Healthcare Analytical Testing Services Market Size by Type (Biomarker Testing, Stability Testing, Raw Material Testing, Batch-release Testing, Cleaning Validation), End User (Pharmaceutical Companies, Medical Device Companies) & Region - Global Forecast to 2029

The global size of healthcare analytical testing services market in terms of revenue was estimated to be worth $7.4 billion in 2024 and is poised to reach $12.6 billion by 2029, growing at a CAGR of 11.2% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. This notable growth driven by various factors.

The growing market for healthcare analytical testing services is driven by various factors. There is a rising demand across industries for services ensuring quality assurance and regulatory compliance. Additionally, the pursuit of precise analytical techniques presents opportunities for service providers, while governmental initiatives support investment and innovation. These efforts collectively contribute to the global expansion of the market. Moreover, outsourcing strategies driven by cost-effectiveness and the evolving pharmaceutical landscape further stimulate market growth. Additionally, expanding into new markets amplifies the need for tailored testing solutions, thereby increasing demand for healthcare analytical testing services. The evolving regulatory landscape, the imperative to avoid impractical investments, and the necessity to minimize the risk of product recalls are significant drivers for the Healthcare analytical testing services market.

Healthcare Analytical Testing Services Market Size, Dynamics & Ecosystem

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare analytical testing services Industry Dynamics

Driver: Changing regulatory landscape and the increasing complexity of products to drive the market

The growth of the market in healthcare is propelled by changing regulatory mandates and the increasing complexity of healthcare products. Regulatory agencies enforce stringent standards for pharmaceuticals, medical devices, and other healthcare products, necessitating comprehensive testing to ensure compliance. Additionally, advancements in medical technology have led to the development of complex drugs, biologics, and medical devices, requiring sophisticated analytical techniques for characterization and quality assurance. These factors drive the demand for healthcare analytical testing services in the healthcare industry, contributing to market growth.

Rising number of Clinical Trials

The rise in clinical trials is a significant driver behind the growth of the market. As pharmaceutical, biopharmaceutical, and medical device companies continue to innovate and develop new products, the demand for healthcare analytical testing services surges. Clinical trials are crucial stages in the development and approval process of new drugs and medical devices. These trials require rigorous testing to ensure safety, efficacy, and regulatory compliance. Healthcare analytical testing services play a pivotal role in conducting various tests, including bioanalytical, pharmacokinetic, and biomarker testing, among others. The increasing number of clinical trials globally, fueled by advancements in medical research and the quest for novel treatments, directly translates to a higher demand for healthcare analytical testing services. Moreover, the complexity of clinical trial designs and the stringent regulatory requirements further accentuate the need for specialized testing capabilities, driving the growth of the market.

Restraint: Lack of skilled professionals

The lack of skilled professionals poses a significant challenge that could hamper market growth for market. As demand for testing services continues to rise across various industries, including pharmaceuticals, food and beverage, and environmental testing, there is a growing need for trained personnel proficient in operating Analytical testing equipment and interpreting analytical results accurately. However, the shortage of skilled professionals in this field can hinder the growth of the market, leading to delays in research and development activities, quality control processes, and regulatory compliance efforts. Addressing this skills gap through training programs, educational initiatives, and talent development strategies will be essential to overcome this obstacle and sustain market growth for market.

Opportunity: Harnessing Government Support and Technology Advancements in Healthcare analytical testing services

Supportive government initiatives, coupled with the increasing adaptability to Software as a Service (SaaS) and outcome-based software technology, present significant opportunities for the market in healthcare. Government funding programs, tax incentives, and regulatory reforms aimed at improving healthcare infrastructure and research capabilities drive investment in healthcare analytical testing services, ensuring compliance and quality control. The adoption of SaaS models enables smaller laboratories and healthcare facilities to access advanced analytical capabilities cost-effectively, enhancing efficiency and data management practices. Additionally, outcome-based software technology delivers measurable results and value by providing predictive analytics and customized recommendations, optimizing decision-making processes. Collectively, these trends empower healthcare organizations to leverage sophisticated analytical tools, streamline workflows, and deliver better outcomes for patients and stakeholders, driving the growth of the market.

Challenge: Need for improvement to the sensitivity of analytical testing

The need for improvement in sensitivity of bioanalytical methods poses a significant challenge for the pharmaceutical industry. With the development of new chemical entities (NCEs) that are increasingly potent and effective, there is growing pressure to detect drug substances and their metabolites with greater sensitivity. This demand is further compounded by the exploration of unconventional chemical classes for highly potent therapeutics. Bioanalytical scientists are tasked with supporting early-stage in vivo work by generating high-quality data within shorter timeframes. However, meeting the sensitivity requirements for new and challenging compounds administered at very low levels can be daunting. It often necessitates extensive sample preparation, such as solid-phase or liquid-liquid extraction, as well as complex chromatography techniques like two-dimensional or trap-and-elute liquid chromatography. While automation can streamline the time required for these processes, the development of appropriate methods remains time-consuming, especially given the tight timelines typically faced by bioanalytical departments.

Healthcare Analytical Testing Services Market Segmentation & Geographical Spread

To know about the assumptions considered for the study, download the pdf brochure

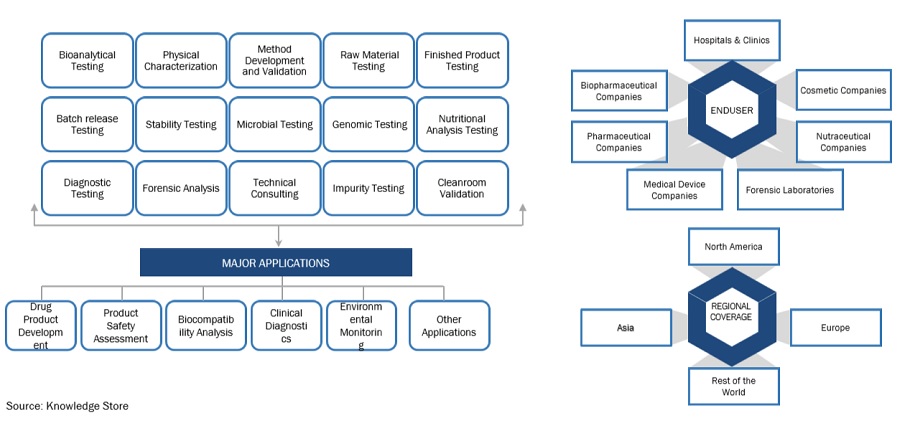

The Healthcare analytical testing services Market ecosystem comprises entities responsible for the end-to-end workflow of analytical testing types and services. The major stakeholders present in this market include Analytical testing service providers, pharmaceutical, biopharmaceutical, and biotechnology companies, food and beverage industry, environment protection and forensic institutes, clinicians, researchers, hospitals, and clinics, and medical device companies. The service providers in the industry continue to enhance and mature their offerings to add value.

The Healthcare analytical testing services industry, is projected to grow at a CAGR of 11.2% between 2024 and 2029.”

The Healthcare analytical testing services market is projected to reach USD 12.6 billion by 2029 from USD 7.4 billion in 2023, at a CAGR of 11.2% during the forecast period. The rising preference to outsource testing, stringent regulatory requirements, increase in clinical trials and rising R & D investments are driving the growth of this market.

Biohealthcare analytical testing services segment accounted for a substantial share of the Healthcare analytical testing services industry, by type in 2023.”

The dominance of the biohealthcare analytical testing services segment in the healthcare analytical testing services market stems from its comprehensive range of services tailored to various drug types, such as vaccines, small molecules, and biologics. These services play a crucial role in ensuring the safety, efficacy, and quality of pharmaceutical products. By offering extensive bioanalytical testing solutions, including assays for drug quantification, metabolite identification, and pharmacokinetic analysis, this segment meets the diverse needs of pharmaceutical companies across the drug development process. Additionally, advancements in analytical techniques and technologies have enabled the segment to enhance its capabilities, further solidifying its position as a key player in the market.

Cell based Assay segment accounted for a considerable share in the Healthcare analytical testing services industry, by type of bioanalytical testing in 2023

The segmentation of the healthcare analytical testing services market based on type includes various categories such as cell-based assays, virology testing, biomarker testing, immunogenicity and neutralizing antibody testing, pharmacokinetic testing, and other biohealthcare analytical testing services. In 2023, the cell-based assays segment emerged as the dominant force within the market. This prominence can be attributed to the increasing adoption of cell-based assays in high-throughput screening applications. Unlike biochemical assays, cell-based assays offer the advantage of providing more relevant in vivo biological information, thereby accelerating the drug discovery process. This preference for cell-based assays reflects the industry's recognition of their efficacy in evaluating compound efficacy, toxicity, and other crucial parameters during preclinical studies. Consequently, pharmaceutical companies and research organizations are increasingly relying on cell-based assays to streamline their drug development efforts and enhance their chances of success in bringing novel therapeutics to market.

Pharmaceutical and biopharmaceutical companies have accounted for the largest share in Healthcare analytical testing services industry by end user in 2023

In the healthcare analytical testing services market, pharmaceutical and biopharmaceutical companies stood out as the major contributors, holding the largest share. This dominance stems from several factors related to the segment's unique needs and operational strategies. The market segmentation, based on end users, includes pharmaceutical and biopharmaceutical companies, medical device companies, forensic labs, hospitals and clinics, cosmetics and nutraceutical companies. Among these, pharmaceutical and biopharmaceutical companies emerged as the primary stakeholders, capturing the largest share in 2023. This significant market presence can be attributed to the growing trend among these companies to outsource healthcare analytical testing services. By outsourcing these services, pharmaceutical and biopharmaceutical firms aim to optimize their profit margins and concentrate on their core competencies, such as research, development, and commercialization of innovative drugs and therapies. Outsourcing analytical testing allows these companies to leverage the specialized expertise and advanced technologies offered by third-party service providers, enabling them to streamline operations, expedite time-to-market for new products, and ensure compliance with stringent regulatory standards. Thus, the substantial market share held by pharmaceutical and biopharmaceutical companies underscores the critical role of healthcare analytical testing services in supporting their overall business objectives and facilitating the delivery of safe, efficacious, and high-quality healthcare products to patients worldwide.

North America dominated the Healthcare analytical testing services industry in 2023

Prominent players in the Healthcare analytical testing services market include The prominent players in the global market include Eurofins Scientific (Luxembourg), Laboratory Corporation of America Holdings (US), SGS S.A. (Switzerland), Charles River Laboratories (US), WuXi AppTec Co. Ltd. (China), Element Materials Technology (UK), Thermo Fisher Scientific, Inc. (US), Pace Analytical Services LLC (US), Intertek Group plc (UK), IQVIA Inc. (US), Merck KGaA (Germany), Source BioScience (UK), Almac Group (UK), ICON Plc (Ireland), Frontage Laboratories, Inc. (US), STERIS Plc (US), Sartorius AG (Germany), ALS Life Science (US), Syneos Health, INC (US), Medpace Holdings, Inc. (US), LGC Limited (UK), Parexel International Corporation (US), Celerion (US). Pharmaron (China), and BioAgilytix Labs (US).

Scope of the Healthcare Analytical Testing Services Industry

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$7.4 billion |

|

Projected Revenue by 2029 |

$12.6 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 11.2% |

|

Market Driver |

Changing regulatory landscape and the increasing complexity of products to drive the market |

|

Market Opportunity |

Harnessing Government Support and Technology Advancements in Healthcare analytical testing services |

The study categorizes the healthcare analytical testing services market to forecast revenue and analyze trends in each of the following submarkets

By Type

-

Bioanalytical Testing Services

- Pharmacokinetic & Toxicokinetic Testing

- Immunogenicity & Neutralizing Antibody Testing

- Biomarker Testing

- Bioassays

- Other Bioanalytical Testing Services

-

Physical Characterization Services

- Laser Particle Size Analysis

- Thermal Analysis

- Optical Characterization

- Surface Area Analysis

- Other Physical Characterization Analysis Services

-

Method Development & Validation Services

- Extractable/Leachables Method Development & Validation

- Process Impurity Method Development & Validation

- Stability-Indicating Method Validation

- Cleaning Validation

- Analytical Standard Characterization

- Technical Consulting

- Other Method Development & Validation Services

-

Raw Material Testing Services

- Complete Compendial Testing

- Container Testing

- Heavy Metal Testing

- Water Content Analysis

- Other Raw Material Testing Services

-

Batch-Release Testing Services

- Dissolution Testing

- Elemental Impurity Testing

- Disintegration Testing

- Hardness Testing

- Friability Testing

- Other Batch-Release Testing Services

-

Stability Testing Services

- Drug Substance Stability Testing

- Formulation Evaluation Stability Testing

- Accelerated Stability Testing

- Photostability Testing

- Foreced Degradation Testing

- Other Stability Testing Services

-

Microbial Testing Services

- Microbial Limit Testing

- Virology Testing

- Sterility Testing

- Endotoxin Testing

- Preservative Efficacy Testing

- Other Microbial Testing Services

- Geonimics Testing Services

- Other Analytical Testing Services*

- (*Other Analytical Testing includes, Clinical Chemistry Testing Services, Nutritional Analysis Testing, Clinical Diagnostics Testing)

By End User

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Medical Device Companies

- Hospitals And Clinics

- Forensic Labs

- Cosmetics & Nutraceuticals Companies

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- Italy

- Spain

- France

- RoE

-

Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- RoAPAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East and Africa

- GCC Countries

- Rest of Middle East and Africa

Recent Developments of Healthcare Analytical Testing Services Industry:

- In March 2024, Thermo Fisher Scientific Inc. (US), collaborated with Symphogen (US), to provide biopharmaceutical discovery and development laboratories with innovative tools and streamlined workflows for efficient characterization of complex therapeutic proteins

- In February 2024, Charles River Laboratories (US) partnered with Wheeler Bio, Inc. (US). This agreement accelerates the transition from preclinical to early clinical stages for biotech firms, streamlining processes and providing a comprehensive solutions.

- In May 2023, Laboratory Corporation of America Holdings (US Collaborated with Forge Biologics (US) to advance gene therapy development and manufacturing. This collaboration aims to expedite clinical timelines, overcome analytical development barriers, and address regulatory hurdles associated with manufacturing and development processes.

- In May 2023, SGS S.A. (Switzerland), SGS SA acquired a majority stake in Nutrasource Pharmaceutical and Nutraceutical Services Inc.(Canada0), Initially acquiring 60% of Nutrasource's shares, SGS also has the option to acquire the remaining 40% in 2026. This strategic acquisition strengthens SGS's presence in key market segments and enhances its ability to deliver comprehensive services to clients worldwide.

- In July 2022, Eurofins Scientific (Luxembourg), acquired WESSLING (Hungary), to strengthen its presence in Central and Eastern Europe and to enhance its BioPharma Product Testing capabilities.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global healthcare analytical testing services market?

The global healthcare analytical testing services market boasts a total revenue value of $12.6 billion by 2029.

What is the estimated growth rate (CAGR) of the global healthcare analytical testing services market?

The global healthcare analytical testing services market has an estimated compound annual growth rate (CAGR) of 11.2% and a revenue size in the region of $7.4 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the Analytical Testing Services Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the Analytical Testing Services Market. Primary sources from the demand side included researchers, lab technicians, reagent suppliers, purchase managers etc, and stakeholders in corporate & government bodies.

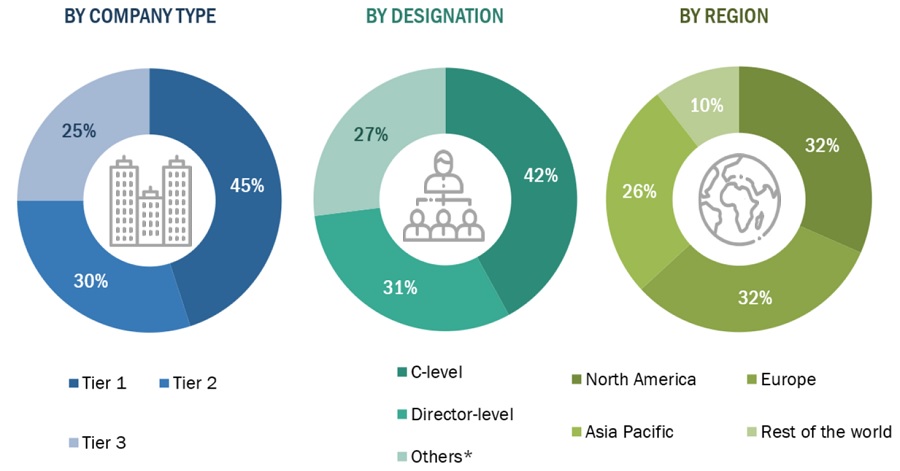

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

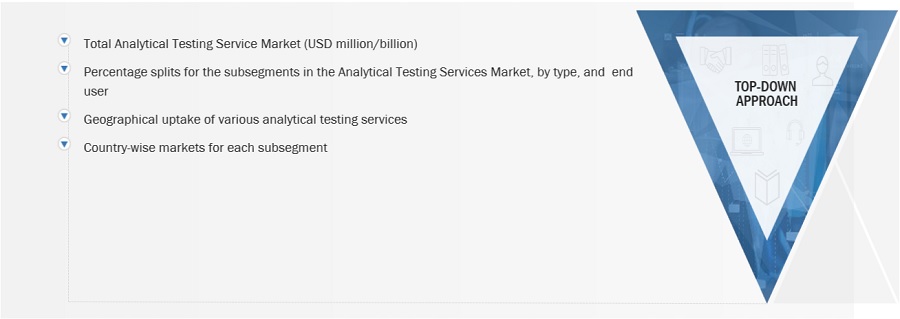

The total size of the Analytical Testing Services Market was arrived at after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The size of the Analytical Testing Service Market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

- Shares of leading players in the Analytical Testing Services Market were gathered from secondary sources to the extent available. In some instances, shares of Analytical Testing Services have been ascertained after a detailed analysis of various parameters, including Service portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

The total revenue in the Analytical Testing Services Market was determined by extrapolating the Market share data of major companies.

Global Analytical Testing Services Market Size: Top-Down Approach

Market Definition

Healthcare analytical testing services are specifically utilized by the healthcare industry, particularly, pharmaceutical, biopharmaceutical, and medical device companies, to streamline the various stages of drug discovery and development as well as the medical device testing process.

Key Stakeholders

- Healthcare Analytical Testing Service Providers

- Pharmaceutical & Biopharmaceutical Companies

- Biotechnology Companies

- Bioanalytical Testing Service Providers

- Environmental Testing Service Providers

- Contract Research Organizations (CROs)

- Medical Device Manufacturing Companies

- Cosmetic Companies

- Nutraceutical Companies

- Forensic Laboratories

- Academic Universities

- Research Institutes

- Research Laboratories

- Government Associations

- Market Research And Consulting Firms

- Venture Capitalists And Investors

Objectives of the Study

- To define, describe, and forecast the healthcare analytical testing services market based on type, end user, and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall healthcare analytical testing services market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the healthcare analytical testing services market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies in the healthcare analytical testing services market

- To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, service launches, agreements, and other developments in the healthcare analytical testing services market

- To benchmark players within the healthcare analytical testing services market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and service offerings

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe Analytical Testing Services Market into Denmark, Norway, and others

- Further breakdown of the Rest of Asia Pacific Analytical Testing Services Market into Vietnam, New Zealand, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Analytical Testing Services Market