Automotive End-point Authentication Market by Advanced Features (ADAS, Battery Status, Service & Maintenance Updates and Others), Type (Wearable, Smartphone Application, Biometric Access), Connectivity, Vehicle (PC, EV), & Region - Global Forecast to 2022

[169 Pages Report] The automotive end-point authentication market is valued at USD 529.5 Million in 2017 and is projected to grow at a CAGR of 14.5% during the forecast period, to reach USD 1042.5 Million by 2022.

In this study, 2016 has been considered as base year, and 2017 to 2022 as forecast period, for estimating the market size of the automotive end point authentication market. The report segments the automotive end point authentication market and forecasts its size, by volume and value, based on advanced features, authentication type, connectivity, vehicle type and region.

It provides a detailed analysis of various forces acting in the market (drivers, restraints, opportunities, and challenges). It strategically profiles key players and comprehensively analyzes their market shares and core competencies. The report also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants. The market for industrial vehicles is estimated to grow at a promising CAGR from 2017 to 2022. Due to high adoptability and increase in demand for high end electronics & safety features in region such as Europe and North America, It is estimated that automotive end point authentication market would rise. Also due to increase in sales of electric vehicle in potential market such as china, South Korea and others would drive the automotive end point authentication market.

The automotive end-point authentication market research methodology used in the report involves various secondary sources such as Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (EAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA). Experts from related industries and suppliers have been interviewed to understand the future trends of the end-point authentication market for automotive. Bottom-up and top-down approaches have been used to estimate and validate the size of the global market. The market size, by volume, is derived by identifying the region-wise production volumes and analyzing the demand trends. The market size, by value, is derived by multiplying the average selling price of end-point authentication market for automotive by the number of end-point authentication systems installed in the automobiles of that region.

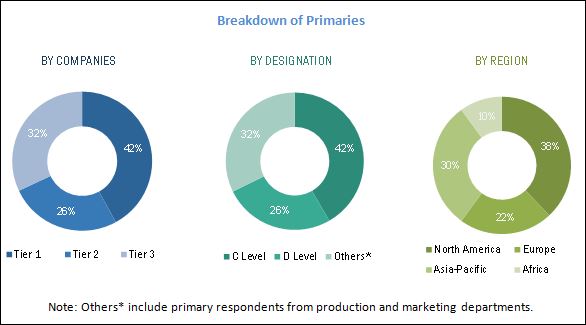

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The primary sources-experts from related industries, electronic device manufacturers, and suppliers–have been interviewed to obtain and verify critical information, as well as to assess future prospects and market estimations. Bottom-up and top-down both the approaches have been used for automotive end-point authentication market estimation and calculating the global industrial vehicles market size.

The ecosystem of the end-point authentication market for automotive consists of manufacturers such as Pebble, a Fitbit brand (U.S.), Continental AG (Germany), Samsung Electronics Ltd. (South Korea), Hitachi Ltd. (Japan), and Fujitsu Ltd. (Japan), and research institutes such as Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (EAMA), Canadian Automobile Association (CAA), and Korea Automobile Manufacturers Association (KAMA).

Target Audience

- Automobile manufacturers

- Automotive end-point authentication systems manufacturers

- Automotive software developing companies

- Automotive hardware component manufacturers

- End-point authentication systems design companies

- Automobile Organizations/Associations

- End-point authentication systems component suppliers

- Raw material suppliers for end-point authentication systems/components

- Traders and Distributors of end-point authentication systems

- Tier 1, Tier 2, and Tier 3 suppliers

- Distributors and suppliers of automotive components/parts

Want to explore hidden markets that can drive new revenue in Automotive End-point Authentication Market?

-

Automotive End-Point Authentication Market, By Authentication Type

-

Biometric Vehicle Access

- Fingerprint Recognition (2017–2022)

- Voice Recognition (2017–2022)

- Iris Recognition (2021–2025)

- Smartphone Applications (2017–2022)

- Automotive Wearables (2019–2025)

-

Biometric Vehicle Access

-

By Vehicle Type

- Passenger car

- Electric vehicle

-

By Connectivity Type

- Wi-Fi

- Bluetooth

- Cellular Network

-

By Component type (Qualitative)

- Advanced Driver Assistance System

- Battery Status

- Door Lock Status

- Real Time Diagnostics Monitoring

- Service and maintenance updates

- Navigation

- Others

-

By Region

- North America

- Asia-Pacific

- Europe

- Rest of the World

Available Customizations

MarketsandMarkets offers the following customizations for automotive end-point authentication market report: Detailed analysis and profiling of additional countries (up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of automotive biometric systems market

- Detailed analysis of automotive security systems market

- Detailed analysis of electric vehicle end-point authentication systems market

The global automotive end-point authentication market, by value, is estimated to be USD 529.5 Million in 2017 and is projected to grow to USD 1,042.5 Million by 2022, at a CAGR of 14.5%.

The fingerprint recognition segment is estimated to account for the largest market share, by value, followed by the voice recognition segment in 2017. The market for wearable end-point authentication systems is projected to grow at a high CAGR during the forecast period due to increasing demand for convenience while driving a vehicle. Due to high production volumes, the passenger car segment is estimated to acquire the largest market share and grow at the highest CAGR during the forecast period.

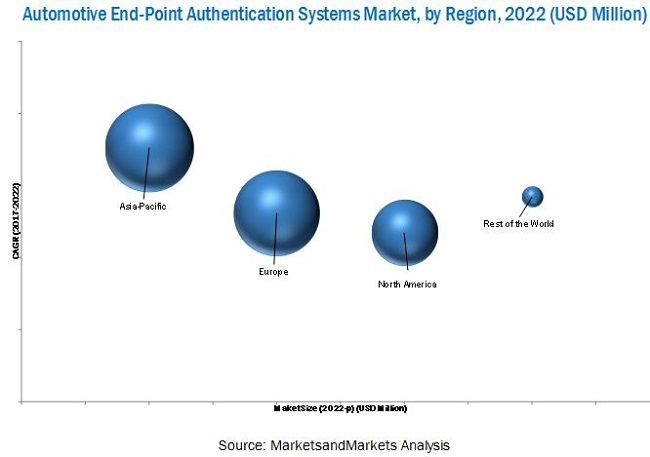

The markets of Asia-Pacific, Europe, and North America are growing at a good pace owing to the increase in automotive production and demand for advanced safety features in these regions.

It is estimated that most of the vehicles are equipped with high-end electronics and safety features in developed regions such as Europe and North America which results in high penetration of end-point authentication systems whereas in countries such as Mexico and Canada still have the potential market due to increasing vehicle production capacity and commissioning of new vehicle assembly plants.

On the other hand, the automotive end-point authentication markets of Asia-Pacific and Rest of the World regions are growing significantly. Growing consumer preference for high-end electronics and safety features, along with the growing demand for passenger cars and electric vehicles in countries such as China, India, South Korea, and Brazil are the key factors driving the market in these regions.

Restraints of the automotive end-point authentication market:

Automotive end-point authentication systems are highly dependent on electronic components such as electrical wiring and batteries for their smooth functioning. Failure of any of these components could adversely affect the vehicle security system. This results in a large number of replacements in case of minor damages to the security system. The reliability of electronic components is extremely important in the case of complex security systems such as fingerprint recognition systems. Thus, the potential failure of electronic components can prove to be a restraint for the end-point authentication systems market.

The global automotive end-point authentication market is dominated by a few players such as Pebble Technology Corporation, a Fitbit, Inc. brand (U.S.), Continental AG (Germany), Garmin Ltd. (U.S.), and Nuance Communications (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Market Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand Side Analysis

2.2.2.1 Growing Demand for Smartphone Features in Cars

2.2.2.2 Increase in Demand for Electric Vehicles

2.2.2.3 Growth in Luxury Vehicle Sales

2.2.3 Supply-Side Analysis

2.2.3.1 Continuous Changing Preferences in End-point Authentication Systems

2.2.3.2 Advanced Mechanisms in Vehicle Security

2.2.3.3 Steady Growth Innovation and Upgradation in Wearable Technology

2.3 Market Size Estimation

2.4 Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in Automotive End-point Authentication Market

4.2 By Authentication

4.3 By Connectivity and By Region 39

4.4 By Vehicle Type

4.5 By Connectivity

4.6 By Smartphone Application and Wearable Technology

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market for Automotive

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Benefits From Insurance Companies for Vehicles Installed With Biometric System

5.3.1.2 Multi-Factor Authentication for Vehicle Safety

5.3.1.3 Increased Legislations Regarding Security of Vehicles

5.3.2 Restraints

5.3.2.1 Potential Failure of Electronic Or Software Components Used in End-point Authentication Device

5.3.2.2 Increased Price Range of End-point Authentication Device

5.3.3 Opportunities

5.3.3.1 Advent of Connected Cars and Electric Vehicles in the Automotive Industry

5.3.3.2 Rising Demand for Safety Features and Convenience

5.3.4 Challenges

5.3.4.1 Increased Connectivity Would Induce Risk of Cyber Attacks

5.3.4.2 Wearable May Cause Distraction While Driving

5.3.4.3 Weather Conditions Affecting the Functionality of End-point Authentication System

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.1.1 Limited Players in the Market

5.4.2 Threat of Substitutes

5.4.2.1 Highest Form of End-point Authentication and Low Penetration of Wireless Systems

5.4.3 Bargaining Power of Suppliers

5.4.3.1 End-point Authentication in Automotive has Small Number of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.4.1 Total Control on Demand

5.4.5 Intensity of Competitive Rivalry

5.4.5.1 High Amount of Investment is Required in Innovation and Upgradation of Technology

6 Technology Overview: Automotive End-point Authentication Market for Automotive, By Advanced Features (Page No. - 58)

6.1 Introduction

6.2 Advanced Driver Assistance Systems

6.3 Battery Status

6.4 Door Lock Status

6.5 Real-Time Diagnostics Monitoring

6.6 Service and Maintenance Updates

6.7 Navigation

6.8 Others

7 By Authentication Type (Page No. - 61)

7.1 Introduction

7.2 Biometric Vehicle Access

7.2.1 Fingerprint Recognition

7.2.2 Voice Recognition

7.2.3 IRIS Recognition

7.3 Smartphone Application

7.4 Automotive Wearable

8 By Connectivity (Page No. - 71)

8.1 Introduction

8.2 Bluetooth

8.3 Wi-Fi

8.4 Cellular Network

9 By Vehicle Type (Page No. - 76)

9.1 Introduction

9.2 Passenger Cars

9.2.1 Automotive End-point Authentication Market for Automotive in Passenger Car

9.2.2 Asia-Pacific

9.2.3 Europe

9.2.4 North America

9.2.5 Rest of the World

9.3 Electric Vehicle

9.3.1 Automotive End-point Authentication Market for Automotive in Electric Vehicle

10 By Region (Page No. - 86)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 Japan

10.2.3 South Korea

10.2.4 India

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.4 North America

10.4.1 U.S.

10.4.2 Canada

10.4.3 Mexico

10.5 Rest of the World

10.5.1 Brazil

10.5.2 Russia

11 Competitive Landscape (Page No. - 111)

11.1 Introduction

11.1.1 Vanguards

11.1.2 Innovator

11.1.3 Dynamic

11.1.4 Emerging

11.2 Competitive Benchmarking

11.2.1 Product Offerings (For All 15 Companies)

11.2.2 Business Strategy (For All 15 Companies)

Top Companies Analyzed for This Study are – Qualcomm Technologies, Inc.; Symantec Corporation; Synaptic Incorporated; Continental AG; Fujitsu Ltd.; Hitachi Ltd.; LG Electronics Corporation; Nuance Communication; Samsung Electronics Co. Ltd.; Fitbit Inc.; Methode Electronics; VOXX International; Garmin Ltd.; Hid Global; Safran S.A.

12 Company Profiles (Page No. - 115)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

12.1 Continental AG

12.2 Fitbit, Inc.

12.3 Fujitsu Ltd.

12.4 Garmin Ltd.

12.5 Hid Global, Subsidiary of Assa Abloy

12.6 Hitachi Ltd.

12.7 Nuance Communications

12.8 Safran S.A.

12.9 Samsung Electronics Co. Ltd.

12.10 Symantec Corporation

12.11 Synaptics Incorporated

12.12 VOXX International

*Details on Company Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Key Expandable (Page No. - 159)

13.1 Introduction

13.2 Empatica Inc.

13.3 Gestigon

13.4 Optalert

13.5 Sober Steering

13.6 Jaguar Land Rover Automotive PLC

*Details on Company Overview, Innovation, and Impact of Innovation on the End-point Authentication in Automotive Industry.

14 Appendix (Page No. - 162)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducting RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (68 Tables)

Table 1 Average American Dollar Exchange Rates (Per 1 USD)

Table 2 Government Incentives for Electric Vehicles

Table 3 Porter’s Five Forces Analysis

Table 4 Automotive End-point Authentication Market for Automotive, By Biometric Vehicle Access, 2015–2022 (‘000 Units)

Table 5 Market, By Biometric Vehicle Access Type, 2015–2022 (USD Million)

Table 6 By Fingerprint Recognition, By Region, 2015–2022 (‘000 Units)

Table 7 Market, By Fingerprint Recognition, By Region, 2015–2022 (USD Million)

Table 8 By Voice Recognition, By Region, 2015–2022 (‘000 Units)

Table 9 By Voice Recognition, By Region, 2015–2022 (USD Million)

Table 10 By IRIS Recognition System, 2021–2025 (‘000 Units)

Table 11 By IRIS Recognition System, 2021–2025 (USD Million)

Table 12 By IRIS Recognition, By Region, 2021–2025 (‘000 Units)

Table 13 By IRIS Recognition, By Region, 2021–2025 (USD Million)

Table 14 By Smartphone Application, By Region, 2015–2022 (‘Million Units)

Table 15 Market for Automotive Wearable, By Region, 2019–2025 (‘000 Units)

Table 16 By Connectivity Type, 2015–2022 (‘000 Units)

Table 17 Bluetooth: By Region, 2015–2022 (‘000 Units)

Table 18 Wi-Fi: By Region, 2015–2022 (‘000 Units)

Table 19 Cellular Networks: By Region, 2015–2022 (‘000 Units)

Table 20 By Vehicle Type, 2015–2022 (‘000 Units)

Table 21 By Vehicle Type, 2015–2022 (USD Million)

Table 22 Passenger Car: By Region, 2015–2022 (‘000 Units)

Table 23 Passenger Car: By Region, 2015–2022 (USD Million)

Table 24 Passenger Car: By Country, 2015–2022 (‘000 Units)

Table 25 Passenger Car: Country, 2015–2022 (USD Million)

Table 26 Passenger Car: By Country, 2015–2022 (‘000 Units)

Table 27 Passenger Car: By Country, 2015–2022 (USD Million)

Table 28 Passenger Car: By Country, 2015–2022 (‘000 Units)

Table 29 Passenger Car: By Country, 2015–2022 (USD Million)

Table 30 Passenger Car: Automotive End-point Authentication Market, By Country, 2015–2022 (‘000 Units)

Table 31 Passenger Car: By Country, 2015–2022 (USD Million)

Table 32 Electric Vehicle: By Region, 2015–2022 (‘000 Units)

Table 33 Electric Vehicle: By Region, 2015–2022 (USD Million)

Table 34 By Region, 2015–2022 (‘000 Units)

Table 35 Market, By Region, 2015–2022 (USD Million)

Table 36 Asia-Pacific: Automotive End-point Authentication Market for Automotive, By Country, 2015–2022 (‘000 Units)

Table 37 Asia-Pacific: By Country, 2015–2022 (USD Million)

Table 38 China: By Product Type, 2015–2022 (‘000 Units)

Table 39 China: By Product Type, 2015–2022 (USD Million)

Table 40 Japan: By Product Type, 2015–2022 (‘000 Units)

Table 41 Japan: By Product Type, 2015–2022 (USD Million)

Table 42 South Korea: By Product Type, 2015–2022 (‘000 Units)

Table 43 South Korea: By Product Type, 2015–2022 (USD Million)

Table 44 India: By Product Type, 2015–2022 (‘000 Units)

Table 45 India: By Product Type, 2015–2022 (USD Million)

Table 46 Europe: Automotive End-point Authentication Market for Automotive, By Country, 2015–2022 (‘000 Units)

Table 47 Europe: By Country, 2015–2022 (USD Million)

Table 48 Germany: By Product Type, 2015–2022 (‘000 Units)

Table 49 Germany: By Product Type, 2015–2022 (USD Million)

Table 50 France: By Product Type, 2015–2022 (‘000 Units)

Table 51 France: By Product Type, 2015–2022 (USD Million)

Table 52 U.K.: By Product Type, 2015–2022 (‘000 Units)

Table 53 U.K.: By Product Type, 2015–2022 (USD Million)

Table 54 North America: Automotive End-point Authentication Market for Automotive, By Country, 2015–2022 (‘000 Units)

Table 55 North America: By Country, 2015–2022 USD Million)

Table 56 U.S.: By Product Type, 2015–2022 (‘000 Units)

Table 57 U.S.: By Product Type, 2015–2022 (USD Million)

Table 58 Canada: By Product Type, 2015–2022 (‘000 Units)

Table 59 Canada: By Product Type, 2015–2022 (USD Million)

Table 60 Mexico: By Product Type, 2015–2022 (‘000 Units)

Table 61 Mexico: By Product Type, 2015–2022 (USD Million)

Table 62 RoW: By Country, 2015–2022 (‘000 Units)

Table 63 RoW: By Country, 2015–2022 (USD Million)

Table 64 Brazil: By Product Type, 2015–2022 (‘000 Units)

Table 65 Brazil: By Product Type, 2015–2022 (USD Million)

Table 66 Russia: By Product Type, 2015–2022 (‘000 Units)

Table 67 Russia: By Product Type, 2015–2022 (USD Million)

Table 68 Key Expandable, Innovations, and Impact on End-point Authentication Market

List of Figures (57 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 HEV and PHEV Sales Data (2016 vs 2021)

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top Down Approach

Figure 8 Key Countries in the Automotive End-point Authentication Market for Automotive (USD Million): China is Estimated to Be the Largest Market By 2022

Figure 9 Voice Recognition Automotive End-point Authentication Market for Automotive is Estimated to Grow at the Highest CAGR During Forecast Period

Figure 10 Asia-Pacific is Expected to Be the Fastest Growing Market Owing to Increasing Production of Passenger Cars

Figure 11 Wi-Fi is Expected to Be the Fastest Growing Technology Owing to Consumer Preference for Secure and High Speed Connectivity

Figure 12 Biometric Vehicle Access is to Estimated to Acquire Largest Market Share By 2022

Figure 13 Asia-Pacific is Expected to Acquire the Largest Market Share Owing to High Production of Automobiles

Figure 14 Automotive End-point Authentication Market for Passenger Car is Estimated to Acquire Highest Market Share During the Forecast Period

Figure 15 Smartphone Application System Market to Grow at the Fastest Rate During the Forecast Period

Figure 16 Bluetooth is Estimated to Have the Largest Market Share in the Global Automotive End-point Authentication Market for Automotive

Figure 17 Asia Pacific is Projected to Have Highest Market Share in 2022 Owing to Highest Number of Smartphone Users

Figure 18 Asia Pacific Projected to Have Highest Market Share in 2022 in Automotive Wearable Authentication System Market

Figure 19 Asia-Pacific Region Will Continue to Be in Introduction Stage

Figure 20 Automotive End-point Authentication Market

Figure 21 By Authentication Type

Figure 22 By Vehicle Type

Figure 23 By Connectivity Type

Figure 24 By Region

Figure 25 By Advanced Feature

Figure 26 Automotive End-point Authentication Market for Automotive: Market Dynamics

Figure 27 Porter’s Five Forces Analysis: Advanced Technology and Presence of Limited Players Affects the Degree of Competition

Figure 28 Moderate to High Impact of Threat of New Entrants in the Automotive End-point Authentication Market Due to Limitation of Players

Figure 29 Low Impact of Threat of Substitutes on the Automotive End-point Authentication Market Owing to High Security of Data

Figure 30 Niche Technology Offers Moderate Impact of Bargaining Power of Suppliers on the End-point Authentication for Automotive

Figure 31 OEM Centric Aspect Provides Moderate to High Bargaining Power to Buyers in the End-point Authentication for Automotive

Figure 32 High Impact of Degree of Competition on the End-point Authentication System for Automotive Owing to Heavy Investments in Technology Innovation

Figure 33 IRIS Recognition Market, By Region, 2021 vs 2025

Figure 34 End-point Authentication for Automotive, By Smartphone Applications, By Region, 2017 vs 2022 (‘000 Units)

Figure 35 Automotive End-point Authentication Market for Automotive Wearable, By Region, 2025 (‘000 Units)

Figure 36 Market, By Connectivity, 2017 vs 2022 (‘000 Units)

Figure 37 Market, By Vehicle Type, 2017 vs 2022 (USD Million)

Figure 38 Passenger Car Automotive End-point Authentication Market, By Region, 2017 vs 2022 (USD Million)

Figure 39 Electric Vehicle: By Region, 2017 vs 2022 (‘000 Units)

Figure 40 Regional Snapshot–Global Automotive End-point Authentication Market for Automotive Set to Grow at CAGR of 14.4% During the Forecast Period

Figure 41 Asia-Pacific Automotive End-point Authentication Market for Automotive Snapshot – China to Account for the Largest Market Share in 2017

Figure 42 Europe Automotive End-point Authentication Market for Automotive Snapshot – Germany to Account for the Largest Market Share in 2017

Figure 43 North American Market Snapshot: Demand to Be Driven By the Increasing Vehicle Production

Figure 44 Rest of the World: By Country (2017 vs 2022)

Figure 45 Dive Chart

Figure 46 Continental AG: Company Snapshot (2016)

Figure 47 Fitbit, Inc.: Company Snapshot (2016)

Figure 48 Fujitsu Ltd.: Company Snapshot (2015)

Figure 49 Garmin Ltd.: Company Snapshot (2016)

Figure 50 Hid Global: Company Snapshot (2016)

Figure 51 Hitachi Ltd.: Company Snapshot (2015)

Figure 52 Nuance Communications: Company Snapshot (2016)

Figure 53 Safran S.A.: Company Snapshot (2015)

Figure 54 Samsung Electronics Co. Ltd.: Company Snapshot (2016)

Figure 55 Symantec Corporation: Company Snapshot (2016)

Figure 56 Synaptics Incorporated: Company Snapshot (2016)

Figure 57 VOXX International: Company Snapshot (2015)

Growth opportunities and latent adjacency in Automotive End-point Authentication Market