Colorless Polyimide Films Market by Application (Flexible Displays, Flexible Solar Cells, Flexible Printed Circuit Boards, Lighting Equipment), End-Use Industry (Electronics, Solar, Medical), and Region - Global Forecast to 2027

Colorless Polyimide Films Market

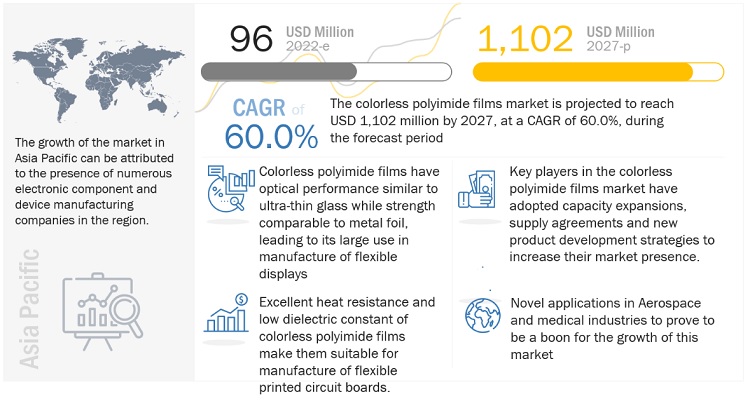

The global colorless polyimide films market was valued at USD 96 million in 2022 and is projected to reach USD 1,102 million by 2027, growing at a cagr 60.0% from 2022 to 2027. The increasing demand for colorless polyimide films from applications such as flexible displays, flexible solar cells, and flexible printed circuit boards, among others, is expected to drive the colorless polyimide films market.

Attractive Opportunities in the Colorless Polyimide Films Market

e-estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Colorless Polyimide Films Market Dynamics

Driver: Increasing demand for the development of flexible displays for electronic and optoelectronic devices

In recent years, there has been significant development in flexible active-matrix organic light-emitting diode (AMOLED) display panels. Flexible substrates are being preferred by AMOLED display manufacturers as a replacement to hard glass as these substrates can make displays thinner, lighter, and less fragmented. In recent years, three substrates gained traction for manufacturing flexible displays, namely, ultra-thin glass, colorless polyimide films, and metal foil. Colorless polyimide films not only have optical transmittance properties similar to ultra-thin glass but also possess toughness comparable to metal foils. Hence, display manufacturers and OEMs are preferring to use these films in their products. For instance, HP’s upcoming foldable screen laptop with a screen size of 17 inches will have LG’s foldable display panel, which will be manufactured using colorless polyimide films from SK IE Technology Company. Furthermore, major phone manufacturers are in the phase of developing the next-gen of their flexible smartphone offerings such as Samsung’s Galaxy Fold, Huawei’s Mate X, and Xiaomi’s Mix Fold. Thus, the demand for polyimide films is expected to be driven by the increase in sales of these flexible electronics.

Restraints: High manufacturing cost and limited availability of monomers for synthesis

Although flexible displays are gaining traction across the globe, they are still preferred by the elite class of society owing to the high cost of manufacturing these panels. The high cost is owing to the high manufacturing cost of colorless polyimide films and the limited availability of monomers for the synthesis of colorless polyimide resin. A report by the OLED Association claims that the cost of colorless polyimide films is 2 to 5 times higher than the cost of a conventional polyimide film and around double as compared to the popular gorilla glass panels used in most commercial smartphone displays. Thus, such a high procurement cost primarily associated with the monomer used during synthesis acts as a restraint for the growth of this market.

Opportunities: Increasing use in aerospace and medical end-use industries

Although the earliest use of polyimide films in aerospace applications can be traced back to the Apollo 11 moon landing wherein conventional Kapton polyimide films were used, its demand is still gaining impetus in the aerospace industry. NASA, in September 2022, announced that its upcoming Artemis I mission will be powered by a solar sail manufactured using NeXolve’s colorless polyimide films. The sail is expected to be very thin – 40 to 100 times thinner than a piece of writing paper (about 2.5 microns).

On the other hand, as colorless polyimide films offer excellent optical quality, are lightweight, and have excellent thermal stability, they are gaining huge traction in the manufacture of medical tubing for drug delivery applications. These novel application areas could provide an excellent growth opportunity for film manufacturers operating in this market.

Challenges: Achieving product chemistry and consistency

Colorless polyimide films have garnered much attention from the optoelectronics industry due to their high heat & chemical resistance, superior mechanical properties, and excellent dielectric features. However, one of the most challenging aspects of fabricating these films is achieving an equilibrium between high-temperature stability and high optical transparency. Therefore, traditional fabricating methods of polyimide films are not optimal to generate the colorless variant. This serves as a major challenge for the market.

Increasing demand for flexible optoelectronics driving the demand for colorless polyimide films for manufacturing flexible display panels

In recent years, millennials and subsequent generations have become fond of using devices such as smartphones and laptops for sharing and consumption of data and entertainment media. In order to attract these customers, electronics manufacturers have given the freedom to designers for development of attractive designs in smartphones including flexible and high-resolution displays, color-changing back panels, and even moving camera setups, among others. Companies such as Samsung, Xiaomi, Lenovo, Motorola, and Oppo have already introduced about 2-3 generations of their flexible smartphones. Laptop manufacturers such as Asus and HP are also following suit and are developing laptops with foldable screens. Thus, as these electronics gain traction in the upcoming years, the demand for flexible displays is going to expand exponentially, further translating into the growth of the colorless polyimide films market.

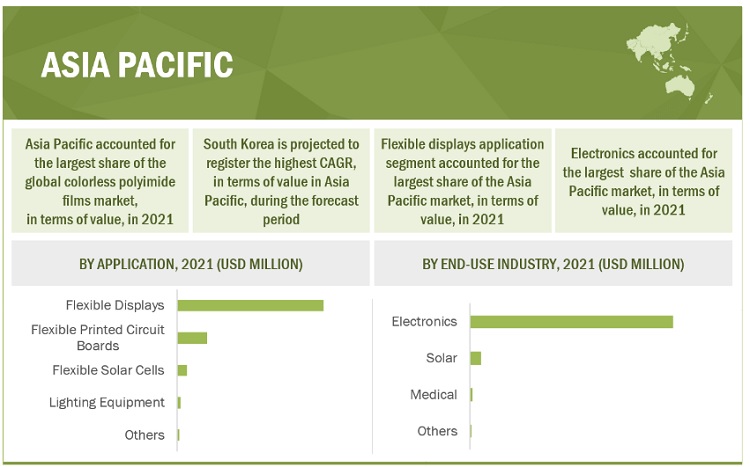

Electronics end-use industry is projected to account for the largest share during the forecast period

Colorless polyimides provide excellent thermo-mechanical properties, have high chemical resistance, and are also optically transparent. These properties are suitable for manufacturing electronic components such as flexible displays and flexible printed circuit boards. With electronics companies constantly developing new products to attract potential customers, including the likes of foldable smartphones, flexible screens for laptops, and curved displays in televisions, the demand for colorless polyimides films is expected to grow during the forecast period.

Consumption of colorless polyimide films in Asia Pacific to account for the largest share during the forecast period due to the presence of numerous electronic manufacturing companies

Asia Pacific is the dominant market for colorless polyimide films. Innovation, price deflation, and rising household incomes, especially in emerging markets in the Asia Pacific, have resulted in high demand for consumer electronics products in the region. Electronics companies including Oneplus, Xiaomi, Samsung, and LG, present in Asia Pacific, are well-positioned in the field of flexible electronics and dominate their commercial applications. These companies have been at the forefront in the development of electronics with flexible design using colorless polyimide films in their components. Research capabilities of these companies have become adept due to government support in the region for the manufacturing sector. Furthermore, key companies manufacturing polyimide films primarily have their manufacturing base in East Asian countries like China, South Korea, Taiwan, and Japan, which help maintain the supply-demand equilibrium.

To know about the assumptions considered for the study, download the pdf brochure

Colorless Polyimide Films Market Players

Key players in this market are DuPont (US), Kaneka Corporation (Japan), Kolon Industries Inc. (South Korea), SK Innovation Co., Ltd. (South Korea), and Sumitomo Chemical Company Ltd. (Japan). Other noteworthy public and private players in this market are Wuhan Imide New Materials Technology Co., Ltd. (China), Industrial Summit Technology (Japan), NeXolve Holding Company (US), Wuxi Shunxuan New Materials Co., Ltd. (China), Suzhou Kinyu Electronics Co., Ltd. (China), Changchun Gao Qi Polyimide Material Co., Ltd. (China), Zymergen Inc. (US), and Dr. Dietrich Muller GmbH (Germany). These players have expansions, and new product development as the major strategies to consolidate their position in the market.

Colorless Polyimide Films Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018 - 2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Thousand/USD Million) |

|

Segments Covered |

Application, End-use Industry and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies Covered |

DuPont (US), Kaneka Corporation (Japan), Kolon Industries Inc. (South Korea), SK Innovation Co., Ltd. (South Korea), Sumitomo Chemical Company Ltd. (Japan), Wuhan Imide New Materials Technology Co., Ltd. (China), Industrial Summit Technology Corporation (Japan), NeXolve Holding Company (US), Wuxi Shunxuan New Materials Co., Ltd. (China), Suzhou Kinyu Electronics Co., Ltd. (China), Changchun Gao Qi Polyimide Material Co., Ltd. (China), Zymergen Inc. (US), and Dr. Dietrich Muller GmbH (Germany) |

This research report categorizes the colorless polyimide films market industry based on application, end-use industry, and region.

Based on application, the colorless polyimide films market has been segmented into:

- Flexible Displays

- Flexible Solar Cells

- Flexible Printed Circuit Boards

- Lighting Equipment

- Others (Optical fibers, touch panels, reflectors & connectors for space antennas, and drug delivery tubes)

Based on end-use industry, the colorless polyimide films market industry has been segmented into:

- Electronics

- Solar Energy

- Medical

- Others (aviation and space research)

Based on the region, the colorless polyimide films market has been segmented into:

- Asia Pacific

- North America

- Europe

- Rest of the World

Recent Developments

- In the first half of 2021, Kolon Industries announced it was selected as the preferred supplier of transparent polyimide films for the cover window application in Xiaomi’s first foldable smartphone, Mi MIX FOLD.

- In November 2020, Kaneka Corporation introduced its super heat-resistant polyimide film, Pixeo-IB for application in the processing of high-speed, high-frequency 5G. The company has targeted the fast-growing technology in order to gain the first mover’s advantage in the region for this application area.

- In April 2022, SK Innovation Company Ltd. was selected to supply colorless polyimide films for Asus’ first foldable display in Zenbook 17 fold laptop. Asus is expected to manufacture 10,000 of these laptops in its first batch and is expected to further expand the supply agreement in the near future.

Frequently Asked Questions (FAQ):

What is a colorless polyimide film?

According to the Korean Society of Industrial and Engineering Chemistry, a colorless polyimide film is a thin film of polymeric optical material having a transmittance rate of approximately 90%, a linear thermal expansion coefficient of less than 30 parts per million (ppm) per 1ºC increase in temperature, water vapor transmission rate of less than 10-5 cm3/m2 per day, oxygen transmission rate less than 10-6 g/m2 per day, and thermal stability at 300 ºC.

What are the different applications for colorless polyimide films?

Colorless polyimide films are used in manufacturing flexible displays, flexible printed circuit boards, flexible solar cells, lighting equipment, optical fibers, touch panels, reflectors & connectors for space antennas, and drug delivery tubes.

Who are the major players involved in this market?

DuPont (US), Kaneka Corporation (Japan), Kolon Industries Inc. (South Korea), SK Innovation Co., Ltd. (South Korea), and Sumitomo Chemical Company Ltd. (Japan) are the key players involved in this market

What are the key driving factors for the growth of the global colorless polyimide films market?

Increased demand for the manufacturing of flexible electronics and optoelectronic devices is driving the growth of this market.

What is the biggest challenge for the growth of the global colorless polyimide films market?

Achieving consistency in product chemistry and optical transparency are the biggest challenges hindering the growth of the colorless polyimide films market.

What are the key regions in the global colorless polyimide films market?

In terms of region, the key markets are observed to be in Asia Pacific countries such as South Korea, China, Japan, and Taiwan, due to the presence of numerous electronic manufacturing companies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

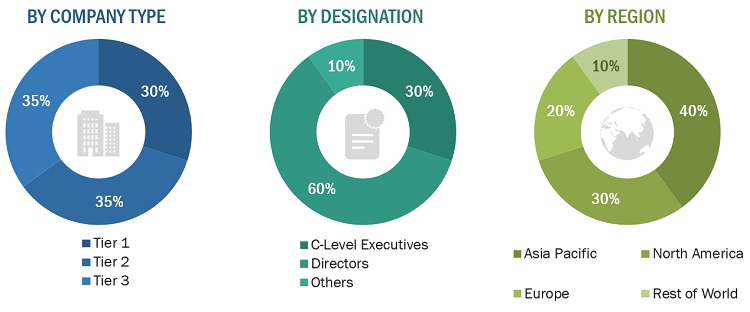

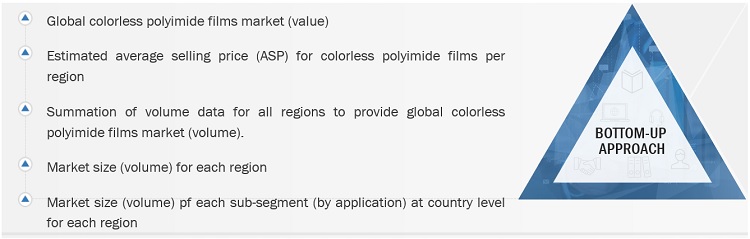

This study involved four major activities to estimate the current size of the colorless polyimide films market. Exhaustive secondary research was undertaken to collect information on the colorless polyimide films industry, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the colorless polyimide films value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the colorless polyimide films market.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet. Other key secondary sources were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analysed to determine the overall market size, further validated by primary research.

Primary Research

The colorless polyimide films market comprises several stakeholders in the value chain, including raw material suppliers, product manufacturers, contractors, research organizations, and end users. In the primary research process, experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from major companies and organizations operating in the colorless polyimide films industry. Primary sources from the demand side included end-users such as flexible printed circuit board manufacturers, solar cell manufacturers, flexible display manufacturers, and OEMs.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the colorless polyimide films market. These methods were also used extensively to estimate the size of various segments and sub-segments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research

- The value chain of the industry and the market size of the colorless polyimide films, in terms of value, were determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research includes the study of reports, reviews, and newsletters of the key market players along with extensive interviews for opinions from leaders, such as directors and marketing executives

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size - using the market size estimation processes as explained above - the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the market size for colorless polyimide films market in terms of value and volume.

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market.

- To define and segment the market size by application, and end-use industry.

- To forecast the market size with respect to four main regions, namely, Asia Pacific, North America, Europe, and the Rest of the World, along with their respective key countries.

- To analyze competitive developments such as agreements, expansions and new product developments in the colorless polyimide films market

- To strategically profile key players and comprehensively analyze their market share and core competencies

The following customization options are available for the report:

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of product portfolio of each company in the colorless polyimide market

- A further breakdown of a region of the colorless polyimide market with respect to a particular country

- Details and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Colorless Polyimide Films Market