CVD Lab-grown Diamonds Market by Type (Rough, Polished), Color ( Colored, Colorless), Application (Machine & Cutting Tools; Heat Sinks & Exchangers; Optical, Laser, & X-ray; Electronics; Healthcare; Gemstone, Others), and Region - Global Forecast to 2027

Updated on : March 19, 2024

CVD Lab Grown Diamonds Market Size

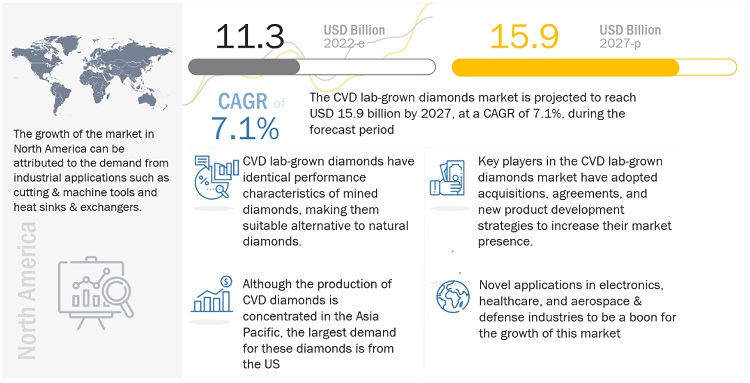

The global CVD lab grown diamonds market was valued at USD 11.3 billion in 2022 and is projected to reach USD 15.9 billion by 2027, growing at 7.1% cagr from 2022 to 2027. Rising demand for alternative sourcing for mined products supported by growing awareness amongst millennial consumers about the authenticity of lab-grown diamonds is expected to be the driving factor for the market.

Attractive Opportunities in the CVD Lab-grown Diamonds Market

e-estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

CVD Lab Grown Diamond Market Dynamics

Driver: Growing interest in CVD lab-grown diamonds in the gem and jewelry sector

The increased interest in CVD lab-grown diamonds among millennials and generation Z is one of the main factors contributing to the anticipated growth. It was estimated that around 70% of millennials have considered buying a CVD lab-grown diamond for an engagement ring to tackle the negative social and environmental effects associated with mined diamonds. One such effect is the destruction caused by the extraction of natural diamonds—mining from deep caves and diamond mines could damage the environment. Thus, as the synthetic manufacturing of diamonds could reduce the overall impact of the jewelry industry on the environment, both the jewelry manufacturers and consumers are increasingly demanding CVD lab-grown diamonds. In fact, according to a report by Goldiam, the share of lab-grown diamonds in the global diamond market is expected to grow by 7% between 2020 and 2030.

Restraints: Unclear long-term value

Although the jewelry industry has started accepting the usage of CVD lab-grown diamonds, the long-term worth of these gems is still under the radar. Technological advancements in synthetic diamond production could reduce the value of lab-created diamonds that have already been sold. Furthermore, as these gems could be mass-produced, their allure and rarity are affected, further pushing down their market prices. Thus, it is estimated that the overall price of lab-grown diamonds is going to dip in the upcoming years, while that of mined diamonds has experienced a growing trend. Thus, the resale value of synthetic diamonds is largely uncertain, which is one of the key barriers for the growth of the market.

Opportunities: Potential applications in quantum devices and semiconductors

Research in quantum technology is being carried out in a plethora of areas including quantum computing, simulation, communication, and sensing. For these novel applications, a wide range of technological options, including trapped ions, superconductors, quantum dots, photons, and semiconductor flaws, are now being developed.

There are advantages and disadvantages to every technical solution. While superconducting circuits can be made, they can only be used at cryogenic temperatures; trapped ions offer exquisite quantum properties but are difficult to integrate. This is where materials like CVD diamond come into play. They provide a compromise by operating at normal temperature and being solid-state, making it simpler to integrate into devices. One of the advantages of diamond-based quantum devices is their simplicity. A basic device can be made from a green light source, a diamond, a small microwave source, and a photodetector. With these super-technologies gaining traction in electronics and semiconductor manufacturing, the demand for CVD-lab-grown diamonds could see a shining light during the forecast period.

Challenges: Challenges in CVD diamond manufacturing process

Manufacturers face many challenges when trying to produce consistently high-quality lab-grown diamonds. System stability, vacuum leaks, and component costs need to be carefully monitored by manufacturers. The color of CVD lab-grown diamonds is a major concern. At high growth rates, diamonds grown in a CVD lab appear brown. After HPHT, the brown is reduced or eliminated, but most manufacturers’ CVD diamonds are gray and black in the initial production phase. Manufacturers have to invest further in solutions for clearing the color of diamonds, which reduces their margins in the market.

Increasing demand from industrial applications driving demand for rough CVD lab-grown diamonds

The high hardness and high wear resistance of CVD synthetic diamonds make them excellent material to film industrial tools and machinery components. Furthermore, their high thermal conductivity and appreciable electrical insulation capability make them suitable thermal management systems such as heat sinks. In abrasive industrial applications, rough diamonds can suitably fulfil these requirements and at a considerably lower cost than polished diamonds, making them account for the larger market share in the global market.

Colorless CVD lab-grown diamonds are projected to account for the largest share through the forecast period

Colorless diamonds not only cost less but are also largely devoid of impurities and doping. They provide excellent optical properties such as high transmission, suitable refractory index, and shiny bling suitable for industrial as well as gemstone applications. Furthermore, most colorless and near-colorless CVD diamonds are inert to longwave UV light, making them suitable for optical applications. Also, the colorless CVD method is less expensive because it can be manufactured at moderate temperatures and low pressure, requiring smaller and less expensive equipment. Therefore, owing to these factors, the demand for colorless CVD diamonds is projected to expand considerably through the forecast period.

Rising awareness about the authenticity of CVD diamonds pushing its demand from the gemstone segment

In the initial years, the CVD lab-grown diamonds were perceived as fake diamonds. Therefore, consumers did not accept them as gemstones in their jewelry and luxury goods purchases. However, with the effort from the companies manufacturing CVD diamonds for increasing awareness as well as institutions such as the International Gemological Institution and Gemological Institute of America defining CVD lab-grown diamonds as real diamonds, the interest amongst consumers has spiked in recent years. According to a survey, about 70% of the millennial generation have considered purchasing jewelry made of CVD lab-grown diamonds for their loved ones. Moreover, jewelry manufacturers such as Ritani and Swarovski have also started offering CVD diamonds with a certificate of authenticity, assuring the consumers about their purchases. As these diamonds cost around 50 – 60% lower than mined diamonds, a significant part of the global population has became capable of buying diamond jewelry, which is driving the growth of this market.

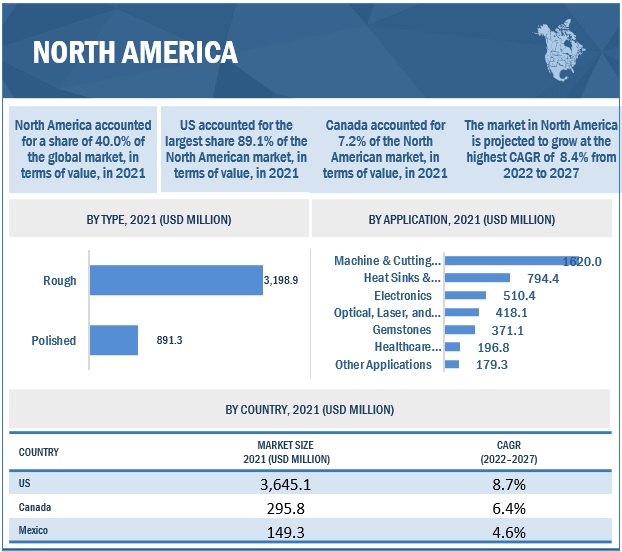

Consumption of CVD lab-grown diamond in North America to account for the largest share during the forecast period with growing demand from both industrial as well as jewelry applications

North America is the dominant market for CVD lab-grown diamonds, driven by the demand from the US. According to US Geological Survey, about 99% of the industrial diamond tools in the US are manufactured using CVD process. With high-strength materials such as reinforced plastics and ceramics gaining impetus for weight reduction applications, the demand for diamond-based tools is expected to increase in the region for machining and abrasion applications. On the other hand, diamonds manufactured synthetically are also gaining traction in the US owing to their lower cost and overall lower environmental impact. Even though the manufacturing of CVD lab-grown diamonds is concentrated in the Asia Pacific region, a major share is imported in the US owing to the considerable demand.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key players in this market are De Beers (UK), Goldiam (India), Adamas One Corp (US), and Sumitomo Electric Industries Ltd. (Japan). Other noteworthy private players in this market are Bhanderi Lab-grown Diamonds LLP (India), Hebei Plasma Diamond Technology Co., Ltd. (China), SP3 Diamond Technologies (US), Delaware Diamond Knives, Inc. (US), EDP Corporation (Japan), Tomei Diamond Corporation (Japan), Heyaru (Belgium), Beijing Worldia Diamond Tools Co., Ltd. (China), Ritani (US), and Shanghai Zhengshi Technology Co., Ltd. (China). These players have acquisition, agreements and new product development as the major strategies to consolidate their position in the market.

Read More: CVD Lab Grown Diamonds Companies

CVD Lab Grown Diamonds Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 11.3 Billion |

|

Revenue Forecast in 2027 |

USD 15.9 Billion |

|

CAGR |

7.1% |

|

Market Size Available for Years |

2019-2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Type, Color, Application, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies Covered |

De Beers Group(UK), Bhanderi Lab Grown Diamonds LLP(India), Sumitomo Electric Industries Ltd. (Japan), sp3 Diamond Technologies(US), Hebei Plasma Diamond Technology(China), Delaware Diamond Knives, Inc.(US), ABD Diamonds Pvt. Ltd.(India), CVD Diamond Inc.(US), Vibranium Lab(UK), Shanghai Zhengshi Technology Co., Ltd.(China), Ritani(US), Nova Diamant(Sweden), Grown Diamond Corporation(India), EDP Corporation(Japan), Tomei Diamond Corporation(Japan), Heyaru(Belgium), Beijing Worldia Diamond Tools Co., Ltd.(China), Henan Huanghe Whirlwind Co., Ltd.(China), UniDiamond Superabrasives(UK), IIa Technologies(Singapore), Goldiam International Ltd.(India), Adamas One Corp(US) |

This research report categorizes the CVD Lab-grown diamonds market based on type, color, application, and region.

Based on type, the CVD Lab-grown diamonds market has been segmented into:

- Rough

- Polished

Based on color, the CVD Lab-grown diamonds market has been segmented into:

- Colored

- Colorless

Based on application, the CVD Lab-grown diamonds market has been segmented into:

- Machine and Cutting tools

- Heat Sinks & Exchangers

- Optical, Laser and X-ray

- Electronics

- Healthcare Instruments

- Gemstone

- Others (oil and gas, automotive, water treatment and aerospace & defence)

Based on the region, the CVD Lab-grown diamonds market has been segmented into:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South America

Recent Developments

- In June 2021, Goldiam announced the acquisition of an 88% stake in EcoFriendly Diamonds LLP (EDL). EDL was engaged in the manufacturing of lab-created diamonds using the CVD method. The acquisition was done by Goldiam in order to enter the fast-growing lab-grown diamond market in the Asia Pacific region.

- In January 2021, SP3 Diamond Technologies signed an agreement with MAPAL for the supply of diamond coatings. The OptiMill-Composite-Speed-Plus coating was the first successfully supplied coating to the company by SP3 Diamond Technologies.

- In 2020, Element Six developed its new CVD diamond-based offering, Diamfilm 2020, a thermally isotropic diamond film. The film has excellent heat sink characteristics along with dielectric permittivity, optical clarity, excellent electrical insulation, low density, and chemical inertness, making it an ideal material for advanced thermal management components.

Frequently Asked Questions (FAQ):

What is a CVD lab-grown diamond?

According to the Lab Grown Diamond and Jewellery Promotion Council, a laboratory-grown diamond (LGD) has been produced artificially using all the elements found in mined diamonds, including pure carbon. CVD is a comparatively newer process of diamond manufacturing and involves filling a vacuum chamber with carbon-containing gas that crystallizes on a synthetic diamond seed. This method requires lower pressure and temperature conditions.

What are the different applications for CVD lab-grown diamond?

CVD lab-grown diamonds find application in machine & cutting tools; heat sinks & exchangers; optical, lasers & X-ray; electronics; healthcare instruments; aerospace & defense component manufacturing; water treatment; and as gemstones.

Who are the major players involved in this market?

De Beers (UK), Goldiam (India), Adamas One Corp (US), Sumitomo Electric Industries Ltd. (Japan), Bhanderi Lab-grown Diamonds LLP (India), Hebei Plasma Diamond Technology Co., Ltd. (China), and SP3 Diamond Technologies (US) are the key players involved in this market

What are the key driving factors for the growth of the global CVD lab-grown diamond market?

Increased demand for the manufacturing of flexible electronics and optoelectronic devices is driving the growth of this market.

What is the biggest challenge for the growth of the global CVD lab-grown diamond market?

Achieving color consistency, system stability, and reducing vacuum leaks are the biggest challenges hindering the growth of the CVD lab-grown diamond market.

What are the key regions in the global CVD lab-grown diamond market?

In terms of region, the key markets are observed to be in North America. The US is the largest consumer of CVD lab-grown diamonds owing to the presence of key diamond tools and diamond jewelry manufacturers in the country. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing interest in CVD lab-grown diamonds in gem and jewelry sectors- Affordability over naturally mined diamonds- Better control over impuritiesRESTRAINTS- Unclear long-term value- Lack of perceived allure and unfavorable customer outlookOPPORTUNITIES- Potential applications in quantum devices and semiconductorsCHALLENGES- Resistance from jewelers and traders- Challenges in CVD diamond manufacturing process

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 HISTORY OF LAB-GROWN DIAMONDS

- 6.2 DIAMOND INDUSTRY TRANSFORMATION: ASSESSMENT OF SHORT-TERM AND LONG-TERM IMPACT FACTORS

- 6.3 VALUE CHAIN ANALYSIS

-

6.4 TECHNOLOGY ANALYSISDIAMOND FORMATION TECHNOLOGYAI TECHNOLOGY FOR DIAMOND CLARITY GRADINGBLOCKCHAIN TECHNOLOGY IN DIAMOND INDUSTRY

-

6.5 ECOSYSTEM ANALYSIS

-

6.6 CASE STUDY ANALYSISSTUDY ON MILLENNIAL CONSUMER BEHAVIOR- Objective- Solution statement

-

6.7 PATENT ANALYSISPATENT PUBLICATION TRENDSINSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS- List of major patents

- 6.8 KEY CONFERENCES & EVENTS IN 2022–2023

-

6.9 REGULATORY LANDSCAPEKEY DIAMOND CERTIFICATION LABSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 TREND/DISRUPTION IMPACT

- 6.11 TRADE DATA STATISTICS

- 6.12 AVERAGE SELLING PRICE ANALYSIS

- 7.1 INTRODUCTION

-

7.2 ROUGH DIAMONDSROUGH CVD DIAMONDS TO REGISTER HIGH DEMAND IN DIFFERENT INDUSTRIAL APPLICATIONS

-

7.3 POLISHED DIAMONDSHIGH DEMAND FOR POLISHED CVD DIAMONDS IN JEWELRY MANUFACTURING TO BOOST MARKET

- 8.1 INTRODUCTION

-

8.2 COLORED DIAMONDSMARKET GROWTH DRIVEN BY USE OF COLORED DIAMONDS IN JEWELRY, OPTICAL & LASER, AND ELECTRONICS INDUSTRIES

-

8.3 COLORLESS DIAMONDSCOST-EFFECTIVENESS DRIVING MARKET GROWTH FOR COLORLESS DIAMONDS

- 9.1 INTRODUCTION

-

9.2 MACHINE & CUTTING TOOLSPOTENTIAL TO REDUCE TOOLING COSTS TO DRIVE GROWTH

-

9.3 HEAT SINKS & EXCHANGERSGROWING DEMAND FOR HIGH-POWERED ELECTRONICS TO DRIVE MARKET FOR CVD DIAMOND HEAT SINKS

-

9.4 OPTICAL, LASER, AND X-RAYFAVORABLE PROPERTIES TO BOOST ADOPTION OF CVD DIAMONDS

-

9.5 ELECTRONICSEXCELLENT THERMAL AND ELECTRIC PROPERTIES TO BOOST END-USER ADOPTION

-

9.6 HEALTHCARE INSTRUMENTSGROWING USE IN MEDICAL DEVICES, ORTHOPEDICS, INSTRUMENTS, AND OTHER HEALTHCARE INSTRUMENTS TO BOOST DEMAND

-

9.7 GEMSTONESSHARE OF CVD-LAB GROWN DIAMONDS TO INCREASE IN GEMSTONE APPLICATIONS

- 9.8 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- US to remain a leading market for lab-grown diamondsCANADA- Rising investment in diamond production to support marketMEXICO- Stable demand for diamonds to ensure sustained growth

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Germany to hold leading share in European marketFRANCE- Rising investment in LGDs to drive marketUK- Rising interest in LGDs to support market growthSPAIN- Expansion efforts by companies to support market growth in SpainRUSSIA- Economic sanctions to boost demand for lab-grown diamondsITALY- Increasing consumer preference to drive demandREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- High growth in electronics industry to boost demandINDIA- Rising trade in synthetic diamonds worldwide to drive marketJAPAN- Growing interest in synthetic diamonds to ensure sustained demandSOUTH KOREA- Presence of few manufacturers to slow growthAUSTRALIA- Electronics segment to show highest growth in AustraliaREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTSAUDI ARABIA- Rising interest in jewelry to boost market in Saudi ArabiaUAE- Growing mechanical applications to augment marketSOUTH AFRICA- Younger population to drive the marketREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTBRAZIL- Increasing demand in dentistry to drive marketARGENTINA- Development in mining industry to boost marketREST OF SOUTH AMERICA

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

-

11.3 MARKET SHARE ANALYSISREVENUE ANALYSIS OF PUBLIC PLAYERS

-

11.4 COMPANY FOOTPRINT ANALYSISSTRENGTH OF STRATEGY EXCELLENCECOMPANY PRODUCT FOOTPRINTCOMPANY APPLICATION FOOTPRINTCOMPANY REGIONAL FOOTPRINT

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

-

11.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSDE BEERS GROUP- Business overview- Products offered- Recent developments- MnM viewBHANDERI LAB GROWN DIAMONDS LLP- Business overview- Products offeredSUMITOMO ELECTRIC INDUSTRIES, LTD.- Business overview- Products offered- MnM viewSP3 DIAMOND TECHNOLOGIES- Business overview- Products offered- Recent developments- MnM viewHEBEI PLASMA DIAMOND TECHNOLOGY CO., LTD.- Business overview- Products offered- MnM viewDELAWARE DIAMOND KNIVES, INC.- Business overview- Products offered- MnM viewABD DIAMONDS PVT. LTD.- Business overview- Products offeredCVD DIAMOND INC.- Business overview- Products offeredVIBRANIUM LAB- Business overview- Products offeredSHANGHAI ZHENGSHI TECHNOLOGY CO., LTD.- Business overview- Products offeredRITANI- Business overview- Products offeredNOVA DIAMANT- Business overview- Products offeredGROWN DIAMOND CORPORATION- Business overview- Products offeredEDP CORPORATION- Business overview- Products offeredTOMEI DIAMOND CORPORATION- Business overview- Products offeredHEYARU GROUP- Business overview- Products offeredBEIJING WORLDIA DIAMOND TOOLS CO., LTD.- Business overview- Products offeredHENAN HUANGHE WHIRLWIND CO., LTD.- Business overview- Products offeredUNIDIAMOND SUPERABRASIVES- Business overview- Products offeredIIA TECHNOLOGIES PTE. LTD.- Business overview- Products offeredGOLDIAM INTERNATIONAL LTD.- Business overview- Products offered- Recent developmentsADAMAS ONE CORP- Business overview- Products offered

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 CVD LAB-GROWN DIAMONDS MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

- TABLE 2 CVD LAB-GROWN DIAMONDS MARKET, BY COLOR: INCLUSIONS AND EXCLUSIONS

- TABLE 3 CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

- TABLE 4 CVD LAB-GROWN DIAMONDS MARKET, BY REGION: INCLUSIONS AND EXCLUSIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR KEY INDUSTRIAL APPLICATIONS (%)

- TABLE 6 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 7 CVD LAB-GROWN DIAMONDS MARKET ECOSYSTEM

- TABLE 8 CVD LAB-GROWN DIAMONDS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 9 INDIA: LAB-GROWN DIAMOND EXPORT DATA (USD MILLION)

- TABLE 10 US: LAB-GROWN DIAMOND IMPORT DATA (THOUSAND CARATS)

- TABLE 11 AVERAGE PRICES OF CVD LAB-GROWN DIAMONDS, BY REGION (USD THOUSAND/CARAT)

- TABLE 12 AVERAGE PRICES OF CVD LAB-GROWN DIAMONDS, BY TYPE (USD THOUSAND/CARAT)

- TABLE 13 AVERAGE PRICES OF CVD LAB-GROWN DIAMONDS, BY APPLICATION (USD THOUSAND/CARAT)

- TABLE 14 CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (THOUSAND CARATS)

- TABLE 15 CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (THOUSAND CARATS)

- TABLE 16 CVD LAB-GROWN DIAMONDS MARKET, 2019–2021 (USD MILLION)

- TABLE 17 CVD LAB-GROWN DIAMONDS MARKET, 2022–2027 (USD MILLION)

- TABLE 18 ROUGH CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 19 ROUGH CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 20 ROUGH CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 21 ROUGH CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 22 POLISHED CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 23 POLISHED CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 24 POLISHED CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 25 POLISHED CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 26 CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (THOUSAND CARATS)

- TABLE 27 CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (THOUSAND CARATS)

- TABLE 28 CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (USD MILLION)

- TABLE 29 CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (USD MILLION)

- TABLE 30 COLORED CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 31 COLORED CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 32 COLORED CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 33 COLORED CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 34 COLORLESS CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 35 COLORLESS CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 36 COLORLESS CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 37 COLORLESS CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 38 CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 39 CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 40 CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 41 CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 42 CVD LAB-GROWN DIAMONDS MARKET FOR MACHINE & CUTTING TOOLS, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 43 CVD LAB-GROWN DIAMONDS MARKET FOR MACHINE & CUTTING TOOLS, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 44 CVD LAB-GROWN DIAMONDS MARKET FOR MACHINE & CUTTING TOOLS, BY REGION, 2019–2021 (USD MILLION)

- TABLE 45 CVD LAB-GROWN DIAMONDS MARKET FOR MACHINE & CUTTING TOOLS, BY REGION, 2022–2027 (MILLION CARATS)

- TABLE 46 CVD LAB-GROWN DIAMONDS MARKET FOR HEAT SINKS & EXCHANGERS, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 47 CVD LAB-GROWN DIAMONDS MARKET FOR HEAT SINKS & EXCHANGERS, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 48 CVD LAB-GROWN DIAMONDS MARKET FOR HEAT SINKS & EXCHANGERS, BY REGION, 2019–2021 (USD MILLION)

- TABLE 49 CVD LAB-GROWN DIAMONDS MARKET FOR HEAT SINKS & EXCHANGERS, BY REGION, 2022–2027 (USD MILLION)

- TABLE 50 CVD LAB-GROWN DIAMONDS MARKET FOR OPTICAL, LASER, AND X-RAY, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 51 CVD LAB-GROWN DIAMONDS MARKET FOR OPTICAL, LASER, AND X-RAY, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 52 CVD LAB-GROWN DIAMONDS MARKET FOR OPTICAL, LASER, AND X-RAY, BY REGION, 2019–2021 (USD MILLION)

- TABLE 53 CVD LAB-GROWN DIAMONDS MARKET FOR OPTICAL, LASER, AND X-RAY, BY REGION, 2022–2027 (USD MILLION)

- TABLE 54 CVD LAB-GROWN DIAMONDS MARKET FOR ELECTRONICS, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 55 CVD LAB-GROWN DIAMONDS MARKET FOR ELECTRONICS, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 56 CVD LAB-GROWN DIAMONDS MARKET FOR ELECTRONICS, BY REGION, 2019–2021 (USD MILLION)

- TABLE 57 CVD LAB-GROWN DIAMONDS MARKET FOR ELECTRONICS, BY REGION, 2022–2027 (USD MILLION)

- TABLE 58 CVD LAB-GROWN DIAMONDS MARKET FOR HEALTHCARE INSTRUMENTS, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 59 CVD LAB-GROWN DIAMONDS MARKET FOR HEALTHCARE INSTRUMENTS, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 60 CVD LAB-GROWN DIAMONDS MARKET FOR HEALTHCARE INSTRUMENTS, BY REGION, 2019–2021 (USD MILLION)

- TABLE 61 CVD LAB-GROWN DIAMONDS MARKET FOR HEALTHCARE INSTRUMENTS, BY REGION, 2022–2027 (USD MILLION)

- TABLE 62 CVD LAB-GROWN DIAMONDS MARKET FOR GEMSTONES, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 63 CVD LAB-GROWN DIAMONDS MARKET FOR GEMSTONES, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 64 CVD LAB-GROWN DIAMONDS MARKET FOR GEMSTONES, BY REGION, 2019–2021 (USD MILLION)

- TABLE 65 CVD LAB-GROWN DIAMONDS MARKET FOR GEMSTONES, BY REGION, 2022–2027 (USD MILLION)

- TABLE 66 CVD LAB-GROWN DIAMONDS MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 67 CVD LAB-GROWN DIAMONDS MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 68 CVD LAB-GROWN DIAMONDS MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2021 (USD MILLION)

- TABLE 69 CVD LAB-GROWN DIAMONDS MARKET FOR OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

- TABLE 70 CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2019–2021 (THOUSAND CARATS)

- TABLE 71 CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2022–2027 (THOUSAND CARATS)

- TABLE 72 CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 73 CVD LAB-GROWN DIAMONDS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 74 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2019–2021 (THOUSAND CARATS)

- TABLE 75 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2022–2027 (THOUSAND CARATS)

- TABLE 76 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 77 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (THOUSAND CARATS)

- TABLE 79 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (THOUSAND CARATS)

- TABLE 80 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 81 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 82 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (THOUSAND CARATS)

- TABLE 83 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (THOUSAND CARATS)

- TABLE 84 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (USD MILLION)

- TABLE 85 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 87 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 88 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 89 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 90 US: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 91 US: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 92 US: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 93 US: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 94 CANADA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 95 CANADA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 96 CANADA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 97 CANADA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 98 MEXICO: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 99 MEXICO: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 100 MEXICO: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 101 MEXICO: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 102 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2019–2021 (THOUSAND CARATS)

- TABLE 103 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2022–2027 (THOUSAND CARATS)

- TABLE 104 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 105 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 106 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (THOUSAND CARATS)

- TABLE 107 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (THOUSAND CARATS)

- TABLE 108 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 109 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 110 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (THOUSAND CARATS)

- TABLE 111 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (THOUSAND CARATS)

- TABLE 112 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (USD MILLION)

- TABLE 113 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (USD MILLION)

- TABLE 114 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 115 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 116 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 117 EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 118 GERMANY: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 119 GERMANY: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 120 GERMANY: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 121 GERMANY: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 122 FRANCE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 123 FRANCE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 124 FRANCE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 125 FRANCE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 126 UK: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 127 UK: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 128 UK: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 129 UK: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 130 SPAIN: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 131 SPAIN: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 132 SPAIN: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 133 SPAIN: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 134 RUSSIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 135 RUSSIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 136 RUSSIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 137 RUSSIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 138 ITALY: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 139 ITALY: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 140 ITALY: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 141 ITALY: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 142 REST OF EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 143 REST OF EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 144 REST OF EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 145 REST OF EUROPE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 146 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2019–2021 (THOUSAND CARATS)

- TABLE 147 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2022–2027 (THOUSAND CARATS)

- TABLE 148 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 149 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 150 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (THOUSAND CARATS)

- TABLE 151 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (THOUSAND CARATS)

- TABLE 152 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 153 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 154 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (THOUSAND CARATS)

- TABLE 155 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (THOUSAND CARATS)

- TABLE 156 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (USD MILLION)

- TABLE 157 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (USD MILLION)

- TABLE 158 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 159 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 160 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 161 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 162 CHINA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 163 CHINA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 164 CHINA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 165 CHINA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 166 INDIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 167 INDIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 168 INDIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 169 INDIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 170 JAPAN: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 171 JAPAN: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 172 JAPAN: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 173 JAPAN: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 174 SOUTH KOREA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 175 SOUTH KOREA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 176 SOUTH KOREA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 177 SOUTH KOREA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 178 AUSTRALIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 179 AUSTRALIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 180 AUSTRALIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 181 AUSTRALIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 183 REST OF ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 184 REST OF ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2019–2021 (THOUSAND CARATS)

- TABLE 187 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2022–2027 (THOUSAND CARATS)

- TABLE 188 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (THOUSAND CARATS)

- TABLE 191 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (THOUSAND CARATS)

- TABLE 192 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (THOUSAND CARATS)

- TABLE 195 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (THOUSAND CARATS)

- TABLE 196 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 199 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 200 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 202 SAUDI ARABIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 203 SAUDI ARABIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 204 SAUDI ARABIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 205 SAUDI ARABIA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 206 UAE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 207 UAE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 208 UAE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 209 UAE: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 210 SOUTH AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 211 SOUTH AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 212 SOUTH AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 213 SOUTH AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 214 REST OF MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 217 REST OF MIDDLE EAST & AFRICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 218 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2019–2021 (THOUSAND CARATS)

- TABLE 219 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2022–2027 (THOUSAND CARATS)

- TABLE 220 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 221 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 222 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (THOUSAND CARATS)

- TABLE 223 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (THOUSAND CARATS)

- TABLE 224 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 225 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 226 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (THOUSAND CARATS)

- TABLE 227 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (THOUSAND CARATS)

- TABLE 228 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2019–2021 (USD MILLION)

- TABLE 229 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022–2027 (USD MILLION)

- TABLE 230 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 231 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 232 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 233 SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 234 BRAZIL: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 235 BRAZIL: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 236 BRAZIL: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 237 BRAZIL: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 238 ARGENTINA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 239 ARGENTINA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 240 ARGENTINA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 241 ARGENTINA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 242 REST OF SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (THOUSAND CARATS)

- TABLE 243 REST OF SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (THOUSAND CARATS)

- TABLE 244 REST OF SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 245 REST OF SOUTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 246 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 247 CVD LAB-GROWN DIAMONDS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 248 CVD LAB-GROWN DIAMONDS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 249 CVD LAB-GROWN DIAMONDS: PRODUCT LAUNCHES (2018–2021)

- TABLE 250 CVD LAB-GROWN DIAMONDS: DEALS (2018–2021)

- TABLE 251 DE BEERS GROUP: COMPANY OVERVIEW

- TABLE 252 DE BEERS: PRODUCT LAUNCHES

- TABLE 253 BHANDERI LAB GROWN DIAMONDS LLP: COMPANY OVERVIEW

- TABLE 254 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 255 SP3 DIAMOND TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 256 SP3 DIAMOND TECHNOLOGIES: DEALS

- TABLE 257 HEBEI PLASMA DIAMOND TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 258 DELAWARE DIAMOND KNIVES, INC.: COMPANY OVERVIEW

- TABLE 259 ABD DIAMONDS PVT. LTD.: COMPANY OVERVIEW

- TABLE 260 CVD DIAMOND INC.: COMPANY OVERVIEW

- TABLE 261 VIBRANIUM LAB: COMPANY OVERVIEW

- TABLE 262 SHANGHAI ZHENGSHI TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 263 RITANI: COMPANY OVERVIEW

- TABLE 264 NOVA DIAMANT: COMPANY OVERVIEW

- TABLE 265 GROWN DIAMOND CORPORATION: COMPANY OVERVIEW

- TABLE 266 EDP CORPORATION: COMPANY OVERVIEW

- TABLE 267 TOMEI DIAMOND CORPORATION: COMPANY OVERVIEW

- TABLE 268 HEYARU GROUP: COMPANY OVERVIEW

- TABLE 269 BEIJING WORLDIA DIAMOND TOOLS CO., LTD.: COMPANY OVERVIEW

- TABLE 270 HENAN HUANGHE WHIRLWIND CO., LTD.: COMPANY OVERVIEW

- TABLE 271 UNIDIAMOND SUPERABRASIVES: COMPANY OVERVIEW

- TABLE 272 IIA TECHNOLOGIES PTE. LTD.: COMPANY OVERVIEW

- TABLE 273 GOLDIAM INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 274 GOLDIAM INTERNATIONAL LIMITED: DEALS

- TABLE 275 ADAMAS ONE CORP: COMPANY OVERVIEW

- FIGURE 1 CVD LAB-GROWN DIAMONDS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY, DESIGNATION, AND REGION

- FIGURE 3 BASE NUMBER CALCULATION METHODOLOGY: SUPPLY–SIDE APPROACH (VOLUME)

- FIGURE 4 BASE NUMBER CALCULATION METHODOLOGY: DEMAND–SIDE APPROACH (VOLUME)

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 ROUGH DIAMONDS TO HOLD LARGEST SHARE OF CVD LAB-GROWN DIAMONDS, BY TYPE

- FIGURE 9 COLORED DIAMONDS TO REGISTER HIGHEST GROWTH IN CVD LAB-GROWN DIAMONDS MARKET, BY COLOR

- FIGURE 10 CUTTING & MACHINE TOOLS TO DOMINATE APPLICATIONS MARKET

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 12 LOW CARBON FOOTPRINT OF MANUFACTURING PROCESS TO DRIVE DEMAND FOR CVD LAB-GROWN DIAMONDS

- FIGURE 13 ROUGH DIAMONDS TO LEAD OVERALL MARKET

- FIGURE 14 COLORLESS DIAMONDS TO DOMINATE MARKET BY 2027 (THOUSAND CARATS)

- FIGURE 15 GEMSTONES TO REGISTER HIGHEST MARKET GROWTH RATE

- FIGURE 16 CUTTING & MACHINE TOOLS SEGMENT AND US TO LEAD NORTH AMERICAN MARKET

- FIGURE 17 CHINA TO BE FASTEST-GROWING MARKET (2022–2027)

- FIGURE 18 CVD LAB-GROWN DIAMONDS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 PREDICTED GROWTH OF LAB-GROWN DIAMONDS SHARE

- FIGURE 20 PRICES OF LAB-GROWN DIAMONDS RELATIVE TO NATURAL DIAMONDS

- FIGURE 21 LAB-GROWN DIAMOND PRICE INDEX, 2018–2022

- FIGURE 22 CVD LAB-GROWN DIAMONDS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR KEY INDUSTRIAL SEGMENTS

- FIGURE 24 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 25 CVD LAB-GROWN DIAMONDS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 ECOSYSTEM MAPPING: CVD LAB-GROWN DIAMONDS MARKET

- FIGURE 27 NUMBER OF PATENTS YEAR-WISE (2014-2022)

- FIGURE 28 CHINA ACCOUNTED FOR HIGHEST NUMBER OF PATENTS FROM 2014–2022

- FIGURE 29 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 30 REVENUE SHIFTS AND NEW REVENUE POCKETS F OR CVD LAB-GROWN DIAMONDS MARKET

- FIGURE 31 AVERAGE SELLING PRICE OF CVD LAB-GROWN DIAMONDS, BY REGION (USD THOUSAND/CARAT)

- FIGURE 32 CVD LAB-GROWN DIAMONDS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 33 CVD LAB-GROWN DIAMONDS MARKET, BY COLOR, 2022 VS. 2027 (USD MILLION)

- FIGURE 34 CVD LAB-GROWN DIAMONDS MARKET, BY APPLICATION, 2022 & 2027 (USD MILLION)

- FIGURE 35 GEOGRAPHIC SNAPSHOT: CHINA TO SHOW HIGHEST GROWTH

- FIGURE 36 NORTH AMERICA: CVD LAB-GROWN DIAMONDS MARKET SNAPSHOT

- FIGURE 37 EUROPE: CVD LAB-GROWN DIAMONDS MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: CVD LAB-GROWN DIAMONDS MARKET SNAPSHOT

- FIGURE 39 RANKING OF KEY MARKET PLAYERS, 2021

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES DURING PAST FIVE YEARS

- FIGURE 41 COMPANY OVERALL FOOTPRINT

- FIGURE 42 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS

- FIGURE 43 CVD LAB-GROWN DIAMONDS MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

- FIGURE 44 CVD LAB-GROWN DIAMONDS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021

- FIGURE 45 DE BEERS GROUP: COMPANY SNAPSHOT

- FIGURE 46 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 47 GOLDIAM INTERNATIONAL LTD.: COMPANY SNAPSHOT

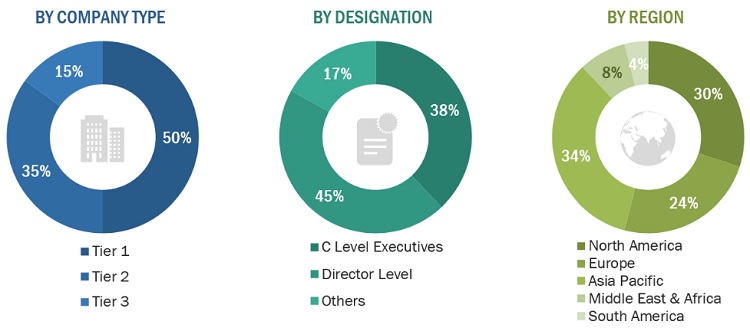

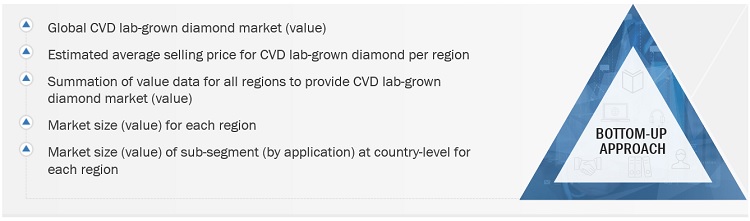

This study involved four major activities to estimate the current size of the CVD lab-grown diamonds market. Exhaustive secondary research was undertaken to collect information on the CVD lab-grown diamonds market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the CVD lab-grown diamonds value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the CVD lab-grown diamonds market.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet. Other key secondary sources were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

The CVD Lab-grown diamonds market comprises several stakeholders in the value chain, including raw material suppliers, product manufacturers, contractors, research organizations, and end users. In the primary research process, experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from major companies and organizations operating in the CVD Lab-grown diamonds market. Primary sources from the demand side included end-users such as electronics item manufacturers, jewelry manufacturers, cutting tools manufacturers, and others.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the CVD Lab-grown diamonds market. These methods were also used extensively to estimate the size of various segments and sub-segments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research

- The value chain of the industry and the market size of the CVD Lab-grown diamonds, in terms of value, were determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research includes the study of reports, reviews, and newsletters of the key market players along with extensive interviews for opinions from leaders, such as directors and marketing executives

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size - using the market size estimation processes as explained above - the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the market size for CVD lab-grown diamonds market in terms of value and volume.

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze micro-markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market.

- To define and segment the market size by application, color, and type.

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, South America, and Middle East & Africa, along with their respective key countries.

- To analyze competitive developments such as agreements, acquisitions, and new product developments in the CVD lab-grown diamonds market

- To strategically profile key players and comprehensively analyze their market share and core competencies

The following customization options are available for the report:

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of product portfolio of each company in the CVD lab-grown diamonds market

- A further breakdown of a region of the CVD lab-grown diamonds market with respect to a particular country

- Details and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in CVD Lab-grown Diamonds Market