Edible Inkjet Ink Market by Type (Edible Ink Cartridges, Bottled Edible Ink), Material (Natural, Synthetic), Color (Cyan, Magenta, Yellow, Black), Application (Bakery, Tablets & Capsules), End Use and Region - Global Forecast 2027

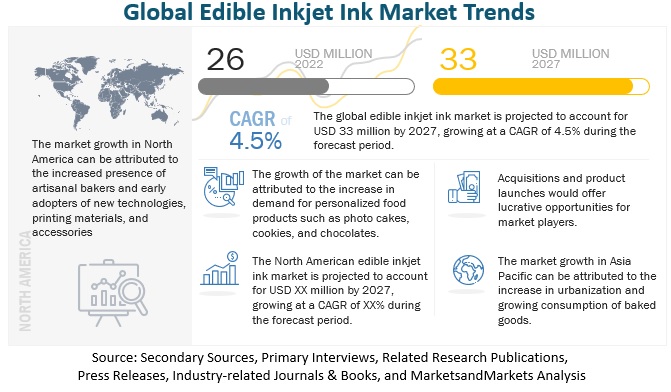

[207 Pages Report] Modern-day customers desire a more individualized experience with regard to the goods and services they use. The rise of social media empowers consumers to increasingly define their demands. Consumers are eager to participate in the development process and are willing to pay more for a customized product or service. Consequently, businesses offer customized product possibilities to diversify their product portfolios and boost sales. The changes in consumers’ dietary preferences have become increasingly varied with rapid urbanization. Customizing products or personalized preferences is a huge consideration for increasing competitive edge. The rising trend of novelty baked goods like printed cakes and cookies is resulting in a rise in demand for edible inkjet inks. The global edible inkjet ink market is projected to reach from 26 million in 2022 to USD 33 million by 2027, growing at a CAGR of 4.5% from 2022 to 2027. Edible inkjet inks are used in various items such as cakes, chocolates, cookies, capsules, and tablets. The features of inkjet printing, such as high speed, with no human contact, minimal cost, and less pollution, result in their usage in food and drugs for direct printing with edible inks.

In the recent years, exclusive 3D printing restaurants and innovative food printers are available in the market. The exponential growth in the technology and growing consumers interest towards customized food which are safe are propelling the market growth. Moreover, due to the increased demand for clean label and safer food products, the demand for edible inkjet ink products that comply with FDA and other safety standards are high on demand. Thus, by following the government regulations and food safety standards, the market players are maintaining their credibility and strengthening their position in the edible inkjet ink market.

To know about the assumptions considered for the study, Request for Free Sample Report

Edible Inkjet Ink Market Dynamics

Driver: Increasing demand for personalization of food products

Personalization is a key driving force disrupting the traditional ways food is delivered to customers. In the past couple of years, the customization trend has increased among consumers. Customizations such as printing the brand logos on bakery products, decorating cupcakes for an event, customized printing on cookies, etc., have become easier using inkjet printers that use edible inkjet inks. Edible inkjet printers also automate the process of customization, saving time, effort, and cost required for artisans. Brands increasingly use customizations as it increases their brand visibility and helps in the word-of-mouth marketing while improving customer satisfaction. With the changing consumer interests toward customization and personalization of products, the demand for edible ink in inkjet printers is growing.

Restraints: Threat from counterfeit products

Counterfeit edible ink cartridges are widely available in the market, where cartridges of key manufacturing brands are filled with fake ink and sold as new cartridges. Counterfeit inks compromise printer performance, affect the lifespan of printer parts, produce inferior-quality prints, and may leak and damage the printer. Counterfeit cartridges are not approved by regulatory bodies such as the FDA, FSSAI, and Food Sanitation Law, and do not have certifications such as National Sanitation Foundation (NSF) Certification. These products are available at lower prices, making them attractive to price-conscious consumers. The lower price leads to low quality and has hazardous health impacts.

Opportunities: Edible inkjet ink increasingly favorable for food packaging

Edible inkjet ink, in addition to being used for edible printing, can also be utilized as food-grade packaging ink for a variety of edible products, which increases its scope for market expansion. One of the best inks for food packaging is the superior eco-friendly water-based inkjet ink, which is versatile, adaptable, and emphasizes food safety while not endangering the environment. Low migration potential electron beam inkjet inks may also work well for use on food packaging. This ink type is more affordable than certain other kinds of inkjet inks as it employs its electron beam to finish the polymerization process. It is also possible to print on food packaging using low-migration UV/LED inkjet inks. However, to be acceptable in food packing, they require photo initiators and thorough curing.

Natural edible inkjet ink is witnessing a high growth rate during the forecast period owing to the clean label claims

Natural edible ink is made from natural ingredients and adheres to the trend of healthy and natural eating. It is suitable for all kinds of food art food printers. These inks are certified by FDA, ISO22000, kosher, and halal standards. They are most popularly used by commercial and home bakers to customize the requirements of health-conscious consumers. Sino Joinsun Technology & Trade Co., Ltd. offers natural edible ink with Jetcare to address the increasing popularity of natural and healthy ingredients in food industry. Jetcare natural edible inks are used for printing edible images on coffee latte, milk tea, ice cream, pizza, etc.

Black color held the largest market share in 2021 and will witness the similar trends throughout the forecast period

Natural black edible inkjet ink is made of plant material (onion skins to flower petals), water, oil, and binder. The edible inkjet ink works well with frosting sheets, icing sheets, wafer paper, chocolate transfer sheets, rice paper, fondant sheets, cake topper, and sugar sheets. Black is an unusual color to be used in food items and often surprises people owing to its uniqueness, in a positive way. Black color is preferred by the brands that wish to create an elegant and sophisticated image of themselves. Black color is often associated with luxury and with the changing lifestyle and preferences of consumers, the color is widely being used in the food industry.

Tablets and capsules segment is the fastest growing application segment in edible inkjet ink market

The pharmaceutical industry has seen a rise in the deployment of printing technologies between 2010 and 2020. Inkjet printing in particular is a non-contact method for producing orally administered formulations. In terms of pharmaceutical technology, drop-on-demand thermal inkjet printing offers a variety of benefits. The formulation is based on digital designs that have already been created, and it makes it easier to deposit small volumes of liquid onto edible surfaces. Inkjet printing has been used in conjunction with other formulation techniques to create hybrid medication delivery system. Not just this, manufacturers have been using edible inkjet inks on tablets and capsules to print brand logos on the product for promotional purposes.

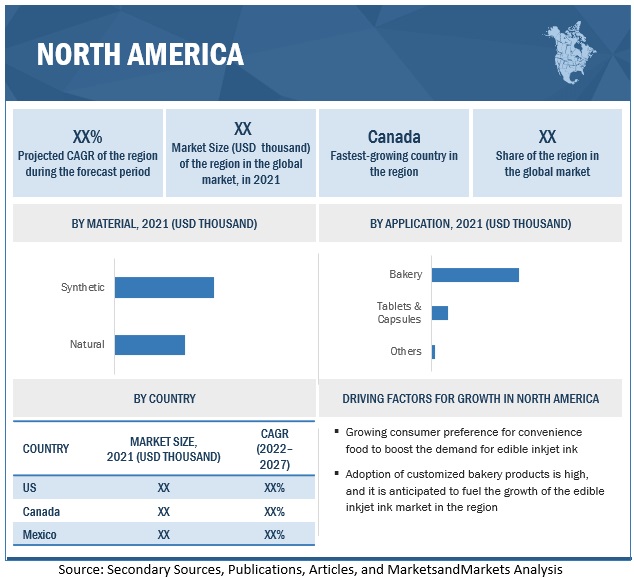

North America: Edible Inkjet Ink Market Snapshot

To know about the assumptions considered for the study, download the pdf brochure

North America dominated the edible inkjet ink market in 2021

North America is one of the most potential markets for edible inkjet ink owing to the growing demand for inkjet printers for household and commercial purposes. The number of commercial bakers in the North American market is increasing at a fast pace, which is expected to drive the market for customized bakery products with photos and other graphics printed on them. The preferences of modern-day consumers are greatly inclining toward convenience foods, including confectioneries, baked goods, and snacks. In 2021, the Canadian bakery goods market was worth USD 2.31 billion, followed by Mexico, with a value of USD 0.39 billion, as per the USDA statistics. Customized gifting trends also foster the demand for household inkjet printers to print edible graphics at home. Edible printing has been a well-known trend in North America, where producers have made use of edible inkjet ink to introduce variations in traditional food products and satisfy the growing needs of the wide consumer base for convenience foods.

Key Market Players

Key players in this market include Sun Chemical Corporation (US), Toyochem Co., Ltd. (Japan), Linx Printing Technologies (UK), Union Chemicar Co., ltd. (Japan), The Cake Decorating Co. (UK), MagicFrost (US), Icing Images (US), Icinginks (US), Edible Supply (US), and Edible Image Supplies (Australia), among others.

Want to explore hidden markets that can drive new revenue in Edible Inkjet Ink Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Edible Inkjet Ink Market?

|

Report Metrics |

Details |

| Market size estimation | 2022–2027 |

| Base year considered | 2021 |

| Forecast period considered | 2022–2027 |

| Units considered | Value (USD) |

| Segments covered | By Type, Color, Material, End Use, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

| Companies studied |

|

This research report categorizes the edible inkjet ink market., based on type, material, color, application, end use, and region.

Target Audience

- Edible inkjet ink manufacturers

- Edible inkjet ink raw material suppliers and manufacturers

- Edible inkjet ink material importers and exporters

- Edible inkjet ink material traders and distributors

- Bakery companies, artisanal bakers, and home bakers

- Printing ink manufacturers and suppliers

- End users

Report Scope:

Edible inkjet ink Market:

By Type

- Edible ink cartridges

- Bottled edible ink

By Material

- Natural

- Synthetic

By Color

- Cyan

- Magenta

- Yellow

- Black

By End Use

- Industrial

- Food Service

- Household

By Application

-

Bakery

- Cakes & Pastries

- Cookies

- Others

- Tablets & Capsules

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In March 2022, Sun Chemical Corporation launched a range of FSR Edible Inkjet Inks, for food and pharmaceutical applications, with direct printing. This product launch provides an opportunity to support the current trend of food customization.

- In January 2022, Union Chemicar expanded its production facilities of inkjet, thermal inkjet and edible inks, and stationery items such as correction and glue tapes from Japan to different international locations. This expansion aims to strengthen the global presence.

- In June 2021, Sun Chemical strategically partnered with VPK France, a subsidiary of VPK Group, to develop sustainable ink products. This partnership aimed to switch French sites’ printing operations to Sun Chemical’s SunVisto AquaGreen renewable inks.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the edible inkjet ink market?

North America accounted for the largest share of about 36.1% of the overall edible inkjet ink market in 2021 and is projected to sustain its leading position by 2027.

What is the forecasted size of the global edible inkjet ink market?

The global edible inkjet market is projected to reach USD 33 million by 2027 growing at a CAGR of 4.5% from 2022 to 2027.

Which are the major colors of edible inkjet inks considered in the study and which segments are projected to have promising growth rates in the future?

Majorly used edible inkjet inks are colors cyan, magenta, yellow and black. Black the largest segment comprising of powder and granules whereas magenta is the fastest growing.

Which are the key players in the market, and how intense is the competition?

Key players in this market include Sun Chemical Corporation (US), Toyochem Co., Ltd. (Japan), Linx Printing Technologies (UK), Union Chemicar Co., ltd. (Japan), The Cake Decorating Co. (UK), MagicFrost (US), Icing Images (US), Icinginks (US), Edible Supply (US), and Edible Image Supplies (Australia), among others.

What kind of information is provided in the competitive landscape section?

For the list of players mentioned above, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, and MnM view to elaborate analyst view on the company. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 EDIBLE INKJET INK MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

TABLE 1 INCLUSIONS & EXCLUSIONS

1.4 YEARS CONSIDERED

FIGURE 3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED, 2019–2021

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 4 EDIBLE INKJET INK MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

FIGURE 5 EDIBLE INKJET INK MARKET: KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

TABLE 3 PRIMARY INTERVIEWS WITH EXPERTS

2.1.2.2 Key primary interview participants

TABLE 4 KEY PRIMARY INTERVIEW PARTICIPANTS

2.1.2.3 Key industry insights

FIGURE 6 MARKET FOR EDIBLE INKJET INK: KEY INDUSTRY INSIGHTS

2.1.2.4 Breakdown of primary interviews

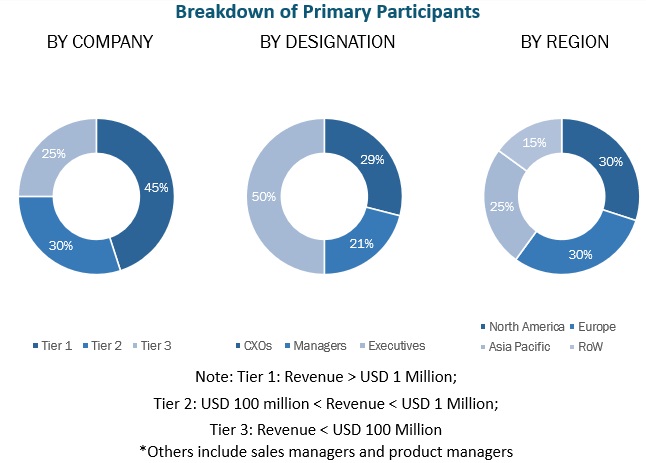

FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY, DESIGNATION, AND REGION

2.1.2.5 Primary sources

FIGURE 8 PRIMARY SOURCES

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 9 MARKET FOR EDIBLE INKJET INK SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 10 MARKET FOR EDIBLE INKJET INK SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

FIGURE 12 ASSUMPTIONS

2.5 LIMITATIONS

FIGURE 13 STUDY LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 5 EDIBLE INKJET INK MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 14 MARKET FOR EDIBLE INKJET INK, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET FOR EDIBLE INKJET INK BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 16 MARKET FOR EDIBLE INKJET INK, BY COLOR, 2022 VS. 2027 (USD MILLION)

FIGURE 17 MARKET FOR EDIBLE INKJET INK, BY END USE, 2022 VS. 2027 (USD MILLION)

FIGURE 18 MARKET FOR EDIBLE INKJET INK SHARE & GROWTH RATE, BY REGION

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 BRIEF OVERVIEW OF EDIBLE INKJET INK MARKET

FIGURE 19 INCREASING DEMAND FOR PERSONALIZED FOOD PRODUCTS TO DRIVE MARKET

4.2 MARKET FOR EDIBLE INKJET INK GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

FIGURE 20 STRONG DEMAND FROM ASIA PACIFIC REGION TO DRIVE THE MARKET

4.3 ASIA PACIFIC: MARKET FOR EDIBLE INKJET INK, BY MATERIAL & COUNTRY

FIGURE 21 CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2022

4.4 MARKET FOR EDIBLE INKJET INK, BY MATERIAL

FIGURE 22 SYNTHETIC SEGMENT TO FUEL EDIBLE INKJET INK MARKET IN 2022

4.5 MARKET FOR EDIBLE INKJET INK, BY COLOR

FIGURE 23 BLACK COLOR TO DOMINATE THE MARKET IN 2027

4.6 MARKET FOR EDIBLE INKJET INK, BY APPLICATION

FIGURE 24 BAKERY SEGMENT TO BOLSTER THE MARKET IN 2022

4.7 MARKET FOR EDIBLE INKJET INK, BY END USE

FIGURE 25 FOOD SERVICE TO DOMINATE THEMARKET DURING FORECAST PERIOD

4.8 MARKET FOR EDIBLE INKJET INK, BY REGION

FIGURE 26 NORTH AMERICA TO DRIVE THE MARKET THROUGHOUT FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 27 EDIBLE INKJET INK MARKET DYNAMICS

5.3 DRIVERS

5.3.1 STABLE GROWTH IN BAKERY INDUSTRY

5.3.2 INCREASING DEMAND FOR PERSONALIZATION OF FOOD PRODUCTS

5.4 RESTRAINTS

5.4.1 THREAT FROM COUNTERFEIT PRODUCTS

5.5 OPPORTUNITIES

5.5.1 EDIBLE INKJET INK INCREASINGLY FAVORABLE FOR FOOD PACKAGING

5.5.2 GROWING NEED FOR FAST RESPONSE MARKETING CAMPAIGNS

5.5.3 ABILITY TO AID IN PRODUCT MARKETING

5.6 CHALLENGES

5.6.1 RISK OF CONTAMINATION WITH NON-FOOD-GRADE INK MIGRATION

6 INDUSTRY TRENDS (Page No. - 62)

6.1 INTRODUCTION

6.2 TRENDS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 28 REVENUE SHIFT FOR EDIBLE INKJET INK MARKET

6.3 VALUE CHAIN

6.3.1 RESEARCH & PRODUCT DEVELOPMENT

6.3.2 RAW MATERIAL SOURCING

6.3.3 PROCESSING & PRODUCTION

6.3.4 CERTIFICATIONS/REGULATORY BODIES

6.3.5 MARKETING & SALES

FIGURE 29 MARKET FOR EDIBLE INKJET INK: VALUE CHAIN

6.4 TRADE DATA

6.4.1 IMPORT SCENARIO

FIGURE 30 IMPORT DATA FOR HS CODE 321590 OF TOP 10 COUNTRIES, 2017–2021 (USD MILLION)

TABLE 6 IMPORT DATA FOR HS CODE 321590 OF TOP 10 COUNTRIES, 2017–2021 (USD MILLION)

6.4.2 EXPORT SCENARIO

FIGURE 31 EXPORT DATA FOR HS CODE 321590, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 7 EXPORT DATA FOR HS CODE 8443, BY TOP 10 COUNTRIES, 2016–2020 (USD MILLION)

6.5 TECHNOLOGY ANALYSIS

6.5.1 INCREASING DROPLET QUALITY OF EDIBLE INK

6.5.2 RHEOLOGY OF EDIBLE INKS

6.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 EDIBLE INKJET INK MARKET: PORTER’S FIVE FORCES ANALYSIS

6.6.1 THREAT OF NEW ENTRANTS

6.6.2 THREAT OF SUBSTITUTES

6.6.3 BARGAINING POWER OF SUPPLIERS

6.6.4 BARGAINING POWER OF BUYERS

6.6.5 DEGREE OF COMPETITION

6.7 PRICING ANALYSIS

6.7.1 AVERAGE SELLING RETAIL PRICES OF BOTTLED EDIBLE INKS, BY COMPANY, 2022 (USD)

TABLE 9 AVERAGE SELLING RETAIL PRICES OF BOTTLED EDIBLE INKS, BY COMPANY, 2022 (USD)

6.7.2 AVERAGE SELLING RETAIL PRICES OF EDIBLE INK CARTRIDGES, BY COMPANY, 2022 (USD)

TABLE 10 AVERAGE SELLING RETAIL PRICES OF EDIBLE INK CARTRIDGES, BY COMPANY, 2022 (USD)

6.8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.8.1 NORTH AMERICA

6.8.1.1 US

6.8.1.2 Canada

6.8.1.3 Mexico

6.8.1.3.1 Mexican Food Regulations

6.8.2 EUROPE

6.8.2.1 Food and Agricultural Import Regulations and Standards (Berlin, Germany)

6.8.2.2 France

6.8.2.2.1 Food and Agriculture Imports Regulations and Standards

6.8.2.3 Italy

6.8.3 ASIA PACIFIC

6.8.3.1 China

6.8.3.2 India

6.8.3.3 Japan

6.8.3.3.1 Japanese Ministry of Health, Labour and Welfare

6.8.3.3.2 Japan Food Chemical Research Foundation (JFCRF)

6.8.3.4 South Korea

6.8.3.4.1 Ministry of Food and Drug Safety (MFDS)

6.8.3.5 Australia & New Zealand

6.8.3.5.1 Australia New Zealand Food Standards Code - Standard 1.3.1 - Food Additives

6.8.4 SOUTH AMERICA

6.8.4.1 Brazil

6.8.4.1.1 Brazilian Health Regulatory Agency (ANVISA)

6.8.4.1.2 (Section II) Food Additive Regulations

6.8.4.1.3 Brazilian Food and Regulations and Standards

6.8.4.2 Argentina

6.8.4.2.1 The Argentina Food Safety Act

6.9 KEY STAKEHOLDERS AND BUYING CRITERIA

6.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

6.9.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 12 KEY CRITERIA FOR TOP THREE APPLICATIONS

6.10 KEY CONFERENCES AND EVENTS

TABLE 13 EDIBLE INKJET INK MARKET: CONFERENCES AND EVENTS, 2022–2023

6.10.1 BUYING CRITERIA

6.11 PATENT ANALYSIS

FIGURE 34 NUMBER OF PATENTS ISSUED FOR EDIBLE INKJET INK, 2019-2022

TABLE 14 KEY PATENTS PERTAINING TO EDIBLE INKJET INKS, JAN 2019-OCT 2022

6.12 CASE STUDIES

6.12.1 GROWING DEMAND FOR FOOD CUSTOMIZATION AND REGULATIONS ON INKS WITH DIRECT FOOD CONTACT

TABLE 15 PERSONALIZED COOKIES FOR GIFTING

TABLE 16 PRINTING ON COFFEE

6.13 ECOSYSTEM/MARKET MAP

6.13.1 MARKET FOR EDIBLE INKJET INK ECOSYSTEM

TABLE 17 EDIBLE INKJET INKS MARKET ECOSYSTEM

FIGURE 35 EDIBLE INKJET INKS: MARKET MAP

7 EDIBLE INKJET INK MARKET, BY TYPE (Page No. - 83)

7.1 INTRODUCTION

7.2 EDIBLE INK CARTRIDGES

7.2.1 INCREASED DEMAND FOR INNOVATIONS IN BAKERY & CONFECTIONERY ITEMS TO PROPEL MARKET

7.3 BOTTLED EDIBLE INK

7.3.1 COST-EFFECTIVENESS AND SUSTAINABILITY OF BOTTLED EDIBLE INK TO FOSTER MARKET GROWTH

8 EDIBLE INKJET INK MARKET, BY MATERIAL (Page No. - 85)

8.1 INTRODUCTION

FIGURE 36 EDIBLE INKJET INK MARKET, BY MATERIAL, 2022 VS. 2027 (USD THOUSAND)

TABLE 18 MARKET FOR EDIBLE INKJET INK , BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 19 MARKET FOR EDIBLE INKJET INK , BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 20 MARKET FOR EDIBLE INKJET INK , BY MATERIAL, 2019–2021 (THOUSAND LITERS)

TABLE 21 MARKET FOR EDIBLE INKJET INK , BY MATERIAL, 2022–2027 (THOUSAND LITERS)

8.2 NATURAL

8.2.1 NATURAL COLORANTS MOST PREFERRED OWING TO CLEAN LABEL CLAIMS

TABLE 22 NATURAL MARKET FOR EDIBLE INKJET INK , BY REGION, 2019–2021 (USD THOUSAND)

TABLE 23 NATURAL MARKET FOR EDIBLE INKJET INK , BY REGION, 2022–2027 (USD THOUSAND)

8.3 SYNTHETIC

8.3.1 SYNTHETIC EDIBLE INKS TO HAVE HIGHER DEMAND DUE TO COST-EFFECTIVENESS AND EXCELLENT COLOR DEVELOPMENT ABILITY

TABLE 24 SYNTHETIC MARKET FOR EDIBLE INKJET INK , BY REGION, 2019–2021 (USD THOUSAND)

TABLE 25 SYNTHETIC EDIBLE INKJET INK MARKET, BY REGION, 2022–2027 (USD THOUSAND)

9 EDIBLE INKJET INK MARKET, BY COLOR (Page No. - 90)

9.1 INTRODUCTION

FIGURE 37 EDIBLE INKJET INK MARKET, BY COLOR, 2022 VS. 2027 (USD THOUSAND)

TABLE 26 MARKET FOR EDIBLE INKJET INK, BY COLOR, 2019–2021 (USD THOUSAND)

TABLE 27 MARKET FOR EDIBLE INKJET INK, BY COLOR, 2022–2027 (USD THOUSAND)

9.2 CYAN

9.2.1 CONFECTIONERY SECTOR TO DRIVE DEMAND FOR CYAN INKS

TABLE 28 CYAN: EDIBLE INKJET INK MARKET, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 29 CYAN: MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

9.3 MAGENTA

9.3.1 APPLICABILITY OF MAGENTA COLOR IN WIDE RANGE OF SHADES

TABLE 30 MAGENTA: MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 31 MAGENTA: MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

9.4 YELLOW

9.4.1 ABILITY OF YELLOW TO MAKE PRODUCT MORE VISUALLY APPEALING

TABLE 32 YELLOW: MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 33 YELLOW: MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

9.5 BLACK

9.5.1 BLACK COLOR TO BE INCREASINGLY USED IN DECORATIVE CAKES FOR MORE SOPHISTICATION

TABLE 34 BLACK: MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 35 BLACK: EDIBLE INKJET INK MARKET, BY REGION, 2022–2027 (USD THOUSAND)

10 EDIBLE INKJET INK MARKET, BY APPLICATION (Page No. - 96)

10.1 INTRODUCTION

FIGURE 38 EDIBLE INKJET INK MARKET, BY APPLICATION, 2022 VS. 2027 (USD THOUSAND)

TABLE 36 MARKET FOR EDIBLE INKJET INK, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 37 MARKET FOR EDIBLE INKJET INK, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 38 MARKET FOR EDIBLE INKJET INK, BY BAKERY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 39 MARKET FOR EDIBLE INKJET INK, BY BAKERY APPLICATION, 2022–2027 (USD THOUSAND)

10.2 BAKERY

10.2.1 RISING POPULARITY OF PHOTO CAKES TO STIMULATE MARKET EXPANSION

TABLE 40 BAKERY: MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 41 BAKERY: MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

10.2.2 COOKIES

10.2.2.1 Rising demand for cookies influenced by changing lifestyles to induce increased application of edible inkjet ink

TABLE 42 COOKIES: MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 43 COOKIES: MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

10.2.3 CAKES & PASTRIES

10.2.3.1 Rising number of home bakeries post-pandemic to drive growth

TABLE 44 CAKES & PASTRIES: EDIBLE INKJET INK MARKET, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 45 CAKES & PASTRIES: MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

10.2.4 OTHER BAKERY

10.2.4.1 Emerging trend of personalization to propel increased usage of edible inkjet ink

TABLE 46 OTHER BAKERY: MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 47 OTHER BAKERY: MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

10.3 TABLETS & CAPSULES

10.3.1 INCREASED DEPLOYMENT OF EDIBLE PRINTING TECHNOLOGY IN PHARMACEUTICAL INDUSTRY

TABLE 48 TABLETS & CAPSULES: MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 49 TABLETS & CAPSULES: MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

10.4 OTHERS

10.4.1 PREMIUM GIFTING TRENDS TO ACCELERATE MARKET FOR PRINTED CONFECTIONERIES

TABLE 50 OTHERS: MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 51 OTHERS: EDIBLE INKJET INK MARKET, BY REGION, 2022–2027 (USD THOUSAND)

11 EDIBLE INKJET INK MARKET, BY END USE (Page No. - 106)

11.1 INTRODUCTION

FIGURE 39 EDIBLE INKJET INK MARKET, BY END USE, 2022 VS. 2027 (USD THOUSAND)

TABLE 52 MARKET FOR EDIBLE INKJET INK, BY END USE, 2019–2021 (USD THOUSAND)

TABLE 53 MARKET FOR EDIBLE INKJET INK, BY END USE, 2022–2027 (USD THOUSAND)

11.2 INDUSTRIAL

11.2.1 DEMAND FOR CUSTOMIZED BAKED ITEMS AND MEDICINES TO FOSTER GROWTH

TABLE 54 INDUSTRIAL: MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 55 INDUSTRIAL: MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

11.3 FOOD SERVICE

11.3.1 INCREASED PRODUCTION OF PHOTO CAKES BY BAKERY AND ARTISANAL STORES TO AUGMENT GROWTH

TABLE 56 FOOD SERVICE:MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 57 FOOD SERVICE: MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

11.4 HOUSEHOLD

11.4.1 RISE IN HOME BAKING TREND TO BOOST EDIBLE INK CONSUMPTION

FIGURE 40 GOOGLE SEARCHES FOR BAKING TERMS, 2020

FIGURE 41 INSTAGRAM POSTS MENTIONING #HOMEBAKE, MARCH 2020

TABLE 58 HOUSEHOLD: MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 59 HOUSEHOLD: EDIBLE INKJET INK MARKET, BY REGION, 2022–2027 (USD THOUSAND)

12 EDIBLE INKJET INK MARKET, BY REGION (Page No. - 112)

12.1 INTRODUCTION

FIGURE 42 US ACCOUNTED FOR LARGEST COUNTRY-LEVEL MARKET SHARE IN 2021

TABLE 60 EDIBLE INKJET INK MARKET, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 61 MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 62 MARKET FOR EDIBLE INKJET INK, BY REGION, 2019–2021 (THOUSAND LITERS)

TABLE 63 MARKET FOR EDIBLE INKJET INK, BY REGION, 2022–2027 (THOUSAND LITERS)

12.2 NORTH AMERICA

12.2.1 SURGING DEMAND FOR CONVENIENCE TO FUEL GROWTH

FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

TABLE 64 NORTH AMERICA: EDIBLE INKJET INK MARKET, BY COUNTRY, 2019–2021 (USD THOUSAND)

TABLE 65 NORTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 66 NORTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 67 NORTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 68 NORTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 69 NORTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 70 NORTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY BAKERY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 71 NORTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY BAKERY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 72 NORTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY COLOR, 2019–2021 (USD THOUSAND)

TABLE 73 NORTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY COLOR, 2022–2027 (USD THOUSAND)

TABLE 74 NORTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY END USE, 2019–2021 (USD THOUSAND)

TABLE 75 NORTH AMERICA: EDIBLE INKJET INK MARKET, BY END USE, 2022–2027 (USD THOUSAND)

12.2.2 US

12.2.2.1 Increased consumption of processed and fast foods to drive expansion of edible inkjet ink market

TABLE 76 US: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 77 US: MARKET FOR EDIBLE INKJET INK, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 78 US: MARKET FOR EDIBLE INKJET INK, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 79 US: MARKET FOR EDIBLE INKJET INK, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.2.3 CANADA

12.2.3.1 Exponential growth of bread industry in Canada to boost edible inkjet ink market

TABLE 80 CANADA: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 81 CANADA: MARKET FOR EDIBLE INKJET INK, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 82 CANADA: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 83 CANADA: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.2.4 MEXICO

12.2.4.1 Growing business of tacos and tortillas to lead to rapid expansion of edible inkjet ink market

TABLE 84 MEXICO: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 85 MEXICO: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 86 MEXICO: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 87 MEXICO: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.3 EUROPE

12.3.1 GROWING BAKERY AND CONFECTIONERY INDUSTRIES TO FOSTER EXPANSION OF EDIBLE INKJET INK MARKET

TABLE 88 EUROPE: EDIBLE INKJET INK MARKET, BY COUNTRY, 2019–2021 (USD THOUSAND)

TABLE 89 EUROPE: EDIBLE INKJET INK MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 90 EUROPE: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 91 EUROPE: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 92 EUROPE: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 93 EUROPE: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 94 EUROPE: EDIBLE INKJET INK MARKET, BY BAKERY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 95 EUROPE: EDIBLE INKJET INK MARKET, BY BAKERY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 96 EUROPE: EDIBLE INKJET INK MARKET, BY COLOR, 2019–2021 (USD THOUSAND)

TABLE 97 EUROPE: EDIBLE INKJET INK MARKET, BY COLOR, 2022–2027 (USD THOUSAND)

TABLE 98 EUROPE: EDIBLE INKJET INK MARKET, BY END USE, 2019–2021 (USD THOUSAND)

TABLE 99 EUROPE: EDIBLE INKJET INK MARKET, BY END USE, 2022–2027 (USD THOUSAND)

12.3.2 GERMANY

12.3.2.1 Sizeable bread industry and robust export sector to drive growth of edible inkjet ink market

TABLE 100 GERMANY: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 101 GERMANY: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 102 GERMANY: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 103 GERMANY: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.3.3 UK

12.3.3.1 Strong pharmaceutical sector projected to boost edible inkjet ink market

TABLE 104 UK: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 105 UK: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 106 UK: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 107 UK: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.3.4 FRANCE

12.3.4.1 Promotion of traditional artisan bakeries to bolster market growth

TABLE 108 FRANCE: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 109 FRANCE: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 110 FRANCE: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 111 FRANCE: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.3.5 ITALY

12.3.5.1 Widespread confectionery industry in Italy to propel expansion of edible inkjet ink market

TABLE 112 ITALY: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 113 ITALY: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 114 ITALY: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 115 ITALY: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.3.6 SPAIN

12.3.6.1 Spanish pastries and bread products to present growth opportunities

TABLE 116 SPAIN: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 117 SPAIN: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 118 SPAIN: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 119 SPAIN: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.3.7 REST OF EUROPE

12.3.7.1 Swedish biotechnological sector to augment growth of edible inkjet ink market

TABLE 120 REST OF EUROPE: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 121 REST OF EUROPE: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 122 REST OF EUROPE: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 123 REST OF EUROPE: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.4 ASIA PACIFIC

12.4.1 REGIONAL SUPPLIERS OF EDIBLE INKS TO DOMINATE MARKET

TABLE 124 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY COUNTRY, 2019–2021 (USD THOUSAND)

TABLE 125 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 126 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 127 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 128 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 129 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 130 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY BAKERY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 131 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY BAKERY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 132 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY COLOR, 2019–2021 (USD THOUSAND)

TABLE 133 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY COLOR, 2022–2027 (USD THOUSAND)

TABLE 134 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY END USE, 2019–2021 (USD THOUSAND)

TABLE 135 ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY END USE, 2022–2027 (USD THOUSAND)

12.4.2 CHINA

12.4.2.1 Consumption of customized baked goods in China to drive growth

TABLE 136 CHINA: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 137 CHINA: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 138 CHINA: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 139 CHINA: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.4.3 INDIA

12.4.3.1 Rising demand for innovations in baked goods to increase use of edible inkjet inks

TABLE 140 INDIA: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 141 INDIA: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 142 INDIA: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 143 INDIA: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.4.4 JAPAN

12.4.4.1 Introduction of customized products to address growing demand

TABLE 144 JAPAN: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 145 JAPAN: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 146 JAPAN: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 147 JAPAN: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.4.5 AUSTRALIA & NEW ZEALAND

12.4.5.1 Increasing consumer demand and support from bakery associations to proliferate market growth

TABLE 148 AUSTRALIA & NEW ZEALAND: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 149 AUSTRALIA & NEW ZEALAND: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 150 AUSTRALIA & NEW ZEALAND: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 151 AUSTRALIA & NEW ZEALAND: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.4.6 REST OF ASIA PACIFIC

TABLE 152 REST OF ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 153 REST OF ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 154 REST OF ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 155 REST OF ASIA PACIFIC: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.5 REST OF THE WORLD

TABLE 156 ROW: EDIBLE INKJET INK MARKET, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 157 ROW: EDIBLE INKJET INK MARKET, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 158 ROW: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 159 ROW: EDIBLE INKJET INK MARKET, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 160 ROW: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 161 ROW: EDIBLE INKJET INK MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 162 ROW: EDIBLE INKJET INK MARKET, BY BAKERY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 163 ROW: EDIBLE INKJET INK MARKET, BY BAKERY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 164 ROW: EDIBLE INKJET INK MARKET, BY COLOR, 2019–2021 (USD THOUSAND)

TABLE 165 ROW: EDIBLE INKJET INK MARKET, BY COLOR, 2022–2027 (USD THOUSAND)

TABLE 166 ROW: EDIBLE INKJET INK MARKET, BY END USE, 2019–2021 (USD THOUSAND)

TABLE 167 ROW: EDIBLE INKJET INK MARKET, BY END USE, 2022–2027 (USD THOUSAND)

12.5.1 SOUTH AMERICA

12.5.1.1 Increasing consumption of printed cakes and pastries to drive growth of edible inkjet ink market

TABLE 168 SOUTH AMERICA: EDIBLE INKJET INK MARKET, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 169 SOUTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 170 SOUTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 171 SOUTH AMERICA: MARKET FOR EDIBLE INKJET INK, BY APPLICATION, 2022–2027 (USD THOUSAND)

12.5.2 MIDDLE EAST & AFRICA

12.5.2.1 High-end customization of cakes and other food items to augment expansion of edible inkjet ink market

TABLE 172 MIDDLE EAST & AFRICA: MARKET FOR EDIBLE INKJET INK, BY MATERIAL, 2019–2021 (USD THOUSAND)

TABLE 173 MIDDLE EAST & AFRICA: MARKET FOR EDIBLE INKJET INK, BY MATERIAL, 2022–2027 (USD THOUSAND)

TABLE 174 MIDDLE EAST & AFRICA: EDIBLE INKJET INK MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 175 MIDDLE EAST & AFRICA: MARKET FOR EDIBLE INKJET INK, BY APPLICATION, 2022–2027 (USD THOUSAND)

13 COMPETITIVE LANDSCAPE (Page No. - 154)

13.1 OVERVIEW

13.2 MARKET RANKING

TABLE 176 RANKING OF PLAYERS, 2021

13.2.1 COMPANY EVALUATION QUADRANT

13.2.2 STARS

13.2.3 PERVASIVE PLAYERS

13.2.4 EMERGING LEADERS

13.2.5 PARTICIPANTS

FIGURE 44 EDIBLE INKJET INK MARKET: COMPANY EVALUATION QUADRANT, 2021 (OVERALL MARKET)

13.2.6 PRODUCT FOOTPRINT, BY KEY PLAYER

TABLE 177 COMPANY FOOTPRINT, BY COLOR

TABLE 178 COMPANY FOOTPRINT, BY APPLICATION

TABLE 179 COMPANY FOOTPRINT, BY REGION

TABLE 180 OVERALL COMPANY FOOTPRINT

13.3 COMPETITIVE BENCHMARKING

TABLE 181 EDIBLE INKJET INK MARKET: KEY STARTUP/SMES

TABLE 182 MARKET FOR EDIBLE INKJET INK: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

13.4 COMPETITIVE SCENARIO AND TRENDS

13.4.1 EDIBLE INKJET INK MARKET

13.4.2 PRODUCT LAUNCHES

TABLE 183 EDIBLE INKJET INK MARKET: PRODUCT LAUNCHES, 2019–SEPTEMBER 2022

13.4.3 DEALS

TABLE 184 MARKET FOR EDIBLE INKJET INK: DEALS, JANUARY 2019–OCTOBER 2022

13.4.4 OTHERS

TABLE 185 EDIBLE INKJET INK MARKET: OTHERS, JANUARY 2019–OCTOBER 2022

14 COMPANY PROFILES (Page No. - 165)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

14.1 KEY PLAYERS

14.1.1 SUN CHEMICAL CORPORATION

TABLE 186 SUN CHEMICAL CORPORATION: BUSINESS OVERVIEW

TABLE 187 SUN CHEMICAL CORPORATION: PRODUCTS OFFERED

TABLE 188 SUN CHEMICAL CORPORATION: PRODUCT LAUNCHES

TABLE 189 SUN CHEMICAL CORPORATION: DEALS

14.1.2 TOYOCHEM CO., LTD.

TABLE 190 TOYOCHEM CO., LTD.: BUSINESS OVERVIEW

TABLE 191 TOYOCHEM CO., LTD.: PRODUCTS OFFERED

14.1.3 UNION CHEMICAR CO., LTD.

TABLE 192 UNION CHEMICAR CO., LTD.: BUSINESS OVERVIEW

TABLE 193 UNION CHEMICAR CO., LTD.: PRODUCTS OFFERED

TABLE 194 UNION CHEMICAR CO., LTD.: OTHER DEVELOPMENTS

14.1.4 KOPYFORM GMBH

TABLE 195 KOPYFORM GMBH: BUSINESS OVERVIEW

TABLE 196 KOPYFORM GMBH: PRODUCTS OFFERED

14.1.5 ICING IMAGES

TABLE 197 ICING IMAGES: BUSINESS OVERVIEW

TABLE 198 ICING IMAGES: PRODUCTS OFFERED

14.1.6 INK 4 CAKES

TABLE 199 INK 4 CAKES: BUSINESS OVERVIEW

TABLE 200 INK 4 CAKES: PRODUCTS OFFERED

14.1.7 PRINTING IMAGES CTC, INC.

TABLE 201 PRINTING IMAGES CTC, INC.: BUSINESS OVERVIEW

TABLE 202 PRINTING IMAGES CTC, INC.: PRODUCTS OFFERED

14.1.8 THE CAKE DECORATING CO.

TABLE 203 THE CAKE DECORATING CO.: BUSINESS OVERVIEW

TABLE 204 THE CAKE DECORATING CO.: PRODUCTS OFFERED

14.1.9 KOPYKAKE ENTERPRISES, INC.

TABLE 205 KOPYKAKE ENTERPRISES, INC.: BUSINESS OVERVIEW

TABLE 206 KOPYKAKE ENTERPRISES, INC.: PRODUCTS OFFERED

14.1.10 LINX PRINTING TECHNOLOGIES

TABLE 207 LINX PRINTING TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 208 LINX PRINTING TECHNOLOGIES: PRODUCTS OFFERED

14.1.11 EDIBLE SUPPLY

TABLE 209 EDIBLE SUPPLY: BUSINESS OVERVIEW

TABLE 210 EDIBLE SUPPLY: PRODUCTS OFFERED

14.1.12 PHOTOFROST

TABLE 211 PHOTOFROST: BUSINESS OVERVIEW

TABLE 212 PHOTOFROST: PRODUCTS OFFERED

14.1.13 ICINGINKS

TABLE 213 ICINGINKS: BUSINESS OVERVIEW

TABLE 214 ICINGINKS: PRODUCTS OFFERED

14.1.14 ANYCAKE.COM LTD

TABLE 215 ANYCAKE.COM LTD: BUSINESS OVERVIEW

TABLE 216 ANYCAKE.COM LTD: PRODUCTS OFFERED

14.1.15 EDIBLE IMAGE SUPPLIES

TABLE 217 EDIBLE IMAGE SUPPLIES: BUSINESS OVERVIEW

TABLE 218 EDIBLE IMAGE SUPPLIES: PRODUCTS OFFERED

14.1.16 MAGICFROST

TABLE 219 MAGICFROST: BUSINESS OVERVIEW

TABLE 220 MAGICFROST: PRODUCTS OFFERED

14.1.17 NEEDHAM INK TECHNOLOGIES

TABLE 221 NEEDHAM INK TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 222 NEEDHAM INK TECHNOLOGIES: PRODUCTS OFFERED

14.1.18 WUHAN KEYIHUA TECHNOLOGY CO., LTD.

TABLE 223 WUHAN KEYIHUA TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

14.1.19 COLORCON NO-TOX

TABLE 224 COLORCON NO-TOX: BUSINESS OVERVIEW

14.1.20 PRIMERA TECHNOLOGY, INC

TABLE 225 PRIMERA TECHNOLOGY, INC: BUSINESS OVERVIEW

14.1.21 EASTMAN KODAK COMPANY

TABLE 226 EASTMAN KODAK COMPANY: BUSINESS OVERVIEW

14.1.22 SQUID INK

TABLE 227 SQUID INK: BUSINESS OVERVIEW

TABLE 228 SQUID INK: PRODUCT LAUNCHES (2019-2022)

14.1.23 KAO COLLINS CORPORATION

TABLE 229 KAO COLLINS CORPORATION: BUSINESS OVERVIEW

TABLE 230 KAO COLLINS CORPORATION: PRODUCT LAUNCHES (2019-2022)

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 198)

15.1 INTRODUCTION

TABLE 231 ADJACENT AND RELATED MARKETS TO EDIBLE INKJET INK MARKET

15.2 LIMITATIONS

15.3 3D FOOD PRINTING MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 232 3D FOOD PRINTING MARKET, BY TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 233 3D FOOD PRINTING MARKET, BY TECHNIQUE, 2022–2027 (USD MILLION)

16 APPENDIX (Page No. - 200)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of edible inkjet ink market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the edible inkjet ink market.

To know about the assumptions considered for the study, download the pdf brochure

Report Objectives

- To define, segment, and project the global market size for edible inkjet ink on the basis of type, material, color, application, end use, and region ranging from 2022 to 2027

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and the influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe into Netherlands, Sweden, and Switzerland.

- Further breakdown of the Rest of Asia Pacific into Malaysia, Indonesia, Thailand, Vietnam, and the Philippines.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Edible Inkjet Ink Market