IT Asset Disposition Market by Service Type, Asset Type (Computers/Laptops, Servers, Mobile Devices, Storage Devices, Peripherals), Organization Size (Small and Medium-sized Enterprises, Large Enterprises), Vertical and Region - Global forecast to 2029

Updated on : Oct 22, 2024

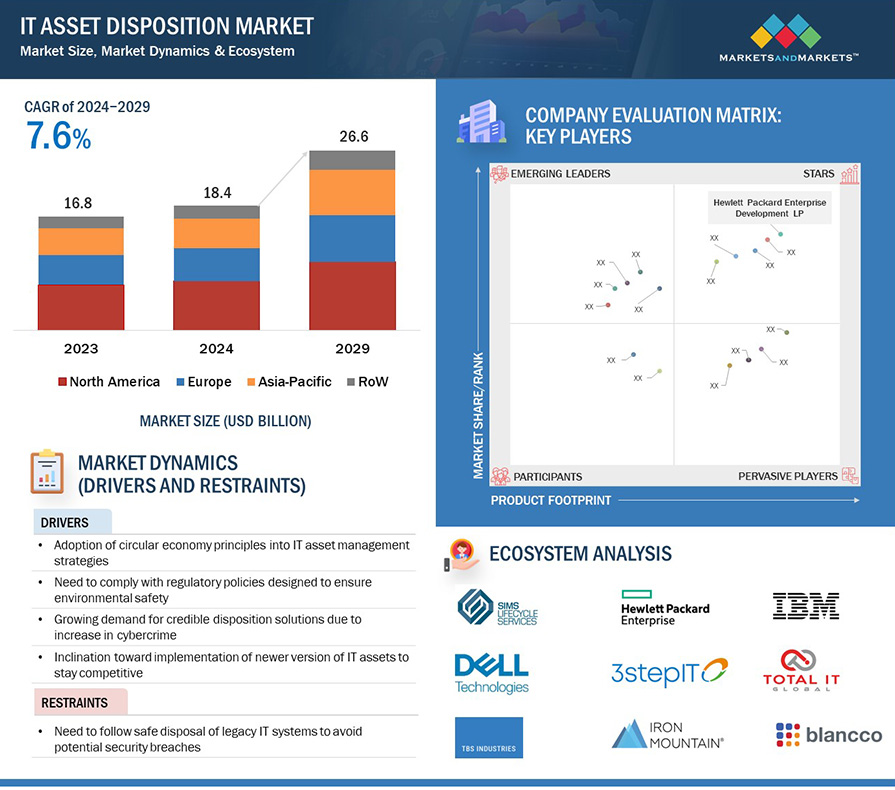

The global IT asset disposition market size is projected to grow from USD 18.4 billion in 2024 and is anticipated to be USD 26.6 billion by 2029, growing at a CAGR of 7.6% during the forecast period from 2024 to 2029.

Factors such as Early replacement of IT assets with newer versions to keep up with new technologies, and Adoption of cloud-based solutions and data center consolidation provide market growth opportunities for the IT asset disposition market.

IT Asset Disposition Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

IT asset disposition Market Dynamics

Driver: Adoption of circular economy principles into IT asset management strategies

Circular economy initiatives play a pivotal role in propelling the ITAD (IT Asset Disposition) market forward. The concept of a circular economy involves creating a closed-loop system where products and materials are reused, refurbished, and recycled rather than being disposed of as waste. In the context of ITAD, this means extending the lifespan of IT assets through sustainable practices by refurbishing and remarketing, aligning with the principles of reduce, reuse, and recycle. As companies become more cognizant of environmental impact and resource conservation, there is a growing emphasis on incorporating circular economy principles into their IT asset management strategies.

The adoption of circular economy principles in ITAD is driven by a dual commitment: minimizing electronic waste and maximizing the utility of IT assets. Rather than following a linear model of production, consumption, and disposal, businesses are increasingly recognizing the economic and environmental benefits of a circular approach. ITAD services that align with circular economy principles focus on the responsible disposal of electronic equipment, emphasizing refurbishment and recycling to extract value from retired assets. This not only addresses environmental concerns associated with e-waste but also contributes to the efficient use of resources by extending the life cycle of IT equipment. In this way, circular economy initiatives are shaping the ITAD market by fostering sustainability, resource efficiency, and a more responsible approach to IT asset disposition.

Restraint: Safe disposal of legacy IT systems

Legacy IT systems often contain hazardous materials, such as lead, mercury, or certain chemicals, that pose environmental and safety risks. Disposing of these aging IT assets inappropriately can contribute to electronic waste (e-waste) problems and environmental contamination. As organizations upgrade their technology, the disposal of legacy systems becomes a critical consideration in the IT Asset Disposition (ITAD) lifecycle. Unlike modern equipment designed with recycling and environmental considerations in mind, older technologies may lack the same eco-friendly features.

ITAD service providers must employ specialized expertise to identify and manage the hazardous materials within these older technologies. They must prioritize the safe extraction and disposal of potentially harmful substances. Additionally, refurbishing or repurposing components where possible can contribute to sustainable ITAD practices, minimizing the environmental impact associated with the disposal of legacy IT systems. It underscores the importance of implementing responsible ITAD processes that consider the unique challenges posed by older technology.

Opportunity: Adoption of cloud-based solutions and data center consolidation

As businesses move toward cloud-based solutions and data center consolidation, there is an increasing demand for ITAD (IT Asset Disposition) services. While cloud migration involves transferring data, applications, and IT infrastructure to cloud platforms, data center consolidation aims to centralize computing resources. In both cases, companies are left with decommissioned IT assets that require proper disposal and management.

The need for ITAD services in the context of cloud migration and data center consolidation arises from several reasons. Firstly, as businesses move their operations to the cloud, on-premises hardware becomes obsolete, necessitating responsible disposal of servers, storage devices, networking equipment, and other IT assets. Secondly, in data center consolidation efforts, where organizations seek to optimize efficiency and reduce operational costs, decommissioning of redundant data center equipment becomes a critical step.

ITAD services are equipped to handle the complexities associated with large-scale IT infrastructure decommissioning. These include tasks such as data sanitization to ensure sensitive information is securely erased, logistics management for the physical removal of equipment, and environmentally sustainable disposal methods such as recycling and refurbishment.

By engaging ITAD services, businesses can navigate the challenges associated with the disposal of outdated IT assets, ensuring compliance with data protection regulations and environmental standards. This trend underscores the integral role that ITAD providers play in supporting businesses throughout the entire IT lifecycle, from procurement and deployment to decommissioning and disposal, particularly in the evolving landscape of cloud-centric and consolidated IT infrastructures.

Challenge: Inadequate infrastructure for recycling

The challenge of inadequate infrastructure for recycling in the ITAD (IT Asset Disposition) market is rooted in the limited availability of well-established facilities and processes designed for the proper recycling of electronic components, especially in specific geographic regions. Electronic devices contain a variety of materials, including metals, plastics, and hazardous substances, making responsible disposal crucial for environmental sustainability. However, the absence of robust recycling infrastructure can impede the effective and environmentally friendly management of discarded IT assets. Without adequate infrastructure, there may be a higher likelihood of improper disposal practices, such as incineration or dumping, leading to environmental pollution and health hazards. Additionally, the lack of recycling facilities can limit the recovery of valuable materials from IT assets, contributing to resource inefficiency.

IT Asset Disposition Market Ecosystem

The IT asset disposition market is competitive. It is marked by the presence of a few tier-1 companies, such as Dell Inc. (US); IBM (US); Hewlett Packard Enterprise Development LP (US); Iron Mountain, Inc. (US); and Sims Limited (Australia). These companies have created a competitive ecosystem by focusing on partnership, collaboration, and acquisition to achieve competitive advantage.

IT asset disposition Market Segmentation

Data sanitization/data destruction segment to hold the largest share of market during the forecast period

The data sanitization/data destruction segment led the IT asset disposition market for services during the forecast period. The growing need for the proper disposal of IT assets and the threat of important information stored in old assets getting leaked are fueling the demand for data destruction/data sanitization services. Due to the importance of data security for any company, the complete destruction of data or information from an asset is imperative before its physical destruction or transition to the next phase of asset disposition. This proactive measure aims to minimize the risks associated with data breaches, financial implications, and threats to the brand image. IT asset disposition service providers leverage advanced software and solutions for comprehensive device sanitization to ensure the absolute destruction of data. Blancco Drive Erasure is a robust data sanitization solution for PCs, laptops, servers, and loose drives offered by Blancco Technology Group (US). The specialized software and appliances required for this process are used by an experienced IT asset disposition service provider, which provides certification that the data was sanitized according to common industry standards, such as the US's National Institute of Standards and Technology (NIST) Special Publication 800-88.

Server segment to display highest CAGR during forecast period

The global surge in Internet and social media applications, along with the introduction of technologies like software-defined networking and virtualization, has led to a widespread increase in the utilization of servers and data centers. Servers, which are designed for prolonged uninterrupted operation, consist of essential components such as Central Processing Units (CPUs), high-performance RAM, and one or more hard drives. Several factors contribute to the growing deployment of advanced servers, including technological advancements and a rising number of businesses transitioning to cloud-based services. Many companies adopt a regular cycle of refreshing their data centers with networking or server upgrades every three to four years. The escalating threat of data breaches has compelled data center providers to implement secure disposal practices for data and equipment before decommissioning.

Media & entertainment segment to grow at the highest CAGR during the forecast period

The media and entertainment industry requires a continual and frequent refresh cycle for IT assets to meet the demands of graphic and audio production programs and software demands. As the industry increasingly prioritizes environmentally conscious strategies, there is an increased demand for effective e-waste disposal and data sanitation. Technological advancements have also fueled a significant demand for IT asset disposition services within the media and entertainment sector, which encompasses the delivery of television and radio programs, online games, and advertisements. Due to the industry's heavy reliance on technology, it undergoes constant evolution to keep pace with ongoing technological developments. This rapid adoption of new technologies mandates the safe disposal of obsolete assets, particularly storage devices, where data wiping is crucial due to the confidentiality of stored data.

In the media and entertainment industry, data destruction services are widely employed, given the industry's nature, where online and web penetration drives the need for high-end servers and extensive storage capacity. Once data has been thoroughly wiped from these devices, they can be repurposed for further use by internal staff or external clients.

Asia Pacific to grow at the fastest CAGR during the forecast period.

The Asia Pacific IT asset disposition market is poised for significant growth during the forecast period, driven by the establishment of regulatory policies governing the proper disposal of IT assets. These policies aim to mitigate environmental hazards associated with retired IT equipment by prohibiting their disposal in landfills. In Asia Pacific, initiatives such as the Extended Producer Responsibility (EPR) schemes, notably implemented in Japan and South Korea, incentivize manufacturers to take responsibility for end-of-life products. This approach contributes significantly to the growth of the ITAD market. Additionally, regulatory frameworks like the Personal Data Protection Law in China and the Personal Data Protection Act in India, coupled with GDPR compliance requirements for multinational companies, accentuate the importance of data security.

IT Asset Disposition Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The IT asset disposition companies is dominated by globally established players such as Dell Inc. (US); IBM (US); Hewlett Packard Enterprise Development LP (US); Iron Mountain, Inc. (US); Sims Limited (Australia); 3stepIT (Finland); TES (Singapore); Apto Solutions Inc. (US); LifeSpan International Inc. (US); Total IT Global (UK); Flex IT Distribution (Netherlands); Ingram Micro (US); CSI Leasing, Inc. (US); Inrego AB (Sweden);Tier1 (UK); Atea (Norway); OceanTech (US); Blancco Technology Group (US); Renewtech (Netherlands); BRP Infotech Pvt. Ltd.(India); CHG-MERIDIAN (Germany); Park Place Technologies (US); TBS Industries Inc. (US); ReluTech (US);and Prolimax (Netherlands). These players have adopted service launches/developments, contracts, collaborations, agreements, and acquisitions for growth in the market.

Want to explore hidden markets that can drive new revenue in IT Asset Disposition Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in IT Asset Disposition Market?

|

Report Metric |

Details |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Service, By Asset Type, By Organization Size, By Vertical, and By Region |

|

Region covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Companies covered |

The key players in the IT Asset disposition market are Dell Inc. (US); IBM (US); Hewlett Packard Enterprise Development LP (US); Iron Mountain, Inc. (US); Sims Limited (Australia); 3stepIT (Finland); TES (Singapore); Apto Solutions Inc. (US); LifeSpan International Inc. (US); Total IT Global (UK); Flex IT Distribution (Netherlands); Ingram Micro (US); CSI Leasing, Inc. (US); Inrego AB (Sweden);Tier1 (UK); Atea (Norway); OceanTech (US); Blancco Technology Group (US); Renewtech (Netherlands); BRP Infotech Pvt. Ltd.(India); CHG-MERIDIAN (Germany); Park Place Technologies (US); TBS Industries Inc. (US); ReluTech (US);and Prolimax (Netherlands) |

IT Asset Disposition Market Highlights

The study categorizes the IT Asset disposition market based on Service, Asset Type, Organization Size, Vertical and Region

|

Segment |

Subsegment |

|

By Service: |

|

|

By Asset type: |

|

|

By Organisation size: |

|

|

By Vertical: |

|

|

By Region: |

|

Recent Developments

- In August 2023, Hewlett Packard Enterprise (US) collaborated with Cyxtera (US) to offer Asset Upcycling Services, allowing organizations to recover value securely and sustainably from retired hardware. As part of this collaboration, HPE facilitates the purchase of old hardware when customers deploy new, more efficient infrastructure with Cyxtera.

- In March 2023, Redington Limited (India) partnered with Dell Inc. (US) to promote sustainability initiatives in India. Through this partnership, Redington would offer Dell's Asset Resale and Recycling Services (ARRS) to help businesses securely and sustainably manage legacy IT equipment, reducing environmental impact.

- In January 2022, Iron Mountain, Inc. (US) acquired ITRenew (US), a global leader in mission-critical data center lifecycle management solutions. ITRenew became the platform for Iron Mountain’s Global IT Asset Lifecycle Management business, enhancing its ability to provide end-to-end services for the hyperscale, corporate data center, and corporate end-user device segments.

Frequently Asked Questions (FAQs):

Which are the major companies in the IT asset disposition market? What are their major strategies to strengthen their market presence?

Dell Inc. (US); IBM (US); Hewlett Packard Enterprise Development LP (US); Iron Mountain, Inc. (US); and Sims Limited (Australia) are some of the major companies operating in the IT asset disposition market. Partnerships, and acquisitions were the key strategies these companies adopted to strengthen their IT asset disposition market presence.

What are the drivers for the IT asset disposition market?

Drivers for the IT asset disposition market are:

- Adoption of circular economy principles into IT asset management strategies

- Need to comply with regulatory compliances meant for environment safety

- Growing demand for credible disposition solutions due to rising cybercrime

- Early replacement of IT assets with newer versions to keep up with new technologies

- Shift toward energy-efficient products

What are the challenges in the IT asset disposition market?

Inadequate infrastructure for recycling, adoption of gray IT disposition services, and lack of budget for IT asset disposition are among the challenges faced by the IT asset disposition market.

What are the technological trends in the IT asset disposition market?

Block chain, integration of artificial intelligence in IT asset disposition services are a few of the key technology trends in the IT asset disposition market.

What is the total CAGR expected to be recorded for the IT asset disposition market from 2024 to 2029?

The CAGR is expected to record a CAGR of 7.6% from 2024-2029.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

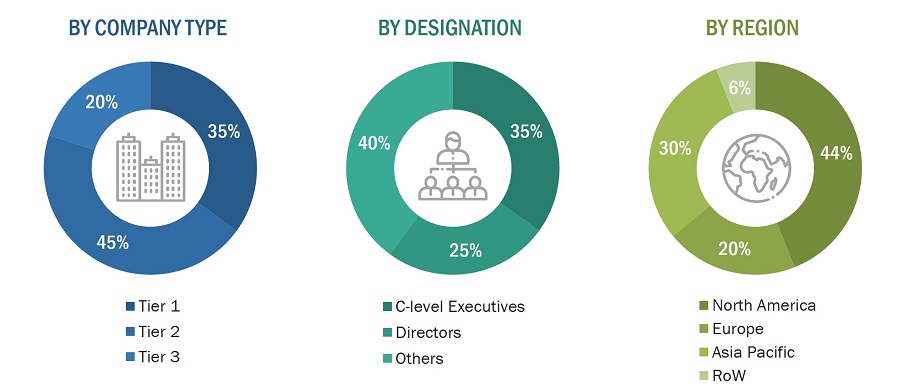

The study involved four major activities in estimating the size of the IT asset disposition market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources were used to identify and collect relevant information. These include corporate filings such as annual reports, press releases, investor presentations, and financial statements; trade, business, and professional associations; white papers, journals, and articles from recognized authors; certified publications related to IT asset disposition; directories; and databases.

Secondary research was conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of key players, the segmentation of the market according to industry trends to the bottommost level, geographic markets, and key developments from the market-oriented perspective. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

In the primary research process, various primary sources, from both supply and demand sides, were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, SMEs, consultants, and related key executives from the major companies and organizations operating in the IT asset disposition market.

After the complete market engineering process (which includes market statistics calculations, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical market numbers.

Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews were conducted with demand respondents and 75% with supply respondents. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

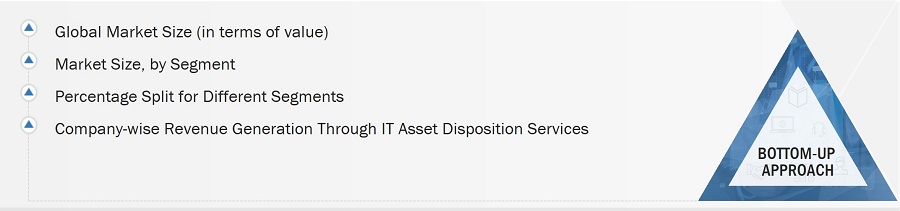

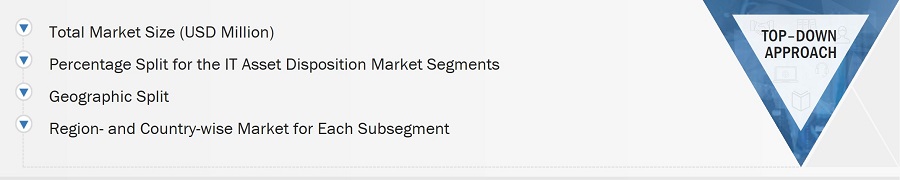

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the IT asset disposition market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- More than 25 companies offering IT asset disposition services were identified, and their offerings were mapped based on service, end-user, and region.

- The global IT asset disposition market was derived through the data sanity method. The revenues of ITAD service providers were analyzed through annual reports and press releases and summed up to derive the overall market size.

- For each company, a percentage was assigned to the overall revenue to derive the revenues from the IT asset disposition segment.

- The percentage of each company was assigned after analyzing various factors, including the company’s product offerings, its range of IT asset disposition-related offerings, geographic presence, research & development expenditure and initiatives, and recent developments/strategies adopted for growth in the IT asset disposition market.

- For the CAGR, the market trend analysis of IT asset disposition was carried out by understanding the industry penetration rate and the demand for and supply of IT asset disposition services in different sectors.

- Estimates at every level were verified and crosschecked through discussions with key opinion leaders, including CXOs, directors, operation managers, and domain experts in MarketsandMarkets.

- Various paid and unpaid information sources were studied, such as annual reports, press releases, white papers, and databases.

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size through the earlier process, the total market was split into several segments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market was validated using both the top-down and bottom-up approaches.

Market Definition

IT asset disposition refers to the disposal of obsolete or unwanted IT equipment in a safe, secure, and environmentally friendly manner. Due to rapid technological advances and the innovation of new products, the IT market is becoming more advanced and competitive. As a result, there is a rise in the number of obsolete equipment in the market—the proper and safe disposal of which is critical to ensure compliance with stringent regulatory standards for the safety of the environment.

End-user organizations often prefer third-party vendors or service providers for the disposition of their used and old IT assets in a safe and secure manner. The key offerings of these service providers in this market space are data destruction/data sanitization, asset recycling, asset remarketing, logistics management, and reverse logistics. These service providers are certified in accordance with regulatory compliances and mandates for the proper disposal of e-waste and data destruction. Assets such as computers/laptops, servers, storage devices, mobile devices, and peripherals are considered for disposition. The market is diversified, with more than 25 companies competing across the value chain to sustain their position and increase their market share.

Stakeholders

- IT asset disposition service providers

- IT asset manufacturing organizations

- Research organizations and consulting companies

- Associations, organizations, forums, and alliances related to IT asset disposition

- Government bodies such as regulatory authorities and policymakers

- Venture capitalists, private equity firms, and start-up companies

Research Objectives

- To define, describe, and forecast the IT asset disposition (ITAD) market, by service, asset type, organization size, vertical, and region, in terms of value

- To provide the market size for North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth

- To provide a detailed overview of the IT asset disposition value chain

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze key trends that shape and influence the global IT asset disposition market

- To profile key players and comprehensively analyze their ranking/share based on their revenues and core competencies2

- To evaluate opportunities in the market for stakeholders and provide details about the competitive landscape of the market

- To scrutinize competitive developments in the IT asset disposition market, such as partnerships, contracts, and research and development (R&D)

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IT Asset Disposition Market

Looking for detailed breakdown of ITAD market size by region and by asset type. Particular looking for laptops, notebooks, desktops, tablets etc...

Hi everybody. I am looking for information about the IT remarketing and I think this PDF could have interesting information about it.

I am very interested in learning more about the ITAD market and would like some additional market research info

I would like to know more about the stronger ITAD suppliers in the region (North America and Latin America).