3D and 4D Technology Market by Solution Type (3D & 4D Input Devices, 3D and 4D Imaging Solutions, 3D Output Devices), End Use Application (3D and 4D Gaming, 3D & 4D Cinema), Vertical (Entertainment, Military and Defense), Region - Global Forecast to 2029

Updated on : October 23, 2024

3D and 4D Technology Market Size

[325 Pages Report] The 3D and 4D technology market size was valued at USD 399.7 billion in 2024 and is estimated to reach USD 866.5 billion by 2029, growing at a CAGR of 16.7% during the forecast period.from 2024 to 2029

The growth of the 3D and 4D technology market is driven by surge in the trend of 3D and 4D gaming, rising demand for 3D-enabled devices across verticals, and rising demand for 3D and 4D technology in entertainment industry.

3D and 4D Technology Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

3D and 4D Technology Market Trends & Growth :

Drivers: Increasing urbanization, push for productivity, and environment concerns in architecture and construction verticals

The construction industry is currently emerging toward the adoption of 3D technologies to enhance and accelerate the construction process. The Las Vegas municipal government and utilities constantly faced the issue of hitting underground infrastructure during excavations. To address this issue, the Las Vegas city government initiated a 3D project to model one-and-half miles of Main Street in the older part of Las Vegas. The project intended to scan below- and above-ground facilities, including roadways, utilities, telecommunications, and buildings. The project was intended to build a 3D model of the city’s infrastructure so the engineers could rely on the 3D model for accurate and up-to-date information for planning, designing, and maintenance of buildings. The engineering design and other data were combined with the city’s geoimagery, digital terrain models, and other GIS data. In addition, a mobile AR application was developed for the iPad, allowing the staff in the field to view underground facilities virtually under the actual roadway. With the development of the 3D imaging model, Las Vegas experienced increased safety due to the reduced risk of unexpectedly hitting underground utilities, especially hazardous facilities, such as gas mains. With the result of the adoption of 3D technologies, the city is now expanding the 3D modeling to an area six times larger than the original project.

Restraint: Interoperability issues with 3D imaging solutions and hardware

A 3D imaging hardware, such as a 3D sensor or 3D camera, is designed and manufactured with specific interfaces that make it difficult to integrate with other devices. While some machines may accept the interface, not every device supports the same one. Even newly developed technologies like Microsoft Kinect lack flexibility in integration. The continuous technological advancements and upgrades lead to further limitations in the healthcare, construction, media, and entertainment industries, which face significant challenges concerning connectivity and interoperability of any devices or software systems. To make advanced 3D imaging technology more accessible across various platforms, the industry needs to develop hardware and solutions that can work together more seamlessly based on clearer interoperability standards.

Opportunity: Rising adoption of 3D printing in healthcare

The rising adoption of 3D printing in healthcare has brought a significant change by creating customized medical devices, implants, anatomical models, and prosthetics that perfectly fit a patient’s unique anatomy. One of the main benefits of 3D printing is the ability to produce complex and intricate structures that are tailored to a patient’s specific needs. This is particularly important in surgeries where precision and customization are crucial. Surgeons can now use 3D-printed anatomical models to plan procedures more efficiently, replicating a patient’s specific anatomy. With 3D printing, it’s now possible to create personalized healthcare solutions such as orthopedic implants, dental prosthetics, patient-specific surgical models, and dental devices and even organ replicas, which were previously impossible to attain.

The healthcare industry has embraced 3D printing for applications such as custom implants, prosthetics, patient-specific surgical models, and dental devices. The ability to create intricate and patient-specific medical components has been a significant driver.

Challenge: Demand for data processing and storage

The challenge of processing and storing data in 3D imaging arises from the complexity and volume of generated data. High-resolution 3D scans from medical imaging devices or industrial scanners produce large datasets that can strain computational resources. Real-time processing of this data for applications like medical diagnostics or rendering virtual environments requires robust computing systems and optimized algorithms to handle the intricacies of 3D data efficiently.

Storing these vast datasets while ensuring accessibility and maintaining data integrity presents a considerable challenge. Balancing the need for high-capacity storage with cost-effectiveness and data retrieval speeds becomes crucial, especially as the amount of 3D imaging data grows with technological advancements and the expansion of application areas.

3D and 4D Technology Market Ecosystem

3D and 4D Technology Market Segmentation

3D and 4D Technology Market Share

3D and 4D scanners sub-segment to account for second largest share of the 3D and 4D input devices market during forecast period

3D Laser scanners play a pivotal role in 3D/4D imaging, offering precise and rapid data acquisition for diverse applications. These scanners utilize laser beams to measure the shape and contours of objects, enabling the creation of highly detailed 3D/4D models. The market for 3D/4D imaging is witnessing significant growth, driven by the escalating demand for efficient and accurate spatial data across industries such as manufacturing, healthcare, and architecture.

The market for 3D and 4D rendering sub-segment is expected to hold the largest share of the 3D and 4D imaging solutions market during the forecast period

3D and 4D rendering are used to convert a model into a 3D photorealistic image and 4D video. Its features include quick preview animations, high-performance interactive workflows, and photorealistic detail for a pixel-perfect final image (for offering enhanced images). One of the key factors contributing to the growth of this market segment is the increasing demand from the global entertainment industry to incorporate special effects in a cost-efficient manner. The increased emphasis on virtualization software is another key factor supporting the growth of this market segment.

3D and 4D Gesture Recognition end use application segment to hold the second largest share of market during the forecast period

The rising prominence of 3D and 4D gesture recognition is driven by the desire for more natural and immersive ways of interacting with technology. As these technologies continue to advance, their applications across various industries and everyday life are expected to expand, further enriching user experiences and opening new possibilities for human-computer interaction.

3D and 4D technology market in Asia Pacific estimated to grow at the fastest rate during the forecast period

The 3D and 4D technology industry , in Asia Pacific is expected to grow at the highest CAGR during the forecast period. Asia Pacific is expected to witness highest growth during the forecast period. The growth of this market can be attributed to the tremendous market potential for 3D and 4D applications. Countries in the Asia Pacific, such as China and Japan, are known for consumer electronics, automotive, and manufacturing. 3D and 4D input and 3D output devices such as cameras, sensors, scanners, smartphones, TVs, printers, and projectors are produced, consumed, and exported on a large scale by these countries.

3D and 4D Technology Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top 3D and 4D Technology Companies - Key Market Players:

Major vendors in the 3D and 4D technology companies include

- Samsung (South Korea),

- GE Healthcare (US),

- Hexagon AB (Sweden),

- Autodesk, Inc. (US),

- Sony (Japan),

- Dassault Systèmes (France),

- Stratasys (Israel),

- FARO (US),

- 3D Systems (US),

- Vicon (UK),

- Panasonic (Japan),

- Philip (Netherlands),

- Qualisys (Sweden),

- Barco (Belgium),

- Google (US),

- Cognex (US),

- LG Electronics (South Korea),

- Basler AG (Germany),

- DreamWorks Animation (US),

- Dolby Laboratories, Inc. (US),

- NANSENSE (US),

- Quidient (US),

- Rokoko (Denmark),

- 4D Sensor Inc. (Japan),

- Vayyar Imaging (Israel),

- Matterport (US),

- Creality (China),

- INTAMSYS (China), Eplus3D (China).

3D and 4D Technology Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 399.7 billion in 2024 |

| Projected Market Size | USD 866.5 billion by 2029 |

| Growth Rate | CAGR of 16.7% |

|

Market size available for years |

2020—2029 |

|

Base year |

2023 |

|

Forecast period |

2024—2029 |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered |

Samsung (South Korea), GE Healthcare (US), Hexagon AB (Sweden), Autodesk, Inc. (US), Sony (Japan), Dassault Systèmes (France), Stratasys (Israel), FARO (US), 3D Systems (US), Vicon (UK), Panasonic (Japan), Philip (Netherlands), Qualisys (Sweden), Barco (Belgium), Google (US), Cognex (US), LG Electronics (South Korea), Basler AG (Germany), DreamWorks Animation (US), Dolby Laboratories, Inc. (US), NANSENSE (US), Quidient (US), Rokoko (Denmark), 4D Sensor Inc. (Japan), Vayyar Imaging (Israel), Matterport (US), Creality (China), INTAMSYS (China), Eplus3D (China) |

3D and 4D Technology Market Highlights

This research report categorizes the 3D and 4D technology market based on solution type, installation, , end-use application, vertical, and region

|

Segment |

Subsegment |

|

By Solution Type: |

|

|

By End Use Application |

|

|

By Vertical: |

|

|

By Region: |

|

Recent Developments in 3D and 4D technology Industry :

- In October 2023, FARO announced the release of the FARO Orbis Mobile Scanner, a groundbreaking advancement to redefine 3D reality capture. Orbis is the first to market a hybrid SLAM scanner that can be used for mobile and stationary data capture in one device. It offers local or cloud-based data processing and collaboration. The product is the latest evolution in FARO’s industry-leading Simultaneous Localization and Mapping (SLAM)-enabled LiDAR technology.

- In April 2023, Teledyne Optech introduced the marine lidar sensor, CL-360 for marine applications. This lidar sensor can be seamlessly integrated with high-resolution multibeam systems and the CARIS Ping-To-Chart workflow, allowing full above and below-water image capture with survey-grade accuracy in a single workflow.

Key Questions Addressed in the Report:

What will be the dynamics for the adoption of 3D and 4D technology market based on the solution type?

In 2023, the 3D and 4D technology market for end-use applications accounted for the largest market share in 2023. The large share of this market segment can be attributed to the growing deployment of various 3D and 4D input devices, 3D and 4D imaging solutions, and 3D and 4D output devices in gaming, cinemas, navigation, layout and animation, motion capture, machine vision, metrology, and gesture recognition applications. The growing demand for virtual reality games is another key factor fueling market growth.

Which end use application segment will contribute more to the overall market share by 2029?

The 3D and 4D gaming end use application segment will contribute the most to the 3D and 4D technology. 3D games add an exciting element of reality to the experience of video games. As the graphics have been specially designed for the 3D gaming experience, users do not even have to wear 3D glasses while playing the games. These games are available in various categories such as sports games, racing games, shooting games, and mental tests. There are different types of 3D gaming software available to enhance the stereoscopic 3D and 4D gaming experience while playing the games on computers, laptops, smartphones, or tablets. Continuous advancements in the gaming field with increased emphasis on enhanced user experience is driving the growth of the 3D and 4D technology market.

How will technological developments such as artificial intelligence (AI), IoT change the 3D and 4D technology market landscape in the future?

In recent years, the demand for AI has increased in the medical field for the detection and treatment of diseases. AI is increasingly being used in X-ray, ultrasound, and MRI scans, resulting in more efficient automatic image scans and better examination and diagnosis workflows. In the US, Computer-aided Design (CAD) software and automatic diagnostic solutions that incorporate AI technology have been adopted by various medical vendors. Companies such as Hitachi focus on developing unique AI technologies for cardiovascular ultrasound, leading to high accuracy and medically relevant results. The IoT technology can relate to various technologies and models through the cognitive recognition layer, network construction layer, management services layer, and integrated application layer to get better functionalities. In the medical field, IoT technology is applied to 3D medical image models to improve treatments.

Which region is expected to adopt 3D and 4D technology solutions at a fast rate?

The Asia Pacific region is expected to adopt 3D and 4D technology solutions at the fastest rate. Countries such as the China and India are expected to have a high potential for the future growth of the market.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

The ever-growing gaming industry and enhanced gaming hardware and software enable the formation of complex 3D and 4D games. This is a key factor driving the market growth. The growing number of users of gaming consoles is another major factor boosting the market growth. Sony Corporation, Microsoft, and Nintendo are among the leading manufacturers of gaming consoles. According to Ampere Games, as of 2022, the PS4 offered by Sony Corporation captures a share of 45.0% of the gaming consoles market, followed by Nintendo Switch at 27.7% and Microsoft’s Xbox One at 27.3%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

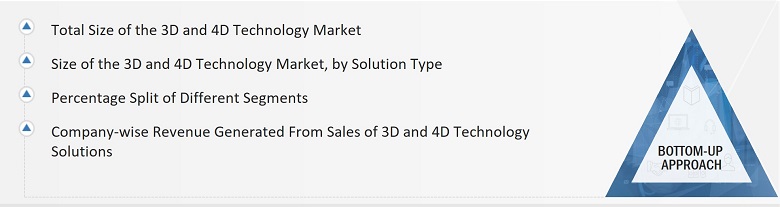

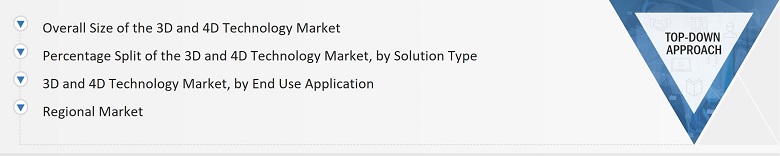

The study involved four major activities in estimating the size for 3D and 4D technology market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, and certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the 3D and 4D technology market size . Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the 3D and 4D technology market size scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (3D and 4D technology solution providers) across 4 major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

3D and 4D Technology Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the 3D and 4D technology market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

3D and 4D Technology Market: Bottom-Up Approach

3D and 4D Technology Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Definition

3D and 4D technology stands for three- and four-dimensional technology. 3D technology can be defined as the illusion of depth or a visual representation system that tries to create or reproduce a moving object in the third dimension. 3D technology provides users with a whole new level of experience, immersion, interaction, and realism; the technology has become a mainstream element in cinemas, televisions, the internet, video games, mobile phones, and other products.

4D technology combines the effects of 3D, along with the external physical effects with respect to time. 4D technology finds applications in 4D cinemas, games, and ultrasound systems. 4D printing is another upcoming application. 4D printing allows objects to be 3D-printed and then self-transform in shape and material property when exposed to a predetermined stimulus, such as submersion in water or exposure to heat, pressure, current, ultraviolet light, or some other sources of energy.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To describe, segment, and forecast the overall size of the 3D and 4D technology market , by solution type, end-use application, vertical, and region, in terms of value

- To describe and forecast the global 3D and 4D technology market, by 3D and 4D input devices, in terms of volume

- To describe and forecast the market size for various segments with regard to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding major drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze the supply chain, trends/disruptions impacting customer business, market/ecosystem map, pricing, and regulatory landscape pertaining to the 3D and 4D technology market size

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To describe the value chain of 3D and 4D technology solutions in brief

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To profile key players and comprehensively analyze their market position in terms of their ranking and core competencies2, along with the detailed competitive landscape of the

- market

- To analyze competitive developments, such as product launches and developments, partnerships, agreements, expansions, acquisitions, contracts, alliances, and research & development (R&D), undertaken in the 3D and 4D technology market size

- To benchmark market players using the proprietary ‘Company Evaluation Matrix,’ which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- To analyze the probable impact of the recession on the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in 3D and 4D Technology Market

Interested in market developments related to minimally invasive surgery with 3D endoscope system.