Laboratory Mixers Market by product (Shaker (Rocker, Roller) Magnetic Stirrer, Vortex Mixer, Accessories), Platform (Digital), Operability (Linear, Orbital), End User (Research Labs, Pharma-Biotech, CROs, Environmental Testing) - Global Forecasts to 2027

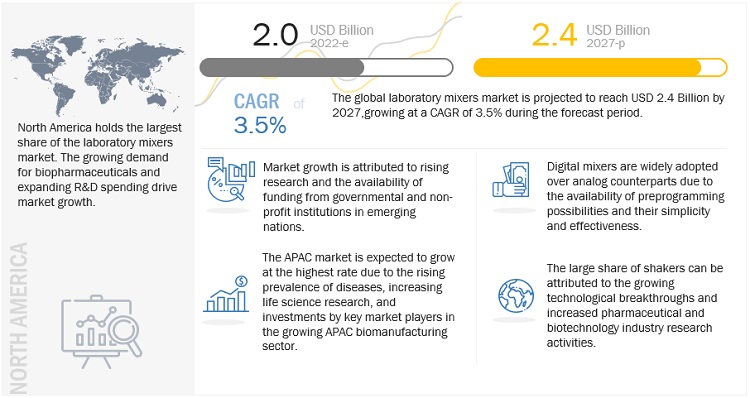

[215 Pages Report] The global laboratory mixer market is projected to reach USD 2.4 billion by 2027 from USD 2.0 billion in 2022, at a CAGR of 3.5% from 2022 to 2027. The focusing on developing effective treatment has increased across the world because of the increasing prevalence of life- threating diseases. The R&D expenditure of pharmaceutical companies has thus increased significantly over the last two decades. According to Statista, global pharmaceutical TR&D spending was valued at USD 190 million in 2019 and is expected to reach USD 254 billion by 2026.

Global Laboratory Mixer Market Trends

e- Estimated; p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19

The industry for laboratory mixers has been least impacted by the COVID-19 epidemic. Due to the constant research work and laboratory work, even during the pandemic, the market was not affected to a much extent. The market experienced a brief period of negative growth, which can be attributed to a number of factors, including a decline in product demand from the issues regarding supplying products during the pandemic, limited operations in the majority of industries, the temporary closure of major end-user facilities, disrupted supply chains, and difficulties in providing post-essential services because of the lockdown.

Laboratory: Market Dynamics

Driver: Increasing research activity in the pharmaceutical and biotechnology industries

Due to the rise in the occurrence of life-threatening disorders, more attention has been paid to discovering effective treatments (for these illnesses).

Advanced cancer treatments have been made possible by the emergence of new concepts and methods, like cell therapy. Preclinical stem cell research has demonstrated a lot of potential for usage in applications for tailored anti-cancer therapy in this area.

Over the past two decades, pharmaceutical companies' R&D spending has grown dramatically. Statista estimates that global spending on pharmaceutical R&D was about USD 190 billion in 2019 and will amount to USD 254 billion by 2026. The Pharmaceutical Research and Manufacturers of America (PhRMA), a group of pharmaceutical corporations, invested USD 133 billion in R&D in the US in 2021.

Restraint: High cost of advanced laboratory mixers and long equipment lifespan

Among the essential tools for everyday laboratory tasks like blending, stirring, or mixing substances or microbiological cultures are laboratory mixers. Small research and university labs typically do not have a lot of money set aside for the acquisition of essential lab tools like weighing scales, mixers, and incubators. The use of sophisticated high-throughput mixers in small and medium-sized laboratories has been constrained as a result. This is due to the fact that advanced mixers can range in price from USD 2,000 to USD 7,000, which is substantially more expensive than basic mixers, which start at USD 400. This demonstrates the stark price difference between the two categories of mixers. Additionally, laboratory mixers are long-lasting and exceptionally durable tools. They can endure for about ten years if properly cared for and used, which greatly lowers the requirement for equipment replacement. This has a negative influence on market participants' revenues and leads to little innovation.

Opportunities: Emerging economies in the Asia Pacific Market

The top companies in the laboratory mixers market have a lot of room to grow in emerging markets like India, China, Brazil, Russia, Taiwan, and South Korea. In the upcoming years, the market for analytical instruments (including laboratory mixers) is anticipated to increase favourably because to the rising importance of these emerging economies in terms of R&D and investments from global companies. Due to less onerous rules and data requirements, regulatory policies in the Asia Pacific area are also more flexible and business friendly. Manufacturers of laboratory mixer instruments will be increasingly compelled to concentrate on emerging markets as a result of the growing competition in developed regions

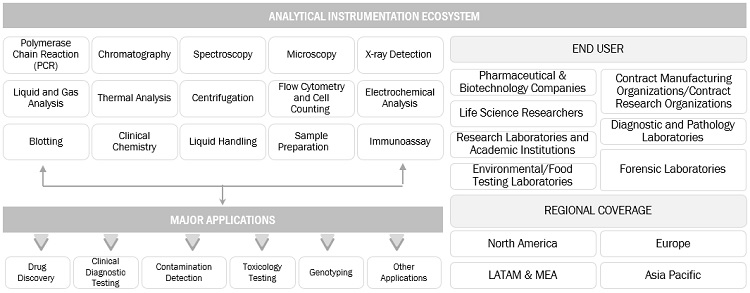

Laboratory mixers Market Ecosystem:

Source: Knowledge Store

By product type, the shakers segment accounted for the largest share during the forecast period.

Shakers, magnetic stirrers, vortex mixers, conical mixers, overhead stirrers, and accessories are some of the additional mixer types covered by each segment in the laboratory mixer market, which is divided into several categories based on product type. In 2021, the shaker goods sector accounted for the biggest market share for laboratory mixers. The magnetic stirrer and vortex mixer are also shown as significant growth by 2027. The expanding technical advancements and expanded pharmaceutical and biotechnology sector research activities can be the main reason for the huge share of this market.

By platform type, the digital segment accounted for the largest share during the forecast period.

Based on platform, the laboratory mixer market is segmented into digital and analog devices. A flask, beaker, motorized platform mounted on a stabilizing base and connected to an analog or digital controller to control the platform's movement and speed make up laboratory mixers. The digital devices segment is expected to account for the largest share of the laboratory mixer market, by platform, in 2020. The substantial share of this market can be linked to the availability of pre-programing possibilities and the considerably simpler and more effective job function of digital devices. However, digital mixers allow users to assign multiple function to one knob or button.

By Mode of Operation type, the digital segment accounted for the largest share during the forecast period.

Based on Mode Of Operation, the laboratory mixer market is segmented into gyratory, linear, rocking/tilting, and orbital motion mixers. Orbital motion laboratory mixers are predicted to account for the biggest percentage of the laboratory mixer, via way of means of Mode of Operation, in 2022. The advantages that those mixers provide, inclusive of their tiny, space-saving designs, virtual pace controls, built-in timers, and elective tier structures for better capacity, may be credited for their good sized marketplace percentage.

By End User, pharmaceutical & biotechnology companies segment to grow at the fastest rate during the forecast period.

Based on end user, the laboratory mixers market is research laboratories & institutes, pharmaceutical & biotechnology companies, clinical research organizations, environmental testing laboratories, food testing laboratories, diagnostic & pathology laboratories, and other end users. The analysis laboratories & institutes phase is predicted to account for the most important share of the laboratory mixer market, by user, in 2022. The substantial proportion of this market is because of enlargement of life sciences analysis funding from governmental and non-profit establishments still because the expansion of analysis facilities in rising nations.

To know about the assumptions considered for the study, download the pdf brochure

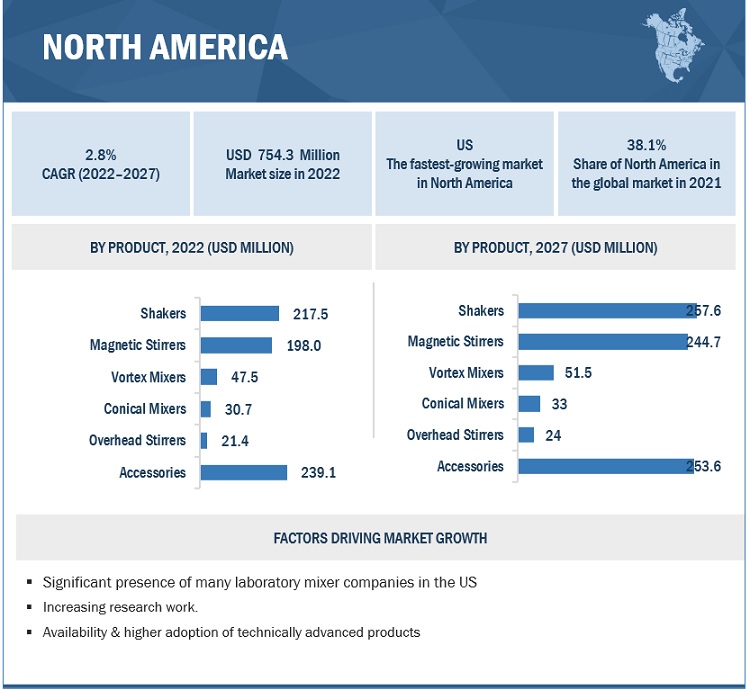

North America is expected to be the largest market during the forecast period.

In 2022, North America is predicted to account for a significant percentage of the laboratory mixers marketplace. North America comprises of US and Canada, among which US is predicted to account for higher percentage of share. The US is one of the major markets for laboratory mixers in North America. The large share of the US market can be attributed to the high healthcare expenditure in the country, the increasing number of drug development activities and clinical trials, and advanced healthcare infrastructure.

Key Market Players

As of 2021, prominent players in the laboratory mixer market are Thermo Fisher Scientific, Inc. (US), Eppendorf AG (Germany), IKA Works (Germany), Cole-Parmer (Germany), Avantor, Inc. (US), Remi Group (India), Bio-Rd Laboratories, Inc. (US), Corning, Inc. (US), Scientific Industries, Inc (US), Silverson Machines (UK), and Sarstedt (Germany) among others.

Want to explore hidden markets that can drive new revenue in Laboratory Mixers Market?

Scope of the Report:

Want to explore hidden markets that can drive new revenue in Laboratory Mixers Market?

|

Report Metric |

Details |

|

Market size available for years |

20202027 |

|

Base year considered |

2021 |

|

Forecast period |

20222027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Product, Platform, Mode of Operation, End User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East, and Africa |

|

Companies covered |

Thermo Fisher Scientific, Inc. (US), Eppendorf AG (Germany), IKA Works (Germany), Cole-Parmer (Germany), Avantor, Inc. (US), Remi Group (India), Bio-Rd Laboratories, Inc. (US), Corning, Inc. (US), Scientific Industries, Inc (US), Heidolph Instrument Gmbh & Co. KG (Germany), Labstac Ltd. (South Korea), Saintyco (China), Silverson Machines (UK), and Sarstedt (Germany) among others. |

This report has segmented the global Laboratory mixer market based on product, platform, mode of operation, end-user, and region.

Global Laboratory mixer Market, by product

- Shakers

- Orbital Shakers

- Rockers

- Roller/Rotators

- Other Shakers

- Magnetic Stirrers

- Vortex Mixer

- Conical Mixer

- Overhead Stirrers

- Accessories

Global Laboratory mixer Market, by platform

- Digital Devices

- Analog Devices

Global Laboratory Mixer Market, by mode of operation

- Gyratory Movement

- Linear Movement

- Rocking/Tilting Movement

- Orbital Movement

- Global Laboratory mixer Market, by end user

- Research Laboratories & Institutes

- Pharmaceutical & Biotechnology Companies

- Clinical Research Organizations

- Environmental Testing Laboratories

- Food Testing Laboratories

- Diagnostic & Pathology Laboratories

- And Other End Users

Laboratory mixer Market, by region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments

- In June 2021, Avantor completed the Acquisition of Ritter GmbH and its Affiliates

- In June 2021, Avantor acquired RIM Bio and expanded its Bioproduction Footprint into China

- In August 2021, Avantor acquired Masterflex and expanded its proprietary Single-Use Offering for Bioproduction.

- In March 2020, Eppendorf AG, have agreed with Koki Holdings Co., Ltd. to acquire Koki's centrifuge business, which includes the premium himac brand. Both businesses signed a similar agreement in Tokyo.

- In April 2019, Thermo Fisher Scientific Inc. purchased Brammer Bio for approximately USD 1.67 Billion in cash.

Frequently Asked Questions (FAQ):

What is the expected addressable market value of the global laboratory mixer market over a 5-year period?

The global laboratory mixer market is projected to reach USD 2.4 billion by 2027 from USD 2.0 billion in 2022, at a CAGR of 3.5% from 2022 to 2027.

Which segment on the basis product is expected to garner the highest traction within the laboratory mixer market?

Based on the product type, the shaker products segment held the largest share of the laboratory mixers market in 2021. The large proportion of this segment can be attributed to the developing technological breakthroughs and extended pharmaceutical and biotechnology companys research activities.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use partnerships, expansion, distribution agreements, product launches, and product approvals as important growth tactics.

What are the major factors expected to limit the growth of the laboratory mixer market?

Product pricing and establishing a market presence.

Are there any challenges that laboratory mixer manufacturers are facing?

No, there are not any industry level challenges the manufacturing company is currently facing. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKETS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH APPROACH

FIGURE 1 LABORATORY MIXERS MARKET: RESEARCH DESIGN METHODOLOGY

2.1.1 SECONDARY RESEARCH

2.1.2 PRIMARY RESEARCH

2.1.2.1 Primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach 1: Company revenue estimation approach

2.2.1.2 Approach 2: Customer-based market estimation

FIGURE 5 BOTTOM-UP APPROACH FOR MARKET SIZE ESTIMATION: LABORATORY MIXERS MARKET

2.2.1.3 Growth forecast

2.2.1.4 CAGR projections

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION APPROACH

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE

2.5 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT

2.7 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 8 LABORATORY MIXERS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 9 LABORATORY MIXERS MARKET, BY PLATFORM, 2022 VS. 2027 (USD MILLION)

FIGURE 10 LABORATORY MIXERS MARKET, BY MODE OF OPERATION, 2022 VS. 2027 (USD MILLION)

FIGURE 11 LABORATORY MIXERS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 12 GEOGRAPHICAL SNAPSHOT: LABORATORY MIXERS MARKET

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 LABORATORY MIXERS MARKET OVERVIEW

FIGURE 13 INCREASING RESEARCH IN PHARMACEUTICAL AND BIOTECHNOLOGY INDUSTRIES TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: LABORATORY MIXERS MARKET, BY PRODUCT

FIGURE 14 SHAKERS TO ACCOUNT FOR LARGEST SHARE IN 2022

4.3 ASIA PACIFIC: LABORATORY MIXERS MARKET, BY END USER

FIGURE 15 RESEARCH LABORATORIES & INSTITUTES TO ACCOUNT FOR LARGEST SHARE IN 2022

4.4 EUROPE: LABORATORY MIXERS MARKET, BY MODE OF OPERATION

FIGURE 16 GYRATORY MIXERS TO WITNESS HIGHEST GROWTH

4.5 LABORATORY MIXERS MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 17 APAC COUNTRIES TO SHOW HIGHEST GROWTH

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

FIGURE 18 LABORATORY MIXERS MARKET: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing research in pharmaceutical and biotechnology industries

TABLE 1 R&D INVESTMENTS BY END USERS

5.2.2 RESTRAINTS

5.2.2.1 High cost of advanced laboratory mixers and long equipment lifespan

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies

5.2.3.2 Growing industry-academia collaborations

5.3 PORTERS FIVE FORCES ANALYSIS

TABLE 2 LABORATORY MIXERS MARKET: PORTERS FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

5.4.1 RESEARCH & DEVELOPMENT

5.4.2 PROCUREMENT AND PRODUCT DEVELOPMENT

5.4.3 MARKETING, SALES & DISTRIBUTION, AND POST-SALES SERVICES

FIGURE 19 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

5.5 SUPPLY CHAIN ANALYSIS

5.5.1 PROMINENT COMPANIES

5.5.2 SMALL & MEDIUM-SIZED ENTERPRISES

5.5.3 END USERS

TABLE 3 SUPPLY CHAIN ECOSYSTEM

FIGURE 20 SUPPLY CHAIN ANALYSIS

5.6 ECOSYSTEM COVERAGE FOR ANALYTICAL INSTRUMENTATION

5.7 PATENT ANALYSIS

FIGURE 21 PATENT DETAILS FOR LABORATORY MIXERS (JANUARY 2012SEPTEMBER 2022)

FIGURE 22 PATENT DETAILS FOR SHAKERS (JANUARY 2012SEPTEMBER 2022)

FIGURE 23 PATENT DETAILS FOR MAGNETIC STIRRERS (JANUARY 2012SEPTEMBER 2022)

FIGURE 24 PATENT DETAILS FOR VORTEX MIXERS (JANUARY 2012SEPTEMBER 2022)

FIGURE 25 PATENT DETAILS FOR CONICAL MIXERS (JANUARY 2012SEPTEMBER 2022)

FIGURE 26 PATENT DETAILS FOR OVERHEAD STIRRERS (JANUARY 2012SEPTEMBER 2022)

5.8 TRADE ANALYSIS

5.8.1 TRADE ANALYSIS: LABORATORY MIXERS

TABLE 4 IMPORT DATA FOR LABORATORY MIXERS (HS CODE 847982) BY COUNTRY, 20172021 (USD)

TABLE 5 EXPORT DATA FOR LABORATORY MIXERS (HS CODE 847982) BY COUNTRY, 20172021 (USD)

5.9 KEY CONFERENCES & EVENTS (20222024)

TABLE 6 LABORATORY MIXERS MARKET: MAJOR CONFERENCES & EVENTS, 20222023

5.1 TECHNOLOGY ANALYSIS

6 LABORATORY MIXERS MARKET, BY PRODUCT (Page No. - 65)

6.1 INTRODUCTION

TABLE 7 LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

6.2 SHAKERS

TABLE 8 SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

TABLE 9 SHAKERS MARKET, BY REGION, 20202027 (USD MILLION)

TABLE 10 SHAKERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

TABLE 11 SHAKERS MARKET, BY PLATFORM, 20202027 (USD MILLION)

TABLE 12 SHAKERS MARKET, BY END USER, 20202027 (USD MILLION)

6.2.1 ORBITAL SHAKERS

6.2.1.1 Orbital shakers to dominate parent market during forecast period

TABLE 13 ORBITAL SHAKERS MARKET, BY REGION, 20202027 (USD MILLION)

6.2.2 ROCKERS

6.2.2.1 Wide usage in labs to drive demand for rockers

TABLE 14 ROCKERS MARKET, BY REGION, 20202027 (USD MILLION)

6.2.3 ROLLERS/ROTATORS

6.2.3.1 High mixing capabilities for wide sample range to ensure sustained demand

TABLE 15 ROLLERS/ROTATORS MARKET, BY REGION, 20202027 (USD MILLION)

6.2.4 OTHER SHAKERS

TABLE 16 OTHER SHAKERS MARKET, BY REGION, 20202027 (USD MILLION)

6.3 MAGNETIC STIRRERS

6.3.1 MAGNETIC STIRRERS SEGMENT TO WITNESS HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 17 MAGNETIC STIRRERS MARKET, BY REGION, 20202027 (USD MILLION)

TABLE 18 MAGNETIC STIRRERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

TABLE 19 MAGNETIC STIRRERS, BY PLATFORM, 20202027 (USD MILLION)

TABLE 20 MAGNETIC STIRRERS, BY END USER, 20202027 (USD MILLION)

6.4 VORTEX MIXERS

6.4.1 WIDE USAGE IN BIOSCIENCE, MICROBIOLOGY, BIOCHEMICAL, AND ANALYTICAL LABORATORY SETTINGS TO SUSTAIN DEMAND

TABLE 21 VORTEX MIXERS MARKET, BY REGION, 20202027 (USD MILLION)

TABLE 22 VORTEX MIXERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

TABLE 23 VORTEX MIXERS MARKET, BY PLATFORM, 20202027 (USD MILLION)

TABLE 24 VORTEX MIXERS MARKET, BY END USER, 20202027 (USD MILLION)

6.5 CONICAL MIXERS

6.5.1 ACCURACY BENEFITS OF CONICAL MIXERS TO DRIVE MARKET

TABLE 25 CONICAL MIXERS MARKET, BY REGION, 20202027 (USD MILLION)

TABLE 26 CONICAL MIXERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

TABLE 27 CONICAL MIXERS MARKET, BY PLATFORM, 20202027 (USD MILLION)

TABLE 28 CONICAL MIXERS MARKET, BY END USER, 20202027 (USD MILLION)

6.6 OVERHEAD STIRRERS

6.6.1 GROWING PHARMA INDUSTRY AND RESEARCH ACTIVITY TO DRIVE DEMAND FOR STIRRERS

TABLE 29 OVERHEAD STIRRERS MARKET, BY REGION, 20202027 (USD MILLION)

TABLE 30 OVERHEAD STIRRERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

TABLE 31 OVERHEAD STIRRERS MARKET, BY PLATFORM, 20202027 (USD MILLION)

TABLE 32 OVERHEAD STIRRERS MARKET, BY END USER, 20202027 (USD MILLION)

6.7 ACCESSORIES

TABLE 33 ACCESSORIES MARKET, BY REGION, 20202027 (USD MILLION)

7 LABORATORY MIXERS MARKET, BY PLATFORM (Page No. - 80)

7.1 INTRODUCTION

TABLE 34 LABORATORY MIXERS MARKET, BY PLATFORM, 20202027 (USD MILLION)

7.2 DIGITAL DEVICES

7.2.1 DIGITAL DEVICES TO DOMINATE MARKET

TABLE 35 LABORATORY MIXERS MARKET FOR DIGITAL DEVICES, BY REGION, 20202027 (USD MILLION)

7.3 ANALOG DEVICES

7.3.1 AFFORDABILITY AND SIMPLER DESIGN TO ENCOURAGE ADOPTION OF ANALOG MIXERS

TABLE 36 LABORATORY MIXERS MARKET FOR ANALOG DEVICES, BY REGION, 20202027 (USD MILLION)

8 LABORATORY MIXERS MARKET, BY MODE OF OPERATION (Page No. - 83)

8.1 INTRODUCTION

TABLE 37 LABORATORY MIXERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

8.2 ORBITAL MIXERS

8.2.1 EVENNESS OF DISTRIBUTION ALLOWED BY ORBITAL MIXERS TO AID ADOPTION

TABLE 38 ORBITAL MIXERS MARKET, BY REGION, 20202027 (USD MILLION)

8.3 GYRATORY MIXERS

8.3.1 SPACE-SAVING DESIGN AND DIGITAL SPEED CONTROL TO SUPPORT MARKET GROWTH

TABLE 39 GYRATORY MIXERS MARKET, BY REGION, 20202027 (USD MILLION)

8.4 LINEAR MIXERS

8.4.1 GROWING ADOPTION OF LINEAR MIXERS FOR LARGER-VOLUME SAMPLES TO AID MARKET GROWTH

TABLE 40 LINEAR MIXERS MARKET, BY REGION, 20202027 (USD MILLION)

8.5 ROCKING/TILTING MIXERS

8.5.1 INCREASING BLOTTING APPLICATIONS IN PROTEIN ANALYSIS TO FUEL MARKET GROWTH

TABLE 41 ROCKING/TILTING MIXERS MARKET, BY REGION, 20202027 (USD MILLION)

9 LABORATORY MIXERS MARKET, BY END USER (Page No. - 88)

9.1 INTRODUCTION

TABLE 42 LABORATORY MIXERS MARKET, BY END USER, 20202027 (USD MILLION)

9.2 RESEARCH LABORATORIES & INSTITUTES

9.2.1 RISE IN LIFE SCIENCES RESEARCH FUNDING TO SUPPORT GROWTH

FIGURE 27 GROSS DOMESTIC SPENDING ON R&D BY TOP FIVE COUNTRIES (TOTAL, % OF GDP, 20162020)

TABLE 43 LABORATORY MIXERS MARKET FOR RESEARCH LABORATORIES & INSTITUTES, BY REGION, 20202027 (USD MILLION)

9.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

9.3.1 INCREASING R&D EXPENDITURE TO ENCOURAGE ADOPTION OF MIXERS

TABLE 44 US NIH NATIONAL CANCER INSTITUTE FUNDING FOR RESEARCH AREAS (USD MILLION, 20152020)

TABLE 45 LABORATORY MIXERS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 20202027 (USD MILLION)

9.4 CLINICAL RESEARCH ORGANIZATIONS

9.4.1 RISING ADOPTION OF MOLECULAR DIAGNOSTIC TECHNOLOGIES BY RESEARCH ORGANIZATIONS TO DRIVE MARKET

TABLE 46 LABORATORY MIXERS MARKET FOR CLINICAL RESEARCH ORGANIZATIONS, BY REGION, 20202027 (USD MILLION)

9.5 ENVIRONMENTAL TESTING LABORATORIES

9.5.1 INCREASING REGULATIONS FOR ENVIRONMENTAL TESTING TO DRIVE ADOPTION OF ANALYTICAL TOOLS

TABLE 47 LABORATORY MIXERS MARKET FOR ENVIRONMENTAL TESTING LABORATORIES, BY REGION, 20202027 (USD MILLION)

9.6 FOOD TESTING LABORATORIES

9.6.1 ANALYSIS OF FOOD PRODUCTS FOR MAINTAINING QUALITY & SAFETY TO INCREASE ADOPTION OF LABORATORY MIXERS

TABLE 48 LABORATORY MIXERS MARKET FOR FOOD TESTING LABORATORIES, BY REGION, 20202027 (USD MILLION)

9.7 DIAGNOSTIC & PATHOLOGY LABORATORIES

9.7.1 GROWING ADOPTION OF MOLECULAR DIAGNOSTICS TO BOOST USE OF LABORATORY MIXERS IN DIAGNOSTIC LABS

TABLE 49 LABORATORY MIXERS MARKET FOR DIAGNOSTIC & PATHOLOGY LABORATORIES, BY REGION, 20202027 (USD MILLION)

9.8 OTHER END USERS

TABLE 50 LABORATORY MIXERS MARKET FOR OTHER END USERS, BY REGION, 20202027 (USD MILLION)

10 LABORATORY MIXERS MARKET, BY REGION (Page No. - 97)

10.1 INTRODUCTION

TABLE 51 LABORATORY MIXERS MARKET, BY REGION, 20202027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: LABORATORY MIXERS MARKET SNAPSHOT

TABLE 52 NORTH AMERICA: LABORATORY MIXERS MARKET, BY COUNTRY, 20202027 (USD MILLION)

TABLE 53 NORTH AMERICA: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 54 NORTH AMERICA: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

TABLE 55 NORTH AMERICA: LABORATORY MIXERS MARKET, BY PLATFORM, 20202027 (USD MILLION)

TABLE 56 NORTH AMERICA: LABORATORY MIXERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

TABLE 57 NORTH AMERICA: LABORATORY MIXERS MARKET, BY END USER, 20202027 (USD MILLION)

10.2.1 US

10.2.1.1 US to dominate North American market

FIGURE 29 R&D EXPENDITURE OF US PHARMACEUTICAL COMPANIES, 20122021 (USD BILLION)

TABLE 58 US: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 59 US: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Government investments to support market growth

TABLE 60 CANADA: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 61 CANADA: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.3 EUROPE

FIGURE 30 PHARMACEUTICAL R&D EXPENDITURE BY TOP 10 EUROPEAN COUNTRIES IN 2020 (USD BILLION)

TABLE 62 EUROPE: LABORATORY MIXERS MARKET, BY COUNTRY, 20202027 (USD MILLION)

TABLE 63 EUROPE: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 64 EUROPE: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

TABLE 65 EUROPE: LABORATORY MIXERS MARKET, BY PLATFORM, 20202027 (USD MILLION)

TABLE 66 EUROPE: LABORATORY MIXERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

TABLE 67 EUROPE: LABORATORY MIXERS MARKET, BY END USER, 20202027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Favorable reimbursement and insurance scenario to support market growth

TABLE 68 GERMANY: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 69 GERMANY: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Increasing investments in R&D infrastructure and activities to drive adoption of new lab instruments

TABLE 70 FRANCE: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 71 FRANCE: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.3.3 UK

10.3.3.1 Rising research and industry-academia partnerships to boost product demand

TABLE 72 UK: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 73 UK: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Increasing R&D investments by biopharmaceutical companies to aid market growth

TABLE 74 ITALY: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 75 ITALY: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Growing focus on cancer research and advanced R&D infrastructure to support market

TABLE 76 SPAIN: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 77 SPAIN: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 78 ROE: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 79 ROE: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: LABORATORY MIXERS MARKET SNAPSHOT

TABLE 80 APAC: LABORATORY MIXERS MARKET, BY COUNTRY, 20202027 (USD MILLION)

TABLE 81 APAC: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 82 APAC: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

TABLE 83 APAC: LABORATORY MIXERS MARKET, BY PLATFORM, 20202027 (USD MILLION)

TABLE 84 APAC: LABORATORY MIXERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

TABLE 85 APAC: LABORATORY MIXERS MARKET, BY END USER, 20202027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to dominate APAC market

TABLE 86 CHINA: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 87 CHINA: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Favorable government initiatives for life science research to support market growth

TABLE 88 JAPAN: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 89 JAPAN: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Rising outsourcing and growth of contract research sector to drive market

TABLE 90 INDIA: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 91 INDIA: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Personalized medical care, cancer diagnostics, and agricultural research to boost market

TABLE 92 AUSTRALIA: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 93 AUSTRALIA: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.4.5 SOUTH KOREA

10.4.5.1 Growing awareness and broad applications of life science technologies to boost market growth

TABLE 94 SOUTH KOREA: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 95 SOUTH KOREA: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 96 ROAPAC: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 97 ROAPAC: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.5 LATIN AMERICA

TABLE 98 LATAM: LABORATORY MIXERS MARKET, BY COUNTRY, 20202027 (USD MILLION)

TABLE 99 LATAM: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 100 LATAM: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

TABLE 101 LATAM: LABORATORY MIXERS MARKET, BY PLATFORM, 20202027 (USD MILLION)

TABLE 102 LATAM: LABORATORY MIXERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

TABLE 103 LATAM: LABORATORY MIXERS MARKET, BY END USER, 20202027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Minimal trade barriers for laboratory equipment and medical devices to drive market growth

TABLE 104 BRAZIL: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 105 BRAZIL: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Favorable business environment for market players to attract investments from major stakeholders

TABLE 106 MEXICO: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 107 MEXICO: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 108 ROLATAM: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 109 ROLATAM: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 ECONOMIC GROWTH, RISING INVESTMENTS IN END-USE INDUSTRIES TO BOOST PRODUCT DEMAND

TABLE 110 MEA: LABORATORY MIXERS MARKET, BY PRODUCT, 20202027 (USD MILLION)

TABLE 111 MEA: SHAKERS MARKET, BY TYPE, 20202027 (USD MILLION)

TABLE 112 MEA: LABORATORY MIXERS MARKET, BY PLATFORM, 20202027 (USD MILLION)

TABLE 113 MEA: LABORATORY MIXERS MARKET, BY MODE OF OPERATION, 20202027 (USD MILLION)

TABLE 114 MEA: LABORATORY MIXERS MARKET, BY END USER, 20202027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 137)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS

11.3 REVENUE SHARE ANALYSIS

FIGURE 32 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

11.4 MARKET SHARE ANALYSIS

FIGURE 33 LABORATORY MIXERS MARKET SHARE, BY KEY PLAYER, 2021

TABLE 115 LABORATORY MIXERS MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 34 LABORATORY MIXERS MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2021)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 35 LABORATORY MIXERS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021

11.7 COMPETITIVE BENCHMARKING

TABLE 116 LABORATORY MIXERS MARKET: PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

TABLE 117 COMPANY PRODUCT FOOTPRINT

TABLE 118 COMPANY REGIONAL FOOTPRINT

11.8 COMPETITIVE SITUATION AND TRENDS

TABLE 119 PRODUCT LAUNCHES

TABLE 120 DEALS

TABLE 121 OTHER DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 148)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 THERMO FISHER SCIENTIFIC

TABLE 122 THERMO FISHER SCIENTIFIC: COMPANY OVERVIEW

FIGURE 36 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2021)

12.1.2 EPPENDORF AG

TABLE 123 EPPENDORF AG: COMPANY OVERVIEW

FIGURE 37 EPPENDORF AG: COMPANY SNAPSHOT (2021)

12.1.3 AVANTOR

TABLE 124 AVANTOR: COMPANY OVERVIEW

FIGURE 38 AVANTOR: COMPANY SNAPSHOT (2021)

12.1.4 SCIENTIFIC INDUSTRIES

TABLE 125 SCIENTIFIC INDUSTRIES: COMPANY OVERVIEW

FIGURE 39 SCIENTIFIC INDUSTRIES: COMPANY SNAPSHOT (2021)

12.1.5 BIO-RAD LABORATORIES

TABLE 126 BIO-RAD LABORATORIES: COMPANY OVERVIEW

FIGURE 40 BIO-RAD LABORATORIES: COMPANY SNAPSHOT (2021)

12.1.6 BENCHMARK SCIENTIFIC

TABLE 127 BENCHMARK SCIENTIFIC: COMPANY OVERVIEW

FIGURE 41 BENCHMARK SCIENTIFIC: COMPANY SNAPSHOT (2021)

12.1.7 CORNING

TABLE 128 CORNING: COMPANY OVERVIEW

FIGURE 42 CORNING: COMPANY SNAPSHOT (2021)

12.1.8 COLE-PARMER INSTRUMENT COMPANY

TABLE 129 COLE-PARMER INSTRUMENT COMPANY: COMPANY OVERVIEW

12.1.9 HEIDOLPH INSTRUMENTS

TABLE 130 HEIDOLPH INSTRUMENTS: COMPANY OVERVIEW

12.1.10 IKA WORKS

TABLE 131 IKA WORKS: COMPANY OVERVIEW

12.1.11 LABSTAC

TABLE 132 LABSTAC: COMPANY OVERVIEW

12.1.12 REMI GROUP

TABLE 133 REMI GROUP: COMPANY OVERVIEW

12.1.13 SAINTYCO

TABLE 134 SAINTYCO: COMPANY OVERVIEW

12.1.14 SARSTEDT

TABLE 135 SARSTEDT: COMPANY OVERVIEW

12.1.15 SILVERSON

TABLE 136 SILVERSON: COMPANY OVERVIEW

12.2 OTHER COMPANIES

12.2.1 BIONICS SCIENTIFIC TECHNOLOGIES

12.2.2 SHUANGLONG GROUP

12.2.3 SUMINISTROS GRUPO ESPER

12.2.4 RETSCH

12.2.5 PHOENIX INSTRUMENT

12.2.6 SIEHE INDUSTRY

12.2.7 AASABI MACHINERY

12.2.8 JINHU GINHONG MACHINERY

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 207)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the laboratory mixer market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the laboratory mixer market. The primary sources from the demand side include medical OEMs, Analytical instrument OEMs, CDMOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

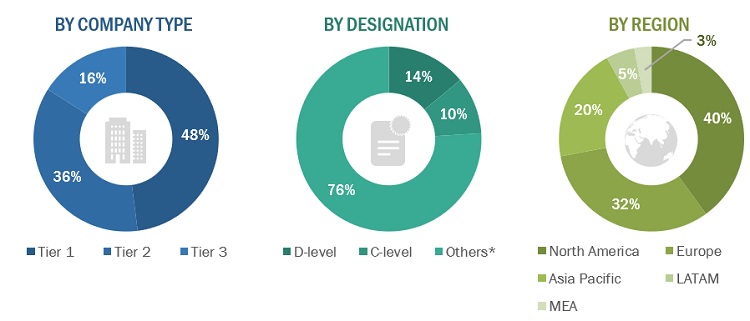

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

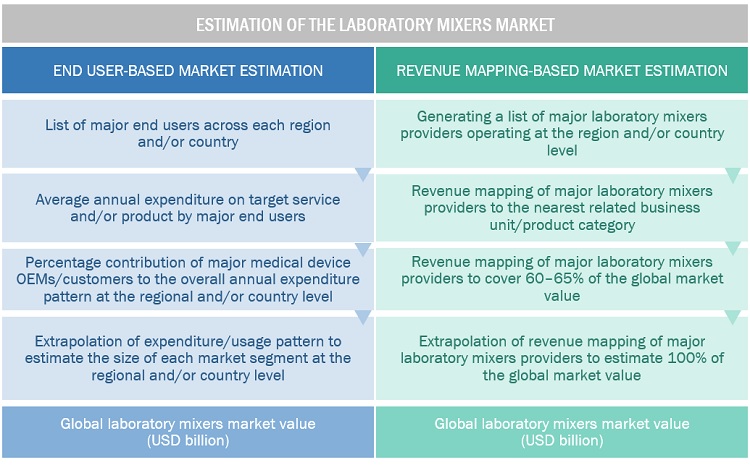

In this report, the global laboratory mixer market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the laboratory mixer business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the laboratory mixer market

- Mapping annual revenues generated by major global players from the laboratory mixer segment (or nearest reported business unit/product category)

- Revenue mapping of key players to cover major share of the global market, as of 2021

- Extrapolating the global value of the laboratory mixer industry

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global laboratory mixer market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the laboratory mixer market was validated using both top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, and forecast the Laboratory mixer market on the basis of product, platform, mode of operation, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global Laboratory mixer market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global Laboratory mixer market

- To analyze key growth opportunities in the global Laboratory mixer market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the global Laboratory mixer market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global Laboratory mixer market, such as product launches , agreements , expansions , and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the present global laboratory mixer market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe laboratory mixer market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of Asia Pacific laboratory mixer market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Latin American laboratory mixer market into Colombia, Chile, Argentina, and Peru, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Mixers Market