Artificial Intelligence Robots Market Size, Share, Industry Growth, Trends & Analysis by Robot Type (Service, and Industrial), Technology (Machine Learning, Computer Vision, Context Awareness, and NPL), Offering, Application, and Geography

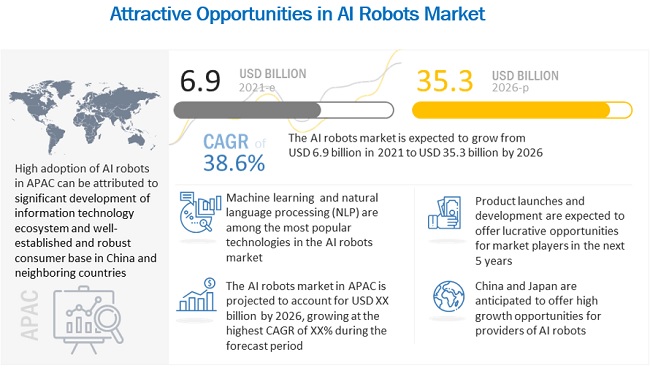

The Artificial Intelligence Robots Market is expected to grow from USD 6.9 billion in 2021 to USD 35.3 billion by 2026; it is expected to grow at a CAGR of 38.6 % during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact on Artificial Intelligence Robots Market:

The Artificial Intelligence Robots Market has been witnessing significant growth over the years. However, the sudden outbreak of the COVID-19 pandemic has impacted the demand for AI robots both positively and negatively, especially in 2020 and 2021. The pandemic has forced companies to adopt remote working practices. The imposition of lockdown in almost all major countries to curb the spread of COVID-19 has disrupted the supply chain and halted manufacturing activities, resulting in delayed production. Nevertheless, during the COVID-19 pandemic, AI robots have proved beneficial in some application areas, such as healthcare and law enforcement.

AI Robots Size Market Dynamics:

Driver: Rise in demand for industrial robots

Implementing automation technology and installing industrial robots throughout the production processes has helped industrial businesses enable human employees to dedicate more time to other demanding projects. This has improved quality, reduced risks for associates with dangerous tasks, and lowered the overall operational costs. As labor costs rise, automation technologies come as alternate options. Robots help complete monotonous tasks more quickly and consistently than humans.

Restraint: Absence of standardized regulations to prevent risks associated with networked and autonomous robots

With the adoption of technologies such as cloud computing, robots are now becoming networked. For instance, Ozobot & Evollve (US) offers Evo, which is equipped with OzoChat software for worldwide messaging between Evo robots. These networked robots can potentially be hacked, and their abilities can be adversely used. Also, global military & defense sector has started considering AI-based robots as a vital part of any military fleet.

Opportunity: Focus on developing robots with special application cases that work and add value

AI-integrated robots are gaining traction with the increasing requirement of social robots to interact with humans and for assistance, among others. Assistant robots need to perform various tasks involving home security, patient care, companionship, and elderly assistance. Companies are now increasingly focusing on developing robots that are suitable for the entire family and excel in performing the abovementioned tasks.

Challenge: Developing AI to help robots make better decisions and make them safe for humans

Over the years, robots have become smarter and more autonomous; however, they still lack moral reasoning. The colossal hurdle to moral reasoning is that there is no universal set of human morals. As morality is culturally specific, evolving continuously, and eternally debated, developing a perfect AI system is a major challenge faced by players in the AI robots market

Artificial Intelligence Robots Market Size by Stock Management

Stock Management is expected to lead AI Robots market during the forecast period

In 2020, the stock management application accounted for the largest size of the AI robots market and is expected to record a significant growth rate during the forecast period. Robots are being widely adopted for stock management applications, which comprise warehouse stock management, retail store stock management, and factory stock management. The major tasks performed by robots to manage stocks include sorting, sequencing, and delivery.

To know about the assumptions considered for the study, download the pdf brochure

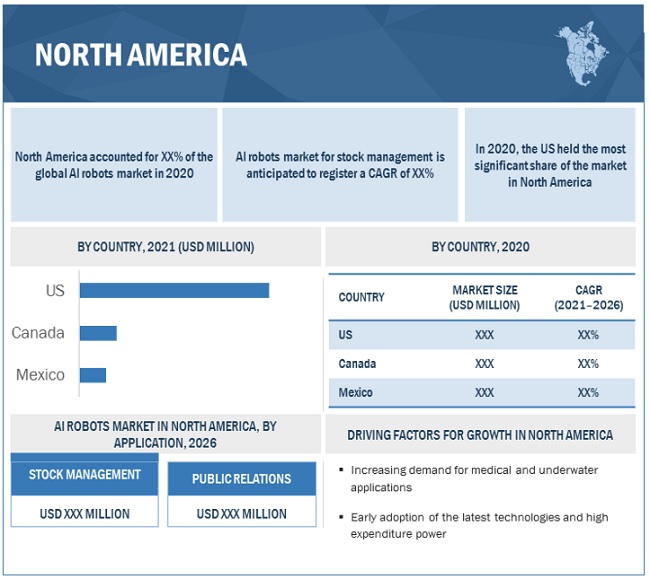

AI Robots Market Size by North America

North-America is expected to winteness significant CAGR in the AI Robots Industry during the forecast period

For several years, service robots have been used for military and defense applications in the US. Also, drones are adopted for various commercial applications such as media and entertainment, precision agriculture, law enforcement, inspection, and surveys. The increasing demand for AI-integrated professional service robots, especially for medical and underwater applications, is driving the growth of the AI robots market in North America.

Key Market Players

The AI Robots companies such as SoftBank (Japan), NVDIA (US), Intel (US), Microsoft (US), IBM (US), Hanson Robotics (China), Alphabet (US), Xilinx (US), ABB (Switzerland), Fanuc (Japan), Alphabet (US), Harman International (US)are among the key players operating in the AI Robots market.

Artificial Intelligence Robots Market Report Scope

|

Report Metric |

Details |

|

Market Growth Rate |

CAGR of 38.6% |

|

Expected to Reach |

USD 35.3 billion by 2026 |

|

Projected Value |

USD 6.9 billion in 2021 |

|

Largest Share Region |

North America |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD), Volume (Thousand Units) |

|

Segments covered |

Offerings, Robot Type, Technology, Deployment mode, Application, and Region |

|

Regions covered |

North America, Europe, APAC and RoW |

|

Companies covered |

SoftBank (Japan), NVDIA (US), Intel (US), Microsoft (US), IBM (US), Hanson Robotics (China), Alphabet (US), Xilinx (US), ABB (Switzerland), Fanuc (Japan) are among the key players operating in the AI Robots market. |

This research report categorizes the AI Robots market based on offering, robot type, technology, deployment mode, application and region.

AI Robots Market, by offering

- Software

- Hardware

AI Robots Market, by Robot Type

- Service Robots

- Industrial Robots

AI Robots Market, by Technology

- Machine Learning

- Computer Vision

- Context Awareness

- Natural Language Processing

AI Robots Market, by Deployment mode

- Cloud

- On-premises

AI Robots Market, by Application

- Military & Defence

- Law Enforcement

- Personal Assistance and Care giving

- Security and Surveillance

- Public Relations

- Education and Entertainment

- Research and Space exploration

- Industrial

- Agriculture

- Healthcare Assistance

- Stock Management

- Others

AI Robots Market, by Region

- North America

- Europe

- APAC

- ROW

Recent Developments

- In February 2021, ABB launched new GoFa™ and SWIFTI™ cobot families, offering higher payloads and speeds, to complement YuMi® and Single Arm YuMi® in ABB’s cobot line-up. These cobots will accelerate the company’s expansion in high-growth segments, including electronics, healthcare, consumer goods, coordination and food and beverage, amongst others, meeting the growing demand for automation across multiple industries.

- In May 2020, Hanson Robotics and CereProc collaborated on an innovative AI project, Sophia. Sophia, using CereProc’s singing TTS system, is the first robot to sing a duet with a human on the Tonight Show, starring Jimmy Fallon. This collaborative AI project gives Sophia an enhanced AI-based synthetic voice, with the ability to deliver more dramatic and entertaining performances in real-time while also enabling her to express humor, suspense, excitement, and the odd cheeky remark.

- In October 2020, NVIDIA launched Jetson Nano™ 2GB Developer Kit, which is designed for teaching and learning AI by creating hands-on projects in such areas as robotics and intelligent IoT.

Frequently Asked Questions (FAQ):

How big Artificial Intelligence Robots Market?

The AI Robots market is expected to reach USD 35.3 billion by 2026 from USD 6.9 billion in 2021 to grow at a CAGR of 38.6 % during the forecast period.

Which is the emerging technology in AI Robots market?

Machine learning and computer vision are the emerging technologies in the AI Robots market.

Which application dominates AI Robots market?

Stock management application dominates AI Robots market

Who are the major companies in the AI Robots market?

SoftBank (Japan), NVDIA (US), Intel (US), Microsoft (US), IBM (US), Hanson Robotics (China) .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AI ROBOT MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 PROCESS FLOW: AI ROBOTS MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Primary interviews with experts

2.1.3.4 List of key primary respondents

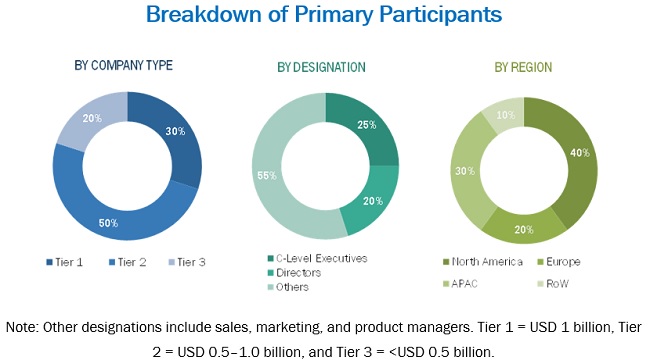

2.1.3.5 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis

FIGURE 4 AI ROBOTS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 5 AI ROBOTS MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR RESEARCH STUDY

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 1 RISKS

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 AI ROBOTS MARKET: POST COVID-19

3.1.1 REALISTIC SCENARIO

FIGURE 7 REALISTIC SCENARIO: AI ROBOTS MARKET, 2017–2026 (USD BILLION)

3.1.2 PESSIMISTIC SCENARIO

FIGURE 8 PESSIMISTIC SCENARIO: AI ROBOTS MARKET, 2017–2026 (USD BILLION)

3.1.3 OPTIMISTIC SCENARIO

FIGURE 9 OPTIMISTIC SCENARIO: AI ROBOTS MARKET, 2017–2026 (USD BILLION)

FIGURE 10 IMPACT OF COVID-19 ON AI ROBOTS MARKET

FIGURE 11 SOFTWARE TO ACCOUNT FOR LARGER MARKET SHARE IN 2026

FIGURE 12 SERVICE ROBOTS TO COMMAND AI ROBOTS MARKET THROUGHOUT FORECAST PERIOD 49

FIGURE 13 MACHINE LEARNING TECHNOLOGY TO HOLD LARGEST SIZE OF AI ROBOTS MARKET THROUGHOUT FORECAST PERIOD

FIGURE 14 STOCK MANAGEMENT APPLICATION TO ACCOUNT FOR LARGEST SIZE OF AI ROBOTS MARKET DURING FORECAST PERIOD

FIGURE 15 APAC CAPTURED LARGEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN AI ROBOTS MARKET

FIGURE 16 INCREASING ADOPTION OF AI ROBOTS IN APAC TO DRIVE MARKET GROWTH

4.2 AI ROBOTS MARKET, BY OFFERING

FIGURE 17 HARDWARE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

4.3 AI ROBOTS MARKET, BY TECHNOLOGY

FIGURE 18 MACHINE LEARNING DOMINATED AI ROBOTS MARKET IN 2020

4.4 AI ROBOTS MARKET IN APAC, BY COUNTRY AND APPLICATION

FIGURE 19 CHINA AND STOCK MANAGEMENT SEGMENT TO HOLD LARGEST SHARE OF AI ROBOTS MARKET IN APAC BY 2026

4.5 AI ROBOTS MARKET, BY ROBOT TYPE

FIGURE 20 SERVICE ROBOTS TO EXHIBIT HIGHER CAGR

4.6 AI ROBOTS MARKET, BY COUNTRY (2021)

FIGURE 21 US TO HOLD LARGEST SHARE OF AI ROBOTS MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 AI ROBOTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High adoption of robots for personal use

5.2.1.2 Support from governments worldwide

5.2.1.3 Rise in adoption of AI Robots in healthcare industry to control COVID-19

5.2.1.4 Rise in demand for industrial robots

FIGURE 23 OPERATIONAL STOCK OF INDUSTRIAL ROBOTS FOR LAST 10 YEARS

FIGURE 24 IMPACT ANALYSIS: DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Reluctance to adopt new technologies

5.2.2.2 Absence of standardized regulations to prevent risks associated with networked and autonomous robots

FIGURE 25 IMPACT ANALYSIS: RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Focus on developing robots with special application cases that work and add value

5.2.3.2 Increasing aging population worldwide boosting the demand for AI-based robots for elderly assistance

FIGURE 26 POPULATION AGED 65 YEARS AND ABOVE TO REACH 1 BILLION BY 2030

5.2.3.3 Increasing investments in AI robotics

FIGURE 27 IMPACT ANALYSIS: OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Developing AI to help robots make better decisions and make them safe for humans

5.2.4.2 Long time to commercialize robots and high maintenance cost

FIGURE 28 IMPACT ANALYSIS: CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN ANALYSIS OF AI ROBOT ECOSYSTEM: R&D AND MANUFACTURING PHASES CONTRIBUTE MAXIMUM VALUE

FIGURE 30 REVENUE SHIFT IN AI ROBOTS MARKET

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 AI ROBOTS MARKET: PORTER’S FIVE FORCES ANALYSIS, 2020

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.5 DEGREE OF COMPETITION

5.5 TRADE ANALYSIS

5.5.1 TRADE ANALYSIS FOR AI ROBOTS MARKET

FIGURE 31 INDUSTRIAL ROBOT: GLOBAL IMPORTS DATA, 2016–2020 (USD THOUSAND)

TABLE 3 INDUSTRIAL ROBOT: GLOBAL IMPORTS DATA, 2016–2020 (USD THOUSAND)

FIGURE 32 INDUSTRIAL ROBOT: GLOBAL EXPORTS DATA, 2016–2020 (USD THOUSAND)

TABLE 4 INDUSTRIAL ROBOT: GLOBAL EXPORTS DATA, 2016–2020 (USD THOUSAND)

5.5.2 TARIFF ANALYSIS

TABLE 5 INDUSTRIAL ROBOTS EXPORTED BY JAPAN

TABLE 6 INDUSTRIAL ROBOTS EXPORTED BY GERMANY

TABLE 7 INDUSTRIAL ROBOTS EXPORTED BY ITALY

TABLE 8 INDUSTRIAL ROBOTS EXPORTED BY FRANCE

TABLE 9 INDUSTRIAL ROBOTS EXPORTED BY CHINA

5.6 ECOSYSTEM

FIGURE 33 ARTIFICIAL INTELLIGENCE (AI) ROBOT MARKET: ECOSYSTEM

TABLE 10 AI ROBOTS MARKET: ECOSYSTEM

5.7 CASE STUDY ANALYSIS

5.7.1 SOFTBANK’S AI ROBOT HELPS IN IMPROVED AND EFFICIENT WORKING

5.7.2 HANSON ROBOTICS HELPS AUTISM RESEARCH AND ELDER CARE

5.7.3 MOBILE ROBOTS HELP IMPROVE PRODUCTIVITY AND EFFICIENCY OF AUDI ASSEMBLY LINE

5.7.4 NEXCOM USES INTEL’S ROBOTICS WITH AI FOR INDUSTRY 4.0

5.8 PATENT ANALYSIS

FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENTS APPLICATIONS IN LAST 10 YEARS

FIGURE 35 NUMBER OF PATENTS GRANTED IN A YEAR OVER LAST 10 YEARS

TABLE 11 TOP 20 PATENT OWNERS (US) IN LAST 10 YEARS

5.9 TECHNOLOGY ANALYSIS

5.9.1 CEREPROC’S TECHNOLOGY ENHANCES ROBOT’S VOICE

5.9.2 ROBOTIC PROCESS AUTOMATION TECHNOLOGY

5.9.3 ROBOT ASSISTANT BY SAMSUNG FOR PEOPLE’S CHANGING NEEDS

5.9.4 INNOVATION TO EXPAND ROLE OF ROBOTS

5.9.5 KEY REGULATIONS FOR AI ROBOTS MARKET

TABLE 12 KEY REGULATIONS: AI ROBOTS MARKET

6 AI ROBOTS MARKET, BY OFFERING (Page No. - 78)

6.1 INTRODUCTION

FIGURE 36 SOFTWARE TO HOLD LARGER SIZE OF AI ROBOTS MARKET DURING FORECAST PERIOD

TABLE 13 AI ROBOTS MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 14 AI ROBOTS MARKET, BY OFFERING, 2021–2026 (USD MILLION)

6.2 SOFTWARE

TABLE 15 AI ROBOTS MARKET FOR SOFTWARE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 16 AI ROBOTS MARKET FOR SOFTWARE, BY TYPE, 2021–2026 (USD MILLION)

6.2.1 AI SOLUTIONS

6.2.1.1 AI solutions allow robots to learn and modify responses

6.2.2 AI PLATFORMS

6.2.2.1 Machine learning frameworks form a major part of AI platforms

6.2.3 AI ROBOTS MARKET FOR SOFTWARE: COVID-19 IMPACT

FIGURE 37 IMPACT OF COVID-19 ON AI ROBOTS MARKET FOR SOFTWARE

TABLE 17 POST-COVID-19: AI ROBOTS MARKET FOR SOFTWARE, 2017–2026 (USD MILLION)

6.3 HARDWARE

FIGURE 38 PROCESSORS TO HOLD THE LARGEST SIZE OF THE AI ROBOTS MARKET FOR HARDWARE DURING FORECAST PERIOD

TABLE 18 AI ROBOTS MARKET, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 19 AI ROBOTS MARKET, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 20 AI ROBOTS MARKET, BY HARDWARE, 2017–2020 (THOUSAND UNITS)

TABLE 21 AI ROBOTS MARKET, BY HARDWARE, 2021–2026 (THOUSAND UNITS)

6.3.1 PROCESSORS

6.3.1.1 GPUs and FPGAs are widely used to implement machine learning algorithms in robots

6.3.2 STORAGE DEVICES

6.3.2.1 Storage robots are being used for external or extra storage capacity

6.3.3 NETWORK DEVICES

6.3.3.1 Hardware used in network systems includes network interface cards (Ethernet adaptors) and interconnects

7 AI ROBOTS MARKET, BY ROBOT TYPE (Page No. - 87)

7.1 INTRODUCTION

FIGURE 39 MARKET FOR SERVICE ROBOTS EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 22 AI ROBOTS MARKET, BY ROBOT TYPE, 2017–2020 (USD MILLION)

TABLE 23 AI ROBOTS MARKET, BY ROBOT TYPE, 2021–2026 (USD MILLION)

7.2 SERVICE ROBOTS

7.2.1 GROUND

7.2.1.1 Ground robots are used as both personal and professional robots

7.2.2 AERIAL

7.2.2.1 AI drones are largely used for military applications such as surveillance, targeting, and strike missions

7.2.3 UNDERWATER

7.2.3.1 AI-integrated underwater robots can react to any random changes in the operating environment

7.3 INDUSTRIAL ROBOTS

7.3.1 TRADITIONAL INDUSTRIAL ROBOTS

7.3.1.1 Articulated robots

7.3.1.1.1 Articulated robots having six degrees of freedom are the most used industrial robots

FIGURE 40 REPRESENTATION OF 6-AXIS ARTICULATED ROBOT

7.3.1.2 SCARA robots

7.3.1.2.1 Integrating AI has fastened adoption of SCARA robots

FIGURE 41 REPRESENTATION OF 4-AXIS SCARA ROBOT

7.3.1.3 Parallel robots

7.3.1.3.1 AI-powered parallel robots have force and collision detection sensors

FIGURE 42 REPRESENTATION OF A PARALLEL ROBOT

7.3.1.4 Cartesian robots

7.3.1.4.1 Cartesian robots are highly customizable, making them a popular choice

FIGURE 43 REPRESENTATION OF A CARTESIAN ROBOT

7.3.1.5 Other robots

7.3.2 COLLABORATIVE INDUSTRIAL ROBOTS

7.3.2.1 Collaborative robots have good RoI as they are easy to install and simple to program

8 AI ROBOTS MARKET, BY TECHNOLOGY (Page No. - 97)

8.1 INTRODUCTION

FIGURE 44 AI ROBOTS MARKET, BY TECHNOLOGY

FIGURE 45 MACHINE LEARNING TO HOLD LARGEST SIZE DURING FORECAST PERIOD

TABLE 24 AI ROBOTS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 25 AI ROBOTS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

8.2 MACHINE LEARNING

8.2.1 VARIOUS RESEARCHERS DEPEND ON MACHINE LEARNING TO TEACH HUMANOID ROBOTS

TABLE 26 AI ROBOTS MARKET FOR MACHINE LEARNING TECHNOLOGY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 27 AI ROBOTS MARKET FOR MACHINE LEARNING TECHNOLOGY, BY APPLICATION, 2021–2026 (USD MILLION)

8.2.2 AI ROBOTS MARKET FOR MACHINE LEARNING: COVID-19 IMPACT

FIGURE 46 IMPACT OF COVID-19 ON AI ROBOTS MARKET FOR MACHINE LEARNING

TABLE 28 POST-COVID-19: AI ROBOTS MARKET FOR MACHINE LEARNING, 2017–2026 (USD MILLION)

8.3 COMPUTER VISION

8.3.1 COMPUTER VISION TECHNOLOGY HELPS COMPUTER SYSTEMS AND ROBOTS TO PRECISELY LOCATE AND IDENTIFY IMAGES AND VIDEOS

TABLE 29 AI ROBOTS MARKET FOR COMPUTER VISION TECHNOLOGY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 30 AI ROBOTS MARKET FOR COMPUTER VISION TECHNOLOGY, BY APPLICATION, 2021–2026 (USD MILLION)

8.4 CONTEXT AWARENESS

8.4.1 CONTEXT-AWARE SYSTEMS IN ROBOTS AIM AT CONSIDERING MORE CONTEXTUAL INFORMATION RELATED TO DEDICATED TASKS

TABLE 31 AI ROBOTS MARKET FOR CONTEXT AWARENESS TECHNOLOGY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 32 AI ROBOTS MARKET FOR CONTEXT AWARENESS TECHNOLOGY, BY APPLICATION, 2021–2026 (USD MILLION)

8.5 NATURAL LANGUAGE PROCESSING (NLP)

8.5.1 NLP USED IN HUMANOID ROBOTS TO COMPREHEND HUMAN SPEECH

TABLE 33 AI ROBOTS MARKET FOR NATURAL LANGUAGE PROCESSING TECHNOLOGY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 34 AI ROBOTS MARKET FOR NATURAL LANGUAGE PROCESSING TECHNOLOGY, BY APPLICATION, 2021–2026 (USD MILLION)

9 AI ROBOTS MARKET, BY DEPLOYMENT MODE (Page No. - 108)

9.1 INTRODUCTION

FIGURE 47 DEPLOYMENT MODES IN AI ROBOTS

9.2 CLOUD

9.2.1 CLOUD-BASED AI ROBOTS PROVIDE ADDITIONAL FLEXIBILITY AND MORE ACCURATE REAL-TIME DATA ESSENTIAL FOR EFFECTIVE BUSINESS OPERATIONS

9.3 ON-PREMISES

9.3.1 DATA-SENSITIVE ENTERPRISES PREFER ON-PREMISES AI PLATFORMS BASED ON ADVANCED NLP TECHNIQUES AND ML MODELS

10 AI ROBOTS MARKET, BY APPLICATION (Page No. - 110)

10.1 INTRODUCTION

FIGURE 48 AI ROBOTS MARKET FOR STOCK MANAGEMENT APPLICATIONS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 35 AI ROBOTS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 36 AI ROBOTS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.2 MILITARY & DEFENSE

FIGURE 49 AI ROBOTS MARKET FOR MILITARY & DEFENSE APPLICATIONS IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 37 AI ROBOTS MARKET FOR MILITARY & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 AI ROBOTS MARKET FOR MILITARY & DEFENSE, BY REGION, 2021–2026 (USD MILLION)

TABLE 39 AI ROBOTS MARKET FOR MILITARY & DEFENSE APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 40 AI ROBOTS MARKET FOR MILITARY & DEFENSE APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 41 AI ROBOTS MARKET FOR MILITARY & DEFENSE APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 42 AI ROBOTS MARKET FOR MILITARY & DEFENSE APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 43 AI ROBOTS MARKET FOR MILITARY & DEFENSE APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 44 AI ROBOTS MARKET FOR MILITARY & DEFENSE APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 45 AI ROBOTS MARKET FOR MILITARY & DEFENSE APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 AI ROBOTS MARKET FOR MILITARY & DEFENSE APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.2.1 SPYING

10.2.1.1 Increase in demand for AI integrated drones worldwide for spying

10.2.2 SEARCH AND RESCUE OPERATIONS

10.2.2.1 Utilization of smart service robots in rescue missions

10.2.3 BORDER SECURITY

10.2.3.1 Advancements in cameras and sensors of AI drones are playing crucial role in enhancing border security

10.2.4 COMBAT OPERATIONS

10.2.4.1 Increase in demand for military robots for combat operations

10.3 LAW ENFORCEMENT

FIGURE 50 AI ROBOTS MARKET FOR LAW ENFORCEMENT APPLICATIONS IN APAC HELD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 47 AI ROBOTS MARKET FOR LAW ENFORCEMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 AI ROBOTS MARKET FOR LAW ENFORCEMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 49 AI ROBOTS MARKET FOR LAW ENFORCEMENT APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 50 AI ROBOTS MARKET FOR LAW ENFORCEMENT APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 51 AI ROBOTS MARKET FOR LAW ENFORCEMENT APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 52 AI ROBOTS MARKET FOR LAW ENFORCEMENT APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 53 AI ROBOTS MARKET FOR LAW ENFORCEMENT APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 54 AI ROBOTS MARKET FOR LAW ENFORCEMENT APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 55 AI ROBOTS MARKET FOR LAW ENFORCEMENT APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 AI ROBOTS MARKET FOR LAW ENFORCEMENT APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.3.1 ROAD PATROLLING

10.3.1.1 AI robots are installed in assisting human officers with road patrolling

10.3.2 RIOT CONTROL

10.3.2.1 Use of AI robots helps in improving safety of human forces

10.4 PERSONAL ASSISTANCE AND CAREGIVING

FIGURE 51 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING APPLICATIONS IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 57 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING, BY REGION, 2021–2026 (USD MILLION)

TABLE 59 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 60 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 61 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 62 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 63 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 64 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 65 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 AI ROBOTS MARKET FOR PERSONAL ASSISTANCE AND CAREGIVING APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.4.1 ELDERLY ASSISTANCE

10.4.1.1 Demand for personal assistant AI robots in US is expected to increase

10.4.2 COMPANIONSHIP

10.4.2.1 Advancements in AI technology to have positive impact on demand for personal AI robots

10.4.3 SECURITY AND SURVEILLANCE

10.4.3.1 AI robots to help in security and surveillance of private properties

10.5 PUBLIC RELATIONS

FIGURE 52 AI ROBOTS MARKET FOR PUBLIC RELATION APPLICATIONS IN APAC TO HOLD LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 67 AI ROBOTS MARKET FOR PUBLIC RELATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 AI ROBOTS MARKET FOR PUBLIC RELATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 69 AI ROBOTS MARKET FOR PUBLIC RELATIONS APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 70 AI ROBOTS MARKET FOR PUBLIC RELATIONS APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 71 AI ROBOTS MARKET FOR PUBLIC RELATIONS APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 72 AI ROBOTS MARKET FOR PUBLIC RELATIONS APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 73 AI ROBOTS MARKET FOR PUBLIC RELATIONS APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 74 AI ROBOTS MARKET FOR PUBLIC RELATIONS APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 75 AI ROBOTS MARKET FOR PUBLIC RELATIONS APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 76 AI ROBOTS MARKET FOR PUBLIC RELATIONS APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.5.1 AI ROBOTS MARKET FOR PUBLIC RELATIONS: COVID-19 IMPACT

FIGURE 53 IMPACT OF COVID-19 ON AI ROBOTS MARKET FOR PUBLIC RELATIONS

TABLE 77 POST-COVID-19: AI ROBOTS MARKET FOR PUBLIC RELATIONS, 2017–2026 (USD MILLION)

10.5.2 RECEPTION CARE AT COMMERCIAL PLACES

10.5.2.1 Increase in adoption of AI robots in hospitality to personalize consumer experience

10.5.3 TOUR GUIDANCE

10.5.3.1 Utilization of AI robots at tourist places to limit human interface

10.6 EDUCATION AND ENTERTAINMENT

FIGURE 54 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT APPLICATIONS IN APAC TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 78 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 79 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 80 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 81 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 82 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 83 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 84 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 85 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 86 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 87 AI ROBOTS MARKET FOR EDUCATION AND ENTERTAINMENT APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.6.1 EDUCATION

10.6.1.1 AI robots help in enhancing learning experience

10.6.2 ENTERTAINMENT

10.6.2.1 Boost in gaming industry increased the demand for AI gaming robots

10.7 RESEARCH AND SPACE EXPLORATION

10.7.1 AI ROBOTS TO PROVIDE ASSISTANT TO SPACE SCIENTISTS

FIGURE 55 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION APPLICATIONS IN APAC TO HOLD LARGEST MARKET SHARE DURING THE FORECAST PERIOD 141

TABLE 88 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 90 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 91 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 92 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 93 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 94 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 95 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 96 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 97 AI ROBOTS MARKET FOR RESEARCH AND SPACE EXPLORATION APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.8 INDUSTRIAL

10.8.1 INDUSTRIAL AI ROBOTS HELP IN IMPROVING QUALITY AND EFFICIENCY OF MANUFACTURING ACTIVITIES

FIGURE 56 AI ROBOTS MARKET FOR INDUSTRIAL APPLICATIONS IN APAC TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 98 AI ROBOTS MARKET FOR INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 99 AI ROBOTS MARKET FOR INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 100 AI ROBOTS MARKET FOR INDUSTRIAL APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 101 AI ROBOTS MARKET FOR INDUSTRIAL APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 102 AI ROBOTS MARKET FOR INDUSTRIAL APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 103 AI ROBOTS MARKET FOR INDUSTRIAL APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 104 AI ROBOTS MARKET FOR INDUSTRIAL APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 105 AI ROBOTS MARKET FOR INDUSTRIAL APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 106 AI ROBOTS MARKET FOR INDUSTRIAL APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 107 AI ROBOTS MARKET FOR INDUSTRIAL APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.9 AGRICULTURE

10.9.1 AI ROBOTS HELPS TO OPTIMIZE EFFICIENCY OF CROP PRODUCTION

FIGURE 57 AI ROBOTS MARKET FOR AGRICULTURAL APPLICATIONS IN APAC TO HOLD LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 108 AI ROBOTS MARKET FOR AGRICULTURE, BY REGION, 2017–2020 (USD MILLION)

TABLE 109 AI ROBOTS MARKET FOR AGRICULTURE, BY REGION, 2021–2026 (USD MILLION)

TABLE 110 AI ROBOTS MARKET FOR AGRICULTURE APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 111 AI ROBOTS MARKET FOR AGRICULTURE APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 112 AI ROBOTS MARKET FOR AGRICULTURE APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 113 AI ROBOTS MARKET FOR AGRICULTURE APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 114 AI ROBOTS MARKET FOR AGRICULTURE APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 115 AI ROBOTS MARKET FOR AGRICULTURE APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 116 AI ROBOTS MARKET FOR AGRICULTURE APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 117 AI ROBOTS MARKET FOR AGRICULTURE APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.1 HEALTHCARE ASSISTANCE

10.10.1 AI ROBOTS HELP IN PREDICTING HIGH-RISK CONDITIONS OF PATIENTS TO AVOID HEART FAILURE

FIGURE 58 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE APPLICATIONS IN APAC TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 118 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE, BY REGION, 2017–2020 (USD MILLION)

TABLE 119 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE, BY REGION, 2021–2026 (USD MILLION)

TABLE 120 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 121 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 122 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 123 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 124 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 125 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 126 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 127 AI ROBOTS MARKET FOR HEALTHCARE ASSISTANCE APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.11 STOCK MANAGEMENT

10.11.1 AI ROBOTS HELPS IN IMPROVING WAREHOUSE EFFICIENCY AND COST OF OPERATIONS

FIGURE 59 AI ROBOTS MARKET FOR STOCK MANAGEMENT APPLICATIONS IN APAC TO HOLD LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 128 AI ROBOTS MARKET FOR STOCK MANAGEMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 129 AI ROBOTS MARKET FOR STOCK MANAGEMENT, BY REGION, 2021–2026 (USD MILLION)

TABLE 130 AI ROBOTS MARKET FOR STOCK MANAGEMENT APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 131 AI ROBOTS MARKET FOR STOCK MANAGEMENT APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 132 AI ROBOTS MARKET FOR STOCK MANAGEMENT APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 133 AI ROBOTS MARKET FOR STOCK MANAGEMENT APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 134 AI ROBOTS MARKET FOR STOCK MANAGEMENT APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 135 AI ROBOTS MARKET FOR STOCK MANAGEMENT APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 136 AI ROBOTS MARKET FOR STOCK MANAGEMENT APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 137 AI ROBOTS MARKET FOR STOCK MANAGEMENT APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.11.2 AI ROBOTS MARKET FOR STOCK MANAGEMENT: COVID-19 IMPACT

FIGURE 60 IMPACT OF COVID-19 ON AI ROBOTS MARKET FOR STOCK MANAGEMENT

TABLE 138 POST-COVID-19: AI ROBOTS MARKET FOR STOCK MANAGEMENT, 2017–2026 (USD MILLION)

10.12 OTHERS

10.12.1 INCREASE IN ADOPTION OF AI ROBOTS FOR MINING AND UTILITY MANAGEMENT APPLICATIONS

TABLE 139 AI ROBOTS MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 140 AI ROBOTS MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

TABLE 141 AI ROBOTS MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 142 AI ROBOTS MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 143 AI ROBOTS MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 144 AI ROBOTS MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 145 AI ROBOTS MARKET FOR OTHER APPLICATIONS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 146 AI ROBOTS MARKET FOR OTHER APPLICATIONS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 147 AI ROBOTS MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 148 AI ROBOTS MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2021–2026 (USD MILLION)

11 AI ROBOTS MARKET, BY GEOGRAPHY (Page No. - 166)

11.1 INTRODUCTION

FIGURE 61 AI ROBOTS MARKET IN APAC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 149 AI ROBOTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 150 AI ROBOTS MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 62 SNAPSHOT OF AI ROBOTS MARKET IN NORTH AMERICA

TABLE 151 AI ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 152 AI ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.1 AI ROBOTS MARKET IN NORTH AMERICA: COVID-19 IMPACT

FIGURE 63 IMPACT OF COVID-19 ON AI ROBOTS MARKET IN NORTH AMERICA

TABLE 153 POST-COVID-19: AI ROBOTS MARKET IN NORTH AMERICA, 2017–2026 (USD MILLION)

11.2.2 US

11.2.2.1 Strong presence of AI companies to drive the market

11.2.3 CANADA

11.2.3.1 Increasing investments in AI technologies to drive the market

11.2.4 MEXICO

11.2.4.1 Emerging economy for development of AI to drive the market

11.3 EUROPE

FIGURE 64 SNAPSHOT OF AI ROBOTS MARKET IN EUROPE

TABLE 154 AI ROBOTS MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 155 AI ROBOTS MARKET IN EUROPE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

11.3.1 UK

11.3.1.1 Continuous focus on innovation and development of AI robots to drive the market

11.3.2 GERMANY

11.3.2.1 High adoption of AI robots in automotive manufacturing and logistics to drive the market

11.3.3 FRANCE

11.3.3.1 AI startups in the AI robots ecosystem to drive the market

11.3.4 ITALY

11.3.4.1 Partnership with NVIDIA to drive the market

11.3.5 SPAIN

11.3.5.1 Usage of AI robots in healthcare & agriculture to drive the market

11.3.6 REST OF EUROPE

11.4 APAC

FIGURE 65 SNAPSHOT OF AI ROBOTS MARKET IN APAC

TABLE 156 AI ROBOTS MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 157 AI ROBOTS MARKET IN APAC, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

11.4.1 AI ROBOTS MARKET IN APAC: COVID-19 IMPACT

FIGURE 66 IMPACT OF COVID-19 ON AI ROBOTS MARKET AI APAC

TABLE 158 POST-COVID-19: AI ROBOTS MARKET IN APAC, 2017–2026 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Increase in demand for industrial robots in automation to drive the market

11.4.3 JAPAN

11.4.3.1 Growing number of exporters to drive the market

11.4.4 SOUTH KOREA

11.4.4.1 National AI strategy to drive the market

11.4.5 INDIA

11.4.5.1 Government initiatives to drive the market

11.4.6 REST OF APAC

11.5 ROW

TABLE 159 AI ROBOTS MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 160 AI ROBOTS MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 AI robots are a major boom for public and private sectors in South America

11.5.2 MIDDLE EAST AND AFRICA

11.5.2.1 Training AI engineers will boost AI robot projects in the region

12 COMPETITIVE LANDSCAPE (Page No. - 183)

12.1 OVERVIEW

12.2 REVENUE ANALYSIS OF TOP 5 COMPANIES

FIGURE 67 REVENUE ANALYSIS (USD BILLION), 2016–2020

12.3 MARKET SHARE ANALYSIS, 2020

TABLE 161 GLOBAL AI ROBOTS MARKET: DEGREE OF COMPETITION

FIGURE 68 MARKET SHARE ANALYSIS: GLOBAL AI ROBOTS MARKET, 2020

12.4 COMPANY EVALUATION QUADRANT

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE

12.4.4 PARTICIPANTS

FIGURE 69 AI ROBOTS MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

12.4.5 PRODUCT FOOTPRINT

TABLE 162 COMPANY PRODUCT FOOTPRINT: AI ROBOTS MARKET

FIGURE 70 COMPANY APPLICATION FOOTPRINT: AI ROBOTS MARKET

TABLE 163 COMPANY OFFERING FOOTPRINT: AI ROBOTS MARKET

TABLE 164 COMPANY REGION FOOTPRINT: AI ROBOTS MARKET

12.5 AI ROBOTS MARKET STARTUP/SME EVALUATION QUADRANT, 2020

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 DYNAMIC COMPANIES

12.5.4 STARTING BLOCKS

FIGURE 71 AI ROBOTS MARKET, STARTUP/SME EVALUATION QUADRANT, 2020

12.6 COMPETITIVE SITUATIONS AND TRENDS

12.6.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 165 PRODUCT LAUNCHES AND DEVELOPMENTS, 2019–2021

12.6.2 DEALS

TABLE 166 DEALS, 2019–2020

13 COMPANY PROFILES (Page No. - 196)

13.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

13.1.1 SOFTBANK

TABLE 167 SOFTBANK: BUSINESS OVERVIEW

FIGURE 72 SOFTBANK: COMPANY SNAPSHOT

13.1.2 NVIDIA

TABLE 168 NVIDIA: BUSINESS OVERVIEW

FIGURE 73 NVIDIA: COMPANY SNAPSHOT

13.1.3 INTEL

TABLE 169 INTEL: BUSINESS OVERVIEW

FIGURE 74 INTEL: COMPANY SNAPSHOT

13.1.4 MICROSOFT

TABLE 170 MICROSOFT: BUSINESS OVERVIEW

FIGURE 75 MICROSOFT: COMPANY SNAPSHOT

13.1.5 IBM

TABLE 171 IBM: BUSINESS OVERVIEW

FIGURE 76 IBM: COMPANY SNAPSHOT

13.1.6 HANSON ROBOTICS

TABLE 172 HANSON ROBOTICS: BUSINESS OVERVIEW

13.1.7 ALPHABET

TABLE 173 ALPHABET: BUSINESS OVERVIEW

FIGURE 77 ALPHABET: COMPANY SNAPSHOT

13.1.8 HARMAN INTERNATIONAL

TABLE 174 HARMAN INTERNATIONAL: BUSINESS OVERVIEW

13.1.9 XILINX

TABLE 175 XILINX: BUSINESS OVERVIEW

FIGURE 78 XILINX: COMPANY SNAPSHOT

13.1.10 ABB

TABLE 176 ABB: BUSINESS OVERVIEW

FIGURE 79 ABB: COMPANY SNAPSHOT

13.1.11 FANUC

TABLE 177 FANUC: BUSINESS OVERVIEW

FIGURE 80 FANUC: COMPANY SNAPSHOT

13.1.12 KUKA

TABLE 178 KUKA: BUSINESS OVERVIEW

FIGURE KUKA: COMPANY SNAPSHOT

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 BLUE FROG ROBOTICS

13.2.2 PROMOBOT

13.2.3 JIBO

13.2.4 LG

13.2.5 NEURALA

13.2.6 F&P PERSONAL ROBOTICS

13.2.7 STÄUBLI

13.2.8 RETHINK ROBOTICS

13.2.9 BOSTON DYNAMICS

13.2.10 DILIGENT ROBOTICS

13.2.11 FRANKA EMIKA

13.2.12 PAL ROBOTICS

13.2.13 COMAU

14 APPENDIX (Page No. - 246)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

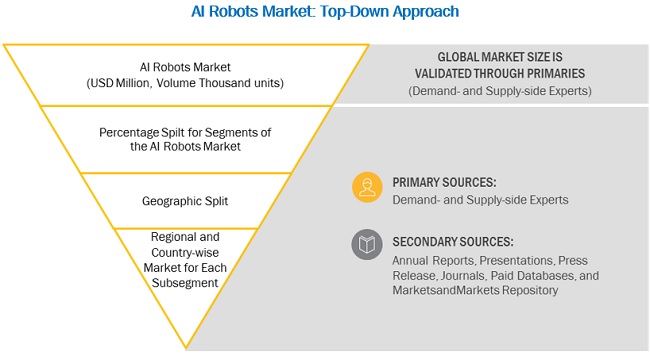

The study involved four major activities in estimating the current size of the AI Robots market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include AI Robots journals and magazines, annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the AI Robots market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the AI Robots market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides.

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the AI robots market, by offering, robot type, technology, and application, in terms of value

- To provide the size of the market across four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence the market growth

- To provide a detailed overview of AI robots value chain

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze key trends related to components, connectivity technologies, and applications that shape and influence the global AI robots market

- To profile key players and comprehensively analyze their rankings based on their revenues and core competencies

- To explore and analyze opportunities in the market for stakeholders and provide a detailed overview of the competitive landscape of the market

- To analyze competitive developments in the AI robots market, such as expansions, agreements, partnerships, contracts, product developments, and research and development (R&D)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Intelligence Robots Market

We founded a startup which helps corporates to learn about new technologies. We are interested in market data and insights due to two facts: - To know what's new - To get a better understanding of market size etc. What is the scope of the artificial intelligence that you have considered in your research?

I am graduate student and trying to analyze the field of AI & robotics, and I want to know the statistical data in this field. Could you tell me your research methodology so that I can understand the directions and also the scope of your research.

Our company want to buy this report. But our budget is only US $2,600. Is it possible that discount price? What all future trends other than AI have you included in your scope?

Looking on a good report on recent market trends of AI and Robotics and what is the future for the same. How have you segmented AI and Robotics based on applications, regions, technologies, etc.?

Forward Pass is a start-up which provides custom Machine-Learning-based software and robotics solutions, including data-set creation and cleansing, ML model design, on premise and Cloud deployment, and mechatronic solutions development. We are in the process of outlining our business plan and executive summary, for which a thorough market research is necessary.