High-speed Data Converter Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Analog-to-digital Converter, and Digital-to-analog Converter), Frequency Band (<125 MSPS, 125 MSPS to 1 GSPS, and >1 GSPS), Application (Communications, Test & Measurement) and Region - Global Forecast to 2028

Updated on : October 23, 2024

High-speed Data Converter Market Size & Growth

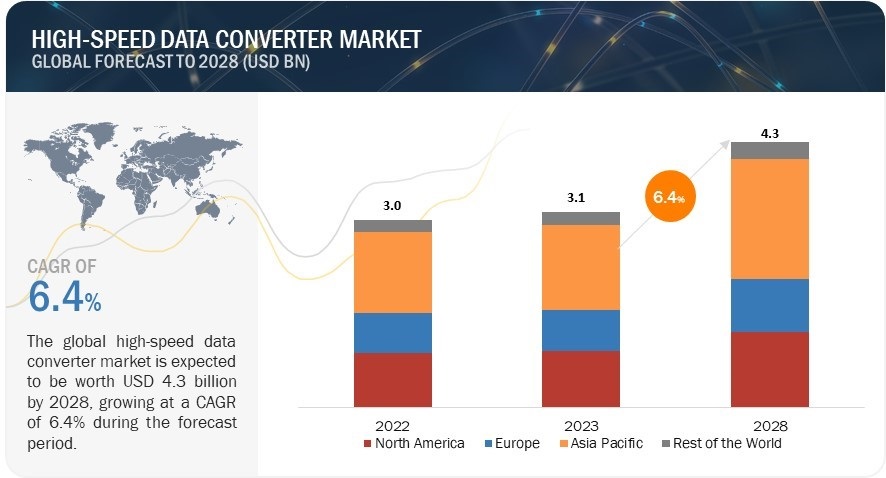

The High-Speed Data Converter Market size was valued at USD 3.0 billion in 2022 and is projected to reach USD 4.3 billion by 2028; growing at a CAGR of 6.4% during the forecast period from 2023 to 2028.

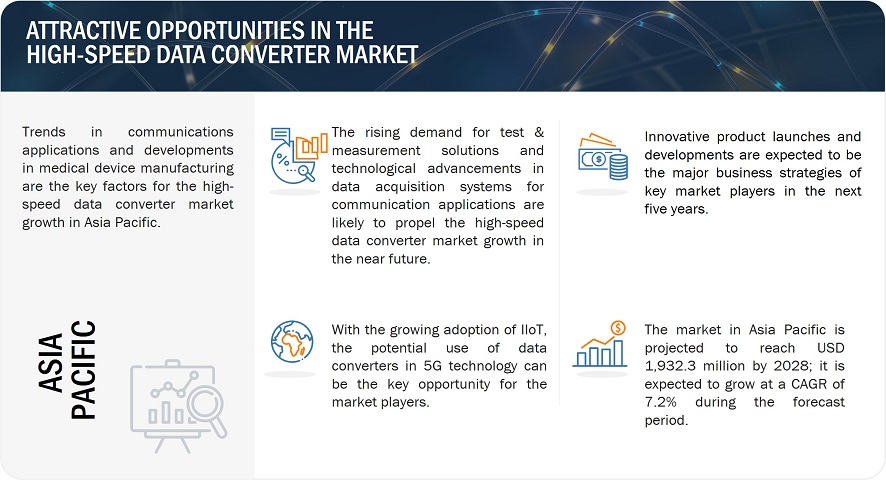

potential use of high-speed data converters in developing advanced 5G infrastructure, rapid adoption of IoT devices and data consumption creates lucrative opportunities whereas integration of RF data converters into FPGA and system-on-chip (SoC), and high development cost are major restraint for the growth of the high-speed data converter market.

High-speed Data Converter Market Size Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

High-speed Data Converter Market Trends and Dynamics:

Driver: Rising demand for test & measurement solutions by end users

Advanced modulation and antenna techniques have improved the data services and voice quality in communications sector. Various networking components such as routers, repeaters, and connectors are thoroughly tested which requires test & measurement instruments, such as RF signal analysis equipment, logic analyzers, signal generators, cable testers, and network analyzers. These equipments widely uses analog-to-digital converters and digital-to-analog converters for signal conversions. This increasing use of analog-to-digital converters and digital-to-analog converters in communication testing equipment is driving the high-speed data converter market. Similarly in industrial sector, the test & measurement equipments are used to measure and monitor various parameters such as quality of product and safety, current, voltage, frequency signal, pressure, and temperature by mobile device manufacturers, network equipment manufacturers and telecom service providers. Thus, the rising demand for test & measurement equipment drives the growth of the high-speed data converter market.

Restraint: High development cost

The development of high-speed data converter is a complex and expensive process, requiring significant investments in research and development. This is due to the need for advanced semiconductor technologies, sophisticated circuit design techniques, and rigorous testing and characterization methodologies to ensure high performance and reliability.

High-speed data converters require the use of cutting-edge semiconductor technologies, such as FinFETs and advanced CMOS processes, which are expensive to develop and manufacture, designing high-speed and high-performance data converters is a complex and time-consuming process, requiring expertise in analog and digital circuit design, as well as signal processing and error correction techniques. High-speed data converters must undergo rigorous testing and characterization to ensure they meet stringent performance and reliability requirements. This testing involves specialized equipment and expertise, adding to the overall development costs.

The high development costs associated with high-speed data converters pose a significant restraint for the market, as they can hinder innovation and limit market entry for new players. However, as the demand for high-speed data conversion continues to grow, advancements in semiconductor technologies and design methodologies could lead to more cost-effective development processes, opening up new opportunities for the high-speed data converter market.

Opportunity: Rapid adoption of IoT devices and data consumption

IoT innovation is mostly focused on digital technology. From robust cloud servers running software to ever-smarter, edge-operating appliances in homes, businesses, and personal electronics. High-speed data converters are essential when working with digital systems interacting with real-time signals. These digital systems must be able to read real-world/time signals for the rapidly growing Internet of Things to reliably transmit vital information. Smart devices such as Alexa, smart wearables, and advanced cars constantly interact with users to provide critical information and perform voice commands. Since the adoption of devices is increasing rapidly, the need for high-speed data converters is also increasing as IoT devices require analog and digital data converters to communicate effectively with users. The exponential rise in data consumption, and the rising usage of IoT devices, are leading to the increased need for analog-to-digital converters (ADCs) and digital-to-analog converters (DACs), which provides lucrative market growth opportunities.

Challenges: Development of low-power consumption high-speed data converters

The high-speed data converter is an electronic circuit that converts the data from analog sensor nodes to the digital domain. During signal conversion, the high-speed data converter consumes large amounts of power. Several types of portable battery-operated equipment have limitations in terms of power capacity. It is one of the key challenges to providing greener designs of high-speed data converters with minimum power consumption.

The Development of low-power consumption high-speed data converters is a challenging task due to the inherent trade-off between power consumption and performance. High-speed data converters typically operate at high sampling rates and resolutions, which demand significant power to achieve the desired performance metrics. However, reducing power consumption is crucial for extending battery life in portable devices, minimizing heat generation in densely packed electronic systems, and improving overall energy efficiency. The packaging of high-speed data converter is critical for protecting the delicate circuitry and for providing electrical connections to the outside world. The packaging must also meet the environmental requirements of the application. Also, these data converters must be rigorously tested to ensure that they meet their performance specifications.

High-speed data converter market map:

High-speed Data Converter Market Segmentation

By frequency band, the >1 GSPS segment in the high-speed data converter market is expected to grow at the highest growth rate during the forecast period

The high-speed data converter market with a frequency band of >1 GSPS is expected to grow at the highest growth rate during the forecast period from 2023 to 2028. This is fueled by the rapid development of 5G and future generations of wireless communication, artificial intelligence and machine learning, high-performance computing, and advanced radar and imaging systems.

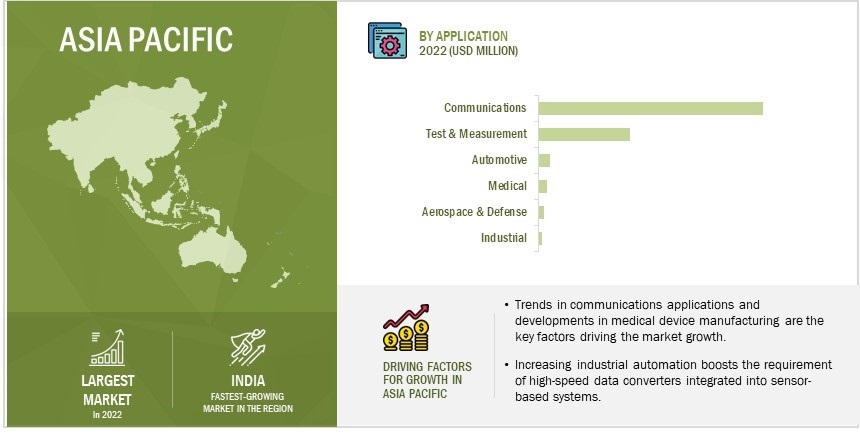

Communications segment account for the largest market share of the high-speed data converter market, by application, during the forecast period

The communications application is expected to hold the largest share of ~65% of the high-speed data converter market in 2022 and is expected to retain its position during the forecast period. Infrastructure manufacturers will likely focus more on research and development to create new and innovative products to fulfill the rising demand for high-speed communication channels. The upcoming 5G infrastructure is anticipated to create opportunities for the providers of high-speed data converters.

High-speed Data Converter Industry Regional Analysis

Asia Pacific region account for the largest market share of the high-speed data converter during forecast period

The high-speed data converter industry in Asia Pacific holds the largest market share and is expected to retain its position during the forecast period from 2023 to 2028, growing at the highest growth rate. Asia Pacific has a strong demand for communication systems, consumer equipment, and white goods. Furthermore, increasing industrial automation would enable the requirement of high-speed data converters integrated into sensor-based systems. Major high-speed data converter providers in the regions are Renesas Electronics Corporation (Japan), ROHM CO., LTD. (Japan), Corebai Microelectronics (Beijing) Co., Ltd. (China), and Atom Semiconductor Technologies Limited (China)

High-speed Data Converter Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top High-speed Data Converter Companies - Key Market Players

- Texas Instruments Incorporated (US);

- Analog Devices, Inc. (US);

- Infineon Technologies AG (Germany);

- Microchip Technology Inc. (US);

- STMicroelectronics (Switzerland);

- Teledyne Technologies Incorporated (US);

- ROHM CO., LTD. (Japan);

- Renesas Electronics Corporation (Japan);

- Synopsys, Inc. (US);

- ADSANTEC (US);

- IQ-ANALOG (US);

- Omni Design Technologies, Inc. (US);

- Corebai Microelectronics (Beijing) Co., Ltd. (China);

- Atom Semiconductor Technologies Limited (China);

- Data Device Corporation (US);

- Antelope Audio (US);

- Agile Analog Ltd. (UK);

- Rio Systems (Israel) are some key players operating in the High-speed Data Converter Companies.

High-speed Data Converter Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 3.0 billion in 2022 |

|

Expected Market Size |

USD 4.3 billion by 2028 |

|

Growth Rate |

CAGR of 6.4% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Million/Billion |

|

Segments Covered |

Type, Frequency Band, Application, and Region. |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies covered |

Some of the leading companies operating in the high-speed data converter market are Texas Instruments Incorporated (US); Analog Devices, Inc. (US); Infineon Technologies AG (Germany); Microchip Technology Inc. (US); STMicroelectronics (Switzerland); Teledyne Technologies Incorporated (US); ROHM CO., LTD. (Japan); Renesas Electronics Corporation (Japan); Synopsys, Inc. (US); ADSANTEC (US); IQ-ANALOG (US); Omni Design Technologies, Inc. (US); Corebai Microelectronics (Beijing) Co., Ltd. (China); Atom Semiconductor Technologies Limited (China); Data Device Corporation (US); Antelope Audio (US); Agile Analog Ltd. (UK); Rio Systems (Israel); Molex (US); TEWS Technologies GmbH (Germany); Numato Systems Private Limited (India); VadaTech (US); Vervesemi Microelectronics Pvt LTD (India); Alphacore Inc. (US); and Koheron (France). |

High-speed Data Converter Market Highlights

This research report categorizes the high-speed data converter market share based on Type, Frequency Band, Application, and Region.

|

Segment |

Subsegment |

|

By Type |

|

|

By Frequency Band |

|

|

By Application |

|

|

By Region |

|

Recent developments in High-speed Data Converter Industry

- In November 2023, Synopsys, Inc. (US) and the Indian Institute of Technology Bombay (IIT Bombay) (India) announced the inauguration of the Synopsys Semiconductor Lab for Virtual Fab Solutions at IIT Bombay as part of the Department of Electrical Engineering under the Center for Semiconductor Technologies (SemiX). With the semiconductor industry facing a major talent shortage to meet anticipated future semiconductor demand, SemiX was established at IIT Bombay to provide an interdisciplinary platform for industry-focused research and education, entrepreneurship, and policy studies.

- In November 2023, ROHM CO., LTD. (Japan) announced the acquisition of the assets of Solar Frontier’s former Kunitomi Plant in Japan, based on its basic agreement signed with SOLAR FRONTIER K.K. (Japan). The plant will be operated by LAPIS Semiconductor Co., Ltd. (Japan), a subsidiary of the ROHM Group (Japan), as its Miyazaki Plant No. 2. During 2024, it aims to begin operations as the Group's primary production site for SiC power devices.

- In September 2023, Foxconn (Taiwan) partnered with STMicroelectronics (Switzerland) to establish a 40-nanometer chip plant in India.

Critical questions answered by this report:

What are the key strategies adopted by key companies in the high-speed data converter market share?

Product launches, acquisitions, and collaborations have been and continue to be some of the major strategies the key players adopted to grow in the high-speed data converter market.

What region dominates the high-speed data converter market share?

The Asia Pacific region will dominate the high-speed data converter market.

What application dominates the high-speed data converter market?

Communications applications are expected to dominate the high-speed data converter market.

Which frequency band segment dominates the high-speed data converter market share?

The <125 MSPS segment is expected to have the largest market size during the forecast period.

Who are the major high-speed data converter market companies?

Texas Instruments Incorporated (US), Analog Devices, Inc. (US), Teledyne Technologies Incorporated (US), Infineon Technologies AG (Germany), and Microchip Technology Inc. (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased use of T&M solutions in telecommunications and industrial sectors- Significant demand for high-resolution images in scientific and medical applications- Elevated demand for technologically advanced data acquisition systemsRESTRAINTS- Growing trend of integrating RF data converters into FPGA devices and systems-on-chip (SoCs)- Elevated costs associated with developing high-speed data convertersOPPORTUNITIES- Increasing focus on 5G infrastructure development- Surging adoption of IoT/connected devices and data-intensive applications in industrial environmentsCHALLENGES- Developing energy-efficient high-speed data converters

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY FREQUENCY BAND

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM MAPPING

-

5.7 TECHNOLOGY TRENDSRF INNOVATION FOR 5GFPGAS DESIGNED FOR DATA CONVERTERSMICROCONTROLLERS INTEGRATED WITH ADC, DAC, AND TEMPERATURE SENSORS FOR ANALOG AND DIGITAL SENSINGSTUDIO-QUALITY AUDIO FOR PLAYBACK MUSIC

-

5.8 CASE STUDY ANALYSISAMPHENOL ARDENT CONCEPTS (US) OFFERED TELECOM COMPANY 12-CHANNEL TR CONNECTOR TO REDUCE TEST SETUP TIMEDATANG MOBILE ADOPTED ADI'S HIGH-SPEED-QUAD DACS TO ENSURE HIGH PERFORMANCE IN SMALL FORM FACTOR WIRELESS BASE STATIONS

-

5.9 PATENT ANALYSISKEY PATENTS

-

5.10 TRADE (HS CODE 854231) AND TARIFF ANALYSESTRADE ANALYSIS- Trade data for HS code 854231TARIFF ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2024

-

5.12 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.13 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ANALOG-TO-DIGITAL CONVERTERGROWING ADOPTION OF DATA ACQUISITION SYSTEMS TO FUEL MARKET GROWTH

-

6.3 DIGITAL-TO-ANALOG CONVERTERHIGH ADOPTION OF ENTERTAINMENT SYSTEMS TO CONTRIBUTE TO MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 <125 MSPSRISING ADOPTION OF AUTOMATION TO ACCELERATE SEGMENTAL GROWTH

-

7.3 125 MSPS TO 1 GSPSHIGH DEMAND FOR WIRELESS COMMUNICATION TECHNOLOGY TO SUPPORT MARKET GROWTH

-

7.4 >1 GSPSSTRONG FOCUS ON COMMERCIALIZATION OF 5G TO BOOST DEMAND

- 8.1 INTRODUCTION

-

8.2 COMMUNICATIONSINCREASING INVESTMENTS IN 5G INFRASTRUCTURE DEVELOPMENT TO BOOST DEMAND

-

8.3 TEST & MEASUREMENTSURGING USE OF T&M INSTRUMENTS WITH HEIGHTENED FOCUS ON PRODUCT QUALITY IMPROVEMENT TO ELEVATE DEMAND

-

8.4 AUTOMOTIVEACCELERATING TREND OF IN-CAR INFOTAINMENT SYSTEMS TO FUEL MARKET GROWTH

-

8.5 MEDICALGROWING ADOPTION OF ADVANCED IMAGING AND MONITORING DEVICES BY MEDICAL PROFESSIONALS TO SUPPORT MARKET GROWTH

-

8.6 AEROSPACE & DEFENSEINCREASING DEMAND FOR RADAR AND SATELLITE COMMUNICATION SYSTEMS TO STIMULATE MARKET GROWTH

-

8.7 INDUSTRIALELEVATING ADOPTION OF M2M COMMUNICATION AND IOT TECHNOLOGIES TO CONTRIBUTE TO MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAIMPACT OF RECESSION ON HIGH-SPEED DATA CONVERTER MARKET IN NORTH AMERICAUS- Requirement for data acquisition systems in various industries to increase demand for high-speed data convertersCANADA- Increasing demand for communication technologies and broadband services to drive marketMEXICO- Digital monitoring solutions to create demand for high-speed data converters

-

9.3 EUROPEIMPACT OF RECESSION ON HIGH-SPEED DATA CONVERTER MARKET IN EUROPEGERMANY- Rising demand for in-building solutions to drive marketUK- Strong communication infrastructure to increase demand for high-speed data convertersFRANCE- Growing penetration of IoT in industrial sector to propel marketITALY- Government initiatives to promote semiconductor manufacturing to support market growthREST OF EUROPE

-

9.4 ASIA PACIFICIMPACT OF RECESSION ON HIGH-SPEED DATA CONVERTER MARKET IN ASIA PACIFICCHINA- Growing adoption of electronics and infotainment systems in automotive segment to drive marketJAPAN- Developed industrial infrastructure to boost demand for high-speed data convertersINDIA- Deployment of 5G communication infrastructure to propel marketREST OF ASIA PACIFIC

-

9.5 ROWIMPACT OF RECESSION ON HIGH-SPEED DATA CONVERTER MARKET IN ROWSOUTH AMERICA- Increasing demand for connected devices and medical equipment to drive marketGCC COUNTRIES- Growing investments in networking infrastructure to support market growthREST OF MIDDLE EAST & AFRICA- Rising adoption of IIoT by oil and gas companies to fuel market growth

-

10.1 OVERVIEWINTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT ANALYSIS

-

10.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKINGSTART-UP/SME FOOTPRINT

-

10.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHES/DEVELOPMENTSDEALS

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSANALOG DEVICES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTEXAS INSTRUMENTS INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINFINEON TECHNOLOGIES AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROCHIP TECHNOLOGY INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTELEDYNE TECHNOLOGIES INCORPORATED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSTMICROELECTRONICS- Business overview- Products/Solutions/Services offered- Recent developmentsRENESAS ELECTRONICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsROHM CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsSYNOPSYS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsADSANTEC- Business overview- Product/Solutions/Services offered

-

11.3 OTHER PLAYERSIQ-ANALOGOMNI DESIGN TECHNOLOGIES, INC.COREBAI MICROELECTRONICS (BEIJING) CO., LTD.ATOM SEMICONDUCTOR TECHNOLOGIES LIMITEDDATA DEVICE CORPORATIONANTELOPE AUDIOAGILE ANALOG LTD.RIO SYSTEMSMOLEXTEWS TECHNOLOGIES GMBHNUMATO SYSTEMS PRIVATE LIMITEDVADATECHVERVESEMI MICROELECTRONICS PVT LTDALPHACORE INC.KOHERON

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 HIGH-SPEED DATA CONVERTER MARKET, 2019–2028 (MILLION UNITS)

- TABLE 2 ROLE OF PLAYERS IN HIGH-SPEED DATA CONVERTER ECOSYSTEM

- TABLE 3 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- TABLE 4 LIST OF MAJOR PATENTS IN MARKET

- TABLE 5 MFN TARIFFS FOR HS CODE 854231-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 6 MFN TARIFFS FOR HS CODE 854231-COMPLIANT PRODUCTS EXPORTED BY SINGAPORE

- TABLE 7 MFN TARIFFS FOR HS CODE 854231-COMPLIANT PRODUCTS EXPORTED BY REPUBLIC OF KOREA

- TABLE 8 LIST OF MAJOR CONFERENCES AND EVENTS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 CODES AND STANDARDS RELATED TO HIGH-SPEED DATA CONVERTERS

- TABLE 14 IMPACT OF PORTER'S FIVE FORCES ON MARKET

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA, BY TOP 3 APPLICATIONS

- TABLE 17 HIGH-SPEED DATA CONVERTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 18 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 19 ANALOG-TO-DIGITAL CONVERTER: MARKET, BY FREQUENCY BAND, 2019–2022 (USD MILLION)

- TABLE 20 ANALOG-TO-DIGITAL CONVERTER: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 21 ANALOG-TO-DIGITAL CONVERTER: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 22 ANALOG-TO-DIGITAL CONVERTER: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 ANALOG-TO-DIGITAL CONVERTER: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 ANALOG-TO-DIGITAL CONVERTER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 DIGITAL-TO-ANALOG CONVERTER: MARKET, BY FREQUENCY BAND, 2019–2022 (USD MILLION)

- TABLE 26 DIGITAL-TO-ANALOG CONVERTER: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 27 DIGITAL-TO-ANALOG CONVERTER: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 28 DIGITAL-TO-ANALOG CONVERTER: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 29 DIGITAL-TO-ANALOG CONVERTER: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 DIGITAL-TO-ANALOG CONVERTER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 HIGH-SPEED DATA CONVERTER MARKET, BY FREQUENCY BAND, 2019–2022 (USD MILLION)

- TABLE 32 MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 33 <125 MSPS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 34 <125 MSPS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 35 125 MSPS TO 1 GSPS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 36 125 MSPS TO 1 GSPS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 >1 GSPS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 38 >1 GSPS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 39 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 40 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 41 COMMUNICATIONS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 42 COMMUNICATIONS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 COMMUNICATIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 COMMUNICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 TEST & MEASUREMENT: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 46 TEST & MEASUREMENT: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 47 TEST & MEASUREMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 TEST & MEASUREMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 AUTOMOTIVE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 50 AUTOMOTIVE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 51 AUTOMOTIVE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 AUTOMOTIVE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MEDICAL: HIGH-SPEED DATA CONVERTER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 54 MEDICAL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 MEDICAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 MEDICAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 AEROSPACE & DEFENSE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 58 AEROSPACE & DEFENSE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 AEROSPACE & DEFENSE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 AEROSPACE & DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 INDUSTRIAL: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 62 INDUSTRIAL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 63 INDUSTRIAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 INDUSTRIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 HIGH-SPEED DATA CONVERTER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 74 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 77 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 78 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: HIGH-SPEED DATA CONVERTER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 ROW: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 88 ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 ROW: MARKET, BY GEOGRAPHY, 2019–2022 (USD MILLION)

- TABLE 90 ROW: MARKET, BY GEOGRAPHY, 2023–2028 (USD MILLION)

- TABLE 91 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HIGH-SPEED DATA CONVERTER MARKET

- TABLE 92 MARKET: DEGREE OF COMPETITION

- TABLE 93 MARKET: RANKING ANALYSIS

- TABLE 94 COMPANY APPLICATION FOOTPRINT (17 COMPANIES)

- TABLE 95 COMPANY REGION FOOTPRINT (17 COMPANIES)

- TABLE 96 COMPANY OVERALL FOOTPRINT (17 COMPANIES)

- TABLE 97 HIGH-SPEED DATA CONVERTER MARKET: LIST OF KEY START-UPS/SMES

- TABLE 98 START-UP/SME APPLICATION FOOTPRINT (8 COMPANIES)

- TABLE 99 START-UP/SME REGION FOOTPRINT (8 COMPANIES)

- TABLE 100 START-UP/SME OVERALL FOOTPRINT

- TABLE 101 MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021–2022

- TABLE 102 DEALS, 2021–2023

- TABLE 103 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 104 ANALOG DEVICES, INC.: PRODUCTS OFFERED

- TABLE 105 ANALOG DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 106 ANALOG DEVICES, INC.: DEALS

- TABLE 107 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 108 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS OFFERED

- TABLE 109 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 110 TEXAS INSTRUMENTS INCORPORATED: DEALS

- TABLE 111 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 112 INFINEON TECHNOLOGIES AG: PRODUCTS OFFERED

- TABLE 113 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 114 INFINEON TECHNOLOGIES AG: OTHERS

- TABLE 115 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 116 MICROCHIP TECHNOLOGY INC.: PRODUCTS OFFERED

- TABLE 117 MICROCHIP TECHNOLOGY INC.: OTHERS

- TABLE 119 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

- TABLE 121 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 122 STMICROELECTRONICS: PRODUCTS OFFERED

- TABLE 123 STMICROELECTRONICS: DEALS

- TABLE 124 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 125 RENESAS ELECTRONICS CORPORATION: PRODUCTS OFFERED

- TABLE 126 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 127 ROHM CO., LTD.: COMPANY OVERVIEW

- TABLE 128 ROHM CO., LTD.: PRODUCTS OFFERED

- TABLE 129 ROHM CO., LTD.: DEALS

- TABLE 130 SYNOPSYS, INC.: COMPANY OVERVIEW

- TABLE 131 SYNOPSYS, INC.: PRODUCTS OFFERED

- TABLE 132 SYNOPSYS, INC.: DEALS

- TABLE 133 ADSANTEC: COMPANY OVERVIEW

- TABLE 134 ADSANTEC: PRODUCTS OFFERED

- FIGURE 1 HIGH-SPEED DATA CONVERTER MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ANALOG-TO-DIGITAL CONVERTERS TO RECORD HIGHER CAGR FROM 2023 TO 2028

- FIGURE 8 >1 GSPS SEGMENT TO RECORD HIGHEST CAGR IN MARKET, BY FREQUENCY BAND, FROM 2023 TO 2028

- FIGURE 9 AUTOMOTIVE SEGMENT TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC CAPTURED LARGEST SHARE OF MARKET IN 2022

- FIGURE 11 RISING DEMAND FOR HIGH-SPEED DATA CONVERTERS IN COMMUNICATIONS APPLICATIONS TO DRIVE MARKET

- FIGURE 12 <125 MSPS FREQUENCY BAND TO ACCOUNT FOR LARGEST SHARE OF MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 13 ANALOG-TO-DIGITAL CONVERTERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 CHINA AND COMMUNICATIONS APPLICATIONS TO HOLD LARGEST SHARE OF MARKET IN ASIA PACIFIC IN 2028

- FIGURE 15 COMMUNICATIONS APPLICATIONS TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 17 HIGH-SPEED DATA CONVERTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 IMPACT ANALYSIS OF DRIVERS ON MARKET

- FIGURE 19 IMPACT ANALYSIS OF RESTRAINTS ON MARKET

- FIGURE 20 IMPACT ANALYSIS OF OPPORTUNITIES ON MARKET

- FIGURE 21 IMPACT ANALYSIS OF CHALLENGES ON MARKET

- FIGURE 22 TRENDS INFLUENCING HIGH-SPEED DATA CONVERTER BUSINESS OWNERS

- FIGURE 23 AVERAGE SELLING PRICE OF HIGH-SPEED DATA CONVERTERS, BY FREQUENCY BAND, 2019–2028 (USD)

- FIGURE 24 HIGH-SPEED DATA CONVERTER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 HIGH-SPEED DATA CONVERTER ECOSYSTEM ANALYSIS

- FIGURE 26 TOP 10 PATENT APPLICANTS IN LAST 10 YEARS

- FIGURE 27 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- FIGURE 28 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 854231, BY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 854231, BY COUNTRY, 2018−2022 (USD THOUSAND)

- FIGURE 30 MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 33 MARKET, BY TYPE

- FIGURE 34 ANALOG-TO-DIGITAL CONVERTERS TO RECORD HIGHER CAGR FROM 2023 TO 2028

- FIGURE 35 BLOCK DIAGRAM OF ADC INPUT AND OUTPUT

- FIGURE 36 BLOCK DIAGRAM OF DAC INPUT AND OUTPUT

- FIGURE 37 MARKET, BY FREQUENCY BAND

- FIGURE 38 MARKET FOR HIGH-SPEED DATA CONVERTERS WITH FREQUENCY BAND OF >1 GSPS TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 39 MARKET, BY APPLICATION

- FIGURE 40 COMMUNICATIONS APPLICATIONS TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 41 HIGH-SPEED DATA CONVERTER MARKET, BY REGION

- FIGURE 42 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: MARKET, BY COUNTRY

- FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 45 ANALYSIS OF MARKET IN NORTH AMERICA: PRE- AND POST-RECESSION SCENARIOS

- FIGURE 46 EUROPE: MARKET, BY COUNTRY

- FIGURE 47 EUROPE: MARKET SNAPSHOT

- FIGURE 48 ANALYSIS OF MARKET IN EUROPE: PRE- AND POST-RECESSION SCENARIOS

- FIGURE 49 ASIA PACIFIC: MARKET, BY COUNTRY

- FIGURE 50 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 51 ANALYSIS OF MARKET IN ASIA PACIFIC: PRE- AND POST-RECESSION SCENARIOS

- FIGURE 52 ROW: MARKET, BY GEOGRAPHY

- FIGURE 53 ANALYSIS OF HIGH-SPEED DATA CONVERTER MARKET IN ROW: PRE- AND POST-RECESSION SCENARIOS

- FIGURE 54 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET, 2020–2022

- FIGURE 55 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 56 MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 57 MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 58 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 59 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 60 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 61 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 62 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 63 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 64 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 ROHM CO., LTD.: COMPANY SNAPSHOT

- FIGURE 66 SYNOPSYS, INC.: COMPANY SNAPSHOT

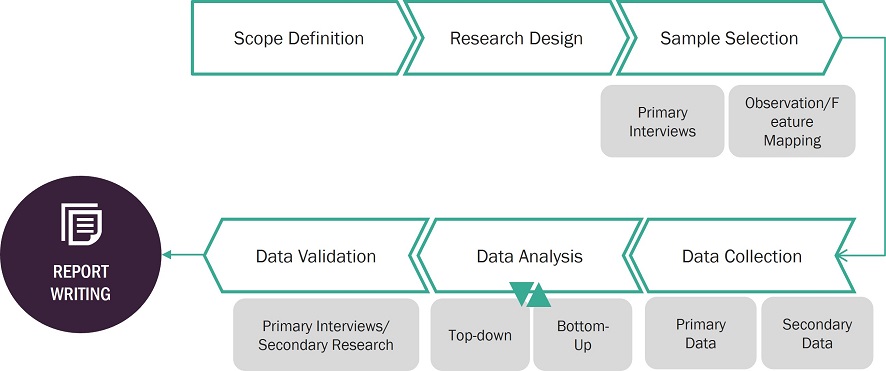

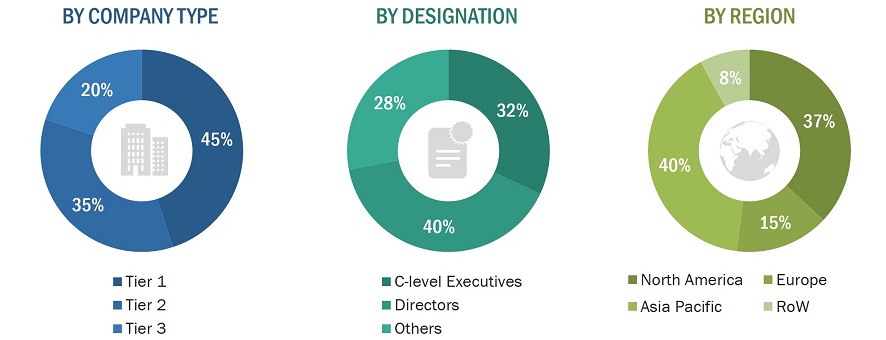

The study involved four major activities in estimating the current size of the high-speed data converter market—exhaustive secondary research collected information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. These secondary sources include high-speed data converter technology journals and magazines, annual reports, press releases, investor presentations of companies, white papers, certified publications and articles from recognized authors, and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

Various primary sources from both supply and demand sides have been interviewed in the primary research process to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the high-speed data converter market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

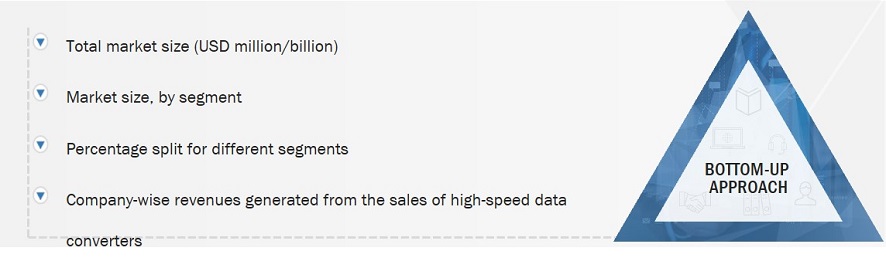

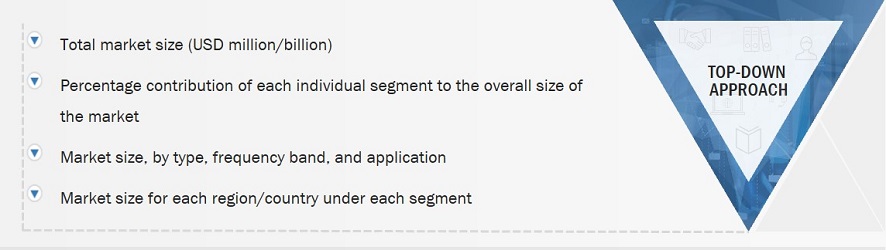

In the complete market estimation process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the high-speed data converter market and other dependent submarkets listed in this report.

- Extensive secondary research has identified key players in the industry and market.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

High-Speed Data Converter Market: Bottom-Up Approach

High-Speed Data Converter Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments and subsegments. The data has been triangulated by studying several factors and trends identified from both the demand and supply sides.

Market Definition

A high-speed data converter is an electronic circuit that converts a signal into a digital or an analog form based on the requirement of the application. It operates at a sampling rate of 10 MSPS to multi-GSPS. These types of converters are highly used for communications applications due to their ability to convert analog signals to a digital form, or vice versa, at high speed and resolution. High-speed data converters are of two types: analog-to-digital converter (ADC) and digital-to-analog converter (DAC).

Key Stakeholders

- Data Converter Manufacturers

- Integrated Device Manufacturers (IDMs)

- Data Converter IP Providers

- Communication Technology, Service, And Solution Providers

- Technology Investors

- Research Institutes and Organizations

Report Objectives

The following are the primary objectives of the study.

- To forecast the size of the high-speed data converter market based on type, application, frequency band, and region, in terms of value

- To describe and forecast the market for various segments across four main regions: North America, Asia Pacific, Europe, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the high-speed data converter market landscape

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities in the market for the stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and provide a detailed competitive landscape of the high-speed data converter market

- To analyze strategic approaches adopted by the leading players in the high-speed data converter market, including product launches/developments and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in High-speed Data Converter Market