Flow Imaging Microscopy/Dynamic Image Analysis Market by Type (Small Biomolecules, Nanofibers, Viscous Liquids), Dispersion (Wet/Dry Dispersion), Enduser (Pharma-Biotech Cos, CROs, CMOs, F&B, Petrochemicals, Water Testing) - Global Forecast to 2025

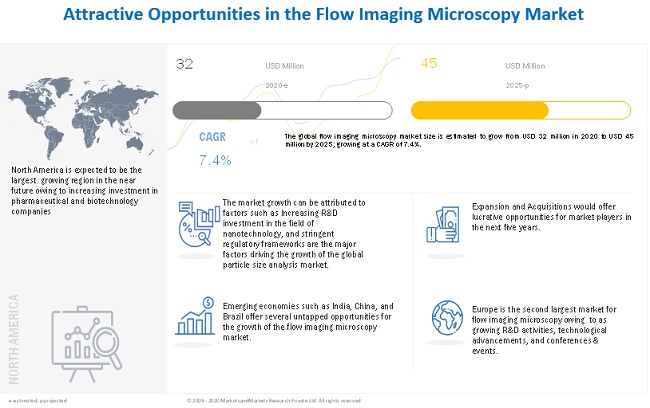

[123 Pages Report] The global flow imaging microscopy market size is projected to grow from an estimated USD 32 million in 2020 to USD 45 million by 2025, at a CAGR of 7.4% during the forecast period. Market growth is driven largely by factors such as increasing research activities in the field of nanotechnology, growing investments in pharmaceutical R&D, and stringent regulatory guidelines for product quality across industries. However, the technological limitation is the major factors that are expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Flow Imaging Microscopy Market

The novel coronavirus has impacted multiple industries across various sectors. It is evident that overall growth across sectors would be heavily impacted, especially in regions where the virus has a higher incidence rate, such as the US, Europe, and China. Industries such as oil and petroleum, mining, and aeronautics are the most severely impacted, while the pharmaceutical, biotechnology, and healthcare industries are optimizing this situation in order to reach and serve a maximum number of patients and healthcare professionals. Thus, impacting long term market flow imaging microscopy.

Flow Imaging Microscopy Market Dynamics

Driver: Increased investments in pharmaceutical

Pharmaceutical and biotechnology companies are making significant investments in research to meet the growing needs of the healthcare sector. For instance, According to 2019 Pharmaceutical Research and Manufacturers of America (PhRMA) member annual survey, in 2018 its member companies invested a USD 79.6 billion in research and development (R&D).Moreover, collaborations between pharma companies and healthcare stakeholders for R&D into therapeutics will also stimulate the use of lab automation., hence exceeding the production levels this will likely to drive the demand of flow imaging microscopy market.

Restraints: Technological limitations

The major drawback of flow imaging microscopy is that particle size is limited to the flow cell depth. Thus, only particles within a certain range can be characterized using single magnification/flow cell depth combination. This could pose bottlenecks in processes wherein samples contain varying sizes of particles, thereby affecting the process as a whole. Such limitations of flow imaging microscopy can be expected to affect market growth during the forecast period.

Opportunities: Growing opportunities in emerging countries

Emerging markets are expected to offer significant growth opportunities to flow imaging microscopy product manufacturers and distributors during the forecast period. This can be attributed to the growing number of research activities in the field of nanotechnology, increasing R&D initiatives, and the rising focus of key market players in this region. Market growth across emerging countries is further supported by improvements in healthcare infrastructures, growing healthcare expenditure, and the availability of flow imaging microscopy manufacturers. This offer a lucrative opportunity for flow imaging microscopy.

Challenges: Lack of well-established distribution networks among SMEs

There are several small and medium-sized organizations offering niche technologies. SMEs, in particular, are facing issues in the marketing and distribution of instruments owing to budgetary constraints. This may adversely affect their revenues and survival in the market. This create an challenge flow imaging microscopy.

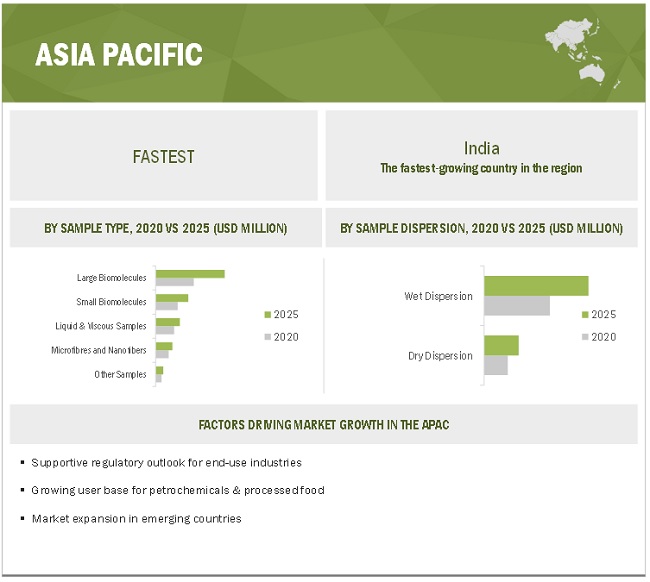

By sample type, the large bomolecule segment is expected to grow at the highest rate during the forecast period

Based on technology, the flow imaging microscopy market is segmented into large biomolecules, small biomolecules, microfibers and nanofibers, liquid & viscous samples, and other samples. The large biomolecules segment is expected to register the highest growth over the forecast period. The significant growth of this segment is attributed to the regulatory recommendations to analyze subvisible. In addition, company offering dynamic image analysis which can measure a wide range of particles are expected to drive the market growth of this segment.

By sample dispersion, the wet dispersion segment was the largest contributor to the imaging technologies market in 2019

Based on sample dispersion, the market is segmented into two major typeswet dispersion and dry dispersion. Factors such as increasing use of nanotechnology in the food & beverage industry, rising applications of nanoparticles, and increasing research & development activities in the pharma & biotechnology industries are driving the growth of the wet dispersion segment.

The biotechnology companies segment was the largest contributor to the flow imaging microscopy market in 2019

The biotechnology companies segment accounted for the largest share of the flow imaging microscopy market, by end user, in 2019. Factors such as the development of novel therapies to address unmet needs, increased access to medicines, and government initiatives to support biotechnology research in emerging regions have also supported market growth in this end-user segment during the forecast period. Moreover, particle analysis of biologics during formulation development and manufacturing is performed in the biotechnology industry.

Asia Pacific is expected to grow at the highest CAGR in the flow imaging microscopy market during the forecast period

The Asia Pacific is a major revenue-generating region in the flow imaging microscopy industry. Factors such as increasing awareness of nanotechnology, implementation of government reforms & regulations to improve product quality, high quality in industry standards, and the gradual movement of manufacturing activities and pharmaceutical R&D from developed markets to Asian markets are propelling the growth of the APAC flow imaging microscopy market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the flow imaging microscopy market include Bio-Techne (US), Yokogawa Electric Corporation (Japan), MICROTRAC MRB (Germany), Micromeritics Instrument Corporation (US), FRITSCH (Germany)

Want to explore hidden markets that can drive new revenue in Flow Imaging Microscopy/Dynamic Image Analysis Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Flow Imaging Microscopy/Dynamic Image Analysis Market?

|

Report Metric |

Details |

|

Market Size Available for Years |

20182025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

20202025 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Sample Type, Sample Dispersion , End user, and Region |

|

Geographies Covered |

North America (US & Canada), Europe (Germany, France, UK, Italy, Spain, and RoE), APAC (Japan, China, India, Australia, South Korea, and RoAPAC), Latin America (Brazil, Mexico, and, RoLA), and Middle East & Africa |

|

Companies Covered |

Bio-Techne (US), Yokogawa Electric Corporation (Japan), Microtrac MRB (Germany), Micromeritics Instrument Corporation (US), Fritsch (Germany), Haver & Boecker (Germany), Spectris (UK), HORIBA (Japan),Shimadzu Corporation (Japan), (Germany), Anton Paar (Austria), Bettersize Instruments (China), and Occhio (Germany). |

This research report categorizes the flow imaging microscopy market based on technology and region.

By Sample Type

- Large Biomolecule

- Small Biomolecules

- Microfibers and Nanofibers

- Liquid & Viscous Samples

- Other Samples

By Sample Dispersion

- Wet Dispersion

- Dry Dispersion

By End-use Industry

- Biotechnology Companies

- Pharmaceutical Companies

- Food & Beverage Companies

- Water Testing Labortaories

- Metal Manufacturing

- Chemical & Petrochemical Industries

- Research & Academia

By Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

- Latin America

- Brazil

- Mexico

- RoLA

- Middle East & Africa

Recent Developments:

- In 2019, HORIBA Instruments Incorporated (Japan) acquired MANTA Instruments, Inc. (US). This acquisition expanded the companys technology of particle characterization instruments.

- In 2020, Bio-Techne (US), opened an office located in Toronto, Canada to support the Canadian life sciences industry for continued growth in this geography.

- In 2020, Yokogawa Electric Corporation (Japan) acquired Fluid Imaging Technologies .This will help Yokogawa to expand the portfolio of cell observation solutions offered by its life innovation business, and thereby strengthen its business targeting the bioeconomy market

Frequently Asked Questions (FAQ):

What is the current size of the flow imaging microscopy market?

The current market size of global flow imaging microscopy market is 31 million in 2019.

What are the growth opportunities related to the adoption of flow imaging microscopy across major regions in the future?

New applications for dynamic image analysis, increasing number of conferences and events growth opportunities in emerging countries are some of the major opportunities of flow imaging microscopy market

Which is the largest growing region during the forecasted period in flow imaging microscopy market?

North America is expected to be the largest region during the forecasted period owing to presence of strong pharmaceutical industry, continued public- private funding related research and stringent industrial compliance to regulation.

Which are the key flow imaging microscopy technologies adopted by end users over the forecast period?

Biotechnology companies segment accounted for the largest share of the flow imaging microscopy market. Owing to the government initiatives to support biotechnology research in emerging regions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONS COVERED

1.3.3 YEARS COVERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Indicative list of secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

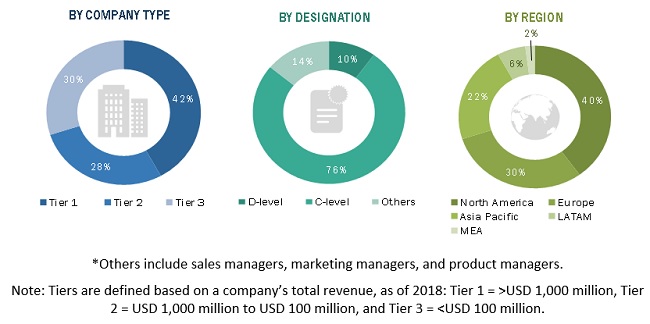

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 REVENUE-BASED MARKET ESTIMATION

FIGURE 4 FLOW IMAGING MICROSCOPY MARKET: REVENUE-BASED ESTIMATION

2.2.2 END-USER BASED MARKET ESTIMATION

FIGURE 5 FLOW IMAGING MICROSCOPY MARKET: END-USER BASED ESTIMATION

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 7 FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 2020 VS. 2025 (USD MILLION)

FIGURE 9 FLOW IMAGING MICROSCOPY MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 10 FLOW IMAGING MICROSCOPY MARKET: GEOGRAPHIC SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 FLOW IMAGING MICROSCOPY MARKET OVERVIEW

FIGURE 11 INCREASING R&D INVESTMENT IN NANOTECHNOLOGY TO DRIVE MARKET GROWTH

4.2 NORTH AMERICAN FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION & COUNTRY

FIGURE 12 WET DISPERSION SEGMENT HELD THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2019

4.3 FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION (2019)

FIGURE 13 WET DISPERSION WAS THE LARGEST MARKET SEGMENT IN 2019

4.4 FLOW IMAGING MICROSCOPY MARKET, BY END USER

FIGURE 14 BIOTECHNOLOGY AND PHARMACEUTICAL COMPANIES HOLD THE LARGEST MARKET SHARES

4.5 GEOGRAPHIC SNAPSHOT OF THE FLOW IMAGING MICROSCOPY MARKET

FIGURE 15 ASIA PACIFIC MARKET TO GROW AT THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 FLOW IMAGING MICROSCOPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing investments in the pharmaceutical industry

5.2.1.2 Increasing R&D funding in the field of nanotechnology

5.2.1.3 Stringent regulatory guidelines for product quality across target industries

5.2.1.4 Rising public-private investments in research

5.2.2 RESTRAINTS

5.2.2.1 Technological limitations

5.2.3 OPPORTUNITIES

5.2.3.1 New applications for dynamic image analysis

5.2.3.2 Rising awareness

5.2.3.3 Growth opportunities in emerging countries

5.2.4 CHALLENGES

5.2.4.1 Lack of well-established distribution networks among SMEs

5.2.4.2 Inadequate infrastructure for research in emerging countries

5.3 IMPACT OF COVID-19 ON THE FLOW IMAGING MICROSCOPY MARKET

6 FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE (Page No. - 44)

6.1 INTRODUCTION

TABLE 1 FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

6.2 LARGE BIOMOLECULES

6.2.1 LARGE BIOMOLECULES DOMINATE THE MARKET, BY SAMPLE TYPE

TABLE 2 FLOW IMAGING MICROSCOPY MARKET FOR LARGE BIOMOLECULES, BY REGION, 20182025 (USD MILLION)

6.3 SMALL BIOMOLECULES

6.3.1 RAPID AND EASY ANALYSIS OF SMALL-MOLECULE DRUG PARTICLES SUPPORTS PRODUCT DEMAND

TABLE 3 FLOW IMAGING MICROSCOPY MARKET FOR SMALL BIOMOLECULES, BY REGION, 20182025 (USD MILLION)

6.4 LIQUID & VISCOUS SAMPLES

6.4.1 NEED TO DETERMINE THE CHARACTERISTICS OF LIQUID SAMPLES IS DRIVING THE MARKET

TABLE 4 FLOW IMAGING MICROSCOPY MARKET FOR LIQUID & VISCOUS SAMPLES, BY REGION, 20182025 (USD MILLION)

6.5 MICROFIBERS & NANOFIBERS

6.5.1 INCREASING ATTENTION ON MICROPLASTIC POLLUTION HAS SUPPORTED THE USE OF IMAGE ANALYSIS, ESPECIALLY IN TEXTILES

TABLE 5 FLOW IMAGING MICROSCOPY MARKET FOR MICROFIBERS & NANOFIBERS, BY REGION, 20182025 (USD MILLION)

6.6 OTHER SAMPLES

TABLE 6 FLOW IMAGING MICROSCOPY MARKET FOR OTHER SAMPLES, BY REGION, 20182025 (USD MILLION)

7 FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION (Page No. - 49)

7.1 INTRODUCTION

TABLE 7 FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

7.2 WET DISPERSION

7.2.1 DUE TO COMPARATIVE EASE OF DISPERSION IN LIQUID MEDIA, WET DISPERSION ANALYSIS IS WIDELY USED

TABLE 8 FLOW IMAGING MICROSCOPY MARKET FOR WET DISPERSION, BY REGION, 20182025 (USD MILLION)

7.3 DRY DISPERSION

7.3.1 DRY DISPERSION IS WIDELY USED IN ANALYZING SMALL MOLECULES

TABLE 9 FLOW IMAGING MICROSCOPY MARKET FOR DRY DISPERSION, BY REGION, 20182025 (USD MILLION)

8 FLOW IMAGING MICROSCOPY MARKET, BY END USER (Page No. - 52)

8.1 INTRODUCTION

TABLE 10 FLOW IMAGING MICROSCOPY MARKET, BY END USER, 20182025 (USD MILLION)

8.2 BIOTECHNOLOGY COMPANIES

8.2.1 RISING FORMULATION AND DEVELOPMENT OF BIOLOGICS WILL DRIVE THE SEGMENT

TABLE 11 FLOW IMAGING MICROSCOPY MARKET FOR BIOTECHNOLOGY COMPANIES, BY REGION, 20182025 (USD MILLION)

8.3 PHARMACEUTICAL COMPANIES

8.3.1 INCREASING FOCUS OF PHARMA COMPANIES ON EXTENDING THEIR PRODUCT PIPELINE WILL BOOST THE MARKET GROWTH

TABLE 12 FLOW IMAGING MICROSCOPY MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 20182025 ((USD MILLION)

8.4 RESEARCH & ACADEMIA

8.4.1 INCREASED PUBLIC & PRIVATE INVESTMENT IN RESEARCH & ACADEMICS SUPPORTS MARKET GROWTH

TABLE 13 FLOW IMAGING MICROSCOPY MARKET FOR RESEARCH & ACADEMIA, BY REGION, 20182025 (USD MILLION)

8.5 FOOD & BEVERAGE INDUSTRIES

8.5.1 INCREASING APPLICATION OF QUALITY CONTROL IN THE FOOD INDUSTRY DRIVES THE MARKET FOR FLOW IMAGING MICROSCOPY

TABLE 14 FLOW IMAGING MICROSCOPY MARKET FOR FOOD & BEVERAGE INDUSTRIES, BY REGION, 20182025 (USD MILLION)

8.6 CHEMICAL & PETROCHEMICAL INDUSTRIES

8.6.1 SIGNIFICANT DEMAND FOR CHEMICAL ANALYSIS IN THE CHEMICAL INDUSTRY TO SUPPORT MARKET GROWTH

TABLE 15 FLOW IMAGING MICROSCOPY MARKET FOR CHEMICAL & PETROCHEMICAL INDUSTRIES, BY REGION, 20182025 (USD MILLION)

8.7 WATER TESTING LABORATORIES

8.7.1 INCREASING DEMAND FOR PRECISE TESTING OF WATER TO MAINTAIN HEALTH AND SAFETY IS A KEY GROWTH DRIVER

TABLE 16 FLOW IMAGING MICROSCOPY MARKET FOR WATER TESTING LABORATORIES, BY REGION, 20182025 (USD MILLION)

8.8 METAL MANUFACTURERS

8.8.1 WIDESPREAD UTILIZATION OF METALS TO AID IN MARKET GROWTH

TABLE 17 FLOW IMAGING MICROSCOPY MARKET FOR METAL MANUFACTURERS, BY REGION, 20182025 (USD MILLION)

9 FLOW IMAGING MICROSCOPY MARKET, BY REGION (Page No. - 59)

9.1 INTRODUCTION

TABLE 18 FLOW IMAGING MICROSCOPY MARKET, BY REGION, 20182025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 17 NORTH AMERICA: FLOW IMAGING MICROSCOPY MARKET SNAPSHOT

TABLE 19 NORTH AMERICA: FLOW IMAGING MICROSCOPY MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 20 NORTH AMERICA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 21 NORTH AMERICA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

TABLE 22 NORTH AMERICA: FLOW IMAGING MICROSCOPY MARKET, BY END USER, 20182025 (USD MILLION)

9.2.1 US

9.2.1.1 The presence of a large number of pharma and biotech companies in the country will fuel the market growth

TABLE 23 US: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 24 US: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rising R&D activities in the country will drive the market

TABLE 25 CANADA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 26 CANADA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.3 EUROPE

TABLE 27 EUROPE: FLOW IMAGING MICROSCOPY MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 28 EUROPE: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 29 EUROPE: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

TABLE 30 EUROPE: FLOW IMAGING MICROSCOPY MARKET, BY END USER, 20182025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany dominates the EU market for flow imaging microscopy

TABLE 31 GERMANY: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 32 GERMANY: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.3.2 UK

9.3.2.1 Increasing demand for flow imaging microscopy in the food& beverage industry will fuel market growth

TABLE 33 UK: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 34 UK: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Government investments in biotechnology will boost the adoption of flow imaging microscopy

TABLE 35 FRANCE: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 36 FRANCE: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increasing exports and investments in the chemical industry are fueling the growth of flow imaging microscopy

TABLE 37 ITALY: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 38 ITALY: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Increasing R&D activities and an emerging nanotechnology ecosystem will boost the flow imaging microscopy market

TABLE 39 SPAIN: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 40 SPAIN: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 41 ROE: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 42 ROE: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 18 ASIA PACIFIC: FLOW IMAGING MICROSCOPY MARKET SNAPSHOT

TABLE 43 ASIA PACIFIC: FLOW IMAGING MICROSCOPY MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 44 ASIA PACIFIC: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 45 ASIA PACIFIC: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

TABLE 46 ASIA PACIFIC: FLOW IMAGING MICROSCOPY MARKET, BY END USER, 20182025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Government initiatives and investment in various end-use industries will fuel the market

TABLE 47 CHINA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 48 CHINA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Growing food safety concerns and rising R&D investment will drive the market

TABLE 49 JAPAN: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 50 JAPAN: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Growing food safety and potential investment in biotechnology in the country will drive the market

TABLE 51 INDIA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 52 INDIA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Increasing research in the field of nanotechnology in the country will boost market growth

TABLE 53 AUSTRALIA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 54 AUSTRALIA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.4.5 SOUTH KOREA

9.4.5.1 Strong research capabilities in biotechnology to boost the market in Korea

TABLE 55 SOUTH KOREA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 56 SOUTH KOREA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 57 ROAPAC: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 58 ROAPAC: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.5 LATIN AMERICA

TABLE 59 LATIN AMERICA: FLOW IMAGING MICROSCOPY MARKET, BY COUNTRY, 20182025 (USD MILLION)

TABLE 60 LATIN AMERICA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 61 LATIN AMERICA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

TABLE 62 LATIN AMERICA: FLOW IMAGING MICROSCOPY MARKET, BY END USER, 20182025 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Collaboration with public and private organizations to drive market growth

TABLE 63 BRAZIL: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 64 BRAZIL: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Growth in the pharma industries to boost the market

TABLE 65 MEXICO: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 66 MEXICO: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 67 ROLA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 68 ROLA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 INCREASING INVESTMENTS IN THE PETROCHEMICAL INDUSTRY ARE DRIVING MARKET GROWTH

TABLE 69 MIDDLE EAST & AFRICA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE TYPE, 20182025 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA: FLOW IMAGING MICROSCOPY MARKET, BY SAMPLE DISPERSION, 20182025 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA: FLOW IMAGING MICROSCOPY MARKET, BY END USER, 20182025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 93)

10.1 INTRODUCTION

FIGURE 19 KEY DEVELOPMENTS BY LEADING MARKET PLAYERS IN THE FLOW IMAGING MICROSCOPY MARKET, 2017 TO 2020

10.2 MARKET SHARE ANALYSIS, 2019

FIGURE 20 GLOBAL FLOW IMAGING MICROSCOPY, RANKING ANALYSIS FOR TOP FIVE PLAYERS, 2019

10.3 COMPETITIVE SCENARIO

10.3.1 PRODUCT LAUNCHES

10.3.2 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS

10.3.3 EXPANSIONS

10.3.4 ACQUISITIONS

10.4 COMPETITIVE EVALUATION MATRIX, 2019

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 EMERGING COMPANIES

FIGURE 21 FLOW IMAGING MICROSCOPY MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

11 COMPANY PROFILES (Page No. - 98)

(Business overview, Products offered, Recent developments, MNM view)*

11.1 BIO-TECHNE CORPORATION

FIGURE 22 BIO-TECHNE: COMPANY SNAPSHOT

11.2 YOKOGAWA ELECTRIC CORPORATION

FIGURE 23 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

11.3 MICROTRAC MRB

11.4 MICROMERITICS INSTRUMENT CORPORATION

11.5 FRITSCH GMBH

11.6 HORIBA GROUP

FIGURE 24 HORIBA: COMPANY SNAPSHOT

11.7 SPECTRIS

FIGURE 25 SPECTRIS: COMPANY SNAPSHOT

11.8 SHIMADZU CORPORATION

FIGURE 26 SHIMADZU CORPORATION: COMPANY SNAPSHOT

11.9 ANTON PAAR GMBH

11.10 BETTERSIZE INSTRUMENTS

11.11 SYMPATEC GMBH

11.12 OCCHIO

11.13 HAVER & BOECKER

*Business overview, Products offered, Recent developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 116)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study on the global flow imaging microscopy market involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the flow imaging microscopy market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the flow imaging microscopy market scenario through secondary research. A significant number of primary interviews were conducted from both the demand (flow imaging microscopy instruments suppliers, vendors, and distributors, personnel from pharmaceutical and biotechnology companies, public and private institutions. and academic institutions) and supply sides (presidents, CEOs, vice presidents, directors, general managers, heads of business segments, and senior managers). The primaries interviewed for this study include experts from the flow imaging microscopy industry, such as CEOs, VPs, directors, sales heads, and marketing managers of tier 1, 2, and 3 companies engaged in offering flow imaging microscopy devices across the globe; administrators and purchase managers; and academic research institutes.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by technology, dispersion type, end user, and region).

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the flow imaging microscopy industry.

Report Objectives

- To define, describe, segment, and forecast the global flow imaging microscopy/ dynamic imaging analysis market on the basis of sample type, sample dispersion, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall flow imaging microscopy/ dynamic imaging analysis market

- To analyze the opportunities in the global flow imaging microscopy/ dynamic imaging analysis market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies2

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To track & analyze competitive developments such as new product launches; agreements & partnerships; mergers & acquisitions; and research activities in the flow imaging microscopy/ dynamic imaging analysis market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the present global flow imaging microscopy market report:

Company Information

- Detailed analysis and profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flow Imaging Microscopy/Dynamic Image Analysis Market