Microscope Software Market by Microscope (Optical, Electron, Raman), Category (Integrated, Standalone), Application (Semiconductor, Aerospace, Automotive, Healthcare, Medical Device, Implant), Region (North America, Europe) - Global Forecast to 2025

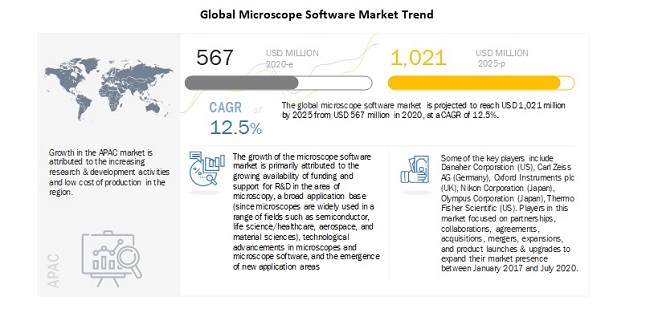

The global microscope software market in terms of revenue was estimated to be worth $567 million in 2020 and is poised to reach $1,021 million by 2025, growing at a CAGR of 12.5% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growing availability of funding & support for R&D in the area of microscopy, a broad application base (since microscopes are used widely in a range of fields, such as semiconductor, life science/healthcare, aerospace, and material sciences), technological advancements in microscopes & microscope software, and the emergence of new application areas is driving market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Microscope Software Market Dynamics

Driver: Technological advancements in microscopy software & microscopes

Technological advancements in microscopy include digitization, live-cell imaging, super-resolution, and high-throughput methods. These advancements serve to reduce product and test costs. Moreover, recent developments in microscopes include expansion microscopes, scanning helium microscopes, multi-view microscopes, and integrated microscopy workflows. Another significant trend in this market is digital microscopy, which offers enhanced image resolution with greater precision, leading to fewer distorted images and better viewing of samples.

Advances in software and graphical processing have also vastly improved the ability to clearly and accurately visualize samples and capture, store, and examine the data generated. Furthermore, manufacturers are developing solutions for extracting as much information as possible from samples. Confocal laser scanning microscopy is the standard for true 3D-resolved fluorescence imaging and, together with modern technologies, helps researchers extract as much information as possible from images.

Restraint: High cost of microscopes and software subscription

Owing to technological advancements, there has been a shift in the usage patterns of microscopes. Conventional microscopes are gradually losing their market to high-end microscopes such as electron microscopes, scanning probe microscopes, and digital microscopes due to their advanced features, higher resolution, and magnification power. However, these microscopes cost between USD 25,000 to USD 2 million, which is a major factor limiting their adoption in hospitals, pathological laboratories, and small-scale industries.

The cost of these systems rises exponentially with the addition of sample preparation & transfer systems and customized software for analyzing the generated images. While basic software is priced low, software with advanced features and specific applications such as applied sciences and materials is often costly. This still varies based on end user; academic and research institutes are offered lower prices than industrial end-users, due to their budgets.

Challenge: Availability of open-source microscopy software

The availability of open-source software is an important challenge for this market. Any programmer with access to the software can inspect and improve that program or, if required, can fix any issues as needed. In contrast, most software solutions available in the market are closed-source and proprietary—and, more importantly, expensive where open-source software is usually free. Some open-source confocal microscopy analysis solutions—available freely—are ImageJ/FIJI, Cell Profiler/Cell Analyst, Neuronstudio, Volume Integration and Alignment System (VIAS), and L-measure. Most small-scale end-users, academic institutes, and research centers show a high preference for open-source solutions, which directly hampers end-user demand for licensed closed-source software.

Opportunity: Emerging Markets

Developing countries, including BRIC, offer significant growth opportunities for players in the market. Government funding for R&D in advanced microscopes and software has increased considerably in these countries. Due to the low manufacturing cost and higher production volumes, these countries will further require advanced microscopes along with enhanced software to compete in the international market. The growth of their life sciences, semiconductor, and automotive industries will also support their demand for microscopes and software.

Optical microscopes accounted for the largest share of the microscope software industry in 2019

In 2019, the optical microscopes segment accounted for the largest share of the microscope software market. Growth in this market segment can be attributed to the wide availability of advanced optical microscopy instruments and techniques. Also, the low cost of optical microscope software is contributing to the growth of this market segment.

Integrated software dominated the microscope software industry in 2019

Based on the type of software, the microscope software market is segmented into integrated software and standalone software. In 2019, the integrated software segment accounted for the largest share of the market.

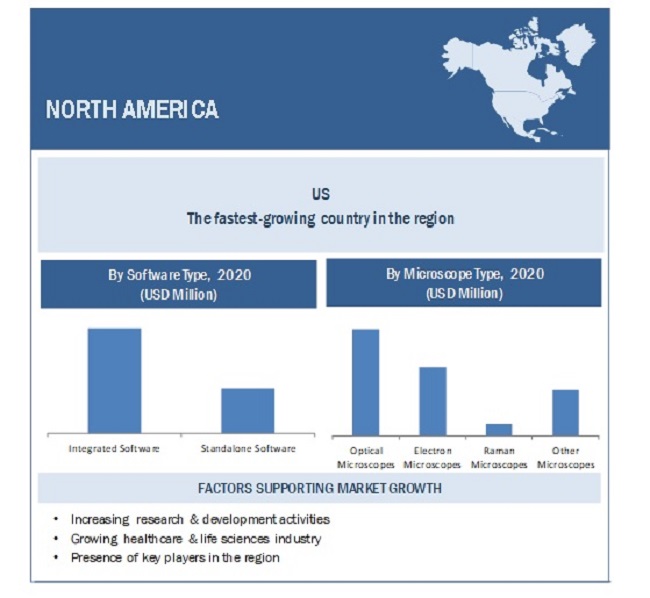

North America accounted for the second-largest share of the global microscope software industry in 2019 and is likely to remain an important region for manufacturers to concentrate

North America (comprising the US and Canada) accounted for the second-largest share of the global microscope software market in 2019. North America is a mature market for microscope software. The major players operating in the market, including Danaher Corporation and Thermo Fisher Scientific, have a strong presence in North America with a wide customer base and established distribution channels. The penetration of advanced microscopy systems and software such as electron microscopes, digital microscopes, and confocal microscopes is significantly high in various end-use industries in this region. These companies are actively involved in research to expand the applications of correlative microscopy in materials science and geology in the region and contribute towards its growth.

To know about the assumptions considered for the study, download the pdf brochure

Some of the key players include Danaher Corporation (US), Carl Zeiss AG (Germany), Oxford Instruments plc (UK), Nikon Corporation (Japan), Olympus Corporation (Japan), Thermo Fisher Scientific (US), Hitachi High-Tech Corporation (Japan), JEOL Ltd. (Japan), Scientific Volume Imaging B.V. (Netherlands), arivis AG (Germany), DRVISION Technologies (US), Media Cybernetics, Inc. (US), Gatan, Inc. (US), Basler AG (Germany), Nanolive SA (Switzerland), Nion Company (US), and Object Research Systems, Inc. (Canada).

Scope of the Microscope Software Industry

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$567 million |

|

Projected Revenue by 2025 |

$1,021 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 12.5% |

|

Market Driver |

Technological advancements in microscopy software & microscopes |

|

Market Opportunity |

Emerging Markets |

This research report categorizes the microscope software market to forecast revenue and analyze trends in each of the following submarkets:

By Type of Microscopes

- Optical Microscopes

- Electron Microscopes

- Raman Microscopes

- Other Microscopes

By Type

- Integrated Software

- Standalone Software

By Application

- Semiconductor Industry

- Healthcare Industry

- Medical Devices

- Implants

- Automotive Industry

- Aerospace Industry

- Other Industries

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Microscope Software Industry

- In 2019, Leica Microsystems ( A part of Danaher) launched LAS X Steel Expert software for the fast and accurate rating of non-metallic inclusions in steel.

- In 2020, JOEL Ltd had an agreement with DI Corporation (South Korea) to acquire all of the DI-owned shares of JEOL Korea Ltd. and make JK a wholly-owned subsidiary of JEOL.

- In 2019, Carl Zeiss AG launched the ZEISS ZEN core software suite that offers new analysis and connectivity modules

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global microscope software market?

The global microscope software market boasts a total revenue value of $1,021 million by 2025.

What is the estimated growth rate (CAGR) of the global microscope software market?

The global microscope software market has an estimated compound annual growth rate (CAGR) of 12.5% and a revenue size in the region of $567 million in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKETS COVERED

FIGURE 1 MICROSCOPE SOFTWARE MARKET SEGMENTATION

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.1.2 PRIMARY RESEARCH

FIGURE 3 PRIMARY SOURCES

2.1.1.3 KEY DATA FROM PRIMARY SOURCES

2.1.1.4 KEY INDUSTRY INSIGHTS

2.1.1.5 BREAKDOWN OF PRIMARIES

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY TYPE OF END-USE INDUSTRY, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET: TOP-DOWN APPROACH

2.2.3 GROWTH FORECAST

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET PLAYER RANKING

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 8 MICROSCOPE SOFTWARE MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 MICROSCOPE SOFTWARE INDUSTRY, BY TYPE OF MICROSCOPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 11 MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 MICROSCOPE SOFTWARE MARKET OVERVIEW

FIGURE 12 FAVORABLE FUNDING SCENARIO FOR MICROSCOPY R&D TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY TYPE & COUNTRY (2020)

FIGURE 13 INTEGRATED SOFTWARE SEGMENT TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2020

4.3 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 14 ASIA PACIFIC COUNTRIES TO REGISTER THE HIGHEST GROWTH IN THE MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 MICROSCOPE SOFTWARE: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 FAVORABLE FUNDING SCENARIO FOR MICROSCOPY R&D

TABLE 1 FUNDING FOR R&D IN MICROSCOPY

5.2.1.2 TECHNOLOGICAL ADVANCEMENTS IN MICROSCOPY SOFTWARE & MICROSCOPES

5.2.1.3 EMERGING APPLICATIONS OF MICROSCOPY

5.2.2 RESTRAINTS

5.2.2.1 HIGH COST OF MICROSCOPES AND SOFTWARE SUBSCRIPTIONS

5.2.3 OPPORTUNITIES

5.2.3.1 EMERGING MARKETS

5.2.4 CHALLENGES

5.2.4.1 LACK OF SKILLED PROFESSIONALS

5.2.4.2 AVAILABILITY OF OPEN-SOURCE MICROSCOPY SOFTWARE

5.3 ROLE AND IMPACT OF AI AND MACHINE VISION ON THE MARKET

5.4 IMPACT OF COVID-19 ON THE MARKET

6 MICROSCOPE SOFTWARE MARKET, BY TYPE OF MICROSCOPE (Page No. - 46)

6.1 INTRODUCTION

TABLE 2 MICROSCOPE SOFTWARE INDUSTRY, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

6.2 OPTICAL MICROSCOPES

6.2.1 LARGE INSTALLATION BASE OF OPTICAL MICROSCOPES TO DRIVE MARKET GROWTH

6.2.2 IMPACT OF COVID-19 ON THE OPTICAL MICROSCOPE S/W MARKET

TABLE 3 OPTICAL MICROSCOPE S/W MARKET, BY REGION, 2018-2025 (USD MILLION)

6.3 ELECTRON MICROSCOPES

6.3.1 DEMAND FOR AUTOMATED SOFTWARE TOOLS IS INCREASING IN ELECTRON MICROSCOPY

6.3.2 IMPACT OF COVID-19 ON THE ELECTRON MICROSCOPE S/W MARKET

TABLE 4 ELECTRON MICROSCOPE SOFTWARE INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

6.4 RAMAN MICROSCOPES

6.4.1 LOW COST OF RAMAN MICROSCOPY TO DRIVE MARKET GROWTH

6.4.2 IMPACT OF COVID-19 ON THE RAMAN MICROSCOPE S/W MARKET

TABLE 5 RAMAN MICROSCOPE S/W MARKET, BY REGION, 2018-2025 (USD MILLION)

6.5 OTHER MICROSCOPES

TABLE 6 OTHER MICROSCOPE S/WMARKET, BY REGION, 2018-2025 (USD MILLION)

7 MICROSCOPE SOFTWARE MARKET, BY TYPE (Page No. - 51)

7.1 INTRODUCTION

TABLE 7 MICROSCOPE SOFTWARE INDUSTRY, BY TYPE, 2018-2025 (USD MILLION)

7.2 INTEGRATED SOFTWARE

7.2.1 HIGH HARDWARE AND SOFTWARE INTEGRATION CAPABILITIES WILL DRIVE MARKET GROWTH

7.2.2 IMPACT OF COVID-19 ON THE INTEGRATED MICROSCOPE S/W MARKET

TABLE 8 INTEGRATED SOFTWARE MARKET, BY REGION, 2018-2025 (USD MILLION)

7.3 STANDALONE SOFTWARE

7.3.1 LOW COST OF STANDALONE SOFTWARE TO DRIVE MARKET GROWTH

7.3.2 IMPACT OF COVID-19 ON THE STANDALONE MICROSCOPE S/W MARKET

TABLE 9 STANDALONE SOFTWARE MARKET, BY REGION, 2018-2025 (USD MILLION)

8 MICROSCOPE SOFTWARE MARKET, BY APPLICATION (Page No. - 54)

8.1 INTRODUCTION

TABLE 10 MICROSCOPE SOFTWARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

8.2 SEMICONDUCTORS INDUSTRY

8.2.1 STRINGENT QUALITY CONTROL PROCESSES WILL DRIVE MARKET GROWTH

8.2.2 IMPACT OF COVID-19 ON THE MARKET FOR

THE SEMICONDUCTORS INDUSTRY 55

TABLE 11 MARKET FOR THE SEMICONDUCTORS INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

8.3 HEALTHCARE INDUSTRY

8.3.1 MICROSCOPES ARE WIDELY USED IN THE HEALTHCARE INDUSTRY FOR SEVERAL APPLICATIONS

8.3.2 IMPACT OF COVID-19 ON THE MARKET FOR THE HEALTHCARE INDUSTRY

TABLE 12 MARKET FOR THE HEALTHCARE INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

TABLE 13 MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

8.3.3 MEDICAL DEVICES

TABLE 14 MARKET FOR MEDICAL DEVICE APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

8.3.4 IMPLANTS

TABLE 15 MARKET FOR IMPLANT APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

8.4 AUTOMOTIVE INDUSTRY

8.4.1 STRICT SAFETY AND EMISSION STANDARDS TO DRIVE MARKET GROWTH

8.4.2 IMPACT OF COVID-19 ON THE MARKET FOR THE AUTOMOTIVE INDUSTRY

TABLE 16 MARKET FOR THE AUTOMOTIVE INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

8.5 AEROSPACE INDUSTRY

8.5.1 HIGH FOCUS ON PRECISION AND RELIABILITY TO DRIVE THE ADOPTION OF ADVANCED MICROSCOPES IN THIS INDUSTRY

8.5.2 IMPACT OF COVID-19 ON THE MARKET FOR THE AEROSPACE INDUSTRY

TABLE 17 MARKET FOR THE AEROSPACE INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

8.6 OTHER INDUSTRIES

TABLE 18 MARKET FOR OTHER INDUSTRIES, BY REGION, 2018-2025 (USD MILLION)

9 MICROSCOPE SOFTWARE MARKET, BY REGION (Page No. - 61)

9.1 INTRODUCTION

TABLE 19 MICROSCOPE SOFTWARE INDUSTRY, BY REGION, 2018-2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 16 NORTH AMERICA: MICROSCOPE SOFTWARE MARKET SNAPSHOT

TABLE 20 NORTH AMERICA: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 21 NORTH AMERICA: MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 22 NORTH AMERICA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 23 NORTH AMERICA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.2.1 US

9.2.1.1 THE US IS THE LARGEST MARKET FOR MICROSCOPE SOFTWARE IN NORTH AMERICA

TABLE 25 US: MICROSCOPE SOFTWARE MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 26 US: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 27 US: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 28 US: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 INCREASING GOVERNMENT FUNDING FOR R&D TO DRIVE THE MARKET GROWTH

TABLE 29 CANADA: MICROSCOPE SOFTWARE INDUSTRY, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 30 CANADA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 31 CANADA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 32 CANADA: MICROSCOPE SOFTWARE INDUSTRY FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.3 EUROPE

TABLE 33 EUROPE: MICROSCOPE SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 34 EUROPE: MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 35 EUROPE: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 36 EUROPE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 37 EUROPE: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 GERMANY IS THE LARGEST & FASTEST-GROWING MARKET FOR MICROSCOPE SOFTWARE IN EUROPE

TABLE 38 GERMANY: MICROSCOPE SOFTWARE MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 39 GERMANY: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 40 GERMANY: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 41 GERMANY: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.3.2 UK

9.3.2.1 INCREASING R&D INVESTMENTS TO DRIVE MARKET GROWTH

TABLE 42 UK: MICROSCOPE SOFTWARE INDUSTRY, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 43 UK: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 44 UK: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 45 UK: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 GROWING BIOTECHNOLOGY INDUSTRY IN FRANCE TO SUPPORT MARKET GROWTH

TABLE 46 FRANCE: MICROSCOPE SOFTWARE MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 47 FRANCE: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 48 FRANCE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 49 FRANCE: MICROSCOPE SOFTWARE INDUSTRY FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 WELL-ESTABLISHED MEDICAL DEVICES INDUSTRY IN THE COUNTRY TO SUPPORT MARKET GROWTH

TABLE 50 ITALY: MICROSCOPE SOFTWARE MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 51 ITALY: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 52 ITALY: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 53 ITALY: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 GROWING AEROSPACE INDUSTRY IN THE COUNTRY TO AID MARKET GROWTH

TABLE 54 SPAIN: MICROSCOPE SOFTWARE INDUSTRY, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 55 SPAIN: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 56 SPAIN: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 57 SPAIN: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.3.6 ROE

TABLE 58 ROE: MICROSCOPE SOFTWARE MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 59 ROE: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 60 ROE: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 61 ROE: MICROSCOPE SOFTWARE INDUSTRY FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.4 ASIA PACIFIC

TABLE 62 APAC: MICROSCOPE SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 63 APAC: MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 64 APAC: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 65 APAC: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 66 APAC: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 CHINA HOLDS THE LARGEST SHARE OF THE APAC MARKET

TABLE 67 CHINA: MICROSCOPE SOFTWARE INDUSTRY, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 68 CHINA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 69 CHINA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 70 CHINA: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 STRONG PRESENCE OF MARKET PLAYERS ENSURES ACCESS TO ADVANCED PRODUCTS

TABLE 71 JAPAN: MICROSCOPE SOFTWARE MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 72 JAPAN: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 73 JAPAN: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 74 JAPAN: MICROSCOPE SOFTWARE INDUSTRY FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 GROWING BIOTECH INDUSTRY AND GOVERNMENT SUPPORT ARE KEY MARKET DRIVERS

TABLE 75 INDIA: MICROSCOPE SOFTWARE MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 76 INDIA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 77 INDIA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 78 INDIA: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 79 ROAPAC: MICROSCOPE SOFTWARE INDUSTRY, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 80 ROAPAC: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 81 ROAPAC: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 82 ROAPAC: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 BRAZIL IS AN IMPORTANT SEGMENT OF THE LATAM MARKET

TABLE 83 LATAM: MICROSCOPE SOFTWARE MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 84 LATAM: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 85 LATAM: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 86 LATAM: MICROSCOPE SOFTWARE INDUSTRY FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 MEA COUNTRIES TO SHOWCASE OPPORTUNITIES FOR GROWTH IN THE COMING YEARS

TABLE 87 MEA: MICROSCOPE SOFTWARE MARKET, BY TYPE OF MICROSCOPE, 2018-2025 (USD MILLION)

TABLE 88 MEA: MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 89 MEA: MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 90 MEA: MARKET FOR THE HEALTHCARE INDUSTRY, BY APPLICATION, 2018-2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 93)

10.1 OVERVIEW

FIGURE 17 PRODUCT LAUNCHES WAS THE KEY GROWTH STRATEGY ADOPTED BY MARKET PLAYERS FROM JANUARY 2017 TO AUGUST 2020

10.2 MARKET SHARE ANALYSIS

TABLE 91 MICROSCOPE SOFTWARE MARKET RANKING, BY PLAYER, 2019

10.3 COMPETITIVE LEADERSHIP MAPPING

10.3.1 STARS

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE

10.3.4 PARTICIPANTS

FIGURE 18 MICROSCOPE SOFTWARE MARKET-GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2019

10.4 COMPETITIVE SITUATIONS AND TRENDS

10.4.1 KEY PRODUCT LAUNCHES

TABLE 92 PRODUCT LAUNCHES, JANUARY 2017?AUGUST 2020

10.4.2 KEY PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

TABLE 93 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS, JANUARY 2017?AUGUST 2020

10.4.3 KEY ACQUISITIONS

TABLE 94 ACQUISITIONS, JANUARY 2017?AUGUST 2020

10.4.4 KEY EXPANSIONS

TABLE 95 EXPANSIONS, JANUARY 2017?AUGUST 2020

11 COMPANY PROFILES (Page No. - 99)

(BUSINESS OVERVIEW, PRODUCTS OFFERED, RECENT DEVELOPMENTS)*

11.1 DANAHER CORPORATION

FIGURE 19 DANAHER CORPORATION: COMPANY SNAPSHOT (2019)

11.2 THERMO FISHER SCIENTIFIC

FIGURE 20 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2019)

11.3 JEOL LTD.

FIGURE 21 JEOL LTD.: COMPANY SNAPSHOT (2019)

11.4 OXFORD INSTRUMENTS

FIGURE 22 OXFORD INSTRUMENTS: COMPANY SNAPSHOT (2019)

11.5 CARL ZEISS AG

FIGURE 23 CARL ZEISS: COMPANY SNAPSHOT (2019)

11.6 OLYMPUS CORPORATION

FIGURE 24 OLYMPUS CORPORATION: COMPANY SNAPSHOT

11.7 NIKON CORPORATION

FIGURE 25 NIKON CORPORATION: COMPANY SNAPSHOT

11.8 HITACHI HIGH-TECH CORPORATION

FIGURE 26 HITACHI HIGH-TECH CORPORATION: COMPANY SNAPSHOT

11.9 SCIENTIFIC VOLUME IMAGING

11.1 ARIVIS AG

11.11 DRVISION TECHNOLOGIES

11.12 MEDIA CYBERNETICS

11.13 OBJECT RESEARCH SYSTEMS

11.14 GATAN, INC.

FIGURE 27 AMETEK: COMPANY SNAPSHOT (2019)

11.15 NION COMPANY

11.16 BASLER AG

FIGURE 28 BASLER AG: COMPANY SNAPSHOT (2019)

11.17 NANOLIVE SA

*BUSINESS OVERVIEW, PRODUCTS OFFERED, RECENT DEVELOPMENTS, SWOT ANALYSIS, MNM VIEW MIGHT NOT BE CAPTURED IN CASE OF UNLISTED COMPANIES.

12 APPENDIX (Page No. - 133)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

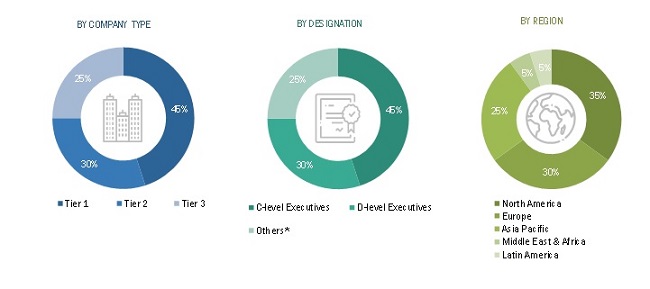

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial analysis of the global microscope software market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the microscope software market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

This research study involved the widespread usage of secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the microscope software market.

It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was prepared using secondary research.

Some of the key secondary sources referred to for this study include:

- World Health Organization (WHO)

- National Institutes of Health (NIH)

- Organisation for Economic Co-operation and Development (OECD)

- Food and Drug Administration (FDA)

- National Center for Biotechnology Information (NCBI)

- European Commission (EC)

- Annual Reports/SEC Filings, Investor Presentations, and Press Releases of Key Players

- White Papers, Journals/Magazines, and News Articles

- Paid Databases: Factiva, Hoover’s, and Bloomberg Business

Secondary research was used mainly to obtain key information about the industry’s total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, global market trends, and key developments by public and private organizations in the microscope software market.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (healthcare facilities & life science laboratories, hospitals, pharma companies, semiconductor manufacturers, aerospace equipment manufacturers, automotive equipment providers and manufacturers, academic and industry research institutes, and medical device companies, among others) and supply sides (microscope software providers and microscope providers).

The primaries interviewed for this study include experts from the industry, such as CEOs, VPs, directors, sales heads, and marketing managers of tier 1 and tier 2 companies engaged in offering microscope software products across the globe, and administrators & purchase managers of different industries in relevant application areas. This primary data was collected through questionnaires, e-mails, and telephonic interviews.

A robust primary research methodology has been adopted to validate the contents of the report. Both telephonic and e-mail interviews of primary participants were conducted through questionnaires. Primary research was used mainly for the following aspects:

- To validate the market segmentation through an assessment of the product portfolios of the leading players

- To understand the key industry trends and technologies defining the growth objectives of market players

- To gather both demand- and supply-side validation of the key factors affecting market growth, such as market drivers, restraints, opportunities, and challenges

- To validate the assumptions made for the market size and forecast model used for this study

- To understand the market positions of leading players and determine their market ranking.

BREAKDOWN OF PRIMARY PARTICIPANTS

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report presents a detailed assessment of the market, along with qualitative inputs and insights from MarketsandMarkets. Both top-down and bottom-up approaches were used to estimate and validate the size of the market and dependent submarkets. The research methodology used to estimate the market size includes the following details:

- The key players in the market were identified through secondary research, and their market shares in respective regions were determined through primary and secondary research.

- This entire procedure includes studying the annual and financial reports of the top market players and extensive interviews for key insights with industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- This data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global microscope software market was split into segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the global microscope software market was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and segment the global microscope software market by type, type of microscope, application, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the global microscope software market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market players

- To forecast the size of market segments with respect to four major regional segments—North America, Europe, the Asia Pacific (APAC), Latin America, and the Middle East and Africa

- To analyze the impact of COVID-19 on the microscope software market in the short- and long-term

- To profile the key players in the market and comprehensively analyze their market positions and core competencies2

- To track and analyze competitive developments such as acquisitions, product launches, upgrades, expansions, agreements, collaborations, and partnerships in the microscope software market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

GEOGRAPHICAL ANALYSIS

- Further for LATAM and MEA countries market into countries.

- Product analysis by product matrix, which gives a detailed comparison of the product portfolios of top companies

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microscope Software Market