Mid and High-Level Precision GPS Receiver Market by Type (Differential Grade, Survey Grade), Functional Deployment (Navigation, Surveying and Mapping), Frequency Type (Single, Dual, Triple), End-user Industry and Region - Global Forecast to 2029

Updated on : Oct 22, 2024

Mid and High-Level Precision GPS Receiver Market Size & Share

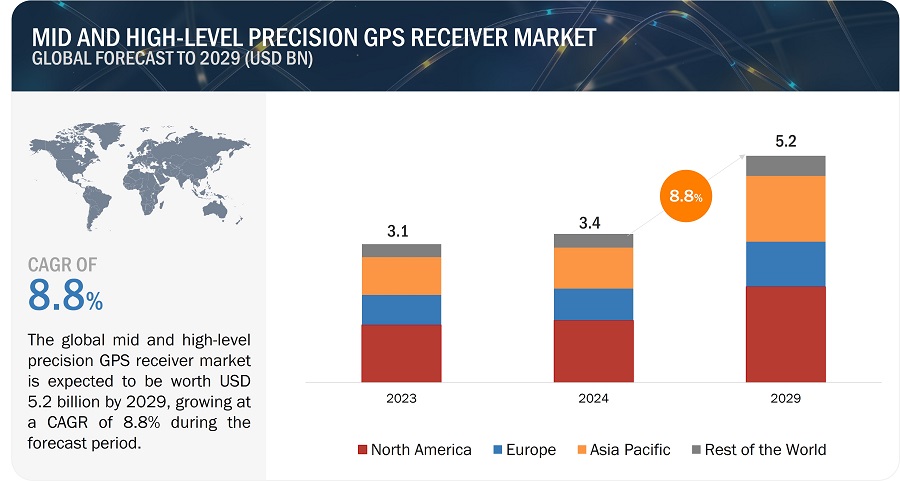

The global mid and high-level precision GPS receiver market size was valued at USD 3.4 billion in 2024 and is estimated to reach USD 5.2 billion by 2029, growing at a CAGR of 8.8% during the forecast period from 2024 to 2029.

The rising automation in industries and increasing demand for precision GPS in construction industries have driven the demand for mid and high-level precision GPS receivers. Also, the expanding adoption of GPS receivers in autonomous driving is fueling the market's growth.

Mid and High-Level Precision GPS Receiver Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Mid and High-Level Precision GPS Receiver Market Trends

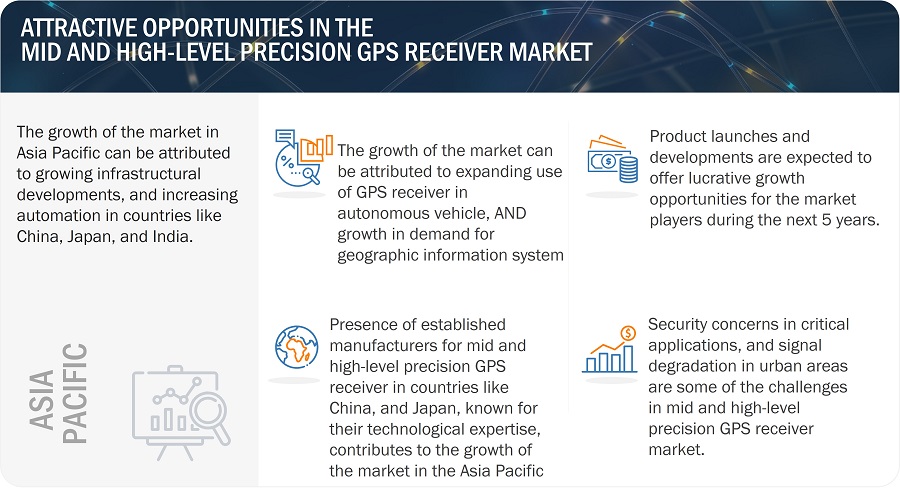

Driver: Rising demand for geographic information systems

The growing need for GIS applications is driving the mid and high-level precision GPS receiver industry, with applications spanning multiple industries. The integration of mid and high-precision GPS with GIS is notably expanding in sectors such as logistics and transportation.

Fleet management systems utilize GIS to streamline routes, track vehicle locations, and enhance overall transportation efficiency. The incorporation of high-precision GPS guarantees accurate positioning, substantially boosting the reliability of these systems in delivering timely and cost-effective logistics solutions. This integration underscores the pivotal role of high-precision GPS in augmenting GIS applications' functionality and efficiency across various industrial domains.

Restraint: Security concerns in critical applications

Security considerations concerning mid and high-level GPS receivers revolve around ensuring the precision and dependability of GPS signals, particularly in applications where accuracy is crucial. As GPS technology is more extensively incorporated into vital systems like autonomous vehicles, defense applications, and critical infrastructure, guarding against potential threats and vulnerabilities becomes of utmost importance. A notable security challenge lies in the risk of spoofing, wherein malicious entities create deceptive GPS signals to trick a receiver into furnishing inaccurate location information.

Opportunity: Expanding adoption of GPS receivers in autonomous driving

GPS technology is fundamental for autonomous vehicles to precisely ascertain their location, route, and speed, enabling them to function without human intervention. Essential for the advancement and deployment of autonomous driving systems, GPS receivers empower vehicles to navigate intricate routes, evade obstacles, and uphold a safe distance from other objects. These receivers collaborate with other sensors, including cameras, LiDAR, and radar, forming a comprehensive understanding of the vehicle's surroundings. This integrated sensor fusion allows autonomous vehicles to make real-time decisions, leveraging accurate positioning information.

Challenge: Interference and signal degradation in urban areas

In urban settings or areas marked by dense vegetation, towering buildings, or electromagnetic interference, signals transmitted by GPS satellites may face obstructions or reflections, resulting in a decline in signal quality. This occurrence can lead to inaccuracies in the positioning information provided by GPS receivers. Urban environments, characterized by intricate architectural structures and high population density, frequently present challenges for GPS signals to travel directly from satellites to receivers without encountering obstacles. Tall buildings, in particular, can cause signals to bounce off surfaces, creating multiple signal paths that reach the receiver. This multipath interference has the potential to introduce errors in the calculation of the receiver's position, impacting the overall accuracy of the GPS system.

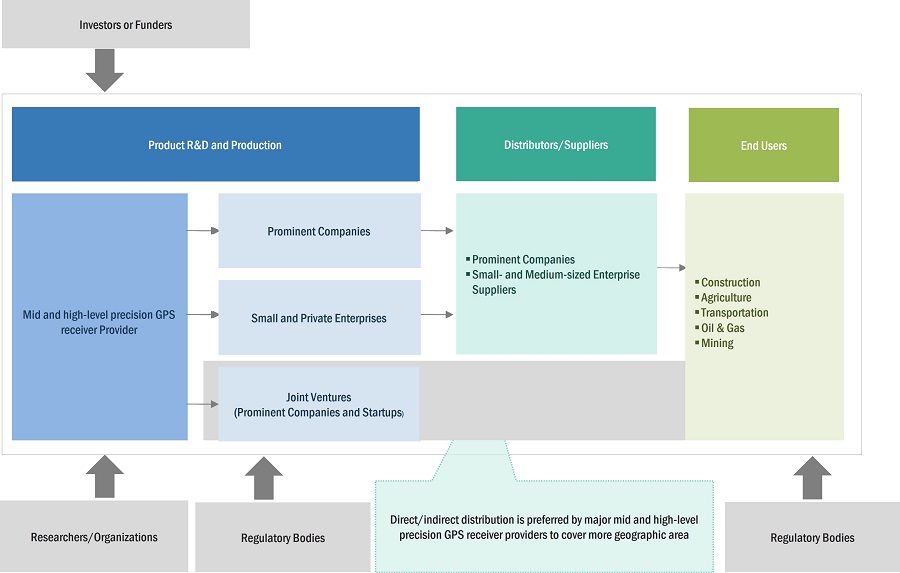

Mid And High-Level Precision Gps Receiver Market Ecosystem

The mid and high-level precision GPS receiver market is consolidated, with major companies such as Trimble Inc. (US), Topcon (Japan), Hexagon AB (Sweden), Hemisphere GNSS Inc. (US), Javad GNSS (US), Geneq (Canada), South Surveying & Mapping Technology Co. Ltd. (China), Septentrio (Belgium), CNH Industrial N.V. (UK), Comnav Technology Ltd. (China) and numerous small- and medium-sized enterprises. Almost all players offer various products in mid and high-level precision GPS receivers. These products are used for construction, agriculture, transportation, mining and oil & gas industries.

Mid And High-Level Precision Gps Receiver Market Segment Analysis

Based on type, the differential grade segment is expected to grow fastest during the forecast period.

Differential-grade GPS receivers offer higher accuracy compared to standard-grade receivers. This level of precision is crucial for applications where precise location information is essential, such as in automotive navigation systems and mining operations. Differential-grade GPS receivers are becoming more prevalent in infrastructure development projects.

The construction industry, for example, relies on precise positioning for tasks like grading and surveying, driving the demand for high-precision receivers.

Based on the end-user industry, the agriculture segment is projected to grow fastest during the forecast period

The agriculture sector is rapidly adopting automation technologies to enhance efficiency and productivity. High-precision GPS receivers are integral components in automated agricultural machinery, enabling precise navigation, planting, harvesting, and other tasks.

Precision GPS receivers enable farmers to apply inputs precisely where they are needed, reducing over-application and minimizing the environmental impact of agricultural activities. This environmentally sustainable approach is gaining importance in modern agriculture. Moreover, Many governments recognize the importance of adopting advanced technologies in agriculture for food security and sustainability. Incentives and support programs for adopting precision farming technologies, including GPS receivers, contribute to the sector's growth.

Mid And High-Level Precision Gps Receiver Market Regional Analysis

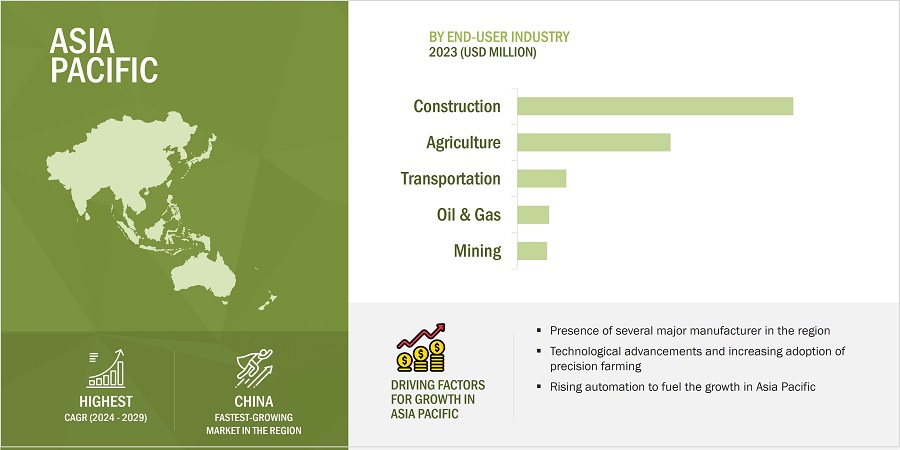

Based on region, China in the Asia Pacific region is expected to dominate in the forecasted period

China emerged as the dominant player in the mid and high-level precision GPS receiver market, a trend expected to continue with the highest growth rate in the foreseeable future. This dominance is attributed to several factors. Notably, China has made substantial investments in both the development and implementation of the BeiDou system, aiming to provide global coverage encompassing positioning, navigation, and timing services. The country's active international collaboration in satellite technology further extends the global utilization of advanced technology, leading to an increased demand for GPS receivers across various industries. Furthermore, the ongoing urban development in China is contributing to the escalating demand for such technology.

Mid and High-Level Precision GPS Receiver Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Mid And High-Level Precision Gps Receiver Companies - Key Market Players

The mid and high-level precision GPS receiver companies is dominated by a few globally established players such as

- Trimble Inc. (US),

- Topcon (Japan),

- Hexagon AB (Sweden),

- Hemisphere GNSS Inc. (US),

- Javad GNSS (US),

- Geneq (Canada),

- South Surveying & Mapping Technology Co. Ltd. (China),

- Septentrio (Belgium),

- CNH Industrial N.V. (UK),

- Comnav Technology Ltd. (China).

Mid And High-Level Precision Gps Receiver Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 3.4 billion in 2024 |

| Projected Market Size | USD 5.2 billion by 2029 |

| Growth Rate | CAGR of 8.8% |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By functional deployment, type, end-user industry, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies Covered |

Trimble Inc. (US), Topcon (Japan), Hexagon AB (Sweden), Hemisphere GNSS Inc. (US), Javad GNSS (US), Geneq (Canada), South Surveying & Mapping Technology Co. Ltd. (China), Septentrio (Belgium), CNH Industrial N.V. (UK), Comnav Technology Ltd. (China) |

Mid and High-Level Precision GPS Receiver Market Highlights

This research report categorizes the mid and high-level precision GPS receiver market based on functional deployment, type, end-user industry, and region

|

Segment |

Subsegment |

|

Based on functional Deployment: |

|

|

Based on Type: |

|

|

Based on end-user Industry: |

|

|

Based on Region: |

|

Recent Developments in Mid And High-Level Precision Gps Receiver Industry

- In November 2023, Hexagon's Autonomy & Positioning division, in collaboration with Munhwa Broadcasting Corporation (MBC), announced their partnership to introduce accurate positioning to South Korea via the TerraStar-X Enterprise Correction Service.

- In October 2022, Septentrio announced the introduction of the AsteRx SB3 ProBase, a new version within its well-received ruggedized receiver lineup. The AsteRx SB3 ProBase is a GNSS base station receiver housed in an IP68 enclosure, incorporating the latest quad-constellation GNSS technology to ensure optimal quality measurements.

- In May 2022, Septentrio unveiled the introduction of two novel GNSS products designed for marine applications: AsteRx-U3 Marine and AsteRx-m3 Fg. These products provide precise positioning both near and offshore, offering centimeter-level RTK or utilizing the integrated Fugro PPP sub-decimeter subscription service. The delivery options include NTRIP internet or L-band satellite communication.

- In March 2022, Hemisphere GNSS launched the Vector VS-i8 Inertial Navigation System (INS). This inertial navigation system, the Hemisphere Vector VS-i8, is compact, lightweight, self-contained, and operates at all altitudes. It proves to be highly versatile and suitable for a diverse range of industrial applications where constant navigation information is essential.

- In January 2022, Hexagon's Autonomy & Positioning division announced the declaration of its collaboration with the Chinese positioning company Dayou. This partnership aims to introduce TerraStar X technology to the Chinese market, delivering rapid and precise point positioning (PPP) corrections for applications like autonomous vehicles and widespread use, including smartphones.

- In January 2022, Hemisphere GNSS (Hemisphere) unveiled a new Vega heading and positioning OEM board that incorporates the Lyra II and Aquila chipsets. The Vega 60 GNSS board is designed to seamlessly integrate into industry-standard 46 by 71mm form factors, featuring a 60-pin connector.

Frequently Asked Questions (FAQs):

Which are the major companies in the mid and high-level precision GPS receiver market? What are their significant strategies to strengthen their market presence?

The major companies in the mid and high-level precision GPS receiver market are – Trimble Inc. (US), Topcon (Japan), Hexagon AB (Sweden), Hemisphere GNSS Inc. (US), and Septentrio (Belgium). The major strategies adopted by these players are product launches and developments, collaborations, acquisitions, and expansions.

What is the potential market for the mid and high-level precision GPS receiver in terms of the region?

The North American region is expected to dominate the mid and high-level precision GPS receiver market due to the presence of major companies in construction, agriculture, and automation.

What are the opportunities for new market entrants?

There are significant opportunities in the mid and high-level precision GPS receiver market for start-up companies. These companies provide innovative and diverse product portfolios for construction, agriculture, and other applications.

What are the drivers and opportunities for the mid and high-level precision GPS receiver market?

Factors such as increasing adoption of precision agriculture and rising demand for geographic information systems are fueling the growth of mid and high-level precision GPS receivers are among the factors driving the development of the market.

What are the major applications of mid and high-level precision GPS receivers that are expected to drive the market's growth in the next five years?

The major application for the mid and high-level precision GPS receiver is construction. The mid and high-level precision GPS receiver is also in demand in agriculture, transportation, mining, and oil & gas. They are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

To estimate the size of the mid and high-level precision GPS receiver market, the study utilized four major activities. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the mid and high-level precision GPS receiver market. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

SOURCE NAME |

WEBLINK |

|

European Union Agency for Space Programme |

|

|

BeiDou Navigation Satellite System |

|

|

National Coordination Office for Space-based Positioning Navigation and Timing |

|

|

National Environmental Satellite Data and Information Services |

Primary Research

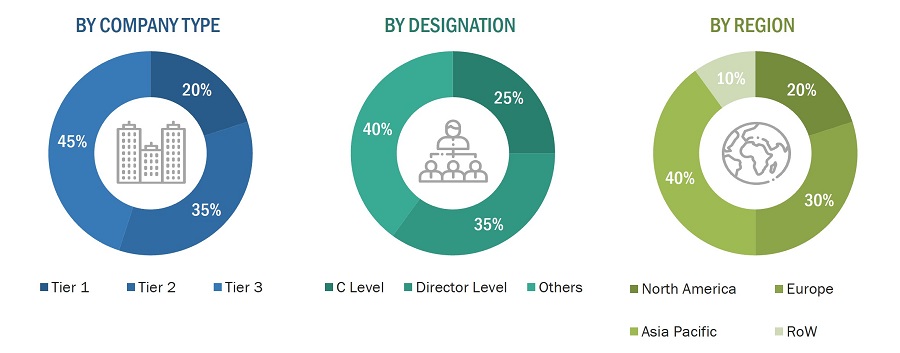

To gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting, primary interviews were conducted. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using mid and high-level precision GPS receivers, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of mid and high-level precision GPS receiver, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

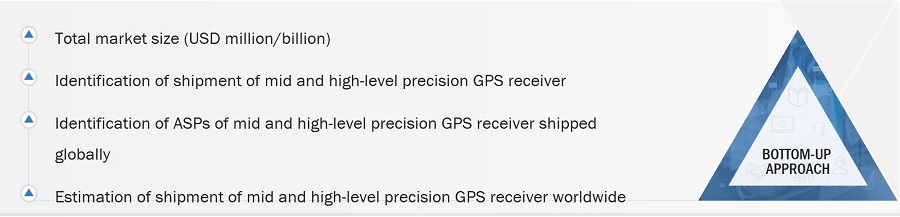

Market Size Estimation

To estimate and validate the size of the mid and high-level precision GPS receiver market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying the annual and financial reports of top players and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were then verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Global Mid and high-level Precision GPS Receiver Market Size: Botton Up Approach

- Companies offering mid and high-level precision GPS receiver products have been identified, and their product mapping with respect to different parameters, such as functional deployment, type, and end-user industry has been carried out.

- The market size has been estimated based on the demand for different mid and high-level precision GPS receivers for different applications. The anticipated change in demand for mid and high-level precision GPS receivers offered by these companies in the recession and company revenues have been analyzed and estimated.

- Primary research has been conducted with a few major players operating in the mid and high-level precision GPS receiver market to validate the global market size. Discussions included the impact of the recession on the mid and high-level precision GPS receiver ecosystem.

- The size of the mid and high-level precision GPS receiver market has been validated through secondary sources, which include the International Trade Centre (ITC), the World Trade Organization, and the World Economic Forum.

- The CAGR of the mid and high-level precision GPS receiver market has been calculated considering the historical and future market trends and the impact of the recession by understanding the adoption rate of mid and high-level precision GPS receiver for different applications.

- The estimates at every level have been verified and cross-checked through discussions with key opinion leaders, such as corporate executives (CXOs), directors, and sales heads, and with the domain experts in MarketsandMarkets.

- Various paid and unpaid information sources, such as company websites, annual reports, press releases, research journals, magazines, white papers, and databases, have also been studied.

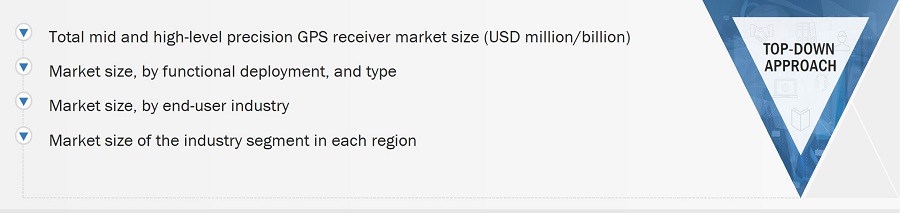

Global Mid and high-level Precision GPS Receiver Market Size: Top Down Approach

The top-down approach has been used to estimate and validate the total size of the mid and high-level precision GPS receiver market.

- Focusing initially on R&D investments and expenditures being made in the ecosystem of the mid and high-level precision GPS receiver market, further splitting the market on the basis of type, functional deployment, and region and listing key developments.

- Identifying leading players in the mid and high-level precision GPS receiver market through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications for which all identified players serve products to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments.

Data Triangulation

Once the overall size of the mid and high-level precision GPS receiver market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

Mid and high-level precision GPS receivers are specialized devices designed to provide accurate and reliable positioning information for various applications. These receivers operate within the broader category of Global Positioning System (GPS) technology but differ in terms of their precision and intended uses. High-level precision GPS receivers are engineered to deliver extremely accurate and reliable positioning information. These receivers are often employed in professional fields that demand precise location data, such as surveying, geodetic mapping, scientific research, and certain aspects of agriculture and construction.

Key Stakeholders

- GPS product designers and fabricators

- GPS receiver providers

- Application providers

- Business providers

- GPS product distributors and providers

- Research institutes and organizations

- Governments and other regulatory bodies

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Report Objectives

- To describe and forecast the mid and high-level precision GPS receiver market, by functional deployment, type, end-user industry, and region, in terms of value.

- To describe and forecast the market for various segments across four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To forecast the mid and high-level precision GPS receiver market by type, in terms of volume

- To strategically analyze the micro-markets with regard to the individual growth trends, prospects, and contribution to the mid and high-level precision GPS receiver market

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the mid and high-level precision GPS receiver market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the mid and high-level precision GPS receiver value chain

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios trade landscape, and case studies pertaining to the market under study

- To strategically profile key players in the mid and high-level precision GPS receiver market and comprehensively analyze their market shares and core competencies

- To strategically profile the key players and provide a detailed competitive landscape of the mid and high-level precision GPS receiver market.

- To analyze competitive developments such as partnerships, acquisitions, expansions, collaborations, and product launches, along with research and development (R&D) in the mid and high-level precision GPS receiver market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the mid and high-level precision GPS receiver market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the mid and high-level precision GPS receiver market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mid and High-Level Precision GPS Receiver Market