Large Format Printer Market by Offering, Connectivity, Printing Material (Porous, Non-porous), Technology (Ink-based, Toner-based), Print Width, Ink Type, Application (Apparel & Textile, Signage & Advertising, Decor) and Region – Forecast to 2028

Updated on : October 23, 2024

Large Format Printer Market Size

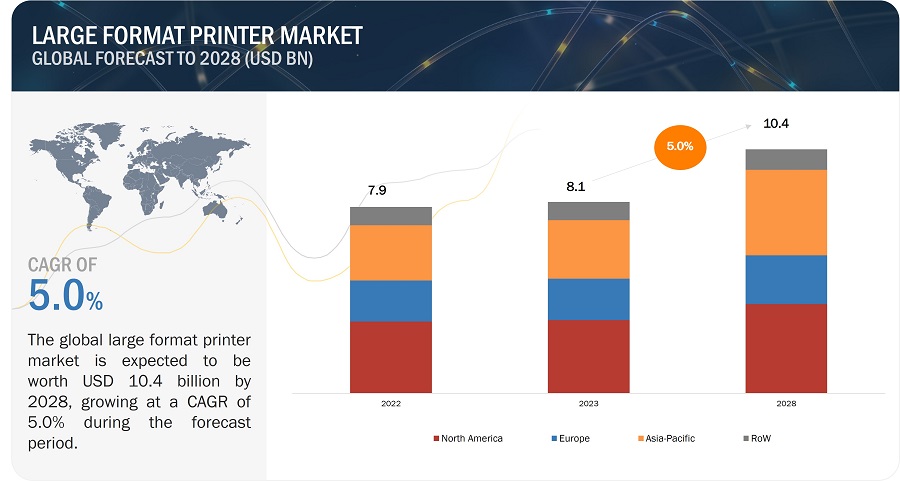

The global large format printer market size is projected to grow from USD 8.1 billion in 2023 to USD 10.4 billion by 2028; growing at a CAGR of 5.0% from 2023 to 2028. The printing sector has experienced notable technological progress, leading to diverse printing choices. Digital printing, in particular, has gained popularity for its capacity to swiftly and effectively generate high-quality prints.

Large Format Printer Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Large Format Printer Market Trends

Driver: Increasing demand for large format printers in Textiles, E-commerce, and Retail

Large format printers empower textiles, e-commerce, and retail businesses to provide customized visuals and branding across various materials, from apparel and packaging to in-store presentations. This degree of customization resonates with consumers and differentiates businesses in a competitive market. Large format prints possess substantial visual influence. Within the retail and e-commerce sectors, captivating packaging, displays, and signs are necessary for drawing in customers and boosting sales. Large format prints empower businesses to craft attractive visuals that make a memorable mark. Companies in the textile industry use large format printers to print small designs onto garments such as T-shirts, dresses, and promotional wear. Within the e-commerce industry, online shopping heavily relies on visual elements. Large format prints play a crucial role in crafting attractive product listings, dynamic website banners, and engaging social media campaigns, all of which gain attraction for online shoppers, ultimately leading to higher conversion rates.

Restraint: High costs associated with initial investments and operations

Although the manufacturers are now offering large format printers at low prices, their high maintenance and operational costs are the major points of concern. The companies in the advertising sector, major end-users of large format printers, are shifting their focus from traditional printers to super-wide format printers in case the associated costs are high. Thus, the requirement for initial investment is expected to hamper the growth of the large format printer industry size . Moreover, large format printers typically utilize specially formulated inks and consumables to provide durability, UV resistance, and precise color accuracy. These specialized ink solutions often come at a premium price compared to the inks used in smaller printers, which increases the overall operation cost.

Opportunity: Increasing demand for large format printers in the in-plant market

There is a high demand for printing posters, signage, and wall wraps from in-plant customers, and large format printers are used to fulfill these requirements. The rising need for large format printers in in-plant operations highlights the importance of having adaptable, budget-friendly, and versatile printing options readily accessible within a company. This pattern will persist as technology advances and organizations emphasize efficiency, customization, and cost-effective printing alternatives.

Challenge: Growing popularity of digital advertising media

The growing popularity of digital media is expected to lower the demand for large format printers in specific categories, such as directories and advertisements. Digital signage is used for various applications, such as providing public information, displaying a menu, advertising and brand building, influencing customer behavior, enhancing customer experience, and improving the ambiance. Advertising using large format printers incurs high costs and allows static information display only; all these factors pose a challenge for the players operating in the large format printer market share.

Large Format Printer Market Ecosystem

The prominent players in the large format printer market size are HP Development Company, L.P. (US), Canon Inc. (Japan), Seiko Epson Corporation (Japan), Brother Industries, Ltd. (Japan), MIMAKI ENGINEERING CO., LTD. (Japan). These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

Large Format Printer Market Share

Wired connectivity accounted for the larger market share during the forecast period.

The forecasted period is expected to grow significantly in the wired connectivity segment, primarily driven by industry demand. The preference for wired connectivity over wireless is due to its advantages in large format printing, which offers a more convenient and reliable printing experience. Wired printers are the preferred choice for extensive volume printing, as they mitigate the risk of data loss during transfer with wireless alternatives.

Porous printing material to account for the larger market share during the forecast period.

The utilization of porous materials as a printing base in large format printers is on the rise, driven by technological innovations like additive manufacturing and 3D printing. Porous printing material boasts a lightweight characteristic, rendering it suitable for applications that prioritize weight considerations, such as in constructing drones and other lightweight structures. Furthermore, incorporating multiscale, multifunctional porous materials plays a significant role in bolstering the expansion of the porous materials market within the large format printer industry.

Decor application is expected to grow at the highest rate from 2023 to 2028.

The decor segment is anticipated to exhibit the highest CAGR during the forecast period. Large format printers provide the necessary document size and enhanced image clarity for efficient printing on various media, making them perfect for producing high-quality images and graphic presentations.

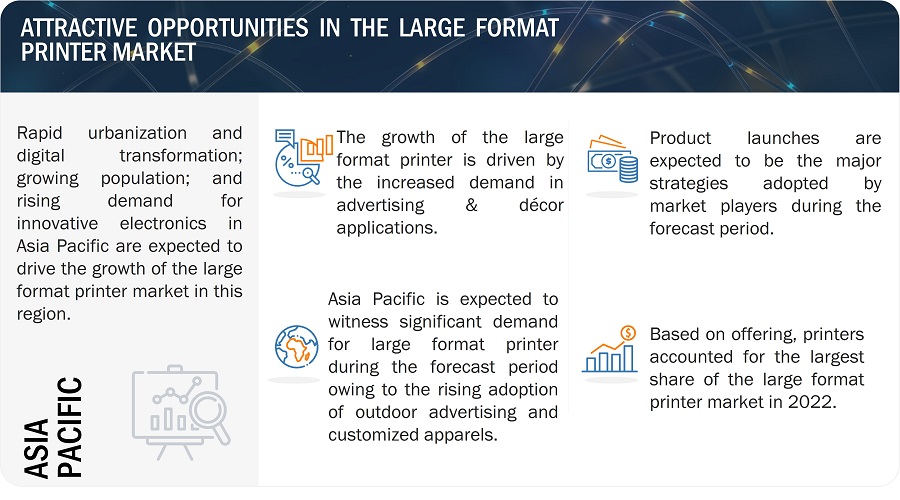

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period.

Large Format Printer Market Regional Analysis

Asia Pacific is witnessing a surge in demand for large format printers due to factors like developing economies, rising textile and apparel needs, substantial growth in graphic design, advertising, and signage sectors, and a conducive environment for product manufacturers. The significant presence of major regional laser printer manufacturers primarily drives Asia Pacific’s market leadership. This intense industry competition has decreased the average selling price of laser printers in Asia Pacific, thereby supporting market expansion. Additionally, the potential for growth in the textile industry and the increasing popularity of direct-to-fabric printers are expected to further contribute to the market’s growth.

Large Format Printer Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Large Format Printer Companies - Key Market Players:

The major players in the large format printer companies include

- HP Development Company, L.P. (US),

- Canon Inc. (Japan),

- Seiko Epson Corporation (Japan),

- Brother Industries, Ltd. (Japan),

- MIMAKI ENGINEERING CO., LTD. (Japan),

- Roland DGA Corporation (Japan),

- Ricoh (Japan),

- DURST GROUP AG (Italy),

- Xerox Corporation (US),

- Konica Minolta, Inc. (Japan),

- Agfa-Gevaert Group (Belgium). These companies have used organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships, to strengthen their position in the industry.

Large Format Printer Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 8.1 billion in 2023 |

| Projected Market Size | USD 10.4 billion by 2028 |

| Growth Rate | CAGR of 5.0% |

|

Large Format Printer Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Companies Covered |

HP Development Company, L.P. (US), Canon Inc. (Japan), Seiko Epson Corporation (Japan), Brother Industries, Ltd. (Japan), MIMAKI ENGINEERING CO., LTD. (Japan), Roland DGA Corporation (Japan), Ricoh (Japan), DURST GROUP AG (Italy), Xerox Corporation (US), Konica Minolta, Inc. (Japan), Agfa-Gevaert Group (Belgium), Electronics For Imaging, Inc. (US), KYOCERA Corporation (Japan), Lexmark International, Inc. (US), FUJIFILM Holdings Corporation (Japan), ARC Document Solutions, LLC (US), Dilli (South Korea), Mutoh (Belgium), swissQprint AG (Switzerland), Shenyang Sky Air-Ship Digital Printing Equipment Co.,Ltd (China), Oki Electric Industry Co., Ltd. (Japan), SOMA TECH INTL (US), Floraprinter (China), Dover Corporation (US), Shenzhen Sanyi Technology Co., Ltd. (China) |

Large Format Printer Market Size Highlights

This research report categorizes the Large Format Printer Market size based on offering, technology, ink type, printing material, print width, connectivity, application, and region.

|

Segment |

Subsegment |

|

By Offering |

|

|

Large Format Printer Market Size, By Technology |

|

|

By Ink Type |

|

|

By Printing Material |

|

|

By Print Width |

|

|

By Connectivity |

|

|

Large Format Printer Market Size, By Application |

|

|

By Region |

|

Recent Developments in large format printer Industry

- In May 2023, HP Development Company, L.P. developed the HP Latex R2000 Plus Printer, a versatile hybrid printer suitable for rigid and flexible materials. The printer will showcase applications, including thermoforming samples, short-run packaging, and signage on various media.

- In February 2023, MIMAKI ENGINEERING C0., LTD. developed the TxF150-75, an inkjet printer capable of producing DTF print transfer sheets with a maximum printing width of 80 cm.

- In January 2023, Canon Inc. introduced the imagePROGRAF TC-20 to consumerize 24-inch large-format printing. This printer is tailored for compact spaces like home offices, small offices, schools, and temporary workspaces.

- In January 2023, Seiko Epson Corporation introduced the 44-inch SureColor F6470 and SureColor F6470H dye-sublimation printers. These printers are engineered to enhance productivity, swiftly delivering top-quality images suitable for various applications, including promotional products, apparel, home décor, soft signage, and more.

Frequently Asked Questions (FAQs):

What is the current size of the Global Large Format Printer Market?

The large format printer market is projected to grow from USD 8.1 billion in 2023 to USD 10.4 billion by 2028; it is expected to grow at a CAGR of 5.0% from 2023 to 2028.

Who are the winners in the Global Large Format Printer Market?

Companies such as HP Development Company, L.P. (US), Canon Inc. (Japan), Seiko Epson Corporation (Japan), Brother Industries, Ltd. (Japan), MIMAKI ENGINEERING CO., LTD. (Japan).

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the large format printer market during the forecast period. There is a growing demand for apparel and textile applications, and the region holds a strong base of textile manufacturers and the increasing popularity of direct-to-fabric printers in the region.

What are the major drivers and opportunities for the large format printer market?

The surge in global demand for Increasing demand for large format printers in Textiles, E-commerce, and Retail. The surge in outdoor advertising boosting the large format printer market, Growing adoption of large format printers in home furnishing, decor, and vehicle wrap applications, and Increasing demand for large format printers in the in-plant market are some of the major drivers and opportunities related to the large format printer market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the large format printer market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased use of large format printers by textile, e-commerce, and retail companies- Substantial surge in outdoor advertising- High adoption of UV-curable inks in outdoor advertising, CAD, and technical printing applicationsRESTRAINTS- Requirement for high initial investmentOPPORTUNITIES- Growing adoption of large format printers in home furnishing, decor, and vehicle wrap applications- Rising use of large format printers in in-plant operations- Increasing focus on manufacturing budget-friendly printers with advanced featuresCHALLENGES- High preference for digital advertising over conventional advertising techniques

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.5 ECOSYSTEM/MARKET MAP

-

5.6 TECHNOLOGY ANALYSISDYE-SUBLIMATION INKSUV-CURABLE INKSLASER PRINTINGORGANIC INKS

- 5.7 AVERAGE SELLING PRICE TRENDS

-

5.8 CASE STUDY ANALYSISADVER MEDIA DELIVERS PRINTING PROJECTS USING CANON’S LARGE FORMAT GRAPHICS SOLUTIONSCANON TRANSFORMS CHILDCARE CENTER IN POLAND WITH LARGE FORMAT SOLUTIONSDUKE CONSTRUCTION BOOSTS EFFICIENCY AND PRODUCTIVITY USING HP’S VERSATILE LARGE FORMAT PRINTING TECHNOLOGYJBF SELECTS EPSON’S PRINTING SOLUTION TO IMPROVE PRODUCTION QUALITY

-

5.9 PATENT ANALYSIS

-

5.10 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 TARIFFS, REGULATORY LANDSCAPE, AND STANDARDSTARIFFSSTANDARDS- International Organization for Standardization (ISO)REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.13 KEY CONFERENCES AND EVENTS, 2023–2024LARGE FORMAT PRINTER MARKET: LIST OF CONFERENCES AND EVENTS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 PRINTERSINCREASED DEMAND FOR PRINTERS TO PRINT BANNERS, POSTERS, WALLPAPERS, AND CONSTRUCTION PLANS TO DRIVE MARKET

-

6.3 RIP SOFTWARECAPACITY TO SIMULTANEOUSLY PROCESS MULTIPLE JOBS IN POOL TO BOOST DEMAND FOR RIP SOFTWARE

-

6.4 AFTER-SALES SERVICESNECESSITY TO MAINTAIN PERFORMANCE OF LARGE FORMAT PRINTERS TO BOOST DEMAND FOR AFTER-SALES SERVICES

- 7.1 INTRODUCTION

-

7.2 WIREDRISING AWARENESS ABOUT STABILITY AND RELIABILITY OF WIRED PRINTERS TO PROPEL MARKET

-

7.3 WIRELESSINCREASING USE OF FLEXIBLE AND LOW-COST WIRELESS PRINTERS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 POROUS MATERIALSUSE OF POROUS MATERIALS WITH HIGH ABSORPTION CAPACITY TO ACCELERATE SEGMENTAL GROWTH

-

8.3 NON-POROUS MATERIALSADOPTION OF NON-POROUS MATERIALS WITH UV INK ADHESION AND CURING CAPABILITIES TO DRIVE MARKETSYNTHETIC PAPERS- Polyester (PET) synthetic papers- Polypropylene (PP) synthetic papers- Vinyl synthetic papers- Biaxially oriented polypropylene (BOPP) synthetic papers- High-density polyethylene (HDPE) synthetic papersOTHER NON-POROUS SYNTHETIC PAPERS

- 9.1 INTRODUCTION

-

9.2 INK-BASED (INKJET)RISING EMPHASIS ON DEVELOPING ENVIRONMENT-FRIENDLY AND HIGH-QUALITY INKS TO FUEL SEGMENTAL GROWTH- Thermal inkjet printing- Piezo crystal-based inkjet printing- Electrostatic inkjet printing- MEMS-based inkjet printing

-

9.3 TONER-BASED (LASER)SHIFTING PREFERENCE TOWARD WATER- AND SMUDGE-RESISTANT PRINTERS TO BOOST SEGMENTAL GROWTH

- 10.1 INTRODUCTION

-

10.2 17–24”GARMENT PRINTING AND OFFICE APPLICATIONS TO SUPPORT SEGMENTAL GROWTH

-

10.3 24–36”GROWING TREND OF CUSTOMIZED APPAREL WITH THRIVING FASHION INDUSTRY TO CONTRIBUTE TO MARKET GROWTH

-

10.4 36–44”TEXTILES, SIGNAGE, BLUEPRINT APPLICATIONS TO BOOST DEMAND FOR PRINTERS WITH PRINT WIDTHS RANGING FROM 36 TO 44 INCHES

-

10.5 44–60”POSTERS, ARCHITECTURAL DRAWINGS, AND GIS APPLICATIONS TO DRIVE SEGMENTAL GROWTH

-

10.6 60–72”BANNERS, LARGE VEHICLE GRAPHICS, AND ADVERTISEMENT APPLICATIONS TO SUPPORT SEGMENTAL GROWTH

-

10.7 72” AND ABOVECAPABILITY TO PRODUCE EXCEPTIONALLY LARGE AND VISUALLY IMPACTFUL PRINTS TO DRIVE DEMAND

- 11.1 INTRODUCTION

-

11.2 AQUEOUSCAPABILITY TO PROVIDE EXCELLENT IMAGE QUALITY AT LOW COST TO DRIVE DEMAND

-

11.3 SOLVENTNEED FOR VIBRANT COLORS IN OUTDOOR ADVERTISING APPLICATIONS TO FUEL DEMAND

-

11.4 UV-CUREDHIGH DURABILITY AND FAST CURING TIME TO DRIVE ADOPTION

-

11.5 LATEXCAPACITY TO PRODUCE TOP-NOTCH PRINTS ON DIVERSE SURFACES TO DRIVE DEMAND IN ADVERTISING APPLICATIONS

-

11.6 DYE SUBLIMATIONGROWING USE TO PRINT IMAGES ON POLYESTER-BASED TEXTILES TO FUEL MARKET GROWTH

- 12.1 INTRODUCTION

-

12.2 APPAREL & TEXTILERISING DEMAND FOR CUSTOMIZED APPAREL AND TEXTILES TO CREATE NEED FOR EFFICIENT PRINTING SOLUTIONS

-

12.3 SIGNAGE & ADVERTISINGINCREASING USE OF BANNERS, BILLBOARDS, POSTERS, AND DISPLAYS TO DRIVE MARKET

-

12.4 DECORGROWING DEMAND FOR LARGE-SCALE DECORATIVE PIECES SUCH AS WALL ART TO SUPPORT SEGMENTAL GROWTH

-

12.5 CAD & TECHNICAL PRINTINGNEED FOR PRECISION IN CAD & CAM APPLICATIONS TO DRIVE MARKET

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing demand for large format printers from packaging and textiles industries to foster market growthCANADA- Rising focus of key players on development of innovative large format printers to drive marketMEXICO- Increasing investments from multinational printer manufacturers to drive market

-

13.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Thriving manufacturing sector to boost demand for large format printers in packaging and advertisement applicationsUK- Growing use of printing technology in commercial and publishing applications to accelerate market growthFRANCE- Rising demand from food & beverages and cosmetics industries to drive marketITALY- Increasing demand for cost-efficient and multi-function printers to fuel market growthREST OF EUROPE

-

13.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Commitment of key players in offering best-in-class inkjet printers to accelerate market growthJAPAN- Rapid urbanization to drive demand for printers with greater speedINDIA- Booming packaging and textiles industries to boost demand for large format printersAUSTRALIA- Rising consumption of packaged food to fuel demand large format printersREST OF ASIA PACIFIC

-

13.5 REST OF THE WORLD (ROW)ROW: RECESSION IMPACTSOUTH AMERICA- Growing apparel industry to fuel demand for large format printersMIDDLE EAST & AFRICA- UAE- Saudi Arabia

- 14.1 OVERVIEW

-

14.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2023PRODUCT PORTFOLIO EXPANSIONREGIONAL FOCUSMANUFACTURING FOOTPRINT EXPANSIONORGANIC/INORGANIC EXPANSION

- 14.3 MARKET SHARE ANALYSIS, 2022

- 14.4 REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022

-

14.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

14.6 START UPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

14.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

15.1 KEY PLAYERSHP DEVELOPMENT COMPANY, L.P.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCANON INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSEIKO EPSON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBROTHER INDUSTRIES, LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMIMAKI ENGINEERING CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROLAND DGA CORPORATION- Business overview- Product/Solutions/Services offered- Recent developments- MnM viewRICOH- Business overview- Products/Solutions/Services offered- Recent developmentsDURST GROUP AG- Business overview- Products/Solutions/Services offered- Recent developmentsXEROX CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsKONICA MINOLTA, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsAGFA-GEVAERT GROUP- Business overview- Products/Solutions/Services offered- Recent developments

-

15.2 OTHER PLAYERSELECTRONICS FOR IMAGING, INC.KYOCERA CORPORATIONLEXMARK INTERNATIONAL, INC.FUJIFILM HOLDINGS CORPORATIONARC DOCUMENT SOLUTIONS, LLCDILLIMUTOHSWISSQPRINT AGSHENYANG SKY AIR SHIP DIGITAL PRINTING EQUIPMENT CO.,LTDOKI ELECTRIC INDUSTRY CO., LTD.SOMA TECH INTLFLORAPRINTERDOVER CORPORATIONSHENZHEN SANYI TECHNOLOGY CO., LTD.

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT: LARGE FORMAT PRINTER MARKET

- TABLE 2 KEY COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 3 INDICATIVE PRICING OF LARGE FORMAT PRINTERS, BY KEY PLAYER, 2022

- TABLE 4 LIST OF PATENTS PERTAINING TO LARGE FORMAT PRINTERS, 2020–2023

- TABLE 5 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 6 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 7 LARGE FORMAT PRINTER MARKET: PORTER’S FIVE FORCES ANALYSIS, 2022

- TABLE 8 MFN TARIFF FOR HS CODE 8443-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2022

- TABLE 9 MFN TARIFF FOR HS CODE 8443-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2022

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS (%)

- TABLE 14 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

- TABLE 15 LARGE FORMAT PRINTER MARKET, BY OFFERING, 2019–2022 (USD BILLION)

- TABLE 16 LARGE FORMAT PRINTER MARKET, BY OFFERING, 2023–2028 (USD BILLION)

- TABLE 17 PRINTERS: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 18 PRINTERS: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 RIP SOFTWARE: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 20 RIP SOFTWARE: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 AFTER-SALES SERVICES: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 AFTER-SALES SERVICES: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY, 2019–2022 (USD BILLION)

- TABLE 24 LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY, 2023–2028 (USD BILLION)

- TABLE 25 WIRED: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 26 WIRED: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 WIRELESS: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 WIRELESS: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 LARGE FORMAT PRINTER MARKET, BY PRINTING MATERIAL, 2019–2022 (USD BILLION)

- TABLE 30 LARGE FORMAT PRINTER MARKET, BY PRINTING MATERIAL, 2023–2028 (USD BILLION)

- TABLE 31 LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 32 LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 33 LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2019–2022 (THOUSAND UNITS)

- TABLE 34 LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2023–2028 (THOUSAND UNITS)

- TABLE 35 INK-BASED (INKJET): LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 INK-BASED (INKJET): LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 TONER-BASED (LASER): LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 TONER-BASED (LASER): LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, 2019–2022 (USD MILLION)

- TABLE 40 LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, 2023–2028 (USD MILLION)

- TABLE 41 17– 24”: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 17– 24”: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 24–36”: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 24–36”: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 36–44”: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 36–44”: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 44–60”: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 44–60”: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 60–72”: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 60–72”: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 72” AND ABOVE: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 72” AND ABOVE: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 LARGE FORMAT PRINTER MARKET, BY INK TYPE, 2019–2022 (USD MILLION)

- TABLE 54 LARGE FORMAT PRINTER MARKET, BY INK TYPE, 2023–2028 (USD MILLION)

- TABLE 55 LARGE FORMAT PRINTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 56 LARGE FORMAT PRINTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 57 APPAREL & TEXTILE: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 APPAREL & TEXTILE: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 SIGNAGE & ADVERTISEMENT: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 SIGNAGE & ADVERTISEMENT: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 DECOR: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 DECOR: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 CAD & TECHNICAL PRINTING: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 CAD & TECHNICAL PRINTING: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 66 LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 67 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, 2019–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: LARGE FORMAT PRINTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 EUROPE: LARGE FORMAT PRINTER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 EUROPE: LARGE FORMAT PRINTER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 82 EUROPE: LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: LARGE FORMAT PRINTER MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 84 EUROPE: LARGE FORMAT PRINTER MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 86 EUROPE: LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, 2019–2022 (USD MILLION)

- TABLE 88 EUROPE: LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: LARGE FORMAT PRINTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 EUROPE: LARGE FORMAT PRINTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, 2019–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, 2023–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 ROW: LARGE FORMAT PRINTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 ROW: LARGE FORMAT PRINTER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 ROW: LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY, 2019–2022 (USD MILLION)

- TABLE 106 ROW: LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY, 2023–2028 (USD MILLION)

- TABLE 107 ROW: LARGE FORMAT PRINTER MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 108 ROW: LARGE FORMAT PRINTER MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 109 ROW: LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 110 ROW: LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 111 ROW: LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, 2019–2022 (USD MILLION)

- TABLE 112 ROW: LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, 2023–2028 (USD MILLION)

- TABLE 113 ROW: LARGE FORMAT PRINTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 ROW: LARGE FORMAT PRINTER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2023

- TABLE 116 LARGE FORMAT PRINTER MARKET: DEGREE OF COMPETITION

- TABLE 117 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 118 COMPANY APPLICATION FOOTPRINT

- TABLE 119 COMPANY REGION FOOTPRINT

- TABLE 120 COMPANY OVERALL FOOTPRINT

- TABLE 121 LARGE FORMAT PRINTER MARKET: LIST OF KEY START-UPS/SMES

- TABLE 122 LARGE FORMAT PRINTER MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (TECHNOLOGY FOOTPRINT)

- TABLE 123 LARGE FORMAT PRINTER MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (APPLICATION FOOTPRINT)

- TABLE 124 LARGE FORMAT PRINTER MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (REGIONAL FOOTPRINT)

- TABLE 125 LARGE FORMAT PRINTER MARKET: PRODUCT LAUNCHES, SEPTEMBER 2020–JUNE 2023

- TABLE 126 LARGE FORMAT PRINTER MARKET: DEALS, JANUARY 2020–SEPTEMBER 2023

- TABLE 127 LARGE FORMAT PRINTER MARKET: OTHERS, SEPTEMBER 2021

- TABLE 128 HP DEVELOPMENT COMPANY, L.P.: COMPANY OVERVIEW

- TABLE 129 HP DEVELOPMENT COMPANY, L.P.: PRODUCT LAUNCHES

- TABLE 130 CANON INC.: COMPANY OVERVIEW

- TABLE 131 CANON INC.: PRODUCT LAUNCHES

- TABLE 132 CANON INC.: DEALS

- TABLE 133 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- TABLE 134 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES

- TABLE 135 SEIKO EPSON CORPORATION: DEALS

- TABLE 136 BROTHER INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 137 BROTHER INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 138 MIMAKI ENGINEERING C0., LTD.: COMPANY OVERVIEW

- TABLE 139 MIMAKI ENGINEERING C0., LTD.: PRODUCT LAUNCHES

- TABLE 140 MIMAKI ENGINEERING C0., LTD.: DEALS

- TABLE 141 ROLAND DGA CORPORATION: COMPANY OVERVIEW

- TABLE 142 ROLAND DGA CORPORATION: PRODUCT LAUNCHES

- TABLE 143 ROLAND DGA CORPORATION: DEALS

- TABLE 144 RICOH: COMPANY OVERVIEW

- TABLE 145 RICOH: PRODUCT LAUNCHES

- TABLE 146 DURST GROUP AG: COMPANY OVERVIEW

- TABLE 147 DURST GROUP AG: PRODUCT LAUNCHES

- TABLE 148 DURST GROUP AG: DEALS

- TABLE 149 DURST GROUP AG: OTHERS

- TABLE 150 XEROX CORPORATION: COMPANY OVERVIEW

- TABLE 151 XEROX CORPORATION: DEALS

- TABLE 152 KONICA MINOLTA, INC.: COMPANY OVERVIEW

- TABLE 153 KONICA MINOLTA, INC.: PRODUCT LAUNCHES

- TABLE 154 AGFA-GEVAERT GROUP: COMPANY OVERVIEW

- TABLE 155 AGFA-GEVAERT GROUP: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 156 AGFA-GEVAERT GROUP: DEALS

- TABLE 157 ELECTRONICS FOR IMAGING, INC.: COMPANY OVERVIEW

- TABLE 158 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 159 LEXMARK INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 160 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 161 ARC DOCUMENT SOLUTIONS, LLC: COMPANY OVERVIEW

- TABLE 162 DILLI: COMPANY OVERVIEW

- TABLE 163 MUTOH: COMPANY OVERVIEW

- TABLE 164 SWISSQPRINT AG: COMPANY OVERVIEW

- TABLE 165 SHENYANG SKY AIR SHIP DIGITAL PRINTING EQUIPMENT CO., LTD: COMPANY OVERVIEW

- TABLE 166 OKI ELECTRIC INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 167 SOMA TECH INTL: COMPANY OVERVIEW

- TABLE 168 FLORAPRINTER: COMPANY OVERVIEW

- TABLE 169 DOVER CORPORATION: COMPANY OVERVIEW

- TABLE 170 SHENZHEN SANYI TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 LARGE FORMAT PRINTER MARKET: RESEARCH DESIGN

- FIGURE 3 LARGE FORMAT PRINTER MARKET: RESEARCH APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS IN LARGE FORMAT PRINTER MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS IN LARGE FORMAT PRINTER MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) —BOTTOM-UP ESTIMATION OF LARGE FORMAT PRINTER MARKET, BY REGION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 LARGE FORMAT PRINTER MARKET, 2019–2028

- FIGURE 12 PRINTERS SEGMENT TO HOLD MAJORITY OF MARKET SHARE, BY OFFERING, THROUGHOUT FORECAST PERIOD

- FIGURE 13 24–36” SEGMENT TO HOLD LARGEST SHARE OF LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH, IN 2028

- FIGURE 14 SOLVENT SEGMENT TO DOMINATE LARGE FORMAT PRINTER MARKET, BY INK TYPE, IN 2028

- FIGURE 15 SIGNAGE & ADVERTISING SEGMENT TO COMMAND LARGE FORMAT PRINTER MARKET, BY APPLICATION, THROUGHOUT FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN LARGE FORMAT PRINTER MARKET DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO EMERGE AS LUCRATIVE AVENUE FOR LARGE FORMAT PRINTER MARKET

- FIGURE 18 INK-BASED TECHNOLOGY TO CAPTURE LARGER MARKET SHARE IN 2023

- FIGURE 19 WIRED CONNECTIVITY TO HOLD LARGER MARKET SHARE IN 2028

- FIGURE 20 POROUS MATERIALS TO CAPTURE LARGER MARKET SHARE IN 2028

- FIGURE 21 PRINTERS AND SIGNAGE & ADVERTISING SEGMENTS TO CAPTURE LARGEST SHARE OF LARGE FORMAT MARKET, BY OFFERING AND APPLICATION, RESPECTIVELY, IN 2023

- FIGURE 22 LARGE FORMAT PRINTER MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 23 LARGE FORMAT PRINTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 DRIVERS AND THEIR IMPACT ON LARGE FORMAT PRINTER MARKET

- FIGURE 25 RESTRAINTS AND THEIR IMPACT ON LARGE FORMAT PRINTER MARKET

- FIGURE 26 OPPORTUNITIES AND THEIR IMPACT ON LARGE FORMAT PRINTER MARKET

- FIGURE 27 CHALLENGES AND THEIR IMPACT ON LARGE FORMAT PRINTER MARKET

- FIGURE 28 SUPPLY CHAIN ANALYSIS: LARGE FORMAT PRINTER MARKET

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 KEY PLAYERS IN LARGE FORMAT PRINTER MARKET

- FIGURE 31 INDICATIVE PRICING ANALYIS, BY TECHNOLOGY, 2019–2028

- FIGURE 32 NUMBER OF PATENTS GRANTED FROM 2012 TO 2022

- FIGURE 33 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8443 FOR KEY COUNTRIES, 2018-2022

- FIGURE 34 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8443 FOR KEY COUNTRIES, 2018-2022

- FIGURE 35 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS

- FIGURE 38 LARGE FORMAT PRINTER MARKET, BY OFFERING

- FIGURE 39 PRINTERS TO CAPTURE LARGEST MARKET SHARE IN 2028

- FIGURE 40 LARGE FORMAT PRINTER MARKET, BY CONNECTIVITY

- FIGURE 41 WIRED SEGMENT TO ACCOUNT FOR LARGER SHARE OF LARGE FORMAT PRINTER MARKET IN 2028

- FIGURE 42 LARGE FORMAT PRINTER MARKET, BY PRINTING MATERIAL

- FIGURE 43 POROUS MATERIALS TO HOLD MAJORITY OF MARKET SHARE IN 2023

- FIGURE 44 LARGE FORMAT PRINTER MARKET, BY TECHNOLOGY

- FIGURE 45 INK-BASED (INKJET) SEGMENT TO DOMINATE LARGE FORMAT PRINTER MARKET DURING FORECAST PERIOD

- FIGURE 46 LARGE FORMAT PRINTER MARKET, BY PRINT WIDTH

- FIGURE 47 24–36” SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 48 LARGE FORMAT PRINTER MARKET, BY INK TYPE

- FIGURE 49 UV-CURED SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 LARGE FORMAT PRINTER MARKET, BY APPLICATION

- FIGURE 51 DECOR SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 52 LARGE FORMAT PRINTER MARKET, BY REGION

- FIGURE 53 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN LARGE FORMAT PRINTER MARKET DURING FORECAST PERIOD

- FIGURE 54 NORTH AMERICA: LARGE FORMAT PRINTER MARKET SNAPSHOT

- FIGURE 55 EUROPE: LARGE FORMAT PRINTER MARKET SNAPSHOT

- FIGURE 56 ASIA PACIFIC: LARGE FORMAT PRINTER MARKET SNAPSHOT

- FIGURE 57 MARKET SHARE ANALYSIS OF TOP 5 KEY PLAYERS, 2022

- FIGURE 58 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022

- FIGURE 59 LARGE FORMAT PRINTER MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 60 LARGE FORMAT PRINTER MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- FIGURE 61 HP DEVELOPMENT COMPANY, L.P.: COMPANY SNAPSHOT

- FIGURE 62 CANON INC.: COMPANY SNAPSHOT

- FIGURE 63 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 BROTHER INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 65 MIMAKI ENGINEERING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 66 ROLAND DGA CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 RICOH: COMPANY SNAPSHOT

- FIGURE 68 XEROX CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 KONICA MINOLTA, INC.: COMPANY SNAPSHOT

- FIGURE 70 AGFA-GEVAERT GROUP: COMPANY SNAPSHOT

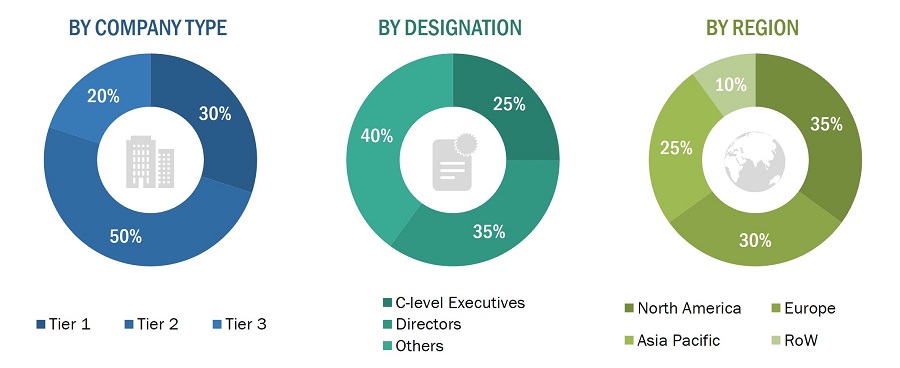

The study involved four major activities in estimating the size of the large format printer market. Exhaustive secondary research has been conducted to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research:

Revenues of companies offering large format printers have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Secondary research has been conducted mainly to obtain critical information about the market’s value chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from demand- and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research:

Extensive primary research has been conducted after understanding and analyzing the current scenario of the large format printer market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across 4 major regions: North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

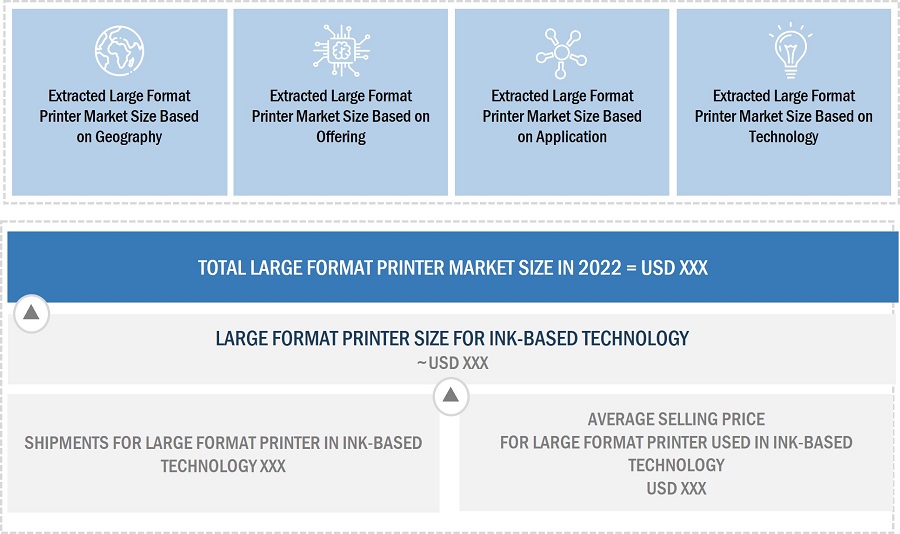

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the Large Format Printer Market.

- Identifying applications that use or are expected to use large format printers.

- Analyzing major providers of large format printers and original equipment manufacturers (OEMs), studying their portfolios, and understanding different technologies used.

- Analyzing historical and current data pertaining to the market, in terms of volume, for each large format printer market technology.

- Analyzing the average selling price of large format printers based on different technologies used in different products.

- Arriving at the market estimates by analyzing companies' revenue and combining these figures to determine the market size.

- Studying paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information.

- Tracking the ongoing developments and identifying the upcoming ones in the market that include investments, research and development activities, product launches, collaborations, and partnerships undertaken, as well as forecasting the market based on these developments and other critical parameters.

- Carrying out multiple discussions with the key opinion leaders to understand the large format printer technologies and related raw materials, as well as products designed and developed to analyze the break-up of the scope of work carried out by the key companies' manufacturing panels.

- Verifying and cross-checking the estimate at every level through discussions with key opinion leaders such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets

The top-down approach has been used to estimate and validate the total size of the Large Format Printer Market.

- Focusing initially on the investments and expenditures being made in the ecosystems of various applications

- Calculating the market size considering revenues generated by major players through the cost of the large format printers.

- Segmenting each application of large format printer in each region and deriving the global market size based on region.

- Acquiring and analyzing information related to revenues generated by players through their key offerings.

- Conducting multiple on-field discussions with key opinion leaders in developing various large format printer offerings.

- Estimating the geographic split using secondary sources based on multiple factors, such as the number of players in a specific country and region and the types of large format printers technology used in apparel & and textiles, signage & and advertising, décor, CAD & technical printing.

Data Triangulation

After arriving at the overall size of the large format printer market through the process explained, the total market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using the top-down and bottom-up approaches.

Market Definition

Large format printing (LFP), also known as wide-format printing, is basically a type of printing done using wide/large format printers for printing documents that range from 17 inches to 72 inches in width. Printers that print over 72 inches are called super-wide or grand format printers. Images to be printed in a large format must have a resolution of 150 dots per inch (DPI) or more due to the size of the end product. Inkjet technology is more commonly used in wide-format printers than other technologies such as laser or dot matrix because of its lower initial cost, higher quality, and fine prints. The large format printer market is mainly consolidated with big players; however, the market for materials is fragmented.

Key Stakeholders

- Large format printer material and component suppliers

- Manufacturing Equipment Suppliers

- System Integrators

- Technology/IP Developers

- End users of printers, such as printing service providers and presses

- Investors (private equity, venture capital, and others)

- Original equipment manufacturers (OEMs)

- Large format printer and Material-related Associations, Organizations, Forums, and Alliances

- Venture Capitalists and Startups

- Research institutes and organizations

- Market research and consulting firms

- Distributors and Resellers

Report Objectives

- To define, describe, and forecast the large format printer market size by offering, connectivity, print width, printing material, ink type, and application in terms of value

- To describe and forecast the market size for the technology of large format printer market, in terms of value and volume

- To estimate and forecast the market size, in terms of value, for various segments across four regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain pertaining to the large format printer ecosystem, along with the average selling prices of different types of large format printer

- To strategically analyze the ecosystem, Porter’s five forces, technology analysis, tariffs and regulations, patent analysis, trade analysis, key conferences and events, and case studies pertaining to the market under study

- To analyze the manufacturers of large format printers, their strategies, and new production plans to analyze the large format printer ecosystem/supply chain, which consists of suppliers of materials and components and product manufacturers

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market and provide a detailed competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share analysis and ranking as well as core competencies

- To analyze competitive developments in the large format printer market, such as collaborations, contracts, partnerships, acquisitions, and product launches and developments

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Large Format Printer Market

I am entering the large format digital printing market, both Mexico and USA, therefore I am looking for statisticts