Food Encapsulation Market by Shell Material (Lipids, Polysaccharides, Emulsifiers, Proteins), Technology (Microencapsulation, Nanoencapsulation, Hybrid Encapsulation), Application, Method, Core Phase and Region - Global Forecast to 2027

Food Encapsulation Market Size

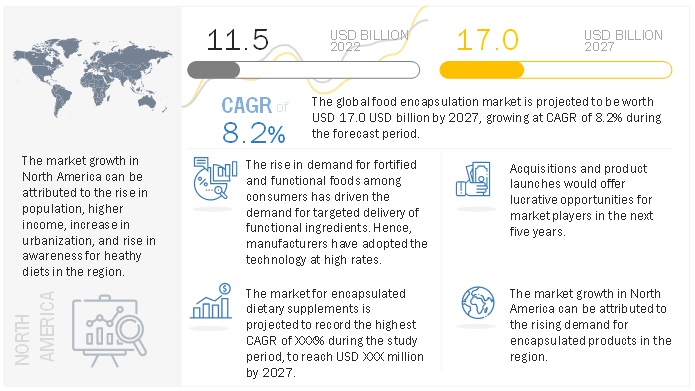

The global food encapsulation market was valued USD 11.5 billion in 2022 and is projected to reach USD 17.0 billion by 2027, growing at a CAGR of 8.2% during the study period. The market for encapsulation is growing globally at a significant pace due to its numerous applications and multiple advantages over other technologies. Some of the major advantages of encapsulation are that it helps provide enhanced stability and bioavailability to the bioactive ingredients and also helps increase the shelf life of food products and maintains the taste and flavor for a longer period. Encapsulation is increasingly used in various industrial areas such as nutraceuticals and food & beverages.

The high growth opportunities in emerging regions are attributed to the growing economies and technological advancements. North America accounts for the largest share of the food encapsulation market, with the US being the largest contributor. This is because of the presence of most of the major players in the market and the availability of advanced technologies. Asia Pacific is projected to grow at the highest rate due to the increase in industrial activities and health consciousness among consumers.

The development of advanced technologies to tap niche markets and the growth in demand for encapsulation in emerging economies are opportunities for this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Food Encapsulation Market Dynamics

Drivers: Innovative food encapsulation technologies enhance market penetration.

Food encapsulation technology has evolved from being a fundamental preservation technology to a complex food processing technology. This technology enables many properties such as color and taste-masking and controlled release of bioactive ingredients. The evolution of encapsulation technology has happened through many stages. They have been further classified into microencapsulation, microencapsulation, and nanoencapsulation. Food manufacturers are developing newer encapsulation technologies. The aim to maximize and preserve product taste without environmental degradation. The preservation of potency along with health benefits value addition to the product is pushing manufacturers towards adopting food encapsulation.

One of the major applications of food encapsulation is the controlled release of bioactive agents in the food and nutraceutical industries. The increasing complex production of processed foods propels the demand for a controlled release of bioactive compounds. The hydrophobic spheres encapsulated in moisture-sensitive microspheres help improve the shelf-life of foods & beverages. Spheres are homogeneously dispersed in the microsphere matrix and dissolve after encountering saliva or water. This helps in releasing the encapsulated ingredients and prolonging the sensation of flavor and taste since a controlled release of bioactive compounds is a major application in frozen dough, baked foods, confectionery, health bars, processed meats, desserts, nutrition foods, dry beverage powder mixes, and other wellness products.

The introduction of new technologies in encapsulation, such as nanoencapsulation and bio-encapsulation, drives the demand for encapsulation in several food applications. Encapsulation helps in enhancing the taste of many food products. Initially, products containing omega-3 fatty acids had a very bad odor. With encapsulation technology, the fragrance and taste of omega-3 fatty acids have been enhanced. Recent advancements in liposome technology are used in manufacturing several products, such as probiotics, nutraceuticals, and nutrigenomics, offering numerous health benefits. Technological advancements have increased the adoption of encapsulation in niche applications such as gourmet and infant food. Another major reason for increasing the adoption of encapsulation in the food market could be the increasing innovations for offering reduced costs and technological advancements for providing additional benefits.

Restraints: More inclination toward traditional preservation methods over encapsulation techniques

The manufacturers of small and medium-sized companies in the food & beverage industry use the traditional method of preservation techniques over the encapsulation technique because food encapsulation can be expensive. New markets are being established within the functional foods sector, and researchers are in the process of meeting this demand to reduce high production costs. Encapsulation results in extra cost, which needs to be minimized to be economically acceptable by all manufacturers. This applies not only to the materials used to build capsules but also to the equipment or processing conditions. The number of core materials suitable for encapsulation is also limited. Currently, only a few bioactive ingredients and specialty ingredients, such as artificial sweeteners and encapsulated flours, which have been encapsulated, are showing desired results in terms of their sensorial properties in food applications. Further research is needed to successfully encapsulate ingredients that provide an edge over other techniques.

Opportunities: Reducing capsule size and increasing bioavailability

According to IUUPAC, nanocapsules size ranges from 1−100 nm range. These nanocapsules are the perfect size for enclosing highly potent bioactive while ensuring targeted delivery. For dietary supplements, the best-suited size is sizes 1, 0, through 00. These capsules can hold up to 290 and 850 mg of the core material. They are ideally suited for powdered and granulated substances. These small capsule sizes are best suited for minerals, water- and fat-soluble vitamins and antioxidants. Hence, it is necessary to focus on reducing the size of the capsule to increase its utility and bioavailability.

Challenges: Poor stability of microencapsulated ingredients in varying atmosphere

Optimizing the physical and chemical properties of microcapsules is necessary to achieve the stability of microencapsulated ingredients or products. Manufacturers find it challenging to maintain the stability of microencapsulated ingredients in varying environmental conditions. The parameters for the optimization of properties include microencapsulation process type, material type, or capacity of the microsphere. The properties of microcapsules, including permeability, mechanical stability, cell viability, controlled release, targeted delivery, drug stability, and shelf-life, need to be optimized. Achieving these parameters to achieve stability is challenging because of varying atmospheric conditions such as temperature, humidity, and pressure.

Even with the adoption of advanced technologies, some challenges persist, such as combining moisture-sensitive ingredients with liquid food. This is because of the failure to achieve the required stability of microcapsules in the humid atmosphere.

Maintaining the optimum physical stability of microencapsulated food during processing and packaging is a major challenge. There are no defined approaches that apply to the microencapsulation of food ingredients. A customized solution is required considering every stage of processing, packaging, storage, and delivery. This is due to the wide variation in the types of food, transportation modes, and the necessity of different release triggers and consumption requirements.

Vitamins and mineral is projected to grow in the food encapsulation market because of usage in superfoods for boosting brain and bone health

Consumers’ increasing attention to health and prevention, greater customized nutrition needs for different segments of the population, rising healthcare costs, search for alternatives to cure specific problems, and rising consumer awareness regarding the severity of chronic diseases drive the need for vitamins and minerals.

Vitamins are functional ingredients used in food products due to their specific nutritional properties. They are classified as fat-soluble and water-soluble vitamins. Fat-soluble vitamins contain Vitamins A, D, E and K. Vitamins B and C form a part of water-soluble vitamins. When added as a food ingredient, it is vital to target and control the release of these vitamins. This drives the need for their encapsulation. According to an article by Nutraingredients in 2019, over 40% of the vitamins consumed in the food industry are encapsulated. The encapsulation of vitamins is necessary to enclose vitamin molecules in a stable shell to prevent oxidation, preserve the nutrients, and avoid the products from deteriorating for a longer period.

On the other hand, minerals are formulated in the form of salts for food application. According to industry experts, encapsulation of these salts not only increases the cost but also becomes redundant. Thus, the adoption of this technology for minerals is minimal, estimated to be less than 5%.

Robotic Technology in Food Encapsulation is One of the Major Trends

Robots enhance the process of packaging nutraceutical supplements by being time-efficient and accurate. They increase the shelf life of nutraceutical ingredient products and help them to comply with regulatory guidelines by reducing the risk of contamination. Furthermore, the recent increase in the demand for nutritional supplements requires large-scale production, increasing the demand for robots to optimize production facilities.

Analyzing machine performance, gathering data, and troubleshooting in advance are the key robotics trends in the nutraceutical ingredients market projected to increase technology adoption in the industry. COBOTs are primarily used in the nutraceutical industry for such applications. According to TransAutomation Technologies, the labor expenditures of three people each day can be offset by a single robot that can perform one function for 24 hours per day. This helped several pharmaceutical and nutritional supplement manufacturers increase productivity, reducing their need for human labor and the challenges and costs that go along with it. Collaborative robots enable humans and robots to work together effectively in open or uncaged environments. Through collaborative robots, a human operator and robot can be engaged together in the same process, or the operator can simultaneously manage other tasks that a person might better solve.

To know about the assumptions considered for the study, download the pdf brochure

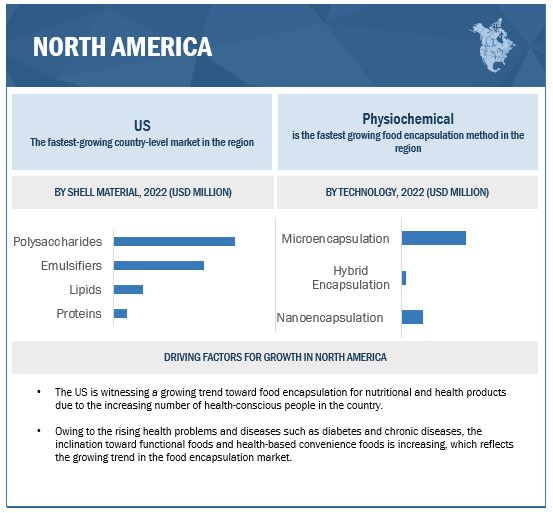

North America dominated the food encapsulation market; it is projected to grow at a CAGR of 7.8% during the forecast period.

The food encapsulation market in North America is influenced by factors like health awareness, promotion of nutraceuticals and functional foods and growing expenditure on prevention of chronic non communicable diseases. Food encapsulation adds value to foods and effectively delivers potent bioactives in isolation as supplements or as value addition in functional foods. The US dominated the market in 2021 and is projected to be the fastest-growing market for food encapsulation in North America. The market in this region is driven by technological advancements in food encapsulation techniques such as liposome compression, inclusion complex and centrifugal extrusion and the growing demand for functional and fortified foods that use encapsulated nutrients and the growing consumption of convenience foods that use encapsulated flavors and colors. Most of the key market players have a presence in the region. These include International Flavors and Fragrances Inc (US), Sensient Technologies Corporation (US), Balchem Corporation (US), Encapsys LLC (US), Ingredion Incorporated (US), Cargill (US), DuPont (US), Aveka Group (US), and Advanced BioNutrition Corp. (US).

Food Encapsulation Market Share

The key players in this market include Cargill, Incorporated (US), Balchem (US), International Flavors & Fragrances Inc. (US), and Encapsys LLC (US).

Want to explore hidden markets that can drive new revenue in Food Encapsulation Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Food Encapsulation Market?

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 11.5 billion |

|

Revenue forecast in 2027 |

USD 17.0 billion |

|

Growth Rate |

CAGR of 8.2% from 2022 to 2027 |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments covered |

By Core phase, Shell material, Application, Technology, Method and Region |

|

Regional Scope |

North America, Asia Pacific, South America, Europe, and RoW |

|

Key Companies Profiled |

|

Food Encapsulation Market:

This research report categorizes the food encapsulation market, based on Core Phase, Shell Material, technology, Method, Application and Region.

By Core Phase

- Vitamins and Mineral

- Enzymes

- Organic Acids

- Probiotics

- Sweeteners

- Nutritional Lipids

- Prebiotics

- Preservatives

- Colors

- Amino Acids

- Flavours

- Proteins

- Other Core Phases

Market, By Application

- Functional Foods

- Dietary Supplements

- Bakery Products

- Confectionary Products

- Beverages

- Frozen products

- Dairy Products

By Method

- Physical Method

- Chemical Method

- Physicochemical Method

By Shell Material

- Polysaccharides

- Lipids

- Proteins

- Emulsifiers

Market, By Technology

- Nanoencapsulation

- Microencapsulation

- Hybrid Encapsulation

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Target Audience:

- Raw material suppliers of core phase materials in the food encapsulation market

- Food encapsulation technology providers

- Intermediate stakeholders, including distributors, retailers, associations, and regulatory bodies.

- Manufacturers and traders of food products, including dairy products, bakery products, nutritional products, convenience foods, meat products, and other food applications.

- Trade associations and industry bodies

- Government organizations, research organizations, and consulting firms

- Importers and exporters of core phase materials in the food encapsulation market

- Commercial research & development (R&D) institutions and financial institutions

-

Associations, regulatory bodies, food safety agencies, and other industry-related bodies:

- Food and Drug Administration (FDA)

- European Food Safety Authority (EFSA)

- United States Department of Agriculture (USDA)

- Food Standards Australia New Zealand (FSANZ)

- Food and Agriculture Organization (FAO)

- Food Standards Australia New Zealand

- Organization for Economic Co-operation and Development (OECD)

Food Encapsulation Market Industry News

- In November 2021, Ingredion expanded its partnership with Verdient Foods to produce a variety of protein concentrates flour from lentils and fava beans and peas. This would help the company expand its protein production capacity and innovate with newer technologies.

- In September 2021, DSM acquired First Choice Ingredients; this acquisition gives DSM to allow a dairy-based savory flavoring portfolio of First Choice Ingredients.

- In March 2022, Kerry opened a-USD 137-million food technology and innovation center of excellence in Rome, Georgia. This would help the company innovate and enter new market with food technologies.

- In May 2021, Kerry announced it would develop a purpose-built food technology and innovation center of excellence in Queensland, Australia. This would help the company innovate and enter new market with food technologies.

- In November 2020, Cargill Incorporated invested USD 100 million in its Indonesian sweetener plant to build a corn wet mill with a starch dryer to increase the production of starches & sweeteners. This would help the company expand in the encapsulated sweeteners markets.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the food encapsulation market?

North America dominated the food encapsulation market, with a value of USD 3.7 billion in 2022; it is projected to reach USD 5.4 billion by 2027, at a CAGR of 7.8% during the forecast period. The major players in the market are Cargill (US), DuPont (US), and Sensient Technologies Corporation (US).

What is the current size of the global food encapsulation market?

The global food encapsulation market is estimated to be valued at USD 11.5 billion in 2022. It is projected to reach USD 17.0 billion by 2027, recording a CAGR of 8.2% during the forecast period.

Which are the key players in the market?

Key players operating in this market include Cargill, Incorporated (US), BASF SE (Germany), Kerry (Ireland), DSM (Netherlands), Ingredion (US), Symrise (Germany), Sensient (Germany), Balchem (US), International Flavors & Fragrances Inc. (US), Firmenich SA (Switzerland), FrieslandCampina (Netherlands), TasteTech (UK), LycoRed Corp (Israel), Ronald T Dodge Company (US), Innov’io (France), Givaudan (Australia), AnaBio Technologies (Ireland), Sphera Encapsulation (Italy), Reed Pacific (Australia), Aveka (US), Advanced Bionutrition Corp (US), Clextral France (US), Vitablend (Netherlands), and Encapsys LLC (US).

What are the most used core phase materials for food encapsulation?

Common core phase used for encapsulation include vitamins, minerals, enzymes, organic acids, probiotics, prebiotics, sweeteners, preservatives, nutritional lipids, colors, amino acids, flavors, and others. Other core phase includes fats, salts, proteins, and phytochemicals. These core phase find application in different food processing and dietary supplement applications.

What are the most used food encapsulation technologies?

Based on technology, the food encapsulation market is divided into three segments: microencapsulation, nanoencapsulation, and hybrid encapsulation. Recently, microencapsulation and nanoencapsulation technologies of encapsulation have improved in the food encapsulation industry. Microencapsulation technology is preferred to nanoencapsulation and hybrid encapsulation technologies because of its flexibility, cost-effectiveness, and versatility.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSDEVELOPMENTS IN RETAIL INDUSTRYRISE IN NUMBER OF DUAL-INCOME HOUSEHOLDSGROWING INCIDENCES OF CHRONIC DISEASES DRIVE DEMAND FOR DIETARY SUPPLEMENTS

-

5.3 MARKET DYNAMICSINTRODUCTIONDRIVERS- Increase in consumption of nutritional convenience and functional foods- Innovative food encapsulation technologies enhance market penetrationRESTRAINTS- More inclination toward traditional preservation methods over encapsulation techniques- High costs of food products using encapsulated ingredientsOPPORTUNITIES- Development of enhanced techniques for food encapsulation to bridge various gaps in food industry- Government support and improving economic conditions in developing nationsCHALLENGES- Poor stability of microencapsulated ingredients in varying atmospheres

- 6.1 INTRODUCTION

-

6.2 REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORKCODEX ALIMENTARIUS COMMISSION (CAC)JOINT EXPERT COMMITTEE FOOD AND AGRICULTURE (JECFA)FOOD AND DRUG ADMINISTRATIONEUROPEAN COMMISSIONCOUNTRY-WISE REGULATORY AUTHORITIES FOR MICROENCAPSULATION IN FOOD- North America- Europe- Asia Pacific- South America- Rest of the World

-

6.3 PATENT ANALYSIS

-

6.4 VALUE CHAIN ANALYSISSOURCING OF RAW MATERIALSPRODUCTION & PROCESSINGDISTRIBUTION, MARKETING, AND SALESEND-USER INDUSTRY

-

6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS IN FOOD ENCAPSULATION MARKET

-

6.6 MARKET ECOSYSTEMUPSTREAM- Encapsulated product and ingredient manufacturers- Technology providersDOWNSTREAM- Startups/Emerging companies- Regulatory bodies- End users

- 6.7 TRADE ANALYSIS

-

6.8 TECHNOLOGY ANALYSISMICROENCAPSULATION OF FUNCTIONAL FOOD INGREDIENTS- Encapsulation of omega-3 to mask odorINNOVATIVE AND DISRUPTIVE TECH- Robotics leading to innovations- 3D printing to uplift dietary supplements market

-

6.9 CASE STUDY ANALYSISKERRY USED COATING CRUMB TECHNOLOGY TO CREATE APPEALING PRODUCTSFRUNUTTA OFFERED EASY-TO-USE AND EFFICIENT-TO-TAKE VITAMIN AND MINERAL PILLS THAT DISSOLVE INSTANTLY

-

6.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT FROM SUBSTITUTESTHREAT FROM NEW ENTRANTS

- 6.11 KEY CONFERENCES & EVENTS

-

6.12 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 6.13 BUYING CRITERIA

-

6.14 RECESSION IMPACT ON FOOD ENCAPSULATION MARKETMACROECONOMIC INDICATORS OF RECESSION

- 7.1 INTRODUCTION

-

7.2 VITAMINS & MINERALSRISE IN NEED FOR SUPERFOODS TO IMPROVE BONE AND BRAIN HEALTHFAT-SOLUBLE VITAMINS- Nutrient retention and flavor masking to support market- Vitamin A- Vitamin D- Vitamin E- Vitamin KWATER-SOLUBLE VITAMINS- Stability of encapsulated water-soluble vitamins- Vitamin B complex- Vitamin C

-

7.3 ENZYMESTARGETED DELIVERY OF NUTRIENTS SENSITIVE TO VARIOUS EXTERNAL FACTORSCARBOHYDRASES- Rise in demand for sports drinks globallyPROTEASE- Growth in adoption of baked products with better textureLIPASES- Rise in preference for flavored dairy productsOTHER ENZYMES

-

7.4 ORGANIC ACIDSPROMPT ABSORPTION AND HIGH SOLUBILITY OF ENCAPSULATED CITRIC ACIDSCITRIC ACID- High dispersibility and preservation capacity of organic acidsACETIC ACID- Increased demand for pickles and wineMALIC ACID- Flavor enhancement properties of malic acid to better sugar- free confectioneryFUMARIC ACID- Rise in demand for confectionery with increased shelf lifeLACTIC ACID- Flavor-enhancement an attribute of lactic acidPROPIONIC ACID- Increase in popularity of propionic acid as preservativeASCORBIC ACID- Rise in adoption of nutritional beveragesOTHER ORGANIC ACIDS

-

7.5 PROBIOTICSGROWTH IN CONSUMPTION OF PROBIOTICS TO BOOST IMMUNITYBACTERIA- Higher usage of encapsulated bacterial probiotics in women’s health supplementsYEAST- Growth in genetic engineering in yeast-based probiotics encapsulation

-

7.6 SWEETENERSSHIFT IN CONSUMPTION HABITS TOWARD LOW-CALORIE FOODS

-

7.7 NUTRITIONAL LIPIDSHIGH STABILITY AND HIGH DOSAGE DELIVERY OF ENCAPSULATED NUTRITIONAL LIPIDS

-

7.8 PRESERVATIVESOXYGEN-SCAVENGING ABILITY OF ENCAPSULATED PRESERVATIVESANTIMICROBIALS- Ability of antimicrobials to prevent enzymatic degradation in food productsANTIOXIDANTS- Preventing rancidity of food containing fats to be major challenge to be tackledOTHER PRESERVATIVES

-

7.9 PREBIOTICSINCREASED FOCUS ON DIGESTIVE HEALTH AND IMMUNITYOLIGOSACCHARIDES- Growth in usage of encapsulated oligosaccharides in nutraceuticalsINULIN- Surge in gastrointestinal issuesPOLYDEXTROSE- Higher demand for gut health-boosting productsOTHER PREBIOTICS

-

7.10 COLORSGREATER DEMAND FOR NATURAL COLORS IN CONFECTIONERYNATURAL- Shift in consumer preferences for clean food & beveragesARTIFICIAL- Rise in inclination toward visually appealing health-oriented beverages

-

7.11 AMINO ACIDSINCREASE IN NEED TO IMPROVE METABOLIC HEALTH

-

7.12 FLAVORSLIMITING DEGRADATION OR LOSS OF AROMA DURING PROCESSING OR STORAGECHOCOLATES & BROWNS- Innovation in chocolate flavors in bakery and confectionery industriesVANILLA- Rise in demand for balanced taste and strong aromaFRUITS & NUTS- Growth in health awareness regarding fruits and nutsDAIRY- Surge in demand for dairy products in developing countriesSPICES- Globalization of food systems increased popularity of spices & savory flavorsOTHER FLAVORS

-

7.13 PROTEINSEASE OF AVAILABILITY OF PROTEIN CONCENTRATES

- 7.14 OTHER CORE PHASES

- 8.1 INTRODUCTION

-

8.2 MICROENCAPSULATIONGROWTH IN USE OF MICROENCAPSULATION TO MASK UNWANTED FLAVOR AND TASTE OF BIOACTIVE INGREDIENTS

-

8.3 NANOENCAPSULATIONRISE IN NEED TO IMPROVE MENTAL HEALTH

-

8.4 HYBRID ENCAPSULATIONHIGH BIOACTIVITY AND TARGETED DELIVERY OF BIOACTIVES

- 9.1 INTRODUCTION

-

9.2 POLYSACCHARIDESCOMPOSITE MOLECULAR ARRANGEMENT OF POLYSACCHARIDES IN HEALTH SUPPLEMENTS

-

9.3 PROTEINSABILITY OF PROTEIN-BASED SHELL MATERIALS TO STABILIZE GEL FORMULATION IN FOOD PRODUCTS

-

9.4 LIPIDSHIGHER DEMAND FOR LIPIDS FOR ENCAPSULATION OF FUNCTIONAL FOODS

-

9.5 EMULSIFIERSINCREASE IN USE OF EMULSIFIERS IN PRODUCING BAKED GOODS

- 10.1 INTRODUCTION

-

10.2 PHYSICAL METHODIMPROVED STABILITY OF BIOACTIVE INGREDIENTS ACHIEVED THROUGH PHYSICAL METHODATOMIZATION- Ease of usage of atomization equipmentSPRAY DRYING- Rise in need to adopt cost-effective methodsSPRAY CHILLING- Energy-efficiency of spray chilling technique in bakery productsSPINNING DISK- High functionality and bioactivity of flavonoids to drive usage of spinning disk techniqueFLUID BED COATING- Greater demand for low maintenance cost of encapsulating health supplementsEXTRUSION- Rise in use of extrusion method for encapsulating functional foodsOTHER PHYSICAL METHODS

-

10.3 CHEMICAL METHODUSE OF CHEMICAL METHOD TO ENCAPSULATE FUNCTIONAL FOODPOLYMERIZATION- Adhesion to shell material and controlled bioactive diffusion encourage polymerization for food encapsulationSOL-GEL METHOD- Growth in need to prevent oxidative damage

-

10.4 PHYSICO-CHEMICAL METHODRISE IN NEED FOR LOW COST AND REPRODUCIBILITYCOACERVATION- High establishment and processing cost of coacervation to restrain usage in nutraceuticalsEVAPORATION-SOLVENT DIFFUSION- Clinical benefits due to controlled release of bioactive agentsLAYER-BY-LAYER ENCAPSULATION- Growth in need for cost-effectiveness in food encapsulationCYCLODEXTRINS- Rise in demand to ensure safety and affordability in food encapsulationLIPOSOMES- Increase in need for targeted controlled release of bioactive ingredients in vitamin encapsulationOTHER PHYSICO-CHEMICAL METHODS

- 11.1 INTRODUCTION

-

11.2 DIETARY SUPPLEMENTSHIGHER NEED FOR EFFICIENT DELIVERY AND BIOAVAILABILITY OF BIOACTIVES

-

11.3 FUNCTIONAL FOOD PRODUCTSRISE IN NEED FOR HIGH SOLUBILITY OF MICROENCAPSULATED BIOACTIVES IN FUNCTIONAL FOOD PRODUCTS

-

11.4 BAKERY PRODUCTSRISE IN PREFERENCE FOR BAKERY PRODUCTS WITH ENHANCED FLAVORS

-

11.5 CONFECTIONERY PRODUCTSNEED TO ENHANCE AESTHETICS IN CONFECTIONERY PRODUCTS

-

11.6 BEVERAGESGREATER NEED FOR IMPROVED PALATABILITY IN BEVERAGES

-

11.7 FROZEN PRODUCTSENCAPSULATED PROBIOTICS ADD SMOOTHNESS TO FROZEN FOODS

-

11.8 DAIRY PRODUCTSENCAPSULATION GRANTS UNIFORM TASTE TO DAIRY PRODUCTS

- 11.9 OTHER APPLICATIONS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Encapsulation to aid in development of treatment options for various chronic diseases in USCANADA- Emergence of novel drug delivery strategies utilizing encapsulationMEXICO- Encapsulation to extend shelf life of packaged foods

-

12.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Consuming encapsulated dietary supplements to help people meet nutritional needs while also pursuing healthier lifestylesUK- Increase in demand for healthy functional food to enhance its bioavailabilityFRANCE- Consumption of probiotics in France due to health benefits associatedITALY- Shifting dietary choices and adoption of high antioxidant dietary supplements to enhance active content drives marketSPAIN- Increase in awareness of encapsulated nutrition and dietary supplementsREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Encapsulated dietary supplements and sports nutrition in ChinaJAPAN- Rise in aging population to drive demand for encapsulated functional foodsINDIA- Encapsulation of herbs and spices for cooking to help mask flavor and taste of productsAUSTRALIA & NEW ZEALAND- Changing preferences of consumers to prevent chronic diseases to increase demand for encapsulated functional food productsREST OF ASIA PACIFIC

-

12.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Expansions and investments in Brazil by key companiesARGENTINA- Rise in adoption of healthy foods and functional beveragesREST OF SOUTH AMERICA

-

12.6 REST OF THE WORLDROW: RECESSION IMPACT ANALYSISMIDDLE EAST- Rise in number of local payers and continuous innovations in regionAFRICA- Increase in government initiatives for fortification of food with essential vitamins and minerals

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 13.4 MARKET SHARE ANALYSIS

-

13.5 KEY PLAYER EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 13.6 PRODUCT FOOTPRINT

-

13.7 COMPETITIVE LEADERSHIP MAPPING (STARTUPS/SMES)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 13.8 COMPETITIVE BENCHMARKING

-

13.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSCARGILL, INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent Developments- MnM viewKERRY- Business overview- Products/Solutions offered- Recent developments- MnM viewDSM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINGREDION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYMRISE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSENSIENT TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBALCHEM INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTERNATIONAL FLAVORS & FRAGRANCES INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFIRMENICH SA- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewFRIESLANDCAMPINA- Business overview- Recent developments- MnM viewTASTETECH- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewLYCORED- Business overview- Recent developments- MnM viewRONALD T. DODGE COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBLUE CALIFORNIA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINNOV’IA- Business overview- Products offered- Recent developments- MnM ViewGIVAUDAN- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewANABIO TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewSPHERA ENCAPSULATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewREED PACIFIC- Business overview- Products/Solutions/Services offered- Recent developments- MnM View

-

14.2 OTHER PLAYERSAVEKAADVANCED BIONUTRITION CORPCLEXTRALVITABLENDENCAPSYS LLC

- 15.1 INTRODUCTION

-

15.2 MICROENCAPSULATION MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWMICROENCAPSULATION MARKET, BY CORE MATERIALMICROENCAPSULATION MARKET, BY REGION

-

15.3 FOOD FLAVORS MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWFOOD FLAVORS MARKET, BY LABELING/REGULATIONFOOD FLAVORS MARKET, BY REGION

-

15.4 FUNCTIONAL FOOD INGREDIENTS MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWFUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPEFUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2017–2022

- TABLE 2 ASSUMPTIONS

- TABLE 3 LIMITATIONS & ASSOCIATED RISKS

- TABLE 4 FOOD ENCAPSULATION MARKET SNAPSHOT, 2022 VS. 2027

- TABLE 5 FOOD ENCAPSULATION TECHNOLOGIES

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LIST OF MAJOR PATENTS PERTAINING TO FOOD ENCAPSULATION, 2012–2021

- TABLE 12 FOOD ENCAPSULATION: ECOSYSTEM VIEW

- TABLE 13 EXPORT VALUE OF PROVITAMINS AND VITAMINS, BY KEY COUNTRY, 2021 (USD)

- TABLE 14 IMPORT VALUE OF PROVITAMINS AND VITAMINS, BY KEY COUNTRY, 2021 (USD)

- TABLE 15 EXPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2021 (USD)

- TABLE 16 IMPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2021 (USD)

- TABLE 17 EXPORT VALUE OF ACIDS, SATURATED ACYCLIC MONOCARBOXYLIC ACIDS, AND ACETIC ACID, BY KEY COUNTRY, 2021 (USD)

- TABLE 18 IMPORT VALUE OF ACIDS, SATURATED ACYCLIC MONOCARBOXYLIC ACIDS, AND ACETIC ACID, BY KEY COUNTRY, 2021 (USD)

- TABLE 19 EXPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2021 (USD)

- TABLE 20 IMPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2021 (USD)

- TABLE 21 EXPORT VALUE OF SATURATED ACYCLIC MONOCARBOXYLIC ACIDS AND PROPIONIC ACID AND ITS SALTS AND ESTERS, BY KEY COUNTRY, 2021 (USD)

- TABLE 22 IMPORT VALUE OF SATURATED ACYCLIC MONOCARBOXYLIC ACIDS AND PROPIONIC ACID AND ITS SALTS AND ESTERS, BY KEY COUNTRY, 2021 (USD)

- TABLE 23 EXPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2021 (USD)

- TABLE 24 IMPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2021 (USD)

- TABLE 25 EXPORT VALUE OF INULIN, BY KEY COUNTRY, 2021 (USD)

- TABLE 26 IMPORT VALUE OF INULIN, BY KEY COUNTRY, 2021 (USD)

- TABLE 27 EXPORT VALUE OF YEASTS (ACTIVE OR INACTIVE), BY KEY COUNTRY, 2021 (USD)

- TABLE 28 IMPORT VALUE OF YEASTS (ACTIVE OR INACTIVE), BY KEY COUNTRY, 2021 (USD)

- TABLE 29 FOOD ENCAPSULATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 30 KEY CONFERENCES & EVENTS, 2022–2023

- TABLE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TECHNOLOGY

- TABLE 32 KEY BUYING CRITERIA FOR FOOD ENCAPSULATION TECHNOLOGY

- TABLE 33 FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018–2021 (USD MILLION)

- TABLE 34 FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022–2027 (USD MILLION)

- TABLE 35 VITAMINS & MINERALS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 36 VITAMINS & MINERALS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 37 VITAMINS & MINERALS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 38 VITAMINS & MINERALS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 40 VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 41 FAT-SOLUBLE VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 42 FAT-SOLUBLE VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 43 WATER-SOLUBLE VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 44 WATER-SOLUBLE VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 45 ENZYMES: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 46 ENZYMES: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 ENZYMES: ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 48 ENZYMES: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 49 ORGANIC ACIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 50 ORGANIC ACIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 ORGANIC ACIDS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 52 ORGANIC ACIDS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 53 PROBIOTICS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 54 PROBIOTICS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 PROBIOTICS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 56 PROBIOTICS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 57 SWEETENERS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 58 SWEETENERS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 59 NUTRITIONAL LIPIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 60 NUTRITIONAL LIPIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 61 PRESERVATIVES: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 62 PRESERVATIVES: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 63 PRESERVATIVES: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 64 PRESERVATIVES: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 65 PREBIOTICS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 66 PREBIOTICS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 PREBIOTICS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 68 PREBIOTICS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 69 COLORS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 70 COLORS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 71 COLORS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 72 COLORS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 73 AMINO ACIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 74 AMINO ACIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 75 FLAVORS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 76 FLAVORS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 77 FLAVORS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 78 FLAVORS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 79 PROTEINS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 80 PROTEINS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 81 OTHER CORE PHASES: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 82 OTHER CORE PHASES: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 83 FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 84 FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 85 MICROENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 86 MICROENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 87 NANOENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 88 NANOENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 89 HYBRID ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 90 HYBRID ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 91 FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 92 FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 93 POLYSACCHARIDES: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 94 POLYSACCHARIDES: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 95 PROTEINS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 96 PROTEINS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 97 LIPIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 98 LIPIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 99 EMULSIFIERS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 100 EMULSIFIERS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 101 FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 102 FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 103 PHYSICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 104 PHYSICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 105 PHYSICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 106 PHYSICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 107 ATOMIZATION: PHYSICAL FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 108 ATOMIZATION: PHYSICAL FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 109 CHEMICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 110 CHEMICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 111 CHEMICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 112 CHEMICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 113 PHYSICO-CHEMICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 114 PHYSICO-CHEMICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 115 PHYSICO-CHEMICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 116 PHYSICO-CHEMICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 117 FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 118 FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 119 DIETARY SUPPLEMENTS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 120 DIETARY SUPPLEMENTS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 121 FUNCTIONAL FOOD PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 122 FUNCTIONAL FOOD PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 123 BAKERY PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 124 BAKERY PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 125 CONFECTIONERY: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 126 CONFECTIONERY: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 127 BEVERAGES: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 128 BEVERAGES: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 129 FROZEN PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 130 FROZEN PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 131 DAIRY PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 132 DAIRY PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 133 OTHER APPLICATIONS: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 134 OTHER APPLICATIONS: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 135 FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 136 FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 137 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 138 NORTH AMERICA: FOOD ENCAPSULATION MARKET, 2022–2027 (USD MILLION)

- TABLE 139 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018–2021 (USD MILLION)

- TABLE 140 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022–2027 (USD MILLION)

- TABLE 141 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 142 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 143 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 144 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 145 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 146 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 147 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 148 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 149 US: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 150 US: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 151 US: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 152 US: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 153 CANADA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 154 CANADA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 155 CANADA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 156 CANADA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 157 MEXICO: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 158 MEXICO: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 159 MEXICO: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 160 MEXICO: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 161 EUROPE: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 162 EUROPE: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 163 EUROPE: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018–2021 (USD MILLION)

- TABLE 164 EUROPE: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022–2027 (USD MILLION)

- TABLE 165 EUROPE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 166 EUROPE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 167 EUROPE: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 168 EUROPE: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 169 EUROPE: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 170 EUROPE: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 171 EUROPE: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 172 EUROPE: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 173 GERMANY: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 174 GERMANY: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 175 GERMANY: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 176 GERMANY: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 177 UK: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 178 UK: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 179 UK: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 180 UK: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 181 FRANCE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 182 FRANCE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 183 FRANCE: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 184 FRANCE: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 185 ITALY: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 186 ITALY: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 187 ITALY: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 188 ITALY: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 189 SPAIN: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 190 SPAIN: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 191 SPAIN: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 192 SPAIN: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 193 REST OF EUROPE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 194 REST OF EUROPE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 195 REST OF EUROPE: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 196 REST OF EUROPE: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 197 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 198 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 199 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018–2021 (USD MILLION)

- TABLE 200 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022–2027 (USD MILLION)

- TABLE 201 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 202 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 203 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 204 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 205 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 206 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 207 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 208 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 209 CHINA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 210 CHINA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 211 CHINA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 212 CHINA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 213 JAPAN: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 214 JAPAN: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 215 JAPAN: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 216 JAPAN: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 217 INDIA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 218 INDIA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 219 INDIA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 220 INDIA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 221 AUSTRALIA & NEW ZEALAND: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 222 AUSTRALIA & NEW ZEALAND: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 223 AUSTRALIA & NEW ZEALAND: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 224 AUSTRALIA & NEW ZEALAND: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 227 REST OF ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 229 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 230 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 231 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 232 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 233 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 234 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 235 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 236 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 237 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 238 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 239 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018–2021 (USD MILLION)

- TABLE 240 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022–2027 (USD MILLION)

- TABLE 241 BRAZIL: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 242 BRAZIL: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 243 BRAZIL: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 244 BRAZIL: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 245 ARGENTINA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 246 ARGENTINA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 247 ARGENTINA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 248 ARGENTINA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 249 REST OF SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 250 REST OF SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 251 REST OF SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 252 REST OF SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 253 ROW: FOOD ENCAPSULATION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 254 ROW: FOOD ENCAPSULATION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 255 ROW: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 256 ROW: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 257 ROW: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 258 ROW: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 259 ROW: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 260 ROW: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 261 ROW: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 262 ROW: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 263 ROW: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018–2021 (USD MILLION)

- TABLE 264 ROW: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022–2027 (USD MILLION)

- TABLE 265 MIDDLE EAST: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 266 MIDDLE EAST: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 267 MIDDLE EAST: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 268 MIDDLE EAST: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 269 AFRICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018–2021 (USD MILLION)

- TABLE 270 AFRICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022–2027 (USD MILLION)

- TABLE 271 AFRICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018–2021 (USD MILLION)

- TABLE 272 AFRICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022–2027 (USD MILLION)

- TABLE 273 FOOD ENCAPSULATION MARKET: DEGREE OF COMPETITION (COMPETITIVE), 2021

- TABLE 274 COMPANY PRODUCT FOOTPRINT, BY APPLICATION

- TABLE 275 COMPANY PRODUCT FOOTPRINT, BY METHOD

- TABLE 276 COMPANY PRODUCT FOOTPRINT, BY REGION

- TABLE 277 COMPANY OVERALL FOOTPRINT

- TABLE 278 FOOD ENCAPSULATION: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 279 COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- TABLE 280 PRODUCT LAUNCHES, 2018

- TABLE 281 DEALS, 2019–2022

- TABLE 282 OTHERS, 2020–2022

- TABLE 283 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 284 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS OFFERED

- TABLE 285 CARGILL, INCORPORATED: OTHERS

- TABLE 286 BASF SE: BUSINESS OVERVIEW

- TABLE 287 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 BASF SE: PRODUCT LAUNCHES

- TABLE 289 BASF SE: DEALS

- TABLE 290 KERRY: BUSINESS OVERVIEW

- TABLE 291 KERRY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 KERRY: DEALS

- TABLE 293 KERRY: OTHERS

- TABLE 294 DSM: BUSINESS OVERVIEW

- TABLE 295 DSM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 DSM: DEALS

- TABLE 297 INGREDION: BUSINESS OVERVIEW

- TABLE 298 INGREDION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 INGREDION: DEALS

- TABLE 300 SYMRISE: BUSINESS OVERVIEW

- TABLE 301 SYMRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 SYMRISE: DEALS

- TABLE 303 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 304 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 305 BALCHEM INC.: BUSINESS OVERVIEW

- TABLE 306 BALCHEM INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- TABLE 308 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 309 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 310 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

- TABLE 311 FIRMENICH SA: BUSINESS OVERVIEW

- TABLE 312 FIRMENICH SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 FRIESLANDCAMPINA: BUSINESS OVERVIEW

- TABLE 314 FRIESLANDCAMPINA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 TASTETECH: BUSINESS OVERVIEW

- TABLE 316 TASTETECH: PRODUCTS OFFERED

- TABLE 317 LYCORED: BUSINESS OVERVIEW

- TABLE 318 LYCORED: PRODUCTS OFFERED

- TABLE 319 RONALD T. DODGE COMPANY: BUSINESS OVERVIEW

- TABLE 320 BLUE CALIFORNIA: BUSINESS OVERVIEW

- TABLE 321 INNOV’IA: BUSINESS OVERVIEW

- TABLE 322 GIVAUDAN: BUSINESS OVERVIEW

- TABLE 323 ANABIO TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 324 SPHERA ENCAPSULATION: BUSINESS OVERVIEW

- TABLE 325 REED PACIFIC: BUSINESS OVERVIEW

- TABLE 326 MICROENCAPSULATION MARKET, BY CORE MATERIAL, 2020–2025 (USD MILLION)

- TABLE 327 MICROENCAPSULATION MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 328 FOOD FLAVORS MARKET, BY LABELING/REGULATION, 2019–2021 (USD MILLION)

- TABLE 329 FOOD FLAVORS MARKET, BY LABELING/REGULATION, 2022–2027 (USD MILLION)

- TABLE 330 FOOD FLAVORS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 331 FOOD FLAVORS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 332 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 333 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 334 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 335 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 FOOD ENCAPSULATION MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 FOOD ENCAPSULATION MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 FOOD ENCAPSULATION MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 6 FOOD ENCAPSULATION MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 FOOD ENCAPSULATION MARKET SIZE ESTIMATION, BY CORE PHASE (FLAVORS): SUPPLY SIDE

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 FOOD ENCAPSULATION MARKET SHARE, BY SHELL MATERIAL, 2022 VS. 2027

- FIGURE 11 FOOD ENCAPSULATION MARKET, BY METHOD, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 FOOD ENCAPSULATION MARKET, BY REGION

- FIGURE 15 FOOD ENCAPSULATION: EMERGING MARKET WITH STEADY GROWTH POTENTIAL

- FIGURE 16 EUROPE TO LEAD ACROSS TECHNOLOGIES IN FOOD ENCAPSULATION MARKET BY 2027

- FIGURE 17 GERMANY: MAJOR CONSUMER OF FOOD ENCAPSULATION IN 2022

- FIGURE 18 US ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 19 INDIA: RETAIL MARKET, 2017–2026 (USD BILLION)

- FIGURE 20 AUSTRALIA: RETAIL SALES OF FUNCTIONAL AND FORTIFIED FOOD PRODUCTS, 2018–2022 (USD MILLION)

- FIGURE 21 GLOBAL RETAIL SALES, 2017–2022 (USD TRILLION)

- FIGURE 22 US: EMPLOYMENT STATUS OF PARENTS WITH CHILDREN OF UNDER 18 YEARS, 2020 VS. 2021

- FIGURE 23 US: POPULATION WITH MULTIPLE CHRONIC ILLNESSES, 2021

- FIGURE 24 FOOD ENCAPSULATION MARKET DYNAMICS

- FIGURE 25 NUMBER OF PATENTS APPROVED FOR FOOD ENCAPSULATION IN GLOBAL MARKET, 2012–2021

- FIGURE 26 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR FOOD ENCAPSULATION, 2012–2021

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 REVENUE SHIFT IMPACTING TRENDS/DISRUPTIONS FOOD ENCAPSULATION MARKET

- FIGURE 29 FOOD ENCAPSULATION: MARKET ECOSYSTEM MAP

- FIGURE 30 EXPORT VALUE OF PROVITAMINS AND VITAMINS, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 31 IMPORT VALUE OF PROVITAMINS AND VITAMINS, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 32 EXPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 33 IMPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 34 EXPORT VALUE OF ACIDS, RATED ACYCLIC MONOCARBOXYLIC ACIDS, AND ACETIC ACID, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 35 IMPORT VALUE OF ACIDS, SATURATED ACYCLIC MONOCARBOXYLIC ACIDS, AND ACETIC ACID, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 36 EXPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 37 IMPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 38 EXPORT VALUE OF SATURATED ACYCLIC MONOCARBOXYLIC ACIDS AND PROPIONIC ACID AND ITS SALTS AND ESTERS, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 39 IMPORT VALUE OF SATURATED ACYCLIC MONOCARBOXYLIC ACIDS AND PROPIONIC ACID AND ITS SALTS AND ESTERS, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 40 EXPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 41 IMPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 42 EXPORT VALUE OF INULIN, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 43 IMPORT VALUE OF INULIN, BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 44 EXPORT VALUE OF YEASTS (ACTIVE OR INACTIVE), BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 45 IMPORT VALUE OF YEASTS (ACTIVE OR INACTIVE), BY KEY COUNTRY, 2017–2021 (USD)

- FIGURE 46 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TECHNOLOGY

- FIGURE 47 KEY BUYING CRITERIA FOR FOOD ENCAPSULATION TECHNOLOGY

- FIGURE 48 INDICATORS OF RECESSION

- FIGURE 49 WORLD INFLATION RATE, 2011–2021

- FIGURE 50 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 51 GLOBAL CORE PHASE MATERIAL MARKET: PREVIOUS FORECAST VS. RECESSION FORECAST

- FIGURE 52 RECESSION INDICATORS AND THEIR IMPACT ON FOOD ENCAPSULATION MARKET

- FIGURE 53 GLOBAL FOOD ENCAPSULATION MARKET: PREVIOUS FORECAST VS. RECESSION FORECAST

- FIGURE 54 FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022 VS. 2027 (USD MILLION)

- FIGURE 55 MICROENCAPSULATION SEGMENT TO LEAD MARKET BY 2027

- FIGURE 56 POLYSACCHARIDES SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2027

- FIGURE 57 PHYSICAL SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2027

- FIGURE 58 FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 59 FOOD ENCAPSULATION: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 60 NORTH AMERICA: FOOD ENCAPSULATION MARKET SNAPSHOT

- FIGURE 61 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018–2021

- FIGURE 62 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 63 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2018–2021

- FIGURE 64 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 65 ASIA PACIFIC: FOOD ENCAPSULATION MARKET SNAPSHOT

- FIGURE 67 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 68 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018–2021

- FIGURE 69 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 70 ROW: INFLATION RATES, BY KEY COUNTRY, 2018–2021

- FIGURE 71 ROW: FOOD ENCAPSULATION MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 72 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD MILLION)

- FIGURE 73 FOOD ENCAPSULATION MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- FIGURE 74 FOOD ENCAPSULATION MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

- FIGURE 75 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 77 KERRY: COMPANY SNAPSHOT

- FIGURE 78 DSM: COMPANY SNAPSHOT

- FIGURE 79 INGREDION: COMPANY SNAPSHOT

- FIGURE 80 SYMRISE: COMPANY SNAPSHOT

- FIGURE 81 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 82 BALCHEM INC.: COMPANY SNAPSHOT

- FIGURE 83 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 84 FRIESLANDCAMPINA: COMPANY SNAPSHOT

This research study involved the extensive use of secondary sources—directories and databases such as the Food and Agriculture Organization and World Health Organization—to identify and collect information useful for a technical, market-oriented, and commercial study of the food encapsulation market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure depicts the research design applied in drafting this report on the food encapsulation market.

Secondary Research

In the secondary research process, various sources such as website information, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the food encapsulation market.

To know about the assumptions considered for the study, download the pdf brochure

Food Encapsulation Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food encapsulation market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- All macroeconomic and microeconomic factors affecting the growth of the food encapsulation market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for food encapsulation on the basis of core phase, application, shell material, method, technology and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyse the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyse the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyse their market position and core competencies.

- To analyse the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the food encapsulation market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe for food encapsulation market includes the Sweden, Belgium, Greece, Switzerland, and other EU & Non-EU Countries

- Further breakdown of the Rest of South America for food encapsulation market includes Peru, Uruguay, and Venezuela.

- Further breakdown of the Rest of Asia Pacific for food encapsulation market includes Thailand, Indonesia, South Korea, Malaysia, Singapore, the Philippines, and Vietnam.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Encapsulation Market