Abrasives Market by Raw material (Natural & Synthetic), Product type (Coated, Bonded, and Super), End-use Industry (Automotive, Machinery, Aerospace, Metal fabrication, Electrical & electronics equipment, Others), and Region - Global Forecast to 2025

Updated on : April 04, 2024

Abrasives Market

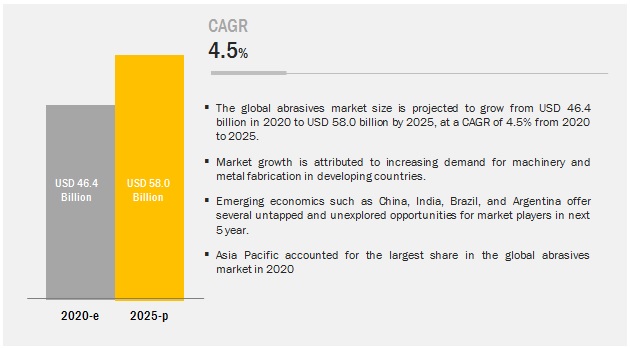

The global abrasives market was valued at USD 46.4 billion in 2020 and is projected to reach USD 58.0 billion by 2025, growing at 4.5% cagr from 2020 to 2025. The growth of this market is attributed to the growing automotive, metal fabrication, machinery, electronics, electrical, medical, and construction industries have contributed significantly towards the growth of the market. However, factors such as uncertainty in economic conditions and rising raw material costs inhibit the growth of the market.

Abrasives Market Dynamics

In terms of value and volume, the coated segment is projected to lead the abrasives market from 2020 to 2025.

Based on type, the coated segment is projected to account for the higher demand in the abrasives market during the forecast period. Due to the focus on rapid industrialization in emerging economies, and the development of the metal fabrication industry is expected to shift the inclination of both suppliers and consumers towards abrasive. Moreover, increasing demand for coated abrasives in all end-use industries is expected to propel the growth in the abrasives market.

In terms of value and volume, the metal fabrication segment of the end-use industry is projected to grow at the highest CAGR during the forecast period.

The metal fabrication segment is the fastest-growing end-use industry segment in the abrasives market. This growth is attributed to its usage and demand in the metal fabrication for cutting-off and grinding, removing welds and excess material, surface blending, finishing, and polishing.

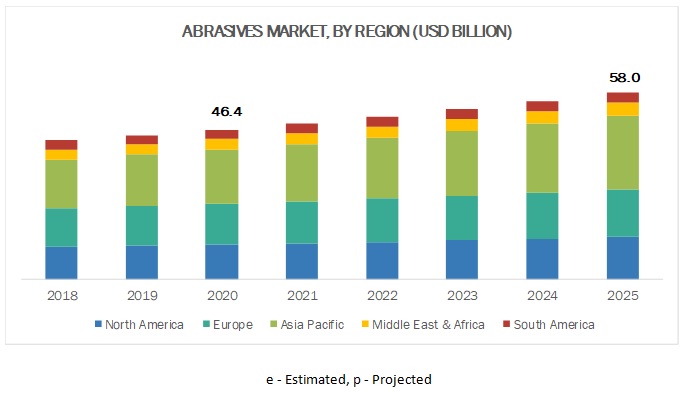

In terms of both value as well as volume, the Asia Pacific region is expected to account for the largest share in the global abrasives market during the forecast period.

Asia Pacific is the fastest-growing market for abrasives due to its increasing economic growth. owing to the rapid growth in industries such as automotive, machinery and metal fabrication in the region. The growth of this region is supplemented by the increase in the consumption and production of industrial products in developing economies such as India and China. A rise in disposable income, especially in developing countries, has led to an exceptional demand for passenger and commercial vehicles. Thus, this augmented demand for automobiles is expected to indirectly drive the growth prospects of the abrasives market in the coming years. The rise in the sales of electronic devices is likely to boost the demand for coated abrasives in the electronic industry during the forecast period, especially in the consumer goods sector.

Abrasives Market Players

At a global level, companies such as Robert Bosch GMBH (Germany), 3M Company (US), Saint-Gobain Abrasives, Inc. (US), and Fujimi Incorporated (Japan) are providing abrasive products. Large construction players such as LafargeHolcim (France), Balfour Beatty PLC (UK), Kier Group PLC (UK), and Carillon PLC (UK) have scope to enter into abrasive services. Other players in the market include Henkel AG & CO. KGAA (Germany), Tyrolit Group (Austria), Asahi Diamond Industrial Co., LTD (Japan), Sak Industries (India), Deerfos Co., Ltd (Korea), and Carborundum Universal Limited (India).

Robert Bosch GmbH (Germany) is one of the leading company in Europe operating in the abrasives market. It is a supplier of technology and services, offering end-to-end engineering and business solutions. The company manufactures and distributes automotive, industrial, consumer goods, and building technologies. It was established as a workshop for precision mechanics and electrical engineering in Stuttgart, Germany. The company’s majority capital share is held by Robert Bosch Stiftung GmbH, a charitable foundation. It has greatly influenced the world’s automobile technology along with its presence in sectors such as energy and building technology, industrial technology, and consumer goods.

The Boschgroup operates through four business segments: mobility solutions, industrial technology, energy, and building technology, and consumer goods. Abrasives fall under the consumer goods segment, which includes the power tools and accessories subdivisions, and provides a comprehensive range of abrasive systems, drill bits, and saw blades. These abrasives are used in various end-use industries such as automotive, electrical, electronics, healthcare, and others. The company’s subsidiary Robert Bosch Power Tools GmbH designs and markets abrasives.

Abrasives Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 46.4 billion |

|

Revenue Forecast in 2025 |

USD 58.0 billion |

|

CAGR |

4.5% |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) and Volume (Kilotons) |

|

Segments covered |

Raw material, type, end-use industry, and region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

Robert Bosch GMBH (Germany), 3M Company (US), Compagnie de Saint-Gobain S.A. (France), and Fujimi Incorporated (Japan). The other players in the market are Henkel (Germany), Tyrolit Group (Austria), Asahi Diamond Industrial (Japan) Deerfos (Korea), Sak Industries (India), and Carborundum Universal Limited (India). are the key players operating in the abrasives market. |

This research report categorizes the abrasives market based on scrap type, type, equipment, end-use sector, and region.

Abrasives market, by raw material:

- Natural

- Synthetic

Abrasives market, by type:

- Coated abrasives

- Bonded abrasives

- Super abrasives

Abrasives market, by end-use industry:

- Aerospace

- Automotive

- Machinery

- Metal fabrication

- Electrical & electronics equipment

- Others (Medical devices, consumer goods, construction, and cleaning & maintainance)

Abrasives market, by region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South Africa

Recent Developments

- In May 2019, Henkel acquired all shares of Molecule Corp (US). This acquisition strengthens the adhesives technologies business unit’s, technology portfolio in the field of 3D printing & industrial inkjet solutions.

- In May 2018, Bosch extended its new product in the range of abrasives by developing 2 step grinding system for angle grinders that enable higher removal rate and offer finer surfaces. The abrasive product helps in saving time up to 25%. The launch of this product has strengthened the company’s product portfolio.

- In May 2018, Saint-Gobain Group in Thailand launched a brand new abrasive product called “Weber by Norton” at The Architect Fair 2018. The new “Weber by Norton” diamond blade range was the very first new product among many others to come. The company is now offering a new range of products under the Weber brand in Thailand, including 4” diamond blades, thin wheel, GC grinding wheel, flap disc, and fiber disc. The launch of this new product was due to the collaboration of the company with the Weber Team in Thailand.

Key Questions Addressed by the Report

- What are the global trends in the abrasives market? Would the market witness an increase or decline in the demand in the coming years?

- What is the estimated demand for different types of products in abrasives?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for abrasives market?

- Who are the major players in the abrasives market globally?

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of Abrasives Market?

The growth of abrasives market attributed to the factors such as growing demand for the abrasives product in grinding and polishing applications in various end-use industries including, automotive, machinery, electronic and electrical equipment, metal fabrication, and aerospace.

What are the oportunities in the abrasives market?

Asia Pacific region has most attractive oportunities in the abrasives market, owing to the rapid groth in industries such as automotive, machinery, and metal fabrication in the region. The growth of this region is supplemented by the increasing consumption and production of industrial products in developing economic such as India and china.

What are the factors contributing to the final price of Abrasives?

Raw material and the use of manufacturing abrasives types plays a vital role in the costs. Almost 20-30% cost is contributed by raw material, followed by abrasives type being employed which might take up almost 25%. Type of abrasives used in various end-use sector also contributes to almost 30% of the overall price. Rest is contributed by fixed costs such as transportation, labor, etc.

What are the raw materials used for abrasives manufacturing?

There are two types of raw material used widely for the manufacturing of abrasives, namely, natural and synthetic. Natural type of raw material accounted for the largest share in the abrasives market. Whereas, synthetic is forcasted to grow at the higher rate.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Tables of Contents

1 Introduction

1.1. Key Objectives

1.2. Report Description

1.3. Markets covered

1.4. Scope of Research

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Market Drivers

5.2.2. Market Restraints

5.2.3. Market Challenges

5.2.4. Market Opportunities

6 Abrasives Market, By Raw Material, 2018-2025 (Value & Volume)

6.1. Introduction

6.2. Natural

6.3. Synthetic

6.3.1. Metallic abrasives

6.3.2. Aluminum oxide

6.3.3. Silicon carbide

6.3.4. Others

7 Abrasives Market, By Type, 2018-2025 (Value & Volume)

7.1. Introduction

7.2. Bonded Abrasive

7.3. Coated Abrasive

7.4. Super Abrasive

8 Abrasives Market, By End-Use Industry, 2018-2025 (Value & Volume)

8.1. Introduction

8.2. Aerospace

8.3. Automotive

8.4. Machinery

8.5. Metal Fabrication

8.6. Electrical & Electronics Equipment

8.7. Others

9 Bonded Abrasives Market, By Bonding Agents, 2018-2025 (Value and Volume)

9.1. Introduction

9.2. Vitreous

9.3. Resin

9.4. Metal Bonded

9.5. Electroplated

9.6. Rubber

9.7. Others

10 Abrasives Market, By Region, 2018-2025 (Value & Volume)

10.1. North America

10.1.1. US

10.1.2. Canada

10.1.3. Mexico

10.2. Europe

10.2.1. UK

10.2.2. Germany

10.2.3. France

10.2.4. Italy

10.2.5. Spain

10.2.6. Others

10.3. Asia Pacific

10.3.1. China

10.3.2. India

10.3.3. South Korea

10.3.4. Japan

10.3.5. Others

10.4. South America

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Others

10.5. MEA

10.5.1. UAE

10.5.2. Saudi Arabia

10.5.3. South Africa

10.5.4. Morocco

10.5.5. Algeria

10.5.6. Others

11 Competitive Landscape

11.1. Overview

11.2. Competitive Situations & Trends

11.3. Mergers & Acquisitions

11.4. Agreements, Collaborations & Joint Ventures

11.5. Expansions & Investments

11.6. New Product/ Service Launches

12 Company Profiles

(Company at a Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1. Introduction

12.2. Robert Bosch GMBH

12.3. 3M Company

12.4. DuPont

12.5. DRONCO GmbH

12.6. Saint-Gobain Abrasives, Inc.

12.7. GRUPO COSENTINO, S.L. (COSENTINO S.A)

12.8. Fujimi Incorporated

12.9. Asahi Diamond Industrial Co., Ltd.

12.10. Cumi Murugappa Group (Carborundum Universal Limited)

12.11. KWH Mirka

12.12. HENKEL AG & CO. KGAA

12.13. NIPPON RESIBON

12.14. Sankyo Rikagaku Co., Ltd.

12.15. Abrasiflex Pty Ltd

12.16. NORITAKE CO.,LIMITED

12.17. Tyrolit Group

12.18. Boride Engineered Abrasives

12.19. VSM

12.20. Flexovit

12.21. SurfacePrep

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix

13.1. Discussion Guide

13.2. Introducing RT: Real Time Market Intelligence

13.3. Available Customizations

13.4. Related Reports

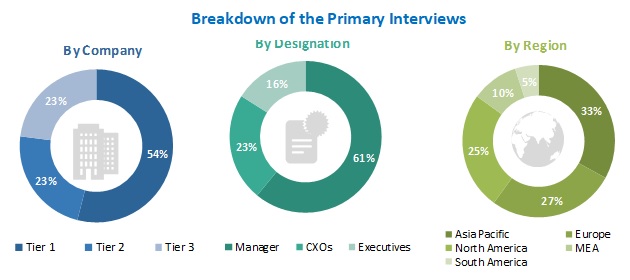

The study involved four major activities for estimating the current global size of the abrasives market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of the abrasives market through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the abrasives market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study on the abrasives market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the abrasives market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the abrasives market. The primary sources from the demand-side included key executives from various end-use sectors, association members, and government organizations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the abrasives market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the abrasives market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the abrasives market in terms of value and volume based on raw material, type, end-use industry, and region.

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market.

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as expansions and acquisitions in the abrasives market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the abrasives report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the abrasives market for additional countries

Company Information

- Detailed analysis and profiling of other market players (up to Seven)

Growth opportunities and latent adjacency in Abrasives Market