Chromatography Instruments Market by Type (Liquid Chromatography, Gas Chromatography), Consumable & Accessory (Columns, Detectors, Pressure Regulators), End User (Life Science Industry, Oil & Gas Industry), and Region - Analysis & Global Forecasts to 2025

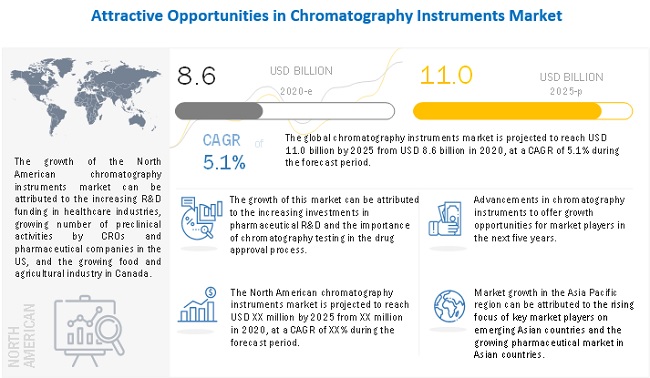

The global Chromatography Instruments Market in terms of revenue was estimated to be worth $8.6 billion in 2020 and is poised to reach $11.0 billion by 2025, growing at a CAGR of 5.1% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Growth in the chromatography instruments market can be attributed to factors such as growing investments in the pharmaceutical R&D, rising food safety concerns worldwide, increasing adoption of gas chromatography in oil & gas industry and numerous policies to reduce environmental pollution.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Chromatography Instruments Market

The COVID-19 pandemic has upended many lives and businesses on an unprecedented scale. The analytical instrumentation sector is facing challenges in its manufacturing and supply chain, such as delivering products to end-users in a timely manner as well as attending to an uneven demand for products and services. The chromatography instruments market is also facing a period of short-term negative growth, which can be attributed to factors such as a decline in the product demand from major end-users, limited operations in most of the industries, inadequate funding to research and academic institutes, temporary closure of major academic institutes, and disrupted supply chain and challenges in terms of providing essential/post-sales services. However, the pandemic is not estimated to have long-term effects on the fundamental growth drivers in the chromatography products market. With many pharmaceutical and biopharmaceutical companies focusing on new drug development to combat the pandemic, the growth of the chromatography instruments market is likely to augment considerably over the forecast period.

Chromatography Instruments Market Dynamics

Drivers: Rising popularity of hyphenated chromatography techniques

Hyphenated techniques usually involve chromatographic separation followed by peak identification with a traditional detector such as UV combined with further identification with MS (mass spectrometry), IR (infrared), or NMR (nuclear magnetic resonance) spectrometers. Some of the common hyphenated chromatography techniques include LC-MS, GC-MS, LC-NMR, and LC-FTIR. Advantages of state-of-the-art hyphenated chromatography techniques, such as the requirement of less time for analysis as compared to conventional methods, better reproducibility and enhanced selectivity, capacity to deliver greater automation and sample throughput, and reduced contamination risks, have expanded their application in various fields. Apart from applications in the pharmaceutical industry, LC-MS is widely used in clinical screening, pesticide residue analysis, forensic investigations, and food testing. GC-MS offers improved sample run cycle times and increased instrument efficacy. The use of technologically advanced devices can help fulfill the requirements of better reproducibility, ease of operation, and computerized results in pharmaceutical and biotechnology companies.

Restrains: High cost of chromatography equipment

Chromatography instruments are equipped with advanced features and functionalities and thus are priced at a premium. The cost of a new instrument differs as per the applications. Chromatography instruments used in the pharmaceutical industry are expensive as they use capillary columns to separate compounds like oxygen, hydrogen, and methane. Small- & medium-sized companies in the oil & gas, food & beverage, and biotech & pharmaceutical industries, as well as research and academic institutions, require many such systems in their processes. Hence, the capital cost spent on these systems increases significantly. Moreover, academic research laboratories find it difficult to afford such systems, as they have controlled budgets. The maintenance costs and other indirect expenses result in an overall increase in the total cost of ownership of these instruments. This restricts the adoption of chromatographic accessories & consumables among price-sensitive end users, such as research laboratories, academic institutes, and small companies.

Opportunities: Advancement in gas chromatography columns for petrochemical applications

Gas chromatography remains the most preferred analytical technique in the petroleum industry due to its high sensitivity for volatile substances. Petroleum analysis makes extensive use of specialized gas chromatography columns, with continuous expectations from the industry for better columns that improve analytical performance and chromatographic efficiency. Moreover, advanced gas chromatographic systems have improved technology to detect both finished goods as well as in-process samples. Petroleum analysis makes extensive use of specialized gas chromatography columns, with continuous expectations from the industry for better columns that improve analytical performance and chromatographic efficiency. New developments in GC columns help improve petroleum analyses, while reducing instrument downtime and maintenance costs. As a result of the significant requirement for specialized and advanced GC columns in the petroleum industry, the successful development of such columns is considered as a potential growth avenue for players operating in this market.

Challenges: Presence of alternative technologies to chromatography

Precipitation, high-resolution ultrafiltration, crystallization, high-pressure refolding, charged ultra-filtration membranes, protein crystallization, capillary electrophoresis, aqueous two-phase extraction, three-phase partitioning, monoliths, and membrane chromatography are some of the prominent techniques that are available as alternatives to chromatography. These techniques can be used as alternatives to column chromatography, which is extensively used to manufacture protein therapeutics and also for the separation of monoclonal antibodies. Column chromatography employs a minimum of two steps to manufacture protein therapeutics, which increases the cost. Furthermore, column chromatography requires additional steps such as equilibration, wash, elution, regeneration, and sanitization, which escalate the cost even further. On the other hand, alternative techniques require fewer steps and a large volume of antibodies can be separated in a single step. This helps in reducing the manufacturing cost, and also helps in increasing the manufacturing volume. Such benefits provided by alternative techniques are likely to hinder the growth of the chromatography accessories market.

Increasing investments in pharmaceutical R&D to drive the market growth

On the basis of type, the chromatography instruments market is broadly segmented into liquid chromatography (LC) systems, gas chromatography (GC) systems, supercritical fluid chromatography (SFC) systems and thin-layer chromatography systems (TLC). The liquid chromatography (LC) systems segment is expected to grow at the highest rate during the forecast period. The high growth rate of this segment can be attributed to the surge in demand for liquid chromatography systems in various analytical processes. Wide usage of these systems in pharmaceutical and biotechnology companies is expected to support the chromatography systems market growth.

Columns segment to account for the largest market share in 2020

On the basis of consumable and accessory, the global chromatography instruments market is segmented into column, column accessories, autosampler, autosampler accessories, flow management accessories, solvents/reagents/adsorbents, chromatography fittings and tubing, detectors, mobile phase accessories, fraction collectors, pressure regulators, and other accessories. The columns segment is expected to command the largest share of the market in 2020. The large share is attributed to the upsurge in demand for the prepacked and empty columns in various separation processes.

Life science industry is expected to be the largest contributor to the chromatography instruments market growth

On the basis of end-user industry, the market is segmented into life science industry, academic & research institutes, oil & gas industry, environmental agencies, food & beverage industry and other end-user industries. The life science industry accounted for the largest share of the market in 2019 owing to numerous applications of chromatography techniques throughout the drug development process. Technological advancements in chromatography instruments have increased their adoption in pharmaceutical companies to improve their productivity and efficiency.

Asia Pacific to emerge as a potential market for chromatography instruments solutions

The global chromatography instruments market has been categorized on the basis of four major regional segments—North America, Europe, Asia Pacific, and the Rest of the World. Asia Pacific is expected to grow at the highest CAGR during the forecast period. Factors such as environmental protection activities and strategic expansions by key players in China, growth in biomedical and medical research and an increase in awareness about chromatography in Japan, and government initiatives supporting the growth of the pharmaceutical industry in India are driving the growth of the chromatography instruments market in the Asia Pacific region. Moreover, the current outbreak of COVID-19 in the region has resulted in an increased patient pool, leading to subsequent surge in R&D activities. Increasing investments in drug discovery is thus, expected to fuel the growth of the chromatography instruments market in the APAC region.

To know about the assumptions considered for the study, download the pdf brochure

Agilent Technologies (US), Waters Corporation (US), Shimadzu (Japan), Thermo Fisher Scientific (US), PerkinElmer (US), Merck KGaA (Germany), Phenomenex (US) and Bio-Rad Laboratories (US), among others, are some of the leading players of the chromatography instruments market.

Scope of Market

|

Report Metric |

Details |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Type, By Consumable & Accessory, By End-User Industry |

|

Geographies covered |

North America, Europe, Asia Pacific, ROW |

|

Companies covered |

The major market players include Agilent Technologies (US), Waters Corporation (US), Shimadzu (Japan), Thermo Fisher Scientific (US), PerkinElmer (US), Merck KGaA (Germany), Phenomenex (US), Bio-Rad Laboratories (US), Cytiva (US), Hitachi (Japan), Restek Corporation (US), Scion Instruments (US), SRI Instruments (US) and Gilson, Inc (US) (Total 20 companies) |

The study categorizes the chromatography instruments market based on type, consumables & accessories and end-user industry at the regional and global level.

By Type

-

Liquid Chromatography Systems

- High-Performance Liquid Chromatography Systems

- Ultra-High Performance Liquid Chromatography Systems

- Medium-Pressure Liquid Chromatography Systems

- Flash Chromatography Systems

- Other LC Systems

- Gas Chromatography Systems

- Supercritical Fluid Chromatography Systems

- Thin-Layer Chromatography Systems

By Consumable & Accessory

-

Columns

- Pre-packed Columns

- Empty Columns

-

Column Accessories and Consumables

- Heaters & Ovens

- Guard Holders

- Other Column Accessories and Consumables

- Autosamplers

-

Autosampler Accessories and Consumables

- Autosampler Syringes/

- Sample Needles

- Vials

- Septa

-

Flow Management Accessories and Consumables

- Flowmeters

- Flow Splitters

- Pumps

- Solvents/Reagents/Adsorbents

-

Chromatography Fittings and Tubing

- Tubing

- Ferrules and Nuts

- Valves and Gauges

- Liners and Seals

-

Detectors

-

LC Detectors

- UV Visible PDA Detectors

- Refractive Index Detectors

- Fluorescence Detectors

- Other LC Detectors

-

GC Detectors

- Flame Ionization Detectors

- Mass Spectrometry Detectors

- Thermal Conductivity Detectors

- Other GC Detectors

-

LC Detectors

-

Mobile Phase Accessories and Consumables

- Mixers and Mixing Chambers

- Degassers

- Other Mobile Phase Accessories and Consumables

- Fraction Collectors

- Pressure Regulators

- Other Accessories and Consumables

By End-User Industry

- Life Science Industry

- Academic & Research Institutes

- Oil & Gas Industry

- Environmental Agencies

- Food & Beverage Industry

- Other End-user Industries

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In 2020, Waters Corporation (US) acquired Andrew Alliance (Switzerland), a software company, to broaden its technology portfolio for including advanced robotics and software to enable scientists to perform both routine and complex laboratory work processes

- In 2020, Thermo Fisher Scientific (US) launched the Thermo Scientific Vanquish Core HPLC systems to maintain consistent throughput and ensure dependable analytical results

- In 2020, Hitachi (Japan) acquired all the remaining shares of Hitachi High-Technologies for USD 5 billion and later announced it as a subsidiary of Hitachi. This subsidiary will be responsible for the manufacturing of measuring and analytical equipment, along with the development of chip-making equipment and industrial materials and systems

- In 2020, SCION Instruments (Scotland) developed a new factory and warehouse facility in the Netherlands to boost laboratory demonstration testing, manufacturing operations, and local procurement processes

Frequently Asked Questions (FAQ):

What is the market size of the chromatography instruments market?

The chromatography instruments market is projected to reach USD 11.0 billion by 2025 from USD 8.6 billion in 2020, at a CAGR of 5.1%.

What are some of the major drivers for this market?

The market is primarily driven by the increasing investments in pharmaceutical R&D, growing food safety concerns, rising popularity of hyphenated chromatography techniques, importance of chromatography tests in drug approval process and initiatives to reduce environmental pollution levels, among others.

Who are the major players in the chromatography instruments market?

The major players include Agilent Technologies (US), Waters Corporation (US), Shimadzu (Japan), Thermo Fisher Scientific (US), PerkinElmer (US), Merck KGaA (Germany), Phenomenex (US), Bio-Rad Laboratories (US), Cytiva (US), Hitachi (Japan), Restek Corporation (US), Scion Instruments (US), Gilson, Inc (US), JASCO, Inc. (US) and SRI Instruments (US) among others.

What is the impact of COVID-19 on the chromatography instruments market?

The rising prevalence of COVID-19 has hit the analytical instruments market, hindering new sales and purchases by the end users. The analytical instrumentation sector is facing challenges in its manufacturing and supply chain, such as delivering products to end users in a timely manner as well as attending to an uneven demand for products and services. The chromatography instruments market is also facing a period of short-term negative growth, which can be attributed to factors such as a decline in the product demand from major end users, limited operations in most of the industries, inadequate funding to research and academic institutes, temporary closure of major academic institutes, and disrupted supply chain and challenges in terms of providing essential/post-sales services due to the lockdown. However, the pandemic is not estimated to have long-term effects on the fundamental growth drivers in the chromatography products market. It is estimated that the market reconciliation and development would be seen towards the start of 2021.

What are the newer government initiatives undertaken to improve adoption of the chromatography instruments solutions?

The Government of India, in January 2019, launched the National Clean Air Program (NCAP) with the aim of controlling and preventing air pollution and augmenting air quality monitoring networks across the country. In January 2017, the Ministry of Environmental Protection (MEP), China extended its central environment inspection initiative from 15 provincial regions to all regions. MEP inspectors monitor local conditions and impose fines for environment related wrong doings. The US federal government finalized the rule on Foreign Supplier Verification Programs (FSVP) of the Food Safety Modernization Act (FSMA) in May 2017. This law aims at verifying that foreign suppliers of food adhere to the same level of food quality and safety as the local suppliers to prevent the contamination of the food supply. In May 2017, the Codex Alimentarius committee (the world food code) proposed an electronic working group with the aim of defining and creating scope for food fraud/food authenticity/food integrity/related terms. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS & EXCLUSIONS

1.2.2 MARKET SCOPE

1.2.3 MARKETS COVERED

1.2.4 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

2.2 RESEARCH METHODOLOGY STEPS

FIGURE 1 RESEARCH METHODOLOGY: CHROMATOGRAPHY INSTRUMENTS MARKET

FIGURE 2 RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2.2.1 Primary sources

2.2.2.2 Key insights from primary sources

2.3 MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3.1 REVENUE MAPPING-BASED MARKET ESTIMATION

2.3.2 USAGE PATTERN-BASED MARKET ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: CHROMATOGRAPHY INSTRUMENTS MARKET

2.3.3 PRIMARY RESEARCH VALIDATION

2.4 MARKET DATA ESTIMATION AND TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19-SPECIFIC ASSUMPTIONS

2.7 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2020 VS. 2025 (USD MILLION)

FIGURE 9 CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 10 NORTH AMERICA DOMINATES THE GLOBAL CHROMATOGRAPHY INSTRUMENTS MARKET

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 CHROMATOGRAPHY INSTRUMENTS MARKET OVERVIEW

FIGURE 11 GROWING INVESTMENTS IN PHARMACEUTICAL R&D TO DRIVE THE MARKET GROWTH

4.2 LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 12 HPLC SYSTEMS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 CHROMATOGRAPHY INSTRUMENTS MARKET SHARE, BY CONSUMABLE & ACCESSORY, 2020 VS. 2025

FIGURE 13 COLUMNS SEGMENT WILL CONTINUE TO DOMINATE THE MARKET IN 2025

4.4 CHROMATOGRAPHY INSTRUMENTS MARKET SHARE, BY END USER, 2020 VS. 2025

FIGURE 14 LIFE SCIENCE INDUSTRY IS THE LARGEST END-USER SEGMENT OF THE CHROMATOGRAPHY INSTRUMENTS MARKET

4.5 NORTH AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE & COUNTRY

FIGURE 15 LIQUID CHROMATOGRAPHY SYSTEMS SEGMENT TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 CHROMATOGRAPHY INSTRUMENTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Policies and initiatives to reduce environmental pollution levels

5.2.1.2 Growing food safety concerns

5.2.1.3 Increasing investments in pharmaceutical R&D

5.2.1.4 Importance of chromatography tests in the drug approval process

5.2.1.5 Rising popularity of hyphenated chromatography techniques

5.2.1.6 Growing collaborations between chromatography instrument manufacturers and research laboratories/academic institutes

5.2.2 RESTRAINTS

5.2.2.1 High cost of chromatography equipment

5.2.2.2 Dearth of skilled professionals

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for chromatography instruments in emerging markets

5.2.3.2 Growing proteomics and genomics markets

5.2.3.3 Application of chromatography in the purification of monoclonal antibodies

5.2.3.4 Advancements in gas chromatography columns for petrochemical applications

5.2.4 CHALLENGES

5.2.4.1 Presence of alternative technologies to chromatography

5.2.4.2 Lack of long-term reproducibility

5.3 IMPACT OF COVID-19 ON THE CHROMATOGRAPHY INSTRUMENTS MARKET

5.4 ECOSYSTEM: CHROMATOGRAPHY INSTRUMENTS MARKET

5.4.1 ROLE IN ECOSYSTEM

5.5 PRICING ANALYSIS: CHROMATOGRAPHY INSTRUMENTS MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS: CHROMATOGRAPHY INSTRUMENTS MARKET

5.7 REGULATORY GUIDELINES

5.7.1 NORTH AMERICA

5.7.2 EUROPE

5.7.3 EMERGING MARKETS

5.8 TECHNOLOGY ANALYSIS

6 CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE (Page No. - 69)

6.1 INTRODUCTION

TABLE 2 CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 3 CHROMATOGRAPHY INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.1 LIQUID CHROMATOGRAPHY SYSTEMS

TABLE 4 LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 5 LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.1.1 High-performance Liquid Chromatography Systems

6.1.1.1.1 HPLC systems held the largest share of the liquid chromatography systems market

TABLE 6 HIGH-PERFORMANCE LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.1.2 Ultra-high-performance Liquid Chromatography Systems

6.1.1.2.1 UHPLC differs from HPLC in terms of the size of particles filled into the column

TABLE 7 ULTRA-HIGH-PERFORMANCE LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.1.3 Medium-pressure Liquid Chromatography Systems

6.1.1.3.1 Application of MPLC in the pharmaceutical industry to boost the market growth

TABLE 8 MEDIUM-PRESSURE LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.1.4 Flash Chromatography Systems

6.1.1.4.1 Flash chromatography is cost-effective as it does not require elaborate and expensive equipment

TABLE 9 FLASH CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.1.5 Other Liquid Chromatography Systems

TABLE 10 OTHER LIQUID CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.2 GAS CHROMATOGRAPHY SYSTEMS

6.1.2.1 GC is widely used in the analysis of pharmaceutical products

TABLE 11 GAS CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.3 SUPERCRITICAL FLUID CHROMATOGRAPHY SYSTEMS

6.1.3.1 SFC offers high efficiency and low environmental impact

TABLE 12 SUPERCRITICAL FLUID CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.4 THIN-LAYER CHROMATOGRAPHY SYSTEMS

6.1.4.1 Technological advancements in TLC to favor market growth

TABLE 13 THIN-LAYER CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

7 CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY (Page No. - 80)

7.1 INTRODUCTION

TABLE 14 CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

7.2 COLUMNS

TABLE 15 CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 16 CHROMATOGRAPHY COLUMNS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.1 PREPACKED COLUMNS

7.2.1.1 Prepacked columns dominate the chromatography columns market

TABLE 17 PREPACKED COLUMNS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.2.2 EMPTY COLUMNS

7.2.2.1 Empty columns provide flexibility in performing chromatography

TABLE 18 EMPTY COLUMNS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3 COLUMN ACCESSORIES & CONSUMABLES

TABLE 19 COLUMN ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 20 COLUMN ACCESSORIES & CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.1 GUARD HOLDERS

7.3.1.1 Guard holders extend the life of columns

TABLE 21 GUARD HOLDERS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.2 HEATERS & OVENS

7.3.2.1 Heaters & ovens are used to control the temperature of an analytical process

TABLE 22 HEATERS & OVENS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3.3 OTHER COLUMN ACCESSORIES & CONSUMABLES

TABLE 23 OTHER COLUMN ACCESSORIES & CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4 AUTOSAMPLERS

7.4.1 AUTOSAMPLERS ENABLE THE AUTOMATIC INTRODUCTION OF SAMPLES INTO AN INLET

TABLE 24 AUTOSAMPLERS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.5 AUTOSAMPLER ACCESSORIES & CONSUMABLES

TABLE 25 AUTOSAMPLER ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 26 AUTOSAMPLER ACCESSORIES & CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.5.1 AUTOSAMPLER SYRINGES/SAMPLE NEEDLES

7.5.1.1 Selection of the correct autosampler needle avoids flooding of the inlet

TABLE 27 AUTOSAMPLER SYRINGES/SAMPLE NEEDLES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.5.2 VIALS

7.5.2.1 Vial selection depends on the sample to be analyzed

TABLE 28 VIALS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.5.3 SEPTA

7.5.3.1 Septa are made of materials like silicone rubber, PTFE, and polypropylene

TABLE 29 SEPTA MARKET, BY REGION, 2018–2025 (USD MILLION)

7.6 FLOW MANAGEMENT ACCESSORIES & CONSUMABLES

TABLE 30 FLOW MANAGEMENT ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 31 FLOW MANAGEMENT ACCESSORIES & CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.6.1 FLOW METERS

7.6.1.1 Flow meters measure the amount of gas exiting a column or split vent

TABLE 32 FLOW METERS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.6.2 FLOW SPLITTERS

7.6.2.1 Flow splitters are generally classified as fixed, adjustable, and multiport fixed

TABLE 33 FLOW SPLITTERS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.6.3 PUMPS

7.6.3.1 Pumps provide a continuous and consistent flow of the mobile phase through the chromatography system

TABLE 34 PUMPS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.7 SOLVENTS, REAGENTS, AND ADSORBENTS

7.7.1 ADSORBENTS HELP IN THE RECOVERY OF SYNTHESIZED COMPOUNDS FROM REACTION MIXTURES

TABLE 35 SOLVENTS, REAGENTS, & ADSORBENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.8 CHROMATOGRAPHY FITTINGS AND TUBING

TABLE 36 CHROMATOGRAPHY FITTINGS & TUBING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 37 CHROMATOGRAPHY FITTINGS & TUBING MARKET, BY REGION, 2018–2025 (USD MILLION)

7.8.1 TUBING

7.8.1.1 Stainless steel is the most common material used for tubing

TABLE 38 TUBING MARKET, BY REGION, 2018–2025 (USD MILLION)

7.8.2 FERRULES & NUTS

7.8.2.1 Ferrules and nuts are used in both GC and LC systems to seal tube connections

TABLE 39 FERRULES & NUTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.8.3 VALVES & GAUGES

7.8.3.1 Valves and gauges are used to control the flow of fluids and column pressure

TABLE 40 VALVES & GAUGES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.8.4 LINERS & SEALS

7.8.4.1 Liners and seals assist with the complete transfer of samples into columns

TABLE 41 LINERS & SEALS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9 DETECTORS

TABLE 42 DETECTORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 43 DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9.1 LIQUID CHROMATOGRAPHY DETECTORS

TABLE 44 LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9.1.1 UV/Visible PDA Detectors

7.9.1.1.1 UV/Vis PDA detectors are the most commonly used detectors in LC

TABLE 46 UV/VISIBLE PDA DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9.1.2 Refractive index detectors

7.9.1.2.1 RI detectors are beneficial for analyzing compounds like carbohydrates

TABLE 47 REFRACTIVE INDEX DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9.1.3 Fluorescence detectors

7.9.1.3.1 Fluorescence detectors are highly sensitive chromatography detectors

TABLE 48 FLUORESCENCE DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9.1.4 Other liquid chromatography detectors

TABLE 49 OTHER LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9.2 GAS CHROMATOGRAPHY DETECTORS

TABLE 50 GAS CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 51 GAS CHROMATOGRAPHY DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9.2.1 Flame ionization detectors

7.9.2.1.1 FID is a mass flow-dependent detector

TABLE 52 FLAME IONIZATION DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9.2.2 Mass spectrometry detectors

7.9.2.2.1 MS detectors are the most powerful of all gas chromatography detectors

TABLE 53 MASS SPECTROMETRY DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9.2.3 Thermal conductivity detectors

7.9.2.3.1 TCD is a type of concentration-dependent detector

TABLE 54 THERMAL CONDUCTIVITY DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.9.2.4 Other gas chromatography detectors

TABLE 55 OTHER GAS CHROMATOGRAPHY DETECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.1 MOBILE PHASE ACCESSORIES & CONSUMABLES

TABLE 56 MOBILE PHASE ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 MOBILE PHASE ACCESSORIES & CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.10.1 MIXERS & MIXING CHAMBERS

7.10.1.1 Mixers and mixing chambers are used to homogenize the mobile phase composition

TABLE 58 MIXERS & MIXING CHAMBERS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.10.2 DEGASSERS

7.10.2.1 Mobile phase degassing is important for the functioning of pump check valves

TABLE 59 DEGASSERS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.10.3 OTHER MOBILE PHASE ACCESSORIES & CONSUMABLES

TABLE 60 OTHER MOBILE PHASE ACCESSORIES & CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

7.11 FRACTION COLLECTORS

7.11.1 FRACTION COLLECTORS ARE USED TO COLLECT THE SAMPLE AFTER SEPARATION

TABLE 61 FRACTION COLLECTORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.12 PRESSURE REGULATORS

7.12.1 PRESSURE REGULATORS DO NOT ALLOW CONTAMINATORS TO ENTER THE GAS STREAM

TABLE 62 PRESSURE REGULATORS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.13 OTHER ACCESSORIES & CONSUMABLES

TABLE 63 OTHER CHROMATOGRAPHY ACCESSORIES & CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

8 CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER (Page No. - 113)

8.1 INTRODUCTION

TABLE 64 CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

8.2 LIFE SCIENCE INDUSTRY

8.2.1 APPLICATION OF CHROMATOGRAPHY IN ALL DRUG DEVELOPMENT PHASES TO BOOST THE MARKET GROWTH

TABLE 65 CHROMATOGRAPHY INSTRUMENTS MARKET FOR LIFE SCIENCE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

8.3 ACADEMIC & RESEARCH INSTITUTES

8.3.1 EMPHASIS ON PRACTICAL APPLICATIONS HAS INCREASED THE USE OF HIGH-END CHROMATOGRAPHY INSTRUMENTS IN THIS SEGMENT

TABLE 66 CHROMATOGRAPHY INSTRUMENTS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2018–2025 (USD MILLION)

8.4 OIL & GAS INDUSTRY

8.4.1 WIDE USE OF GAS CHROMATOGRAPHY IN THE OIL & GAS INDUSTRY TO PROPEL MARKET GROWTH

TABLE 67 CHROMATOGRAPHY INSTRUMENTS MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

8.5 ENVIRONMENTAL AGENCIES

8.5.1 STRINGENT GOVERNMENT REGULATIONS REGARDING ENVIRONMENTAL PROTECTION TO FAVOR THE MARKET GROWTH

TABLE 68 CHROMATOGRAPHY INSTRUMENTS MARKET FOR ENVIRONMENTAL AGENCIES, BY REGION, 2018–2025 (USD MILLION)

8.6 FOOD & BEVERAGE INDUSTRY

8.6.1 GROWING FOCUS ON FOOD QUALITY AND SAFETY TO SUPPORT THE GROWTH OF THIS END-USER SEGMENT

TABLE 69 CHROMATOGRAPHY INSTRUMENTS MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

8.7 OTHER END USERS

TABLE 70 CHROMATOGRAPHY INSTRUMENTS MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

9 CHROMATOGRAPHY INSTRUMENTS MARKET, BY REGION (Page No. - 121)

9.1 INTRODUCTION

TABLE 71 CHROMATOGRAPHY INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 17 NORTH AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET SNAPSHOT

TABLE 72 NORTH AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 NORTH AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing funding for R&D activities in the healthcare industries to drive the market growth

TABLE 76 US: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 US: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 78 US: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growth in the food industry to support market growth in Canada

TABLE 79 CANADA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 CANADA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 81 CANADA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.3 COVID-19 IMPACT ON THE NORTH AMERICAN CHROMATOGRAPHY INSTRUMENTS MARKET

9.3 EUROPE

TABLE 82 EUROPE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 83 EUROPE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 EUROPE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 85 EUROPE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Strong R&D footprint and high investments in pharmaceutical research to drive the German market

TABLE 86 GERMANY: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 87 GERMANY: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 88 GERMANY: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.2 UK

9.3.2.1 Partnerships & research funding in the UK to favor market growth

TABLE 89 UK: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 UK: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 91 UK: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Strong perfume industry to drive the market growth

TABLE 92 FRANCE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 FRANCE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 94 FRANCE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Growth in the biotechnology and pharmaceutical industries to support market growth in Italy

TABLE 95 ITALY: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 96 ITALY: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 97 ITALY: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Growth in the food, agriculture, and biotechnology sector to drive the market growth

TABLE 98 SPAIN: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 99 SPAIN: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 100 SPAIN: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.6 REST OF EUROPE (ROE)

TABLE 101 ROE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 102 ROE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 103 ROE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.7 COVID-19 IMPACT ON THE EUROPEAN CHROMATOGRAPHY INSTRUMENTS MARKET

9.4 ASIA PACIFIC

FIGURE 18 ASIA PACIFIC: CHROMATOGRAPHY INSTRUMENTS MARKET SNAPSHOT

TABLE 104 ASIA PACIFIC: CHROMATOGRAPHY INSTRUMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 105 ASIA PACIFIC: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 ASIA PACIFIC: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 107 ASIA PACIFIC: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Growth in generics and biosimilars production to boost market growth in Japan

TABLE 108 JAPAN: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 JAPAN: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 110 JAPAN: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Surge in production and export of pharmaceuticals to support market growth in China

TABLE 111 CHINA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 CHINA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 113 CHINA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Introduction of food safety standards and growing pharmaceutical sector to drive the Indian market

TABLE 114 INDIA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 115 INDIA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 116 INDIA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Growth of the food industry in Australia to drive the market growth

TABLE 117 AUSTRALIA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 AUSTRALIA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 119 AUSTRALIA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.5 SOUTH KOREA

9.4.5.1 Growing pharmaceutical sector in South Korea to favor the market growth

TABLE 120 SOUTH KOREA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 121 SOUTH KOREA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 122 SOUTH KOREA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC (ROAPAC)

TABLE 123 ROAPAC: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 124 ROAPAC: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 125 ROAPAC: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.7 COVID-19 IMPACT ON THE ASIA PACIFIC CHROMATOGRAPHY INSTRUMENTS MARKET

9.5 REST OF THE WORLD (ROW)

TABLE 126 ROW: CHROMATOGRAPHY INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 127 ROW: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 128 ROW: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 129 ROW: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.1 LATIN AMERICA

9.5.1.1 Growing biologics sector in Latin America to drive the market growth

TABLE 130 LATIN AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 131 LATIN AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 132 LATIN AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA (MEA)

9.5.2.1 Increasing oil & gas production in MEA and improved laws to tackle counterfeit medicines will favor the market growth

TABLE 133 MEA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 134 MEA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY CONSUMABLE & ACCESSORY, 2018–2025 (USD MILLION)

TABLE 135 MEA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.3 COVID-19 IMPACT ON THE ROW CHROMATOGRAPHY INSTRUMENTS MARKET

10 COMPETITIVE LANDSCAPE (Page No. - 167)

10.1 OVERVIEW

FIGURE 19 KEY DEVELOPMENTS IN THE CHROMATOGRAPHY INSTRUMENTS MARKET (2017-2020)

10.2 MARKET SHARE ANALYSIS (2019)

FIGURE 20 CHROMATOGRAPHY INSTRUMENTS MARKET SHARE, BY KEY PLAYER, 2019

10.3 RIGHT TO WIN

TABLE 136 RIGHT TO WIN

10.4 COMPETITIVE SCENARIO

10.4.1 PRODUCT LAUNCHES AND APPROVALS

TABLE 137 PRODUCT LAUNCHES AND APPROVALS (2017–2020)

10.4.2 ACQUISITIONS

TABLE 138 ACQUISITIONS (2017–2020)

10.4.3 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

TABLE 139 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS (2017–2020)

10.4.4 EXPANSIONS

TABLE 140 EXPANSIONS (2017–2020)

10.4.5 OTHER DEVELOPMENTS

TABLE 141 OTHER DEVELOPMENTS (2017–2020)

10.5 MARKET EVALUATION FRAMEWORK

FIGURE 21 MARKET EVALUATION FRAMEWORK

10.6 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

10.6.1 STARS

10.6.2 EMERGING LEADERS

10.6.3 PARTICIPANTS

10.6.4 PERVASIVE

FIGURE 22 CHROMATOGRAPHY INSTRUMENTS MARKET: COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET), 2019

10.7 COMPETITIVE LEADERSHIP MAPPING (EMERGING PLAYERS)

10.7.1 PROGRESSIVE COMPANIES

10.7.2 STARTING/EMERGING BLOCKS

10.7.3 RESPONSIVE COMPANIES

10.7.4 DYNAMIC COMPANIES

FIGURE 23 CHROMATOGRAPHY INSTRUMENTS MARKET: COMPETITIVE LEADERSHIP MAPPING (EMERGING PLAYERS), 2019

11 COMPANY PROFILES (Page No. - 178)

11.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, MNM view)*

11.1.1 AGILENT TECHNOLOGIES, INC.

FIGURE 24 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT (2019)

11.1.2 SHIMADZU CORPORATION

FIGURE 25 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2019)

11.1.3 WATERS CORPORATION

FIGURE 26 WATERS CORPORATION: COMPANY SNAPSHOT (2019)

11.1.4 THERMO FISHER SCIENTIFIC, INC.

FIGURE 27 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2019)

11.1.5 PERKINELMER, INC.

FIGURE 28 PERKINELMER, INC.: COMPANY SNAPSHOT (2019)

11.1.6 MERCK KGAA

FIGURE 29 MERCK KGAA: COMPANY SNAPSHOT (2019)

11.1.7 PHENOMENEX

FIGURE 30 DANAHER CORPORATION: COMPANY SNAPSHOT (2019)

11.1.8 BIO-RAD LABORATORIES

FIGURE 31 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2019)

11.1.9 GE HEALTHCARE (CYTIVA)

FIGURE 32 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

11.1.10 HITACHI, LTD.

FIGURE 33 HITACHI LTD.: COMPANY SNAPSHOT (2019)

11.2 OTHER PLAYERS

11.2.1 RESTEK CORPORATION

11.2.2 DANI INSTRUMENTS SPA

11.2.3 SCION INSTRUMENTS

11.2.4 GILSON, INC.

11.2.5 JASCO, INC.

11.2.6 HAMILTON COMPANY

11.2.7 SRI INSTRUMENTS

11.2.8 TRAJAN SCIENTIFIC

11.2.9 GL SCIENCES

11.2.10 VALCO INSTRUMENTS COMPANY, INC.

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 238)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

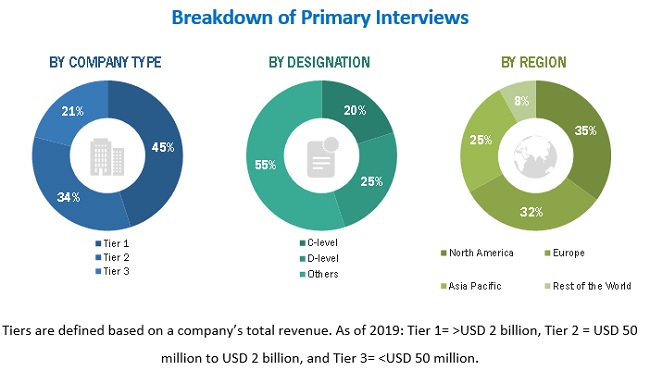

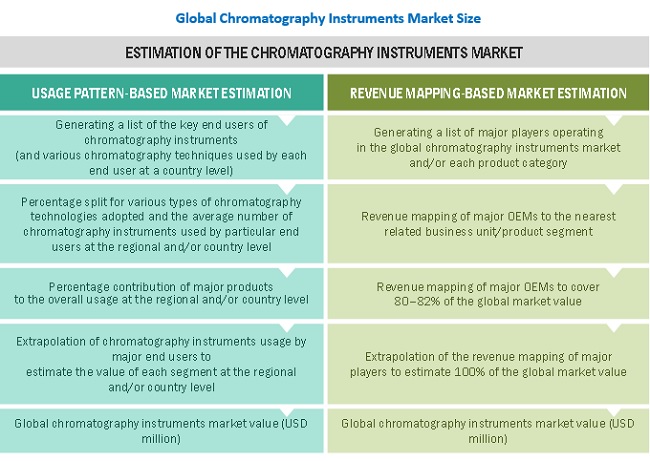

This study involved the four major activities in estimating the size of the chromatography instruments market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include National Center for Biotechnology Information (NCBI), The Chromatographic Society (ChromSoc), Chinese American Chromatography Association (CACA), Research Institute for Chromatography (RIC), Gas Processors Association, Chromatography Institute of America, Chromatographic Society of India, European Society for Separation Science, The Food Safety Authority of Ireland (FSAI), World Health Organization (WHO), USDA Foreign Agricultural Service (FAS), American Association for Laboratory Accreditation (A2LA), US Environmental Protection Agency (US EPA), The EU Food and Agricultural Import Regulations and Standards (FAIRS), European Environment Agency (EEA), OECD, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the chromatography instruments market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply and demand side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, sales heads, and marketing managers of tier I, II, and III companies offering chromatography instruments, administrators and purchase managers of pharmaceutical companies, CROs, and academic research institutes and related key executives from various key companies and organizations operating in the chromatography instruments market. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the calculation of the market value, a detailed market estimation approach was followed to estimate and validate the size of the global chromatography instruments market and other dependent submarkets:

- Identifying key players in the global chromatography instruments market through secondary research and determine their respective market shares through primary and secondary research

- Analysis of the annual and quarterly financial reports of the top market players and conducting interviews with industry experts for key insights on the global chromatography instruments market

- Determining percentage shares, splits, and breakdowns of the overall chromatography instruments market by using secondary sources and verifying them through primary sources

- Applying percentage shares on the respective segments to arrive at the country-wise chromatography instruments market

- Extrapolating the market size in major countries to arrive at the regional-level market numbers and adding them up to derive the global chromatography instruments market

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the life science, oil & gas, food & beverage, and other industries.

Report Objectives

- To define, describe, and forecast the global chromatography instruments market on the basis of type, consumable & accessory, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the global chromatography instruments market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely,

- North America, Europe, the Asia Pacific, and the Rest of the World (RoW)

- To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches, partnerships, agreements, collaborations, expansions, and acquisitions in the global chromatography instruments market

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of chromatography instruments market

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Chromatography Instruments Market