Gluten-free Products Market by Type (Bakery Products, Snacks & RTE Products, Pizzas & Pastas, Condiments & Dressings), Form, Distribution Channel (Conventional Stores, Specialty Stores, and Drugstores & Pharmacies), Source - Global Forecast to 2029

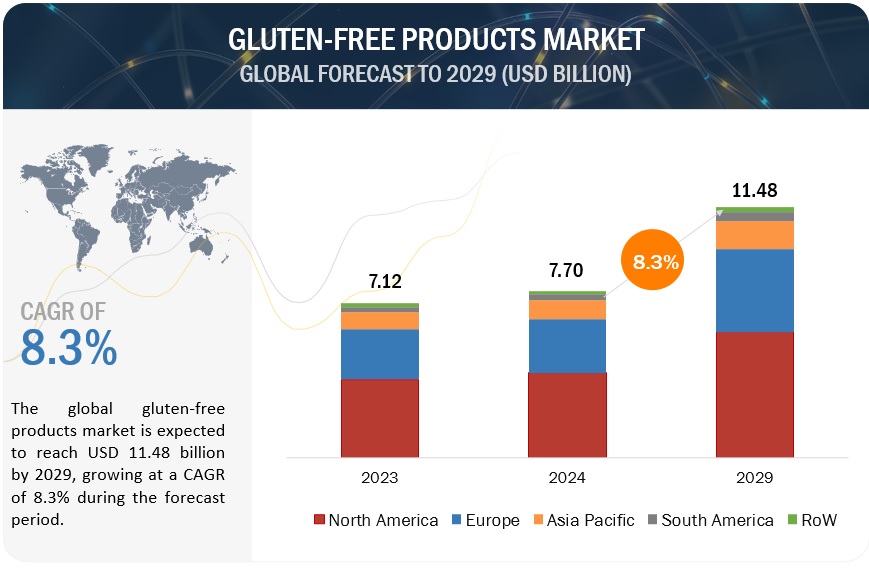

[323 Pages Report] The global gluten-free products market is expanding significantly. It is estimated to be valued at USD 7.70 billion in 2024 and is expected to reach USD 11.48 billion by 2029 at a CAGR of 8.3%. This upward trend is driven by the increasing rates of celiac disease and gluten sensitivities, which have expanded the market client base. The National Library of Medicine reported in 2023 that celiac disease had a prevalence of about 0.5–1% in the general population. However, the incidence has risen over the past 10–20 years with improved detection and diagnosis. The incidence is strikingly higher in people with other autoimmune diseases, including type I diabetes, and first-degree relatives of affected people have a risk of 1 in 10. The worldwide demand for gluten-free foods is rising as more consumers seek dietary solutions to manage celiac disease and gluten sensitivities.

To know about the assumptions considered for the study, download the pdf brochure

To know about the assumptions considered for the study, Request for Free Sample Report

Gluten intolerance, or sensitivity to gluten proteins in wheat, barley, and rye, differs by percent across countries. According to World Population Review 2024 data, Finland leads at 1.67%, the UK and Australia at 1.00%, and the US and Canada at 0.75%. Argentina and Italy have middle rates; the Netherlands has 0.50%; and Brazil has 0.37%, signifying countries with the lowest rates. The only reason that affects global demand for gluten-free products is the relative change in these prevalence rates.

To know about the assumptions considered for the study, Request for Free Sample Report

Manufacturing and production of gluten-free products require hygienic special facilities with separate equipment to prevent the gluten-free product line from getting contaminated with gluten-containing dust. It also requires advanced extrusion technology and enzyme technology for superior quality. For example, adding enzymes such as BakeZyme by dsm-firmenich (Switzerland) imparts dough consistency and stability during baking, prolongs the shelf life of gluten-free baked goods with a good crumb structure, and maintains a consistent appearance. Key players, such as The Kraft Heinz Company (US), The Hain Celestial Group (US), General Mills Inc. (US), Conagra Brands, Inc. (US), Kellanova (US), and Barilla G. e R. F.lli S.p.A. (Italy), apply these innovations in the manufacturing of gluten-free bakery items, cereals, snacks, and pizzas to meet consumer expectations by offering taste, texture, and safety while complying with gluten-free certifications such as BRC and Kosher.

Transportation & logistics is the next stage of the value chain. Gluten-free products are transported in controlled conditions to maintain integrity without contamination. Special handling at shipment requires maintaining gluten-free certification. Companies like Genius Foods, from the UK, distribute its gluten-free baked goods through major UK supermarkets like ASDA, Tesco, and Sainsbury. North American manufacturers, including The Kraft Heinz Company and Barilla G. e R. F.lli S.p.A., sell their gluten-free products through major retailers in the US, such as Walmart, Whole Foods, and Kroger. Thus, gluten-free products are mainly distributed globally.

Consumer interaction and feedback drive innovation and sustainability in the value chain of gluten-free products. For instance, Dr. Schär AG / SPA (Italy) incorporates customer insights to enhance its products' quality and sustainability. It is committed to completely switching to recyclable and compostable packaging by 2024. The brand has already reduced plastic use by 15%, introducing the world's first gluten-free bread packaging made of 46% recycled plastic into the market. These illustrate the role of consumer feedback in shaping product and sustainability strategies.

Market Dynamics

Drivers: Rising diagnosis of celiac disease and other food allergies

Nature Reviews Gastroenterology & Hepatology reported in January 2022 that the prevalence of celiac disease is approximately 1% globally. Treating celiac disease requires a strict gluten-free diet, which drives the market.

In 2020, The American College of Gastroenterology reported that the increasing incidence of celiac disease over the years, with a sharp increase in females and children globally, has further contributed to the market’s growth. The rise in self-diagnosed gluten-sensitive consumers and health-conscious individuals contributes to the market growth. First-degree relatives of celiac disease patients are also maintained on gluten-free diets without testing, thus boosting the market.

Overall, the rise in sales of gluten-free products is attributed to higher consumer awareness of celiac disease, an overall increase in the incidence of gluten-related disorders, and rising health consciousness. This leads to increased availability of gluten-free products, contributing to market growth.

Restraints: High cost of gluten-free products than conventional gluten-containing products

Gluten-free products are expensive compared to gluten-based products. The University of Massachusetts Amherst reported in March 2024 that foods under the gluten-free category can be 87% costlier than the others, especially bread. Similarly, Dalhousie University research estimated that the average price of gluten-free goods exceeded that of their regularly sold counterparts by 242%: USD 1.71 for 100g of gluten-free food to USD 0.61 for their gluten-containing alternatives. The high prices of gluten-free food products restrict consumers from maintaining a strict gluten-free diet.

Opportunities: Adoption of microencapsulation technology to improve shelf life of gluten-free products

The adoption of microencapsulation technology to improve the shelf life of gluten-free products presents a great opportunity for the gluten-free products market. Microencapsulation technology refers to the process of protecting sensitive ingredients, such as gluten-free flours and additions, by placing them in a coating that protects them from oxidation, moisture absorption, or flavor degradation. This helps not only in the enhancement of stability and freshness in gluten-free products but also in the reduction of the usage of artificial preservatives, meeting the demand from consumers for clean-label products. The extended shelf life from microencapsulation can reduce waste, enhance distribution efficiency, and extend the market reach to make gluten-free products more acceptable and desirable to the mass market. This development gives the manufacturers a competitive edge in the rapidly growing gluten-free products market.

Challenges: Formulation challenges faced by manufacturers

Gluten provides texture, elasticity, and structure in traditional baked goods, but it presents formulation challenges to the manufacturers of gluten-free products. Replacing gluten is a balancing act that involves other expensive ingredients such as xanthan gum, guar gum, or psyllium husk. Achieving an appealing taste, mouthfeel, and appearance without using gluten is a complex process; many gluten-free products are dense, crumbly, and lack flavor. Moreover, maintaining quality across batches is difficult since gluten-free flours absorb and function differently. The risk of cross-contamination also means controls in manufacturing facilities have to be incredibly stringent, adding further complexity to the production process. The formulation difficulties associated with gluten-free products raise their production cost and limit the variety and desirability of gluten-free products available in the market.

Market Ecosystem

Based on type, bakery products accounted for the largest market share in 2023

Based on type, bakery products dominate the gluten-free market because of their broad consumption and vital intake in daily diets, including bread, cakes, cookies, etc. The surging demand for gluten-free alternatives has influenced innovation in the segment; hence, high-quality, better-for-you products with improved taste, texture, and nutritional benefits are now available with more variety. These products are mainly prepared using whole grains, seeds, and alternative flours. Hence, they appeal to health-oriented customers who seek nutritious and gluten-free foods. The convenience and versatility of gluten-free bakery products in fresh, frozen, and packaged goods formats also drive the demand, thus contributing to the market growth. Their wide acceptance and accessibility also fuel the market growth.

Conventional stores in the distribution channel segment is projected to dominate the market during the forecast period

Conventional stores, which comprise supermarkets, hypermarkets, and internet retailers, are expected to dominate the gluten-free products market during the forecast period. Their comprehensive accessibility, convenience, and extensive range of products make them the primary choice among consumers seeking gluten-free food. In-person shopping is convenient and offered through supermarkets and hypermarkets. However, online shopping offers benefits such as doorstep delivery and a wide range of products. The rising number of gluten-sensitive consumers compels traditional stores to expand their inventory of gluten-free items.

Europe is expected to be the fastest-growing region during the forecast period

Europe's gluten-free products market is expected to grow significantly due to the rising health consciousness and increasing dietary preferences. The surging demand for gluten-free items from health-conscious individuals and those with gluten intolerance drives the market. The presence of key players, such as Barilla G. e R. F.lli S.p.A. (Italy), Raisio Oyj (Finland), Dr. Schär AG / SPA (Italy), Ecotone (France), and Alara Wholefoods (UK), further boosts the market growth through active investment in product innovation and the expansion of production capacity to meet market demand.

For example, Raisio Oyj (Finland) invested in a new heating plant in June 2020 at its Nokia oat mill, which can be utilized for production by-products as fuel to pursue carbon neutrality. The USD 9.46 million investment fits Raisio's responsibility program and decreases energy costs, creating a successful company for the growing gluten-free products market. The largest oat mill in Finland, Nokia produces Elovena, Nalle, and Nordic-branded oat flakes in pursuit of the growing demand for gluten-free products on the global market. Such expansions and strategic moves accelerate the rapid market growth. This also indicates the element of increased dominance and consumer preference in the global industry.

Key Market Players

The key players in this market include The Kraft Heinz Company (US), The Hain Celestial Group (US), General Mills Inc. (US), Conagra Brands, Inc. (US), Kellanova (US), Barilla G. e R. F.lli S.p.A. (Italy), Raisio Oyj (Finland), Dr. Schär AG / SPA (Italy), Ecotone (France), and Enjoy Life (US).

Want to explore hidden markets that can drive new revenue in Gluten-free Products Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Gluten-free Products Market?

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments Covered |

By Type, Form, Source, Distribution Channel and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies observed in this report |

|

This research report categorizes the Gluten-free products market based on type, form, distribution channel, source, and region.

Target Audience

- Gluten-free products Manufacturers

- Food & Beverage Producers

- Food Processing Manufacturers

- Government Agencies (related to food safety and regulations such as FDA, EFSA, and FSSAI)

Gluten-free Products Market:

By Type

- Bakery Products

- Snacks & RTE Products

- Pizzas & Pastas

- Condiments & Dressings

- Other Types

By Distribution Channel

- Conventional Stores

- Specialty Stores

- Drugstores & Pharmacies

By Form

- Solid

- Liquid

By Source (Qualitative)

- Animal Source

- Plant Source

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In July 2024, the flavors of Ore-Ida and GoodPop, brands of The Kraft Heinz Company, joined forces with frozen novelties in the creation of Fudge n' Vanilla French Fry Pops, which is manufactured using vanilla oat milk, a chocolate fudge shell, crispy potato bits. With strategic placement into the gluten-free category, these two innovative, first-of-their-kind products were expected to place the companies in an excellent position to meet the increasing consumer demand for unique and allergen-friendly snacks.

- In March 2024, Garden Veggie, The Hain Celestial Group’s brand, introduced Flavor Burst Tortilla Chips. These gluten-free tortilla chips were expected to be available in vegetable-infused flavors like Nacho Cheese and Zesty Ranch. This innovation is expected to help the company grow by providing consumers with healthy and nutritious gluten-free snacking options.

- In February 2024, General Mills Inc.'s yogurt brand, Yoplait, also launched Yoplait Original with Chocolate Shavings in Cherry, Raspberry, and Strawberry flavors to add creaminess to this guilt-free treat of real chocolate. These gluten-free product offerings are expected to give the company a competitive edge in the market.

Frequently Asked Questions (FAQ):

What is the current size of the gluten-free products market?

The gluten-free products market forecast is estimated at USD 7.7 billion in 2024 and is projected to reach USD 11.5 billion by 2029, at a CAGR of 8.3% from 2024 to 2029.

What are the key market players, and how intense is the competition?

Gluten-free products key market players include The Kraft Heinz Company (US), The Hain Celestial Group (US), General Mills Inc. (US), Conagra Brands, Inc. (US), Kellanova (US), Barilla G. e R. F.lli S.p.A. (Italy), Raisio Oyj (Finland), Dr. Schär AG / SPA (Italy), Ecotone (France), and Enjoy Life (US). These companies manufacture reliable gluten-free products and have robust distribution networks spanning crucial regions. They possess a well-established portfolio of esteemed services, commanding a robust market presence supported by sound business strategies. Additionally, they hold substantial market share, offer services with versatile applications, cater to a diverse geographical clientele, and maintain an extensive service range.

Which region is projected to account for the largest share during the forecast period for the gluten-free products market?

North America is projected to dominate the gluten-free products market due to the rising awareness of celiac disease and the quick accessibility of gluten-free diets. The wide range of gluten-free food products and an extended retail network also contribute to the market growth. The rising health and wellness consciousness is expected to fuel the market growth.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information, such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and revenue breakdown. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to explain the company's potential further.

What are the growth prospects for the gluten-free products market in the next five years?

Rising health awareness, the prevalence of gluten-free products, and increasing product innovations are expected to drive the market during the forecast period. Various regulations regarding labeling and improved retail availability will further fuel the growth of gluten-free markets globally. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

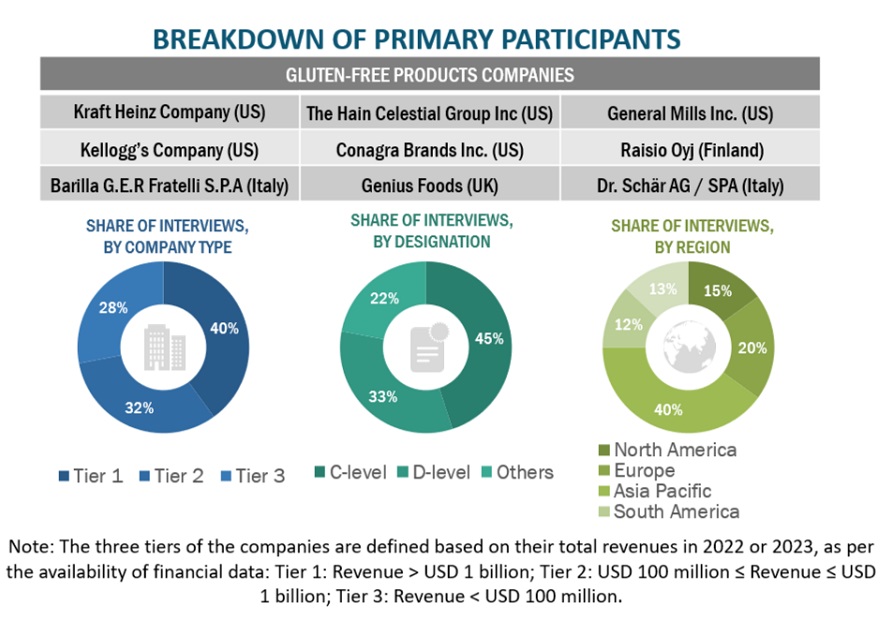

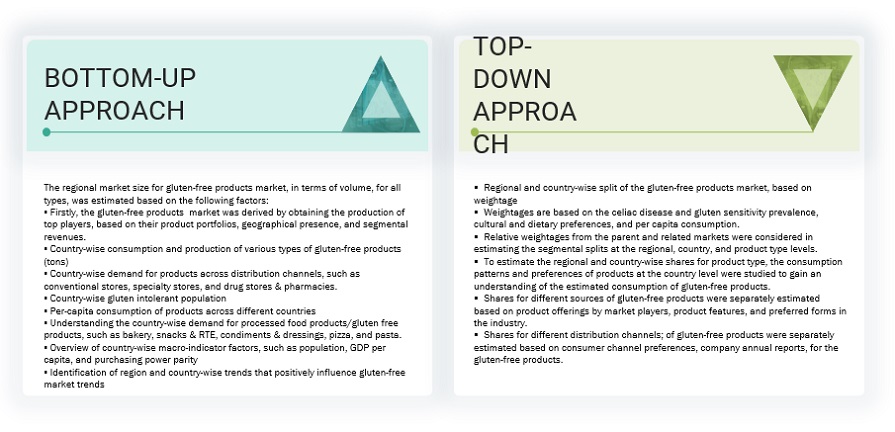

The study involved major segments in estimating the current size of the gluten-free products market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the gluten-free products market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the gluten-free products market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to gluten-free products type, form, distribution channel and region. Stakeholders from the demand side, who use gluten-free ingredients, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of gluten-free products and the outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

designation |

|

Kraft Heinz Company (US) |

Regional Sales Manager |

|

The Hain Celestial Group Inc (US) |

Marketing Manager |

|

General Mills (US) |

General Manager |

|

Conagra Brands Inc (US) |

Sales Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total market size. These approaches were also used to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global Gluten-free Products Market: Bottom-Up Approach and Top-Down Approach.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall gluten-free products market and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

- According to the Food and Drug Administration (FDA), gluten-free products are food products that do not contain any of the following:

- An ingredient that is any type of wheat, rye, barley, or crossbreeds of these grains

- An ingredient derived from these grains, and that has not been processed to remove gluten

- An ingredient derived from these grains that has been processed to remove gluten, if it results in the food containing 20 or more parts per million (ppm) gluten.

Key Stakeholders

- Supply-side: Gluten-free products manufacturers, suppliers, distributors, importers, and exporters

- Gluten-free products additive manufacturers and traders

- Demand-side: Gluten-free product manufacturers

- Regulatory side: Concerned government authorities, commercial research & development (R&D) institutions, and other regulatory bodies.

- Associations and industry bodies such as:

- Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- Food Standards Australia New Zealand (FSANZ)

- Gluten-Free Certification Organization (GFCO)

- National Foundation for Celiac Awareness (NFCA)

- Gluten-Free Standards Organization (GFSA)

- International Certification Services (ICS)

Report Objectives

- To define, segment, and forecast the global gluten-free products market based on type, form, source, distribution channel and region from 2020 to 2023 and a forecast period from 2024 to 2029

- To provide detailed information about the key factors, including drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify attractive opportunities in the market by determining the largest and fastest-growing segments across regions

-

To analyze the demand-side factors based on the following:

- Impact of macro and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Strategically profile the key players and comprehensively analyze their core competencies

- Competitive developments, such as partnerships, mergers & acquisitions, new product developments, and expansions & investments in the gluten-free products market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

PRODUCT ANALYSIS

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

GEOGRAPHIC ANALYSIS

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the European Gluten-free products market into key countries

- Further breakdown of the Rest of Asia Pacific Gluten-free products market into key countries

- Further breakdown of the South American Gluten-free products market into key countries

COMPANY INFORMATION

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Gluten-free Products Market