Chromatography Resin Market by type (Natural, Synthetic, Inorganic Media), Technique (Ion Exchange, Affinity, Hydrophobic Interaction, Size Exclusion, Mixed Mode), Application (Pharmaceutical & Biotechnology, FnB), Region - Global Forecasts to 2028

Chromatography Resin Market Overview

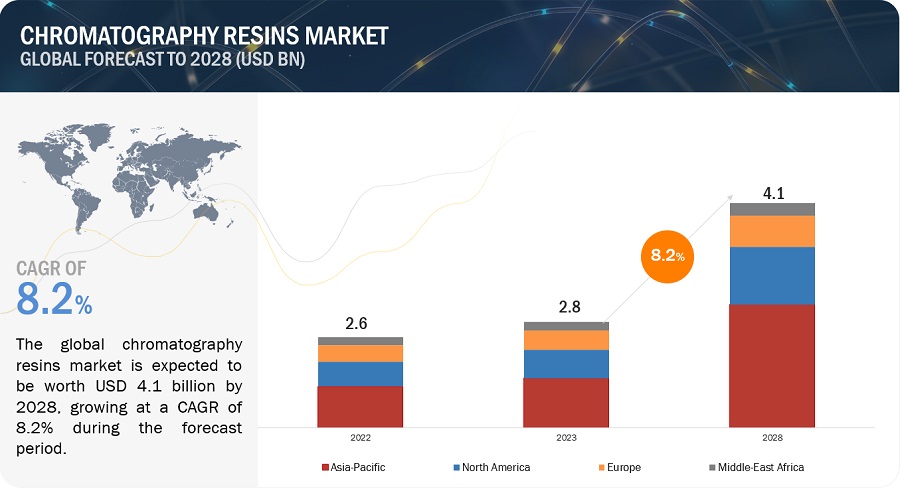

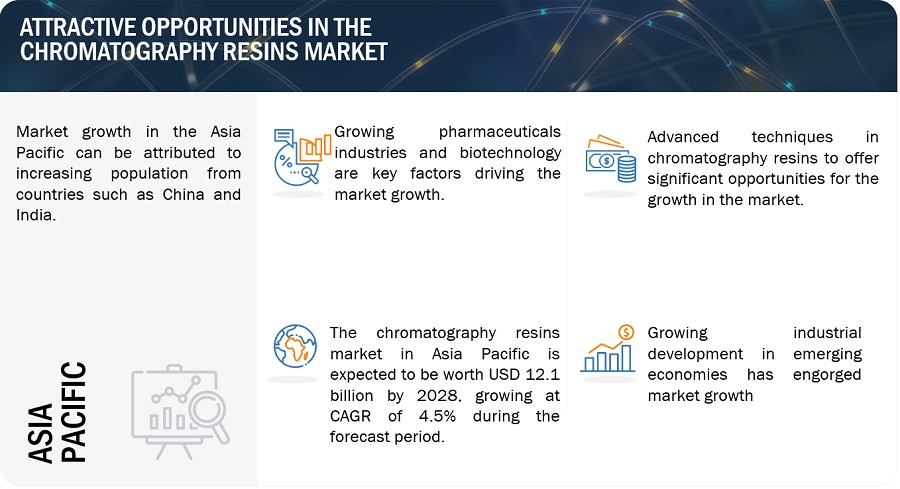

The global chromatography resin market size was valued at USD 2.8 billion in 2023 and is projected to reach USD 4.1 billion by 2028, growing at 8.2% cagr during the forecast period. The market growth of chromatography resins is propelled by two key factors: the rising demand for biosimilars and the continuous expansion of pharmaceutical and biopharmaceutical R&D activities. Particularly, the growing demand for biosimilars in the Asia Pacific region is driving the need for chromatography resins, while further growth is anticipated in the US and Japan. As R&D spending continues to increase, the demand for chromatography resins is expected to grow, with their integral role in various pharmaceutical R&D processes.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growing demand for biosimilars

Biosimilars have proven effective in the treatment of various medical conditions such as cancer, rheumatoid arthritis, infectious disorders, psoriasis, anemia, kidney failure, type 1 and type 2 diabetes, post-menopausal osteoporosis, and hormonal disorders. Ongoing research and development efforts are focused on utilizing biosimilars in therapeutic areas, including oncology, autoimmune disorders, diabetes, and hepatitis. Furthermore, there is potential for biosimilars to be developed for other chronic conditions such as meningitis, breast cancer, adult T-cell leukemia, obesity, hypertension, and hepatitis E. The demand for biosimilars continues to rise, and the utilization of chromatography resins is expected to increase accordingly.

Restraint: Shortage of suitably trained professionals

In recent years, the chromatography resin market has witnessed significant technological advancements. However, a pressing challenge in the pharmaceutical industry is the scarcity of skilled professionals who can effectively operate chromatography instruments and perform the necessary techniques. The successful utilization of chromatography equipment demands expertise, hands-on experience, and comprehensive knowledge of various chromatography techniques. This shortage of skilled labor has the potential to impede the growth of the global chromatography resins market. By nurturing a skilled labor force, the chromatography sector can thrive, fueling further advancements and expansion in the market.

Opportunity: Rising demand for chromatography in drug development and omics research

Chromatography is an exceptionally adaptable separation technique that offers extensive availability. During the initial stages of drug discovery, it is crucial to separate numerous closely related compounds that have been synthesized. The identification and assessment of their purity are of utmost importance. Chromatography methods are widely utilized for these purposes. Chromatography instruments find extensive applications in separating, purifying, and analyzing raw materials, Active Pharmaceutical Ingredients (APIs), and excipients. As a result, the growing need for high-quality medications and the implementation of stringent government regulations have led to an increased demand for chromatography resins in several countries.

Challenge: The presence of unconventional technologies in chromatography

There are various alternative techniques available that can serve as substitutes for chromatography, including precipitation, high-resolution ultrafiltration, crystallization, high-pressure refolding, charged ultrafiltration membranes, protein crystallization, capillary electrophoresis, aqueous two-phase extraction, three-phase partitioning, monoliths, and membrane chromatography. These alternative techniques offer distinct advantages, which may pose challenges to the growth of the chromatography resin market. The availability of these alternative methods introduces competition and prompts the industry to continuously innovate and enhance the performance and efficiency of chromatography resin to maintain its market position.

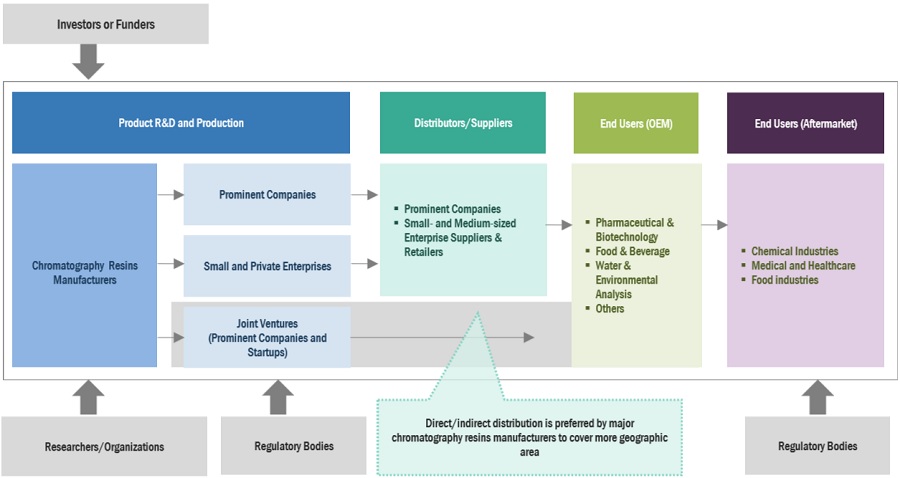

Chromatography resins market ecosystem

Preceding companies in this market include well-established, financially stable chromatography resins. These businesses have been in business for a while and have an extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include Bio-Rad Laboratories Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Tosoh Corporation (Japan), Bio-Works Technologies AB (Sweden), Avantor Performance Materials, Inc. (US), Mitsubishi Chemical Corporation (Japan).

“Synthetic resins are forecasted to be the fastest-growing chromatography resin type between 2023 and 2028.”

The synthetic resins segment is forecasted to exhibit the highest growth rate Between 2023 and 2028. The demand for synthetic resins is primarily fueled by their utilization in ion exchange chromatography. Among synthetic resins, polystyrene divinylbenzene stands out as the most frequently employed type due to its superior performance attributes when compared to natural polymers. The increasing adoption of the IEX technique further contributes to the growing prominence of polystyrene divinyl benzene. This surge in the synthetic resins segment is predominantly driven by the escalating usage of synthetic resins in analytical and laboratory-scale applications.

“Affinity was the largest chromatography technique in 2022 in terms of value.”

The principle of affinity chromatography revolves around the specific affinity between molecules in the mobile phase and ligands attached to the stationary resin. The affinity chromatography resin market segment is anticipated to experience growth due to the increasing need for protein A, which enables convenient and effective antibody purification. Affinity chromatography offers notable benefits, including excellent selectivity, resolution, and capacity in various protein purification processes. One of its advantages lies in leveraging a protein's inherent biological structure or function to facilitate purification. These factors collectively contribute to the rising demand for affinity chromatography techniques.

“Food & Beverages was the second-largest chromatography resin application in 2022 in terms of value.”

Chromatography resin plays a vital role as an analytical technique in food analysis, with its application primarily focused on three areas: assessing the nutritional quality of food, detecting spoilage, and identifying additives in food. The demand for chromatography resin in the food and beverage sector is driven by various factors. These include the rapid advancements in science and technology, the escalating costs of healthcare, the growing consumer preference for natural food products, the evolving lifestyles and dietary choices, and the increasing awareness of the importance of health and wellness. Additionally, the demand for beverages, dairy products, and natural ingredients such as food colors, flavors, flavonoids, and carotenoids further contributes to the need for chromatography resin in the food and beverage industry.

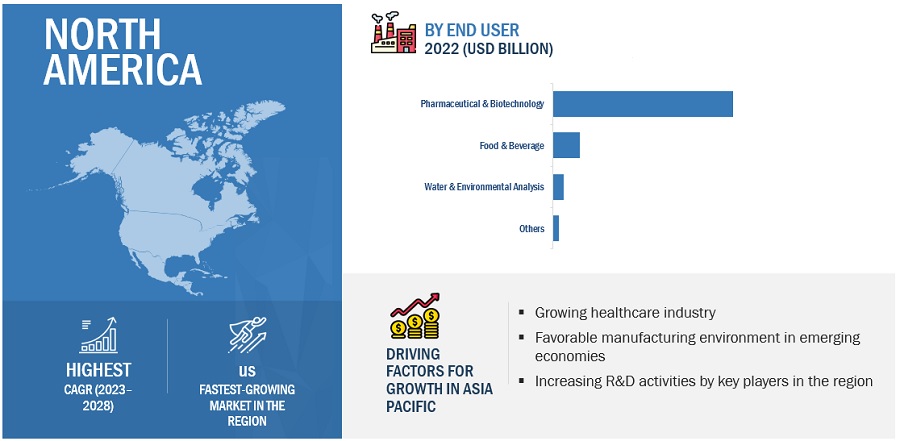

“North America to account for the largest share of the global chromatography resin market during the forecasted period between 2023 and 2028.”

In 2022, North America emerged as the dominant region in the global chromatography resin market, both in terms of volume and value. The United States stands as the leading market for chromatography resin in North America, closely followed by Canada. The strong presence of the therapeutic monoclonal antibody market in North America significantly contributes to the demand for chromatography resin. Moreover, modern chromatographic techniques are increasingly being employed for food analysis and various diagnostic applications in both the US and Canada. North America houses several prominent pharmaceutical companies, many of which have established their research centers in the region. These factors collectively drive the demand for chromatography resin in North America.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The chromatography resin market is dominated by a few globally established players such as Danaher Corporation (US), Bio-Rad Laboratories Inc. (US), Merck KGaA (Germany), Tosoh Corporation (Japan), BioWorks Technologies AB (Sweden), and among others, are the key manufacturers that hold major market share in the last few years. The major focus was given to acquisition, innovation, and new product development due to the changing requirements of users across the world.

Want to explore hidden markets that can drive new revenue in Chromatography Resin Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Chromatography Resin Market?

|

Report Metric |

Details |

|

Years considered for the study |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million), Volume (Liters) |

|

Segments Covered |

Type, Technique, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies profiled |

Bio-Rad Laboratories, Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Tosoh Corporation (Japan), Bio-Works Technologies AB (Sweden), Avantor Performance Materials, Inc. (US), Mitsubishi Chemical Corporation (Japan), among others Top 25 major players covered |

This report categorizes the global chromatography resin market based on type, technique, application, and region.

On the basis of type, the chromatography resin market has been segmented as follows:

- Synthetic Resins

- Natural Polymers

- Inorganic Media

On the basis of technique, the chromatography resin market has been segmented as follows:

-

Ion Exchange

- Cation

- Anion

- Affinity

- Size Exclusion

- Hydrophobic Interaction

- Mixed Mode Chromatography Resin Market

- Others

On the basis of application, the chromatography resin market has been segmented as follows:

-

Pharmaceutical & Biotechnology

- Production

- Academics & Research

- Food & Beverage

- Water & Environmental Analysis

- Others

On the basis of region, the chromatography resin market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments:

- In April 2020, Bio-Rad Laboratories, Inc. recently introduced its SARS-CoV-2 Total Ab test, a kit designed for blood-based immunoassays. This test aids in the identification of antibodies developed against SARS-CoV-2, the virus responsible for COVID-19. It has the capability to detect IgG, IgM, and IgA antibodies, offering a more comprehensive approach compared to tests that target a single immunoglobulin. The utilization of multiple immunoglobulins enhances the sensitivity of the assay, providing more accurate results in determining the presence of antibodies against SARS-CoV-2.

- In October 2021, Tosoh Bioscience LLC, a subsidiary of Tosoh Corporation, successfully finalized the acquisition of Semba Biosciences. Semba Biosciences is a renowned pioneer in the development of multi-column chromatography (MCC) instrumentation and technology, specifically for the downstream purification of biologics. This strategic acquisition has enabled Tosoh Biosciences to enhance and broaden its chromatography resin-related business.

- In March 2020, The acquisition of General Electric Company's life sciences division's Biopharma business by Danaher Corporation was successfully concluded. Following the acquisition, the business has been renamed Cytiva and will operate independently as a standalone company within Danaher's life sciences segment.

Frequently Asked Questions (FAQ):

Which is the largest type of chromatography resin market in the year 2022?

In terms of both value and volume in the year 2022,Natural polymers are the largest type of chromatography resin market

Which is the largest application of chromatography resin market?

In terms of both volume and value, Pharmaceuticals & Biotechnology accounts the largest application for chromatography resins market

Which technique of the chromatography resins market will grow during the forecasted period?

Affinity technique will lead the chromatography resins market during the forecasted period.

What is the major factor impacting market growth during the forecast period 2023-2028?

The market growth is primarily due to a shortage of sufficient trained professionals to handle chromatography resin in most countries.

Who are the major players in the chromatography resins market?

The key players profiled in the report include Bio-Rad Laboratories Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Tosoh Corporation (Japan), Bio-Works Technologies AB (Sweden), Avantor Performance Materials, Inc. (US), Mitsubishi Chemical Corporation (Japan). .

What are Chromatography Resins?

Chromatography resins are materials used in chromatographic processes to separate and purify components in a mixture based on their interactions with the resin, facilitating applications in biopharmaceuticals and bioseparations.

What are the types of Chromatography Resins?

The types of chromatography resins include ion exchange resins, affinity resins, hydrophobic interaction resins, and size exclusion resins, each designed for specific separation and purification needs in various chromatographic applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing pharmaceutical and biopharmaceutical R&D activities- Increasing demand for therapeutic antibodies- Increasing demand for biosimilars- Rising concern for food safety- Increasing use of liquid chromatography-mass spectrometry (LC-MS) in analytics and researchRESTRAINTS- Lack of adequate skilled professionalsOPPORTUNITIES- Rise of contract manufacturing organizations (CMOs) and contract research organizations (CROs) in pharmaceutical industry- Growing demand for disposable pre-packed columns- Growing demand for chromatography in drug development and omics research- Growing use of chromatography in proteomicsCHALLENGES- Presence of alternative technologies to chromatography

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALSMANUFACTURERSDISTRIBUTION NETWORKEND-USE INDUSTRIES

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESSREVENUE SHIFTS & NEW REVENUE POCKETS FOR CHROMATOGRAPHY RESIN MARKET

-

6.3 CONNECTED MARKETS: ECOSYSTEM MAPPING

-

6.4 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.5 PRICING ANALYSISAVERAGE SELLING PRICE OF TECHNIQUE, BY KEY PLAYERAVERAGE SELLING PRICE, BY REGION

-

6.6 TECHNOLOGY ANALYSISJETTING TECHNOLOGY

-

6.7 CASE STUDY ANALYSISCASE STUDY ON SARTORIUS STEDIM BIOTECH S.A.

-

6.8 TRADE DATA STATISTICSIMPORT SCENARIO OF CHROMATOGRAPHY RESINEXPORT SCENARIO OF CHROMATOGRAPHY RESINS

-

6.9 REGULATORY LANDSCAPEREGULATIONS RELATED TO CHROMATOGRAPHY RESINSREGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES & EVENTS IN 2023–2024

-

6.11 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 NATURAL POLYMERGREATER DEGREE OF CROSS-LINKAGE IN INDUSTRIAL SCALE UNDER MODERATE CONDITIONS TO DRIVE MARKETAGAROSECELLULOSEOTHERS

- 7.3 AGAROSE PRODUCERS ANALYSIS, CYTIVA VS PUROLITE CORPORATION

-

7.4 SYNTHETIC RESINRISING DEMAND FROM LABORATORIES TO DRIVE MARKET

-

7.5 INORGANIC MEDIAWIDE USAGE IN PARTITION, ADSORPTION, AND REVERSED-PHASE CHROMATOGRAPHY TECHNIQUES TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 ION EXCHANGE CHROMATOGRAPHYHIGH DEMAND IN BIOPHARMACEUTICAL PROCESSES TO DRIVE MARKETCATION EXCHANGE CHROMATOGRAPHYANION EXCHANGE CHROMATOGRAPHY

-

8.3 AFFINITY CHROMATOGRAPHYINCREASING DEMAND FOR THERAPEUTIC PROTEINS TO DRIVE MARKETBIOSPECIFIC LIGAND-BASED AFFINITY CHROMATOGRAPHY- Protein A affinity- Protein G affinity- Protein L affinity- Lectin affinity- OthersPSEUDO-BIOSPECIFIC LIGAND-BASED AFFINITY CHROMATOGRAPHY- IMAC- Dye-based ligands- Others

-

8.4 SIZE EXCLUSION CHROMATOGRAPHY (SEC)WIDE APPLICATION IN LABORATORIES TO CONTRIBUTE TO MARKET GROWTH

-

8.5 HYDROPHOBIC INTERACTION CHROMATOGRAPHY (HIC)RISING DEMAND FOR BIOSIMILARS TO DRIVE DEMAND

-

8.6 MIXED-MODE CHROMATOGRAPHYBETTER DEGREE OF PURIFICATION THAN OTHER TECHNIQUES TO DRIVE MARKET

-

8.7 OTHERSPARTITION CHROMATOGRAPHYADSORPTION CHROMATOGRAPHY

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICAL & BIOTECHNOLOGYINCREASED R&D EXPENDITURE OF BIOTECHNOLOGY COMPANIES TO DRIVE DEMANDPRODUCTIONACADEMICS & RESEARCH

-

9.3 FOOD & BEVERAGESTRINGENT REGULATIONS FOR FOOD SAFETY TO DRIVE MARKET

-

9.4 WATER & ENVIRONMENTAL ANALYSISRISING DEMAND FOR SAFE WATER AND STRINGENT REGULATIONS TO DRIVE GROWTH

- 9.5 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACTASIA PACIFIC CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUEASIA PACIFIC CHROMATOGRAPHY RESIN MARKET, BY APPLICATIONASIA PACIFIC CHROMATOGRAPHY RESIN MARKET, BY COUNTRY- China- Japan- South Korea- India- Australia- New Zealand

-

10.3 NORTH AMERICARECESSION IMPACTNORTH AMERICA CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUENORTH AMERICA CHROMATOGRAPHY RESIN MARKET, BY APPLICATIONNORTH AMERICA CHROMATOGRAPHY RESIN MARKET, BY COUNTRY- US- Canada- Mexico

-

10.4 EUROPERECESSION IMPACTEUROPE CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUEEUROPE CHROMATOGRAPHY RESIN MARKET, BY APPLICATIONEUROPE CHROMATOGRAPHY RESIN MARKET, BY COUNTRY- Germany- France- UK- Italy- Spain- Scandinavia- Austria- Switzerland

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACTMIDDLE EAST & AFRICA CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUEMIDDLE EAST & AFRICA CHROMATOGRAPHY RESIN MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY- Saudi Arabia- UAE

-

10.6 SOUTH AMERICARECESSION IMPACTSOUTH AMERICA CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUESOUTH AMERICA CHROMATOGRAPHY RESIN MARKET, BY APPLICATIONSOUTH AMERICA CHROMATOGRAPHY RESIN MARKET, BY COUNTRY- Brazil

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 RANKING OF KEY MARKET PLAYERS, 2022

- 11.5 REVENUE ANALYSIS OF KEY COMPANIES

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.7 COMPANY EVALUATION MATRIX (TIER 1)STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 11.8 COMPETITIVE BENCHMARKING

-

11.9 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

11.10 COMPETITIVE SITUATIONS AND TRENDSDEALSPRODUCT LAUNCHESOTHER DEVELOPMENTS

-

12.1 MAJOR PLAYERSBIO-RAD LABORATORIES, INC.- Business overview- Products offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products offered- Recent developments- MnM viewDANAHER CORPORATION- Business overview- Products offered- Recent developments- MnM viewTOSOH CORPORATION- Business overview- Products offered- Recent developments- MnM viewSARTORIUS STEDIM BIOTECH S.A.- Business overview- Products offered- Recent developments- MnM viewBIO-WORKS TECHNOLOGIES AB- Business overview- Products offered- Recent developments- MnM viewAVANTOR, INC.- Business overview- Products offered- Recent developments- MnM viewMITSUBISHI CHEMICAL CORPORATION- Business overview- Products offeredPUROLITE- Business overview- Products offered- Recent developmentsREPLIGEN CORPORATION- Business overview- Products offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- Recent developments- MnM view

-

12.2 OTHER KEY MARKET PLAYERSNOVASEPSEPRAGEN CORPORATIONSTEROGENE BIOSEPARATIONS, INC.FINEX OYCHEMRA GMBHSUNRESIN NEW MATERIALS CO. LTD.BIOTOOLOMICS LIMITEDCUBE BIOTECH GMBHJSR LIFE SCIENCES, LLCNINGBO ZHENGGUANG RESIN CO., LTD.CONCISE SEPARATIONSGENSCRIPT BIOTECH CORPORATIONEICHROM TECHNOLOGIES, LLCAGILENT TECHNOLOGIES, INC.KANEKA CORPORATION

- 13.1 INTRODUCTION

- 13.2 LIMITATION

-

13.3 CHROMATOGRAPHY REAGENTS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.4 CHROMATOGRAPHY REAGENTS MARKET, BY REGIONNORTH AMERICA- By countryEUROPE- By countryASIA PACIFIC- By countryLATIN AMERICA- By country

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 CHROMATOGRAPHY RESIN MARKET: RISK ASSESSMENT

- TABLE 2 PHARMACEUTICAL & BIOTECHNOLOGY R&D INVESTMENTS, BY COUNTRY

- TABLE 3 KEY BIOLOGICS UNDER THREAT OF PATENT EXPIRY

- TABLE 4 APPLICATIONS OF LC-MS

- TABLE 5 ADVANTAGES OF PRE-PACKED COLUMNS

- TABLE 6 CHROMATOGRAPHY RESIN MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2027 (USD BILLION)

- TABLE 8 CHROMATOGRAPHY RESIN MARKET: ECOSYSTEM

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 10 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 11 AVERAGE SELLING PRICES OF TOP 3 TECHNIQUES (USD/LITER), BY KEY PLAYER

- TABLE 12 AVERAGE SELLING PRICE OF CHROMATOGRAPHY RESIN, BY REGION (USD/LITER)

- TABLE 13 ADVANTAGES OF JETTING TECHNOLOGY

- TABLE 14 OUTCOMES OF CASE STUDY

- TABLE 15 IMPORTS OF CHROMATOGRAPHY RESINS, BY REGION, 2013–2022 (USD MILLION)

- TABLE 16 EXPORT OF CHROMATOGRAPHY RESINS, BY REGION, 2013–2022 (USD MILLION)

- TABLE 17 CHROMATOGRAPHY RESIN MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 18 GRANTED PATENTS ACCOUNTED FOR 26% OF ALL PATENTS IN LAST 11 YEARS

- TABLE 19 PATENTS BY FUJIFILM HOLDINGS CORPORATION

- TABLE 20 PATENTS BY DOW INC.

- TABLE 21 PATENTS BY OTHER COMPANIES

- TABLE 22 TOP 10 PATENT OWNERS IN US, 2012–2022

- TABLE 23 CHROMATOGRAPHY RESIN MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 24 CHROMATOGRAPHY RESIN MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 25 NATURAL POLYMER: SOURCES OF PRODUCTION

- TABLE 26 CHROMATOGRAPHY RESIN MARKET IN NATURAL POLYMER, BY SUB-TYPE, 2021–2028 (USD MILLION)

- TABLE 27 CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 28 CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 29 CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 30 CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 31 CHROMATOGRAPHY RESIN MARKET IN IEX TECHNIQUE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 32 CHROMATOGRAPHY RESIN MARKET IN IEX TECHNIQUE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 33 CHROMATOGRAPHY RESIN MARKET IN IEX TECHNIQUE, BY REGION, 2017–2021 (LITER)

- TABLE 34 CHROMATOGRAPHY RESIN MARKET IN IEX TECHNIQUE, BY REGION, 2022–2028 (LITER)

- TABLE 35 CHROMATOGRAPHY RESIN MARKET IN IEX TECHNIQUE SEGMENT, BY TYPE OF CHARGE, 2017–2021 (USD MILLION)

- TABLE 36 CHROMATOGRAPHY RESIN MARKET IN IEX TECHNIQUE SEGMENT, BY TYPE OF CHARGE, 2022–2028 (USD MILLION)

- TABLE 37 CHROMATOGRAPHY RESIN MARKET IN IEX TECHNIQUE SEGMENT, BY TYPE OF CHARGE, 2017–2021 (LITER)

- TABLE 38 CHROMATOGRAPHY RESIN MARKET IN IEX TECHNIQUE SEGMENT, BY TYPE OF CHARGE, 2022–2028 (LITER)

- TABLE 39 CATION EXCHANGE CHROMATOGRAPHY RESINS: LIGAND FUNCTIONAL GROUPS

- TABLE 40 ANION EXCHANGE CHROMATOGRAPHY RESINS: LIGAND FUNCTIONAL GROUPS

- TABLE 41 AFFINITY CHROMATOGRAPHY RESINS: LIGANDS

- TABLE 42 CHROMATOGRAPHY RESIN MARKET IN AFFINITY TECHNIQUE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 43 CHROMATOGRAPHY RESIN MARKET IN AFFINITY TECHNIQUE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 44 CHROMATOGRAPHY RESIN MARKET IN AFFINITY TECHNIQUE, BY REGION, 2017–2021 (LITER)

- TABLE 45 CHROMATOGRAPHY RESIN MARKET IN AFFINITY TECHNIQUE, BY REGION, 2022–2028 (LITER)

- TABLE 46 AFFINITY CHROMATOGRAPHY: LIGANDS

- TABLE 47 CHROMATOGRAPHY RESIN MARKET IN AFFINITY, BY TYPE OF LIGAND INTERACTION, 2017–2021 (USD MILLION)

- TABLE 48 CHROMATOGRAPHY RESIN MARKET IN AFFINITY CHROMATOGRAPHY SEGMENT, BY TYPE OF LIGAND INTERACTION, 2022–2028 (USD MILLION)

- TABLE 49 CHROMATOGRAPHY RESIN MARKET IN SIZE EXCLUSION TECHNIQUE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 50 CHROMATOGRAPHY RESIN MARKET IN SIZE EXCLUSION TECHNIQUE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 51 CHROMATOGRAPHY RESIN MARKET IN SIZE EXCLUSION TECHNIQUE, BY REGION, 2017–2021 (LITER)

- TABLE 52 CHROMATOGRAPHY RESIN MARKET IN SIZE EXCLUSION TECHNIQUE, BY REGION, 2022–2028 (LITER)

- TABLE 53 CHROMATOGRAPHY RESIN MARKET IN HIC TECHNIQUE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 54 CHROMATOGRAPHY RESIN MARKET IN HIC TECHNIQUE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 55 CHROMATOGRAPHY RESIN MARKET IN HIC TECHNIQUE, BY REGION, 2017–2021 (LITER)

- TABLE 56 CHROMATOGRAPHY RESIN MARKET IN HIC TECHNIQUE, BY REGION, 2022–2028 (LITER)

- TABLE 57 CHROMATOGRAPHY RESIN MARKET IN MIXED-MODE TECHNIQUE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 58 CHROMATOGRAPHY RESIN MARKET IN MIXED-MODE TECHNIQUE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 59 CHROMATOGRAPHY RESIN MARKET IN MIXED-MODE TECHNIQUE, BY REGION, 2017–2021 (LITER)

- TABLE 60 CHROMATOGRAPHY RESIN MARKET IN MIXED-MODE TECHNIQUE, BY REGION, 2022–2028 (LITER)

- TABLE 61 CHROMATOGRAPHY RESIN MARKET IN OTHER TECHNIQUES, BY REGION, 2017–2021 (USD MILLION)

- TABLE 62 CHROMATOGRAPHY RESIN MARKET IN OTHER TECHNIQUES, BY REGION, 2022–2028 (USD MILLION)

- TABLE 63 CHROMATOGRAPHY RESIN MARKET IN OTHER TECHNIQUES, BY REGION, 2017–2021 (LITER)

- TABLE 64 CHROMATOGRAPHY RESIN MARKET IN OTHER TECHNIQUES, BY REGION, 2022–2028 (LITER)

- TABLE 65 CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 66 CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 67 CHROMATOGRAPHY RESIN MARKET IN PHARMACEUTICAL & BIOTECHNOLOGY, BY REGION, 2017–2021 (USD MILLION)

- TABLE 68 CHROMATOGRAPHY RESIN MARKET IN PHARMACEUTICAL & BIOTECHNOLOGY, BY REGION, 2022–2028 (USD MILLION)

- TABLE 69 CHROMATOGRAPHY RESIN MARKET IN PHARMACEUTICAL & BIOTECHNOLOGY PRODUCTION, BY REGION, 2017–2021 (USD MILLION)

- TABLE 70 CHROMATOGRAPHY RESIN MARKET IN PHARMACEUTICAL & BIOTECHNOLOGY PRODUCTION, BY REGION, 2022–2028 (USD MILLION)

- TABLE 71 CHROMATOGRAPHY RESIN MARKET IN PHARMACEUTICAL & BIOTECHNOLOGY FOR ACADEMICS & RESEARCH, BY REGION, 2017–2021 (USD MILLION)

- TABLE 72 CHROMATOGRAPHY RESIN MARKET IN PHARMACEUTICAL & BIOTECHNOLOGY FOR ACADEMICS & RESEARCH, BY REGION, 2022–2028 (USD MILLION)

- TABLE 73 CHROMATOGRAPHY RESIN MARKET IN FOOD & BEVERAGE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 74 CHROMATOGRAPHY RESIN MARKET IN FOOD & BEVERAGE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 75 CHEMICAL CONTAMINANTS AND CHROMATOGRAPHY TECHNOLOGIES

- TABLE 76 CHROMATOGRAPHY RESIN MARKET IN WATER & ENVIRONMENTAL ANALYSIS, BY REGION, 2017–2021 (USD MILLION)

- TABLE 77 CHROMATOGRAPHY RESIN MARKET IN WATER & ENVIRONMENTAL ANALYSIS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 78 CHROMATOGRAPHY RESIN MARKET IN OTHER APPLICATIONS, BY REGION, 2017–2021 (USD MILLION)

- TABLE 79 CHROMATOGRAPHY RESIN MARKET IN OTHER APPLICATIONS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 80 CHROMATOGRAPHY RESIN MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 81 CHROMATOGRAPHY RESIN MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 82 CHROMATOGRAPHY RESIN MARKET, BY REGION, 2017–2021 (LITER)

- TABLE 83 CHROMATOGRAPHY RESIN MARKET, BY REGION, 2022–2028 (LITER)

- TABLE 84 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 85 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 87 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 88 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 89 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 91 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2017–2021 (LITER)

- TABLE 93 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2022–2028 (LITER)

- TABLE 94 CHINA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 95 CHINA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 96 CHINA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 97 CHINA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 98 JAPAN: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 99 JAPAN: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 100 JAPAN: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 101 JAPAN: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 102 SOUTH KOREA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 103 SOUTH KOREA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 104 SOUTH KOREA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 105 SOUTH KOREA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 106 INDIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 107 INDIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 108 INDIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 109 INDIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 110 AUSTRALIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 111 AUSTRALIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 112 AUSTRALIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 113 AUSTRALIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 114 NEW ZEALAND: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 115 NEW ZEALAND: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 116 NEW ZEALAND: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 117 NEW ZEALAND: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 118 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 119 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 121 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 122 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 123 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 125 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 126 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2017–2021 (LITER)

- TABLE 127 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2022–2028 (LITER)

- TABLE 128 US: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 129 US: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 130 US: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 131 US: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 132 CANADA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 133 CANADA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 134 CANADA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 135 CANADA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 136 MEXICO: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 137 MEXICO: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 138 MEXICO: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 139 MEXICO: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 140 EUROPE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 141 EUROPE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 142 EUROPE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 143 EUROPE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 144 EUROPE: CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 145 EUROPE: CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 146 EUROPE: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 147 EUROPE: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 148 EUROPE: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2017–2021 (LITER)

- TABLE 149 EUROPE: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2022–2028 (LITER)

- TABLE 150 GERMANY: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 151 GERMANY: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 152 GERMANY: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 153 GERMANY: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 154 FRANCE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 155 FRANCE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 156 FRANCE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 157 FRANCE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 158 UK: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 159 UK: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 160 UK: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 161 UK: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 162 ITALY: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 163 ITALY: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 164 ITALY: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 165 ITALY: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 166 SPAIN: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 167 SPAIN: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 168 SPAIN: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 169 SPAIN: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 170 SCANDINAVIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 171 SCANDINAVIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 172 SCANDINAVIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 173 SCANDINAVIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 174 AUSTRIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 175 AUSTRIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 176 AUSTRIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 177 AUSTRIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 178 SWITZERLAND: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 179 SWITZERLAND: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 180 SWITZERLAND: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 181 SWITZERLAND: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 182 MIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 185 MIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 186 MIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2017–2021 (LITER)

- TABLE 191 MIDDLE EAST & AFRICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2022–2028 (LITER)

- TABLE 192 SAUDI ARABIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 193 SAUDI ARABIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 194 SAUDI ARABIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 195 SAUDI ARABIA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 196 UAE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 197 UAE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 198 UAE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 199 UAE: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 200 SOUTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 201 SOUTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 202 SOUTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 203 SOUTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 204 SOUTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 205 SOUTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 206 SOUTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 207 SOUTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 208 SOUTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2017–2021 (LITER)

- TABLE 209 SOUTH AMERICA: CHROMATOGRAPHY RESIN MARKET, BY COUNTRY, 2022–2028 (LITER)

- TABLE 210 BRAZIL: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (USD MILLION)

- TABLE 211 BRAZIL: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (USD MILLION)

- TABLE 212 BRAZIL: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2017–2021 (LITER)

- TABLE 213 BRAZIL: CHROMATOGRAPHY RESIN MARKET, BY TECHNIQUE, 2022–2028 (LITER)

- TABLE 214 OVERVIEW OF STRATEGIES ADOPTED BY KEY CHROMATOGRAPHY RESIN MANUFACTURERS

- TABLE 215 CHROMATOGRAPHY RESIN MARKET: DEGREE OF COMPETITION

- TABLE 216 CHROMATOGRAPHY RESIN MARKET: TECHNIQUE FOOTPRINT

- TABLE 217 CHROMATOGRAPHY RESIN MARKET: APPLICATION FOOTPRINT

- TABLE 218 CHROMATOGRAPHY RESIN MARKET: REGION FOOTPRINT

- TABLE 219 CHROMATOGRAPHY RESIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 220 CHROMATOGRAPHY RESIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SME

- TABLE 221 CHROMATOGRAPHY RESIN MARKET: DEALS (2019–2023)

- TABLE 222 CHROMATOGRAPHY RESIN MARKET: PRODUCT LAUNCHES (2019–2023)

- TABLE 223 CHROMATOGRAPHY RESIN MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2019-2023)

- TABLE 224 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 225 MERCK KGAA: COMPANY OVERVIEW

- TABLE 226 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 227 TOSOH CORPORATION: COMPANY OVERVIEW

- TABLE 228 SARTORIUS STEDIM BIOTECH S.A.: COMPANY OVERVIEW

- TABLE 229 BIO-WORKS TECHNOLOGIES AB: COMPANY OVERVIEW

- TABLE 230 AVANTOR, INC.: COMPANY OVERVIEW

- TABLE 231 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 232 PUROLITE: COMPANY OVERVIEW

- TABLE 233 REPLIGEN CORPORATION: COMPANY OVERVIEW

- TABLE 234 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 235 NOVASEP: COMPANY OVERVIEW

- TABLE 236 SEPRAGEN CORPORATION: COMPANY OVERVIEW

- TABLE 237 STEROGENE BIOSEPARATIONS, INC.: COMPANY OVERVIEW

- TABLE 238 FINEX OY: COMPANY OVERVIEW

- TABLE 239 CHEMRA GMBH: COMPANY OVERVIEW

- TABLE 240 SUNRESIN NEW MATERIALS CO. LTD.: COMPANY OVERVIEW

- TABLE 241 BIOTOOLOMICS LIMITED: COMPANY OVERVIEW

- TABLE 242 CUBE BIOTECH GMBH: COMPANY OVERVIEW

- TABLE 243 JSR LIFE SCIENCES, LLC: COMPANY OVERVIEW

- TABLE 244 NINGBO ZHENGGUANG RESIN CO., LTD.: COMPANY OVERVIEW

- TABLE 245 CONCISE SEPARATIONS: COMPANY OVERVIEW

- TABLE 246 GENSCRIPT BIOTECH CORPORATION: COMPANY OVERVIEW

- TABLE 247 EICHROM TECHNOLOGIES, LLC: COMPANY OVERVIEW

- TABLE 248 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 249 KANEKA CORPORATION: COMPANY OVERVIEW

- TABLE 250 CHROMATOGRAPHY REAGENTS MARKET SIZE, BY REGION, 2013–2015 (USD MILLION)

- TABLE 251 CHROMATOGRAPHY REAGENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 252 NORTH AMERICA: CHROMATOGRAPHY REAGENTS MARKET, BY COUNTRY, 2013–2015 (USD MILLION)

- TABLE 253 NORTH AMERICA: CHROMATOGRAPHY REAGENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

- TABLE 254 EUROPE: CHROMATOGRAPHY REAGENTS MARKET, BY COUNTRY, 2013–2015 (USD MILLION)

- TABLE 255 EUROPE: CHROMATOGRAPHY REAGENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

- TABLE 256 ASIA PACIFIC: CHROMATOGRAPHY REAGENTS MARKET, BY COUNTRY, 2013–2015 (USD MILLION)

- TABLE 257 ASIA PACIFIC: CHROMATOGRAPHY REAGENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

- TABLE 258 LATIN AMERICA: CHROMATOGRAPHY REAGENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

- TABLE 259 LATIN AMERICA: CHROMATOGRAPHY REAGENTS MARKET, BY TYPE, 2013–2015 (USD MILLION)

- FIGURE 1 CHROMATOGRAPHY RESIN MARKET SEGMENTATION

- FIGURE 2 CHROMATOGRAPHY RESIN MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION - SUPPLY SIDE: COMBINED MARKET SHARE OF MAJOR PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION - BOTTOM-UP APPROACH 1 (SUPPLY SIDE): COLLECTIVE REVENUE FROM SALE OF CHROMATOGRAPHY RESIN

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 2 (DEMAND SIDE): PRODUCTS SOLD AND THEIR AVERAGE SELLING PRICE

- FIGURE 6 CHROMATOGRAPHY RESIN MARKET: DATA TRIANGULATION

- FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- FIGURE 9 PHARMACEUTICAL & BIOTECHNOLOGY TO BE LARGEST APPLICATION SEGMENT OF CHROMATOGRAPHY RESIN MARKET

- FIGURE 10 SYNTHETIC RESIN SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 AFFINITY CHROMATOGRAPHY TECHNIQUE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 13 GROWING DEMAND FROM PHARMACEUTICAL & BIOTECHNOLOGY SEGMENT TO DRIVE MARKET

- FIGURE 14 NORTH AMERICA TO BE LARGEST MARKET FOR CHROMATOGRAPHY RESIN

- FIGURE 15 US ACCOUNTED FOR LARGEST SHARE OF CHROMATOGRAPHY RESIN MARKET IN NORTH AMERICA

- FIGURE 16 ION EXCHANGE TO BE MOST WIDELY ADOPTED TECHNIQUE DURING FORECAST PERIOD

- FIGURE 17 ION EXCHANGE LED GLOBAL CHROMATOGRAPHY RESIN MARKET

- FIGURE 18 CHROMATOGRAPHY RESIN MARKET IN INDIA TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CHROMATOGRAPHY RESIN MARKET

- FIGURE 20 GLOBAL PHARMACEUTICAL R&D SPENDING, 2012–2021 (USD BILLION)

- FIGURE 21 WORLDWIDE GENERIC DRUG SALES

- FIGURE 22 CHROMATOGRAPHY RESIN MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 CHROMATOGRAPHY RESIN MARKET: SUPPLY CHAIN

- FIGURE 24 REVENUE SHIFT FOR CHROMATOGRAPHY RESIN MARKET

- FIGURE 25 CHROMATOGRAPHY RESIN: ECOSYSTEM

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 28 AVERAGE SELLING PRICE OF TOP 3 TECHNIQUES, BY KEY PLAYER

- FIGURE 29 REFER TO FIGURE 29 FOR MORE INFORMATION. AVERAGE SELLING PRICE OF CHROMATOGRAPHY RESIN, BY REGION (USD/LITER)

- FIGURE 30 IMPORTS OF ION EXCHANGE RESINS, BY KEY COUNTRY (2013–2022)

- FIGURE 31 EXPORTS OF ION EXCHANGE RESINS, BY KEY COUNTRY (2013–2022)

- FIGURE 32 PATENTS REGISTERED FOR CHROMATOGRAPHY RESIN, 2012–2022

- FIGURE 33 PATENT PUBLICATION TRENDS FOR CHROMATOGRAPHY RESINS, 2012–2022

- FIGURE 34 LEGAL STATUS OF PATENTS FILED FOR CHROMATOGRAPHY RESINS

- FIGURE 35 MAXIMUM PATENTS FILED BY COMPANIES IN US

- FIGURE 36 FUJIFILM HOLDINGS CORPORATION REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2012 AND 2022

- FIGURE 37 SYNTHETIC RESIN TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 MIXED-MODE TECHNIQUE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 PHARMACEUTICAL & BIOTECHNOLOGY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC: CHROMATOGRAPHY RESIN MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: CHROMATOGRAPHY RESIN MARKET SNAPSHOT

- FIGURE 43 EUROPE: CHROMATOGRAPHY RESIN MARKET SNAPSHOT

- FIGURE 44 DANAHER CORPORATION LED CHROMATOGRAPHY RESIN MARKET IN 2022

- FIGURE 45 RANKING OF TOP FOUR PLAYERS IN CHROMATOGRAPHY RESIN MARKET, 2022

- FIGURE 46 REVENUE ANALYSIS OF KEY COMPANIES DURING PAST FIVE YEARS

- FIGURE 47 CHROMATOGRAPHY RESIN MARKET: COMPANY FOOTPRINT

- FIGURE 48 COMPANY EVALUATION QUADRANT FOR CHROMATOGRAPHY RESIN MARKET (TIER 1)

- FIGURE 49 STARTUP/SME EVALUATION MATRIX FOR CHROMATOGRAPHY RESIN MARKET

- FIGURE 50 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

- FIGURE 51 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 52 DANAHER CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 TOSOH CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 SARTORIUS STEDIM BIOTECH S.A.: COMPANY SNAPSHOT

- FIGURE 55 BIO-WORKS TECHNOLOGIES AB: COMPANY SNAPSHOT

- FIGURE 56 AVANTOR, INC.: COMPANY SNAPSHOT

- FIGURE 57 REPLIGEN CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

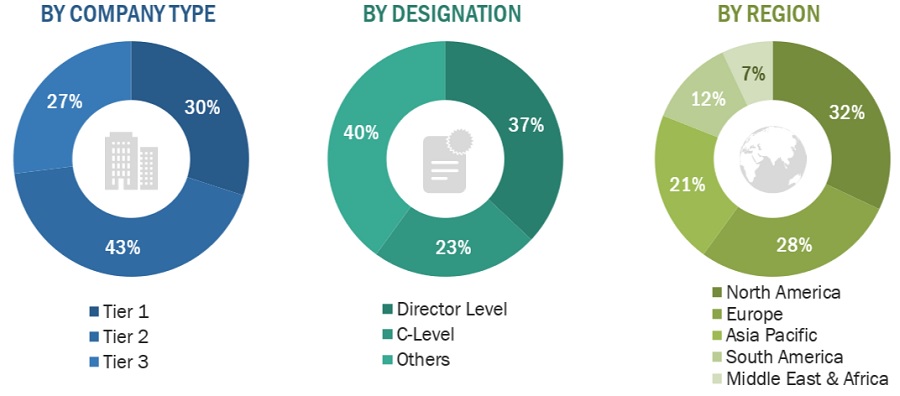

The study involved four major activities in estimating the market size of the chromatography resin market. Intensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study involved annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were demonstrated through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The chromatography resin market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of food & beverages, pharmaceuticals & biotechnology, and other industries. The supply side is differentiated by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Danaher Corporation |

Global Strategy & Innovation Manager |

|

Tosoh Corporation |

Technical Sales Manager |

|

Bio-Rad Laboratories, Inc. |

Production Supervisor |

|

Merck KGaA |

Vice-President |

Market Size Estimation

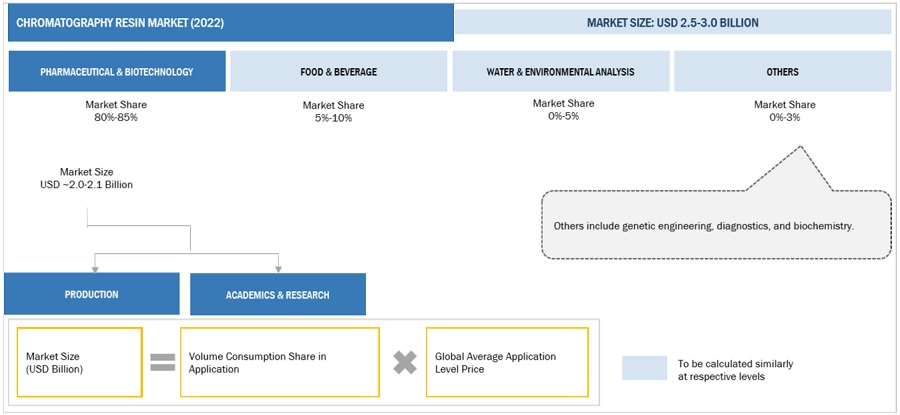

Both top-down and bottom-up approaches were used to estimate and validate the total size of the chromatography resin market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Chromatography Resins Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Chromatography Resins Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food & beverages, pharmaceuticals & biotechnology industries, among others.

Market Definition

The chromatography resins market refers to the industry involved in the manufacturing, distribution, and utilization of specialized materials known as chromatography resins. These resins play a crucial role in chromatography processes, which are widely applied in scientific and industrial settings to separate and purify different components of a mixture. Chromatography is a technique that utilizes a stationary phase, often in the form of chromatography resins, and a mobile phase (solvent or eluent) to separate individual components based on their distinct interactions. The properties of chromatography resins, including their chemical composition and physical structure, determine the effectiveness of the separation and purification process.

Key Stakeholders

- Chromatography resins manufacturers

- Raw material manufacturers

- Government planning commissions and research organizations

- Industry associations

- End-use industries

- R&D institutions

Report Objectives

- To analyze and forecast the size of the chromatography resin market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the chromatography resin market based on type, technique, and application.

- To forecast the size of the market segments for regions such as North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Chromatography Resin Market