Delivery Robots Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Hardware, Software), Load Carrying Capacity, Number of Wheels (3 wheels, 4 wheels, 6 wheels), Speed Limit, End-user Industry (Food & Beverage, Retail, Healthcare, Postal) and Region - Global Forecast to 2028

Updated on : October 22, 2024

Delivery Robots Market Size & Growth

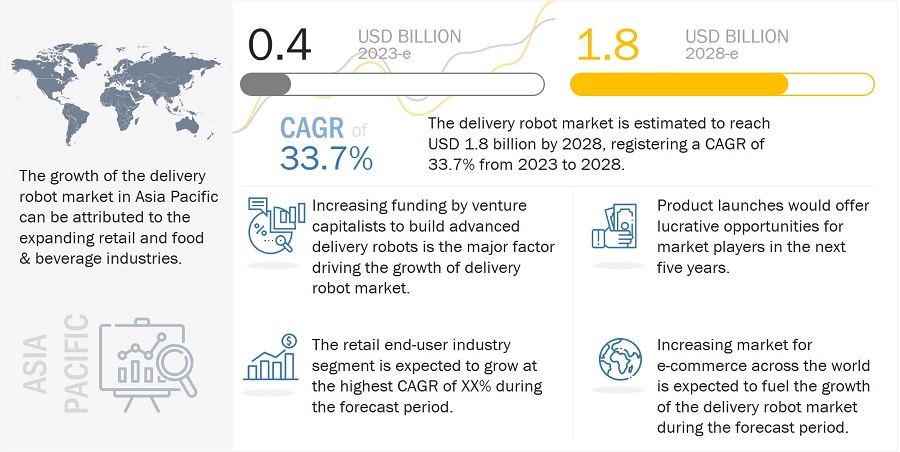

The Delivery Robots Market Size is projected to grow from USD 0.4 Billion in 2023 to USD 1.8 Billion by 2028; growing at a CAGR of 33.7% during the forecast period from 2023 to 2028.

A rise in venture funding will drive the Delivery Robots market growth in the coming years. Cost reduction achieved in last-mile delivery through delivery robots has accelerated the development of delivery robots, further strengthening the market growth. Deploying autonomous delivery robots companies for product delivery will reduce labor costs significantly, constituting only 20–25% of the total delivery cost.

The report aims to define, describe, and forecast the delivery robots industry size based on load-carrying capacity, offering, number of wheels, speed limit, end-user industry, and region.

Delivery Robots Industry Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Delivery Robots Market Trends and Dynamics:

Drivers: Increase in venture funding

Autonomous delivery robots are primarily used by the food & beverage, retail, hospitality, and healthcare industries. These robots are highly efficient and energy-saving compared to traditional electric vehicles. Hence, several venture firms are offering funds to companies developing delivery robots. In March 2022, Starship Technologies, one of the prominent players in the autonomous delivery robots marketspace, raised another round of funding just after 30 days after its last financial infusion. The company has picked USD 42 million in equity, which raised the total valuation of the company to over USD 100 million. This latest Series B all-equity round was co-led by NordicNinja and Taavet+Sten. Previous strategic backers TDK Ventures and Goodyear also participated. The company is currently operating a fleet of 1,700 robots every day and records about 10,000 deliveries daily. The Series B funding will be used to expand the company's footprint and accelerate its operation in US and Europe, and invest in new initiatives.

Restraints: Stringent regulations pertaining to the operations of delivery robots

Most western legal authorities hold the manufacturer responsible for the tort of negligence if the delivery robot causes damage or injury to a user or nearby human. Therefore, the underlying risk and liabilities have slowed down the deployment of autonomous delivery vehicles in cities. Companies also have to comply with privacy and data protection laws, as delivery robots use cameras for recording and collecting consumer data during the delivery process. The federal, state, and local authorities are responsible for regulating the data collection and retention processes. Thereby, delivery robot companies have to be aware of data protection regulations and have to ensure that the collected data is handled in compliance with such regulations

Opportunity: Advancements in features of autonomous delivery robots

Autonomous delivery robots feature advanced electronics to ensure safe, reliable, and efficient operations. Several technological advancements are taking place in delivery vehicles regarding improved power sources, data gathering, and processing technologies. Lithion-ion batteries are predominantly used in delivery vehicles. However, hydrogen fuel cell batteries are expected to be used in autonomous delivery vehicles in the future due to their excellent endurance and low weight. Moreover, manufacturers of delivery robots companies are also making efforts to incorporate sense and obstacle-avoidance systems in their vehicles. Furthermore, technological advancements such as sensor technology, AI, and 5G technology have led to an evolution in the design and operations of delivery robots. For example, 5G networks could pace up the transfer of a large volume of data and responsiveness of devices associated with IoT networks, along with the usage and processing of real-time data and data exchange with GPS or devices with built-in cameras.

Challenge: Safety issues associated with operations of delivery robots in populated areas

With escalating cost of traditional delivery methods, rapid technological advancements, and increased adoption of artificial intelligence (AI) and integrated technology, the adoption of delivery robots has increased significantly, mainly for the delivery of groceries, food items, postal parcels, and medicines, as well as in the hospitality sector to provide room services to customers. They are also used for carrying luggage and follow the user wherever they go. However, making delivery robots industry safe for routine interaction with humans and smooth operations in high-density traffic areas is among the major technological challenges faced by the industry. For robots to interact closely and safely with humans, the hardware and software of robots should be safe, and there should not be any potential risk of malfunctioning of delivery robots market. Concrete efforts are being made by original equipment manufacturers (OEMs) to program robots in such a way that they can deal with humans and varying environmental conditions.

Delivery Robots Market Segmentation

Hardware to witness the highest market demand during the forecast period

Broadly, hardware is categorized into GPS, cameras, radars, ultrasonic/LiDAR sensors, control systems, chassis and motors, and others. The market for control systems is expected to grow at the highest rate as delivery robots companies are complex in their design and function, and more sophisticated microcontrollers will be required to control various functions of robots. A controller or control system is the primary device used in any delivery robot. Every robot must have a control system to operate its drive system, which is used to move the body of a robot. Hence, it is also known as the central processing unit (CPU) or processor, or the brain of the robot. The prime function of the controller is to allow various components of a robot to operate together by processing the information and carrying out several instructions that are given to a robot, such as pick and place an object from one position to another, program run/stop, motor ON/OFF, go home, and start searching destination, depending on the application. Mainly, processors with high processing speed are integrated into delivery robots as they need to make decisions depending on the real-time situation. For instance, Starship Delivery Robot is equipped with the NVIDIA Tegra K1 processor, which has a maximum clock speed of 2.3 GHz

4-wheeled delivery robots is expected to hold the majority market share during the forecast period

The 4-wheeled will account for a majority of the share in the delivery robots market in 2022. Reducing the distance between the front and rear wheels will result in better zero-radius turning in any desired direction with 4-wheeled robots. Hence, most robotics companies worldwide offer delivery robots with 4 wheels, which are more efficient in rotating in place. Just Eat, a delivery firm in the UK, has also employed robots to deliver food to customers even in the event of snow and severe weather by switching from 6 wheels to 4 wheels for navigating in tough snowy conditions. In May 2022, Uber Eats announced plans to launch two new test programs to deliver Uber Eats in Los Angeles. This will include four-wheeled delivery robots on the sidewalk for short trips and self-driving cars for long distances.

Food &Beverage industry to boost market growth during the forecast period

Delivery robots have been extensively used in the food & beverage industry to deliver food items and beverages from restaurants. In terms of volume, the food & beverage industry constituted ~56% share of the delivery robots market in 2022. In the past few years, the industry has witnessed gradual growth due to the introduction of various ventures offering food parcels from restaurants at the consumer's doorstep. In December 2022, Uber Eats partnered with Cartken to deliver Uber Eats orders through autonomous, sidewalk-trotting robots in Miami. Through this new service, the customers will be alerted of the food order and will be instructed to meet the remotely supervised robots on the sidewalk. Consumers expect the minimum cost, along with less time for delivery. The delivery robot is a low-cost delivery option that helps in time optimization. Starship Technologies (US) and Segway Robotics (US) are examples of some of the companies engaged in the manufacturing and development of delivery robots companies for the food & beverage industry.

Load-bearing capacity (> 10 kg) Robots to grow at highest CAGR in 2028

Robots with a load-carrying capacity of up to 10 kg are mainly adopted by local restaurants to deliver food parcels and beverages to consumers. Delivery robots with a load-carrying capacity of up to 10 kg accounted for a market share of ~23%, in terms of volume, in 2022. As these robots weigh around 25 kg, they can carry a limited weight and are adopted to deliver products in a shorter range. Also, their battery life is about 2 hours, and they can traverse 6 to 8 km on a single charge. These robots, with their miniature structure, are a perfect fit to travel on sidewalks causing less interference for pedestrians. The current traffic scenario makes it difficult for robots with larger dimensions to travel easily without harming humans; hence, legal authorities limit the weight, size, and speed of delivery robots.

Delivery Robots Industry Regional Analysis

Delivery Robots market to witness the highest demand in the North American region

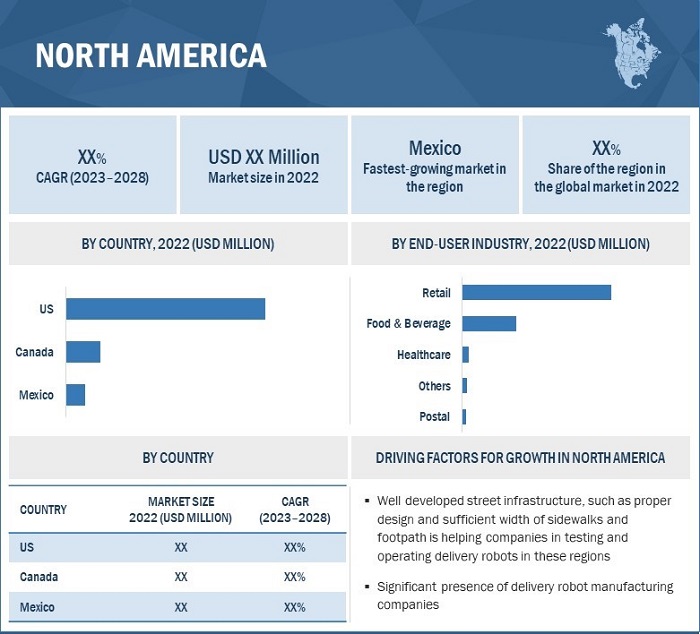

The market in North America was valued at USD 147.8 million in 2022 and is expected to reach USD 830.7 million by 2028, at a CAGR of 32.7% during the forecast period. North America has been home to many delivery robots manufacturing companies, such as Nuro Inc (US) and BoxBot (US). Sophisticated and adequate street infrastructure, such as proper design and sufficient width of sidewalks and footpaths, helps companies test and operate delivery robots in this region. In North America, especially in the US, ground delivery robots companies have become commercialized in the last few years. The US is leading the robotics market as the US government supports various innovative robotics research programs by investing millions of dollars; most of them are defense-related projects.

Delivery Robots Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

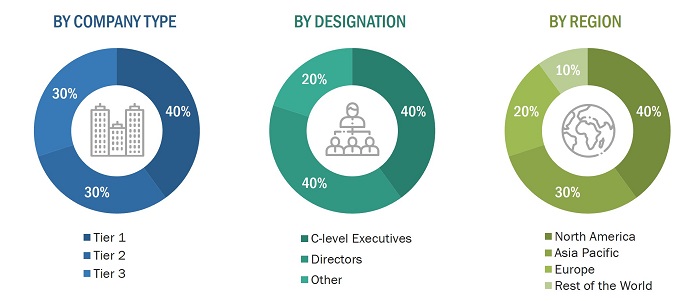

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the Delivery Robots market space. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 – 40%, Tier 2 – 30%, and Tier 30%

- By Designation: C-level Executives – 40%, Directors – 40%, and Others – 20%

- By Region: North America –40%, APAC– 30%, Europe – 20%, and RoW – 10%

Top Delivery Robots Companies - Key Market Players

Major vendors in the Delivery Robots Companies include

- Starship Technologies (US),

- JD.com, Inc. (China),

- Panasonic Holdings Corporation (Japan),

- Relay Robotics, Inc. (US),

- Nuro, Inc. (US), among others

The study includes an in-depth competitive analysis of these key players in the Delivery Robot industry with their company profiles, recent developments, and key market strategies.

Delivery Robots Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 0.4 Billion in 2023 |

|

Projected Market Size in 2028 |

USD 1.8 Billion by 2028 |

|

Growth Rate |

CAGR of 33.7% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Units |

Value (USD Million/USD Billion), Volume (Thousand Units) |

|

Segments Covered |

Load Carrying Capacity, Offering, Speed Limits, Number of Wheels, End-user Industry, and Geography |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Starship Technologies (US), JD.com, Inc. (China), Panasonic Holdings Corporation (Japan), Relay Robotics, Inc. (US), Nuro, Inc. (US), Boston Dynamics (US), Eliport (Spain), Kiwibot (US), Alibaba Group Holding Limited (China), Ottonomy.IO (US) are the major players in the market. |

Delivery Robots Market Highlights

This report categorizes the Delivery Robots market share based on load-carrying capacity, offering, speed limits, number of wheels, end-user industry, and geography.

|

Segment |

Subsegment |

|

Delivery Robots Market Size, by Load Carrying Capacity: |

|

|

Delivery Robots Market, by Offering: |

|

|

Delivery Robots Market, by Speed Limit: |

|

|

Delivery Robots Market, by Number of Wheels: |

|

|

Delivery Robots Market, by End-user Industry: |

|

|

Delivery Robots Market, by Region: |

|

Recent Developments in Delivery Robots Industry

- In February 2023, Starship Technologies announced a partnership with Teal to offer unmatched connectivity and reliability for automated delivery robots. This partnership will help the company to gain access to any of the global networks through Teal's single eSIM, which includes a management platform that ensures connectivity in its robots.

- In November 2022, Ottonomy. IO. announced its partnership with Posten Norge AS and Holo to trial its autonomous first-mile delivery robot. Through this partnership, the company will leverage its Ottobots for receiving and delivering goods for the digital marketplace.

- In June 2022, Relay Robotics, Inc. announced the launch of its new delivery robot, "Relay+ Service Robot," for the hospitality industry. The robot can make deliveries in less than 10 minutes and operate at about USD 4 per hour.

- In March 2022, JD.com, Inc., through its logistics arm JD Logistics, introduced autonomous delivery robots in Shanghai to offer contactless last-mile delivery. These robots can load up to 100 kilograms of goods and drive up to 80 kilometers per charge.

- In January 2022, Nuro, Inc. announced the launch of its third-generation autonomous delivery vehicle, "Nuro." The new vehicle is designed to carry more goods and enables more deliveries, which is twice the cargo volume of the company's second-generation vehicle.

Frequently Asked Questions (FAQ):

Which are the major companies in the Delivery Robots market? What are their major strategies to strengthen their market presence?

Starship Technologies (US), JD.com, Inc. (China), Panasonic Holdings Corporation (Japan), Relay Robotics, Inc. (US), and Nuro, Inc. (US) are the top players in the market. The delivery robots market is highly competitive with several global market players. Product launches and developments, acquisitions, collaborations, and expansions were among the major strategies adopted by these players to compete in the market.

Which is the potential market for the Delivery Robots market share in terms of the region?

Asia Pacific will grow at the fastest rate in the Delivery Robots market in the forecast timeline. The growing awareness regarding the benefits of using delivery robots and the rapid inclusion of robotics in academic and educational institutions are expected to drive market growth. Apart from this, the absence of any regulations or regulatory bodies in Asia Pacific countries for operating delivery robots is also fueling the market growth.

What are the opportunities for new market entrants

The growing awareness regarding the benefits of using delivery robots and the rapid inclusion of robotics in academic and educational institutions are expected to drive market growth. Apart from this, the absence of regulations or regulatory bodies in Asia Pacific countries for operating delivery robots is also fueling market growth.

Which applications are expected to drive the market's growth in the next six years

Retail is one of the prominent applications and is expected to drive the market's growth in the forecast timeline. Adopting delivery robots for the delivery of groceries not only assures delivery of quality products but also at a minimum price.

Which are the major factors driving the demand for delivery robots in the forecast timeline

Reduction in the delivery cost in last-mile deliveries and increase in venture funding are a few factors driving the market for delivery robots.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Last mile delivery cost reduction achieved through use of delivery robots- Increase in venture fundingRESTRAINTS- Stringent regulations pertaining to operations of delivery robotsOPPORTUNITIES- Advancements in features of autonomous delivery robots- Worldwide growth of e-commerce market- Restrictions on use of drones for delivery servicesCHALLENGES- Limited range of operation of ground delivery robots- Safety issues associated with operations of delivery robots in populated areas

- 5.3 INVESTMENT ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM/MARKET MAPSUPPLIERSROBOT INTEGRATORSSOFTWARE SOLUTION PROVIDERS

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE ANALYSIS OF DELIVERY ROBOTS OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE TRENDS

-

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSGROWING ADOPTION OF DELIVERY ROBOTS IN E-COMMERCEINCREASING USE OF DELIVERY ROBOTS TO DELIVER PARCELS, GROCERIES, AND FOOD ITEMS ORDERED THROUGH SMARTPHONE APPLICATIONS BY CUSTOMERS

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- LiDAR sensors- GPSCOMPLEMENTARY TECHNOLOGIES- Vision guidanceADJACENT TECHNOLOGIES- Laser guidance

-

5.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 5.11 CASE STUDY ANALYSIS

- 5.12 TRADE ANALYSIS

-

5.13 PATENT ANALYSISMAJOR PATENTS

-

5.14 TARIFF AND REGULATORY LANDSCAPETARIFF- Negative impact of tariff on delivery robots market- Positive impact of tariff on delivery robots marketREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO DELIVERY ROBOTSREGULATIONS RELATED TO DELIVERY ROBOTS

- 6.1 INTRODUCTION

-

6.2 UP TO 10 KGUSED FOR DELIVERY OF FOOD AND BEVERAGES

-

6.3 MORE THAN 10 KG UP TO 50 KGUSED FOR DELIVERY OF GROCERIES

-

6.4 MORE THAN 50 KGIDEAL FOR DELIVERY OF HEAVY PARCELS

- 7.1 INTRODUCTION

-

7.2 HARDWAREULTRASONIC/LIDAR SENSORS- Provide high-resolution, three-dimensional information about surrounding environment to delivery robotsCHASSIS AND MOTORS- Provide stability to robotsCONTROL SYSTEMS- Allow various components of robots to operate togetherRADARS- Help delivery robots avoid collisionGPS- Monitor routes and progress of delivery robotsCAMERAS- Enable delivery robots to detect and identify objects in their pathOTHERS

-

7.3 SOFTWAREFLEET MANAGEMENT SOFTWARE- Ensure successful autonomous delivery of packagesCOMPUTER VISION- Implemented for dynamic path planning and obstacle identification applications

- 8.1 INTRODUCTION

-

8.2 3 WHEELS3-WHEELED DELIVERY ROBOTS LIKELY TO SIMPLIFY INDUSTRIAL LOGISTICS OPERATIONS

-

8.3 4 WHEELS4 WHEELS MAKE ROTATING IN PLACE EASY FOR DELIVERY ROBOTS

-

8.4 6 WHEELS6 WHEELS PROVIDE HIGH STABILITY TO DELIVERY ROBOTS

- 9.1 INTRODUCTION

-

9.2 UP TO 3 KPHIDEAL FOR APPLICATIONS IN HEALTHCARE INDUSTRY

-

9.3 3 KPH TO 6 KPHSUITABLE FOR DELIVERY OF PACKAGES, IMPORTANT DOCUMENTS, AND FOOD ITEMS

-

9.4 HIGHER THAN 6 KPHDELIVER GOODS IN SHORT TIME

- 10.1 INTRODUCTION

-

10.2 FOOD & BEVERAGEFOOD & BEVERAGE INDUSTRY HELD LARGEST MARKET SHARE IN 2022

-

10.3 RETAILINCREASING DEMAND FOR DELIVERY ROBOTS IN E-COMMERCE TO FUEL MARKET GROWTH

-

10.4 HEALTHCAREGROWING USE OF DELIVERY ROBOTS IN HOSPITALS TO OPTIMIZE LABOR PRODUCTIVITY TO DRIVE MARKET GROWTH

-

10.5 POSTALGROWING ADOPTION OF DELIVERY ROBOTS FOR PACKAGE DELIVERIES TO ACCELERATE MARKET GROWTH

- 10.6 OTHERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- Presence of major ground delivery robot manufacturers to drive market- Regulations for delivery robots in USCANADA- Government grants and funds to encourage developments related to robotics to boost marketMEXICO- Booming e-commerce sector to drive market

-

11.3 EUROPEUK- High adoption of delivery robots in food & beverage industry to accelerate market growthGERMANY- Increasing use of delivery robots for food deliveries to fuel market growthSWITZERLAND- Switzerland to register highest CAGR in European delivery robots market during forecast periodREST OF EUROPE

-

11.4 ASIA PACIFICCHINA- Growing adoption of delivery robots for e-commerce deliveries to propel marketJAPAN- Increasing use of delivery robots to fulfill requirements of aging population to support market growthSOUTH KOREA- Demand from food & beverage industry to foster market growthREST OF ASIA PACIFIC

-

11.5 REST OF THE WORLD (ROW)MIDDLE EAST & AFRICA- Growing adoption of delivery robots in hospitality and food delivery sectors to favor market growthSOUTH AMERICA- Use of delivery robots for e-commerce deliveries to augment market growth

- 12.1 OVERVIEW

-

12.2 MARKET EVALUATION FRAMEWORKPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC PLAY

- 12.3 REVENUE ANALYSIS OF TOP PLAYERS IN DELIVERY ROBOTS MARKET

- 12.4 MARKET SHARE ANALYSIS, 2022

-

12.5 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

12.6 STARTUPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.7 DELIVERY ROBOTS MARKET: COMPANY FOOTPRINT

- 12.8 COMPETITIVE BENCHMARKING

-

12.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHES AND DEVELOPMENTSDEALSOTHERS

-

13.1 KEY PLAYERSSTARSHIP TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJD.COM, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPANASONIC HOLDINGS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRELAY ROBOTICS, INC. (SAVIOKE)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNURO, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBOSTON DYNAMICS- Business overview- Products/Solutions/Services offered- Recent developmentsELIPORT- Business overview- Products/Solutions/Services offeredKIWIBOT- Business overview- Products/Solutions/Services offered- Recent developmentsALIBABA GROUP HOLDING LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsOTTONOMY.IO- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSPIAGGIO & C. SPATELERETAILAETHONCLEVERONUDELV, INC.SEGWAY ROBOTICSPOSTMATES INC.EFFIDENCEANYBOTICSNEOLIX HUITONG (BEIJING) TECHNOLOGY CO., LTD.BEIJING ZHEN ROBOTICS CO. LTDTWINSWHEELDELIVERS.AI A.SSHENZHEN REEMAN INTELLIGENT EQUIPMENT CO., LTD.PUDU TECHNOLOGY INC.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 ASSOCIATED RISKS

- TABLE 2 ANALYSIS OF RECENT FINANCIAL INVESTMENTS BY VENTURE CAPITALISTS

- TABLE 3 COMPANIES AND THEIR ROLE IN DELIVERY ROBOTS ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF DELIVERY ROBOTS WITH 3 WHEELS

- TABLE 5 AVERAGE SELLING PRICE OF DELIVERY ROBOTS WITH 4 WHEELS

- TABLE 6 AVERAGE SELLING PRICE OF DELIVERY ROBOTS WITH 6 WHEELS

- TABLE 7 AVERAGE SELLING PRICE ANALYSIS OF DELIVERY ROBOTS OFFERED BY KEY PLAYERS

- TABLE 8 IMPACT OF PORTER’S FIVE FORCES ON DELIVERY ROBOTS MARKET

- TABLE 9 NURO AUTONOMOUS DELIVERY ROBOTS PROVIDE COST-EFFICIENT GROCERY DELIVERY SERVICES FOR KROGER

- TABLE 10 TONY MILE ACCELERATED ITS ROBOT AUTOMATION WITH AWS AND BELL

- TABLE 11 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 12 MAJOR PATENTS IN DELIVERY ROBOTS MARKET

- TABLE 13 EXPORT TARIFF DATA OF CHINA

- TABLE 14 EXPORT TARIFF DATA OF GERMANY

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (USD MILLION)

- TABLE 20 DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (USD MILLION)

- TABLE 21 DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (UNITS)

- TABLE 22 DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (UNITS)

- TABLE 23 UP TO 10 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (USD THOUSAND)

- TABLE 24 UP TO 10 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (USD THOUSAND)

- TABLE 25 UP TO 10 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (UNITS)

- TABLE 26 UP TO 10 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (UNITS)

- TABLE 27 MORE THAN 10 KG UP TO 50 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (USD THOUSAND)

- TABLE 28 MORE THAN 10 KG UP TO 50 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (USD THOUSAND)

- TABLE 29 MORE THAN 10 KG UP TO 50 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (UNITS)

- TABLE 30 MORE THAN 10 KG UP TO 50 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (UNITS)

- TABLE 31 MORE THAN 50 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (USD THOUSAND)

- TABLE 32 MORE THAN 50 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (USD THOUSAND)

- TABLE 33 MORE THAN 50 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (UNITS)

- TABLE 34 MORE THAN 50 KG: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (UNITS)

- TABLE 35 DELIVERY ROBOTS MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 36 DELIVERY ROBOTS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 37 HARDWARE: DELIVERY ROBOTS MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 38 HARDWARE: DELIVERY ROBOTS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 39 DELIVERY ROBOTS MARKET, BY NUMBER OF WHEELS, 2019–2022 (USD MILLION)

- TABLE 40 DELIVERY ROBOTS MARKET, BY NUMBER OF WHEELS, 2023–2028 (USD MILLION)

- TABLE 41 DELIVERY ROBOTS MARKET, BY NUMBER OF WHEELS, 2019–2022 (UNITS)

- TABLE 42 DELIVERY ROBOTS MARKET, BY NUMBER OF WHEELS, 2023–2028 (UNITS)

- TABLE 43 DELIVERY ROBOTS MARKET, BY SPEED LIMIT, 2019–2022 (USD MILLION)

- TABLE 44 DELIVERY ROBOTS MARKET, BY SPEED LIMIT, 2023–2028 (USD MILLION)

- TABLE 45 DELIVERY ROBOTS MARKET, BY SPEED LIMIT, 2019–2022 (UNITS)

- TABLE 46 DELIVERY ROBOTS MARKET, BY SPEED LIMIT, 2023–2028 (UNITS)

- TABLE 47 DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 48 DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 49 DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (UNITS)

- TABLE 50 DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (UNITS)

- TABLE 51 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 52 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 53 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 54 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 55 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 56 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 57 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 58 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 59 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 60 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 61 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 62 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 63 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (UNITS)

- TABLE 64 FOOD & BEVERAGE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (UNITS)

- TABLE 65 RETAIL: DELIVERY ROBOTS MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 66 RETAIL: DELIVERY ROBOTS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 67 RETAIL: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 68 RETAIL: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 69 RETAIL: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 70 RETAIL: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 71 RETAIL: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 72 RETAIL: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 73 RETAIL: DELIVERY ROBOTS MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 74 RETAIL: DELIVERY ROBOTS MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 75 RETAIL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 76 RETAIL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 77 RETAIL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (UNITS)

- TABLE 78 RETAIL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (UNITS)

- TABLE 79 HEALTHCARE: DELIVERY ROBOTS MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 80 HEALTHCARE: DELIVERY ROBOTS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 81 HEALTHCARE: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 82 HEALTHCARE: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 83 HEALTHCARE: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 84 HEALTHCARE: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 85 HEALTHCARE: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 86 HEALTHCARE: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 87 HEALTHCARE: DELIVERY ROBOTS MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 88 HEALTHCARE: DELIVERY ROBOTS MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 89 HEALTHCARE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 90 HEALTHCARE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 91 HEALTHCARE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (UNITS)

- TABLE 92 HEALTHCARE: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (UNITS)

- TABLE 93 POSTAL: DELIVERY ROBOTS MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 94 POSTAL: DELIVERY ROBOTS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 95 POSTAL: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 96 POSTAL: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 97 POSTAL: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 98 POSTAL: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 99 POSTAL: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 100 POSTAL: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 101 POSTAL: DELIVERY ROBOTS MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 102 POSTAL: DELIVERY ROBOTS MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 103 POSTAL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 104 POSTAL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 105 POSTAL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022(UNITS)

- TABLE 106 POSTAL: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (UNITS)

- TABLE 107 OTHERS: DELIVERY ROBOTS MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 108 OTHERS: DELIVERY ROBOTS MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 109 OTHERS: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 110 OTHERS: DELIVERY ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 111 OTHERS: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 112 OTHERS: DELIVERY ROBOTS MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 113 OTHERS: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 114 OTHERS: DELIVERY ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 115 OTHERS: DELIVERY ROBOTS MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 116 OTHERS: DELIVERY ROBOTS MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 117 OTHERS: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 118 OTHERS: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 119 OTHERS: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2019–2022 (UNITS)

- TABLE 120 OTHERS: DELIVERY ROBOTS MARKET, BY LOAD CARRYING CAPACITY, 2023–2028 (UNITS)

- TABLE 121 DELIVERY ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 122 DELIVERY ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 123 NORTH AMERICA: DELIVERY ROBOTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 124 NORTH AMERICA: DELIVERY ROBOTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 126 NORTH AMERICA: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 127 EUROPE: DELIVERY ROBOTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 128 EUROPE: DELIVERY ROBOTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 129 EUROPE: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (USD THOUSAND)

- TABLE 130 EUROPE: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (USD THOUSAND)

- TABLE 131 ASIA PACIFIC: DELIVERY ROBOTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DELIVERY ROBOTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 135 REST OF THE WORLD: DELIVERY ROBOTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 136 REST OF THE WORLD: DELIVERY ROBOTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 137 REST OF THE WORLD: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 138 REST OF THE WORLD: DELIVERY ROBOTS MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 139 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN DELIVERY ROBOTS MARKET

- TABLE 140 DELIVERY ROBOTS MARKET: DEGREE OF COMPETITION

- TABLE 141 COMPANY FOOTPRINT

- TABLE 142 COMPANY NUMBER OF WHEELS FOOTPRINT

- TABLE 143 END-USER INDUSTRY FOOTPRINT OF COMPANIES

- TABLE 144 REGIONAL FOOTPRINT OF COMPANIES

- TABLE 145 STARTUPS/SMES MATRIX: DETAILED LIST OF KEY STARTUPS

- TABLE 146 DELIVERY ROBOTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 147 PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2019–DECEMBER 2022

- TABLE 148 DEALS, JANUARY 2019–DECEMBER 2022

- TABLE 149 OTHERS, JANUARY 2019–DECEMBER 2022

- TABLE 150 STARSHIP TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 151 JD.COM, INC.: BUSINESS OVERVIEW

- TABLE 152 PANASONIC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 153 RELAY ROBOTICS, INC: BUSINESS OVERVIEW

- TABLE 154 NURO, INC.: BUSINESS OVERVIEW

- TABLE 155 BOSTON DYNAMICS: BUSINESS OVERVIEW

- TABLE 156 ELIPORT: BUSINESS OVERVIEW

- TABLE 157 KIWIBOT: BUSINESS OVERVIEW

- TABLE 158 ALIBABA GROUP HOLDING LIMITED: BUSINESS OVERVIEW

- TABLE 159 OTTONOMY.IO: BUSINESS OVERVIEW

- TABLE 160 PIAGGIO & C. SPA: BUSINESS OVERVIEW

- TABLE 161 TELERETAIL: BUSINESS OVERVIEW

- TABLE 162 AETHON: BUSINESS OVERVIEW

- TABLE 163 CLEVERON: BUSINESS OVERVIEW

- TABLE 164 UDELV, INC.: BUSINESS OVERVIEW

- TABLE 165 SEGWAY ROBOTICS: BUSINESS OVERVIEW

- TABLE 166 POSTMATES INC.: BUSINESS OVERVIEW

- TABLE 167 EFFIDENCE: BUSINESS OVERVIEW

- TABLE 168 ANYBOTICS: BUSINESS OVERVIEW

- TABLE 169 NEOLIX HUITONG (BEIJING) TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 170 BEIJING ZHEN ROBOTICS CO. LTD: BUSINESS OVERVIEW

- TABLE 171 TWINSWHEEL: BUSINESS OVERVIEW

- TABLE 172 DELIVERS.AI A.S: BUSINESS OVERVIEW

- TABLE 173 SHENZHEN REEMAN INTELLIGENT EQUIPMENT CO., LTD.: BUSINESS OVERVIEW

- TABLE 174 PUDU TECHNOLOGY INC.: BUSINESS OVERVIEW

- FIGURE 1 DELIVERY ROBOTS MARKET: RESEARCH DESIGN

- FIGURE 2 DELIVERY ROBOTS MARKET: RESEARCH APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY FOR DELIVERY ROBOTS MARKET USING SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH: DEMAND-SIDE ANALYSIS

- FIGURE 7 DELIVERY ROBOTS MARKET: DATA TRIANGULATION

- FIGURE 8 RECESSION IMPACT: GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 9 RECESSION IMPACT ON DELIVERY ROBOTS MARKET, 2019–2028 (USD MILLION)

- FIGURE 10 MORE THAN 50 KG SEGMENT TO HOLD LARGEST SHARE OF DELIVERY ROBOTS MARKET FROM 2023 TO 2028

- FIGURE 11 HARDWARE SEGMENT TO HOLD LARGER SIZE OF DELIVERY ROBOTS MARKET FROM 2023 TO 2028

- FIGURE 12 6 WHEELS SEGMENT TO REGISTER HIGHEST CAGR IN DELIVERY ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 13 HIGHER THAN 3 KPH UP TO 6 KPH SEGMENT TO HOLD LARGEST SIZE OF DELIVERY ROBOTS MARKET IN 2028

- FIGURE 14 RETAIL SEGMENT TO GROW AT HIGHEST CAGR IN DELIVERY ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF DELIVERY ROBOTS MARKET IN 2022

- FIGURE 16 EXPANDING E-COMMERCE INDUSTRY TO DRIVE DELIVERY ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 17 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF DELIVERY ROBOTS MARKET FROM 2023 TO 2028

- FIGURE 18 MORE THAN 50 KG SEGMENT TO BE LARGEST SHAREHOLDER IN DELIVERY ROBOTS MARKET FROM 2023 TO 2028

- FIGURE 19 6 WHEEL SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 20 3 KPH SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 21 RETAIL SEGMENT TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 22 DELIVERY ROBOTS MARKET IN SOUTH KOREA AND CHINA TO GROW AT HIGHEST CAGRS FROM 2023 TO 2028

- FIGURE 23 DELIVERY ROBOTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 ANALYSIS OF IMPACT OF DRIVERS ON DELIVERY ROBOTS MARKET

- FIGURE 25 ANALYSIS OF IMPACT OF RESTRAINTS ON DELIVERY ROBOTS MARKET

- FIGURE 26 ANALYSIS OF IMPACT OF OPPORTUNITIES ON DELIVERY ROBOTS MARKET

- FIGURE 27 ANALYSIS OF IMPACT OF CHALLENGES ON DELIVERY ROBOTS MARKET

- FIGURE 28 VALUE CHAIN ANALYSIS: R&D AND MANUFACTURING STAGES ADD MAJOR VALUE TO DELIVERY ROBOTS MARKET

- FIGURE 29 DELIVERY ROBOTS MARKET: SUPPLY CHAIN, 2022

- FIGURE 30 DELIVERY ROBOTS ECOSYSTEM

- FIGURE 31 AVERAGE SELLING PRICE OF DELIVERY ROBOTS OFFERED BY KEY PLAYERS

- FIGURE 32 REVENUE SHIFTS FOR DELIVERY ROBOTS MARKET

- FIGURE 33 PORTER’S FIVE FORCES ANALYSIS: DELIVERY ROBOTS MARKET

- FIGURE 34 IMPORT DATA, BY COUNTRY, 2017−2021 (USD THOUSAND)

- FIGURE 35 EXPORT DATA, BY COUNTRY, 2017−2021 (USD THOUSAND)

- FIGURE 36 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 37 NUMBER OF PATENTS GRANTED PER YEAR, 2012−2022

- FIGURE 38 MORE THAN 50 KG SEGMENT HELD LARGEST MARKET SHARE IN 2022

- FIGURE 39 HARDWARE SEGMENT HELD LARGER SHARE OF DELIVERY ROBOTS MARKET IN 2022

- FIGURE 40 CONTROL SYSTEMS SUB-SEGMENT TO REGISTER HIGHEST CAGR IN DELIVERY ROBOTS MARKET FOR HARDWARE DURING FORECAST PERIOD

- FIGURE 41 6 WHEELS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 HIGHER THAN 3 KPH UP TO 6 KPH SEGMENT TO CAPTURE LARGEST SIZE OF DELIVERY ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 43 FOOD & BEVERAGE INDUSTRY HELD LARGEST MARKET SHARE IN 2022

- FIGURE 44 DELIVERY ROBOTS MARKET FOR RETAIL INDUSTRY IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 ROBOTS WITH LOAD CARRYING CAPACITY OF MORE THAN 50 KG TO HOLD LARGEST SHARE OF DELIVERY ROBOTS MARKET FOR POSTAL INDUSTRY BY 2028

- FIGURE 46 ROBOTS WITH LOAD CARRYING CAPACITY OF MORE THAN 50 KG TO HOLD LARGEST SHARE OF DELIVERY ROBOTS MARKET FOR OTHER INDUSTRIES BY 2028

- FIGURE 47 DELIVERY ROBOTS MARKET IN SOUTH KOREA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: DELIVERY ROBOTS MARKET SNAPSHOT

- FIGURE 50 US TO CAPTURE LARGEST SIZE OF DELIVERY ROBOTS MARKET IN NORTH AMERICA IN 2028

- FIGURE 51 EUROPE: DELIVERY ROBOTS MARKET SNAPSHOT

- FIGURE 52 SWITZERLAND TO EXHIBIT HIGHEST CAGR IN EUROPE DELIVERY ROBOTS MARKET

- FIGURE 53 ASIA PACIFIC: DELIVERY ROBOTS MARKET SNAPSHOT

- FIGURE 54 SOUTH KOREA TO EXHIBIT HIGHEST CAGR IN ASIA PACIFIC DELIVERY ROBOTS MARKET IN 2028

- FIGURE 55 REST OF THE WORLD: DELIVERY ROBOTS MARKET SNAPSHOT

- FIGURE 56 DELIVERY ROBOTS MARKET IN MIDDLE EAST & AFRICA TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 57 REVENUE ANALYSIS OF TOP PLAYERS IN DELIVERY ROBOTS MARKET

- FIGURE 58 DELIVERY ROBOTS MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 59 DELIVERY ROBOTS MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 60 JD.COM, INC.: COMPANY SNAPSHOT

- FIGURE 61 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 ALIBABA GROUP HOLDING LIMITED: COMPANY SNAPSHOT

The research process for this study included the systematic gathering, recording, and analysis of data about customers and companies operating in the delivery robots market. This research study involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for this extensive technical, market-oriented, and commercial study of the delivery robots industry. In-depth interviews have been conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects. Key players in the delivery robots market analysis have been identified through secondary research, and their market rankings have been determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases. Secondary research has been mainly carried out to obtain key information about the supply chain of the delivery robots industry, the value chain of the market, the total pool of the key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and key executives from major companies and organizations operating in the delivery robots market.

After going through the entire market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the obtained critical numbers. Primary research has been conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses have been carried out on the complete market engineering process to list the key information/insights pertaining to the delivery robots market.

The key players in the market have been identified through secondary research, and their rankings in the respective regions have been determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for both quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Delivery Robots Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the delivery robots market size in terms of value, segmented based on load carrying capacity, offering, end-user industry, number of wheels, speed limit, and region

-

To describe and forecast the market in terms of volume based on

load carrying capacity, end-user industry, number of wheels, and speed limit - To describe important safety components of delivery robots

- To describe and forecast the market size, in terms of value, for various segments with regard to 4 main regions: North America, Europe, Asia Pacific, and RoW

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain of the delivery robots ecosystem, along with the supply chain analysis; key industry trends; technology, patent, trade, Porter’s five forces, and average selling price analyses; and tariffs and regulations

- To strategically analyze micromarkets1 for individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the delivery robots market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To provide a detailed impact of the recession on market, its segments, and market players

- To analyze the competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research and development (R&D), in the delivery robots market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Delivery Robots Market

I work for a retail cluster and we are involved in a European project about last mile delivery and we are very interested in your report. Can you share a brochure of the report so that we can review it and think about allocating the budget for it.

We would like to analyze the business opportunities of entering the exterior lighting business for delivery robots.

We would specifically like to look into the projected volume forecasts of the market, as well as the newly developing technologies within the delivery robot field.

Of course the demand for robots with larger load capacity and the faster speed would be more in the future, but for technological realization the larger load capacity and faster speed means more complicated system and higher costing. In few situations, we need to compromise on load capacity or speed. So, in which cases we need to do trade-off and on which parameter?

What is a Delivery robot, quadruped robot market in China and RoA?

Wanted to Analyze the market for food delivery robots.

I am interested in South Korea Market and Indoor delivery (food/office building etc.) .

Hi, We are a teleoperation company interested in your report. What does the 34 million represent? Robots on the road, revenue or what?