Chlorinated Polyvinyl Chloride Market by Grade (Injection, Extrusion), Form (Pellet, Powder), Sales Channel (Direct Sales, Indirect Sales), Production Process, End-use Industry( Residential, Commercial, Industrial), & Region - Global Forecast to 2028

Updated on : April 03, 2024

Chlorinated Polyvinyl Chloride Market

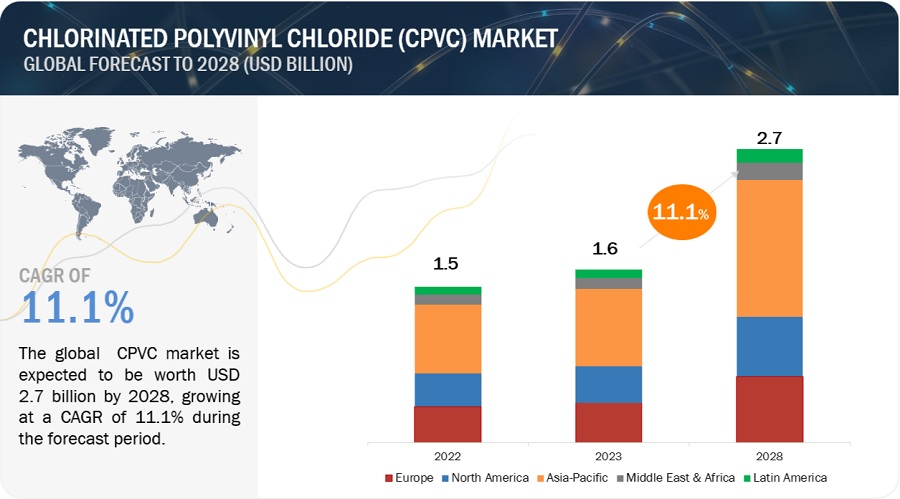

The global chlorinated polyvinyl chloride market was valued at USD 1.6 billion in 2023 and is projected to reach USD 2.7 billion by 2028, growing at 11.1% cagr from 2023 to 2028. The chlorinated polyvinyl chloride (CPVC) resin registered high growth in the residential sector, particularly in Asia Pacific. China and India were the largest markets for CPVC resin due to its significant application in plumbing systems, fire protection, chemical & industrial equipment, and power cable casing in these countries. The CPVC market is highly competitive, with both big and small players. This section will examine drivers, restraints, opportunities, and challenges.

The CPVC market has grown significantly due to its unique properties, allowing it to address specific challenges across various applications. The market’s expansion is driven by various factors, including the growing demand for robust and reliable materials in critical sectors.

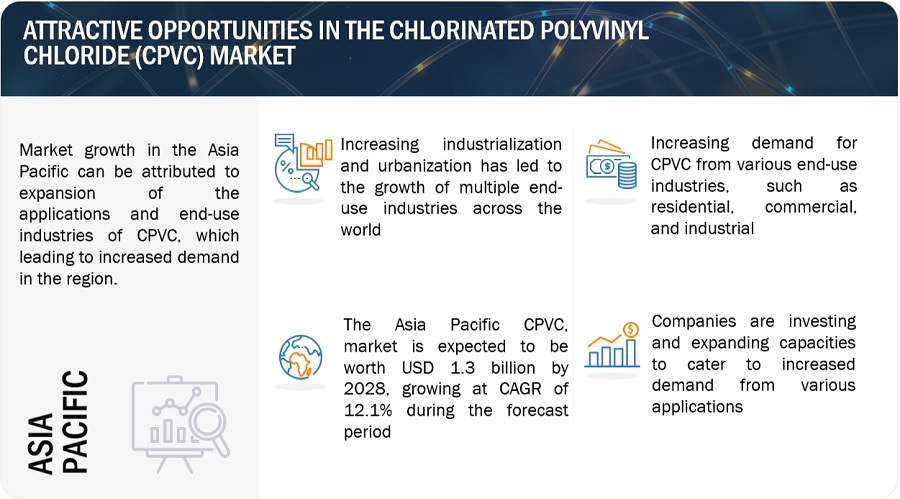

Attractive Opportunities in CPVC Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

CPVC Market Dynamics

Driver: Growth of construction industry across the globe

CPVC resin is a dependable material that's gaining popularity in construction, especially in plumbing systems, due to the industry's growth in residential and commercial sectors. CPVC’s corrosion resistance and cost-effectiveness make it an attractive choice for plumbing applications. Infrastructure modernization and urbanization fuel the construction of new buildings, commercial spaces, and residential complexes in developed and emerging economies. As construction activities surge, the need for efficient, durable, and sustainable materials becomes more pronounced.

Restraint: High processing temperature than conventional PVC

While CPVC resin offers a range of enhanced properties that make it an attractive choice for various applications, there are certain processing challenges associated with its production and utilization. Manufacturing processes can be impacted by these challenges, influencing industries considering CPVC adoption. One of the prominent challenges in working with CPVC is its higher processing temperature than conventional PVC. The chlorination process elevates the melting point of CPVC, necessitating the use of higher temperatures during extrusion, injection molding, or other shaping processes, thereby posing difficulties in maintaining precise temperature control within production machinery and molds. The elevated processing temperature of CPVC may require manufacturers to use specialized equipment capable of withstanding higher temperatures.

Opportunity: Rapid urbanization and infrastructural development

The rapid growth and evolution of infrastructure worldwide present a substantial opportunity for innovative materials that can meet the demands of modern construction and urbanization. CPVC resin is poised to capitalize on this opportunity, finding a significant role in diverse infrastructure projects.

The expansion of wastewater treatment facilities to ensure environmental sustainability necessitates the use of materials that can withstand aggressive chemicals and corrosive environments. CPVC’s chemical resistance makes it a reliable choice for conveying and treating wastewater. As urban areas expand, the importance of fire safety systems in buildings and public spaces escalates. CPVC’s flame-retardant properties and ability to withstand high temperatures make it an excellent material for fire sprinkler systems and fire protection infrastructure.

Challenge: Increase in CPVC waste and microplastic pollution

Although CPVC resin offers numerous benefits, it is essential to address potential environmental concerns associated with its use. These concerns revolve around the long-term impact of CPVC on the environment and sustainability.

Unlike standard PVC, CPVC’s chlorination process can complicate its recycling. Separating CPVC from other plastics in the recycling stream can be challenging, leading to the downcycling or disposal of CPVC waste. Proper recycling infrastructure for CPVC is limited, leading to CPVC accumulation. Chlorine or other chemicals may be emitted due to CPVC accumulation and degradation. The long-term behavior of CPVC in various environmental conditions and its potential contribution to microplastic pollution require thorough assessment.

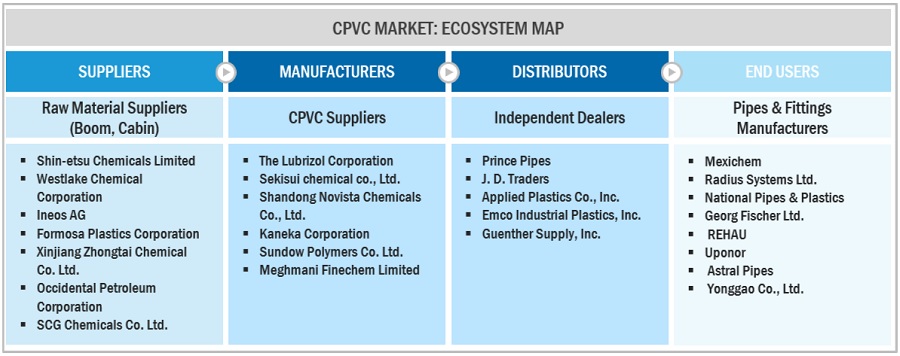

Chlorinated Polyvinyl Chloride Market Ecosystem

Extrusion grade of CPVC to register the largest market share in the CPVC market.

CPVC powder is mostly used to manufacture continuous and long shapes such as sheets and pipes, making extrusion-grade CPVC widely preferred. CPVC powder is fed into an extruder where it is melted and pushed through a die head to form the desired shape. The material then moves through additional downstream processing equipment to correct any present disproportions. After the extrusion process, which involves the melting and shaping of CPVC material, the end products, such as sheets and pipes, are cooled, hardened, and cut to be utilized in various applications. CPVC’s extrusion process is particularly effective in creating sheets and pipes as the manufacturing machine can operate continuously as long as there is material available.

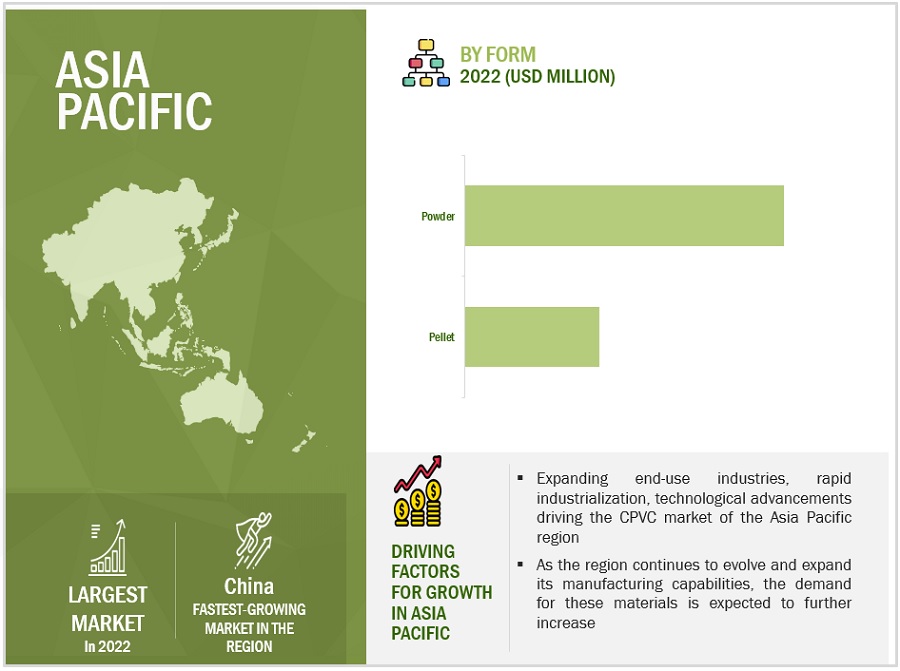

Based on form, powder segment is anticipated to register the highest CAGR in the CPVC market.

The powder form is more versatile and can be easily tailored to meet the specific needs and requirements of the end-use applications. Powder CPVC allows manufacturers to produce various products to meet end-user expectations. CPVC powder is manufactured by chlorinating PVC resin. This process results in a product that offers outstanding temperature stability, chemical resistance, and impressive flame-retardant properties. The extent of the chlorination process determines the final properties of CPVC powder. It has wide applications in coatings & linings, injection molded products, pipe and fittings, industrial piping, and others.

Based on the sales channel, direct sales segment is anticipated to account for largest market share in CPVC market.

Direct distribution is a direct-to-consumer approach where the manufacturer controls all distribution aspects. Direct sales channel is opted by CPVC manufacturers who are more focused on providing customized products to end-use markets such as industrial piping, industrial fire suppression, and industrial fluid handling components. Customers from various industries buy specific, prequalified materials directly from suppliers.

Further, in direct sales, by managing all aspects of the distribution channel, manufacturers retain more control over how goods are delivered. They can cut out inefficiencies, add new services, and set prices.

Based on the production process, aqueous suspension method is expected to dominate the CPVC market.

The aqueous suspension method is a prominent production process for chlorinated polyvinyl chloride (CPVC) resin, known for its widespread applications in various industries. This method involves suspending PVC particles in water along with a chlorine source and subsequently subjecting the mixture to chlorination. The resulting CPVC resins attain enhanced heat resistance, flame retardancy, and chemical durability, making them highly suitable for applications demanding these qualities.

Based on the applications, plumbing systems is expected to dominate the CPVC market.

CPVC has extensive applications in plumbing systems as it is used mainly in hydronic piping and distribution, hot and cold water plumbing distribution, chilled water piping, etc., together with providing durability, corrosion-resistance, toughness, design flexibility, resilience, and high performance. CPVC is utilized in plumbing systems in a wide range of applications, including industrial piping, reclaimed water piping, pool & spa piping, residential piping, fittings, valves, connectors, and manifolds, among others. The chlorine molecules in the pipe effectively block the chlorine and chloramine in the water supply from attacking the pipe, making the material immune to chlorine degradation and extending its lifespan. CPVC pipes & fittings are also virtually impermeable and are not subject to unsafe leaching.

Based on the end-use industry, residential segment is anticipated to register the highest CAGR in the CPVC market

CPVC plays a crucial role in the residential application by providing durable and efficient plumbing solutions. It is extensively used in plumbing systems, delivering corrosion resistance and the ability to handle hot and cold water. CPVC ensures consistent water flow, facilitates hot water distribution, and connects appliances and fixtures securely. It also contributes to fire safety due to its flame-retardant properties in fire sprinkler systems. The versatility of CPVC extends to outdoor plumbing, water heater connections, and more, making it a material that enhances the reliability and convenience of residential plumbing systems.

Asia Pacific to hold the largest market share of CPVC market during the forecast period.

The increasing production of CPVC to cater to the domestic requirements of the residential, commercial, and industrial sectors is fueling the demand for CPVC in the region. The population growth and the growing number of end-use industries in Asia Pacific have also led to the growth of the CPVC market. An increasing number of construction projects, such as the Beijing New International Airport (China) and the South to North Water Transfer Project (China), are set up in the region. The region is estimated to be the most populated in the world, which creates opportunities for the growth of residential and commercial projects and, thereby, the CPVC market.

To know about the assumptions considered for the study, download the pdf brochure

Chlorinated Polyvinyl Chloride Market Players

The CPVC market is dominated by a few globally established players such as The Lubrizol Corporation (US), Sekisui Chemical Co., Ltd. (Japan), Meghmani Finechem Limited (India), Shandong Novista Chemical Co., Ltd. (China), Shandong Pujie Rubber & Plastic Co., Ltd. (China), Kaneka Corporation (Japan), Shandong Yada New Material Co., Ltd. (China), KEM ONE (France), Shandong Xuye New Materials Co., Ltd. (China), DCW Limited (India), Sundow Polymers Co., Ltd. (China), Mitsui & Co., Ltd. (Japan), Shanghai Chlor-Alkali Chemical Co., Ltd. (China), and Shandong Gaoxin Chemical Co., Ltd. (China) among others, are the key manufacturers that secured major contracts in the last few years. The major focus was given to the contracts and new product development due to the changing requirements across the world.

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the CPVC market. The research includes a detailed competitive analysis of these key players in the CPVC market, including recent developments, company profiles, and key market strategies.

Read More: Chlorinated Polyvinyl Chloride Companies

Chlorinated Polyvinyl Chloride Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 1.6 billion |

|

Revenue Forecast in 2028 |

USD 2.7 billion |

|

CAGR |

11.1% |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD billion/million), Volume (Kiloton) |

|

Segments Covered |

By Grade, By Form, By Sales Channel, By Production Process, By Application, By End-use Industry, and By Region |

|

Geographies covered |

Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa |

|

Companies covered |

The Lubrizol Corporation (US), Sekisui Chemical Co., Ltd. (Japan), Meghmani Finechem Limited (India), Shandong Novista Chemical Co., Ltd. (China), Shandong Pujie Rubber & Plastic Co., Ltd. (China), Kaneka Corporation (Japan), Shandong Yada New Material Co., Ltd. (China), KEM ONE (France), Shandong Xuye New Materials Co., Ltd. (China), DCW Limited (India), Sundow Polymers Co., Ltd. (China), Mitsui & Co., Ltd. (Japan), and others. |

The study categorizes the CPVC market based on type, application, end-use industry, and region.

Chlorinated Polyvinyl Chloride Market by Grade:

- Injection Grade

- Extrusion Grade

Chlorinated Polyvinyl Chloride Market by Form:

- Pellet Form

- Powder Form

Chlorinated Polyvinyl Chloride Market by Sales Channel:

- Direct Sales

- Indirect Sales

Chlorinated Polyvinyl Chloride Market by Production Process:

- Aqueous Suspension Method

- Solvent Method

- Solid Phase Method

Chlorinated Polyvinyl Chloride Market by Application:

- Plumbing Systems

- Fire Protection Systems

- Chemical & Industrial Equipment

- Power Cable Casing

- Adhesives & Coatings

- Others

Chlorinated Polyvinyl Chloride Market by End-use Industry:

- Residential

- Commercial

- Industrial

Chlorinated Polyvinyl Chloride Market by Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In June 2023, The Lubrizol Corporation announced an investment of more than USD 150 million across several projects dedicated to its wide portfolio in India. Through this, the company is focusing on opening India’s largest CPVC resin production plant in Gujarat.

- In December 2022, DCW Limited announced its plans to expand the production of CPVC resin in India by commissioning a new manufacturing unit in the country.

- In December 2021, Apollo announced that it completed the acquisition of KEM ONE. This acquisition is helping KEM ONE to pursue its growth strategy and execution of growth plans. With its significant knowledge and successful track record, Appollo plans to leverage the knowledge along with the investment platform to support KEM ONE.

- In July 2021, Meghmani Finechem Limited expanded its CPVC production facility by setting up a new plant in Dahej, Gujarat. This plant has a production capacity of 30 KT per annum.

- In October 2020, The Lubrizol Corporation announced a partnership with Grasim Industries Limited, a flagship company belonging to the Aditya Birla Group. This partnership aims to manufacture and supply CPVC resin across India.

Frequently Asked Questions (FAQ):

Which are the major companies in the CPVC market? What are their major strategies to strengthen their market presence?

Some of the key players in the CPVC market are The Lubrizol Corporation (US), Sekisui Chemical Co., Ltd. (Japan), Meghmani Finechem Limited (India), Shandong Novista Chemical Co., Ltd. (China), Shandong Pujie Rubber & Plastic Co., Ltd. (China), and Kaneka Corporation (Japan) are some of the key manufacturers that secured expansions, acquisitions, and deals in the last few years.

What are the drivers and opportunities for the CPVC market?

The versatile properties of CPVC such as resistance to chemicals and high temperatures, and growing applications in various end-use industries can be a driver and opportunity, respectively.

Which region is expected to hold the highest market share?

In 2022, Asia Pacific dominated the global CPVC market, showcasing strong demand for CPVC from this region.

What is the total CAGR expected to be recorded for the CPVC market during 2023-2028?

The CAGR is expected to record a CAGR of 11.1% from 2023-2028.

How is the CPVC market aligned?

The market is growing at a significant pace. The market is a potential market, and many manufacturers are planning business strategies to expand their existing business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Resistance to chemicals and high temperatures- Growth of construction sectorRESTRAINTS- High processing temperature of CPVC than conventional PVC- High material costOPPORTUNITIES- Rapid urbanization and infrastructure development- Retrofitting and upgrading of existing infrastructureCHALLENGES- Increase in CPVC waste and microplastic pollution- Supply chain disruptions and consumer spending patterns

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE, BY END-USE INDUSTRY

- 5.6 AVERAGE SELLING PRICE, BY APPLICATION

- 5.7 AVERAGE SELLING PRICE, BY REGION

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.9 TECHNOLOGY ANALYSIS

-

5.10 ECOSYSTEM

- 5.11 VALUE CHAIN ANALYSIS

- 5.12 CASE STUDY ANALYSIS

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.14 IMPORT–EXPORT SCENARIOCHINAUSINDIAJAPAN

-

5.15 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS IN CPVC MARKET

- 5.16 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.17 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPESINSIGHTSLEGAL STATUSJURISDICTION ANALYSISTOP APPLICANTS

- 6.1 INTRODUCTION

-

6.2 AQUEOUS SUSPENSION METHODLARGEST PRODUCTION PROCESS IMPARTING CHEMICAL RESISTANCE TO DRIVE MARKETAQUEOUS SUSPENSION METHOD CPVC MARKET, BY REGION

-

6.3 SOLVENT METHODEFFICIENT REMOVAL OF SOLVENTS AFTER CHLORINATION TO DRIVE MARKETSOLVENT METHOD CPVC MARKET, BY REGION

-

6.4 SOLID PHASE METHODHIGH SOLUBLE CPVC OUTPUT FROM PVC MATRIX TO DRIVE MARKETSOLID PHASE METHOD CPVC MARKET, BY REGION

- 7.1 INTRODUCTION

-

7.2 PELLET FORMEXTENSIVE USE IN PIPES AND FITTINGS TO DRIVE SEGMENTPELLET CPVC MARKET, BY REGION

-

7.3 POWDER FORMCHEMICAL RESISTANCE AND FLAME RETARDANCE TO DRIVE APPLICATIONPOWDER CPVC MARKET, BY REGION

- 8.1 INTRODUCTION

-

8.2 INJECTION GRADEGROWING APPLICATION IN VALVES, FITTINGS, AND FLANGE ADAPTERS TO DRIVE MARKETINJECTION GRADE CPVC MARKET, BY REGION

-

8.3 EXTRUSION GRADERISING USE TO MANUFACTURE SHEETS AND PIPES TO DRIVE SEGMENTEXTRUSION GARDE CPVC, BY REGION

- 9.1 INTRODUCTION

-

9.2 DIRECT SALESCONTROL OVER ENTIRE PROCESS TO INCREASE DEMANDDIRECT SALES CPVC MARKET, BY REGION

-

9.3 INDIRECT SALESFOCUS ON CORE BUSINESS TO DRIVE MARKETINDIRECT SALES CPVC MARKET, BY REGION

- 10.1 INTRODUCTION

-

10.2 PLUMBING SYSTEMSINCREASING DEMAND FOR EXTENDED LIFESPAN PRODUCTS TO DRIVE DEMANDINDUSTRIAL PIPINGRECLAIMED WATER PIPINGPOOL & SPA PIPINGRESIDENTIAL PIPINGFITTINGS, VALVES, & CONNECTORSCPVC MARKET IN PLUMBING SYSTEMS, BY REGION

-

10.3 FIRE PROTECTION SYSTEMSSAFER ASSEMBLY THAN METAL ALTERNATIVES TO DRIVE MARKETINDUSTRIAL FIRE SUPPRESSIONFIRE SPRINKLER SYSTEMSFIRE HYDRANT SYSTEMSCPVC MARKET IN FIRE PROTECTION SYSTEMS APPLICATION, BY REGION

-

10.4 CHEMICAL & INDUSTRIAL EQUIPMENTLOWER INSTALLATION COSTS TO FUEL MARKET GROWTHCORROSION-RESISTANT COMPONENTSINDUSTRIAL FLUID HANDLING COMPONENTSCHEMICAL PROCESSING EQUIPMENTCPVC MARKET IN CHEMICAL & INDUSTRIAL EQUIPMENT APPLICATION, BY REGION

-

10.5 POWER CABLE CASINGSELF-EXTINGUISHING PROPERTIES TO DRIVE MARKETCABLE CONDUITSPROTECTIVE ENCLOSURESCPVC MARKET IN POWER CABLE CASING APPLICATION, BY REGION

-

10.6 ADHESIVES & COATINGSHIGHER SOLUBILITY THAN PVC IN ORGANIC SOLVENTS TO DRIVE MARKETCPVC MARKET IN ADHESIVES & COATINGS APPLICATION, BY REGION

-

10.7 OTHER APPLICATIONSCPVC MARKET SIZE IN OTHER APPLICATIONS, BY REGION

- 11.1 INTRODUCTION

-

11.2 RESIDENTIALDURABLE AND EFFICIENT PLUMBING SOLUTIONS TO DRIVE MARKETCPVC MARKET IN RESIDENTIAL END-USE INDUSTRY, BY REGION

-

11.3 COMMERCIALSAFETY, RELIABILITY, AND DURABILITY TO DRIVE MARKETCPVC MARKET IN COMMERCIAL END-USE INDUSTRY, BY REGION

-

11.4 INDUSTRIALDEMAND FROM VARIOUS INDUSTRIAL SECTORS TO DRIVE MARKETELECTRICAL & ELECTRONICSCHEMICALS & PETROCHEMICALSPHARMACEUTICALSPOWER GENERATIONFOOD & BEVERAGEAGRICULTURE & IRRIGATIONPULP & PAPEROTHERS- Fertilizer, oil & gasCPVC MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICARECESSION IMPACT ON NORTH AMERICANORTH AMERICA: CPVC MARKET, BY GRADENORTH AMERICA: CPVC MARKET, BY FORMNORTH AMERICA: CPVC MARKET, BY SALES CHANNELNORTH AMERICA: CPVC MARKET, BY PRODUCTION PROCESSNORTH AMERICA: CPVC MARKET, BY APPLICATIONNORTH AMERICA: CPVC MARKET, BY END-USE INDUSTRYNORTH AMERICA: CPVC MARKET, BY COUNTRY- US- Canada

-

12.3 EUROPERECESSION IMPACT ON EUROPEEUROPE: CPVC MARKET, BY GRADEEUROPE: CPVC MARKET, BY FORMEUROPE: CPVC MARKET, BY SALES CHANNELEUROPE: CPVC MARKET, BY PRODUCTION PROCESSEUROPE: CPVC MARKET, BY APPLICATIONEUROPE: CPVC MARKET, BY END-USE INDUSTRYEUROPE: CPVC MARKET, BY COUNTRY- Germany- UK- France- Italy- Spain- Rest of Europe

-

12.4 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICASIA PACIFIC: CPVC MARKET, BY GRADEASIA PACIFIC: CPVC MARKET, BY FORMASIA PACIFIC: CPVC MARKET, BY SALES CHANNELASIA PACIFIC: CPVC MARKET, BY PRODUCTION PROCESSASIA PACIFIC: CPVC MARKET, BY APPLICATIONASIA PACIFIC: CPVC MARKET, BY END-USE INDUSTRYASIA PACIFIC: CPVC MARKET, BY COUNTRY- China- India- South Korea- Japan- Rest of Asia Pacific

-

12.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: CPVC MARKET, BY GRADEMIDDLE EAST & AFRICA: CPVC MARKET, BY FORMMIDDLE EAST & AFRICA: CPVC MARKET, BY SALES CHANNELMIDDLE EAST & AFRICA: CPVC MARKET, BY PRODUCTION PROCESSMIDDLE EAST & AFRICA: CPVC MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: CPVC MARKET, BY END-USE INDUSTRYMIDDLE EAST & AFRICA: CPVC MARKET, BY COUNTRY- Saudi Arabia- UAE- Rest of Middle East & Africa

-

12.6 LATIN AMERICARECESSION IMPACT ON LATIN AMERICALATIN AMERICA: CPVC MARKET, BY GRADELATIN AMERICA: CPVC MARKET, BY FORMLATIN AMERICA: CPVC MARKET, BY SALES CHANNELLATIN AMERICA: CPVC MARKET, BY PRODUCTION PROCESSLATIN AMERICA: CPVC MARKET, BY APPLICATIONLATIN AMERICA: CPVC MARKET, BY END-USE INDUSTRYLATIN AMERICA: CPVC MARKET, BY COUNTRY- Mexico- Brazil- Rest of Latin America

- 13.1 INTRODUCTION

- 13.2 MARKET SHARE ANALYSIS

- 13.3 MARKET RANKING

- 13.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- 13.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

13.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

- 13.7 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

13.8 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.9 COMPETITIVE SITUATIONS AND TRENDS

-

14.1 KEY PLAYERSTHE LUBRIZOL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSEKISUI CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewMEGHMANI FINECHEM LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHANGDONG NOVISTA CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewSHANDONG PUJIE RUBBER & PLASTIC CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewKANEKA CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewSHANGDONG YADA NEW MATERIAL CO., LTD.- Business overview- Products/Solutions/Services offered- MNM viewKEM ONE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHANDONG XUYE NEW MATERIALS CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewDCW LIMITED- Business overview- Products/Solutions/Services offered- Other developments- MnM view

-

14.2 KEY COMPANIESSUNDOW POLYMERS CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewMITSUI & CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewSHANGHAI CHLOR-ALKALI CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- MnM view

-

14.3 OTHER COMPANIESSHANDONG GAOXIN CHEMICAL CO., LTD.HANWHA SOLUTIONSHANGZHOU ELECTROCHEMICAL GROUP CO. LTD.EN-DOORWEIFANG YADA PLASTIC CO., LTD.SHANDONG KETIAN CHEMICAL CO., LTD.VIA CHEMICAL CO., LTD.JIANGSU TIANTENG CHEMICAL CO., LTD.AVIENT CORPORATIONKUNSHAN MAIJISEN COMPOSITE MATERIALS CO., LTD.ZHONGTAI IMPORT & EXPORT CORPORATION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 CONTRIBUTION TO GROWTH IN GLOBAL CONSTRUCTION OUTPUT, BY COUNTRY (2019–2030)

- TABLE 2 CPVC MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 CPVC MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE TREND BY KEY PLAYERS, BY END-USE INDUSTRY (USD/KG)

- TABLE 5 CPVC AVERAGE SELLING PRICE, BY REGION

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 8 COMPARATIVE STUDY OF CPVC MANUFACTURING PROCESSES

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 CURRENT STANDARD CODES FOR CPVC

- TABLE 14 CPVC MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 15 CPVC MARKET: GLOBAL PATENT COUNT

- TABLE 16 PATENTS BY LUBRIZOL ADVANCED MATERIALS INC

- TABLE 17 PATENTS BY SEKISUI CHEMICAL CO LTD.

- TABLE 18 PATENTS BY HUAYA IND PLASTIC TAICANG CO LTD.

- TABLE 19 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 20 CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (USD MILLION)

- TABLE 21 CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (KILOTON)

- TABLE 22 CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (USD MILLION)

- TABLE 23 CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (KILOTON)

- TABLE 24 AQUEOUS SUSPENSION METHOD: CPVC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 AQUEOUS SUSPENSION METHOD: CPVC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 26 AQUEOUS SUSPENSION METHOD: CPVC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 AQUEOUS SUSPENSION METHOD: CPVC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 28 SOLVENT METHOD: CPVC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 SOLVENT METHOD: CPVC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 30 SOLVENT METHOD: CPVC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 SOLVENT METHOD: CPVC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 32 SOLID PHASE METHOD: CPVC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 SOLID PHASE METHOD: CPVC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 34 SOLID PHASE METHOD: CPVC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 SOLID PHASE METHOD: CPVC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 36 CPVC MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 37 CPVC MARKET, BY FORM, 2018–2022 (KILOTON)

- TABLE 38 CPVC MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 39 CPVC MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 40 PELLET: CPVC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 PELLET: CPVC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 42 PELLET: CPVC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 PELLET: CPVC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 44 POWDER: CPVC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 POWDER: CPVC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 46 POWDER: CPVC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 POWDER: CPVC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 48 CPVC MARKET, BY GRADE, 2018–2022 (USD MILLION)

- TABLE 49 CPVC MARKET, BY GRADE, 2018–2022 (KILOTON)

- TABLE 50 CPVC MARKET, BY GRADE, 2023–2028 (USD MILLION)

- TABLE 51 CPVC MARKET, BY GRADE, 2023–2028 (KILOTON)

- TABLE 52 INJECTION GRADE: CPVC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 INJECTION GRADE: CPVC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 54 INJECTION GRADE: CPVC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 INJECTION GRADE: CPVC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 56 EXTRUSION GRADE: CPVC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 EXTRUSION GRADE: CPVC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 58 EXTRUSION GRADE: CPVC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 EXTRUSION GRADE: CPVC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 60 CPVC MARKET, BY SALES CHANNEL, 2018–2022 (USD MILLION)

- TABLE 61 CPVC MARKET, BY SALES CHANNEL, 2018–2022 (KILOTON)

- TABLE 62 CPVC MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 63 CPVC MARKET, BY SALES CHANNEL, 2023–2028 (KILOTON)

- TABLE 64 DIRECT SALES: CPVC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 DIRECT SALES: CPVC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 66 DIRECT SALES: CPVC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 DIRECT SALES: CPVC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 68 INDIRECT SALES: CPVC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 INDIRECT SALES: CPVC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 70 INDIRECT SALES: CPVC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 INDIRECT SALES: CPVC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 72 CPVC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 73 CPVC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 74 CPVC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 CPVC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 76 CPVC MARKET IN PLUMBING SYSTEMS APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 77 CPVC MARKET IN PLUMBING SYSTEMS APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 78 CPVC MARKET IN PLUMBING SYSTEMS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 CPVC MARKET IN PLUMBING SYSTEMS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 80 CPVC MARKET IN FIRE PROTECTION SYSTEMS APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 81 CPVC MARKET IN FIRE PROTECTION SYSTEMS APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 82 CPVC MARKET IN FIRE PROTECTION SYSTEMS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 CPVC MARKET IN FIRE PROTECTION SYSTEMS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 84 CPVC MARKET IN CHEMICAL & INDUSTRIAL EQUIPMENT APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 85 CPVC MARKET IN CHEMICAL & INDUSTRIAL EQUIPMENT APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 86 CPVC MARKET IN CHEMICAL & INDUSTRIAL EQUIPMENT APPLICATION, BY REGION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 CPVC MARKET IN CHEMICAL & INDUSTRIAL EQUIPMENT APPLICATION, BY REGION, BY REGION, 2023–2028 (KILOTON)

- TABLE 88 CPVC MARKET IN POWER CABLE CASING APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 89 CPVC MARKET IN POWER CABLE CASING APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 90 CPVC MARKET IN POWER CABLE CASING APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 CPVC MARKET IN POWER CABLE CASING APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 92 CPVC MARKET IN ADHESIVES & COATINGS APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 93 CPVC MARKET IN ADHESIVES & COATINGS APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 94 CPVC MARKET IN ADHESIVES & COATINGS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 CPVC MARKET IN ADHESIVES & COATINGS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 96 CPVC MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 97 CPVC MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2022 (KILOTON)

- TABLE 98 CPVC MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 CPVC MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (KILOTON)

- TABLE 100 CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 101 CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 102 CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 103 CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 104 CPVC MARKET IN RESIDENTIAL END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 105 CPVC MARKET IN RESIDENTIAL END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 106 CPVC MARKET IN RESIDENTIAL END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 CPVC MARKET IN RESIDENTIAL END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 108 CPVC MARKET IN COMMERCIAL END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 109 CPVC MARKET IN COMMERCIAL END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 110 CPVC MARKET IN COMMERCIAL END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 CPVC MARKET IN COMMERCIAL END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 112 CPVC MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2018–2022 (USD MILLION)

- TABLE 113 CPVC MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2018–2022 (KILOTON)

- TABLE 114 CPVC MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 CPVC MARKET IN INDUSTRIAL END-USE INDUSTRY, BY REGION, 2023–2028 (KILOTON)

- TABLE 116 CPVC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 117 CPVC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 118 CPVC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 119 CPVC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 120 NORTH AMERICA: PHYSICAL CPVC MARKET, BY GRADE, 2018–2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: CPVC MARKET, BY GRADE, 2018–2022 (KILOTON)

- TABLE 122 NORTH AMERICA: CPVC MARKET, BY GRADE, 2023–2028 (USD MILLION)

- TABLE 123 NORTH AMERICA: CPVC MARKET, BY GRADE, 2023–2028 (KILOTON)

- TABLE 124 NORTH AMERICA: CPVC MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 125 NORTH AMERICA: CPVC MARKET, BY FORM, 2018–2022 (KILOTON)

- TABLE 126 NORTH AMERICA: CPVC MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 127 NORTH AMERICA: CPVC MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 128 NORTH AMERICA: CPVC MARKET, BY SALES CHANNEL, 2018–2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: CPVC MARKET, BY SALES CHANNEL, 2018–2022 (KILOTON)

- TABLE 130 NORTH AMERICA: CPVC MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: CPVC MARKET, BY SALES CHANNEL, 2023–2028 (KILOTON)

- TABLE 132 NORTH AMERICA: CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (USD MILLION)

- TABLE 133 NORTH AMERICA: CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (KILOTON)

- TABLE 134 NORTH AMERICA: CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (KILOTON)

- TABLE 136 NORTH AMERICA: CPVC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: CPVC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 138 NORTH AMERICA: CPVC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: CPVC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 140 NORTH AMERICA: CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 142 NORTH AMERICA: CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 143 NORTH AMERICA: CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 144 NORTH AMERICA: CPVC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: CPVC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 146 NORTH AMERICA: CPVC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: CPVC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 148 EUROPE: PHYSICAL CPVC MARKET, BY GRADE, 2018–2022 (USD MILLION)

- TABLE 149 EUROPE: CPVC MARKET, BY GRADE, 2018–2022 (KILOTON)

- TABLE 150 EUROPE: CPVC MARKET, BY GRADE, 2023–2028 (USD MILLION)

- TABLE 151 EUROPE: CPVC MARKET, BY GRADE, 2023–2028 (KILOTON)

- TABLE 152 EUROPE: CPVC MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 153 EUROPE: CPVC MARKET, BY FORM, 2018–2022 (KILOTON)

- TABLE 154 EUROPE: CPVC MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 155 EUROPE: CPVC MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 156 EUROPE: CPVC MARKET, BY SALES CHANNEL, 2018–2022 (USD MILLION)

- TABLE 157 EUROPE: CPVC MARKET, BY SALES CHANNEL, 2018–2022 (KILOTON)

- TABLE 158 EUROPE: CPVC MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 159 EUROPE: CPVC MARKET, BY SALES CHANNEL, 2023–2028 (KILOTON)

- TABLE 160 EUROPE: CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (USD MILLION)

- TABLE 161 EUROPE: CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (KILOTON)

- TABLE 162 EUROPE: CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (USD MILLION)

- TABLE 163 EUROPE: CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (KILOTON)

- TABLE 164 EUROPE: CPVC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 165 EUROPE: CPVC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 166 EUROPE: CPVC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 167 EUROPE: CPVC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 168 EUROPE: CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 169 EUROPE: CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 170 EUROPE: CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 171 EUROPE: CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 172 EUROPE: CPVC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 173 EUROPE: CPVC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 174 EUROPE: CPVC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 175 EUROPE: CPVC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 176 ASIA PACIFIC: CPVC MARKET, BY GRADE, 2018–2022 (USD MILLION)

- TABLE 177 ASIA PACIFIC: CPVC MARKET, BY GRADE, 2018–2022 (KILOTON)

- TABLE 178 ASIA PACIFIC: CPVC MARKET, BY GRADE, 2023–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: CPVC MARKET, BY GRADE, 2023–2028 (KILOTON)

- TABLE 180 ASIA PACIFIC: CPVC MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: CPVC MARKET, BY FORM, 2018–2022 (KILOTON)

- TABLE 182 ASIA PACIFIC: CPVC MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: CPVC MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 184 ASIA PACIFIC: CPVC MARKET, BY SALES CHANNEL, 2018–2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: CPVC MARKET, BY SALES CHANNEL, 2018–2022 (KILOTON)

- TABLE 186 ASIA PACIFIC: CPVC MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 187 ASIA PACIFIC: CPVC MARKET, BY SALES CHANNEL, 2023–2028 (KILOTON)

- TABLE 188 ASIA PACIFIC: CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (KILOTON)

- TABLE 190 ASIA PACIFIC: CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (USD MILLION)

- TABLE 191 ASIA PACIFIC: CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (KILOTON)

- TABLE 192 ASIA PACIFIC: CPVC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 193 ASIA PACIFIC: CPVC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 194 ASIA PACIFIC: CPVC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 195 ASIA PACIFIC: CPVC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 196 ASIA PACIFIC: CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 197 ASIA PACIFIC: CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 198 ASIA PACIFIC: CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 199 ASIA PACIFIC: CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 200 ASIA PACIFIC: CPVC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 201 ASIA PACIFIC: CPVC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 202 ASIA PACIFIC: CPVC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 203 ASIA PACIFIC: CPVC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 204 MIDDLE EAST & AFRICA: CPVC MARKET, BY GRADE, 2018–2022 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: CPVC MARKET, BY GRADE, 2018–2022 (KILOTON)

- TABLE 206 MIDDLE EAST & AFRICA: CPVC MARKET, BY GRADE, 2023–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: CPVC MARKET, BY GRADE, 2023–2028 (KILOTON)

- TABLE 208 MIDDLE EAST & AFRICA: CPVC MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: CPVC MARKET, BY FORM, 2018–2022 (KILOTON)

- TABLE 210 MIDDLE EAST & AFRICA: CPVC MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: CPVC MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 212 MIDDLE EAST & AFRICA: CPVC MARKET, BY SALES CHANNEL, 2018–2022 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: CPVC MARKET, BY SALES CHANNEL, 2018–2022 (KILOTON)

- TABLE 214 MIDDLE EAST & AFRICA: CPVC MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: CPVC MARKET, BY SALES CHANNEL, 2023–2028 (KILOTON)

- TABLE 216 MIDDLE EAST & AFRICA: CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (KILOTON)

- TABLE 218 MIDDLE EAST & AFRICA: CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (KILOTON)

- TABLE 220 MIDDLE EAST & AFRICA: CPVC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: CPVC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 222 MIDDLE EAST & AFRICA: CPVC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: CPVC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 224 MIDDLE EAST & AFRICA: CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 226 MIDDLE EAST & AFRICA: CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 228 MIDDLE EAST & AFRICA: CPVC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: CPVC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 230 MIDDLE EAST & AFRICA: CPVC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: CPVC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 232 LATIN AMERICA: CPVC MARKET, BY GRADE, 2018–2022 (USD MILLION)

- TABLE 233 LATIN AMERICA: CPVC MARKET, BY GRADE, 2018–2022 (KILOTON)

- TABLE 234 LATIN AMERICA: CPVC MARKET, BY GRADE, 2023–2028 (USD MILLION)

- TABLE 235 LATIN AMERICA: CPVC MARKET, BY GRADE, 2023–2028 (KILOTON)

- TABLE 236 LATIN AMERICA: CPVC MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 237 LATIN AMERICA: CPVC MARKET, BY FORM, 2018–2022 (KILOTON)

- TABLE 238 LATIN AMERICA: CPVC MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 239 LATIN AMERICA: CPVC MARKET, BY FORM, 2023–2028 (KILOTON)

- TABLE 240 LATIN AMERICA: CPVC MARKET, BY SALES CHANNEL, 2018–2022 (USD MILLION)

- TABLE 241 LATIN AMERICA: CPVC MARKET, BY SALES CHANNEL, 2018–2022 (KILOTON)

- TABLE 242 LATIN AMERICA: CPVC MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 243 LATIN AMERICA: CPVC MARKET, BY SALES CHANNEL, 2023–2028 (KILOTON)

- TABLE 244 LATIN AMERICA: CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (USD MILLION)

- TABLE 245 LATIN AMERICA: CPVC MARKET, BY PRODUCTION PROCESS, 2018–2022 (KILOTON)

- TABLE 246 LATIN AMERICA: CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (USD MILLION)

- TABLE 247 LATIN AMERICA: CPVC MARKET, BY PRODUCTION PROCESS, 2023–2028 (KILOTON)

- TABLE 248 LATIN AMERICA: CPVC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 249 LATIN AMERICA: CPVC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 250 LATIN AMERICA: CPVC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 251 LATIN AMERICA: CPVC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 252 LATIN AMERICA: CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 253 LATIN AMERICA: CPVC MARKET, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 254 LATIN AMERICA: CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 255 LATIN AMERICA: CPVC MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 256 LATIN AMERICA: CPVC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 257 LATIN AMERICA: CPVC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 258 LATIN AMERICA: CPVC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 259 LATIN AMERICA: CPVC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 260 DEGREE OF COMPETITION: CPVC MARKET

- TABLE 261 COMPANY PRODUCT FOOTPRINT

- TABLE 262 COMPANY GRADE FOOTPRINT

- TABLE 263 COMPANY SALES CHANNEL FOOTPRINT

- TABLE 264 COMPANY APPLICATION FOOTPRINT

- TABLE 265 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 266 COMPANY REGION FOOTPRINT

- TABLE 267 CPVC MARKET: KEY STARTUPS/SMES

- TABLE 268 CPVC MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 269 CPVC MARKET: DEALS, 2018–2023

- TABLE 270 CPVC MARKET: OTHER DEVELOPMENTS, 2018–2023

- TABLE 271 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 272 SEKISUI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 273 MEGHMANI FINECHEM LIMITED: COMPANY OVERVIEW

- TABLE 274 SHANDONG NOVISTA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 275 SHANDONG PUJIE RUBBER & PLASTIC CO., LTD.: COMPANY OVERVIEW

- TABLE 276 KANEKA CORPORATION: COMPANY OVERVIEW

- TABLE 277 SHANDONG YADA NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 278 KEM ONE: COMPANY OVERVIEW

- TABLE 279 SHANDONG XUYE NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 280 DCW LIMITED: COMPANY OVERVIEW

- TABLE 281 SUNDOW POLYMERS CO., LTD.: COMPANY OVERVIEW

- TABLE 282 MITSUI & CO., LTD.: COMPANY OVERVIEW

- TABLE 283 SHANGHAI CHLOR-ALKALI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 284 SHANDONG GAOXIN CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 285 HANWHA SOLUTIONS: COMPANY OVERVIEW

- TABLE 286 HANGZHOU ELECTROCHEMICAL GROUP CO. LTD.: COMPANY OVERVIEW

- TABLE 287 EN-DOOR: COMPANY OVERVIEW

- TABLE 288 WEIFANG YADA PLASTIC CO., LTD.: COMPANY OVERVIEW

- TABLE 289 SHANDONG KETIAN CHEMICAL CO., LTD..: COMPANY OVERVIEW

- TABLE 290 VIA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 291 JIANGSU TIANTENG CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 292 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 293 KUNSHAN MAIJISEN COMPOSITE MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 294 ZHONGTAI IMPORT & EXPORT CORPORATION: COMPANY OVERVIEW

- FIGURE 1 CPVC MARKET SEGMENTATION

- FIGURE 2 CPVC MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 CPVC MARKET: DATA TRIANGULATION

- FIGURE 6 RECESSION IMPACT ON CPVC MARKET

- FIGURE 7 EXTRUSION GRADE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 POWDER FORM TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 DIRECT SALES CHANNEL TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 AQUEOUS SUSPENSION METHOD TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 PLUMBING SYSTEMS DOMINATED MARKET IN 2022

- FIGURE 12 RESIDENTIAL END-USE INDUSTRY LED MARKET IN 2022

- FIGURE 13 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 SIGNIFICANT GROWTH IN CPVC MARKET BETWEEN 2023 AND 2028

- FIGURE 15 RESIDENTIAL AND ASIA PACIFIC WERE LARGEST MARKET SEGMENTS IN 2022

- FIGURE 16 EXTRUSION GRADE SEGMENT DOMINATED MARKET IN 2022

- FIGURE 17 POWDER FORM SEGMENT T0 LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 DIRECT SALES CHANNEL TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

- FIGURE 19 AQUEOUS SUSPENSION METHOD DOMINATED MARKET IN 2022

- FIGURE 20 PLUMBING SYSTEMS APPLICATION REGISTERED HIGHEST GROWTH IN 2022

- FIGURE 21 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CPVC MARKET

- FIGURE 23 CPVC MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE BY KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES (USD/KG)

- FIGURE 25 AVERAGE SELLING PRICE BASED ON APPLICATION (USD/KG)

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 28 VALUE CHAIN ANALYSIS: CPVC MARKET

- FIGURE 29 REVENUE SHIFT AND NEW REVENUE POCKETS FOR CPVC MARKET

- FIGURE 30 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 31 GLOBAL PATENT PUBLICATION TREND, 2017–2022

- FIGURE 32 CPVC MARKET: LEGAL STATUS OF PATENTS

- FIGURE 33 GLOBAL JURISDICTION ANALYSIS

- FIGURE 34 LUBRIZOL ADVANCED MATERIALS INC REGISTERED HIGHEST PATENT COUNT

- FIGURE 35 AQUEOUS SUSPENSION METHOD TO LEAD CPVC MARKET DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO LEAD AQUEOUS SUSPENSION SEGMENT DURING FORECAST PERIOD

- FIGURE 37 POWDER FORM TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO BE LARGEST MARKET FOR PELLETS DURING FORECAST PERIOD

- FIGURE 39 EXTRUSION GRADE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO BE LARGEST MARKET OF INJECTION GRADE CPVC DURING FORECAST PERIOD

- FIGURE 41 INDIRECT SALES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 EUROPE TO BE SECOND-LARGEST MARKET FOR INDIRECT SALES SEGMENT DURING FORECAST PERIOD

- FIGURE 43 PLUMBING SYSTEMS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO BE LARGEST CPVC MARKET DURING FORECAST PERIOD

- FIGURE 45 RESIDENTIAL INDUSTRY SEGMENT TO LEAD CPVC MARKET DURING FORECAST PERIOD

- FIGURE 46 ASIA PACIFIC TO LEAD CPVC MARKET IN RESIDENTIAL SEGMENT DURING FORECAST PERIOD

- FIGURE 47 UK TO BE FASTEST-GROWING CPVC MARKET DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: CPVC MARKET SNAPSHOT

- FIGURE 49 EUROPE: CPVC MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: CPVC MARKET SNAPSHOT

- FIGURE 51 SHARES OF TOP COMPANIES IN CPVC MARKET

- FIGURE 52 RANKING OF TOP SIX PLAYERS IN CPVC MARKET

- FIGURE 53 COMPANY EVALUATION MATRIX FOR CPVC MARKET (GLOBAL), 2022

- FIGURE 54 STARTUPS/SMES EVALUATION MATRIX FOR CPVC MARKET, 2022

- FIGURE 55 SEKISUI CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 56 MEGHMANI FINECHEM LIMITED: COMPANY SNAPSHOT

- FIGURE 57 KANEKA CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 DCW LIMITED: COMPANY SNAPSHOT

- FIGURE 59 MITSUI & CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 SHANGHAI CHLOR-ALKALI CHEMICAL CO., LTD.: COMPANY SNAPSHOT

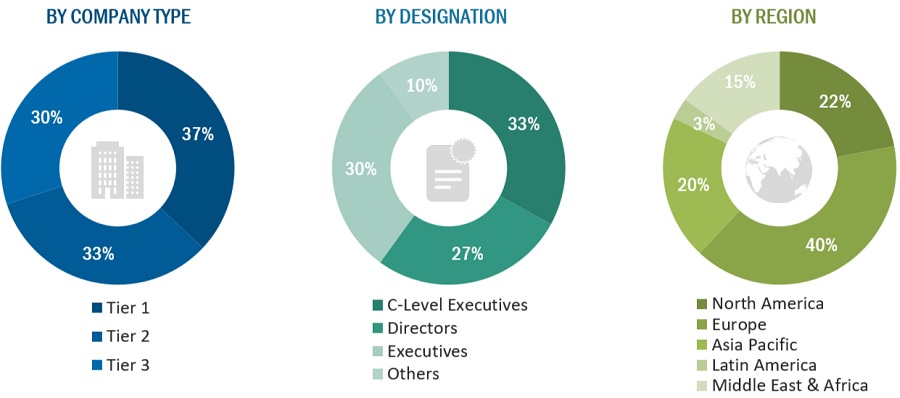

The study involves two major activities in estimating the current market size for the CPVC market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering CPVC and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the CPVC market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the CPVC market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from CPVC industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the CPVC industry, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of CPVC and future outlook of their business which will affect the overall market.

The Breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

The Lubrizol Corporation |

Product Development Head |

|

Sekisui Chemical Co., Ltd. |

Operations Manager |

|

Kaneka Corporation |

R&D Head |

|

Shandong Novista Chemicals Co., Ltd |

Sales Head |

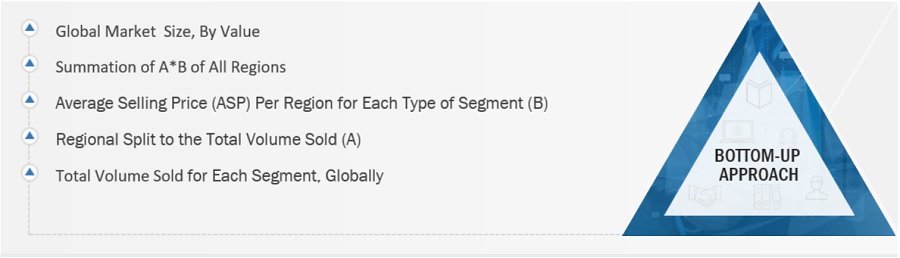

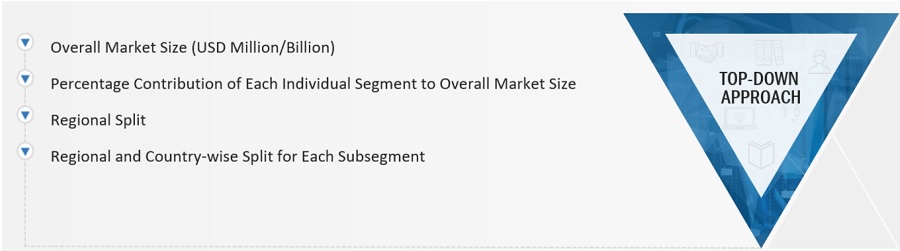

Market Size Estimation

The research methodology used to estimate the size of the CPVC market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in CPVC in different type applications of the CPVC at a regional level. Such procurements provide information on the demand aspects of the CPVC industry for each application. For each application, all possible segments of the CPVC market were integrated and mapped.

CPVC Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

CPVC Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Chlorinated polyvinyl chloride (CPVC) is a thermoplastic polymer derived from polyvinyl chloride (PVC) through chlorination. The CPVC market encompasses diverse applications across construction, plumbing, fire protection, chemical processing, industrial equipment, and other industries. Manufacturers in this market employ different processes to produce CPVC resins used in pipes, fittings, valves, sheets, and other components.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the global CPVC based on grade, form, sales channel, production process, application, end-use industry, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region

- Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region restraints, opportunities, and challenges) influencing the growth of the market

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the CPVC market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with a market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the CPVC market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Growth opportunities and latent adjacency in Chlorinated Polyvinyl Chloride Market