Fluorescent Pigment Market by Formulation (Organic, Inorganic), Characteristic Type, Type, Intensity (High Intensity, Medium Intensity, Low Intensity), Application (Paints & Coatings, Printing Inks), End-Use Industry, & Region - Global Forecast to 2028

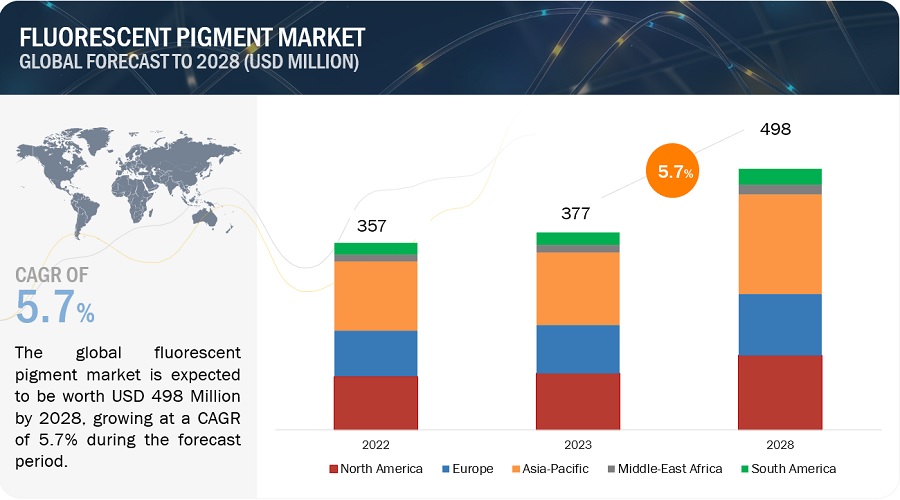

The fluorescent pigment market is projected to reach USD 498 million by 2028, at a CAGR of 5.7 % from USD 377 million in 2023. The fluorescent pigment market is characterized by its dynamic and diverse landscape, driven by increasing demand across various industries. These pigments, known for their ability to emit visible light when exposed to ultraviolet (UV) light, find extensive applications in sectors such as security and currency, packaging, automotive and transportation, building and construction, textiles, and cosmetics. In the realm of security, fluorescent pigments play a crucial role in anti-counterfeiting measures, adding authenticity to currency and important documents. The packaging industry values these pigments for their attention-grabbing properties, enhancing the visual appeal of labels and packaging materials. Automotive and transportation sectors utilize fluorescent pigments in high-visibility coatings for safety and aesthetic purposes, while building and construction applications include safety markings and decorative elements. The textile industry benefits from the vibrancy these pigments add to fabrics, meeting the demand for trendy and fashionable products. Additionally, fluorescent pigments are widely incorporated in the cosmetics industry to create bold and vibrant color formulations. With their versatile applications and ability to meet diverse aesthetic and functional needs, the fluorescent pigment market continues to play a pivotal role in shaping the visual landscape across various industries.

Attractive Opportunities in the Fluorescent Pigment Market

To know about the assumptions considered for the study, Request for Free Sample Report

Fluorescent Pigment Market Dynamics

Driver: Growth in emerging markets

The growth in the emerging markets such as India, China, Indonesia, Vietnam, and Brazil are the significant propelling factor for fluorescent pigment market. As these markets undergo rapid economic expansion, characterized by increased industrialization and infrastructure development, there is a notable surge in the consumption of products that prominently feature fluorescent pigments. This demand is particularly pronounced in the construction and architectural sectors, where vibrant and durable finishes, achieved through the use of fluorescent pigments in paints and coatings, are increasingly sought after. The rising affluence of the middle class in emerging markets significantly contributes to the burgeoning demand for goods that incorporate fluorescent pigments. This demographic, with its heightened purchasing power, actively seeks visually appealing products, thus influencing the adoption of these pigments in textiles, cosmetics, and various consumer goods. Furthermore, the ongoing urbanization in these markets leads to a higher demand for architectural coatings and paints, further fueling the integration of fluorescent pigments into these products.

Globalization and increased international trade have also played a crucial role in propelling the market for fluorescent pigments in emerging markets. The exchange of ideas, technologies, and products across borders has facilitated the integration of advanced pigment technologies, making fluorescent pigments more accessible and desirable. Additionally, emerging markets are becoming integral players in global supply chains, influencing the manufacturing landscape and contributing to the increased utilization of fluorescent pigments in various industries.

Restraint: Elevated cost of fluorescent pigment

The substantial cost of fluorescent pigments is a critical factor influencing their widespread adoption, particularly in industries where cost-effectiveness is paramount. One primary determinant is the complexity inherent in the manufacturing processes of fluorescent pigments. The synthesis and formulation of these pigments necessitate precision and specialization, demanding advanced equipment and intricate technologies. This complexity not only increases production time but also requires a higher level of expertise, consequently driving up manufacturing costs. Raw material costs constitute another pivotal component of the overall expense associated with fluorescent pigments. Certain formulations incorporate unique or specialized compounds, contributing to the comparatively high cost of these raw materials.

The process of developing innovative fluorescent pigments with enhanced properties further escalates costs through substantial investments in research and development (R&D). The continuous pursuit of improved performance characteristics, color stability, and adherence to stringent regulatory standards necessitates ongoing R&D efforts. These endeavors, while critical for maintaining a competitive edge, contribute significantly to the overall cost structure of fluorescent pigments.

Furthermore, the specialized nature of fluorescent pigments, designed for applications demanding unique properties such as fluorescence under UV light, presents challenges in achieving economies of scale. The limited scope of these applications results in lower demand and production volumes, which, in turn, can increase the per-unit production costs. This niche characteristic makes it challenging for fluorescent pigments to attain the cost competitiveness enjoyed by more widely adopted pigments.

Opportunity: Expanding use in 3D printing

The burgeoning landscape of 3D printing technology unfurls a compelling frontier of opportunity for the fluorescent pigment market. Positioned at the confluence of innovation and aesthetics, fluorescent pigments emerge as pivotal components poised for integration into 3D printing materials. This strategic assimilation facilitates the production of visually striking and dynamically colored 3D-printed objects, resonating across diverse industries, including art, design, and manufacturing.

Within the artistic domain, fluorescent pigments unlock a myriad of possibilities, empowering artists and designers to infuse their creations with intense and vibrant hues. The unique capacity of these pigments to emit fluorescence under specific lighting conditions adds a layer of complexity and allure to 3D-printed artistic expressions. This artistic fusion of technology and color not only captivates creative sensibilities but also positions fluorescent pigments as catalysts for pushing the envelope of design boundaries. From a commercial standpoint, enterprises entrenched in the 3D printing sector can strategically leverage the distinctive features of fluorescent pigments to carve out a competitive edge. In alignment with prevailing customization trends observed in industries such as consumer goods and promotional products, the integration of fluorescent pigments facilitates the production of bespoke and visually striking 3D-printed items. This strategic alignment with customization trends positions businesses for differentiation and heightened consumer appeal. Moreover, the utility of fluorescent pigments extends beyond artistic and commercial realms. In sectors such as healthcare, the integration of fluorescent pigments in 3D printing can play a pivotal role in the creation of anatomical models for surgical planning and medical education. The ability to incorporate vivid colors into these models enhances their accuracy and utility, offering surgeons and medical professionals a comprehensive visualization tool.

Challenge: Complex manufacturing process

The production of fluorescent pigments involves highly complex manufacturing processes, presenting challenges that extend across scalability, efficiency, and cost-effectiveness. The intricate manufacturing processes involved in producing fluorescent pigments encompass several key stages, each demanding precision and specialized techniques. The formulation phase is critical, requiring the careful blending of specific chemical compounds to achieve the desired fluorescent properties. This formulation is followed by the synthesis process, where the compounds undergo reactions under controlled conditions to produce the fluorescent pigments. Businesses in this sector face challenges related to scalability, particularly when aiming to expand production volumes. The complexity of these processes may present hurdles in seamlessly increasing output while maintaining the necessary precision and quality. Ensuring efficiency throughout these manufacturing stages is imperative. From raw material handling to synthesis and finishing, optimizing workflows and minimizing waste become focal points for enhancing efficiency.

Cost-effectiveness emerges as a central concern due to the specialized nature of the materials involved and the need for advanced equipment. The raw materials involved, often consisting of unique and specialized compounds, contribute significantly to the overall production expenses. As these materials may be sourced from limited suppliers or involve intricate extraction processes, businesses face challenges related to supply chain dynamics and cost fluctuations.

Fluorescent Pigment Market: Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Security and currency type Segment type was the largest segment for fluorescent pigment market in 2022, in terms of value."

The security and currency segment constitutes a critical and specialized niche within the fluorescent pigment market. Fluorescent pigments play an integral role in this sector, primarily focusing on anti-counterfeiting measures and enhancing the security features of currency and important documents. The unique properties of fluorescent pigments, which emit visible light when exposed to ultraviolet (UV) light, provide a distinct advantage in creating intricate and tamper-evident security features.

In currency applications, fluorescent pigments are often incorporated into the printing process to produce elements such as threads, inks, and security strips. These pigments contribute to the development of complex and visually striking designs that are not easily replicable, thus safeguarding against counterfeit currency production. The ability of fluorescent pigments to emit specific and identifiable colors under UV light adds an additional layer of authenticity verification.

"Asia Pacific was the fastest growing market for fluorescent pigment in 2022, in terms of value.

Asia Pacific was the fastest growing market for global fluorescent pigment market, in terms of value, in 2022. considered an optimal market for fluorescent pigments owing to several compelling factors. First and foremost, the region's robust industrialization and economic growth have spurred significant demand across diverse industries, establishing a substantial market for specialty products such as fluorescent pigments. Rapid urbanization and ongoing infrastructure development, particularly in countries such as China and India, contribute to an increased application of these pigments in construction, safety markings, and architectural coatings.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market Radiant Color NV (Belgium), Luminochem (Hungary), Wanlong Chemical Co., Ltd. (China), Sinloihi Co., Ltd. (Japan), Wuxi Minghui International Trading Co., Ltd. (China), DayGlo Color Corp. (US), Aron Universal Limited (India), Vicome Corp. (China), Hangzhou Aibai Chemical Co., Ltd. (China), Brilliant Group Inc. (US).

Read More: Fluorescent Pigments Companies

Want to explore hidden markets that can drive new revenue in Fluorescent Pigment Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Fluorescent Pigment Market?

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Kiloton; Value (USD Million/Billion) |

|

Segments |

Formulation, Characteristic type, Type, Intensity, End-use Industry Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Radiant Color NV (Belgium), Luminochem (Hungary), Wanlong Chemical Co., Ltd. (China), Sinloihi Co., Ltd. (Japan), Wuxi Minghui International Trading Co., Ltd. (China), DayGlo Color Corp. (US), Aron Universal Limited (India), Vicome Corp. (China), Hangzhou Aibai Chemical Co., Ltd. (China), Brilliant Group Inc. (US). |

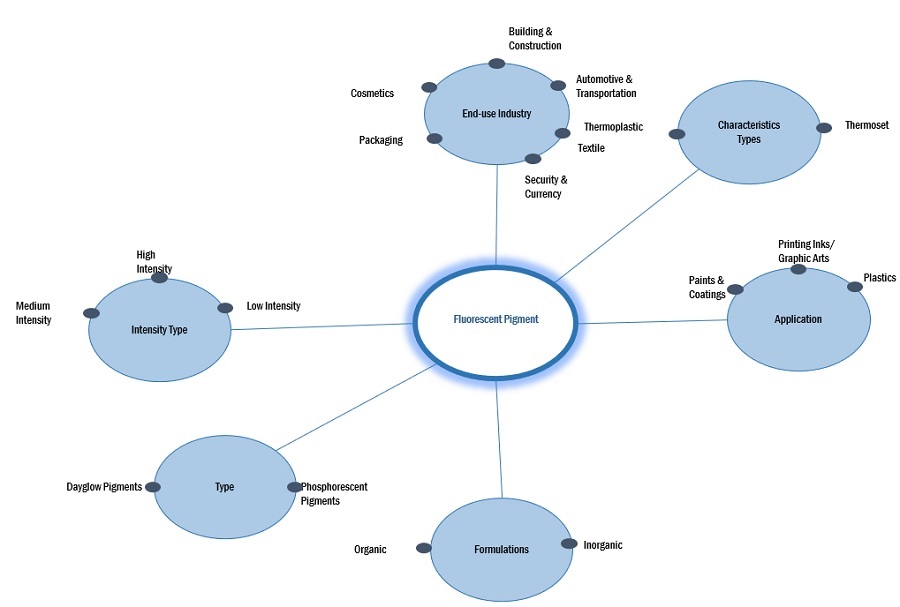

This report categorizes the global fluorescent pigment market based on formulation, characteristic type, type, intensity, end-use industry, application, and region.

Based on the formulation:

- Organic Fluorescent Pigment

- Inorganic Fluorescent Pigment

Based on the characteristic type:

- Thermoplastic

- Thermoset

Based on the type:

- Dayglow Pigments

- Phosphorescent Pigments

- Other Types

Based on the intensity:

- High Intensity

- Medium Intensity

- Low Intensity

Based on the application:

- Printing Inks / Graphic Arts

- Paints & Coatings

- Plastics

- Other Applications

Based on the end-use industry:

- Security & Currency

- Packaging

- Automotive & Transportation

- Building & Construction

- Textile

- Cosmetics

- Other End-Use Industries

Based on the region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In April 2019, DayGlo Introduced the second generation of legal fluorescent colorants for cosmetics. It can be used in oil-based, and solvent or water born formulations.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the fluorescent pigment market?

The forecast period for the fluorescent pigment market in this study is 2023-2028. The hy fluorescent pigment market is expected to grow at a CAGR of 5.7 %in terms of value, during the forecast period.

Who are the major key players in the fluorescent pigment market?

Radiant Color NV (Belgium), Luminochem (Hungary), Wanlong Chemical Co., Ltd. (China), Sinloihi Co., Ltd. (Japan), Wuxi Minghui International Trading Co., Ltd. (China), DayGlo Color Corp. (US), Aron Universal Limited (India), Vicome Corp. (China), Hangzhou Aibai Chemical Co., Ltd. (China), Brilliant Group Inc. (US) are the leading manufacturers of fluorescent pigment.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use, product launch as important growth tactics.

What are the drivers and opportunities for the fluorescent pigment market?

Growth in emerging markets is driving the market during the forecast period. Expanding use in 3D printing acts as an opportunity during the forecast period.

Which are the key technology trends prevailing in the fluorescent pigment market?

The key technologies prevailing in the fluorescent pigment market include nanotechnology, and smart pigments. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

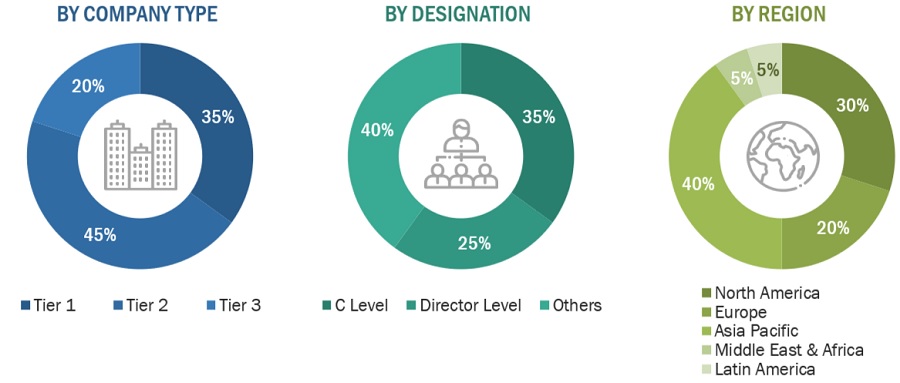

The study involved four major activities in estimating the market size of the fluorescent pigment market. Exhaustive secondary research was done to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The fluorescent pigment market comprises several stakeholders in the value chain, which include manufacturers, and end users. Various primary sources from the supply and demand sides of the fluorescent pigment market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in promotional and security sector. The primary sources from the supply side include manufacturers, associations, and institutions involved in the fluorescent pigment industry. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to formulation, characteristic type, type, intensity, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of fluorescent pigment and outlook of their business, which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

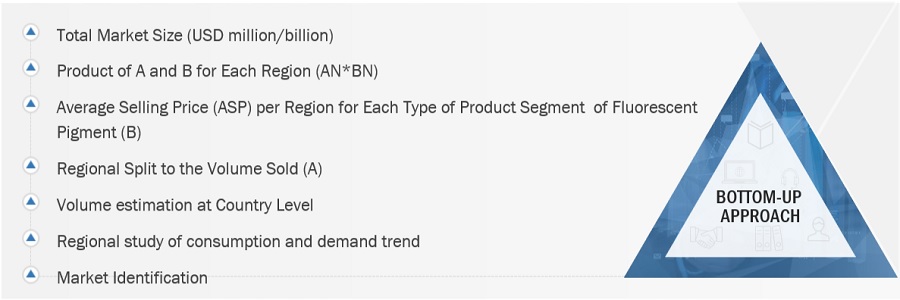

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the fluorescent pigment market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Top - Down Approach-

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom - Up Approach-

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Fluorescent pigments are colorants that can be stimulated by light to give brighter and more brilliant colors than conventional pigments. They are luminescent materials that reflect colored light and give off fluorescent light without requiring artificially generated energy. Fluorescent pigments often produce colors that are more intense and vivid compared to conventional pigments. This makes them popular for applications where bright and eye-catching colors are desired. Fluorescent pigments are used in various industries, including textiles, printing inks, plastics, coatings, paints, and cosmetics.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the fluorescent pigment market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on formulation, characteristic type, intensity, type, end-use industry, application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and Impact on fluorescent pigment market

Growth opportunities and latent adjacency in Fluorescent Pigment Market