Metal Recycling Market by Type (Ferrous Metals, Non-Ferrous Metals), Scrap Type (Old Scrap, New Scrap), Equipment Used (Shredder, Shear, Granulation Machine, Briquetting Machine), End-Use Industry, and Region - Global Forecast to 2029

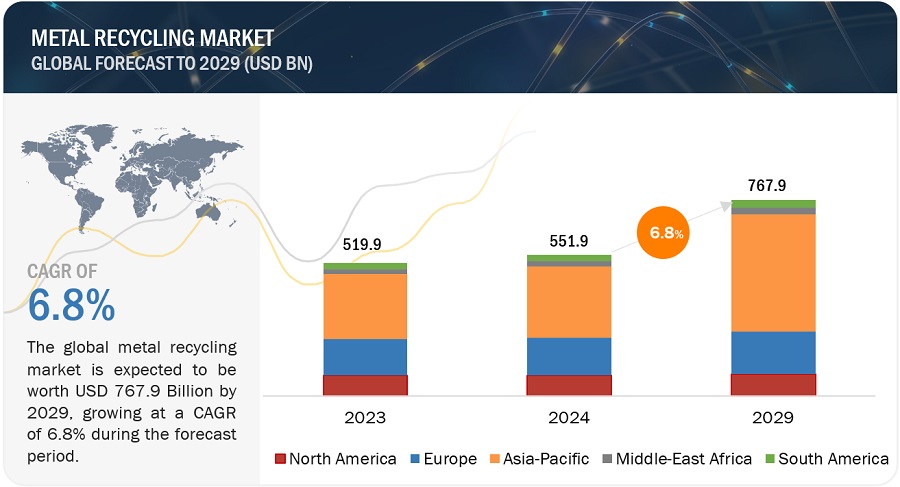

The metal recycling market size is projected to grow from USD 551.9 billion in 2024 and is projected to reach USD 767.9 billion by 2029, at a CAGR of 6.8%. The metal recycling market is experiencing a significant surge, largely driven by environmental regulations, the industrial need for sustainable raw materials, cost savings, and technological advancements. This trend is particularly evident in the Asia Pacific (APAC) region, which stands out as the fastest-growing market for metal recycling. China, in particular, plays a pivotal role in this growth trajectory, witnessing a substantial rise in both production and consumption of metal recycling. The metal recycling market in the Asia Pacific region is driven by rapid industrialization, urbanization, stringent environmental regulations, and the economic and environmental benefits of recycling, such as reduced energy consumption and lower production costs. Technological advancements also enhance recycling efficiency and quality. Key end-use industries experiencing growth include automotive, construction, and electronics. The automotive sector benefits from cost savings and sustainability, the construction industry uses recycled metals for urban development and infrastructure projects, and the electronics industry recycles metals to manage e-waste and meet regulatory and consumer demands for eco-friendly products. This growth not only underscores the region's industrial prowess but also highlights the indispensable role metal recycling play in driving technological innovation and sustainable development initiatives.

Attractive Opportunities in the Metal Recycling Market

To know about the assumptions considered for the study, Request for Free Sample Report

Metal recycling Market Dynamics

Driver: Increasing urbanization and industrialization

Increasing urbanization and industrialization significantly drive the metal recycling market. As cities expand, the construction of buildings, infrastructure, and transportation systems creates substantial demand for metals. This demand leads to a greater reliance on recycled metals, which are more cost-effective and environmentally friendly than newly mined materials. Industrialization increases the production of goods, generating more manufacturing waste and end-of-life products that can be recycled. Recycling metals helps industries reduce production costs, lower their carbon footprint, and comply with stringent environmental regulations. This sustainable approach supports resource conservation and is integral to modern urban and industrial growth.

Restraint: Disorganized metal waste collection in developing countries

Disorganized metal waste collection in developing countries poses a significant restrains to the growth of the metal recycling market. In these regions, the absence of a structured waste management system leads to inefficient collection and segregation of recyclable metals. As a result, large quantities of metal waste end up in landfills or remain unmanaged, making it challenging to recover and recycle these valuable materials. While informal recycling sectors exist, they often lack the necessary capacity, technology, and regulatory oversight to process metals effectively and safely. This inefficiency leads to low recycling rates, preventing the full realization of the economic and environmental benefits associated with metal recycling. Consequently, the disorganization within the waste collection system hampers the development of a sustainable metal recycling industry and obstructs efforts to achieve broader environmental and resource management objectives.

Opportunities: Metal recovery from slag residue

Slag is a valuable resource for steelmakers, as a significant amount of metal is often lost in slag and metal-slag mixtures during the smelting process. Depending on the smelting method and the age of the slag dump, metal content can range from 3% to 15%. Globally, slag stockpiles are estimated to exceed 60 million tons. Companies such as Harsco Corporation (US), Fandej Corporation (The Netherlands), and LOESCHE GmbH (Germany) specialize in recovering metal from slag. Before signing a metal recovery contract with a client, these companies analyze a sample of the slag to assess the potential for metal recovery and the properties of the slag. Recovering metal from slag benefits steelmakers by reducing disposal costs and providing recovered metal for further steel production. Metal can be reclaimed from slag produced during the manufacture of stainless steel, LD slag, and metallurgical modified slag.

Metal recovery from slag residue presents opportunities in the metal recycling market by offering a sustainable and economical method to extract valuable metals from waste materials. This approach reduces reliance on virgin ore mining, preserves natural resources, and reduces environmental harm. The reclaimed metals can be reintegrated into the supply chain, fulfilling the growing demand for recycled materials across different industries. It advances circular economy principles, fostering innovation and expansion in the metal recycling industry.

Challenges: Growing complexity of products poses challenges to recycling efforts

The increasing complexity of modern products significantly challenges metal recycling efforts. Advanced products often incorporate a variety of metals and other materials that are tightly integrated and difficult to separate. For example, electronic devices like smartphones and laptops contain intricate assemblies of metals, plastics, and other components, making the recycling process labor-intensive and technologically demanding. One major challenge is the need for advanced sorting and separation technologies. Traditional recycling methods are often inadequate for handling the mixed materials and intricate designs of contemporary products. This requires developing and implementing innovative recycling technologies, which can be costly and necessitate significant investment.

The presence of hazardous materials and rare earth elements in modern products complicates the recycling process. These substances must be carefully handled to prevent environmental contamination and ensure the safety of recycling workers. Extracting valuable metals from these complex products also requires specialized processes that can be both time-consuming and expensive. Hence, the growing complexity of products poses challenges to metal recycling efforts by necessitating advanced sorting and separation technologies, careful handling of hazardous materials, and continuous adaptation to new product designs. These factors collectively increase the cost and complexity of recycling, hindering the efficiency and effectiveness of metal recovery efforts.

ECOSYSTEM

The ferrous metals segment is projected to be the larger type segment of metal recycling market during the forecast period.

Ferrous metals, which primarily consist of iron and steel, include materials such as steel, carbon steel, alloy steel, cast iron, and wrought iron. These metals are characterized by their magnetic properties and high tensile strength, making them crucial for a variety of applications. In construction, ferrous metals are used for structural frameworks, bridges, and reinforcement bars due to their strength and durability. The automotive industry relies on them for manufacturing car bodies, engines, and various components. Additionally, these metals are vital in the production of industrial machinery, tools, and equipment.

Recycling ferrous metals is an important process that involves collecting scrap metal from several end-use industries. The construction and demolition sector is a major contributor, providing steel beams, rebar, and other structural elements. The automotive industry also contributes significantly with scrap from old vehicles and parts. The manufacturing industry supplies ferrous scrap from machinery, and tools. Recycling ferrous metals not only conserves natural resources but also reduces energy consumption and greenhouse gas emissions compared to producing new metals from raw materials.

The old scrap segment is projected to grow at the highest CAGR during the forecast period.

Outdated or post-consumer scrap, commonly referred to as old scrap, originates from discarded goods that are no longer concidered functional. This type of scrap comes from various sources including electrical and electronic appliances, municipal waste, rejected automobiles, building metal scrap, railway tracks, and others. Old scrap encompasses any steel product that has reached the end of its utility, such as automobile, recycled cans, and structural beams from infrastructure like buildings or bridges. Annually, the scrap recycling industry converts over 130 million metric tons of obsolete materials sourced from consumers, businesses, and manufacturers into valuable raw material.

Asia Pacific is estimated to account for the largest market share during the forecast period.

The Asia Pacific region is poised to dominate the metal recycling industry during the forecast period, with China at the forefront of this dominance. The metal recycling market in the Asia Pacific region is bolstered by factors like rapid industrialization, urbanization, and growing environmental awareness. China, being a major producer and consumer of metals, plays a crucial role in this growth. Its large manufacturing sector generates significant metal scrap, driving the demand for recycling. Additionally, Chinese government policies promoting domestic recycling and restricting imported scrap further stimulate market expansion. China's influence as a major exporter of goods also contributes to the region's demand for recycling services and technologies.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Metal recycling market comprises key manufacturers such as are ArcelorMittal (Luxembourg), Nucor (US), CMC (US), Sims Limited (Australia), Aurubis AG (Germany), Dowa Holdings Co., Ltd. (Japan), Tata Steel (India), Radius Recycling, Inc. (US), European Metal Recycling Ltd. (UK), and Upstate Shredding – Weitsman Recycling (US) are the top manufacturers covered in the metal recycling market. Expansions, mergers & acquisitions, new product launches and deals were some of the major strategies adopted by these key players to enhance their positions in the metal recycling market. A major focus was given to the expansions and deals.

Want to explore hidden markets that can drive new revenue in Metal Recycling Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Metal Recycling Market?

|

Report Metric |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million), Volume (Million Ton) |

|

Segments Covered |

Type, Scrap Type, Equipment Used, End-Use Industry, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

|

Companies covered |

ArcelorMittal (Luxembourg), Nucor (US), CMC (US), Sims Limited (Australia), Aurubis AG (Germany), Dowa Holdings Co., Ltd. (Japan), Tata Steel (India), Radius Recycling, Inc. (US), European Metal Recycling Ltd. (UK), and Upstate Shredding – Weitsman Recycling (US), among others. |

This research report categorizes the metal recycling market based on Type, Scrap Type, Equipment Used, End-Use Industry, and Region.

Based on Type:

- Ferrous Metals

- Non-Ferrous Metals

Based on Scrap Type:

- New Scrap

- Old Scrap

Based on Equipment Used:

- Shredder

- Shearing

- Granulation Machine

- Briquetting Machine

Based on End-Use Industry:

- Building & Construction

- Automotive

- Equipment Manufacturing

- Shipbuilding

- Packaging

- Consumer Appliances

- Other End-Use Industries

Based on Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In January 2023, ArcelorMittal finalized the acquisition of Riwald Recycling ("Riwald"), a cutting-edge ferrous scrap metal recycling company in the Netherlands, as part of its decarbonization strategy. The company also acquired Italpannelli Germany, a German manufacturer of insulation panels, enhancing its geographic reach and bolstering the product offerings of ArcelorMittal Downstream Solutions' construction division.

- In November 2023, ArcelorMittal and Schneider Electric formed a partnership in which ArcelorMittal will provide Schneider Electric with XCarb recycled and renewably produced steel for use in its electrical cabinets and enclosures.

- In October 2023, Nucor Corporation's recycling subsidiary, River Metals Recycling (RMR), completed an acquisition, acquiring all assets of Cincinnati-based Garden Street Iron & Metal. This includes one feeder and one shredder yard, thereby expanding RMR's network to a total of 19 recycling facilities.

- In July 2023, CMC declared that it received a permit from the West Virginia Department of Environmental Protection, enabling the commencement of construction for its fourth state-of-the-art micro mill. This permit marks a significant milestone in its Steel West Virginia micro mill project.

- In February 2024, Sims Metal made investment in sustainable technology at Providence Facility. Sims Metal unveiled its investment in a state-of-the-art electric car flattener, replacing the previous diesel model, at the local Sims Metal facility situated on Allens Avenue. This cutting-edge electric equipment is anticipated to diminish the site's CO2 emissions by 9.6 tons annually, aligning with the company's sustainability endeavors and coinciding with the State of Rhode Island's 2021 Act on Climate.

Frequently Asked Questions (FAQ):

What is metal recycling?

Metal recycling is the process of recovering and reprocessing scrap metals to create new raw materials for manufacturing.

What are the types of mets which goes into metal recycling?

Ferrous and Non-Ferrous metals.

What are the major end-use industries of metal recycling?

The major end-use industries of metal recycling include Building & Construction, Automotive, Equipment manufacturing, Shipbuilding, Packaging, and Consumer applications.

What are the major drivers of the metal recycling market?

The major drivers of metal recycling are the Increasing urbanization and industrialization and awareness programs for sustainable waste management practices.

What are the upcoming opportunities in the metal recycling market globally?

Metal recovery from slag residue and emerging economies are the upcoming opportunities in the metal recycling market globally. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities for estimating the current size of the global Metal recycling market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of Metal recycling through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the Metal recycling market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the Metal recycling market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The Metal recycling market comprises several stakeholders in the supply chain, which include raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Metal recycling market. Primary sources from the supply side include associations and institutions involved in the Metal recycling industry, key opinion leaders, and processing players.

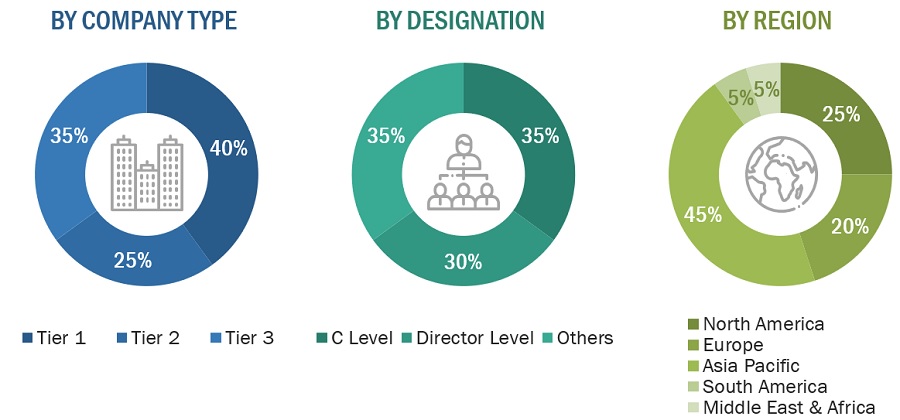

Following is the breakdown of primary respondents

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2022: Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

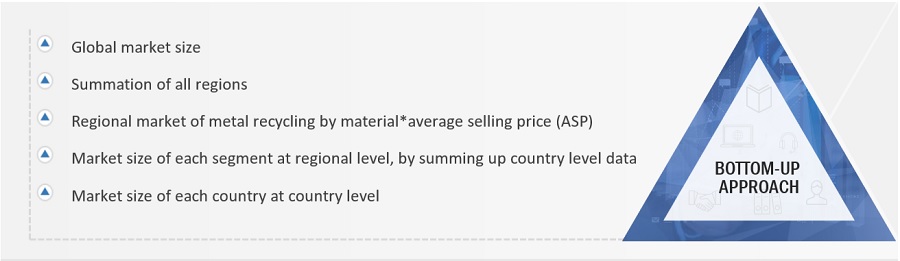

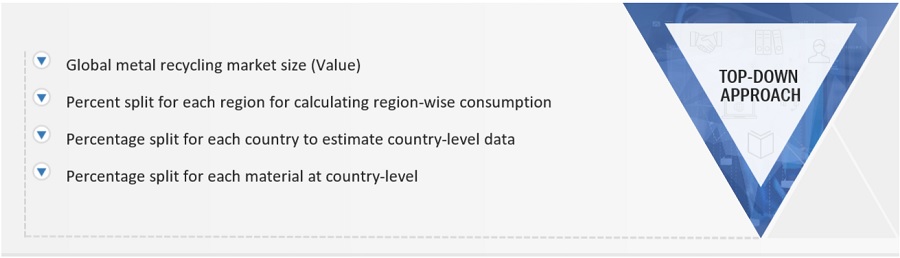

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global metal recycling market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the metal recycling market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Metal recycling involves recovering ferrous and non-ferrous scrap metal from unused products, structures, and manufacturing processes, then converting it into new metal materials. The process encompasses several crucial stages: collecting scrap metal from sources such as old vehicles, appliances, construction debris, and electronic devices; sorting and separating different metal types; processing the metals through shredding, melting, and purifying to remove contaminants; and finally, forming the purified metal into new products or raw materials for manufacturing. Recycled metal can be used to create new products, which can themselves be recycled at the end of their lifecycle. This approach conserves natural resources by reducing the need for raw material extraction and saves energy, as recycling metals typically requires less energy than producing new metals from ore. Additionally, metal recycling helps reduce greenhouse gas emissions and environmental pollution, promoting more sustainable and eco-friendly industrial practices. Recycled metals are widely used in various end-use sectors, including building and construction, automotive, shipbuilding, packaging, equipment manufacturing, consumer appliances, aerospace and defense, and industrial and commercial furniture and utensils.

Key Stakeholders

- Metal producing & recycling companies

- Environmental service providers

- Government and regulatory bodies

- Market research and consulting firms

- Commercial R&D institutions

- Associations and industry bodies

- Conservation professionals

- Municipalities and local & regional authorities

- Other end users (materials recovery facilities, processors, sorters, metal recycling plants, and manufacturers).

Report Objectives

- To define, analyze, and project the size of the metal recycling market in terms of value based on type, scrap type, equipment used, end-use industry, and region.

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders.

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the metal recycling market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of Asia Pacific market

- Further breakdown of Rest of Europe market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Metal Recycling Market