Environmental Monitoring Market Size, Share & Trends by Product Type (Sensors, Indoor Monitors, Outdoor Monitors), Sampling Method (Continuous, Active, Passive, Intermittent), Component, Application, End-User, and Region - Global Forecast to 2029

Environmental Monitoring Market Size, Share & Trends

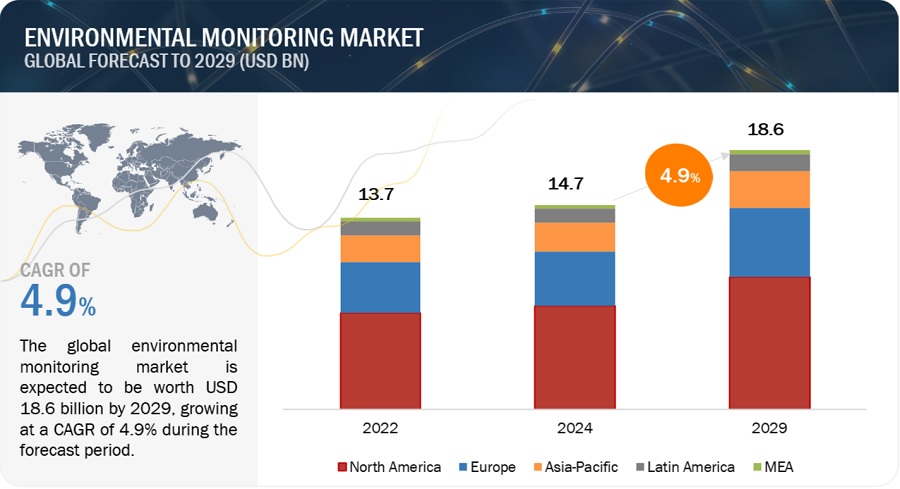

The size of global environmental monitoring market in terms of revenue was estimated to be worth $14.7 billion in 2024 and is poised to reach $18.6 billion by 2029, growing at a CAGR of 4.9% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

During the forecast years, the growth of the market is attributed to increasing public awareness about different environmental pollution and related health issues, strict pollution monitoring standards by government, deterioration of air quality due to rise in PM2.5 levels.

Environmental Monitoring Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Sepsis Diagnostics: Market Dynamics

Driver: Need for efficient natural resource management

The main driving force for the growth of the environmental monitoring market is the increasing need for efficient natural resource management. Economies rely on natural resources (biomass, water, and land) including material resources (fossil fuels, metals and non-metallic minerals) for revenue generation. Most nations are now adopting circular business models and are becoming resilient by reducing dependence on material. Limiting the environmental impacts of agriculture, forestry, fishing, mining, and quarrying industries by sustainable management of resources thus help mitigate climate change.

Restraint: High costs of environmental monitoring devices

The material used in the development of monitoring devices significantly contributes to the cost of the advanced monitoring devices. For instance, technological advancements in sensors have revolutionized monitoring systems, with digital sensors addressing noise and security issues once prevalent in analog counterparts. Continuous innovation in sensor and depth print components has driven the development of sophisticated monitoring solutions, with a focus on enhancing measurement accuracy and reliability. Digital sensors offer cost-effective solutions, simplified installation, and seamless data transmission, making them the preferred choice for various applications.

Opportunity: Supportive rules and regulations by government to reduce environmental pollution

To reduce industrial pollutants and to promote cleaner technologies the “Policy Statement for abatement of pollution, 1992” and “National Conservation Strategy and the Policy Statement on Environment & Development, 1992” were emphasized. The Ministry of Environment and Forests prioritizes safeguarding animal welfare and mitigating pollution, particularly in aquatic ecosystems like lakes and rivers, as well as preserving biodiversity, forests, and wildlife. The primary emphasis is on implementing policies and initiatives geared towards preserving the natural resources of the nation.

Challenge: Slow adoption of pollution control policies

The slow adoption of pollution control policies is a major concern worldwide. In the past decade, a combination of energy and pollution control policies, along with structural shifts in the economy, has disconnected emission trends from economic expansion. The external costs of air pollution, as well as the adverse impacts of individual pollutants on human health and the environment, are quantified using a standardized metric—a monetary value devised through collaboration among various scientific and economic fields. While National Pollution Control Regulations aim to facilitate economic growth without significant degradation of air quality, they may not suffice to lower pollution levels in many areas. The establishment of the European Pollutant Release and Transfer Register (EPTR) in 2006 was intended to improve public access to environmental data.

Environmental Monitoring Industry Ecosystem

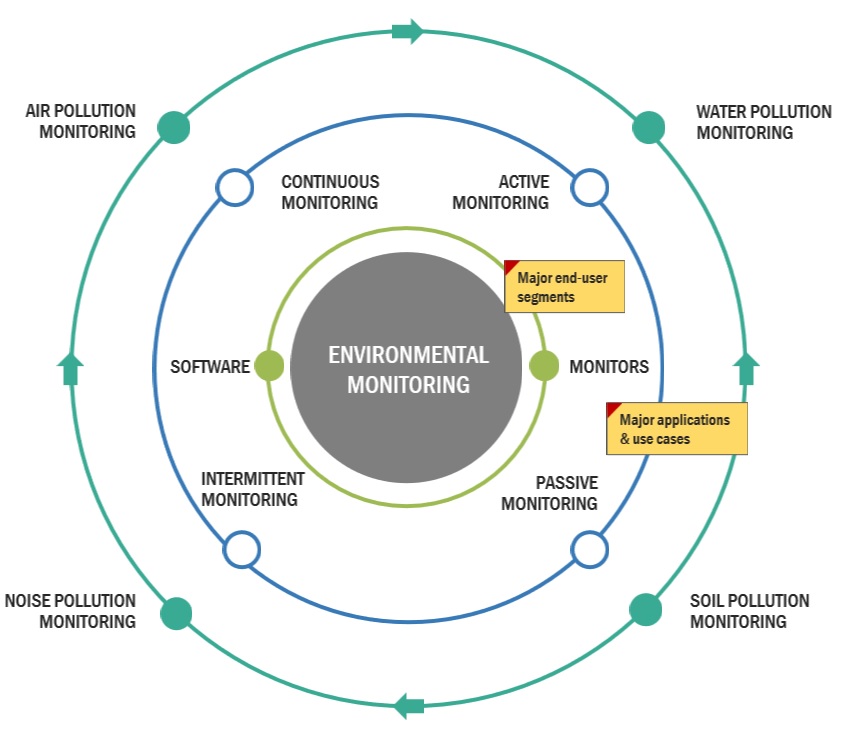

By product, the monitors segment accounted for the largest share of the environmental monitoring industry during the forecast period.

Based on the product, the environmental monitoring is segmented into monitors and software. Environmental monitors are further sub-segmented into indoor monitors, outdoor monitors, and portable monitors. The monitors segment accounts for the largest share of the environmental monitoring market. The increase in industry adoption of pollution monitoring strategies also the continuous development and commercialization of outdoor environment monitoring sensors and increasing public awareness contribute to the large share.

By sampling method, the continuous monitoring segment of the environmental monitoring industry is expected to grow at the highest rate during the forecast period.

Based on the sampling method, the environmental monitoring market is divided into active, passive, intermittent, and continuous monitoring. In 2024, the continuous monitoring segment is projected to hold the biggest market share throughout the forecast period. This growth is driven by growing focus on the development of eco-friendly industries, the need for real-time sample monitoring and the increasing environmental pollution levels in major regions worldwide.

By application, the air pollution monitoring segment of the environmental monitoring industry is expected to witness significant growth during the forecast period.

Based on the application, the environmental monitoring market is divided into air pollution monitoring, noise pollution monitoring, water pollution monitoring and soil pollution monitoring. Within water pollution monitoring segment there are sub-segments including wastewater monitoring and surface & groundwater monitoring. The air pollution monitoring segment is expected to witness significant growth during the forecast period. The growing acceptance and demand for sensor-based air quality monitoring systems have led to the significant growth and dominance of the segment in the industry in the upcoming years.

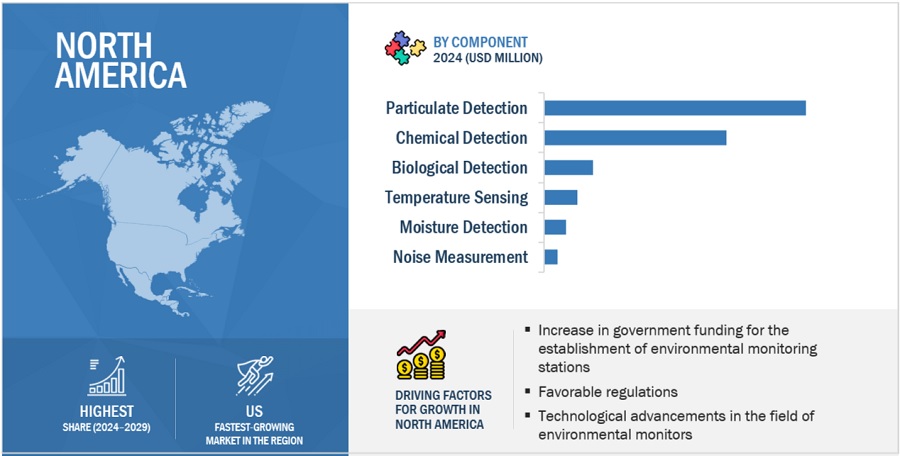

North America is expected to be the environmental monitoring industry largest market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

The environmental monitoring market has been segmented into five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America, comprising the US and Canada, held the largest share of the global environmental monitoring market in 2023. This region is witnessing growth due to growing government initiatives in pollution control, technological advancements in environmental sensors, increased government funding to establish environmental monitoring stations and stringent regulations supporting the greater adoption of pollution monitoring technologies.

On the other hand, the Asia-Pacific market is projected to experience the most significant growth rate throughout the forecast period. North America held the largest market share for environmental monitoring at 50.6%, trailed by Europe at 25.5%.

As of 2023, prominent players in the environmental monitoring market are Agilent Technologies (US), Danaher Corporation (US), Thermo Fisher Scientific (US), Shimadzu Corporation (Japan), PerkinElmer (US), 3M (US), Emerson Electric Co. (US), bioMérieux S.A. (France), Honeywell International Inc. (US), Merck KGaA (Germany), Siemens AG (Germany), and Forbes Marshall (India), among others.

Scope of the Environmental Monitoring Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$14.7 billion |

|

Projected Revenue by 2029 |

$18.6 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 4.9% |

|

Market Driver |

Need for efficient natural resource management |

|

Market Opportunity |

Supportive rules and regulations by government to reduce environmental pollution |

This report has segmented the global environmental monitoring market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Monitors

- Indoor Monitors

- Outdoor Monitors

- Portable Monitors

- Software

By Sampling Method

- Continuous Monitoring

- Active Monitoring

- Passive Monitoring

- Intermittent Monitoring

By Component

-

Particulate Detection

- PM2.5 Detection

- PM10 Detection

- Other Particulate Detection

-

Chemical Detection

- Gas Detection

- Volatile organic Compound Detection

- Pesticide Detection

- Other Chemicals

- Biological Detection

- Temperature Sensing

- Moisture Detection

- Noise Measurement

By Application

- Air Pollution Monitoring

-

Water Pollution Monitoring

- Wastewater Monitoring

- Surface & Groundwater Monitoring

- Soil Pollution Monitoring

- Noise Pollution Monitoring

By End User

- Government Agencies & Smart City Authorities

- Enterprise

- Commercial users

- Residential users

- Healthcare & Pharmaceutical

- Industrial users (should include petrochemical and power generation cos)

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLA

-

Middle East & Africa

- GCC Countries

- Rest of the Middle East & Africa

Recent Developments of The Environmental Monitoring Industry:

- In March 2024, Emerson Electric co. launched Rosemount 3490 Controller that helps to optimize processes, enhance sustainability and ensure regulatory compliance for water and wastewater applications

- In December 2021, Honeywell International Inc. announced a user-friendly monitor that alerts users when indoor air conditions may present an increased risk of potentially transmitting airborne viruses.

- In February 2021, 3M invested $1 Billion to achieve carbon neutrality, reduce water use, and improve water quality

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global environmental monitoring market?

The global environmental monitoring market boasts a total revenue value of $18.6 billion by 2029.

What is the estimated growth rate (CAGR) of the global environmental monitoring market?

The global environmental monitoring market has an estimated compound annual growth rate (CAGR) of 4.9% and a revenue size in the region of $14.7 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

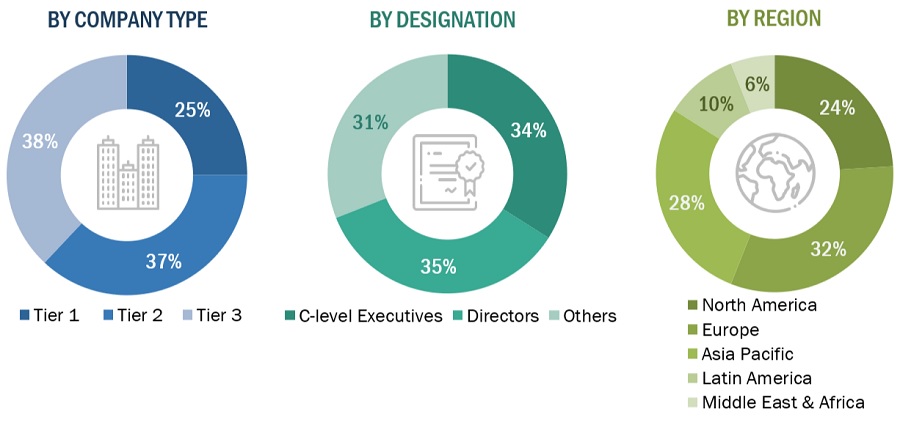

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the environmental monitoring market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the environmental monitoring market. The primary sources from the demand side include OEMs, private and contract testing organizations and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

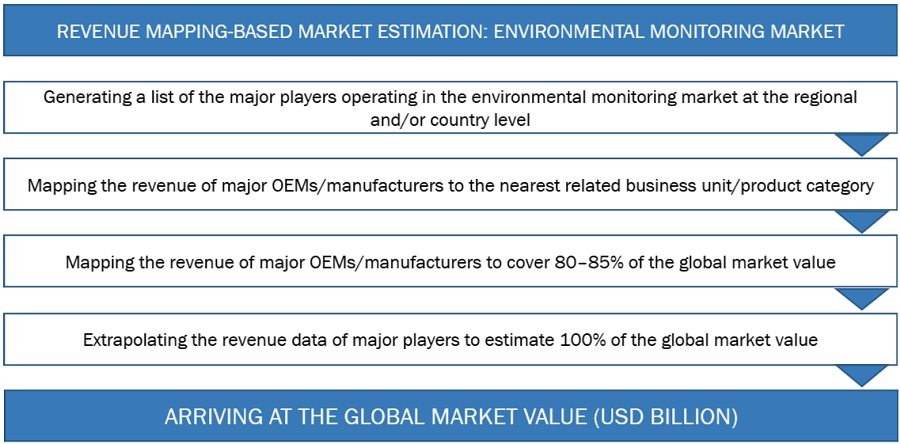

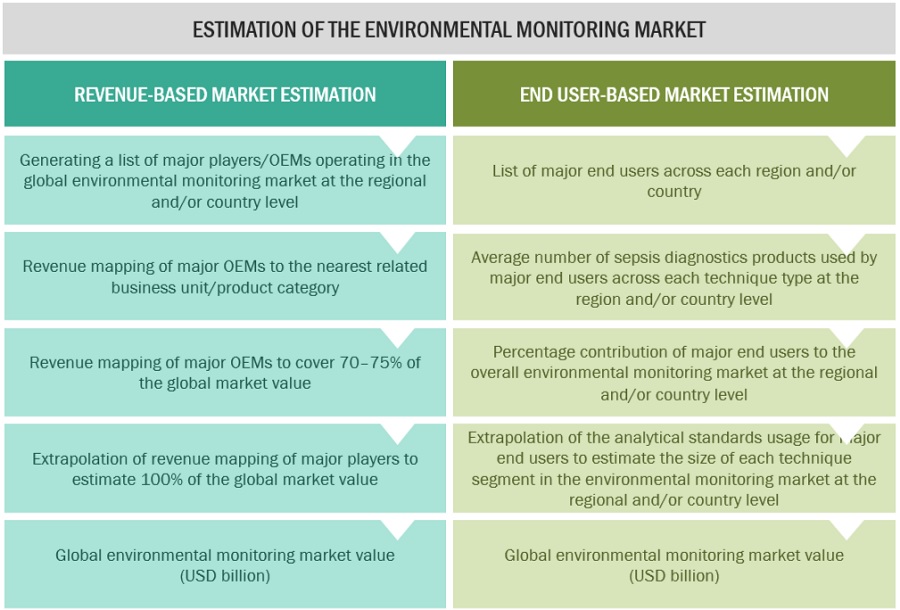

Market Estimation Methodology

In this report, the global environmental monitoring market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the environmental monitoring products business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

Approach 1: Revenue-based estimation approach

To calculate the global market value, installation/volume consumption of environmental monitoring products was calculated. This process involved the following steps:

- Revenues of individual companies were gathered from public sources and databases.

- Shares of the leading players in the individual product segments of the environmental monitoring market were gathered from secondary sources to the extent available. In some instances, shares of the individual product segments were ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, average selling price, and geographic reach of the company.

- Individual shares or revenue estimates were validated through expert interviews.

To know about the assumptions considered for the study, Request for Free Sample Report

Approach 2: End user-based market estimation

During preliminary secondary research, the total sales revenue of environmental monitoring was estimated and validated at the regional and country level, triangulated, and validated to estimate the global market value. This process involved the following steps:

- Generating a list of major customer facilities across each region and country

- Identifying the average number of environmental monitoring product supplies used by major customer facilities across each product type at the regional/country level, annually

- Identifying the percentage contribution of major customer facilities to the overall environmental monitoring expenditure and usage at the regional/country level, annually

- Extrapolating the annual usage patterns for various products across major customer facilities to estimate the size of each product segment at the regional/country level, annually

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global environmental monitoring market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the environmental monitoring market was validated using both top-down and bottom-up approaches.

Market Definition

Environmental monitoring is a tool to assess environmental conditions and trends, support policy development and its implementation, and prepare information for reporting to national policymakers, international forums, and the public. Environmental monitoring is used for numerous purposes, such as detecting changes in temperature, humidity, smoke, airflow, or water in data centers and remote sites.

Key Market Stakeholders

- Environmental monitoring and related devices manufacturing companies

- Suppliers and distributors of environmental monitoring devices and other associated components

- Public health officials and healthcare providers

- Municipal engineers, farmers, and industrialists

- Government bodies and regulatory authorities

- Business research and consulting service providers

- Venture capitalists

Objectives of the Study

- To define, describe, and forecast the environmental monitoring market on the basis of on product, sampling method, application, component, end user and region.

- To provide detailed information regarding the major factors influencing the growth potential of the global environmental monitoring market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global environmental monitoring market.

- To analyze key growth opportunities in the global environmental monitoring market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East and Africa (GCC Countries and Rest of MEA).

- To profile the key players in the global environmental monitoring market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global environmental monitoring market, such as agreements, expansions, and & acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global environmental monitoring market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis

- Further breakdown of the Rest of Europe's environmental monitoring market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of Asia Pacific environmental monitoring market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of the Latin America environmental monitoring market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Environmental Monitoring Market

Which strategies are being followed by the key players operating in the global Environmental Monitoring Market?

Which geography is expected to hold the largest share of the global Environmental Monitoring Market?