Cybersecurity Insurance Market by Component (Solutions and Services), Type (Standalone & Packaged), Coverage (Data Breach & Cyber Liability), Compliance Requirement, End User (Technology & Insurance) and Region - Global Forecast to 2028

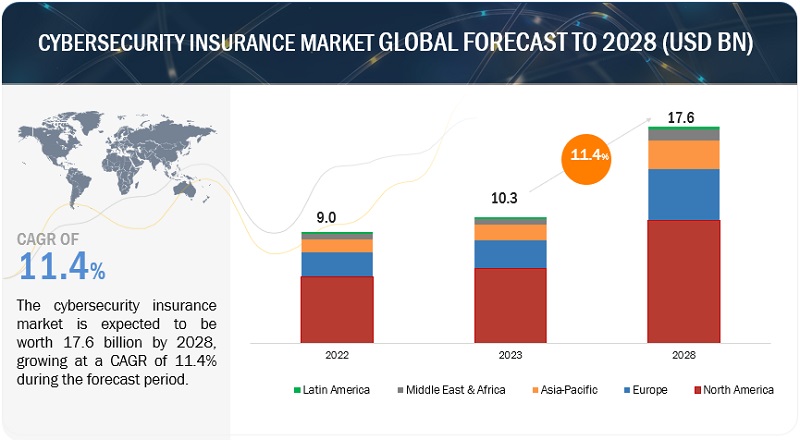

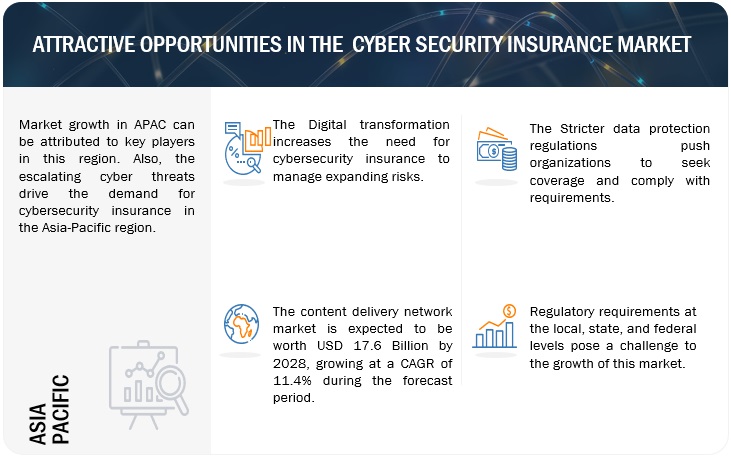

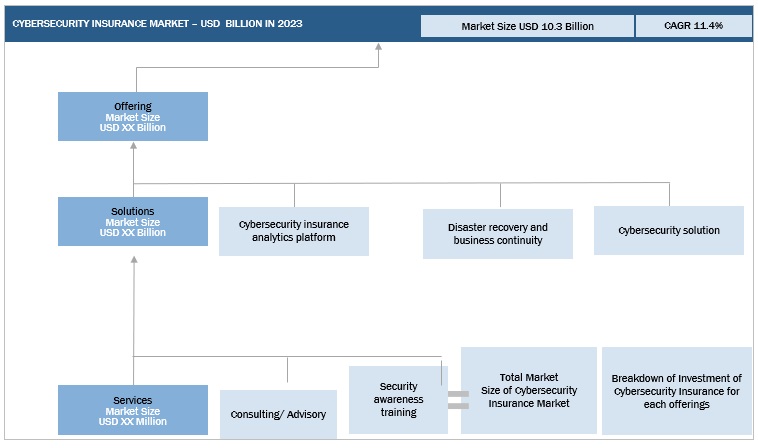

[373 Pages Report] The cybersecurity insurance market size is projected to grow from USD 10.3 billion in 2023 to USD 17.6 billion by 2028, at a CAGR of 11.4% during the forecast period. As digital transformation advances, the expanded use of digital technologies and emerging tech increases the vulnerability to cyber threats. Cybersecurity insurance assists organizations in managing and mitigating these risks.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Cybersecurity Insurance Market Dynamics

Driver: Increase in frequency and sophistication of cyber threats

Instances of massive cyberattacks are on the rise globally, causing substantial financial losses for individuals, enterprises, and governments. Cybercriminals target various IT infrastructure, aiming for political, financial, reputational, or radical interests. Ransomwares like WannaCry, Petya, NotPetya, and BadRabbit have affected organizations extensively. For instance, the SamSam ransomware attack disrupted municipal services in Atlanta, demanding a ransom of around USD 50,000. Cyber threats hamper business productivity and necessitate safeguarding critical IT infrastructure and data. Enterprises are increasingly investing in cybersecurity products and services to mitigate the risk of data breaches. As cyberattacks become more sophisticated, organizations worldwide turn to cybersecurity insurance to counteract the financial impact of swarm cyberattack losses.

Restraint: Lack of awareness related to cybersecurity insurance and reluctance in choosing cybersecurity insurance over cybersecurity solutions

With the increasing awareness of security risks and the rise in cyberattacks, governments and organizations are increasing their cybersecurity expenditure. However, many enterprises neglect cybersecurity insurance, which can help combat financial losses. The annual cost of cybercrime is estimated to reach USD 1.5 trillion, with only a small fraction covered by insurance companies. The lack of clarity and awareness about cybersecurity insurance hinders market growth, with some enterprises mistaking it for Errors and Omissions insurance. Enterprises globally should realize that the financial damage from a security incident can surpass the initial investment in cybersecurity insurance.

Opportunity: Exclusion of cybersecurity insurance cover from Property and Casualty (P&C) insurance

With the rise in social media usage and IoT, the risks of cyberattacks are growing massively. In the past, casualty policies only insured against third-party damage to only tangible computer property. However, with the proliferation of digital devices and advancements in new technologies, casualty insurers have realized that the rise of cyber exposures has also soared. The regulatory pressure from the EU GDPR and the Prudential Regulatory Authority (PRA) is also persuading insurers to manage cyber risks with a dedicated cybersecurity insurance policy. Insurers and regulators are concentrating on developing standalone cybersecurity insurance policies for better clarity and eliminating the ‘silent cyber’ claims. Hence, insurers are looking forward to adopting the usage of exclusive cybersecurity insurance policies to prevent unintended exposure from unclear cyber cover.

Challenge: Data privacy concerns

Data privacy concerns about how critical enterprise data or personal information to be used or misused is a barrier to adopting cybersecurity insurance. The global spread of COVID-19 has generated many questions about data protection, privacy, security, and compliance. Due to COVID-19, companies and organizations are reviewing their privacy policies to ensure the appropriate disclosure of Personally Identifiable Information (PII) to government agencies and cyber insurers to ensure data privacy. Some enterprises hesitate to reveal reliable information related to environmental risk exposures, making it burdensome for insurers to guide effective cybersecurity insurance policies. Insureds are reluctant to share information with insurers due to the fear of disclosure risks. Enterprises are wary of revealing cyber incident data as they feel that the exposed data could further intensify attacks and expose it to regulatory fines or legal fees.

Cybersecurity insurance Market Ecosystem

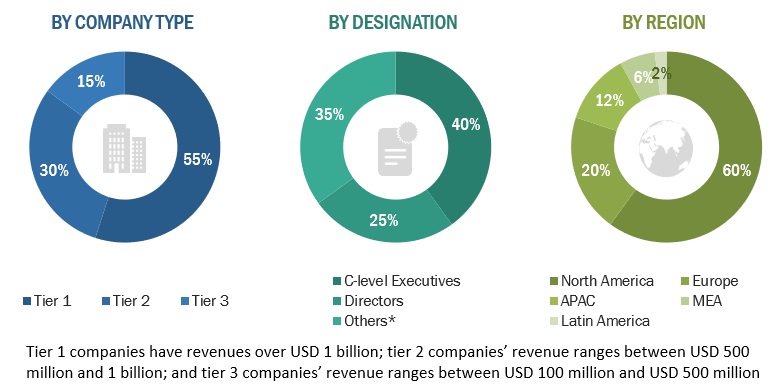

Prominent companies in this market include well-established, financially stable providers of cybersecurity insurance solutions and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include CyberCube, BitSight Technologies, and SecurityScorecard.

By insurance coverage, the cyber liability segment expected to hold a larger market size during the forecast period

Cyber risk insurance or cyber liability insurance helps organizations recover from the financial costs associated with data breaches, viruses, and other cyber-attacks. This insurance covers expenses incurred by the organization itself (first-party claims) and expenses arising from claims made by external parties (third-party claims). The policy reimburses various costs such as investigation expenses, business losses, legal proceedings, extortion, privacy issues, and notifications. Due to the increasing sophistication of cyber-attacks and stricter regulations, businesses are encouraged to adopt cybersecurity insurance solutions proactively. By offering both first-party and third-party coverage, cyber liability insurance policies can help insurers mitigate the negative consequences of a security breach, which could otherwise lead to significant business losses. Key vendors in the cybersecurity insurance market include Allianz Group, AIG, Chubb, Aon, Zurich, AXA, and Berkshire Hathaway, among others.

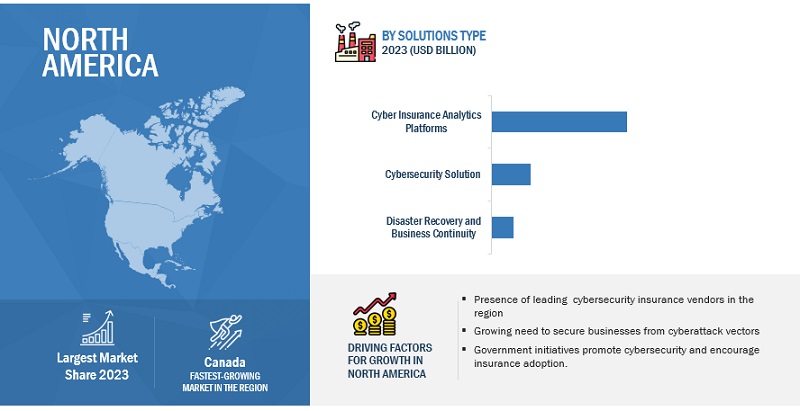

By solution, cybersecurity insurance analytics platform is expected to register higher CAGR during forecast period

Analytics platforms for cybersecurity insurance provide valuable insights into security risks and targeted attacks, offering actionable intelligence. These platforms cater to insurance brokers, insurers, reinsurance brokers, and reinsurers, providing them with a comprehensive view of enterprise risk profiles. CyberCube, a leading cyber risk analytics platform, has partnered with major insurance industry players, including Aon, Chubb, Hiscox, CNA, Woodruff Sawyer, and Munich RE. These collaborations empower insurance companies with data-driven risk assessment solutions. In 2019, CyberCube collaborated with Aon to deliver their insurance clients an effective cybersecurity insurance analytics platform for improved risk management and exposure measurement. The growing impact of cyber threats has led insurance companies to adopt data risk and analytics platforms more extensively. Arceo.ai, for example, offers a range of tools to assist brokers and underwriters in covering cyber risks. Verisk, a data analytics provider, introduced the Cyber Underwriting Report in 2020, utilizing AI modeling and ML capabilities to help insurers underwrite cyber policies based on data from 100,000 cyberattacks. Other companies such as Corax, and Cytegic also provide AI-based risk management solutions to insurance providers.

Based on region, North America is expected to hold the largest market size during the forecast

North America dominates the global cybersecurity insurance market, with the US and Canada leading the way. This region benefits from advanced infrastructure and widespread adoption of cyber technology. It is expected to hold the largest market share in terms of size. The US, in particular, presents significant opportunities for cybersecurity insurance solution providers due to strict regulations and a diverse range of industries. Cyberattacks have a substantial financial impact on enterprises of all sizes, including critical industries. According to a report by Emsisoft featured in The New York Times, 205,280 organizations in North America fell victim to ransomware attacks in 2019. With the increasing frequency of attacks and the rise of Bring Your Own Device (BYOD), especially in the context of the COVID-19 pandemic, US and Canadian enterprises are recognizing the importance of securing their data and mitigating financial losses through cybersecurity insurance policies.

Market Players:

The major vendors in this market include BitSight (US), Prevalent (US), RedSeal (US), SecurityScorecard (US), Cyber Indemnity Solutions (Australia), Cisco (US), UpGuard (US), Microsoft (US), Check Point (US), AttackIQ (US), SentinelOne (US), Broadcom (US), Accenture (Ireland), Cylance (US), Trellix (US), CyberArk (US), CYE (Israel), SecurIT360 (US), and Founder Shield (US). The insurance vendors covered in the cybersecurity insurance market are Allianz (Germany), AIG (US), Aon (UK), Arthur J. Gallagher & Co (US), Travelers Insurance (US), AXA XL (US), AXIS Capital (Bermuda), Beazley (UK), Chubb (Switzerland), CNA Financial (US), Fairfax Financial (Canada), Liberty Mutual (US), Lloyd’s of London (UK), Lockton (US), Munich Re Group (Germany), and Sompo International (Bermuda). The startup vendors covered in the cybersecurity insurance market are At-Bay (US), Cybernance (US), Coalition (US), Resilience (US), Kovrr (Israel), Sayata Labs (Israel), Zeguro (US), Ivanti (US), SafeBreach (US), and Cronus Cyber Technologies (Israel). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the cybersecurity insurance market.

Want to explore hidden markets that can drive new revenue in Cybersecurity Insurance Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Cybersecurity Insurance Market?

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments covered |

By Offering, Insurance coverage, Insurance type, Compliance Requirements, End user, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

BitSight (US), Prevalent (US), RedSeal (US), SecurityScorecard (US), Cyber Indemnity Solutions (Australia), Cisco (US), UpGuard (US), Microsoft (US), Check Point (US), AttackIQ (US), SentinelOne (US), Broadcom (US), Accenture (Ireland), Cylance (US), Trellix (US), CyberArk (US), CYE (Israel), SecurIT360 (US), and Founder Shield (US). The insurance vendors covered in the cybersecurity insurance market are Allianz (Germany), AIG (US), Aon (UK), Arthur J. Gallagher & Co (US), Travelers Insurance (US), AXA XL (US), AXIS Capital (Bermuda), Beazley (UK), Chubb (Switzerland), CNA Financial (US), Fairfax Financial (Canada), Liberty Mutual (US), Lloyd’s of London (UK), Lockton (US), Munich Re Group (Germany), and Sompo International (Bermuda). The startup vendors covered in the cybersecurity insurance market are At-Bay (US), Cybernance (US), Coalition (US), Resilience (US), Kovrr (Israel), Sayata Labs (Israel), Zeguro (US), Ivanti (US), SafeBreach (US), and Cronus Cyber Technologies (Israel). |

This research report categorizes the cybersecurity insurance market to forecast revenues and analyze trends in each of the following submarkets:

Based on offering:

-

Solution

- Cybersecurity insurance analytics platform

- Disaster recovery and business continuity

-

Cybersecurity solution

- Cyber risk and vulnerability assessment

- Cybersecurity resilience

-

Service

- Consulting/ Advisory

- Security awareness training

- Others (infrastructure services, implementation, and support and maintenance)

Based on insurance coverage:

-

Data breach

- Data loss

- Denial of service and down-time

- Ransomware attacks

- Others (third party data, business disruption, and social engineering)

-

Cyber liability

-

Type

- Data protection and privacy costs

- Non-compliance penalty

- Brand and related intellectual property protection

- Others (human error, systems failure, controls framework, Inadequate IT security measures, and non-security related IT)

-

Source/ Target

- Internal

- External

-

Type

Compliance Requirements:

- Healthcare Compliance

- Financial Services Compliance

- GDPR Compliance

- Data Privacy Compliance

- Other Compliances

Based on the insurance type:

- Packaged

- Stand-alone

Based on the end user:

-

Technology provider

- Insurance companies

- Third-party administrators, brokers, and consultancies

- Government agencies

-

Insurance provider

- Financial services

- IT and ITES

- Healthcare and life science

- Retail and ecommerce

- Telecom

- Travel, tourism, and hospitality

- Others (Education, Manufacturing, Energy and Utilities, and Government)

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

- UAE

- KSA

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2022, Microsoft developed Defender to support security systems of SMEs and reduce cyber risk. The solution provides end-point security, which includes Endpoint Detection and Response (EDR).

- In April 2022, AttackIQ entered into partnership with Vectra, an AI based threat detection and response platform. This integration enabled customers to use AttackIQ’s PCAP and Vectra AI Platform to check efficacy.

- In November 2021, BitSight and Marsh McLennan collaborated to improve cybersecurity performance and efficiency of the organization and help to reduce cyber risk. The Cyber Risk Analytics Center offered by Marsh McLenna leverage the capabilities of BitSight rating, data which help client to monitor their cyber security system performance.

Frequently Asked Questions (FAQ):

What is cybersecurity insurance?

Cybersecurity insurance, also referred to as cyber risk insurance or cyber liability insurance, is a form of insurance that assists organizations in managing and mitigating financial risks associated with cyber incidents. It offers protection against losses resulting from data breaches, cyberattacks, ransomware, business disruptions, legal liabilities, and other related expenses. Cybersecurity insurance policies cover costs such as investigation and remediation, legal fees, notification services, regulatory fines, and public relations efforts. By providing financial support, cybersecurity insurance helps organizations recover from cyber incidents, minimize financial damages, and navigate the complex world of cyber threats.

What is the market size of the cybersecurity insurance market?

The cybersecurity insurance market size is projected to grow from USD 10.3 billion in 2023 to USD 17.6 billion by 2028, at a CAGR of 11.4% during the forecast period.

What are the major drivers in the cybersecurity insurance market?

The major drivers in the cybersecurity insurance market include the increasing frequency of cyber threats, stricter regulatory requirements, the financial impact of cyber incidents, digital transformation, industry-specific risks, risk awareness and preparedness, and the shortage of cybersecurity talent. These factors have led to a rising demand for cybersecurity insurance as organizations seek financial protection and risk mitigation against cyber risks.

Who are the key players operating in the cybersecurity insurance market?

The key vendors operating in the cybersecurity insurance market include BitSight (US), Prevalent (US), RedSeal (US), SecurityScorecard (US), Cyber Indemnity Solutions (Australia), Cisco (US), UpGuard (US), Microsoft (US), Check Point (US), AttackIQ (US), SentinelOne (US), Broadcom (US), Accenture (Ireland), Cylance (US), Trellix (US), CyberArk (US), CYE (Israel), SecurIT360 (US), and Founder Shield (US). The insurance vendors covered in the cybersecurity insurance market are Allianz (Germany), AIG (US), Aon (UK), Arthur J. Gallagher & Co (US), Travelers Insurance (US), AXA XL (US), AXIS Capital (Bermuda), Beazley (UK), Chubb (Switzerland), CNA Financial (US), Fairfax Financial (Canada), Liberty Mutual (US), Lloyd’s of London (UK), Lockton (US), Munich Re Group (Germany), and Sompo International (Bermuda). The startup vendors covered in the cybersecurity insurance market are At-Bay (US), Cybernance (US), Coalition (US), Resilience (US), Kovrr (Israel), Sayata Labs (Israel), Zeguro (US), Ivanti (US), SafeBreach (US), and Cronus Cyber Technologies (Israel).

What are the opportunities for new market entrants in the cybersecurity insurance market?

New entrants in the cybersecurity insurance market have opportunities to capitalize on the growing demand for coverage against cyber threats. They can target niche segments, offer customized solutions, leverage technological innovation, form strategic partnerships, explore global expansion, and provide value-added regulatory compliance services. With agility and innovation, new entrants can establish themselves as competitive players in this evolving market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Surge in mandatory cybersecurity regulations and legislations to boost demand for insurance protection- High rate of recovery of financial losses to promote cybersecurity insurance market growth- Increase in frequency and sophistication of cyber threatsRESTRAINTS- Lack of awareness related to cybersecurity insurance and reluctance in choosing cybersecurity insurance over cybersecurity solutions- Soaring cybersecurity insurance costsOPPORTUNITIES- Exclusion of cybersecurity insurance cover from Property and Casualty (P&C) insurance- Adoption of artificial intelligence and blockchain technology for risk analyticsCHALLENGES- Cyber insurers grapple to gain traction despite soaring cybersecurity risks- Data privacy concerns- Lack of understanding, technical knowledge, and absence of historical cyber data for effective underwriting

-

5.3 INDUSTRY TRENDSVALUE CHAIN ANALYSISBRIEF HISTORY OF CYBERSECURITY INSURANCE SOLUTIONS- 1990s- 2000s- 2010s- 2020s-PresentECOSYSTEMCYBERSECURITY INSURANCE TOOLS, FRAMEWORKS, AND TECHNIQUESBUSINESS MODELPORTER’S FIVE FORCES MODEL- Threat of new entrants- Threat of substitutes- Bargaining power of suppliers- Bargaining power of buyers- Intensity of competitive rivalryIMPACT OF CYBERSECURITY INSURANCE ON ADJACENT NICHE TECHNOLOGIES- Internet of Things (IoT) Security- Cloud Computing Security- Artificial Intelligence (AI) Security- Blockchain Security- Biometric SecurityKEY STAKEHOLDERS AND BUYING CRITERIA- KEY STAKEHOLDERS IN BUYING PROCESS- BUYING CRITERIATECHNOLOGY ANALYSIS- Adjacent technologies- Related TechnologiesFUTURE OF CYBERSECURITY INSURANCE MARKET LANDSCAPETRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESBEST PRACTICES OF CYBERSECURITY INSURANCE MARKETPATENT ANALYSIS- Methodology- Document type- Innovation and patent applications- Top applicantsPRICING MODEL ANALYSIS- Average selling price trendsCYBERSECURITY INSURANCE AVERAGE SELLING PRICE FOR SMESTREND OF CYBERSECURITY INSURANCE PREMIUMSCASE STUDY ANALYSIS- SecurityScorecard helped cyber insurance provider better understand customer risk- European financial service providers leveraged BitSight for security performance management- Country Mutual Insurance Company leveraged CyberArk’s privileged security access platform- Global 500 insurance company chose Prevalent’s third-party risk management solution- AON secured financial institution’s funds and data from third-party cyber risks- Chubb’s cybersecurity insurance cover assisted SME in recovering financial lossesKEY CONFERENCES & EVENTS IN 2023- Cybersecurity insurance market: Detailed list of conferences & eventsREGULATORY COMPLIANCES- Regulatory bodies, government agencies, and other organizations- General Data Protection Regulation- Payment Card Industry-Data Security Standard- Health Insurance Portability and Accountability Act- Federal Information Security Management Act- Gramm-Leach-Bliley Act- Sarbanes-Oxley Act- International Organization for Standardization 27001

-

6.1 INTRODUCTIONOFFERING: CYBERSECURITY INSURANCE MARKET DRIVERS

-

6.2 SOLUTIONSCYBERSECURITY INSURANCE SOLUTIONS TO PROVIDE HIGH DATA SECURITY AND PREVENT DATA BREACHESCYBERSECURITY INSURANCE ANALYTICS PLATFORMSDISASTER RECOVERY AND BUSINESS CONTINUITYCYBERSECURITY SOLUTIONS- Cyber risk and vulnerability assessment- Cybersecurity resilience

-

6.3 SERVICESNEED FOR PROFESSIONAL CONSULTANTS TO PROVIDE 24/7 SERVICE RESPONSECONSULTING/ADVISORYSECURITY AWARENESS TRAININGOTHER SERVICES

-

7.1 INTRODUCTIONINSURANCE COVERAGE: CYBERSECURITY INSURANCE MARKET DRIVERS

-

7.2 DATA BREACHCYBERSECURITY INSURANCE COVERAGE TO PROTECT BUSINESSES AGAINST SECURITY AND CYBER BREACHESDATA LOSSDENIAL OF SERVICE AND DOWNTIMERANSOMWARE ATTACKS

-

7.3 CYBER LIABILITYCYBERSECURITY INSURANCE TO COVER CYBER LIABILITY, REDUCING DATA RECOVERY COST FROM DATA BREACHES AND CYBERATTACKSTYPES OF CYBER LIABILITIES- Data protection and privacy costs- Non-compliance penalty- Brand and related intellectual property protection- Other cyber liability typesSOURCE/TARGET OF CYBER LIABILITIES- Internal- External

-

8.1 INTRODUCTIONINSURANCE TYPE: CYBERSECURITY INSURANCE MARKET DRIVERS

-

8.2 PACKAGEDPACKAGED INSURANCE TO ENHANCE DIGITAL TRANSFORMATION AND SUPPORT TRADITIONAL POLICIES

-

8.3 STANDALONESTANDALONE INSURANCE TO MANAGE COMPLEX CYBER RISKS AND IMPROVE CYBER RISK PROTECTION

-

9.1 INTRODUCTIONCOMPLIANCE REQUIREMENT: CYBERSECURITY INSURANCE MARKET DRIVERS

- 9.2 HEALTHCARE COMPLIANCE

- 9.3 FINANCIAL SERVICES COMPLIANCE

- 9.4 GDPR COMPLIANCE

- 9.5 DATA PRIVACY COMPLIANCE

- 9.6 OTHER COMPLIANCES

-

10.1 INTRODUCTIONEND USER: CYBERSECURITY INSURANCE MARKET DRIVERS

-

10.2 TECHNOLOGY PROVIDERSTECHNOLOGY PROVIDERS TO HELP INSURANCE INDUSTRY ASSESS ITS CYBERSECURITY RISKSINSURANCE COMPANIESINSURANCE COMPANIES: CYBERSECURITY INSURANCE APPLICATIONS- Data Breach Protection- Business Interruption Coverage- Ransomware ProtectionTHIRD-PARTY ADMINISTRATORS (TPAS), BROKERS, AND CONSULTANCIESTHIRD-PARTY ADMINISTRATORS (TPAS), BROKERS, AND CONSULTANCIES: CYBERSECURITY INSURANCE APPLICATIONS- Policy Administration (TPAs)- Claim Advocacy (Brokers)- Risk Assessment and Mitigation (Consultancies)GOVERNMENT AGENCIESGOVERNMENT AGENCIES: CYBERSECURITY INSURANCE APPLICATIONS- Data Breach Protection- Business Interruption Coverage- Ransomware Protection

-

10.3 INSURANCE PROVIDERSINSURANCE PROVIDERS TO UNDERWRITE INSURANCE POLICIES FOR IMPROVING CYBERSECURITY SYSTEMS OF ORGANIZATIONSFINANCIAL SERVICESFINANCIAL SERVICES: CYBERSECURITY INSURANCE APPLICATIONS- Risk Assessment and Mitigation- Cyber Extortion Coverage- Ransomware ProtectionIT AND ITESIT AND ITES: CYBERSECURITY INSURANCE APPLICATIONS- Protection for Sensitive Client Data- Intellectual Property Protection- Comprehensive Coverage for IT InfrastructureHEALTHCARE AND LIFE SCIENCESHEALTHCARE AND LIFE SCIENCES: CYBERSECURITY INSURANCE APPLICATIONS- Protected Health Information (PHI) Data Breach Coverage- Regulatory Compliance Support- Cybersecurity Incident Response SupportRETAIL AND ECOMMERCERETAIL AND ECOMMERCE: CYBERSECURITY INSURANCE APPLICATIONS- Ecommerce Website Protection- Supply Chain Cyber Risk Coverage- Brand Reputation ManagementTELECOMTELECOM: CYBERSECURITY INSURANCE APPLICATIONS- Network Security Coverage- Communication Infrastructure Protection- Customer Notification and SupportTRAVEL, TOURISM, AND HOSPITALITYTRAVEL, TOURISM, AND HOSPITALITY: CYBERSECURITY INSURANCE APPLICATIONS- Reservation System and Booking Protection- Payment Card Data Protection- Data Breach Notification CostsOTHER INSURANCE PROVIDERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: CYBERSECURITY INSURANCE MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Numerous laws and regulations promoting proactive incorporation of cybersecurity insurance policy cover in US to drive marketCANADA- Presence of prominent cybersecurity insurance providers in Canada to drive market

-

11.3 EUROPEEUROPE: CYBERSECURITY INSURANCE MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Cyber insurance in UK to be comparatively affordable measure against data breaches with cyber extortion cover, recovery, and compliance costsGERMANY- Increasing instances of cybercrimes to drive market growth in GermanyFRANCE- Alarming cyber-attack rates and ransomware insurance coverage gaps in France to fuel demand for cybersecurity insuranceSPAIN- Rising cybersecurity incidents in Spain amidst 5G transition to drive market growthITALY- Ransomware surges and growing adoption of cybersecurity insurance in Italy to drive market growthREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: CYBERSECURITY INSURANCE MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTAUSTRALIA & NEW ZEALAND- Enforcement of Notifiable Data Breach Scheme and Australian Prudential Regulatory Authority to help enterprises improve their business resiliency toward risksCHINA- Increasing investments in advanced technologies and ascending rates of cybercrimes to drive growth in ChinaJAPAN- Growing security breaches across various verticals to present opportunities for Japanese cybersecurity insurance marketSOUTHEAST ASIA- Growth prospects in Southeast Asia's evolving cybersecurity landscape to drive cybersecurity insurance market in regionINDIA- Rising cybersecurity risks to accelerate cyber insurance adoption in IndiaREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKSA- Growing awareness to lead to increase in inquiries and adoption of cyber insurance policies among organizationsUAE- Increasing adoption of advanced technologies and fast development in UAE to be major factors driving adoption of cybersecurity insuranceSOUTH AFRICA- Companies becoming potential targets for cybercriminals due to increased mobile and internet penetration to drive growthREST OF MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: CYBERSECURITY INSURANCE MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Increased automation and digitalization in businesses and fear of severe penalties to lead to market growth in BrazilMEXICO- Data protection regulations expected to hold great scope for market growth in MexicoREST OF LATIN AMERICA

- 12.1 INTRODUCTION

-

12.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY CYBERSECURITY INSURANCE TECHNOLOGY VENDORS

- 12.3 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- 12.4 HISTORIC REVENUE ANALYSIS

-

12.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.7 RANKING OF KEY TECHNOLOGY PLAYERS IN CYBERSECURITY INSURANCE MARKET, 2022

- 12.8 RANKING OF KEY INSURANCE PROVIDERS IN CYBERSECURITY INSURANCE MARKET, 2022

- 12.9 COMPETITIVE BENCHMARKING

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 13.1 INTRODUCTION

-

13.2 TECHNOLOGY PROVIDERSBITSIGHT- Business overview- Products offered- Recent developments- MnM viewPREVALENT- Business overview- Products Offered- Recent developments- MnM viewREDSEAL- Business overview- Platform offered- Recent developments- MnM viewSECURITYSCORECARD- Business overview- Products offered- Recent developments- MnM viewCYBER INDEMNITY SOLUTIONS- Business overview- Products offered- MnM viewCISCO- Business overview- Products offered- Deals- OthersUPGUARD- Business overview- Products/Solutions/Services offered- Recent developmentsMICROSOFT- Business overview- Products offered- Recent developmentsCHECK POINT- Business overview- Products offered- DealsATTACKIQ- Business overview- Products offered- Recent developmentsSENTINELONEBROADCOMACCENTURECYLANCETRELLIXCYBERARKCYESECURIT360FOUNDER SHIELD

-

13.3 INSURANCE PROVIDERSCHUBBAXA XLAIGTRAVELERSBEAZLEYALLIANZAONARTHUR J. GALLAGHERAXIS CAPITALCNAFAIRFAXLIBERTY MUTUAL HOLDINGLLOYD’S OF LONDONLOCKTONMUNICH RESOMPO INTERNATIONAL

-

13.4 STARTUPS/SMESAT-BAYCYBERNANCECOALITIONRESILIENCEKOVRRSAYATA LABSZEGUROIVANTISAFEBREACHCRONUS CYBER TECHNOLOGIES

-

14.1 INTRODUCTIONLIMITATIONS

-

14.2 CYBERSECURITY MARKET– GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEW- Cybersecurity market, by component- Cybersecurity market, by software- Cybersecurity market, by service- Cybersecurity market, by security type- Cybersecurity market, by vertical- Cybersecurity market, by region

-

14.3 DIGITAL INSURANCE PLATFORM MARKETINTRODUCTIONDIGITAL INSURANCE PLATFORM MARKET, BY COMPONENTDIGITAL INSURANCE PLATFORM MARKET, BY END USER

-

14.4 INSURANCE ANALYTICS MARKETINTRODUCTIONINSURANCE ANALYTICS MARKET, BY COMPONENTINSURANCE ANALYTICS MARKET, BY END USER

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 DIRECT WRITTEN PREMIUMS Y-O-Y GROWTH OF STANDALONE AND PACKAGE CYBERSECURITY INSURANCE UNDERWRITERS

- TABLE 4 CYBERSECURITY INSURANCE MARKET: ECOSYSTEM

- TABLE 5 IMPACT OF PORTER’S FIVE FORCES ON CYBERSECURITY INSURANCE MARKET

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USER INSURANCE PROVIDERS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE END USER INSURANCE PROVIDERS

- TABLE 8 PATENTS FILED, 2020–2023

- TABLE 9 CYBERSECURITY INSURANCE PREMIUM TRENDS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 14 CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 15 OFFERING: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 16 OFFERING: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 18 CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 19 SOLUTIONS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 SOLUTIONS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 DISASTER RECOVERY AND BUSINESS CONTINUITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 DISASTER RECOVERY AND BUSINESS CONTINUITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 CYBERSECURITY SOLUTIONS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 CYBERSECURITY SOLUTIONS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 28 CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 29 SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 CONSULTING/ADVISORY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 CONSULTING/ADVISORY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 SECURITY AWARENESS TRAINING: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 SECURITY AWARENESS TRAINING: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 OTHER SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 OTHER SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 38 CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 39 INSURANCE COVERAGE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 INSURANCE COVERAGE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 DATA BREACH: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 DATA BREACH: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 CYBER LIABILITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 CYBER LIABILITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 46 CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 47 INSURANCE TYPE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 INSURANCE TYPE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 PACKAGED: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 PACKAGED: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 STANDALONE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 STANDALONE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 54 CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 55 END USER: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 END USER: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 58 CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 59 TECHNOLOGY PROVIDERS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 TECHNOLOGY PROVIDERS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 INSURANCE COMPANIES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 INSURANCE COMPANIES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 THIRD-PARTY ADMINISTRATORS, BROKERS, AND CONSULTANCIES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 THIRD-PARTY ADMINISTRATORS, BROKERS, AND CONSULTANCIES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 GOVERNMENT AGENCIES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 GOVERNMENT AGENCIES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 68 CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 69 INSURANCE PROVIDERS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 INSURANCE PROVIDERS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 FINANCIAL SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 72 FINANCIAL SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 IT AND ITES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 IT AND ITES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 HEALTHCARE AND LIFE SCIENCES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 76 HEALTHCARE AND LIFE SCIENCES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 RETAIL AND ECOMMERCE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 RETAIL AND ECOMMERCE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 TELECOM: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 80 TELECOM: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 TRAVEL, TOURISM, AND HOSPITALITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 TRAVEL, TOURISM, AND HOSPITALITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 OTHER INSURANCE PROVIDERS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 84 OTHER INSURANCE PROVIDERS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 CYBERSECURITY INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 CYBERSECURITY INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 US: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 106 US: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 107 US: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 108 US: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 109 US: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 110 US: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 111 US: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 112 US: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 113 US: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 114 US: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 115 US: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 116 US: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 117 US: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 118 US: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 119 US: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 120 US: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 121 CANADA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 122 CANADA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 123 CANADA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 124 CANADA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 125 CANADA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 126 CANADA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 127 CANADA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 128 CANADA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 129 CANADA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 130 CANADA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 131 CANADA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 132 CANADA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 133 CANADA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 134 CANADA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 135 CANADA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 136 CANADA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 137 EUROPE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 138 EUROPE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 139 EUROPE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 140 EUROPE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 142 EUROPE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 143 EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 144 EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 145 EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 146 EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 148 EUROPE: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 149 EUROPE: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 150 EUROPE: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 151 EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 152 EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 153 EUROPE: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 154 EUROPE: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 155 UK: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 156 UK: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 157 UK: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 158 UK: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 159 UK: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 160 UK: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 161 UK: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 162 UK: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 163 UK: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 164 UK: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 165 UK: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 166 UK: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 167 UK: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 168 UK: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 169 UK: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 170 UK: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 171 GERMANY: CYBERSECURITY INSURANC E MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 172 GERMANY: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 173 GERMANY: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 174 GERMANY: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 175 GERMANY: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 176 GERMANY: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 177 GERMANY: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 178 GERMANY: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 179 GERMANY: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 180 GERMANY: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 181 GERMANY: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 182 GERMANY: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 183 GERMANY: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 184 GERMANY: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 185 GERMANY: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 186 GERMANY: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 187 FRANCE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 188 FRANCE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 189 FRANCE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 190 FRANCE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 191 FRANCE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 192 FRANCE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 193 FRANCE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 194 FRANCE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 195 FRANCE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 196 FRANCE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 197 FRANCE: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 198 FRANCE: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 199 FRANCE: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 200 FRANCE: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 201 FRANCE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 202 FRANCE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 203 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 204 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 205 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 206 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 207 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 208 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 209 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 210 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 211 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 212 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 213 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 214 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 215 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 216 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 217 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 218 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 219 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 220 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 221 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 222 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 223 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 224 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 225 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 226 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 227 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 228 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 229 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 230 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 231 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 232 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 233 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 234 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 235 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 236 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 237 ANZ: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 238 ANZ: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 239 ANZ: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 240 ANZ: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 241 ANZ: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 242 ANZ: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 243 ANZ: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 244 ANZ: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 245 ANZ: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 246 ANZ: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 247 ANZ: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 248 ANZ: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 249 ANZ: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 250 ANZ: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 251 ANZ: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 252 ANZ: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 253 CHINA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 254 CHINA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 255 CHINA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 256 CHINA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 257 CHINA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 258 CHINA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 259 CHINA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 260 CHINA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 261 CHINA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 262 CHINA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 263 CHINA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 264 CHINA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 265 CHINA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 266 CHINA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 267 CHINA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 268 CHINA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 269 JAPAN: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 270 JAPAN: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 271 JAPAN: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 272 JAPAN: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 273 JAPAN: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 274 JAPAN: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 275 JAPAN: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 276 JAPAN: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 277 JAPAN: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 278 JAPAN: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 279 JAPAN: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 280 JAPAN: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 281 JAPAN: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 282 JAPAN: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 283 JAPAN: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 284 JAPAN: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 285 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 286 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 287 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 288 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 289 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 290 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 291 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 292 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 293 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 294 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 295 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 296 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 297 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 298 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 299 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 300 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 302 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 303 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 304 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 305 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 306 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 307 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 308 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 309 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 310 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 313 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 314 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 315 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 317 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 318 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 319 KSA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 320 KSA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 321 KSA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 322 KSA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 323 KSA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 324 KSA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 325 KSA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 326 KSA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 327 KSA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 328 KSA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 329 KSA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 330 KSA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 331 KSA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 332 KSA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 333 KSA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 334 KSA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 335 UAE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 336 UAE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 337 UAE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 338 UAE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 339 UAE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 340 UAE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 341 UAE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 342 UAE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 343 UAE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 344 UAE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 345 UAE: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 346 UAE: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 347 UAE: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 348 UAE: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 349 UAE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 350 UAE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 351 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 352 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 353 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 354 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 355 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 356 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 357 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 358 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 359 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 360 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 361 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 362 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 363 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 364 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 365 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 366 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 367 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 368 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 369 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 370 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 371 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 372 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 373 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 374 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 375 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 376 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 377 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 378 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 379 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 380 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 381 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 382 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 383 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 384 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 385 MEXICO: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 386 MEXICO: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 387 MEXICO: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 388 MEXICO: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 389 MEXICO: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 390 MEXICO: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 391 MEXICO: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 392 MEXICO: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 393 MEXICO: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 394 MEXICO: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 395 MEXICO: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 396 MEXICO: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 397 MEXICO: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 398 MEXICO: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 399 MEXICO: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 400 MEXICO: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 401 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 402 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 403 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 404 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 405 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 406 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 407 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2018–2022 (USD MILLION)

- TABLE 408 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2023–2028 (USD MILLION)

- TABLE 409 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

- TABLE 410 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

- TABLE 411 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 412 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 413 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2018–2022 (USD MILLION)

- TABLE 414 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY TECHNOLOGY PROVIDER, 2023–2028 (USD MILLION)

- TABLE 415 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2018–2022 (USD MILLION)

- TABLE 416 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE PROVIDER, 2023–2028 (USD MILLION)

- TABLE 417 CYBERSECURITY INSURANCE MARKET: DEGREE OF COMPETITION

- TABLE 418 CYBERSECURITY INSURANCE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 419 CYBERSECURITY INSURANCE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 420 CYBERSECURITY INSURANCE MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

- TABLE 421 PRODUCT LAUNCHES, 2019–2022

- TABLE 422 DEALS, 2020–2022

- TABLE 423 OTHERS, 2021

- TABLE 424 BITSIGHT: BUSINESS OVERVIEW

- TABLE 425 BITSIGHT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 426 BITSIGHT: PRODUCT LAUNCHES

- TABLE 427 BITSIGHT: DEALS

- TABLE 428 PREVALENT: BUSINESS OVERVIEW

- TABLE 429 PREVALENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 430 PREVALENT: PRODUCT LAUNCHES

- TABLE 431 PREVALENT: DEALS

- TABLE 432 REDSEAL: BUSINESS OVERVIEW

- TABLE 433 REDSEAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 434 REDSEAL: PRODUCT LAUNCHES

- TABLE 435 SECURITYSCORECARD: BUSINESS OVERVIEW

- TABLE 436 SECURITYSCORECARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 437 SECURITYSCORECARD: PRODUCT LAUNCHES

- TABLE 438 SECURITYSCORECARD: DEALS

- TABLE 439 CYBER INDEMNITY SOLUTIONS: BUSINESS OVERVIEW

- TABLE 440 CYBER INDEMNITY SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 441 CISCO: BUSINESS OVERVIEW

- TABLE 442 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 443 CISCO: DEALS

- TABLE 444 CISCO: OTHERS

- TABLE 445 UPGUARD: BUSINESS OVERVIEW

- TABLE 446 UPGUARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 447 UPGUARD: PRODUCT LAUNCHES

- TABLE 448 MICROSOFT: BUSINESS OVERVIEW

- TABLE 449 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 450 MICROSOFT: PRODUCT LAUNCHES

- TABLE 451 MICROSOFT: DEALS

- TABLE 452 CHECK POINT: BUSINESS OVERVIEW

- TABLE 453 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 454 CHECK POINT: DEALS

- TABLE 455 ATTACKIQ: BUSINESS OVERVIEW

- TABLE 456 ATTACKIQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 457 ATTACKIQ: PRODUCT LAUNCHES

- TABLE 458 ATTACKIQ: DEALS

- TABLE 459 CYBERSECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 460 CYBERSECURITY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 461 CYBERSECURITY MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 462 CYBERSECURITY MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 463 CYBERSECURITY MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 464 CYBERSECURITY MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 465 CYBERSECURITY MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

- TABLE 466 CYBERSECURITY MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

- TABLE 467 CYBERSECURITY MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 468 CYBERSECURITY MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 469 CYBERSECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 470 CYBERSECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 471 DIGITAL INSURANCE PLATFORM MARKET, BY COMPONENT, 2016–2023 (USD BILLION)

- TABLE 472 DIGITAL INSURANCE PLATFORM MARKET, BY END USER, 2016–2023 (USD BILLION)

- TABLE 473 INSURANCE ANALYTICS MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

- TABLE 474 INSURANCE ANALYTICS MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

- TABLE 475 INSURANCE ANALYTICS MARKET, BY END USER, 2016–2019 (USD MILLION)

- TABLE 476 INSURANCE ANALYTICS MARKET, BY END USER, 2020–2026 (USD MILLION)

- FIGURE 1 CYBERSECURITY INSURANCE MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF CYBERSECURITY INSURANCE VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS, SERVICES, AND INSURANCE POLICIES OF CYBERSECURITY INSURANCE VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 3, TOP DOWN (DEMAND SIDE): SHARE OF CYBERSECURITY INSURANCE IN OVERALL INFORMATION TECHNOLOGY MARKET

- FIGURE 7 CYBERSECURITY INSURANCE MARKET SIZE, 2021–2028

- FIGURE 8 CYBERSECURITY INSURANCE MARKET: REGIONAL SNAPSHOT

- FIGURE 9 INCREASING CYBER AND RANSOMWARE ATTACKS TO DRIVE CYBERSECURITY INSURANCE MARKET GROWTH

- FIGURE 10 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS AND CYBER LIABILITY SEGMENT IN NORTH AMERICA TO ACCOUNT FOR LARGEST SHARES IN 2023

- FIGURE 11 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS AND CYBER LIABILITY SEGMENT IN EUROPE TO ACCOUNT FOR LARGEST SHARES IN 2023

- FIGURE 12 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS AND CYBER LIABILITY SEGMENT IN APAC TO ACCOUNT FOR LARGEST SHARES IN 2023

- FIGURE 13 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CYBERSECURITY INSURANCE MARKET

- FIGURE 15 CYBERSECURITY INSURANCE MARKET: VALUE CHAIN

- FIGURE 16 EVOLUTION OF CYBERSECURITY INSURANCE SOLUTIONS

- FIGURE 17 CYBERSECURITY INSURANCE MARKET: ECOSYSTEM

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USER INSURANCE PROVIDERS

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE END USER INSURANCE PROVIDERS

- FIGURE 20 REVENUE SHIFT IN CYBERSECURITY INSURANCE MARKET

- FIGURE 21 TOTAL NUMBER OF PATENTS GRANTED, 2020–2023

- FIGURE 22 TOP TEN PATENT APPLICANTS, 2020–2023

- FIGURE 23 CYBERSECURITY INSURANCE AVERAGE SELLING PRICE TREND IN SMES

- FIGURE 24 CYBERSECURITY INSURANCE AVERAGE SELLING PRICE, BY EMPLOYEE SIZE

- FIGURE 25 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 26 DISASTER RECOVERY AND BUSINESS CONTINUITY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 SECURITY AWARENESS TRAINING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 DATA BREACH SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 PACKAGED SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 TECHNOLOGY PROVIDER SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 GOVERNMENT AGENCIES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 FINANCIAL SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 HISTORIC THREE-YEAR REVENUE ANALYSIS OF LEADING CYBERSECURITY INSURANCE PROVIDERS, 2020–2022 (USD MILLION)