Autonomous Underwater Vehicle (AUV) Market Size, Share & Industry Trends Growth Analysis Report by Shape (Torpedo, Laminar Flow Body, Streamlined Rectangular Style, Multi-hull Vehicle), Type (Shallow, Medium, & Large AUVs), Technology (Imaging, Navigation, Propulsion), Payload - Global Forecast to 2029

Updated on : Oct 22, 2024

Autonomous Underwater Vehicles Market Size & Share

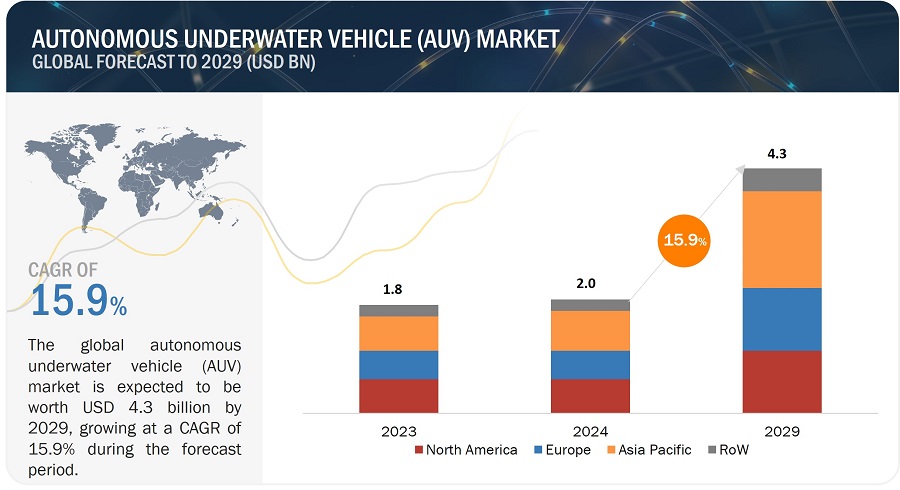

The global autonomous underwater vehicle (AUV) market size is valued at USD 2.0 billion in 2024 and is projected to reach USD 4.3 billion by 2029, growing at a CAGR of 15.9% from 2024 to 2029.

Increasing investments in offshore oil & gas drilling, technological advancements in AUVs, and deployment of advanced technologies to ensure border and maritime security are driving the market for AUVs, whereas growing demand in offshore energy exploration creates a major opportunity for the growth of the market.

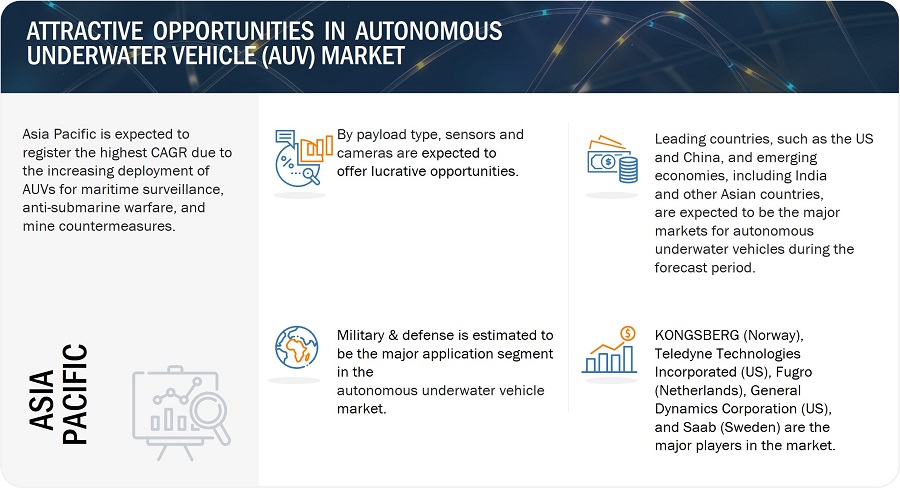

Military & Defense, Oil & Gas, and Archeology and Exploration are among the top three application segments in the autonomous underwater vehicle (AUV) market. The US is the largest market in North America, Germany is the largest market in Europe, and China is the largest market in the Asia Pacific region.

Autonomous Underwater Vehicle (AUV) Market Forecast & Statistics to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of AI on the Autonomous Underwater Vehicle (AUV) Market

Autonomous Underwater Vehicles Market Trends:

Driver: Shifting preference toward renewable energy sources

Alternative energy sources, such as solar, wind, waves, tides, and geothermal energy, are generally supported by environmentalists and environmental groups due to their sustainable and non-polluting nature. Many marine-based renewable energy technologies are in the early stages of development.

Thus, there is limited knowledge of the cost-effectiveness of large-scale ocean-based systems or their environmental effects. However, before investing in these upcoming renewable energy technologies, extensive R&D is required. AUVs play an essential role in inspection and R&D activities to help organizations find the best possible outcomes for investing in renewable energy sources.

Restraint: High development, operational, and maintenance costs

The operational costs of autonomous underwater vehicles are high. Factors contributing to this high overall cost are development & acquisition, maintenance & repair, personnel training, mission-specific costs, logistics & support, and data processing & analysis. For instance, the A-18 AUV of Exail Technologies (France), with a depth rating of up to 3,000 m, costs between USD 2-6 million.

The deployment costs of AUVs used in exploration or survey activities add to the cost of exploration and survey missions. Moreover, the high maintenance, manufacturing, research & development costs, along with system complexity, also result in their slow adoption.

Opportunity: Rising use of AUVs to protect subsea cables and seabed environment

Since 1985, underwater optical fiber cable has played a significant role in communications. It has numerous advantages, such as high reliability, large capacity, as well as an excellent communication quality. However, these cables are also vulnerable to potential hazards, such as turbulent currents, earthquakes, anchor drop, and so on.

To overcome such hazardous issues, two types of autonomous underwater vehicles are generally used. The first one is inspection AUVs that are equipped with high resolution cameras and sensors to inspect all kinds of damages in the cable, and the second category is work class AUVs, that are equipped with manipulator arms and other tools to perform underwater operations.

Challenges: Risk of data loss and prolonged research timelines due to challenging marine environment

Autonomous underwater vehicles can reach altitudes of less than 5 meters by their capability to dive close to the seabed and reach areas with low relief. This allows them to collect seafloor mapping, profiling, and imaging data with exceptional spatial resolution and navigational accuracy, surpassing surface vessels and towed instruments.

Therefore, AUVs can tackle challenging marine environments. Still, their survival in these settings is a concern, and there is a risk of losing valuable data due to natural hazards that could cause the loss of the vehicle.

Autonomous Underwater Vehicle (AUV) Market Map:

Autonomous Underwater Vehicle (AUV) Market Segmentation:

The LED lighting segment in the autonomous underwater vehicle (AUV) market is expected to grow at the highest rate by imaging technology during the forecast period.

The LED lighting segment under the imaging technology segment of the autonomous underwater vehicles (AUV) market is expected to grow at the highest CAGR during the forecast period from 2024 to 2029. Certain challenges related to underwater lighting, such as high pressure and limited light penetration, require specific LED types to overcome these challenges.

The LEDs used in autonomous underwater vehicles consume less power compared to other lights which helps to extend the battery life of the vehicle. Additionally, these lights are specially designed to withstand harsh underwater environments.

Torpedo segment accounts for the largest market share of the autonomous underwater vehicle (AUV) market, by shape during the forecast period.

The Torpedo shaped segment of the autonomous underwater vehicle (AUV) industry holds the largest market share and is expected to grow with the highest growth rate during the forecast period. The growth in this segment can be attributed to their ease of storage and launch from ships, aircraft, and helicopters without significant modifications.

Torpedo-shaped AUVs can be used for a range of applications such as underwater mapping & surveying, oceanography & environmental monitoring, and search & recovery operations.

Autonomous Underwater Vehicle (AUV) Market Regional Analysis

Asia Pacific region is expected to exhibit the highest CAGR during forecast period.

The market for autonomous underwater vehicle (AUV) in the Asia Pacific region is projected to grow at the highest CAGR during the forecast period from 2024 to 2029; this region is also expected to hold the largest share of the market by 2029.

The Asia Pacific region includes countries like China, Japan, India, South Korea, Australia, and others where we find continuous growth in such countries' GDPs, especially China and India, and their respective increasing military expenditures over the years. Apart from this, demand for autonomous underwater vehicles for oceanographic research, and underwater sea exploration has increased in these countries in the past few years. All these factors are contributing to the high growth rate of the market.

Autonomous Underwater Vehicle (AUV) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top AUV Comaines - Key Market Players

- Teledyne Technologies Incorporated (US),

- KONGSBERG (Norway),

- Fugro (Netherlands),

- Saab (Sweden),

- General Dynamics Corporation (US),

- Exail Technologies (France),

- Lockheed Martin Corporation (US),

- ATLAS ELEKTRONIK (Germany),

- L3Harris Technologies, Inc. (US),

- Boston Engineering (US), among others, are some key players operating in the Autonomous Underwater Vehicle (AUV) companies.

Autonomous Underwater Vehicles (AUV) Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 2.0 billion in 2024 |

| Projected Market Size | USD 4.3 billion by 2029 |

| Growth Rate | CAGR of 15.9% |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

USD Million/Billion |

|

Segments Covered |

Technology, Type, Shape, Speed, Payload Type, Application, and Region. |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies covered |

Some of the leading companies operating in the autonomous underwater vehicle (AUV) market are KONGSBERG (Norway), Teledyne Technologies Incorporated (US), General Dynamics Corporation (US), Saab (Sweden), Exail Technologies (France), Lockheed Martin Corporation (US), Fugro (Netherlands), ATLAS ELEKTRONIK (Germany), Boston Engineering Corporation (US), L3Harris Technologies, Inc. (US), Graal Tech S.r.l. (Italy), International Submarine Engineering Limited (Canada), and Boeing (US). Some of the new entrants in the autonomous underwater vehicle (AUV) market include Riptide Autonomous Solutions (US), MSubs (China), Falmouth Scientific, Inc. (FSI) (China), Terradepth (US), ecoSUB Robotics Limited (UK), Eelume AS (Norway), BaltRobotics (Poland), and Hydromea (Switzerland). |

Autonomous Underwater Vehicle (AUV) Market

Highlights

This research report categorizes the autonomous underwater vehicle (AUV) market based on Technology, Type, Shape, Speed, Payload Type, Application, and Region.

|

Segment |

Subsegment |

|

By Technology |

|

|

By Type |

|

|

By Shape |

|

|

By Speed |

|

|

By Payload Type |

|

|

By Application |

|

|

By Region |

|

Recent developments in Autonomous Underwater Vehicles (AUV) Industry

- In March 2024, Teledyne Technologies Incorporated (US) announced that it has agreed to acquire Valeport Holdings Limited (UK), which designs and manufactures underwater sensors for environmental, energy, construction, and defense applications.

- In February 2024, The Italian Ministry of Defence awarded KONGSBERG (Norway) a contract to supply a lightweight, unmanned submersible vehicle (AUV) capable of surveying shallow waters.

- In November 2022, Fugro (Netherlands) was awarded two geotechnical investigation contracts for the development of the Dutch IJmuiden Ver Site V-VI, Nederwiek (zuid) Site I, and Hollandse Kust (west) Site VIII offshore wind zones. It is one of the largest campaigns undertaken by the Netherlands Enterprise Agency (RVO) and part of the accelerated development by the Dutch Government in line with the Offshore Wind Energy Roadmap 2030.

Critical questions answered by this report:

What are the key strategies adopted by key companies in the autonomous underwater vehicle (AUV) market?

Product launches, acquisitions, and collaborations have been and continue to be some of the major strategies the key players adopted to grow in the autonomous underwater vehicle (AUV) market.

What region dominates the autonomous underwater vehicle (AUV) market?

The Asia Pacific region will dominate the autonomous underwater vehicle (AUV) market.

Which application segment dominates the autonomous underwater vehicle (AUV) market?

Military & Defense segment is expected to dominate the autonomous underwater vehicle (AUV) market.

Which technology segment dominates the autonomous underwater vehicle (AUV) market?

The Imaging segment is expected to have the largest market size during the forecast period.

Who are the major autonomous underwater vehicle (AUV) market companies?

KONGSBERG (Norway), Teledyne Technologies Incorporated (US), General Dynamics Corporation (US), Saab (Sweden), Exail Technologies (France), Lockheed Martin Corporation (US), Fugro (Netherlands), ATLAS ELEKTRONIK (Germany), Boston Engineering Corporation (US), L3Harris Technologies, Inc. (US), Graal Tech S.r.l. (Italy), International Submarine Engineering Limited (Canada), Boeing (US), Riptide Autonomous Solutions (US), MSubs (China), among others, are some key players operating in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing investments in offshore oil & gas drilling- Deployment of advanced technologies to ensure border and maritime security- Shifting preference toward renewable energy sources- Technological advancements in AUVsRESTRAINTS- High development, operational, and maintenance costs- Limited endurance and rangeOPPORTUNITIES- Integration of NiMH batteries into high-speed AUVs- Rising use of AUVs to protect subsea cables and seabed environment- Growing demand in offshore energy explorationCHALLENGES- Low speed, signal processing, and environmental issues during underwater surveys- Risk of data loss and prolonged research timelines due to challenging marine environment- Legal and ethical concerns

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE TRENDAVERAGE COST SPLIT OF VARIOUS AUV COMPONENTS

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

-

5.8 TECHNOLOGY TRENDSINTERNET OF THINGSRESEARCH ON STANDARD OPERATING SYSTEMS IN ROBOTSARTIFICIAL INTELLIGENCE CHIPSDIGITAL MARINE AUTOMATION SYSTEMSIMPROVED BATTERY TECHNOLOGY

-

5.9 CASE STUDY ANALYSISTERRADEPTH OFFERS OCEAN DATA AS A SERVICE USING AUVSTERRADEPTH'S ABSOLUTE OCEAN INCREASES OPERATIONAL EFFICIENCY FOR S. T. HUDSONLONG-ENDURANCE AUV DEVELOPMENT WITH SHALLOW WATER SIMPLICITY

-

5.10 PATENT ANALYSISKEY PATENTS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 TARIFF AND REGULATORY LANDSCAPETARIFF ANALYSISREGULATORY LANDSCAPE- Regulatory bodies, government agencies, and other organizations

- 5.13 KEY CONFERENCES AND EVENTS

-

5.14 PORTER'S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 COLLISION AVOIDANCESONAR- Deployment of SONAR technology in AUVs to detect underwater obstacles

-

6.3 COMMUNICATIONACOUSTIC COMMUNICATION- Reliance on acoustic sound waves for underwater communicationSATELLITE COMMUNICATION- Adoption of satellite communication to enable real-time data transfer between AUVs and operators

-

6.4 NAVIGATIONCOMPASS-BASED NAVIGATION- Use of compass-based systems to increase navigation accuracyINERTIAL NAVIGATION- Typically adopted in deepwater applications

-

6.5 PROPULSIONFIN CONTROL ACTUATORS- Utilization in AUVs to provide roll, pitch, and yaw controlPROPULSION MOTORS- Adoption in AUVs to enable forward and reverse motionsPUMP MOTORS- Use of DC brushless pump motors to offer variable speed controlLINEAR ELECTROMECHANICAL ACTUATORS- Adoption as low-cost alternative to hydraulic actuatorsBATTERY MODULES- Deployment of battery modules in AUVs for energy storage- Applied battery technologies and alternativesTYPES OF PROPULSION SYSTEMS- Electric system- Mechanical system- Hybrid system

-

6.6 IMAGINGSIDE-SCAN SONAR IMAGERS- Adoption in shallow water surveysMULTIBEAM ECHO SOUNDERS- Use for seabed mappingSUB-BOTTOM PROFILERS- Used to detect layers within sedimentsLED LIGHTING- Deployed to provide higher light output

- 7.1 INTRODUCTION

-

7.2 SHALLOW AUVSADOPTION IN OCEAN OBSERVATION, ROUTE MAPPING, AND MINE-HUNTING APPLICATIONS

-

7.3 MEDIUM AUVSWIDE-SCALE UTILIZATION IN MILITARY APPLICATIONS – KEY DRIVER

-

7.4 LARGE AUVSUSE IN DEEPWATER MAPPING AND SURVEY APPLICATIONS TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 LESS THAN 5 KNOTSNEED FOR LONGER ENDURANCE TO DRIVE DEMAND

-

8.3 MORE THAN 5 KNOTSINCREASING USE IN DEFENSE AND SURVEILLANCE APPLICATIONS TO DRIVE DEMAND

- 9.1 INTRODUCTION

-

9.2 TORPEDOWIDELY USED IN MARINE ENGINEERING APPLICATIONS

-

9.3 LAMINAR FLOW BODYINCREASING ADOPTION TO ENSURE BORDER SECURITY TO PROPEL GROWTH

-

9.4 STREAMLINED RECTANGULAR STYLEUSE TO COLLECT UNDERWATER INFORMATION TO DRIVE SEGMENT

-

9.5 MULTI-HULL VEHICLEUSE TO SURVEY SEAFLOORS AND STUDY MAGNETIC PROPERTIES TO BOOST MARKET

- 10.1 INTRODUCTION

-

10.2 CAMERASHIGH-RESOLUTION DIGITAL STILL CAMERAS- Used to monitor fixed underwater assetsDUAL-EYE CAMERAS- Adoption of dual-eye cameras to form 3D images

-

10.3 SENSORSCONDUCTIVITY, TEMPERATURE, AND DEPTH SENSORS- Deployment in AUVs to evaluate water compositionBIOGEOCHEMICAL SENSORS- Turbulence probes- Oxygen, nitrate, chlorophyll, and photosynthetically active radiation sensors

-

10.4 SYNTHETIC APERTURE SONARWIDELY USED FOR UNDERWATER ACOUSTIC IMAGING

-

10.5 ECHO SOUNDERSINTEGRATION OF ECHO SOUNDERS IN AUVS TO ENABLE OPERATORS TO VIEW SEABED

-

10.6 ACOUSTIC DOPPLER CURRENT PROFILERSUSED TO MEASURE CURRENT VELOCITIES AND WATER DEPTH

- 10.7 OTHERS

- 11.1 INTRODUCTION

-

11.2 MILITARY & DEFENSEBORDER SECURITY & SURVEILLANCE- Use of SONAR-enabled AUVs for border security and surveillanceANTISUBMARINE WARFARE- Adopted to address antisubmarine warfare challenges in ocean and littoral zonesANTI-TRAFFICKING & CONTRABAND MONITORING- Implementation of communication technology-powered AUVs to track illegal activitiesENVIRONMENTAL ASSESSMENT- Used to collect current and tidal dataMINE COUNTERMEASURE IDENTIFICATION- Deployment for detection and clearance of mines

-

11.3 OIL & GASPIPELINE SURVEYS- Use of side-scan SONAR to detect and track pipelines in real timeGEOPHYSICAL SURVEYS- Adoption of AUVs to inspect traditional sites and survey routesDEBRIS/CLEARANCE SURVEYS- Deployment of time-efficient AUVs in debris assessmentBASELINE ENVIRONMENTAL ASSESSMENT- Use of AUVs to classify seabed types

-

11.4 ENVIRONMENT PROTECTION & MONITORINGHABITAT RESEARCH- Use of AUVs to examine marine habitatWATER SAMPLING- Adoption of AUVs to measure salinity and other physical characteristics of waterFISHERY STUDY- Adoption of AUVs to measure overfishing impactEMERGENCY RESPONSE- Use of AUVs in post-hurricane assessment of subsea infrastructure

-

11.5 OCEANOGRAPHYUSED TO OBTAIN PREVIOUSLY INACCESSIBLE DATA ON TIME AND SPATIAL SCALES

-

11.6 ARCHEOLOGY & EXPLORATIONUSE OF AUVS IN LOCATION OF UNDERWATER ARCHEOLOGICAL SITES

-

11.7 SEARCH & SALVAGE OPERATIONSADOPTION OF AUVS TO DETECT SHIPWRECKS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- Reliance on AUVs for subsea inspection and mapping- US: Rules and regulations for AUVsCANADA- Adoption of AUVs for surveys under thick ice layers to drive marketMEXICO- Utilization of AUVs in underwater habitat research to boost market

-

12.3 EUROPEEUROPE: IMPACT OF RECESSIONUK- Government contracts to drive market- UK: Rules and regulations for AUVsGERMANY- Introduction of innovative AUVs for oceanography applications – key driverFRANCE- Reliance on AUVs and other robotic systems for minehunting to fuel growthITALY- Wide adoption of AUVs to explore underwater archeological sites to boost marketSPAIN- Ban on oil & gas exploration to limit growthREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONCHINA- Deployment of AI-powered AUVs for smart underwater navigation to boost marketINDIA- Adoption of AUVs for offshore crude pipeline inspection to fuel growthJAPAN- Use of AUVs to safeguard coastal areas – key driverSOUTH KOREA- Growing number of AUV manufacturers to drive marketAUSTRALIA- Increasing use of AUVs for various commercial applications to drive marketREST OF ASIA PACIFIC

-

12.5 ROWROW: IMPACT OF RECESSIONSOUTH AMERICA- Use of AUVs for offshore oil & gas drillingGCC COUNTRIES- Increasing oil & gas exploration activities to drive marketAFRICA & REST OF MIDDLE EAST- Employment of AUVs for seabed mapping and oil & gas explorations

- 13.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.2 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- 13.3 MARKET SHARE ANALYSIS

- 13.4 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5 BRAND/PRODUCT COMPARISON

-

13.6 COMPANY EVALUATION MATRIX, 2023 (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT- Company footprint- Type footprint- Shape footprint- Payload type footprint- Application footprint- Region footprint

-

13.7 COMPANY EVALUATION MATRIX, 2023 (STARTUPS/SMES)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

13.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSKONGSBERG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTELEDYNE TECHNOLOGIES INCORPORATED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFUGRO- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSAAB- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEXAIL TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developmentsLOCKHEED MARTIN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsATLAS ELEKTRONIK- Business overview- Products/Services/Solutions offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offeredBOSTON ENGINEERING- Business overview- Products/Services/Solutions offered

-

14.3 OTHER PLAYERSINTERNATIONAL SUBMARINE ENGINEERING LIMITEDMSUBSFALMOUTH SCIENTIFIC, INC.TERRADEPTHECOSUB ROBOTICS LIMITEDEELUME ASHYDROMEABOEINGGRAAL TECH S.R.L.RIPTIDE AUTONOMOUS SOLUTIONS LLCBALTROBOTICSSONARDYNEOCEANSCAN-MSTXYLEMRTSYS

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 PRICING ANALYSIS FOR AUTONOMOUS UNDERWATER VEHICLES

- TABLE 2 AVERAGE COST SPLIT OF COMPONENTS WITH RESPECT TO OVERALL AUV COSTS

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 TOP 20 PATENT OWNERS IN LAST 10 YEARS (US)

- TABLE 5 MAJOR PATENTS IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- TABLE 6 TARIFFS IMPOSED BY US ON EXPORTS OF HIGH-RESOLUTION CAMERAS FOR UNDERWATER USE, 2024

- TABLE 7 TARIFFS IMPOSED BY SOUTH AFRICA ON EXPORTS OF HIGH-RESOLUTION CAMERAS FOR UNDERWATER USE, 2024

- TABLE 8 TARIFFS IMPOSED BY CANADA ON EXPORTS OF HIGH-RESOLUTION CAMERAS FOR UNDERWATER USE, 2024

- TABLE 9 TARIFFS IMPOSED BY UK ON EXPORTS OF HIGH-RESOLUTION CAMERAS FOR UNDERWATER USE, 2024

- TABLE 10 TARIFFS IMPOSED BY FRANCE ON EXPORTS OF HIGH-RESOLUTION CAMERAS FOR UNDERWATER USE, 2024

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 AUTONOMOUS UNDERWATER VEHICLE MARKET: CONFERENCES AND EVENTS, 2024–2025

- TABLE 16 IMPACT OF PORTER'S FIVE FORCES ON AUTONOMOUS UNDERWATER VEHICLES MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 19 AUV MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 20 AUV MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 21 COLLISION AVOIDANCE: AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 22 COLLISON AVOIDANCE: AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 23 COMMUNICATION OPTIONS FOR SEARAPTOR AUVS BY TELEDYNE MARINE (US)

- TABLE 24 COMMUNICATION: AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 25 COMMUNICATION: AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 26 NAVIGATION: AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 27 NAVIGATION: AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 28 AUV MARKET, BY NAVIGATION TYPE, 2020–2023 (USD MILLION)

- TABLE 29 AUV MARKET, BY NAVIGATION TYPE, 2024–2029 (USD MILLION)

- TABLE 30 TYPES OF BATTERIES

- TABLE 31 AUVS AND THEIR RESPECTIVE BATTERIES

- TABLE 32 PROPULSION: AUV MARKET, BY SYSTEM, 2020–2023 (USD MILLION)

- TABLE 33 PROPULSION: AUV MARKET, BY SYSTEM, 2024–2029 (USD MILLION)

- TABLE 34 PROPULSION: AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 35 PROPULSION: AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 36 IMAGING: AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 37 IMAGING: AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 38 IMAGING: AUV MARKET, BY SYSTEM, 2020–2023 (USD MILLION)

- TABLE 39 IMAGING: AUV MARKET, BY SYSTEM, 2024–2029 (USD MILLION)

- TABLE 40 FEATURES OF DIFFERENT AUV TYPES

- TABLE 41 AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 42 AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 43 AUV MARKET, BY TYPE, 2020–2023 (UNITS)

- TABLE 44 AUV MARKET, BY TYPE, 2024–2029 (UNITS)

- TABLE 45 SHALLOW AUVS: APPLICATIONS AND OEMS

- TABLE 46 SHALLOW AUV MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 47 SHALLOW AUV MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 48 SHALLOW AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 49 SHALLOW AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 50 SHALLOW AUV MARKET, BY APPLICATION, 2020–2023 (UNITS)

- TABLE 51 SHALLOW AUV MARKET, BY APPLICATION, 2024–2029 (UNITS)

- TABLE 52 SHALLOW AUV MARKET, BY SHAPE, 2020–2023 (USD MILLION)

- TABLE 53 SHALLOW AUV MARKET, BY SHAPE, 2024–2029 (USD MILLION)

- TABLE 54 MEDIUM AUVS: APPLICATIONS AND OEMS

- TABLE 55 MEDIUM AUV MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 56 MEDIUM AUV MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 57 MEDIUM AUV MARKET, BY SHAPE, 2020–2023 (USD MILLION)

- TABLE 58 MEDIUM AUV MARKET, BY SHAPE, 2024–2029 (USD MILLION)

- TABLE 59 MEDIUM AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 60 MEDIUM AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 61 LARGE AUVS: APPLICATIONS AND OEMS

- TABLE 62 LARGE AUV MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 63 LARGE AUV MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 64 LARGE AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 65 LARGE AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 66 LARGE AUV MARKET, BY SHAPE, 2020–2023 (USD MILLION)

- TABLE 67 LARGE AUV MARKET, BY SHAPE, 2024–2029 (USD MILLION)

- TABLE 68 AUV MARKET, BY SPEED, 2020–2023 (USD MILLION)

- TABLE 69 AUV MARKET, BY SPEED, 2024–2029 (USD MILLION)

- TABLE 70 AUV MARKET, BY SHAPE, 2020–2023 (USD MILLION)

- TABLE 71 AUV MARKET, BY SHAPE, 2024–2029 (USD MILLION)

- TABLE 72 TORPEDO: AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 73 TORPEDO: AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 74 LAMINAR FLOW BODY: AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 75 LAMINAR FLOW BODY: AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 76 STREAMLINED RECTANGULAR STYLE: AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 77 STREAMLINED RECTANGULAR STYLE: AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 78 MULTI-HULL AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 79 MULTI-HULL AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 80 AUV MARKET, BY PAYLOAD TYPE, 2020–2023 (USD MILLION)

- TABLE 81 AUV MARKET, BY PAYLOAD TYPE, 2024–2029 (USD MILLION)

- TABLE 82 CAMERAS: AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 83 CAMERAS: AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 84 CAMERAS: AUV MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 85 CAMERAS: AUV MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 86 SENSORS: AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 87 SENSORS: AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 88 SYNTHETIC APERTURE SONAR: AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 89 SYNTHETIC APERTURE SONAR: AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 90 ECHO SOUNDERS: AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 91 ECHO SOUNDERS: AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 92 ACOUSTIC DOPPLER CURRENT PROFILERS: AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 93 ACOUSTIC DOPPLER CURRENT PROFILERS: AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 94 OTHER PAYLOADS: AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 95 OTHER PAYLOADS: AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 96 AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 97 AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 98 MILITARY & DEFENSE: AUV MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 99 MILITARY & DEFENSE: AUV MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 101 NORTH AMERICA: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 102 EUROPE: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 103 EUROPE: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 104 ASIA PACIFIC: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 105 ASIA PACIFIC: AUV MARKET FOR MILITARY & DEFENSE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 106 ROW: AUV MARKET FOR MILITARY & DEFENSE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 107 ROW: AUV MARKET FOR MILITARY & DEFENSE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 108 OIL & GAS: AUV MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 109 OIL & GAS: AUV MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 110 NORTH AMERICA: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 111 NORTH AMERICA: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 112 EUROPE: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 113 EUROPE: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AUV MARKET FOR OIL & GAS, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 116 ROW: AUV MARKET FOR OIL & GAS, BY REGION, 2020–2023 (USD MILLION)

- TABLE 117 ROW: AUV MARKET FOR OIL & GAS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 118 ENVIRONMENT PROTECTION & MONITORING: AUV MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 119 ENVIRONMENT PROTECTION & MONITORING: AUV MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 120 NORTH AMERICA: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 121 NORTH AMERICA: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 122 EUROPE: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 123 EUROPE: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 124 ASIA PACIFIC: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 125 ASIA PACIFIC: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 126 ROW: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY REGION, 2020–2023 (USD MILLION)

- TABLE 127 ROW: AUV MARKET FOR ENVIRONMENT PROTECTION & MONITORING, BY REGION, 2024–2029 (USD MILLION)

- TABLE 128 OCEANOGRAPHY: AUV MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 129 OCEANOGRAPHY: AUV MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 130 NORTH AMERICA: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 131 NORTH AMERICA: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 132 EUROPE: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 133 EUROPE: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AUV MARKET FOR OCEANOGRAPHY, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 136 ROW: AUV MARKET FOR OCEANOGRAPHY, BY REGION, 2020–2023 (USD MILLION)

- TABLE 137 ROW: AUV MARKET FOR OCEANOGRAPHY, BY REGION, 2024–2029 (USD MILLION)

- TABLE 138 ARCHEOLOGY & EXPLORATION: AUV MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 139 ARCHEOLOGY & EXPLORATION: AUV MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 140 NORTH AMERICA: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 141 NORTH AMERICA: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 142 EUROPE: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 143 EUROPE: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 146 ROW: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY REGION, 2020–2023 (USD MILLION)

- TABLE 147 ROW: AUV MARKET FOR ARCHEOLOGY & EXPLORATION, BY REGION, 2024–2029 (USD MILLION)

- TABLE 148 SEARCH & SALVAGE OPERATIONS: AUV MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 149 SEARCH & SALVAGE OPERATIONS: AUV MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 150 NORTH AMERICA: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 151 NORTH AMERICA: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 152 EUROPE: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 153 EUROPE: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 154 ASIA PACIFIC: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 155 ASIA PACIFIC: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 156 ROW: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY REGION, 2020–2023 (USD MILLION)

- TABLE 157 ROW: AUV MARKET FOR SEARCH & SALVAGE OPERATIONS, BY REGION, 2024–2029 (USD MILLION)

- TABLE 158 AUV MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 159 AUV MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 160 NORTH AMERICA: AUV MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 161 NORTH AMERICA: AUV MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 162 NORTH AMERICA: AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 163 NORTH AMERICA: AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 164 EUROPE: AUV MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 165 EUROPE: AUV MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 166 EUROPE: AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 167 EUROPE: AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 168 ASIA PACIFIC: AUV MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 169 ASIA PACIFIC: AUV MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 170 ASIA PACIFIC: AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 171 ASIA PACIFIC: AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 172 ROW: AUV MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 173 ROW: AUV MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 174 ROW: AUV MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 175 ROW: AUV MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 176 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- TABLE 177 AUTONOMOUS UNDERWATER VEHICLE MARKET: DEGREE OF COMPETITION

- TABLE 178 AUTONOMOUS UNDERWATER VEHICLE MARKET: RANKING ANALYSIS

- TABLE 179 AUTONOMOUS UNDERWATER VEHICLE MARKET: TYPE FOOTPRINT

- TABLE 180 AUTONOMOUS UNDERWATER VEHICLE MARKET: SHAPE FOOTPRINT

- TABLE 181 AUTONOMOUS UNDERWATER VEHICLE MARKET: PAYLOAD TYPE FOOTPRINT

- TABLE 182 AUTONOMOUS UNDERWATER VEHICLE MARKET: APPLICATION FOOTPRINT

- TABLE 183 AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPANY REGION FOOTPRINT

- TABLE 184 AUTONOMOUS UNDERWATER VEHICLE MARKET: KEY STARTUPS/SMES

- TABLE 185 AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 AUTONOMOUS UNDERWATER VEHICLE MARKET: PRODUCT LAUNCHES, 2021–2024

- TABLE 187 AUTONOMOUS UNDERWATER VEHICLE MARKET: DEALS, 2021–2024

- TABLE 188 AUTONOMOUS UNDERWATER VEHICLE MARKET: OTHER DEVELOPMENTS, 2021–2024

- TABLE 189 KONGSBERG: COMPANY OVERVIEW

- TABLE 190 KONGSBERG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 KONGSBERG: RECENT DEVELOPMENTS, 2021–2024

- TABLE 192 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 193 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 194 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES, 2021–2024

- TABLE 195 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS, 2021–2024

- TABLE 196 FUGRO: COMPANY OVERVIEW

- TABLE 197 FUGRO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 198 FUGRO: RECENT DEVELOPMENTS, 2021–2024

- TABLE 199 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 200 GENERAL DYNAMICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 GENERAL DYNAMICS CORPORATION: RECENT DEVELOPMENTS, 2021–2024

- TABLE 202 SAAB: COMPANY OVERVIEW

- TABLE 203 SAAB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 SAAB: RECENT DEVELOPMENTS, 2021–2024

- TABLE 205 EXAIL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 206 EXAIL TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 207 EXAIL TECHNOLOGIES: PRODUCT LAUNCHES, 2021–2024

- TABLE 208 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 209 LOCKHEED MARTIN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES, 2021–2024

- TABLE 211 LOCKHEED MARTIN CORPORATION: DEALS, 2021–2024

- TABLE 212 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS, 2021–2024

- TABLE 213 ATLAS ELECTRONIK: COMPANY OVERVIEW

- TABLE 214 ATLAS ELECTRONIK: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 215 ATLAS ELECTRONIK: DEALS, 2021–2024

- TABLE 216 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 217 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 218 BOSTON ENGINEERING: COMPANY OVERVIEW

- TABLE 219 BOSTON ENGINEERING: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 AUTONOMOUS UNDERWATER VEHICLE MARKET SEGMENTATION

- FIGURE 2 AUTONOMOUS UNDERWATER VEHICLE MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SALES OF AUV PRODUCTS AND SOLUTIONS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION: AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 8 IMAGING SEGMENT TO COMMAND AUV MARKET DURING FORECAST PERIOD

- FIGURE 9 LARGE AUVS SEGMENT TO HOLD LARGEST SHARE BETWEEN 2024 AND 2029

- FIGURE 10 TORPEDO SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 11 LESS THAN 5 KNOTS SEGMENT TO COMMAND LARGER SHARE DURING FORECAST PERIOD

- FIGURE 12 SENSORS SEGMENT TO HOLD LARGEST SHARE OF AUV PAYLOAD MARKET IN 2024

- FIGURE 13 ARCHEOLOGY & EXPLORATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO WITNESS HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 15 INCREASING CAPITAL EXPENDITURE IN OFFSHORE INDUSTRY TO FUEL DEMAND FOR AUV DURING FORECAST PERIOD

- FIGURE 16 LARGE AUV SEGMENT TO DOMINATE IN TERMS OF VALUE DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC AUV MARKET: MILITARY & DEFENSE SEGMENT AND CHINA –LARGEST SHAREHOLDERS IN 2024

- FIGURE 18 MILITARY & DEFENSE TO HOLD LARGEST SHARE OF AUV MARKET BY 2029

- FIGURE 19 AUV MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 AUTONOMOUS UNDERWATER VEHICLE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMPACT OF DRIVERS ON AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 22 IMPACT OF RESTRAINTS ON AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 23 UNDERWATER CONNECTORS MARKET REVENUE FROM 2022 TO 2027

- FIGURE 24 IMPACT OF OPPORTUNITIES ON AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 25 IMPACT OF CHALLENGES ON AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 26 TRENDS INFLUENCING AUTONOMOUS UNDERWATER VEHICLE BUSINESS OWNERS

- FIGURE 27 AUVS: AVERAGE SELLING PRICE

- FIGURE 28 AUTONOMOUS UNDERWATER VEHICLE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 AUTONOMOUS UNDERWATER VEHICLE MARKET ECOSYSTEM

- FIGURE 30 FUNDS ACQUIRED BY COMPANIES IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 31 PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 32 NUMBER OF PATENTS GRANTED, 2013−2023

- FIGURE 33 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 900630, BY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 34 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 900630, BY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS: AUTONOMOUS UNDERWATER VEHICLES MARKET

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 38 FUNDAMENTAL CHARACTERISTICS OF AUVS

- FIGURE 39 IMAGING SEGMENT TO GROW AT HIGHEST CAGR DURING 2024–2029

- FIGURE 40 CLASSIFICATION OF AUVS BY DEPTH

- FIGURE 41 LARGE AUVS SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 42 MORE THAN 5 KNOTS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 43 TORPEDO SEGMENT TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 44 ILLUSTRATION: TORPEDO AUV

- FIGURE 45 ILLUSTRATION: LAMINAR FLOW BODY AUV

- FIGURE 46 ILLUSTRATION: MULTI-HULL VEHICLES

- FIGURE 47 SENSORS SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 ARCHEOLOGY & EXPLORATION SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 50 NORTH AMERICA: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

- FIGURE 51 PRE- AND POST-RECESSION ANALYSIS: NORTH AMERICAN AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 52 EUROPE: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

- FIGURE 53 PRE- AND POST-RECESSION ANALYSIS: EUROPEAN AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 54 ASIA PACIFIC: AUTONOMOUS UNDERWATER VEHICLE MARKET SNAPSHOT

- FIGURE 55 PRE- AND POST-RECESSION ANALYSIS: ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 56 PRE- AND POST-RECESSION ANALYSIS: ROW AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 57 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2021–2023

- FIGURE 58 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 59 VALUATION AND FINANCIAL MATRIX OF KEY PLAYERS IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- FIGURE 60 ENTERPRISE VALUE/EBITDA OF KEY PLAYERS

- FIGURE 61 AUTONOMOUS UNDERWATER VEHICLE MARKET: TOP TRENDING BRANDS/PRODUCTS

- FIGURE 62 AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 63 AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPANY FOOTPRINT

- FIGURE 64 AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 65 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 66 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 67 FUGRO: COMPANY SNAPSHOT

- FIGURE 68 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 SAAB: COMPANY SNAPSHOT

- FIGURE 70 EXAIL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 71 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 72 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

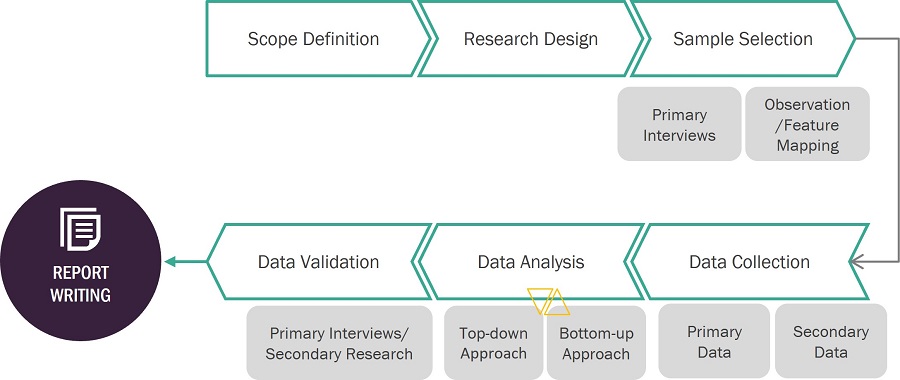

The study involved four major activities in estimating the current size of the autonomous underwater vehicle (AUV) market —exhaustive secondary research collected information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. These secondary sources include AUV technology journals and magazines, annual reports, press releases, investor presentations of companies, white papers, certified publications and articles from recognized authors, and directories and databases such as Factiva, Hoovers, and OneSource.

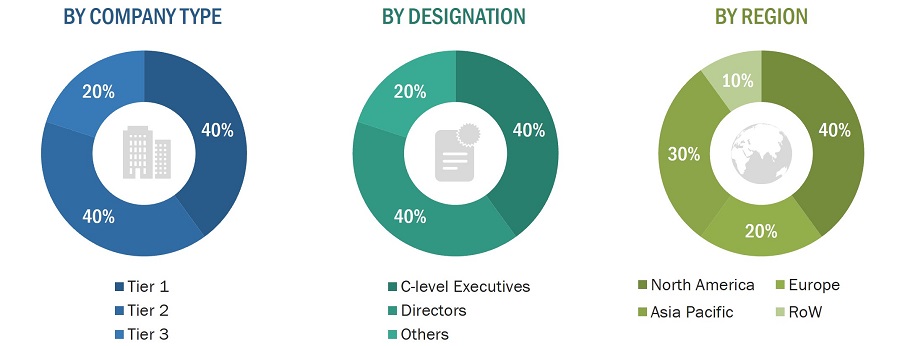

Primary Research

Various primary sources from both supply and demand sides have been interviewed in the primary research process to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the autonomous underwater vehicle (AUV) market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market estimation process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the autonomous underwater vehicle (AUV) market and other dependent submarkets listed in this report.

- Extensive secondary research has identified key players in the industry and market.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Autonomous Underwater Vehicle (Auv) Market: Bottom-Up Approach

Autonomous Underwater Vehicle (Auv) Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments and subsegments. The data has been triangulated by studying several factors and trends identified from both the demand and supply sides.

Market Definition

Autonomous underwater vehicles (AUVs) are unmanned underwater robots that operate independently of humans. They are self-guiding and self-powered vehicles capable of navigating from the sea surface to ocean depths and back. Some AUVs are solar-powered, enabling them to spend time on the surface.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End users

Report Objectives

The following are the primary objectives of the study.

- To forecast the size of the autonomous underwater vehicle (AUV) market, in terms of value, based on technology, type, shape, payload type, speed, application, and region

- To define, describe, and forecast the AUV market size, in terms of volume, based on type

- To describe and forecast the market, in terms of value, for various segments across four main regions: North America, Asia Pacific, Europe, and RoW

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete value chain and related industry segments and conduct a value chain analysis of the autonomous underwater vehicle (AUV) market landscape

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s Five Forces, import and export scenarios, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and provide a detailed competitive landscape of the AUV market

- To analyze strategic approaches adopted by leading players in the market, including product launches/developments, contracts, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Autonomous Underwater Vehicle (AUV) Market

Have you profiled L3Harris technologies? I believe they are one of the top vendors in the AUV market. Apart from the one's mentioned in the company profile chapter what other companies have profiled?

I want to speak to the analyst who wrote this to get more insight for an article about the growth and potential (and pitfalls) of the underwater drone market. Also would like to understand the methodology for the same.

Hi, We are a start up company and would very much like to view this report but we don't have 5k or 8k to do so, do you have any deals that you can offer us as a start up company? Also would like to understand the payloads such as cameras, sensors, etc. and their use in Torpedo's.

Can you provide me comparitive qualitative and quantitave analysis of ROV and AUV? Make sure to provide unit shipments and ASP of ROV and AUV. Also provide me the top 10 vendors in the ROV market.

Is there any scope for new entrants in the market? If yes please provide me few start-ups in the market along with entry barriers in the market. Information on best practices in the market will also be well appriciated.

Have you provided information on ASP and unit shipment of each type of AUV i.e., shallow, medium and large? Can you also provide me both qualitative and quantitative information on each type and its application along with top vendors in each type?

Neptune has recently completed its first deep water AUV survey in oil and gas. However, I would appreciate more information on defense, scientific and geography markets across all water depths as we have not had much visibility on this and believe we can use our vehicle for numerous purposes.

How AUVs are associated with the environmental protection and oceanography?

Hello, I am a PhD student in Engineering/Oceanography concentrating on the technological development of AUVs. Would it be possible to request a sample of this report? Are there any discounts available for students at academic institutions who are using this information for research?

Have been involved for many years now in providing Logistic/Customs Support Services to Clients who operate AUV Systems Worldwide. What are the latest trends of AUVs in military and defense and oil & gas industries

What are the various Technologies and Types covered in the research. Also I would like to understand the opportunities and how government initiatives would be a driving factor for this market>?

I would like to understand about acquisitions and or technology purchases made by market players (purchases of startups, R&D firms or purchases of licenses form universities etc..) in the AUV market. Have you covered this in your scope?

Does your report have information on AUV batteries and various types of AUV batteries? Also can you provide me quantitative information on various AUV batteries? It should also include upcoming AUV battery technologies along with top vendor in each AUV battery type.

Hello. I am the founder of a newly formed autonomous underwater vehicle and I am interested in this report so we can better identify our target markets and customers. Also I would like to know the major areas that have been covered in this market.

We are a team of Electrical Engineering students from ITB (Bandung Institute of Technology) developing an AUV with an open source system for our capstone design project. The project is being developed for academicals maritime research purposes needed in Indonesia as it is the largest archipelago in the world. We request access for this pdf because we need a source of information for researching the global market for AUV development, as the Indonesian market for undersea exploration is currently very limited.