Copper Tubes Market by Type (Straight Length, Coils, Pancakes or Flattened Tubes, U-Bends and Drawn Tubes), Thickness (Standard Gauge, Extra Heavy Gauge, Thin Walled Gauge, Capillary Tubes), Application, and Region- Global Forecast to 2028

Copper Tubes Market

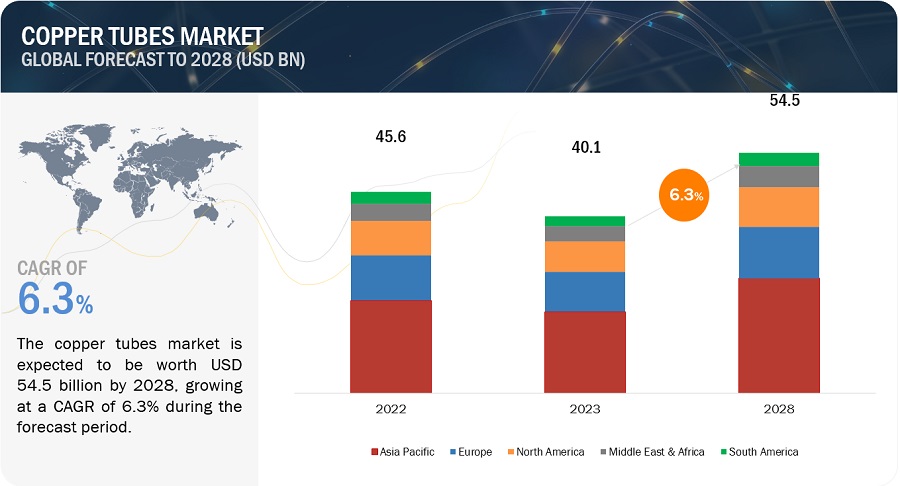

The global copper tubes market is valued at USD 40.1 billion in 2023 and is projected to reach USD 54.5 billion by 2028, growing at 6.3% cagr during the forecast period. The market is mainly led by the significant usage of copper tubes in various end-use industries. The global expansion of the construction industry, expansion of the HVACR sector, continuous technological advancements are driving the market for copper tubes.

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Copper Tubes Market

Copper Tubes Market Dynamics

Driver: Global expansion of the construction industry to drive the demand for copper tubes.

The global expansion of the construction industry is a potent driver for the copper tubes market. Copper tubes are essential components in construction applications. The construction industry's growth, propelled by factors like population growth, urbanization, and economic development, fuels the demand for residential, commercial, and infrastructure projects worldwide. These projects rely on copper tubes for their reliability, longevity, and efficient heat and fluid transfer properties. As more buildings and infrastructure are erected to accommodate the rising global population and expanding urban centers, the demand for copper tubes continues to rise. Additionally, with a growing focus on sustainable and energy-efficient construction practices, copper tubes play a pivotal role in ensuring the performance and sustainability of modern HVAC systems. Consequently, the ongoing global expansion of the construction industry reinforces the copper tubes market's significance as an indispensable component in the building and infrastructure sectors.

Expansion of the HVACR sector

The expansion of the Heating, Ventilation, Air Conditioning, and Refrigeration (HVACR) sector stands as a significant driver for the copper tubes market. Copper tubes are a preferred choice in HVACR systems due to their exceptional heat transfer properties, corrosion resistance, and durability, making them essential components for efficient heat exchange. As the global demand for temperature control and refrigeration systems continues to surge, driven by factors such as urbanization, climate change, and the need for energy-efficient solutions, the HVACR industry is poised for substantial growth. Copper tubes are a fundamental part of these systems, used in applications like air conditioning, refrigeration, and heat pumps. Additionally, the ongoing development of eco-friendly refrigerants and energy-efficient HVACR technologies further emphasizes the importance of copper tubes, as they play a crucial role in maximizing system performance and sustainability. As the HVACR sector expands to meet the increasing demand for comfortable and controlled environments, the copper tubes market is set to benefit significantly from this growth trajectory.

Continuous technological advancements

Continuous technological advancements in the copper tubes market have ushered in a new era of innovation and performance enhancement. Traditional copper tubes have been subject to ongoing research and development efforts aimed at improving their efficiency, sustainability, and adaptability to modern applications. These advancements include innovations in copper alloy compositions, leading to enhanced corrosion resistance and durability, reducing maintenance requirements. Furthermore, technological progress has resulted in the development of more efficient manufacturing processes, reducing energy consumption and waste generation, aligning with environmental sustainability goals. Moreover, innovations in tube design and manufacturing techniques have improved the thermal and electrical conductivity of copper tubes, expanding their usability in various industries, such as HVAC, electronics, and renewable energy. Additionally, the incorporation of smart technologies and sensors into copper tubes allows for real-time monitoring and control, enabling predictive maintenance and improved system performance. As the demand for more efficient, eco-friendly, and versatile solutions continues to grow, ongoing technological advancements in the copper tubes market are expected to drive its competitiveness and relevance in diverse applications.

Restraint: Fluctuations in raw material prices.

Fluctuations in copper prices can pose a significant restraint for the copper tubes market. Copper is a commodity whose market price is influenced by a complex interplay of factors, including global supply and demand, economic conditions, geopolitical events, and currency fluctuations. When copper prices experience volatility or upward spikes, it can lead to increased production costs for copper tubes manufacturers. These higher production costs may, in turn, be passed on to consumers, making copper tubes more expensive. This price sensitivity can deter potential buyers and customers, particularly in industries where cost-efficiency is a critical factor. Moreover, the uncertainty associated with fluctuating copper prices can pose challenges in terms of planning and budgeting for copper tube manufacturers, potentially impacting their profit margins and overall business stability. To mitigate this restraint, companies in the copper tubes market often employ hedging strategies or seek alternative materials when copper prices are exceptionally high. Nonetheless, the market remains susceptible to the inherent unpredictability of copper price fluctuations, necessitating adaptability and strategic planning within the industry.

Environmental concerns and regulatory compliances

Environmental and regulatory compliance is a critical facet of the copper tubes market. Copper is a material known for its long-lasting durability, which aligns with sustainability goals by reducing the need for frequent replacements. However, the copper tubes industry also faces environmental challenges, particularly concerning the extraction and refining of copper ore. Regulations aimed at reducing the environmental impact of mining and processing activities have led to increased scrutiny and compliance requirements for copper producers. Additionally, regulations on emissions and waste disposal drive the adoption of eco-friendly manufacturing processes within the industry. On the product side, copper tubes must meet stringent quality and safety standards to ensure they can be used safely in plumbing, HVAC, and electrical systems. Adherence to these regulations is essential to maintaining the reputation and market presence of copper tubes, as environmentally conscious consumers and industries increasingly seek materials and products that meet high environmental and safety standards. Consequently, companies in the copper tubes market must continually invest in sustainable practices, efficient manufacturing processes, and adherence to evolving regulatory frameworks to remain competitive in an environmentally responsible manner.

Opportunity: Renewable energy industry to create new revenue pockets for copper tubes.

The renewable energy industry has emerged as a significant catalyst for the copper tubes market, creating new revenue opportunities. Copper tubes are increasingly integral to various renewable energy applications, such as solar thermal systems and heat exchangers, due to their exceptional thermal conductivity and durability. These tubes play a crucial role in capturing and transferring heat efficiently, thus enhancing the overall performance and energy output of solar collectors and thermal storage systems. Furthermore, as the demand for clean energy sources like solar and wind power continues to grow globally, copper tubes are poised to benefit from this expanding market. With ongoing investments in renewable energy projects and the increasing adoption of sustainable technologies, the copper tubes market is diversifying its revenue streams by aligning itself with the sustainability goals of the renewable energy sector, solidifying its position as a vital component in the transition to cleaner and more environmentally friendly energy sources.

Challenge: Shift in consumer preferences and increasing competition from alternative materials

In recent years, there has been a notable shift in consumer preferences away from traditional copper tubes, driven by several factors. One significant factor is the increasing emphasis on sustainability and environmental consciousness. As consumers and industries seek more eco-friendly options, alternative materials that are perceived as more environmentally friendly, such as plastic and composite materials, namely PEX (Cross-linked Polyethylene) and CPVC (Chlorinated Polyvinyl Chloride) have gained traction. These materials are often viewed as lighter, easier to install, and less prone to corrosion, making them attractive alternatives to copper tubes in various applications. Additionally, cost considerations play a role in this shift, with some alternative materials offering lower upfront expenses. However, it's essential to note that copper's unique properties, such as its excellent thermal and electrical conductivity and durability, continue to make it indispensable in specific applications. While competition from alternative materials persists, copper tubes remain a preferred choice in many critical industries, and technological advancements in copper alloy manufacturing are helping to address some of the concerns associated with copper, such as its environmental impact and cost-effectiveness, ensuring its continued relevance in various markets.

Copper Tubes Market Ecosystem

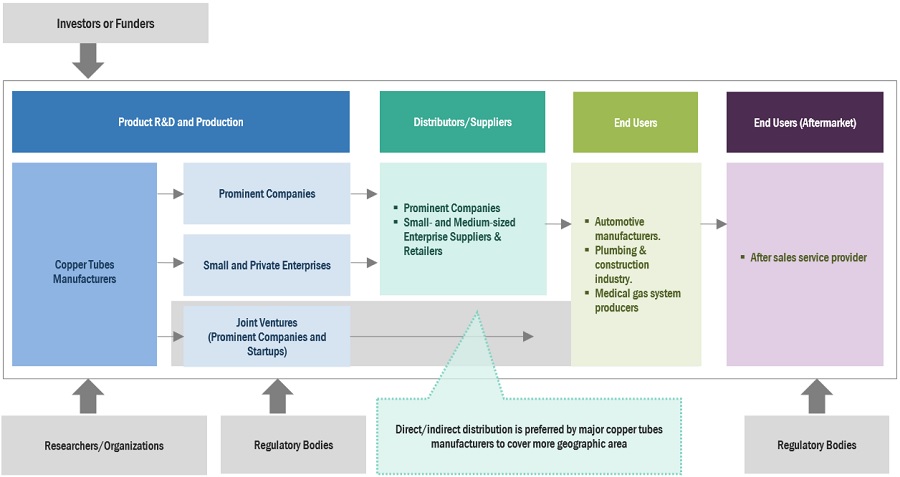

A market ecosystem refers to the intricate and interconnected network of organizations, entities, and factors that collectively influence the production, distribution, and consumption of goods or services within a specific industry or market. It encompasses various stakeholders, including producers, manufacturers, suppliers, distributors, retailers, consumers, regulatory bodies, and supporting industries, all of which play unique roles and interact with one another. Market ecosystems are dynamic and responsive, adapting to shifts in consumer preferences, technological advancements, economic conditions, and regulatory changes. The notable players in this market are those with established financial stability, cutting-edge technologies, a robust global marketing network, and a proven track record in sales. The key players in this market are Mueller Streamline Co.(US), KME Group S.p.A (Italy), Wieland Group (Germany), LUVATA (Finaland), KOBE STEEL, LTD. (Japan), Cambridge – Lee Industries LLC (USA), Shanghai Metal Corporation (China), Qindao Hongtai Copper Co., LTD (China), CERRO Flow Products LLC (USA), MM Kembla (Australia).

"Recycling is the fastest growing application for automotive shredded residue in 2023, in terms of value."

Recycling allows for the recovery of valuable resources from discarded materials, including metals, plastics, paper, and more. Post shredder technologies play a crucial role in efficiently sorting and processing recyclables, making recycling economically viable and helping conserve valuable resources. Governments and municipalities around the world have established recycling objectives and regulations aimed at waste reduction and the promotion of recycling. These regulatory measures frequently incentivize the advancement and uptake of cutting-edge post shredder technologies to improve the efficiency of recycling processes. The idea of a circular economy, characterized by the reuse and recycling of materials to minimize waste, is gaining traction. Recycling stands as a cornerstone of this approach, with post-shredder technologies playing a pivotal role in realizing recycling objectives. Increasing consumer awareness and environmental concerns have resulted in a heightened desire for products and packaging crafted from recycled materials. This incentivizes businesses to integrate recycled content into their offerings, further driving the demand for recycling technologies. The scarcity and rising costs associated with specific materials, such as rare earth metals and certain minerals extracted from natural sources, are prompting the adoption of recycling as a sustainable and cost-efficient means of recovering these resources from discarded products.

"Magnetic separation is the largest technology type for copper tubes market in 2023, in terms of value."

Magnetic separation accounted for the largest market share in the global copper tubes market, in terms of value, in 2023. Magnetic separation stands as the foremost post-shredder technology in recycling and waste management for several compelling reasons. Firstly, it excels in the recovery of ferrous metals from shredded materials, a vital component of recyclables, particularly in automotive scrap, due to its ubiquity. Second, magnetic separation boasts high purity levels in reclaimed metals, crucial for quality-sensitive applications like automotive component manufacturing. Notably, it's non-destructive, preserving material integrity during recovery. Third, its seamless automation capabilities render it suitable for large-scale operations, reducing labor costs while efficiently processing substantial volumes of shredded materials. Moreover, magnetic separation proves cost-effective, with relatively simple equipment integration into existing recycling facilities. Its environmentally friendly profile is evident in the diminished need for virgin metal extraction and reduced greenhouse gas emissions. Additionally, its versatility extends beyond ferrous metals, adaptable to remove other magnetic materials like specific stainless steel variants, nickel, and cobalt. Waste reduction benefits accrue from its effectiveness, lowering waste volumes requiring further processing or disposal. Lastly, magnetic separation ensures regulatory compliance through its provision of high purity in recovered materials.

"Plastics was the largest composition for copper tubes market in 2023, in terms of value."

There has been a global surge in prioritizing recycling and minimizing plastic waste, with governments, businesses, and consumers demonstrating heightened awareness of plastics' environmental impact. This impetus drives intensified endeavors to efficiently recycle and process plastics. Over time, post shredder technologies have evolved, rendering the processing of plastics by composition more feasible and cost-effective. These technologies enable the identification and separation of distinct plastic types based on their composition, enhancing recycling efficiency. The demand for recycled plastics has been on the rise, particularly in sectors such as packaging, automotive, and consumer goods. Companies are actively seeking more sustainable materials, with recycled plastics frequently meeting their sustainability objectives. Governments in many countries have been enacting regulations and offering incentives to stimulate recycling and the utilization of recycled materials. This regulatory support can encourage investments in post shredder technologies tailored for plastics. The concept of a circular economy, advocating for the reuse and recycling of materials instead of disposal, is gaining prominence. This ideology fosters the development of technologies adept at efficiently processing and recycling plastics into new products. Increased public consciousness regarding plastic pollution in oceans and ecosystems has led to demands for more effective recycling and waste management solutions. Consequently, investments in technologies capable of handling post shredder plastics with greater efficiency will ensue.

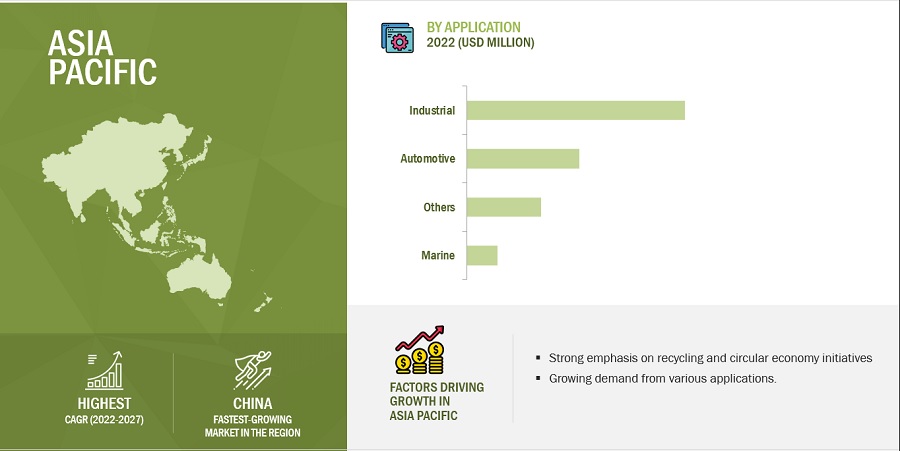

"Asia Pacific was the largest market for copper tubes in 2023, in terms of value."

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific region has emerged as the largest market for copper tubes due to a confluence of compelling factors. Foremost among these is the region's remarkable urbanization and industrialization, with countries like China and India experiencing exponential growth in their cities and manufacturing sectors. This rapid urban expansion necessitates robust infrastructure, construction, and manufacturing activities, all of which rely heavily on copper tubes for applications such as plumbing, HVAC (heating, ventilation, and air conditioning), and electrical networks. Furthermore, Asia Pacific boasts a booming construction sector driven by a burgeoning middle class and population growth. This surge in construction, spanning residential and commercial structures, fuels the demand for copper tubes, particularly in plumbing and air conditioning installations. The automotive industry, especially in China and India, is another significant contributor to this market dominance. Copper tubes play a pivotal role in automotive applications such as radiators and air conditioning systems, and as more individuals in the region attain higher living standards, the automotive sector's growth continues to propel copper tube demand.

Additionally, governments across the Asia Pacific region are investing heavily in infrastructure development, encompassing transportation, energy, and water supply projects. These projects rely on copper tubes for secure and dependable plumbing and electrical systems, further augmenting demand. The thriving electrical and electronics industry, which houses major manufacturers, also drives copper tube usage for components like heat exchangers, connectors, and coils, aligning with the surge in consumer electronics and electrical appliances. Moreover, the focus on renewable energy projects, including solar and wind power, has spurred the use of copper tubes in applications like solar thermal systems and heat exchangers, further bolstering the market.

Copper Tubes Market Players

The key players in this market are Mueller Streamline Co.(US), KME Group S.p.A (Italy), Wieland Group (Germany), LUVATA (Finaland), KOBE STEEL, LTD. (Japan), Cambridge – Lee Industries LLC (USA), Shanghai Metal Corporation (China), Qindao Hongtai Copper Co., LTD (China), CERRO Flow Products LLC (USA), MM Kembla (Australia)

The market's ongoing evolution, which encompasses activities such as the introduction of new products, mergers and acquisitions, agreements, and expansions, is anticipated to drive its growth. Prominent copper tubes manufacturers have chosen to launch new products as a means to maintain their market presence.

Read More: Copper Tubes Companies

Copper Tubes Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 40.1 billion |

|

Revenue Forecast in 2028 |

USD 54.5 billion |

|

CAGR |

6.3% |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million), Volume (Kilotons) |

|

Segments |

Type, Thickness, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa and South America |

|

Companies |

Mueller Streamline Co.(US), KME Group S.p.A (Italy), Wieland Group (Germany), LUVATA (Finaland), KOBE STEEL, LTD. (Japan), Cambridge – Lee Industries LLC (USA), Shanghai Metal Corporation (China), Qindao Hongtai Copper Co., LTD (China), CERRO Flow Products LLC (USA), MM Kembla (Australia). |

This report categorizes the global copper tubes market based on type, thickness, application and region.

On the basis of type, the market has been segmented as follows:

- Straight lengths

- Coils

- Pancake or flattened tubes

- U-Bends

- Drawn tubes

- Others

On the basis of thickness, the market has been segmented as follows:

- Standard gauge

- Extra heavy gauge

- Thin wall gauge

- Capillary tubes

- Others

On the basis of application, the market has been segmented as follows:

- Plumbing

- HVACR

- Industrial

- Medical gas system

- Fire sprinkler system

- Automotive

- Others

On the basis of region, the market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In June 2023, Tomra Systems ASA (Norway) unveils its latest innovation AUTOSORT PULSE. This cutting edge technology machine incorporate dynamic laser induced breakdown spectroscopy (LIBS) and is desiged for high throughput sorting of aluminium alloys and opens up possibilities for green aluminium production.

- In June 2023, Galloo (Belgium) announced its joint venture with Stellantis (Netherlands) to facilitate the end of life vehicles recycling. The service is scheduled for a late 2023 launch and is set to target France, Belgium and Luxembourg expanding its operation in Europe.

- In January 2023, Wendt Corpoartion (US) announced its joint venture with Proman Infrastructure Service limited. (India) resulting in the establishment of a new company Wendt Proman Metal Recycling Pvt. Ltd. As it identified India and an emerging market for shredding and separation technologies.

- In October 2022, MBA Polymers, Inc. (US) has inaugurated its third facility in the UK, situated in the EMR Duddeston site in central Birmingham. This new site provides an opportunity for Uk based manufacturers to minimize plastic waste generation during their production processes and procure environmental friendly recycled materials through a closed loop supply chainfor postindustrial plastics.

- In July 2022, Machinex Industries, Inc. (Canada) announced a new project with long time partner Rumpke Waste and Recycling that includes the delivery of a brand new 56 ton per hour (TPH) residential single stream system in Columbus, Ohio. The new material recovery facility will feature the best sorting capabilities and most automation available. This will also be one of the largest dedicated residential single stream systems in the country.

- In May 2022, Tomra Systems ASA launched a new sorting equipment X-TRACT. This advanced version features a redesigned structure and revolutionary innovations. By leveraging Tomra’s cutting edge x-ray transmission (XRT) technology, it achieves remarkable advancement in metal and diamond recovery, redefining the industry benmarks for sensor based aluminium sorting.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the copper tubes market?

This study's forecast period for the copper tubes market is 2023-2028. The market is expected to grow at a CAGR of 6.3%, in terms of value, during the forecast period.

Who are the major key players in the copper tubes market?

The key players in this market are are Mueller Streamline Co.(US), KME Group S.p.A (Italy), Wieland Group (Germany), LUVATA (Finaland), KOBE STEEL, LTD. (Japan), Cambridge – Lee Industries LLC (USA), Shanghai Metal Corporation (China), Qindao Hongtai Copper Co., LTD (China), CERRO Flow Products LLC (USA), MM Kembla (Australia).

What are the major regulations of the copper tubes market in various countries?

Regulations governing the copper tubes market vary from country to country but often revolve around ensuring product quality, safety, and environmental compliance. In the United States, copper tubes used in plumbing systems must adhere to standards set by organizations like the ASTM (American Society for Testing and Materials) and the NSF (National Sanitation Foundation) to ensure safe drinking water delivery. Europe follows stringent EN (European Norm) standards for copper tube production and usage, emphasizing product quality and conformity. Environmental regulations in many countries impose restrictions on copper production and emissions, pushing the industry towards cleaner and more sustainable practices.

What are the drivers and opportunities for the copper tubes market?

The drivers are global expansion of the construction, expansion of the HVACR sector, continuous technological advancements. The opportunity being renewable energy industry to create new revenue pockets for copper tubes.

Which are the key technology trends prevailing in the copper tubes market?

In the copper tubes market, several key technology trends are shaping the industry. These include the adoption of advanced manufacturing techniques like continuous casting and extrusion to enhance quality and cost-efficiency, ongoing research into copper alloys to create materials with improved properties, and advancements in heat exchanger technology to maximize heat transfer and energy efficiency. Additionally, the integration of smart technologies and IoT into copper tube applications enables real-time monitoring and predictive maintenance. Eco-friendly coatings are being applied to enhance corrosion resistance, reducing environmental impact, while innovations in energy-efficient copper tubes are crucial for HVAC and renewable energy systems. Digitalization and automation streamline production processes, and sustainability efforts focus on recycling and reducing the environmental footprint. Although copper remains a preferred material, exploration of alternatives like plastics and composites is ongoing, and advancements in material testing and quality assurance ensure compliance with industry standards for safety and performance. These trends collectively underscore the industry's dedication to enhancing the efficiency, durability, and sustainability of copper tubes across diverse applications. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Global expansion of construction industry- Expansion of HVACR sector due to increasing global temperatures- Technological advancements enhancing efficiency and sustainability of copper tubesRESTRAINTS- Fluctuations in raw material prices- Environmental concerns and regulatory compliancesOPPORTUNITIES- Renewable energy industry to create new revenue pockets for copper tubesCHALLENGES- Shift in consumer preferences and increasing competition

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISSOURCING RAW MATERIALS- Copper ore extraction- ProcessingMANUFACTURE OF COPPER TUBES- Casting and smelting- Extrusion and drawing- Annealing- Cutting and shaping- Surface treatmentDISTRIBUTORSEND-USE INDUSTRIES

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.4 ECOSYSTEM MAPPING

-

6.5 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPES- Publication trends over last ten yearsINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS

- 6.7 TECHNOLOGY ANALYSIS

-

6.8 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY APPLICATIONAVERAGE SELLING PRICE, BY TYPEAVERAGE SELLING PRICE, BY THICKNESS

- 6.9 KEY CONFERENCES & EVENTS, 2023–2025

-

6.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

6.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR COPPER TUBE MANUFACTURERS

-

6.13 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

6.14 CASE STUDY ANALYSISOPTIMIZING HVACR EFFICIENCY WITH SMALLER DIAMETER COPPER TUBESNOVEL FORM OF PITTING CORROSION IN COPPER TUBES INDUCED BY SILICAINFECTION MINIMIZED IN SUBWAY WITH COPPER HANDRAILS IN SANTIAGO CITY

- 7.1 INTRODUCTION

-

7.2 PLUMBINGRELIABILITY AND EASE OF INSTALLATION TO DRIVE MARKET

-

7.3 HVACREFFICIENT HEAT TRANSFER AND FABRICATION TO DRIVE MARKET

-

7.4 INDUSTRIALHIGH THERMAL CONDUCTIVITY AND DURABILITY TO DRIVE MARKET

-

7.5 MARINERESISTANCE TO CORROSION IN SALTWATER ENVIRONMENTS TO DRIVE MARKET

-

7.6 AUTOMOTIVEEXCELLENT HEAT CONDUCTIVITY FOR RADIATORS AND AIR CONDITIONING SYSTEMS TO DRIVE MARKET

-

7.7 OTHER APPLICATIONSMEDICAL GAS SYSTEMSFIRE SPRINKLER SYSTEMSAUTOMATED CONTROL SYSTEMSINSTRUMENTATION AND MEASUREMENT DEVICES

- 8.1 INTRODUCTION

-

8.2 STANDARD GAGEEXCELLENT THERMAL CONDUCTIVITY AND CORROSION RESISTANCE TO DRIVE MARKET

-

8.3 EXTRA-HEAVY GAGEDURABILITY IN HEAVY-DUTY APPLICATIONS TO DRIVE MARKET

-

8.4 THIN-WALL GAGECOST-EFFECTIVENESS AND EASE OF INSTALLATION TO DRIVE MARKET

-

8.5 CAPILLARY TUBESEFFICIENT SEPARATION OF VOLATILE COMPOUNDS TO DRIVE MARKET

-

8.6 OTHERSCOPPER CLAD TUBESMICROTUBES- Efficient transportation and separation of minute liquid volumes to drive market

- 9.1 INTRODUCTION

- 9.2 MANUFACTURING OF COPPER TUBES

-

9.3 STRAIGHT LENGTHSHIGH THERMAL AND ELECTRICAL CONDUCTIVITY TO DRIVE MARKET

-

9.4 COILSSPACE EFFICIENCY AND REDUCED NEED FOR JOINTS AND BENDS TO DRIVE MARKET

-

9.5 PANCAKES OR FLATTENED TUBESMALLEABILITY AND THERMAL CONDUCTIVITY TO DRIVE MARKET

-

9.6 U-BENDSINCREASED RELIABILITY TO DRIVE MARKET

-

9.7 DRAWN TUBESUNIFORMITY AND PRECISION IN DIMENSIONS TO DRIVE MARKET

-

9.8 OTHER TYPESLARGER-SIZE LEVEL WOUND COILSINNER GROOVED TUBESENHANCED SURFACE TUBESCORRUGATED COPPER TUBES

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Growth of construction and automotive sectors to drive marketCANADA- Investment in renewable energy sources and maritime industry to drive marketMEXICO- Thriving mining and automotive industries to drive demand for copper tubes

-

10.3 EUROPERECESSION IMPACT ON EUROPEGERMANY- Rise in infrastructure development to drive marketUK- Environmental sustainability and energy efficiency to drive marketFRANCE- Rising demand for copper tubes from industrial applications to drive marketITALY- Growth of construction sector to fuel marketSPAIN- Huge investments in water supply and sanitation systems to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Vast electronics manufacturing sector to drive marketJAPAN- Technological advancements in hybrid and electric vehicles to drive marketSOUTH KOREA- Growth of maritime and chemical industries to drive demand for copper tubesINDIA- Increased demand for housing projects to drive marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICASAUDI ARABIA- Growing demand for renewable energy sources to drive marketSOUTH AFRICA- Growth of HVACR and automotive industries to drive marketREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICABRAZIL- Growing demand from plumbing & HVAC applications to drive marketARGENTINA- Rise in construction activities to drive marketREST OF SOUTH AMERICA

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY COPPER TUBE MANUFACTURERS

-

11.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- KOBE STEEL, LTD.- WIELAND GROUP- KME GROUP S.P.A.- LUVATA- CERRO FLOW PRODUCTS, INC.

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT ANALYSIS

-

11.5 STARTUP/SME EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING- COPPER TUBES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

11.6 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSMUELLER STREAMLINE CO.- Business overview- Products/Solutions/Services offered- MnM viewKME GROUP S.P.A.- Business overview- Products /Solutions/ Services offered- Recent developments- MnM viewSHANGHAI METAL CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewLUVATA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCERRO FLOW PRODUCTS, INC.- Business overview- Products/Solutions/Services offered- MnM viewCAMBRIDGE-LEE INDUSTRIES, LLC- Business overview- Products/Solutions/Services offered- MnM viewWIELAND GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewQINGDAO HONGTAI COPPER CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMM KEMBLA- Business overview- Products/Solutions/Services offered- MnM viewKOBE STEEL, LTD.- Business overview- Products/Solutions/Services offered- MnM view

-

12.2 OTHER PLAYERSUNIFLOW COPPER TUBESGOLDEN DRAGON PRECISE COPPER TUBE GROUP INC.JUNBAOCHENG STEEL LIMITEDMEHTA TUBES LIMITEDBRASSCO TUBE INDUSTRIESNIPPONTUBENINGBO JINTIAN COPPER (GROUP) CO., LTD.CUPORIHAILIANG GROUPMAKSAL TUBES (PTY) LTD.METTUBELYON COPPER ALLOYSCUBEX TUBINGS LIMITEDSEAH FS CO., LTD.TUBE TECH COPPER & ALLOYS PVT. LTD.

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 IMPACT OF PORTERS FIVE FORCES ON COPPER TUBES MARKET

- TABLE 2 COPPER TUBES MARKET: ECOSYSTEM

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 PATENT COUNT IN LAST 10 YEARS

- TABLE 9 TOP 20 PATENT OWNERS FOR COPPER TUBES

- TABLE 10 MAJOR PATENTS FOR COPPER TUBES

- TABLE 11 KEY TECHNOLOGIES OFFERED IN COPPER TUBES MARKET

- TABLE 12 COMPLEMENTARY TECHNOLOGIES OFFERED IN COPPER TUBES MARKET

- TABLE 13 ADJACENT TECHNOLOGIES OFFERED FOR COPPER TUBES

- TABLE 14 AVERAGE SELLING PRICE, BY REGION, 2020–2028 (USD/KG)

- TABLE 15 AVERAGE SELLING PRICE, BY APPLICATION, 2020–2028 (USD/KG)

- TABLE 16 AVERAGE SELLING PRICE, BY TYPE, 2020–2028 (USD/KG)

- TABLE 17 AVERAGE SELLING PRICE, BY THICKNESS, 2020–2028 (USD/KG)

- TABLE 18 COPPER TUBES MARKET: KEY CONFERENCES & EVENTS, 2023–2025

- TABLE 19 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP FIVE APPLICATIONS

- TABLE 20 KEY BUYING CRITERIA FOR END-USE APPLICATIONS

- TABLE 21 GDP TRENDS AND FORECAST, BY KEY COUNTRY, 2019–2028 (USD MILLION)

- TABLE 22 COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 23 COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 24 COPPER TUBES MARKET, BY THICKNESS, 2020–2028 (USD MILLION)

- TABLE 25 COPPER TUBES MARKET, BY THICKNESS, 2020–2028 (KILOTON)

- TABLE 26 COPPER TUBES MARKET, BY TYPE, 2020–2028 (USD MILLION)

- TABLE 27 COPPER TUBES MARKET, BY TYPE, 2020–2028 (KILOTON)

- TABLE 28 COPPER TUBES MARKET, BY REGION, 2020–2028 (USD MILLION)

- TABLE 29 COPPER TUBES MARKET, BY REGION, 2020–2028 (KILOTON)

- TABLE 30 NORTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2020–2028 (KILOTON)

- TABLE 32 NORTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 34 US: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 35 US: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 36 CANADA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 37 CANADA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 38 MEXICO: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 39 MEXICO: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 40 EUROPE: COPPER TUBES MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 41 EUROPE: COPPER TUBES MARKET, BY COUNTRY, 2020–2028 (KILOTON)

- TABLE 42 EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 43 EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 44 GERMANY: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 45 GERMANY: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 46 UK: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 47 UK: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 48 FRANCE: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 49 FRANCE: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 50 ITALY: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 51 ITALY: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 52 SPAIN: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 53 SPAIN: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 54 REST OF EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 55 REST OF EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 56 ASIA PACIFIC: COPPER TUBES MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 57 ASIA PACIFIC: COPPER TUBES MARKET, BY COUNTRY, 2020–2028 (KILOTON)

- TABLE 58 ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 60 CHINA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 61 CHINA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 62 JAPAN: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 63 JAPAN: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 64 SOUTH KOREA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 65 SOUTH KOREA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 66 INDIA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 67 INDIA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 68 REST OF ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 69 REST OF ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 70 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 71 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY COUNTRY, 2020–2028 (KILOTON)

- TABLE 72 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 73 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 74 SAUDI ARABIA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 75 SAUDI ARABIA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 76 SOUTH AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 77 SOUTH AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 78 REST OF MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 79 REST OF MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 80 SOUTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2020–2028 (USD MILLION)

- TABLE 81 SOUTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2020–2028 (KILOTON)

- TABLE 82 SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 83 SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 84 BRAZIL: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 85 BRAZIL: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 86 ARGENTINA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 87 ARGENTINA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 88 REST OF SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (USD MILLION)

- TABLE 89 REST OF SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2020–2028 (KILOTON)

- TABLE 90 COPPER TUBES MARKET: DEGREE OF COMPETITION

- TABLE 91 COPPER TUBES MARKET: KEY COMPANY APPLICATION FOOTPRINT

- TABLE 92 COPPER TUBES MARKET: KEY COMPANY TYPE FOOTPRINT

- TABLE 93 COPPER TUBES MARKET: KEY COMPANY THICKNESS FOOTPRINT

- TABLE 94 COPPER TUBES MARKET: KEY COMPANY REGIONAL FOOTPRINT

- TABLE 95 COPPER TUBES MARKET: KEY STARTUPS/SMES

- TABLE 96 COPPER TUBES MARKET: APPLICATION FOOTPRINT OF SME PLAYERS

- TABLE 97 COPPER TUBES MARKET: TYPE FOOTPRINT OF SME PLAYERS

- TABLE 98 COPPER TUBES MARKET: THICKNESS FOOTPRINT OF SME PLAYERS

- TABLE 99 COPPER TUBES MARKET: REGION FOOTPRINT OF SME PLAYERS

- TABLE 100 COPPER TUBES MARKET: PRODUCT LAUNCHES (2020–2023)

- TABLE 101 COPPER TUBES MARKET: DEALS (2017–2023)

- TABLE 102 COPPER TUBES MARKET: OTHER DEVELOPMENTS (2016–2023)

- TABLE 103 MUELLER STREAMLINE CO.: COMPANY OVERVIEW

- TABLE 104 MUELLER STREAMLINE CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 105 KME GROUP S.P.A.: COMPANY OVERVIEW

- TABLE 106 KME GROUP S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 107 KME GROUP S.P.A.: DEALS

- TABLE 108 SHANGHAI METAL CORPORATION: COMPANY OVERVIEW

- TABLE 109 SHANGHAI METAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 110 LUVATA: COMPANY OVERVIEW

- TABLE 111 LUVATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 LUVATA: OTHER DEVELOPMENTS

- TABLE 113 CERRO FLOW PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 114 CERRO FLOW PRODUCTS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 115 CAMBRIDGE-LEE INDUSTRIES, LLC: COMPANY OVERVIEW

- TABLE 116 CAMBRIDGE-LEE INDUSTRIES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 117 WIELAND GROUP: COMPANY OVERVIEW

- TABLE 118 WIELAND GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 119 WIELAND GROUP: PRODUCT LAUNCHES

- TABLE 120 WIELAND GROUP: DEALS

- TABLE 121 WIELAND GROUP: OTHER DEVELOPMENTS

- TABLE 122 QINGDAO HONGTAI COPPER CO., LTD.: COMPANY OVERVIEW

- TABLE 123 QINGDAO HONGTAI COPPER CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 QINGDAO HONGTAI COPPER CO., LTD.: DEALS

- TABLE 125 QINGDAO HONGTAI COPPER CO., LTD.: OTHER DEVELOPMENTS

- TABLE 126 MM KEMBLA: COMPANY OVERVIEW

- TABLE 127 MM KEMBLA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 KOBE STEEL, LTD.: COMPANY OVERVIEW

- TABLE 129 KOBE STEEL, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 UNIFLOW COPPER TUBES: COMPANY OVERVIEW

- TABLE 131 GOLDEN DRAGON PRECISE COPPER TUBE GROUP INC.: COMPANY OVERVIEW

- TABLE 132 JUNBAOCHENG STEEL LIMITED: COMPANY OVERVIEW

- TABLE 133 MEHTA TUBES LIMITED: COMPANY OVERVIEW

- TABLE 134 BRASSCO TUBE INDUSTRIES: COMPANY OVERVIEW

- TABLE 135 NIPPONTUBE: COMPANY OVERVIEW

- TABLE 136 NINGBO JINTIAN COPPER (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 137 CUPORI: COMPANY OVERVIEW

- TABLE 138 HAILIANG GROUP: COMPANY OVERVIEW

- TABLE 139 MAKSAL TUBES (PTY) LTD.: COMPANY OVERVIEW

- TABLE 140 METTUBE: COMPANY OVERVIEW

- TABLE 141 LYON COPPER ALLOYS: COMPANY OVERVIEW

- TABLE 142 CUBEX TUBINGS LIMITED: COMPANY OVERVIEW

- TABLE 143 SEAH FS CO., LTD.: COMPANY OVERVIEW

- TABLE 144 TUBE TECH COPPER & ALLOYS PVT. LTD.: COMPANY OVERVIEW

- FIGURE 1 COPPER TUBES MARKET SEGMENTATION

- FIGURE 2 COPPER TUBES MARKET: RESEARCH DESIGN

- FIGURE 3 COPPER TUBES MARKET: DATA TRIANGULATION

- FIGURE 4 HVACR APPLICATION SEGMENT TO DOMINATE COPPER TUBES MARKET BETWEEN 2023 AND 2028

- FIGURE 5 STRAIGHT LENGTHS TYPE TO DOMINATE MARKET BETWEEN 2023 AND 2028

- FIGURE 6 STANDARD GAGE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 7 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 EXPANSION OF CONSTRUCTION AND HVACR SECTORS TO DRIVE MARKET

- FIGURE 9 HVACR TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 11 COILS TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 STANDARD GAGE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN COPPER TUBES MARKET

- FIGURE 14 COPPER TUBES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 15 PORTER’S FIVE FORCES ANALYSIS: COPPER TUBES MARKET

- FIGURE 16 NUMBER OF PATENTS GRANTED OVER LAST 10 YEARS

- FIGURE 17 REGIONAL ANALYSIS OF PATENTS GRANTED FOR COPPER TUBES

- FIGURE 18 TOP 10 COMPANIES WITH LARGEST NUMBER OF PATENTS IN LAST TEN YEARS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FIVE APPLICATIONS

- FIGURE 20 KEY BUYING CRITERIA FOR END-USE APPLICATIONS

- FIGURE 21 IMPORT OF COPPER TUBES, BY COUNTRY, 2019–2022 (USD MILLION)

- FIGURE 22 EXPORT OF COPPER TUBES, BY COUNTRY, 2019–2022 (USD MILLION)

- FIGURE 23 REVENUE SHIFT OF COPPER TUBES MARKET

- FIGURE 24 HVACR SEGMENT TO LEAD COPPER TUBES MARKET DURING FORECAST PERIOD

- FIGURE 25 STANDARD GAGE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 26 STRAIGHT LENGTHS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 27 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 28 NORTH AMERICA: COPPER TUBES MARKET SNAPSHOT

- FIGURE 29 EUROPE: COPPER TUBES MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: COPPER TUBES MARKET SNAPSHOT

- FIGURE 31 RANKING OF TOP FIVE PLAYERS IN COPPER TUBES MARKET, 2022

- FIGURE 32 COPPER TUBES MARKET: SHARE OF KEY PLAYERS

- FIGURE 33 COPPER TUBES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 34 COPPER TUBES MARKET: STARTUP/SME EVALUATION MATRIX

- FIGURE 35 KOBE STEEL, LTD.: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the copper tubes market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

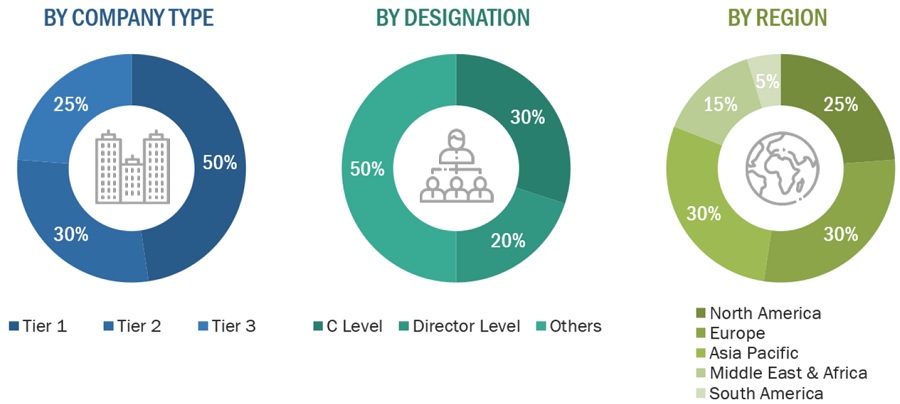

The copper tubes market comprises several stakeholders in the value chain, which include raw material sourcing, component manufacturing, distributors, and end-use industries. Various primary sources from the supply and demand sides of the copper tubes market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use industries. The primary sources from the supply side include manufacturers, associations, and institutions involved in the copper tubes industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, thickness application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of copper tubes and the future outlook of their business, which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Mueller Streamline Co. |

Individual Industry Expert |

|

KME Group S.p.A |

Service Engineer |

|

Wieland Group |

Director |

|

LUVATA |

Sales Engineer |

|

KOBE STEEL, LTD. |

R&D Manager |

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the copper tubes market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's value chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Copper Tubes Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Copper Tubes Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Copper tubes refer to cylindrical tubular products made primarily of copper metal, characterized by their versatile properties and wide range of applications across various industries. These tubes are manufactured in different forms, including seamless and welded variants, with varying diameters, thicknesses, and lengths to suit specific purposes. Copper tubes find extensive use in plumbing systems, HVAC (heating, ventilation, and air conditioning) installations, and electrical applications due to copper's excellent heat and electrical conductivity, corrosion resistance, and malleability. In the electrical sector, copper tubes are employed for their superior electrical conductivity, making them ideal for manufacturing components like connectors, coils, and heat exchangers in various electronic devices and electrical appliances The automotive industry also relies on copper tubes for applications such as radiators and air conditioning systems, where copper's thermal conductivity and durability are advantageous. The copper tubes serves as a critical component in multiple industries, facilitating the efficient flow of fluids, the transmission of electricity, and the exchange of heat, while capitalizing on copper's exceptional properties to meet a broad spectrum of industrial needs.

Key Stakeholders

- Copper tubes manufacturers.

- Raw material suppliers

- End-use companies.

- Copper tubes traders, distributors, and suppliers.

- Research organizations.

- Industry associations

- Governments and research organizations

Report Objectives

- To define, describe, and forecast the size of the copper tubes market in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on type, thickness ,application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Copper Tubes Market