Contactless Connector Market by Product Type (Wireless Charging, Wireless Data Transfer), Technology (Inductive Coupling, RF, Magnetic Field), Operation (Simplex, Half-duplex, Full-duplex), Data Rate Gbps (1, 3, Up to 6) - Global Forecast to 2029

Updated on : October 23, 2024

Contactless Connector Market Size & Growth

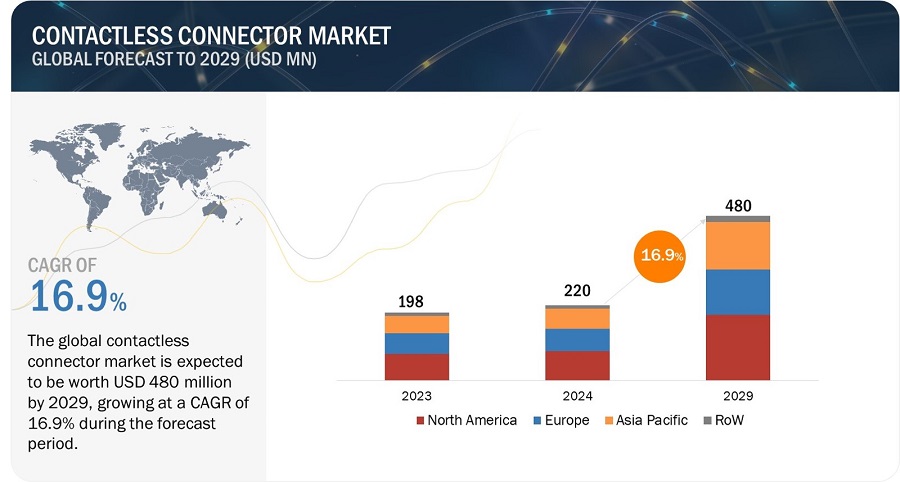

[217 Pages Report] The global contactless connector market size is expected to be valued at USD 220 million in 2024 and is projected to reach USD 480 million by 2029, growing at a CAGR of 16.9% from 2024 to 2029. The growing popularity of wireless charging technology in consumer electronics, automotive, and other industries fuels the demand for contactless connectors. Wireless charging offers users a convenient and cable-free way to power their devices, enhancing user experience and convenience. Contactless connectors enable wireless charging by facilitating power transmission between the charging pad or dock and the device, thereby driving market demand.

Contactless Connector Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Contactless Connector Market Trends

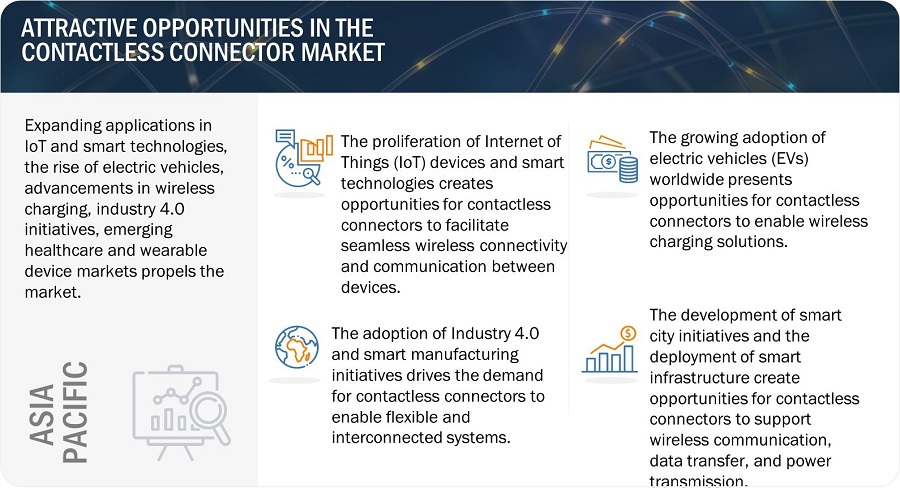

Driver: Increasing adoption of Internet of Things (IoT) devices across various industries

The increasing adoption of IoT devices drives the contactless connector market by creating a demand for seamless wireless connectivity solutions. Contactless connectors play a pivotal role in facilitating the communication and data exchange between IoT devices, enabling the integration of diverse sensors, actuators, and controllers without the constraints of physical connections. This trend is fueled by the need for flexible and interconnected systems that can support the growing complexity and scale of IoT deployments, thereby driving the expansion of the contactless connector market.

Restraint: Risk of system vulnerabilities and exploits

The risk of system vulnerabilities poses a restraint for the contactless connector market as it raises concerns about potential security breaches and data integrity issues. With wireless communication and data transfer integral to contactless connectors, vulnerabilities such as unauthorized access, interception of data, and malicious attacks become significant risks. Addressing these concerns requires robust encryption protocols, authentication mechanisms, and cybersecurity measures to ensure the integrity and security of data transmission, which may increase the complexity and cost of implementing contactless connector solutions, thus restraining market growth.

Opportunity: The evolution of smart homes and the increasing demand for connected consumer electronics devices

The evolution of smart homes and the growing demand for connected devices present significant opportunities for the contactless connector market. As smart home ecosystems become more prevalent, contactless connectors enable seamless wireless connectivity between various devices, sensors, and appliances, facilitating interoperability and enhancing user experience. With the increasing adoption of connected devices such as smart thermostats, security cameras, and voice assistants, the demand for contactless connectors grows as they enable convenient and reliable communication without the constraints of physical connections, positioning the market for substantial growth in the burgeoning smart home industry.

Challenge: Risk of rapid technological changes and obsolescence

The risk of rapid technological changes and obsolescence poses a significant challenge for the contactless connector market as advancements in wireless communication, power transfer, and data transmission technologies may quickly render existing connector solutions outdated. This challenge necessitates continuous innovation and adaptation to emerging technologies to stay competitive and meet evolving customer demands. Moreover, the lifecycle of contactless connector products may be shortened due to rapid technological obsolescence, requiring manufacturers to invest in research and development to maintain relevance in the dynamic market landscape. Additionally, the risk of investing in outdated technology could deter potential adopters, further complicating market growth.

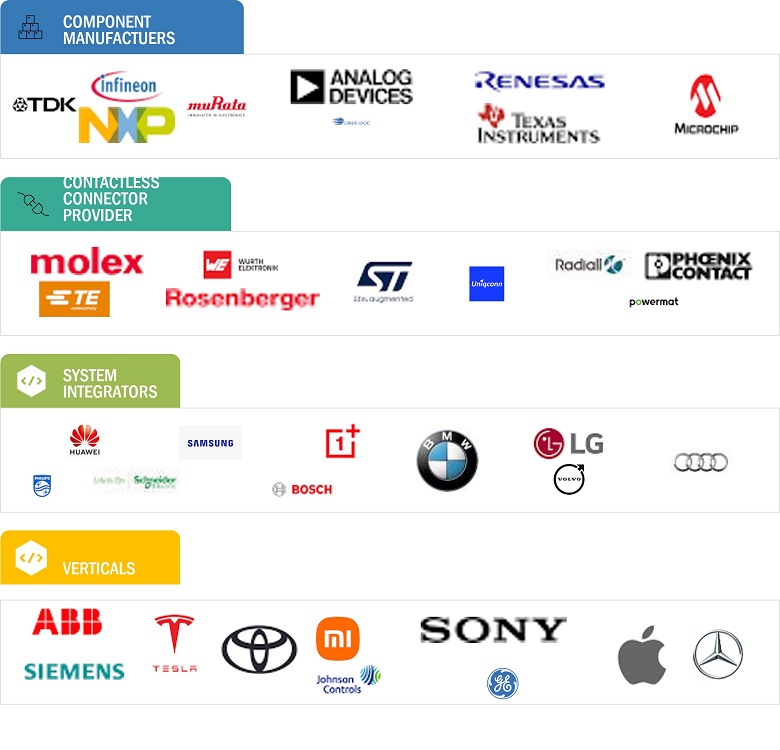

Contactless Connector Market Ecosystem

The contactless connector market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include STMicroelectronics from Switzerland, TE Connectivity from Switzerland, Molex from the US, Rosenberger Hochfrequenztechnik GmbH & Co. KG from Germany, and Radiall from France.

Contactless Connector Market Share

Based on the product type, wireless charging connectors hold the highest market share during the forecast period

the expanding ecosystem of smart home devices and IoT gadgets creates additional opportunities for wireless charging connectors. With the proliferation of connected devices in homes and workplaces, there's a growing need for seamless charging solutions that can accommodate multiple devices simultaneously, further driving the demand for wireless charging connectors. Overall, the increasing popularity of smart devices plays a significant role in driving the adoption of wireless charging technology and, consequently, the growth of the wireless charging connector market.

Based on technology, the contactless connector market for inductive coupling to hold the highest market share during the forecast period

The contactless connector market for inductive coupling technology is growing due to several key factors. The increasing adoption of electric vehicles (EVs) and the need for wireless charging solutions in automotive applications are driving the expansion of the contactless connector market for inductive coupling technology. Inductive coupling technology enables convenient and efficient charging of EVs without the need for cumbersome cables, thus improving user experience and promoting the widespread adoption of electric vehicles.

Based on data rate, the contactless connector market for 1 Gbps data rate to hold the highest market share during the forecast period

the proliferation of IoT devices, smart technologies, and edge computing applications drives the need for high-speed connectivity solutions capable of handling large volumes of data generated by sensors, devices, and systems. Contactless connectors with 1 Gbps data rates enable efficient communication between IoT devices, edge servers, and cloud platforms, facilitating the deployment of smart city, industrial automation, and IoT solutions. Additionally, the evolution of wireless communication standards such as Wi-Fi 6 (802.11ax) and 5G technology is driving the demand for contactless connectors indsutry capable of supporting higher data rates to meet the requirements of next-generation wireless networks.

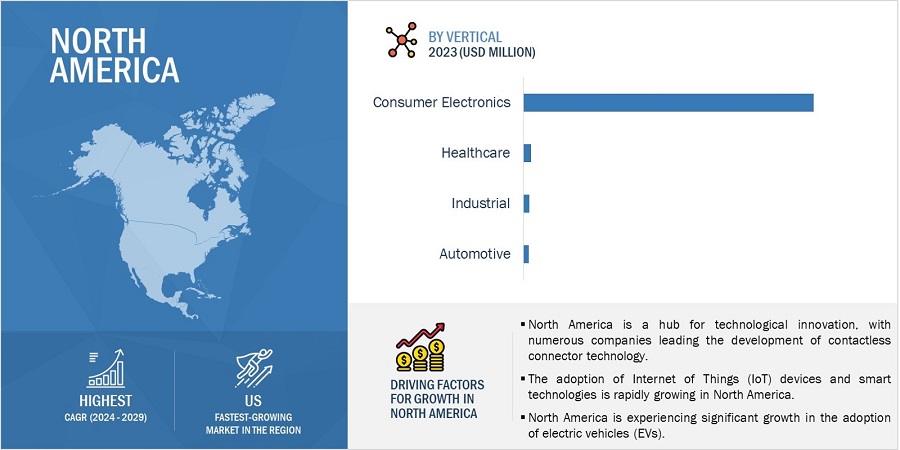

Based on vertical, the contactless connector for consumer electronics to hold the highest market share during the forecast period

Rapid technological advancements in the contactless connector market drive growth in the consumer electronics vertical by enabling innovative features and enhancing user experience. These advancements include data transfer speeds, efficiency, reliability, and compatibility improvements. As consumers increasingly demand high-performance and convenient solutions, such as wireless charging, seamless data transfer, and compact designs, technological advancements in contactless connectors enable manufacturers to meet these expectations and differentiate their products in a competitive market.

Contactless Connector Market Regional Analysis

Contactless connector market in North America to hold the highest market share during the forecast period

Increasing infrastructure investment in North America drives the contactless connector market by creating opportunities to deploy contactless technologies in various sectors. This investment includes the development of wireless charging infrastructure for electric vehicles, smart city initiatives, and expanding telecommunications networks. Contactless connectors enable seamless communication, data transfer, and power transmission in these infrastructure projects, driving the demand for contactless connector solutions. As North America invests in building smart and sustainable infrastructure, the need for reliable and efficient contactless connectors increases, stimulating market growth in the region.

Contactless Connector Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Contactless Connector Companies - Key Market Players:

The contactless connector companies is dominated by players such as

- STMicroelectronics (Switzerland),

- TE Connectivity (Switzerland),

- Molex (US),

- Rosenberger Hochfrequenztechnik GmbH & Co. KG (Germany),

- Radiall (France), and others.

Contactless Connector Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 220 million in 2024 |

| Projected Market Size | USD 480 million by 2029 |

| Growth Rate | At CAGR of 16.9% |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

The major market players include STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Molex (US), Rosenberger Hochfrequenztechnik GmbH & Co. KG (Germany), Radiall (France), Weidmüller (Germany), Uniqconn Inc. (South Korea), Phoenix Contact (Germany), Commscope (US), Omega Engineering Inc. (US). (Total 25 players are profiled) |

Contactless Connector Market Highlights

The study categorizes the contactless connector market based on the following segments:

|

Segment |

Subsegment |

|

By Product Type |

|

|

By Technology |

|

|

By Data Rate |

|

|

By Mode of Operation |

|

|

By Vertical |

|

|

By Rregion |

|

Recent Developments In Contactless Connector Industry

- In September 2023, Molex introduced the MX60 series of contactless connectivity solutions. These low-power, high-speed, solid-state devices feature miniaturized mmWave RF transceivers and built-in antennas in one package for faster, simpler, device-to-device communications without physical cables or connectors.

Frequently Asked Questions:

What are the major driving factors and opportunities in the contactless connector market?

Some of the major driving factors for the growth of this market include the Increasing adoption of Internet of Things (IoT) devices across various industries, The growing popularity of wireless charging technologies, the Rising trend towards Industry 4.0 and smart manufacturing boosts the demand and Rapid advancements in communication technologies. Moreover, the Evolution of smart homes and the increasing demand for connected consumer electronics devices, Government initiatives aimed at developing smart cities and enhancing urban infrastructure, and the Healthcare industry's increasing reliance on connected devices and medical equipment are some of the critical opportunities for the contactless connector market.

Which region is expected to hold the highest market share?

The contactless connector market share is higher in North America due to several factors. Firstly, North America has a robust technological infrastructure and a high level of innovation, with many companies leading the development of contactless connector technology. Additionally, the region has a strong consumer demand for cutting-edge technology and convenience, driving the adoption of contactless connectors in various industries such as consumer electronics, automotive, and healthcare. Furthermore, supportive regulatory frameworks and significant investments in infrastructure, including wireless charging infrastructure and smart city initiatives, contribute to the growth of the contactless connector market in North America.

Who are the leading players in the global contactless connector market?

Companies such as STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Molex (US), Rosenberger Hochfrequenztechnik GmbH & Co. KG (Germany), and Radiall (France) are the leading players in the market.

What are some of the technological advancements in the market?

Key technological advancements in the contactless connector market include data transfer speeds, efficiency, reliability, and compatibility improvements. These advancements enable faster and more reliable wireless communication, seamless power transfer, and enhanced device interoperability. Additionally, innovations such as advanced materials, miniaturization, and improved signal integrity contribute to the development of compact and high-performance contactless connectors, meeting the evolving needs of consumers and industries for convenient and reliable connectivity solutions.

What is the impact of the global recession on the market?

The contactless connector industry is expected to be slightly impacted by the recession and rising inflation in 2024. The growth primarily depends on the production and sales of a broad range of semiconductor devices, including ICs (Integrated Circuits), antenna, printed circuit boards (PCBs), capacitors, resistors, and inductors, which are primary components of contactless connector systems. With the increased inflation, interest rates, and unemployment, demand for contactless connectors among consumers and enterprises is bound to be less, which, in turn, will affect production and investments across the globe. Due to the recession, verticals such as consumer electronics, industrial, healthcare, and automotive, which use contactless connectors, would have low CAPEX spending for contactless connector-based development.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

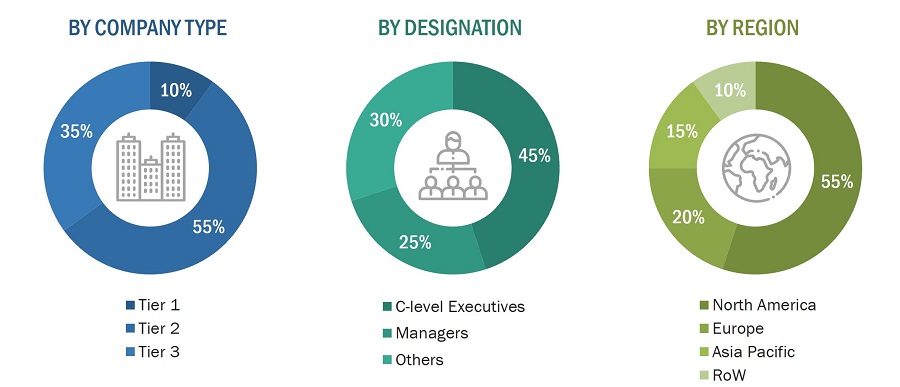

The study involved four major activities in estimating the current size of the contactless connector market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

SWEB LINK |

|

Federal Communications Commission (FCC) |

|

|

National Institute of Standards and Technology (NIST) |

|

|

Ministry of Electronics and Information Technology (MeitY) |

|

|

Ministry of Industry and Information Technology (MIIT) |

|

|

Ministry of Internal Affairs and Communications (MIC) |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the contactless connector market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the contactless connector market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

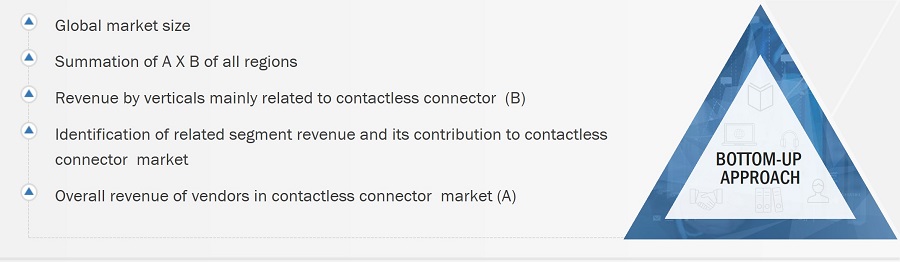

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the contactless connector market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various verticals using or expected to implement Contactless connector

- Analyzing each verticals, along with the major related companies and Contactless connector providers

- Estimating the Contactless connector market for verticals

- Understanding the demand generated by companies operating across different verticals

- Tracking the ongoing and upcoming implementation of projects based on Contactless connector technology by vertical and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of Contactless connector products designed and developed vertically. This information would help analyze the breakdown of the scope of work carried out by each major company in the Contactless connector market

- Arriving at the market estimates by analyzing Contactless connector companies as per their countries, and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

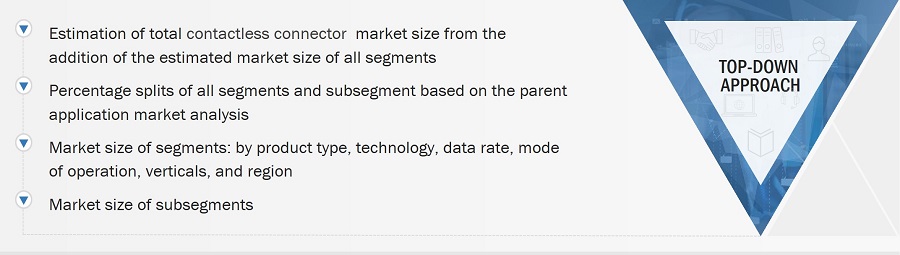

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various verticals.

- Building and developing the information related to the market revenue generated by key Contactless connector manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of Contactless connector products in various verticals

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of Contactless connector, and the level of solutions offered in verticals

- Impact of the recession on the steps mentioned above has also been considered.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Contactless connector encompass a comprehensive set of measures, technologies, and practices designed to protect physical assets, facilities, and individuals from unauthorized access, theft, vandalism, and other potential threats. These solutions often include a combination of hardware and software components such as access control systems, surveillance cameras, perimeter barriers (e.g., fences, gates), alarm systems, biometric identification systems, and visitor management systems. The primary goal is to create a secure environment that deters intrusions, monitors activities and responds promptly to security incidents. By deploying tailored physical contactless connector, organizations can safeguard their premises, assets, and personnel, thereby mitigating risks, ensuring safety compliance, and maintaining operational continuity.

Key Stakeholders

- Component Manufacturers

- End-User Organizations

- System Integrators

- Consumers

- Regulatory Bodies and Compliance Agencies

- Research Institutions

- Distributors and Resellers

- Industry Associations and Organizations

- Investors and Financial Institutions

Report Objectives

- To define, describe, and forecast the contactless connector market based on product type, technology, data rate, mode of operation, vertical, and region.

- To forecast the shipment data of contactless connector market.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as collaborations, partnerships, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the contactless connector market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the contactless connector market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the contactless connector market.

Growth opportunities and latent adjacency in Contactless Connector Market