industrial-Grade Operations

5.3 Value Chain Analysis

6 Architecture of Modular Robots (Page No. - 40)

6.1 Introduction

6.2 Chain Type

6.3 Lattice Type

6.4 Hybrid Type

7 Modular Robotics Market, By Robot Type (Page No. - 42)

7.1 Introduction

7.2 Articulated Modular Robots

7.2.1 Articulated Modular Robots to Hold Largest Share of Market By 2018

7.3 Cartesian Modular Robots

7.3.1 Cartesian Modular Robots to Hold Second-Largest Share of Market By 2018.

7.4 Scara Modular Robots

7.4.1 Best Price-To-Performance Ratio Offered By Scara Modular Robots for High-Speed Applications to Drive Market During Forecast Period

7.5 Parallel Modular Robots

7.5.1 High Adoption Rate for Pick-And-Place Applications in Food & Beverages Industry to Drive Market for Parallel Modular Robots

7.6 Collaborative Modular Robots

7.6.1 Ability to Work Safely Alongside Humans Expected to Fuel Growth of Market for Collaborative Modular Robots

7.7 Other Modular Robots

7.7.1 Spherical Robots

7.7.1.1 Ability to Optimally Perform Tasks Involving Low-Weight Payloads Drives Market for Spherical Modular Robots

7.7.2 Cylindrical Robots

7.7.2.1 Adoption of Cylindrical Modular Robots in Manufacturing Industries for Welding Applications is Key Factor Driving Factor

8 Modular Robotics Market, By Industry (Page No. - 53)

8.1 Introduction

8.2 Automotive

8.2.1 Adoption of Modular Robots for Automatizing Assembly Lines is Key Factor Driving Growth of Market for Automotive Industry

8.3 Electrical and Electronics

8.3.1 Ability of Modular Robotics Systems to Enable Efficient Automation and Systematic Manufacturing Processes to Boost Their Adoption in Electrical and Electronics Industry

8.4 Plastics, Rubber, and Chemicals

8.4.1 Capability to Handle Hazardous Explosive Substances Boosts Adoption of Modular Robots in Plastics, Rubber, and Chemicals Industry

8.5 Metals and Machinery

8.5.1 High Rate of Adoption of Modular Robots for Applications Such as Welding and Pick-And-Place to Drive Market for Metals and Machinery Industry

8.6 Food & Beverages

8.6.1 Adoption of Parallel Modular Robots for Pick-And-Place Application is Key Trend Observed in Food & Beverages Industry

8.7 Precision Engineering and Optics

8.7.1 Adoption of Modular Robotics System for Error-Proofing Processes in Precision Engineering and Optics Industry to Fuel Growth of Modular Robotics Market During Forecast Period

8.8 Pharmaceuticals and Cosmetics

8.8.1 Use of Modular Robots in Pharmaceuticals and Cosmetics Industries to Handle Hazardous Biologicals and Radioactive Substances to Drive Growth of Market

8.9 Others

8.9.1 Adoption of Modular Robots in Other Industries to Perform Tasks Such as Material Removal Increasing Adoption of Modular Robotic Systems in Industries Such as Wood and Glass to Fuel Growth of Market for Other Industries

9 Geographic Analysis (Page No. - 85)

9.1 Introduction

9.2 North America

9.2.1 Us

9.2.1.1 US Held Largest Share of Modular Robotics Market in 2017

9.2.2 Canada

9.2.2.1 Increasing Adoption of Modular Robots in Electrical and Electronics Industry to Drive Market in Canada During Forecast Period

9.2.3 Mexico

9.2.3.1 Increasing Adoption of Modular Robotic Systems in Automotive Industry to Fuel Growth of Market in Mexico

9.3 Europe

9.3.1 Germany

9.3.1.1 Automotive Industry Was Largest Contributor to Market in Germany in 2017

9.3.2 France

9.3.2.1 Adoption of Modular Robotics Systems in Electrical and Electronics Industry to Automate Integration Process to Fuel Growth of Market in France

9.3.3 Uk

9.3.3.1 Food & Beverages Industry to Drive Market in the UK During Forecast Period

9.3.4 Italy

9.3.4.1 High Rate of Adoption of Modular Robots for Applications Such as Welding, Pick and Place, and Packing is Key Driver for Market in Italy

9.3.5 Spain

9.3.5.1 Increasing Adoption of Modular Robotic Systems for Applications Such as Handling and Painting Drives Market in Spain

9.3.6 Rest of Europe

9.3.6.1 Shortage of Skilled Labors is Key Factor Driving Market in Rest of European Countries

9.4 APAC

9.4.1 China

9.4.1.1 Automotive Industry Held Largest Share of Modular Robotics Market in China in 2017

9.4.2 Japan

9.4.2.1 Various Government Polices Promoting Utilization of Robots in Various Industries Fuel Implementation of Modular Robotics in Japan

9.4.3 South Korea

9.4.3.1 Increasing Adoption of Modular Robotic Systems in Electrical and Electronics Industry to Contribute to Growth of Market in South Korea

9.4.4 India

9.4.4.1 Rising Labor Cost is Key Factor Driving Growth of Market in India

9.4.5 Rest of APAC

9.4.5.1 Increasing Penetration Rate of Modular Robotic Systems in Automotive Industry to Drive Market in Rest of APAC

9.5 RoW

9.5.1 South America

9.5.1.1 Increasing Focus on Manufacturing By Global Players is Key Factor Driving Market in South America

9.5.2 Middle East and Africa

9.5.2.1 Rising Adoption of Automation Services is Leading to Steady Growth of Market in Middle East and Africa

10 Competitive Landscape (Page No. - 97)

10.1 Introduction

10.2 Modular Robotics Market Ranking Analysis, 2017

10.3 Competitive Situations and Trends

10.3.1 Product Launches

10.3.2 Partnerships and Collaborations

10.3.3 Expansions

10.3.4 Contracts and Agreements

10.3.5 Acquisitions

11 Company Profiles (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Key Players

11.1.1 ABB

11.1.2 Fanuc

11.1.3 Kuka

11.1.4 Yaskawa

11.1.5 Kawasaki Heavy Industries

11.1.6 Mitsubishi Electric

11.1.7 Denso

11.1.8 Nachi-Fujikoshi

11.1.9 Universal Robots A/S

11.1.10 Rethink Robotics

11.2 Other Key Players

11.2.1 Stäubli International

11.2.2 Daihen

11.2.3 Cma Robotics Spa

11.2.4 Yamaha Motor

11.2.5 Engel

11.2.6 Comau S.P.A

11.2.7 Aurotek

11.2.8 Toshiba Machine

11.2.9 Acmi Spa

11.2.10 Cassioli Srl

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 133)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (68 Tables)

Table 1 Modular Robotics Market, By Robot Type, 2015–2023 (USD Million)

Table 2 Market, By Robot Type, 2015–2023 (Units)

Table 3 Market for Articulated Modular Robots, By Industry, 2015–2023 (USD Million)

Table 4 Market for Cartesian Modular Robots, By Industry, 2015–2023 (USD Million)

Table 5 Market for Scara Modular Robots, By Industry, 2015–2023 (USD Million)

Table 6 Market for Parallel Modular Robots, By Industry, 2015–2023 (USD Million)

Table 7 Market for Collaborative Modular Robots, By Industry, 2015–2023 (USD Million)

Table 8 Market for Other Modular Robots, By Industry, 2015–2023 (USD Million)

Table 9 Market, By Industry, 2015–2023 (USD Million)

Table 10 Market for Automotive, By Region, 2015–2023 (USD Million)

Table 11 Market for Automotive in North America, By Country, 2015–2023 (USD Million)

Table 12 Market for Automotive in Europe, By Country, 2015–2023 (USD Million)

Table 13 Market for Automotive in APAC, By Country, 2015–2023 (USD Million)

Table 14 Market for Automotive in RoW, By Region, 2015–2023 (USD Million)

Table 15 Market for Automotive, By Robot Type, 2015–2023 (USD Million)

Table 16 Market for Electrical and Electronics in North America, By Country, 2015–2023 (USD Million)

Table 17 Market for Electrical and Electronics, By Region, 2015–2023 (USD Million)

Table 18 Market for Electrical and Electronics in Europe, By Country, 2015–2023 (USD Million)

Table 19 Market for Electrical and Electronics Industry in APAC, By Country, 2015–2023 (USD Million)

Table 20 Market for Electrical and Electronics in RoW, By Region, 2015–2023 (USD Million)

Table 21 Market for Electrical and Electronics, By Robot Type, 2015–2023 (USD Million)

Table 22 Market for Plastics, Rubber, and Chemicals, By Region, 2015–2023 (USD Million)

Table 23 Market for Plastics, Rubber, and Chemicals Industries in North America, By Country, 2015–2023 (USD Million)

Table 24 Market for Plastics, Rubber, and Chemicals in Europe, By Country, 2015–2023 (USD Million)

Table 25 Market for Plastics, Rubber, and Chemicals in APAC, By Country, 2015–2023 (USD Million)

Table 26 Market for Plastics, Rubber, and Chemicals in RoW, By Region, 2015–2023 (USD Million)

Table 27 Market for Plastics, Rubber, and Chemicals, By Robot Type, 2015–2023 (USD Million)

Table 28 Market for Metals and Machinery, By Region, 2015–2023 (USD Million)

Table 29 Market for Metals and Machinery in North America, By Country, 2015–2023 (USD Million)

Table 30 Market for Metals and Machinery in Europe, By Country, 2015–2023 (USD Million)

Table 31 Market for Metals and Machinery in APAC, By Country, 2015–2023 (USD Million)

Table 32 Market for Metals and Machinery in RoW, By Region, 2015–2023 (USD Million)

Table 33 Market for Metal and Machinery, By Rob0t Type, 2015–2023 (USD Million)

Table 34 Market for Food & Beverages, By Region, 2015–2023 (USD Million)

Table 35 Market for Food & Beverages in North America, By Country, 2015–2023 (USD Million)

Table 36 Market for Food & Beverages in Europe, By Country, 2015–2023 (USD Million)

Table 37 Market for Food & Beverages in APAC, By Country, 2015–2023 (USD Million)

Table 38 Market for Food & Beverages in RoW, By Region, 2015–2023 (USD Million)

Table 39 Market for Food & Beverages, By Robot Type, 2015–2023 (Million)

Table 40 Market for Precision Engineering and Optics, By Region, 2015–2023 (USD Million)

Table 41 Market for Precision Engineering and Optics in North America, By Country, 2015–2023 (USD Million)

Table 42 Market for Precision Engineering and Optics in Europe, By Country, 2015–2023 (USD Million)

Table 43 Market for Precision Engineering and Optics in APAC, By Country, 2015–2023 (USD Million)

Table 44 Market for Precision Engineering and Optics in RoW, By Region, 2015–2023 (USD Million)

Table 45 Market for Precision Engineering and Optics Industry, By Robot Type, 2015–2023 (Million)

Table 46 Market for Pharmaceuticals and Cosmetics, By Region, 2015–2023 (USD Million)

Table 47 Market for Pharmaceuticals and Cosmetics in North America, By Country, 2015–2023 (USD Million)

Table 48 Market for Pharmaceuticals and Cosmetics in Europe, By Country, 2015–2023 (Million)

Table 49 Market for Pharmaceuticals and Cosmetics in APAC, By Country, 2015–2023 (USD Million)

Table 50 Market for Pharmaceuticals and Cosmetics in RoW, By Region, 2015–2023 (USD Million)

Table 51 Market for Pharmaceuticals and Cosmetics, By Robot Type, 2015–2023 (USD Million)

Table 52 Market for Others, By Region, 2015–2023 (USD Million)

Table 53 Market for Others in North America, By Country, 2015–2023 (USD Million)

Table 54 Market for Others in Europe, By Country, 2015–2023 (USD Million)

Table 55 Market for Others in APAC, By Country, 2015–2023 (USD Million)

Table 56 Market for Others in RoW, By Region, 2015–2023 (USD Million)

Table 57 Market for Others, By Robot Type, 2015–2023 (USD Million)

Table 58 Market, By Region, 2015–2023 (USD Million)

Table 59 Market in North America, By Country, 2015–2023 (USD Million)

Table 60 Market in Europe, By Country, 2015–2023 (USD Million)

Table 61 Market in APAC, By Country, 2015–2023 (USD Million)

Table 62 Market in RoW, By Region, 2015–2023 (USD Milllion)

Table 63 Market Ranking, 2017

Table 64 Product Launches, 2015–2017

Table 65 Partnerships and Collaborations, 2015–2017

Table 66 Expansions, 2015–2017

Table 67 Contracts and Agreements, 2015–2017

Table 68 Acquisitions, 2015–2017

List of Figures (45 Figures)

Figure 1 Segmentation of Modular Robotics Market

Figure 2 Market: Research Design

Figure 3 Market: Bottom-Up Approach

Figure 4 Market: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Articulated Modular Robots to Hold Largest Share of Market Based on Robot Type By 2018

Figure 7 Automotive Industry to Hold Largest Share of Market By 2018

Figure 8 APAC to Hold Largest Share of Market By 2018

Figure 9 Growing Investments for Automation in Industries Drives Growth of Market

Figure 10 Articulated Modular Robots to Hold Largest Size of Market By 2018

Figure 11 Automotive Industry to Hold Largest Share of Market By 2018

Figure 12 China to Hold Largest Share of Market in APAC By 2018

Figure 13 China to Hold Largest Share of Market From 2018–2023

Figure 14 Growing Investments in Industrial Automation Drives Market

Figure 15 Modular Robotic Value Chain Analysis: Maximum Value Added During R&D Stage

Figure 16 Diagrammatic Representation of Chain Type Modular Robots

Figure 17 Diagrammatic Representation of Lattice Type Modular Robots

Figure 18 Market for Collaborative Robots to Grow at Highest CAGR During Forecast Period

Figure 19 Automotive to Hold Largest Share of Market for Articulated Modular Robots By 2018

Figure 20 Electrical & Electronics to Hold Largest Size of Market for Scara Modular Robots By 2023

Figure 21 Automotive Industry to Hold Largest Share of Market for Collaborative Modular Robots By 2023

Figure 22 Market for Metals & Machinery to Grow at Highest CAGR During Forecast Period

Figure 23 Modular Robotics Market for Automotive in APAC to Grow at Highest CAGR During Forecast Period

Figure 24 US to Hold Largest Size of Market for Electrical and Electronics in North America By 2018

Figure 25 China to Hold Largest Size of Market for Plastics, Rubber, and Chemicals in APAC in 2018

Figure 26 APAC to Hold Largest Size of Market for Metals and Machinery in 2023

Figure 27 Germany to Hold Largest Size of Market for Food and Beverages in 2018

Figure 28 Market for Precision Engineering and Optics in APAC to Grow at Highest CAGR During Forecast Period

Figure 29 Market for Pharmaceuticals and Cosmetics in Mexico to Grow at Highest CAGR During Forecast Period

Figure 30 US to Hold Largest Size of Market for Others During Forecast Period

Figure 31 Market in APAC to Grow at Significant CAGR During Forecast Period

Figure 32 North America: Market Snapshot

Figure 33 Europe: Market Snapshot

Figure 34 APAC: Market Snapshot

Figure 35 Market in South America to Grow at Higher CAGR During Forecast Period

Figure 36 Players in Market Adopted Product Launches as Their Key Growth Strategy From 2015 to 2017

Figure 37 Product Launches, Partnerships, and Collaborations as Key Business Strategies Adopted By Market Players During 2015–2017

Figure 38 ABB: Company Snapshot

Figure 39 Fanuc: Company Snapshot

Figure 40 Kuka: Company Snapshot

Figure 41 Yaskawa: Company Snapshot

Figure 42 Kawasaki Heavy Industries: Company Snapshot

Figure 43 Mitsubishi Electric: Company Snapshot

Figure 44 Denso: Company Snapshot

Figure 45 Nachi-Fujikoshi: Company Snapshot

The study involved four major activities in estimating the current size of the modular robotics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the modular robotics market begins with capturing data on revenue of key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the market. Vendor offerings have also been considered to determine the market segmentation. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

The modular robotics market comprises several stakeholders, such as suppliers of raw material and manufacturing equipment; standard components, original equipment manufacturers (OEMs); original device manufacturers (ODMs) of modular robotics; solutions providers; vendors of assembly, testing, and packaging solutions; and system integrators in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the modular robotics market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major application areas and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Research Objective

- To define, describe, and forecast the overall modular robotics market, in terms of value, segmented based on robot type, industry, and geography

- To forecast the market size for various segments with regard to 4 regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To forecast the market based on robot type in terms of volume

- To provide qualitative information regarding various architectures of modular robotic systems

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide a detailed overview of modular robotics value chain

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To strategically profile key players, comprehensively analyze their market rankings and core competencies, and detail the competitive landscape for market leaders

- To analyze competitive developments such as product launches and development; contracts and agreement; partnerships and collaboration; and acquisition in the overall modular robotics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Market size for 2019 and 2021 for segments such as robot type, and vertical, geography.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Critical questions would be;

- The modular robotics ecosystem faces the major challenge regarding the interoperability and integration with existing platforms. When will this scenario ease out?

- What are the approaches followed by the industry players to address this challenge?

Growth opportunities and latent adjacency in Modular Robotics Market

Why the modular robots emerging? People won't buy the modular robotic joints/gear, reconfigure their own robot at all. Robot is a robotic system. What's the potential of modular robotic joint/gear?