Extended Detection and Response Market by Offering (Solutions and Services), Deployment Mode (Cloud and On-premises), Organization Size (SMEs and Large Enterprises), Vertical (BFSI, Government, Retail & eCommerce) and Region - Global Forecast to 2028

Updated on : Oct 11, 2024

Extended Detection and Response Market Size, Share, Industry, Latest Trends Global Analysis - 2028

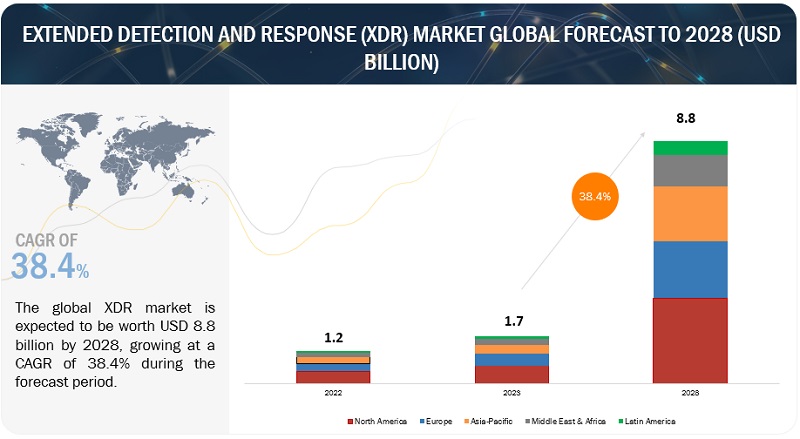

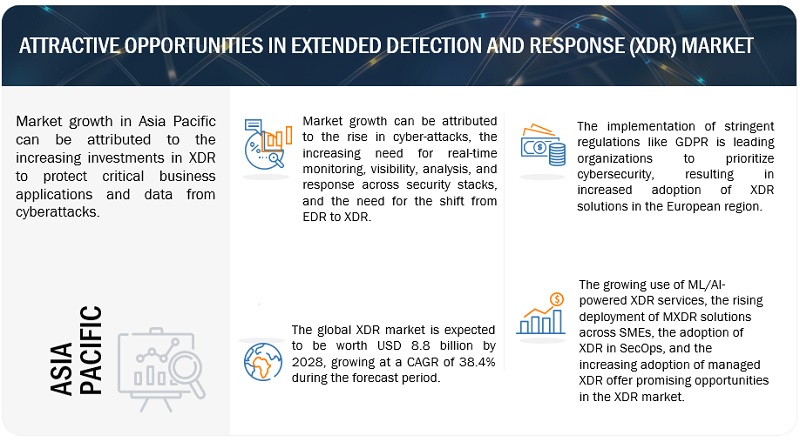

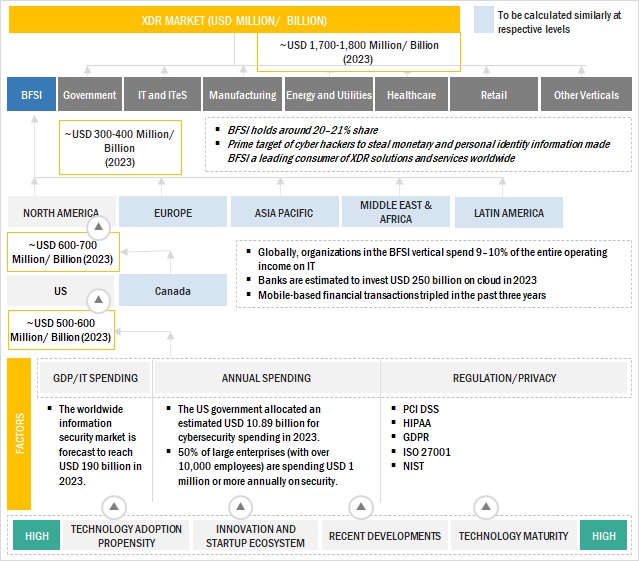

The global Extended Detection and Response Market Size is expected to reach USD 1.7 billion in 2023 to USD 8.8 billion by 2028, at a CAGR of 38.4% during the forecast period. The growth of the The global XDR Market is driven by various factors, including the evolving cyber threat landscape and increasing cyber-attacks, the complexity of IT environments, the integration of security technologies into unified platforms, and the shift from EDR to XDR. Furthermore, the future of the Extended Detection and Response Market looks promising due to the growing use of AI/ML-powered services, the rising deployment of MXDR solutions in SMEs, the adoption of XDR in SecOps, and the increasing popularity of managed XDR. These factors contribute to enhanced threat detection and response capabilities, tailored security solutions for SMEs, efficient SecOps processes, and specialized managed services. These trends indicate a positive trajectory for the XDR market’s growth and advancement.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Extended Detection and Response Market Dynamics

Driver: Integration of security technologies into a unified platform

The integration of various security technologies, such as EDR, NDR, SIEM, and threat intelligence, into a unified platform is a significant driver for the XDR market. This integration facilitates a cohesive and efficient approach to security operations, enabling faster identification, examination, and resolution of threats. By harnessing the strengths of each component technology, XDR enhances detection, correlation, and remediation capabilities. The unified platform enables the consolidation and analysis of data from diverse sources, empowering organizations to proactively detect, respond to, and mitigate security threats across their entire IT landscape.

Restraint: Privacy and compliance concerns with XDR

Adopting XDR brings privacy and compliance considerations as organizations collect and analyze data from various sources like endpoints, networks, and cloud platforms. To address these concerns, organizations must ensure that data collection processes align with privacy regulations and internal policies. Implementing robust data protection measures, such as access controls and encryption, becomes crucial to safeguard sensitive information. Additionally, XDR’s data aggregation and correlation capabilities necessitate access to sensitive information from different security tools and systems, requiring compliance with relevant data protection regulations and privacy requirements. Adequate controls and measures must be implemented to protect personally identifiable information (PII) and other sensitive data from unauthorized access or misuse.

Opportunity: Rising deployment of MXDR solution across the SMEs

XDR presents an opportunity for small and medium-sized enterprises (SMEs) to leverage cybersecurity capabilities and features that were previously inaccessible to them. SMEs often face financial resources and IT expertise limitations, making it challenging to establish sophisticated security systems like SIEM or SOAR. However, the growing prevalence of cloud computing and remote work has expanded the attack surface for SMEs, compelling them to strengthen their cybersecurity defenses and improve infrastructure visibility. XDR effectively addresses these challenges by offering a consolidated solution, allowing SMEs to enhance their cybersecurity posture and protect their electronic information assets. In today’s digital landscape, organizations of all sizes face similar concerns regarding data security and are attractive targets for cybercriminals. XDR levels the playing field by providing SMEs with a valuable tool to bolster their cybersecurity capabilities.

Challenge: Lack of awareness about XDR and vendor lock-in period

The relatively new technology of XDR faces challenges in terms of limited end-user awareness regarding its benefits. A survey by Enterprise Strategy Group (ESG) reveals that only 24% of security professionals are familiar with XDR, indicating a lack of understanding among the majority of professionals regarding the fundamentals and advantages of this technology.

Palo Alto Networks introduced the concept of XDR in 2018, with Cortex XDR being their offering in this space. However, due to its novelty, XDR remains unfamiliar to many users. Additionally, organizations often rely on a combination of vendors to build their security infrastructure. XDR consolidates all security solutions into a single vendor offering, which raises concerns about vendor lock-in. Also, organizations prefer the flexibility of choosing the best security offerings from multiple vendors, presenting a significant challenge in the widespread adoption of XDR.

Extended Detection and Response Market Ecosystem

Based on organization size, the large enterprises segment is to grow at the largest market size during the forecast period.

Large enterprises dominate the Extended Detection and Response Market due to their substantial resources and budgets. They can invest heavily in cybersecurity, allocating significant funds for advanced solutions like XDR. With the ability to hire skilled professionals and deploy robust infrastructure, they can effectively safeguard their complex networks and data. This advantage allows large enterprises to embrace cutting-edge technologies and stay ahead in the evolving landscape of cybersecurity threats. Thus, large enterprises dominate the organization size segment in terms of the largest market size during the forecasted period.

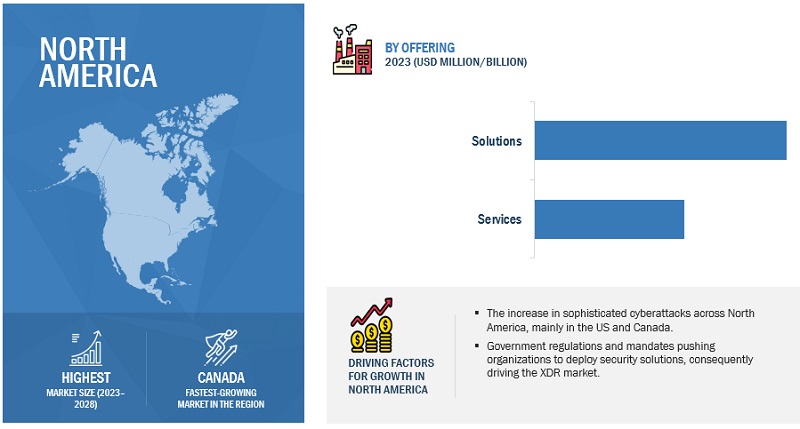

By offering, the solution segment holds the largest market size.

The solution segment holds the highest market size in the XDR market during the forecasted period because XDR solutions offer comprehensive security capabilities, including threat detection, incident response, and endpoint security. They effectively combat the increasing sophistication of cyber threats and simplify security operations by integrating various security tools into a unified platform. XDR solutions also help organizations meet regulatory compliance requirements and benefit from the consolidation of the market, as established cybersecurity vendors offer mature and trusted offerings in this space.

Based on regions, North America holds the largest market size during the forecast period.

Region-wise, North America holds the largest market size in the Extended Detection and Response Market due to several key factors. Firstly, the region experiences a rise in sophisticated cyberattacks, compelling organizations to seek robust solutions like XDR to protect their systems and data. Secondly, the increasing adoption of automated threat response solutions in North America allows security teams to address multiple tasks, enhancing their overall effectiveness efficiently. Furthermore, the collaboration between agencies such as CISA in the United States and Public Safety in Canada, along with government regulations and mandates focused on safeguarding critical infrastructure, further drives the deployment of security solutions, including XDR. These combined factors contribute to North America’s dominant market size in the XDR market as organizations prioritize strong cybersecurity measures in the face of evolving threats.

List of Top Extended Detection and Response Market Companies

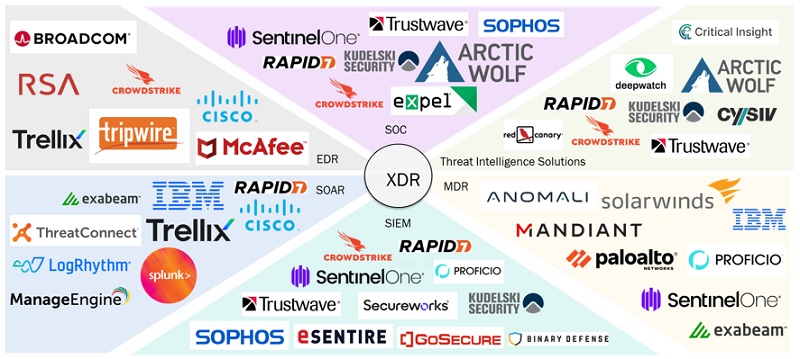

The XDR market includes analysis of globally established venders, such as Trend Micro (Japan), Microsoft (US), Bitdefender (Romania), Palo Alto Networks (US), CrowdStrike (US), SentinelOne (US), IBM (US), Trellix (US), Cybereason (US), Elastic (US), Fortinet (US), Secureworks (US), Cisco (US), Sophos (UK), Broadcom (US), Barracuda Networks (US), eSentire (Canada), Qualys (US), Blueshift (US), Rapid7 (US), Exabeam (US), VMware (US), Cynet (US), LMNTRIX (US), Stella Cyber (US), and Confluera (US).

Want to explore hidden markets that can drive new revenue in Extended Detection and Response Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Extended Detection and Response Market?

|

Report Metrics |

Details |

|

Market size available for years |

|

|

Base year considered |

|

|

Forecast period |

|

|

Forecast units |

|

|

Segments Covered |

|

|

Geographies covered |

|

|

List of top Extended Detection and Response Market Companies covered |

|

The study categorizes the Extended Detection and Response Market by offering, deployment mode, organization size, verticals, and regions.

By Offering:

- Solutions

- Services

By Deployment Mode:

- On-premises

- Cloud

By Organization Size:

- Large Enterprises

- SMEs

By Vertical:

- BFSI

- Government

- Manufacturing

- Energy and Utilities

- Healthcare

- Retail and eCommerce

- IT and ITeS

- Other Verticals (Research and Academia, Energy and Utilities, and Media and Entertainment)

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In April 2023, CrowdStrike (US) launched CrowdStrike Falcon Insight for IoT. It is the first and only EDR/XDR solution for Extended Internet of Things (XIoT) assets worldwide. It provides robust threat detection, tailored threat prevention, custom policy recommendations, rapid response, interoperability with mission-critical XIoT assets, and deep integrations with CrowdStrike Alliance and XIoT partners.

- In February 2023, Trend Micro (Japan) partnered with LogRhythm (US). With this partnership, Trend Micro and LogRhythm integrate their SIEM and XDR platforms to enable security teams to pull threat data from multiple sources, correlate it, and respond automatically to potential threats.

- In May 2022, Microsoft (US) announced the general availability of the Microsoft Defender for business. With this offering, SMBs can leverage enterprise-grade endpoint security, including endpoint detection and response capabilities, to safeguard against ransomware and other sophisticated cyber threats.

- In April 2022, Bitdefender (Romania) launched a native XDR solution named GravityZone XDR, designed to provide rich security context, correlation of disparate alerts, and out-of-the-box analytics. The product has features such as rapid cross-correlation threat detection, automated threat identification & prioritization, and recommended threat response actions.

- In January 2022, Palo Alto Networks (US) and KPMG (Netherlands) partnered to provide cybersecurity services to businesses in India. They aim to offer Managed Security Services (MSS) using Palo Alto Networks’ Cortextm XDR and XSOAR security platforms. These services include Zero Trust and multi-cloud cybersecurity solutions.

Frequently Asked Questions (FAQ):

What are the opportunities in the global Extended Detection and Response Market?

Rising deployment of MXDR solutions across the SMEs, adoption of XDR in SecOps, the increasing adoption of managed XDR, and growing use of ML/Al-powered XDR services are a few factors contributing to the growth and creating new opportunities for the Extended Detection and Response Market.

What is the definition of the XDR market?

XDR is a unified security platform that consolidates various security products. It offers real-time visibility into threats by analyzing, prioritizing, and remediating data across endpoints, emails, servers, cloud workloads, and networks. With its ability to provide deep visibility into advanced threats, XDR ensures rapid threat analysis, enhanced visibility, and faster response times, resulting in effective detection and response to security threats. Additionally, XDR offers the advantage of a lower total cost of ownership, making it an attractive solution in the market.

Which region is expected to show the largest market share in the Extended Detection and Response Market?

North America is expected to account for the largest market share during the forecast period.

Who are the major market players covered in the report?

Major vendors in the market are Trend Micro (Japan), Microsoft (US), Bitdefender (Romania), Palo Alto Networks (US), CrowdStrike (US), SentinelOne (US), IBM (US), Trellix (US), Cybereason (US), Elastic (US), Fortinet (US), Secureworks (US), Cisco (US), Sophos (UK), Broadcom (US), Barracuda Networks (US), eSentire (Canada), Qualys (US), Blueshift (US), Rapid7 (US), Exabeam (US), VMware (US), Cynet (US), LMNTRIX (US), Stella Cyber (US), and Confluera (US).

What is the current size of the global XDR market?

The global Extended Detection and Response Market size is projected to grow from USD 1.7 billion in 2023 to USD 8.8 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 38.4% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Evolving cyber threat landscape/Increasing cyber attacks- Need for real-time monitoring, visibility, analysis, and response across security stacks- Increase in complexity of IT environments- Integration of security technologies into unified platform- Need for shift from EDR to XDRRESTRAINTS- Lack of trust among enterprises to provide complete control of system architecture to XDR providers- XDR deployment issues- Privacy and compliance concerns with XDROPPORTUNITIES- Growing use of ML/AI-powered XDR services- Rising deployment of MXDR solutions across SMEs- Adoption of XDR in SecOps- Increasing adoption of managed XDRCHALLENGES- Lack of awareness about XDR and vendor lock-in period

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPESINNOVATIONS AND PATENT APPLICATIONSTOP APPLICANTS

-

5.6 PRICING ANALYSISSELLING PRICES OF KEY PLAYERS, BY TEAM SIZE AND ENDPOINT

-

5.7 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)IOT SECURITYNETWORK TRAFFIC ANALYSIS (NTA) TOOLSUSER AND ENTITY BEHAVIOR ANALYTICS (UEBA)ENDPOINT DETECTION AND RESPONSE (EDR) TOOLS

-

5.8 USE CASESENPI GROUP REDUCED RISK WITH BETTER ENDPOINT VISIBILITYING USED MICROSOFT 365 DEFENDER SOLUTION TO IMPROVE SECURITY POSTURETHINK WHOLE PERSON HEALTHCARE CHOSE PALO ALTO NETWORKS CORTEX XDR FOR ENDPOINT PROTECTIONCARBERY GROUP DEPLOYED TREND MICRO’S MANAGED XDR SERVICESGKN WHEELS & STRUCTURES CHOSE SECUREWORK’S MANAGED XDR SOLUTIONS FOR ALL-TIME PROACTIVE MONITORING

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 TARIFF AND REGULATORY LANDSCAPEPAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI DSS)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)FEDERAL INFORMATION SECURITY MANAGEMENT ACT (FISMA)GRAMM-LEACH-BLILEY ACT (GLBA)SARBANES-OXLEY ACT (SOX)INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) STANDARD 27001EUROPEAN UNION GENERAL DATA PROTECTION REGULATION (EU GDPR)FFIEC CYBERSECURITY ASSESSMENT TOOLNIST CYBERSECURITY FRAMEWORKDEFENSE FEDERAL ACQUISITION REGULATION SUPPLEMENT (DFARS)CSA STAR

-

5.13 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES & EVENTS IN 2022–2023

- 5.15 TECHNOLOGY ROADMAP OF XDR MARKET

-

5.16 BUSINESS MODEL OF XDRMANAGED SECURITY SERVICE (MSS)SUBSCRIPTION SERVICEINTEGRATION AND CONSULTING SERVICE

- 6.1 INTRODUCTION

-

6.2 SOLUTIONSXDR TO REVOLUTIONIZE ENDPOINT SECURITY AND ANALYTICS, ADDRESSING CYBERSECURITY GAPS AND BOOSTING EFFICIENCYSOLUTIONS: EXTENDED DETECTION AND RESPONSE MARKET DRIVERSGRANULAR VISIBILITYADVANCED THREAT DETECTION AND INVESTIGATIONCOMPREHENSIVE ATTACK SURFACE COVERAGEPRIORITIZATION OF THREATS AND ALERTSINCIDENT RESPONSE AND ORCHESTRATION

-

6.3 SERVICESSECURITY VENDORS TO PROVIDE MANAGED XDR SERVICES FOR CYBERSECURITY NEEDSSERVICES: EXTENDED DETECTION AND RESPONSE MARKET DRIVERSMANAGED EXTENDED DETECTION AND RESPONSE SERVICES

- 7.1 INTRODUCTION

-

7.2 ON-PREMISESON-PREMISES XDR TO PROVIDE ORGANIZATIONS FULL CONTROL OVER OPERATIONSON-PREMISES: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

-

7.3 CLOUDDEMAND FOR CLOUD DEPLOYMENT TO BE DRIVEN BY COST OPTIMIZATION, SCALABILITY, AND FLEXIBILITYCLOUD: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

- 8.1 INTRODUCTION

-

8.2 LARGE ENTERPRISESRISING CONCERNS ABOUT REGULATORY COMPLIANCE TO FUEL ADOPTION OF XDR SERVICESLARGE ENTERPRISES: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

-

8.3 SMALL AND MEDIUM-SIZED ENTERPRISESFLEXIBILITY AND SCALABILITY TO BOOST ADOPTION OF XDR SOLUTIONSSMALL AND MEDIUM-SIZED ENTERPRISES: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCEINCREASE IN INTERNET AND MOBILE BANKING TO DRIVE ADOPTION OF XDR SOLUTIONSBANKING, FINANCIAL SERVICES, AND INSURANCE: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

-

9.3 GOVERNMENTIMPLEMENTING E-GOVERNANCE IN GOVERNMENT AGENCIES LEADING TO INCREASED ADOPTION OF XDR SERVICESGOVERNMENT: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

-

9.4 MANUFACTURINGADOPTION OF DIGITAL TECHNOLOGIES IN MANUFACTURING SECTOR TO DRIVE DEMAND FOR XDR SOLUTIONSMANUFACTURING: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

-

9.5 ENERGY AND UTILITIESSECURITY OF ENERGY AND UTILITIES INFRASTRUCTURE CRITICAL TO EVERY COUNTRY’S ECONOMYENERGY AND UTILITIES: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

-

9.6 HEALTHCAREHEALTHCARE ORGANIZATIONS FACING SIGNIFICANT RISK OF CYBERATTACKS AND DATA BREACHESHEALTHCARE: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

-

9.7 RETAIL AND ECOMMERCERETAILERS TO PROTECT SENSITIVE CUSTOMER DATA USING XDR SOLUTIONSRETAIL AND ECOMMERCE: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

-

9.8 IT AND ITESXDR SOLUTIONS TO DETECT AND RESPOND TO THREATS ACROSS CLIENT ENVIRONMENTSIT AND ITES: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

-

9.9 OTHER VERTICALSOTHER VERTICALS: EXTENDED DETECTION AND RESPONSE MARKET DRIVERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Presence of several XDR vendors to drive adoption of XDR solutionsCANADA- Government initiatives to drive adoption of XDR for defending against cyberattacks within networks

-

10.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- UK being prone to most cybersecurity attacks in Europe to drive XDR marketGERMANY- German government’s updated Cyber Security Strategy to provide framework for cybersecurity over next five yearsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Technological advancements in China to drive XDR adoptionJAPAN- Initial adoption of high-end technology, such as XDR, to help cybersecurity developments in JapanINDIA- Increasing losses due to cyber-attacks to boost demand for XDR solutionsAUSTRALIA- Various initiatives by government to boost cybersecurity awarenessREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Government strategies being updated to improve cybersecurity in regionAFRICA- Rising cloud adoption to drive demand for advanced cybersecurity solutions

-

10.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Cyber-attacks in Brazil driving cybersecurity demand, which, in turn, will drive demand for XDR solutionsMEXICO- Various global XDR vendors to put efforts to grow in Mexican marketspaceREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 HISTORICAL REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS

- 11.4 MARKET RANKING OF KEY PLAYERS

- 11.5 VALUATION AND FINANCIAL METRICS OF XDR VENDORS

-

11.6 EVALUATION QUADRANT FOR KEY PLAYERS, 2023DEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 COMPETITIVE BENCHMARKING FOR KEY PLAYERSEVALUATION CRITERIA FOR KEY COMPANIES

-

11.8 EVALUATION QUADRANT FOR STARTUPS/SMES, 2023DEFINITIONS AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.9 COMPETITIVE BENCHMARKING FOR STARTUPS/SMESEVALUATION CRITERIA FOR STARTUPS/SMES

-

11.10 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND PRODUCT ENHANCEMENTSDEALS

-

12.1 KEY PLAYERSPALO ALTO NETWORKS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCROWDSTRIKE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSECUREWORKS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSENTINELONE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTREND MICRO- Business overview- Products/Solutions/Services offered- Recent developmentsBITDEFENDER- Business overview- Products/Solutions/Services offered- Recent developmentsIBM- Business overview- Products/Solutions/Services offered- Recent developmentsTRELLIX- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER KEY PLAYERSSOPHOSBROADCOMCYBEREASONELASTICFORTINETBARRACUDA NETWORKSESENTIREQUALYSBLUESHIFTRAPID7EXABEAMVMWARE

-

12.3 STARTUPSCYNETLMNTRIXSTELLAR CYBERCONFLUERA

- 13.1 LIMITATIONS

- 13.2 MANAGED DETECTION AND RESPONSE MARKET

- 13.3 ENDPOINT DETECTION AND RESPONSE MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 EXTENDED DETECTION AND RESPONSE MARKET SIZE AND GROWTH, 2018–2022 (USD MILLION, Y-O-Y %)

- TABLE 4 EXTENDED DETECTION AND RESPONSE MARKET SIZE AND GROWTH, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 5 ROLE OF COMPANIES IN EXTENDED DETECTION AND RESPONSE MARKET ECOSYSTEM

- TABLE 6 PATENTS FILED, 2020–2023

- TABLE 7 PATENTS GRANTED IN XDR MARKET, 2020–2023

- TABLE 8 RELATED PATENTS

- TABLE 9 XDR MARKET: PRICING ANALYSIS

- TABLE 10 SELLING PRICES, BY KEY PLAYER (USD)

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 PORTER’S FIVE FORCES IMPACT ON XDR MARKET

- TABLE 14 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 XDR MARKET: LIST OF CONFERENCES AND EVENTS, 2022–2023

- TABLE 16 SHORT-TERM ROADMAP, 2023–2025

- TABLE 17 LONG-TERM ROADMAP, 2029–2030

- TABLE 18 EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 19 EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 SOLUTIONS: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 SOLUTIONS: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 SERVICES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 SERVICES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 MANAGED EXTENDED DETECTION AND RESPONSE SERVICES

- TABLE 25 EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 26 EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 27 ON-PREMISES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 ON-PREMISES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 CLOUD: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 CLOUD: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 32 EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 33 LARGE ENTERPRISES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 LARGE ENTERPRISES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 SMALL AND MEDIUM-SIZED ENTERPRISES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 SMALL AND MEDIUM-SIZED ENTERPRISES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 38 EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 39 BANKING, FINANCIAL SERVICES, AND INSURANCE: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 BANKING, FINANCIAL SERVICES, AND INSURANCE: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 GOVERNMENT: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 GOVERNMENT: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 MANUFACTURING: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 MANUFACTURING: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 ENERGY AND UTILITIES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 ENERGY AND UTILITIES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 HEALTHCARE: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 HEALTHCARE: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 RETAIL AND ECOMMERCE: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 RETAIL AND ECOMMERCE: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 IT AND ITES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 IT AND ITES: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 OTHER VERTICALS: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 OTHER VERTICALS: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 67 US: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 68 US: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 69 US: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 70 US: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 71 US: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 72 US: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 73 US: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 74 US: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 75 CANADA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 76 CANADA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 78 CANADA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 79 CANADA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 80 CANADA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 81 CANADA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 82 CANADA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 84 EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 86 EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 88 EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 90 EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 92 EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 UK: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 94 UK: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 95 UK: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 96 UK: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 97 UK: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 98 UK: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 99 UK: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 100 UK: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 101 GERMANY: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 102 GERMANY: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 103 GERMANY: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 104 GERMANY: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 105 GERMANY: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 106 GERMANY: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 107 GERMANY: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 108 GERMANY: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 112 REST OF EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 114 REST OF EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 116 REST OF EUROPE: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 122 ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 127 CHINA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 128 CHINA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 129 CHINA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 130 CHINA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 131 CHINA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 132 CHINA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 133 CHINA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 134 CHINA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 135 JAPAN: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 136 JAPAN: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 137 JAPAN: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 138 JAPAN: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 139 JAPAN: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 140 JAPAN: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 141 JAPAN: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 142 JAPAN: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 143 INDIA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 144 INDIA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 145 INDIA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 146 INDIA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 147 INDIA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 148 INDIA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 149 INDIA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 150 INDIA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 151 AUSTRALIA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 152 AUSTRALIA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 153 AUSTRALIA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 154 AUSTRALIA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 155 AUSTRALIA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 156 AUSTRALIA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 157 AUSTRALIA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 158 AUSTRALIA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 177 MIDDLE EAST: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 178 MIDDLE EAST: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 180 MIDDLE EAST: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 181 MIDDLE EAST: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 182 MIDDLE EAST: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 183 MIDDLE EAST: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 185 AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 186 AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 187 AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 188 AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 189 AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 190 AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 191 AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 192 AFRICA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 193 LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 194 LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 195 LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 196 LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 197 LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 198 LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 199 LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 200 LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 201 LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 202 LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 203 BRAZIL: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 204 BRAZIL: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 205 BRAZIL: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 206 BRAZIL: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 207 BRAZIL: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 208 BRAZIL: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 209 BRAZIL: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 210 BRAZIL: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 211 MEXICO: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 212 MEXICO: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 213 MEXICO: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 214 MEXICO: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 215 MEXICO: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 216 MEXICO: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 217 MEXICO: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 218 MEXICO: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 219 REST OF LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 220 REST OF LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 221 REST OF LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 222 REST OF LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 223 REST OF LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 224 REST OF LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 225 REST OF LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 226 REST OF LATIN AMERICA: EXTENDED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 227 EXTENDED DETECTION AND RESPONSE MARKET: DEGREE OF COMPETITION

- TABLE 228 COMPANY FOOTPRINT, BY REGION

- TABLE 229 COMPANY FOOTPRINT, BY OFFERING

- TABLE 230 COMPANY FOOTPRINT, BY VERTICAL

- TABLE 231 LIST OF STARTUPS/SMES

- TABLE 232 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY REGION

- TABLE 233 EXTENDED DETECTION AND RESPONSE MARKET: PRODUCT LAUNCHES

- TABLE 234 EXTENDED DETECTION AND RESPONSE MARKET: DEALS

- TABLE 235 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- TABLE 236 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- TABLE 238 PALO ALTO NETWORKS: DEALS

- TABLE 239 MICROSOFT: BUSINESS OVERVIEW

- TABLE 240 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 MICROSOFT: PRODUCT LAUNCHES

- TABLE 242 MICROSOFT: DEALS

- TABLE 243 CROWDSTRIKE: BUSINESS OVERVIEW

- TABLE 244 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 CROWDSTRIKE: PRODUCT LAUNCHES

- TABLE 246 CROWDSTRIKE: DEALS

- TABLE 247 SECUREWORKS: BUSINESS OVERVIEW

- TABLE 248 SECUREWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 SECUREWORKS: PRODUCT LAUNCHES

- TABLE 250 SECUREWORKS: DEALS

- TABLE 251 SENTINELONE: BUSINESS OVERVIEW

- TABLE 252 SENTINELONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 SENTINELONE: PRODUCT LAUNCHES

- TABLE 254 SENTINELONE: DEALS

- TABLE 255 TREND MICRO: BUSINESS OVERVIEW

- TABLE 256 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 TREND MICRO: PRODUCT LAUNCHES

- TABLE 258 TREND MICRO: DEALS

- TABLE 259 BITDEFENDER: BUSINESS OVERVIEW

- TABLE 260 BITDEFENDER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 BITDEFENDER: PRODUCT LAUNCHES

- TABLE 262 BITDEFENDER: DEALS

- TABLE 263 IBM: BUSINESS OVERVIEW

- TABLE 264 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 IBM: PRODUCT LAUNCHES

- TABLE 266 IBM: DEALS

- TABLE 267 TRELLIX: BUSINESS OVERVIEW

- TABLE 268 TRELLIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 TRELLIX: DEALS

- TABLE 270 CISCO: BUSINESS OVERVIEW

- TABLE 271 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 CISCO: PRODUCT LAUNCHES

- TABLE 273 CISCO: DEALS

- TABLE 274 ADJACENT MARKETS AND FORECASTS

- TABLE 275 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 276 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 277 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 278 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 279 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 280 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 281 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 282 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 283 MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 284 MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 285 ENDPOINT DETECTION AND RESPONSE MARKET, BY COMPONENT, 2014–2021 (USD MILLION)

- TABLE 286 ENDPOINT DETECTION AND RESPONSE MARKET, BY ENFORCEMENT POINT, 2014–2021 (USD MILLION)

- TABLE 287 ENDPOINT DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2014–2021 (USD MILLION)

- TABLE 288 ENDPOINT DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2014–2021 (USD MILLION)

- TABLE 289 ENDPOINT DETECTION AND RESPONSE MARKET, BY VERTICAL, 2014–2021 (USD MILLION)

- TABLE 290 ENDPOINT DETECTION AND RESPONSE MARKET, BY REGION, 2014–2021 (USD MILLION)

- FIGURE 1 EXTENDED DETECTION AND RESPONSE MARKET: RESEARCH DESIGN

- FIGURE 2 EXTENDED DETECTION AND RESPONSE MARKET: DATA TRIANGULATION

- FIGURE 3 EXTENDED DETECTION AND RESPONSE MARKET: RESEARCH FLOW

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE) - REVENUE OF SOLUTIONS/SERVICES OF EXTENDED DETECTION AND RESPONSE VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR SOLUTIONS/SERVICES: APPROACH, BOTTOM-UP (DEMAND SIDE)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH, TOP-DOWN (DEMAND SIDE)

- FIGURE 8 EXTENDED DETECTION AND RESPONSE FUNCTION

- FIGURE 9 GLOBAL EXTENDED DETECTION AND RESPONSE MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 11 FASTEST-GROWING SEGMENTS OF XDR MARKET

- FIGURE 12 EVOLVING CYBER THREAT LANDSCAPE AND GROWING USE OF ML/AI-POWERED XDR SOLUTIONS TO DRIVE XDR MARKET GROWTH

- FIGURE 13 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 14 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 15 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 16 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 17 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: XDR MARKET

- FIGURE 19 XDR: TYPES OF SERVICES

- FIGURE 20 XDR MARKET: VALUE CHAIN

- FIGURE 21 EXTENDED DETECTION AND RESPONSE MARKET ECOSYSTEM

- FIGURE 22 NUMBER OF PATENTS GRANTED ANNUALLY, 2020–2023

- FIGURE 23 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020–2023

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 26 XDR MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- FIGURE 27 EXTENDED DETECTION AND RESPONSE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 29 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 31 RETAIL AND ECOMMERCE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 35 HISTORICAL FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY EXTENDED DETECTION AND RESPONSE PROVIDERS

- FIGURE 36 EXTENDED DETECTION AND RESPONSE MARKET SHARE ANALYSIS

- FIGURE 37 MARKET RANKING OF KEY EXTENDED DETECTION AND RESPONSE PLAYERS, 2023

- FIGURE 38 VALUATION AND FINANCIAL METRICS OF EXTENDED DETECTION AND RESPONSE VENDORS

- FIGURE 39 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 40 EVALUATION QUADRANT FOR KEY PLAYERS, 2023

- FIGURE 41 EVALUATION QUADRANT FOR SMES/STARTUPS: CRITERIA WEIGHTAGE

- FIGURE 42 EVALUATION QUADRANT FOR STARTUPS/SMES, 2023

- FIGURE 43 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 44 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 45 CROWDSTRIKE: COMPANY SNAPSHOT

- FIGURE 46 SECUREWORKS: COMPANY SNAPSHOT

- FIGURE 47 SENTINELONE: COMPANY SNAPSHOT

- FIGURE 48 TREND MICRO: COMPANY SNAPSHOT

- FIGURE 49 IBM: COMPANY SNAPSHOT

- FIGURE 50 CISCO: COMPANY SNAPSHOT

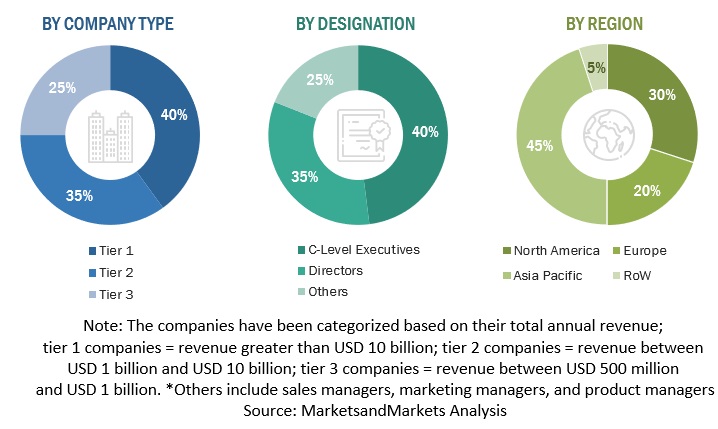

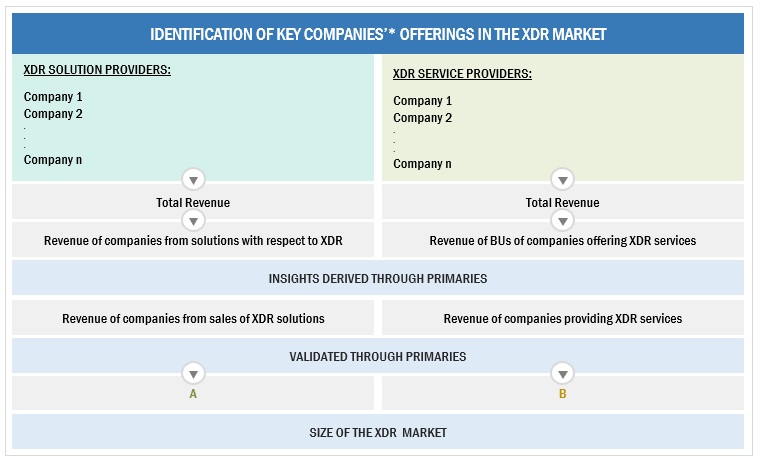

The study involved major activities in estimating the market size for the Extended Detection and Response market. An exhaustive secondary research analysis was conducted to collect information on the XDR market. The next step was to validate the market insights with industry experts across the value chain using primary research. Various approaches, such as top-down and bottom-up, were employed to estimate the total market size. Post that, the market breakup and data triangulation process was used to estimate the market size of the market segments and subsegments.

This research study used secondary sources, directories, several research papers, and databases, such as D&B Hoovers, Bloomberg Businessweek, MSSPAlert, CyberDB, and Factiva, to identify and collect information for a technical and market-oriented study of the global Extended Detection and Response Market. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, industry consultants, and C-level executives of multiple companies offering XDR solutions and services, to verify critical qualitative and quantitative information, as well as assess market prospects and industry trends. Sources such as the Information System Security Association, National Association of Information Sharing and Analysis Centers (ISACs), and various cybersecurity associations were used to collect information specific to the market.

The primary sources were industry experts from core and related industries, preferred suppliers, developers, distributors, service providers, technology developers, and technologists from companies and organizations related to all segments of the XDR market’s value chain.

Secondary Research

The market size of the companies offering XDR solutions and services was determined based on the secondary data available through credible paid and unpaid sources from our repository. It was also arrived at by analyzing the product/ service portfolios of key companies in the market. Secondary research was mainly used to obtain information about the industry’s supply chain, country-based technology spending, the total number of key players and startups, market segmentation, key developments from both market and technology perspectives, and economic trends. For instance, the market size of vendors offering XDR solutions is based on the secondary sources available through paid databases and publicly available information.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for Extended Detection and Response Market report. The primary sources from the supply side included various industry experts, including Vice Presidents (VPs), Chief Executive Officers (CEOs), marketing heads, technology and innovation directors, and related key executives from key companies and organizations operating in the XDR market. Extensive primary research was conducted during the study to collect information and verify and validate the critical numbers. The primary analysis was also undertaken to identify the market segmentation types; industry trends; the competitive landscape of the Extended Detection and Response Market players; and the fundamental market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the XDR market. Top-down and bottom-up approaches and several data triangulation methods were extensively used to perform market estimation, market forecasting, and validation for the overall market segments and sub-segments listed in this report.

Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-Up Approach

Data Triangulation

After arriving at the total XDR market size using the market size estimation processes explained above, the market was split into several segments. The data triangulation and market breakup processes were employed to complete the overall market engineering process and arrive at the numbers for each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Extended Detection and Response (XDR) is a security platform consolidating multiple security products. It provides real-time visibility into threats by analyzing, prioritizing, and remediating data from various sources such as endpoints, emails, servers, cloud workloads, and networks. Key advantages of XDR include quick threat analysis, enhanced visibility, faster response times, and a lower total cost of ownership. Overall, XDR is a comprehensive solution that enables firms to efficiently detect and respond to security threats across multiple platforms.

Key Stakeholders

- XDR Solution Vendors

- Information Security Consultants

- Security System Integrators (SSIs)

- Cybersecurity Software Vendors

- Cybersecurity Service Providers

- Government Agencies

- Independent Software Vendors (ISVs)

- Consulting Firms

- System Integrators

- Value-added Resellers (VARs)

- IT Security Agencies

- Managed Security Service Providers (MSSPs)

Report Objectives

- To define, describe, and forecast the Extended Detection and Response Market based on offerings, deployment mode, organization size, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the XDR market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the Extended Detection and Response Market

- To profile the key players of the XDR market and comprehensively analyze their market size and core competencies.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global Extended Detection and Response Market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Extended Detection and Response Market