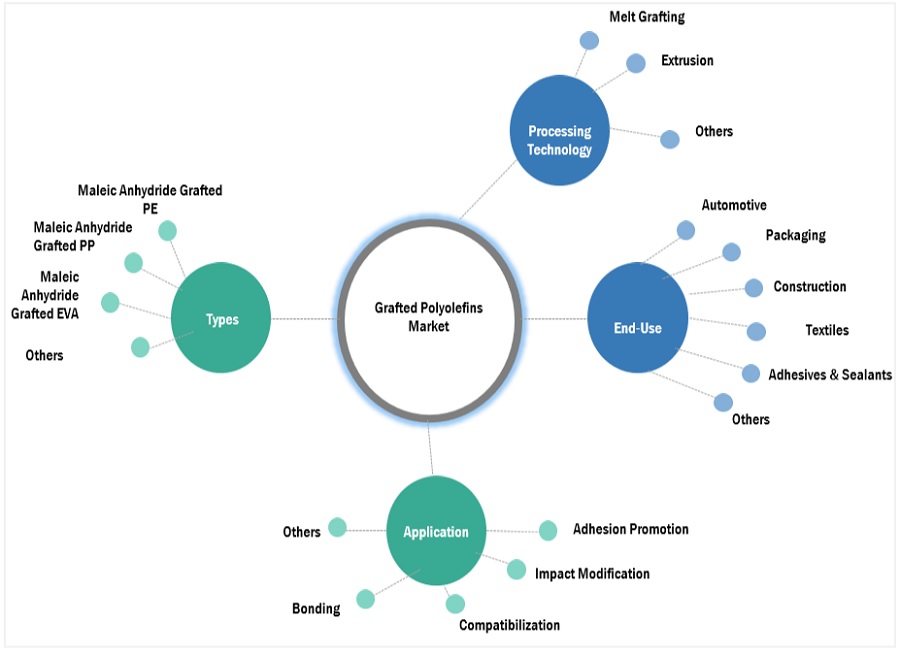

Grafted Polyolefins Market by Type (Maleic Anhydride Grafted PE, Maleic Anhydride Grafted PP, Maleic Anhydride Grafted EVA), Application (Adhesion Promotion, Impact Modification, Compatibilization, Bonding), End-Use Industry - Global Forecast 2029

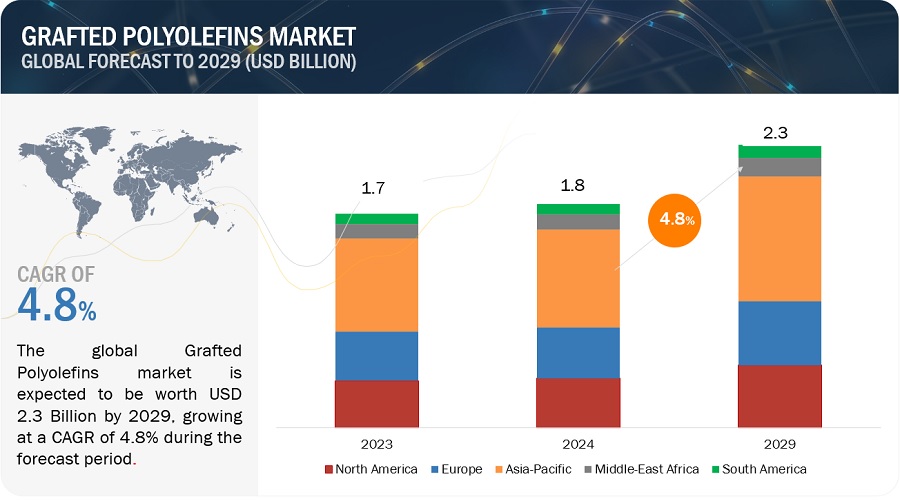

The Grafted polyolefins market size is projected to grow from USD 1.8 billion in 2024 to USD 2.3 billion by 2029, registering a CAGR of 4.8% during the forecast period. The grafted polyolefins market experiences robust growth driven by a multitude of influential factors. These grafted polyolefins, engineered materials with exceptional properties, find applications across a diverse range of high-tech industries.

Attractive Opportunities in the Grafted Polyolefins Market

To know about the assumptions considered for the study, Request for Free Sample Report

Grafted polyolefins Market Dynamics

Driver: Increasing demand for enhanced polymers

The grafted polyolefins market is experiencing a surge in demand driven by the need for polymers with enhanced properties. Traditional polyolefins like polyethylene (PE) and polypropylene (PP) have long been favoured for their versatility, cost-effectiveness, and widespread availability. However, as industries evolve and requirements become more stringent, there is a growing need for polymers that go beyond the standard properties of polyolefins. Enhanced polymers, achieved through grafting processes, offer a range of benefits that address specific application requirements. These benefits include improved adhesion, compatibility with other materials, enhanced thermal stability, resistance to chemicals and UV radiation, and tailored mechanical properties such as impact strength and flexibility. For instance, grafted polyolefins can exhibit superior adhesion to substrates, making them ideal for adhesive and sealant applications in industries like automotive, construction, and packaging. The demand for enhanced polymers is fuelled by several factors. In the automotive sector, for example, the push for lightweight materials with high performance has led to increased use of grafted polyolefins in applications such as interior trim components, under-the-hood parts, and exterior body panels. These materials offer a balance of strength, durability, and weight savings, contributing to fuel efficiency and overall vehicle performance.

Restraint: Stringent regulatory compliances

Regulatory compliance poses significant restraints for the grafted polyolefins market, impacting manufacturers in several ways and presenting challenges that can hinder market growth and competitiveness. Compliance with stringent regulatory standards means that manufacturers of grafted polyolefins face increased scrutiny and oversight from regulatory bodies, industry watchdogs, and environmental agencies. This heightened scrutiny translates into a more complex regulatory landscape where companies must navigate numerous regulations, standards, and guidelines to ensure compliance. The need to stay abreast of evolving regulations, interpret their implications, and implement necessary changes can be time-consuming and resource-intensive for manufacturers. The regulatory framework governing grafted polyolefins encompasses a wide range of areas including safety, health, environmental impact, product labelling, disposal, and transportation. This complexity arises from regional, national, and international regulations that vary in scope, requirements, and enforcement mechanisms.

Opportunities: Innovative & emerging applications across various industries

Innovative applications of grafted polyolefins leverage advancements in functional additives, nanocomposites, and surface modifications to enhance their properties and cater to diverse industry needs. One notable opportunity lies in developing grafted polyolefins with antimicrobial properties, which are increasingly sought after in industries such as healthcare, food packaging, and consumer goods. By incorporating antimicrobial agents during the grafting process, grafted polyolefins can inhibit the growth of bacteria, fungi, and other microorganisms on surfaces, contributing to improved hygiene, product longevity, and safety. Another innovative application area is the use of grafted polyolefins with conductive properties for electronic applications. Through the incorporation of conductive fillers or additives, such as carbon nanotubes or graphene, into the polyolefin matrix during grafting, grafted polyolefins can exhibit electrical conductivity. This opens up opportunities for their use in electronic components, printed circuit boards, flexible electronics, and EMI shielding applications, where electrical conductivity and compatibility with polymer materials are essential. Furthermore, grafted polyolefins can be tailored to possess flame-retardant properties, making them suitable for safety-critical applications in industries such as automotive, construction, and aerospace.

Challenges: Cost of production & technical complexity

The challenges related to the cost of production and technical complexity are significant factors that can impact the adoption and growth of the grafted polyolefins market. The cost of producing grafted polyolefins involves various elements, including raw material costs, specialized equipment for advanced grafting techniques, quality control measures, and economies of scale in production. These factors contribute to the challenge of maintaining competitive prices, especially in cost-sensitive markets where price competitiveness is crucial. Additionally, the technical complexity of grafting processes, quality assurance, skilled personnel requirements, and the need for continuous innovation pose significant challenges for manufacturers. Implementing advanced grafting techniques like controlled/living polymerization or reactive extrusion requires specialized knowledge, expertise, and investment in technology and research. Ensuring consistent product quality, meeting regulatory standards, and addressing variations in raw materials and processing conditions further add to the complexity.

GRAFTED POLYOLEFINS MARKET: ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of wet room waterproofing solutions. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Mitsubishi Chemical Group Corporation (Japan), Guangzhou Lushan New Materials Co., Ltd.(China), LyondellBasell Industries Holdings B.V.(USA), Mitsui Chemicals Asia Pacific, Ltd.(Japan), Arkema (France), Clariant (Switzerland), Borealis AG (Austria), SI Group, Inc.(US), Dow (US), COACE (China).

Based on type, Maleic Anhydride Grafted Pp is projected to account for the second largest share of the Grafted polyolefins market.

Because of its exceptionally compatible with polar substrates such as metals and numerous other polymers, making it useful in adhesive formulations and composite materials. Maleic anhydride polypropylene also has great thermal stability, chemical resilience, and mechanical qualities, which broadens its applicability in harsh situations. Furthermore, its ability to improve polypropylene features such as impact resistance and tensile strength without compromising its fundamental traits makes it a popular choice for producers looking to improve the performance of their goods.

Based on application, Impact Modification is projected to account for the second largest share of the Grafted polyolefins market.

Due to Its ability to increase the toughness and durability of polyolefin materials. This method of modification involves grafting elastomeric polymers onto polyolefin matrices, which improves impact resistance while maintaining other mechanical properties. This increased toughness makes impact-modified polyolefins appropriate for a wide range of applications, including automotive parts and packaging materials, where impact and stress resistance is critical. Furthermore, as industries increasingly prioritise sustainability and recyclability, impact-modified polyolefins offer a feasible answer by extending product lifetimes and minimising material waste.

Based on processing technology, melt grafting is projected to account for the second largest share of the Grafted polyolefins market.

Because of It has unique advantages. Melt grafting, unlike other grafting procedures that require solvents or chemical initiators, takes place immediately in the melt phase of polyolefins. This eliminates the need for additional processing stages, lowering production costs dramatically. Furthermore, melt grafting provides greater control over the grafting process, allowing for exact adjustments to grafting parameters such as monomer concentration and reaction time. This leads to enhanced product uniformity and quality. Furthermore, melt grafting is better for the environment because it uses less solvent and generates less trash. Overall, melt grafting's simplicity, cost-effectiveness, and environmental sustainability make it an appealing alternative for producers in the grafted polyolefins market, resulting in its growing adoption and expansion.

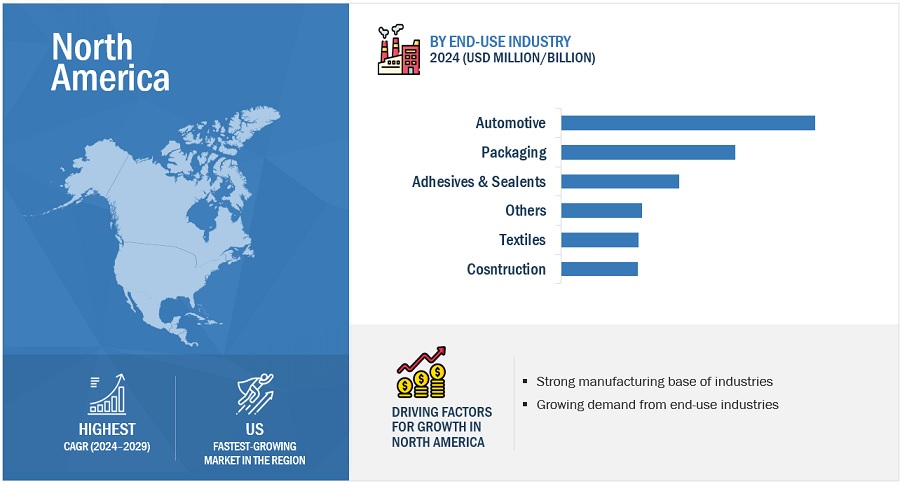

North America is expected to be the fastest growing market during the forecast period.

North America is the fastest-growing area in the grafted polyolefins market due to numerous factors, including its strong economy, high disposable income, and advanced technical infrastructure. The region is home to a large number of renowned grafted polyolefins manufacturers. These companies are heavily spending on research and development to generate new and innovative grafted polyolefins products. The growing need for grafted polyolefins in a variety of applications, such as packaging, electronics, and automotive, is also driving the North American grafted polyolefins market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Grafted polyolefins market is dominated by a few major players that have a wide regional presence. The key players in the Grafted polyolefins market are include Mitsubishi Chemical Group Corporation (Japan), Guangzhou Lushan New Materials Co., Ltd.(China), LyondellBasell Industries Holdings B.V.(USA), Mitsui Chemicals Asia Pacific, Ltd.(Japan), Arkema (France), Clariant (Switzerland), Borealis AG (Austria), SI Group, Inc.(US), Dow (US), COACE (China). In the last few years, the companies have adopted growth strategies such as expansions and acquisition to capture a larger share of the Grafted polyolefins market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2021-2029 |

|

Base Year |

2022 |

|

Forecast period |

2023–2029 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments |

application, Type, processing technolgy, end-use, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Mitsubishi Chemical Group Corporation (Japan), Guangzhou Lushan New Materials Co., Ltd.(China), LyondellBasell Industries Holdings B.V.(USA), Mitsui Chemicals Asia Pacific, Ltd.(Japan), Arkema (France), Clariant (Switzerland), Borealis AG (Austria), SI Group, Inc.(US), Dow (US), COACE (China). |

This report categorizes the global Grafted Polyolefins market based on raw material, Type, uses, application, and region.

On the basis of type, the Grafted Polyolefins market has been segmented as follows:

- Maleic Anhydride Grafted PE

- Maleic Anhydride Grafted PP

- Maleic Anhydride Grafted EVA

- Others

On the basis of processing technology, the Grafted Polyolefins market has been segmented as follows

- Extrusion

- Melt grafting

- Others

On the basis of application, the Grafted Polyolefins market has been segmented as follows

- Adhesion Promotion

- Impact Modification

- Compatibilization

- Bonding

- Others

On the basis of end-use, the Grafted Polyolefins market has been segmented as follows:

- Automotive

- Packaging

- Construction

- Textiles

- Adhesives & Sealants

- Others

On the basis of region, the Grafted Polyolefins market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2021, LyondellBasell (NYSE: LYB) announced another step towards its ambition to advance the circular economy by making virgin quality polymers from raw materials derived from plastic waste at its Wesseling, Germany, site. Produced by the thermal conversion of plastic waste, this raw material is converted into ethylene and propylene in the LyondellBasell production facilities and then processed into polypropylene (PP) and polyethylene (PE) in the downstream units for plastics production.

- In November 2023, Borealis has announced the acquisition of Integra Plastics AD, a leading advanced mechanical recycling company based in Bulgaria. This strategic move will bolster Borealis' advanced recycling capabilities, adding over 20,000 tons of recycling capacity to meet the rising demand for sustainable solutions. Integra Plastics' modern plant in Elin Pelin, Bulgaria, equipped with state-of-the-art technology, specializes in transforming post-consumer waste into high-quality polyolefin recyclates suitable for various applications.

- In November 2023, Borealis has completed the acquisition of Rialti S.p.A., an Italian polypropylene (PP) compounder specializing in recyclates. This strategic move enhances Borealis' PP compounds portfolio with an additional 50,000 tons per year of mechanical recyclates, meeting growing customer demand for sustainable solutions.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the Grafted polyolefins market?

The growth of this market can be attributed to the Increasing demand from emerging industries and growing awareness of the benefits of grafted polyolefins.

Which are the key applications driving the Grafted polyolefins market?

The sectors driving the demand for Grafted polyolefins are Growing demand for smart packaging materials the rising demand for grafted polyolefins in the automotive industry.

Who are the major manufacturers?

Major manufacturers include Mitsubishi Chemical Group Corporation. (Japan), Guangzhou Lushan New Materials Co., Ltd (China), LyondellBasell Industries Holdings B.V (USA), MITSUI CHEMICALS ASIA PACIFIC, LTD (Japan), arkema (France), Nitto Denko Corporation (Japan), clariant (Switzerland), borealis ag (Austria), si group, inc (US), dow (US) among others.

What will be the growth prospects of the Grafted polyolefins market?

Rising demand from the packaging industry, Growing demand from the automotive industry, are some of the driving factors.

Which end-use segment has the largest market share in the grafted polyolefins market ?

Automotive, end-use segment covers the largest market share in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the Grafted Polyolefins market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key Grafted Polyolefins, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Grafted Polyolefins market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the grafted polyolefins market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the Grafted Polyolefins industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Grafted Polyolefins and future outlook of their business which will affect the overall market.

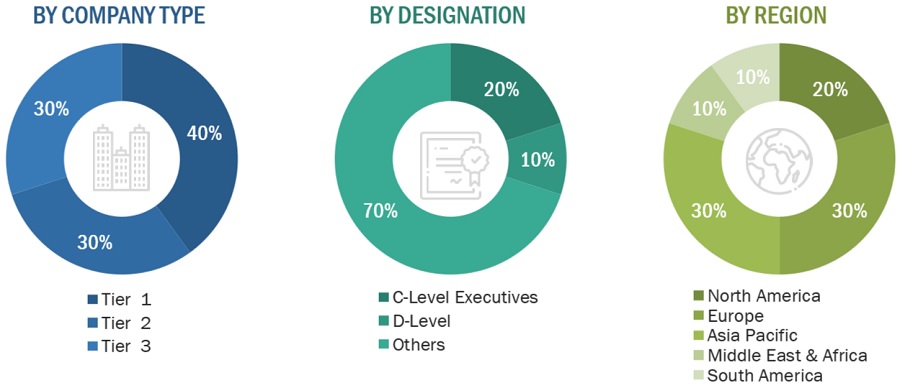

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for Grafted Polyolefins for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on application, processing technology, type, end-use, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Grafted Polyolefins Market: Bottum-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Grafted Polyolefins Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process Grafted Polyolefins above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The grafted polyolefins market refers to the industry that produces, distributes, and uses polyolefin-based polymers that have been modified through grafting reactions with functional monomers. This method improves the characteristics and adaptability of polyolefins, making them suitable for a variety of applications in industries such as automotive, packaging, construction, textiles, and adhesives. Opportunities in the grafted polyolefins market include the development of bio-based and sustainable alternatives to address rising environmental concerns. Advances in polymer science and processing technologies provide opportunities to improve performance and broaden application scopes, while increased R&D expenditure drives innovation and market distinction. These factors jointly drive the growth and evolution of the grafted polyolefins market, defining its trajectory to satisfy varied industry needs.

Key Stakeholders

- Grafted Polyolefins Manufacturers

- Grafted Polyolefins Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the Grafted Polyolefins market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on type, end-use, application, processing technology and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on Grafted Polyolefins market

By Form Analysis

- Market size for Grafted Polyolefins in terms of value and volume

Growth opportunities and latent adjacency in Grafted Polyolefins Market