Chromatography Reagents Market by Technology (LC (HPLC, UPLC, LPLC), GC, SFC, TLC), Type (Solvent (LC, GC), Derivatization Reagent (Acylation, Silylation), Ion-Pair Reagent, Buffer), Mechanism, End User (Pharma, Academia, Hospital) & Region - Global Forecast to 2029

Market Growth Outlook Summary

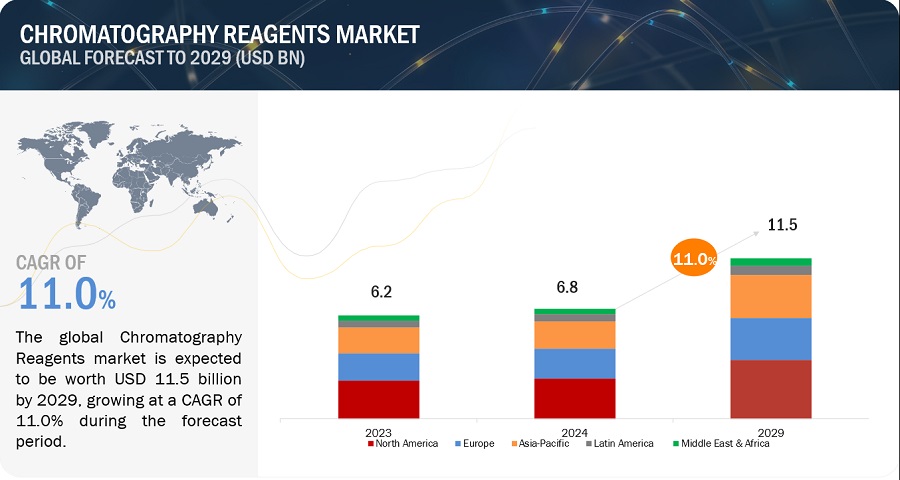

The global chromatography reagents market growth forecasted to transform from USD 6.8 billion in 2024 to USD 11.5 billion by 2029, driven by a CAGR of 11.0%. This notable growth driven by various factors. Enhanced research and development efforts in pharmaceutical and biotechnology fields are increasing the demand for advanced chromatography techniques to facilitate drug development and ensure quality control. Moreover, the significance of chromatography tests in maintaining product safety and quality standards in the food and beverage industry is growing, contributing to market expansion. Additionally, the increasing utilization of chromatography in clinical diagnostics, particularly for disease diagnosis and monitoring, is driving demand for chromatography reagents. These factors underscore the growing significance of chromatography reagents across industries, fueling market growth.

Chromatography Reagents Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Chromatography Reagents Market Dynamics

Driver: Growing pharmaceutical and biopharmaceutical R & D activities

The market is driven by expanding research and development (R&D) activities in pharmaceutical and biotechnology sectors. Companies like Pfizer and Novartis are investing heavily in discovering novel therapeutics. Chromatography techniques such as HPLC are widely used in pharmaceutical labs for drug analysis and quality control. In the food and beverage industry, chromatography tests ensure product safety. For example, LC-MS/MS detects contaminants in food samples. Additionally, chromatography aids clinical diagnostics, with LC-MS/MS quantifying therapeutic drugs in patient samples, supporting personalized medicine. These factors collectively propel the growth of the market.

Rising Concerns for Food safety

The rising concerns for food safety are poised to drive market growth for chromatography reagents. As regulatory standards become more stringent and consumers demand higher quality and safety assurances in their food products, there is a growing need for advanced analytical techniques to detect contaminants and ensure compliance. Chromatography reagents play a crucial role in this process by enabling accurate and reliable analysis of food samples for various contaminants, including pesticides, additives, and adulterants. This increasing demand for chromatography reagents in food safety testing is expected to propel market growth as food manufacturers and regulatory agencies prioritize stringent quality control measures to safeguard public health and maintain consumer trust.

Restraint: Lack of skilled professionals

The lack of skilled professionals poses a significant challenge that could hamper market growth for chromatography reagents. As demand for chromatography techniques continues to rise across various industries, including pharmaceuticals, food and beverage, and environmental testing, there is a growing need for trained personnel proficient in operating chromatography equipment and interpreting analytical results accurately. However, the shortage of skilled professionals in this field can hinder the adoption and utilization of chromatography technologies, leading to delays in research and development activities, quality control processes, and regulatory compliance efforts. Addressing this skills gap through training programs, educational initiatives, and talent development strategies will be essential to overcome this obstacle and sustain market growth for chromatography reagents

Opportunity: Increasing use of chromatography in proteomics and the purification of monoclonal antibodies

The increasing use of chromatography in proteomics and the purification of monoclonal antibodies presents a significant opportunity in the market. Proteomics, the study of proteins and their functions, relies heavily on chromatography techniques for separating and analyzing complex protein mixtures. Similarly, the purification of monoclonal antibodies, a critical step in biopharmaceutical production, often involves chromatography processes for isolating and purifying these therapeutic proteins.As the fields of proteomics and biopharmaceuticals continue to expand, driven by advancements in research and the development of new therapeutic modalities, the demand for chromatography reagents is expected to rise substantially. Chromatography reagents play a vital role in these applications by enabling precise separations, high-resolution analysis, and efficient purification of proteins and antibodies.

Moreover, the increasing adoption of chromatography techniques in proteomics and antibody purification presents opportunities for innovation and product development in the market. Companies can capitalize on this trend by introducing specialized reagents tailored to the unique requirements of proteomic analysis and antibody purification, thereby catering to the evolving needs of researchers and biopharmaceutical manufacturers.

Overall, the growing use of chromatography in proteomics and monoclonal antibody purification represents a promising avenue for market expansion in the chromatography reagents segment, offering opportunities for growth, innovation, and competitive differentiation.

Challenge: Premium prices of organic solvents

The premium prices of organic solvents and reagents present a significant challenge in the market. High costs can hinder adoption, especially for users with budget constraints. Fluctuations in prices further exacerbate the issue, leading to unpredictability in procurement costs. Addressing this challenge requires optimizing production processes, exploring innovative solutions, and fostering collaboration among industry stakeholders. By overcoming the hurdle of premium prices, the market can better serve the needs of researchers and industries relying on chromatographic analyses.

Chromatography Reagents Industry Ecosystem

The market ecosystem comprises entities responsible for the end-to-end workflow of chromatography reagents and techniques. The major stakeholders present in this market include chromatography reagent manufacturers, third-party chromatography reagent suppliers, reagent raw material suppliers, pharmaceutical, biopharmaceutical, and biotechnology companies, food and beverage industry, environment protection and forensic institutes, clinicians, researchers, hospitals, and pharmaceutical research laboratories, research institutes and academic centers, and government bodies/municipal corporations. The suppliers in the industry continue to enhance and mature their offerings to add value.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

Note: Research and Development is restricted to softwares only.

The Chromatography Reagents industry, is projected to grow at a CAGR of 11.0% between 2024 and 2029.

The Chromatography Reagents market is projected to reach USD 11.5 billion by 2029 from USD 6.8 billion in 2023, at a CAGR of 11.0% during the forecast period. The rising aging population, increased chronic conditions, rising awareness and government initiatives will provide lucrative opportunities to the market during the forecast period.

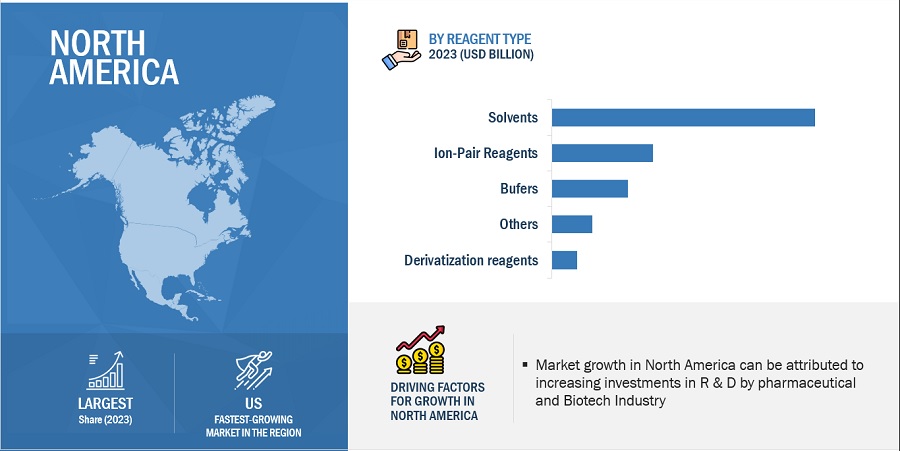

Solvents segment accounted for a substantial share of the Chromatography Reagents industry, by type in 2023.

The solvents segment is positioned to lead the chromatography reagents market owing to its vital role in chromatographic processes. Solvents facilitate sample movement and ensure precise separations of complex mixtures. They enable analytes to interact with the stationary phase, resulting in selective retention and elution of target compounds. Moreover, solvents optimize chromatographic separations, enhancing the accuracy and reliability of analytical results. Given their fundamental importance and extensive use across chromatographic techniques like liquid chromatography (LC) and gas chromatography (GC), the solvents segment is anticipated to remain dominant in the market.

Liquid Chromatography segment accounted for a considerable share in the Chromatography Reagents industry, by technology in 2023

The liquid chromatography segment is poised to lead the chromatography reagents market, attributed to its versatility, efficiency, and widespread adoption across various industries. It encompasses techniques like high-performance liquid chromatography (HPLC), ultra-high-performance liquid chromatography (UHPLC), and liquid chromatography-mass spectrometry (LC-MS), offering high resolution, sensitivity, and reproducibility. Liquid chromatography is adaptable to different sample matrices and analyte types, enhancing its utility in pharmaceutical, biotechnology, food and beverage, environmental, and clinical research. With its robust performance and broad applicability, the liquid chromatography segment is expected to maintain dominance in the market.

Adsorption Chromatography accounted for the largest share in Chromatography Reagents industry by Separation mechanism in 2023

The adsorption chromatography segment is poised for dominance in the chromatography reagents market, thanks to its versatile separation mechanism. This technique, also referred to as liquid-solid chromatography, relies on the adsorption and desorption of analytes onto a solid stationary phase. Offering high selectivity and sensitivity, it finds applications across various industries. Moreover, the competitive binding of analytes to both the stationary and mobile phases enhances the efficiency and resolution of target compounds' separation. With its widespread adoption in pharmaceuticals, biotechnology, and environmental sectors, the adsorption chromatography segment is primed for significant growth and market leadership in chromatography reagents.

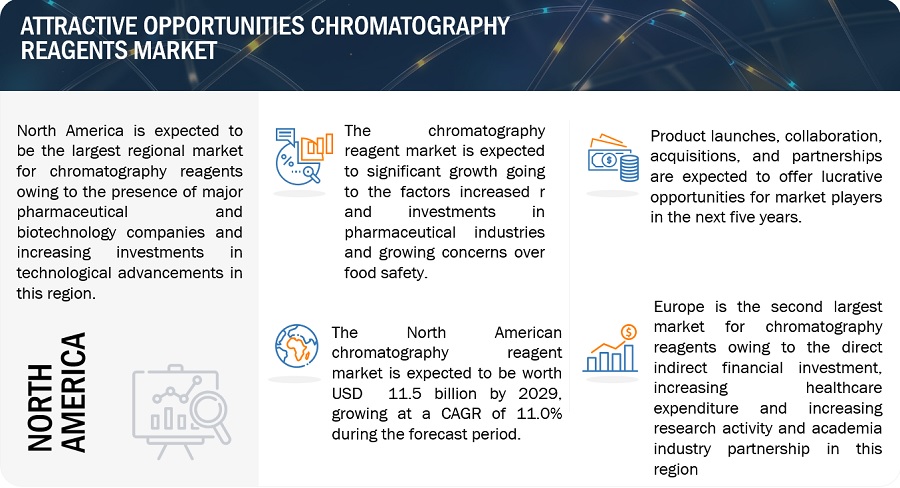

North America dominated the Chromatography Reagents industry in 2023

Throughout the forecast period, North America is anticipated to maintain its leading position in the chromatography reagents market. This region, comprising primarily the United States and Canada, is at the forefront of this market study. North America boasts a diverse and robust research and development (R&D) infrastructure, leading to the rapid adoption of chromatography techniques across various industries. In 2023, North America held the largest global market share at 37.0%. This growth is fueled by factors such as increased drug development activities, government funding for life science R&D, widespread adoption of advanced technological solutions, and numerous ongoing clinical research studies. These elements collectively propel the growth of the market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the Chromatography Reagents market include Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Avantor, Inc. (US), Waters Corporation (US), Agilent Technologies, Inc.(US), Bio-Rad Laboratories, Inc. (US), Danaher Corporation (US), Chiron AS (Norway), Loba Chemie (India), GFS Chemicals, Inc. (US), Regis Technologies, Inc. (US), Tokyo Chemical Industry Co., Ltd (TCI) (Japan), Honeywell International Inc. (US), Shimadzu Corporation (Japan), Santa Cruz Biotechnology, Inc. (US), Restek Corporation (US), Spectrum Chemical Mfg. Corp. (US), Kanto Kagaku (Japan), Tedia Company, Inc. (US), ITW Reagents Division (Spain),Tosoh Corporation (Japan), Concord Technology Co., Ltd. (Tianjin), Thomas Baker (Chemicals) Pvt. Ltd.(India), Alpha Laboratories Ltd. (Hampshire), Spectrochem (India), Columbus Chemical Industry (WI).

Scope of the Chromatography Reagents Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2024 |

USD 6.8 billion |

|

Projected Revenue Size by 2029 |

USD 11.5 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 11.0% |

|

Market Driver |

Growing pharmaceutical and biopharmaceutical R & D activities |

|

Market Opportunity |

Increasing use of chromatography in proteomics and the purification of monoclonal antibodies |

The study categorizes the chromatography reagents market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Solvent

- LC Solvent

- GC Solvent

- Other Solvents

-

Derivatization reagents

- Acylation reagents

- Silylation reagents

- Alkylation Reagetion and Esterification Reagents

-

Ion-Pair Reagents

- Acidic Ion-Pair Reagents

- Basic Ion-Pair Reagents

- Buffers

- Others

By Technology

-

Liquid Chromatography

- Low Pressure

- HPLC

- UHPLC

- Gas Chromatography

- Thin Layer Chromatography

- Supercritical Fluid Chromatography

By Separation Mechanism

- Adsorption Chromatography

- Partition Chromatography

- Ion Exchange Chromatography

- Size Exclusion Chromatography

- Affinity Chromatography

- Other Separation Techniques

By End User

- Pharmaceutical Companies

- Biopharmaceutical Company

- Research And Academic Laboratories

- Hospitals And Clinical Testing Laboratories

- Environmental Testing Laboratories

- Forensic Testing Laboratories

- Food And Beverage Industry

- Petrochemical Industry

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- Italy

- Spain

- France

- RoE

-

Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- RoAPAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East and Africa

- GCC Countries

- Rest of Middle East and Africa

Recent Developments of Chromatography Reagents Industry:

- In September 2023, Restek Corporation (US) entered into a partnership with Mastek Limites (US), The partnership allowed Restek to enhance chromatography online solutions by leveraging Oracle expertise from Mastek.

- In june 2023, Merck KGaA (Germany) formed a partenership with Nantong Economic and Technological Development Area (NETDA)(China) aiming to increase the production capacity of highly purified reagents for biopharma quality control, resulting in a significant boost to annual output by several thousand tons..

- In April 2023, Agilent Technologies, Inc. (US) partnered with PathAI (US), The partnership combined Agilent's assay expertise with PathAI's algorithms, focusing on integrated solutions and companion diagnostics in digital pathology..

- In June 2022, Waters Corporation (US) collaborated with BioInfra, Inc. (Korea), aiming to enhance regional scientific competitiveness and the quality of pharmaceutical research and testing. The academy will provide hands-on training for scientists in bioanalytical methods crucial for drug discovery and development. With a focus on bioequivalence trials, the training will support the growing demand for lower-cost generic drugs in Southeast Asia

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global chromatography reagents Market?

The global chromatography reagents market boasts a total revenue value of USD 11.5 billion by 2029.

What is the estimated growth rate (CAGR) of the global chromatography reagents Market?

The global chromatography reagents market has an estimated compound annual growth rate (CAGR) of 11.0% and a revenue size in the region of USD 6.8 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

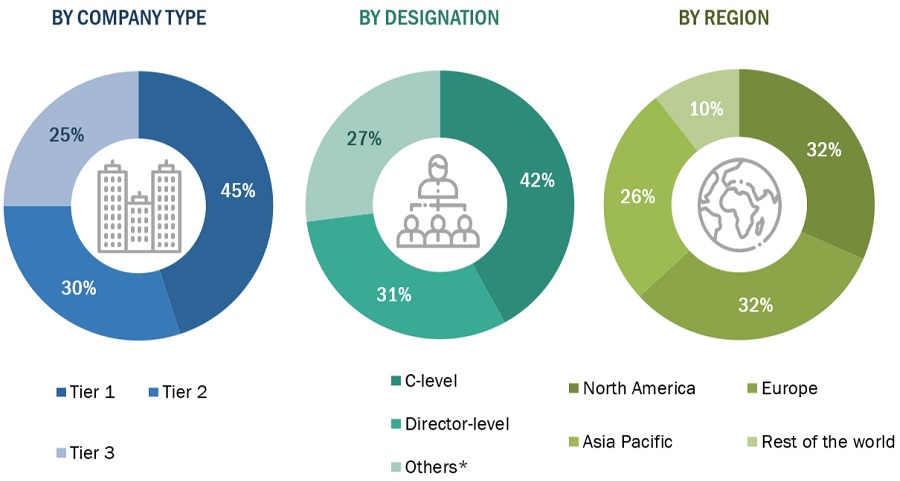

This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research:

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the Chromatography reagents market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research:

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the Chromatography reagents market. Primary sources from the demand side included researchers, lab technicians, reagent suppliers, purchase managers etc, and stakeholders in corporate & government bodies.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

The total size of the Chromatography reagents was arrived at after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation:

The size of the Chromatography reagents was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

- Shares of leading players in the Chromatography reagents market were gathered from secondary sources to the extent available. In some instances, shares of Chromatography reagents have been ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

The total revenue in the Chromatography reagents was determined by extrapolating the Market share data of major companies.

Global Chromatography reagents market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Definition:

Chromatography Reagents:

Chromatography is a biophysical technique that separates, identifies, and/or purifies the components of a mixture for qualitative and quantitative analysis. Chromatography reagents are essential chemicals used in chromatographic processes to separate and analyze complex mixtures of compounds. They enable accurate qualitative and quantitative analyses across various industries, including pharmaceuticals, biotechnology, environmental testing, food and beverage, and forensic science.

Key Stakeholders:

- Chromatography reagent manufacturers

- Third-party chromatography reagent suppliers

- Reagent raw material suppliers

- Pharmaceutical, biopharmaceutical, and biotechnology companies

- Food and beverage industry

- Environment protection and forensic institutes

- Clinicians, researchers, hospitals, and pharmaceutical research laboratories

- Research institutes and academic centers

- Government bodies/municipal corporations

- Contract research organizations (CROs)

- Business research and consulting service providers

- Forensic laboratories

- Diagnostic laboratories

- Research institutes and laboratories

- Academic centers

- Product manufacturers, distributors, and suppliers

- Venture capitalists and other government funding organizations

Objectives of the Study:

- To define, describe, segment, and forecast the chromatography reagents market based on type, technology, separation mechanism, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges), key industry trends, regulatory landscape, and pricing trends of major reagent categories at a regional level

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall chromatography reagents market

- To analyze the opportunities in the global chromatography reagents market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of market segments with respect to five major regions: North America (US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (GCC Countries and Rest of Middle East & Africa)

- To profile the key players and comprehensively analyze their market shares and core competencies2

- To benchmark players within the market using a proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To track and analyze competitive developments such as product launches, agreements & partnerships, mergers & acquisitions, and research activities in the chromatography reagents market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis:

- Further breakdown of the Rest of Europe Chromatography reagents market into Denmark, Norway, and others

- Further breakdown of the Rest of Asia Pacific Chromatography reagents market into Vietnam, New Zealand, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Chromatography Reagents Market