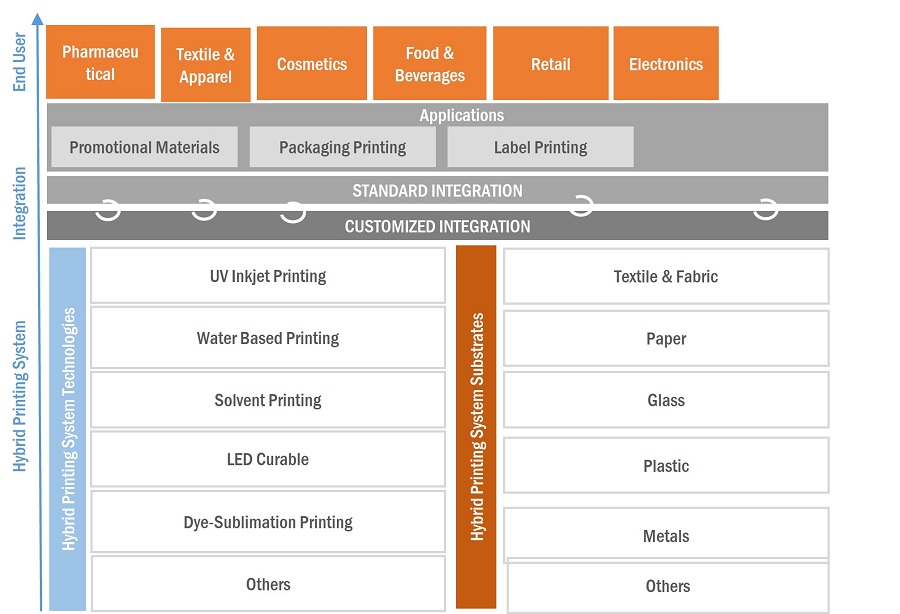

Hybrid Printing Market by Technology (UV Inkjet Printing, Water Based Printing, Solvent Printing, LED Curable, Dye Sublimation), Substrate (Textile & Fabric, Paper, Glass, Plastic, Metal), Application, End-use Industry and Region – Global Forecast to 2028

Updated on : Oct 22, 2024

Hybrid Printing Market Size & Growth

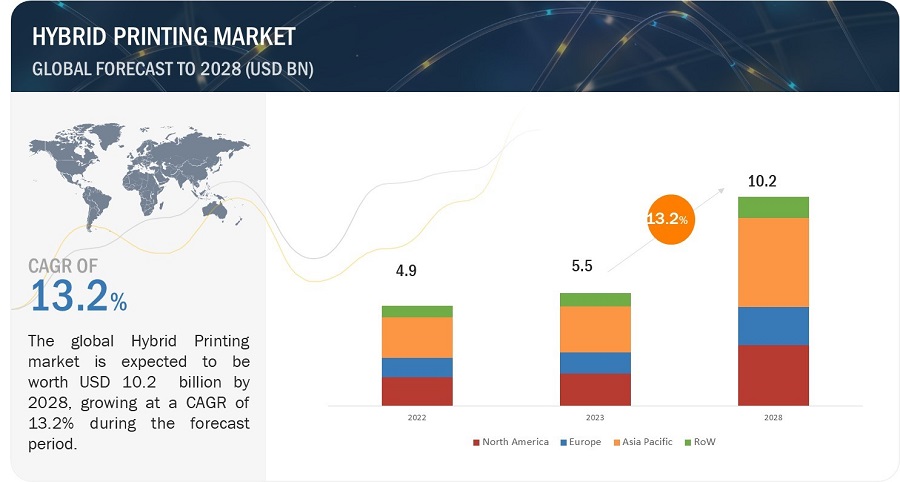

The global hybrid printing market size was valued at USD 5.5 billion in 2023 and is estimated to reach USD 10.2 billion by 2028, growing at a CAGR of 13.2% during the forecast period 2023 to 2028. The growth of the market is driven by increasing demand for short-run printing, the proliferation of high-quality printing in packaging and labeling applications, and the growing adoption of personalized printing material.

Hybrid Printing Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Hybrid Printing Market Dynamics:

Drivers: Rising demand for personalized printed material

The rising demand for personalized printing materials is set to drive the growth of the hybrid printing industry, a powerful solution that combines digital and traditional printing technologies. This demand acts as a driving factor for hybrid printing by fuelling the need for customized and unique printed products.

Hybrid printing allows businesses to seamlessly integrate variable data and design flexibility with the efficiency and cost-effectiveness of traditional printing methods, catering to the growing demand for personalized materials. The advantages of the increasing demand for personalized printing materials are manifold. Primarily, it enables businesses to enhance their brand presence by offering tailored and captivating printed materials that resonate with their target audience.

Restraint: Operational complexities and need of skilled operators.

The complexity of operation poses a significant challenge and acts as a restraining factor for hybrid printing. Hybrid printing involves intricate workflows, integration of different printing technologies, and the need for skilled operators to efficiently manage and troubleshoot various aspects of the printing process.

This complexity can lead to operational inefficiencies, increased setup time, and potential errors, hindering the adoption and implementation of hybrid printing solutions. One of the major loopholes in managing the complexity of operation in hybrid printing is the need for seamless integration between digital and traditional printing technologies. Ensuring compatibility between different equipment, software, and workflows can be complex, requiring technical expertise and investment in interoperability solutions.

Opportunities: Expanding e-commerce market

The growth of the e-commerce market is creating new opportunities for hybrid printing providers. E-commerce retailers need to be able to print high-quality labels and packaging quickly and cost-effectively, and hybrid printing is a good solution for this.

One of the key advantages of hybrid printing is its ability to offer customization and personalization at scale. E-commerce businesses thrive on delivering personalized experiences to consumers, and hybrid printing allows them to create tailored packaging, labels, and promotional materials that resonate with individual customers. This capability enhances brand loyalty and enables e-commerce companies to stand out in a crowded marketplace.

Challenge: Need for specialized training and expertise.

Operators of hybrid printing presses must possess comprehensive knowledge of both digital and traditional printing methods to ensure the production of high-quality prints. The demand for specialized training and expertise in hybrid printing poses hurdles for the industry players due to the limited availability of training programs and associated costs, hindering the widespread adoption of hybrid printing and its potential benefits.

Hybrid Printing Ecosystem

Hybrid Printing Market Share

UV Inkjet Printing segment to hold larger market share during the forecast period.

UV inkjet printing produces high-quality prints with precise details and vivid colors. This is because the UV light instantaneously dries the ink, preventing it from spreading or smearing. Fast printing techniques like UV inkjet printing can aid in cutting down on manufacturing costs and time. This is crucial for businesses that need to print numerous products fast.

Many substrates, including paper, plastic, metal, and glass, are suitable for UV inkjet printing. This makes it a flexible printing method that may be applied to various products. Prints made with UV inkjet technology are robust and scratch- and fade-resistant. Therefore, UV inkjet printing is highly adopted for products that are handled frequently or exposed to the environment. UV inkjet printing is also used in various other applications, such as textiles, wood, and glass printing.

Paper substrate segment account for the largest share of the hybrid printing market for during the forecast period

Hybrid printing on paper-based substrates is widely used in packaging applications, including folding cartons, corrugated boxes, bags, and pouches. It allows to create attractive and informative packaging designs, product branding, and label printing for various industries such as food & beverage, cosmetic, pharmaceutical, and consumer goods. Hybrid printing enables the production of high-quality marketing and promotional materials on paper substrates.

This includes brochures, catalogs, flyers, direct mailers, and posters. The combination of digital and analog printing technologies allows for eye-catching graphics, personalized messages, and variable data, enhancing the effectiveness of marketing campaigns. Hybrid printing on paper-based substrates is utilized in security printing applications, such as banknotes, passports, identity cards, and secure documents. The combination of analog and digital printing techniques allows for intricate designs, complex security features, and variable data, ensuring the integrity and authenticity of printed materials.

Packaging printing segment to exhibit the largest share in terms of hybrid printing market during the forecast period

Packaging printing is making significant contributions to the pharmaceutical industry in various aspects. It aids in compliance by printing essential drug information to meet regulations. Additionally, they enhance security by incorporating features that deter counterfeiting, such as holograms and microprinting. Moreover, packaging printing supports branding through eye-catching graphics and colors, providing consumers with crucial product information and marketing messages.

Leading pharmaceutical companies utilize packaging printing to create interactive features such as clear & personalized labels, enhanced security, and sustainable solutions for their medications. Several leading pharmaceutical companies, such as Pfizer (US), Novartis (Switzerland), Sanofi (France), AbbVie (US), and Johnson & Johnson (US), are utilizing hybrid printing, which combines digital and analog methods to create personalized, eco-friendly, and secure packaging for their drugs.

Hybrid Printing Market Regional Analysis

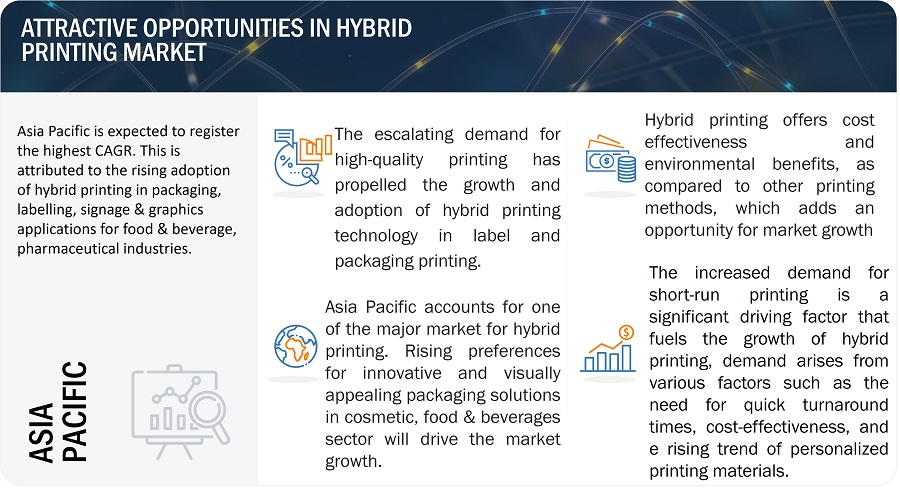

Hybrid Printing market in Asia Pacific estimated to grow at the fastest rate during the forecast period.

The cosmetic industry in the Asia Pacific region is growing due to the rise in the number of working women, increased spending of masses on cosmetic products, and an increase in the young population in the region. This industry is expected to contribute significantly to the growth of the market. Increasing population, improving standards of living, increasing self-care awareness, and rising e-commerce activities have led to increased demand for cosmetic products in this region.

The emerging economies of China and India are high-growth markets for skincare, haircare, and makeup products, supported by the economic growth in these countries and increased consumer spending on cosmetic products. All these factors are expected to drive the growth of the Asia Pacific cosmetics, beauty & personal care market, thus driving the demand for hybrid printing.

Hybrid Printing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Hybrid Printing Industry

Major vendors in the hybrid printing companies include FUJIFILM Holdings Corporation (Japan), HP Development Company, L.P (US), Ricoh (Japan), Konica Minolta (Japan), Bobst (Switzerland), Electronics For Imaging, Inc. (US), Seiko Epson (Japan), Koenig & Bauer AG (Germany), Heidelberger Druckmaschinen AG (Germany), among others. Apart from this, Kento Digital Printing (Spain), KTK (Spain), The M&R Companies (US), Floraprinter (China), JETSCI (India), and Xeikon (Netherlands) are among a few emerging companies in the hybrid printing market.

Recent Developments in Hybrid Printing Industry

- In March 2023, Durst Group AG (Italy) launched Durst Tau 330 RSC-E, a high-performance hybrid printing system that combines digital inkjet printing with screen printing. It is designed for printing on a wide range of materials, including textiles, ceramics, and glass. This is used to print high-quality, variable data labels for a variety of applications, including food and beverage, pharmaceutical, and industrial.

- In January 2023, Konica Minolta (Japan) launched AccurioLabel 400, a dynamic digital label press that presents compelling features for swift, high-quality label production. With speeds reaching 39.9 meters per minute and 1200 dpi resolution, it accommodates various media, including film and foil, and supports white toner for opacity. Enhanced by an integrated color management system and automated media handling, it's an ideal solution for efficient, top-notch label printing across diverse applications.

- In November 2022, Konica Minolta (Japan) and Agfa-Gevaert Group (Belgium) announced their partnership to distribute Anapurna inkjet printers across Norway, Denmark, and Sweden. This amplifies the wide-format printing market presence in the Nordic region, offering enhanced value and technology to customers.

Frequently Asked Questions (FAQs)

What is the total CAGR expected to be recorded for the hybrid printing market during 2023-2028?

The global hybrid printing market is expected to record a CAGR of 13.2% from 2023-2028.

Which regions are expected to pose significant demand for the hybrid printing market from 2023-2028?

Asia Pacific and North America are expected to pose significant demand from 2023 to 2028. Major economies such as China, Japan, the US, Canada, and India are expected to have a high potential for the future growth of the market.

What are the major market opportunities in the hybrid printing market?

Increasing adoption of high-quality printing in labeling and packaging applications, Growing demand for personalized printing material, and increased demand for short-run print are projected to create lucrative opportunities for the players operating in the hybrid printing market during the forecast period.

Which are the significant players operating in the hybrid printing market?

Key players operating in the hybrid printing market are FUJIFILM Holdings Corporation (Japan), HP Development Company, L.P (US), Ricoh (Japan), Konica Minolta (Japan), and Bobst (Switzerland).

What are the major applications of the hybrid printing market?

Food and Beverages, Pharmaceutical, Textile and Fabric, Cosmetic, Retail, and Electronics are the major applications of the hybrid printing market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased demand for high-quality printing in packaging and labeling applications- Rising demand for personalized printed materials- Increased demand for short-run printing- Cost-effective and environmentally friendly than other printing methodsRESTRAINTS- Operational complexities and need for skilled operatorsOPPORTUNITIES- Expanding e-commerce market- Development of new technologies related to hybrid printingCHALLENGES- Need for specialized training and expertise- High initial investment and maintenance costs

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) OF DIFFERENT HYBRID PRINTERSAVERAGE SELLING PRICE (ASP) TREND

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR HYBRID PRINTING PROVIDERS

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGY TRENDS- Variable Data Printing (VDP)- Offset printingADJACENT TECHNOLOGIES- Lamination and coating in hybrid printing

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.12 TARIFF ANALYSIS

-

5.13 PATENT ANALYSISLIST OF MAJOR PATENTS

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO HYBRID PRINTINGSTANDARDS

- 6.1 INTRODUCTION

-

6.2 PAPERINCREASING DEMAND FOR PAPER AS SUBSTRATE IN PACKAGING APPLICATIONS

-

6.3 PLASTICSGROWING ADOPTION OF PLASTIC SUBSTRATES IN HYBRID PRINTING IN COSMETICS AND CONSUMER ELECTRONICS INDUSTRIES

-

6.4 METALSINCREASING DEMAND FOR ALUMINUM SUBSTRATES IN PACKAGING APPLICATIONS

-

6.5 TEXTILE & FABRICRISING USE OF TEXTILE & FABRIC SUBSTRATES IN HYBRID PRINTING OF PROMOTIONAL MATERIALS

-

6.6 GLASSGROWING USE OF GLASS SUBSTRATES IN PACKAGING AND LABELING APPLICATIONS

- 6.7 OTHERS

- 7.1 INTRODUCTION

-

7.2 UV INKJET PRINTINGOFFERS HIGH VERSATILITY AND EFFICIENCY IN VARIOUS APPLICATIONS

-

7.3 WATER-BASED PRINTINGWIDELY USED IN PACKAGING INDUSTRY

-

7.4 SOLVENT PRINTINGRISING APPLICATIONS IN PROMOTIONAL MATERIALS AND LARGE-FORMAT DISPLAYS

-

7.5 LED CURABLEHIGHLY PREFERRED IN FOOD & BEVERAGE, PHARMACEUTICAL, AND COSMETICS INDUSTRIES

-

7.6 DYE-SUBLIMATION PRINTINGEXTENSIVELY USED IN TEXTILE INDUSTRY

- 7.7 OTHERS

- 8.1 INTRODUCTION

-

8.2 PROMOTIONAL MATERIALINCREASING DEMAND FOR PROMOTIONAL MATERIALS IN COSMETICS AND FOOD & BEVERAGE INDUSTRIES

-

8.3 PACKAGING PRINTINGRISING TREND OF PACKAGING PRINTING IN PHARMACEUTICAL AND COSMETICS INDUSTRIES

-

8.4 LABEL PRINTINGGROWING DEMAND FOR LABEL PRINTING IN FOOD & BEVERAGE INDUSTRY

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICALINCREASED USE OF PACKAGING IN PHARMACEUTICAL INDUSTRY

-

9.3 TEXTILE & APPARELGROWING DEMAND FOR DYE-SUBLIMATION TECHNOLOGY IN TEXTILE INDUSTRY

-

9.4 COSMETICSINCREASING USE OF HYBRID PRINTING FOR CUSTOMIZED PACKAGING IN COSMETICS INDUSTRY

-

9.5 FOOD & BEVERAGEGROWING ADOPTION OF UV INKJET PRINTING TECHNOLOGY IN FOOD & BEVERAGE INDUSTRY

-

9.6 RETAILRISING USE OF HYBRID PRINTING AS SUSTAINABLE SOLUTION

-

9.7 ELECTRONICSRISING DEMAND FOR HYBRID PRINTING IN ELECTRONICS PACKAGING AND LABELING

- 9.8 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Growing adoption of high-quality printing solutionsCANADA- Rising use of hybrid printing to create labels and packaging materials in food & beverage industryMEXICO- Rising demand in various applications in packaging, textile, and glass industriesNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEGERMANY- Increasing focus on development of textile and food & beverage industriesUK- Advancements in hybrid printing technologyFRANCE- Increasing use of hybrid printing in pharmaceutical industry attributed to superior benefits over traditional printingITALY- Expanding cosmetics and pharmaceutical industriesSPAIN- Growing use in food & beverage industryREST OF EUROPEEUROPE: RECESSION IMPACT

-

10.4 ASIA PACIFICCHINA- Increasing adoption of packaging in healthcare and food & beverage industriesINDIA- Increasing demand for hybrid printing technology in textile industryJAPAN- Growing adoption in automotive industryAUSTRALIA- Increasing use of hybrid printing in packaging and textile industriesREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

10.5 ROWMIDDLE EAST & AFRICA- Increasing demand for packaging printing in fast-moving consumer goods industrySOUTH AMERICA- Increasing applications in food & beverage industryROW: RECESSION IMPACT

- 11.1 OVERVIEW

-

11.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2022

- 11.4 MARKET SHARE ANALYSIS, 2022

-

11.5 COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.6 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

- 11.8 KEY STARTUPS/SMES

-

11.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSFUJIFILM HOLDINGS CORPORATION- Business overview- Products offered- Recent developments- MnM viewHP DEVELOPMENT COMPANY, L.P.- Business overview- Products offered- Recent developments- MnM viewRICOH- Business overview- Products offered- Recent developments- MnM viewKONICA MINOLTA, INC.- Business overview- Products offered- Recent developments- MnM viewBOBST- Business overview- Products offered- MnM viewELECTRONICS FOR IMAGING, INC.- Business overview- Products offered- Recent developmentsDOMINO PRINTING SCIENCES PLC- Business overview- Products offered- Recent developmentsDURST GROUP AG- Business overview- Products offered- Recent developmentsKOENIG & BAUER AG- Business overview- Products offered- Recent developmentsMARKEM-IMAJE, A DOVER COMPANY- Business overview- Products offered- Recent developmentsHEIDELBERGER DRUCKMASCHINEN AG- Business overview- Products offered- Recent developmentsMIMAKI ENGINEERING CO., LTD.- Business overview- Products offered- Recent developmentsSEIKO EPSON CORPORATION- Business overview- Products offered- Recent developmentsAGFA-GEVAERT GROUP- Business overview- Products offered- Recent developmentsROLAND DGA CORPORATION- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSKENTO DIGITAL PRINTINGKTKTHE M&R COMPANIESJETSCIMPSHAPA AGPIXELJETFLORAPRINTERFOCUS LABELADELCO SCREEN PROCESS LTD.KUEN YUH MACHINERY ENGINEERING CO.COLORJET GROUPMARK ANDY INC.NILPETER A/SXEIKON

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS

- TABLE 2 COMPANIES AND THEIR ROLE IN HYBRID PRINTING ECOSYSTEM

- TABLE 3 HYBRID PRINTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- TABLE 6 PCI PRINTING INCORPORATED EFI PRO 16H HYBRID PRINTERS INTO OPERATIONS TO BOOST PROFITABILITY AND EFFICIENCY

- TABLE 7 MAMS IMPROVED PRINTING CAPABILITIES USING RICOH PRO C9210S

- TABLE 8 CHIYODA REVOLUTIONIZED INTERIOR DECORATION PRINTING USING AGFA INTERIOJET PRINTING PRESS

- TABLE 9 DAIDOHBAGS INCREASED PRODUCTION OF PERSONALIZED LEATHER BAGS USING MIMAKI UJF-3001 LED UV PRINTER

- TABLE 10 MD LABELS DEPLOYED MARK ANDY’S HYBRID PRINTING SOLUTIONS

- TABLE 11 TARIFF FOR HYBRID PRINTERS EXPORTED BY US, 2022

- TABLE 12 TARIFF FOR HYBRID PRINTERS EXPORTED BY CHINA, 2022

- TABLE 13 TARIFF FOR HYBRID PRINTERS EXPORTED BY GERMANY, 2022

- TABLE 14 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 15 HYBRID PRINTING MARKET: PATENT ANALYSIS

- TABLE 16 HYBRID PRINTING MARKET: LIST OF KEY CONFERENCES AND EVENTS

- TABLE 17 INTERNATIONAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 NORTH AMERICA: SAFETY STANDARDS FOR HYBRID PRINTING MARKET

- TABLE 23 EUROPE: SAFETY STANDARDS FOR HYBRID PRINTING MARKET

- TABLE 24 ASIA PACIFIC: SAFETY STANDARDS FOR HYBRID PRINTING MARKET

- TABLE 25 ROW: SAFETY STANDARDS FOR HYBRID PRINTING MARKET

- TABLE 26 HYBRID PRINTING MARKET, BY SUBSTRATE, 2019–2022 (USD MILLION)

- TABLE 27 HYBRID PRINTING MARKET, BY SUBSTRATE, 2023–2028 (USD MILLION)

- TABLE 28 PAPER: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 29 PAPER: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 PLASTICS: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 31 PLASTICS: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 32 METAL: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 33 METAL: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 TEXTILE & FABRIC: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 35 TEXTILE & FABRIC: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 36 GLASS: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 GLASS: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 OTHERS: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 39 OTHERS: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 HYBRID PRINTING MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 41 HYBRID PRINTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 42 UV INKJET PRINTING: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 43 UV INKJET PRINTING: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 WATER-BASED PRINTING: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 45 WATER-BASED PRINTING: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 SOLVENT PRINTING: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 47 SOLVENT PRINTING: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 48 LED CURABLE PRINTING: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 49 LED CURABLE PRINTING: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 DYE-SUBLIMATION PRINTING: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 51 DYE-SUBLIMATION PRINTING: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 52 OTHERS: HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 53 OTHERS: HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 54 HYBRID PRINTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 55 HYBRID PRINTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 56 PROMOTIONAL MATERIAL: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 57 PROMOTIONAL MATERIAL: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 58 PACKAGING PRINTING: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 59 PACKAGING PRINTING: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 60 LABEL PRINTING: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 61 LABEL PRINTING: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 62 OTHERS: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 63 OTHERS: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 64 HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 65 HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 66 PHARMACEUTICAL: HYBRID PRINTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 PHARMACEUTICAL: HYBRID PRINTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 TEXTILE & APPAREL: HYBRID PRINTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 TEXTILE & APPAREL: HYBRID PRINTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 COSMETICS: HYBRID PRINTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 COSMETICS: HYBRID PRINTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 FOOD & BEVERAGE: HYBRID PRINTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 FOOD & BEVERAGE: HYBRID PRINTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 RETAIL: HYBRID PRINTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 RETAIL: HYBRID PRINTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 HYBRID PRINTING MARKET IN ELECTRONICS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 HYBRID PRINTING MARKET IN ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 OTHERS: HYBRID PRINTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 OTHERS: HYBRID PRINTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 HYBRID PRINTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 HYBRID PRINTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: HYBRID PRINTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: HYBRID PRINTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: HYBRID PRINTING MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 86 US: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 87 US: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 88 CANADA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 89 CANADA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 90 MEXICO: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 91 MEXICO: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: HYBRID PRINTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: HYBRID PRINTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 95 EUROPE: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 96 GERMANY: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 97 GERMANY: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 98 UK: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 99 UK: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 100 FRANCE: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 101 FRANCE: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 102 ITALY: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 103 ITALY: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 104 SPAIN: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 105 SPAIN: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 106 REST OF EUROPE: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: HYBRID PRINTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: HYBRID PRINTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 112 CHINA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 113 CHINA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 114 INDIA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 115 INDIA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 116 JAPAN: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 117 JAPAN: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 118 AUSTRALIA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 119 AUSTRALIA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 122 ROW: HYBRID PRINTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 123 ROW: HYBRID PRINTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 124 ROW: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 125 ROW: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 128 SOUTH AMERICA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 129 SOUTH AMERICA: HYBRID PRINTING MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 130 HYBRID PRINTING MARKET: MAJOR STRATEGIES DEPLOYED BY KEY PLAYERS

- TABLE 131 HYBRID PRINTING MARKET: DEGREE OF COMPETITION

- TABLE 132 COMPANY FOOTPRINT

- TABLE 133 TECHNOLOGY: COMPANY FOOTPRINT

- TABLE 134 END-USER INDUSTRY: COMPANY FOOTPRINT

- TABLE 135 REGION: COMPANY FOOTPRINT

- TABLE 136 HYBRID PRINTING MARKET: KEY STARTUPS/SMES

- TABLE 137 HYBRID PRINTING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 138 HYBRID PRINTING MARKET: PRODUCT LAUNCHES, JANUARY 2019– AUGUST 2023

- TABLE 139 HYBRID PRINTING MARKET: DEALS, JANUARY 2018–MAY 2022

- TABLE 140 HYBRID PRINTING MARKET: OTHERS, JANUARY 2018–MAY 2022

- TABLE 141 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 142 FUJIFILM HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 143 FUJIFILM HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 144 FUJIFILM HOLDINGS CORPORATION: DEALS

- TABLE 145 FUJIFILM HOLDINGS CORPORATION: OTHERS

- TABLE 146 HP DEVELOPMENT COMPANY L.P.: COMPANY OVERVIEW

- TABLE 147 HP DEVELOPMENT COMPANY L.P.: PRODUCTS OFFERED

- TABLE 148 HP DEVELOPMENT COMPANY L.P.: PRODUCT LAUNCHES

- TABLE 149 RICOH: COMPANY OVERVIEW

- TABLE 150 RICOH: PRODUCTS OFFERED

- TABLE 151 RICOH: PRODUCT LAUNCHES

- TABLE 152 RICOH: DEALS

- TABLE 153 KONICA MINOLTA, INC.: COMPANY OVERVIEW

- TABLE 154 KONICA MINOLTA, INC.: PRODUCTS OFFERED

- TABLE 155 KONICA MINOLTA, INC.: PRODUCT LAUNCHES

- TABLE 156 KONICA MINOLTA, INC.: DEALS

- TABLE 157 BOBST: COMPANY OVERVIEW

- TABLE 158 BOBST: PRODUCTS OFFERED

- TABLE 159 ELECTRONICS FOR IMAGING, INC.: COMPANY OVERVIEW

- TABLE 160 ELECTRONICS FOR IMAGING, INC.: PRODUCTS OFFERED

- TABLE 161 ELECTRONICS FOR IMAGING, INC.: PRODUCT LAUNCHES

- TABLE 162 ELECTRONICS FOR IMAGING, INC.: DEALS

- TABLE 163 DOMINO PRINTING SCIENCES PLC: COMPANY OVERVIEW

- TABLE 164 DOMINO PRINTING SCIENCES PLC: PRODUCTS OFFERED

- TABLE 165 DOMINO PRINTING SCIENCES PLC: PRODUCT LAUNCHES

- TABLE 166 DOMINO PRINTING SCIENCES PLC: DEALS

- TABLE 167 DURST GROUP AG: COMPANY OVERVIEW

- TABLE 168 DURST GROUP AG: PRODUCTS OFFERED

- TABLE 169 DURST GROUP AG: PRODUCT LAUNCHES

- TABLE 170 DURST GROUP AG: DEALS

- TABLE 171 DURST GROUP AG: OTHERS

- TABLE 172 KOENIG & BAUER AG: COMPANY OVERVIEW

- TABLE 173 KOENIG & BAUER AG: PRODUCTS OFFERED

- TABLE 174 KOENIG & BAUER AG: DEALS

- TABLE 175 KOENIG & BAUER AG: OTHERS

- TABLE 176 MARKEM-IMAJE, A DOVER COMPANY: COMPANY OVERVIEW

- TABLE 177 MARKEM-IMAJE, A DOVER COMPANY: PRODUCTS OFFERED

- TABLE 178 MARKEM-IMAJE, A DOVER COMPANY: PRODUCT LAUNCHES

- TABLE 179 MARKEM-IMAJE, A DOVER COMPANY: DEALS

- TABLE 180 HEIDELBERGER DRUCKMASCHINEN AG: COMPANY OVERVIEW

- TABLE 181 HEIDELBERGER DRUCKMASCHINEN AG: PRODUCTS OFFERED

- TABLE 182 HEIDELBERGER DRUCKMASCHINEN AG: DEALS

- TABLE 183 MIMAKI ENGINEERING CO., LTD.: COMPANY OVERVIEW

- TABLE 184 MIMAKI ENGINEERING CO., LTD.: PRODUCTS OFFERED

- TABLE 185 MIMAKI ENGINEERING CO., LTD.: PRODUCT LAUNCHES

- TABLE 186 MIMAKI ENGINEERING CO., LTD.: DEALS

- TABLE 187 MIMAKI ENGINEERING CO., LTD.: OTHERS

- TABLE 188 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- TABLE 189 SEIKO EPSON CORPORATION: PRODUCTS OFFERED

- TABLE 190 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES

- TABLE 191 SEIKO EPSON CORPORATION: OTHERS

- TABLE 192 AGFA-GEVAERT GROUP: COMPANY OVERVIEW

- TABLE 193 AGFA-GEVAERT GROUP: PRODUCTS OFFERED

- TABLE 194 AGFA-GEVAERT GROUP: PRODUCT LAUNCHES

- TABLE 195 AGFA-GEVAERT GROUP: DEALS

- TABLE 196 AGFA-GEVAERT GROUP: OTHERS

- TABLE 197 ROLAND DGA CORPORATION: COMPANY OVERVIEW

- TABLE 198 ROLAND DGA CORPORATION: PRODUCTS OFFERED

- TABLE 199 ROLAND DGA CORPORATION: PRODUCT LAUNCHES

- TABLE 200 ROLAND DGA CORPORATION: DEALS

- FIGURE 1 HYBRID PRINTING MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW FOR MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF MARKET PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 RISK ASSESSMENT

- FIGURE 9 UV INKJET PRINTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 PAPER SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 11 LABEL PRINTING SEGMENT TO RECORD HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 12 FOOD & BEVERAGE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF HYBRID PRINTING MARKET IN 2022

- FIGURE 14 INCREASING DEMAND FOR HYBRID PRINTING IN FOOD & BEVERAGE AND PHARMACEUTICAL INDUSTRIES

- FIGURE 15 UV INKJET PRINTING SEGMENT TO DOMINATE HYBRID PRINTING MARKET DURING FORECAST PERIOD

- FIGURE 16 PAPER SEGMENT TO HOLD LARGEST SHARE OF HYBRID PRINTING MARKET IN 2023

- FIGURE 17 LABEL PRINTING SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 18 PHARMACEUTICAL SEGMENT TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 19 HYBRID PRINTING MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 20 HYBRID PRINTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 HYBRID PRINTING MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 22 HYBRID PRINTING MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 23 HYBRID PRINTING MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 24 HYBRID PRINTING MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 25 HYBRID PRINTING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 HYBRID PRINTING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 AVERAGE SELLING PRICE (ASP) OF HYBRID PRINTING TECHNOLOGIES OFFERED BY FOUR KEY PLAYERS, BY APPLICATION

- FIGURE 28 AVERAGE SELLING PRICE (ASP) OF LED CURABLE TECHNOLOGY, 2023–2028

- FIGURE 29 AVERAGE SELLING PRICE (ASP) OF UV INKJET PRINTING TECHNOLOGY, 2023–2028

- FIGURE 30 REVENUE SHIFT AND NEW REVENUE POCKETS FOR HYBRID PRINTING MARKET PLAYERS

- FIGURE 31 HYBRID PRINTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- FIGURE 34 IMPORT DATA FOR PRODUCTS UNDER HS CODE 844339, BY COUNTRY, 2018−2022 (USD MILLION)

- FIGURE 35 EXPORT DATA FOR PRODUCTS UNDER HS CODE 844339, BY COUNTRY, 2018−2022 (USD MILLION)

- FIGURE 36 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 37 NUMBER OF PATENTS GRANTED PER YEAR, 2012−2023

- FIGURE 38 PAPER SEGMENT TO DOMINATE HYBRID PRINTING MARKET DURING FORECAST PERIOD

- FIGURE 39 UV INKJET PRINTING SEGMENT TO DOMINATE HYBRID PRINTING MARKET DURING FORECAST PERIOD

- FIGURE 40 PACKAGING PRINTING SEGMENT TO DOMINATE HYBRID PRINTING MARKET DURING FORECAST PERIOD

- FIGURE 41 FOOD & BEVERAGE SEGMENT TO HOLD LARGEST SHARE OF HYBRID PRINTING MARKET DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC HYBRID PRINTING MARKET TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 43 NORTH AMERICA: HYBRID PRINTING MARKET SNAPSHOT

- FIGURE 44 US TO RECORD HIGHEST CAGR IN NORTH AMERICAN HYBRID PRINTING MARKET FROM 2023 TO 2028

- FIGURE 45 EUROPE: HYBRID PRINTING MARKET SNAPSHOT

- FIGURE 46 UK TO RECORD HIGHEST CAGR IN EUROPEAN HYBRID PRINTING MARKET FROM 2023 TO 2028

- FIGURE 47 ASIA PACIFIC: HYBRID PRINTING MARKET SNAPSHOT

- FIGURE 48 CHINA TO RECORD HIGHEST CAGR IN ASIA PACIFIC HYBRID PRINTING MARKET FROM 2023 TO 2028

- FIGURE 49 ROW: HYBRID PRINTING MARKET SNAPSHOT

- FIGURE 50 MIDDLE EAST & AFRICA TO RECORD HIGHEST CAGR IN ROW HYBRID PRINTING MARKET FROM 2023 TO 2028

- FIGURE 51 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2022

- FIGURE 52 HYBRID PRINTING MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 53 HYBRID PRINTING MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 54 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 HP DEVELOPMENT COMPANY L.P.: COMPANY SNAPSHOT

- FIGURE 56 RICOH: COMPANY SNAPSHOT

- FIGURE 57 KONICA MINOLTA, INC.: COMPANY SNAPSHOT

- FIGURE 58 BOBST: COMPANY SNAPSHOT

- FIGURE 59 KOENIG & BAUER AG: COMPANY SNAPSHOT

- FIGURE 60 HEIDELBERGER DRUCKMASCHINEN AG: COMPANY SNAPSHOT

- FIGURE 61 MIMAKI ENGINEERING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 AGFA-GEVAERT GROUP: COMPANY SNAPSHOT

- FIGURE 64 ROLAND DGA CORPORATION: COMPANY SNAPSHOT

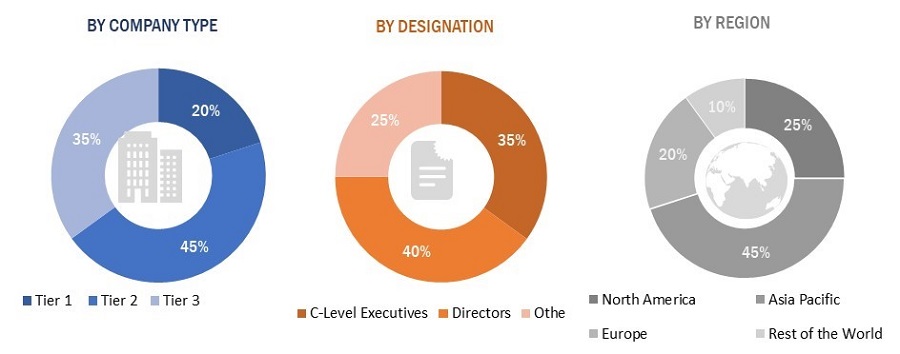

The study involved four major activities in estimating the size of the hybrid printing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, and articles by recognized authors have been referred to. Secondary research has been done to obtain key information about the market’s supply chain, the value chain, the pool of key market players, and market segmentation according to industry trends, regions, and developments from both market and technology perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the hybrid printing market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected through telephonic interviews, questionnaires, and emails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to perform the market size estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report. The following table explains the process flow of the market size estimation.

In this approach, important players such as FUJIFILM Holdings Corporation (Japan), HP Development Company, L.P (US), Konica Minolta (Japan), Ricoh (Japan), and Bobst (Switzerland) have been identified. After confirming these companies through primary interviews with industry experts, their total revenue has been estimated by referring to annual reports, SEC filings, and paid databases. Revenues of these companies pertaining to the business units (BUs) that offer hybrid printing systems have been identified through similar sources. Collective revenues of key companies that offer hybrid printing systems have been estimated for the market. Industry experts have reconfirmed these revenues through primary interviews. With the assumption that small players account for the rest of the market, the collective contribution of key players and other players has been assumed to be the size of the hybrid printing systems market for the financial year 2022.

Hybrid Printing Market: Bottom-Up Approach

The bottom-up approach has been employed to arrive at the overall size of the hybrid printing market from the revenues of key players and their share in the market.

Hybrid Printing Market: Top-Down Approach

In the top-down approach, the overall size of the hybrid printing market has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. For calculating the size of specific market segments, the size of the most appropriate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for the data extracted from the secondary research to validate the size of various segments and subsegments of the hybrid printing market.

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, market breakdown, and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Definition

Hybrid printing is a cutting-edge technique that combines different printing technologies, such as digital and flexographic, to create printed products that are versatile and visually appealing. This innovative approach can produce personalized marketing materials that are flexible, cost-effective, and efficient, catering to both small and large-volume needs. The market for hybrid printing is expected to grow significantly as it can be used for a wide range of applications, including labels, packaging, promotional materials, among others. Hybrid printing is a dynamic solution for modern businesses as its adaptable configurations can meet varying printing demands.

Key Stakeholders

- Hybrid printing material providers

- Hybrid printing system providers

- OEM technology solution providers

- Technology, service, and solution providers

- Hybrid printing distributors, suppliers, and service providers

- Technology standards organizations, forums, alliances, and associations

- End users from various verticals

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and startups

Report Objectives

- To define, describe, segment, and forecast the size of the hybrid printing market in terms of value based on technology, substrate, application, end-use industry, and region

- To forecast the market size for various segments with respect to four main regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the significant drivers, restraints, opportunities, and challenges influencing the growth of the hybrid printing market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the hybrid printing market

- To provide a detailed overview of the value chain of the hybrid printing ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the market

- To strategically profile key players, comprehensively analyze their market position in terms of ranking and core competencies2, and provide a competitive landscape of the market.

- To analyze strategic approaches such as product launches, acquisitions, mergers, agreements, collaboration, and partnerships in the hybrid printing market

- To study the impact of the recession on the hybrid printing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in Hybrid Printing Market