Human Augmentation Market Size, Share, Statistics and Industry Growth Analysis Report by Wearable (Wristwear, Bodywear, Footwear, Eyewear), AR (Head-mounted display), VR (Head-up display), Biometric (Fingerprint, Face, Iris), Exoskeleton (Powered, Passive), IVA (Chatbot), Functionality - Global Forecast to 2028

Updated on : Oct 22, 2024

Human Augmentation Market Size & Share

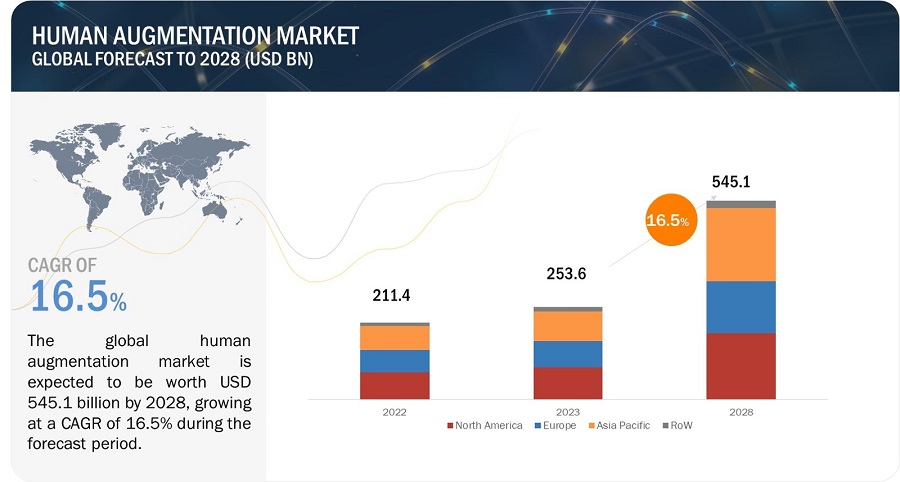

The global Human Augmentation Market size is expected to be valued at USD 253.6 Billion in 2023 and is projected to reach USD 545.1 Billion by 2028, growing at a CAGR of 16.5% during the forecast period from 2023 to 2028.

Product launches, acquisitions, partnerships, collaborations, agreements, and expansions are the major growth strategies adopted by the human augmentation industry players. These strategies have enabled them to efficiently fulfill the growing demand for human augmentation from different end-user industries and expand their global footprint by offering their products in all the major regions.

Human Augmentation Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Human Augmentation Market Trends

Driver: Growth in Virtual Reality (VR) and Augmented Reality (AR) technologies

The Virtual Reality (VR) and Augmented Reality (AR) technologies is a significant driver for the human augmentation market growth, as these immersive technologies enhance training, simulation, and real-time data visualization, allowing users to interact with digital information and objects in ways that augment their skills and experiences, whether in fields like healthcare, education, or workplace training, thereby expanding the applications and adoption of human augmentation technologies.

Restraint: High cost of technology

One significant restraint in the human augmentation market is the high cost associated with developing and implementing these advanced technologies. The research, development, and manufacturing of human augmentation solutions involve cutting-edge materials, intricate engineering, and sophisticated software. These factors result in high initial capital investments, making the technology expensive for both developers and end-users. The cost of research and clinical trials to ensure safety and efficacy also adds to the overall expense.

Opportunity: Growing adoption of technologies in military and defense

The growing adoption of advanced technologies in the aerospace and defense sectors presents a significant opportunity for the human augmentation market. In these fields, technological advancements are often a matter of life and death, making the integration of human augmentation technologies crucial. Exoskeletons, wearable devices, augmented reality (AR), and cognitive enhancements are being employed to enhance the physical and cognitive capabilities of soldiers, pilots, and ground personnel. These technologies improve soldier performance, reduce the physical strain of lifting heavy equipment, and provide critical information through heads-up displays.

Challenge: Safety and liability issues

The human augmentation market presents a significant challenge in addressing safety and liability issues associated with the adoption of these technologies. As human augmentation technologies become more integrated into various aspects of life, including healthcare, the workplace, and everyday activities, ensuring the safety of users and establishing clear liability frameworks becomes crucial. There's a risk of unforeseen health complications, such as allergic reactions to implanted devices or cyberattacks targeting wearable technologies.

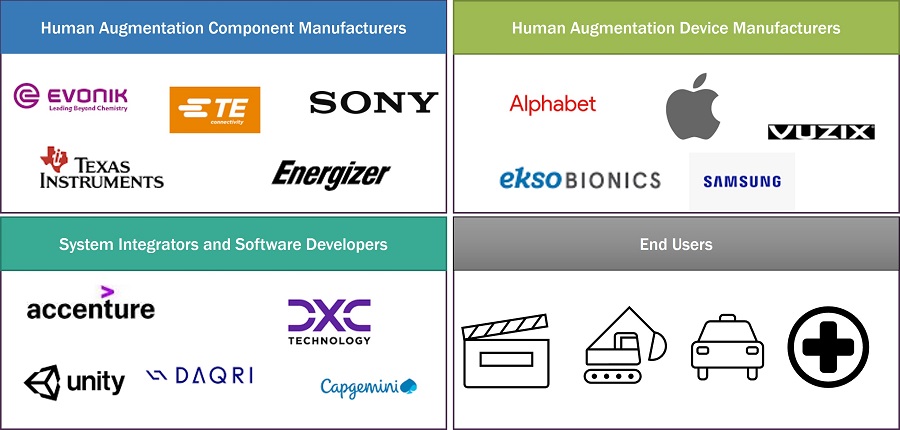

Human Augmentation Market Ecosystem

The human augmentation industry is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include Samsung from South Korea, Alphabet Incorporation from US, Apple Inc. from US, Meta from US, Microsoft from US.

Human Augmentation Market Segment

Based on product type, the biometric systems market for human augmentation to hold second highest market share during the forecast period

With increasing concerns about security in various sectors, such as finance, healthcare, and government, the demand for robust authentication and identification methods is growing. Biometric systems offer highly secure and reliable ways to verify and validate individual identities.

Ongoing advancements in biometric technology, including facial recognition, fingerprint scanning, and iris recognition, have made these systems more accurate, accessible, and cost-effective, increasing their adoption in various industries.

Based on functionality, the non body-worn market for human augmentation to hold second highest market share during the forecast period

Non-body-worn devices, such as brain-computer interfaces (BCIs) and neural implants, offer the potential to enhance cognitive and physical performance without the need for external wearables. BCIs enable direct communication between the brain and external devices, allowing for improved control and interaction. Regulatory bodies in healthcare are increasingly approving and regulating the use of non-body-worn medical devices, providing a supportive environment for their development and adoption.

Based on end-user, the medical end-user market for human augmentation to hold second highest market share during the forecast period

The medical field is constantly innovating, and human augmentation technologies play a vital role in improving healthcare outcomes. Medical augmentations include wearable health devices, robotic surgery systems, and neural implants, which enhance patient care and treatment.

Remote patient monitoring and telemedicine are on the rise. Wearable medical devices allow healthcare providers to monitor patients' vital signs and health conditions remotely, leading to better care and early interventions.

Human Augmentation Market Regional Analysis

Human augmentation market in Asia Pacific to hold the second highest market share during the forecast period

The Asia Pacific region, including countries like China, Japan, and South Korea, is known for its rapid technological advancements. These nations invest heavily in research and development, fostering innovation in human augmentation technologies. Asia Pacific countries are experiencing an increased demand for healthcare services. This has led to the development of medical augmentations, wearable medical devices, and surgical robotics, all of which contribute to the growth of the human augmentation market.

Human Augmentation Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Human Augmentation Companies - Key Market Players

The human augmentation companies is dominated by players such

- Samsung (South Korea),

- Alphabet Incorporation (US),

- Apple Inc. (US),

- Meta (US),

- Microsoft (US), and others

Human Augmentation Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 253.6 Billion in 2023 |

|

Projected Market Size |

USD 545.1 Billion by 2028 |

|

Growth Rate |

CAGR of 16.5% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Forecast Units |

USD Millions/USD Billions and Million Units |

|

Segments Covered |

By Product Type, By Technology, By Functionality, and By End-User |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Samsung (South Korea), Alphabet Incorporation (US), Apple Inc. (US), Meta (US), Microsoft (US), Sony Group Corporation (Japan), Ekso Bionics (US), Vuzix (US), Garmin Ltd. (US), Fossil Group Inc. (US), B-Temia (Canada), Casio Computers Co., Ltd. (Japan), ReWalk Robotics (US), Cyberdyne Inc. (Japan). A total of 29 players are covered. |

Human Augmentation Market Highlights

The study categorizes the human augmentation market based on the following segments:

|

Segment |

Subsegment |

|

By Product Type |

|

|

By Technology |

|

|

By Functionality |

|

|

By End-user |

|

|

By Region |

|

Recent Developments in Human Augmentation Industry

- In September 2023, Apple Watch Series 9 also has a new 4-core Neural Engine that can process machine learning tasks up to twice as fast, when compared with Apple Watch Series 8. The power efficiency of the S9 SiP allows Apple Watch Series 9 to maintain all-day 18-hour battery life.

- In September 2023, Fitbit launched Charge 6 fitness tracker. It has most accurate heart rate on a fitness tracker and the ability to connect to compatible gym equipment.

- In July 2023, Garmin the launch of two powerful and feature-rich outdoor smartwatch series: the fenix 7 Pro and epix Pro Series. These next-generation smartwatches are designed to meet the demands of athletes, adventurers, and fitness enthusiasts, providing them with the ultimate performance and tracking capabilities.

- In June 2023, Samsung launched its next generation Galaxy Watch6 series. Galaxy Watch6 series now offers in-depth analysis of Sleep Score Factors — total sleep time, sleep cycle, awake time, plus physical and mental recovery to help users understand the quality of sleep received each night.

- In April 2023, Casio launched the smartwatch. The smartwatch has a built-in optical sensor which can be used to track your heart rate, and you can also track your blood oxygen levels with the gadget. An accelerometer tracks your steps though the wearables do not have GPS; linking the watch to your smartphone enables you to track your distance, and route travelled while walking or running.

- In February 2023, Sony launched the VR glasses. These are virtual reality glasses that were released in 2023. They have the highest pixel density display among commercial OLED panels. PlayStation VR2 can be used with the PlayStation 5 console.

- In October 2022, Fossil launched the Gen 6 Wellness edition smartwatch powered by Google’s updated Wear OS 3 platform. The Fossil Gen 6 Wellness edition features Snapdragon Wear 4100+, fast charging, and Bluetooth connectivity above 5.0.

- In August 2022, Vuzix introduced Blade 2 smart glasses, its third generation Blade model. Configured primarily for commercial use, Vuzix Blade 2 smart glasses pack a power efficient high performance Qualcomm processor that now runs Android 11 in support of a large variety of enterprise-focused apps.

Frequently Asked Questions:

What are the major driving factors and opportunities in the human augmentation market?

Some of the major driving factors for the growth of this market include Growth in virtual reality (VR) and augmented reality (AR) technologies, Advancements in medical technology, Increasing adoption of wearable devices, Growing adoption of advanced technologies in sports. Moreover, Growing adoption of technologies in military and defense, Adoption of remote work and telemedicine, Wide range of applications in gaming and entertainment industries are some of the key opportunities for the human augmentation market.

Which region is expected to hold the highest market share?

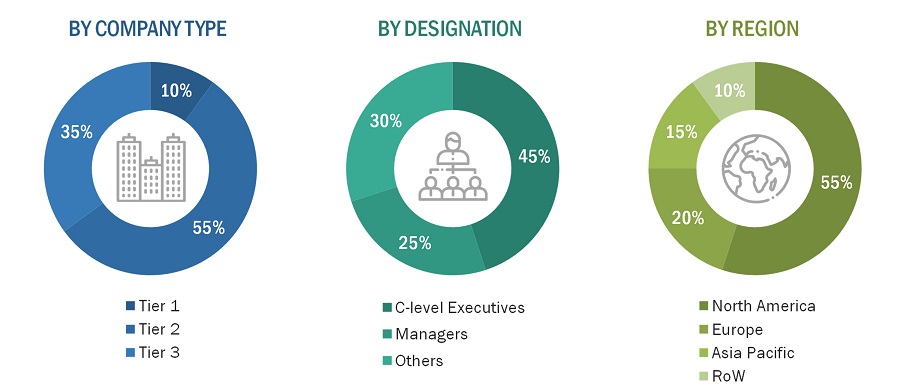

North America, particularly the United States, is a hub for technological innovation. Ongoing advancements in fields like robotics, artificial intelligence, biotechnology, and materials science are driving the development of advanced human augmentation technologies. The United States and Canada, as leading North American countries, have seen economic growth and significant investment in research and development of human augmentation technologies.

Who are the leading players in the global human augmentation market?

Companies such as as Samsung (South Korea), Alphabet Incorporation (US), Apple Inc. (US), Meta (US), Microsoft (US) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What are some of the technological advancements in the market?

Technological advancements in the human augmentation market are rapidly transforming the landscape. Breakthroughs in artificial intelligence, robotics, biotechnology, and materials science are enabling the development of highly sophisticated and integrated augmentation solutions. For instance, Brain-computer interfaces are becoming more precise, allowing for seamless communication between the brain and external devices. Wearable technologies are getting smarter, offering real-time health monitoring and augmented reality experiences. As these technologies continue to evolve, they hold the promise of improving human capabilities, enhancing healthcare, and revolutionizing various industries, from manufacturing to entertainment.

What is the impact of global recession on the market?

The Human Augmentation industry is expected to face challenges in 2023, primarily due to the economic recession and the rising tide of inflation. Its growth is intricately tied to the production and sale of various semiconductor components, including sensors, microelectronics, and batteries, which are the fundamental building blocks of human augmentation technologies. As inflation and interest rates climb while unemployment rates increase, the demand for human augmentation solutions from both consumers and enterprises is likely to diminish, thereby affecting production and global investments. The recession will result in reduced capital expenditures (CAPEX) across end-user industries such as consumer, medical, commercial, and industrial sectors that rely on human augmentation solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth in virtual reality (VR) and augmented reality (AR) technologies- Advancements in medical technology- Increasing adoption of wearable devices- Growing adoption of advanced technologies in sportsRESTRAINTS- High costs associated with human augmentation technologies- Integration issues with existing systemsOPPORTUNITIES- Growing adoption of human augmentation technologies in military and defense sector- Shift toward remote work and telemedicine- Emerging applications of human augmentation technologies in gaming and entertainment industriesCHALLENGES- Long-term health effects and biocompatibility issues related to prolonged use of human augmentation technologies- Safety and liability issues associated with augmentation devices

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 PRICING ANALYSIS

- 5.9 CASE STUDY ANALYSIS

-

5.10 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Exoskeletons- Augmented reality (AR) and virtual reality (VR)- Brain-computer interfaces (BCIs)- Biotechnology and biohacking- Prosthetics and bionicsCOMPLEMENTARY TECHNOLOGIES- Artificial intelligence (AI)- Internet of Things (IoT)- Biometrics and biosensors- CybersecurityADJACENT TECHNOLOGIES- Biomechanics and robotics- Biotechnology and regenerative medicine- Sensors and wearable technology- Materials science

-

5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.13 TARIFF ANALYSIS

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS & REGULATIONS RELATED TO HUMAN AUGMENTATION MARKET- Restriction of hazardous substances (RoHS) directiveAMERICAN SOCIETY FOR TESTING AND MATERIALS (ASTM)

- 5.15 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 WEARABLE DEVICESBODYWEAR- Innerwear- OuterwearFOOTWEAR- Special-purpose footwear- Casual footwearWRISTWEAR- Smartwatch- WristbandEYEWEAR- Increasing demand for AR experiences to boost adoption of eyewearNECKWEAR- Rising adoption of neckwear for posture correction to drive segmental growthOTHERS- Ring scanners- Body-worn cameras- ImplantsAPPLICATIONS OF WEARABLE DEVICES- Consumer- Healthcare- Enterprise & industrial- Others

-

6.3 AUGMENTED REALITY DEVICESHARDWARE- Head-mounted displays- Head-up displaysSOFTWARE- Growing adoption of AR software for gaming and entertainment applications to drive marketAPPLICATIONS OF AR DEVICES- Consumer- Commercial- Enterprise- Healthcare- Aerospace & defense- Energy- Automotive- Others

-

6.4 VIRTUAL REALITY DEVICESHARDWARE- Head-mounted displays- Gesture-tracking devices- Projector and display wallsSOFTWARE- Rising demand for immersive experiences within virtual environments to fuel segmental growthAPPLICATIONS OF VR DEVICES- Consumer- Commercial- Enterprise- Healthcare- Aerospace & defense- Others

-

6.5 EXOSKELETONSPOWERED- Increasing demand for powered exoskeletons to enhance user endurance to drive marketPASSIVE- Increasing adoption of passive exoskeletons for ergonomic support to drive segmental growthAPPLICATIONS OF EXOSKELETONS- Healthcare- Defense- Industrial- Others

-

6.6 BIOMETRIC SYSTEMSSINGLE-FACTOR AUTHENTICATION- Fingerprint recognition- IRIS recognition- Palm print recognition- Face recognition- Vein recognition- Signature recognition- Voice recognition- OthersMULTI-FACTOR AUTHENTICATION- Biometric smart card- Biometric PIN- MultimodalAPPLICATIONS OF BIOMETRIC SYSTEMS- Government- Military and defense- Healthcare- Banking and finance- Consumer electronics- Travel and immigration- Automotive- Security- Others

-

6.7 INTELLIGENT VIRTUAL ASSISTANTS (IVAS)CHATBOTS- Rising adoption of chatbots to enhance customer engagement and operational efficiency to drive marketSMART SPEAKERS- Increasing usage of smart speakers in smart homes to fuel segmental growthAPPLICATIONS OF INTELLIGENT VIRTUAL ASSISTANTS- Consumer- BFSI- Healthcare- Education- Retail- Government- Utilities- Travel and hospitality- Others

- 7.1 INTRODUCTION

-

7.2 ARTIFICIAL INTELLIGENCE (AI) INTEGRATIONAI-POWERED AUGMENTATIONCOGNITIVE AUGMENTATION

-

7.3 QUANTUM COMPUTING AUGMENTATIONQUANTUM-ENHANCED PROCESSINGQUANTUM COMMUNICATION

-

7.4 BIOHACKING AND BIO-AUGMENTATIONGENETIC ENGINEERINGBRAIN-COMPUTER INTERFACES

- 8.1 INTRODUCTION

-

8.2 BODY WORNRISING ADOPTION OF WEARABLE DEVICES IN CONSUMER AND MEDICAL APPLICATIONS TO BOOST MARKET GROWTH

-

8.3 NON-BODY-WORNINCREASING ADOPTION OF NON-BODY-WORN PRODUCTS TO IMPROVE COGNITIVE AND SENSORY EXPERIENCES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 CONSUMERRISING ADOPTION OF WEARABLES DEVICES TO BOOST SEGMENTAL GROWTHCASE STUDY: APPLE AND COCHLEAR COLLABORATED TO DEVELOP NUCLEUS 7 SOUND PROCESSOR

-

9.3 COMMERCIALGROWING ADOPTION OF AR AND VR TECHNOLOGIES IN COMMERCIAL APPLICATIONS TO ACCELERATE MARKET GROWTHCASE STUDY: LOWE'S PARTNERED WITH EXOVR TO LEVERAGE VIRTUAL REALITY TECHNOLOGY FOR EMPLOYEE TRAINING

-

9.4 MEDICALIMPLEMENTATION OF HUMAN AUGMENTATION TECHNOLOGIES TO IMPROVE PATIENT CARE TO DRIVE SEGMENTAL GROWTHCASE STUDY: EKSO BIONICS AND HOCOMA JOINED FORCES TO ENHANCE CAPABILITIES OF EKSO’S EXOSKELETONS

-

9.5 AEROSPACE & DEFENSERISING ADOPTION OF VR AND AR TECHNOLOGIES IN PILOT TRAINING TO DRIVE MARKETCASE STUDY: RAYTHEON ADOPTED SMART GLASSES OFFERED BY VUZIX FOR MILITARY APPLICATIONS

-

9.6 INDUSTRIALRISING ADOPTION OF EXOSKELETONS IN MANUFACTURING TO DRIVE SEGMENTAL GROWTHCASE STUDY: AIRBUS INTEGRATED DAQRI'S AUGMENTED REALITY HELMETS INTO ITS AIRCRAFT ASSEMBLY PROCESSES

- 9.7 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Rising implementation of human augmentation technology in wearable devices to drive regional market growth- Case study: DHL collaborated with Ekso Bionics to deploy wearable exoskeletons for warehouse workersCANADA- Increasing adoption of AR/VR technology in healthcare industry to fuel market growth- Case study: Bionik Laboratories partnered with TIRR Memorial Hermann Rehabilitation Hospital to pilot use of ARKE exoskeleton in stroke rehabilitationMEXICO- Increasing investments in industrial automation to propel adoption of human augmentation technologies- Case study: GE partnered with RealWear to deploy wearable AR devices in industrial maintenance and service operations

-

10.3 EUROPEEUROPE: RECESSION IMPACTUK- Increasing investments in AR/VR to fuel market growth- Case study: Airbus partnered with Magic Leap to introduce AR solutions into its aircraft design and maintenance operationsGERMANY- Rising adoption of human augmentation technologies in automotive and industrial sectors to drive market- Case study: Audi collaborated with Ottobock to develop specialized exoskeletons for employeesFRANCE- Increasing investments in smart infrastructure to fuel regional market growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Growing focus on industrialization and manufacturing expansion to foster market growth- Case study: OnePlus partnered with VR headset manufacturers to provide VR experiences on smartphonesJAPAN- Increasing adoption of robotics in industrial sector to drive market- Case study: Toyota collaborated with exoskeleton technology providers to provide exoskeletons for enhancing workers’ movementsSOUTH KOREA- Government-led investments in medical devices to drive marketINDIA- Growing adoption of consumer electronics devices to contribute to market growthREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)ROW: RECESSION IMPACTMIDDLE EAST & AFRICA- Increasing government investments in development of innovative human augmentation products to enhance market growthSOUTH AMERICA- Rising technological advancements to drive adoption of human augmentation technologies

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.3 MARKET SHARE ANALYSIS, 2022KEY PLAYERS IN HUMAN AUGMENTATION MARKET, 2022

- 11.4 REVENUE ANALYSIS OF KEY PLAYERS IN HUMAN AUGMENTATION MARKET

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 STARTUPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 11.7 COMPETITIVE SCENARIOS AND TRENDS

-

12.1 KEY PLAYERSSAMSUNG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewALPHABET- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAPPLE INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMETA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSONY GROUP CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsEKSO BIONICS- Business overview- Products/Services/Solutions offered- Recent developmentsVUZIX- Business overview- Products/Services/Solutions offered- Recent developmentsGARMIN LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsFOSSIL GROUP INC.- Business overview- Products/Services/Solutions offered- Recent developmentsB-TEMIA- Business overview- Products/Services/Solutions offered- Recent developmentsCASIO COMPUTER CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsREWALK ROBOTICS- Business overview- Products/Services/Solutions offeredCYBERDYNE INC.- Business overview- Products/Services/Solutions offered

-

12.2 OTHER PLAYERSMAGIC LEAP, INC.POLAR ELECTROP&S MECHANICS CO., LTD.LIFESENSEHK SMARTMV LIMITEDREX BIONICS LTD.ATHEER, INCCORTIGENTINBENTA HOLDINGS INC.MYCROFT AI, INC.CYBERGLOVE SYSTEMS INC.SCOPE ARMERGE LABS, INC.WEARABLE ROBOTICS SRLGOQII

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 HUMAN AUGMENTATION MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 IMPACT OF PORTER'S FIVE FORCES ON HUMAN AUGMENTATION MARKET

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 6 AVERAGE SELLING PRICE TRENDS, BY REGION (USD)

- TABLE 7 PRICING ANALYSIS OF PRODUCTS OFFERED BY KEY PLAYERS, BY APPLICATION (USD)

- TABLE 8 PFIZER COLLABORATED WITH MAGIC LEAP TO DEVELOP MIXED-REALITY SOLUTION FOR DRUG DISCOVERY AND VISUALIZATION

- TABLE 9 TOYOTA MOTOR MANUFACTURING IMPLEMENTED EXOSKELETONS FROM EKSO BIONICS IN ITS MANUFACTURING FACILITIES

- TABLE 10 GENERAL MOTORS PARTNERED WITH SARCOS ROBOTICS TO DEPLOY WEARABLE EXOSKELETONS FOR FACTORY WORKERS

- TABLE 11 SIEMENS POWER GENERATION SERVICES COLLABORATED WITH REALWEAR TO ENHANCE REMOTE TECHNICAL SUPPORT USING AR TECHNOLOGY

- TABLE 12 MERCEDES-BENZ STREAMLINED REPAIR PROCEDURES BY EQUIPPING TECHNICIANS WITH GOOGLE’S GLASS ENTERPRISE EDITION AR GLASSES

- TABLE 13 LIST OF FEW PATENTS IN HUMAN AUGMENTATION MARKET, 2020–2022

- TABLE 14 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 15 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 16 MFN TARIFFS FOR HS CODE 9021-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 17 MFN TARIFFS FOR HS CODE 9021-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 18 MFN TARIFF FOR HS CODE 9021-COMPLIANT PRODUCTS EXPORTED BY JAPAN

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 HUMAN AUGMENTATION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 24 HUMAN AUGMENTATION MARKET, BY PRODUCT TYPE, 2019–2022 (USD BILLION)

- TABLE 25 HUMAN AUGMENTATION MARKET, BY PRODUCT TYPE, 2023–2028 (USD BILLION)

- TABLE 26 WEARABLE DEVICES: HUMAN AUGMENTATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 27 WEARABLE DEVICES: HUMAN AUGMENTATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 28 WEARABLE DEVICES: HUMAN AUGMENTATION MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 29 WEARABLE DEVICES: HUMAN AUGMENTATION MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 30 WEARABLE DEVICES: HUMAN AUGMENTATION MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 31 WEARABLE DEVICES: HUMAN AUGMENTATION MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 32 WEARABLE DEVICES: HUMAN AUGMENTATION MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 33 WEARABLE DEVICES: HUMAN AUGMENTATION MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 34 BODYWEAR: HUMAN AUGMENTATION MARKET FOR WEARABLE DEVICES, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 35 BODYWEAR: HUMAN AUGMENTATION MARKET FOR WEARABLE DEVICES, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 36 FOOTWEAR: HUMAN AUGMENTATION MARKET FOR WEARABLE DEVICES, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 37 FOOTWEAR: HUMAN AUGMENTATION MARKET FOR WEARABLE DEVICES, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 38 WRISTWEAR: HUMAN AUGMENTATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 39 WRISTWEAR: HUMAN AUGMENTATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 40 OTHERS: HUMAN AUGMENTATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 41 OTHERS: HUMAN AUGMENTATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 42 AR DEVICES: HUMAN AUGMENTATION MARKET, BY OFFERING, 2019–2022 (USD BILLION)

- TABLE 43 AR DEVICES: HUMAN AUGMENTATION MARKET, BY OFFERING, 2023–2028 (USD BILLION)

- TABLE 44 AR DEVICES: HUMAN AUGMENTATION MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 45 AR DEVICES: HUMAN AUGMENTATION MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 46 HARDWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 47 HARDWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 48 HARDWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 49 HARDWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 50 HARDWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 51 HARDWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 52 HARDWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY REGION, 2019–2022 (USD BILLION)

- TABLE 53 HARDWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY REGION, 2023–2028 (USD BILLION)

- TABLE 54 SOFTWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 55 SOFTWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 56 SOFTWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY REGION, 2019–2022 (USD BILLION)

- TABLE 57 SOFTWARE: HUMAN AUGMENTATION MARKET FOR AR DEVICES, BY REGION, 2023–2028 (USD BILLION)

- TABLE 58 AR DEVICES: HUMAN AUGMENTATION MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 59 AR DEVICES: HUMAN AUGMENTATION MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 60 VR DEVICES: HUMAN AUGMENTATION MARKET, BY OFFERING, 2019–2022 (USD BILLION)

- TABLE 61 VR DEVICES: HUMAN AUGMENTATION MARKET, BY OFFERING, 2023–2028 (USD BILLION)

- TABLE 62 VR DEVICES: HUMAN AUGMENTATION MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 63 VR DEVICES: HUMAN AUGMENTATION MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 64 HARDWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES MARKET, BY DEVICE TYPE, 2019–2022 (USD BILLION)

- TABLE 65 HARDWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES MARKET, BY DEVICE TYPE, 2023–2028 (USD BILLION)

- TABLE 66 HARDWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES, BY DEVICE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 67 HARDWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES, BY DEVICE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 68 HARDWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 69 HARDWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 70 HARDWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES, BY REGION, 2019–2022 (USD BILLION)

- TABLE 71 HARDWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES, BY REGION, 2023–2028 (USD BILLION)

- TABLE 72 SOFTWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES, BY APPLICATION 2019–2022 (USD BILLION)

- TABLE 73 SOFTWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 74 SOFTWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES, BY REGION, 2019–2022 (USD BILLION)

- TABLE 75 SOFTWARE: HUMAN AUGMENTATION MARKET FOR VR DEVICES, BY REGION, 2023–2028 (USD BILLION)

- TABLE 76 VR DEVICES: HUMAN AUGMENTATION MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 77 VR DEVICES: HUMAN AUGMENTATION MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 78 EXOSKELETONS: HUMAN AUGMENTATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 79 EXOSKELETONS: HUMAN AUGMENTATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 80 EXOSKELETONS: HUMAN AUGMENTATION MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 81 EXOSKELETONS: HUMAN AUGMENTATION MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 82 EXOSKELETONS: HUMAN AUGMENTATION MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 83 EXOSKELETONS: HUMAN AUGMENTATION MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 84 POWERED: HUMAN AUGMENTATION MARKET FOR EXOSKELETONS, BY END USER, 2019–2022 (USD MILLION)

- TABLE 85 POWERED: HUMAN AUGMENTATION MARKET FOR EXOSKELETONS, BY END USER, 2023–2028 (USD MILLION)

- TABLE 86 POWERED: HUMAN AUGMENTATION MARKET FOR EXOSKELETONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 POWERED: HUMAN AUGMENTATION MARKET FOR EXOSKELETONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 PASSIVE: HUMAN AUGMENTATION MARKET FOR EXOSKELETONS, BY END USER, 2019–2022 (USD BILLION)

- TABLE 89 PASSIVE: HUMAN AUGMENTATION MARKET FOR EXOSKELETONS, BY END USER, 2023–2028 (USD BILLION)

- TABLE 90 PASSIVE: HUMAN AUGMENTATION MARKET FOR EXOSKELETONS, BY REGION, 2019–2022 (USD BILLION)

- TABLE 91 PASSIVE: HUMAN AUGMENTATION MARKET FOR EXOSKELETONS, BY REGION, 2023–2028 (USD BILLION)

- TABLE 92 BIOMETRIC SYSTEMS: HUMAN AUGMENTATION MARKET, BY AUTHENTICATION TYPE, 2019–2022 (USD BILLION)

- TABLE 93 BIOMETRIC SYSTEMS: HUMAN AUGMENTATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD BILLION)

- TABLE 94 BIOMETRIC SYSTEMS: HUMAN AUGMENTATION MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 95 BIOMETRIC SYSTEMS: HUMAN AUGMENTATION MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 96 BIOMETRIC SYSTEMS: HUMAN AUGMENTATION MARKET, BY SINGLE-FACTOR AUTHENTICATION, 2019–2022 (USD BILLION)

- TABLE 97 BIOMETRIC SYSTEMS: HUMAN AUGMENTATION MARKET, BY SINGLE-FACTOR AUTHENTICATION, 2023–2028 (USD BILLION)

- TABLE 98 SINGLE-FACTOR AUTHENTICATION: HUMAN AUGMENTATION MARKET FOR BIOMETRIC SYSTEMS, BY END USER, 2019–2022 (USD BILLION)

- TABLE 99 SINGLE-FACTOR AUTHENTICATION: HUMAN AUGMENTATION MARKET FOR BIOMETRIC SYSTEMS, BY END USER, 2023–2028 (USD BILLION)

- TABLE 100 BIOMETRIC SYSTEMS: HUMAN AUGMENTATION MARKET, BY FINGERPRINT RECOGNITION TYPE, 2019–2022 (USD BILLION)

- TABLE 101 BIOMETRIC SYSTEMS: HUMAN AUGMENTATION MARKET, BY FINGERPRINT RECOGNITION TYPE, 2023–2028 (USD BILLION)

- TABLE 102 BIOMETRIC SYSTEMS: HUMAN AUGMENTATION MARKET, BY MULTI-FACTOR AUTHENTICATION, 2019–2022 (USD BILLION)

- TABLE 103 BIOMETRIC SYSTEMS: HUMAN AUGMENTATION MARKET, BY MULTI-FACTOR AUTHENTICATION, 2023–2028 (USD BILLION)

- TABLE 104 MULTI-FACTOR AUTHENTICATION: HUMAN AUGMENTATION MARKET FOR BIOMETRIC SYSTEMS, BY REGION, 2019–2022 (USD BILLION)

- TABLE 105 MULTI-FACTOR AUTHENTICATION: HUMAN AUGMENTATION MARKET FOR BIOMETRIC SYSTEMS, BY REGION, 2023–2028 (USD BILLION)

- TABLE 106 MULTI-FACTOR AUTHENTICATION: HUMAN AUGMENTATION MARKET FOR BIOMETRIC SYSTEMS, BY END USER, 2019–2022 (USD BILLION)

- TABLE 107 MULTI-FACTOR AUTHENTICATION: HUMAN AUGMENTATION MARKET FOR BIOMETRIC SYSTEMS, 2023–2028 (USD BILLION)

- TABLE 108 INTELLIGENT VIRTUAL ASSISTANTS: HUMAN AUGMENTATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 109 INTELLIGENT VIRTUAL ASSISTANTS: HUMAN AUGMENTATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 110 INTELLIGENT VIRTUAL ASSISTANTS: HUMAN AUGMENTATION MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 111 INTELLIGENT VIRTUAL ASSISTANTS: HUMAN AUGMENTATION MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 112 INTELLIGENT VIRTUAL ASSISTANTS: HUMAN AUGMENTATION MARKET, BY APPLICATION, 2019–2022 (USD BILLION)

- TABLE 113 INTELLIGENT VIRTUAL ASSISTANTS: HUMAN AUGMENTATION MARKET, BY APPLICATION, 2023–2028 (USD BILLION)

- TABLE 114 HUMAN AUGMENTATION MARKET, BY FUNCTIONALITY, 2019–2022 (USD BILLION)

- TABLE 115 HUMAN AUGMENTATION MARKET, BY FUNCTIONALITY, 2023–2028 (USD BILLION)

- TABLE 116 BODY-WORN: HUMAN AUGMENTATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 117 BODY-WORN: HUMAN AUGMENTATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 118 NON-BODY-WORN: HUMAN AUGMENTATION MARKET, BY TYPE, 2019–2022 (USD BILLION)

- TABLE 119 NON-BODY-WORN: HUMAN AUGMENTATION MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 120 HUMAN AUGMENTATION MARKET, BY END USER, 2019–2022 (USD BILLION)

- TABLE 121 HUMAN AUGMENTATION MARKET, BY END USER, 2023–2028 (USD BILLION)

- TABLE 122 HUMAN AUGMENTATION MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 123 HUMAN AUGMENTATION MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 124 NORTH AMERICA: HUMAN AUGMENTATION MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 125 NORTH AMERICA: HUMAN AUGMENTATION MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 126 NORTH AMERICA: HUMAN AUGMENTATION MARKET, BY PRODUCT TYPE, 2019–2022 (USD BILLION)

- TABLE 127 NORTH AMERICA: HUMAN AUGMENTATION MARKET, BY PRODUCT TYPE, 2023–2028 (USD BILLION)

- TABLE 128 EUROPE: HUMAN AUGMENTATION MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 129 EUROPE: HUMAN AUGMENTATION MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 130 EUROPE: HUMAN AUGMENTATION MARKET, BY PRODUCT TYPE, 2019–2022 (USD BILLION)

- TABLE 131 EUROPE: HUMAN AUGMENTATION MARKET, BY PRODUCT TYPE, 2023–2028 (USD BILLION)

- TABLE 132 ASIA PACIFIC: HUMAN AUGMENTATION MARKET, BY COUNTRY, 2019–2022 (USD BILLION)

- TABLE 133 ASIA PACIFIC: HUMAN AUGMENTATION MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 134 ASIA PACIFIC: HUMAN AUGMENTATION MARKET, BY PRODUCT TYPE, 2019–2022 (USD BILLION)

- TABLE 135 ASIA PACIFIC: HUMAN AUGMENTATION MARKET, BY PRODUCT TYPE, 2023–2028 (USD BILLION)

- TABLE 136 ROW: HUMAN AUGMENTATION MARKET, BY REGION, 2019–2022 (USD BILLION)

- TABLE 137 ROW: HUMAN AUGMENTATION MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 138 ROW: HUMAN AUGMENTATION MARKET, BY PRODUCT TYPE, 2019–2022 (USD BILLION)

- TABLE 139 ROW: HUMAN AUGMENTATION MARKET, BY PRODUCT TYPE, 2023–2028 (USD BILLION)

- TABLE 140 HUMAN AUGMENTATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 141 HUMAN AUGMENTATION MARKET: MARKET SHARE ANALYSIS (2022)

- TABLE 142 HUMAN AUGMENTATION MARKET: COMPANY PRODUCT FOOTPRINT

- TABLE 143 HUMAN AUGMENTATION MARKET: COMPANY PRODUCT TYPE FOOTPRINT

- TABLE 144 HUMAN AUGMENTATION MARKET: COMPANY TECHNOLOGY FOOTPRINT

- TABLE 145 HUMAN AUGMENTATION MARKET: COMPANY FUNCTIONALITY FOOTPRINT

- TABLE 146 HUMAN AUGMENTATION MARKET: COMPANY END-USER FOOTPRINT

- TABLE 147 HUMAN AUGMENTATION MARKET: COMPANY REGION FOOTPRINT

- TABLE 148 HUMAN AUGMENTATION MARKET: DETAILED LIST OF KEY STARTUPS

- TABLE 149 HUMAN AUGMENTATION MARKET: STARTUP OVERALL FOOTPRINT

- TABLE 150 HUMAN AUGMENTATION MARKET: STARTUP PRODUCT TYPE FOOTPRINT

- TABLE 151 HUMAN AUGMENTATION MARKET: STARTUP TECHNOLOGY FOOTPRINT

- TABLE 152 HUMAN AUGMENTATION MARKET: STARTUP FUNCTIONALITY FOOTPRINT

- TABLE 153 HUMAN AUGMENTATION MARKET: STARTUP END-USER FOOTPRINT

- TABLE 154 HUMAN AUGMENTATION MARKET: STARTUP REGION FOOTPRINT

- TABLE 155 HUMAN AUGMENTATION MARKET: TOP PRODUCT LAUNCHES AND DEVELOPMENTS, FEBRUARY 2020 TO OCTOBER 2023

- TABLE 156 HUMAN AUGMENTATION MARKET: TOP DEALS AND OTHER DEVELOPMENTS, JANUARY 2019 TO SEPTEMBER 2023

- TABLE 157 SAMSUNG: COMPANY OVERVIEW

- TABLE 158 SAMSUNG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 159 SAMSUNG: PRODUCT LAUNCHES

- TABLE 160 SAMSUNG: DEALS

- TABLE 161 ALPHABET: COMPANY OVERVIEW

- TABLE 162 ALPHABET: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 163 ALPHABET: PRODUCT LAUNCHES

- TABLE 164 ALPHABET: DEALS

- TABLE 165 APPLE INC.: COMPANY OVERVIEW

- TABLE 166 APPLE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 APPLE INC.: PRODUCT LAUNCHES

- TABLE 168 MICROSOFT: COMPANY OVERVIEW

- TABLE 169 MICROSOFT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 MICROSOFT: PRODUCT LAUNCHES

- TABLE 171 MICROSOFT: DEALS

- TABLE 172 META: COMPANY OVERVIEW

- TABLE 173 META: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 174 META: PRODUCT LAUNCHES

- TABLE 175 META: DEALS

- TABLE 176 SONY GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 177 SONY GROUP CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 178 SONY GROUP CORPORATION: PRODUCT LAUNCHES

- TABLE 179 SONY GROUP CORPORATION: DEALS

- TABLE 180 EKSO BIONICS: COMPANY OVERVIEW

- TABLE 181 EKSO BIONICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 182 EKSO BIONICS: PRODUCT LAUNCHES

- TABLE 183 EKSO BIONICS: DEALS

- TABLE 184 VUZIX: COMPANY OVERVIEW

- TABLE 185 VUZIX: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 186 VUZIX: PRODUCT LAUNCHES

- TABLE 187 VUZIX: DEALS

- TABLE 188 GARMIN LTD.: COMPANY OVERVIEW

- TABLE 189 GARMIN LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 190 GARMIN LTD.: PRODUCT LAUNCHES

- TABLE 191 GARMIN LTD.: DEALS

- TABLE 192 FOSSIL GROUP INC.: COMPANY OVERVIEW

- TABLE 193 FOSSIL GROUP INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 194 FOSSIL GROUP INC.: PRODUCT LAUNCHES

- TABLE 195 B-TEMIA: COMPANY OVERVIEW

- TABLE 196 B-TEMIA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 197 B-TEMIA: PRODUCT LAUNCHES

- TABLE 198 B-TEMIA: DEALS

- TABLE 199 CASIO COMPUTER CO., LTD.: COMPANY OVERVIEW

- TABLE 200 CASIO COMPUTER CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 CASIO COMPUTER CO., LTD.: PRODUCT LAUNCHES

- TABLE 202 REWALK ROBOTICS: COMPANY OVERVIEW

- TABLE 203 REWALK ROBOTICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 CYBERDYNE INC.: COMPANY OVERVIEW

- TABLE 205 CYBERDYNE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 HUMAN AUGMENTATION MARKET SEGMENTATION

- FIGURE 2 HUMAN AUGMENTATION MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION (SUPPLY SIDE): REVENUE FROM SALES OF HUMAN AUGMENTATION PRODUCTS AND SOLUTIONS

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 WEARABLE DEVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HUMAN AUGMENTATION MARKET DURING FORECAST PERIOD

- FIGURE 9 BODY-WORN SEGMENT TO REGISTER HIGHER CAGR IN HUMAN AUGMENTATION MARKET DURING FORECAST PERIOD

- FIGURE 10 CONSUMER SEGMENT TO COMMAND LARGEST SHARE OF HUMAN AUGMENTATION DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF HUMAN AUGMENTATION MARKET IN 2022

- FIGURE 12 TECHNOLOGICAL ADVANCEMENTS IN VARIOUS INDUSTRIES TO DRIVE MARKET

- FIGURE 13 US AND WEARABLE DEVICES TO HOLD LARGEST SHARE OF NORTH AMERICA HUMAN AUGMENTATION MARKET IN 2023

- FIGURE 14 US TO HOLD LARGEST SHARE OF HUMAN AUGMENTATION MARKET IN NORTH AMERICA DURING FORECAST PERIOD

- FIGURE 15 HUMAN AUGMENTATION MARKET IN CHINA TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 16 HUMAN AUGMENTATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 IMPACT ANALYSIS OF DRIVERS ON HUMAN AUGMENTATION MARKET

- FIGURE 18 IMPACT ANALYSIS OF RESTRAINTS ON HUMAN AUGMENTATION MARKET

- FIGURE 19 IMPACT ANALYSIS OF OPPORTUNITIES IN HUMAN AUGMENTATION MARKET

- FIGURE 20 IMPACT ANALYSIS OF CHALLENGES ON HUMAN AUGMENTATION MARKET

- FIGURE 21 HUMAN AUGMENTATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 KEY PLAYERS IN HUMAN AUGMENTATION MARKET

- FIGURE 23 HUMAN AUGMENTATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 AVERAGE SELLING PRICE TRENDS OF PRODUCTS OFFERED BY KEY PLAYERS, BY END USER

- FIGURE 28 NUMBER OF PATENTS GRANTED IN HUMAN AUGMENTATION MARKET, 2012–2022

- FIGURE 29 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 EXOSKELETONS TO RECORD HIGHEST CAGR IN HUMAN AUGMENTATION MARKET DURING FORECAST PERIOD

- FIGURE 32 BODY-WORN SEGMENT TO REGISTER HIGHER CAGR IN HUMAN AUGMENTATION MARKET DURING FORECAST PERIOD

- FIGURE 33 COMMERCIAL SEGMENT TO EXHIBIT HIGHEST CAGR IN HUMAN AUGMENTATION MARKET FROM 2023 TO 2028

- FIGURE 34 HUMAN AUGMENTATION MARKET TO REGISTER HIGHEST CAGR IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: HUMAN AUGMENTATION MARKET SNAPSHOT

- FIGURE 36 EUROPE AMERICA: HUMAN AUGMENTATION MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: HUMAN AUGMENTATION MARKET SNAPSHOT

- FIGURE 38 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 39 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN HUMAN AUGMENTATION MARKET

- FIGURE 40 HUMAN AUGMENTATION MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 HUMAN AUGMENTATION MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 42 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 43 ALPHABET: COMPANY SNAPSHOT

- FIGURE 44 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 45 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 46 META: COMPANY SNAPSHOT

- FIGURE 47 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 EKSO BIONICS: COMPANY SNAPSHOT

- FIGURE 49 VUZIX: COMPANY SNAPSHOT

- FIGURE 50 GARMIN LTD.: COMPANY SNAPSHOT

- FIGURE 51 FOSSIL GROUP INC.: COMPANY SNAPSHOT

- FIGURE 52 CASIO COMPUTER CO., LTD.: COMPANY SNAPSHOT

- FIGURE 53 REWALK ROBOTICS: COMPANY SNAPSHOT

- FIGURE 54 CYBERDYNE INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the human augmentation market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Federal Communications Commission (FCC) |

|

|

Food and Drug Administration (FDA) |

|

|

Canadian Radio-television and Telecommunications Commission (CRTC) |

|

|

Medicines and Healthcare Products Regulatory Agency (MHRA)) |

https://www.gov.uk/government/organisations/medicines-and-healthcare-products-regulatory-agency |

|

National Medical Products Administration (NMPA) |

|

|

Pharmaceuticals and Medical Devices Agency (PMDA) |

|

|

European Medicines Agency (EMA) |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the human augmentation market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the human augmentation market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the Human Augmentation market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various applications using or expected to implement Human Augmentation

- Analyzing each end-user, along with the major related companies and Human Augmentation providers

- Estimating the Human Augmentation market for end-user

- Understanding the demand generated by companies operating across different end-user

- Tracking the ongoing and upcoming implementation of projects based on Human Augmentation technology by vertical and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of Human Augmentation products designed and developed vertically. This information would help analyze the breakdown of the scope of work carried out by each major company in the Human Augmentation market

- Arriving at the market estimates by analyzing Human Augmentation companies as per their countries, and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various verticals.

- Building and developing the information related to the market revenue generated by key Human Augmentation manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of Human Augmentation products in various applications

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of Human Augmentation, and the level of solutions offered in end-user industries

- Impact of the recession on the steps mentioned above has also been considered

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Human augmentation refers to the use of various technologies and techniques to enhance or augment the capabilities of the human body and mind. It involves the integration of artificial elements, such as devices or implants, with the human biological system to improve physical, cognitive, sensory, or other functional aspects of an individual.

Key Stakeholders

- Technology Developers

- Medical Device Manufacturers

- Healthcare Providers

- Consumers

- Regulatory Authorities

- Insurance Companies

- Investors and Venture Capitalists

- Ethics and Advocacy Groups

- Researchers and Academia

- Manufacturers of Components

- End-User Industries

- Government Agencies

Report Objectives

- To define, describe, and forecast the Human Augmentation market based on product type, technology, functionality, end-user, and region.

- To forecast the shipment data of Human Augmentation market.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the Human Augmentation market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the human augmentation market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the human augmentation market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Human Augmentation Market