Household Robots Market Size, Share & Industry Trends Analysis Report by Offering, Type (Domestic, Entertainment & Leisure), Distribution Channel, Application (Vacuuming, Lawn Mowing, Companionship, Elderly and Handicap Assistance, Robot Toys and Hobby Systems) and Region – Global Forecast to 2028

Updated on : Oct 22, 2024

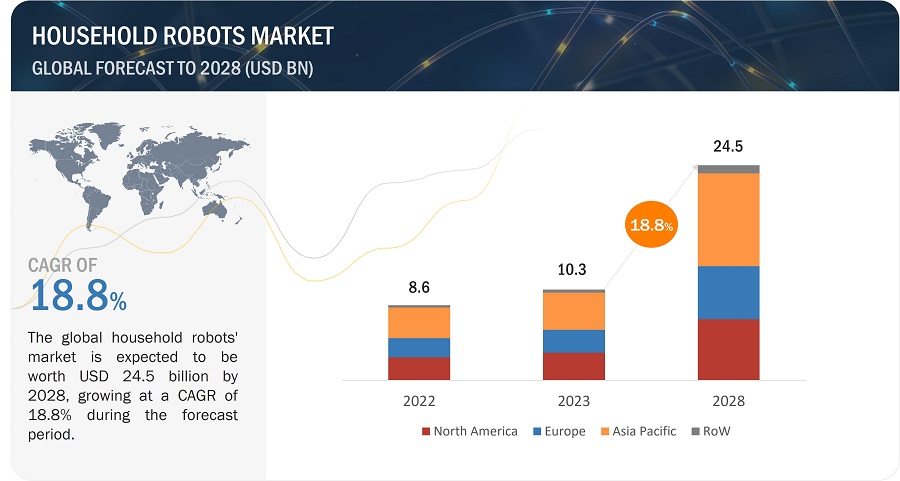

The global household robots market size is valued at USD 10.3 billion in 2023 and is anticipated to USD 24.5 billion by 2028; growing at a CAGR of 18.8% during the forecast period from 2023 to 2029.

A growing focus on improving the endurance capability of robots is a major opportunity for the household robots industry. Currently these robots can operate for a short period of 1-2 hours when they are fully charged. Companies have the opportunity to work on charging capabilities and get an edge over others in the market.

Household Robots Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Household Robots Market Trends

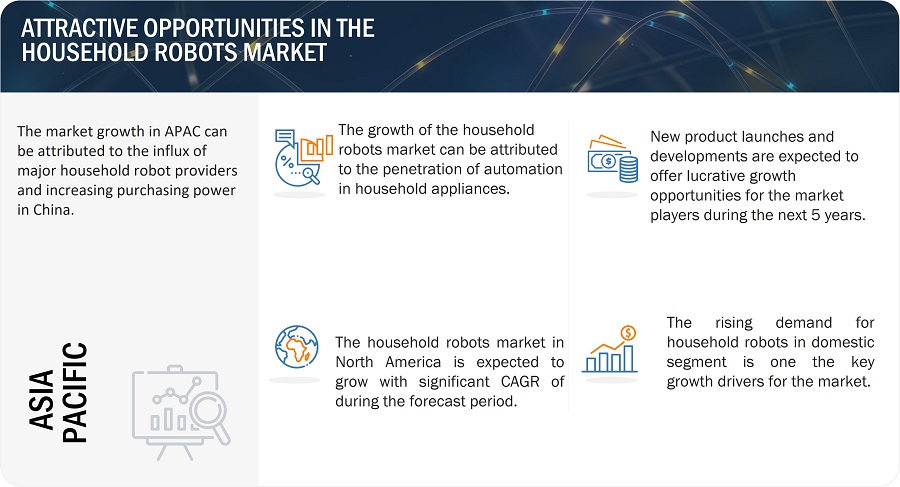

Driver: Rising demand for robots in domestic segment

Robotics has witnessed a huge leap in usability and convenience with the introduction of technologies such as the Simultaneous Localization and Mapping (SLAM) algorithm and Artificial Intelligence.

Such technologies have been adopted by major market players to bring key innovations to their product offerings. Consumers want to spend less time or completely avoid household chores, such as vacuuming, pool cleaning, and mowing, which has a direct impact on the growing need for domestic robots, maximizing their revenue potential.

As these robots are used for indoor as well as outdoor household activities, their area of operation is limited. Since these robots are more cost-efficient and long-lasting in comparison to hired domestic help, the adoption rate of these robots has been increasing significantly over the past few years.

Restraint: Legal safety and data protection regulations

Regulatory issue related to the protection of data collected by robots has come into the picture in the last 2–3 years. For instance, in May 2018, the European Union and European Parliament approved General Data Protection Regulation (GDPR).

The regulation helps to protect the personal information of individuals within the European Union and provides guidelines for the control of citizen and resident data. The household robots collect data such as the floor plan of a house and garden through smartphone applications integrated with the robots. This personal information may be compromised if the data is not stored or managed using authentic applications.

Opportunity: Various upgrades to household robots in elderly assistance application

The rapid increase in the number of the aging population due to better healthcare in developed countries, such as the US and Japan is driving the need for medical assistance robots for home deployment.

According to the Statistics Bureau of Japan, the population of elderly citizens (65 and over) constituted about 28.8% of the total population in 2020, which has surpassed the proportion of children (14 and younger) in the country.

This also implies that there are fewer people to look after the elderly. It is estimated by the Administration of Ageing that more than 25% of the population in the US will be above 65 years by 2060. The US Census Bureau forecasts that every 1 in 5 residents will be of retirement age and the elderly people will outnumber children by 2030.

Challenge: Making household robots affordable and available globally

In several developing countries, due to lower per capita income and government taxes, affordability for consumers remains a challenge due to the high cost of acquiring consumer products. In India, the import duty could be as high as 27%. In several countries, hiring domestic help is much more economical.

The availability of such products is also limited and they are mostly sold by third-party retailers and online stores. Even multinational companies such as Samsung Electronics Co., Ltd., and LG Electronics Inc. offer robots such as POWERbot and HOM-BOT that are not globally available and are mostly offered online through third-party sites such as Amazon (US) or brick-and-mortar stores. Strong players in this segment, such as Ecovacs Robotics Co., Ltd., and Neato Robotics, Inc., who have witnessed success in the US market, have also not officially made their products available worldwide.

Household Robots Market Map:

Online distribution channel to capture the largest market growth of the household robots market during the forecast period.

The online channel includes the sale of household robots through the websites of companies, and various e-commerce platforms such as Amazon, Croma, Best Buy, and eBay. Customers can easily review the product with specifications and designs and can order online. Companies usually provide setup and installation services for smart appliances.

The online channel offers the convenience and accessibility that make them an ideal space for marketing and selling robots. Consumers can easily browse through a wide range of options, compare features, read reviews, and make purchases without leaving their homes.

Service segment to have significant CAGR growth of the market during the forecast period.

In terms of offering services to is significant CAGR growth during the forecast period. This segment aims to provide ongoing assistance and improvements beyond the initial purchase like customer support which involves providing assistance to customers regarding product inquiries, troubleshooting, technical support, and general guidance.

It could be through online resources, dedicated helplines, chat support, or even in-person assistance in some cases. Maintenance and repair which includes services related to maintaining the robot's functionality, including software updates, hardware repairs, or replacements if necessary. Some companies offer warranties or service contracts that cover maintenance or repairs for a specific period after purchase.

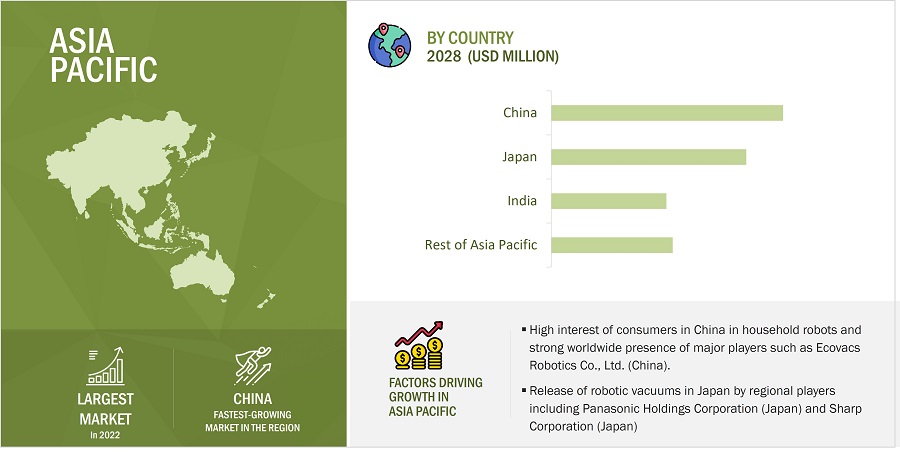

Asia Pacific region to witness the highest market size during the forecast period

Asia Pacific countries, particularly Japan, South Korea, China, and Singapore, are known for their advancements in technology. These nations have been at the forefront of robotics research and development, fostering a conducive environment for innovation in household robotics.

Growing interest from consumers in Singapore for robotic vacuums has led to new players entering the market space. Even in countries such as Japan, where the initial adoption was slower than expected, the market for robotic vacuums is projected to witness significant growth potential.

Household Robots Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Household Robots Companies - Key Market Players

The key players in the household robots companies are

- iRobot Corporation (US),

- Ecovacs Robotics Co., Ltd. (China),

- Xiaomi Corporation (China),

- Maytronics, Ltd. (Israel),

- Samsung Electronics Co., Ltd. (South Korea),

- Neato robotics, Inc. (US),

- Dyson Limited (Singapore),

- LG Electronics Inc. (South Korea),

- LEGO A/S (Denmark),

- Hayward Holdings, Inc. (US), etc.

Household Robots Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 10.3 billion |

|

Projected Market Size

|

USD 24.5 billion |

| Household Robots Market Growth Rate | CAGR of 18.8% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Thousand/Million/Billion |

|

Segments Covered |

By Product, By offering, By Distribution Channel, By Application and By Region |

|

Geographies covered |

Asia Pacific, Europe, North America and the Rest of the World |

|

Companies covered |

The key players operating in the household robots market are iRobot Corporation (US), Ecovacs Robotics Co., Ltd. (China), Xiaomi Corporation (China), Maytronics, Ltd (Israel), Samsung Electronics Co., Ltd. (South Korea), Neato robotics, Inc. (US), Dyson Limited (Singapore), LG Electronics Inc. (South Korea), LEGO A/S (Denmark), Hayward Holdings, Inc. (US), UBTECH Robotics (China), Husqvarna Group (Sweden), Miele (Germany), Robomow (Isreal), Cecotec Innovaciones S.L. (Spain), Monoprice, Inc. (US), temi (US), Deere & Company (US), BObsweep (Canada), ILIFE Innovation (China), Sharp Corporation (Japan), SharkNinja Operating LLC (US), Bissell Inc.(US), Blue Frog Robotics (France), Beijing Roborock Technology Co. Ltd. (China). |

Household Robots Market Highlights

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Type: |

|

|

By Distribution Channel: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments in Household Robots Industry

- In September 2023, Samsung Electronics Co., Ltd. announced the launch of its new Jet™ Cordless Vacuum range, the Jet™ 65, 75E, 85 and 95. It has lightweight designs than previous models, increased power, and pet tools as standard. The latest Jet™ Cordless vacuum range is set to deliver a hygienic cleaning solution for all homes.

- In March 2023, Dyson Limited announced its presence in Colombia and the first availability of its full hair care product lineup and high-performing cord-free vacuum cleaners. This latest investment will help the company to expand footprint in the Latin American region.

- In June 2022, LG Electronics jumped into the logistics robot market in cooperation with CJ Logistics (South Korea), a major logistics company that has used artificial intelligence, big data, and robots for digital transformation. The two companies would push for the joint development of an order-picking system based on autonomous driving robots, establish optimized robot operation processes for each logistics base, and expand the application of robot solutions in logistics centers.

- In June 2022, LEGO A/S announced to build of a new toy brick factory in Chesterfield County, Virginia. The plant will cost USD 1 billion over 10 years and will employ more than 1,760 people. Lego projects production of the company’s colorful bricks will start in the second half of 2025. The Virginia factory will be the Danish company’s first in the United States, and it's second in the Americas after LEGO’s existing factory in Monterrey, Mexico.

Critical questions answered by this report:

What is current size of the global household robots market?

The global household robots market is estimated to be around USD 10.3 billion in 2023 and is projected to reach USD 24.5 billion by 2028 at a CAGR of 18.8%.

Where will all these developments take the industry in the mid-to-long term?

Advancements in demand for robots in domestic household is driving the market.

Who are the winners of global household robots market?

Companies such as iRobot Corporation (US), Ecovacs Robotics Co., Ltd. (China), Xiaomi Corporation (China), Maytronics, Ltd. (Israel), and Samsung Electronics Co., Ltd. (South Korea) are among a few key players in this market.

What application is expected to have the largest market size?

Vacuum cleaning application is expected to lead the market during the forecast period.

Which distribution channel is leading the household robots?

Online channel is expected to have a larger market size during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for robots for domestic work- Growing popularity of autonomous robots- Surging use of IoT in robots for cost-effective predictive maintenance- Increasing government initiatives for development of robotic technologiesRESTRAINTS- Legal safety and data protection regulationsOPPORTUNITIES- Focus on improving endurance of robots- Various upgrades to household robots in elderly assistance applicationsCHALLENGES- Use of service robots for house cleaning and companionship- Low per capita income

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR HOUSEHOLD ROBOT PROVIDERS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE OF HOUSEHOLD ROBOTS FOR KEY PLAYERS, BY OFFERINGAVERAGE SELLING PRICE TRENDS

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM/MARKET MAP

-

5.7 TECHNOLOGY ANALYSISINTEGRATION OF AI INTO ROBOTSRESEARCH ON STANDARD OPERATING SYSTEMS FOR ROBOTSHOUSEHOLD ROBOTS MARKET: BUSINESS MODELS

-

5.8 PATENT ANALYSISLIST OF MAJOR PATENTS

-

5.9 TRADE AND TARIFF ANALYSISTRADE ANALYSIS- Trade data for HS code 850860TARIFF ANALYSIS

- 5.10 KEY CONFERENCES & EVENTS

-

5.11 REGULATORY LANDSCAPEGUIDELINES FOR SAFE ROBOTIC ENVIRONMENT BY OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION (OSHA)

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITION RIVALRY

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.14 CASE STUDY ANALYSISCINCINNATI INTERNATIONAL AIRPORT DEPLOYED SOFTBANK ROBOTICS’ COMMERCIAL ROBOTIC VACUUM CLEANERS TO IMPROVE CLEANING OPERATIONSXENEX DEPLOYED UVD’S CLEANING ROBOTS POWERED BY UVC LIGHT TO MAINTAIN HYGIENE IN HEALTHCARE FACILITIES

- 6.1 INTRODUCTION

-

6.2 PRODUCTSHOUSEHOLD ROBOTS STREAMLINE TASKS, PROVIDE ASSISTANCE, AND OFFER COMPANIONSHIP

-

6.3 SERVICESDEMAND FOR VALUE-ADDED HOUSEHOLD ROBOTS TO DRIVE DEMAND

- 7.1 INTRODUCTION

-

7.2 DOMESTICBUSY LIFESTYLES AND INCREASING AUTOMATION TO LEAD TO DEMAND FOR DOMESTIC ROBOTS

-

7.3 ENTERTAINMENT & LEISURE ROBOTSRISING INCLINATION TOWARD CONVENIENT LIFESTYLES TO DRIVE DEMAND FOR HOME ENTERTAINMENT AND LEISURE ROBOTS

- 8.1 INTRODUCTION

-

8.2 ONLINEINCREASE IN ONLINE SALES OF HOUSEHOLD ROBOTS AS EFFECT OF PANDEMIC TO SPUR GROWTH

-

8.3 OFFLINEFIRSTHAND EXPERIENCE OFFERED BY OFFLINE SALES CHANNELS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 VACUUMINGPOPULARITY OF FLOOR CLEANING ROBOTS TO DRIVE MARKET FOR VACUUMS

-

9.3 LAWN MOWINGADVANCED FEATURES OF ROBOTIC LAWN MOWERS TO DRIVE MARKET DEMAND

-

9.4 POOL CLEANINGSMARTPHONE CONNECTIVITY AND INTEGRATION OF INTELLIGENT SENSORS TO BROADEN CAPABILITIES OF POOL CLEANING ROBOTS

-

9.5 COMPANIONSHIPGROWING NEED FOR INTERACTION AND DECLINE IN EXTENDED FAMILIES TO DRIVE DEMAND FOR COMPANIONSHIP ROBOTS

-

9.6 ELDERLY ASSISTANCE AND HANDICAP SYSTEMSGROWING ELDERLY POPULATION AND THEIR RISING ISOLATION TO PROPEL MARKET

-

9.7 ROBOT TOYS AND HOBBY SYSTEMSNEED FOR INTERESTING AND ENGAGING SUBSTITUTES FOR SMARTPHONES AND TABLETS TO BOOST MARKET

- 9.8 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Rapid adoption of robotic vacuums for daily activities to drive marketCANADA- Need for robotic vacuums enabled with high-efficiency particulate air filters to boost marketMEXICO- Gradual adoption of robotic vacuums and presence of domestic players to spur growth

-

10.3 EUROPEEUROPE: RECESSION IMPACTUK- Rising popularity of robotic vacuum cleaners to propel marketGERMANY- Presence of major household robot manufacturers to propel growthFRANCE- Changing consumer behavior to lead to increased acceptance of household robotsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Surging demand from middle-class population for domestic cleaning robots to spur market expansionJAPAN- Growing need for elderly assistance due to rise in aging population to boost market growthSOUTH KOREA- Positive sentiment toward household robots from consumers to drive marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)ROW: RECESSION IMPACTGCC- Use of household robots for daily chores to drive market growthSOUTH AMERICA- Increasing investments by major players and rising income levels to drive marketREST OF MIDDLE EAST & AFRICA

- 11.1 INTRODUCTION

- 11.2 KEY STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

- 11.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSIROBOT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewECOVACS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewXIAOMI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMAYTRONICS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAMSUNG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEATO ROBOTICS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsDYSON- Business overview- Products/Solutions/Services offered- Recent developmentsLG ELECTRONICS INC.- Business overview- Products/Solutions/Services offered- Recent developmentsLEGO SYSTEM A/S- Business overview- Products/Solutions/Services offered- Recent developmentsHAYWARD HOLDINGS, INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER KEY PLAYERSUBTECH ROBOTICS, CORP LTD.HUSQVARNA GROUPMIELEROBOMOWCECOTEC INNOVACIONES S.L.MONOPRICE, INC.TEMIDEERE & COMPANYBOBSWEEPILIFESHARP CORPORATIONSHARKNINJA OPERATING LLCBISSELL, INC.BLUE FROG ROBOTICSBEIJING ROBOROACH TECHNOLOGY CO. LTD.

-

13.1 DISCUSSION GUIDEADDITIONAL QUESTIONS FOR DISTRIBUTORS

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE OF TOP 3 HOUSEHOLD ROBOTS, BY KEY PLAYER

- TABLE 2 HOUSEHOLD ROBOTS MARKET: ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 3 TOP 10 PATENT OWNERS IN US IN LAST 10 YEARS

- TABLE 4 LIST OF MAJOR PATENTS IN HOUSEHOLD ROBOTS MARKET

- TABLE 5 MFN TARIFF FOR VACUUM CLEANERS, INCLUDING DRY CLEANERS AND WET VACUUM CLEANERS (EXCLUDING SELF-CONTAINED ELECTRIC MOTORS), EXPORTED BY US, 2022

- TABLE 6 MFN TARIFF FOR VACUUM CLEANERS, INCLUDING DRY CLEANERS AND WET VACUUM CLEANERS (EXCLUDING SELF-CONTAINED ELECTRIC MOTORS), EXPORTED BY CHINA, 2022

- TABLE 7 HOUSEHOLD ROBOTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022–2024

- TABLE 8 IMPACT OF PORTER’S FIVE FORCES ON HOUSEHOLD ROBOTS MARKET

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 10 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 11 HOUSEHOLD ROBOTS MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 12 HOUSEHOLD ROBOTS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 13 HOUSEHOLD ROBOTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 14 HOUSEHOLD ROBOTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 15 HOUSEHOLD ROBOTS MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 16 HOUSEHOLD ROBOTS MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 17 DOMESTIC ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 18 DOMESTIC ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 19 DOMESTIC ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 20 DOMESTIC ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 21 ENTERTAINMENT & LEISURE ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 22 ENTERTAINMENT & LEISURE ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 ENTERTAINMENT & LEISURE ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 24 ENTERTAINMENT & LEISURE ROBOTS: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 25 HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 26 HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 27 ONLINE: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 ONLINE: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 OFFLINE: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 OFFLINE: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 32 HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 34 HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 35 VACUUMING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 VACUUMING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 VACUUMING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 38 VACUUMING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 39 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 41 EUROPE: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 42 EUROPE: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATION, BY COUNTRY, 2019–2022(USD MILLION)

- TABLE 44 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 45 ROW: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 ROW: HOUSEHOLD ROBOTS MARKET FOR VACUUMING APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 LAWN MOWING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 LAWN MOWING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 LAWN MOWING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 50 LAWN MOWING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 51 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 53 EUROPE: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 54 EUROPE: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 56 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 57 ROW: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 ROW: HOUSEHOLD ROBOTS MARKET FOR LAWN MOWING APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 POOL CLEANING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 POOL CLEANING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 POOL CLEANING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 62 POOL CLEANING: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 63 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 EUROPE: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 66 EUROPE: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 67 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 68 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 69 ROW: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 ROW: HOUSEHOLD ROBOTS MARKET FOR POOL CLEANING APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 COMPANIONSHIP: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 COMPANIONSHIP: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 COMPANIONSHIP: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 74 COMPANIONSHIP: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 75 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 77 EUROPE: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 78 EUROPE: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 ROW: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP APPLICATION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 ROW: HOUSEHOLD ROBOTS MARKET FOR COMPANIONSHIP APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 ELDERLY ASSISTANCE AND HANDICAP SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 ELDERLY ASSISTANCE AND HANDICAP SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 ELDERLY ASSISTANCE AND HANDICAP SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 86 ELDERLY ASSISTANCE AND HANDICAP SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 87 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 90 EUROPE: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 ROW: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS APPLICATION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 ROW: HOUSEHOLD ROBOTS MARKET FOR ELDERLY ASSISTANCE AND HANDICAP SYSTEMS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 ROBOT TOYS AND HOBBY SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 ROBOT TOYS AND HOBBY SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 ROBOT TOYS AND HOBBY SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 98 ROBOT TOYS AND HOBBY SYSTEMS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 99 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 EUROPE: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS APPLICATION, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS APPLICATION, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 ROW: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS APPLICATION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 106 ROW: HOUSEHOLD ROBOTS MARKET FOR ROBOT TOYS AND HOBBY SYSTEMS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 OTHER APPLICATIONS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 108 OTHER APPLICATIONS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 OTHER APPLICATIONS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 110 OTHER APPLICATIONS: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 111 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: HOUSEHOLD ROBOTS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 114 EUROPE: HOUSEHOLD ROBOTS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 ROW: HOUSEHOLD ROBOTS MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 118 ROW: HOUSEHOLD ROBOTS MARKET FOR OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 119 HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 120 HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 121 HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 122 HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 123 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 124 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 126 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 128 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 129 EUROPE: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 130 EUROPE: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 131 EUROPE HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 132 EUROPE: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 EUROPE: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 134 EUROPE: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 141 ROW: HOUSEHOLD ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 142 ROW: HOUSEHOLD ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 143 ROW: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 144 ROW: HOUSEHOLD ROBOTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 145 ROW: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2019–2022 (USD MILLION)

- TABLE 146 ROW: HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

- TABLE 147 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 148 HOUSEHOLD ROBOTS MARKET: INTENSITY OF COMPETITION RIVALRY

- TABLE 149 KEY PLAYER RANKING

- TABLE 150 COMPANY FOOTPRINT, BY TYPE (20 COMPANIES)

- TABLE 151 COMPANY FOOTPRINT, BY APPLICATION (20 COMPANIES)

- TABLE 152 COMPANY FOOTPRINT, BY REGION (20 COMPANIES)

- TABLE 153 COMPANY PRODUCT FOOTPRINT

- TABLE 154 HOUSEHOLD ROBOTS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 155 HOUSEHOLD ROBOTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 156 HOUSEHOLD ROBOTS MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 157 HOUSEHOLD ROBOTS MARKET: DEALS, 2021–2023

- TABLE 158 IROBOT CORPORATION: COMPANY OVERVIEW

- TABLE 159 IROBOT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 IROBOT CORPORATION: PRODUCT LAUNCHES

- TABLE 161 IROBOT CORPORATION: DEALS

- TABLE 162 ECOVACS: BUSINESS OVERVIEW

- TABLE 163 ECOVACS: PRODUCT LAUNCHES

- TABLE 164 ECOVACS: DEALS

- TABLE 165 XIAOMI: BUSINESS OVERVIEW

- TABLE 166 XIAOMI: PRODUCT LAUNCHES

- TABLE 167 MAYTRONICS.: BUSINESS OVERVIEW

- TABLE 168 MAYTRONICS: DEALS

- TABLE 169 SAMSUNG: BUSINESS OVERVIEW

- TABLE 170 SAMSUNG: PRODUCT LAUNCHES

- TABLE 171 NEATO ROBOTICS, INC.: BUSINESS OVERVIEW

- TABLE 172 NEATO ROBOTICS, INC.: PRODUCT LAUNCHES

- TABLE 173 DYSON: BUSINESS OVERVIEW

- TABLE 174 DYSON: DEALS

- TABLE 175 LG ELECTRONICS INC.: BUSINESS OVERVIEW

- TABLE 176 LG ELECTRONICS INC.: DEALS

- TABLE 177 LEGO SYSTEM A/S: BUSINESS OVERVIEW

- TABLE 178 LEGO SYSTEM A/S: DEALS

- TABLE 179 HAYWARD HOLDINGS, INC.: BUSINESS OVERVIEW

- TABLE 180 HAYWARD HOLDINGS, INC.: PRODUCT LAUNCHES

- TABLE 181 HAYWARD HOLDINGS, INC.: DEALS

- FIGURE 1 PROCESS FLOW: HOUSEHOLD ROBOTS MARKET SIZE ESTIMATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 APPROACH USED TO CAPTURE HOUSEHOLD ROBOTS MARKET SIZE FROM SUPPLY SIDE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 IMPACT OF RECESSION ON HOUSEHOLD ROBOTS MARKET, 2019–2028 (USD MILLION)

- FIGURE 8 PRODUCTS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 DOMESTIC ROBOTS SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 10 VACUUMING SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 11 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 INCREASING DEMAND FOR ROBOTIC VACUUMS TO DRIVE GROWTH OF HOUSEHOLD ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 13 DOMESTIC SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 14 VACUUMING SEGMENT AND CHINA TO ACHIEVE SIGNIFICANT GROWTH BY 2028

- FIGURE 15 MIDDLE EAST & AFRICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 HOUSEHOLD ROBOTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 GROWING ELDERLY POPULATION (65 YEARS & ABOVE) IN US, 1900–2060

- FIGURE 18 REVENUE SHIFT IN HOUSEHOLD ROBOTS MARKET

- FIGURE 19 AVERAGE SELLING PRICE OF HOUSEHOLD ROBOTS FOR TOP 3 PRODUCTS (KEY PLAYER)

- FIGURE 20 AVERAGE PRICE TRENDS OF HOUSEHOLD ROBOTS, 2022–2028

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED AT R&D AND MANUFACTURING STAGES

- FIGURE 22 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 23 NUMBER OF PATENTS GRANTED ANNUALLY, 2012–2022

- FIGURE 24 IMPORT DATA, BY COUNTRY, 2019−2022 (USD THOUSAND)

- FIGURE 25 EXPORT DATA, BY COUNTRY, 2019−2022 (USD THOUSAND)

- FIGURE 26 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 29 HOUSEHOLD ROBOTS MARKET, BY OFFERING

- FIGURE 30 PRODUCTS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 31 HOUSEHOLD ROBOTS MARKET, BY TYPE

- FIGURE 32 DOMESTIC SEGMENT TO LEAD MARKET BY 2028

- FIGURE 33 HOUSEHOLD ROBOTS MARKET, BY DISTRIBUTION CHANNEL

- FIGURE 34 ONLINE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 35 HOUSEHOLD ROBOTS MARKET, BY APPLICATION

- FIGURE 36 VACUUMING SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 37 HOUSEHOLD ROBOTS MARKET: REGIONAL ANALYSIS

- FIGURE 38 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: HOUSEHOLD ROBOTS MARKET, BY COUNTRY

- FIGURE 40 NORTH AMERICAN HOUSEHOLD ROBOTS MARKET SNAPSHOT

- FIGURE 41 EUROPE: HOUSEHOLD ROBOTS MARKET, BY COUNTRY

- FIGURE 42 EUROPEAN HOUSEHOLD ROBOTS MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: HOUSEHOLD ROBOTS MARKET, BY COUNTRY

- FIGURE 44 ASIA PACIFIC HOUSEHOLD ROBOTS MARKET SNAPSHOT

- FIGURE 45 HOUSEHOLD ROBOTS MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020–2022

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 47 HOUSEHOLD ROBOTS MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 48 HOUSEHOLD ROBOTS MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 49 IROBOT CORPORATION.: COMPANY SNAPSHOT

- FIGURE 50 ECOVACS: COMPANY SNAPSHOT

- FIGURE 51 XIAOMI: COMPANY SNAPSHOT

- FIGURE 52 MAYTRONICS: COMPANY SNAPSHOT

- FIGURE 53 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 54 LG ELECTRONICS INC.: COMPANY SNAPSHOT

- FIGURE 55 HAYWARD HOLDINGS, INC.: COMPANY SNAPSHOT

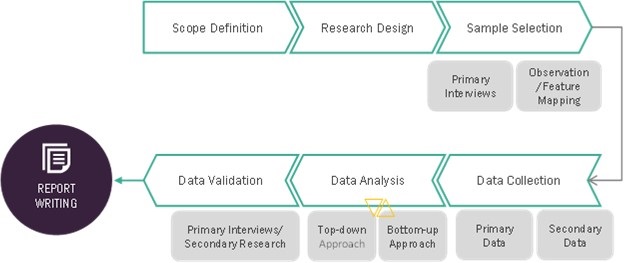

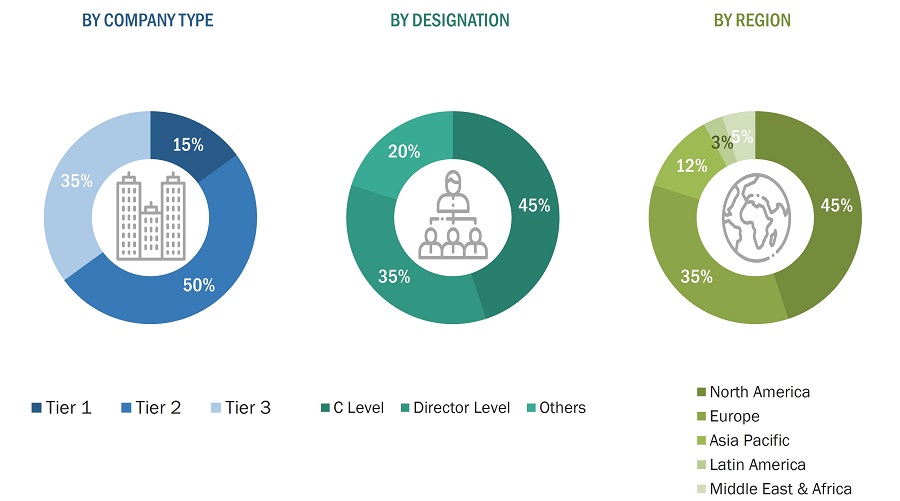

The study involved four major activities in estimating the size of the household robots market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Secondary sources that were referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles from recognized authors; directories; and databases. Secondary data was collected and analyzed to arrive at the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after understanding and analyzing the household robots market scenario through the secondary research process. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Asia Pacific, Europe, and RoW (including the Middle East & Africa and South America).

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, both the top-down and bottom-up approaches were used to estimate and validate the household robots market size along with the size of various other dependent submarkets. The key players in the household robots market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research processes. This entire research methodology includes the study of annual and financial reports of top players, as well as interviews with experts such as CEOs, VPs, directors, and marketing executives to obtain key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets, and finally, the data was presented in this report.

This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

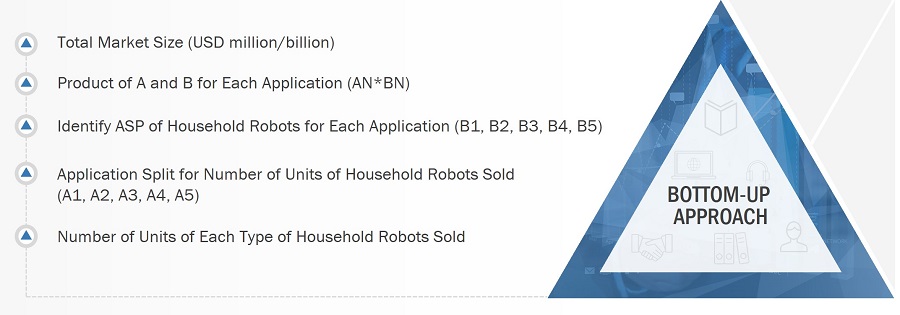

Market Size Estimation Methodology-Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the household robots market from the shipment. The overall market size was calculated by adding the revenues derived by multiplying the average selling prices of all the household robots by their respective shipments.

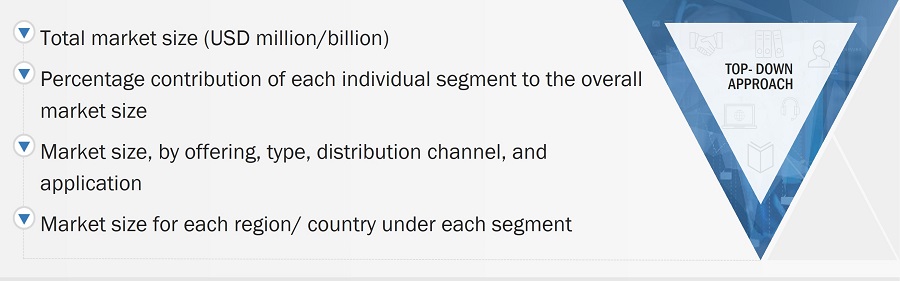

Market Size Estimation Methodology-Top-Down Approach

In top-down approach the overall market size was used to estimate the size of the individual market through percentage split from secondary and primary research.

For the calculation of specific market segments the most appropriate immediate parent market size was used to implement the top-down approach.

The market share of each company in the household robots market was estimated to verify the revenue share used earlier in the bottom-up approach. The overall parent market size and individual market size were determined and confirmed in this study through the data triangulation procedure and the validation of the data through primaries.

Data Triangulation

After arriving at the overall market size through the process explained earlier, the total market was split into several segments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market was validated using both the top-down and bottom-up approaches.

Market Definition

Household robots, also known as home or domestic robots, are essentially programmable computers integrated with electrically powered machines that perform household chores. They typically have some capacity for movement, either for moving themselves or manipulating objects, or both. Home robots differ from appliances (dishwashers, for example) or even internet-connected appliances since they do all the work as opposed to simply making a task easier. These labor-saving devices not only allow people to perform multiple tasks in less time but also assist disabled or elderly people if required. Service robots, when integrated with technologies such as artificial intelligence (AI) and the Internet of Things (IoT), can perform mundane household tasks. Service robots, which are specifically adapted for performing household tasks are termed household robots.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End-users who want to know more about the technology and the latest technological developments in the industry

Report Objectives

- To describe, segment, and forecast the household robots market, by offering, type, distribution channel, and application, in terms of value

- To describe, segment, and forecast the household robots market, by type and application, in terms of volume

- To describe and forecast the market for various segments by region—North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges that influence the growth of the household robots market

- To provide a detailed overview of the value chain pertaining to the household robot ecosystem

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall household robots market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the household robots market

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as acquisitions, product launches and developments, and research and developments in the household robots market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Household Robots Market